At the Evaluation Time, the Trustee values the Trust's gold on the basis of that day's London PM Fix or, if no London PM Fix is made on such day or has not been announced by the Evaluation Time, the next most recent London gold price fix (AM or PM) determined prior to the Evaluation Time will be used, unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate as a basis for evaluation. In the event the Trustee and the Sponsor determine that the London PM Fix or last prior London "fix" is not an appropriate basis for evaluation of the Trust's gold, they will identify an alternative basis for such evaluation to be employed by the Trustee.

Once the value of the gold has been determined, the Trustee subtracts all estimated accrued but unpaid fees (other than the fees to be computed by reference to the value of the ANAV of the Trust or custody fees computed by reference to the value of gold held in the Trust), expenses and other liabilities of the Trust from the total value of the gold and all other assets of the Trust (other than any amounts credited to the Trust's reserve account, if established). The resulting figure is the ANAV of the Trust. The ANAV of the Trust is used to compute the fees of the Trustee, the Sponsor and the Marketing Agent.

To determine the Trust's NAV, the Trustee subtracts from the ANAV of the Trust the amount of estimated accrued but unpaid fees computed by reference to the value of the ANAV of the Trust and computed by reference to the value of the gold held in the Trust (i.e., the fees of the Trustee, the Sponsor, the Marketing Agent and the Custodian). The Trustee determines the NAV per Share by dividing the NAV of the Trust by the number of shares outstanding as of the close of trading on the NYSE.

Gold acquired, or disposed of, by the Trust is recorded at average cost. The table below summarizes the impact of unrealized gains or losses on the Trust's gold holdings at March 31, 2006 and September 30, 2005:

Gold acquired, or disposed of, by the Trust is recorded at average cost. Gold is valued at the lower of cost or market.

The Trust's total gain on gold for the three months ending March 31, 2006 is made up of a gain of $819 on the sale of gold to pay expenses plus a gain of $8,064 on gold distributed on the redemption of shares.

The Trust's total loss on gold for the three months ending March 31, 2005 is made up of diminution in value of investment in gold of $30,399 plus a loss of $45 on the sale of gold to pay expenses plus a loss of $284 on gold distributed on the redemption of shares.

Table of ContentsThe Trust's total gain on gold for the six months ending March 31, 2006 is made up of a gain of $1,066 on the sale of gold to pay expenses plus a gain of $8,064 on gold distributed on the redemption of shares.

The Trust's total loss on gold from November 12, 2004 (Date of Inception) to March 31, 2005 is made up of diminution in value of investment in gold of $50,696 plus a loss of $44 on the sale of gold to pay expenses offset by a gain of $2,425 on gold distributed on the redemption of shares.

Selected Supplemental Data - For the period November 12, 2004 (Date of Inception) through September 30, 2005 and for the six months ended March 31, 2006

|  |  |  |  |  |  |  |  |  |  |

| (All amounts, except per ounce and per share, are in 000's) |  | Mar-31,

2006 |  | Sep-30,

2005 |

| Ounces of Gold: |  | | | |  | | | |

| Opening Balance |  | | 6,669.3 | |  | | 30.0 | |

| Creations |  | | 4,629.0 | |  | | 7,464.2 | |

| Redemptions |  | | (99.5 | ) |  | | (809.4 | ) |

| Sales of gold |  | | (15.9 | ) |  | | (15.5 | ) |

| Closing Balance |  | | 11,182.9 | |  | | 6,669.3 | |

| Gold price per ounce - London PM fix |  | $ | 582.00 | |  | $ | 473.25 | |

| Market value of gold holdings |  | $ | 6,508,444 | |  | $ | 3,156,223 | |

| Number of Shares: |  | | | |  | | | |

| Opening Balance |  | | 66,900 | |  | | 300 | |

| Creations |  | | 46,500 | |  | | 74,700 | |

| Redemptions |  | | (1,000 | ) |  | | (8,100 | ) |

| Closing Balance |  | | 112,400 | |  | | 66,900 | |

| Net Asset Value per share: |  | | | |  | | | |

| Creations |  | $ | 52.97 | |  | $ | 43.68 | |

| Redemptions |  | | (55.38 | ) |  | | (44.49 | ) |

| Net Loss for the period |  | | 0.00 | |  | | (0.11 | ) |

| At Period End |  | $ | 57.89 | |  | $ | 47.16 | |

| Net Asset Value at Period End |  | $ | 6,506,396 | |  | $ | 3,155,107 | |

| Change in Net Asset Value through period end |  | | 106.2 | % |  | | 24,018.8 | % |

% Difference between Net Asset Value per share and market value of ounces

represented by each share |  | | (0.031 | )% |  | | (0.035 | )% |

|

Results of Operations

On November 12, 2004, the date of formation of the Trust, the Custodian received 30,000 ounces of gold on behalf of the Trust in exchange for 300,000 shares (3 Baskets). Trading in the shares in the Trust commenced on November 18, 2004 and on that date the Trust offered 2,300,000 shares (23 Baskets) through UBS Securities LLC, as underwriter, in exchange for 230,000 ounces of gold. Through September 30, 2005 an additional 72,400,000 shares (724 Baskets) were created in exchange for 7,234,246 ounces of gold and 8,100,000 shares (81 Baskets) were redeemed in exchange for 809,421 ounces of gold and 15,574 ounces of gold were sold to pay expenses.

In the six months ended March 31, 2006, 46,500,000 shares (465 Baskets) were created in exchange for 4,628,984 ounces of gold and 1,000,000 shares (10 Baskets) were redeemed in exchange for 99,467 ounces of gold and 15,873 ounces of gold were sold to pay expenses.

As at March 31, 2006 the amount of gold owned by the Trust was 11,182,894 ounces with a market value of $6,508,444,312 (cost − $5,319,422,316), based on the London PM Fix on March 31, 2006 (in accordance with the Trust Indenture.

13

Table of ContentsCash flow from operations

The Trust had no cash flow from operations in the three months ending March 31, 2006 and 2005, or for the six moths ending March 31, 2006 or for the period November 12, 2004 (Date of Inception) to March 31, 2005. Cash received in respect of gold sold to pay expenses in the six months ending March 31, 2006 and the period November 12, 2004 (Date of Inception) to March 31, 2005 was the same as those expenses, resulting in zero cash balances at March 31, 2006 and at March 31, 2005.

Cash Resources and Liquidity

At March 31, 2006 the Trust did not have any cash balances. When selling gold to pay expenses, the Trustee endeavors to sell the exact amount of gold needed to pay expenses in order to minimize the Trust's holdings of assets other than gold. As a consequence, we expect that the Trust will not record any cash flow from its operations and that its cash balance will be zero at the end of each reporting period.

Analysis of Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Trust's shares, investors should understand what the recent movements in the price of gold have been. Investors, however, should also be aware that past movements in the gold price are not indicators of future movements. This section identifies recent trends in the movements of the gold price and discusses some of the important events that have influenced these movements.

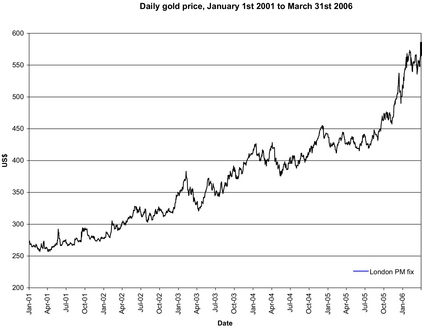

The following chart provides historical background on the price of gold. The chart illustrates movements in the price of gold in US dollars per ounce over the period from January 1, 2001 to March 31, 2006, and is based on the London PM Fix.

14

Table of ContentsThe average, high, low and end-of-period gold prices for the period from the inception of the Trust on November 12, 2004, through March 31, 2005, based on the London PM Fix, were:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Period |  | Average |  | High |  | Date |  | Low |  | Date |  | End of

period |

| November 12, 2004 to December 31, 2004(1) |  | $443.59 |  | $454.20 |  | Dec 2, 2004 |  | $434.00 |  | Dec 10, 2004 |  | $438.00 |

| Three months to March 31, 2005 |  | $427.35 |  | $443.70 |  | Mar 11, 2005 |  | $411.10 |  | Feb 8, 2005 |  | $427.50 |

| Three months to June 30, 2005 |  | $427.39 |  | $440.55 |  | Jun 24, 2005 |  | $414.45 |  | May 31, 2005 |  | $437.10 |

| Three months to September 30, 2005 |  | $439.72 |  | $473.25 |  | Sep 30, 2005 |  | $418.35 |  | Jul 15, 2005 |  | $473.25 |

| Three months to December 31, 2005(2) |  | $484.20 |  | $536.50 |  | Dec 12, 2005 |  | $456.50 |  | Nov 7, 2005 |  | $513.00 |

| Three Months to March 31, 2006 |  | $554.07 |  | $584.00 |  | Mar 30, 2006 |  | $524.75 |  | Jan 5, 2006 |  | $582.00 |

| November 12, 2004 to March 31, 2006 |  | $464.64 |  | $584.00 |  | Mar 30,2006 |  | $411.10 |  | Feb 8, 2005 |  | $582.00 |

|

|  |

| (1) | There was no London PM Fix on December 31, 2004. The London AM Fix on that date was $438.00. The Net Asset Value of the Trust on December 31, 2004 was calculated using the London AM Fix, in accordance with the Trust Indenture. |

|  |

| (2) | There was no London PM Fix on December 31, 2005 and December 30, 2005. The Net Asset Value of the Trust on December 31, 2005 was calculated using the London AM Fix on December 30, 2005, which was $513.00, in accordance with the Trust Indenture. |

The upward price trend that has been in place since early 2001 continued during the period between the inception of the Trust on November 12, 2004 and March 31, 2006. During this latter period, the gold price based on the London PM Fix traded between a low of $411.10 per ounce (February 8, 2005) and a high of $584.00 (March 30, 2006), and the average was $464.64. The price rose by 36 per cent during the 12 months ending March 31, 2006, in the process reaching its highest levels since 1981. Investment demand has been the driving force behind the sharp rally in the price since September 2005. Investment demand continued to be supported by widespread expectations of renewed and long term dollar weakness. Another factor behind the surge in investment was growing concern about inflation.

Cautionary Statement Regarding Forward-Looking Information and Risk Factors

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are predictions and actual events or results may differ materially from those expressed in our forward-looking statements. Risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements. These uncertainties and other factors include, but are not limited to, the following:

The value of the shares relates directly to the value of the gold held by the Trust and fluctuations in the price of gold could materially adversely affect an investment in the shares.

The Shares are designed to mirror as closely as possible the price of gold bullion, and the value of the Shares relates directly to the value of the gold held by the Trust, less the Trust's liabilities (including estimated accrued but unpaid expenses). The price of gold has fluctuated widely over the past several years. Several factors may affect the price of gold, including:

|  |

| • | Global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries such as South Africa, the United States and Australia; |

|  |

| • | Investors' expectations with respect to the rate of inflation; |

|  |

| • | Currency exchange rates; |

15

Table of Contents |  |

| • | Interest rates; |

|  |

| • | Investment and trading activities of hedge funds and commodity funds; and |

|  |

| • | Global or regional political, economic or financial events and situations. |

In addition, investors should be aware that there is no assurance that gold will maintain its long term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately.

The sale of gold by the Trust to pay expenses will reduce the amount of gold represented by each share on an ongoing basis irrespective of whether the trading price of the shares rises or falls in response to changes in the price of gold.

Each outstanding Share will represent a proportional interest in the gold held by the Trust. As the Trust will not generate any income and as the Trust will regularly sell gold over time to pay for its ongoing expenses, the amount of gold represented by each Share will gradually decline over time. This is true even if additional Shares are issued in exchange for additional deposits of gold into the Trust, as the amount of gold required to create Shares will proportionately reflect the amount of gold represented by the Shares outstanding at the time of creation. Assuming a constant gold price, the trading price of the Shares is expected to gradually decline relative to the price of gold as the amount of gold represented by the Shares gradually declines. The Shares will only maintain their original price if the price of gold increases.

Investors should be aware that the gradual decline in the amount of gold represented by the Shares will occur regardless of whether the trading price of the Shares rises or falls in response to changes in the price of gold.

Readers are urged to review the Risk Factors section contained in the Prospectus for a description of other risks and uncertainties that may affect an investment in our shares.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Item 4. Controls and Procedures

Disclosure controls and procedures. Under the supervision and with the participation of the sponsor, World Gold Trust Services, LLC, including its chief executive officer and chief financial officer, we carried out an evaluation of the effectiveness of the design and operation of our company's disclosure controls and procedures pursuant to Rule 13a-14 of the Securities Exchange Act of 1934. Based upon that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this quarterly report.

Internal control over financial reporting. There has been no change in our internal control over financial reporting (as defined in the Securities Exchange Act of 1934 Rules 13a-15(f) and 15d-15(f)) that occurred during our most recent fiscal quarter that has materially affected or is reasonably likely to materially affect, our internal control over financial reporting.

16

Table of ContentsPART II - OTHER INFORMATION:

Item 1. Legal Proceedings

The Sponsor, the World Gold Council, the Trust and BNY, as Trustee of the Trust, have been named as defendants in a civil lawsuit filed by plaintiffs Gemini Diversified Holdings LLC and Dan Ascani in the Supreme Court of the State of New York, County of New York, on November 6, 2003 (Index No. 119243/03). The complaint alleges breach of contract and misappropriation of trade secrets under the Trade Secrets Act of the State of Georgia, and seeks compensatory damages in excess of $450,000, preliminary and permanent injunctive relief, costs and attorneys fees and other relief. The discovery phase of the lawsuit is now concluded and the case is expected to be tried in the summer of 2006. The Sponsor has moved for summary judgment and the motion is pending. The Sponsor believes it has good defenses and, therefore, believes that the outcome of the litigation will not have a material adverse effect on the financial statements of the Trust. The Sponsor and the World Gold Council have agreed to indemnify the Marketing Agent and UBS Securities LLC, as Purchaser in the initial public offering of 2,300,000 Shares, against liabilities arising out of the complaint.

Item 1A. Risk Factors

There have been no material changes in our risk factors since we last reported under Part I, Item 1A, in our Annual Report on Form 10-K for the year ended September 30, 2005.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

As of the date of the formation of the Trust on November 12, 2004, the NAV of the Trust, which represents the value of the gold deposited into the Trust, was $13,081,500, and the NAV per Share was $43.60. Since formation and through March 31, 2006, 1,215 Baskets (121,500,000 Shares) have been created, including 23 Baskets (2,300,000 Shares) issued in connection with the initial public offering of our Shares on November 18, 2004 (Registration No. 333-105202). During the period from October 1, 2005 to March 31, 2006, 465 Baskets (46,500,000 Shares) were created and 10 Baskets (1,000,000 Shares) were redeemed. As of April 30, 2006, 115,900,000 Shares were outstanding and the estimated NAV per Share as determined by the Trustee for April 30, 2006 was $64.03.

Item 3. Defaults Upon Senior Securities

None

Item 4. Submission of Matters to a Vote of Security Holders

None

Item 5. Other Information

None

Item 6. Exhibits and Reports on Form 8-K

|  |

| (a) | Exhibits |

|  |  |

| 31.1 | Certification by Principal Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 31.2 | Certification by Principal Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 32.1 | Certification by Principal Executive Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

17

Table of Contents |  |  |

| 32.2 | Certification by Principal Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|  |

| (b) | Reports on Form 8-K filed during the quarter for which this report is filed: |

None.

18

Table of ContentsSIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

| WORLD GOLD TRUST SERVICES, LLC

Sponsor of the Equity Gold Trust

(Registrant) |

/s/ J. Stuart Thomas

| J. Stuart Thomas

Managing Director

(principal executive officer) |

/s/ James Lowe

| James Lowe

Chief Financial Officer and Treasurer

(principal financial officer and

principal accounting officer) |

Date: May 5, 2006

|  |

| * | The Registrant is a trust and the persons are signing in their capacities as officers of World Gold Trust Services, LLC, the Sponsor of the Registrant. |

18