The Trust’s total gain on gold for the three months ending December 31, 2006 of $5,130 is made up of a gain of $1,373 on the sale of gold to pay expenses plus a gain of $3,757 on gold distributed on the redemption of shares.

The Trust’s total gain on gold for the three months ending December 31, 2005 is made up of a gain of $247 on the sale of gold to pay expenses.

Selected Supplemental Data - For the three months ended December 31, 2006 and for the year ended September 30, 2006.

Results of Operations

In the three months ended December 31, 2006, 22,300,000 shares (223 Baskets) were created in exchange for 2,212,408 ounces of gold including gold receivable (39,668 ounces of gold) and 500,000 shares (5 Baskets) were redeemed in exchange for 49,618 ounces of gold and 13,163 ounces of gold were sold to pay expenses.

As at December 31, 2006 the amount of gold owned by the Trust including gold receivable was 14,572,124 ounces with a market value of $9,263,499,409 (cost − $7,552,854,496). There was no London PM Fix on December 31, 2006. The AM Fix on that date was $635.70. The market value on December 31, 2006 was calculated using the London AM Fix, in accordance with the Trust Indenture.

In the year ended September 30, 2006 68,400,000 shares (684 Baskets) were created in exchange for 6,805,286 ounces of gold and 10,200,000 shares (102 Baskets) were redeemed in exchange for 1,013,631 ounces of gold and 38,409 ounces of gold were sold to pay expenses.

As at September 30, 2006 the amount of gold owned by the Trust was 12,422,497 ounces (there was no gold receivable) with a market value of $7,444,181,626 (cost – $6,200,226,450).

Cash flow from operations

The Trust had no cash flow from operations in the three months ended December 31, 2006, and 2005. Cash received in respect of gold sold to pay expenses in the three months ended December 31, 2006 and 2005 was the same as those expenses, resulting in zero cash balances at December 31, 2006 and at December 31, 2005.

Cash Resources and Liquidity

At December 31, 2006 the Trust did not have any cash balances. When selling gold to pay expenses, the Trustee endeavors to sell the exact amount of gold needed to pay expenses in order to minimize the Trust’s holdings of assets other than gold. As a consequence, we expect that the Trust will not record any cash flow from its operations and that its cash balance will be zero at the end of each reporting period.

Analysis of Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Trust’s shares, investors should understand what the recent movements in the price of gold have been. Investors, however, should also be aware that past movements in the gold price are not indicators of future movements. This section identifies recent trends in the movements of the gold price and discusses some of the important events that have influenced these movements.

14

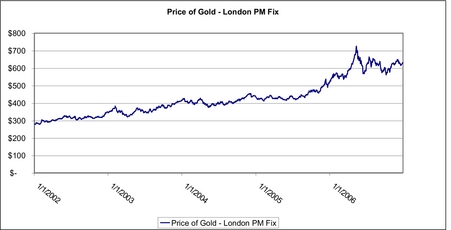

The following chart provides historical background on the price of gold. The chart illustrates movements in the price of gold in US dollars per ounce over the period from January 1, 2002 to December 31, 2006, and is based on the London PM Fix.

Five Year Daily Gold Price ($US/ounce)

The average, high, low and end-of-period gold prices for the period from the inception of the Trust on November 12, 2004, through December 31, 2006, based on the London PM Fix, were:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Period |  |  | Average |  |  | High |  |  | Date |  |  | Low |  |  | Date |  |  | End of

period(1) |

| November 12, 2004 to December 31, 2004 |  |  | $443.59 |  |  | $454.20 |  |  | Dec 2, 2004 |  |  | $434.00 |  |  | Dec 10, 2004 |  |  | $438.00 |

| Three months to March 31, 2005 |  |  | $427.35 |  |  | $443.70 |  |  | Mar 11, 2005 |  |  | $411.10 |  |  | Feb 8, 2005 |  |  | $427.50 |

| Three months to June 30, 2005 |  |  | $427.39 |  |  | $440.55 |  |  | Jun 24, 2005 |  |  | $414.45 |  |  | May 31, 2005 |  |  | $437.10 |

| Three months to September 30, 2005 |  |  | $439.72 |  |  | $473.25 |  |  | Sep 30, 2005 |  |  | $418.35 |  |  | Jul 15, 2005 |  |  | $473.25 |

| Three months to December 31, 2005 |  |  | $484.20 |  |  | $536.50 |  |  | Dec 12, 2005 |  |  | $456.50 |  |  | Nov 7, 2005 |  |  | $513.00 |

| Three months to March 31, 2006 |  |  | $554.07 |  |  | $584.00 |  |  | Mar 30, 2006 |  |  | $524.75 |  |  | Jan 5, 2006 |  |  | $582.00 |

| Three months to June 30, 2006 |  |  | $627.71 |  |  | $725.00 |  |  | May 12, 2006 |  |  | $567.00 |  |  | Jun 20, 2006 |  |  | $613.50 |

| Three months to September 30, 2006 |  |  | $621.67 |  |  | $663.25 |  |  | Jul 14, 2006 |  |  | $573.60 |  |  | Sep 15, 2006 |  |  | $599.25 |

| Three months to December 31, 2006 |  |  | $613.21 |  |  | 648.75 |  |  | Dec 1, 2006 |  |  | $560.75 |  |  | Oct 6, 2006 |  |  | $635.70 |

| November 12, 2004 to December 31, 2006 |  |  | $519.27 |  |  | $725.00 |  |  | May 12, 2006 |  |  | $411.10 |  |  | Feb 8, 2005 |  |  | $635.70 |

| Twelve months ended December 31, 2005 |  |  | $444.45 |  |  | $536.50 |  |  | Dec 12, 2005 |  |  | $411.10 |  |  | Feb 8, 2005 |  |  | $513.00 |

| Twelve months ended December 31, 2006 |  |  | $603.77 |  |  | $725.00 |  |  | May 12, 2006 |  |  | $524.75 |  |  | Jan 5, 2006 |  |  | $635.70 |

|

|  |

| (1) | There was no London PM Fix on December 31, 2004, 2005 and 2006. The London AM Fix on these dates was $438.00, $513.00 and $635.70, respectively. The Net Asset Value of the Trust on December 31, 2004, 2005 and 2006 was calculated using the London AM Fix, in accordance with the Trust Indenture. |

The upward price trend that has been in place since 2001 has continued for much of the period since the inception of the Trust on November 12, 2004. In 2006, after reaching a peak of $725 at the London PM Fix on May 12, gold corrected down to a low for the second quarter of $567 at the PM

15

Fix on June 20. The reason most often cited for the correction was a concern among investors that monetary authorities, especially in the U.S., would move to counter the threat of rising inflation by aggressively raising interest rates. The price subsequently recovered to $635.70 by the end of 2006. The average for the three months to December 31, 2006, was $613.21.

Cautionary Statement Regarding Forward-Looking Information and Risk Factors

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are predictions and actual events or results may differ materially from those expressed in our forward-looking statements. Risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements. These uncertainties and other factors include, but are not limited to, the following:

The value of the shares relates directly to the value of the gold held by the Trust and fluctuations in the price of gold could materially adversely affect an investment in the shares.

The Shares are designed to mirror as closely as possible the price of gold bullion, and the value of the Shares relates directly to the value of the gold held by the Trust, less the Trust’s liabilities (including estimated accrued but unpaid expenses). The price of gold has fluctuated widely over the past several years. Several factors may affect the price of gold, including:

|  |

| • | Global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries such as South Africa, the United States and Australia; |

|  |

| • | Investors’ expectations with respect to the rate of inflation; |

|  |

| • | Currency exchange rates; |

|  |

| • | Interest rates; |

|  |

| • | Investment and trading activities of hedge funds and commodity funds; and |

|  |

| • | Global or regional political, economic or financial events and situations. |

In addition, investors should be aware that there is no assurance that gold will maintain its long term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately.

The sale of gold by the Trust to pay expenses reduces the amount of gold represented by each share on an ongoing basis irrespective of whether the trading price of the shares rises or falls in response to changes in the price of gold.

Each outstanding Share represents a proportional interest in the gold held by the Trust. As the Trust does not generate any income and as the Trust regularly sells gold over time to pay for its ongoing expenses, the amount of gold represented by each Share has gradually declined over time. This is true even if additional Shares are issued in exchange for additional deposits of gold into the Trust, as the amount of gold required to create Shares will proportionately reflect the amount of gold represented by the Shares outstanding at the time of creation. Assuming a constant gold price, the trading price of the Shares is expected to gradually decline relative to the price of gold as the amount of gold represented by the Shares gradually declines.

Investors should be aware that the gradual decline in the amount of gold represented by the Shares will occur regardless of whether the trading price of the Shares rises or falls in response to changes in the price of gold.

Readers are urged to review the Risk Factors section contained in the Trust’s annual report on Form 10-K for a description of other risks and uncertainties that may affect an investment in our shares.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

16

Item 4. Controls and Procedures

Disclosure controls and procedures. Under the supervision and with the participation of the Sponsor, World Gold Trust Services, LLC, including its chief executive officer and chief financial officer, we carried out an evaluation of the effectiveness of the design and operation of our company’s disclosure controls and procedures. Based upon that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this quarterly report.

Internal control over financial reporting. There has been no change in our internal control over financial reporting that occurred during our most recent fiscal quarter that has materially affected or is reasonably likely to materially affect, our internal control over financial reporting.

17

PART II - OTHER INFORMATION:

Item 1. Legal Proceedings

The Sponsor, the WGC, the Trust and the Trustee, as Trustee of the Trust, were named as defendants in a civil lawsuit filed by plaintiffs Gemini Diversified Holdings LLC and Dan Ascani in the Supreme Court of the State of New York, County of New York (Index No. 119243/03). The complaint alleged breach of contract and misappropriation of trade secrets under the Trade Secrets Act of the State of Georgia. In December 2006, the lawsuit was dismissed.

Item 1A. Risk Factors

There have been no material changes in our risk factors since we last reported under Part I, Item 1A, in our Annual Report on Form 10-K for the year ended September 30, 2006.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

As of the date of the formation of the Trust on November 12, 2004, the NAV of the Trust, which represents the value of the gold deposited into the Trust, was $13,081,500, and the NAV per Share was $43.60. Since formation and through December 31, 2006, 1,657 Baskets (165,700,000 Shares) have been created, including 23 Baskets (2,300,000 Shares) issued in connection with the initial public offering of our Shares on November 18, 2004 (Registration No. 333-105202). As of January 31, 2007, 147,000,000 Shares were outstanding and the estimated NAV per Share as determined by the Trustee for January 31, 2007 was $64.49.

Item 3. Defaults Upon Senior Securities

None

Item 4. Submission of Matters to a Vote of Security Holders

None

Item 5. Other Information

On February 6, 2007, Mr. J. Stuart Thomas resigned as Managing Director of World Gold Trust Services, LLC, the sponsor of the Trust, and Mr. James E. Burton, Chief Executive Officer of the World Gold Council, was appointed to succeed Mr. Thomas as Managing Director.

The opening of trading in the Shares on the New York Stock Exchange will be changed from 9:30 a.m. to 8:20 a.m., effective Friday, February 9, 2007. The earlier opening will allow investors to start trading the Shares at the same time that trading in COMEX® gold futures and gold options commences at the New York Mercantile Exchange Inc.

Item 6. Exhibits and Reports on Form 8-K

|  |

| (a) | Exhibits |

|  |  |

| 31.1 | Certification by Principal Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 31.2 | Certification by Principal Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 32.1 | Certification by Principal Executive Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 32.2 | Certification by Principal Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|  |

| (b) | Reports on Form 8-K filed during the quarter for which this report is filed: |

None.

18

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

| WORLD GOLD TRUST SERVICES, LLC

Sponsor of the Equity Gold Trust

(Registrant) |

/s/ James E. Burton

| James E. Burton

Managing Director

(principal executive officer) |

/s/ James Lowe

| James Lowe

Chief Financial Officer and Treasurer

(principal financial officer and

principal accounting officer) |

Date: February 9, 2007

|  |

| * | The Registrant is a trust and the persons are signing in their capacities as officers of World Gold Trust Services, LLC, the Sponsor of the Registrant. |

19