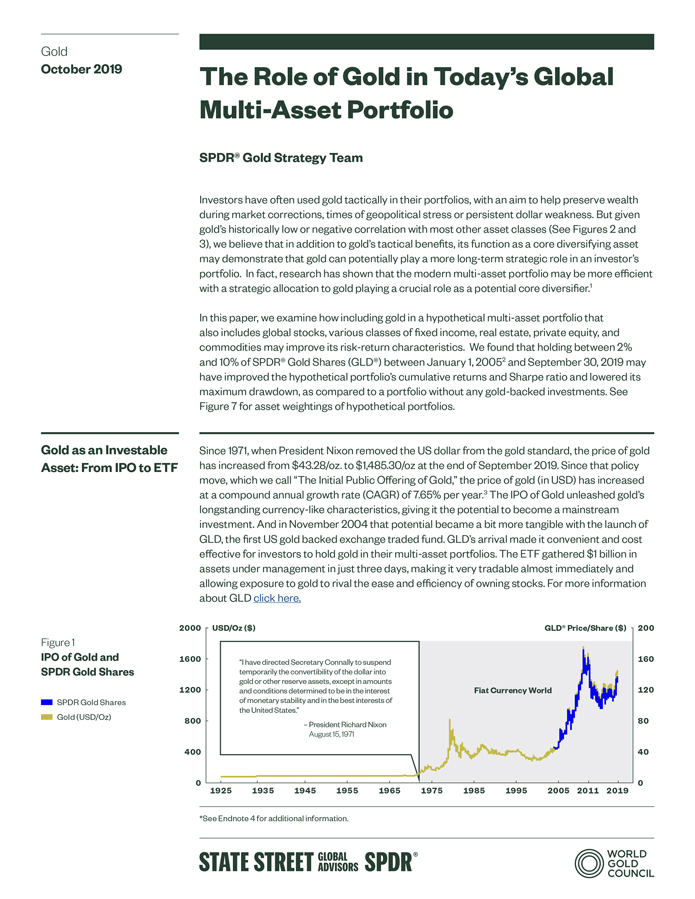

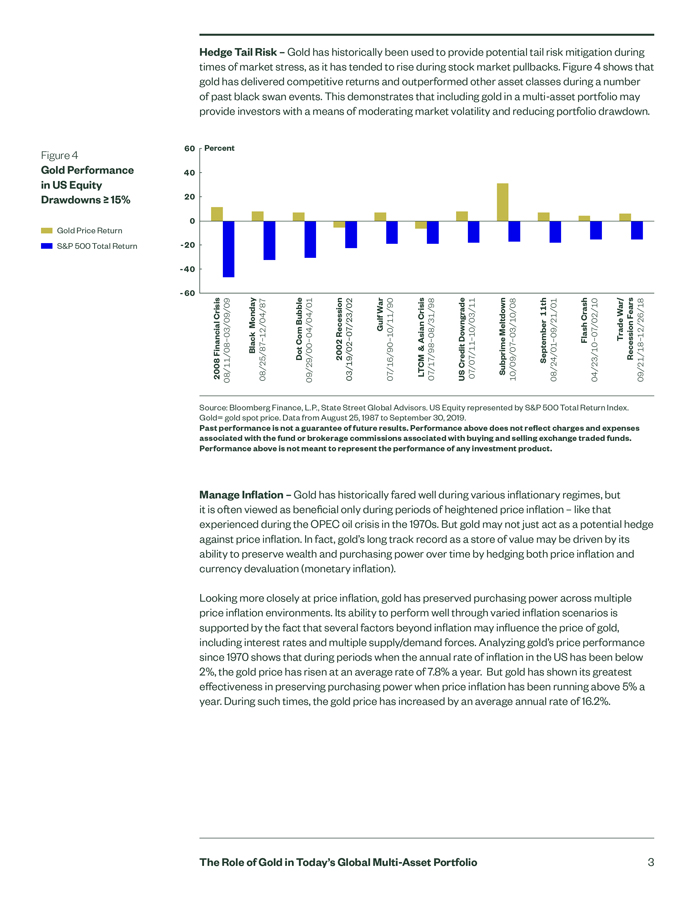

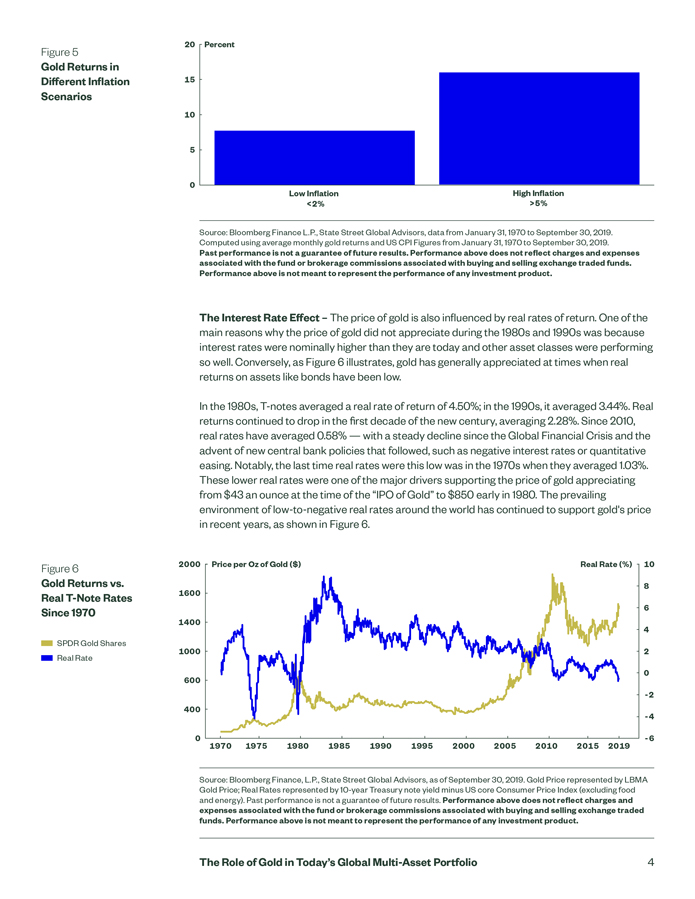

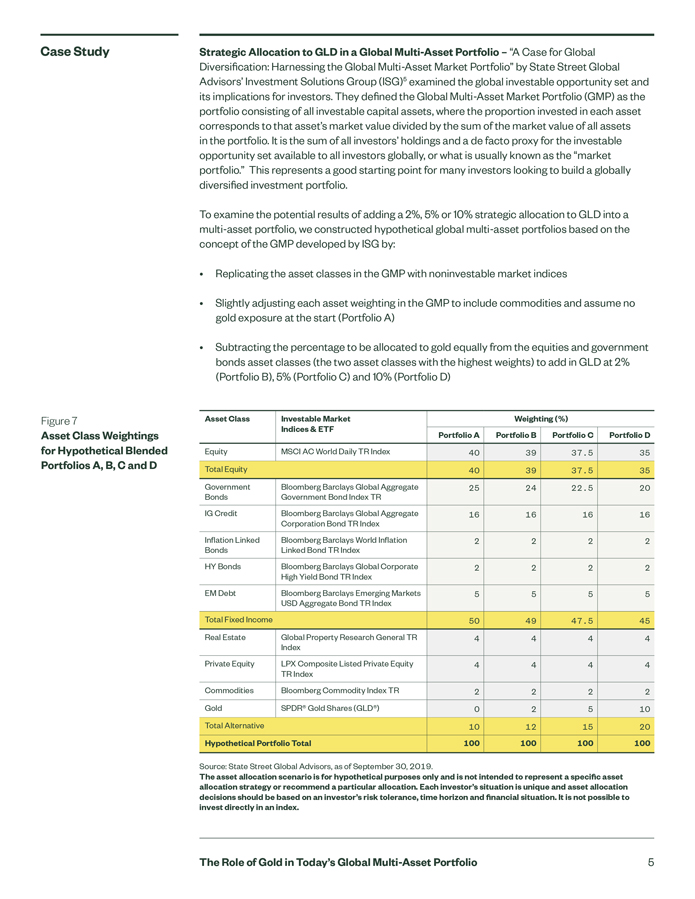

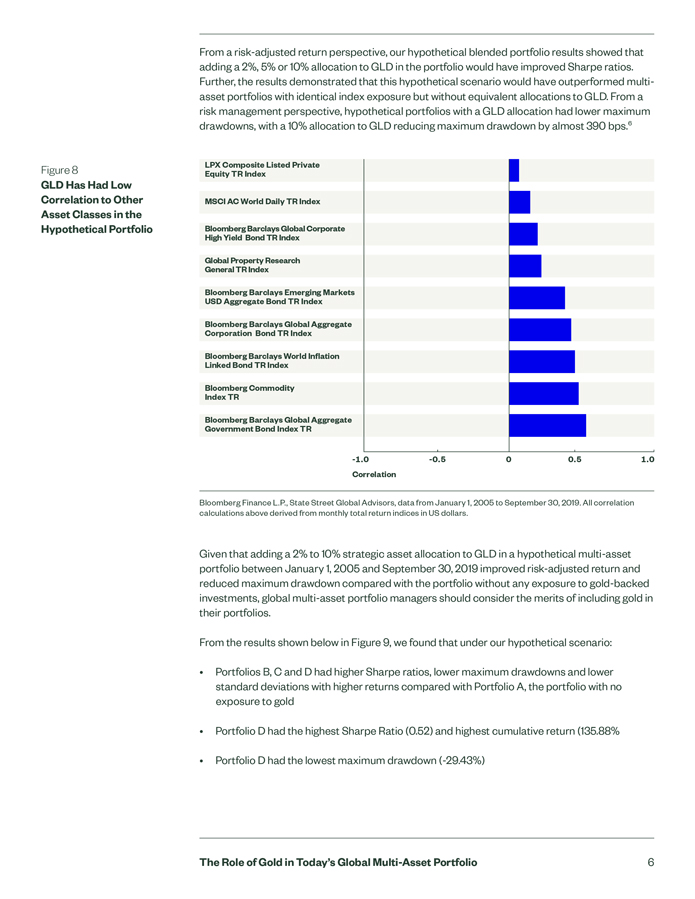

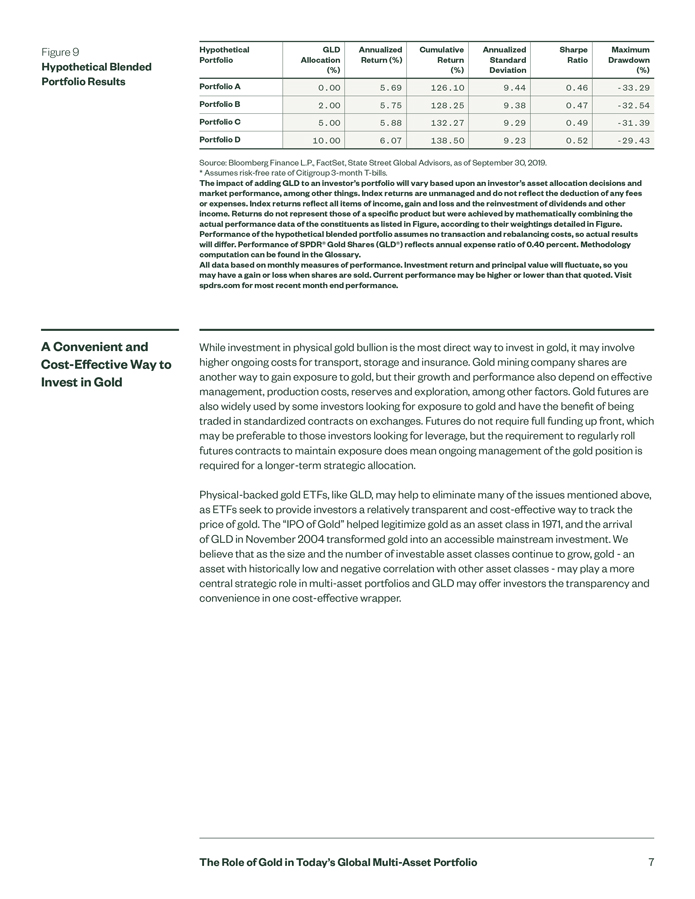

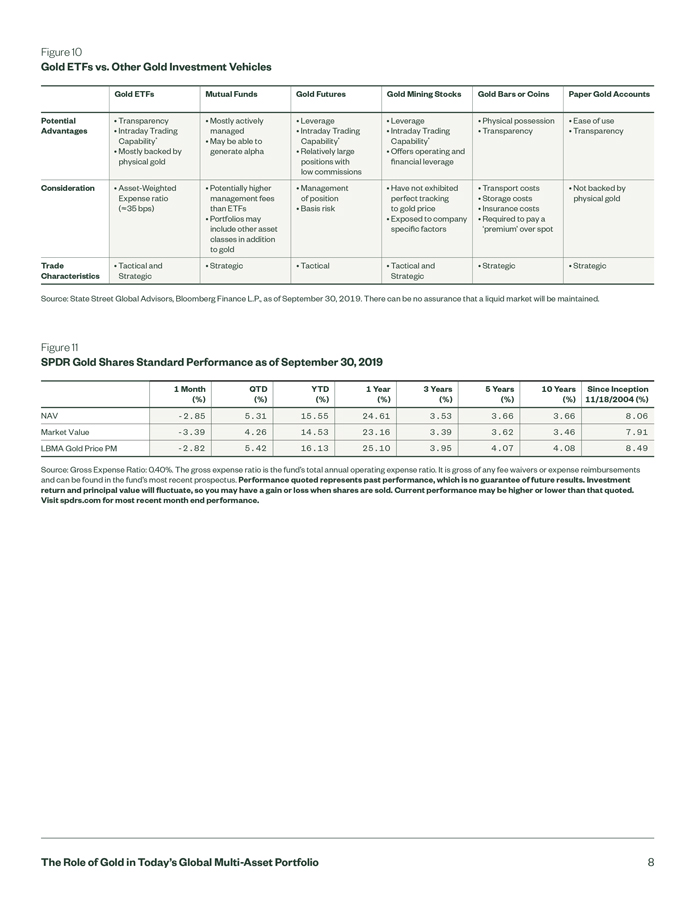

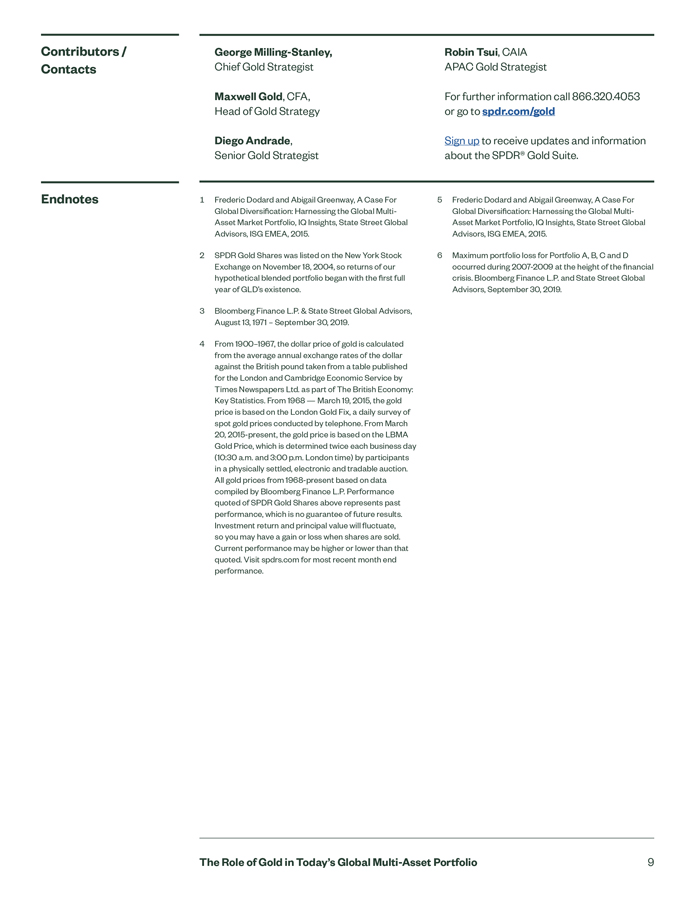

ssga.com spdrs.com Glossary Bloomberg Barclays U.S. Aggregate Bond Index A benchmark that provides a measure of the performance of the US dollar denominated investment grade bond market, which includes investment grade government bonds, investment grade corporate bonds, mortgage pass through securities, commercial mortgage backed securities. Bloomberg Barclays U.S. Treasury Bond Index A benchmark of US dollar denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. Bloomberg Commodity Index A broadly diversified commodity price index distributed by Bloomberg Indexes that tracks 22 commodity futures and seven sectors. No one commodity can compose less than 2 percent or more than 15 percent of the index, and no sector can represent more than 33 percent of the index. Brexit An abbreviation of the term “British Exit” referring to the UK referendum on June 23, 2016 that resulted in the country’s decision to withdraw from the European Union. CPI, or Consumer Price Index A widely used measure of inflation at the consumer level that helps to evaluate changes in cost of living. Debt Ceiling Crisis A contentious debate in July 2011 regarding the maximum amount of money that the US government should be allowed to borrow. Congress did end up immediately raising the “debt ceiling” by $400 billion, from $14.3 trillion to $14.7 trillion, with the possibility of future increases included in the agreement as well, but the contentious nature of the debate led Standard and Poor’s to downgrade the US’ credit rating from AAA to AA+, even though the U.S. did not default. Fiat Currency Currency that a government declares to be legal tender, but that it is not backed by a physical commodity. The value of fiat money is linked to supply and demand rather than the value of the material that the money is made of, such as gold or silver historically. Fiat money’s value is instead based solely on the faith and credit of the economy. Global Financial Crisis The economic crisis that occurred from 2007-2009 that is generally considered biggest economic challenge since the Great Depression of the 1930s. The GFC was triggered largely by the sub-prime mortgage crisis, which led to the collapse of systemically vital US investment banks such as Lehman Brothers. The crisis began with the collapse of two Bear Stearns hedge funds in June 2007, and the stabilization period began in late 2008 and continued until the end of 2009. Global Property Research General Index A broad-based global real estate benchmark that contains all listed real estate companies that conform to General Property Research’s index-qualification rules, bringing the number of index constituents to more than 650. The index’s inception date was Dec. 31 1983. Gold Standard A monetary standard under which the basic unit of currency is defined by a stated quantity of gold. In 1971 US President Richard Nixon ended the ability to convert US dollars into gold at the fixed price of $35 per ounce. LBMA Gold Price The LBMA Gold Price is determined twice each business day 10:30 a.m. London time (i.e., the LBMA Gold Price AM) and 3:00 p.m. London time (i.e., the LBMA Gold Price PM) by the participants in a physically settled, electronic and tradable auction. LPX Composite Listed Private Equity Index A broad global listed private equity index whose number of constituents is not limited. The LPX Composite includes all major private equity companies listed on global stock exchanges that fulfils the index provider’s liquidity criteria. The index composition is well diversified across listed private equity categories, styles, regions and vintage years. The index has two versions: a price index (PI) and a total return index (TR) that includes all payouts. MSCI ACWI Index, or MSCI All Country World Index A free-float weighted global equity index that includes companies in 23 emerging market countries and 23 developed market countries and is designed to be a proxy for most of the investable equities universe around the world. Real Rate of Return The return realized on an investment, usually expressed annually as a percentage, which is adjusted to reflect the effects of inflation or other external factors, on the so-called nominal return. The real rate of return is calculated as follows: Real Rate of Return = Nominal Interest Rate Inflation. Sharpe Ratio A measure for calculating risk-adjusted returns that has become the industry standard for such calculations. It was developed by Nobel laureate William F. Sharpe. The Sharpe ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. The higher the Sharpe ratio the better. Sovereign Debt Crisis A period of time beginning in 2008 when several European countries on the periphery of the Eurozone became unable to repay or refinance government debt or bail out banks without the assistance of the European Central Bank and the International Monetary Fund. It was brought to heel in July 2012 with the ECB’s pledge to save the euro and the Eurozone at all costs. While the crisis began with the collapse of Icelandic and Irish banks, it became largely focused on southern European countries mainly Greece, but also Spain, Portugal and even Italy. Standard Deviation A statistical measure of volatility that quantifies the historical dispersion of a security, fund or index around an average. Investors use standard deviation to measure expected risk or volatility, and a higher standard deviation means the security has tended to show higher volatility or price swings in the past. As an example, for a normally distributed return series, about two-thirds of the time returns will be within 1 standard deviation of the average return. Hypothetical Blended Portfolio Performance Methodology Returns shown in Figure 9 do not represent those of a fund but were achieved by mathematically combining the actual performance data of MSCI AC World Daily TR Index, Bloomberg Barclays Global Aggregate Government Bond Index, Bloomberg Barclays Aggregate Global Corporate Bond Index, Bloomberg Barclays Emerging Markets Debt Index, Global Property Research General Index, S&P Listed Private Equity Index, Bloomberg Barclays World Inflation Linked Bond Index, Bloomberg Barclays Global Corporate High Yield Index, S&P GSCI Index, and SPDR® Gold Shares (GLD®) between January 1, 2005 and September 30, 2019. Each portfolio is re-balanced at the beginning of each year to maintain target portfolio weights. The performance assumes no transaction and rebalancing costs, so actual results will differ. It is not possible to invest directly in an index. Performance of GLD reflects annual expense ratio of 0.40%. The impact of adding GLD to an investor’s portfolio will vary based upon an investor’s asset allocation decisions and market performance, among other things. Disclosure The views expressed in this material are the views of the SPDR® Gold Strategy Team and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The information provided does not constitute investment advice and it should not be relied on as such. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor. There is no representation or warranty as to the accuracy of the information and State Street shall have no liability for decisions based on such information. Government bonds and corporate bonds generally have more moderate short-term price fluctuations than stocks, but provide lower potential long-term returns. Foreign investments involve greater risks than US investments, including political and economic risks and the risk of currency fluctuations, all of which may be magnified in emerging markets. Asset Allocation is a method of diversification which positions assets among major investment categories. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Diversification does not ensure a profit or guarantee against loss. Investments in small-sized companies may involve greater risks than in those of larger, better known companies. Equity securities may fluctuate in value in response to the activities of individual companies and general market and economic conditions. Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. International Government bonds and corporate bonds generally have more moderate short-term price fluctuations than stocks, but provide lower potential long-term returns. Increase in real interest rates can cause the price of inflation-protected debt securities to decrease. Interest payments on inflation-protected debt securities can be unpredictable. Investing in high yield fixed income securities, otherwise known as junk bonds, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Investing in futures is highly risky. Futures positions are considered highly leveraged because the initial margins are significantly smaller than the cash value of the contracts. The smaller the value of the margin in comparison to the cash value of the futures contract, the higher the leverage. There are a number of risks associated with futures investing including but not limited to counterparty credit risk, currency risk, derivatives risk, foreign issuer exposure risk, sector concentration risk, leveraging and liquidity risks. Derivative investments may involve risks such as potential illiquidity of the markets and additional risk of loss of principal. The use of leverage, as part of the investment process, can multiply market movements into greater changes in an investment’s value, thus The Role of Gold in Today’s Global Multi-Asset Portfolio 10