Filed Pursuant To Rule 433

RegistrationNo. 333-233191

October 8, 2019

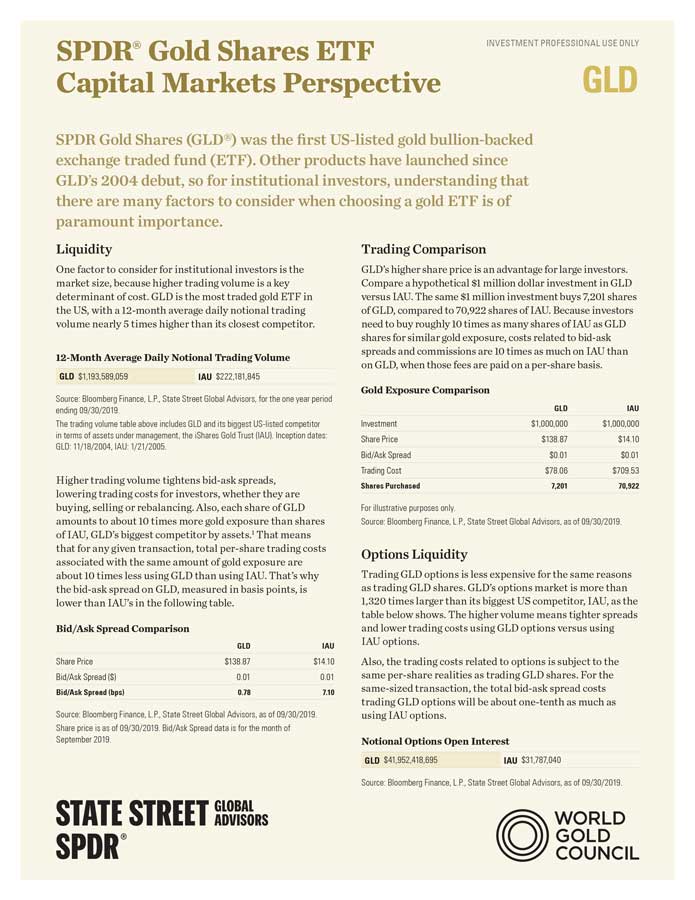

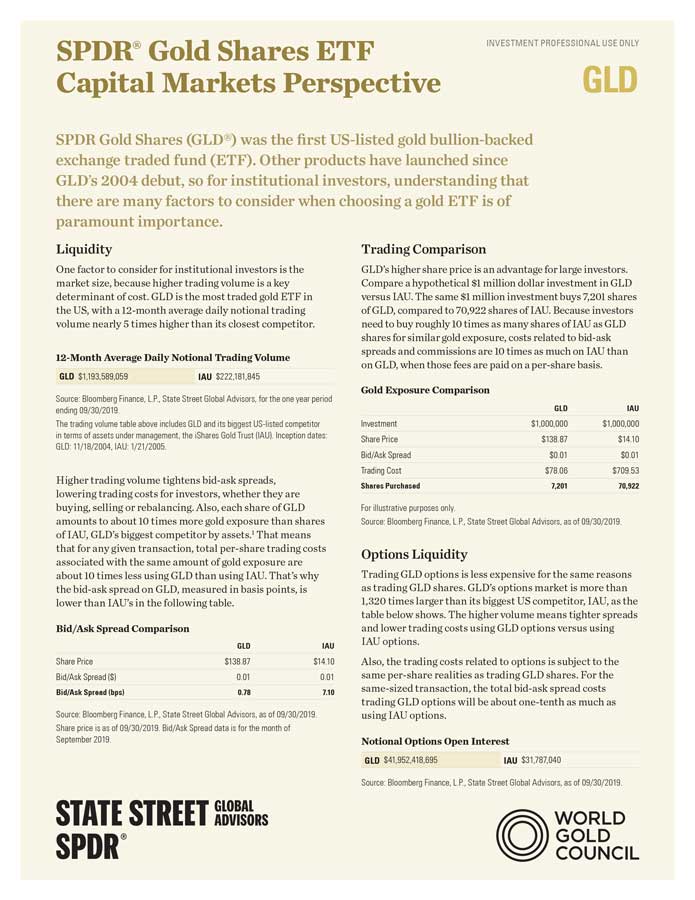

GLD SPDR® Gold Shares ETF Capital Markets Perspective SPDR Gold Shares (GLD®) was the firstUS-listed gold bullion-backed exchange traded fund (ETF). Other products have launched since GLD’s 2004 debut, so for institutional investors, understanding that there are many factors to consider when choosing a gold ETF is of paramount importance. Liquidity One factor to consider for institutional investors is the market size, because higher trading volume is a key determinant of cost. GLD is the most traded gold ETF in the US, with a12-month average daily notional trading volume nearly 5 times higher than its closest competitor. Higher trading volume tightensbid-ask spreads, lowering trading costs for investors, whether they are buying, selling or rebalancing. Also, each share of GLD amounts to about 10 times more gold exposure than shares of IAU, GLD’s biggest competitor by assets.1 That means that for any given transaction, totalper-share trading costs associated with the same amount of gold exposure are about 10 times less using GLD than using IAU. That’s why thebid-ask spread on GLD, measured in basis points, is lower than IAU’s in the following table. Trading Comparison GLD’s higher share price is an advantage for large investors. Compare a hypothetical $1 million dollar investment in GLD versus IAU. The same $1 million investment buys 7,201 shares of GLD, compared to 70,922 shares of IAU. Because investors need to buy roughly 10 times as many shares of IAU as GLD shares for similar gold exposure, costs related tobid-ask spreads and commissions are 10 times as much on IAU than on GLD, when those fees are paid on aper-share basis. Options Liquidity Trading GLD options is less expensive for the same reasons as trading GLD shares. GLD’s options market is more than 1,320 times larger than its biggest US competitor, IAU, as the table below shows. The higher volume means tighter spreads and lower trading costs using GLD options versus using IAU options. Also, the trading costs related to options is subject to the sameper-share realities as trading GLD shares. For thesame-sized transaction, the totalbid-ask spread costs trading GLD options will be aboutone-tenth as much as using IAU options.12-Month Average Daily Notional Trading Volume GLD $1,193,589,059 IAU $222,181,845 Source: Bloomberg Finance, L.P., State Street Global Advisors, for the one year period ending 09/30/2019. The trading volume table above includes GLD and its biggestUS-listed competitor in terms of assets under management, the iShares Gold Trust (IAU). Inception dates: GLD: 11/18/2004, IAU: 1/21/2005.