Critical Accounting Policy

Valuation of Gold, Definition of NAV

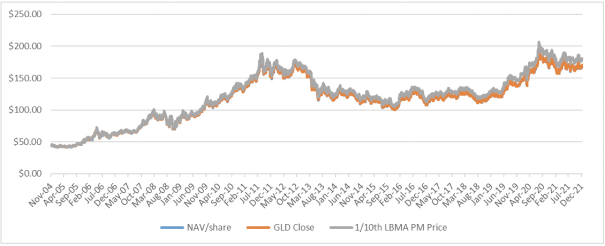

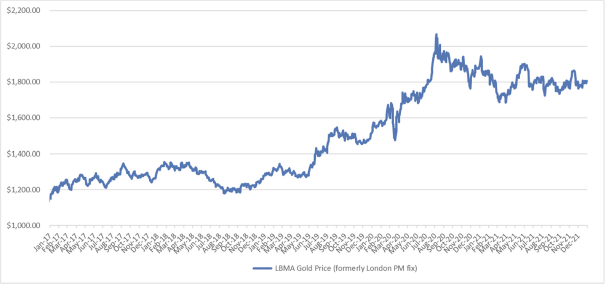

The Trustee values the gold held by the Trust and determines the NAV of the Trust as of the LBMA Gold Price PM on each day that the NYSE Arca is open for regular trading, at the earlier of the LBMA Gold Price PM for the day or 12:00 PM New York time. If no LBMA Gold Price PM is announced on a particular evaluation day or if the LBMA Gold Price PM has not been announced by 12:00 PM New York time on a particular evaluation day, the next most recent LBMA Gold Price (AM or PM) is used in the determination of the NAV of the Trust, unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for such determination. In the event the Trustee and the Sponsor determine that such price is not an appropriate basis for valuation of the Trust’s gold, they will identify an alternative basis for such valuation to be employed by the Trustee. While we believe that the LBMA Gold Price is an appropriate indicator of the value of gold, there are other indicators that are available that could be different than the LBMA Gold Price. The use of such an alternative indicator could result in materially different fair value pricing of the gold in the Trust which could result in different market adjustments or redemption value adjustments of our outstanding redeemable Shares.

Once the value of the gold has been determined, the Trustee subtracts all estimated accrued fees, expenses and other liabilities of the Trust from the total value of the gold and all other assets of the Trust (other than any amounts credited to the Trust’s reserve account, if established). The resulting figure is the NAV of the Trust. The Trustee determines the NAV per Share by dividing the NAV of the Trust by the number of Shares outstanding as of the close of trading on NYSE Arca.

Inspectorate International Limited (“Inspectorate”) conducts two counts each year of the gold bullion held on behalf of the Trust at the vaults of the Custodian. A complete bar count is conducted once per year and coincides with the Trust’s financial year end at September 30

th

. On October 5, 2021, Inspectorate concluded the annual full count of the Trust’s gold bullion held by the Custodian. The second count is a random sample count and is conducted at a date which falls within the same financial year and was conducted most recently on April 16, 2021. The results can be found on

www.spdrgoldshares.com

. The Sponsor generally visits the vaults of the Custodian twice a year as part of its due diligence procedures.

In the three months ended December 31, 2021, an additional 9,600,000 Shares (96 Baskets) were created in exchange for 897,188.8 ounces of gold, 14,200,000 Shares (142 Baskets) were redeemed in exchange for 1,327,131.5 ounces of gold, and 31,886.1 ounces of gold were sold to pay expenses.

At December 31, 2021, the amount of gold owned by the Trust and held by the Custodian in its vault was 31,368,572 ounces, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $57,093,938,097 based on the LBMA Gold Price AM on December 31, 2021 (cost—$48,753,564,928).

At September 30, 2021, the amount of gold owned by the Trust and held by the Custodian in its vault was 31,830,401 ounces, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $55,474,022,504 based on the LBMA Gold Price PM on September 30, 2021 (cost—$49,227,343,846).

Cash Resources and Liquidity

At December 31, 2021, the Trust did not have any cash balances. When selling gold to pay expenses, the Trustee endeavors to sell the exact amount of gold needed to pay expenses in order to minimize the Trust’s holdings of assets other than gold. As a consequence, we expect that the Trust will not record any net cash flow from its operations and that its cash balance will be zero at the end of each reporting period.