and the price of the Shares. In addition, the conflict in Ukraine, along with global political fallout and implications including sanctions, shipping disruptions, collateral war damage, and a potential expansion of the conflict beyond Ukraine’s borders, could disturb the gold market.

War and other geopolitical events in eastern Europe, including but not limited to Russia and Ukraine, may cause volatility in commodity prices including precious metals prices. These events are unpredictable and may lead to extended periods of price volatility. To date, the impact of the conflict in Ukraine, including the regulatory responses to such conflict, have not materially affected the operations of the Trust and have not materially impacted the price of gold or the share price of the Trust.

Results of Operations

In the three months ended June 30, 2022, an additional 25,900,000 Shares (259 Baskets) were created in exchange for 2,415,876.5 ounces of gold, 39,700,000 Shares (397 Baskets) were redeemed in exchange for 3,702,812.2 ounces of gold, and 35,368.8 ounces of gold were sold to pay expenses.

At June 30, 2022, the amount of gold owned by the Trust and held by the Custodian in its vault was 33,898,942 ounces, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $61,594,419,304 based on the LBMA Gold Price PM on June 30, 2022 (cost—$55,048,557,435).

At September 30, 2021, the amount of gold owned by the Trust and held by the Custodian in its vault was 31,830,401 ounces, 100% of which is allocated gold in the form of London Good Delivery gold bars with a market value of $55,474,022,504 based on the LBMA Gold Price PM on September 30, 2021 (cost—$49,227,343,846).

Cash Resources and Liquidity

At June 30, 2022, the Trust did not have any cash balances. When selling gold to pay expenses, the Trustee endeavors to sell the exact amount of gold needed to pay expenses in order to minimize the Trust’s holdings of assets other than gold. As a consequence, we expect that the Trust will not record any net cash flow from its operations and that its cash balance will be zero at the end of each reporting period.

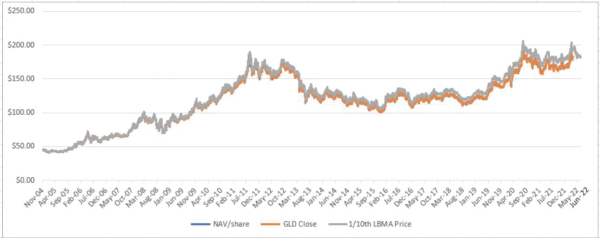

Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Trust’s Shares, investors should understand what the recent movements in the price of gold have been. Investors, however, should also be aware that past movements in the gold price are not indicators of future movements.

14