QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Maine & Maritimes Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | 209 State Street

PO Box 789

Presque Isle, ME 04769-0789 |

April 1, 2004

Dear Stockholder,

We are pleased to invite you to our Annual Meeting of Stockholders to be held Tuesday, May 11, 2004, at 9:30 a.m. (Eastern Daylight Time). The meeting will be held at the Northern Maine Community College, Edmunds Conference Center, 33 Edgemont Drive, Presque Isle, Maine 04769. Directions are on the back cover of this Proxy Statement.

This year's Annual Meeting and enclosed Proxy will include the election of Directors and a proposal to amend the Company's Articles of Incorporation to increase the Director election age limitation. Our Board of Directors and Management recommend shareholder approval to amend the Company's Articles of Incorporation to increase the director age limitation from the current 67 and 75 year requirements to a single 78 year limitation. It has been our experience that as a rural, small, publicly traded company, expanding our universe of qualified board candidates is essential to our corporate well-being. We believe effective corporate governance is highly dependent upon the Company's continuing ability to recruit and retain experienced, contributory, and qualified members to the Board. In today's changing demographic climate, we also strongly believe that age should not be a limiting criterion for Board membership. Rather, we believe the criteria for Board eligibility should be based on an individual's commitment, expertise, involvement, contributions, and integrity. We do not believe that age limitations set in a previous era should be a limiting edict for future Board nominations.

Every vote is important. Approval of Proposal (2) requires the favorable vote of more than one half of our outstanding common shares. If you do not send in your Proxy, and/or do not vote in person at the meeting, that will have the effect of a vote "against" the proposal to amend the Articles of Incorporation. We ask that you please vote your Proxy—even if you are planning to attend the meeting.

We thank you in advance for voting and sending in your Proxy.

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS DETERMINED IF THIS PROXY STATEMENT IS ACCURATE OR ADEQUATE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

MAINE & MARITIMES CORPORATION

209 STATE STREET, PO BOX 789

PRESQUE ISLE, MAINE 04769-0789

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY 11, 2004

April 1, 2004

To the Common Stockholders of

MAINE & MARITIMES CORPORATION

Notice is hereby given that the Annual Meeting of the Stockholders of Maine & Maritimes Corporation ("MAM" or the "Company") will be held at the Northern Maine Community College, Edmunds Conference Center, 33 Edgemont Drive, Presque Isle, Maine on Tuesday, May 11, 2004, at 9:30 a.m. (Eastern Daylight Time), for the following purposes:

- 1.

- To consider and act upon a proposal by the Board of Directors of MAM to approve Proposal (1), to elect three members of the Board of Directors to serve until the Annual Meeting of the Stockholders in 2007, or until their successors are elected and qualified; and

- 2.

- To consider and act upon a proposal by the Board of Directors of MAM to approve Proposal (2), amending the Company's Articles of Incorporation to increase the age a Director may stand for election to 78, consistent with the provisions of the Company's By-laws.

Further information regarding voting rights and the business to be transacted at the meeting is given in the annexed Proxy Statement.

By order of the Board of Directors,

Scott L. Sells, Secretary

YOUR VOTE IS VERY IMPORTANT TO US. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE ACT PROMPTLY TO VOTE YOUR SHARES. YOU MAY VOTE YOUR SHARES BY MARKING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE RETURN ENVELOPE PROVIDED. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE YOUR SHARES IN PERSON, EVEN IF YOU HAVE PREVIOUSLY SUBMITTED A PROXY IN WRITING.

This Proxy Statement is dated March 26, 2004 and is first being mailed to stockholders on April 1, 2004.

TABLE OF CONTENTS

| | PAGE

|

|---|

| WHERE YOU CAN FIND MORE INFORMATION | | 1 |

| THE ANNUAL STOCKHOLDERS MEETING | | 3 |

| | Adjournments | | 3 |

| | Common Stock Outstanding and Voting Rights | | 4 |

| | Security Ownership by Management | | 5 |

PROPOSAL (1) ELECTION OF DIRECTORS |

|

6 |

| | Nominees and Current Directors | | 7 |

| | Directors and Committee Meetings | | 10 |

| | Business Relationships with Directors | | 13 |

| | Audit Committee Report | | 13 |

| | Audit Fees | | 13 |

| | Audit Related Fees | | 13 |

| | Tax Fees | | 14 |

| | All Other Fees | | 14 |

| | Executive Compensation | | 14 |

| | Stock Option Plan | | 16 |

| | Retirement Plan | | 17 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 18 |

| | Directors' Compensation | | 19 |

| | Performance and Compensation Committee Interlocks and Insider Participation | | 19 |

| | Performance and Compensation Committee Report on Executive Compensation | | 20 |

| | Independent Public Accountants | | 28 |

| | Shareholder Communications with the Board of Directors | | 28 |

| | Board Members' Attendance at Annual Meetings | | 28 |

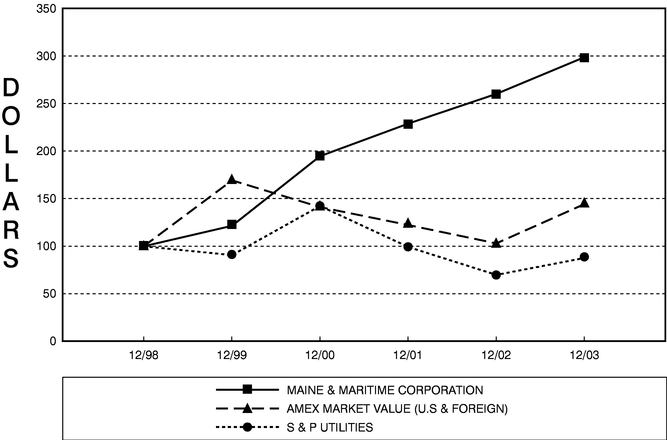

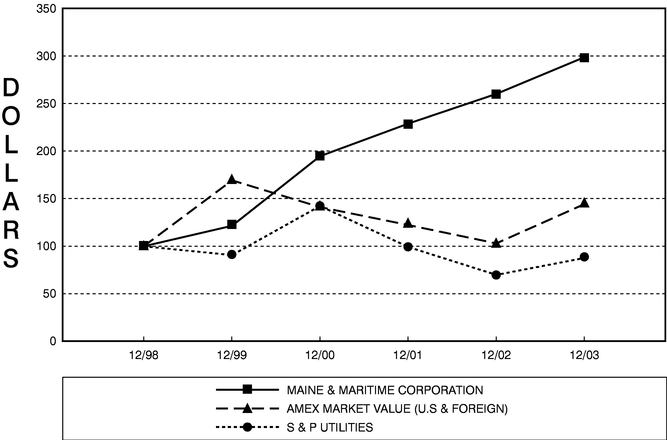

| | Corporate Performance Graph | | 29 |

PROPOSAL (2) AMENDING THE COMPANY CHARTER TO INCREASE THE DIRECTOR ELECTION AGE LIMITATION |

|

30 |

| OTHER MATTERS | | 31 |

| STOCKHOLDER PROPOSALS FOR THE NEXT ANNUAL MEETING | | 31 |

| ADDITIONAL INFORMATION TO STOCKHOLDERS | | 31 |

| DISCRETIONARY AUTHORITY | | 31 |

| VOTING BY PROXY | | 31 |

APPENDIX A: AUDIT COMMITTEE CHARTER |

|

32 |

| APPENDIX A1: PRE-APPROVAL OF AUDIT FIRM SERVICES | | 36 |

| APPENDIX B: GOVERNANCE COMMITTEE CHARTER | | 39 |

| APPENDIX C: PERFORMANCE AND COMPENSATION COMMITTEE CHARTER | | 42 |

| APPENDIX D: PROPOSED AMENDED AND RESTATED ARTICLES OF INCORPORATION | | 44 |

i

WHERE YOU CAN FIND MORE INFORMATION

MAM files annual, quarterly and current reports, and proxy statements and other information with the U.S. Securities and Exchange Commission (the "SEC"). You may read and copy any of the materials the Company files at the SEC's public reference room located at: Public Reference Room, Judiciary Plaza, 450 Fifth Street, N.W., Room 1024, Washington, D.C. 20549.

Information on the operation of the SEC's public reference room can be obtained by calling the SEC at 1-800-SEC-0330. You may also obtain copies of this material from the public reference section of the Securities and Exchange Commission, located at Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates. The SEC filings of MAM are also available to the public from commercial document retrieval services, over the Internet at the SEC's web site athttp://www.sec.gov and at the MAM web site athttp://www.maineandmaritimes.com by selecting "SEC Filings" under the "Investor Relations" option located at that web site.

MAM's Common Stock is listed on the American Stock Exchange, and reports, proxy statements and other information concerning MAM can also be inspected at the offices of that securities exchange located at the American Stock Exchange, 86 Trinity Place, New York, NY 10006.

The SEC allows the Company to incorporate by reference previously filed information into its Proxy Statement. This means that we can disclose important information to you by incorporating information in another document filed separately with the SEC and referring you to that document without having to reproduce the text in its entirety. The information incorporated by reference is deemed to be part of this Proxy Statement, except for any information superseded by information in this Proxy Statement. This Proxy Statement incorporates by reference the documents set forth below that we have previously filed with the SEC. These documents contain important information about MAM and its finances.

DOCUMENT

| | PERIOD/DATE

|

|---|

| Annual Reports on Form 10-K | | Year ended December 31, 2003 |

Current Reports on Form 8-K |

|

January 2, 2004; March 2, 2004; March 8, 2004; March 15, 2004 |

We have enclosed a copy of the Annual Report for 2003 along with this Proxy Statement.

If you are a Stockholder, we may have previously sent you some of the documents that are incorporated by reference in this Proxy. We are also incorporating by reference any additional documents, if any, that we may file with the SEC under the Securities Exchange Act of 1934 between the date of this Proxy Statement and the date of the meeting of our stockholders. You can obtain any of the incorporated documents by contacting us or the SEC. Stockholders may obtain any documents incorporated by reference in this Proxy Statement from MAM's web site or by requesting them in writing, or by electronic mail, by sending your request to the following address:

Vice President, Corporate Compliance and Investor Relations

Maine & Maritimes Corporation

P.O. Box 789

209 State Street

Presque Isle, ME 04769-0789

http://www.maineandmaritimes.com

e-mail:aarribas@maineandmaritimes.com

1-207-760-2499 (telephone)

1-207-760-2403 (facsimile)

1

Upon receipt of your written request, the Company will send the requested documents without charge, excluding exhibits, unless such exhibits are specifically incorporated by reference in this Proxy Statement. If you would like to request documents from us in advance of the Annual Meeting, including any documents we may subsequently file with the SEC prior to the Annual Meeting,the Company must receive your request no later than May 3, 2004, in order for you to obtain timely delivery of them before the Annual Meeting.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFRENCE IN THIS PROXY STATEMENT TO VOTE ON THE PROPOSALS DESCRIBED IN THIS DOCUMENT. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT FROM WHAT IS CONTAINED IN THIS PROXY STATEMENT. THIS PROXY STATEMENT IS DATED MARCH 26, 2004. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS PROXY STATEMENT IS ACCURATE AS OF ANY OTHER DATE THAN THAT DATE, AND THE MAILING OF THIS PROXY STATEMENT TO STOCKHOLDERS SHALL NOT CREATE ANY IMPLICATION TO THE CONTRARY. IN THE EVENT ANY INFORMATION CONTAINED IN THIS PROXY STATEMENT IS MATERIALLY CHANGED AFTER THE DATE LISTED ABOVE, MAM WILL RECIRCULATE THE PROXY STATEMENT TO STOCKHOLDERS.

2

THE ANNUAL STOCKHOLDERS MEETING

We are furnishing you with this Proxy Statement in connection with a solicitation of Proxies by the Board of Directors of MAM to be used at the Annual Meeting of Stockholders of MAM to be held on Tuesday, May 11, 2004, at 9:30 a.m. (Eastern Daylight Time) and at any adjournment or postponement of that Annual Meeting. The meeting will be held at the Northern Maine Community College, Edmunds Conference Center, 33 Edgemont Drive, Presque Isle, Maine 04769 at 9:30 a.m. If you execute and return the enclosed Proxy card, it will be voted in the manner directed, but if you return and do not otherwise mark your Proxy card, it will be voted "FOR" Proposal (1) and will be considered an abstention on Proposal (2). You may revoke your Proxy card at any time prior to the Annual Meeting in the following ways:

- •

- Delivering to the clerk of MAM, before the vote at the Annual Meeting, a written notice of revocation bearing a later date than the returned Proxy;

- •

- Executing a later dated Proxy relating to the same shares and delivering it to the Clerk of MAM before the vote at the special meeting; or

- •

- Attending the Annual Meeting and voting in person at the Annual Meeting, although attending the Annual Meeting will not itself constitute a revocation of Proxy.

Each holder of Common Stock is entitled to one vote for each share of the stock outstanding in the name of the holder on the records of MAM at the close of business on March 26, 2004. As of March 26, 2004, the outstanding voting securities of MAM consisted of 1,580,701 shares of Common Stock. This Proxy Statement describes the matters to be voted on at the Annual Meeting.

As provided in MAM's By-laws:

- •

- A majority of the shares entitled to vote at the Annual Meeting, present in person or represented by Proxy, will constitute a quorum of the meeting;

- •

- Proposal (2) must be approved by the affirmative vote of the majority of the outstanding shares of MAM Common Stock;

- •

- With respect to Proposal (1), the three director nominees receiving the greatest number of votes will be elected;

- •

- Abstentions and broker non-votes will be counted in determining a quorum for the meeting;

- •

- Shares withheld and broker non-votes will have no effect on the election of Directors;

- •

- Abstentions as to the approval of Proposal (2) will have the same effect as votes "against" this matter; and

- •

- Broker non-votes will have the same effect as votes "against" on Proposal (2).

Adjournments

We currently expect to take votes and close the polls on all proposals on the scheduled date of the Annual Meeting. However, we may:

- •

- Keep the polls open to facilitate additional Proxy solicitation with regard to any or all proposals; and/or

- •

- Allow the inspectors of the election to count and report on the votes that have been cast after the polls have closed.

If any of the above occurs, we could propose one or more adjournments of the Annual Meeting. For any adjournment to be approved, the votes cast in favor of the adjournment must represent a

3

majority of the total number of votes entitled to be cast by the holders of all classes of stock present at the meeting in person or by Proxy, voting together as a single class.

Proxies that we have solicited will be voted in favor of any adjournment that we propose, but will not be considered a direction to vote for any adjournment proposed by anyone else; provided, however, that no Proxy in the form included with this Proxy Statement shall be voted in favor of adjournment or postponement of the votes on Proposals (1) and (2). If any adjournment is properly proposed at the meeting on behalf of anyone else, the persons named as Proxies, acting in that capacity, will have discretion to vote on the adjournment in accordance with their best judgment.

Common Stock Outstanding and Voting Rights

On March 26, 2004, the record date, MAM had 1,580,701 shares of Common Stock. The Common Stock is the only class of stock entitled to vote at this meeting and all Common Stockholders are entitled to one vote for each share held on all matters, except that in the election of Directors, each Common Stockholder upon proper notice is entitled to cumulative voting. For cumulative voting, each Common Stockholder will be entitled to as many votes as shall equal the number of shares held on the record date multiplied by the number of Directors to be elected, and each stockholder may cast all of the stockholders votes for a single Director or distribute them among the total number of Directors to be elected or among any number of Directors as the stockholder may see fit. Only Common Stockholders of record on the stock transfer books of the Company at the close of business on the record date will be entitled to vote at the meeting.

In connection with Proposal (1), if any Common Stockholder either gives written notice to the President of MAM before the time fixed for the meeting of his or her intention to vote cumulatively, or states his or her intention to vote cumulatively at the meeting before the voting for Directors commences, all Common Stockholders shall be entitled to cumulate their votes on election of Directors. Any Common Stockholder who wishes to vote cumulatively, but who will not be present at the meeting, should give written notice to the President of MAM of such intention before the meeting and should clearly indicate in writing on the accompanying Proxy the Director or Directors for whom he or she wishes to vote and the number of votes he or she wishes to distribute to each such Director. If no written indication is made on the Proxy, the votes will be evenly distributed among all nominees. If any Common Stockholder has indicated his or her intention to vote cumulatively (either by written notice or by a statement made at the meeting), each Common Stockholder present at the meeting, who has not given his or her Proxy, or who has revoked his or her Proxy in the manner described in the following paragraph, may vote cumulatively at the meeting by means of a written ballot distributed at the meeting.

Common Stockholders may vote at the meeting either in person or by duly authorized Proxy. The giving of a Proxy by a Common Stockholder will not affect the Common Stockholder's right to vote his or her shares if he or she attends the meeting and wishes to vote in person. A Proxy may be revoked or withdrawn by the person giving it, at any time prior to the voting thereof, at the registration desk for the meeting or by advising the Secretary of MAM. In addition, the proper execution of a new Proxy will operate to revoke a prior Proxy. All shares represented by effective Proxies on the enclosed form, received by MAM, will be voted at the meeting or any adjourned session thereof, all in accordance with the terms of such Proxies.

4

The following table provides information about the beneficial ownership of MAM Common Stock as of December 31, 2003, by each person or entity known to own more than five percent of MAM Common Stock:

Name and Address of Beneficial Owner

| | Number of Shares of Common Stock Beneficially Owned

| | Percent of Class

Beneficially Owned

| |

|---|

Gabelli Asset Management Inc.

One Corporate Center

Rye, New York 10580-1435 | | 119,900 | | 7.6 | % |

FMR Corp.

82 Devonshire Street

Boston, MA 02109 |

|

99,100 |

|

6.3 |

% |

SECURITY OWNERSHIP BY MANAGEMENT

The following table provides information about the beneficial ownership of MAM Common Stock as of December 31, 2003, by:

- •

- Each of the named Executive Officers

- •

- Each of our Directors

- •

- All of our Executive Officers and Directors as a group

Name of Beneficial Owner

| | Position

| | Number of Shares (1)(5)(6)

Beneficially Owned

|

|---|

| Robert E. Anderson | | Director | | 1,304 |

| J. Nicholas Bayne | | President, Chief Executive Officer and Director | | 500 |

| Michael W. Caron | | Director | | 527 |

| D. James Daigle | | Director | | 804 |

| Richard G. Daigle | | Director | | 934 |

| David N. Felch | | Director | | 569 |

| J. Gregory Freeman | | Director(2) | | 776 |

| Deborah L. Gallant | | Director | | 804 |

| Nathan L. Grass | | Director | | 818 |

| G. Melvin Hovey | | Chairman of the Board(3) | | 3,504 |

| J. Paul Levesque | | Director(4) | | 776 |

| Lance A. Smith | | Director | | 645 |

| Larry E. LaPlante | | Vice President, Chief Accounting Officer, Controller, Clerk, Assistant Treasurer and Assistant Secretary | | 542.4 |

| Kurt A. Tornquist | | Senior Vice President and Chief Financial Officer | | 0 |

| John P. Havrilla | | Vice President, Business Development and Unregulated Businesses | | 0 |

| Scott L. Sells | | General Counsel, Secretary and Assistant Clerk | | 0 |

| Annette N. Arribas | | Vice President, Corporate Compliance and Investor Relations | | 0 |

| | | | | |

5

| Brent M. Boyles | | Senior Vice President and Chief Operating Officer for MPS | | 0 |

| Tim D. Brown | | Vice President, Engineering, Corporate Planning and Regulatory Affairs for MPS | | 0 |

| Calvin D. Deschene | | General Manager, Energy Atlantic | | 7 |

| All directors and officers as a group (twenty persons) | | 12,510.4 |

- (1)

- The Directors and Officers as a group own in the aggregate less than 1% of MAM's outstanding Common Stock.

- (2)

- Resigned from the Board on May 30, 2003.

- (3)

- 1,650 of these shares are held by Mr. Hovey's spouse. Mr. Hovey disclaims beneficial ownership of all these shares.

- (4)

- Retired from the Board on May 30, 2003.

- (5)

- All members of the Board of Directors are required to purchase a minimum of 500 shares.

- (6)

- Board of Director purchases of additional shares are restricted, due to insider trading policies and "blackout" periods.

None of the persons listed above own beneficially, or directly, any of the securities of MAM's subsidiaries, Maine Public Service Company, Maine & Maritimes Energy Services, Maricor Ltd., Energy Atlantic, LLC, or Maine and New Brunswick Electrical Power Company, Limited.

There has been no arrangement in the past year known to the Company, including any pledge by any person of MAM securities, which may result in a change in control of MAM currently or in the future.

The Company is not aware of any material proceedings to which any Director, Officer or affiliate of MAM, any owner of record or beneficially of more than five percent of the Common Stock of MAM, or any associate of any such Director, Officer or affiliate of MAM, or security holder, is a party adverse to MAM or any of its subsidiaries or has a material interest adverse to MAM or any of its subsidiaries.

PROPOSAL (1)

ELECTION OF DIRECTORS

MAM's Articles of Incorporation authorize the Board of Directors or the Stockholders to fix the number of Directors from time to time, provided that the number of Directors may not be less than nine or more than eleven, except in certain extraordinary circumstances set forth in the "Articles of Incorporation." In accordance with the Articles, the Board of Directors has fixed the number of Directors at eleven. We currently have ten Directors, of which three have a term of office that will expire with the upcoming Annual Meeting on May 11, 2004. On August 2, 2002, the Board appointed J. Nicholas Bayne to fill the vacancy created by the retirement of Paul R. Cariani and to serve until the 2004 Annual Meeting. On May 30, 2003, Stockholders voted for David N. Felch to serve until the 2004 meeting, following the Board's appointment of David N. Felch to the Board of Directors effective January 24, 2003. Richard G. Daigle's three-year term expires in 2004 and is up for re-election to the Board of Directors.

The Board is divided into three classes of directorships, with Directors in each class serving staggered three-year terms. One class is elected each year for a three-year term. There are currently

6

three Directors whose terms will expire at the 2004 Annual Meeting. The three nominees are named in the table set forth below. The Stockholders are asked to elect Messrs. Bayne, Felch and R. Daigle, all of whom have been duly nominated by the Board of Directors, to serve a term of office until the 2007 Annual Meeting of Stockholders and their respective successors have been elected and qualified.

The shares represented by the Proxies, which are executed and returned without direction, will be voted at the meeting for the election of Directors of the persons named as nominees in the table set forth below. However, in the event that Directors are to be elected by cumulative voting, shares represented by the Proxies, which are executed and returned without direction will be voted at the meeting in the discretion of the Proxy holders, as to the manner in which votes represented thereby will be distributed among such nominees. All of the nominees have indicated their willingness to serve as Director until the expiration of their respective terms and until their successors shall have been duly chosen and qualified.

Should any of the nominees for the office of Director become unable to accept a nomination or election, which is not anticipated, it is intended that the persons named in the accompanying form of Proxy will vote for the election of such other person as the Board of Directors may recommend in the place of such nominee. Nominees for Director who receive the greatest number of votes by Common Stockholders entitled to vote, even though not a majority of the votes cast, shall be elected. Therefore, abstentions and broker non-votes have no effect on the election of Directors.

NOMINEES AND CURRENT DIRECTORS BY CLASS

Name and Business Experience for Last 5 Years

| | Age

| | Year First Elected Director

|

|---|

| (Nominees for terms expiring in 2007—Class II) | | | | |

| | J. NICHOLAS BAYNE (for re-election)(1)(6)

President and Chief Executive Officer of Maine & Maritimes Corporation since March 7, 2003

Presque Isle, Maine

President and Chief Executive Officer of Maine Public Service Company since September 1, 2002

Presque Isle, Maine

President, Maine Public Service Company

Since May 15, 2002

Presque Isle, Maine

President-Elect of Maine Public Service Company

March 18, 2002 to May 14, 2002

Presque Isle, Maine Public Service Company

Executive consultant to the energy, utilities, and energy-software Industries, 2001 to 2002

Charlotte, North Carolina

Chief Executive Officer and Director, Aspect, LP, (energy software/FAS 133 solution development firm) 2001

Houston, Texas

Senior Vice President of Strategic Advisory Services Energy E-Comm.com, 2000 to 2001 (energy and strategic consulting practice) Charlotte, North Carolina

Senior Vice President for Energy Sales and Operations and Director of Duke Solutions, Inc., Duke Energy's unregulated retail energy services company, 1997 to 2000 Charlotte, North Carolina | | 50 | | 2002 |

| | | | | |

7

RICHARD G. DAIGLE (for re-election)(2)(3)(6)

Chairman and CEO since before 1998, Daigle Oil Company (retail and wholesale distributor of petroleum products) Fort Kent, Maine |

|

56 |

|

1994 |

DAVID N. FELCH (for re-election)(2)(4)(6)

Senior Partner since before 1998

Felch & Company, LLC

(Certified Public Accountants) Caribou, Maine |

|

59 |

|

2003 |

(Directors whose terms expire in 2006—Class I) |

|

|

|

|

ROBERT E. ANDERSON(4)(6)

Chairman of the Board, Chief Financial Officer, since before 1998

F. A. Peabody Company (Insurance) Houlton, Maine |

|

66 |

|

1993 |

MICHAEL W. CARON(2)(4)(6)

Chief Financial Officer

Catholic Charities Maine

(Social service agency of the Diocese of Portland) Falmouth, Maine, since 2002

Mr. Caron was not employed between 2000 and 2002.

Controller, Central Maine Power Company, 1996-2000

Managing Director—Finance

NYNEX, Boston, Massachusetts, 1994-1996. |

|

56 |

|

2003 |

NATHAN L. GRASS(3)(5)(6)

President since before 1998, Grassland Equipment, Inc. (holding company for personal investments)

Presque Isle, Maine |

|

65 |

|

1983 |

(Directors for terms expiring in 2005—Class III) |

|

|

|

|

D. JAMES DAIGLE(3)(5)(6)

President since before 1998

D & D Management Co.

(real estate investment and management company, which is currently inactive)

Orlando, Florida |

|

68 |

|

1973 |

DEBORAH L. GALLANT(3)(5)(6)

President & CEO since before 1998, D. Gallant Management Associates

(Management Consultants) Portland, Maine |

|

51 |

|

1994 |

G. MELVIN HOVEY(1)(2)(4)(6)

Chairman of the Board of MPS since 1998 and now also MAM

Presque Isle, Maine |

|

74 |

|

1981 |

LANCE A. SMITH(2)(5)(6)

President and Co-owner since before 1998

Smith Farms, Inc.

(agricultural farm; broccoli is currently its principal crop)

Presque Isle, Maine |

|

52 |

|

2002 |

- (1)

- Mr. Hovey is Director; Chairman of the Board of Maine & Maritimes Corporation; and Chairman of Boards of its Subsidiaries: Maine Public Service Company, Maine and New Brunswick Electrical

8

Power Company, Ltd., Maine & Maritimes Energy Services (dba, The Maricor Group), and Maricor Ltd. Mr. Bayne is President of Maine & Maritimes Corporation and its Subsidiaries: Maine Public Service Company, Maine and New Brunswick Electrical Power Company, Ltd., Maine & Maritimes Energy Services (dba, The Maricor Group), and Maricor Ltd.

- (2)

- Member of the Audit Committee.

- (3)

- Member of the Performance and Compensation Committee.

- (4)

- Member of the Pension and Benefits Committee.

- (5)

- Member of the Corporate Governance Committee.

- (6)

- Member of the Strategic Planning Committee.

9

DIRECTORS AND COMMITTEE MEETINGS

The initial organizational meeting of the Board of Directors of Maine & Maritimes Corporation (MAM) was held March 7, 2003 and a total of seven additional MAM Board meetings were held during the year. As the result of reorganization into a holding company structure, Maine Public Service Company (MPS) became a direct subsidiary of MAM, effective June 30, 2003. MPS's Board met nine times during the year. As part of the July 2003 MAM Board of Directors meeting, a day-long orientation session was held to familiarize all Directors with MPS's operations. MAM's Board of Directors regularly meets in Executive Session without members of Management to discuss various business-related issues. Directives and/or policies approved by the Board in Executive Session are communicated, as appropriate, to the Chief Executive Officer and/or Chief Legal Officer for their information and/or implementation.

Mr. David N. Felch was appointed to the Board of Directors, effective January 24, 2003 and was assigned to the Pension and Benefits Committee and the Audit Committee. Michael W. Caron was elected to the Board on May 30, 2003, replacing J. Paul Levesque who retired after serving 18 years on the MPS Board of Directors. Mr. Caron was assigned to the Pension and Benefits Committee and the Audit Committee. Mr. J. Gregory Freeman resigned on May 30, 2003. Directors currently serving dual positions on the Maine & Maritimes Corporation Board of Directors and the Maine Public Service Company Board of Directors include: Robert E. Anderson, J. Nicholas Bayne, Michael W. Caron, D. James Daigle, Richard G. Daigle, David N. Felch, Deborah L. Gallant, Nathan L. Grass, G. Melvin Hovey, and Lance A. Smith. MAM and MPS Directors currently serving on the Board of Directors of Maine and New Brunswick Electrical Power Company, Ltd., Maine & Maritimes Energy Services, and Maricor Ltd include J. Nicholas Bayne and G. Melvin Hovey.

The Maine & Maritimes Corporation Board of Directors has five standing committees.

- •

- Audit Committee;

- •

- Strategic Planning Committee;

- •

- Pension and Benefits Committee;

- •

- Corporate Governance Committee (which also acts as the nominating committee); and

- •

- Performance and Compensation Committee

Audit Committee

The members of the Audit Committee are: Richard G. Daigle, the chairperson, Michael W. Caron, David N. Felch, G. Melvin Hovey, and Lance A. Smith. All members of the Audit Committee are independent in accordance with the current definition in Rule 121 of the American Stock Exchange. During 2003, the Audit Committee held eleven meetings, three of which were telephonic, and one which was held jointly with the Corporate Governance Committee. In an attempt to strengthen financial proficiency on the Audit Committee, Mr. Felch was assigned to the Audit Committee in January, 2003. Mr. Michael W. Caron was elected a Class I Director and assigned to the Audit Committee in May, 2003 and later declared the Audit Committee's Financial Expert. In May 2003, Mr. D. James Daigle, per his request, was reassigned to the Corporate Governance Committee. The Audit Committee recommends to the Board of Directors the engagement of Maine & Maritimes Corporation's independent auditors, provides independent oversight with respect to financial reporting and internal controls, the internal audit function and the independent auditors, determines whether the independent auditors are independent and makes recommendations on audit matters and internal controls to the Board of Directors. The Charter of the Audit Committee is attached as Appendix A. The Audit Committee regularly meets in Executive Session without Management, meets in Executive

10

Session individually with the Chief Executive Officer and Chief Financial Officer, and also meets in Executive Session without Management to discuss issues with the Company's Auditor.

Strategic Planning Committee

At the December 5, 2003 MAM Regular Board of Directors meeting, the membership of the Strategic Planning Committee was increased to include all members of the Board of Directors. The members of the Strategic Planning Committee are G. Melvin Hovey, the chairperson, Robert E. Anderson, J. Nicholas Bayne, Michael W. Caron, D. James Daigle, Richard G. Daigle, David N. Felch, Deborah L. Gallant, Nathan L. Grass, and Lance A. Smith. During 2003, the Strategic Planning Committee held seven meetings, three of which were held jointly with all Directors. The Strategic Planning Committee considers all matters of strategic importance including, without limitation, matters related to the Company's strategy, mergers and acquisition activities, budgets, operations, customer relations, system security and reliability, and other significant regulatory, transactional, business or political matters of strategic significance. The Committee typically meets the day before the MAM Board of Director meetings and, as a Committee of the whole Board, it serves as a detailed work session for issues regarding, but not necessarily limited to, strategic planning, operational issues, regulatory affairs, and capital structure objectives to come before the Board.

Pension and Benefits Committee

The members of the Pension and Benefits Committee, formerly the Pension Investment Committee, are Robert E. Anderson, the chairperson, Michael W. Caron, David N. Felch, and G. Melvin Hovey. Mr. David N. Felch was assigned to the Pension and Benefits Committee in January, 2003. Mr. J. Paul Levesque retired from the Board and the Pension and Benefits Committee in May, 2003 and was replaced by Mr. Michael W. Caron. During 2003, the Pension and Benefits Committee held six meetings. The Pension and Benefits Committee reviews the management of the Company's pension fund by the pension fund trustee and makes recommendations with respect to the management of such fund to the Board and Management as it deems necessary. The Pension and Benefits Committee also makes recommendations in connection with the Company's Pension Plan and 401(k) Plan. In addition, the Committee is responsible for oversight of employee health care and insurance-related benefits and closely coordinates with the Performance and Compensation Committee to ensure equitable total compensation structures throughout the Company.

Corporate Governance Committee

The members of the Corporate Governance Committee are Deborah L. Gallant, the chairperson, D. James Daigle, Nathan L. Grass, and Lance A. Smith. Mr. D. James Daigle joined the Corporate Governance Committee, replacing Mr. J. Gregory Freeman who resigned on May 30, 2003. The Corporate Governance Committee held six meetings during 2003. The Committee considers matters related to corporate governance and formulates and periodically revises principles for Board governance, recommends to the Board of Directors the size and composition of the Board of Directors within the limits set forth in the Articles of Incorporation and By-laws and recommends potential successors for the position of Chairman of the Board. This Committee also considers nominees, who are either submitted by Stockholders or otherwise, for the Board of Directors and makes recommendations to the Board who may, in turn nominate the candidates for election by the Stockholders. Stockholder nominations of Directors, intended for inclusion in the 2005 Proxy and Proxy Statement must be submitted to the Clerk of Maine & Maritimes Corporation, P. O. Box 789, Presque Isle, Maine 04769-0789. The Clerk will forward such nominations to the Corporate Governance Committee. Nominations received from Stockholders after December 3, 2004, are not required to be considered at the 2005 Annual Meeting.

11

The Charter of the Corporate Governance Committee is attached as Appendix B. All members of the Corporate Governance Committee are independent in accordance with the current definition in Rule 121 of the American Stock Exchange.

Performance and Compensation Committee

The members of the Performance and Compensation Committee are Nathan L. Grass, the chairperson, D. James Daigle, Richard G. Daigle, and Deborah L. Gallant. The Performance and Compensation Committee held seven meetings during 2003 and consists of all independent Directors. The Performance and Compensation Committee sets financial and operating performance standards for consideration and approval by the Board of Directors, including performance benchmarks associated with executive incentive compensation. The Committee develops salary and other compensation recommendations for the position of Chief Executive Officer of Maine & Maritimes Corporation. These recommendations are developed in Executive Session without the presence of the CEO and are based on CEO performance reviews undertaken by the Committee. The Committee is responsible for independently recommending all other MAM and MPS Executive Officers salaries and other compensation, as well as setting overall enterprise-wide compensation philosophies, utilizing input from the CEO. The Committee's independent recommendations are made to the Board of Directors for consideration and action in Board of Director meeting Executive Session without the CEO or any Executive Officer.

As a part of the Committee's annual responsibilities they develop succession plans for the position of CEO and work with the CEO to develop succession plans for all key Executive Officer positions. In addition, the Committee researches and develops recommendations to the Board of Directors concerning compensation for outside Directors. The Charter of the Performance and Compensation Committee is attached as Appendix C.

Joint Committee Meetings

On January 13, 2003, a special teleconference meeting between the President and CEO, the Board Chairperson, Audit Committee Chairperson, and Corporate Governance Committee was held to discuss new criteria for selecting a financial expert to enhance the expertise of the Audit Committee. On January 23, 2003, the Audit and Corporate Governance Committees conducted candidate interviews for a financial expert. The members of the Audit and Corporate Governance Committees met to discuss candidate interviews and jointly developed recommendations for the Governance Committee's recommendation to the Board of Directors.

On November 6, 2003, the Audit and Strategic Planning Committees met jointly to review analysis and proposals for a new financial and information technology system. Based on potential options and lifecycle cost analyses, the Committees jointly approved for recommendation to the Board of Directors an investment in a new financial information system, which includes a utility enterprise management system.

On December 4, 2003, a joint Maine & Maritimes and Maine Public Service Strategic Planning Committee meeting was held to discuss proposed holding company and subsidiary operating and capital budgets. All Directors were in attendance.

During 2003, all Directors attended 75% or more of the aggregate number of meetings of the Board of Directors and Committees on which they serve. Actual overall attendance was 97%.

12

BUSINESS RELATIONSHIPS AND TRANSACTIONS WITH DIRECTORS AND EXECUTIVE OFFICERS

No Director, or any Executive Officer, has any business relationships with MAM, nor in 2003 has any of them entered into any transaction with MAM, nor in 2003 has any of them been indebted to MAM, in all cases at or greater than the minimum threshold for SEC reporting.

AUDIT COMMITTEE REPORT

The Audit Committee, consisting of all independent Directors, has reviewed and discussed with Management the Company's 2003 audited financial statements. It has discussed with the firm of PricewaterhouseCoopers, LLP, ("PWC") the Company's independent auditors, the matters required to be discussed by Statement of Auditing Standards No. 61, and has received from PWC the written disclosure and letter required by Independence Standards Board Standard No. 1. The Audit Committee has discussed with PWC the firm's status as an independent auditor. Based on this review and these discussions, the Audit Committee has recommended to the Company's entire Board of Directors that the Company's financial statements, audited by PWC, be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2003. The Audit Committee has also made every effort to conform with new requirements of the Sarbanes-Oxley Act of 2002 (the "Act") concerning Audit Committee composition, governance and responsibilities. The Company continues to monitor SEC and American Stock Exchange rule issuances resulting from the Act to ensure continuing compliance.

The Audit Committee pre-approves all audit and non-audit services rendered by PWC permissible under the Act. The Audit Committee does not consider that PWC's provision of services involving matters other than auditing the Company's financial statements in any way impairs PWC's status as an independent auditor of the Company's financial statements.

All five members of the Audit Committee are independent as defined under Section 121(A) of the AMEX's listing standards. At least one member of the Audit Committee has the required experience in finance and accounting, as required under Section 121(B) (b) of the AMEX listing standards. On September 5, 2003, Michael W. Caron was designated by the Company's Board of Directors as the Audit Committee's "financial expert" as that term has been defined by the SEC under the Act.

AUDIT FEES

The aggregate fees billed for services rendered by PWC for the audit of the annual financial statements of the Company and its predecessor for fiscal years 2002 and 2003 and reviews of the financial statements in the Company's Form 10-Q for those fiscal years were $128,000 and $163,619, respectively. The fees in 2003 include filings with the Securities and Exchange Commission primarily related to the formation of Maine & Maritimes Corporation, totaling $24,602.

For fiscal years 2002 and 2003, the aggregate fees billed for services rendered by PWC for assurance and related services, which are reasonably related to the performance of the audit or review

13

of the financial statements of the Company and its predecessor, were $18,850 and $45,189, respectively, broken down as follows:

| | 2002

| | 2003

|

|---|

| Audits of the Company's pension plan & nonunion retirement savings plan (401(k)) | | $ | 13,600 | | $ | 24,098 |

| Other services regarding tax-exempt bond filings | | | 5,250 | | | 12,831 |

| Other audit related services | | | 0 | | | 8,260 |

| | |

| |

|

| Total | | $ | 18,850 | | $ | 45,189 |

| | |

| |

|

For fiscal years 2002 and 2003, the aggregate fees billed for services rendered by PWC for professional services for tax compliance, tax advice and tax planning for the Company and its predecessor were $16,540 and $9,603, respectively, broken down as follows:

| | 2002

| | 2003

|

|---|

| Tax services for review of corporate tax return and earnings and profits (2 yrs in 2002) | | $ | 12,715 | | $ | 7,100 |

| Other tax consulting services | | | 3,825 | | | 2,503 |

| | |

| |

|

| Total | | $ | 16,540 | | $ | 9,603 |

| | |

| |

|

For fiscal years 2002 and 2003, there were no services, in addition to those listed above, rendered by PWC for services that did not involve auditing and reviewing the Company's financial statements.

EXECUTIVE COMPENSATION

The following summary compensation table sets forth the total compensation paid by the Company and its subsidiaries in 2001, 2002, and 2003 to J. Nicholas Bayne, the Company's President and Chief Executive Officer; and to the other persons listed below. Except as listed, no other Executive Officer or employee of the Company had an annual compensation of more than $100,000 during the Company's last fiscal year, ended December 31, 2003.

14

Summary Compensation Table

| |

| | Annual Compensation (1)

| |

|

|---|

Name & Principal Position

| | Year

| | Salary

($)

| | Bonus (2)

($)

| | Other Annual (4)

Compensation

($)

| | All Other

Compensation

|

|---|

|

|---|

J. NICHOLAS BAYNE

President and Chief Executive Officer

Maine & Maritimes Corporation

Maine Public Service Company

President

Maine & New Brunswick Electrical Power Company, Ltd.

Maine & Maritimes Energy Services

(dba, The Maricor Group)

Maricor Ltd. | | 2003

2002 | | 175,739

138,308 | | 52,578

0 | | 3,098

156 | | 0

0 |

LARRY E. LAPLANTE

Vice President, Chief Accounting

Officer and Controller (MAM)

Maine & Maritimes Corporation

Vice President, Chief Accounting

Officer and Controller

Maine Public Service Company |

|

2003

2002

2001 |

|

120,000

116,199

109,356 |

|

2,726

8,661

11,743 |

|

2,651

2,680

2,589 |

|

0

0

0 |

WILLIAM L. CYR (3)

Vice President, Engineering and

Asset Management (MPS)

Vice President, Power Delivery (MPS) |

|

2003

2002 |

|

112,000

103,685 |

|

2,437

7,270 |

|

2,364

2,285 |

|

0

0 |

CALVIN D. DESCHENE

General Manager, Energy Atlantic |

|

2003

2002 2001 |

|

100,000

94,180 83,885 |

|

12,275

11,347 25,485 |

|

2,386

2,190

2,250 |

|

0

0

0 |

JOHN P. HAVRILLA

Vice President, Business Development

And Unregulated Businesses (MAM) |

|

2003 |

|

110,000 |

|

5,000 |

|

108 |

|

0 |

|

|---|

- (1)

- The Company does not provide any long-term compensation.

- (2)

- Refer to the Performance and Compensation Committee report on executive compensation, beginning on Page 18.

- (3)

- Resigned January 9, 2004.

- (4)

- The amounts in this column include the following:

15

Name

| | Year

| | 401(k)

Match (a)

| | Group Term

Life(b)

| | Total

|

|---|

|

|---|

| J. Nicholas Bayne | | 2003

2002 | | 2,751

0 | | 347

156 | | 3,098

156 |

Larry E. LaPlante |

|

2003

2002

2001 |

|

2,458

2,497

2,425 |

|

193

183

164 |

|

2,651

2,680

2,589 |

William L. Cyr |

|

2003

2002 |

|

2,290

2,220 |

|

74

65 |

|

2,364

2,285 |

Calvin D. Deschene |

|

2003

2002

2001 |

|

2,248

2,112

2,189 |

|

138

78

61 |

|

2,386

2,190

2,250 |

John P. Havrilla |

|

2003 |

|

0 |

|

108 |

|

108 |

|

|---|

- (a)

- The Company's match under the 401(k) plan.

- (b)

- Value of insurance previously paid by the Company for Term Life Insurance in an amount equal to annual salary.

As of March 15, 2004, the Company had in effect employment retention agreements with J. Nicholas Bayne, President & Chief Executive Officer; Kurt A. Tornquist, Senior Vice President & Chief Financial Officer; Brent M. Boyles, Senior Vice President and Chief Operating Officer for Maine Public Service Company; Larry E. LaPlante, Vice President, Chief Accounting Officer and Controller; Calvin D. Deschene, General Manager of Energy Atlantic; and John P. Havrilla, Vice President, Business Development and Unregulated Businesses. The term of each of these agreements extends through December 31, 2005. With the exception of Mr. Bayne's and Mr. Deschene's agreement, under these agreements, should a change of control event occur and the acquiring Company terminate the employment of the above listed Executive Officers within two years following such change in control; the Company will pay the executive an amount equal to two times the executive's then current salary. The agreements also provide for the continuation of the executive's benefits under the then current health, life and disability (but not pension) for two years after termination. Mr. Bayne's agreement is for a period of three years providing for the payment of three times his current salary with no continuation of benefits. Under Mr. Bayne's agreement he retains the right to continue employment or request an immediate lump sum payment in the event of a change in control. Mr. Deschene's agreement is for a period of one year providing for the payment of one times his current salary in the amount he would have been entitled under Energy Atlantic's incentive compensation plan, and the provision of benefits for a two-year period. The employment retention agreements are discussed more fully in the section entitled "Performance and Compensation Committee Report on Executive Compensation," on Page 18.

STOCK OPTION PLAN

With the approval by the Company's Stockholders at the 2002 Annual Meeting, the Company adopted the 2002 stock option plan. The 2002 plan provides designated employees of the Company and its subsidiaries with stock ownership opportunities and additional incentives to contribute to the success of the Company, and to attract, reward and retain employees of outstanding ability. The plan is administered by the members of the Performance and Compensation Committee of the Board, who are not employees of the Company or any subsidiaries. The Company may grant options to its employees for up to 150,000 shares of Common Stock, provided the maximum aggregate number of shares which may be issued under the plan pursuant to incentive stock options shall be 120,000 shares. The exercise

16

price for shares to be issued under any stock option shall not be less than one hundred percent (100%) of the fair market value of such shares on the date the option is granted. An option's maximum term is ten (10) years. The Board, based on a recommendation of the Performance and Compensation Committee, and full concurrence of J. Nicholas Bayne, modified the grant agreement to the Company's President and Chief Executive Officer, from an aggregate of 52,500 shares to be awarded after three years in equal installments spread over seven years with immediate vesting of all options in the event of a merger or acquisition. The revised allocation allocates 5,250 shares per year for ten years with a three-year vesting period and maturing only of those options issued in the event of a change of control. A total of 10,500 options have been granted to J. Nicholas Bayne, 5,250 options granted in 2003 and in 2002. The Company expenses all options at the time of the grant, even though the options are not vested for a three-year term post the grant.

Option/SAR Grants in Last Fiscal Year (2003)

Name

| | Number of

Securities

Underlying

Options/SARs

Granted(#)

| | % of Total

Options/SARs

Granted to

Employees in

Fiscal Year

| | Exercise or Base

Price ($/Sh)

| | Expiration Date

| | Grant Date

Present Value $

(1)

|

|---|

|

|---|

| J. Nicholas Bayne | | 5,250 | | 100 | | 32.51 | | 05-30-2013 | | $ | 20,999 |

|

|---|

- (1)

- Present value per share as of grant date calculated using Black-Scholes Valuation Model with the following assumptions: 20% expected volatility, 3.02% risk-free rate of return, 4.55% dividend yield, and exercise at the end of seven (7) years from date of grant.

RETIREMENT PLAN

Pension costs are not and cannot be readily allocated to individual employees. The Company normally contributes 100% of the remuneration of plan participants. The following pension plan table shows the estimated annual benefits payable upon retirement:

Pension Plan Table

In Dollars

| | Annual Benefits for Years of Service

|

|---|

Highest Average Annual Three Consecutive Years Base Salary (1)

| | 15 yrs

| | 20 yrs

| | 25 years

| | 30 yrs or more

|

|---|

|

|---|

| 120,000 | | 21,186 | | 31,686 | | 42,186 | | 52,686 |

| 140,000 | | 26,436 | | 38,686 | | 50,936 | | 63,186 |

| 160,000 | | 31,686 | | 45,686 | | 59,686 | | 73,686 |

| 180,000 | | 36,936 | | 52,686 | | 68,436 | | 84,186 |

| 200,000 | | 42,186 | | 59,686 | | 77,186 | | 94,686 |

|

|---|

- (1)

- Because of requirements of the Internal Revenue Code, annual compensation that can be used in calculating retirement benefits is limited to a maximum of $200,000 in 2003.

The compensation covered by the pension plan consists of the participant's highest average annual three consecutive year's salary, which corresponds to the salary shown on the Summary Compensation Table above. Benefits under the pension plan are computed based on a straight-life annuity and are subject to benefits under the Federal Social Security Act. The table above reflects benefits after the Social Security offset.

The estimated annual benefits payable upon retirement to the Company's current Executive Officers, Messrs. Bayne, LaPlante, Cyr, Deschene and Havrilla were $36,394, $52,686, $48,486, $42,186,

17

and $26,899 respectively. These amounts are based upon the assumption that these Officers will continue their employment at their salary rate at January 1, 2004, until their normal retirement dates and the Company's retirement plan will continue in effect. As of January 1, 2004, Messrs. Bayne, LaPlante, Cyr, Deschene and Havrilla had less than approximately two years, 19 years, 20 years, 23 years and less than two years, respectively, in the plan.

Directors who are not employees of the Company are not eligible to participate in the Company's retirement plan.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires a company's directors and executive officers and persons who own more than ten percent of the registered class of the Company's equity securities to file with the SEC and the American Stock Exchange initial reports of changes in ownership of common stock of the company. Officers, directors and greater than ten-percent beneficial owners are required by the SEC to furnish the company with copies of all Section 16(a) forms they file.

Section 16(a) also requires a company's directors and executive officers and persons who own more than ten percent of the registered class of the Company's equity securities to file with the SEC and the American Stock Exchange initial reports when they take such offices or acquire such quantity of securities. Such reports have not been filed until recently by persons with such positions, in neither MAM nor MPS. For all but one position, such forms were first filed in 2004. Forms were due in 2003 for the following persons:

| Robert E. Anderson | | Director |

| J. Nicholas Bayne | | President, Chief Executive Officer and Director |

| Michael W. Caron | | Director |

| D. James Daigle | | Director |

| Richard G. Daigle | | Director |

| David N. Felch | | Director |

| Deborah L. Gallant | | Director |

| Nathan L. Grass | | Director |

| G. Melvin Hovey | | Director; Chairman of the Board |

| Lance A. Smith | | Director |

| Larry E. LaPlante | | Vice President, Chief Accounting Officer, Controller, Clerk, Assistant Treasurer and Assistant Secretary |

| Kurt A. Tornquist | | Senior Vice President and Chief Financial Officer |

| John P. Havrilla | | Vice President, Business Development and Unregulated Businesses |

| Scott L. Sells | | General Counsel, Secretary and Assistant Clerk |

| Brent M. Boyles | | Senior Vice President, Operations, of MPS |

| Calvin D. Deschene | | General Manager, Energy Atlantic |

Except as stated in the immediately preceding paragraph, to the Company's knowledge, based solely on review of the copies of such reports furnished to the Company and written representations that no other reports were required during the fiscal year ended December 31, 2003, all such Section 16(a) filing requirements were complied with.

18

DIRECTORS' COMPENSATION

Effective December 5, 2003, the Maine & Maritimes Corporation Board of Directors approved the 2004 Directors' Fee Structure without increase or change. The structure closely tracks a level 85% of the Directors fees for small utilities and energy companies as published by the National Association of Corporate Directors' (NACD) "Directors Compensation Survey for 2002-2003. The Board also agreed to hold bi-monthly Strategic Planning and Regular Board of Directors meetings every other month, and a minimum of four Committee meetings per year, once each quarter, with flexibility to hold special Committee meetings and teleconference meetings, as required. Additional details concerning Directors' compensation can be found in the Performance and Compensation Committee Report on Executive Compensation found on Page 18, herein.

The fees are as follows:

| | Effective Since

September 1, 2002

(Dollars)

|

|---|

| Annual Retainer—Chairperson | | 15,000 |

| Annual Retainer—Other | | 10,000 |

| Committee Chairs—Annual | | 800 |

| Meeting Attendance—Per Meeting | | 800 |

| Committee Meetings—Per Meeting | | 800 |

| Committee Meetings—(Same Day as Board Meeting) — Per Meeting | | 800 |

| Telephonic Meetings—Per Meeting | | 300 |

| Stock Grant—Annual | | 3,000 |

A Deferred Compensation Plan for Outside Directors has been in place since 2000. Under the Plan, participants may defer up to 100% of their retainer, meeting, and committee chairperson fees. The Company establishes an account for the deferred Director fees and adjusts the account balance for fees deferred and by the value of a deemed investment on five-years U.S. Treasury Notes or the Company's Stock. Such deferred amounts will be paid to the Director or to a designated beneficiary in a lump sum or an equal monthly payment over ten years when the Director ceases to serve on the Company's Board of Directors.

At the November 7, 2003 Maine & Maritimes Corporation Regular Board meeting, Directors approved a resolution to establish a "rabbi trust" under the MPS Deferred Compensation Plan for Outside Directors and under the supplemental retirement arrangement for G. Melvin Hovey (the Plans), through which the Company may, from time to time, fund its obligations through the Plans, and shall, in the event of a change-in-control of the Company, immediately fund such obligations in full. It was further resolved that the Maine Public Service Company Deferred Compensation Plan be renamed the "Maine & Maritimes Corporation Deferred Compensation Plan for Outside Directors." The appropriate Officer of the Company, so designated with this responsibility, was granted the authority to take such further action as may be necessary or desirable to effectuate the resolutions, including but not limited to, the execution of Plans and trust documents and the appointment of an independent trustee.

PERFORMANCE AND COMPENSATION COMMITEE INTERLOCKS AND INSIDER PARTICPATION

The members of the MAM Performance and Compensation Committee during the fiscal year 2003 were Messrs. N.L. Grass, R.G. Daigle, D.J. Daigle and Ms. D.L. Gallant, none of whom are now, or have ever been, employees or officers of the Company. Except for their positions as Directors, Messrs. N.L. Grass, R.G. Daigle, D.J. Daigle and Ms. D.L. Gallant, have not engaged and are not

19

proposing to engage, in any transactions with the Company in which they have a direct or indirect material interest. None of the Company's executives served as directors of any other entity under conditions requiring disclosure in this Proxy Statement.

PERFORMANCE AND COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Board of Directors' Performance and Compensation Committee (formerly the Executive Compensation Committee) consists of all independent directors. The Committee is responsible for:

- •

- Development and recommendation of executive compensation levels for Officers, as well as incentive compensation plans for Officers, Managers and employees, including performance measurements and goals for consideration by the Board of Directors;

- •

- Development and recommendation of executive compensation philosophies and plans for consideration by the Board of Directors;

- •

- Development and recommendation of Director compensation for consideration by the Board of Directors;

- •

- Administering the Company's Stock Option Plan approved by the Board of Directors and Shareholders during the Maine Public Service Company 2002 Annual Meeting;

- •

- Administering all Board approved executive, manager and employee incentive compensation plans;

- •

- Evaluating the CEO's annual performance; and

- •

- Development and monitoring of executive succession planning and executive development.

The Committee met on May 29, 2003, to discuss compensation philosophies and develop recommendations for salary adjustments for all Executive Officers for the twelve months beginning June 1, 2003. This is the report of the Performance and Compensation Committee describing the Company's executive compensation program and the basis upon which compensation determinations were made.

Compensation Policies

In order to ensure retention and recruitment of superior management talent, the Committee believes that total executive compensation should be competitive among similar positions within similar-sized utility and utility-based holding companies within the New England region. Executive compensation should be aligned with corporate performance and should be market-based. The Committee desires to increase the percentage of executive compensation "at risk" over the next several years. The Committee believes that a significant portion of executive compensation should be dependent upon achievement of annual financial goals, the actual financial condition of the Company, and creation of long-term shareholder value. In 2003, the Committee began the process of migrating toward more performance-based compensation.

Executive compensation consists of a base salary, incentive compensation, performance bonuses and stock options. Bonuses may be provided to Executive Management, other than the CEO, based on performance evaluations by the CEO, his recommendation to the Performance and Compensation Committee, and their recommendation to the Board of Directors. The CEO may be provided a bonus based on his performance evaluation by the Performance and Compensation Committee and their recommendation to the Board of Directors. The Company does not offer a long-term incentive program. The Performance and Compensation Committee can recommend issuance of stock options for executives to the Board of Directors. Currently, only the CEO receives stock options, as later

20

described. Specific salaries, incentive compensation, and bonuses for all executives with compensation over $100,000 are detailed in the Summary Compensation Table on Page 14.

Executive Officers' Base Annual Salary

The Committee reviewed executive salaries and total executive compensation packages of other smaller investor-owned utilities within New England, including but not necessarily limited to Green Mountain Power Corporation, Central Vermont Public Service Corporation and Unitil. Given the diversity and wide range of executive salaries in the region, the Committee did not use any specific quantitative measures or percentiles to set executive salaries. Rather, judgment was used to ensure salaries are both aligned with Shareholder interests and competitive, to ensure necessary executive retention and recruitment. In all cases, executive salaries are less than regional comparisons for similar executive positions.

Specific executive salary recommendations were based on an evaluation of both the market value of the position, as well as the individual's qualifications, experience, and proven performance. The Committee independently developed a recommendation of the CEO's base salary. The CEO recommended to the Committee the base salary for other Executive Officers for the Committee's consideration and ultimate recommendation to the Board of Directors. As a part of this process, the CEO reviewed performance evaluations of executives with the Committee.

Based on the Committee's desire to migrate to increased executive "at risk" compensation, the Committee recommended to the Board of Directors that all executive salaries be frozen in 2003 at their existing annual level, with the exception of promotions. Specific recommended promotions from the Committee to the Board of Directors included: (a) Kurt A. Tornquist promoted to Senior Vice President and Chief Financial Officer of Maine & Maritimes Corporation and Maine Public Service Company at a recommended annual salary of $100,000 per year and (b) Mr. Brent M. Boyles promoted to Senior Vice President, Operations for Maine Public Service Company at a recommended annual salary of $100,000 per year. The Committee's 2003 executive salary recommendations, including the promotions, were adopted by the entire Board, without material modification, on May 30, 2003, effective June 1, 2003.

On January 8, 2004, the Performance and Compensation Committee approved the CEO's recommendations to promote Brent M. Boyles to Senior Vice President and Chief Operating Officer for Maine Public Service Company and Tim D. Brown to Vice President, Engineering, Corporate Planning & Regulatory Affairs for Maine Public Service Company. The Performance and Compensation Committee recommended on January 8, 2004 to the Board of Directors these positions at annual salaries of $105,000 and $95,000, respectively. The Board approved the Committee's recommendations effective January 12, 2004.

On March 5, 2004, the Performance and Compensation Committee approved the CEO's recommendation to promote Annette N. Arribas to Vice President Corporate Compliance and Investor Relations. The Performance and Compensation Committee recommended on March 5, 2004, to the Board of Directors this position at an annual salary of $85,000. The Board approved the Committee's recommendations effective March 8, 2004.

Incentive Compensation Plan and Bonuses

The Performance and Compensation Committee reviewed the results of the Maine Public Service Company's 2002 Incentive Compensation Plan for executives during its March 7, 2003 meeting. Plan elements for 2002, for payment in 2003, included achievement of the following goals:

- •

- Targeted stock price;

- •

- Targeted net income;

21

- •

- Targeted expenditure control level;

- •

- Various customer satisfaction and service quality indices;

- •

- Customer retention and economic development goals;

- •

- Safety and wellness goals;

- •

- Employee satisfaction targets; and

- •

- Full compliance with Maine Public Utilities Commission's standards of conduct.

Four of the eight goals were met in full and one met at the 50% level. As a result, the Committee recommended to the Board of Directors a payout of 2.35% of base salary. However, some members of Senior Management received a prorated amount based on active contribution time and promotions. The total executive incentive compensation payout for 2002 was $12,715.32, distributed among six Executive Officers. The Committee's incentive compensation recommendations were adopted by the entire Board, without material modification, on March 7, 2003 for payout on effective May 29, 2003.

In 2003, the Committee altered the executive incentive compensation plan requiring that a target net income be achieved before the plan was in effect for both executives and all staff. The net income target was not achieved; therefore, no 2004 payout was approved for the 2003 Plan. Based on the Committee's goal of increasing the percentage of total compensation "at risk," a revised incentive compensation plan for 2004, for payout in 2005, has been developed. The 2004 Executive Incentive Compensation Plan focuses on the achievement of four specific financial targets:

- •

- Net Income;

- •

- Targeted Earnings Per Share;

- •

- Targeted Free Cash Flow; and

- •

- Targeted Return on Capital Employed.

Based on recommendations by the CEO to the Performance and Compensation Committee, performance bonuses of $5,000 each were recommended to the Board of Directors for John P. Havrilla, Vice President, Business Development and Unregulated Businesses and Brent M. Boyles, Senior Vice President, Operations for Maine Public Service Company (now Senior Vice President and Chief Operating Officer of Maine Public Service Company). A bonus of $2,500 was recommended to the Board of Directors for Mike A. Thibodeau, Vice President, Compliance and Risk Management. These bonuses were approved by the Board of Directors on November 7, 2003 for payout on December 24, 2003.

In addition, based on the CEO's performance and significant positive impact made on the Company, the Performance and Compensation Committee independently recommended to the Board of Directors a bonus of $50,000 for the CEO. The recommended bonus was based on achievement of a number of key milestones including, but not limited to:

- •

- Formation of Maine & Maritimes Corporation as a holding company;

- •

- Resolution of regulatory issues;

- •

- Reduction and control of operating costs;

- •

- Enhanced operational design and integration of asset management programs;

- •

- Institution of an enhanced technology platform to increase productivity;

- •

- Development of the Company's strategic growth plan; and

22

- •

- Implementation of the first phase of the Company's growth strategy and achievement of the Company's first acquisition.

The Committee recommended the proposed CEO bonus to the Board of Directors on November 7, 2003 for payout on December 24, 2003. The Board approved the Committee's recommendation on November 7, 2003.

Stock Option Program

As a part of the CEO's initial recruitment offer, a total of 52,500 stock options were offered to Mr. Bayne to be distributed equally over 10 years, subject to Shareholder approval. Under the originally proposed stock option terms, after a three-year term, Mr. Bayne would have been granted 7,500 stock options per year for seven years at a June 1, 2002 strike price. In the event of a change of control of the Company, all non-granted stock options would have been immediately granted and vested at the June 1, 2002 strike price. Although the overall plan was approved by Shareholders, due to expressed concerns of Shareholders, Mr. Bayne voluntarily agreed to alter the terms of his employment agreement. The revised stock option terms developed within the approved stock option plan provides that Mr. Bayne be granted 5,250 stock options for each of ten years, at the fair market value on June 1 of the grant year, versus the June 1, 2002 strike price. The initial grant was made on June 1, 2002 and each year's grant requires a three-year vesting period before becoming exercisable. Additionally, in the event of change of control of the Company, only those stock options that have been granted will be vested, versus the vesting of all non-granted shares of the 52,500 stock options. The Company does expense the value of granted options.

In 2003, 5,250 stock options were granted to the CEO, subject to prior Board approval and the original terms of the Board's offer of employment to the CEO and subsequent revisions by the Board. A total of 10,500 stock options have been granted to the CEO since 2002.

The CEO and all other members of the Board of Directors are required to achieve an ownership stake in Maine & Maritimes Corporation of at least 500 shares. Stock options do not count toward this minimum. Such shares must be purchased by the CEO or other Director from their personal funds.

Employment Retention Agreements

As an executive retention benefit, the Performance and Compensation Committee administers, based on approval by the Board of Directors, employment retention agreements for key executives within the Company. These agreements, with the exception of the CEO's and Calvin D. Deschene's, provide for continuing employment for a period of two years after a potential change of control of the Company. Should an acquiring company dismiss the executive without good cause, he or she will receive an amount equal to two times their annual base salary, as well as continued health, life, disability and other employee benefit plans, programs and arrangements (excluding the Pension Plan and the Non-Union Retirement Savings Plan) health care coverage for two years. Mr. Calvin D. Deschene's agreement provides for one year's salary equivalent in a lump sum payment, as well as continued health, life, disability, and other employee benefit plans, programs and arrangements (excluding the Pension Plan and the Non-Union Retirement Savings Plan) in the event of change of control or closure of Energy Atlantic. Mr. Bayne's agreement is for a term of three years and allows Mr. Bayne the option of either continuing his employment in the event of change of control, or requesting a payout under his agreement at his sole discretion, equal to three times his annual base salary. All three forms of agreements, other than the terms of compensation, generally reflect similar terms with the exception of Mr. Bayne's, as noted.

23

Executive employment retention agreements in place during 2003 included the following:

Maine & Maritimes Corporation

Mr. James Nicholas Bayne (President and Chief Executive Officer);

Mr. Kurt A. Tornquist (Sr. Vice President and Chief Financial Officer)

Mr. Larry E. LaPlante (Vice President, Chief Accounting Officer and Controller);

Mr. Michael A. Thibodeau (Vice President, Compliance and Risk Management—Resigned 2/27/04); and

Mr. John P. Havrilla (Vice President, Business Development and Unregulated Businesses)

Maine Public Service Company

Mr. Brent M. Boyles (Sr. Vice President, Operations); and

Mr. William L. Cyr (Vice President, Engineering & Asset Management—Resigned 1/9/04)

Energy Atlantic, LLC

Calvin D. Deschene (General Manager)