UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

Maine and Maritimes Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

209 State Street

PO Box 789

Presque Isle, ME

04769-0789

March 31, 2006

Dear Stockholder,

We are pleased to invite you to our Annual Meeting of Stockholders of Maine & Maritimes Corporation (the “Company”) to be held Tuesday, May 9, 2006, at 9:30 a.m. (Eastern Daylight Time). The meeting will be held at the Northern Maine Community College, 33 Edgemont Drive, Presque Isle, ME 04769. Directions are on the back cover of this Proxy Statement.

This year’s Annual Meeting and enclosed Proxy will include (1) the election of Directors and (2) the ratification of Vitale Caturano & Company as the Company’s independent auditors for the 2006 fiscal year.

Every vote is important. We ask that you please vote your Proxy—even if you are planning to attend the meeting.

We thank you in advance for voting and sending in your Proxy.

| | Sincerely, |

| |

|

| | J. Nicholas Bayne |

| | President and Chief Executive Officer |

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS DETERMINED IF THIS PROXY STATEMENT IS ACCURATE OR ADEQUATE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

MAINE & MARITIMES CORPORATION

209 STATE STREET, PO BOX 789

PRESQUE ISLE, MAINE 04769-0789

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY 9, 2006

March 31, 2006

To the Common Stockholders of

MAINE & MARITIMES CORPORATION

Notice is hereby given that the Annual Meeting of the Stockholders of Maine & Maritimes Corporation (“MAM” or the “Company”) will be held at the Northern Maine Community College, 33 Edgemont Drive, Presque Isle, ME on Tuesday, May 9, 2006, at 9:30 a.m. (Eastern Daylight Time), for the following purposes:

1. To consider and act upon a proposal by the Board of Directors of MAM to elect three members of the Board of Directors to serve until the Annual Meeting of the Stockholders in 2009, or until their successors are elected and qualified;

2. To ratify the selection of Vitale Caturano & Company as the Company’s independent auditors for the 2006 fiscal year.

Further information regarding voting rights and the business to be transacted at the meeting is given in the annexed Proxy Statement.

| | By order of the Board of Directors, |

| | Patrick C. Cannon, Secretary |

YOUR VOTE IS VERY IMPORTANT TO US. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE ACT PROMPTLY TO VOTE YOUR SHARES. YOU MAY VOTE YOUR SHARES BY MARKING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE RETURN ENVELOPE PROVIDED. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE YOUR SHARES IN PERSON, EVEN IF YOU HAVE PREVIOUSLY SUBMITTED A PROXY IN WRITING.

This Proxy Statement is dated March 31, 2006 and is first being mailed to stockholders on April 5, 2006.

WHERE YOU CAN FIND MORE INFORMATION

MAM files annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission (the “SEC”). You may read and copy any of the materials the Company files at the SEC’s public reference room located at: Public Reference Room, Judiciary Plaza, 100 F Street, N.E., Room 1580, Washington, D.C. 20549.

Information on the operation of the SEC’s public reference room can be obtained by calling the SEC at 1-800-SEC-0330. You may also obtain copies of this material from the public reference section of the Securities and Exchange Commission, located at Judiciary Plaza, 100 F Street, N.E., Room 1580, Washington, D.C. 20549, at prescribed rates. The SEC filings of MAM are also available to the public from commercial document retrieval services, over the Internet at the SEC’s website at http://www.sec.gov and at the MAM website at http://www.maineandmaritimes.com by selecting “SEC Filings” under the “Investor Relations” option located on that website.

MAM’s Common Stock is listed on the American Stock Exchange, and reports, proxy statements and other information concerning MAM can also be inspected at the offices of that securities exchange located at the American Stock Exchange, 86 Trinity Place, New York, NY 10006.

The SEC allows the Company to incorporate by reference previously filed information into its Proxy Statement. This means that we can disclose important information to you by incorporating information in another document filed separately with the SEC and referring you to that document without having to reproduce the text in its entirety. The information incorporated by reference is deemed to be part of this Proxy Statement, except for any information superseded by information in this Proxy Statement. This Proxy Statement incorporates by reference the documents set forth below that we have previously filed with the SEC. These documents contain important information about MAM and its finances.

| DOCUMENT | | | PERIOD/DATE | | |

Annual Report on Form 10-K | | Year ended December 31, 2005 |

Current Reports on Form 8-K | | January 17, 2006; January 27, 2006; and |

| | February 27, 2006 |

We have enclosed a copy of the 2005 Annual Report along with this Proxy Statement.

If you are a Stockholder, we may have previously sent you some of the documents that are incorporated by reference in this Proxy. We are also incorporating by reference any additional documents, if any, that we may file with the SEC under the Securities Exchange Act of 1934 between the date of this Proxy Statement and the date of the meeting of our stockholders. You can obtain any of the incorporated documents by contacting us or the SEC. Stockholders may obtain any documents incorporated by reference in this Proxy Statement from MAM’s website or by requesting them in writing, or by electronic mail, by sending your request to the following address:

Vice President, Investor Relations and Treasurer

Maine & Maritimes Corporation

P.O. Box 789

209 State Street

Presque Isle, ME 04769-0789

http://www.maineandmaritimes.com

e-mail: investors@maineandmaritimes.com

1-207-760-2402 (telephone)

1-207-760-2403 (facsimile)

1

Upon receipt of your written request, the Company will send the requested documents without charge, excluding exhibits, unless such exhibits are specifically incorporated by reference in this Proxy Statement. If you would like to request documents from us in advance of the Annual Meeting, including any documents we may subsequently file with the SEC prior to the Annual Meeting, the Company must receive your request no later than April 28, 2006, in order for you to obtain timely delivery of them before the Annual Meeting.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROXY STATEMENT TO VOTE ON THE PROPOSALS DESCRIBED IN THIS DOCUMENT. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT FROM WHAT IS CONTAINED IN THIS PROXY STATEMENT. THIS PROXY STATEMENT IS DATED MARCH 31, 2006. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS PROXY STATEMENT IS ACCURATE AS OF ANY OTHER DATE THAN THAT DATE, AND THE MAILING OF THIS PROXY STATEMENT TO STOCKHOLDERS SHALL NOT CREATE ANY IMPLICATION TO THE CONTRARY. IN THE EVENT ANY INFORMATION CONTAINED IN THIS PROXY STATEMENT IS MATERIALLY CHANGED AFTER THE DATE LISTED ABOVE, MAM WILL RECIRCULATE THE PROXY STATEMENT TO STOCKHOLDERS.

2

THE ANNUAL STOCKHOLDERS MEETING

We are furnishing you with this Proxy Statement in connection with a solicitation of Proxies by the Board of Directors of MAM to be used at the Annual Meeting of Stockholders of MAM to be held on Tuesday, May 9, 2006, at 9:30 a.m. (Eastern Daylight Time) and at any adjournment or postponement of that Annual Meeting. The meeting will be held at Northern Maine Community College, 33 Edgemont Drive, Presque Isle, ME 04769. If you execute and return the enclosed Proxy card, it will be voted in the manner directed, but if you return and do not otherwise mark your Proxy card, it will be voted “FOR” Proposal (1). You may revoke your Proxy card at any time prior to the Annual Meeting in the following ways:

· Delivering to Patrick C. Cannon, the clerk of MAM, before the vote at the Annual Meeting, a written notice of revocation bearing a later date than the returned Proxy;

· Executing a later dated Proxy relating to the same shares and delivering it to the clerk of MAM before the vote at the special meeting; or

· Attending the Annual Meeting and voting in person at the Annual Meeting, although attending the Annual Meeting will not itself constitute a revocation of Proxy.

Each holder of Common Stock is entitled to one vote for each share of the stock outstanding in the name of the holder on the records of MAM at the close of business on March 31, 2006. As of March 31, 2006, the outstanding voting securities of MAM consisted of 1,637,211 shares of Common Stock. This Proxy Statement describes the matters to be voted on at the Annual Meeting.

As provided under Maine law:

· A majority of the shares entitled to vote at the Annual Meeting, present in person or represented by Proxy, will constitute a quorum of the meeting;

· With respect to Proposal (1), the three director nominees receiving the greatest number of votes will be elected;

· Abstentions and broker non-votes will be counted in determining a quorum for the meeting; and

· Shares withheld and broker non-votes will have no effect on the election of Directors or any of the other proposals.

Adjournments

We currently expect to take votes and close the polls on all proposals on the scheduled date of the Annual Meeting. However, we may:

· Keep the polls open to facilitate additional Proxy solicitation with regard to any or all proposals; and/or

· Allow the inspectors of the election to count and report on the votes that have been cast after the polls have closed.

If any of the above occurs, we could propose one or more adjournments of the Annual Meeting. For any adjournment to be approved, the votes cast in favor of the adjournment must represent a majority of the total number of votes entitled to be cast by the holders of all classes of stock present at the meeting in person or by Proxy, voting together as a single class.

Proxies that we have solicited will be voted in favor of any adjournment that we propose, but will not be considered a direction to vote for any adjournment proposed by anyone else; provided, however, that no Proxy in the form included with this Proxy Statement shall be voted in favor of adjournment or

3

postponement of the votes on Proposal (1). If any adjournment is properly proposed at the meeting on behalf of anyone else, the persons named as Proxies, acting in that capacity, will have discretion to vote on the adjournment in accordance with their best judgment.

Common Stock Outstanding and Voting Rights

On March 31, 2006, the record date, MAM had 1,637,211 shares of Common Stock issued and outstanding. The Common Stock is the only class of stock entitled to vote at this meeting and all Common Stockholders are entitled to one vote for each share held on all matters, except that in the election of Directors, each Common Stockholder upon proper notice is entitled to cumulative voting. For cumulative voting, each Common Stockholder will be entitled to as many votes as shall equal the number of shares held on the record date multiplied by the number of Directors to be elected, and each stockholder may cast all of the stockholders votes for a single Director or distribute them among the total number of Directors to be elected or among any number of Directors as the stockholder may see fit. Only Common Stockholders of record on the stock transfer books of the Company at the close of business on the record date will be entitled to vote at the meeting.

In connection with Proposal (1), if any Common Stockholder either gives written notice to the President of MAM before the time fixed for the meeting of his or her intention to vote cumulatively, or states his or her intention to vote cumulatively at the meeting before the voting for Directors commences, all Common Stockholders shall be entitled to cumulate their votes on election of Directors. Any Common Stockholder who wishes to vote cumulatively, but who will not be present at the meeting, should give written notice to the President of MAM of such intention before the meeting and should clearly indicate in writing on the accompanying Proxy the Director or Directors for whom he or she wishes to vote and the number of votes he or she wishes to distribute to each such Director. If no written indication is made on the Proxy, the votes will be evenly distributed among all nominees. If any Common Stockholder has indicated his or her intention to vote cumulatively (either by written notice or by a statement made at the meeting), each Common Stockholder present at the meeting, who has not given his or her Proxy, or who has revoked his or her Proxy in the manner described in the following paragraph, may vote cumulatively at the meeting by means of a written ballot distributed at the meeting.

Common Stockholders may vote at the meeting either in person or by duly authorized Proxy. The giving of a Proxy by a Common Stockholder will not affect the Common Stockholder’s right to vote his or her shares if he or she attends the meeting and wishes to vote in person. A Proxy may be revoked or withdrawn by the person giving it, at any time prior to the voting thereof, at the registration desk for the meeting or by advising the Secretary of MAM. In addition, the proper execution of a new Proxy will operate to revoke a prior Proxy. All shares represented by effective Proxies on the enclosed form, received by MAM, will be voted at the meeting or any adjourned session thereof, all in accordance with the terms of such Proxies.

The following table provides information about the beneficial ownership of MAM Common Stock as of December 31, 2005, by each person or entity known to own more than five percent of MAM Common Stock:

Name and Address of Beneficial Owner | | | | Number of Shares

of Common Stock

Beneficially Owned | | Percent of Class

Beneficially Owned | |

Gabelli Asset Management Inc. | | | 145,800 | | | | 8.91 | % | |

One Corporate Center | | | | | | | | | |

Rye, New York 10580-1435 | | | | | | | | | |

FMR Corp. | | | 103,000 | | | | 6.30 | % | |

82 Devonshire Street | | | | | | | | | |

Boston, MA 02109 | | | | | | | | | |

4

Security Ownership By Management

The following table provides information about the beneficial ownership of MAM Common Stock as of December 31, 2005, by:

· Each of the named Executive Officers;

· Each of our Directors;

· All of our Executive Officers and Directors as a group.

Name of

Beneficial Owner | | Position | | | | Number of

Shares (1) (2) (3)

Beneficially Owned | |

Robert E. Anderson (4) | | Director | | | 1,519 | | |

J. Nicholas Bayne | | President, Chief Executive Officer and Director | | | 500 | | |

Michael W. Caron | | Director | | | 742 | | |

D. James Daigle | | Director | | | 1,019 | | |

Richard G. Daigle (4) | | Chairperson of the Board and Directors | | | 1,149 | | |

David N. Felch (4) | | Director | | | 784 | | |

Deborah L. Gallant | | Director | | | 1,019 | | |

Nathan L. Grass | | Vice Chairperson and Director | | | 1,033 | | |

G. Melvin Hovey (5) | | Director and Retired Chairperson | | | 3,719 | | |

Lance A. Smith (4) | | Director | | | 860 | | |

John P. Havrilla | | Vice President, Corporate Strategy and Chief | | | 0 | | |

| | Development Officer | | | | | |

Patrick C. Cannon | | General Counsel, Corporate Secretary and Clerk | | | 0 | | |

Michael I. Williams | | Vice President and Acting Chief Financial Officer | | | 0 | | |

Kurt A. Tornquist | | Senior Vice President and Chief Financial Officer, | | | 0 | | |

| | Maine Public Service Co. | | | | | |

All Directors and Officers as a group | | | 12,344 | | |

(1) The Directors and Officers as a group own in the aggregate less than 1.05% of MAM’s outstanding Common Stock.

(2) All members of the Board of Directors are required to purchase a minimum of 500 shares.

(3) Board of Director and Officer purchases of additional shares are restricted, due to insider trading policies and “blackout” periods.

(4) Pursuant to the Company’s Deferred Compensation Plan for Outside Directors, Messrs. Anderson, Daigle, Felch, and Smith have elected to defer some of their retainer, meeting, and committee chairperson fees into an account which is adjusted by the value of a deemed investment in the Company’s Common Stock. Such deferred amounts will be paid to these Directors or their designated beneficiaries in a lump sum or an equal monthly payment over ten years when these individuals no longer serve on the Company’s Board of Directors.

(5) Resigned as a director effective March 1, 2006. 1,650 of these shares are held by Mr. Hovey’s spouse.

None of the persons listed above own beneficially, or directly, any of the securities of MAM’s subsidiaries.

There has been no arrangement in the past year known to the Company, including any pledge by any person of MAM securities, which may result in a change in control of MAM currently or in the future.

The Company is not aware of any material proceedings to which any Director, Officer or affiliate of MAM, any owner of record or beneficially of more than five percent of the Common Stock of MAM, or any associate of any such Director, Officer or affiliate of MAM, or security holder, is a party adverse to MAM or any of its subsidiaries or has a material interest adverse to MAM or any of its subsidiaries.

5

PROPOSAL (1)

ELECTION OF DIRECTORS

MAM’s Articles of Incorporation authorize the Board of Directors or the Stockholders to fix the number of Directors from time to time, provided that the number of Directors may not be less than nine or more than eleven, except in certain extraordinary circumstances set forth in the “Articles of Incorporation.” In accordance with the Articles, the Board of Directors has fixed the number of Directors at eleven. We currently have nine Directors, of which three have a term of office that will expire with the upcoming Annual Meeting on May 9, 2006. The three-year terms of Robert E. Anderson, Michael W. Caron, and Nathan L. Grass expire in 2006 and these Directors are up for re-election to the Board of Directors.

The Board is divided into three classes of directorships, with Directors in each class serving staggered three-year terms. One class is elected each year for a three-year term. There are currently three Directors whose terms will expire at the 2006 Annual Meeting. The three nominees are named in the table set forth below. The Stockholders are asked to elect Messrs. Anderson, Caron, and Grass, all of whom have been duly nominated by the Corporate Governance Committee of the Board of Directors, to serve a term of office until the 2009 Annual Meeting of Stockholders and their respective successors have been elected and qualified.

The shares represented by Proxies which are executed and returned without direction will be voted at the meeting for the election of Directors of the persons named as nominees in the table set forth below. However, in the event that Directors are to be elected by cumulative voting, shares represented by Proxies which are executed and returned without direction will be voted at the meeting in the discretion of the Proxy holders as to the manner in which votes represented thereby will be distributed among such nominees. All of the nominees have indicated their willingness to serve as Directors until the expiration of their respective terms and until their successors shall have been duly chosen and qualified.

Should any of the nominees for the office of Director become unable to accept a nomination or election, which is not anticipated, it is intended that the persons named in the accompanying form of Proxy will vote for the election of such other person as the Board of Directors may recommend in the place of such nominee. Nominees for Director who receive the greatest number of votes by Common Stockholders entitled to vote, even though not a majority of the votes cast, shall be elected. Therefore, abstentions and broker non-votes have no effect on the election of Directors.

6

NOMINEES AND CURRENT DIRECTORS BY CLASS

| | | | Year First | |

Name and Business Experience for Last 5 Years | | | | Age | | Elected Director | |

(Nominees whose terms expire in 2009—Class I) | | | | | | | | | |

ROBERT E. ANDERSON (for re-election) (2) (3) (5) | | | 68 | | | | 1993 | | |

Chairman of the Board and Chief Financial Officer since before 2000 | | | | | | | | | |

F. A. Peabody Company (Insurance) | | | | | | | | | |

Houlton, Maine | | | | | | | | | |

MICHAEL W. CARON (for re-election) (1) (3) (5) | | | 58 | | | | 2003 | | |

Chief Financial Officer since 2002 | | | | | | | | | |

Catholic Charities Maine | | | | | | | | | |

(Social service agency of the Diocese of Portland) | | | | | | | | | |

Falmouth, Maine | | | | | | | | | |

Mr. Caron was not employed between 2000 and 2002. | | | | | | | | | |

Controller, 1996-2000 | | | | | | | | | |

Central Maine Power Company | | | | | | | | | |

Augusta, Maine | | | | | | | | | |

NATHAN L. GRASS (for re-election) (2) (3) (5) | | | 67 | | | | 1983 | | |

President since before 2000 | | | | | | | | | |

Grassland Equipment, Inc | | | | | | | | | |

(holding company for personal investments) | | | | | | | | | |

Presque Isle, Maine | | | | | | | | | |

(Directors for terms expiring in 2008—Class III) | | | | | | | | | |

D. JAMES DAIGLE (2) (4) (5) | | | 70 | | | | 1973 | | |

President since before 2000 | | | | | | | | | |

D & D Management Co. | | | | | | | | | |

(real estate investment and management company, | | | | | | | | | |

which is currently inactive) | | | | | | | | | |

Orlando, Florida | | | | | | | | | |

DEBORAH L. GALLANT (2) (4) (5) | | | 53 | | | | 1994 | | |

President & CEO since before 2000 | | | | | | | | | |

D. Gallant Management Associates | | | | | | | | | |

(Management Consultants) | | | | | | | | | |

Portland, Maine | | | | | | | | | |

LANCE A. SMITH (1) (4) (5) | | | 54 | | | | 2002 | | |

President and Co-owner since before 2000 | | | | | | | | | |

Smith’s Farm, Inc. | | | | | | | | | |

(agricultural farm; broccoli is currently its principal crop) | | | | | | | | | |

Presque Isle, Maine | | | | | | | | | |

| | | | | | | | | | | |

7

(Directors for terms expiring in 2007—Class II) | | | | | | | | | |

J. NICHOLAS BAYNE (5) | | | 52 | | | | 2002 | | |

President and Chief Executive Officer of Maine & Maritimes | | | | | | | | | |

Corporation since March 7, 2003 | | | | | | | | | |

Presque Isle, Maine | | | | | | | | | |

Chief Executive Officer of Maine Public Service | | | | | | | | | |

Company since September 1, 2002 | | | | | | | | | |

Presque Isle, Maine | | | | | | | | | |

President, Maine Public Service Company | | | | | | | | | |

From May 15, 2002 to June 6, 2005 | | | | | | | | | |

Presque Isle, Maine | | | | | | | | | |

President-Elect of Maine Public Service Company | | | | | | | | | |

March 18, 2002 to May 14, 2002 | | | | | | | | | |

Presque Isle, Maine | | | | | | | | | |

Executive Consultant to the energy, utilities, and energy-software | | | | | | | | | |

industries, 2001 to 2002 | | | | | | | | | |

Charlotte, North Carolina | | | | | | | | | |

Chief Executive Officer and Director, Aspect, LP, | | | | | | | | | |

(energy software / FAS 133 solution development firm) 2001 | | | | | | | | | |

Houston, Texas | | | | | | | | | |

Senior Vice President of Strategic Advisory Services | | | | | | | | | |

Energy E-Comm.com, 2000 to 2001 (energy and strategic consulting practice) | | | | | | | | | |

Charlotte, North Carolina | | | | | | | | | |

Senior Vice President for Energy Sales and Operations and Director | | | | | | | | | |

of Duke Solutions, Inc., Duke Energy’s unregulated retail energy | | | | | | | | | |

services company, 1997 to 2000 | | | | | | | | | |

Charlotte, North Carolina | | | | | | | | | |

RICHARD G. DAIGLE (1) (4) (5) | | | 58 | | | | 1994 | | |

Chairman and CEO since before 2000 | | | | | | | | | |

Daigle Oil Company | | | | | | | | | |

(retail and wholesale distributor of petroleum products) | | | | | | | | | |

Fort Kent, Maine | | | | | | | | | |

DAVID N. FELCH (1) (3) (5) | | | 61 | | | | 2003 | | |

Senior Partner since before 2000 | | | | | | | | | |

Felch & Company, LLC | | | | | | | | | |

(Certified Public Accountants) | | | | | | | | | |

Caribou, Maine | | | | | | | | | |

(1) Member of the Audit Committee.

(2) Member of the Performance and Compensation Committee.

(3) Member of the Pension and Benefits Committee.

(4) Member of the Corporate Governance Committee.

(5) Member of the Strategic Planning Committee.

8

DIRECTORS AND COMMITTEE MEETINGS

The Directors of Maine & Maritimes Corporation held a total of nine Board meetings during 2005, one of which was a telephonic meeting. At the May 11, 2005 meeting, Mr. G. Melvin Hovey announced his resignation as Chairperson of the Board of Directors. Mr. Richard G. Daigle was named his successor and Mr. Nathan L. Grass was named Vice Chairperson.

During 2005, all Directors attended 75% or more of the aggregate number of meetings of the Board of Directors and Committees on which they serve. Actual overall attendance was 99%. The independent members of MAM’s Board of Directors met in March and November Executive Sessions without members of Management to discuss various business-related issues. Business discussed by the independent directors in Executive Sessions was communicated, as appropriate, to the Chief Executive Officer and/or General Counsel for their information and/or implementation. Ms. Gallant conducted an informational session for the Board highlighting issues discussed at the Directors Consortium, a three-day program accredited by Institutional Shareholder Services (ISS). On September 2, 2005, all Directors attended compliance training and discussed topics concerning Directors’ code of conduct, whistleblower’s policy and procedures, insider trading, and fair disclosure regulations. The training session was conducted by General Counsel.

The Maine & Maritimes Corporation Board of Directors has five standing committees.

· Audit Committee;

· Strategic Planning Committee;

· Pension and Benefits Committee;

· Corporate Governance Committee, which also serves as the nominating committee; and

· Performance and Compensation Committee.

Audit Committee

The members of the Audit Committee are: David N. Felch, the chairperson, Michael W. Caron, Richard G. Daigle, and Lance A. Smith. Mr. Michael W. Caron is the Audit Committee’s designated financial expert. All members of the Audit Committee are independent in accordance with the current definition in Rule 121 of the American Stock Exchange. During 2005, the Audit Committee held five meetings, one of which was a telephonic meeting. At the February 4, 2005 meeting, Mr. G. Melvin Hovey announced his resignation from the Audit Committee. Beginning with the August 10, 2005 meeting, Mr. Felch replaced Mr. Richard G. Daigle as Chairperson. The Audit Committee recommends to the Board of Directors the engagement of Maine & Maritimes Corporation’s independent auditors, provides independent oversight with respect to financial reporting and internal controls, the internal audit function and the independent auditors, determines whether the independent auditors are independent and makes recommendations on audit matters and internal controls to the Board of Directors. The Board of Directors has adopted a Charter for the Audit Committee, which is attached as Appendix A and is also available on the Company’s website.

Strategic Planning Committee

The members of the Strategic Planning Committee are Richard G. Daigle, the chairperson, Robert E. Anderson, J. Nicholas Bayne, Michael W. Caron, D. James Daigle, David N. Felch, Deborah L. Gallant, Nathan L. Grass, and Lance A. Smith. During 2005, the Strategic Planning Committee held six meetings. Beginning with the June 3, 2005 meeting, Mr. Richard G. Daigle replaced Mr. Hovey as Chairperson. The Strategic Planning Committee considers all matters of strategic importance including, without limitation, matters related to the Company’s strategy, mergers and acquisition activities, budgets, operations, customer relations, system security and reliability, and other significant regulatory, transactional, business

9

or political matters of strategic significance. The Committee typically meets the day before the MAM Board of Director meetings and, as a Committee of the whole Board, it serves as a detailed work session for issues regarding, but not necessarily limited to, strategic planning, operational issues, regulatory affairs, and capital structure objectives to come before the Board.

Pension and Benefits Committee

The members of the Pension and Benefits Committee are Robert E. Anderson, the chairperson, Michael W. Caron, David N. Felch, and Nathan L. Grass. During 2005, the Pension and Benefits Committee held four meetings. The Pension and Benefits Committee reviews the management of the Company’s pension fund by the pension fund trustee and makes recommendations with respect to the management of such fund to the Board and Management as it deems necessary. The Pension and Benefits Committee also makes recommendations in connection with the Company’s 401(k) Plan. In addition, the Committee is responsible for oversight of employee health care and insurance-related benefits and closely coordinates with the Performance and Compensation Committee to ensure equitable total compensation structures throughout the Company.

Corporate Governance Committee

The members of the Corporate Governance Committee are Deborah L. Gallant, the chairperson, D. James Daigle, Richard G. Daigle, and Lance A. Smith. All members of the Corporate Governance Committee are independent in accordance with the current definition in Rule 121 of the American Stock Exchange. The Corporate Governance Committee held six meetings during 2005. At the March 4, 2005 meeting, Mr. G. Melvin Hovey announced his resignation from the Corporate Governance Committee. Beginning with the June 2, 2005 meeting, Mr. Richard G. Daigle became a member of the Committee. A four-member Ad Hoc Nominating Committee consisting of Deborah L. Gallant, chairperson, Robert E. Anderson, Nathan L. Grass, and Richard G. Daigle, held one meeting to discuss performance evaluations and qualifications of nominees to stand for election to the office of Class III Directors, serving a three-year term expiring 2008. The Committee considers matters related to corporate governance and formulates and periodically revises principles for Board governance, recommends to the Board of Directors the size and composition of the Board of Directors within the limits set forth in the Articles of Incorporation and By-laws and recommends potential successors for the position of Chairperson of the Board. This Committee also considers nominees, who are either submitted by Stockholders or otherwise, for the Board of Directors and makes recommendations to the Board who may, in turn nominate the candidates for election by the Stockholders. The Charter of the Corporate Governance Committee is available on the Company’s website at www.maineandmaritimes.com.

The Process of Identifying and Evaluating Candidates for Directors

The Board is responsible for recommending Director candidates, either Director and/or Shareholder nominated, for election by the stockholders and for electing Directors to fill vacancies or newly created Directorships. The Board has delegated the screening and evaluation process for Director candidates to the Corporate Governance Committee, which identifies, evaluates and recruits highly qualified Director candidates and recommends them to the Board. The Corporate Governance Committee evaluates nominations for Board members (both shareholder nominated and Board nominated) solely on the basis of qualifications and does not nominate a sitting Board member unless such person is deemed to be the most qualified candidate. The Corporate Governance Committee recognizes that required qualifications for Board members may change as business strategies and conditions change. Consequently, the Corporate Governance Committee closely evaluates each year’s slate of nominations based on merit and skills needs versus the incumbency of Board membership.

10

Shareholder nominated candidates will be reviewed and nominated in the same manner as Board nominated candidates.

Each nominee approved by the Committee for election in 2006 was recommended by a non-management Director or group of Directors.

Qualifications of Directors

Under a policy formulated by our Corporate Governance Committee, the Company generally requires that all candidates for directors possess the following qualifications:

· The highest level of personal and professional ethics, integrity and values;

· A proven personal record of success;

· An inquiring and independent mind;

· Practical wisdom and mature judgment;

· Broad training and experience at the policy-making level in business, finance and accounting, government, education or technology;

· Expertise that is useful to the Company and complementary to the background and experience of other Board members, so that an optimal balance of Board members can be achieved and maintained;

· Willingness to devote the required time to carrying out the duties and responsibilities of Board membership;

· Commitment to serve on the Board for several years to develop knowledge about the Company’s business;

· Willingness to represent the best interests of all stockholders and objectively appraise management performance; and

· Involvement only in activities or interests that do not conflict with the Director’s responsibilities to the Company and its stockholders.

The Company also requires that a majority of directors be independent. For a detailed description of the qualifications required of candidates for director, as well as any specific qualities or skills the Company believes should be possessed by one or more directors, see the Company’s website at www.maineandmaritimes.com.

Security Holder Recommendation of Candidates for Election as Directors

The Corporate Governance Committee will consider recommendations for director nominations submitted by shareholders entitled to vote generally in the election of directors. Submissions must be made in accordance with the Committee’s procedures, as outlined below and set forth on the Company’s website at www.maineandmaritimes.com. The Corporate Governance Committee will only consider candidates who satisfy the Company’s minimum qualifications for director, as outlined above and set forth on the Company’s website at www.maineandmaritimes.com, including that directors represent the interests of all shareholders.

Procedures for Security Holders Submission of Nominating Recommendations

A shareholder wishing to recommend to the Corporate Governance Committee a candidate for election as director must submit the recommendation in writing, addressed to the Committee in care

11

of the Company’s corporate secretary at P.O. Box 789, Presque Isle, ME 04769. Submissions recommending candidates for election at the annual meeting of stockholders must be received no later than 120 calendar days prior to the first anniversary of the date of the proxy statement for the prior annual meeting of stockholders. Nominations received from Stockholders after December 1, 2006, are not required to be considered at the 2007 Annual Meeting. In the event that the date of the next annual meeting of stockholders is more than 30 days following the first anniversary date of the annual meeting of stockholders for the prior year, the submission must be made a reasonable time in advance of the mailing of the Company’s next annual proxy statement. Each nominating recommendation must be accompanied by the consent of the proposed nominee to serve if nominated and the agreement of the nominee to be contacted by the Committee, if the Committee decides in its discretion to do so.

Performance and Compensation Committee

The members of the Performance and Compensation Committee are Nathan L. Grass, the chairperson, Robert E. Anderson, D. James Daigle, and Deborah L. Gallant. The Performance and Compensation Committee, which consists of all independent Directors, held six meetings during 2005. Beginning with the June 2, 2005 meeting, Mr. Anderson became a member of the Performance and Compensation Committee. The Performance and Compensation Committee sets financial and operating performance standards for consideration and approval by the Board of Directors, including performance benchmarks associated with executive incentive compensation. The Committee develops salary and other compensation recommendations for the position of Chief Executive Officer of Maine & Maritimes Corporation. These recommendations are developed in Executive Session without the presence of the CEO and are based on CEO performance reviews undertaken by the Committee. The Committee is responsible for independently recommending salaries and compensation for all other MAM and MPS Executive Officers, as well as setting overall enterprise-wide compensation philosophies, utilizing input from the CEO. The Committee’s independent recommendations are made to the Board of Directors for consideration and action in Board of Directors meetings without the CEO or any Executive Officer.

As a part of the Committee’s annual responsibilities, they develop succession plans for the position of CEO and work with the CEO to develop succession plans for all key Executive Officer positions. In addition, the Committee researches and develops recommendations to the Board of Directors concerning compensation for outside Directors. The Charter of the Performance and Compensation Committee is available on the Company’s website.

BUSINESS AND FAMILY RELATIONSHIPS AND TRANSACTIONS WITH DIRECTORS AND EXECUTIVE OFFICERS

Richard Daigle, Chairperson of the Board of the Company, is the Chief Executive Officer of Daigle Oil Company. The Company paid $82,827 to Daigle Oil Company during fiscal year 2005 for heating oil under a contract awarded pursuant to competitive bidding.

Mark Hovey, son of G. Melvin Hovey, a retired director of the Company, is employed by Maine Public Service Company as Vice President of Human Resources and received a salary of $91,038 during fiscal year 2005.

12

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed and discussed with Management the Company’s 2005 audited financial statements. It has discussed with the firm of Vitale, Caturano & Company (“VCC”) the Company’s independent auditors, the matters required to be discussed by Statement of Auditing Standards No. 61, and has received from VCC the written disclosure and letter required by Independence Standards Board Standard No. 1. The Audit Committee has discussed with VCC the firm’s status as an independent auditor. Based on this review and these discussions, the Audit Committee has recommended to the Company’s entire Board of Directors that the Company’s financial statements, audited by VCC, be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005. The Company’s independent auditor will be present at the security holders’ meeting for statements or questions.

All four members of the Audit Committee are independent as defined under Section 121(A) of the AMEX’s listing standards. At least one member of the Audit Committee has the required experience in finance and accounting, as required under Section 121(B) (b) of the AMEX listing standards. On September 5, 2003, Michael W. Caron was designated by the Company’s Board of Directors as the Audit Committee’s “financial expert” as that term has been defined by the SEC under the Act. In accordance with its charter, the Audit Committee has performed its annual self-evaluation and charter review.

| | Audit Committee Members: |

| | David N. Felch, Chairperson |

| | Michael W. Caron, Financial Expert |

| | Richard G. Daigle |

| | Lance A. Smith |

AUDIT FEES

The aggregate fees billed for services rendered by VCC and PWC for the audit of the annual financial statements of the Company for fiscal years 2004 and 2005 and reviews of the financial statements in the Company’s Form 10-Q for those fiscal years were $160,900 and $196,000, respectively. The Company changed audit firms from PwC to VCC for quarters after June 30, 2004.

Audit-Related Fees

For fiscal years 2004 and 2005, the aggregate fees billed for services rendered on assurance and related services, which are reasonably related to the performance of the audit or review of the financial statements of the Company and its predecessor, were $39,150 and $96,918, respectively, broken down as follows:

| | 2004 | | 2005 | |

Audits of the Company’s pension plan & nonunion retirement savings plan (401(k)) | | $ | 29,000 | | $ | 35,244 | |

Other services regarding tax-exempt bond filings | | 5,000 | | 3,500 | |

Other audit-related services | | 5,150 | | 58,174 | |

Total | | $ | 39,150 | | $ | 96,918 | |

13

Tax Fees

For fiscal years 2004 and 2005, the aggregate fees billed for services rendered by VCC for professional services for tax compliance, tax advice and tax planning for the Company and its predecessor were $12,000 and $72,625, respectively, broken down as follows:

| | 2004 | | 2005 | |

Tax services for review of corporate tax return and earnings and profits | | $ | 7,000 | | $ | 50,500 | |

Other tax consulting services | | 5,000 | | 22,125 | |

Total | | $ | 12,000 | | $ | 72,625 | |

All Other Fees

There were no Other Fees other than Audit-Related and Tax Fees reported above.

The Audit Committee has concluded that the provision of the non-audit services listed above is compatible with maintaining the independence of Vitale Caturano & Company.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditor

The Audit Committee is responsible for appointing, setting compensation, and overseeing the work of the independent auditor. The Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent auditor. A request for pre-approval must be specific as to the particular services to be provided and may be submitted to the Audit Committee in one of the following ways:

1. Request for approval of services at a meeting of the Audit Committee; or

2. Request for approval of services by a designated member of the Audit Committee.

The fees reported under the headings Audit-Related Fees, Tax Fees and All Other Fees were not approved by the Audit Committee pursuant to Rule 2-01(c)(7)(i)(c) of Regulation S-X. This regulation permits the Audit Committee to waive its pre-approval requirement under certain circumstances.

14

EXECUTIVE COMPENSATION

The following summary compensation table sets forth the total compensation paid by the Company and its subsidiaries in 2003, 2004, and 2005 to J. Nicholas Bayne, the Company’s President and Chief Executive Officer; and to the other persons listed below (the “Named Executive Officers”).

Summary Compensation Table

| | Annual Compensation (1) | | Long-term Compensation | |

| | | | | | | | | | Awards | | Payouts | |

Name & Principal Position | | | | Year | | Salary

($) | | Bonus

($) | | Other Annual

Compensation

($) | | Restricted

Stock

Award ($) | | Securities (1)

Underlying

Options (#) | | LTIO

payout ($) | | All Other (2)

Compensation

($) | |

J. NICHOLAS BAYNE | | 2005 | | 224,999 | | 0 | | | 0 | | | | 0 | | | | 5,250 | | | | 0 | | | | 4,027 | | |

President, Chief Executive | | 2004 | | 190,385 | | 0 | | | 0 | | | | 0 | | | | 5,250 | | | | 0 | | | | 2,769 | | |

Officer | | 2003 | | 175,739 | | 52,578 | | | 0 | | | | 0 | | | | 5,250 | | | | 0 | | | | 2,751 | | |

JOHN P. HAVRILLA | | 2005 | | 128,039 | | 5,000 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

Vice President, Corporate | | 2004 | | 116,077 | | 0 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

Strategy and Chief Development | | 2003 | | 110,000 | | 5,000 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | |

KURT A. TORNQUIST | | 2005 | | 120,000 | | 0 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 600 | | |

Former Senior Vice President, | | 2004 | | 112,154 | | 0 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 561 | | |

Chief Financial Officer, and Treasurer | | 2003 | | 94,250 | | 1,491 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 479 | | |

MICHAEL I. WILLIAMS | | 2005 | | 107,616 | | 5,000 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

Vice President, Acting | | 2004 | | 56,154 | | 0 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 4,858 | | |

Chief Financial Officer | | 2003 | | 0 | | 0 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

PATRICK C. CANNON | | 2005 | | 150,010 | | 0 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 20,028 | | |

General Counsel, | | 2004 | | 7,500 | | 10,000 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 1,043 | | |

Corporate Secretary | | 2003 | | 0 | | 0 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) See “Stock Option Plan” starting on Page 17 for further details.

(2) The amounts in this column include the following:

Name | | | | Year | | 401(k)

Match ($) | | Temporary

Living

Expenses ($) | | Relocation

Expenses ($) | | Total ($) | |

J. Nicholas Bayne | | 2005 | | | 4,027 | | | | 0 | | | | 0 | | | | 4,027 | | |

| | 2004 | | | 2,769 | | | | 0 | | | | 0 | | | | 2,769 | | |

| | 2003 | | | 2,751 | | | | 0 | | | | 0 | | | | 2,751 | | |

John P. Havrilla | | 2005 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

| | 2004 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

| | 2003 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

Kurt A. Tornquist | | 2005 | | | 600 | | | | 0 | | | | 0 | | | | 600 | | |

| | 2004 | | | 561 | | | | 0 | | | | 0 | | | | 561 | | |

| | 2003 | | | 479 | | | | 0 | | | | 0 | | | | 479 | | |

Michael I. Williams | | 2005 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

| | 2004 | | | 0 | | | | 1,250 | | | | 3,608 | | | | 4,858 | | |

| | 2003 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

Patrick C. Cannon | | 2005 | | | 58 | | | | 5,179 | | | | 14,791 | | | | 20,028 | | |

| | 2004 | | | 0 | | | | 1,043 | | | | 0 | | | | 1,043 | | |

| | 2003 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | |

15

As of March 1, 2006 the Company had in effect an employment continuity agreement with Mr. Bayne, and Employee Retention Agreements with Messrs. Tornquist, Havrilla, Williams, and Cannon. The term of these agreements for Mr. Tornquist and Mr. Havrilla extends through September 4, 2006. The term of these agreements for Mr. Williams, and Mr. Cannon extends through December 14, 2007. With the exception of Mr. Bayne’s agreement, under these agreements, should a change of control event occur and the acquiring company terminates the employment of the Executive Officers within one year following such change in control, the company will pay the executive an amount equal to two times the executive’s then current salary. The agreements also provide for the continuation of the executives’ benefits under the then current health, life, disability and other employee benefit plans, programs and arrangements (excluding the Pension Plan and Retirement Savings Plan) for a period of twenty-four (24) months after termination. The term of Mr. Bayne’s agreement is for a period of three years and shall automatically renew for additional three-year terms unless otherwise terminated. Under Mr. Bayne’s agreement should a change in control event occur and the acquiring company terminates his employment within twenty-four months following such change in control, the company will pay him an amount equal to three times his annual base salary in effect upon the date of the change in control event with continuation of benefits under the then current health, life, disability and other employee benefit plans, programs and arrangements (excluding the Pension Plan and Retirement Savings Plan) for a period of twenty-four (24) months after termination. Under Mr. Bayne’s agreement he retains the right to continue employment or request an immediate lump sum payment in the event of a change in control.

16

STOCK OPTION PLAN

With the approval by the Company’s Stockholders at the 2002 Annual Meeting, the Company adopted the 2002 Stock Option Plan. The 2002 plan provides employees of the Company and its subsidiaries with stock ownership opportunities and additional incentives to contribute to the success of the Company, and to attract, reward and retain employees of outstanding ability. The plan is administered by the members of the Performance and Compensation Committee of the Board, who are not employees of the Company or any subsidiaries. The Company may grant options to its employees for up to 150,000 shares of Common Stock, provided the maximum aggregate number of shares which may be issued under the plan pursuant to incentive stock options shall be 120,000 shares. The exercise price for shares to be issued under any stock option shall not be less than one hundred percent (100%) of the fair market value of such shares on the date the option is granted. An option’s maximum term is ten (10) years. The Board has granted options to J. Nicholas Bayne for an aggregate of 52,500 shares. Mr. Bayne will receive 5,250 shares per year for ten years with a three-year vesting period. A total of 21,000 options have been granted to J. Nicholas Bayne, with 5,250 options granted in 2005, 2004, 2003 and in 2002. The Company expenses all options at the time of the grant, even though the options are not vested for a three-year term after the grant.

Option/SAR Grants in Last Fiscal Year (2005) | |

Name | | | | Number of

Securities

Underlying

Options/SARs

Granted (#) | | Percent of Total

Options/SARs

Granted to

Employees in

Fiscal Year | | Exercise or Base

Price ($/Sh) | | Expiration

Date | | Grant Date

Present

Value $ (1) | |

J. Nicholas Bayne | | | 5,250 | | | | 100 | | | | 32.00 | | | 05-31-2015 | | | $ | 15,114 | | |

| | | | | | | | | | | | | | | | | | | | | | |

(1) The fair value of each option grant is estimated on the date of the grant using the Black-Scholes option-pricing model, with the following weighted-average assumptions used for the grants: 20% expected volatility, 3.94% risk-free rate of return, 3.80% dividend yield, and exercise at the end of seven (7) years from date of grant.

Equity Compensation Plan Information | |

Plan category | | | | Number of Securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a) | | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b) | | Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities

reflected in column (a))

(c) | |

Equity compensation plans approved by security holders | | | 21,000 | | | | 29.80 | | | | 136,046 | | |

Equity compensation plans not approved by security holders | | | | | | | n/a | | | | | | |

Total | | | 21,000 | | | | | | | | 136,046 | | |

17

RETIREMENT PLAN

Pension costs are not and cannot be readily allocated to individual employees. The Company normally contributes 100% of the remuneration of plan participants. The following pension plan table shows the estimated annual benefits payable upon retirement:

PENSION PLAN TABLE

IN DOLLARS | |

Highest Average Annual

Three Consecutive Years | | Annual Benefits for Years of Service | |

Base Salary (1) | | 15 yrs | | 20 yrs | | 25 yrs | | 30 yrs or more | |

120,000 | | 20,256 | | 30,756 | | 41,256 | | | 51,756 | | |

140,000 | | 25,506 | | 37,756 | | 50,006 | | | 62,256 | | |

160,000 | | 30,756 | | 44,756 | | 58,756 | | | 72,756 | | |

180,000 | | 36,006 | | 51,756 | | 67,506 | | | 83,256 | | |

200,000 | | 41,256 | | 58,756 | | 76,256 | | | 93,756 | | |

210,000 | | 43,881 | | 62,256 | | 80,631 | | | 99,006 | | |

(1) The Internal Revenue Service limits the maximum amount of annual compensation that can be used in calculating retirement benefits. This limit is $210,000 in 2005.

The compensation covered by the pension plan consists of the participant’s highest average annual three consecutive year’s salary, which corresponds to the salary shown on the Summary Compensation Table above. Benefits under the pension plan are computed based on a straight-life annuity and are subject to benefits under the Federal Social Security Act. The table above reflects benefits after the Social Security offset.

The estimated annual benefits payable upon retirement to the Named Executive Officers, Messrs. Bayne, Havrilla, Tornquist, Williams, and Cannon, were $44,805, $32,735, $51,756, $41,215 and $67,506, respectively. These amounts are based upon the assumption that these Officers will continue their employment at their salary rate at January 1, 2006, until their normal retirement dates and the Company’s retirement plan will continue in effect. As of January 1, 2006, Messrs. Bayne, Havrilla, Tornquist, Williams, and Cannon had less than approximately four years, three years, thirteen years, one year, and one year, respectively, of vesting service in the plan.

Employees of Maricor Technologies, Inc., The Maricor Group and its subsidiaries, and employees hired on or after January 1, 2006 are not eligible to participate in the defined benefit pension plan.

Directors who are not employees of the Company are not eligible to participate in the Company’s retirement plan.

Section 16(a) Beneficial Ownership Reporting Compliance

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that during the year ended December 31, 2005, its officers, Directors and greater-than-10% shareholders complied with all Section 16(a) filing requirements.

18

DIRECTORS’ COMPENSATION

Effective June 1, 2005, the Maine & Maritimes Corporation Board of Directors adopted the following Directors’ Fee Structure, which represents an increase based on attracting and retaining qualified Directors, additional scrutiny by courts of independent directors, increased responsibility, workload and risk caused by the Sarbanes-Oxley Act and corporate expansion. The Board also agreed to hold monthly Strategic Planning and Regular Board of Directors meetings, and a minimum of four Committee meetings per year, once each quarter, with flexibility to hold special Committee meetings and teleconference meetings, as required. Additional details concerning Directors’ compensation can be found in the “Performance and Compensation Committee Report on Executive Compensation,” Section on Page 20, herein.

The fees are as follows:

| | Effective Since

June 1, 2005

(Dollars) | |

Annual Retainer—Chairperson | | | 25,000 | | |

Annual Retainer—Vice Chairperson | | | 20,000 | | |

Annual Retainer—Other | | | 15,000 | | |

Audit Committee Chairperson—Annual | | | 1,500 | | |

Committee Chairs—Annual | | | 1,000 | | |

Board Meeting Attendance—Per Meeting | | | 800 | | |

Committee Meetings—Per Meeting | | | 800 | | |

Committee Meetings—(Same Day as Board Meeting)—Per Meeting | | | 800 | | |

Telephonic Meetings—Per Meeting | | | 300 | | |

Stock Grant—Annual | | | 3,000 | | |

A Deferred Compensation Plan for Outside Directors has been in place since 2000. Under the Plan, participants may defer up to 100% of their retainer, meeting, and committee chairperson fees. The Company establishes an account for the deferred Director fees and adjusts the account balance for fees deferred and by the value of a deemed investment on five-year U.S. Treasury Notes or the Company’s Stock. Such deferred amounts will be paid to the Director or to a designated beneficiary in a lump sum or an equal monthly payment over ten years when the Director ceases to serve on the Company’s Board of Directors.

At the November 7, 2003, Maine & Maritimes Corporation Regular Board meeting, Directors approved a resolution to establish a “rabbi trust” under the MPS Deferred Compensation Plan for Outside Directors and the MPS Prior Service Executive Retirement Plan (the “Plans”), through which the Company may, from time to time, fund its obligations through the Plans, and shall, in the event of a change-in-control of the Company, immediately fund such obligations in full.

PERFORMANCE AND COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the MAM Performance and Compensation Committee during the fiscal year 2005 were Messrs. N. L. Grass, R. E. Anderson, R. G. Daigle, D. J. Daigle and Ms. D. L. Gallant, none of whom are now, or have ever been, employees or officers of the Company. Except for their positions as Directors, Messrs. N. L. Grass, R. E. Anderson, R. G. Daigle, D. J. Daigle and Ms. D. L. Gallant, have not engaged and are not proposing to engage, in any transactions with the Company in which they have a direct or indirect material interest, except that the Company paid $82,827 to Daigle Oil Company, of which Richard Daigle, Chairperson of the Board of Daigle Oil Company, is the Chief Executive Officer, during fiscal year 2005 for heating oil under a contract awarded pursuant to competitive bidding. None of the Company’s executives served as directors of any other entity under conditions requiring disclosure in this Proxy Statement.

19

PERFORMANCE AND COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Board of Directors’ Performance and Compensation Committee consists of all independent directors. The Committee is responsible for:

· Development and recommendation of executive compensation levels for Officers, as well as incentive compensation plans for Officers, Managers and employees, including performance measurements and goals for consideration by the Board of Directors;

· Development and recommendation of executive compensation philosophies and plans for consideration by the Board of Directors;

· Development and recommendation of Director compensation for consideration by the Board of Directors;

· Administering the Company’s Stock Option Plan approved by the Board of Directors and Shareholders during the Maine Public Service Company 2002 Annual Meeting;

· Administering all Board approved executive, manager and employee incentive compensation plans;

· Evaluating the CEO’s annual performance; and

· Development and monitoring of executive succession planning and executive development.

The Committee met on six separate occasions during 2005 to review, discuss, and approve corporate compensation philosophies, programs, and to develop recommendations for salary adjustments for all Executive Officers. This is the report of the Performance and Compensation Committee describing the Company’s executive compensation program and the basis upon which compensation determinations are made.

Compensation Policies

Maine & Maritimes Corporation is committed to recruiting and retaining top-tier talent in order to ensure long-term shareholder value. The Performance and Compensation Committee believes that total executive compensation should be competitive among similar positions within similar-sized diversified holding companies, particularly utility-based holding companies within the New England region. Executive compensation should be aligned with corporate performance benchmarks, as well as being market-based. Beyond competitive and market-based wages, the Committee believes that executive compensation incentives should be dependent upon achievement of annual financial and/or strategic goals, the actual financial condition of the Company, progress in implementing the Company’s growth strategy, and creation of long-term shareholder value. Accordingly, the Committee, with the approval of the Board, endorses compensation programs that provide competitive, yet performance-based incentives.

Total compensation may consist of a base salary, incentive and performance bonuses, benefit programs, and stock options. Bonuses may be provided to Executive Management, other than the CEO, based on performance evaluations by the CEO, his recommendation to the Performance and Compensation Committee, and their recommendation to the Board of Directors. The CEO may be provided a bonus based on his performance evaluation by the Performance and Compensation Committee and their recommendation to the Board of Directors. The Company does not offer a long-term incentive program. The Performance and Compensation Committee can recommend to the Board of Directors issuance of stock options for executives. Currently, only the CEO receives stock options. Specific salaries, incentive compensation, and bonuses for the CEO and the four highest executives with compensation over $100,000 are detailed in the Summary Compensation Table on Page 15.

20

Executive Officers’ Base Annual Salary

Annually, the Performance and Compensation Committee reviews executive salaries and total executive compensation packages of other similar holding companies, particularly utility holding companies, as well as electric utilities within New England, including but not necessarily limited to Green Mountain Power Corporation, Central Vermont Public Service Corporation and Unitil. The Committee reviews the information noting the diversity of MAM, as compared to other utility-oriented holding companies. The Committee recognizes that, given the diversity of the Company’s subsidiaries, future benchmarks should include companies that are more closely aligned with the diversified format of MAM, versus utility-based holding companies. The Committee ensures executive salaries are both aligned with Shareholder interests and competitive, to ensure necessary executive retention and recruitment.

Specific executive salary recommendations are based on an evaluation of the market value of the position, compensation packages of similar holding companies, as well as the individual’s qualifications, experience, and proven performance. The Committee independently develops a recommendation of the CEO’s base salary. The CEO recommends to the Performance and Compensation Committee the base salary for other Executive Officers for consideration and potential recommendation to the Board of Directors. As a part of this process, the CEO reviews performance evaluations of executives with the Committee. Performance-based salary increases are in effect versus annualized cost of living adjustments or increases.

Based on his 2004 performance, the CEO was given an increase in base salary to $225,000 annually. No increase in salary was awarded in 2005 as a result of lagging earnings. Given the transitional nature of the Company post-deregulation and divestiture, the CEO is evaluated annually based on a number of quantitative and qualitative factors that may change from year to year based on the transitional nature of the Company and its strategy. The performance factors for 2005 included:

· Successful implementation of MAM’s strategic plan and diversified portfolio approach to growth.

· Successful implementation of financing and capital formation strategy to facilitate growth and operations.

· Recruitment and internal development of executive team to execute growth strategy.

· Full compliance with state and federal regulations, including preparation for full Sarbox compliance.

Stock Option Program

As a part of the CEO’s initial recruitment offer, a total of 52,500 stock options were granted to Mr. Bayne to be distributed equally over 10 years. Mr. Bayne will receive 5,250 stock options every year for ten years, at the fair market value on June 1 of the grant year. The initial grant was made on June 1, 2002 and each year’s grant requires a three-year vesting period before becoming exercisable. Additionally, in the event of a change of control of the Company, only those stock options that have been granted will be vested. The Company expenses the value of granted options.

In 2005, 5,250 stock options were granted to the CEO. A total of 21,000 stock options have been granted to the CEO since 2002.

The CEO and each member of the Board of Directors are required to own at least 500 shares in Maine & Maritimes Corporation. Stock options do not count toward this minimum. Such shares must be purchased by the CEO or other Directors from their personal funds.

21

Board of Director Compensation

Based on the Performance and Compensation Committee’s recommendation, the Board of Directors adopted the following Directors’ Fee Structure, which represents an increase based on attracting and retaining qualified Directors, additional scrutiny by courts of independent directors, increased responsibility, workload and risk caused by the Sarbanes-Oxley Act and corporate expansion. The annual compensation for each Director is $27,600 per year, based on an attendance at six board meetings and six committee meetings per year. An annual retainer of $25,000 is paid to the Chairperson of the Board, $20,000 is paid to the Vice Chairperson, and other Directors receive retainers of $15,000 per year, not including a $3,000 annual stock grant and $800 per meeting and $300 per telephonic meeting. The Audit Committee Chairperson receives an additional $1,500 and other Committee chairpersons receive an additional $1,000 per year fee. For additional details, refer to “Directors’ Compensation” on Page 19.

Other Perquisites

The Committee and the Board of Directors have not developed or offered to compensate Executive Officers through the use of perquisites.

Succession Planning

Working with the CEO, the Performance and Compensation Committee has undertaken and maintains on an ongoing basis a succession plan for the position of CEO. In addition, the Committee has directed and the CEO has undertaken succession planning for all key executive positions within the Company. The Company’s succession plan is evaluated for necessary changes on an annual basis by the Committee. Included in the succession planning process are potential temporary position assignments that would allow for promotion or recruitment of top-tier talent to ensure an effective succession planning process.

Charter

To ensure compliance with statutory, regulatory and listing requirements, the Performance and Compensation Committee reviews the Committee Charter annually. The Charter is available for review on the Company’s web site at www.maineandmaritimes.com. The Committee will continue to evaluate its Charter in order to ensure timely compliance with regulatory developments and align its annual schedule of work to ensure complete execution of the duties of the Committee.

Conclusion

We believe the Company’s executive compensation program appropriately aligns executive compensation with Shareholder interests, individual performance, and our goal of creating added Shareholder value. The level of executive compensation is believed to be reasonable, based on the financial position of the company, and is cognizant of the interests of Shareholders and other constituencies.

| Compensation Committee Members: |

| Nathan L. Grass, Chairperson |

| D. James Daigle |

| Robert E. Anderson |

| Deborah L. Gallant |

22

SHAREHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

If you would like to contact the Maine & Maritimes Corporation’s Board of Directors, you can choose one of the options listed below.

Call the Maine & Maritimes | | Write to the Maine & Maritimes | | Email the Maine & Maritimes |

Board of Directors | | Board of Directors | | Board of Directors |

(877) 272-1523 | | MAM Board of Directors | | directors@maineandmaritimes.com |

(207) 760-2402 | | Maine & Maritimes Corporation | | |

| | 209 State Street | | |

| | P.O. Box 789 | | |

| | Presque Isle, ME 04769-0789 | | |

· Complaints relating to MAM accounting, internal accounting controls or auditing matters will be referred to members of the Audit Committee.

· Other concerns will be referred to the Chairperson of the Governance Committee.

· All complaints and concerns will be received and processed by the MAM Investor Relations Office and forwarded to the appropriate members of the Board of Directors.

· You will receive a written acknowledgement from the Maine & Maritimes Corporation Investor Relations Office upon receipt of your written complaint or concern.

BOARD MEMBERS’ ATTENDANCE AT ANNUAL MEETINGS

It is the Company’s policy that board members attend all Annual Stockholder Meetings. All Directors were present and attended the 2005 Stockholder Meeting.

23

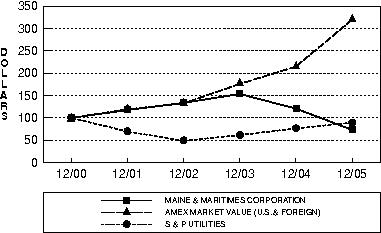

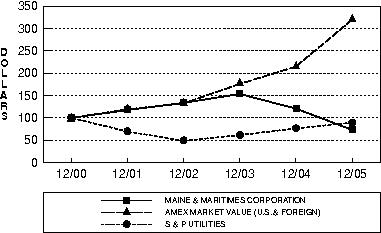

CORPORATE PERFORMANCE GRAPH

The following table compares total Stockholder returns over the last five fiscal years to the American Market Value Index (AMEX) and the S&P Utilities Index (S&P). Total return values for the AMEX, S&P, and MAM were calculated based on cumulative total return values assuming reinvestment of dividends. The Stockholder return, shown on the graph, is not necessarily indicative of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG MAINE & MARITIMES CORPORATION.

THE AMEX MARKET VALUE (U.S. & FOREIGN) INDEX AND THE S&P UTILITIES INDEX

*$100 invested on 12/31/00 in stock or index-including reinvestment of dividends.

Fiscal year ending December 31.

| | Cumulative Total Return | |

| | 12/00 | | 12/01 | | 12/02 | | 12/03 | | 12/04 | | 12/05 | |

MAINE & MARITIMES CORPORATION | | 100.00 | | 117.60 | | 133.71 | | 153.53 | | 120.69 | | 73.21 | |

AMEX MARKET VALUE (U.S. & FOREIGN) | | 100.00 | | 119.14 | | 132.57 | | 176.02 | | 214.97 | | 319.96 | |

S & P UTILITIES | | 100.00 | | 69.56 | | 48.70 | | 61.49 | | 76.41 | | 89.28 | |

24

PROPOSAL (2)

RATIFICATION OF INDEPENDENT AUDITOR

The Audit Committee has selected Vitale, Caturano & Company as the Company’s independent auditor for the current fiscal year, and the Board is asking shareholders to ratify that selection. Although current law, rules, and regulations, as well as the charter of the Audit Committee, require the Company’s independent auditor to be engaged, retained, and supervised by the Audit Committee, and there is no requirement that the shareholders approve the selection, the Board considers the selection of the independent auditor to be an important matter of shareholder concern and is submitting the selection of Vitale, Caturano & Company for ratification by shareholders as a matter of good corporate practice. If a majority of the shares present at the meeting do not ratify the selection, the Audit Committee will review the selection and consider alternatives in the future.

Representatives of Vitale, Caturano & Company, independent auditor for the Company for the current fiscal year, will be present at the Annual Meeting, will have an opportunity to make a statement, and will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE PROPOSAL.

Previous independent registered public accounting firm

(i) On August 16, 2004, the Company, acting by and through its audit committee and based on such committee’s recommendation and approval, dismissed PricewaterhouseCoopers LLP (“PwC”) as its independent accounting firm.

(ii) The reports of PwC on the financial statements for the two fiscal years prior to the change contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle.

(iii) During the two fiscal years prior to the change and through August 16, 2004, there were no disagreements with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to the satisfaction of PwC would have caused them to make reference thereto in their reports on the financial statements for the two fiscal years prior to the change.

(iv) During the two fiscal years prior to the change and through August 16, 2004, there were no reportable events required to be reported under Regulation S-K Item 304(a)(1)(v).

(v) The Company requested that PwC furnish it with a letter addressed to the SEC stating whether or not it agreed with the above statements. A copy of such letter, dated August 23, 2004, was filed as Exhibit 16 to a Report on Form 8-K filed with the SEC on August 23, 2004, and is hereby incorporated by reference.

Current independent registered public accounting firm

The Company engaged Vitale, Caturano & Company PC (“VCC”) as its independent registered public accounting firm on August 16, 2004. Prior to August 23, 2004, the Company did not consult with VCC regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report was provided to the Company or oral advice was provided that VCC concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions

25

to Item 304 of Regulation S-K, or an event required to be reported under Item 304(a)(1)(v) of Regulation S-K.

OTHER MATTERS

As of the date hereof, there are no other matters that the Company intends to present, or has reason to believe others will present, at the Annual Meeting. If, however, other matters properly come before the Annual Meeting, the accompanying proxy authorizes the persons named as proxies or their substitutes to vote on such matters as they determine appropriate.

STOCKHOLDER PROPOSALS FOR THE 2007 ANNUAL MEETING

Shareholders who, in accordance with Securities and Exchange Commission Rule 14a-8, wish to present proposals for inclusion in the proxy materials to be distributed in connection with next year’s Annual Meeting must submit their proposals so that they are received at Maine & Maritimes Corporation’s principal executive offices no later than the close of business on December 1, 2006. As the rules of the SEC make clear, simply submitting a proposal does not guarantee that it will be included.

Notices of intention to present proposals at the 2007 Annual Meeting should be addressed to Secretary, Maine & Maritimes Corporation, PO Box 789, Presque Isle, Maine 04769-0789. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

VOTING BY PROXY