UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantþ Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Jefferson Bancshares, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

N/A

| | 2) | Aggregate number of securities to which transaction applies: |

N/A

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

N/A

| | 4) | Proposed maximum aggregate value of transaction: |

N/A

N/A

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

N/A

| | 2) | Form, Schedule or Registration Statement No.: |

N/A

N/A

N/A

JEFFERSON BANCSHARES, INC.

120 Evans Avenue

Morristown, Tennessee 37814

(423) 586-8421

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | |

| TIME AND DATE | | 2:00 p.m. on Thursday, October 26, 2006 |

| |

| PLACE | | Independence Room |

| | Jefferson Federal Bank |

| | 120 Evans Avenue |

| | Morristown, Tennessee |

| |

| ITEMS OF BUSINESS | | (1) To elect three directors to serve for a term of three years. |

| |

| | (2) To ratify the selection of Craine, Thompson & Jones, P.C. as our independent registered public accounting firm for fiscal year 2007. |

| |

| | (3) To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

| |

| RECORD DATE | | To vote, you must have been a stockholder at the close of business on August 31, 2006. |

| |

| PROXY VOTING | | It is important that your shares be represented and voted at the meeting. You can vote your shares via the Internet, by telephone or by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy or voting instruction card and included in the accompanying proxy statement. You can revoke a proxy at any time before its exercise at the meeting by following the instructions in the proxy statement. |

| |

| | /s/ Jane P. Hutton Jane P. Hutton Chief Financial Officer and Corporate Secretary |

September 18, 2006

JEFFERSON BANCSHARES, INC.

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Jefferson Bancshares, Inc. (“Jefferson Bancshares” or the “Company”) to be used at the annual meeting of shareholders of the Company. Jefferson Bancshares is the holding company for Jefferson Federal Bank (“Jefferson Federal”). The annual meeting will be held in the Independence Room of Jefferson Federal at 120 Evans Avenue, Morristown, Tennessee on October 26, 2006, at 2:00 p.m., local time. This proxy statement and the enclosed proxy card are being first mailed to shareholders of record on or about September 18, 2006.

General Information About Voting

Who Can Vote at the Meeting

You are entitled to vote your Jefferson Bancshares common stock if the records of the Company show that you held your shares as of the close of business on August 31, 2006. As of the close of business on August 31, 2006, a total of 6,601,754 shares of Jefferson Bancshares common stock were outstanding. Each share of common stock has one vote. The Company’s Charter provides that record holders of the Company’s common stock who beneficially own, either directly or indirectly, in excess of 10% of the Company’s outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit. With respect to shares held by a broker, bank or nominee, the Company generally will look beyond the holder of the shares to the person or entity for whom the shares are held when applying the voting limitation. However, where the ultimate owner of the shares has granted voting authority to the broker, bank or nominee that holds the shares, the Company would apply the 10% voting limitation to the broker, bank or nominee.

Attending the Meeting

If you are a beneficial owner of Jefferson Bancshares common stock held by a broker, bank or other nominee (i.e., in “street name”), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Jefferson Bancshares common stock held in street name in person at the meeting, you will have to get a written proxy in your name from the broker, bank or other nominee who holds your shares.

Quorum and Vote Required

The annual meeting will be held only if there is a quorum present. A quorum exists if a majority of the outstanding shares of common stock entitled to vote are represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

In voting on the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In voting on the ratification of the appointment of Craine, Thompson & Jones, P.C. as the independent registered public accounting firm of the Company, you may vote in favor of the proposal, vote against the proposal or abstain from voting. The ratification of Craine, Thompson & Jones, P.C. as the Company’s independent registered public accounting firm will be decided by the affirmative vote of a majority of the votes cast at the annual meeting. On this matter, abstentions and broker non-votes will have no effect on the voting.

Voting by Proxy

The Board of Directors of Jefferson Bancshares is sending you this proxy statement for the purpose of requesting that you allow your shares of Jefferson Bancshares common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Jefferson Bancshares common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors. The Board of Directors recommends that you vote:

| | • | | foreach of the nominees for director; and |

| | • | | for the ratification of Craine, Thompson & Jones, P.C. as the Company’s independent registered public accounting firm. |

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their own best judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the annual meeting in order to solicit additional proxies. If the annual meeting is postponed or adjourned, your Jefferson Bancshares common stock may be voted by the persons named in the proxy card on the new annual meeting date as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the annual meeting.

You may revoke your proxy at any time before the vote is taken at the meeting, regardless of whether you submitted your original proxy by mail, the Internet or telephone. To revoke your proxy, you must either advise the Corporate Secretary of the Company in writing before your common stock has been

2

voted at the annual meeting, deliver a later dated proxy or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in and of itself constitute revocation of your proxy.

If your Jefferson Bancshares common stock is held in “street name,” you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form provided by your broker, bank or other nominee that accompanies this proxy statement.

Instead of voting by mailing a proxy card, registered stockholders can vote their shares of Company common stock via the Internet or by telephone. The Internet and telephone voting procedures are designed to authenticate stockholders’ identities, allow stockholders to provide their voting instructions and confirm that their instructions have been recorded properly. Specific instructions for Internet or telephone voting are set forth on the enclosed proxy card. The deadline for voting by telephone or via the Internet is 11:59 p.m., Eastern time, on Wednesday, October 25, 2006.

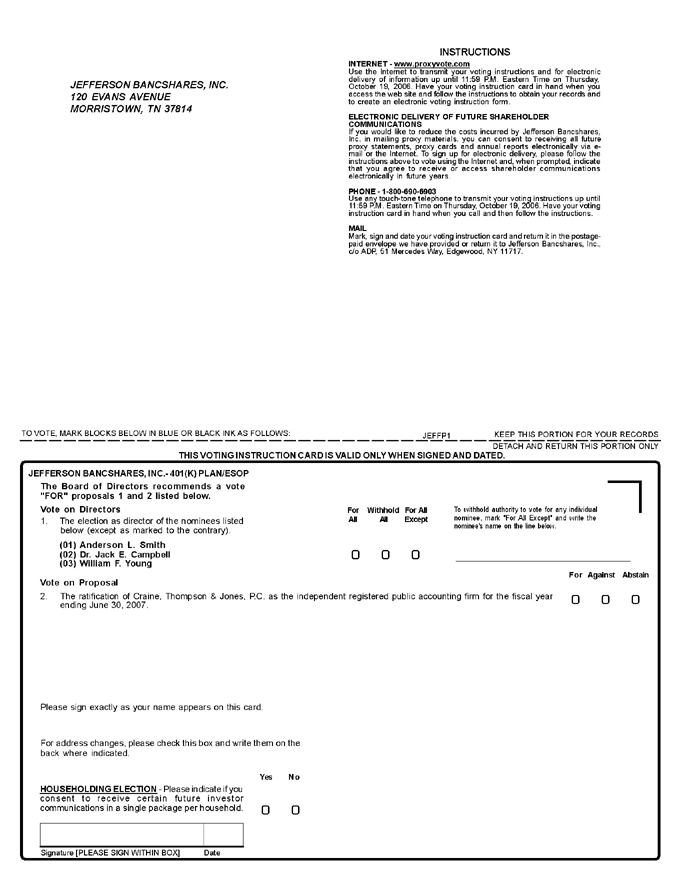

Participants in Jefferson Federal’s ESOP and 401(k) Plan

If you participate in the Jefferson Federal Bank Employee Stock Ownership Plan (the “ESOP”) or if you hold shares through the Jefferson Federal Bank Employees’ Savings & Profit Sharing Plan and Trust (the “401(k) Plan”), you will receive a single voting instruction card for both plans that reflects all shares you may vote under the plans. You may submit the voting instruction card, or convey your voting instructions via the Internet or by telephone. Specific instructions for Internet or telephone submission are set forth in the voting instruction card. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary duties, will vote all unallocated shares of Company common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. Under the terms of the 401(k) Plan, a participant is entitled to direct the trustee as to the shares in the Jefferson Bancshares, Inc. Stock Fund credited to his or her account. The trustee will vote all shares for which no directions are given or for which instructions were not timely received in the same proportion as shares for which the trustee received voting instructions. The deadline for submitting your voting instructions is 11:59 p.m., Eastern time, on Thursday, October 19, 2006.

Corporate Governance

General

The Company periodically reviews its corporate governance policies and procedures to ensure that the Company meets the highest standards of ethical conduct, reports results with accuracy and transparency and maintains full compliance with the laws, rules and regulations that govern the Company’s operations. As part of this periodic corporate governance review, the Board of Directors reviews and adopts best corporate governance policies and practices for the Company.

Corporate Governance Policies and Procedures

Jefferson Bancshares has adopted a corporate governance policy to govern certain activities including:

| | (1) | the duties and responsibilities of each director; |

3

| | (2) | the composition, responsibilities and operation of the board of directors; |

| | (3) | the establishment and operation of board committees; |

| | (5) | appointing an independent lead director and convening executive sessions of independent directors; |

| | (6) | the Board of Directors’ interaction with management and third parties; and |

| | (7) | the evaluation of the performance of the Board of Directors and of the chief executive officer. |

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct that is designed to ensure that the Company’s directors, executive officers and employees meet the highest standards of ethical conduct. The Code of Ethics and Business Conduct requires that the Company’s directors, executive officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interest. Under the terms of the Code of Ethics and Business Conduct, directors, executive officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code.

As a mechanism to encourage compliance with the Code of Ethics and Business Conduct, the Company has established procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner. The Code of Ethics and Business Conduct also prohibits the Company from retaliating against any director, executive officer or employee who reports actual or apparent violations of the Code.

Meetings of the Board of Directors

The Company and Jefferson Federal conduct business through meetings and activities of their Boards of Directors and their committees. During the fiscal year ended June 30, 2006, the Board of Directors of the Company held 12 regular meetings and two special meetings and the Board of Directors of Jefferson Federal held 12 regular meetings and two special meetings. No director attended fewer than 75% of the total meetings of the Boards of Directors and committees on which he served.

Committees of the Board of Directors of Jefferson Bancshares

The following table identifies our standing committees and their members as of June 30, 2006. All members of each committee are independent in accordance with the listing standards of the Nasdaq Stock Market, Inc.

| | | | | | |

Director | | Audit/ Compliance Committee | | Compensation Committee | | Nominating/ Corporate Governance Committee |

| | | |

Dr. Terry M. Brimer | | X | | X* | | X |

Dr. Jack E. Campbell | | X* | | X | | X |

William T. Hale | | X | | X | | X |

John F. McCrary, Jr. | | | | | | |

H. Scott Reams | | | | X | | X* |

Anderson L. Smith | | | | | | |

William F. Young | | | | X | | X |

Number of Meetings in 2006 | | 6 | | 4 | | 1 |

4

Audit/Compliance Committee. The Board of Directors has a separately-designated standing Audit/Compliance Committee (the “Audit Committee”) established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee meets periodically with independent auditors and management to review accounting, auditing, internal control structure and financial reporting matters. Each member of the Audit Committee is independent in accordance with the listing standards of Nasdaq. The Board of Directors has determined that the Audit Committee does not have a member who is an “audit committee financial expert” as such term is defined by the rules and regulations of the Securities and Exchange Commission. While the Board recognizes that no individual Board member meets the qualifications required of an “audit committee financial expert,” the Board believes that appointment of a new director to the Board of Directors and to the Audit Committee at this time is not necessary as the level of financial knowledge and experience of the current members of the Audit Committee, including the ability to read and understand fundamental financial statements, is cumulatively sufficient to discharge adequately the Audit Committee’s responsibilities. The Audit Committee acts under a written charter adopted by the Board of Directors, a copy of which is included asAppendix A to this proxy statement. The report of the Audit Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See“Proposal 2–Ratification of Independent Registered Public Accounting Firm–Report of Audit/Compliance Committee.”

Compensation Committee. The Compensation Committee is responsible for determining annual grade and salary levels for employees and establishing personnel policies. The Compensation Committee operates under a written charter. The report of the Compensation Committee appears in this proxy statement under the heading“Compensation Committee Report on Executive Compensation.”

Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee is responsible for the annual selection of the Board of Directors’ nominees for election as directors and developing and implementing policies and practices relating to corporate governance, including implementation of and monitoring adherence to Jefferson Bancshares’ corporate governance policy. The Nominating/Corporate Governance Committee acts under a written charter adopted by the Board of Directors, a copy of which was included asAppendix A to Jefferson Bancshares’ proxy statement filed on September 15, 2004. Information regarding the director nomination process appears in this proxy statement under the heading“Nominating/Corporate Governance Committee Procedures.”

5

Directors’ Compensation

Cash Retainer and Meeting Fees for Directors. The following table sets forth the applicable retainers and fees that will be paid to our directors for their service on our Board of Directors during 2007.

| | | |

Quarterly Retainer for Board Service | | $ | 1,000 |

Fee for Attendance at Regular Board Meetings | | | 800 |

Fee for Attendance at Special Board Meetings | | | 200 |

Fee for Attendance at Committee Meetings | | | 100 |

Monthly Retainer for Chairman | | | 1,000 |

Director Compensation. The following table sets forth the total cash compensation paid to our directors, except for Mr. Smith, whose compensation is disclosed under“Executive Compensation-Summary Compensation Table”of this proxy statement, for their service on our Board of Directors during 2006. During 2006, no restricted stock awards or stock options were granted to our directors.

| | | |

Directors | | Cash |

Dr. Terry M. Brimer | | $ | 15,100 |

Dr. Jack E. Campbell | | | 15,100 |

William T. Hale | | | 15,100 |

John F. McCrary, Jr. | | | 26,100 |

H. Scott Reams | | | 14,500 |

William F. Young | | | 14,500 |

6

Stock Ownership

The following table provides information as of August 31, 2006 about the persons, other than directors and executive officers, known to the Company to be the beneficial owners of more than 5% of the Company’s outstanding common stock. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power.

| | | | | | |

Name and Address | | Number of Shares Owned | | | Percent of Common Stock Outstanding | |

Jefferson Federal Bank Employee Stock Ownership Plan 120 Evans Avenue Morristown, Tennessee 37814 | | 669,189 | | | 10.1 | % |

| | |

Bank of America Corporation NB Holdings Corporation Bank of America, NA Columbia Management Group, LLC Columbia Management Advisors, LLC 100 North Tryon Street Floor 25 Bank of America Corporate Center Charlotte, North Carolina 28255 | | 473,850 | (1) | | 7.2 | % |

| | |

Friedlander & Co., Inc. Theodore Friedlander III 322 East Michigan Street Suite 250 Milwaukee, Wisconsin 53202 | | 363,300 | (2) | | 5.5 | % |

| (1) | Based upon information in a Schedule 13G/A filed jointly on February 8, 2006 with the U.S. Securities and Exchange Commission (the “SEC”). According to this filing, Bank of America Corporation and NB Holdings Corporation have shared voting power with respect to 377,050 shares and shared dispositive power with respect to 473,850 shares; Bank of America, NA has sole voting power with respect to 79,250 shares, shared voting power with respect to 297,800 shares, sole dispositive power with respect to 86,750 shares and shared dispositive power with respect to 387,100 shares; and Columbia Management Group, LLC and Columbia Management Advisors, LLC have shared voting power with respect to 297,800 shares and shared dispositive power with respect to 387,100 shares. |

| (2) | Based upon information in a Schedule 13G filed on February 8, 2006 with the SEC. According to this filing, Friedlander & Co., Inc. (“Friedlander”) has sole dispositive power with respect to 363,300 shares and Theodore Friedlander III has sole voting power with respect to 20,000 shares. Mr. Friedlander is a controlling person of Friedlander and as such may be deemed to benefically own the shares of Company common stock benefically owned by Friedlander. Mr. Friedlander benefically owns less than 1% of the shares held by Friedlander and disclaims beneficial ownership of all other shares held by Friedlander. |

7

The following table provides information as of August 31, 2006 about the shares of Jefferson Bancshares common stock that may be considered to be beneficially owned by each director, each nominee for director and all directors and executive officers of the Company as a group. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting power and sole investment power with respect to the shares shown.

| | | | | | | | |

Name | | Number of Shares

Owned (Excluding

Options)(1) | | | Number of Shares

That May Be

Acquired Within 60

Days by Exercising

Options | | Percent of

Common

Stock

Outstanding(2) | |

Dr. Terry M. Brimer | | 103,510 | (3) | | 16,881 | | 1.82 | % |

Dr. Jack E. Campbell | | 69,989 | (4) | | 13,681 | | 1.26 | |

Anthony J. Carasso | | 8,604 | (5) | | — | | * | |

William T. Hale | | 97,711 | (6) | | 10,482 | | 1.64 | |

John F. McCrary, Jr. | | 160,191 | (7) | | 10,482 | | 2.58 | |

H. Scott Reams | | 115,627 | (8) | | 10,482 | | 1.91 | |

Charles G. Robinette | | 18,594 | (9) | | — | | * | |

Anderson L. Smith | | 68,479 | (10) | | 35,615 | | 1.57 | |

William F. Young | | 94,116 | (11) | | 14,748 | | 1.65 | |

All directors and executive officers as a group (13 persons) | | 830,766 | | | 151,248 | | 14.54 | % |

| (1) | Includes unvested shares of restricted stock held in trust under the Jefferson Bancshares, Inc. 2004 Stock-Based Incentive Plan, with respect to which the beneficial owner has voting but not investment power as follows: Messrs. Brimer, Campbell, Hale, McCrary, Reams and Young — 8,384 shares; and Mr. Smith — 27,950 shares. |

| (2) | Based on 6,601,754 shares of Company common stock outstanding and entitled to vote as of the close of business on August 31, 2006, plus the number of shares that may be acquired within 60 days by each individual (or group of individuals) by exercising stock options. |

| (3) | Includes 36,500 shares held by his wife. |

| (4) | Includes 54,249 shares held jointly with his wife. |

| (5) | Includes 1,896 shares allocated under the Jefferson Federal Bank Employee Stock Ownership Plan (“ESOP”). |

| (6) | Includes 25,000 shares held by his wife. |

| (7) | Includes 1,760 shares allocated under the ESOP. |

| (8) | Includes 88,632 shares held jointly with his wife, 12,500 shares held by 401(k) plan, 1,500 shares held by IRA and 2,050 shares held by his wife. |

| (9) | Includes 300 shares held by IRA, 700 shares held jointly with his wife and 2,594 shares allocated under the ESOP. |

| (10) | Includes 18,000 shares held jointly with his wife, 4,903 shares held by 401(k) plan, 15,000 shares held by IRA and 9,614 shares allocated under the ESOP. |

| (11) | Includes 24,183 shares held by his wife, 14,820 shares held by his wife’s IRA and 16,845 shares held by IRA. |

8

Proposal 1 — Election of Directors

The Company’s Board of Directors consists of seven members, all of whom are independent under the current listing standards of the Nasdaq Stock Market, except for Mr. Smith and Mr. McCrary. Mr. Smith is not independent because he is an employee of Jefferson Bancshares and Jefferson Federal, and Mr. McCrary is not independent because he receives a salary from Jefferson Federal for his service as Chairman of the Board of Directors. The Board is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. Three directors will be elected at the annual meeting to serve for a three-year term, or until their respective successors have been elected and qualified. The nominees are Anderson L. Smith, Dr. Jack E. Campbell and William F. Young. All of the nominees are currently directors of the Company and Jefferson Federal.

The Board of Directors intends that the proxies solicited by it will be voted for the election of the nominees named above. If any nominee is unable to serve, the persons named in the proxy card will vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote FOR the election of all nominees.

Information regarding the nominees for election at the annual meeting is provided below. Unless otherwise stated, each nominee has held his current occupation for the last five years. The age indicated for each individual is as of June 30, 2006. The indicated period of service as a director includes service as a director of Jefferson Federal. There are no family relationships among directors or executive officers of Jefferson Bancshares.

Board Nominees for Election of Directors

Anderson L. Smith has served as the President and Chief Executive Officer of Jefferson Federal and Jefferson Bancshares since January 2002 and March 2003, respectively. Prior to joining Jefferson Federal, Mr. Smith was President, Consumer Financial Services-East Tennessee Metro, First Tennessee Bank, National Association. Age 58. Director since 2002.

Dr. Jack E. Campbell has served part-time as the President Emeritus of Walters State Community College, Morristown, Tennessee since July 1, 2005. He previously served as the President of Walters State Community College since 1974. Age 67. Director since 1979.

William F. Young is the President and Chief Executive Officer of Young’s Furniture Manufacturing Company, Inc., of Whitesburg, Tennessee. Age 66. Director since 2000.

Directors Continuing in Office

The following directors have terms ending in 2007:

Dr. Terry M. Brimer is the President and majority owner of Doctor’s Hospital Pharmacy, Inc., Morristown, Tennessee. Age 58. Director since 1977.

9

H. Scott Reams is a Partner in the law firm of Taylor, Reams, Tilson and Harrison of Morristown, Tennessee. Age 57. Director since 1982.

The following directors have terms ending in 2008:

William T. Hale is employed by PFG-Hale, Inc., a wholesale food distributor. Age 54. Director since 2000.

John F. McCrary, Jr. is Chairman of the Board of Directors of Jefferson Bancshares and Jefferson Federal. Mr. McCrary is a real estate broker and President of Century 21 Masengill-McCrary Realtors Company and Secretary of Masengill-McCrary-Gregg Company, an insurance agency, both located in Morristown, Tennessee. Age 81. Director since 1963.

10

Proposal 2 — Ratification of Independent Registered

Public Accounting Firm

The Audit/Compliance Committee of the Board of Directors has appointed Craine, Thompson & Jones, P.C. to be the Company’s independent registered public accounting firm for the 2007 fiscal year, subject to ratification by shareholders. A representative of Craine, Thompson & Jones, P.C. is expected to be present at the annual meeting to respond to appropriate questions from shareholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent registered public accounting firm is not approved by a majority of the votes cast by shareholders at the annual meeting, the Audit/Compliance Committee will consider other independent registered public accounting firms.

The Board of Directors recommends a vote FOR the ratification of the appointment of Craine, Thompson & Jones, P.C. as the Company’s independent registered public accounting firm.

Audit Fees

The following table sets forth the fees billed to the Company for the fiscal years ending June 30, 2006 and 2005 by Craine, Thompson & Jones, P.C.:

| | | | | | |

| | | 2006 | | 2005 |

Audit fees | | $ | 62,370 | | $ | 41,000 |

Audit related fees | | | — | | | — |

Tax fees(1) | | | 14,410 | | | 9,130 |

All other fees(2) | | | 13,415 | | | 22,495 |

| (1) | Consists of tax filing and tax related compliance and other advisory services. |

| (2) | Includes fees for assistance with securities filings other than periodic reports and section 404 of the Sarbanes-Oxley Act certification services. |

Policy on Audit/Compliance Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit/Compliance Committee is responsible for appointing and reviewing the work of the independent registered public accounting firm and setting the independent registered public accounting firm’s compensation. In accordance with its charter, the Audit/Compliance Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent registered public accounting firm. This approval process ensures that the independent registered public accounting firm does not provide any non-audit services to the Company that are prohibited by law or regulation. During the year ended June 30, 2006, all services were approved in advance by the Audit/Compliance Committee in compliance with these procedures.

11

Report of the Audit/Compliance Committee

The Audit/Compliance Committee of the Company’s Board of Directors is comprised of three non-employee directors and operates under a written charter adopted by the Board of Directors. The Board of Directors has determined that each Audit/Compliance Committee member is independent in accordance with the listing standards of the Nasdaq Stock Market.

The Company’s management is responsible for the Company’s internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principals. The Audit/Compliance Committee oversees the Company’s internal control over financial reporting on behalf of the Board of Directors.

In this context, the Audit/Compliance Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit/Compliance Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit/Compliance Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit/Compliance Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61 (“Communication With Audit Committees”), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

In addition, the Audit/Compliance Committee has received the written disclosures and the letter from the independent registered public accounting firm required by the Independence Standards Board Standard No. 1 (“Independence Discussions With Audit Committees”) and has discussed with the independent registered public accounting firm the auditors’ independence from the Company and its management. In concluding that the auditors are independent, the Audit/Compliance Committee considered, among other factors, whether the non-audit services provided by the auditors were compatible with its independence.

The Audit/Compliance Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. The Audit/Compliance Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal control over financial reporting, and the overall quality of the Company’s financial reporting process.

In performing all of these functions, the Audit/Compliance Committee acts only in an oversight capacity. In its oversight role, the Audit/Compliance Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent auditors who, in their report, express an opinion on the conformity of the Company’s financial statements to generally accepted accounting principles. The Audit/Compliance Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit/Compliance Committee’s considerations and discussions with management and the independent auditors do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s consolidated financial

12

statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board or that the Company’s independent auditors are in fact “independent.”

In reliance on the reviews and discussions referenced above, the Audit/Compliance Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2006 for filing with the Securities and Exchange Commission. The Audit/Compliance Committee has appointed, subject to shareholder ratification, the selection of the Company’s independent registered public accounting firm for the fiscal year ended June 30, 2007.

The Audit/Compliance Committee of the Board of Directors

of Jefferson Bancshares, Inc.

Dr. Jack E. Campbell (Chairman)

Dr. Terry M. Brimer

William T. Hale

Executive Compensation

Summary Compensation Table

The following information is provided for our President and Chief Executive Officer and other executive officers who received a salary and bonus totaling $100,000 or more during the year ended June 30, 2006.

| | | | | | | | | | | | | | | | | | | |

| | | Annual Compensation | | Long-Term Compensation Awards | | All Other Compensation ($)(4) |

Name and Principal Positions | | Fiscal

Year | | Salary ($) (1) | | Bonus ($) | | Other Annual

Compensation ($) (2) | | Restricted

Stock

Awards

($)(3) | | Securities

Underlying

Options (#) | |

Anderson L. Smith President and Chief Executive Officer | | 2006

2005

2004 | | $

| 189,150

188,950

181,000 | | $

| 42,533

34,650

64,350 | | $

| 21,374

21,077

21,077 | | $

| —

—

478,301 | | —

—

69,875 | | $

| 44,562

63,703

41,259 |

Charles G. Robinette(5) Chairman of the Knoxville Region of the Bank | | 2006

2005 | | $

| 159,400

72,269 | | $

| 68,709

15,940 | | $

| 20,472

7,800 | | $

| 198,750

— | | —

— | | $

| 35,386

— |

Anthony J. Carasso(5) President of the Knoxville Region of the Bank | | 2006

2005 | | $

| 127,500

75,766 | | $

| 22,415

14,583 | | $

| 4,359

— | | $

| 79,500

— | | —

— | | $

| 25,868

— |

| (1) | For Mr. Smith, includes fees received for service on the board of directors which totaled $15,900 in fiscal 2006. |

| (2) | Represents life, health and disability insurance premiums of $5,774, $4,872 and $4,359 that Jefferson Federal paid on behalf of Messrs. Smith, Robinette and Carasso, respectively, in fiscal 2006. For Messrs. Smith and Robinette, also includes an automobile allowance of $12,000 and taxable fringe benefits of $3,600. |

| (3) | The dollar amount represents the market value of 34,938 shares, 15,000 shares and 6,000 shares on the date of grant for Messrs. Smith, Robinette and Carasso, respectively. The restricted stock awards vest over five years, beginning in January 2005 for Mr. Smith and January 2006 for Messrs. Robinette and Carasso. Restricted stock award recipients are entitled to receive all dividends paid (if any) on the shares of common stock, subject to the terms of the restricted stock awards. The number and value of all unvested shares of restricted stock that have been awarded to each named executive officer as of June 30, 2006, based on the closing price of the Company’s common stock on June 30, 2006 ($12.95), is as follows: |

| | | | | |

| | | Number of Unvested Shares | | Value of Unvested Shares |

Anderson L. Smith | | 20,962 | | $ | 271,458 |

Charles G. Robinette | | 15,000 | | $ | 194,250 |

Anthony J. Carasso | | 6,000 | | $ | 77,700 |

13

| (4) | For Mr. Smith in fiscal 2006, includes stock allocated under the employee stock ownership plan with a market value of $38,918 and receipt of $5,644 as the economic benefit of employer-paid premiums for a split-dollar life insurance arrangement. For Messrs. Robinette and Carasso in fiscal 2006, consists of stock allocated under the employee stock ownership plan with a market value of $35,386 and $25,868, respectively. |

| (5) | Messrs. Robinette and Carasso became employees of Jefferson Federal in January 2005. Therefore, information for the first six months of fiscal 2005 and fiscal 2004 is not disclosed since they were not executive officers during that period. |

Aggregated Option Exercises in Last Fiscal Year and Option Value at Fiscal Year End

The following table provides information regarding the exercise of options during the year ended June 30, 2006 and unexercised stock options as of June 30, 2006.

| | | | | | | | | | | | | | | |

Name | | Shares

Acquired

on Exercise | | Dollar

Value

Realized | | Number of Securities Underlying Unexercised

Options | | Value of Unexercised In-the-Money Options at Fiscal Year End (1) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Anderson L. Smith | | 3,000 | | $ | 24,840 | | 35,615 | | 41,925 | | $ | 59,480 | | $ | — |

Charles G. Robinette | | — | | | — | | — | | — | | | — | | | — |

Anthony J. Carasso | | — | | | — | | — | | — | | | — | | | — |

| (1) | Value of unexercised in-the-money stock options equals the market value ($12.95) of shares covered by in-the-money options on June 30, 2006 less the option exercise price. Options are in-the-money if the market value of shares covered by the options is greater than the exercise price. |

Employment Agreements.Jefferson Federal has entered into employment agreements with Anderson L. Smith (effective June 25, 2003 and amended July 1, 2004) and Charles G. Robinette (effective January 1, 2005), each an “executive.” Mr. Smith’s agreement has an initial three-year term, while Mr. Robinette’s agreement has an initial three and a half year term. The agreements commence on the first anniversary date of the employment agreement (or in the case of Mr. Robinette, on June 30, 2006), and continuing on each anniversary thereafter, the disinterested members of the Board of Directors may extend the agreement for an additional year so that the remaining term of the agreement is 36 months, unless Mr. Smith or Mr. Robinette provides written notice of termination. The fiscal 2006 base salaries for Mr. Smith and Mr. Robinette are $173,250 and $159,400, respectively, which amounts may be increased at the discretion of the Board of Directors on an annual basis. The employment agreements provide both Mr. Smith and Mr. Robinette with a bonus program that enables them to earn up to 50% of their respective base salaries, on an annual basis. The amount of the bonus is determined by specific performance standards and a formula agreed to by the executives and Jefferson Federal annually. The employment agreements are terminable by Jefferson Federal at any time, with or without cause, and by the executives at

14

any time with or without cause, or for Good Reason (as defined in the agreements). If an executive is terminated from employment without cause or he elects to terminate his agreement following an event constituting Good Reason, Jefferson Federal would be required to honor the terms of the agreement through the expiration of the current term, including payment of current cash compensation and continuation of employee benefits. In the event an executive is terminated for disability, as defined in the agreements, he will be paid an amount equal to 75% of his weekly rate of base salary in effect as of the date of his termination of employment due to disability.

The employment agreements also provide for severance payments and other benefits in the event an executive is terminated without cause or he elects to terminate the agreement with Good Reason in connection with any change in control of Jefferson Federal. The maximum present value of the severance benefits under the employment agreements is 2.99 times the average of the executive’s five taxable years’ annual compensation preceding the change in control. The employment agreements also provide that the value of the maximum benefit is to be distributed in the form of a lump sum cash payment. Also, upon such event, the executive will continue to participate in any retirement plans he participated in prior to the change in control and under any health, life or disability plans for 36 months following his termination of employment. Section 280G of the Internal Revenue Code provides that severance payments that equal or exceed three times the individual’s base amount are deemed to be “excess parachute payments” if they are contingent upon a change in control. Individuals receiving excess parachute payments are subject to a 20% excise tax on the amount of the payment in excess of the base amount, and we would not be entitled to deduct such an amount.

Mr. Smith’s employment agreement further provides that he will receive a supplemental retirement benefit of $15,083 per year, beginning during the calendar year in which he attains age 65 and continuing for a total of 15 years and a supplemental life insurance policy with a death benefit of not less than $350,000.

The employment agreements restrict the executives’ right to compete against us for a period of two years following their termination of employment for any reason.

Supplemental Executive Retirement Program. The Jefferson Federal Supplemental Executive Retirement Plan provides for supplemental retirement benefits with respect to the ESOP. The plan provides participating executives with benefits otherwise limited by other provisions of the Internal Revenue Code or the terms of the ESOP loan. Specifically, the plan provides benefits to eligible individuals (those designated by the Board of Directors) that cannot be provided under the ESOP as a result of the limitations imposed by the Internal Revenue Code, but that would have been provided under the ESOP but for such limitations. In addition to providing for benefits lost under tax-qualified plans as a result of limitations imposed by the Internal Revenue Code, the plan provides supplemental benefits to designated individuals upon a change of control before the complete scheduled repayment of the ESOP loan. Generally, upon such an event, the supplemental executive retirement plan will provide the individual with a benefit equal to what the individual would have received under the ESOP had he or she remained employed throughout the term of the ESOP loan less the benefits actually provided under the ESOP on behalf of such individual. An individual’s benefits under the supplemental executive retirement plan generally become payable upon a change in control of Jefferson Federal or Jefferson Bancshares. The Board of Directors has designated Mr. Smith as a participant in the plan and may designate other officers as participants in future years.

15

Compensation Committee Report on Executive Compensation

The following is a report of the Compensation Committee of the Board of Directors regarding executive compensation. The Compensation Committee’s membership and duties are described in this proxy statement under the heading“Corporate Governance–Committees of the Board of Directors of Jefferson Bancshares–Compensation Committee.”

Compensation Policies

The Compensation Committee bases its executive compensation policy on the same principles that guide the Company in establishing all of its compensation programs. The Company designs programs to attract, retain and motivate highly talented individuals at all levels of the organization while balancing the interests of stockholders. The compensation program for executives consists of three key elements:

| | • | | Performance-based annual bonus; and |

| | • | | Long-term stock incentive compensation. |

Components of Executive Compensation

Base Salary. Salary levels for all employees, including executive officers, are set so as to reflect the duties and levels of responsibilities inherent in the position and to reflect competitive conditions in the banking business in the Company’s market area. Comparative salaries paid by other financial institutions are considered in establishing the salary for a given position. The Compensation Committee utilizes the Compensation Survey and the Salary and Benefits Survey compiled by the America’s Community Bankers and the Tennessee Bankers Association, respectively, as well as other surveys prepared by trade groups and independent benefits consultants. Base salaries for all employees, including the executive officers, are reviewed annually by the Compensation Committee, which takes into account the competitive level of pay as reflected in the surveys consulted. In setting base salaries, the Compensation Committee also considers a number of factors relating to the particular executive, including individual performance, job responsibilities, level of experience, ability and knowledge of the position. These factors are considered subjectively in the aggregate and none of the factors is accorded a specific weight.

Bonus.During fiscal 2006, bonuses were awarded to executive officers based on the Compensation Committee’s recognition of the individual contributions made by executive officers that enabled the Company to perform well both financially and operationally, despite the very difficult economic environment, and based on competitive levels of compensation at similar companies. Cash bonuses are paid pursuant to a Management Incentive Plan which focuses on components such as asset quality, financial performance and strategy. Goals are weighted differently at each level.

Long-Term Incentive Compensation.Under the Company’s 1995 Jefferson Federal Savings and Loan Association Stock Option Plan (the “1995 Stock Option Plan”) and 2004 Stock-Based Incentive Plan, the Compensation Committee is authorized, in its discretion, to grant stock options and restricted stock awards in such proportions and upon such terms and conditions as the Compensation Committee may determine, subject to regulatory limits. All stock options granted have an exercise price equal to the fair market value of the Company’s common stock at the time of grant and are exercisable within a ten-year period. In order to assure the retention of high level executives and tie the compensation of those executives to the creation of long-term value for stockholders, the Compensation Committee requires that stock options granted under the 1995 Stock Option Plan and the 2004 Stock-Based Incentive Plan vest proportionately over a five-year period.

16

The awards of restricted stock to executive officers and other key employees represent shares of Jefferson Bancshares common stock that the recipient cannot sell or otherwise transfer until the applicable restriction period lapses. Restricted stock awards are also intended to increase the ownership of executives in the Company, thereby further integrating the compensation of the executive with the creation of long-term value for stockholders. The Compensation Committee has provided that restricted stock awards granted under the 2004 Stock-Based Incentive Plan vest in equal portions over five years.

Anderson L. Smith – Chief Executive Officer Compensation

Jefferson Federal and Mr. Smith entered into an employment agreement effective June 25, 2003. The terms of Mr. Smith’s employment agreement are set forth under “Executive Compensation” in this proxy statement. In determining Mr. Smith’s cash compensation for fiscal 2006, the board focused on the Company’s financial performance during the year, the number of initiatives begun, expanded or completed by the Company since Mr. Smith’s employment began, competitive levels of compensation for CEOs managing operations of similar size, complexity and performance level and the importance of retaining a President and Chief Executive Officer with the strategic, financial and leadership skills to ensure the Company’s continued growth into the foreseeable future. Under the Management Incentive Plan, Mr. Smith received a cash payment of $42,500 in September for the 2006 fiscal year. The Committee believes that Mr. Smith’s total compensation package for 2006 will be slightly above the median of total compensation for CEOs in the peer group, based on data obtained via the 2006 Tennessee Bankers Association Salary and Benefits Survey and the America’s Community Bankers Compensation Survey.

The Compensation Committee of the Board of Directors

of Jefferson Bancshares, Inc.

Dr. Terry M. Brimer (Chairman)

Dr. Jack E. Campbell

William T. Hale

H. Scott Reams

William F. Young

Compensation Committee Interlocks and Insider Participation

No executive officer of the Company or the Bank serves or has served as a member of the compensation committee of any other entity, one of whose executive officers serves on the Compensation Committee of the Company. No executive officer of the Company or the Bank serves or has served as a director of another entity, one of whose executive officers serves on the Compensation Committee of the Company.

17

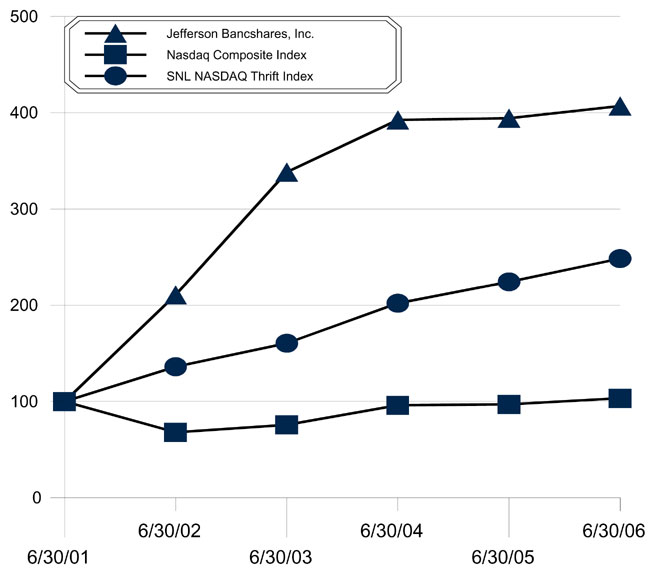

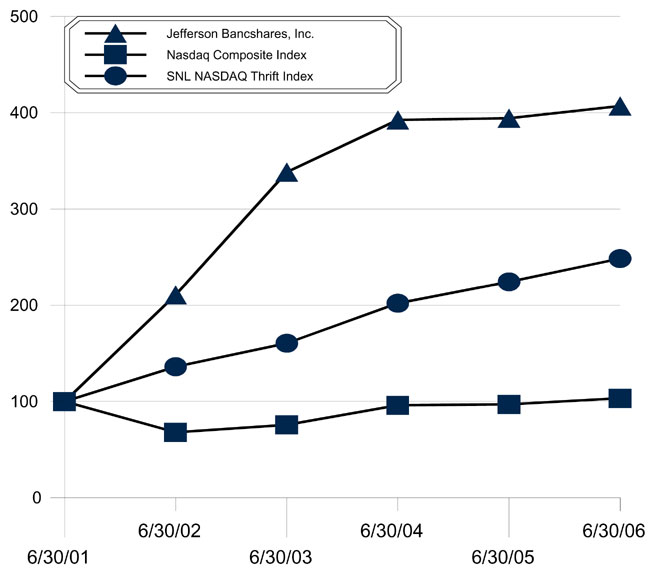

Performance Graph

The following graph compares the cumulative total shareholder return on Jefferson Bancshares common stock with the cumulative total return on the Nasdaq Index (U.S. Companies) and with the SNL Thrift Index. Total return assumes the reinvestment of all dividends.

| | | | | | | | | | | | | | | | | | |

| | | Period Ending |

| | | 6/30/01 | | 6/30/02 | | 6/30/03 | | 6/30/04 | | 6/30/05 | | 6/30/06 |

Jefferson Bancshares, Inc. | | $ | 100.00 | | $ | 210.72 | | $ | 338.25 | | $ | 392.59 | | $ | 394.34 | | $ | 407.02 |

NASDAQ Composite Index | | | 100.00 | | | 67.93 | | | 75.71 | | | 95.97 | | | 97.03 | | | 103.32 |

SNL NASDAQ Thrift Index | | | 100.00 | | | 136.02 | | | 160.38 | | | 202.03 | | | 224.28 | | | 248.47 |

18

Other Information Relating to Directors and Executive Officers

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10% of any registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Executive officers, directors and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on the Company’s review of the copies of the reports it has received and written representations provided to it from the individuals required to file the reports, the Company believes that each of its executive officers, directors and greater than 10% beneficial owners has complied with the applicable reporting requirements for transactions in the Company’s common stock during the year ended June 30, 2006.

Transactions with Management

Loans to Officers and Directors. The Sarbanes-Oxley Act generally prohibits loans by Jefferson Bancshares to its executive officers and directors. However, the Sarbanes-Oxley Act contains a specific exemption from such prohibition for loans by Jefferson Federal to its executive officers and directors in compliance with federal banking regulations. Federal regulations require that all loans or extensions of credit to executive officers and directors of insured institutions must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and must not involve more than the normal risk of repayment or present other unfavorable features. Jefferson Federal is therefore prohibited from making any new loans or extensions of credit to executive officers and directors at different rates or terms than those offered to the general public, except for loans made pursuant to programs generally available to all employees. Notwithstanding this rule, federal regulations permit Jefferson Federal to make loans to executive officers and directors at reduced interest rates if the loan is made under a benefit program generally available to all other employees and does not give preference to any executive officer or director over any other employee. Jefferson Federal has adopted a policy of offering employees residential mortgage loans at a discount of 1/2% to published rates and personal consumer loans at a discount of 1% to published rates. Jefferson Federal gives employees a discount of 50% on closing fees.

In addition, loans made to a director or executive officer in an amount that, when aggregated with the amount of all other loans to the person and his or her related interests, are in excess of the greater of $25,000 or 5% of Jefferson Federal’s capital and surplus, up to a maximum of $500,000, must be approved in advance by a majority of the disinterested members of the Board of Directors.

The aggregate amount of loans by Jefferson Federal to its executive officers and directors was $7.5 million at June 30, 2006, or approximately 10.0% of stockholders’ equity at June 30, 2006. These loans were performing according to their original terms at June 30, 2006.

Other Transactions. H. Scott Reams is a partner in the law firm of Taylor, Reams, Tilson & Harrison of Morristown, Tennessee. We pay a monthly retainer of $500 to the law firm. In fiscal 2006, Jefferson Federal paid a total of $16,000 in legal fees to Mr. Reams’ firm. We believe that the fees paid to Mr. Reams’ firm were based on normal terms and conditions as would apply to other clients of the firm.

19

Nominating/Corporate Governance Committee Procedures

General

It is the policy of the Nominating/Corporate Governance Committee of the Board of Directors of the Company to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Nominating/Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nominating/Corporate Governance Committee does not perceive a need to increase the size of the Board of Directors. In order to avoid the unnecessary use of the Nominating/Corporate Governance Committee’s resources, the Nominating/Corporate Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders

To submit a recommendation of a director candidate to the Nominating/Corporate Governance Committee, a stockholder should submit the following information in writing, addressed to the Chairman of the Nominating/Corporate Governance Committee, care of the Corporate Secretary, at the main office of the Company:

| | 1. | The name of the person recommended as a director candidate; |

| | 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| | 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| | 4. | As to the stockholder making the recommendation, the name and address, as they appear on the Company’s books, of such stockholder; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| | 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, the recommendation must be received by the Nominating/Corporate Governance Committee at least 120 calendar days prior to the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year.

Minimum Qualifications

The Nominating/Corporate Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. A candidate must meet any qualification requirements set forth in any Board or committee governing documents.

20

The Nominating/Corporate Governance Committee will consider the following criteria in selecting nominees: financial, regulatory and business experience; familiarity with and participation in the local community; integrity, honesty and reputation; dedication to the Company and its stockholders; independence; and any other factors the Nominating/Corporate Governance Committee deems relevant, including age, diversity, size of the Board of Directors and regulatory disclosure obligations.

In addition, prior to nominating an existing director for re-election to the Board of Directors, the Nominating/Corporate Governance Committee will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Process for Identifying and Evaluating Nominees

The process that the Nominating/Corporate Governance Committee follows when it identifies and evaluates individuals to be nominated for election to the Board of Directors is as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Nominating/Corporate Governance Committee relies on personal contacts of the committee members and other members of the Board of Directors, as well as their knowledge of members of the communities served by Jefferson Federal. The Nominating/Corporate Governance Committee also will consider director candidates recommended by stockholders in accordance with the policy and procedures set forth above. The Nominating/Corporate Governance Committee has not previously used an independent search firm to identify nominees.

Evaluation. In evaluating potential nominees, the Nominating/Corporate Governance Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. In addition, the Nominating/Corporate Governance Committee will conduct a check of the individual’s background and interview the candidate.

Submission of Business Proposals and Stockholder Nominations

The Company must receive proposals that shareholders seek to include in the proxy statement for the Company’s next annual meeting no later than May 21, 2007. If next year’s annual meeting is held on a date more than 30 calendar days from October 26, 2007, a shareholder proposal must be received by a reasonable time before the Company begins to print and mail its proxy solicitation for such annual meeting. Any shareholder proposals will be subject to the requirements of the proxy rules adopted by the Securities and Exchange Commission.

The Company’s Bylaws provide that, in order for a shareholder to make nominations for the election of directors or proposals for business to be brought before the annual meeting, a shareholder must deliver notice of such nominations and/or proposals to the Corporate Secretary not less than 90 days prior to the date of the annual meeting; however, if less than 100 days’ notice of the annual meeting is given to shareholders, such notice must be delivered not later than the close of the tenth day following the day on which notice of the annual meeting was mailed to shareholders or public disclosure of the meeting date. A copy of the Bylaws may be obtained from the Company.

21

Board Policies Regarding Stockholder Communications

and Attendance at Annual Meetings

The Company encourages stockholder communications to the Board of Directors and/or individual directors. Stockholders who wish to communicate with the Board of Directors or an individual director should send their communications to the care of Jane P. Hutton, Corporate Secretary, Jefferson Bancshares, Inc., 120 Evans Avenue, Morristown, Tennessee 37814. Communications regarding financial or accounting policies should be sent to the attention of the Chairman of the Audit/Compliance Committee. All other communications should be sent to the attention of the Chairman of the Nominating/Corporate Governance Committee.

Directors are expected to prepare themselves for and to attend all Board meetings, the Annual Meeting of Stockholders and the meetings of the committees on which they serve, with the understanding that on occasion a director may be unable to attend a meeting.All of the Company’s directors attended the Company’s 2005 Annual Meeting of Stockholders.

Miscellaneous

The Company will pay the cost of this proxy solicitation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of Jefferson Bancshares common stock. In addition to soliciting proxies by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone without receiving additional compensation.

The Company’s Annual Report to Shareholders has been mailed to persons who were shareholders as of the close of business on August 31, 2006. Any shareholder who has not received a copy of the Annual Report may obtain a copy by writing to the Corporate Secretary of the Company. The Annual Report is not to be treated as part of the proxy solicitation material or as having been incorporated in this proxy statement by reference.

A copy of the Company’s Annual Report on Form 10-K, without exhibits, for the year ended June 30, 2006, as filed with the Securities and Exchange Commission, will be furnished without charge to persons who were shareholders as of the close of business on August 31, 2006 upon written request to Jane P. Hutton, Corporate Secretary, Jefferson Bancshares, Inc., 120 Evans Avenue, Morristown, Tennessee 37814.

Householding of Proxy Statements and Annual Reports

The Securities and Exchange Commission has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report to that address. This practice, known as “householding,” is designed to reduce the Company’s printing and postage costs. Once you have received notice from your broker or the Company that they or it will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in

22

householding and would prefer to receive a separate annual report or proxy statement, please notify your broker or other holder of record if your shares are held in “street name” or the Company if you hold registered shares. You can notify the Company by contacting its transfer agent, Registrar and Transfer Company, either by phone at (800) 368-5948, by fax at (908) 497-2318, by e-mail at info@rtco.com or by mail at 10 Commerce Drive, Cranford, New Jersey 07016. If you are receiving multiple copies of our annual report and proxy statement, you can request householding by contacting the same parties listed above.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

/s/ Jane P. Hutton |

Jane P. Hutton Corporate Secretary |

Morristown, Tennessee

September 18, 2006

23

APPENDIX A

JEFFERSON BANCSHARES, INC.

AUDIT/COMPLIANCE COMMITTEE CHARTER

Organization

The primary function of the Audit/Compliance Committee (the “Audit Committee”) of the Board of Directors (the “Board”) of Jefferson Bancshares, Inc. (the “Company”) is to review: the integrity of the financial reports and other financial information provided by the Company to any governmental body or the public, including any certification, report, opinion or review performed by the Company’s independent accountants; the Company’s compliance with legal and regulatory requirements; the independent accountant’s qualifications and independence; the performance of the Company’s internal audit functions, its independent accountants and system of internal controls and disclosure procedures regarding finance, accounting, legal compliance and ethics that management and the Board have established; the Company’s auditing, accounting and financial reporting processes generally; and the preparation of information required by the Securities and Exchange Commission rules to be included in the Company’s annual proxy statement.

The Audit Committee will be comprised of three or more directors as determined by the Board each of whom shall satisfy the definition of independent director as defined in any qualitative listing requirements for Nasdaq Stock Market, Inc. issuers and any applicable Securities and Exchange Commission rules and regulations. All members of the Audit Committee must be financially literate at time of appointment, meaning they must have the ability to read and understand fundamental financial statements, including the Company’s balance sheet, income statement and cash flow statement. In addition, at least one member of the Audit Committee shall have past employment in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication, including having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities. The members of the Audit Committee will be elected by the Board on an annual basis.

Responsibilities

In carrying out its responsibilities, the Audit Committee believes its policies and procedures should remain flexible, in order to best react to changing conditions and to ensure to the directors and shareholders that the corporate accounting and reporting practices of the Company are in accordance with all requirements and are of the highest quality. To fulfill its responsibilities and duties the Audit Committee shall:

| 1. | Provide an open avenue of communication between management, the independent auditor, internal audit department and the Board. |

| 2. | Meet four times per year or more frequently as circumstances may require. A quorum of the Audit Committee shall be declared when a majority of the appointed members of the Audit Committee are in attendance. |

A-1

| 3. | The Audit Committee shall meet with the independent auditors and management at least quarterly to review the Company’s financial statements. In meetings attended by the independent auditors or by regulatory examiners, a portion of the meeting will be reserved for the Audit Committee to meet in closed session with these parties. |

| 4. | Keep written minutes for all meetings. |

| 5. | Review with the independent auditor and internal audit department the work to be performed by each to assure completeness of coverage, reduction of redundant efforts and the effective use of audit resources. |

| 6. | Review all significant risks or exposures to the Company found during audits performed by the independent auditor and internal audit department and ensure that these items are discussed with management. From these discussions, assess and report to the Board regarding how the findings should be addressed. |

| 7. | Review recommendations from the independent auditor and internal auditing department regarding internal controls and other matters relating to the accounting policies and procedures of the Company. |

| 8. | Following each meeting of the Audit Committee, the chairman of the committee will submit a record of the meeting to the Board including any recommendations that the Committee may deem appropriate. |

| 9. | Ensure that the independent auditor discusses with the Audit Committee their judgments about the quality, not just the acceptability, of the Company’s accounting principles as applied in the financial reports. The discussion should include such issues as the clarity of the Company’s financial disclosures and degree of aggressiveness or conservatism of the Company’s accounting principles and underlying estimates and other significant decisions made by management in preparing the financial disclosures. |

| 10. | Review the Company’s audited annual financial statements and the independent auditor’s opinion regarding such financial statements, including a review of the nature and extent of any significant changes in accounting principles. |

| 11. | Arrange for the independent auditor to be available to the full Board at least annually to discuss the results of the annual audit and the audited financial statements that are a part of the annual report to shareholders. |

| 12. | Review with management, the independent auditor, internal audit department and legal counsel, legal and regulatory matters that may have a material impact on the financial statements. |

| 13. | Review with management and the independent auditor all interim financial reports filed pursuant to the Securities Exchange Act of 1934. |

A-2

| 14. | Generally discuss earnings press releases and financial information as well as earnings guidance provided to analysts and rating agencies. |

| 15. | Select the independent auditor, considering independence and effectiveness, and be ultimately responsible for their compensation, retention and oversight (including resolution of disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work, and each such registered public accounting firm shall report directly to the audit committee. The Audit Committee should confirm the independence of the independent auditor by requiring them to disclose in writing all relationships that, in the auditor’s professional judgment, may reasonably be thought to bear on the ability to perform the audit independently and objectively. |

| 16. | Review the performance of the independent auditor. |

| 17. | Review the activities, organizational structure and qualifications of the internal audit department. The Audit Committee should also review and concur in the appointment, replacement, reassignment, or dismissal of the manager of the internal audit department. |

| 18. | Be authorized to retain independent counsel and other advisors as it deems necessary to carry out its duties. In connection therewith, the Audit Committee shall be provided appropriate funding, as determined by the Audit Committee, for payment to such counsel and other advisors. In addition, the Audit Committee shall be provided funding for ordinary administrative expenses of the Audit Committee. |

| 19. | Have in place procedures for (1) receiving, retaining and treating complaints regarding accounting, internal accounting controls, or auditing matters, and (2) the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

| 20. | Approve, in advance, all permissible non-audit services to be completed by the independent auditor. Such approval process will ensure that the independent auditor does not provide any non-audit services to the Company that are prohibited by law or regulation. |

| 21. | Set clear hiring policies for hiring employees or former employees of the independent auditors. |

| 22. | Review and approve all related-party transactions. |

In addition to the responsibilities presented above, the Audit Committee will examine this Charter on an annual basis to assure that it remains adequate to address the responsibilities that the Committee has. Further, the Committee will disclose in each annual proxy statement to its shareholders whether it satisfied the responsibilities during the prior year in compliance with the Charter, and will disclose a copy of the Charter triennially either in the annual report to shareholders or proxy statement.

A-3

[Jefferson Bancshares, Inc. Letterhead]

Dear Stock Award Recipient:

On behalf of the Board of Directors of Jefferson Bancshares, Inc. (the “Company”), I am forwarding to you the attachedyellow vote authorization form for the purpose of conveying your voting instructions to First Bankers Trust Services, Inc. (the “Trustee”) on the proposals presented at the Annual Meeting of Shareholders of the Company to be held on October 26, 2006. A copy of the Company’s Annual Report to Shareholders and a Notice and Proxy Statement for the Company’s Annual Meeting was forwarded to you under separate cover. If you did not receive a copy of the Company’s Annual Report to Shareholders and/or the Company’s Proxy Statement, please contact Jane Hutton for a copy of the documents.

As a recipient of a Stock Award under the Jefferson Bancshares, Inc. 2004 Stock-Based Incentive Plan (the “Incentive Plan”), you are entitled to vote all shares of restricted Company common stock awarded to you under the Incentive Plan that are unvested as of September 18, 2006. The Trustee will vote the shares of Company common stock held in the Incentive Plan Trust in accordance with instructions it receives from you and other Stock Award Recipients.

In order to direct the voting of the unvested shares of Company common stock awarded to you under the Incentive Plan, you must complete and sign the enclosedyellow vote authorization form and return it in the accompanying postage-paid envelope no later than October 16, 2006.

If you are an employee of Jefferson Federal and a participant in the Jefferson Federal ESOP and/or 401(k) plan, voting instructions cards for the shares credited to your ESOP and/or 401(k) Plan accounts will be sent to your home address on file with Jefferson Federal.Please vote all of the voting materials you receive.

|

| Sincerely, |

|

/s/ Anderson L. Smith |

Anderson L. Smith President and Chief Executive Officer |

Name: ____________________

Shares: ___________________

VOTE AUTHORIZATION FORM