Revised Segment Reporting April 22, 2014 Exhibit 99.1

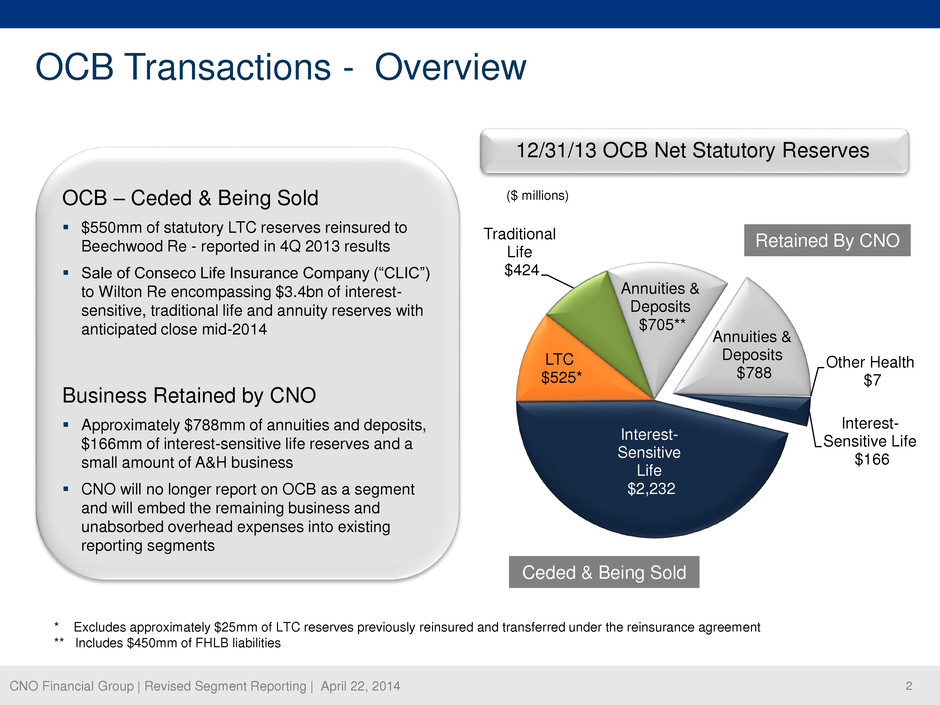

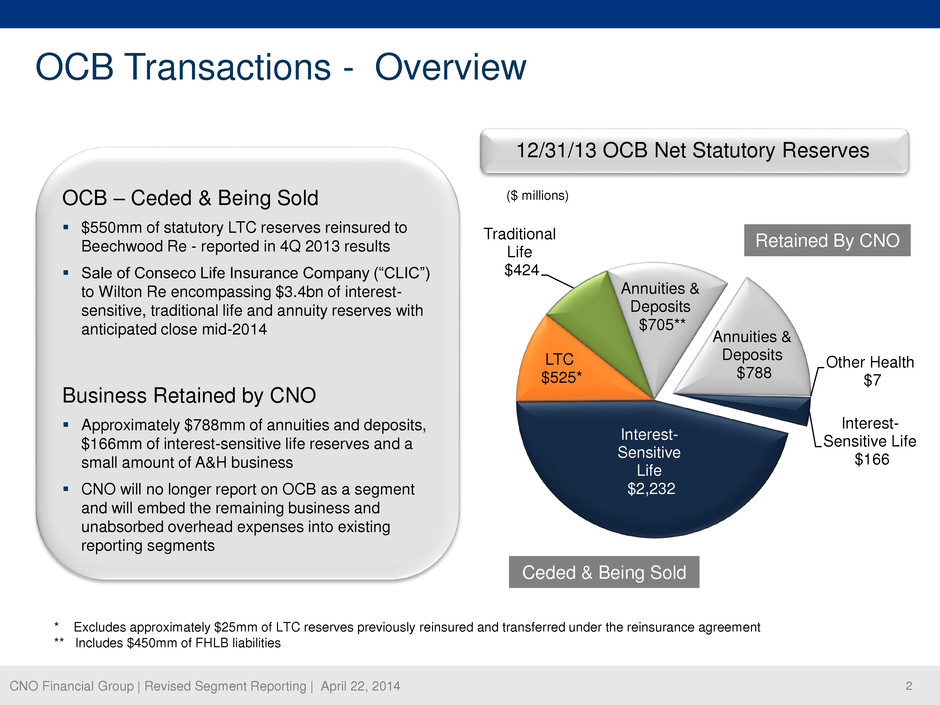

CNO Financial Group | Revised Segment Reporting | April 22, 2014 2 Annuities & Deposits $705** Interest- Sensitive Life $2,232 LTC $525* Traditional Life $424 Annuities & Deposits $788 Other Health $7 Interest- Sensitive Life $166 OCB Transactions - Overview 12/31/13 OCB Net Statutory Reserves Retained By CNO Ceded & Being Sold OCB – Ceded & Being Sold $550mm of statutory LTC reserves reinsured to Beechwood Re - reported in 4Q 2013 results Sale of Conseco Life Insurance Company (“CLIC”) to Wilton Re encompassing $3.4bn of interest- sensitive, traditional life and annuity reserves with anticipated close mid-2014 Business Retained by CNO Approximately $788mm of annuities and deposits, $166mm of interest-sensitive life reserves and a small amount of A&H business CNO will no longer report on OCB as a segment and will embed the remaining business and unabsorbed overhead expenses into existing reporting segments * Excludes approximately $25mm of LTC reserves previously reinsured and transferred under the reinsurance agreement ** Includes $450mm of FHLB liabilities ($ millions)

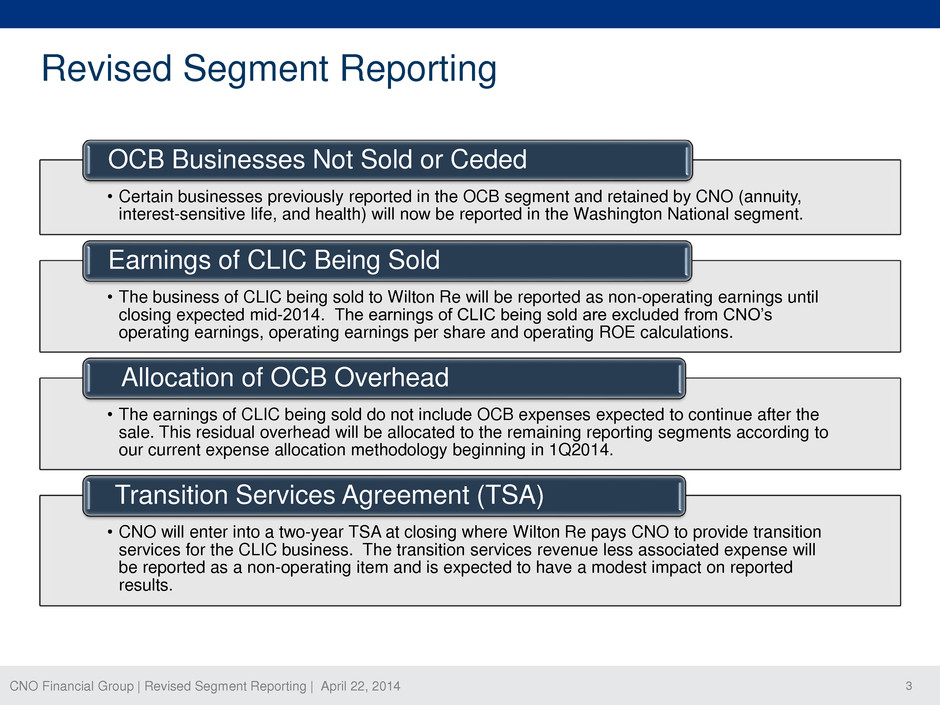

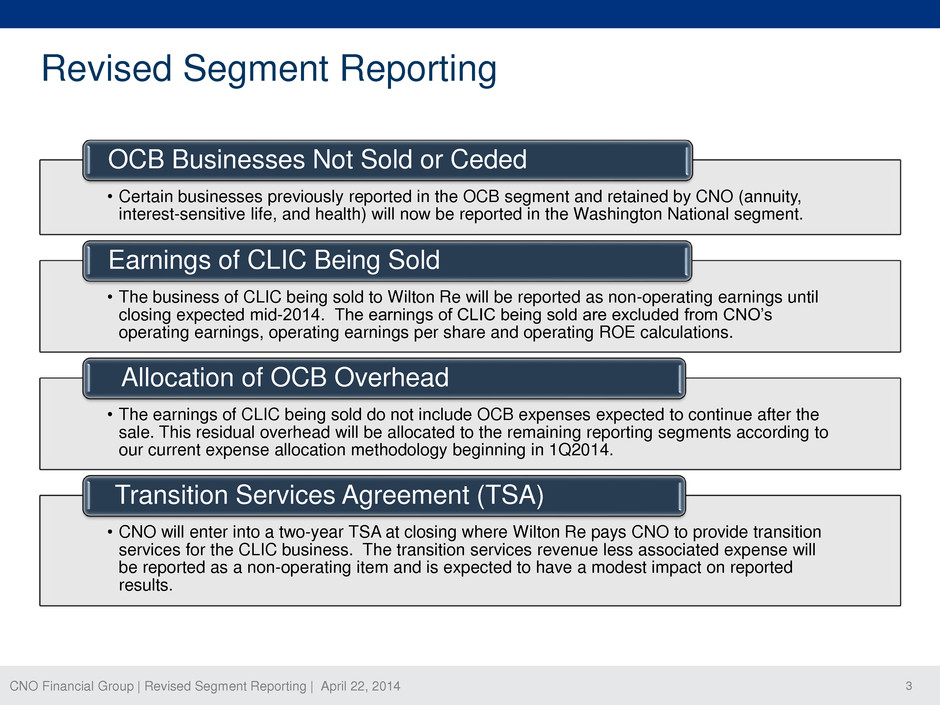

CNO Financial Group | Revised Segment Reporting | April 22, 2014 3 • Certain businesses previously reported in the OCB segment and retained by CNO (annuity, interest-sensitive life, and health) will now be reported in the Washington National segment. OCB Businesses Not Sold or Ceded • The business of CLIC being sold to Wilton Re will be reported as non-operating earnings until closing expected mid-2014. The earnings of CLIC being sold are excluded from CNO’s operating earnings, operating earnings per share and operating ROE calculations. Earnings of CLIC Being Sold • The earnings of CLIC being sold do not include OCB expenses expected to continue after the sale. This residual overhead will be allocated to the remaining reporting segments according to our current expense allocation methodology beginning in 1Q2014. Allocation of OCB Overhead • CNO will enter into a two-year TSA at closing where Wilton Re pays CNO to provide transition services for the CLIC business. The transition services revenue less associated expense will be reported as a non-operating item and is expected to have a modest impact on reported results. Transition Services Agreement (TSA) Revised Segment Reporting

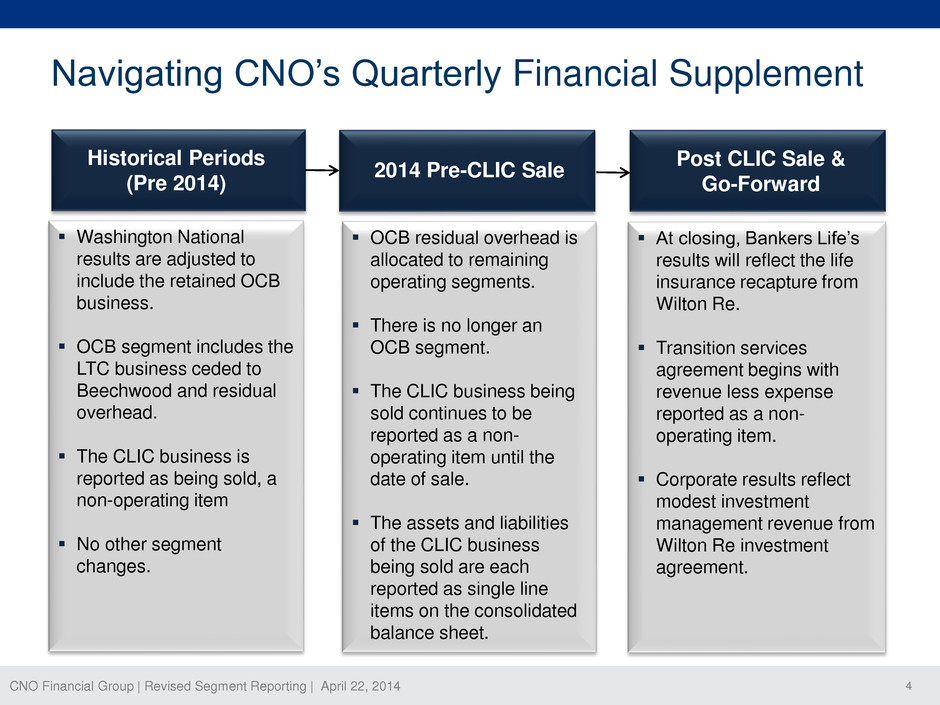

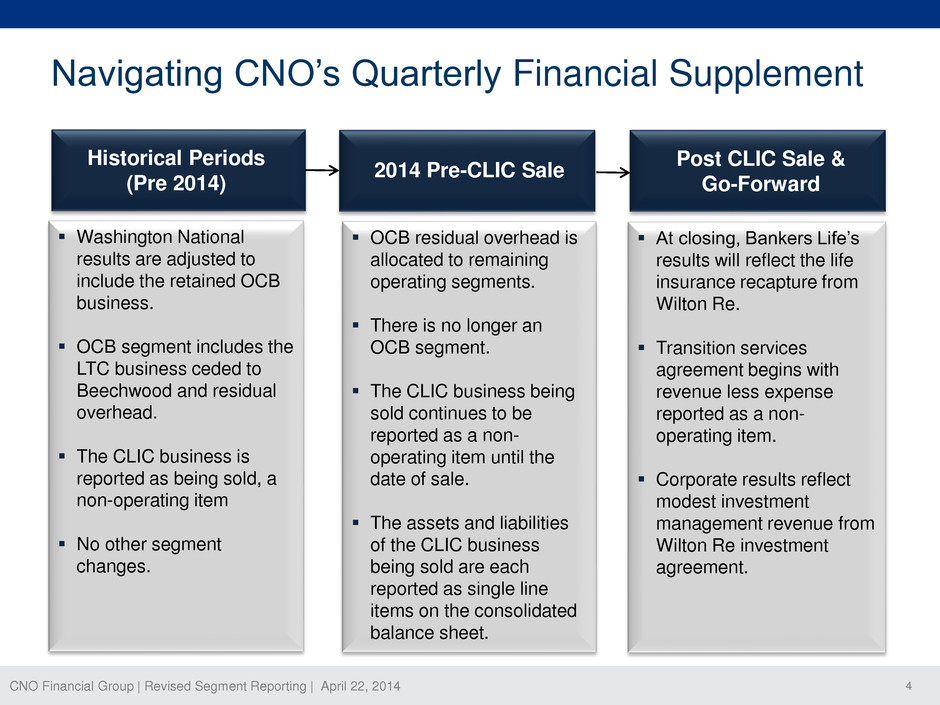

CNO Financial Group | Revised Segment Reporting | April 22, 2014 4 Navigating CNO’s Quarterly Financial Supplement At closing, Bankers Life’s results will reflect the life insurance recapture from Wilton Re. Transition services agreement begins with revenue less expense reported as a non- operating item. Corporate results reflect modest investment management revenue from Wilton Re investment agreement. Historical Periods (Pre 2014) 2014 Pre-CLIC Sale Post CLIC Sale & Go-Forward Washington National results are adjusted to include the retained OCB business. OCB segment includes the LTC business ceded to Beechwood and residual overhead. The CLIC business is reported as being sold, a non-operating item No other segment changes. OCB residual overhead is allocated to remaining operating segments. There is no longer an OCB segment. The CLIC business being sold continues to be reported as a non- operating item until the date of sale. The assets and liabilities of the CLIC business being sold are each reported as single line items on the consolidated balance sheet.

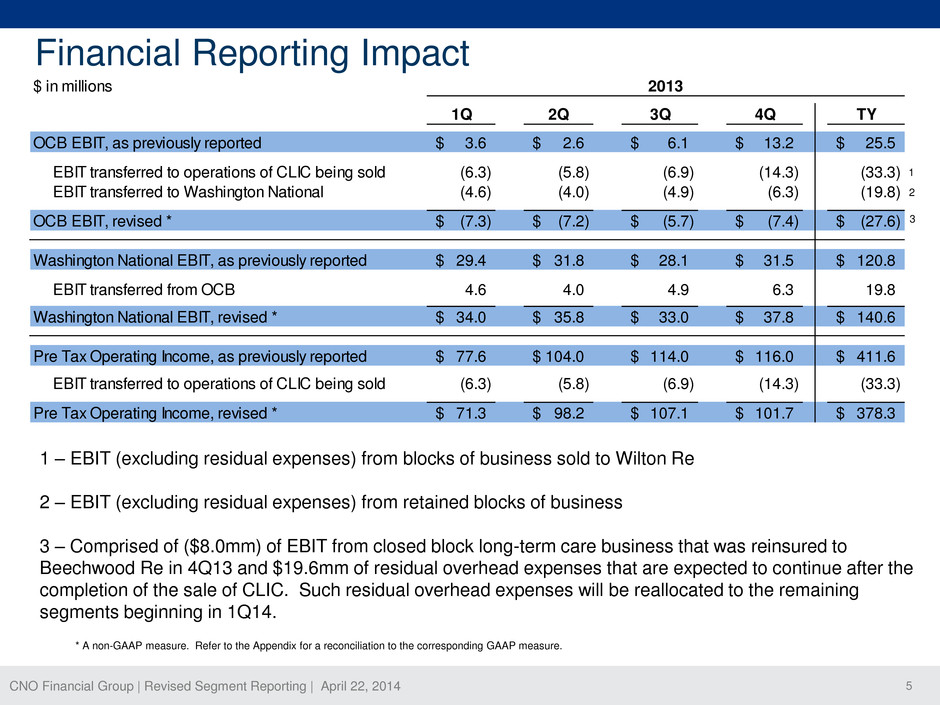

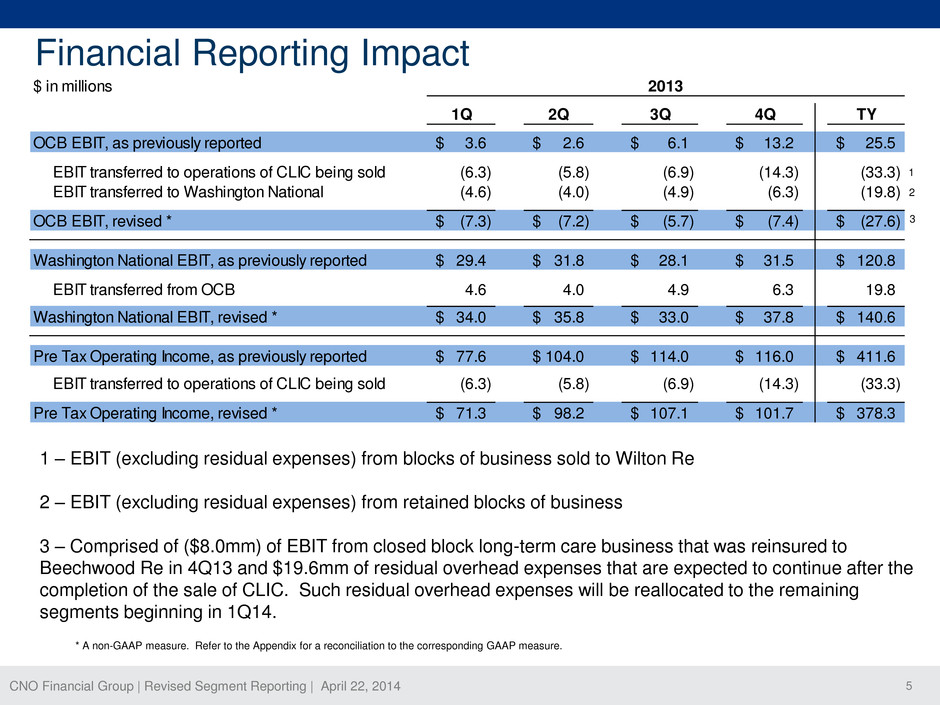

CNO Financial Group | Revised Segment Reporting | April 22, 2014 5 Financial Reporting Impact 1 2 1 – EBIT (excluding residual expenses) from blocks of business sold to Wilton Re 2 – EBIT (excluding residual expenses) from retained blocks of business 3 – Comprised of ($8.0mm) of EBIT from closed block long-term care business that was reinsured to Beechwood Re in 4Q13 and $19.6mm of residual overhead expenses that are expected to continue after the completion of the sale of CLIC. Such residual overhead expenses will be reallocated to the remaining segments beginning in 1Q14. 3 * A non-GAAP measure. Refer to the Appendix for a reconciliation to the corresponding GAAP measure. $ in millions 1Q 2Q 3Q 4Q TY OCB EBIT, as previously reported 3.6$ 2.6$ 6.1$ 13.2$ 25.5$ EBIT transferred to operations of CLIC being sold (6.3) (5.8) (6.9) (14.3) (33.3) EBIT transferred to Washington National (4.6) (4.0) (4.9) (6.3) (19.8) OCB EBIT, revised * (7.3)$ (7.2)$ (5.7)$ (7.4)$ (27.6)$ Washington National EBIT, as previously reported 29.4$ 31.8$ 28.1$ 31.5$ 120.8$ EBIT transferred from OCB 4.6 4.0 4.9 6.3 19.8 Washington National EBIT, revised * 34.0$ 35.8$ 33.0$ 37.8$ 140.6$ Pre Tax Operating Income, as previously reported 77.6$ 104.0$ 114.0$ 116.0$ 411.6$ EBIT transferred to operations of CLIC being sold (6.3) (5.8) (6.9) (14.3) (33.3) Pre Tax Operating Income, revised * 71.3$ 98.2$ 107.1$ 101.7$ 378.3$ 2013

CNO Financial Group | Revised Segment Reporting | April 22, 2014 6 Appendix

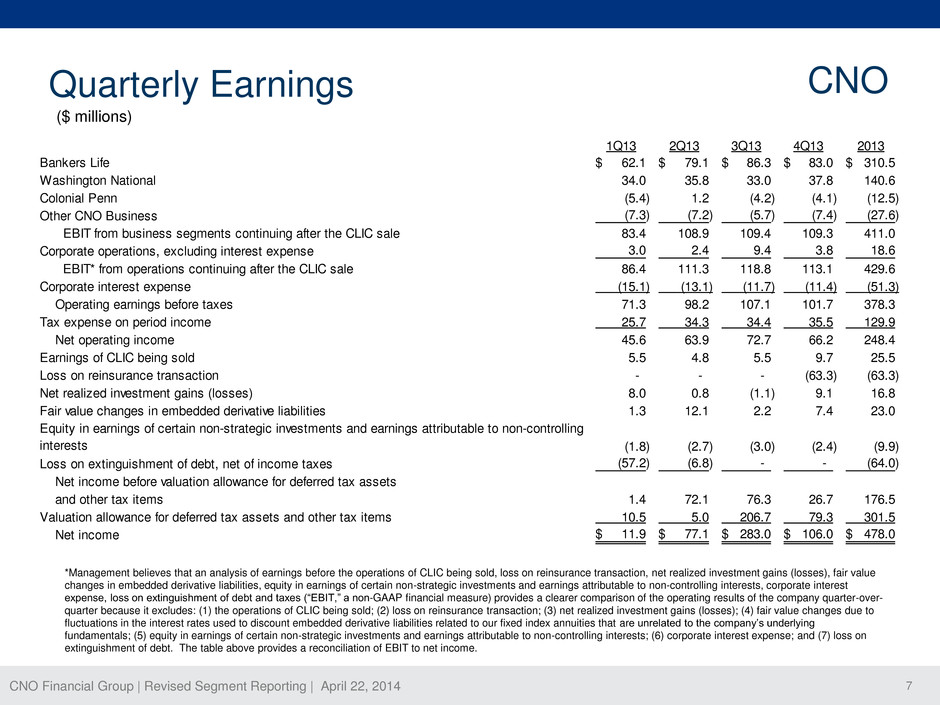

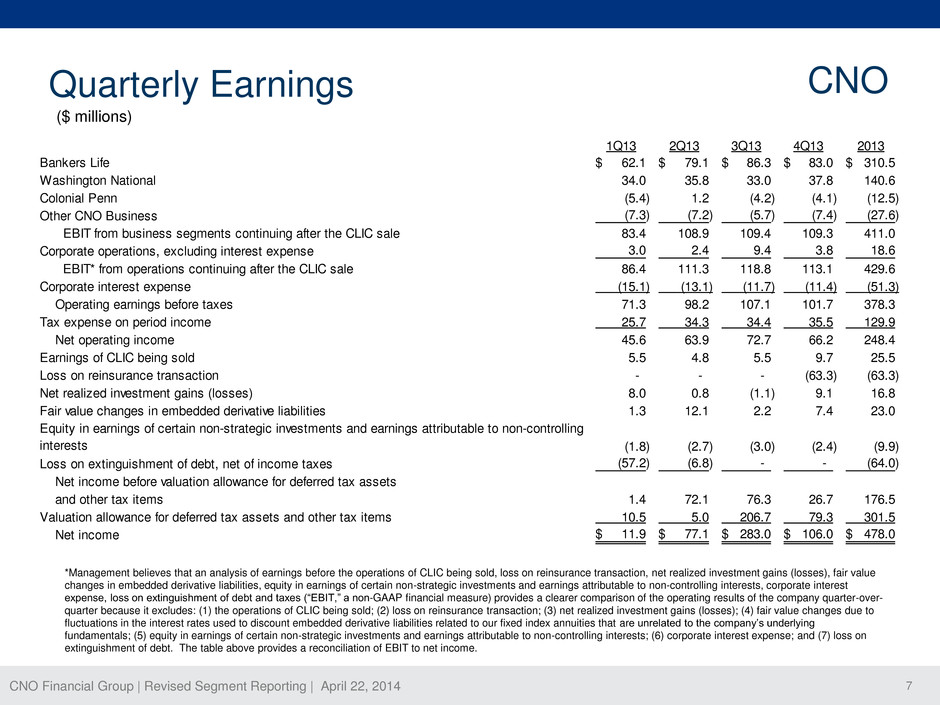

CNO Financial Group | Revised Segment Reporting | April 22, 2014 7 Quarterly Earnings CNO *Management believes that an analysis of earnings before the operations of CLIC being sold, loss on reinsurance transaction, net realized investment gains (losses), fair value changes in embedded derivative liabilities, equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests, corporate interest expense, loss on extinguishment of debt and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over- quarter because it excludes: (1) the operations of CLIC being sold; (2) loss on reinsurance transaction; (3) net realized investment gains (losses); (4) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals; (5) equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests; (6) corporate interest expense; and (7) loss on extinguishment of debt. The table above provides a reconciliation of EBIT to net income. 1Q13 2Q13 3Q13 4Q13 2013 Bankers Life 62.1$ 79.1$ 86.3$ 83.0$ 310.5$ Washington National 34.0 35.8 33.0 37.8 140.6 Colonial Penn (5.4) 1.2 (4.2) (4.1) (12.5) Other CNO Business (7.3) (7.2) (5.7) (7.4) (27.6) EBIT from business segments continuing after the CLIC sale 83.4 108.9 109.4 109.3 411.0 Corporate operations, excluding interest expense 3.0 2.4 9.4 3.8 18.6 EBIT* from operations continuing after the CLIC sale 86.4 111.3 118.8 113.1 429.6 Corporate interest expense (15.1) (13.1) (11.7) (11.4) (51.3) Operating earnings before taxes 71.3 98.2 107.1 101.7 378.3 Tax expense on period income 25.7 34.3 34.4 35.5 129.9 Net operating income 45.6 63.9 72.7 66.2 248.4 Earnings of CLIC being sold 5.5 4.8 5.5 9.7 25.5 Loss on reinsurance transaction - - - (63.3) (63.3) Net realized investment gains (losses) 8.0 0.8 (1.1) 9.1 16.8 Fair value changes in embedded derivative liabilities 1.3 12.1 2.2 7.4 23.0 (1.8) (2.7) (3.0) (2.4) (9.9) Loss on extinguishment of debt, net of income taxes (57.2) (6.8) - - (64.0) Net income before valuation allowance for deferred tax assets and other tax items 1.4 72.1 76.3 26.7 176.5 Valuation allowance for deferred tax assets and other tax items 10.5 5.0 206.7 79.3 301.5 Net income 11.9$ 77.1$ 283.0$ 106.0$ 478.0$ Equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests ($ millions)