QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| DTS, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

DTS, Inc.

5220 Las Virgenes Road

Calabasas, California 91302

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 12, 2011

To Our Stockholders:

The annual meeting of stockholders of DTS, Inc., a Delaware corporation, will be held at 10:00 a.m., local time, on May 12, 2011, at the Mediterraneo Room at the Westlake Village Inn, 32037 Agoura Road, Westlake Village, CA 91361, for the following purposes:

- 1.

- To elect two members of the Board of Directors, whose terms are described in the Proxy Statement;

- 2.

- To vote on an advisory (non-binding) basis on the compensation of our named executive officers;

- 3.

- To vote on an advisory (non-binding) basis on the frequency of an advisory vote on executive compensation in the future;

- 4.

- To ratify the appointment of Grant Thornton LLP to serve as our independent registered public accountants for the 2011 fiscal year; and

- 5.

- To transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

Holders of record of DTS, Inc. Common Stock at the close of business on April 1, 2011, are entitled to vote at the meeting.

In addition to the Proxy Statement, proxy card and voting instructions, a copy of DTS, Inc.'s annual report on Form 10-K, which is not part of the proxy soliciting materials, is enclosed.

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning a proxy card in the enclosed, postage-prepaid envelope. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the enclosed Proxy Statement.

| | |

| |

|

|---|

| | | By Order of the Board of Directors, |

|

|

|

|

|

Blake A. Welcher,

Executive Vice President, Legal, General Counsel, and Corporate Secretary |

Calabasas, California

April 4, 2011 |

|

|

DTS, Inc.

5220 Las Virgenes Road

Calabasas, California 91302

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 12, 2011

This Proxy Statement is furnished on behalf of the Board of Directors of DTS, Inc., a Delaware corporation, for use at the annual meeting of stockholders to be held on May 12, 2011 at 10:00 a.m., local time, and at any postponement or adjournment thereof. The annual meeting will be held at the Mediterraneo Room at the Westlake Village Inn, 32037Agoura Road, Westlake Village, CA 91361.

These proxy solicitation materials were first mailed on or about April 4, 2011 to all stockholders entitled to vote at the annual meeting.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At the annual meeting, stockholders will vote on: (1) the election of two Class II directors, (2) an advisory (non-binding) basis on the compensation of our named executive officers, (3) an advisory (non-binding) basis on the frequency that stockholders should vote on executive compensation (either every three years, two years, or one year), (4) the ratification of Grant Thornton LLP to serve as the Company's independent registered public accountants for the 2011 fiscal year and (5) any other business that may properly come before the meeting.

Who is entitled to vote?

Only stockholders of record at the close of business on the record date, April 1, 2011, are entitled to vote at the annual meeting or any postponement or adjournment of the meeting. For ten days prior to the annual meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose relating to the meeting during ordinary business hours at our principal offices located at 5220 Las Virgenes Road, Calabasas, California, 91302.

What are the Board of Directors' recommendations on the proposals?

The Board's recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board unanimously recommends a vote FOR each of the nominees for director, FOR the compensation of our named executive officers, FOR a vote of stockholders every three years on the executive compensation of our named executive officers, and FOR the ratification of the appointment of Grant Thornton LLP as independent registered public accountants of the Company.

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. With respect to any other matter that properly comes before the annual meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, according to their own best judgment. At the date this Proxy Statement went to press, we did not know of any other matters that are to be presented at the annual meeting.

How do I vote my shares at the annual meeting?

Sign and date each proxy card you receive and return it in the postage-prepaid envelope enclosed with your proxy materials. If you are a registered stockholder and attend the annual meeting, then you may deliver your completed proxy card in person or you may vote in person at the annual meeting.

1

If your shares are held in "street name" by your broker or bank, you will receive a form from your broker or bank seeking instructions as to how your shares should be voted. If you do not instruct your broker or bank how to vote, your broker or bank may vote your shares if it has discretionary power to vote on a particular matter.

Can I change my vote after I return my proxy card?

Yes, you may revoke or change your proxy at any time before the annual meeting by filing with Blake Welcher, our Executive Vice President, Legal, General Counsel and Corporate Secretary, at 5220 Las Virgenes Road, Calabasas, California, 91302, a notice of revocation or another signed proxy card with a later date. You may also revoke your proxy by attending the annual meeting and voting in person.

Who will count the votes?

Our Executive Vice President, Legal, General Counsel, and Corporate Secretary will count the votes and act as the inspector of election.

What does it mean if I get more than one proxy card?

If your shares are registered differently or are in more than one account, you will receive more than one proxy card. Sign and return all proxy cards to ensure that all of your shares are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, Computershare Trust Company, N.A. (877) 282-1168, or, if your shares are held in street name, by contacting the broker or bank that holds your shares.

How many shares can vote?

As of the record date, April 1, 2011, 17,388,131 shares of our Common Stock were outstanding. Every stockholder is entitled to one vote for each share of Common Stock held.

What is a quorum?

The presence at the meeting in person or by proxy of holders of a majority of the outstanding shares of our stock entitled to vote at the meeting will constitute a quorum. A quorum must be met in order to hold the meeting and transact any business, including voting on proposals. Proxies marked as abstaining on any matter to be acted upon by stockholders and "broker non-votes", described below, will be treated as present for purposes of determining if a quorum is present.

What vote is required to approve each proposal?

If a quorum is present: (i) the nominees for director who receive a plurality of the votes, which means that the two director nominees receiving the highest number of "For" votes, will become Class II directors, (ii) the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting is required to approve our executive compensation proposal, (iii) for purposes of the proposal regarding the frequency of the non-binding vote on executive compensation, the option of three years, two years or one year that receives the highest number of "For" votes will be the frequency for the advisory vote on executive compensation that has been selected by stockholders and (iv) the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting is required to ratify the appointment of Grant Thornton LLP as our independent registered public accountants.

2

What are broker non-votes?

Broker non-votes are shares held by brokers that do not have discretionary authority to vote on a matter and have not received voting instructions from their clients. If your broker holds your shares in its name (referred to as "street name") and you do not instruct your broker how to vote, your broker will not have discretion to vote your shares on any of the matters, other than the matter regarding ratification of the appointment of Grant Thornton LLP as the company's independent registered public accountants. Broker non-votes will be counted as shares present for the purpose of determining the presence of a quorum. Broker non-votes will have no effect on any of the proposals. We encourage you to provide instructions to your broker regarding the voting of your shares.

What happens if I abstain?

Proxies marked "abstain" will be counted as shares present for the purpose of determining the presence of a quorum, but for purposes of determining the outcome of a proposal, they will be treated as a "no" or "none" vote. Abstentions will have no effect on the election of directors or the advisory vote on the frequency of future votes on executive compensation.

How will DTS solicit proxies?

We have retained Computershare Trust Company, N.A. and Alliance Advisors, LLC to assist in the distribution of proxy materials. The costs and expenses of preparing and mailing proxy solicitation materials for the annual meeting and reimbursements paid to brokerage firms and others for their reasonable out-of-pocket expenses for forwarding proxy materials to stockholders will be borne by us. We have retained Alliance Advisors, LLC as our proxy solicitor to assist in soliciting proxies and we will bear these costs, which we expect will be approximately $2,500. Proxies may also be solicited in person, by telephone, or by facsimile by our directors, officers, and employees without additional compensation being paid to these persons.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 12, 2011

This is our Proxy Statement for our annual meeting of stockholders to be held on May 12, 2011. Financial and other information concerning DTS, Inc. is contained in our annual report on Form 10-K for the fiscal year ended December 31, 2010. A complete set of proxy materials relating to our annual meeting is available on the Internet. These materials, consisting of our notice of annual meeting, Proxy Statement, proxy card and annual report on Form 10-K, may be viewed at: https://materials.proxyvote.com/23335C

ITEM 1—ELECTION OF DIRECTORS

The Board of Directors currently consists of eight persons and is divided into three classes of directors with staggered three-year terms. There are three Class I directors, two Class II directors, and three Class III directors. The three Class I directors currently consist of Mr. Craig S. Andrews, Mr. L. Gregory Ballard, and Mr. Bradford D. Duea. The two Class II directors currently consist of Mr. Joerg D. Agin and Ms. C. Ann Busby. The three Class III directors currently consist of Mr. Jon E. Kirchner, Ms. V. Sue Molina and Mr. Ronald N. Stone.

The term of the Class II directors will expire at the annual meeting this year, and Ms. Busby has notified the Board that she will not run for re-election at the end of her current term. In order to help balance the number of directors among the classes, Mr. Kirchner has agreed to be moved from a Class III director to a Class II director and to run for re-election as a Class II director this year. The Nominating/Corporate Governance Committee of the Board has nominated Mr. Agin and Mr. Kirchner for election at the annual meeting to serve as Class II directors. You can find information about

3

Mr. Agin and Mr. Kirchner below. A director elected to Class II will serve for a term of three years, expiring at the 2014 annual meeting of stockholders, or until his successor is duly elected and qualified or his earlier death, resignation or removal.

The persons named in the proxy card will vote such proxy for the election of Mr. Agin and Mr. Kirchner unless you indicate that your vote should be withheld or abstained from voting. You cannot vote for a greater number of directors than two. If elected, Mr. Agin and Mr. Kirchner will continue in office until our 2014 annual meeting of stockholders or until their successors have been duly elected and qualified or until the earlier of their respective death, resignation or retirement. Mr. Agin and Mr. Kirchner have each indicated to the Company that they will serve if elected. We do not anticipate that Mr. Agin and Mr. Kirchner will be unable to stand for election, but, if that happens, your proxy will be voted in favor of another person nominated by the Board. We anticipate that the Board of Directors will consist of seven persons immediately following the annual meeting.

The Board of Directors recommends a vote "FOR" the election of Mr. Agin and Mr. Kirchner as directors.

Nominees and Continuing Directors

Each of our directors brings to our board extensive management and leadership experience gained through their service as executives and have diverse experience relating to strategy, operations, capital, risk and business cycles management. In addition, most current directors bring public company board experience—either significant experience on other boards or long service on our Board—that broadens their knowledge of board policies and processes, rules and regulations, and issues and solutions. The Nominating/Corporate Governance Committee's process to recommend qualified director candidates is described under the section titled "Nominating/Corporate Governance Committee" below. In the paragraphs below, we describe specific individual qualifications and skills of our directors that contribute to the overall effectiveness of our Board and its committees.

Set forth below are the names of the nominees for election to the office of director and each current director whose term does not expire at this time, along with their ages, the year first elected as a director, their present positions, principal occupations and public company directorships held in the past five or more years.

NOMINEES FOR TERM EXPIRING AT THE

ANNUAL MEETING OF STOCKHOLDERS IN 2014

Joerg D. Agin, 68, has served as a member of our Board of Directors since July 2003, and currently serves as Lead Independent Director and also serves on our Audit Committee. Since September 2001, he has been the President of Agin Consulting, a consulting business engaged for specific project work associated with hybrid and digital motion imaging systems. Mr. Agin retired in September 2001 from the Eastman Kodak Company, a manufacturer and marketer of imaging products. He first joined Kodak in 1967 as an electrical engineer, but, most recently, from 1995 through August 2001, he served as Senior Vice President and President of the company's Entertainment Imaging division. Mr. Agin also worked at MCA/Universal Studios, a motion picture studio, as Senior Vice President, New Technology and Business Development from 1992 through 1995. Mr. Agin is a Fellow of the Society of Motion Pictures & Television Engineers and the recipient of the Technicolor Herbert T. Kalmus Gold Medal Award for outstanding achievement in color motion pictures. Mr. Agin attended MIT Sloan School of Management for Senior Executives, holds a B.S. in Electrical Engineering from the University of Delaware, and an M.B.A. from Pepperdine University. Mr. Agin was selected to serve on our Board due to his extensive knowledge of digital imaging technologies, his familiarity with technology companies and key contacts within the entertainment industry, his prior experience as a senior executive with major international corporations, and his extensive training in corporate governance matters.

4

Jon E. Kirchner, 43, has served as our Chairman of the Board of Directors and Chief Executive Officer (or "CEO") since February 2010. From September 2001 to February 2010, he served as our President and Chief Executive Officer. He has been a member of our Board of Directors since August 2002. Since joining us in 1993, Mr. Kirchner has served in a number of capacities. From April 2000 to September 2001, he was our President and Chief Operating Officer. From September 1998 to April 2000, he served as our Executive Vice President of Operations, and from March 1996 to September 1998, he was our Vice President of Finance and Business Development. Mr. Kirchner has also served as our Director of International Operations and Controller. Prior to joining us, Mr. Kirchner worked for the Dispute Analysis and Corporate Recovery and Audit Groups of Price Waterhouse LLP (now PricewaterhouseCoopers, LLP), an international accounting firm. During his tenure at Price Waterhouse LLP, he advised clients on financial and operational restructuring, business turnaround, market positioning, and valuation issues. Mr. Kirchner has experience in a variety of industries including entertainment, high technology, manufacturing, distribution, and transportation. He is a Certified Public Accountant and received a B.A. in Economics, Cum Laude, from Claremont McKenna College. Mr. Kirchner was selected to serve on and lead our Board due to his detailed knowledge of all aspects of the operations of the Company, his accounting background and exposure to a number of industries, giving him sound, practical business judgment. We believe that given the size, scope, complexity and expected rapid growth in our business, that oversight, communication, and direction between the Board and management is best achieved by having our CEO also serve as Chairman of the Board of Directors.

CONTINUING DIRECTORS WHOSE TERMS EXPIRE AT THE

ANNUAL MEETING OF STOCKHOLDERS IN 2012

V. Sue Molina, 62, has served on our Board of Directors since January 2008, and currently serves as Chair of our Nominating/Corporate Governance Committee and serves on our Audit Committee. From November 1997 until her retirement in May 2004, she was a tax partner at Deloitte & Touche LLP, an international accounting firm, serving from 2000 until May 2004 as the national partner in charge of Deloitte's Initiative for the Retention and Advancement of Women. Prior to that, she spent twenty years with Ernst & Young LLP, an international accounting firm, the last ten years as a partner. From August 2006 to May 2009, Ms. Molina served as a member of the Board of Directors and Audit Committee, and was Chair of the Compensation Committee of Sucampo Pharmaceuticals, Inc., a pharmaceutical company. Currently, Ms. Molina is a member of the Board of Directors, Chair of the Audit Committee and a member of the Compensation Committee of Royal Neighbors of America, a fraternal insurance company. She holds a B.S.B.A. and a Masters of Accounting degree from the University of Arizona. Ms. Molina was selected to serve on our Board due to her extensive accounting and financial expertise and her experience in advising Boards and serving on Boards of public companies.

Ronald N. Stone, 66, has served as a member of our Board of Directors since April 2004, and currently serves as Chair of our Audit Committee and also serves on our Compensation Committee. Mr. Stone is currently President of Stone Consulting, Inc., a firm providing consulting services to the consumer electronics industry. Until April 2005, Mr. Stone served as an advisor to Pioneer Electronics (USA) Inc., a global consumer electronics company, a role he held after he retired from Pioneer in May 2003. At the time of his retirement, Mr. Stone served as president of Pioneer's Customer Support Division, a position he had held since March 2000. The Customer Support Division was responsible for product services, accessories, and after-sales operations for several Pioneer entities. Prior to his position as president of the Customer Support Division, Mr. Stone served as executive vice president and Chief Financial Officer of Pioneer Electronics (USA) Inc. since 1985. Mr. Stone also served on the board of directors of Pioneer and several of its North American subsidiaries. Mr. Stone began his career with Pioneer Electronics in 1975. Mr. Stone served on the executive committee of the Consumer Electronics Association (CEA), owner of the International Consumer Electronics Show® for more than 15 years,

5

and is a former chairman of that organization's board of directors. He also serves on the UCLA Medical Center board of advisors and on its Information Technology and Finance committees. Mr. Stone received his bachelor's degree in accounting from the University of Southern California. He is a Certified Public Accountant. Mr. Stone was selected to serve on our Board due to his broad and deep experience in the consumer electronics industry, his extensive accounting and financial expertise and his extensive experience as a senior executive.

Mr. Jon E. Kirchner's current term as a director will expire at the annual meeting of stockholders in 2012 unless he is elected a Class II director this year, in which case his term will expire at the annual meeting of stockholders in 2014 along with the other Class II directors.

CONTINUING DIRECTORS WHOSE TERMS EXPIRE AT THE

ANNUAL MEETING OF STOCKHOLDERS IN 2013

Craig S. Andrews, 58, has served as a member of our Board of Directors since June 2010, and currently serves as Chair of our Compensation Committee and also serves on our Nominating/Corporate Governance Committee. Mr. Andrews has been Of Counsel to the law firm of DLA Piper LLP (US) since January 2010, and was a partner at the firm from May 2008 through December 2009. Mr. Andrews has also been Chief Operating Officer of Renova Therapeutics, Inc., a privately held gene therapy company, since June 2008. From March 2003 to June 2008, he was a shareholder of Heller Ehrman, LLP. From March 1987 to February 2003, he was a partner in the Brobeck, Phleger & Harrison law firm, other than for the period from May 2000 to January 2002, during which he spent time as the vice-president of business development at Air Fiber, Inc., a private telecommunications company, and as a partner at the law firm of Latham & Watkins. Mr. Andrews has been advising Boards of Directors of public and private companies for over 25 years, with a focus in representing emerging-growth companies, as well as an expertise in general business and corporate law. Mr. Andrews has played an important role in the formation and development of numerous companies. From September 1999 until August 2010, he was a director of Rubio's Restaurants, Inc. (formerly a NASDAQ listed company), where he was the chairman of the nominating and corporate governance committee and a member of the company's compensation committee. He has previously served as director of numerous other public and private companies, including Encad, Inc. (formerly a NASDAQ listed company), and Collateral Therapeutics, Inc. (formerly a NASDAQ listed company). Mr. Andrews received a Bachelors of Arts degree from the University of California Los Angeles, and a J.D. from the University of Michigan. Mr. Andrews was selected to serve on our Board due to his vast experience in advising boards and companies with respect to legal and general business matters.

L. Gregory Ballard, 57, has served as a member of our Board of Directors since May 2008, and, since February 2011, has served on our Nominating/Corporate Governance Committee. He currently serves as Senior Vice President, Digital Games for Warner Bros Interactive Entertainment. From May 2010 to September 2010, Mr. Ballard served as Chief Executive Officer of Transpera, Inc. a mobile video advertising network. From October 2003 through December 2009, Mr. Ballard served as President & Chief Executive Officer of Glu Mobile Inc., a publisher of mobile video games. In recent years, Mr. Ballard served on the board of Pinnacle Systems, Inc., Imagine Games Network and THQ Inc. He has also served on the Compensation Committee of Pinnacle Systems, Inc. Prior to joining Glu Mobile in October of 2003, Mr. Ballard consulted for Virgin USA, Inc. from April 2003 to September 2003. Prior to then, he served as Chief Executive Officer at SONICblue Incorporated, a manufacturer of ReplayTV digital video recorders and Rio digital music players, from August 2002 to April 2003, when it filed for Chapter 11 bankruptcy protection. Mr. Ballard was also Executive Vice President of Marketing and Product Management at SONICblue from April 2002 to August 2002. Between July 2001 and April 2002, Mr. Ballard worked as a consultant. Mr. Ballard served as Chief Executive Officer of MyFamily.com, Inc., a subscription-based Internet service, from January 2000 to July 2001. Previously, he served as Chief Executive Officer or in another senior executive capacity with

6

3dfx Interactive, Inc., an advanced graphics chip manufacturer, Warner Custom Music Corp., a division of Time Warner, Inc., Capcom Entertainment, Inc., a developer and publisher of video games, and Digital Pictures, Inc., a video game developer and publisher. Mr. Ballard holds a B.A. degree in political science from the University of Redlands and a J.D. from Harvard Law School. Mr. Ballard was selected to serve on our Board due to his substantial experience as an executive and chief executive officer with a number of public and private companies in areas related to the Company's business.

Bradford D. Duea, 42, has served as a member of our Board of Directors since March 2010, and also serves on our Compensation Committee. Mr. Duea currently serves as Senior Vice President, Value Added Services for T-Mobile USA. Mr. Duea is responsible for T-Mobile USA's content business, next generation communication services, mobile portal and related discovery products, search and advertising business and its mobile broadband business, including emerging devices such as tablets. Mr. Duea initially joined T-Mobile in April 2010 as General Manager and Vice President, Communications, Applications and Media and was promoted to his current role in November 2010. From January 2004 until February 2010, Mr. Duea was the President of Napster, Inc. where he was responsible for all international activities, including acting as a board member to Napster Japan (a joint venture with Tower Records Japan) and overseeing the business development activities of the company on a worldwide basis, including Napster Mobile. From May 2003 to January 2004, Mr. Duea served as Vice President, Worldwide Business Development for Roxio, Inc. (which later became Napster, Inc.), where he was responsible for all business development efforts for the company, including those for Napster. Mr. Duea holds a B.A. in Law and Society from the University of California at Santa Barbara, an M.B.A. in Finance and International Business from the University of Southern California, and a J.D. from the University of San Diego. Mr. Duea was selected to serve on our Board due to his background as an executive in the digital media space and his finance and legal background, which will be helpful in evaluating corporate governance and financial matters.

GOVERNANCE OF THE COMPANY

Pursuant to the Delaware General Corporation Law and our by-laws, our business, property and other affairs are managed by or under the direction of the Board of Directors. Members of the Board are kept informed of our business through discussions with our Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees. We currently have eight members of the Board—Mr. Agin, Mr. Andrews, Mr. Ballard, Ms. Busby, Mr. Duea, Mr. Kirchner, Ms. Molina, and Mr. Stone. We currently anticipate that the Board will have seven members immediately following the annual meeting of stockholders this year.

Board Leadership

Our Corporate Governance Guidelines state that the Board is free to choose its Chair in any manner that is in the best interests of the company at the time. When the Chair of the Board also serves as the Company's Chief Executive Officer, as Mr. Kirchner does, or when the Chair is not independent, the Board, by majority vote of the Independent Directors, may designate an Independent Director to serve as the "Lead Independent Director." Mr. Agin currently serves as the Lead Independent Director. The Board believes that this leadership structure is best for the company at the current time, as it appropriately balances the need for the Chief Executive Officer to run the company on a day-to-day basis with involvement and authority vested in an outside independent Board member—the Lead Independent Director. The role of our Lead Independent Director is fundamental to our decision to combine the Chief Executive Officer and Chair of the Board positions. Our Lead Independent Director assumes many functions traditionally within the purview of a chairman of the board. Under our Corporate Governance Guidelines, our Lead Independent Director must be

7

independent, and the specific responsibilities of the Lead Independent Director (if so designated) are as follows:

- •

- Act as a principal liaison between the Independent Directors and the Chair of the Board on sensitive issues;

- •

- Develop the agenda for and moderate executive sessions of the Board's Independent Directors;

- •

- Provide feedback to the Chair of the Board regarding matters discussed in executive sessions of the Independent Directors;

- •

- Work in collaboration with the Chair of the Board in developing the agendas for Board meetings;

- •

- Consult with the Chair of the Board as to an appropriate schedule of Board meetings, seeking to ensure that the Independent Directors can perform their duties responsibly while not interfering with the flow of Company operations;

- •

- Consult with the Chair of the Board as to the quality, quantity, and timeliness of the flow of information from Company management that is necessary for the Independent Directors to effectively and responsibly perform their duties;

- •

- Preside at any meeting of the Board at which the Chair of the Board is not present; and

- •

- Work in collaboration with the Nominating/Corporate Governance Committee and the Chair of the Board with respect to the implementation and periodic review and, as appropriate, alteration of the Company's Corporate Governance Guidelines.

Risk Management

Pursuant to our Corporate Governance Guidelines, the Board's Risk Management Process includes reviewing and assessing business enterprise risk and other major risks facing the company, and evaluating management's approach to addressing such risks. On an ongoing basis, the Board and the Company, in the development and implementation of its strategic growth initiatives, discuss key risks facing the company, plans for addressing these risks and the company's risk management practices overall. In addition, our Board committees consider and address risk as they perform their respective committee responsibilities. For example, financial risks are overseen by our Audit Committee and our internal audit group, our Compensation Committee periodically reviews the Company's compensation programs to assure that they do not encourage excessive risk-taking, and our Nominating/Corporate Governance Committee is tasked with discussing and monitoring best practices for managing all levels of risk. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise risk.

Our management is responsible for day-to-day risk management and regularly reports on risks to the Board or relevant Board committee. With help from the internal audit group as to internal and disclosure control risks, management monitors and tests company-wide policies and procedures, and manages the day-to-day oversight of the risk management strategy for our ongoing business. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, and compliance reporting levels.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

8

Compensation Risk Assessment

In setting each element of executive compensation, the Compensation Committee considers the level of risk-taking that any element may promote. Our Compensation Committee believes it is important to incentivize our executive officers to achieve annual company and individual objectives, but balance promotion of such short-term interests with incentives that promote building long-term stockholder value. The Compensation Committee believes the amount of long-term equity incentives included in our executive compensation packages mitigates the potential for excessive short-term risk-taking. All of our named executive officers' equity awards vest over a period of time, generally annually over four years from the date of grant, and the Compensation Committee has historically granted additional equity awards annually.

Our Compensation Committee has conducted an internal assessment of our compensation policies and practices in response to current public and regulatory concern about the link between incentive compensation and excessive risk taking by corporations. The Committee concluded that the Company's compensation programs do not motivate excessive risk-taking and any risks involved in compensation are unlikely to have a material adverse effect on the Company. Included in the analysis were such factors as the behaviors being induced by our fixed and variable pay components, the balance of short-term and long-term performance goals in our incentive compensation system, the established limits on permissible incentive award levels, our clawback policy, the oversight of our Compensation Committee in the operation of our incentive plans and the high level of board involvement in approving material investments and capital expenditures.

Committees of the Board

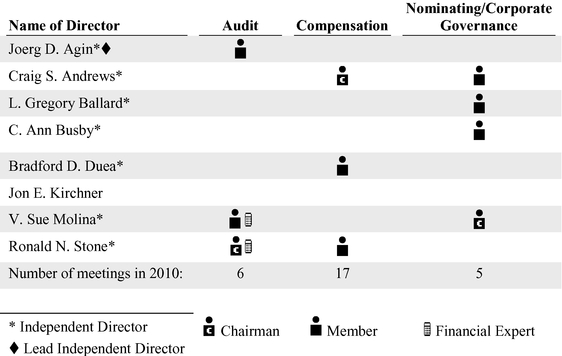

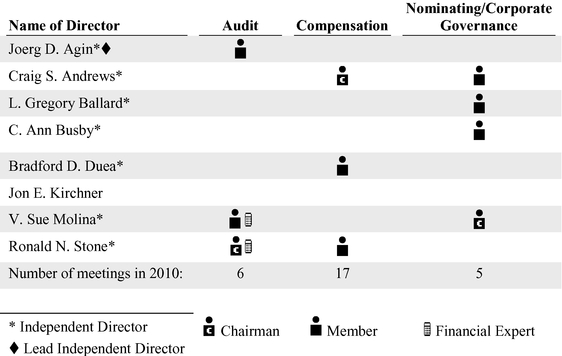

The Board has three standing committees, with the following members:

Mr. Agin, Mr. Andrews, Mr. Ballard, Ms. Busby, Mr. Duea, Ms. Molina and Mr. Stone are not, and have never been, employees of our Company or any of our subsidiaries and the Board has determined that each of these directors is independent in accordance with the requirements regarding director independence set forth under applicable rules of the NASDAQ Stock Market.

9

The Board has adopted a charter for each of the three standing committees. The Board has also adopted a code of ethics and a code of conduct that apply to all of our employees, officers and directors. You can find links to these materials on our website atwww.dts.com under the "Investor Relations" and "Corporate Governance" links. The information on our website is not incorporated by reference in this Proxy Statement.

During 2010, the Board held nine meetings and the three standing committees held the number of meetings indicated above. Each director attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors held during the period for which he or she was a director, and (ii) the total number of meetings of all committees of the Board on which he or she served during the period that he or she served. Although the Company has no formal policy regarding director attendance at annual meetings, it does expect all members of the Board to attend the 2011 annual meeting. All nominees for director and continuing members of our Board attended the 2010 annual meeting.

Audit Committee

Each member of the Audit Committee is independent as determined by the NASDAQ Stock Market listing standards as they apply to Audit Committee members. The Audit Committee is a standing committee of, and operates under a written charter adopted by, our Board of Directors. The Audit Committee reviews and monitors our financial statements and accounting practices, appoints, determines the independence of and funding for, and oversees our independent registered public accountants, reviews the results and scope of the Company's annual audit and other services provided by our independent registered public accountants, reviews and evaluates our audit and control functions and reviews and approves any related party transactions. Mr. Stone chairs the Audit Committee. The Audit Committee met six times during 2010.

Audit Committee Financial Expert. The Board has determined that Ms. Molina and Mr. Stone each qualify as an "audit committee financial expert" under the rules of the Securities and Exchange Commission.

Compensation Committee

Each member of the Compensation Committee is independent as determined by the NASDAQ Stock Market listing standards. The Compensation Committee makes decisions and recommendations regarding salaries, benefits, and incentive compensation for our directors and executive officers and administers our incentive compensation and benefit plans, including our 2003 Equity Incentive Plan and our 2005 Performance Incentive Plan. Mr. Andrews chairs the Compensation Committee. The Compensation Committee met seventeen times during 2010.

Nominating/Corporate Governance Committee

Each member of the Nominating/Corporate Governance Committee is independent for the purposes of the NASDAQ Stock Market listing standards. Ms. Molina chairs the Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee met five times during 2010. The Nominating/Corporate Governance Committee assists the Board of Directors in fulfilling its responsibilities by:

- •

- identifying and approving individuals qualified to serve as members of our Board of Directors;

- •

- selecting director nominees for each election of directors;

- •

- overseeing and administering the Board's evaluation of its performance; and

10

- •

- developing and recommending to our Board updated Corporate Governance Guidelines and providing oversight with respect to corporate governance and ethical conduct.

While we do not have a formal diversity policy, we do seek a diversified Board. Our Nominating/Corporate Governance Committee believes it's important for our Board to have diversity and takes into account a number of the following factors when considering director nominees:

- •

- independence from management;

- •

- age, gender and ethnic background;

- •

- educational and professional background;

- •

- relevant business experience;

- •

- judgment, skill, integrity and reputation;

- •

- existing commitments to other businesses and service on other boards;

- •

- potential conflicts of interest with other pursuits;

- •

- legal considerations such as antitrust issues;

- •

- corporate governance background;

- •

- financial and accounting background, to enable the committee to determine whether the candidate would be suitable for audit committee membership;

- •

- executive compensation background, to enable the committee to determine whether the candidate would be suitable for Compensation Committee membership; and

- •

- the size and composition of the existing Board.

Before nominating a sitting director for re-election at an annual meeting, the committee will further consider:

- •

- the director's performance on the Board; and

- •

- whether the director's re-election would be consistent with the Company's governance guidelines.

The Nominating/Corporate Governance Committee discussed these factors in identifying the two nominees for our Class II directors.

The Nominating/Corporate Governance Committee will also consider candidates for director suggested by stockholders applying the criteria for candidates described above and considering the additional information referred to below. Stockholders wishing to suggest a candidate for director should write to the Company's Corporate Secretary and include the following information:

- •

- a statement that the writer is a stockholder and is proposing a candidate for consideration by the committee;

- •

- the name of and contact information for the candidate;

- •

- a detailed statement of the candidate's business and educational experience as well as how the candidate supports the diversity factors above;

- •

- information regarding the candidate, as required from time to time by the Nominating/Corporate Governance Committee, and as disclosed in the Company's annual Proxy Statement sufficient to enable the committee to evaluate the candidate;

- •

- a statement detailing any relationship between the candidate and any customer, supplier or competitor of the Company;

11

- •

- detailed information about any relationship or understanding between the proposing stockholder and its affiliates and associates, on the one hand, and the candidate, on the other hand;

- •

- a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected; and

- •

- any other information or other documents or agreements required of a Director nominee.

Other Committees

Our Board of Directors may establish other committees as it deems necessary or appropriate from time to time.

Stockholder Communications with Directors and Management

Any stockholder who desires to contact any member of our Board of Directors or management can write to:

Your letter should indicate that you are a DTS stockholder. Depending on the subject matter, our stockholder relations personnel will:

- •

- forward the communication to the director or directors to whom it is addressed;

- •

- forward the communication to the appropriate management personnel;

- •

- attempt to handle the inquiry directly, for example where it is a request for information about the Company, or it is a stock-related matter; or

- •

- not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic.

Compensation of Directors

We currently pay each of our non-employee directors an annual retainer of $30,000, and our Lead Independent Director an annual retainer of $45,000. In addition, we pay each of our non-employee directors the following annual retainers for their service as a member, or chair, as applicable, of our Board committees:

| | | | | |

Annual Retainers for Committee Members: | | | | |

| | Audit Committee | | $ | 7,000 | |

| | Compensation Committee | | $ | 5,000 | |

| | Nominating/Corporate Governance Committee | | $ | 4,000 | |

Annual Retainers for Committee Chairs: | | | | |

| | Audit Committee | | $ | 20,000 | |

| | Compensation Committee | | $ | 12,000 | |

| | Nominating/Corporate Governance Committee | | $ | 8,000 | |

All Board and committee retainers are paid in equal quarterly installments over the course of each year of a director's service on the Board or applicable committee. We also reimburse all non-employee directors for reasonable expenses related to our Board of Directors or committee meetings.

12

In addition, our 2003 Equity Incentive Plan, as amended (the "2003 Plan"), provides for automatic grants of stock options and restricted stock, awards or units, to our non-employee directors in order to provide them with additional incentives and thereby promote the success of our business. In 2010, the 2003 Plan provided for an annual grant of an option to purchase 6,000 shares of our common stock, as well as 2,000 restricted stock units of our common stock for each continuing non-employee director on the date of each annual meeting of the stockholders. In addition, the 2003 Plan also provided for each newly elected or appointed non-employee director an initial, automatic grant of an option to purchase 9,000 shares of our common stock, as well as 3,000 restricted stock units of our common stock. However, a non-employee director who receives an initial stock option grant and restricted stock units grant on, or within a period of six months prior to, the date of an annual meeting of stockholders will not receive an annual stock option grant and restricted stock units grant with respect to that annual stockholders' meeting. Each initial and annual option will have an exercise price equal to the fair market value of a share of our common stock on the date of grant and will have a term of ten years.

Since November 2006 and going forward, the vesting terms of the automatic equity awards to our non-employee directors are as follows: (i) initial restricted stock awards granted to newly elected or appointed non-employee directors vest over a period of three years in three equal installments on each anniversary of the date of grant for so long as the non-employee director continuously remains a director of, or a consultant to, the Company; (ii) initial stock option awards granted to newly elected or appointed non-employee directors vest and become exercisable in 36 equal installments on each monthly anniversary of the date of grant for so long as the non-employee director continuously remains a director of, or a consultant to, the Company; (iii) annual restricted stock units granted to non-employee directors who have served as such for at least six months prior to the annual meeting of stockholders vest in full on the one year anniversary of the date of grant as long as the non-employee director has continuously remained a director of, or consultant to, the Company through such anniversary date; and (iv) annual stock option awards granted to non-employee directors who have served as such for at least six months prior to the annual meeting of stockholders vest and become exercisable in 12 equal installments on each monthly anniversary of the date of grant for so long as the non-employee director continuously remains a director of, or a consultant to, the Company.

All automatic non-employee director options granted under the 2003 Plan will be non-statutory stock options. Options must be exercised, if at all, within three months after a non-employee director's termination of service, except in the case of death in which event the director's estate shall have one year from the date of death to exercise the option. However, in no event shall any option granted to a director be exercisable later than the expiration of the option's term. In the event of our merger with another corporation or another change of control, all outstanding options, restricted stock, awards and units, held by non-employee directors will vest in full.

13

The following table shows compensation information for our non-employee directors for fiscal year 2010.

2010 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | |

|---|

Name(1) | | Fees

Earned

or Paid

in Cash

($)(5) | | Stock

Awards

($)(6) | | Option

Awards

($)(7) | | Non-Equity

Incentive

Plan

Compensation

($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation

($)(8) | | Total

($) | |

|---|

Bradford D. Duea(2) | | $ | 25,000 | | $ | 97,740 | | $ | 119,070 | | | — | | | — | | $ | 5,810 | | $ | 247,620 | |

Craig S. Andrews(3) | | $ | 19,500 | | $ | 98,310 | | $ | 119,970 | | | — | | | — | | $ | 1,355 | | $ | 239,135 | |

Joerg D. Agin | | $ | 54,125 | | $ | 65,540 | | $ | 79,980 | | | — | | | — | | $ | 7,281 | | $ | 206,926 | |

Ronald N. Stone | | $ | 46,000 | | $ | 65,540 | | $ | 79,980 | | | — | | | — | | $ | 8,276 | | $ | 199,796 | |

V. Sue Molina | | $ | 43,000 | | $ | 65,540 | | $ | 79,980 | | | — | | | — | | $ | 6,099 | | $ | 194,619 | |

L. Gregory Ballard | | $ | 42,000 | | $ | 65,540 | | $ | 79,980 | | | — | | | — | | $ | 5,810 | | $ | 193,330 | |

C. Ann Busby | | $ | 36,500 | | $ | 65,540 | | $ | 79,980 | | | — | | | — | | | — | | $ | 182,020 | |

Joseph A. Fischer(4) | | $ | 25,000 | | | — | | | — | | | — | | | — | | $ | 11,326 | | $ | 36,326 | |

- (1)

- Daniel E. Slusser, our Chairman of the Board through February 12, 2010, and Jon E. Kirchner, our current Chairman and Chief Executive Officer, are not included in this table because they did not receive compensation for their service as directors. The compensation received by Mr. Kirchner is shown in the 2010 Summary Compensation Table. Mr. Slusser is not an immediate family member of any of our directors, nominees for director or executive officers and the compensation he earned for his service as an executive officer would have been reported in the Summary Compensation Table if he was one of our named executive officers for 2010. The compensation for Mr. Slusser's service as an executive officer was approved by the Compensation Committee of the Board.

- (2)

- Mr. Duea was elected to our board of directors on March 1, 2010.

- (3)

- Mr. Andrews was elected to our board of directors on June 4, 2010.

- (4)

- Mr. Fischer retired from our board of directors on June 4, 2010.

- (5)

- The Company pays each of its non-employee directors cash amounts as described above.

- (6)

- Reflects the aggregate grant date fair value of stock awards granted by us in 2010, as determined in accordance with generally accepted accounting principles in the United States of America ("GAAP"). Pursuant to the 2003 Plan, Mr. Duea and Mr. Andrews each received an automatic grant of 3,000 restricted stock units on their respective date of election to our board of directors. Pursuant to GAAP, the grant date fair value of each of those grants was $97,740 and $98,310, respectively, which is based on the grant date fair value per share of $32.58 and $32.77, respectively, which was the closing price of our common stock on the aforementioned dates of election for Mr. Duea and Mr. Andrews. Pursuant to the 2003 Plan, the other non-employee directors each received an automatic grant of 2,000 restricted stock units on June 4, 2010, the date of our annual meeting of stockholders. Pursuant to GAAP, the grant date fair value of each of those awards was $65,540, which is based on the grant date fair value per share of $32.77, which was the closing price of our common stock on June 4, 2010. As of December 31, 2010, Ms. Molina and Mr. Ballard each held an additional 2,500 shares of unvested stock awards. These additional shares were granted in 2008 pursuant to the 2003 Plan and in conjunction with each of their

14

elections to our board of directors. As of December 31, 2010, the other non-employee directors did not hold any other unvested stock awards.

- (7)

- Reflects the aggregate grant date fair value of option awards granted by us in 2010, as determined in accordance with GAAP. Compensation expense is calculated based on the grant date fair value of the stock options, which is based on the Black Scholes option valuation method using the assumptions described in Footnote 12, "Stock Based Compensation," to our audited financial statements for the fiscal year ended December 31, 2010 included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 3, 2011. Pursuant to the 2003 Plan, Mr. Duea and Mr. Andrews each received an automatic grant of an option to purchase 9,000 shares of our common stock on their respective date of election to our board of directors. Pursuant to GAAP, the grant date fair value of each of these automatic option grants determined using the Black Scholes method was $119,070 and $119,970, respectively. Pursuant to the 2003 Plan, the other non-employee directors each received an automatic grant of an option to purchase 6,000 shares of our common stock on June 4, 2010, the date of our annual meeting of stockholders. Pursuant to GAAP, the grant date fair value of each option automatically granted on June 4, 2010 determined using the Black Scholes method was $79,980. As of December 31, 2010, these non-employee directors had outstanding options to purchase the following aggregate number of shares of our common stock: Bradford D. Duea: 9,000; Craig S. Andrews: 9,000; Joerg D. Agin: 18,500; Ronald N. Stone: 28,500; V. Sue Molina: 28,500; L. Gregory Ballard: 23,500; C. Ann Busby: 18,500; Joseph A. Fischer: zero.

- (8)

- Includes reimbursement for certain travel and other related costs in connection with our Annual Meeting of Stockholders in Ireland on June 4, 2010.

ITEM 2—ADVISORY (NON-BINDING) VOTE ON EXECUTIVE COMPENSATION

The recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, requires that our stockholders have the opportunity to cast an advisory (non-binding) vote on: (1) executive compensation, commonly referred to as a "Say-on-Pay" vote, and (2) the frequency of future Say-on-Pay votes—every three years, two years or one year, which is the subject of Item 3 in this Proxy Statement.

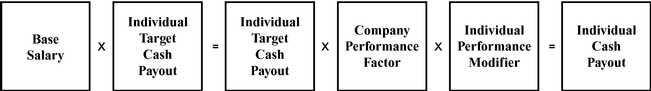

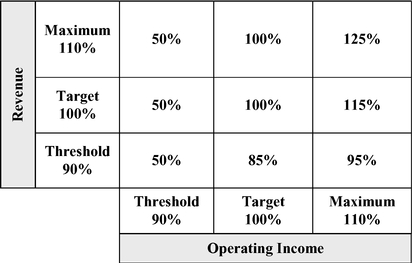

The advisory vote on executive compensation is a non-binding vote on the compensation of our "named executive officers," or "NEOs", as described in the Compensation Discussion and Analysis, or CD&A section, the tabular disclosure regarding such compensation, and the accompanying narrative disclosure, set forth in this Proxy Statement. The advisory vote is not a vote on our general compensation policies, the compensation of our directors, or our compensation policies as they relate to risk management, and is only on the compensation of our named executive officers.

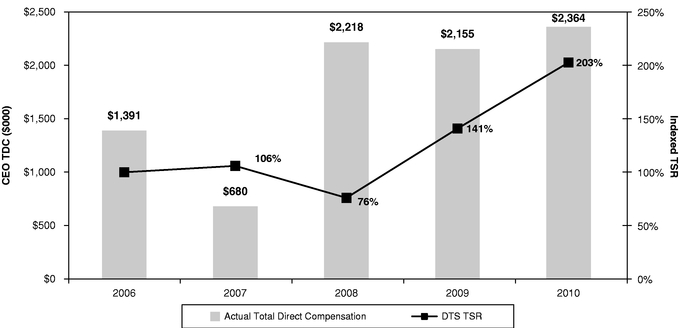

Our compensation philosophy is centered on the principle of aligning pay and performance. Primary objectives of our compensation program are to:

- •

- Pay for performance;

- •

- Align the interests of our named executive officers and other employees with those of our stockholders;

- •

- Recruit, retain and motivate the highest quality executive officers who are critical to our success; and

- •

- Promote excellent corporate governance.

15

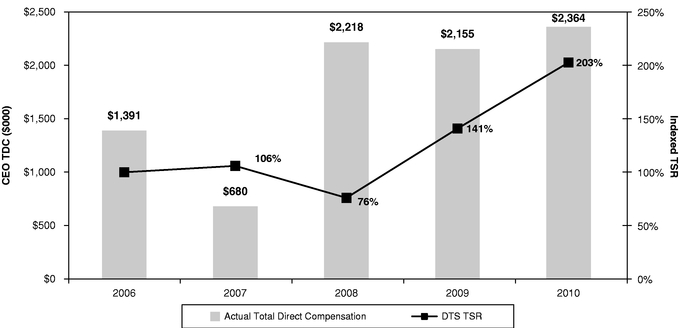

Highlights of our performance in 2010 include:

- •

- Revenues increased 12% for the year ended December 31, 2010, compared to the same prior year period;

- •

- Royalties from Blu-ray product markets increased 71% for the year ended December 31, 2010, compared to the same prior year period;

- •

- Operating income increased 34% compared to the same prior year period and was 28% of revenues for the year ended December 31, 2010;

- •

- Diluted earnings per share from continuing operations increased $0.24 to $0.84 for the year ended December 31, 2010, an increase of 40% compared to the same prior year period; and

- •

- The Company's share price increased 43% during the year as compared to the NASDAQ Composite IXIC increase of 14%.

We believe that our executive compensation program has appropriately rewarded our named executive officers and other key personnel for the significant performance of the company, and that our executive pay aligns well with our overall compensation philosophy of paying for performance. We encourage stockholders to read the CD&A section of this Proxy Statement for a more detailed discussion of our executive compensation programs, and how they reflect our philosophy and link to company performance.

The vote solicited by this Item 2 is advisory, and therefore is not binding on the company, our Board of Directors or our Compensation Committee, nor will its outcome require the company, our Board of Directors or our Compensation Committee to take any action. Moreover, the outcome of the vote will not be construed as overruling any decision by the company or our Board.

Furthermore, because this non-binding, advisory resolution primarily relates to the compensation of our NEOs that has already been paid or contractually committed, there is generally no opportunity for us to revisit these decisions. However, our Board, including our Compensation Committee, values the opinions of our stockholders and, to the extent there is any significant vote against the NEO compensation, we will consider our stockholders' concerns and evaluate what future actions, if any, may be appropriate.

Stockholders will be asked at the annual meeting to approve the following resolution pursuant to this Item 2:

"RESOLVED, that the stockholders of DTS, Inc. approve, on an advisory basis, the compensation of the company's Named Executive Officers, disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table, and the related compensation tables and narratives in the company's definitive Proxy Statement for the 2011 annual meeting of stockholders."

The Board of Directors unanimously recommends a vote "FOR" approval of the foregoing resolution.

Unless otherwise instructed, it is the intention of the persons named in the accompanying proxy card to vote shares represented by properly executed proxy cards for the approval of the foregoing resolution.

ITEM 3—ADVISORY (NON-BINDING) VOTE ON THE FREQUENCY OF

AN ADVISORY VOTE ON EXECUTIVE COMPENSATION

In connection with Item 2 above, the Dodd-Frank Act also requires that we include in this Proxy Statement a separate advisory (non-binding) stockholder vote as to the frequency of future votes on executive compensation; should they be every three years, two years or one year. You have the option to vote for any one of the three options, or to abstain on the matter.

For the reasons described below, our Board of Directors unanimously recommends that our stockholders select a frequency of every three (3) years, or a "triennial vote."

16

Our Board of Directors believes that our current executive compensation directly links executive compensation to our financial performance and aligns the interests of our executive officers with those of our stockholders. Our Board of Directors also believes that, of the three choices, submitting a nonbinding, advisory executive compensation resolution to stockholders every three years is the most appropriate choice.

In determining its recommendation, our Board of Directors is aware of and took into account the other alternatives. They are aware that some believe that annual advisory votes will enhance or reinforce accountability. However, as our executive compensation programs are designed to operate over the long-term and to enhance long-term performance, we believe that an annual advisory vote on executive compensation could lead to an inappropriately short-term perspective when evaluating our executives' compensation. Further, we believe that an annual vote on executive compensation would not (i) allow for changes to our executive compensation policies and practices to be in place long enough for management, the Board of Directors, or stockholders to meaningfully evaluate them, or (ii) allow us sufficient time to be responsive to stockholder views.

The triennial executive compensation vote will also provide stockholders with the ability to assess over a period of years whether the components of the compensation paid to our NEOs have achieved positive results for the company. A three-year vote cycle also gives the Board and Compensation Committee sufficient time to thoughtfully consider the results of the advisory vote, to engage with stockholders to understand and respond to the vote results and effectively implement any appropriate changes to our executive compensation policies and procedures. Finally, although we believe that holding an advisory vote on executive compensation every three years will reflect the right balance of considerations in the normal course, we will periodically reassess that view and can provide for an advisory vote on executive compensation on a more frequent basis if changes in our compensation programs or other circumstances suggest that a more frequent vote would be appropriate.

We understand that our stockholders may have different views as to what is the best approach for the company, and we look forward to hearing from our stockholders on this proposal. The Board will continue to engage with stockholders on executive compensation between stockholder votes.

You may cast your vote on your preferred voting frequency by choosing the option of three years, two years, one year, or abstain from voting when you vote in response to the resolution set forth below.

"RESOLVED, that the stockholders of DTS, Inc. determine, on an advisory basis, that the frequency with which the stockholders of the company shall have an advisory vote on executive compensation, as disclosed pursuant to the compensation disclosure rules of the SEC, is:

Choice 1—every three years;

Choice 2—every two years;

Choice 3—every one year; or

Choice 4—abstain from voting.

This vote may not be construed (1) as overruling a decision by the company or our Board of Directors or (2) to create or imply any change or addition to the fiduciary duties of the company or our board of directors. However, we are required to solicit stockholder approval on the frequency of future executive compensation proposals at least once every six years.

The Board of Directors unanimously recommends that you vote "FOR" the option of once every three (3) years as the frequency with which stockholders are provided an advisory vote on executive compensation, as disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table, and the related compensation tables and narratives in the company's definitive Proxy Statement.

17

ITEM 4—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee appointed Grant Thornton LLP as independent registered public accountants for the Company and its subsidiaries during the year ended December 31, 2010, and has appointed such firm to serve in the same capacity for the 2011 fiscal year. We are asking the stockholders to ratify this appointment. The affirmative vote of a majority of the shares represented and voting at the annual meeting is required to ratify the selection of Grant Thornton LLP.

In the event the stockholders fail to ratify the appointment, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of the Company and its stockholders.

A representative of Grant Thornton LLP is expected to be present at the annual meeting and will have an opportunity to make a statement if the representative so desires. The representative is expected to be available to respond to appropriate questions.

Fees Paid to Grant Thornton LLP

The following table presents fees for professional audit services rendered by Grant Thornton LLP for the audit of the Company's annual financial statements for fiscal years 2010 and 2009, as applicable, and fees billed for other services rendered by Grant Thornton LLP for fiscal years 2010 and 2009, as applicable.

| | | | | | | |

| | Fiscal Year

2010 | | Fiscal Year

2009 | |

|---|

(1)Audit Fees | | $ | 583,019 | | $ | 529,210 | |

(2)Audit-Related Fees | | | 5,300 | | | 24,900 | |

Tax Fees | | | — | | | — | |

All Other Fees | | | — | | | — | |

| | | | | | |

| | $ | 588,319 | | $ | 554,110 | |

| | | | | | |

- (1)

- Audit fees for fiscal 2010 and 2009 include the audit of our financial statements, review of the financial statements included in Form 10-Q filed for the first quarter of 2009 through the third quarter of 2010, and audit of the Company's controls and 404 attestation.

- (2)

- Audit related fees include fees in connection with consultation services related to technical accounting issues.

All non-audit services were reviewed with the Audit Committee, which concluded that the provision of such services by Grant Thornton LLP were compatible with the maintenance of that firm's independence in the conduct of its auditing functions.

18

Our Audit Committee has adopted a Pre-Approval Policy whereby certain engagements and levels of engagement, if necessary, of our independent registered public accountants by the Company have been pre-approved by the Audit Committee. The committee has also delegated to the Chairman of the committee the authority to evaluate and approve other engagements of our independent registered public accountants on behalf of the committee in the event that a need arises for pre-approval between committee meetings. If the Chairman approves any such engagements, he reports that approval to the full committee at the next committee meeting.

The Board of Directors unanimously recommends that the stockholders vote "FOR" the ratification of Grant Thornton LLP as independent registered public accountants of the Company.

19

REPORT OF THE AUDIT COMMITTEE

The Audit Committee evaluates auditor performance, manages relations with the Company's independent registered public accounting firm, and evaluates policies and procedures relating to internal control systems. It operates under a written Audit Committee Charter that has been adopted by the Board of Directors, a copy of which is available on the Company's website at www.dts.com. All members of the Audit Committee currently meet the independence and qualification standards for Audit Committee membership set forth in the listing standards provided by NASDAQ and the SEC.

The Audit Committee members are not actually practicing as professional accountants or auditors. The members' functions are not intended to duplicate or to certify the activities of management or the Company's independent registered public accounting firm. The Audit Committee serves a board-level oversight role in which it provides advice, counsel and direction to management and the Company's independent registered public accounting firm on the basis of the information it receives, discussions with management and the independent registered public accountants, and its experience in business, financial and accounting matters.

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has primary responsibility for the Company's financial statements and the overall reporting process, including the Company's system of internal controls. Management has represented to the Audit Committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States.

In fulfilling the Audit Committee's oversight responsibilities, the Audit Committee has reviewed DTS' audited financial statements as of and for the fiscal year ended December 31, 2010, and met with both management and Grant Thornton LLP, DTS' independent registered public accounting firm ("Grant Thornton"), to discuss those financial statements. This review included a discussion on the quality and the acceptability of the Company's financial reporting, including the nature and extent of disclosures in the financial statements and the accompanying notes.

The Audit Committee discussed with Grant Thornton the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380) (Communication with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has also received from and discussed with Grant Thornton the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the Audit Committee concerning independence. These items relate to that firm's independence from the Company. The Audit Committee has also discussed with Grant Thornton the auditors' independence from DTS and its management.

Based on the review and discussions referred to above in this report, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in DTS' Annual Report on Form 10-K for the year ended December 31, 2010 for filing with the Securities and Exchange Commission.

20

In addition to the matters specified above, the Audit Committee discussed with Grant Thornton the overall scope, plans and estimated costs of its audit. The Audit Committee met with the Company's Auditors periodically, with and without management present, to discuss the results of the independent auditors' examinations, the overall quality of the Company's financial reporting and the Auditors reviews of the quarterly financial statements, and drafts of the quarterly and annual reports. The Audit Committee conducted six (6) meetings with management and the Company's Auditors in 2010.

| | |

| | | AUDIT COMMITTEE |

|

|

Ronald N. Stone, Chair

Joerg Agin

V. Sue Molina |

The preceding "Report of the Audit Committee" shall not be deemed to be "soliciting material" or "filed" with the Securities and Exchange Commission, nor shall any information in this report be incorporated by reference into any past or future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent the Company specifically incorporates it by reference into such filing.

21

EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

Set forth below are the name, age, position, and a brief account of the business experience of each of our executive officers and significant employees.

| | | | | |

Name | | Age | | Position(s) |

|---|

Jon E. Kirchner | | | 43 | | Chairman and Chief Executive Officer, Director |

Melvin L. Flanigan | | | 52 | | Executive Vice President, Finance and Chief Financial Officer |

Frederick L. Kitson | | | 59 | | Executive Vice President and Chief Technology Officer |

Brian D. Towne | | | 46 | | Executive Vice President and Chief Operating Officer |

Blake A. Welcher | | | 49 | | Executive Vice President, Legal, General Counsel and Corporate Secretary |

Sharon K. Faltemier | | | 55 | | Senior Vice President, Human Resources |

Patrick J. Watson | | | 50 | | Senior Vice President, Corporate Strategy and Business Development |

Jon E. Kirchner has served as our Chairman of the Board of Directors and Chief Executive Officer ("CEO") since February 2010. From September 2001 to February 2010, he served as our President and Chief Executive Officer. He has been a member of our Board of Directors since August 2002. Since joining us in 1993, Mr. Kirchner has served in a number of capacities. From April 2000 to September 2001, he was our President and Chief Operating Officer. From September 1998 to April 2000, he served as our Executive Vice President of Operations, and from March 1996 to September 1998, he was our Vice President of Finance and Business Development. Mr. Kirchner has also served as our Director of International Operations and Controller. Prior to joining us, Mr. Kirchner worked for the Dispute Analysis and Corporate Recovery and Audit Groups of Price Waterhouse LLP (now PricewaterhouseCoopers LLP), an international accounting firm. During his tenure at Price Waterhouse LLP, he advised clients on financial and operational restructuring, business turnaround, market positioning, and valuation issues. Mr. Kirchner has experience in a variety of industries including entertainment, high technology, manufacturing, distribution, and transportation. He is a Certified Public Accountant and received a B.A. in Economics, Cum Laude, from Claremont McKenna College.

Melvin L. Flanigan has served as our Executive Vice President, Finance and Chief Financial Officer since September 2003. Prior to that, he served as our Vice President and Chief Financial Officer since joining us in July 1999. From March 1996 to July 1999, he served as Chief Financial Officer and Vice President, Operations at SensArray Corporation, a supplier of thermal measurement products for semiconductor, LCD, and memory-disk fabrication processes. Mr. Flanigan led SensArray's manufacturing and finance efforts. Prior to joining SensArray, Mr. Flanigan was Corporate Controller for Megatest Corporation, a manufacturer of automatic test equipment for logic and memory chips, where he was involved in international mergers and acquisitions activities. Mr. Flanigan has also previously held positions at Cooperative Solutions, Inc., a software developer in the client server transaction processing market, Hewlett-Packard Company, a provider of information technology infrastructure, personal computing and access devices, global services, and imaging and printing, and Price Waterhouse LLP (now PricewaterhouseCoopers LLP). He is a Certified Public Accountant and holds an M.B.A. and B.Sc. in Accounting from Santa Clara University.

Frederick L. Kitson has served as our Executive Vice President and Chief Technology Officer, since February 2010. From June 2008 to February 2010, he was the Corporate Vice President and Head of Corporate R&D of the Applied Research Center at Motorola, and from June 2005 to June 2008, he was the Vice President of Motorola's Global Applications and Software Research Center. From January 2000 to June 2005, he worked for Hewlett Packard as the Senior Director of the Mobile and Media Systems. His areas of expertise include multimedia digital signal processing, mobile systems, computer systems and graphics and consumer electronics. Mr. Kitson holds a Ph.D in Electrical & Computer

22

Engineering in Digital Signal Processing, Speech, and Adaptive Signal Processing from the University of Colorado, an M.S. in Electrical Engineering for the Georgia Institute of Technology, and a B.S. with Honors in Electrical Engineering from the University of Delaware.

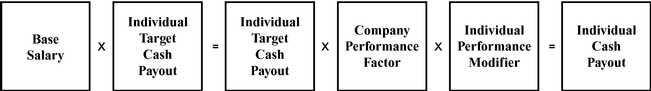

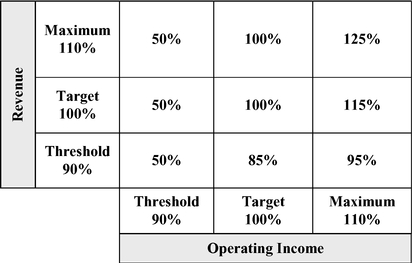

Brian D. Towne has served as our Executive Vice President and Chief Operating Officer since June 2010, prior to that he served as our Executive Vice President and General Manager since February 2009. Previously, he served as our Senior Vice President and General Manager Consumer Division since August 2006 and, prior to that, as our Senior Vice President Consumer/Pro Audio since August 2003. From April 2002 to August 2003, he served as Director of Product Management at Kenwood USA Corporation, a manufacturer of mobile electronics, home entertainment, and communications equipment, where he led all home and mobile entertainment product planning and development for the North American market. From August 1995 to April 2002, Mr. Towne held various product planning, development and marketing positions at Kenwood USA. Prior to Kenwood USA, he held various research and development and marketing positions at Pioneer Electronics (USA) Inc., the sales and marketing arm of Pioneer Corporation, a manufacturer of consumer and commercial electronics. Fluent in Japanese, Mr. Towne spent part of his tenure at Pioneer living and working in Japan. He also previously served as an Electronics Specialist in the United States Marine Corps. Mr. Towne holds a B.S. in Engineering Technology, with honors, from California Polytechnic University, Pomona.