Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| DTS, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

DTS, Inc.

5220 Las Virgenes Road

Calabasas, California 91302

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 10, 2012

To Our Stockholders:

The annual meeting of stockholders of DTS, Inc., a Delaware corporation, will be held at 10:00 a.m., local time, on May 10, 2012, at the Mediterraneo Room at the Westlake Village Inn, 32037 Agoura Road, Westlake Village, CA 91361, for the following purposes:

- 1.

- To elect two members of the Board of Directors, whose terms are described in the Proxy Statement;

- 2.

- To approve the DTS, Inc. 2012 Equity Incentive Plan;

- 3.

- To vote on an advisory (non-binding) basis on the compensation of our named executive officers;

- 4.

- To ratify the appointment of Grant Thornton LLP to serve as our independent registered public accountants for the 2012 fiscal year; and

- 5.

- To transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

Holders of record of DTS, Inc. Common Stock at the close of business on April 2, 2012, are entitled to vote at the meeting.

In addition to the Proxy Statement, proxy card and voting instructions, a copy of DTS, Inc.'s annual report on Form 10-K, which is not part of the proxy soliciting materials, is enclosed.

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning a proxy card in the enclosed, postage-prepaid envelope. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the enclosed Proxy Statement.

By Order of the Board of Directors,

Blake A. Welcher,

Executive Vice President, Legal, General Counsel,

and Corporate Secretary

Calabasas, California

April 10, 2012

DTS, Inc.

5220 Las Virgenes Road

Calabasas, California 91302

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 10, 2012

This Proxy Statement is furnished on behalf of the Board of Directors of DTS, Inc., a Delaware corporation, for use at the annual meeting of stockholders to be held on May 10, 2012 at 10:00 a.m., local time, and at any postponement or adjournment thereof. The annual meeting will be held at the Mediterraneo Room at the Westlake Village Inn, 32037 Agoura Road, Westlake Village, CA 91361.

These proxy solicitation materials were first mailed on or about April 11, 2012 to all stockholders entitled to vote at the annual meeting.

ABOUT THE MEETING

What is the purpose of the annual meeting?

At the annual meeting, stockholders will vote on: (1) the election of two Class III directors, (2) the approval of the DTS, Inc. 2012 Equity Incentive Plan, (3) an advisory (non-binding) basis on the compensation of our named executive officers, (4) the ratification of Grant Thornton LLP to serve as the Company's independent registered public accountants for the 2012 fiscal year and (5) any other business that may properly come before the meeting.

Who is entitled to vote?

Only stockholders of record at the close of business on the record date, April 2, 2012, are entitled to vote at the annual meeting or any postponement or adjournment of the meeting. For ten days prior to the annual meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose relating to the meeting during ordinary business hours at our principal offices located at 5220 Las Virgenes Road, Calabasas, California, 91302.

What are the Board of Directors' recommendations on the proposals?

The Board's recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board unanimously recommends a vote FOR each of the nominees for director, FOR the approval of the DTS, Inc. 2012 Equity Incentive Plan, FOR the compensation of our named executive officers and FOR the ratification of the appointment of Grant Thornton LLP as independent registered public accountants of the Company.

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. With respect to any other matter that properly comes before the annual meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, according to their own best judgment. At the date this Proxy Statement went to press, we did not know of any other matters that are to be presented at the annual meeting.

How do I vote my shares at the annual meeting?

Sign and date each proxy card you receive and return it in the postage-prepaid envelope enclosed with your proxy materials. If you are a registered stockholder and attend the annual meeting, then you may deliver your completed proxy card in person or you may vote in person at the annual meeting.

1

If your shares are held in "street name" by your broker or bank, you will receive a form from your broker or bank seeking instructions as to how your shares should be voted. If you do not instruct your broker or bank how to vote, your broker or bank may vote your shares if it has discretionary power to vote on a particular matter.

Can I change my vote after I return my proxy card?

Yes, you may revoke or change your proxy at any time before the annual meeting by filing with Blake Welcher, our Executive Vice President, Legal, General Counsel and Corporate Secretary, at 5220 Las Virgenes Road, Calabasas, California, 91302, a notice of revocation or another signed proxy card with a later date. You may also revoke your proxy by attending the annual meeting and voting in person.

Who will count the votes?

Our Executive Vice President, Legal, General Counsel, and Corporate Secretary will count the votes and act as the inspector of election.

What does it mean if I get more than one proxy card?

If your shares are registered differently or are in more than one account, you will receive more than one proxy card. Sign and return all proxy cards to ensure that all of your shares are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, Computershare Trust Company, N.A. (877) 282-1168, or, if your shares are held in street name, by contacting the broker or bank that holds your shares.

How many shares can vote?

As of the record date, April 2, 2012, 16,497,490 shares of our Common Stock were outstanding. Every stockholder is entitled to one vote for each share of Common Stock held.

What is a quorum?

The presence at the meeting in person or by proxy of holders of a majority of the outstanding shares of our stock entitled to vote at the meeting will constitute a quorum. A quorum must be met in order to hold the meeting and transact any business, including voting on proposals. Proxies marked as abstaining on any matter to be acted upon by stockholders and "broker non-votes", described below, will be treated as present for purposes of determining if a quorum is present.

What vote is required to approve each proposal?

If a quorum is present: (i) the nominees for director who receive a plurality of the votes, which means that the two director nominees receiving the highest number of "For" votes, will become Class III directors, (ii) the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting is required to approve the DTS, Inc. 2012 Equity Incentive Plan, (iii) the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting is required to approve our executive compensation proposal and (iv) the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting is required to ratify the appointment of Grant Thornton LLP as our independent registered public accountants.

2

What are broker non-votes?

Broker non-votes are shares held by brokers that do not have discretionary authority to vote on a matter and have not received voting instructions from their clients. If your broker holds your shares in its name (referred to as "street name") and you do not instruct your broker how to vote, your broker will not have discretion to vote your shares on any of the matters, other than the matter regarding ratification of the appointment of Grant Thornton LLP as the company's independent registered public accountants. Broker non-votes will be counted as shares present for the purpose of determining the presence of a quorum. Broker non-votes will have no effect on any of the proposals. We encourage you to provide instructions to your broker regarding the voting of your shares.

What happens if I abstain?

Proxies marked "abstain" will be counted as shares present for the purpose of determining the presence of a quorum, but for purposes of determining the outcome of a proposal, they will be treated as a "no" or "none" vote. Abstentions will have no effect on the election of directors.

How will DTS solicit proxies?

We have retained Computershare Trust Company, N.A. and MacKenzie Partners, Inc. to assist in the distribution of proxy materials. The costs and expenses of preparing and mailing proxy solicitation materials for the annual meeting and reimbursements paid to brokerage firms and others for their reasonable out-of-pocket expenses for forwarding proxy materials to stockholders will be borne by us. We have retained MacKenzie Partners, Inc. as our proxy solicitor to assist in soliciting proxies and we will bear these costs, which we expect will be approximately $7,500. Proxies may also be solicited in person, by telephone, or by facsimile by our directors, officers, and employees without additional compensation being paid to these persons.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 10, 2012

This is our Proxy Statement for our annual meeting of stockholders to be held on May 10, 2012. Financial and other information concerning DTS, Inc. is contained in our annual report on Form 10-K for the fiscal year ended December 31, 2011. A complete set of proxy materials relating to our annual meeting is available on the Internet. These materials, consisting of our notice of annual meeting, Proxy Statement, proxy card and annual report on Form 10-K, may be viewed at: https://materials.proxyvote.com/23335C

ITEM 1—ELECTION OF DIRECTORS

The Board of Directors currently consists of seven persons and is divided into three classes of directors with staggered three-year terms. There are three Class I directors, two Class II directors, and two Class III directors. The three Class I directors currently consist of Mr. Craig S. Andrews, Mr. L. Gregory Ballard, and Mr. Bradford D. Duea. The two Class II directors currently consist of Mr. Joerg D. Agin and Mr. Jon E Kirchner. The two Class III directors currently consist of Ms. V. Sue Molina and Mr. Ronald N. Stone.

The term of the Class III directors will expire at the annual meeting this year. The Nominating/Corporate Governance Committee of the Board has nominated Ms. Molina and Mr. Stone for election at the annual meeting to serve as Class III directors. You can find information about Ms. Molina and Mr. Stone below. A director elected to Class III will serve for a term of three years, expiring at the 2015 annual meeting of stockholders, or until his successor is duly elected and qualified or his earlier death, resignation or removal.

3

The persons named in the proxy card will vote such proxy for the election of Ms. Molina and Mr. Stone unless you indicate that your vote should be withheld or abstained from voting. You cannot vote for a greater number of directors than two. If elected, Ms. Molina and Mr. Stone will continue in office until our 2015 annual meeting of stockholders or until their successors have been duly elected and qualified or until the earlier of their respective death, resignation or retirement. Ms. Molina and Mr. Stone have each indicated to the Company that they will serve if elected. We do not anticipate that Ms. Molina and Mr. Stone will be unable to stand for election, but, if that happens, your proxy will be voted in favor of another person nominated by the Board. We anticipate that the Board of Directors will consist of seven persons immediately following the annual meeting.

The Board of Directors recommends a vote "FOR" the election of Ms. Molina and Mr. Stone as directors.

Nominees and Continuing Directors

Each of our directors brings to our Board extensive management and leadership experience gained through their service as executives and has diverse experience relating to strategy, operations, capital, risk, managing technology innovations and business cycles management. In addition, most current directors bring public company board experience—either significant experience on other boards or long service on our Board—that broadens their knowledge of board policies and processes, rules and regulations, and issues and solutions. Collectively, this embodiment of knowledge and experience also allows our board to efficiently address the various actions of regulatory agencies and shareholder groups seeking changes/developments in corporate governance. The Nominating/Corporate Governance Committee's process to recommend qualified director candidates is described under the section titled "Nominating/Corporate Governance Committee" below. In the paragraphs below, we describe specific individual qualifications and skills of our directors that contribute to the overall effectiveness of our Board and its committees.

Set forth below are the names of the nominees for election to the office of director and each current director whose term does not expire at this time, along with their ages, the year first elected as a director, their present positions, principal occupations and public company directorships held in the past five or more years.

NOMINEES FOR TERM EXPIRING AT THE

ANNUAL MEETING OF STOCKHOLDERS IN 2015

V. Sue Molina, 63, has served on our Board of Directors since January 2008, and currently serves as Chair of our Nominating/Corporate Governance Committee and serves on our Audit Committee. From November 1997 until her retirement in May 2004, she was a tax partner at Deloitte & Touche LLP, an international accounting firm, serving from 2000 until May 2004 as the national partner in charge of Deloitte's Initiative for the Retention and Advancement of Women. Prior to that, she spent twenty years with Ernst & Young LLP, an international accounting firm, the last ten years as a partner. From August 2006 to May 2009, Ms. Molina served as a member of the Board of Directors and Audit Committee, and was Chair of the Compensation Committee of Sucampo Pharmaceuticals, Inc., a pharmaceutical company. Currently, Ms. Molina is a member of the Board of Directors, Chair of the Audit Committee and a member of the Compensation Committee of Royal Neighbors of America, a fraternal insurance company. She holds a B.S.B.A. and a Masters of Accounting degree from the University of Arizona. Ms. Molina was selected to serve on our Board due to her extensive accounting and financial expertise and her experience in advising Boards and serving on Boards of public companies.

Ronald N. Stone, 68, has served as a member of our Board of Directors since April 2004, and currently serves as Chair of our Audit Committee and also serves on our Compensation Committee.

4

Mr. Stone is currently President of Stone Consulting, Inc., a firm providing consulting services to the consumer electronics and real estate industries. Until April 2005, Mr. Stone served as an advisor to Pioneer Electronics (USA) Inc., a global consumer electronics company, a role he held after he retired from Pioneer in May 2003. At the time of his retirement, Mr. Stone served as president of Pioneer's Customer Support Division, a position he had held since March 2000. The Customer Support Division was responsible for product services, accessories, and after-sales operations for several Pioneer entities. Prior to his position as president of the Customer Support Division, Mr. Stone served as executive vice president and Chief Financial Officer of Pioneer Electronics (USA) Inc. since 1985. Mr. Stone also served on the board of directors of Pioneer and several of its North American subsidiaries. Mr. Stone began his career with Pioneer Electronics in 1975. Mr. Stone served on the executive committee of the Consumer Electronics Association (CEA), owner of the International Consumer Electronics Show® for more than 15 years, and is a former chairman of that organization's board of directors. He also serves on the UCLA Medical Center board of advisors and on its Information Technology and Finance committees. Mr. Stone received his bachelor's degree in accounting from the University of Southern California. He is a Certified Public Accountant. Mr. Stone was selected to serve on our Board due to his broad and deep experience in the consumer electronics industry, his extensive accounting and financial expertise and his extensive experience as a senior executive.

CONTINUING DIRECTORS WHOSE TERMS EXPIRE AT THE

ANNUAL MEETING OF STOCKHOLDERS IN 2013

Craig S. Andrews, 59, has served as a member of our Board of Directors since June 2010, and currently serves as Chair of our Compensation Committee and also serves on our Nominating/Corporate Governance Committee. Mr. Andrews has been Of Counsel to the law firm of DLA Piper LLP (US) since January 2010, and was a partner at the firm from May 2008 through December 2009. Mr. Andrews has also been Chief Operating Officer of Renova Therapeutics, Inc., a privately held gene therapy company, since June 2008. From March 2003 to June 2008, he was a shareholder of Heller Ehrman, LLP. From March 1987 to February 2003, he was a partner in the Brobeck, Phleger & Harrison law firm, other than for the period from May 2000 to January 2002, during which he spent time as the vice-president of business development at Air Fiber, Inc., a private telecommunications company, and as a partner at the law firm of Latham & Watkins. Mr. Andrews has been advising boards of directors of public and private companies for over 25 years, with a focus in representing emerging-growth companies, as well as an expertise in general business and corporate law. Mr. Andrews has played an important role in the formation and development of numerous companies. From September 1999 until August 2010, he was a director of Rubio's Restaurants, Inc. (formerly a NASDAQ listed company), where he was the chairman of the nominating and corporate governance committee and a member of the company's compensation committee. He has previously served as director of numerous other public and private companies, including Encad, Inc. (formerly a NASDAQ listed company), and Collateral Therapeutics, Inc. (formerly a NASDAQ listed company). Mr. Andrews received a Bachelors of Arts degree from the University of California Los Angeles, and a J.D. from the University of Michigan. Mr. Andrews was selected to serve on our Board due to his vast experience in advising boards and companies with respect to legal and general business matters.

L. Gregory Ballard, 58, has served as a member of our Board of Directors since May 2008, and, since February 2011, has served on our Nominating/Corporate Governance Committee. He currently serves as Senior Vice President, Digital Games for Warner Bros Interactive Entertainment. From May 2010 to September 2010, Mr. Ballard served as Chief Executive Officer of Transpera, Inc. a mobile video advertising network. From October 2003 through December 2009, Mr. Ballard served as President & Chief Executive Officer of Glu Mobile Inc., a publisher of mobile video games. In recent years, Mr. Ballard served on the board of Pinnacle Systems, Inc., Imagine Games Network and THQ Inc. He has also served on the Compensation Committee of Pinnacle Systems, Inc. Prior to joining Glu Mobile in October of 2003, Mr. Ballard consulted for Virgin USA, Inc. from April 2003 to

5

September 2003. Prior to then, he served as Chief Executive Officer at SONICblue Incorporated, a manufacturer of ReplayTV digital video recorders and Rio digital music players, from August 2002 to April 2003, when it filed for Chapter 11 bankruptcy protection. Mr. Ballard was also Executive Vice President of Marketing and Product Management at SONICblue from April 2002 to August 2002. Between July 2001 and April 2002, Mr. Ballard worked as a consultant. Mr. Ballard served as Chief Executive Officer of MyFamily.com, Inc., a subscription-based Internet service, from January 2000 to July 2001. Previously, he served as Chief Executive Officer or in another senior executive capacity with 3dfx Interactive, Inc., an advanced graphics chip manufacturer, Warner Custom Music Corp., a division of Time Warner, Inc., Capcom Entertainment, Inc., a developer and publisher of video games, and Digital Pictures, Inc., a video game developer and publisher. Mr. Ballard holds a B.A. degree in Political Science from the University of Redlands and a J.D. from Harvard Law School. Mr. Ballard was selected to serve on our Board due to his substantial experience as an executive and chief executive officer with a number of public and private companies in areas related to the Company's business.

Bradford D. Duea, 43, has served as a member of our Board of Directors since March 2010, and also serves on our Compensation Committee. Mr. Duea currently serves as Senior Vice President, Value Added Services for T-Mobile USA. Mr. Duea is responsible for T-Mobile USA's content business, next generation communication services, mobile portal and related discovery products, search and advertising business, its mobile broadband business, including emerging devices such as tablets, and its wholesale business, including mobile virtual network operators and machine to machine businesses. Mr. Duea initially joined T-Mobile in April 2010 as General Manager and Vice President, Communications, Applications and Media and was promoted to his current role in November 2010. From January 2004 until February 2010, Mr. Duea was the President of Napster, Inc. where he was responsible for all international activities, including acting as a board member to Napster Japan (a joint venture with Tower Records Japan) and overseeing the business development activities of the company on a worldwide basis, including Napster Mobile. From May 2003 to January 2004, Mr. Duea served as Vice President, Worldwide Business Development for Roxio, Inc. (which later became Napster, Inc.), where he was responsible for all business development efforts for the company, including those for Napster. Mr. Duea holds a B.A. in Law and Society from the University of California at Santa Barbara, an M.B.A. in Finance and International Business from the University of Southern California, and a J.D. from the University of San Diego. Mr. Duea was selected to serve on our Board due to his background as an executive in the digital media space and his finance and legal background, which will be helpful in evaluating corporate governance and financial matters.

CONTINUING DIRECTORS WHOSE TERMS EXPIRE AT THE

ANNUAL MEETING OF STOCKHOLDERS IN 2014

Joerg D. Agin, 69, has served as a member of our Board of Directors since July 2003, and currently serves as Lead Independent Director and also serves on our Audit Committee. Since September 2001, he has been the President of Agin Consulting, a consulting business engaged for specific project work associated with hybrid and digital motion imaging systems. Mr. Agin retired in September 2001 from the Eastman Kodak Company, a manufacturer and marketer of imaging products. He first joined Kodak in 1967 as an electrical engineer, but, most recently, from 1995 through August 2001, he served as Senior Vice President and President of the company's Entertainment Imaging division. Mr. Agin also worked at MCA/Universal Studios, a motion picture studio, as Senior Vice President, New Technology and Business Development from 1992 through 1995. Mr. Agin is a Fellow of the Society of Motion Pictures & Television Engineers and the recipient of the Technicolor Herbert T. Kalmus Gold Medal Award for outstanding achievement in color motion pictures. Mr. Agin attended MIT Sloan School of Management for Senior Executives, holds a B.S. in Electrical Engineering from the University of Delaware, and an M.B.A. from Pepperdine University. Mr. Agin was selected to serve on our Board due to his extensive knowledge of digital imaging technologies, his familiarity with technology companies and key contacts within the entertainment industry, his prior experience as a senior executive with major international corporations, and his extensive training in corporate governance matters.

6

Jon E. Kirchner, 44, has served as our Chairman of the Board of Directors and Chief Executive Officer (or "CEO") since February 2010. From September 2001 to February 2010, he served as our President and Chief Executive Officer. He has been a member of our Board of Directors since August 2002. Since joining us in 1993, Mr. Kirchner has served in a number of capacities. From April 2000 to September 2001, he was our President and Chief Operating Officer. From September 1998 to April 2000, he served as our Executive Vice President of Operations, and from March 1996 to September 1998, he was our Vice President of Finance and Business Development. Mr. Kirchner has also served as our Director of International Operations and Controller. Prior to joining us, Mr. Kirchner worked for the Dispute Analysis and Corporate Recovery and Audit Groups of Price Waterhouse LLP (now PricewaterhouseCoopers, LLP), an international accounting firm. During his tenure at Price Waterhouse LLP, he advised clients on financial and operational restructuring, business turnaround, market positioning, and valuation issues. Mr. Kirchner has experience in a variety of industries including entertainment, high technology, manufacturing, distribution, and transportation. He is a Certified Public Accountant and received a B.A. in Economics, Cum Laude, from Claremont McKenna College. Mr. Kirchner was selected to serve on and lead our Board due to his detailed knowledge of all aspects of the operations of the Company, his accounting background and exposure to a number of industries, giving him sound, practical business judgment. We believe that given the size, scope, complexity and expected rapid growth in our business, that oversight, communication, and direction between the Board and management is best achieved by having our CEO also serve as Chairman of the Board of Directors.

GOVERNANCE OF THE COMPANY

Pursuant to the Delaware General Corporation Law and our by-laws, our business, property and other affairs are managed by or under the direction of the Board of Directors. Members of the Board are kept informed of our business through discussions with our Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees. We currently have seven members of the Board—Mr. Agin, Mr. Andrews, Mr. Ballard, Mr. Duea, Mr. Kirchner, Ms. Molina and Mr. Stone.

Board Leadership

Our Corporate Governance Guidelines state that the Board is free to choose its Chair in any manner that is in the best interests of the company at the time. When the Chairman also serves as the Company's Chief Executive Officer, as Mr. Kirchner does, or when the Chair is not independent, the Board, by majority vote of the Independent Directors, may designate an Independent Director to serve as the "Lead Independent Director." Mr. Agin currently serves as the Lead Independent Director. The Board believes that this leadership structure is best for the company at the current time, as it appropriately balances the need for the Chief Executive Officer to run the company on a day-to-day basis with involvement and authority vested in an outside independent Board member—the Lead Independent Director. The role of our Lead Independent Director is fundamental to our decision to combine the Chief Executive Officer and Chairman positions. Our Lead Independent Director assumes many functions traditionally within the purview of a Chairman of the Board. Under our Corporate Governance Guidelines, our Lead Independent Director must be independent, and the specific responsibilities of the Lead Independent Director (if so designated) are as follows:

- •

- Act as a principal liaison between the Independent Directors and the Chairman on sensitive issues;

- •

- Develop the agenda for and moderate executive sessions of the Board's Independent Directors;

- •

- Provide feedback to the Chairman regarding matters discussed in executive sessions of the Independent Directors;

7

- •

- Work in collaboration with the Chairman in developing the agendas for Board meetings;

- •

- Consult with the Chairman as to an appropriate schedule of Board meetings, seeking to ensure that the Independent Directors can perform their duties responsibly while not interfering with the flow of Company operations;

- •

- Consult with the Chairman as to the quality, quantity, and timeliness of the flow of information from Company management that is necessary for the Independent Directors to effectively and responsibly perform their duties;

- •

- Preside at any meeting of the Board at which the Chairman is not present;

- •

- Work in collaboration with the Nominating/Corporate Governance Committee and the Chairman with respect to the implementation and periodic review and, as appropriate, alteration of the Company's Corporate Governance Guidelines.

- •

- Develop a Board plan with regard to potential crisis management issues;

- •

- Assist in the development of the Board's competency around dealing with crisis management issues;

- •

- Regularly seek feedback and evaluate the Board's interest in modifying its existing procedures for evaluating Board performance including conducting peer to peer Board evaluations;

- •

- Work with Nominating/Corporate Governance Committee Chair to recommend, clarify or enhance Board educational programs, needs, and requirements;

- •

- Work with Chairman and Board Secretary to enhance the productivity and efficiency of Board meetings;

- •

- On a case-by-case basis, address sensitive/dysfunctional issues related to the Board and help facilitate a path to resolution; and

- •

- Work with Board Secretary to incorporate new technology software and hardware to enhance the overall productivity and efficiency of Board meetings.

Risk Management

Pursuant to our Corporate Governance Guidelines, the Board's Risk Management Process includes reviewing and assessing business enterprise risk and other major risks facing the company, and evaluating management's approach to addressing such risks. On an ongoing basis, the Board and the Company, in the development and implementation of its strategic growth initiatives, discuss key risks facing the company, plans for addressing these risks and the company's risk management practices overall. In addition, our Board committees consider and address risk as they perform their respective committee responsibilities. For example, financial risks are overseen by our Audit Committee and our internal audit group, our Compensation Committee periodically reviews the Company's compensation programs to assure that they do not encourage excessive risk-taking, and our Nominating/Corporate Governance Committee is tasked with discussing and monitoring best practices for managing all levels of risk. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise risk.

Our management is responsible for day-to-day risk management and regularly reports on risks to the Board or relevant Board committee. With help from the internal audit group as to internal and disclosure control risks, management monitors and tests company-wide policies and procedures, and manages the day-to-day oversight of the risk management strategy for our ongoing business. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, and compliance reporting levels.

8

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

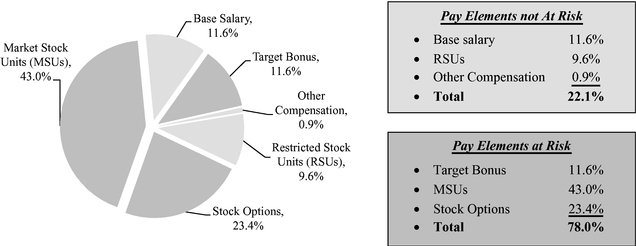

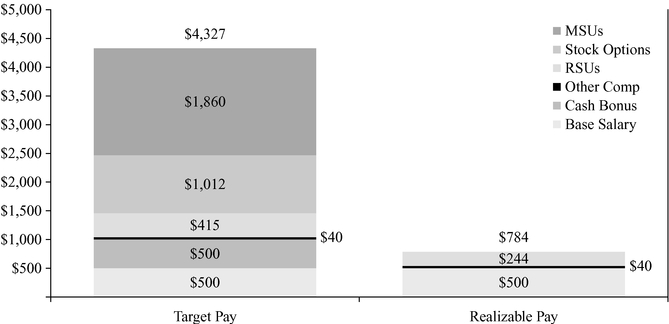

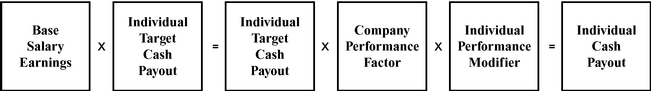

Compensation Risk Assessment

In setting each element of executive compensation, the Compensation Committee considers the level of risk-taking that any element may promote. Our Compensation Committee believes it is important to incentivize our executive officers to achieve annual company and individual objectives, but balance promotion of such short-term interests with incentives that promote building long-term stockholder value. The Compensation Committee believes the amount of long-term equity incentives included in our executive compensation packages mitigates the potential for excessive short-term risk-taking. All of our named executive officers' equity awards vest over a period of time, generally annually over four years from the date of grant, and the Compensation Committee has historically granted additional equity awards annually.

Our Compensation Committee has conducted an internal assessment of our compensation policies and practices in response to current public and regulatory concern about the link between incentive compensation and excessive risk taking by corporations. The Committee concluded that the Company's compensation programs do not motivate excessive risk-taking and any risks involved in compensation are unlikely to have a material adverse effect on the Company. Included in the analysis were such factors as the behaviors being induced by our fixed and variable pay components, the balance of short-term and long-term performance goals in our incentive compensation system, the established limits on permissible incentive award levels, the oversight of our Compensation Committee in the operation of our incentive plans and the high level of board involvement in approving material investments and capital expenditures.

Committees of the Board

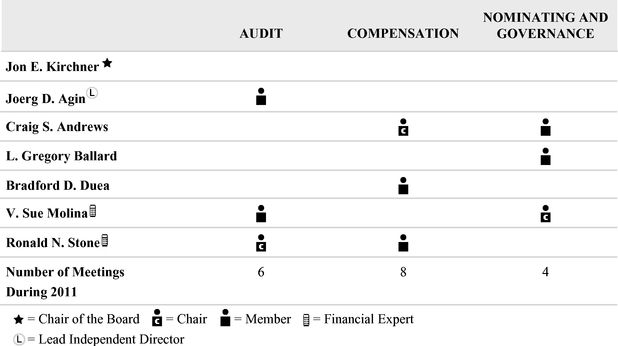

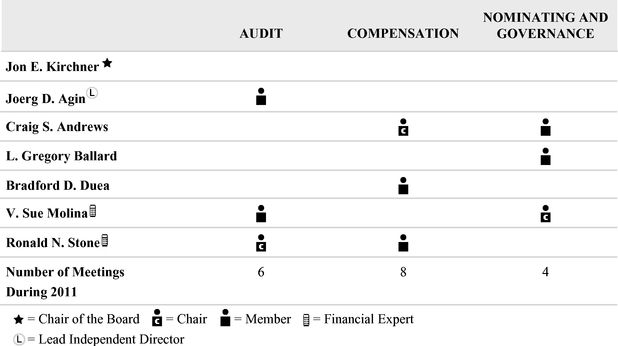

The Board has three standing committees, with the following members:

Mr. Agin, Mr. Andrews, Mr. Ballard, Mr. Duea, Ms. Molina and Mr. Stone are not, and have never been, employees of our Company or any of our subsidiaries and the Board has determined that

9

each of these directors is independent in accordance with the requirements regarding director independence set forth under applicable rules of the NASDAQ Stock Market.

The Board has adopted a charter for each of the three standing committees. The Board has also adopted a code of ethics and a code of conduct that apply to all of our employees, officers and directors. You can find links to these materials on our website atwww.dts.com under the "Investor Relations" and "Corporate Governance" links. The information on our website is not incorporated by reference in this Proxy Statement.

During 2011, the Board held nine meetings and the three standing committees held the number of meetings indicated above. Each director attended or participated in at least 75% of the aggregate of (i) the total number of meetings of the Board of Directors held during the period for which he or she was a director, and (ii) the total number of meetings of all committees of the Board on which he or she served during the period that he or she served. Although the Company has no formal policy regarding director attendance at annual meetings, it does expect all members of the Board to attend the 2012 annual meeting. All nominees for director and continuing members of our Board attended the 2011 annual meeting.

Audit Committee

Each member of the Audit Committee is independent as determined by the NASDAQ Stock Market listing standards as they apply to Audit Committee members. The Audit Committee is a standing committee of, and operates under a written charter adopted by, our Board of Directors. The Audit Committee reviews and monitors our financial statements and accounting practices, appoints, determines the independence of and funding for, and oversees our independent registered public accountants, reviews the results and scope of the Company's annual audit and other services provided by our independent registered public accountants, reviews and evaluates our audit and control functions and reviews and approves any related party transactions. Mr. Stone chairs the Audit Committee. The Audit Committee met six times during 2011.

Audit Committee Financial Expert. The Board has determined that Ms. Molina and Mr. Stone each qualify as an "audit committee financial expert" under the rules of the Securities and Exchange Commission.

Compensation Committee

Each member of the Compensation Committee is independent as determined by the NASDAQ Stock Market listing standards. The Compensation Committee makes decisions and recommendations regarding salaries, benefits, and incentive compensation for our directors and executive officers and administers our incentive compensation and benefit plans, including our 2003 Equity Incentive Plan, our 2005 Performance Incentive Plan, and ultimately, our 2012 Equity Incentive Plan. Mr. Andrews chairs the Compensation Committee. The Compensation Committee met eight times during 2011.

Nominating/Corporate Governance Committee

Each member of the Nominating/Corporate Governance Committee is independent for the purposes of the NASDAQ Stock Market listing standards. Ms. Molina chairs the Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee met four times during 2011. The Nominating/Corporate Governance Committee assists the Board of Directors in fulfilling its responsibilities by:

- •

- identifying and approving individuals qualified to serve as members of our Board of Directors;

- •

- selecting director nominees for each election of directors;

10

- •

- overseeing and administering the Board's evaluation of its performance; and

- •

- developing and recommending to our Board updated Corporate Governance Guidelines and providing oversight with respect to corporate governance and ethical conduct.

While we do not have a formal diversity policy, we do seek a diversified Board. Our Nominating/Corporate Governance Committee believes it's important for our Board to have diversity and takes into account a number of the following factors when considering director nominees:

- •

- independence from management;

- •

- age, gender and ethnic background;

- •

- educational and professional background;

- •

- relevant business experience;

- •

- judgment, skill, integrity and reputation;

- •

- existing commitments to other businesses and service on other boards;

- •

- potential conflicts of interest with other pursuits;

- •

- legal considerations such as antitrust issues;

- •

- corporate governance background;

- •

- financial and accounting background, to enable the committee to determine whether the candidate would be suitable for audit committee membership;

- •

- executive compensation background, to enable the committee to determine whether the candidate would be suitable for Compensation Committee membership; and

- •

- the size and composition of the existing Board.

Before nominating a sitting director for re-election at an annual meeting, the committee will further consider:

- •

- the director's performance on the Board; and

- •

- whether the director's re-election would be consistent with the Company's governance guidelines.

The Nominating/Corporate Governance Committee discussed these factors in identifying the two nominees for our Class III directors.

The Nominating/Corporate Governance Committee will also consider candidates for director suggested by stockholders applying the criteria for candidates described above and considering the additional information referred to below. Stockholders wishing to suggest a candidate for director should write to the Company's Corporate Secretary and include the following information:

- •

- a statement that the writer is a stockholder and is proposing a candidate for consideration by the committee;

- •

- the name of and contact information for the candidate;

- •

- a detailed statement of the candidate's business and educational experience as well as how the candidate supports the diversity factors above;

- •

- information regarding the candidate, as required from time to time by the Nominating/Corporate Governance Committee, and as disclosed in the Company's annual Proxy Statement sufficient to enable the committee to evaluate the candidate;

11

- •

- a statement detailing any relationship between the candidate and any customer, supplier or competitor of the Company;

- •

- detailed information about any relationship or understanding between the proposing stockholder and its affiliates and associates, on the one hand, and the candidate, on the other hand;

- •

- a statement that the candidate is willing to be considered and willing to serve as a Director if nominated and elected; and

- •

- any other information or other documents or agreements required of a Director nominee.

Other Committees

Our Board of Directors may establish other committees as it deems necessary or appropriate from time to time.

Stockholder Communications with Directors and Management

Any stockholder who desires to contact any member of our Board of Directors or management can write to:

Your letter should indicate that you are a DTS stockholder. Depending on the subject matter, our stockholder relations personnel will:

- •

- forward the communication to the Director or Directors to whom it is addressed;

- •

- forward the communication to the appropriate management personnel;

- •

- attempt to handle the inquiry directly, for example where it is a request for information about the Company, or it is a stock-related matter; or

- •

- not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic.

Compensation of Directors

We currently pay each of our non-employee directors an annual retainer of $35,000, and our Lead Independent Director an annual retainer of $50,000. In addition, we pay each of our non-employee directors the following annual retainers for their service as a member, or chair, as applicable, of our Board committees:

| | | | |

Annual Retainers for Committee Members: | | | | |

Audit Committee | | $ | 7,000 | |

Compensation Committee | | $ | 5,000 | |

Nominating/Corporate Governance Committee | | $ | 4,000 | |

Annual Retainers for Committee Chairs: | | | | |

Audit Committee | | $ | 20,000 | |

Compensation Committee | | $ | 12,000 | |

Nominating/Corporate Governance Committee | | $ | 8,000 | |

12

All Board and committee retainers are paid in equal quarterly installments over the course of each year of a director's service on the Board or applicable committee. We also reimburse all non-employee directors for reasonable expenses related to our Board of Directors or committee meetings.

In addition, our 2003 Equity Incentive Plan, as amended (the "2003 Plan"), provides for automatic grants of stock options and restricted stock, awards or units, to our non-employee directors in order to provide them with additional incentives and thereby promote the success of our business. In 2011, the 2003 Plan provided for an annual grant of an option to purchase 6,000 shares of our common stock, as well as 2,000 restricted stock units of our common stock for each continuing non-employee director on the date of each annual meeting of the stockholders. In addition, the 2003 Plan also provided for each newly elected or appointed non-employee director an initial, automatic grant of an option to purchase 9,000 shares of our common stock, as well as 3,000 restricted stock units of our common stock. However, a non-employee director who receives an initial stock option grant and restricted stock units grant on, or within a period of six months prior to, the date of an annual meeting of stockholders will not receive an annual stock option grant and restricted stock units grant with respect to that annual stockholders' meeting. Each initial and annual option will have an exercise price equal to the fair market value of a share of our common stock on the date of grant and will have a term of ten years.

The vesting terms of the automatic equity awards to our non-employee directors are as follows: (i) initial restricted stock awards granted to newly elected or appointed non-employee directors vest over a period of three years in three equal installments on each anniversary of the date of grant for so long as the non-employee director continuously remains a director of, or a consultant to, the Company; (ii) initial stock option awards granted to newly elected or appointed non-employee directors vest and become exercisable in 36 equal installments on each monthly anniversary of the date of grant for so long as the non-employee director continuously remains a director of, or a consultant to, the Company; (iii) annual restricted stock units granted to non-employee directors who have served as such for at least six months prior to the annual meeting of stockholders vest in full on the one year anniversary of the date of grant as long as the non-employee director has continuously remained a director of, or consultant to, the Company through such anniversary date; and (iv) annual stock option awards granted to non-employee directors who have served as such for at least six months prior to the annual meeting of stockholders vest and become exercisable in 24 equal installments on each monthly anniversary of the date of grant for so long as the non-employee director continuously remains a director of, or a consultant to, the Company.

All automatic non-employee director options granted under the 2003 Plan will be non-statutory stock options. Options must be exercised, if at all, within three months after a non-employee director's termination of service, except in the case of death in which event the director's estate shall have one year from the date of death to exercise the option. However, in no event shall any option granted to a director be exercisable later than the expiration of the option's term. In the event of our merger with another corporation or another change of control, all outstanding options, restricted stock, awards and units, held by non-employee directors will vest in full.

13

The following table shows compensation information for our non-employee directors for fiscal year 2011.

2011 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | |

|---|

Name(1) | | Fees

Earned

or Paid

in Cash

($)(3) | | Stock

Awards

($)(4) | | Option

Awards

($)(5) | | Non-Equity

Incentive

Plan

Compensation

($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($) | | All Other

Compensation

($) | | Total

($) | |

|---|

Ronald N. Stone | | $ | 59,500 | | $ | 87,820 | | $ | 102,857 | | | — | | | — | | | — | | $ | 250,177 | |

Craig S. Andrews | | $ | 56,500 | | $ | 87,820 | | $ | 102,857 | | | — | | | — | | | — | | $ | 247,177 | |

Joerg D. Agin | | $ | 54,500 | | $ | 87,820 | | $ | 102,857 | | | — | | | — | | | — | | $ | 245,177 | |

V. Sue Molina | | $ | 47,500 | | $ | 87,820 | | $ | 102,857 | | | — | | | — | | | — | | $ | 238,177 | |

Bradford D. Duea | | $ | 39,500 | | $ | 87,820 | | $ | 102,857 | | | — | | | — | | | — | | $ | 230,177 | |

L. Gregory Ballard | | $ | 35,500 | | $ | 87,820 | | $ | 102,857 | | | — | | | — | | | — | | $ | 226,177 | |

C. Ann Busby(2) | | $ | 17,000 | | | — | | | — | | | — | | | — | | | — | | $ | 17,000 | |

- (1)

- Jon E. Kirchner, our Chairman and Chief Executive Officer, is not included in this table because he did not receive compensation for his service as a director. The compensation received by Mr. Kirchner is shown in the Summary Compensation Table.

- (2)

- Ms. Busby retired from our board of directors on May 12, 2011.

- (3)

- The Company pays each of its non-employee directors cash amounts as described above.

- (4)

- Reflects the aggregate grant date fair value of stock awards granted by us in 2011, as determined in accordance with generally accepted accounting principles in the United States of America ("GAAP"). Pursuant to the 2003 Plan, our non-employee directors each received an automatic grant of 2,000 restricted stock units on May 12, 2011, the date of our annual meeting of stockholders. Pursuant to GAAP, the grant date fair value of each of those awards was $87,820, which is based on the grant date fair value per share of $43.91, which was the closing price of our common stock on May 12, 2011. As of December 31, 2011, Mr. Duea and Mr. Andrews each held an additional 2,000 shares of unvested stock awards. These additional shares were granted in 2010 pursuant to the 2003 Plan and in conjunction with each of their elections to our board of directors. As of December 31, 2011, the other non-employee directors did not hold any other unvested stock awards.

- (5)

- Reflects the aggregate grant date fair value of option awards granted by us in 2011, as determined in accordance with GAAP. Compensation expense is calculated based on the grant date fair value of the stock options, which is based on the Black-Scholes option valuation method using the assumptions described in Footnote 11, "Stock-Based Compensation," to our audited financial statements for the fiscal year ended December 31, 2011 included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 2, 2012. Pursuant to the 2003 Plan, our non-employee directors each received an automatic grant of an option to purchase 6,000 shares of our common stock on May 12, 2011, the date of our annual meeting of stockholders. Pursuant to GAAP, the grant date fair value of each option automatically granted on May 12, 2011, determined using the Black-Scholes method was $102,857. As of December 31, 2011, our non-employee directors had outstanding options to purchase the following aggregate number of shares of our common stock: Ronald N. Stone: 32,500; Craig S. Andrews: 15,000; Joerg D. Agin: 17,000; V. Sue Molina: 34,500; Bradford D. Duea: 15,000; L. Gregory Ballard: 23,500; C. Ann Busby: zero.

14

ITEM 2—APPROVAL OF THE DTS, INC. 2012 EQUITY INCENTIVE PLAN

At the annual meeting, the stockholders will be asked to approve the DTS, Inc. 2012 Equity Incentive Plan (the "2012 Plan"). The Board of Directors adopted the 2012 Plan on April 9, 2012, subject to and effective upon stockholder approval. The 2012 Plan is intended to replace our 2003 Equity Incentive Plan (the "Predecessor Plan"). If stockholders approve the 2012 Plan, it will become effective on the day of the annual meeting, and no further awards will be granted under the Predecessor Plan, which will be terminated.

We operate in a challenging marketplace in which our success depends to a great extent on our ability to attract and retain employees, directors and other service providers of the highest caliber. One of the tools our Board of Directors regards as essential in addressing these challenges is a competitive equity incentive program. Our equity compensation program is designed to provide a vehicle under which a variety of stock-based and other awards can be granted to service providers (including, employees, consultants and directors) of the Company.

The 2012 Plan authorizes the Compensation Committee to provide incentive compensation in the form of stock options, stock appreciation rights, restricted stock and stock units, performance shares and units, other stock-based awards, cash-based awards and deferred compensation awards. Under the 2012 Plan, we will be authorized to issue up to 1,500,000 shares, increased by the number of shares subject to any option or other award outstanding under the Predecessor Plan that expires or is forfeited for any reason after the date of the annual meeting.

As of April 9, 2012, options were outstanding under the Predecessor Plan for a total of 2,640,548 shares of our common stock and a total of 545,571 shares remained subject to unvested awards of restricted stock and restricted stock units outstanding under the Predecessor Plan. As of that date, a total of 1,033,267 shares remained available for the future grant of awards under the Predecessor Plan. If additional awards are made under the Predecessor Plan, the awards will reduce the 1,500,000. The Predecessor Plan will be terminated upon stockholder approval of the 2012 Plan.

Key differences between the 2012 Plan and the Predecessor Plan are:

- •

- Stock options and stock appreciation rights may not be repriced without the approval of our stockholders.

- •

- No discount from fair market value is permitted in setting the exercise price of stock options and stock appreciation rights.

- •

- Each share subject to a "full value" award (i.e., an award settled in stock, other than an option, stock appreciation right or other award that requires the participant to purchase shares for monetary consideration equal to their fair market value at grant) will reduce the number of shares remaining available for grant under the 2012 Plan by 1.71 shares.

- •

- The 2012 Plan establishes an expanded list of measures of business and financial performance from which the Compensation Committee may construct predetermined performance goals that must be met for an award to vest.

- •

- The 2012 Plan permits the grant of deferred compensation awards.

- •

- The 2012 Plan does not contain an evergreen provision and only those shares authorized for issuance under the 2012 Plan, increased by expired awards or forfeited from the Predecessor Plan are available for grant under the 2012 Plan.

15

The 2012 Plan is designed to help the Company comply with the rules relating to its ability to deduct in full for federal income tax purposes the compensation recognized by its executive officers in connection with certain types of awards. Section 162(m) of the Internal Revenue Code (the "Code") generally denies a corporate tax deduction for annual compensation exceeding $1,000,000 paid to the chief executive officer or any of the three other most highly compensated officers of a publicly held company other than the chief financial officer. However, qualified performance-based compensation is excluded from this limit. To enable compensation in connection with stock options, stock appreciation rights, certain restricted stock and restricted stock unit awards, performance shares, performance units and certain other stock-based awards and cash-based awards granted under the 2012 Plan that are intended to qualify as "performance-based" within the meaning of Section 162(m), the stockholders are being asked to approve certain material terms of the 2012 Plan. By approving the 2012 Plan, the stockholders will be specifically approving, among other things:

- •

- the eligibility requirements for participation in the 2012 Plan;

- •

- the maximum numbers of shares for which stock-based awards may be granted to an employee in any fiscal year;

- •

- the maximum dollar amount that a participant may receive under a cash-based award for each fiscal year contained in the performance period; and

- •

- the performance measures that may be used by the Compensation Committee to establish the performance goals applicable to the grant or vesting of awards of restricted stock, restricted stock units, performance shares, performance units, other stock-based awards and cash-based awards that are intended to result in qualified performance-based compensation.

While we believe that compensation provided by such awards under the 2012 Plan generally will be deductible by the Company for federal income tax purposes, under certain circumstances, such as a change in control of the Company, compensation paid in settlement of certain awards may not qualify as performance-based.

The Board of Directors believes that the 2012 Plan will serve a critical role in attracting and retaining the high caliber employees, consultants and directors essential to our success and in motivating these individuals to strive to meet our goals. Therefore, the Board urges stockholders to vote to approve the adoption of the 2012 Plan.

Summary of the 2012 Plan

The following summarizes the principal features of the 2012 Plan which is set forth in its entirety as Appendix A to this Proxy Statement. The following summary is qualified in its entirety by reference to Appendix A.

The purpose of the 2012 Plan is to advance the interests of the Company and its stockholders by providing an incentive program that will enable the Company to attract and retain employees, consultants and directors and to provide them with an equity interest in the growth and profitability of the Company. These incentives are provided through the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares, performance units, other stock-based awards, cash-based awards and deferred compensation awards.

The maximum aggregate number of shares authorized for issuance under the 2012 Plan is the sum of 1,500,000 shares plus additional shares, comprised of the number of shares subject to any option or

16

other award outstanding under the Predecessor Plan that expires or is forfeited for any reason after the date of the annual meeting. As of April 9, 2012, there were 3,186,119 shares subject to unexercised options and other awards remaining unvested and subject to potential forfeiture under the Predecessor Plan.

Each share subject to a stock option, stock appreciation right, or other award that requires the participant to purchase shares for their fair market value determined at the time of grant will reduce the number of shares remaining available for grant under the 2012 Plan by one share. However, each share subject to a "full value" award (i.e., an award settled in stock, other than an option, stock appreciation right, or other award that requires the participant to purchase shares for their fair market value determined at grant) will reduce the number of shares remaining available for grant under the 2012 Plan by 1.71 shares.

If any award granted under the 2012 Plan expires or otherwise terminates for any reason without having been exercised or settled in full, or if shares subject to forfeiture or repurchase are forfeited or repurchased by the Company for not more than the participant's purchase price, any such shares reacquired or subject to a terminated award will again become available for issuance under the 2012 Plan. Shares will not be treated as having been issued under the 2012 Plan and will therefore not reduce the number of shares available for issuance to the extent an award is settled in cash. Shares that are withheld or reacquired by the Company in satisfaction of a tax withholding obligation or that are tendered in payment of the exercise price of an option will not be made available for new awards under the 2012 Plan. Upon the exercise of a stock appreciation right or net-exercise of an option, the number of shares available under the 2012 Plan will be reduced by the gross number of shares for which the award is exercised.

Appropriate and proportionate adjustments will be made to the number of shares authorized under the 2012 Plan, to the numerical limits on certain types of awards described below, and to outstanding awards in the event of any change in our common stock through merger, consolidation, reorganization, reincorporation, recapitalization, reclassification, stock dividend, stock split, reverse stock split, split-up, split-off, spin-off, combination of shares, exchange of shares or similar change in our capital structure, or if we make a distribution to our stockholders in a form other than common stock (excluding normal cash dividends) that has a material effect on the fair market value of our common stock. In such circumstances, the Compensation Committee also has the discretion under the 2012 Plan to adjust other terms of outstanding awards as it deems appropriate.

To enable compensation provided in connection with certain types of awards intended to qualify as "performance-based" within the meaning of Section 162(m) of the Code, the 2012 Plan establishes a limit on the maximum aggregate number of shares or dollar value for which such awards may be granted to an employee in any fiscal year which are intended to qualify as performance-based awards under Section 162(m) of the Code, as follows:

- •

- No more than 500,000 shares under stock-based awards; except that with respect to a new-hire, this limit shall be 750,000 shares.

- •

- No more than $7,500,000 for each full fiscal year contained in the performance period under cash-based awards.

Such limits shall not apply in the case of awards not intended to qualify under Section 162(m).

17

In addition, to comply with applicable tax rules, the 2012 Plan also limits to 1,500,000 the number of shares that may be issued upon the exercise of incentive stock options granted under the 2012 Plan; as adjusted in accordance with the terms of the 2012 Plan.

The 2012 Plan generally will be administered by the Compensation Committee of the Board of Directors, although the Board of Directors retains the right to appoint another of its committees to administer the 2012 Plan or to administer the 2012 Plan directly. In the case of awards intended to qualify for the performance-based compensation exemption under Section 162(m) of the Code, administration of the 2012 Plan must be by a compensation committee comprised solely of two or more "outside directors" within the meaning of Section 162(m). (For purposes of this summary, the term "Committee" will refer to either such duly appointed committee or the Board of Directors.) Subject to the provisions of the 2012 Plan, the Committee determines in its discretion the persons to whom and the times at which awards are granted, the types and sizes of awards, and all of their terms and conditions. The Committee may, subject to certain limitations on the exercise of its discretion required by Section 162(m) or otherwise provided by the 2012 Plan, amend, cancel or renew any award, waive any restrictions or conditions applicable to any award, and accelerate, continue, extend or defer the vesting of any award. The 2012 Plan provides, subject to certain limitations, for indemnification by the Company of any director, officer or employee against all reasonable expenses, including attorneys' fees, incurred in connection with any legal action arising from such person's action or failure to act in administering the 2012 Plan. All awards granted under the 2012 Plan will be evidenced by a written or digitally signed agreement between the Company and the participant specifying the terms and conditions of the award, consistent with the requirements of the 2012 Plan. The Committee will interpret the 2012 Plan and awards granted thereunder, and all determinations of the Committee generally will be final and binding on all persons having an interest in the 2012 Plan or any award.

The 2012 Plan expressly provides that, without the approval of a majority of the votes cast in person or by proxy at a meeting of our stockholders, the Committee may not provide for any of the following with respect to underwater options or stock appreciation rights: (1) either the cancellation of such outstanding options or stock appreciation rights in exchange for the grant of new options or stock appreciation rights at a lower exercise price or the amendment of outstanding options or stock appreciation rights to reduce the exercise price, (2) the issuance of new full value awards in exchange for the cancellation of such outstanding options or stock appreciation rights, or (3) the cancellation of such outstanding options or stock appreciation rights in exchange for payments in cash.

Awards may be granted to employees, directors and consultants of the Company or any present or future parent or subsidiary corporation or other affiliated entity of the Company. Incentive stock options may be granted only to employees who, as of the time of grant, are employees of the Company or any parent or subsidiary corporation of the Company. As of April 9, 2012, we had approximately 266 employees, including seven executive officers, and six non-employee directors who would be eligible under the 2012 Plan.

The Committee may grant nonstatutory stock options, incentive stock options within the meaning of Section 422 of the Code, or any combination of these. The exercise price of each option may not be less than the fair market value of a share of our common stock on the date of grant. However, any incentive stock option granted to a person who at the time of grant owns stock possessing more than

18

10% of the total combined voting power of all classes of stock of the Company or any parent or subsidiary corporation of the Company (a "10% Stockholder") must have an exercise price equal to at least 110% of the fair market value of a share of common stock on the date of grant. On April 9, 2012, the closing price of our common stock as reported on the NASDAQ Global Market was $29.93 per share.

The 2012 Plan provides that the option exercise price may be paid in cash, by check, or cash equivalent; by means of a broker-assisted cashless exercise; by means of a net-exercise procedure; to the extent legally permitted, by tender to the Company of shares of common stock owned by the participant having a fair market value not less than the exercise price; by such other lawful consideration as approved by the Committee; or by any combination of these. Nevertheless, the Committee may restrict the forms of payment permitted in connection with any option grant. No option may be exercised unless the participant has made adequate provision for federal, state, local and foreign taxes, if any, relating to the exercise of the option, including, if permitted or required by the Company, through the participant's surrender of a portion of the option shares to the Company.

Options will become vested and exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Committee. The maximum term of any option granted under the 2012 Plan is ten years, provided that an incentive stock option granted to a 10% Stockholder must have a term not exceeding five years. Unless otherwise permitted by the Committee, an option generally will remain exercisable for three months following the participant's termination of service, provided that if service terminates as a result of the participant's death or disability, the option generally will remain exercisable for 12 months, but in any event the option must be exercised no later than its expiration date, and provided further that an option will terminate immediately upon a participant's termination for cause (as defined by the 2012 Plan).

Options are nontransferable by the participant other than by will or by the laws of descent and distribution, and are exercisable during the participant's lifetime only by the participant. However, a nonstatutory stock option may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Committee.

The Committee may grant stock appreciation rights either in tandem with a related option (a "Tandem SAR") or independently of any option (a "Freestanding SAR"). A Tandem SAR requires the option holder to elect between the exercise of the underlying option for shares of common stock or the surrender of the option and the exercise of the related stock appreciation right. A Tandem SAR is exercisable only at the time and only to the extent that the related stock option is exercisable, while a Freestanding SAR is exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Committee. The exercise price of each stock appreciation right may not be less than the fair market value of a share of our common stock on the date of grant.

Upon the exercise of any stock appreciation right, the participant is entitled to receive an amount equal to the excess of the fair market value of the underlying shares of common stock as to which the right is exercised over the aggregate exercise price for such shares. Payment of this amount upon the exercise of a Tandem SAR may be made only in shares of common stock whose fair market value on the exercise date equals the payment amount. At the Committee's discretion, payment of this amount upon the exercise of a Freestanding SAR may be made in cash or shares of common stock. The maximum term of any stock appreciation right granted under the 2012 Plan is ten years.

Stock appreciation rights are generally nontransferable by the participant other than by will or by the laws of descent and distribution, and are generally exercisable during the participant's lifetime only by the participant. If permitted by the Committee, a Tandem SAR related to a nonstatutory stock

19

option and a Freestanding SAR may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Committee. Other terms of stock appreciation rights are generally similar to the terms of comparable stock options.

The Committee may grant restricted stock awards under the 2012 Plan either in the form of a restricted stock purchase right, giving a participant an immediate right to purchase common stock, or in the form of a restricted stock bonus, in which stock is issued in consideration for services to the Company rendered by the participant. The Committee determines the purchase price payable under restricted stock purchase awards, which may be less than the then current fair market value of our common stock. Restricted stock awards may be subject to vesting conditions based on such service or performance criteria as the Committee specifies, including the attainment of one or more performance goals similar to those described below in connection with performance awards. Shares acquired pursuant to a restricted stock award may not be transferred by the participant until vested. Unless otherwise provided by the Committee, a participant will forfeit any shares of restricted stock as to which the vesting restrictions have not lapsed prior to the participant's termination of service. Unless otherwise determined by the Committee, participants holding restricted stock will have the right to vote the shares and to receive any dividends paid, except that dividends or other distributions paid in shares will be subject to the same restrictions as the original award and dividends paid in cash may be subject to such restrictions.

The Committee may grant restricted stock units under the 2012 Plan, which represent rights to receive shares of our common stock at a future date determined in accordance with the participant's award agreement. No monetary payment is required for receipt of restricted stock units or the shares issued in settlement of the award, the consideration for which is furnished in the form of the participant's services to the Company. The Committee may grant restricted stock unit awards subject to the attainment of one or more performance goals similar to those described below in connection with performance awards, or may make the awards subject to vesting conditions similar to those applicable to restricted stock awards. Unless otherwise provided by the Committee, a participant will forfeit any restricted stock units which have not vested prior to the participant's termination of service. Participants have no voting rights or rights to receive cash dividends with respect to restricted stock unit awards until shares of common stock are issued in settlement of such awards. However, the Committee may grant restricted stock units that entitle their holders to dividend equivalent rights, which are rights to receive additional restricted stock units for a number of shares whose value is equal to any cash dividends the Company pays.

The Committee may grant performance awards subject to such conditions and the attainment of such performance goals over such periods as the Committee determines in writing and sets forth in a written agreement between the Company and the participant. These awards may be designated as performance shares or performance units, which consist of unfunded bookkeeping entries generally having initial values equal to the fair market value determined on the grant date of a share of common stock in the case of performance shares and a monetary value established by the Committee at the time of grant in the case of performance units. Performance awards will specify a predetermined amount of performance shares or performance units that may be earned by the participant to the extent that one or more performance goals are attained within a predetermined performance period. To the extent earned, performance awards may be settled in cash, shares of common stock (including shares of restricted stock that are subject to additional vesting) or any combination thereof.

20

Prior to the beginning of the applicable performance period or such later date as permitted under Section 162(m) of the Code, the Committee will establish one or more performance goals applicable to the award. Performance goals will be based on the attainment of specified target levels with respect to one or more measures of business or financial performance of the Company and each subsidiary corporation consolidated with the Company for financial reporting purposes, or such division or business unit of the Company as may be selected by the Committee. The Committee, in its discretion, may base performance goals on one or more of the following such measures: revenue; sales; expenses; operating income; gross margin; operating margin; earnings before any one or more of: stock-based compensation expense, interest, taxes, depreciation and amortization; pre-tax profit; net operating income; net income; economic value added; free cash flow; operating cash flow; balance of cash, cash equivalents and marketable securities; stock price; earnings per share; return on stockholder equity; return on capital; return on assets; return on investment; total stockholder return, employee satisfaction; employee retention; market share; customer satisfaction; product development; research and development expense; completion of an identified special project; and completion of a joint venture or other corporate transaction.