Exhibit 99.21

Strata Power Corporation (An Exploration Stage Company) FINANCIAL STATEMENTS For the Nine Months ended September 30, 2022 and 2021 (unaudited) (Stated in US Dollars)

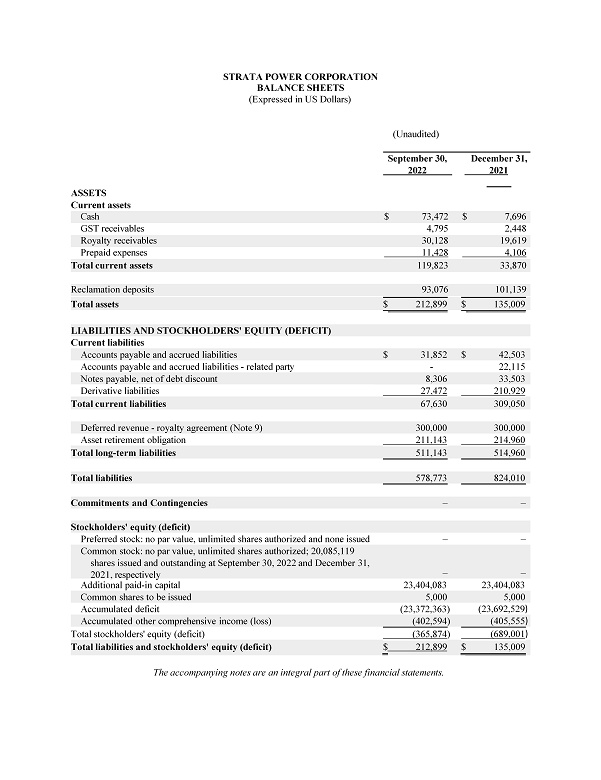

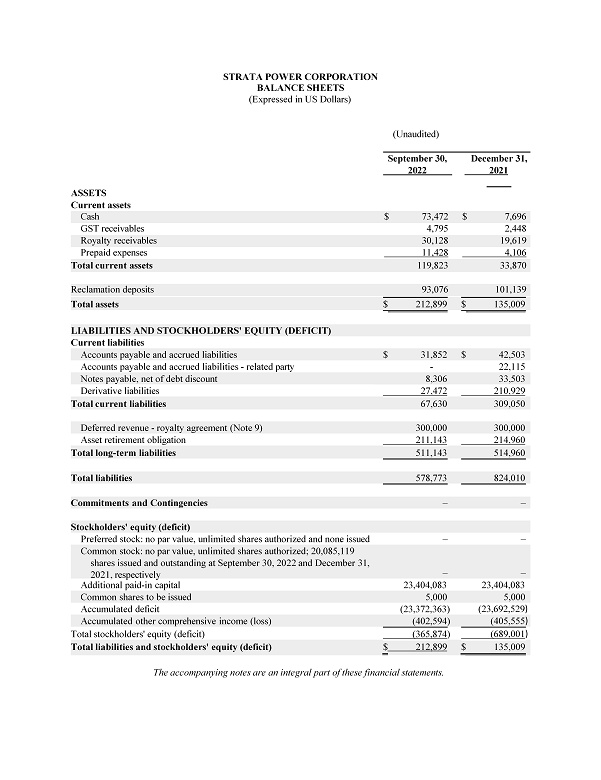

STRATA POWER CORPORATION BALANCE SHEETS (Expressed in US Dollars) (Unaudited) December 31, 2021 September 30, 2022 ASSETS Current assets $ 7,696 $ 73,472 Cash 2,448 4,795 GST receivables 19,619 30,128 Royalty receivables 4,106 11,428 Prepaid expenses 33,870 119,823 Total current assets 101,139 93,076 Reclamation deposits Total assets $ 212,899 $ 135,009 LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) Current liabilities Accounts payable and accrued liabilities $ 31,852 $ 42,503 Accounts payable and accrued liabilities - related party - 22,115 Notes payable, net of debt discount 8,306 33,503 Derivative liabilities 27,472 210,929 Total current liabilities 67,630 309,050 Deferred revenue - royalty agreement (Note 9) 300,000 300,000 Asset retirement obligation 211,143 214,960 Total long - term liabilities 511,143 514,960 Total liabilities 578,773 824,010 Commitments and Contingencies – – Stockholders' equity (deficit) Preferred stock: no par value, unlimited shares authorized and none issued – – Common stock: no par value, unlimited shares authorized; 20,085,119 shares issued and outstanding at September 30, 2022 and December 31, 2021, respectively – – Additional paid - in capital 23,404,083 23,404,083 Common shares to be issued 5,000 5,000 Accumulated deficit (23,372,363) (23,692,529 ) Accumulated other comprehensive income (loss) (402,594) (405,555 ) (689,001 ) $ 135,009 Total stockholders' equity (deficit) (365,874 ) Total liabilities and stockholders' equity (deficit) $ 212,899 The accompanying notes are an integral part of these financial statements.

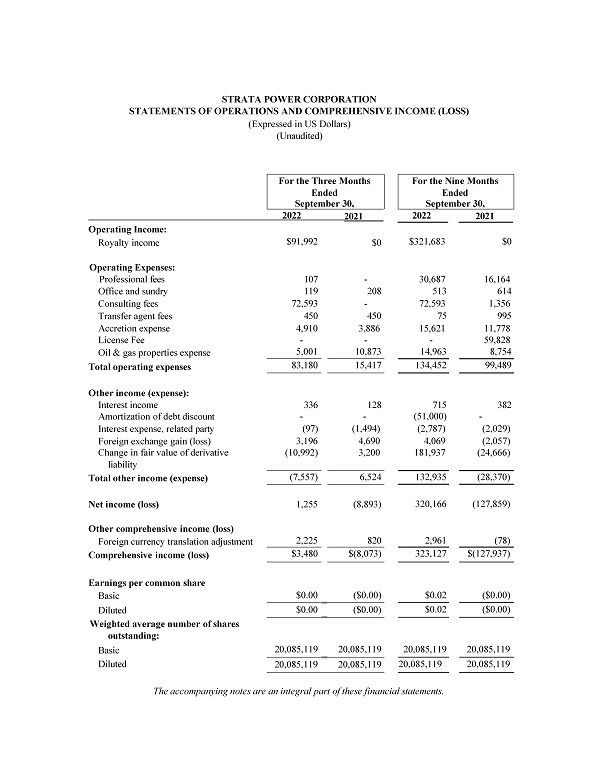

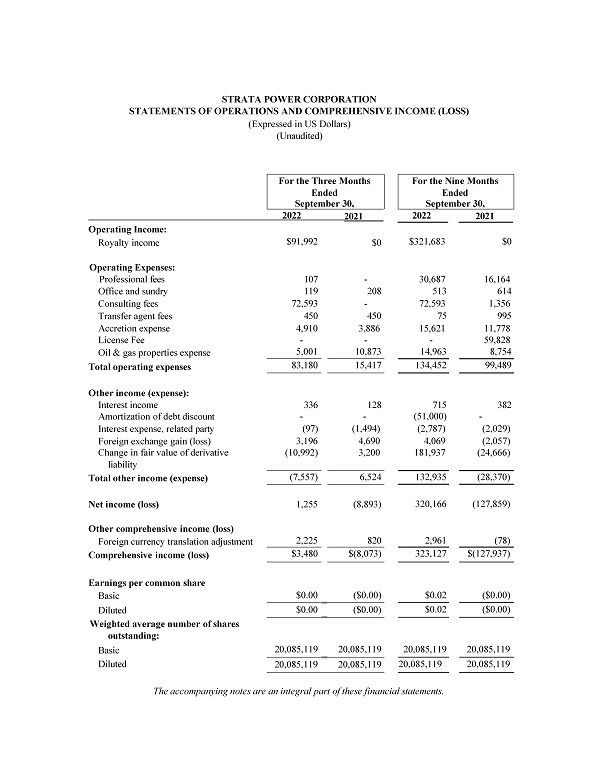

STRATA POWER CORPORATION STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Expressed in US Dollars) (Unaudited) For the Nine Months Ended September 30, For the Three Months Ended September 30, 2021 2022 2022 2021 Operating Income: $0 $321,683 $0 $91,992 Royalty income 16,164 30,687 - 107 Operating Expenses: Professional fees 614 513 208 119 Office and sundry 1,356 72,593 - 72,593 Consulting fees 995 75 450 450 Transfer agent fees 11,778 15,621 3,886 4,910 Accretion expense 59,828 - - - License Fee 8,754 14,963 10,873 5,001 Oil & gas properties expense 99,489 134,452 15,417 83,180 Total operating expenses 382 715 128 336 Other income (expense): Interest income - (51,000) - - Amortization of debt discount (2,029) (2,787) (1,494) (97) Interest expense, related party (2,057) 4,069 4,690 3,196 Foreign exchange gain (loss) (24,666) 181,937 3,200 (10,992) Change in fair value of derivative liability (28,370) 132,935 6,524 (7,557) Total other income (expense) (127,859) 320,166 (8,893) 1,255 Net income (loss) (78) 2,961 820 2,225 Other comprehensive income (loss) Foreign currency translation adjustment $(127,937) 323,127 $(8,073) $3,480 Comprehensive income (loss) ($0.00) $0.02 ($0.00) $0.00 Earnings per common share Basic ($0.00) $0.02 ($0.00) $0.00 Diluted Weighted average number of shares outstanding: 20,085,119 20,085,119 20,085,119 20,085,119 Basic 20,085,119 20,085,119 20,085,119 20,085,119 Diluted The accompanying notes are an integral part of these financial statements.

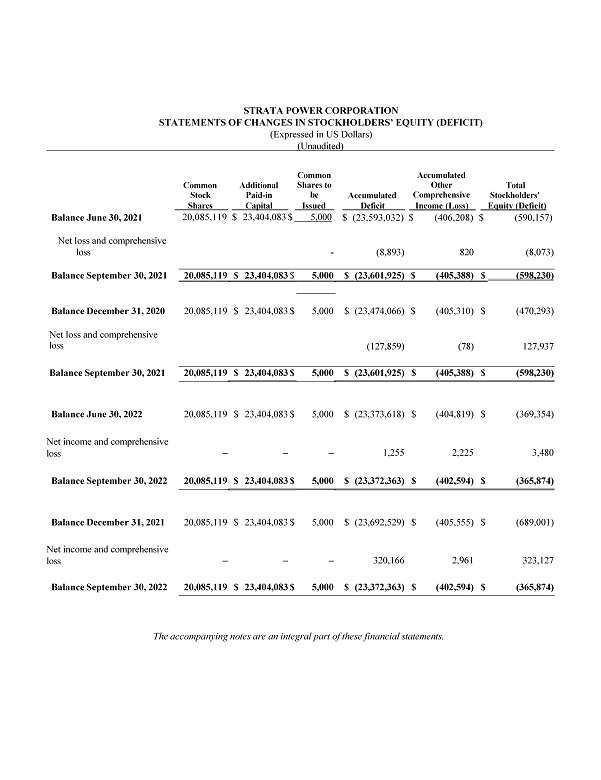

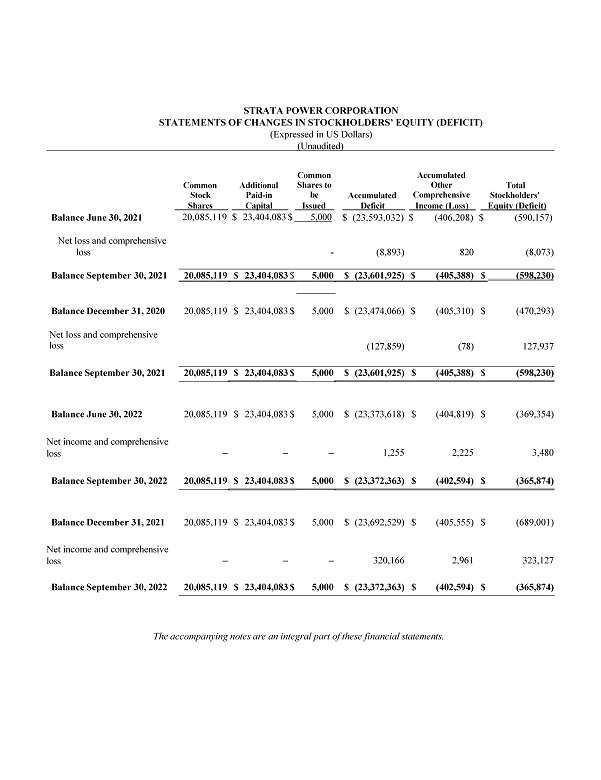

STRATA POWER CORPORATION STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT) (Expressed in US Dollars) (Unaudited) Common Stock Additional Paid - in Common Shares to be Accumulated Accumulated Other Comprehensive Total Stockholders' Shares Capital Issued Deficit Income (Loss) Equity (Deficit) 20,085,119 $ 23,404,083 $ 5,000 Balance June 30, 2021 $ (23,593,032) $ (406,208) $ (590,157) Net loss and comprehensive (8,073) 820 (8,893) - loss $ (598,230) $ (405,388) $ (23,601,925) 5,000 $ 23,404,083 $ 20,085,119 Balance September 30, 2021 $ (470,293) $ (405,310) $ (23,474,066) 5,000 $ 23,404,083 $ 20,085,119 Balance December 31, 2020 127,937 (78) (127,859) Net loss and comprehensive loss $ (598,230) $ (405,388) $ (23,601,925) 5,000 $ 23,404,083 $ 20,085,119 Balance September 30, 2021 $ (369,354) $ (404,819) $ (23,373,618) 5,000 $ 23,404,083 $ 20,085,119 Balance June 30, 2022 3,480 2,225 1,255 – – – Net income and comprehensive loss $ (365,874) $ (402,594) $ (23,372,363) 5,000 $ 23,404,083 $ 20,085,119 Balance September 30, 2022 $ (689,001) $ (405,555) $ (23,692,529) 5,000 $ 23,404,083 $ 20,085,119 Balance December 31, 2021 323,127 2,961 320,166 – – – Net income and comprehensive loss $ (365,874) $ (402,594) $ (23,372,363) 5,000 $ 23,404,083 $ 20,085,119 Balance September 30, 2022 The accompanying notes are an integral part of these financial statements.

STRATA POWER CORPORATION STATEMENTS OF CASH FLOWS (Expressed in US Dollars) (Unaudited) For the nine months ending September 30, 2021 2022 Cash flows from operating activities: $ (127,859) $ 320,166 Net income (loss) Adjustments to reconcile net loss to net cash used in 2,027 2,787 operating activities Accrued interest expense – related party 11,778 15,621 Accretion expense - 51,000 Amortization of debt discount 24,666 (181,938) Change in fair value of derivative liability 59,828 - Change in PetroSteam license (82) (2,346) Change in assets and liabilities GST receivable - (10,508) Royalty receivable (6,021) (7,322) Prepaid expenses (56,777) (10,653) Accounts payable (21,907) Accounts payable – related party (92,440) 154,900 Net cash provided by (used in) operating activities (382) (714) Cash flows from investing activities: Reclamation Deposits (382) (714) Net cash used in investing activities 72,000 - Cash flows from financing activities: Proceeds from issuance of convertible note - (78,209) Repayment of convertible note 72,000 (78,209) Net cash provided by (used in) financing activities (498) (10,201) Foreign exchange effect on cash (21,320) 65,776 Net increase (decrease) in cash 21,717 7,696 Cash, beginning balance $ 397 $ 73,472 Cash, ending balance Supplemental disclosure of cash paid for: $ – $ – Interest $ – $ – Income taxes The accompanying notes are an integral part of these financial statements.

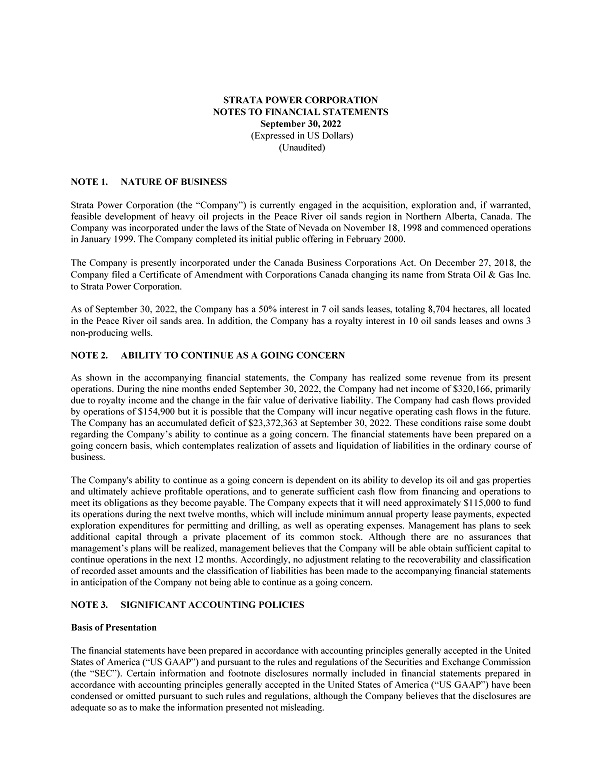

STRATA POWER CORPORATION NOTES TO FINANCIAL STATEMENTS September 30, 2022 (Expressed in US Dollars) (Unaudited) NOTE 1. NATURE OF BUSINESS Strata Power Corporation (the “Company”) is currently engaged in the acquisition, exploration and, if warranted, feasible development of heavy oil projects in the Peace River oil sands region in Northern Alberta, Canada . The Company was incorporated under the laws of the State of Nevada on November 18 , 1998 and commenced operations in January 1999 . The Company completed its initial public offering in February 2000 . The Company is presently incorporated under the Canada Business Corporations Act . On December 27 , 2018 , the Company filed a Certificate of Amendment with Corporations Canada changing its name from Strata Oil & Gas Inc . to Strata Power Corporation . As of September 30 , 2022 , the Company has a 50 % interest in 7 oil sands leases, totaling 8 , 704 hectares, all located in the Peace River oil sands area . In addition, the Company has a royalty interest in 10 oil sands leases and owns 3 non - producing wells . NOTE 2. ABILITY TO CONTINUE AS A GOING CONCERN As shown in the accompanying financial statements, the Company has realized some revenue from its present operations . During the nine months ended September 30 , 2022 , the Company had net income of $ 320 , 166 , primarily due to royalty income and the change in the fair value of derivative liability . The Company had cash flows provided by operations of $ 154 , 900 but it is possible that the Company will incur negative operating cash flows in the future . The Company has an accumulated deficit of $ 23 , 372 , 363 at September 30 , 2022 . These conditions raise some doubt regarding the Company’s ability to continue as a going concern . The financial statements have been prepared on a going concern basis, which contemplates realization of assets and liquidation of liabilities in the ordinary course of business . The Company's ability to continue as a going concern is dependent on its ability to develop its oil and gas properties and ultimately achieve profitable operations, and to generate sufficient cash flow from financing and operations to meet its obligations as they become payable . The Company expects that it will need approximately $ 115 , 000 to fund its operations during the next twelve months, which will include minimum annual property lease payments, expected exploration expenditures for permitting and drilling, as well as operating expenses . Management has plans to seek additional capital through a private placement of its common stock . Although there are no assurances that management’s plans will be realized, management believes that the Company will be able obtain sufficient capital to continue operations in the next 12 months . Accordingly, no adjustment relating to the recoverability and classification of recorded asset amounts and the classification of liabilities has been made to the accompanying financial statements in anticipation of the Company not being able to continue as a going concern . NOTE 3. SIGNIFICANT ACCOUNTING POLICIES Basis of Presentation The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) and pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) . Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate so as to make the information presented not misleading .

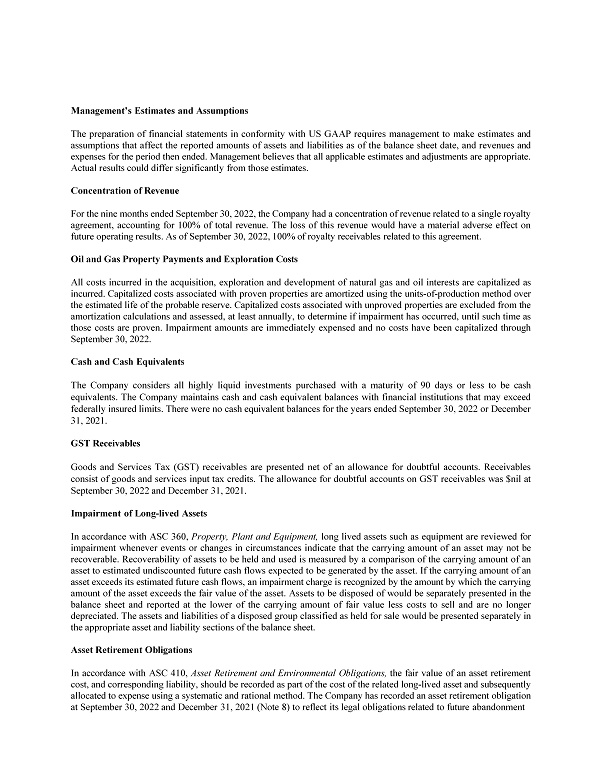

Management’s Estimates and Assumptions The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the balance sheet date, and revenues and expenses for the period then ended . Management believes that all applicable estimates and adjustments are appropriate . Actual results could differ significantly from those estimates . Concentration of Revenue For the nine months ended September 30 , 2022 , the Company had a concentration of revenue related to a single royalty agreement, accounting for 100 % of total revenue . The loss of this revenue would have a material adverse effect on future operating results . As of September 30 , 2022 , 100 % of royalty receivables related to this agreement . Oil and Gas Property Payments and Exploration Costs All costs incurred in the acquisition, exploration and development of natural gas and oil interests are capitalized as incurred . Capitalized costs associated with proven properties are amortized using the units - of - production method over the estimated life of the probable reserve . Capitalized costs associated with unproved properties are excluded from the amortization calculations and assessed, at least annually, to determine if impairment has occurred, until such time as those costs are proven . Impairment amounts are immediately expensed and no costs have been capitalized through September 30 , 2022 . Cash and Cash Equivalents The Company considers all highly liquid investments purchased with a maturity of 90 days or less to be cash equivalents . The Company maintains cash and cash equivalent balances with financial institutions that may exceed federally insured limits . There were no cash equivalent balances for the years ended September 30 , 2022 or December 31 , 2021 . GST Receivables Goods and Services Tax (GST) receivables are presented net of an allowance for doubtful accounts . Receivables consist of goods and services input tax credits . The allowance for doubtful accounts on GST receivables was $ nil at September 30 , 2022 and December 31 , 2021 . Impairment of Long - lived Assets In accordance with ASC 360 , Property, Plant and Equipment, long lived assets such as equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable . Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by the asset . If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the asset . Assets to be disposed of would be separately presented in the balance sheet and reported at the lower of the carrying amount of fair value less costs to sell and are no longer depreciated . The assets and liabilities of a disposed group classified as held for sale would be presented separately in the appropriate asset and liability sections of the balance sheet . Asset Retirement Obligations In accordance with ASC 410 , Asset Retirement and Environmental Obligations, the fair value of an asset retirement cost, and corresponding liability, should be recorded as part of the cost of the related long - lived asset and subsequently allocated to expense using a systematic and rational method . The Company has recorded an asset retirement obligation at September 30 , 2022 and December 31 , 2021 (Note 8 ) to reflect its legal obligations related to future abandonment

of its oil and gas interests using estimated expected cash flow associated with the obligation and discounting the amount using a credit - adjusted, risk - free interest rate . At least annually, the Company will reassess the obligation to determine whether a change in any estimated obligation is necessary . The Company will evaluate whether there are indicators that suggest the estimated cash flows underlying the obligation have materially changed . Should those indicators suggest the estimated obligation has materially changed the Company will accordingly update its assessment . The liability accretes until the Company settles the obligation . Income Taxes The Company follows the asset and liability method of accounting for income taxes whereby deferred tax assets and liabilities are recognized for the future tax consequences of differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases . If it is determined that the realization of the future tax benefit is not more likely than not, the Company establishes a valuation allowance . Foreign Exchange Translation The Company's functional currency is the Canadian dollar but reports its financial statements in US dollars . The Company translates its Canadian dollar balances to US dollars in the following manner : Assets and liabilities have been translated using the rate of exchange at the balance sheet date . Equity transactions and results of operations have been translated at historical rates . Translation gains or losses resulting from the changes in the exchange rates are accumulated as other comprehensive income or loss in a separate component of stockholders' equity . All amounts included in the accompanying financial statements and footnotes are stated in U.S. dollars. Derivative Financial Instruments The Company reviews the terms of its equity instruments and other financing arrangements to determine whether there are embedded derivative instruments that are required to be accounted for separately as a derivative financial instrument . Also, in connection with the issuance of financing instruments, the Company has issued freestanding warrants that are accounted for as derivative instrument liabilities because they are exercisable in a currency other than the functional currency of the Company and thus do not meet the “fixed - for - fixed” criteria of ASC 815 - 40 - 15 . The warrants are exercisable in United States dollars and the Company’s functional currency is the Canadian dollar . Derivative financial instruments are initially measured at their fair value . For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re - valued at each reporting date, with changes in the fair value reported as charges or credits to income . For derivative financial instruments, the Company uses the Black - Scholes option pricing model to value the derivative instruments . Any exercise or cancellation of an equity instrument which meets the classification of a derivative financial instrument is trued - up to fair value at that date and the fair value of the exercised instrument is then reclassified from liability to additional paid in capital . The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is reassessed at the end of each reporting period . If reclassification is required, the fair value of the derivative instrument, as of the determination date, is reclassified . Any previous charges or credits to income for changes in the fair value of the derivative instrument are not reversed . Derivative instrument liabilities are classified in the balance sheet as current or non - current based on whether or not net - cash settlement of the derivative instrument could be required within 12 months of the balance sheet date . Stock Based Compensation In accordance with ASC 718 , “Compensation – Stock Compensation” (“ASC 718 ”), which was adopted as of January 1 , 2019 , the Company measures all employee stock - based compensation awards using a fair value method on the date of grant and recognizes such expense in its financial statements over the requisite service period . The Company uses the Black - Scholes pricing model to determine the fair value of stock - based compensation awards on the date of grant .

The Black - Scholes pricing model requires management to make assumptions regarding option lives, expected volatility, and risk - free interest rates . The Company accounts for non - employee stock - based awards in accordance with the provision of ASC 505 , “Equity Based Payments to Non - Employees” (“ASC 505 ”), which requires that such equity instruments are recorded at their fair value on the measurement date . The measurement of stock - based compensation is subject to periodic adjustment as the underlying equity instruments vest . The Company uses the Black - Scholes pricing model to determine the fair value of stock - based compensation awards . The Black - Scholes pricing model requires management to make assumptions regarding option lives, expected volatility, and risk - free interest rates . The Company uses historical data to estimate option exercise, forfeiture and employee termination within the valuation model . For non - employees, the expected term of the options approximates the full term of the options . The risk - free interest rate is based on a treasury instrument whose term is consistent with the expected term of the stock options . The Company has not paid and does not anticipate paying dividends on its common stock ; therefore, the expected dividend yield is assumed to be zero . In addition, accounting standard requires companies to utilize an estimated forfeiture rate when calculating the expense for the reporting period . Based on its best estimate, management applied the estimated forfeiture rate of nil in determining the expense recorded in the accompanying Statements of Operations and Comprehensive Income (Loss) . Expected volatilities are calculated using the historical volatility of the Company’s stock . When applicable, the Company will use historical data to estimate option exercise, forfeiture and employees’ termination within the valuation model . For non - employees, the expected term of the options approximates the full term of the options . Earnings (Loss) Per Share of Common Stock Basic earnings (loss) per share of common stock is computed by dividing net income (loss) available to common shareholders by the weighted - average number of common shares outstanding for the period . Diluted earnings per share of common stock reflect the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the earnings of the Company . Dilutive potential common shares are calculated in accordance with the treasury stock method, which assumes that proceeds from the exercise of all warrants and options are used to repurchase common stock at market value . The number of shares remaining after the proceeds are exhausted represents the potentially dilutive effect of the securities . For the nine months ended September 30 , 2022 and 2021 , all of the outstanding options and warrants had an exercise price above the average stock price for year - end period . Accordingly, all of the potentially dilutive shares were excluded from the computation of diluted shares outstanding as they would have had an anti - dilutive impact on the Company’s income (loss) from continuing operations . Fair Value of Financial Instruments The book values of GST receivables, notes receivable, accounts payable and accrued expenses approximate their respective fair values due to the short - term nature of these instruments . The fair value hierarchy under GAAP distinguishes between assumptions based on market data (observable inputs) and an entity’s own assumptions (unobservable inputs) . The hierarchy consists of three levels : Level one - Quoted market prices in active markets for identical assets or liabilities; Level two - Inputs other than level one inputs that are either directly or indirectly observable; and Level three - Unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect those assumptions that a market participant would use. Determining which category an asset or liability falls within the hierarchy requires significant judgment . Hierarchy disclosures are evaluated at each balance sheet date . Liabilities measured at fair value are summarized as follows as of :

Fair Value Measurement at September 30, 2022 Using Fair Value Measurement at December 31, 2021 Using Total Level 3 Total Level 3 $ 210,929 $ 210,929 $ 27,472 $ 27,472 Derivative liabilities 214,960 214,960 211,143 211,143 Asset Retirement Obligation (see Note 8) The Company issued a convertible note in which the conversion rate is variable . As a result, a derivative liability was recorded (see Note 9 ) . In addition, the Company has warrants with a strike price currency different than the functional currency as has recorded a derivative liability associated with that . The Company measures and reports the fair value liability for these derivative liabilities on a recurring basis . The fair value liabilities have been recorded as determined utilizing the Black - Scholes option pricing model . A slight change in an unobservable input like historical volatility could have a significant impact on the fair value measurement of the derivative liabilities . See Note 6 “Derivative Liabilities” for further discussion of the inputs used in determining the fair value . Revenue Recognition The Company has adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 606 , Revenue from Contracts with Customers (“ASC 606 ”), which provides a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers . The Company receives an overriding royalty from an unrelated party of 2 . 5 % on all petroleum substances produced from three oil sands leases located in the southeast portion of the Peace River oil sands area that were sold in May 2019 (see Note 4 ) and recognizes revenue at the time petroleum is sold . The Company’s revenue recognition policy standards include the following elements under ASU 606 : 1. Identify the contract with the customer . The contract is documented in the Purchase and Sale Agreement dated 5 / 14 / 2019 . 2. Identify the performance obligations in the contract . The performance obligation in the contract required Strata to relinquish its interest in three oil sands located in the southeast portion of the Peace River oil sands area . 3. Determine the transaction price . The transaction price was C $ 60 , 000 and a 2 . 5 % gross overriding royalty of the petroleum substances produced from the three oil sands leases, in exchange for a 100 % interest in the three oil sands leases . 4. Allocate the transaction price to the performance obligations in the contract . The Company only has one performance obligation, the transfer of the rights to the three oil sands leases, which has already been fulfilled . 5. Recognize revenue when (or as) the entity satisfies a performance obligation . The C $ 60 , 000 was recognized as a sale of the oil sands rights in 2019 , resulting in a gain from the disposition of the leases . The 2 . 5 % overriding petroleum royalties are recognized as revenue in the period that the other party produces and sells petroleum from the oil sands leases, which began in September 2021 . The royalties that have been received to date have been highly variable, as the amounts are dependent upon the monthly production, the demand of the buyers, the spot price of petroleum, etc . As such, management has determined that the revenue recognition shall be treated as variable consideration as defined in ASC 606 . Variable consideration should only be recognized to the extent that it is probable that a significant reversal of revenue will not occur when the uncertainty associated with the variable consideration is subsequently resolved . Given the fact that royalties to date have been highly variable with a great degree of uncertainty, and any attempts to estimate future revenue would likely result in a significant reversal of revenue, royalty revenue will be recognized when payments and settlement statements are received, in the period for which the petroleum was produced . It is at that time that any uncertainty related to royalty payments is resolved . The Company applied ASC 606 using the modified retrospective method applied to contracts not yet completed as of the date of adoption .

Comprehensive Income (Loss) Comprehensive income (loss) is defined to include all changes in equity except those resulting from investments by owners and distributions to owners . The Company's items of other comprehensive income (loss) are foreign currency translation adjustments . Related Party Transactions A related party is generally defined as (i) any person who holds 10 % or more of the Company’s securities and their immediate families, (ii) the Company’s management, (iii) an entity or person who directly or indirectly controls, is controlled by or is under common control and/or management with the Company, or (iv) anyone who can significantly influence the financial and operating decisions of the Company . A transaction is considered to be a related party transaction when there is a transfer of resources or obligations between related parties . New Accounting Pronouncements In August 2020 , the FASB issued ASU 2020 - 06 , Debt - Debt with Conversion and Other Options (Subtopic 470 - 20 ) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815 - 40 ) : Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020 - 06 ”), which simplifies the accounting for certain financial instruments with characteristics of liabilities and equity . This ASU ( 1 ) simplifies the accounting for convertible debt instruments and convertible preferred stock by removing the existing guidance in ASC 470 - 20 , Debt : Debt with Conversion and Other Options, that requires entities to account for beneficial conversion features and cash conversion features in equity, separately from the host convertible debt or preferred stock ; ( 2 ) revises the scope exception from derivative accounting in ASC 815 - 40 for freestanding financial instruments and embedded features that are both indexed to the issuer’s own stock and classified in stockholders’ equity, by removing certain criteria required for equity classification ; and ( 3 ) revises the guidance in ASC 260 , Earnings Per Share, to require entities to calculate diluted earnings per share (EPS) for convertible instruments by using the if - converted method . In addition, entities must presume share settlement for purposes of calculating diluted EPS when an instrument may be settled in cash or shares . For SEC filers, excluding smaller reporting companies, ASU 2020 - 06 is effective for fiscal years beginning after December 15 , 2021 including interim periods within those fiscal years . Early adoption is permitted, but no earlier than fiscal years beginning after December 15 , 2020 . For all other entities, ASU 2020 - 06 is effective for fiscal years beginning after December 15 , 2023 , including interim periods within those fiscal years . Entities should adopt the guidance as of the beginning of the fiscal year of adoption and cannot adopt the guidance in an interim reporting period . The Company is currently evaluating the impact that ASU 2020 - 06 may have on its consolidated financial statements and related disclosures . The Company has implemented all new accounting pronouncements that are in effect . These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations . NOTE 4 . ROYALTY INTEREST Pursuant to the Purchase and Sale Agreement with an unrelated third party dated May 2019 , in which the Company sold three oil sands leases located in the southeast portion of the Peace River oil sands area, the Company retained a 2 . 5 % gross overriding royalty on all petroleum substances produced from the leases . For the nine months ended September 30 , 2022 and 2021 , the Company earned royalties of $ 321 , 683 and $ 0 , respectively . NOTE 5 . PETROSTEAM LICENSE On March 20 , 2019 , the Company entered into an exclusive license agreement with PetroSteam LLC to obtain an exclusive right to deploy patented and field - tested proprietary technologies utilizing steam generation applied to bitumen and heavy oil recovery in the Provinces of Alberta and Saskatchewan . In exchange, the Company issued 2 , 991 , 400 restricted common shares . In addition, the Company agreed, subject to certain qualifications and milestones being met, to purchase steam generation equipment from PetroSteam totaling $ 12 , 500 , 000 to be used on its

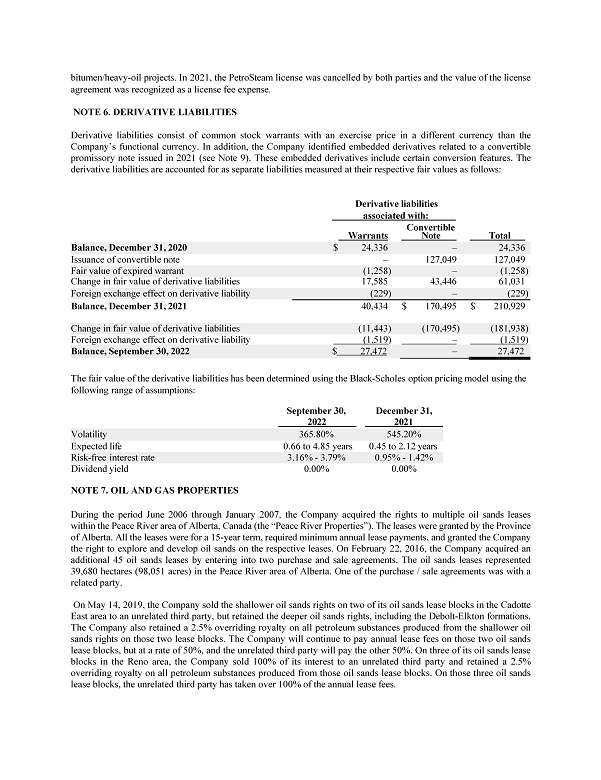

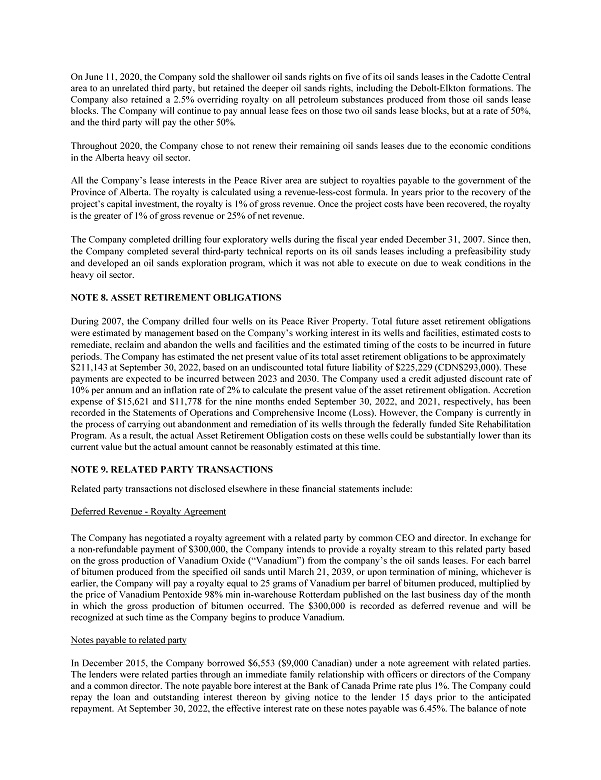

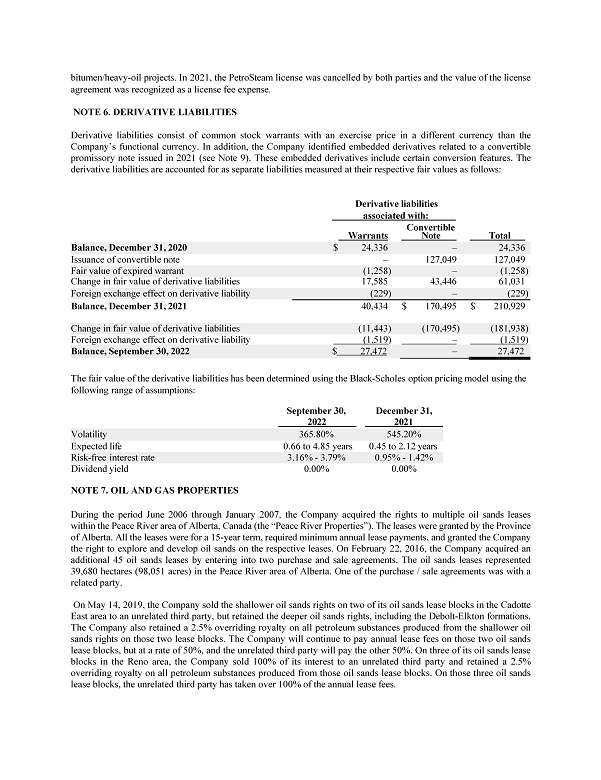

bitumen/heavy - oil projects . In 2021 , the PetroSteam license was cancelled by both parties and the value of the license agreement was recognized as a license fee expense . NOTE 6 . DERIVATIVE LIABILITIES Derivative liabilities consist of common stock warrants with an exercise price in a different currency than the Company’s functional currency . In addition, the Company identified embedded derivatives related to a convertible promissory note issued in 2021 (see Note 9 ) . These embedded derivatives include certain conversion features . The derivative liabilities are accounted for as separate liabilities measured at their respective fair values as follows : Derivative liabilities associated with: Convertible Total Note Warrants 24,336 – $ 24,336 Balance, December 31, 2020 127,049 127,049 – Issuance of convertible note (1,258) – (1,258) Fair value of expired warrant 61,031 43,446 17,585 Change in fair value of derivative liabilities (229) – (229) Foreign exchange effect on derivative liability $ 210,929 $ 170,495 40,434 Balance, December 31, 2021 (181,938) (170,495) (11,443) Change in fair value of derivative liabilities (1,519 ) – (1,519 ) Foreign exchange effect on derivative liability 27,472 – Balance, September 30, 2022 $ 27,472 The fair value of the derivative liabilities has been determined using the Black - Scholes option pricing model using the following range of assumptions: December 31, September 30, 2021 2022 545.20% 365.80% Volatility 0.45 to 2.12 years 0.66 to 4.85 years Expected life 0.95% - 1.42% 3.16% - 3.79% Risk - free interest rate 0.00% 0.00% Dividend yield NOTE 7. OIL AND GAS PROPERTIES During the period June 2006 through January 2007 , the Company acquired the rights to multiple oil sands leases within the Peace River area of Alberta, Canada (the “Peace River Properties”) . The leases were granted by the Province of Alberta . All the leases were for a 15 - year term, required minimum annual lease payments, and granted the Company the right to explore and develop oil sands on the respective leases . On February 22 , 2016 , the Company acquired an additional 45 oil sands leases by entering into two purchase and sale agreements . The oil sands leases represented 39 , 680 hectares ( 98 , 051 acres) in the Peace River area of Alberta . One of the purchase / sale agreements was with a related party . On May 14 , 2019 , the Company sold the shallower oil sands rights on two of its oil sands lease blocks in the Cadotte East area to an unrelated third party, but retained the deeper oil sands rights, including the Debolt - Elkton formations . The Company also retained a 2 . 5 % overriding royalty on all petroleum substances produced from the shallower oil sands rights on those two lease blocks . The Company will continue to pay annual lease fees on those two oil sands lease blocks, but at a rate of 50 % , and the unrelated third party will pay the other 50 % . On three of its oil sands lease blocks in the Reno area, the Company sold 100 % of its interest to an unrelated third party and retained a 2 . 5 % overriding royalty on all petroleum substances produced from those oil sands lease blocks . On those three oil sands lease blocks, the unrelated third party has taken over 100 % of the annual lease fees .

On June 11 , 2020 , the Company sold the shallower oil sands rights on five of its oil sands leases in the Cadotte Central area to an unrelated third party, but retained the deeper oil sands rights, including the Debolt - Elkton formations . The Company also retained a 2 . 5 % overriding royalty on all petroleum substances produced from those oil sands lease blocks . The Company will continue to pay annual lease fees on those two oil sands lease blocks, but at a rate of 50 % , and the third party will pay the other 50 % . Throughout 2020 , the Company chose to not renew their remaining oil sands leases due to the economic conditions in the Alberta heavy oil sector . All the Company’s lease interests in the Peace River area are subject to royalties payable to the government of the Province of Alberta . The royalty is calculated using a revenue - less - cost formula . In years prior to the recovery of the project’s capital investment, the royalty is 1 % of gross revenue . Once the project costs have been recovered, the royalty is the greater of 1 % of gross revenue or 25 % of net revenue . The Company completed drilling four exploratory wells during the fiscal year ended December 31 , 2007 . Since then, the Company completed several third - party technical reports on its oil sands leases including a prefeasibility study and developed an oil sands exploration program, which it was not able to execute on due to weak conditions in the heavy oil sector . NOTE 8 . ASSET RETIREMENT OBLIGATIONS During 2007 , the Company drilled four wells on its Peace River Property . Total future asset retirement obligations were estimated by management based on the Company’s working interest in its wells and facilities, estimated costs to remediate, reclaim and abandon the wells and facilities and the estimated timing of the costs to be incurred in future periods . The Company has estimated the net present value of its total asset retirement obligations to be approximately $ 211 , 143 at September 30 , 2022 , based on an undiscounted total future liability of $ 225 , 229 (CDN $ 293 , 000 ) . These payments are expected to be incurred between 2023 and 2030 . The Company used a credit adjusted discount rate of 10 % per annum and an inflation rate of 2 % to calculate the present value of the asset retirement obligation . Accretion expense of $ 15 , 621 and $ 11 , 778 for the nine months ended September 30 , 2022 , and 2021 , respectively, has been recorded in the Statements of Operations and Comprehensive Income (Loss) . However, the Company is currently in the process of carrying out abandonment and remediation of its wells through the federally funded Site Rehabilitation Program . As a result, the actual Asset Retirement Obligation costs on these wells could be substantially lower than its current value but the actual amount cannot be reasonably estimated at this time . NOTE 9 . RELATED PARTY TRANSACTIONS Related party transactions not disclosed elsewhere in these financial statements include: Deferred Revenue - Royalty Agreement The Company has negotiated a royalty agreement with a related party by common CEO and director . In exchange for a non - refundable payment of $ 300 , 000 , the Company intends to provide a royalty stream to this related party based on the gross production of Vanadium Oxide (“Vanadium”) from the company’s the oil sands leases . For each barrel of bitumen produced from the specified oil sands until March 21 , 2039 , or upon termination of mining, whichever is earlier, the Company will pay a royalty equal to 25 grams of Vanadium per barrel of bitumen produced, multiplied by the price of Vanadium Pentoxide 98 % min in - warehouse Rotterdam published on the last business day of the month in which the gross production of bitumen occurred . The $ 300 , 000 is recorded as deferred revenue and will be recognized at such time as the Company begins to produce Vanadium . Notes payable to related party In December 2015 , the Company borrowed $ 6 , 553 ( $ 9 , 000 Canadian) under a note agreement with related parties . The lenders were related parties through an immediate family relationship with officers or directors of the Company and a common director . The note payable bore interest at the Bank of Canada Prime rate plus 1 % . The Company could repay the loan and outstanding interest thereon by giving notice to the lender 15 days prior to the anticipated repayment . At September 30 , 2022 , the effective interest rate on these notes payable was 6 . 45 % . The balance of note

payable, including interest, to related parties at September 30 , 2022 and December 31 , 2021 was $ 8 , 306 and $ 8 , 844 , respectively . The Company recognized interest expense of $ 236 and $ 232 for the nine months ended September 30 , 2022 , and 2021 , respectively, in its Statements of Operations and Comprehensive Income (Loss) . In 2021 , the Company borrowed $ 72 , 000 under a note agreement with a related party, which has been fully repaid as of September 30 , 2022 . The note payable could be repaid at any time, in part or in full on or before May 25 , 2023 and bore interest at 10 % per annum . The note was convertible into restricted common shares at $ 0 . 01 per share or the most recent 30 - day volume - weighted moving average of the published share price, discounted by 40 % , whichever is higher . Due to the variability of the conversion rate, an embedded derivative was identified . The Company recorded the fair value of the derivatives as of the inception date of the convertible note, which was determined to be $ 127 , 049 . The initial fair value of the embedded debt derivative was allocated as a debt discount up to the face value of the note ( $ 72 , 000 ), with the remaining $ 55 , 049 recognized as a loss on issuance of convertible note . The debt discount was amortized over the life of the note, or until repayment and amortization expense of $ 51 , 000 and $ 0 was recognized for the nine months ended September 30 , 2022 and 2021 , respectively . The balance of the note payable, including interest, at September 30 , 2022 and December 31 , 2021 was $ 0 and $ 75 , 659 , respectively . The Company recognized interest expense of $ 2 , 550 and $ 1 , 841 for the nine months ended September 30 , 2022 and 2021 , respectively, in its Statements of Operations and Comprehensive Income (Loss) . Consulting fees Mr . Newton is the President and a member of the Board of Directors of the Company . Mr . Newton does not bill the Company for his services as President ; however, he has a service agreement with the Company . Consulting fees of $ 75 , 341 and $ 0 were incurred for the nine months ended September 30 , 2022 and 2021 , respectively . Dr . Michael Ranger is a member of the Board of Directors of the Company . Dr . Ranger does not receive compensation for his services as a member of the board ; however, he has a service agreement with the Company, including consulting time and expense reimbursement . Pursuant to this agreement, the Company recognized consulting expenses of $ 0 and $ 1 , 356 , for the nine months ended September 30 , 2022 , and 2021 , respectively . NOTE 10. COMMITMENTS AND CONTINGENCIES In the ordinary course of business, we may be exposed to claims and threatened litigation, and use various methods to resolve these matters in a manner that we believe serves the best interest of our shareholders and other constituents . When a loss is probable, we disclose the amount of probable loss, or disclose a range of reasonably possible losses if they are material and we are able to estimate such a range . If we cannot provide an estimate, we explain the factors that prevent us from doing so . We believe the recorded reserves in our consolidated financial statements are adequate in light of the probable and estimable liabilities . We do not presently believe that any claims or litigation will be material to our results of operations, cash flows, or financial condition . Environmental Matters The Company is engaged in oil and gas exploration and may become subject to certain liabilities as they relate to environmental cleanup of sites or other environmental restoration procedures as they relate to the exploration of oil and gas . Should it be determined that a liability exists with respect to any environmental clean - up or restoration, the liability to cure such a violation could fall upon the Company . No claim has been made, nor is the Company aware of any liability, which it may have, as it relates to any environmental clean - up, restoration or the violation of any rules or regulations relating thereto . Liabilities for expenditures are recorded when environmental assessment and/or remediation is probable, and the costs can be reasonably estimated . NOTE 11. SUBSEQUENT EVENTS In accordance with SFAS 165 (ASC 855 - 10 ) management has performed an evaluation of subsequent events through the date that the financial statements were available to be issued and has determined that it does not have any material subsequent events to disclose in these financial statements .