- EQBK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Equity Bancshares (EQBK) 425Business combination disclosure

Filed: 20 Oct 16, 12:00am

Q3 Results Presentation October 20, 2016 Exhibit 99.2

Disclaimers FORWARD-LOOKING STATEMENTS The following information contains “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity Bancshares Inc.’s (“Equity”) management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses, and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 17, 2016 and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included herein are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding.

Disclaimers Important Additional Information This communication shall not constitute an offer to sell, a solicitation of an offer to sell, or the solicitation or an offer to buy any securities. Investors and security holders are urged to carefully review and consider Equity’s public filings with the SEC, including but not limited to its Annual Reports on Form 10-K, its proxy statements, its Current Reports on Form 8-K and its Quarterly Reports on Form 10-Q. The documents filed by Equity with the SEC may be obtained free of charge at Equity’s investor relations website at investor.equitybank.com or at the SEC’s website at www.sec.gov. Alternatively, these documents, when available, can be obtained free of charge from Equity upon written request to Equity Bancshares, Inc., Attn: Investor Relations, 7701 East Kellogg Drive, Suite 300, Wichita, Kansas 67207 or by calling (316) 612-6000. In connection with the proposed merger transactions, Equity (i) filed a registration statement on Form S-4 (Reg. No. 333-213283) with the SEC on August 24, 2016 for the Community First Bancshares, Inc. (“CFBI”) transaction, which includes a joint proxy statement of CFBI and Equity and a prospectus of Equity, (ii) intends to file a registration statement on Form S-4 with the SEC for the Prairie State Bancshares, Inc. (“Prairie”) merger transaction, which will include a proxy statement of Prairie and a prospectus of Equity, and (iii) will file other documents regarding the proposed CFBI and Prairie merger transactions with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE ENTIRE APPLICABLE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER TRANSACTIONS. The applicable proxy statement/prospectus has or will be sent to the stockholders of each institution seeking the required stockholder approvals. Investors and security holders may obtain the registration statements and the proxy statement/prospectuses free of charge from the SEC’s website or from Equity by writing to the address provided above. Equity, CFBI and Prairie and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from their stockholders in connection with the proposed merger transactions. Information about Equity’s participants may be found in the definitive proxy statement of Equity relating to its 2016 Annual Meeting of Stockholders filed with the SEC on March 28, 2016. The definitive proxy statement can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such participants will be included in the proxy statement and other relevant documents regarding the proposed merger transactions filed with the SEC when they become available, copies of which may also be obtained free of charge from the sources indicated above.

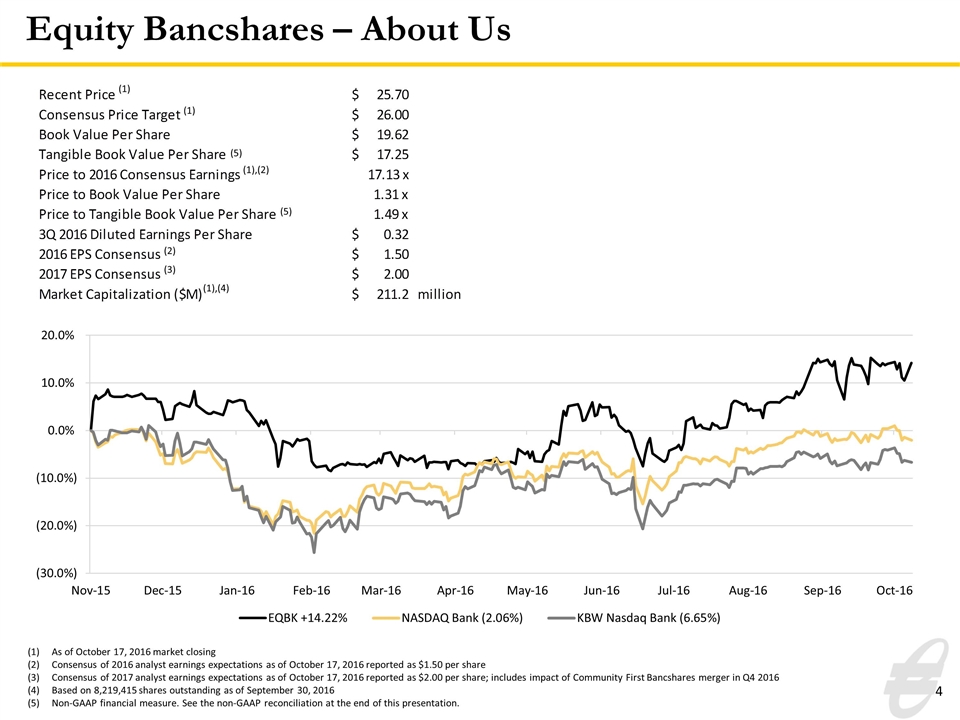

Equity Bancshares – About Us As of October 17, 2016 market closing Consensus of 2016 analyst earnings expectations as of October 17, 2016 reported as $1.50 per share Consensus of 2017 analyst earnings expectations as of October 17, 2016 reported as $2.00 per share; includes impact of Community First Bancshares merger in Q4 2016 Based on 8,219,415 shares outstanding as of September 30, 2016 Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. (1) (1) (1),(2) (5) (2) (3) (1),(4) (5) Recent Price $ 25.7 Consensus Price Target $ 26 Book Value Per Share $ 19.62 Tangible Book Value Per Share $ 17.25 Price to 2016 Consensus Earnings 17.13 x Price to Book Value Per Share 1.31 x Price to Tangible Book Value Per Share 1.49 x 3Q 2016 Diluted Earnings Per Share $ 0.32 2016 EPS Consensus $ 1.5 2017 EPS Consensus $ 2 Market Capitalization ($M) $ 211.2 million

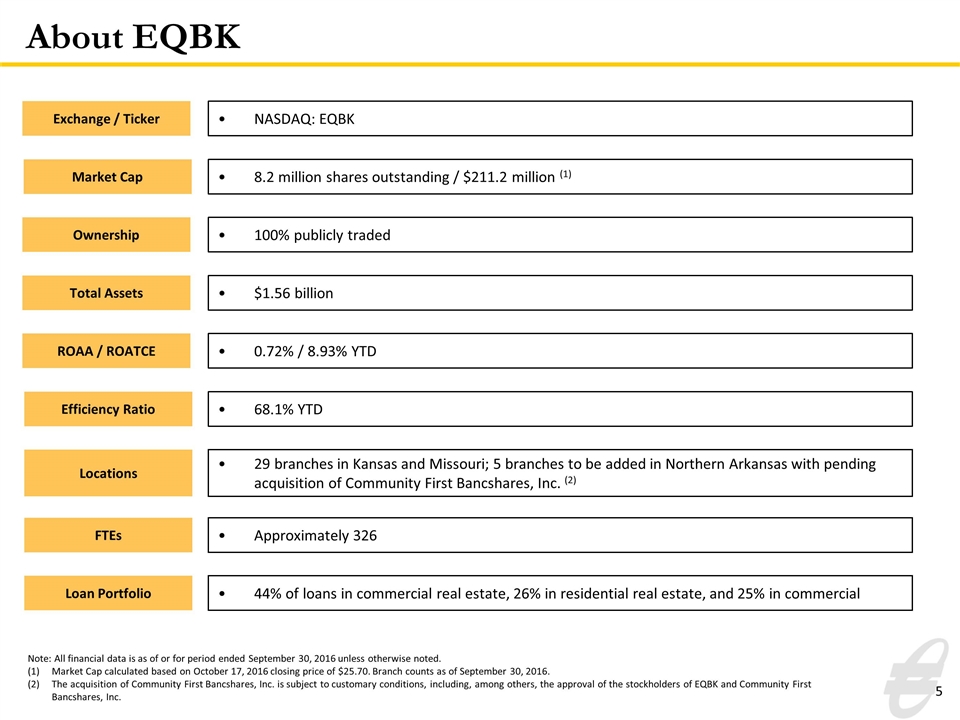

NASDAQ: EQBK 8.2 million shares outstanding / $211.2 million (1) 100% publicly traded $1.56 billion 0.72% / 8.93% YTD Market Cap 68.1% YTD Exchange / Ticker Ownership Total Assets ROAA / ROATCE Efficiency Ratio Locations FTEs Loan Portfolio 29 branches in Kansas and Missouri; 5 branches to be added in Northern Arkansas with pending acquisition of Community First Bancshares, Inc. (2) Approximately 326 44% of loans in commercial real estate, 26% in residential real estate, and 25% in commercial About EQBK Note: All financial data is as of or for period ended September 30, 2016 unless otherwise noted. Market Cap calculated based on October 17, 2016 closing price of $25.70. Branch counts as of September 30, 2016. The acquisition of Community First Bancshares, Inc. is subject to customary conditions, including, among others, the approval of the stockholders of EQBK and Community First Bancshares, Inc.

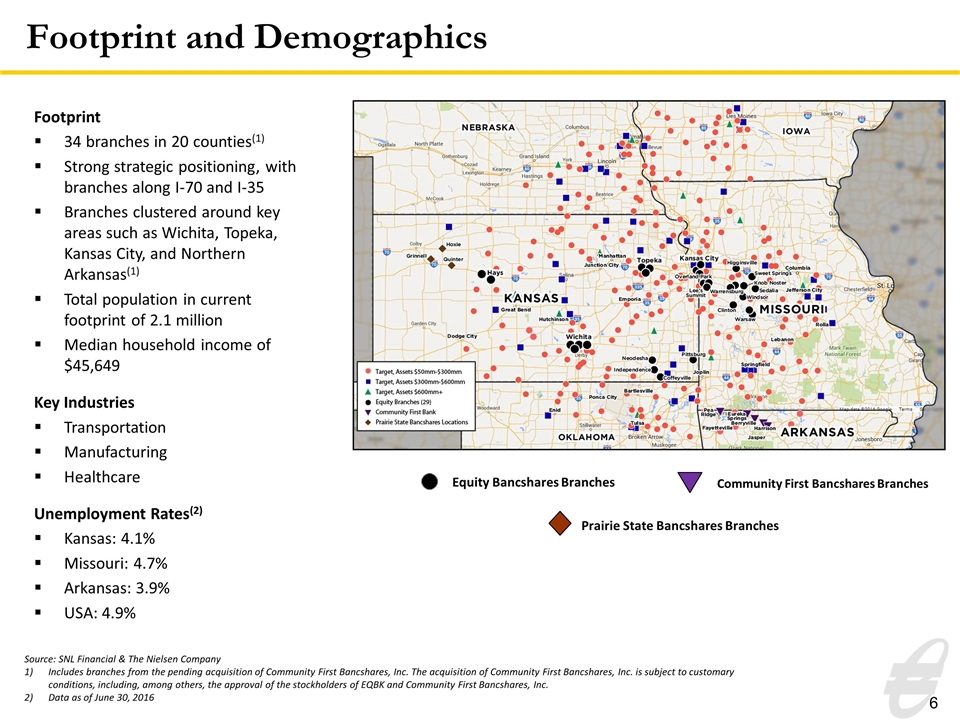

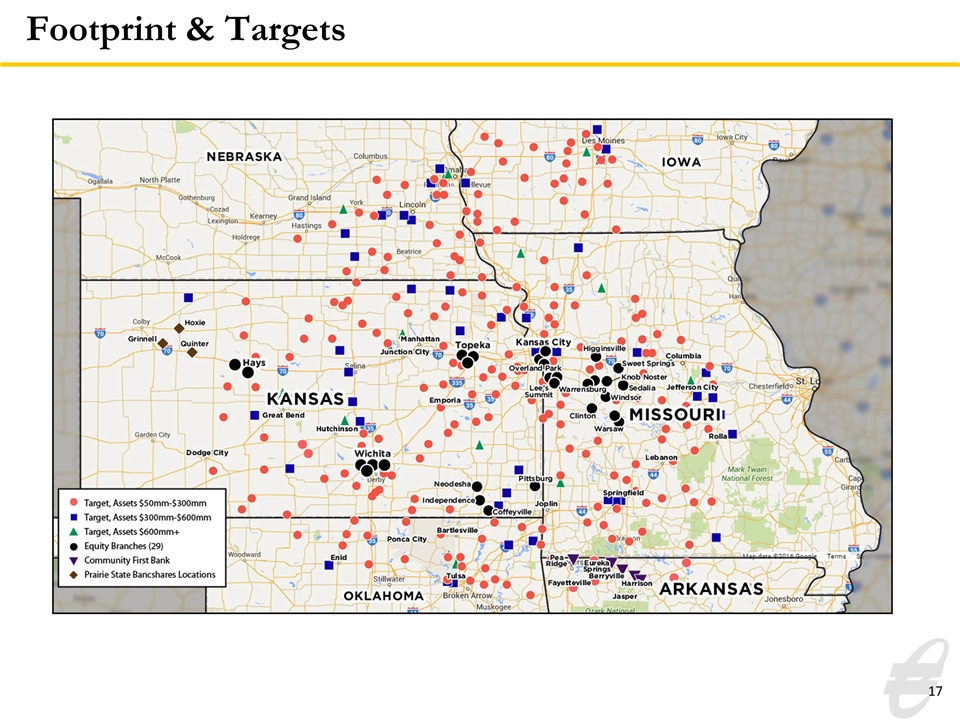

Footprint and Demographics Footprint 34 branches in 20 counties(1) Strong strategic positioning, with branches along I-70 and I-35 Branches clustered around key areas such as Wichita, Topeka, Kansas City, and Northern Arkansas(1) Total population in current footprint of 2.1 million Median household income of $45,649 Key Industries Transportation Manufacturing Healthcare Unemployment Rates(2) Kansas: 4.1% Missouri: 4.7% Arkansas: 3.9% USA: 4.9% Source: SNL Financial & The Nielsen Company Includes branches from the pending acquisition of Community First Bancshares, Inc. The acquisition of Community First Bancshares, Inc. is subject to customary conditions, including, among others, the approval of the stockholders of EQBK and Community First Bancshares, Inc. Data as of June 30, 2016 Equity Bancshares Branches Community First Bancshares Branches Prairie State Bancshares Branches

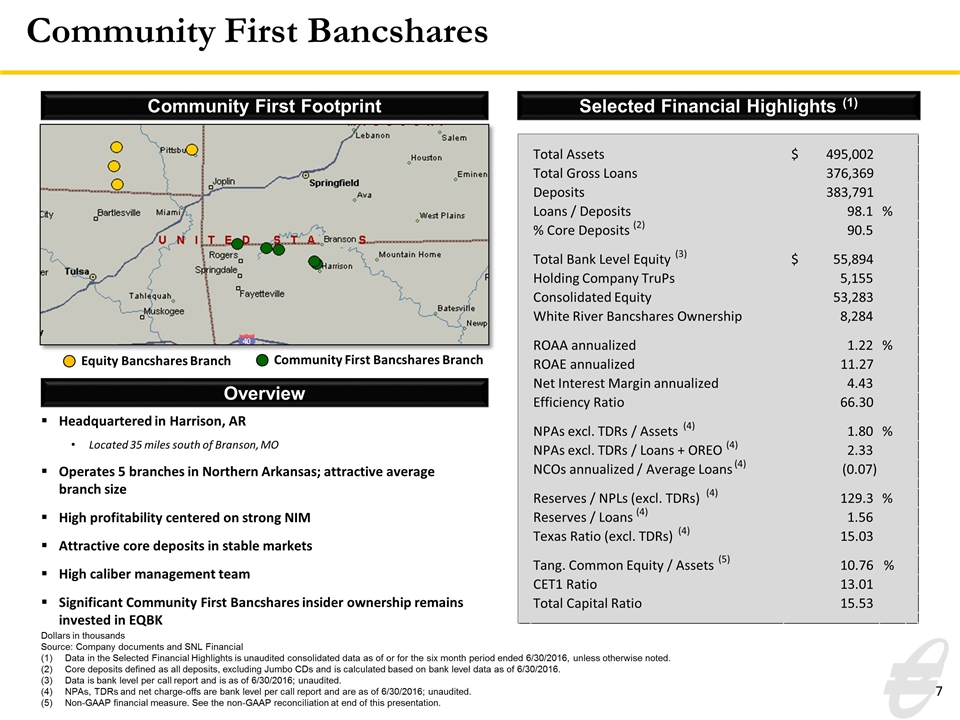

Community First Bancshares Community First Footprint Selected Financial Highlights (1) Dollars in thousands Source: Company documents and SNL Financial Data in the Selected Financial Highlights is unaudited consolidated data as of or for the six month period ended 6/30/2016, unless otherwise noted. Core deposits defined as all deposits, excluding Jumbo CDs and is calculated based on bank level data as of 6/30/2016. Data is bank level per call report and is as of 6/30/2016; unaudited. NPAs, TDRs and net charge-offs are bank level per call report and are as of 6/30/2016; unaudited. Non-GAAP financial measure. See the non-GAAP reconciliation at end of this presentation. Overview Headquartered in Harrison, AR Located 35 miles south of Branson, MO Operates 5 branches in Northern Arkansas; attractive average branch size High profitability centered on strong NIM Attractive core deposits in stable markets High caliber management team Significant Community First Bancshares insider ownership remains invested in EQBK Community First Bancshares Branch Equity Bancshares Branch Total Assets 495,002 $ Total Gross Loans 376,369 Deposits 383,791 Loans / Deposits 98.1 % % Core Deposits (2) 90.5 Total Bank Level Equity (3) 55,894 $ Holding Company TruPs 5,155 Consolidated Equity 53,283 White River Bancshares Ownership 8,284 ROAA annualized 1.22 % ROAE annualized 11.27 Net Interest Margin annualized 4.43 Efficiency Ratio 66.30 NPAs excl. TDRs / Assets (4) 1.80 % NPAs excl. TDRs / Loans + OREO (4) 2.33 NCOs annualized / Average Loans (4) (0.07) Reserves / NPLs (excl. TDRs) (4) 129.3 % Reserves / Loans (4) 1.56 Texas Ratio (excl. TDRs) (4) 15.03 Tang. Common Equity / Assets 10.76 % CET1 Ratio 13.01 Total Capital Ratio 15.53 (5)

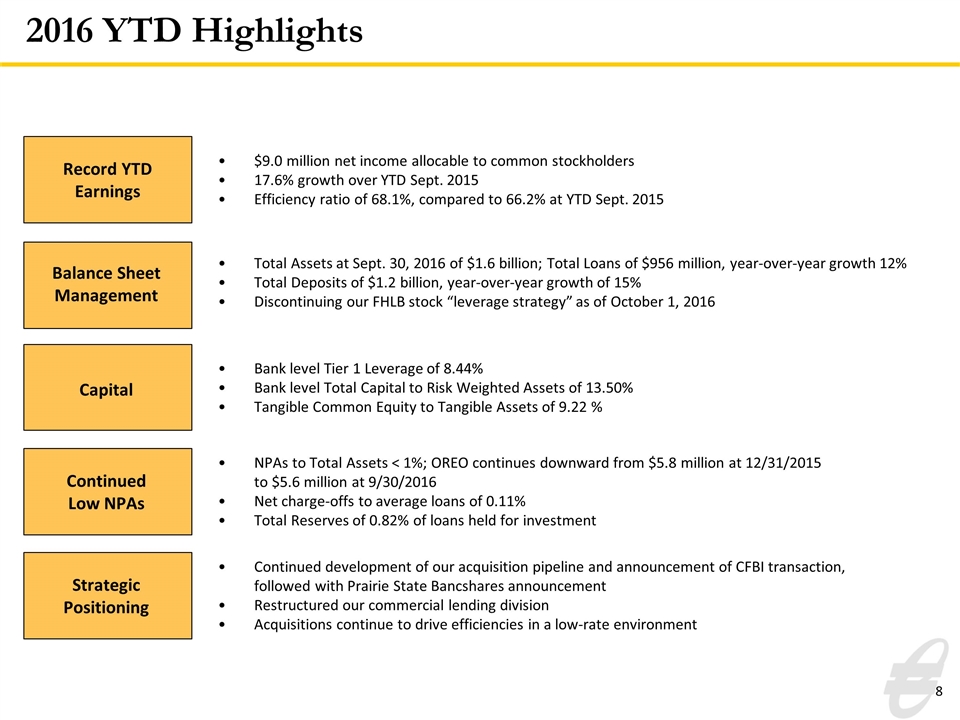

$9.0 million net income allocable to common stockholders 17.6% growth over YTD Sept. 2015 Efficiency ratio of 68.1%, compared to 66.2% at YTD Sept. 2015 Total Assets at Sept. 30, 2016 of $1.6 billion; Total Loans of $956 million, year-over-year growth 12% Total Deposits of $1.2 billion, year-over-year growth of 15% Discontinuing our FHLB stock “leverage strategy” as of October 1, 2016 Bank level Tier 1 Leverage of 8.44% Bank level Total Capital to Risk Weighted Assets of 13.50% Tangible Common Equity to Tangible Assets of 9.22 % NPAs to Total Assets < 1%; OREO continues downward from $5.8 million at 12/31/2015 to $5.6 million at 9/30/2016 Net charge-offs to average loans of 0.11% Total Reserves of 0.82% of loans held for investment 2016 YTD Highlights Record YTD Earnings Continued development of our acquisition pipeline and announcement of CFBI transaction, followed with Prairie State Bancshares announcement Restructured our commercial lending division Acquisitions continue to drive efficiencies in a low-rate environment Balance Sheet Management Capital Continued Low NPAs Strategic Positioning

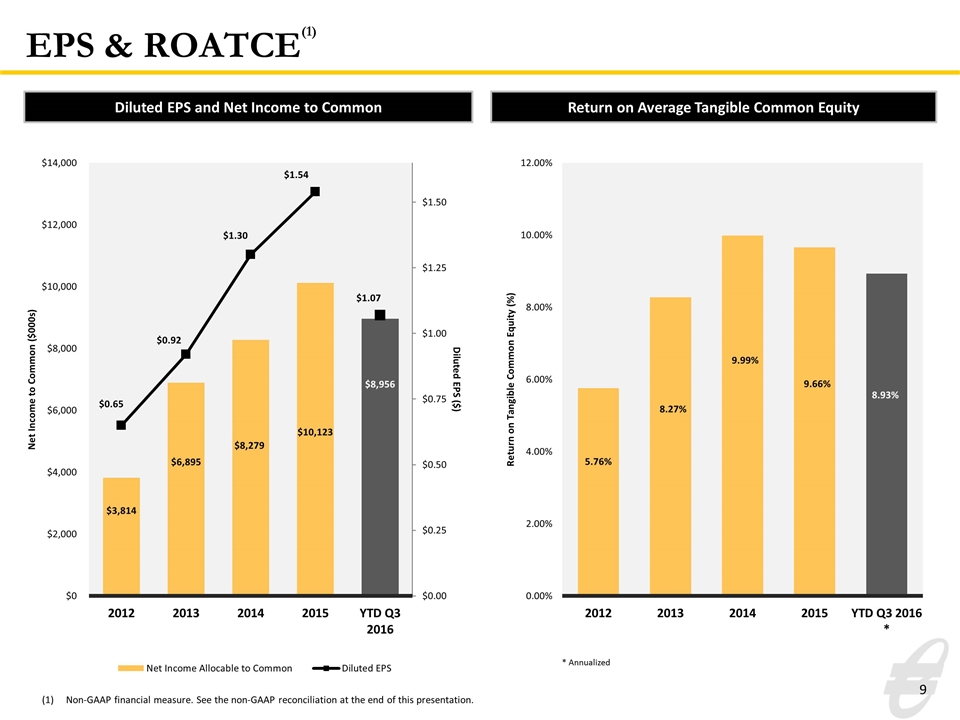

EPS & ROATCE(1) Diluted EPS and Net Income to Common Return on Average Tangible Common Equity * Annualized Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation.

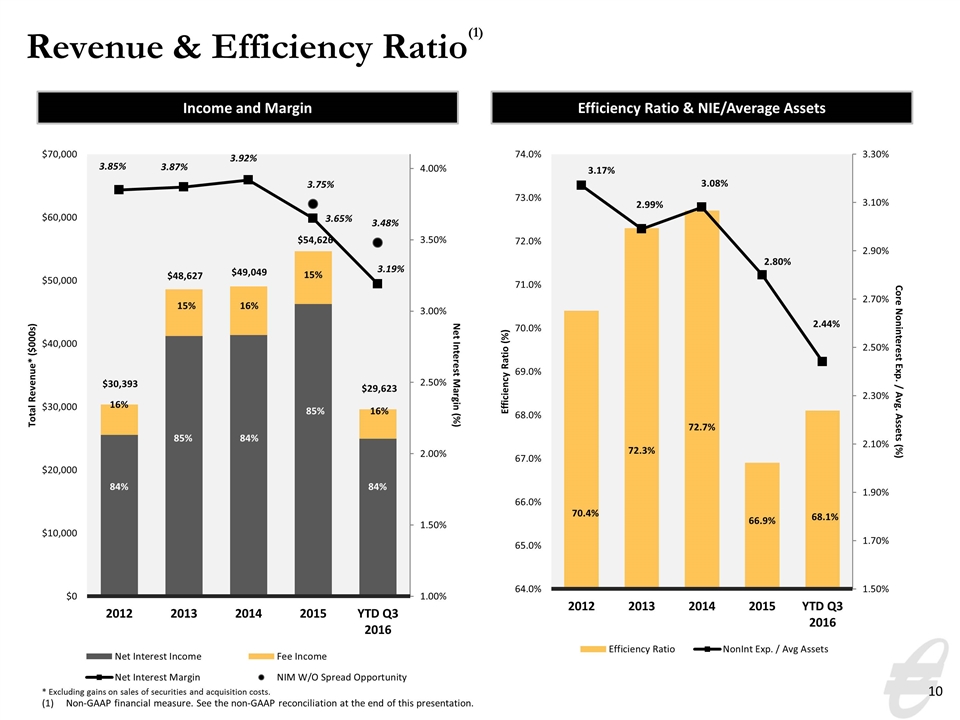

Revenue & Efficiency Ratio(1) Efficiency Ratio & NIE/Average Assets Income and Margin 84% 85% 84% 85% 84% 16% 15% 16% 15% 16% $30,393 $48,627 $49,049 $54,626 $29,623 * Excluding gains on sales of securities and acquisition costs. Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation.

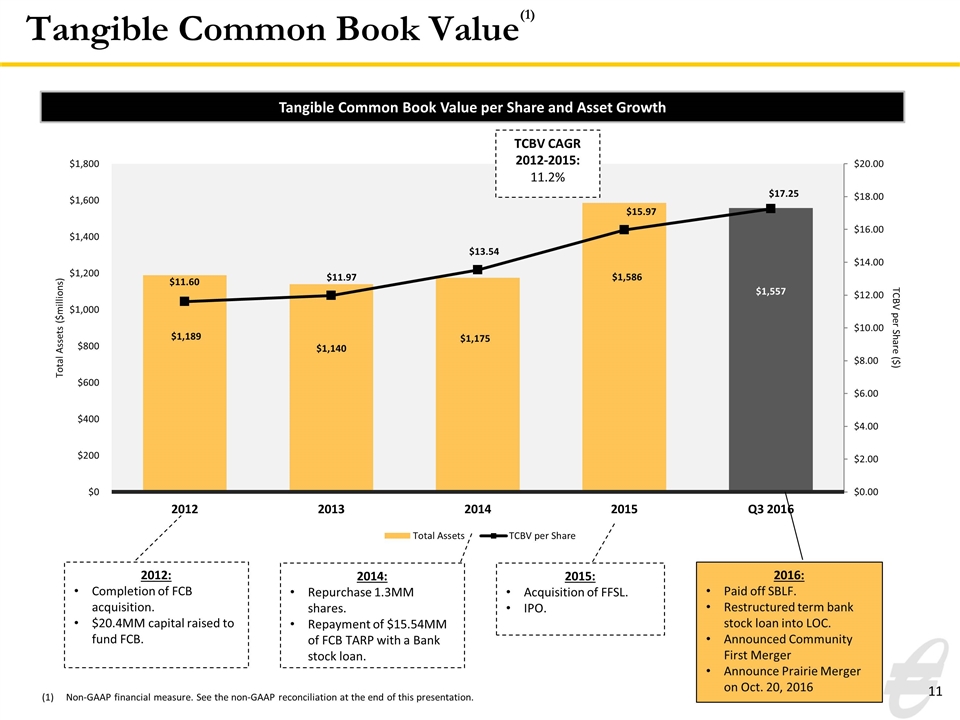

Tangible Common Book Value(1) Tangible Common Book Value per Share and Asset Growth 2012: Completion of FCB acquisition. $20.4MM capital raised to fund FCB. 2014: Repurchase 1.3MM shares. Repayment of $15.54MM of FCB TARP with a Bank stock loan. 2015: Acquisition of FFSL. IPO. TCBV CAGR 2012-2015: 11.2% 2016: Paid off SBLF. Restructured term bank stock loan into LOC. Announced Community First Merger Announce Prairie Merger on Oct. 20, 2016 Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation.

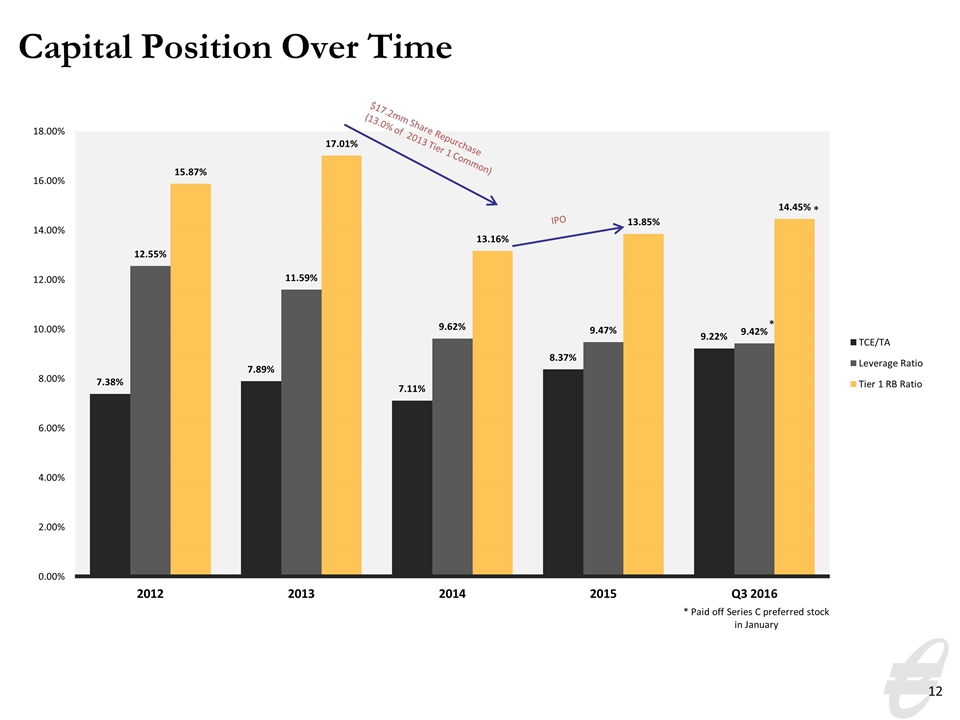

Capital Position Over Time $17.2mm Share Repurchase (13.0% of 2013 Tier 1 Common) IPO * Paid off Series C preferred stock in January

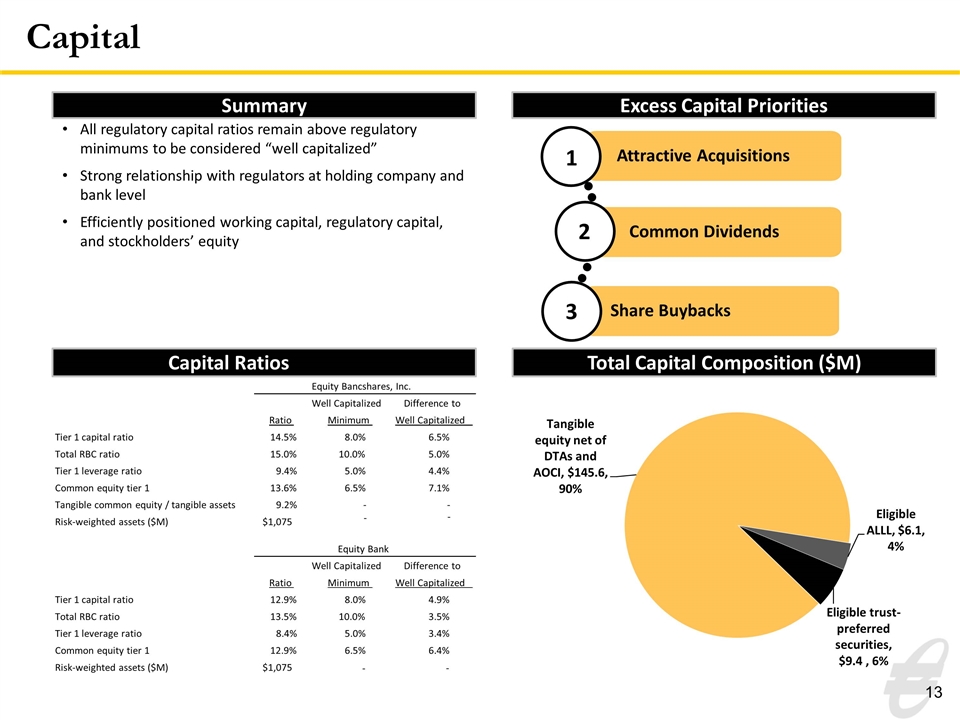

Share Buybacks Attractive Acquisitions Common Dividends Capital Summary Excess Capital Priorities Total Capital Composition ($M) Capital Ratios All regulatory capital ratios remain above regulatory minimums to be considered “well capitalized” Strong relationship with regulators at holding company and bank level Efficiently positioned working capital, regulatory capital, and stockholders’ equity 1 2 3 Equity Bancshares, Inc. Well Capitalized Difference to Ratio Minimum Well Capitalized Tier 1 capital ratio 14.5% 8.0% 6.5% Total RBC ratio 15.0% 10.0% 5.0% Tier 1 leverage ratio 9.4% 5.0% 4.4% Common equity tier 1 13.6% 6.5% 7.1% Tangible common equity / tangible assets 9.2% - - Risk-weighted assets ($M) $1,075 Equity Bank Well Capitalized Difference to Ratio Minimum Well Capitalized Tier 1 capital ratio 12.9% 8.0% 4.9% Total RBC ratio 13.5% 10.0% 3.5% Tier 1 leverage ratio 8.4% 5.0% 3.4% Common equity tier 1 12.9% 6.5% 6.4% Risk-weighted assets ($M) $1,075 - - - -

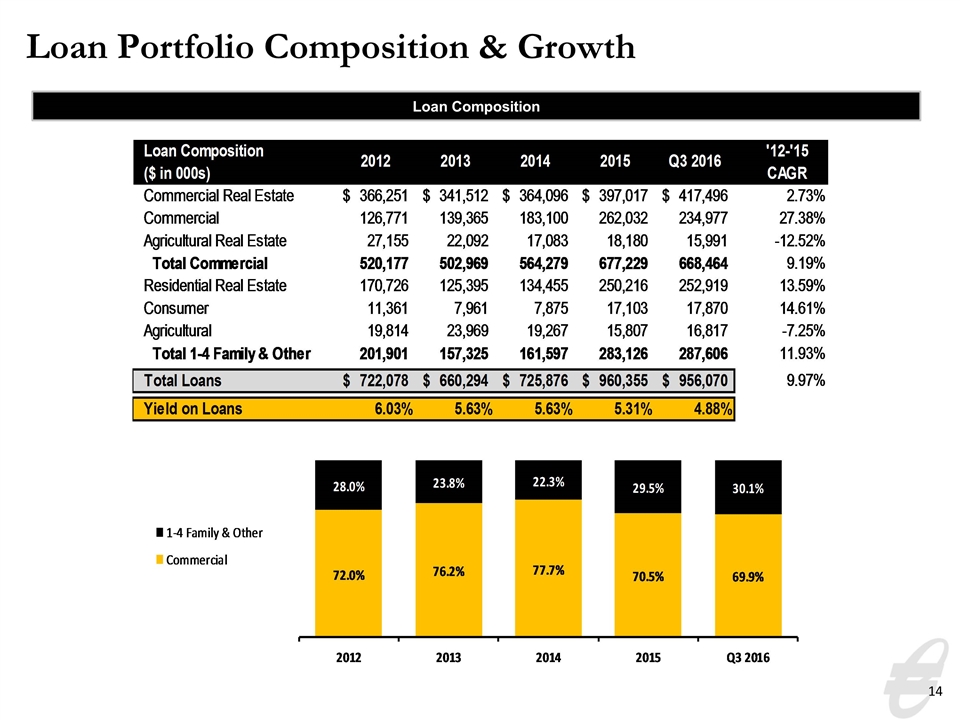

Loan Portfolio Composition & Growth Loan Composition Loan Composition 2012 2013 2014 2015 Q3 2016 '12-'15CAGR ($ in 000s) Commercial Real Estate $,366,251 $,341,512 $,364,096 $,397,017 $,417,496 2.7251446328598883E-2 Commercial ,126,771 ,139,365 ,183,100 ,262,032 ,234,977 0.27382999733306268 Agricultural Real Estate 27,155 22,092 17,083 18,180 15,991 -0.12518808286802907 Total Commercial ,520,177 ,502,969 ,564,279 ,677,229 ,668,464 9.1930005950108029E-2 Residential Real Estate ,170,726 ,125,395 ,134,455 ,250,216 ,252,919 0.13589573957287149 Consumer 11,361 7,961 7,875 17,103 17,870 0.14608961850827096 Agricultural 19,814 23,969 19,267 15,807 16,817 -7.2545886974953344E-2 Total 1-4 Family & Other ,201,901 ,157,325 ,161,597 ,283,126 ,287,606 0.11930152234123081 Total Loans $,722,078 $,660,294 $,725,876 $,960,355 $,956,070 9.9721112781955279E-2 Yield on Loans 6.0299999999999999E-2 5.6300000000000003E-2 5.6300000000000003E-2 5.3100000000000001E-2 4.8800000000000003E-2 Loan Composition 2012 2013 2014 2015 Q3 2016 Commercial 0.72038893305155394 0.76173492413985289 0.77737657671558225 0.70518610305564089 0.69917893041304502 1-4 Family & Other 0.27961106694844601 0.23826507586014714 0.22262342328441773 0.29481389694435911 0.30082106958695493

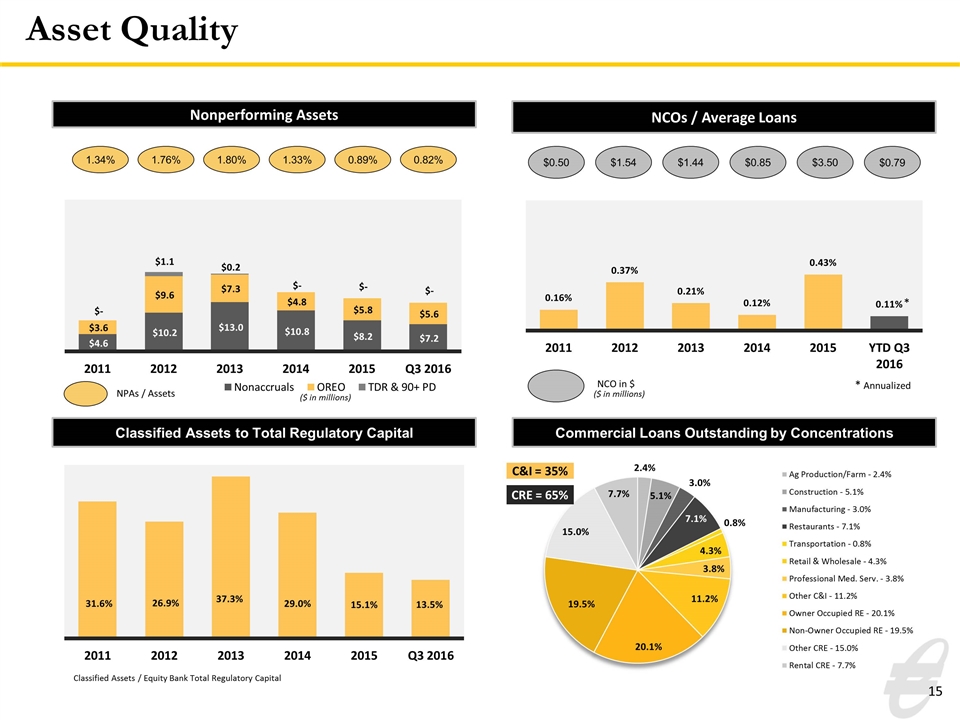

Asset Quality Nonperforming Assets 1.34% 1.76% 1.80% 1.33% NPAs / Assets 0.89% NCOs / Average Loans $0.50 $1.54 $1.44 $0.85 $3.50 NCO in $ ($ in millions) Commercial Loans Outstanding by Concentrations Classified Assets to Total Regulatory Capital CRE = 65% C&I = 35% ($ in millions) Classified Assets / Equity Bank Total Regulatory Capital $0.79 0.82% * * Annualized

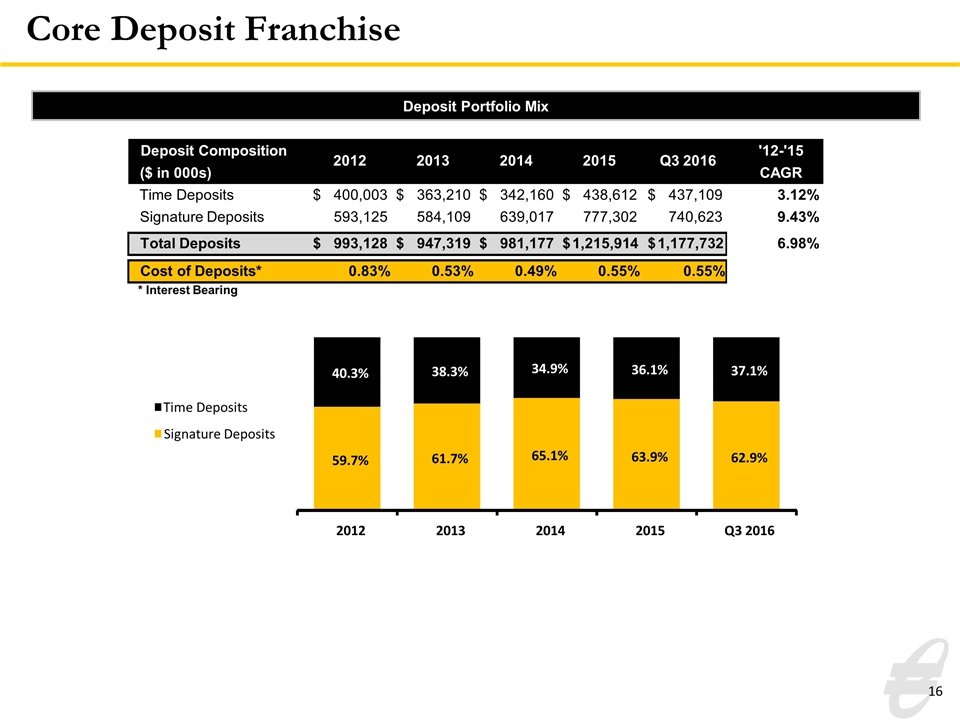

Core Deposit Franchise Deposit Portfolio Mix Deposit Composition ($ in 000s) Time Deposits 400,003 $ 363,210 $ 342,160 $ 438,612 $ 437,109 $ 3.12% Signature Deposits 593,125 584,109 639,017 777,302 740,623 9.43% Total Deposits 993,128 $ 947,319 $ 981,177 $ 1,215,914 $ 1,177,732 $ 6.98% Cost of Deposits* 0.83% 0.53% 0.49% 0.55% 0.55% * Interest Bearing 2012 2013 2014 2015 Q3 2016 '12-'15 CAGR 59.7% 61.7% 65.1% 63.9% 62.9% 40.3% 38.3% 34.9% 36.1% 37.1% 2012 2013 2014 2015 Q3 2016 Time Deposits Signature Deposits

Footprint & Targets

Appendix

Experienced Management Team BRAD ELLIOTT Chairman & CEO Founded Equity Bank in 2002 Served as Regional President of Sunflower Bank prior to forming Equity Bank More than 20 years of banking experience GREG KOSSOVER EVP, Chief Financial Officer Has served as CFO since 2013 and as a Board Director since 2011 Previously served as president of Physicians Development Group and CEO of Value Place, LLC, growing the latter to more than 150 locations in 25 states

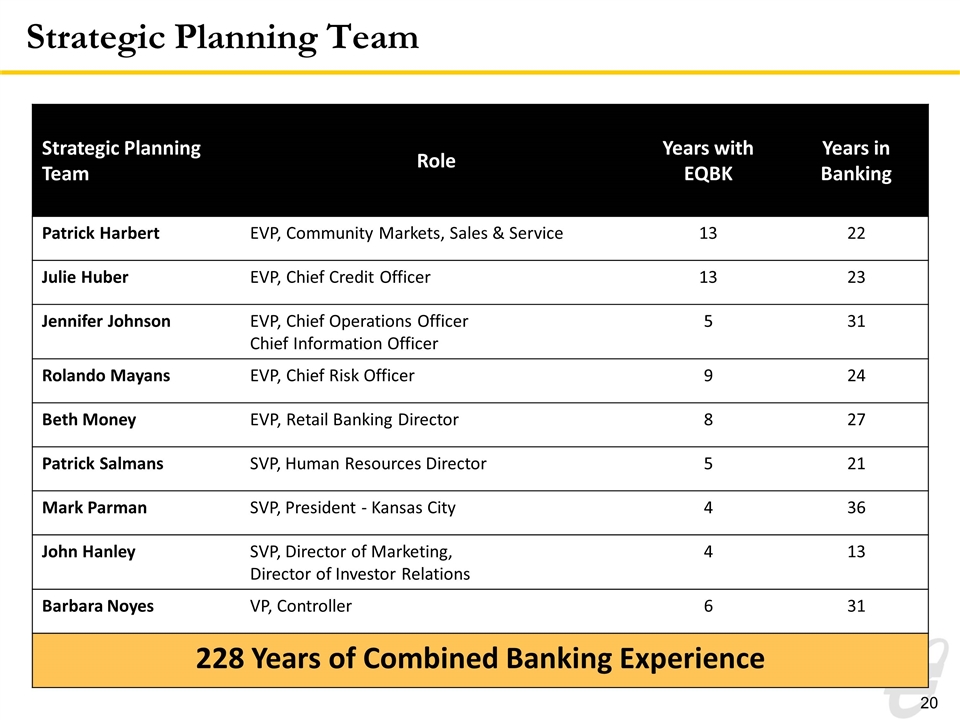

Strategic Planning Team Strategic Planning Team Role Years with EQBK Years in Banking Patrick Harbert EVP, Community Markets, Sales & Service 13 22 Julie Huber EVP, Chief Credit Officer 13 23 Jennifer Johnson EVP, Chief Operations Officer Chief Information Officer 5 31 Rolando Mayans EVP, Chief Risk Officer 9 24 Beth Money EVP, Retail Banking Director 8 27 Patrick Salmans SVP, Human Resources Director 5 21 Mark Parman SVP, President - Kansas City 4 36 John Hanley SVP, Director of Marketing, Director of Investor Relations 4 13 Barbara Noyes VP, Controller 6 31 228 Years of Combined Banking Experience

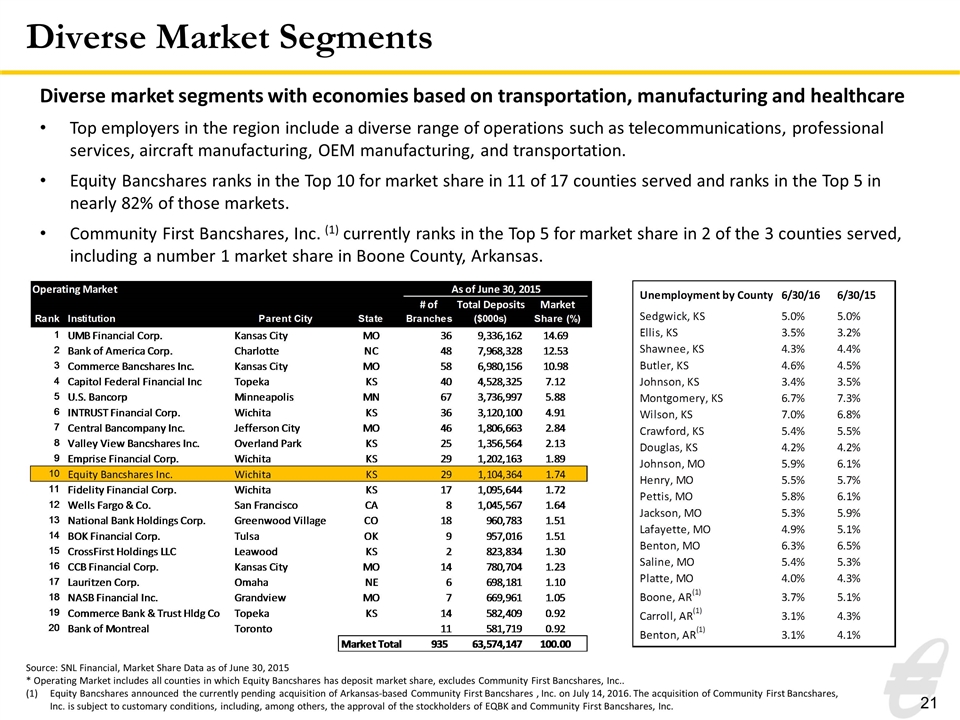

Diverse Market Segments Source: SNL Financial, Market Share Data as of June 30, 2015 * Operating Market includes all counties in which Equity Bancshares has deposit market share, excludes Community First Bancshares, Inc.. Equity Bancshares announced the currently pending acquisition of Arkansas-based Community First Bancshares , Inc. on July 14, 2016. The acquisition of Community First Bancshares, Inc. is subject to customary conditions, including, among others, the approval of the stockholders of EQBK and Community First Bancshares, Inc. Diverse market segments with economies based on transportation, manufacturing and healthcare Top employers in the region include a diverse range of operations such as telecommunications, professional services, aircraft manufacturing, OEM manufacturing, and transportation. Equity Bancshares ranks in the Top 10 for market share in 11 of 17 counties served and ranks in the Top 5 in nearly 82% of those markets. Community First Bancshares, Inc. (1) currently ranks in the Top 5 for market share in 2 of the 3 counties served, including a number 1 market share in Boone County, Arkansas.

Market Data Demographics Kansas Missouri Arkansas(1) National Current Population (2016) 2,919,372 6,091,286 2,980,520 322,431,073 Historical Population Change (2011-2016) 1.9% 1.3% 1.6% 3.8% Median Household Income (2016) $54,275 $49,314 $43,316 $49,726 Household Income Change (2011-2016) 13.5% 9.6% 13.6% 11.7% July 2016 Unemployment Rate 4.1% 4.7% 3.9% 4.9% Source: The Nielsen Company & SNL Financial State of Arkansas, Boone, Carroll and Benton counties presented based on pending acquisition of Community First Bancshares, Inc. Boeing Cargill Meat Solutions Cessna Aircraft Co. Spirit AeroSystems Inc. Blue Cross and Blue Shield of Kansas Payless Shoe Source Hill’s Pet Nutrition Goodyear Tire Co. Jostens Publishing Hallmark Cards, Inc. H&R Block Honeywell Sprint Garmin Teva DST Systems Inc. Whiteman Airforce Base Stahl Specialty Co. Western Missouri Medical Center HaysMed Walmart FedEx Tyson Foods FlexSteel Wabash National Wichita St. University Pittsburg St. University Washburn University Fort Hays St. University University of Central Mo. University of Mo-KC KU – Edwards/Professional Major Employers in Equity Bank Footprint

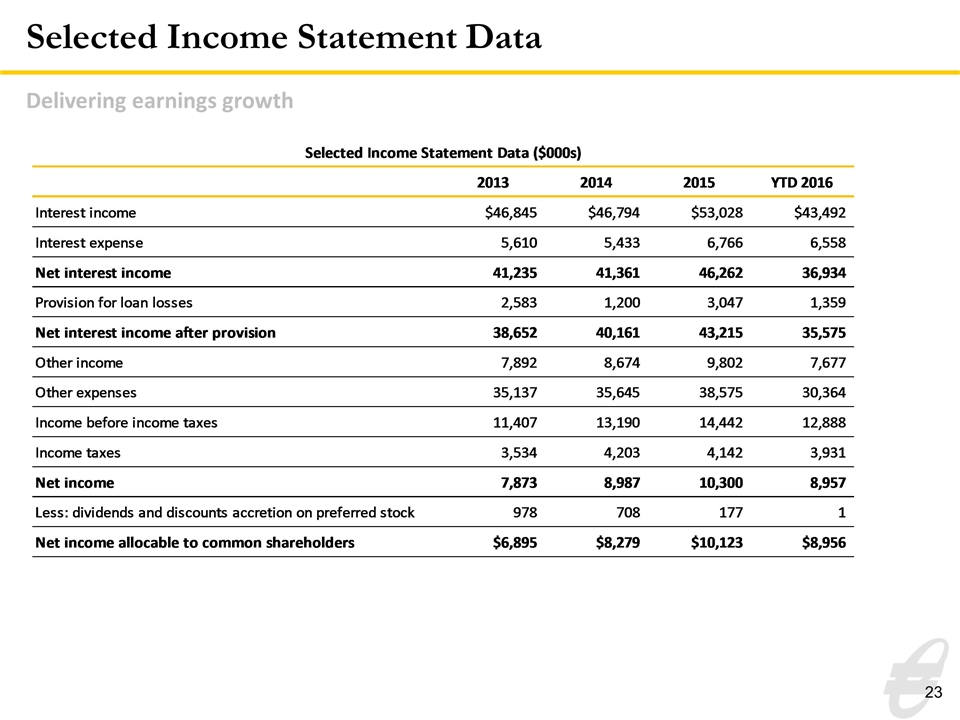

Selected Income Statement Data Delivering earnings growth Selected Income Statement Data ($000s) 2013 2014 2015 YTD 2016 Interest income $46,845 $46,794 $53,028 $43,492 Interest expense 5610 5433 6766 6558 Net interest income 41235 41361 46262 36934 Provision for loan losses 2583 1200 3047 1359 Net interest income after provision 38652 40161 43215 35575 Other income 7892 8674 9802 7677 Other expenses 35137 35645 38575 30364 Income before income taxes 11407 13190 14442 12888 Income taxes 3534 4203 4142 3931 Net income 7873 8987 10300 8957 Less: dividends and discounts accretion on preferred stock 978 708 177 1 Net income allocable to common shareholders $6,895 $8,279 $10,123 $8,956

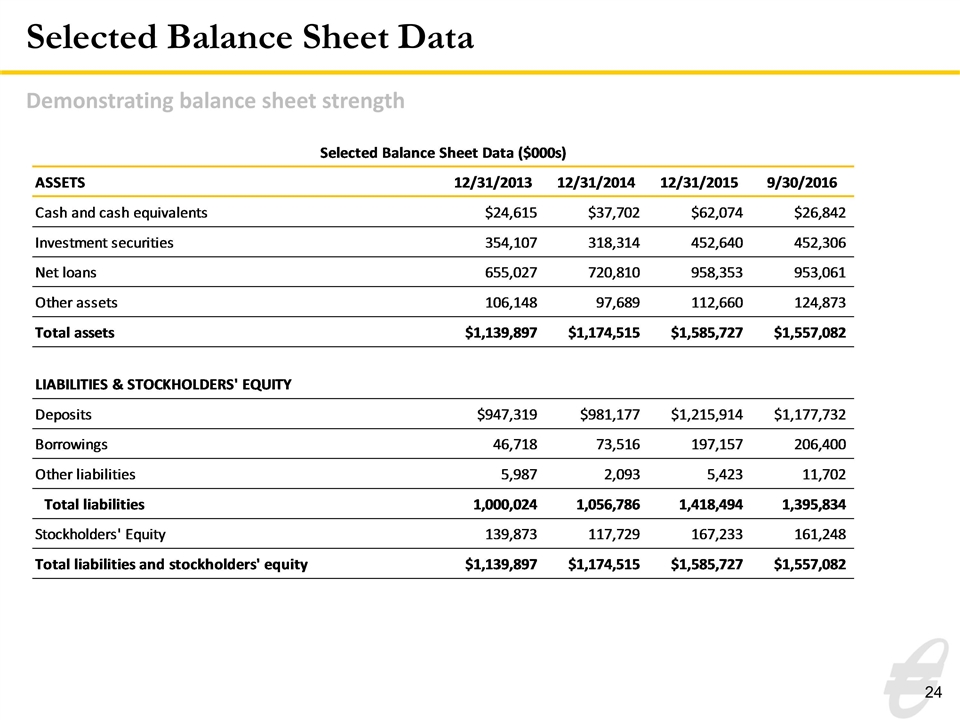

Selected Balance Sheet Data Demonstrating balance sheet strength Selected Balance Sheet Data ($000s) ASSETS 41639 42004 42369 42643 Cash and cash equivalents $24,615 $37,702 $62,074 $26,842 Investment securities 354107 318314 452640 452306 Net loans 655027 720810 958353 953061 Other assets 106148 97689 112660 124873 Total assets $1,139,897 $1,174,515 $1,585,727 $1,557,082 LIABILITIES & STOCKHOLDERS' EQUITY Deposits $,947,319 $,981,177 $1,215,914 $1,177,732 Borrowings 46718 73516 197157 206400 Other liabilities 5987 2093 5423 11702 Total liabilities 1000024 1056786 1418494 1395834 Stockholders' Equity 139873 117729 167233 161248 Total liabilities and stockholders' equity $1,139,897 $1,174,515 $1,585,727 $1,557,082

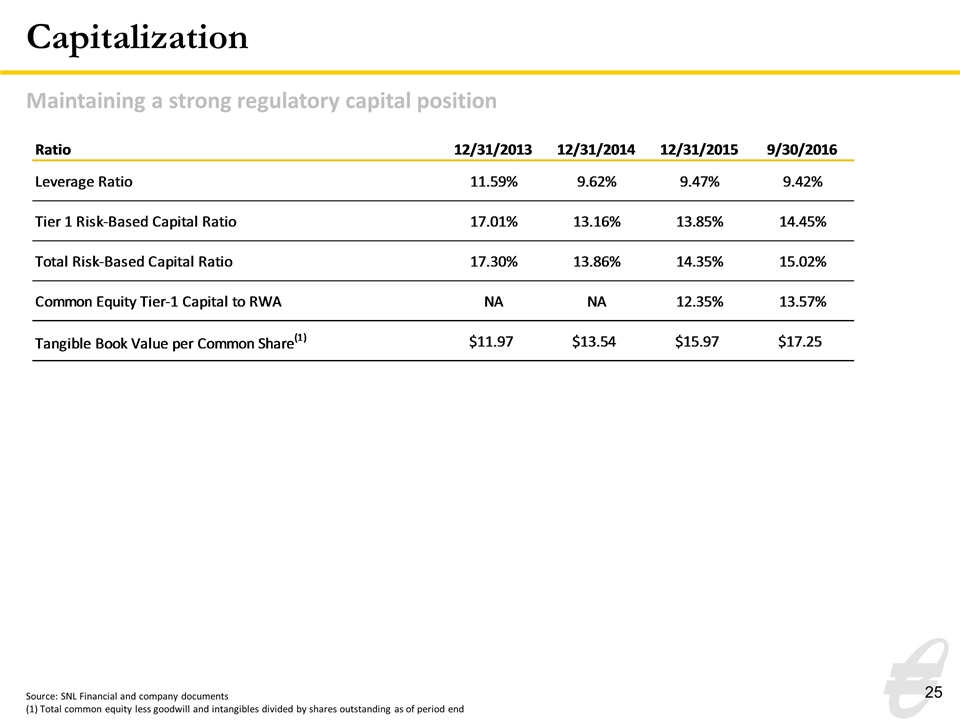

Capitalization Source: SNL Financial and company documents (1) Total common equity less goodwill and intangibles divided by shares outstanding as of period end Maintaining a strong regulatory capital position Ratio 41639 42004 42369 42643 Leverage Ratio 0.1159 9.6199999999999994E-2 9.4700000000000006E-2 9.4200000000000006E-2 Tier 1 Risk-Based Capital Ratio 0.1701 0.13159999999999999 0.13850000000000001 0.14449999999999999 Total Risk-Based Capital Ratio 0.17299999999999999 0.1386 0.14349999999999999 0.1502 Common Equity Tier-1 Capital to RWA NA NA 0.1235 0.13569999999999999 Tangible Book Value per Common Share(1) $11.97 $13.54 $15.97 $17.25

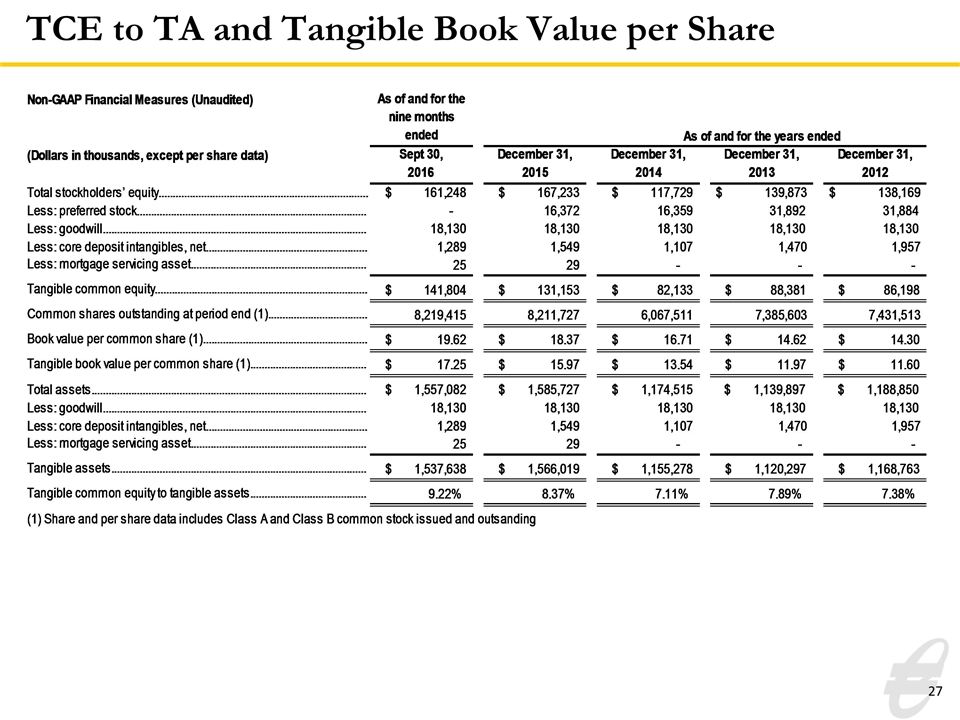

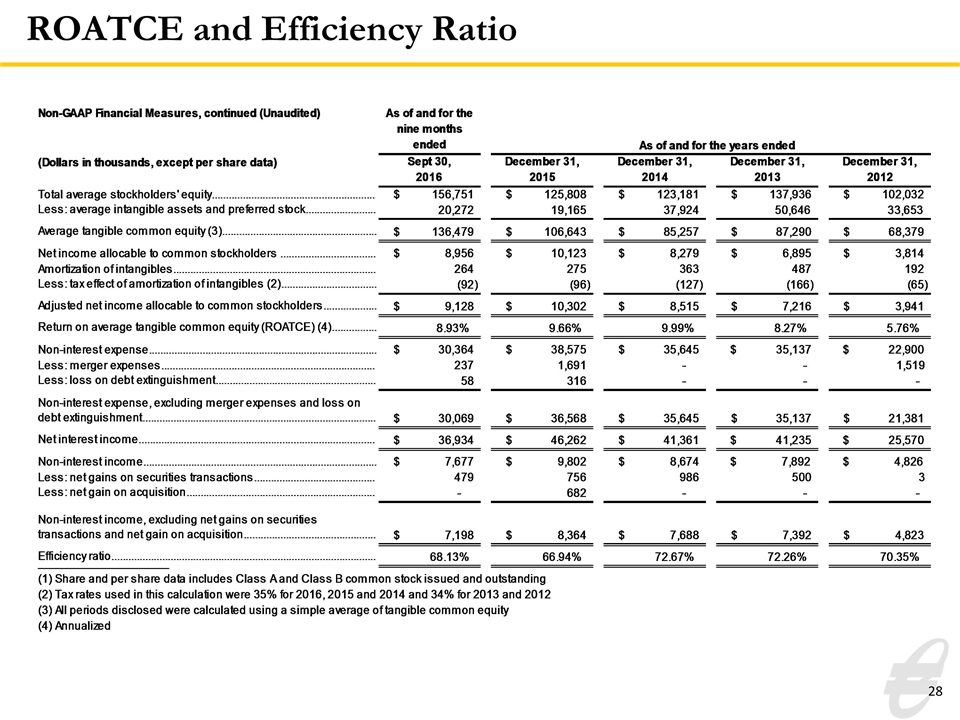

The subsequent tables present non-GAAP reconciliations of the following calculations: Tangible Common Equity (TCE) to Tangible Assets (TA) ratio Tangible Book Value per Common Share Return on average tangible common equity (ROATCE) Efficiency Ratio

TCE to TA and Tangible Book Value per Share Non-GAAP Financial Measures (Unaudited) As of and for the nine months ended As of and for the years ended (Dollars in thousands, except per share data) Sept 30, 2016 December 31,2015 December 31,2014 December 31,2013 December 31,2012 2011 Total stockholders’ equity $,161,248 $,167,233 $,117,729 $,139,873 $,138,169 $80,816 Less: preferred stock 0 16,372 16,359 31,892 31,884 16,337 Less: goodwill 18,130 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,289 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 25 29 0 0 0 0 Tangible common equity $,141,804 $,131,153 $82,133 $88,381 $86,198 $50,559 Common shares outstanding at period end (1) 8,219,415 8,211,727 6,067,511 7,385,603 7,431,513 4,550,206 Book value per common share (1) $19.617941179512169 $18.371409570727327 $16.707015446696349 $14.620471747533681 $14.301932863469389 $14.170567222670797 Tangible book value per common share (1) $17.252322701798121 $15.971427204046117 $13.536522636712155 $11.966660000544303 $11.598983948490705 $11.111365067867256 Total assets $1,557,082 $1,585,727 $1,174,515 $1,139,897 $1,188,850 $,609,998 Less: goodwill 18,130 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,289 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 25 29 0 0 0 0 Tangible assets $1,537,638 $1,566,019 $1,155,278 $1,120,297 $1,168,763 $,596,078 Tangible common equity to tangible assets 9.2221966418623888E-2 8.3749303169374067E-2 7.1093710777838756E-2 7.8890687023173325E-2 7.3751479127932701E-2 8.481943638248686E-2 (1) Share and per share data includes Class A and Class B common stock issued and outsanding Non-GAAP Financial Measures, continued (Unaudited) As of and for the three months ended As of and for the years ended (Dollars in thousands, except per share data) March 31, 2016 December 31,2015 December 31,2014 December 31,2013 December 31,2012 2011 Total average stockholders' equity $,153,929 $,137,936 $,123,174 $,137,913 $,102,032 $75,253 Less: average intangible assets and preferred stock 20,616 31,294 37,917 50,623 33,653 25,148 Average tangible common equity (1) (3) $,133,313 $,106,642 $85,257 $87,290 $68,379 $50,105 Net income allocable to common stockholders (1) 3,439 10,123 8,279 6,895 3,814 1,371 Amortization of core deposit intangible 87 275 363 487 192 182 Less: tax effect of amortization of core deposit intangible (2) -30 -96 -,127 -,166 -65 -62 Adjusted net income allocable to common stockholders $3,496 $10,302 $8,515 $7,216 $3,941 $1,491 Return on average tangible common equity (ROATCE) 0.10547234826937482 9.6603589580090396E-2 9.98744971087418E-2 8.2666972161759653E-2 5.7634653914213428E-2 2.9757509230615709E-2 Non-interest expense $9,689 $38,575 $35,645 $35,137 $22,900 $15,918 Less: merger expenses 0 1,691 0 0 1,519 0 Less: loss on debt extinguishment 58 316 0 0 0 0 Non-interest expense, excluding merger expenses and loss on debt extinguishment $9,631 $36,568 $35,645 $35,137 $21,381 $15,918 Net interest income $12,758 $46,262 $41,361 $41,235 $25,570 $17,890 Non-interest income $2,697 $9,802 $8,674 $7,892 $4,826 $2,252 Less: net gains on sales and settlement of securities 420 756 986 500 3 425 Less: net gain on acquisition 0 682 0 0 0 0 Non-interest income, excluding net gains on sales and settlement of securities and net gain on acquisition $2,277 $8,364 $7,688 $7,392 $4,823 $1,827 Efficiency ratio 0.64057199866977055 0.6694248160216747 0.72672225733450224 0.72258210459209904 0.70348435495015305 0.8073236293553786 ____________________ (1) Share and per share data includes Class A and Class B common stock issued and outstanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity

ROATCE and Efficiency Ratio Non-GAAP Financial Measures (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) 2015 2015 2014 2013 2012 2011 Total stockholders’ equity $,167,232 $,167,232 $,117,729 $,139,873 $,138,169 $80,816 Less: preferred stock 16,372 16,372 16,359 31,892 31,884 16,337 Less: goodwill 18,130 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 29 0 0 0 0 Tangible common equity $,131,152 $,131,152 $82,133 $88,381 $86,198 $50,559 Common shares outstanding at period end (1) 8,211,727 8,211,727 6,067,511 7,385,603 7,431,513 4,550,206 Book value per common share $18.371287793663868 $18.371287793663868 $16.707015446696349 $14.620471747533681 $14.301932863469389 $14.170567222670797 Tangible book value per common share $15.971305426982656 $15.971305426982656 $13.536522636712155 $11.966660000544303 $11.598983948490705 $11.111365067867256 Total assets $1,585,727 $1,585,727 $1,174,515 $1,139,897 $1,188,850 $,609,998 Less: goodwill 18,130 18,130 18,130 18,130 18,130 13,147 Less: core deposit intangibles, net 1,549 1,549 1,107 1,470 1,957 773 Less: mortgage servicing asset 29 29 0 0 0 0 Tangible assets $1,566,019 $1,566,019 $1,155,278 $1,120,297 $1,168,763 $,596,078 Tangible common equity to tangible assets 8.3748664607517537E-2 8.3748664607517537E-2 7.1093710777838756E-2 7.8890687023173325E-2 7.3751479127932701E-2 8.481943638248686E-2 (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity Non-GAAP Financial Measures, continued (Unaudited) As of and for the nine months ended As of and for the years ended (Dollars in thousands, except per share data) Sept 30, 2016 December 31,2015 December 31,2014 December 31,2013 December 31,2012 2011 Total average stockholders' equity $,156,751 $,125,808 $,123,181 $,137,936 $,102,032 $75,253 Less: average intangible assets and preferred stock 20,272 19,165 37,924 50,646 33,653 25,148 Average tangible common equity (3) $,136,479 $,106,643 $85,257 $87,290 $68,379 $50,105 Net income allocable to common stockholders $8,956 $10,123 $8,279 $6,895 $3,814 1,371 Amortization of intangibles 264 275 363 487 192 182 Less: tax effect of amortization of intangibles (2) -92 -96 -,127 -,166 -65 -62 Adjusted net income allocable to common stockholders $9,128 $10,302 $8,515 $7,216 $3,941 $1,491 Return on average tangible common equity (ROATCE) (4) 8.933884269674279E-2 9.6602683720450472E-2 9.98744971087418E-2 8.2666972161759653E-2 5.7634653914213428E-2 2.98E-2 Non-interest expense $30,364 $38,575 $35,645 $35,137 $22,900 $15,918 Less: merger expenses 237 1,691 0 0 1,519 - Less: loss on debt extinguishment 58 316 0 0 0 - Non-interest expense, excluding merger expenses and loss on debt extinguishment $30,069 $36,568 $35,645 $35,137 $21,381 $15,918 Net interest income $36,934 $46,262 $41,361 $41,235 $25,570 $17,890 Non-interest income $7,677 $9,802 $8,674 $7,892 $4,826 $2,252 Less: net gains on securities transactions 479 756 986 500 3 425 Less: net gain on acquisition 0 682 0 0 0 - Non-interest income, excluding net gains on securities transactions and net gain on acquisition $7,198 $8,364 $7,688 $7,392 $4,823 $1,827 Efficiency ratio 0.68134233662648414 0.6694248160216747 0.72672225733450224 0.72258210459209904 0.70348435495015305 0.80730000000000002 ____________________ (1) Share and per share data includes Class A and Class B common stock issued and outstanding (2) Tax rates used in this calculation were 35% for 2016, 2015 and 2014 and 34% for 2013 and 2012 (3) All periods disclosed were calculated using a simple average of tangible common equity (4) Annualized

investor.equitybank.com