Third Quarter 2020 Results Presentation October 21, 2020 Exhibit 99.2

Disclaimers Special Note Concerning Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include COVID-19 related impacts; competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses; and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 10, 2020, and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, such as COVID-19, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding.

EQBK’s Value Proposition Market Diversification and Strategy for Growth Conservative Credit Culture and Effective Risk Management and Mitigation Robust Funding Capacity, Anchored by a Diverse, Low-Cost Deposit Base Experienced and Invested Management Team Focus on Efficient Performance Throughout our Diversified Business Lines

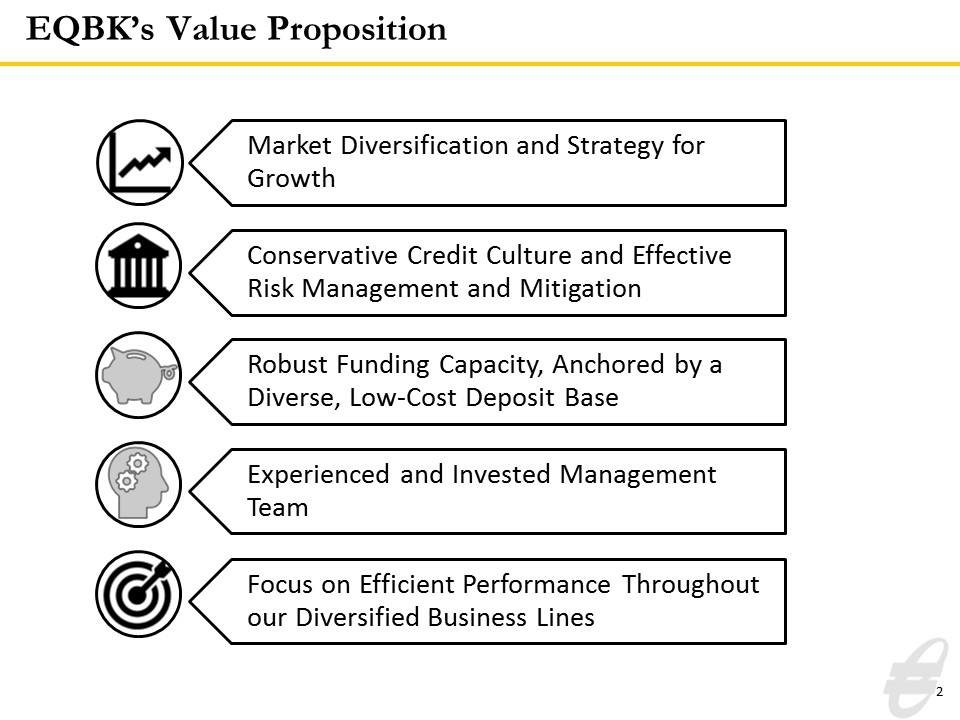

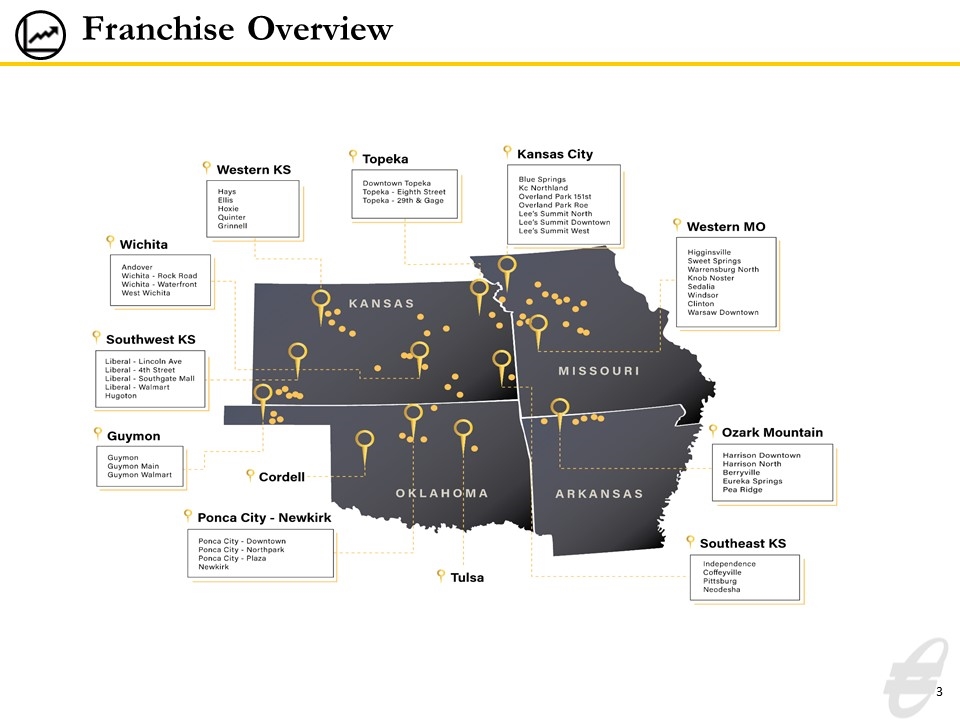

Franchise Overview

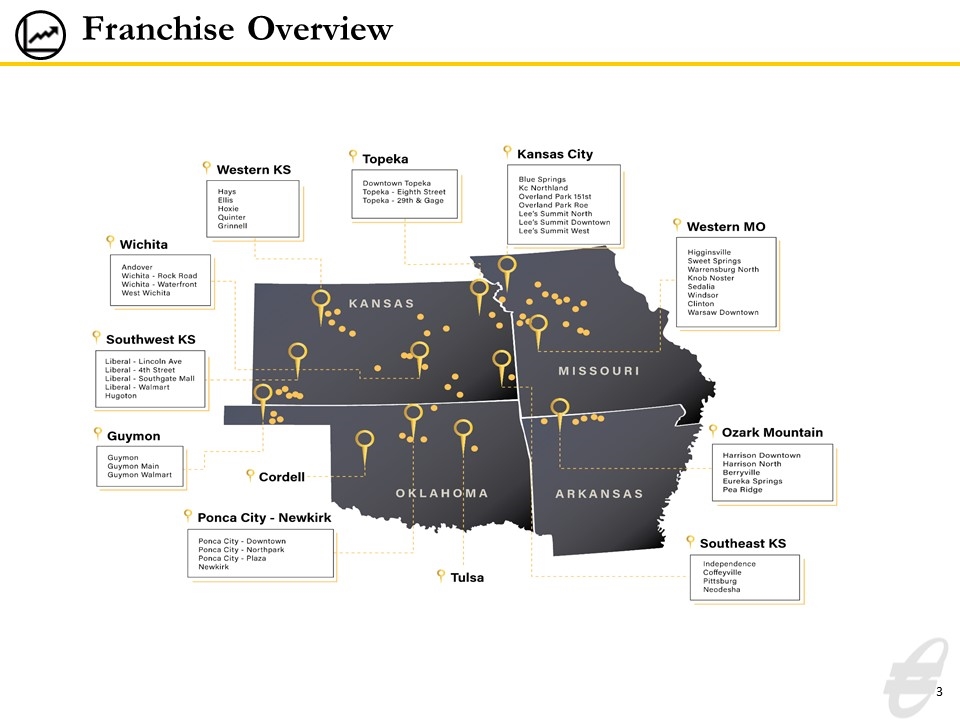

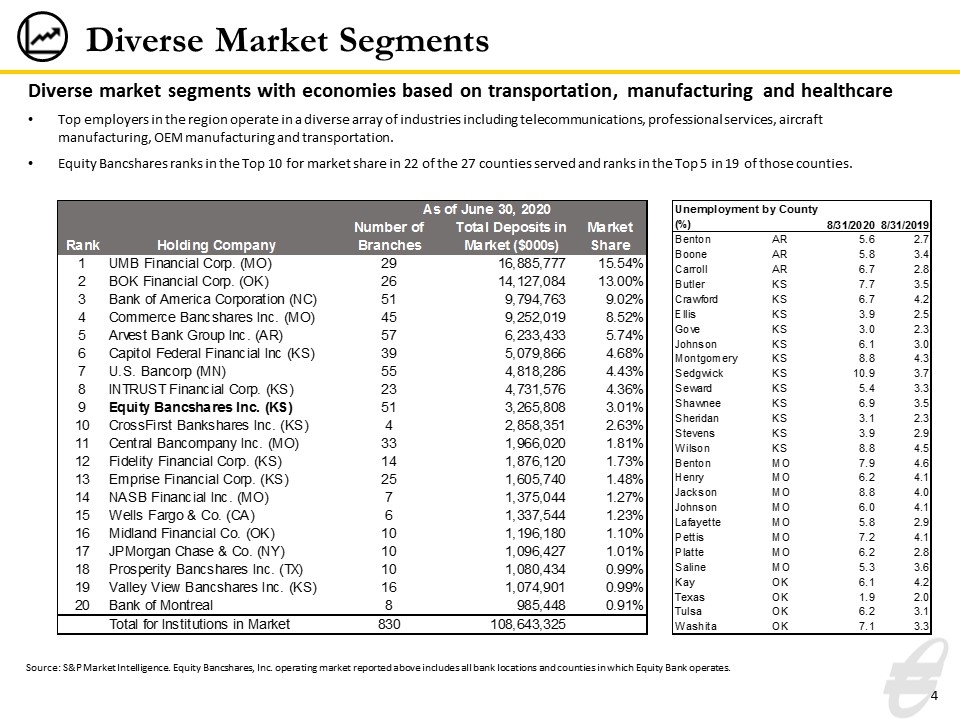

Diverse Market Segments Source: S&P Market Intelligence. Equity Bancshares, Inc. operating market reported above includes all bank locations and counties in which Equity Bank operates. Diverse market segments with economies based on transportation, manufacturing and healthcare Top employers in the region operate in a diverse array of industries including telecommunications, professional services, aircraft manufacturing, OEM manufacturing and transportation. Equity Bancshares ranks in the Top 10 for market share in 22 of the 27 counties served and ranks in the Top 5 in 19 of those counties.

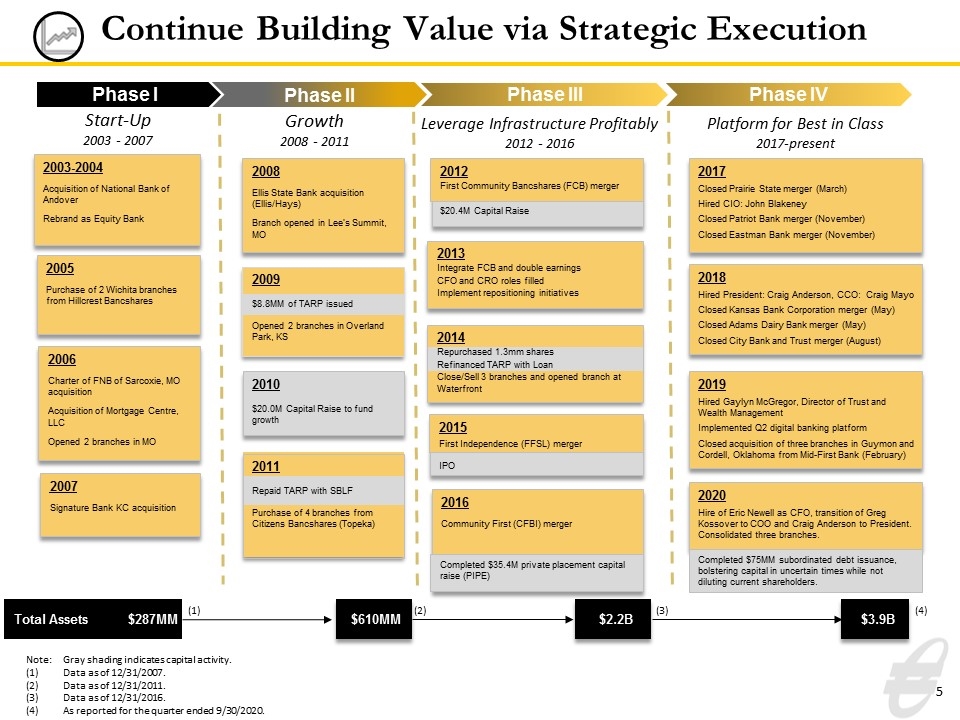

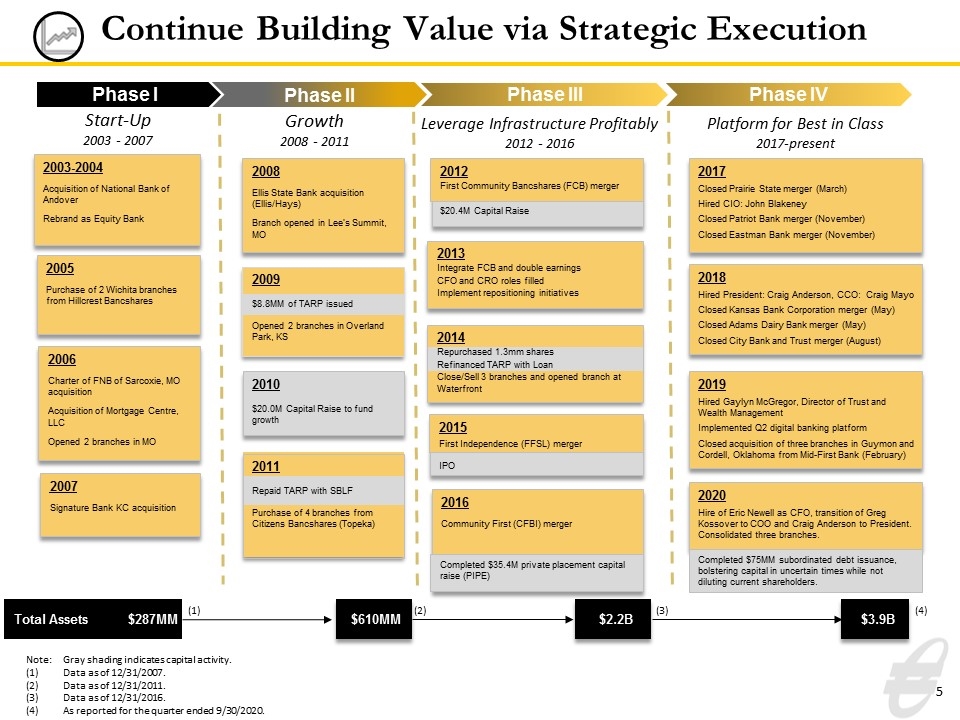

Continue Building Value via Strategic Execution 2009 $8.8MM of TARP issued Opened 2 branches in Overland Park, KS 2014 Repurchased 1.3mm shares Refinanced TARP with Loan Close/Sell 3 branches and opened branch at Waterfront 2012 First Community Bancshares (FCB) merger $20.4M Capital Raise 2011 Repaid TARP with SBLF Purchase of 4 branches from Citizens Bancshares (Topeka) 2003-2004 Acquisition of National Bank of Andover Rebrand as Equity Bank 2005 Purchase of 2 Wichita branches from Hillcrest Bancshares 2006 Charter of FNB of Sarcoxie, MO acquisition Acquisition of Mortgage Centre, LLC Opened 2 branches in MO 2008 Ellis State Bank acquisition (Ellis/Hays) Branch opened in Lee’s Summit, MO 2010 $20.0M Capital Raise to fund growth 2013 Integrate FCB and double earnings CFO and CRO roles filled Implement repositioning initiatives 2007 Signature Bank KC acquisition Phase I Phase II Phase III Start-Up 2003 - 2007 Growth 2008 - 2011 Leverage Infrastructure Profitably 2012 - 2016 2015 First Independence (FFSL) merger IPO 2016 Community First (CFBI) merger Completed $35.4M private placement capital raise (PIPE) Phase IV Platform for Best in Class 2017-present 2017 Closed Prairie State merger (March) Hired CIO: John Blakeney Closed Patriot Bank merger (November) Closed Eastman Bank merger (November) $2.2B Total Assets $287MM $610MM (1) (2) (3) $3.9B (4) 2018 Hired President: Craig Anderson, CCO: Craig Mayo Closed Kansas Bank Corporation merger (May) Closed Adams Dairy Bank merger (May) Closed City Bank and Trust merger (August) 2019 Hired Gaylyn McGregor, Director of Trust and Wealth Management Implemented Q2 digital banking platform Closed acquisition of three branches in Guymon and Cordell, Oklahoma from Mid-First Bank (February) 2020 Hire of Eric Newell as CFO, transition of Greg Kossover to COO and Craig Anderson to President. Consolidated three branches. Note:Gray shading indicates capital activity. (1)Data as of 12/31/2007. (2)Data as of 12/31/2011. (3)Data as of 12/31/2016. (4)As reported for the quarter ended 9/30/2020. Completed $75MM subordinated debt issuance, bolstering capital in uncertain times while not diluting current shareholders.

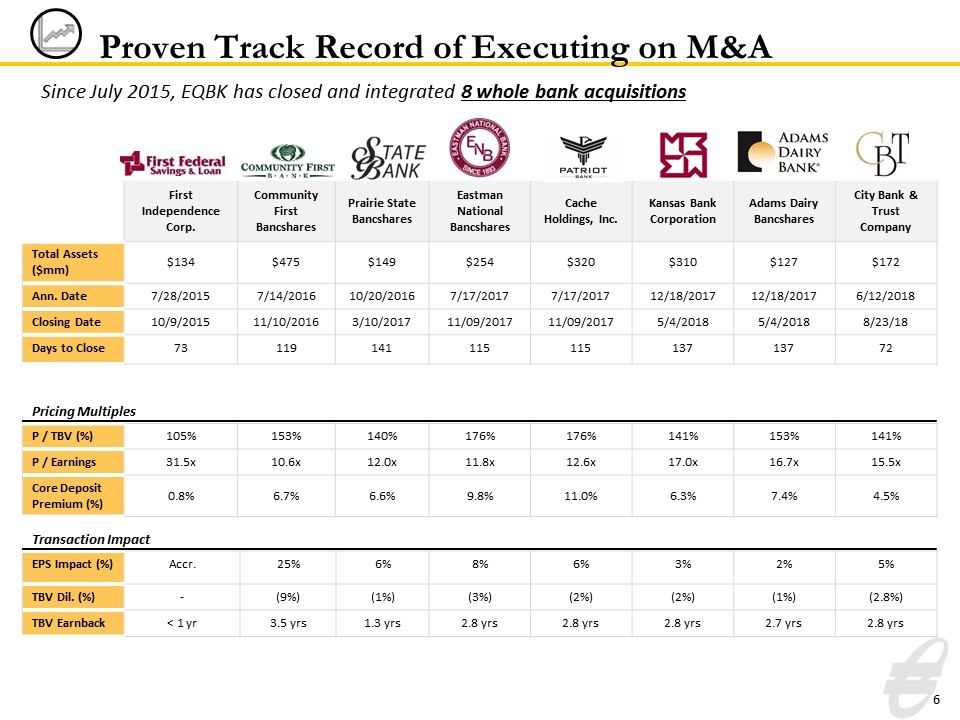

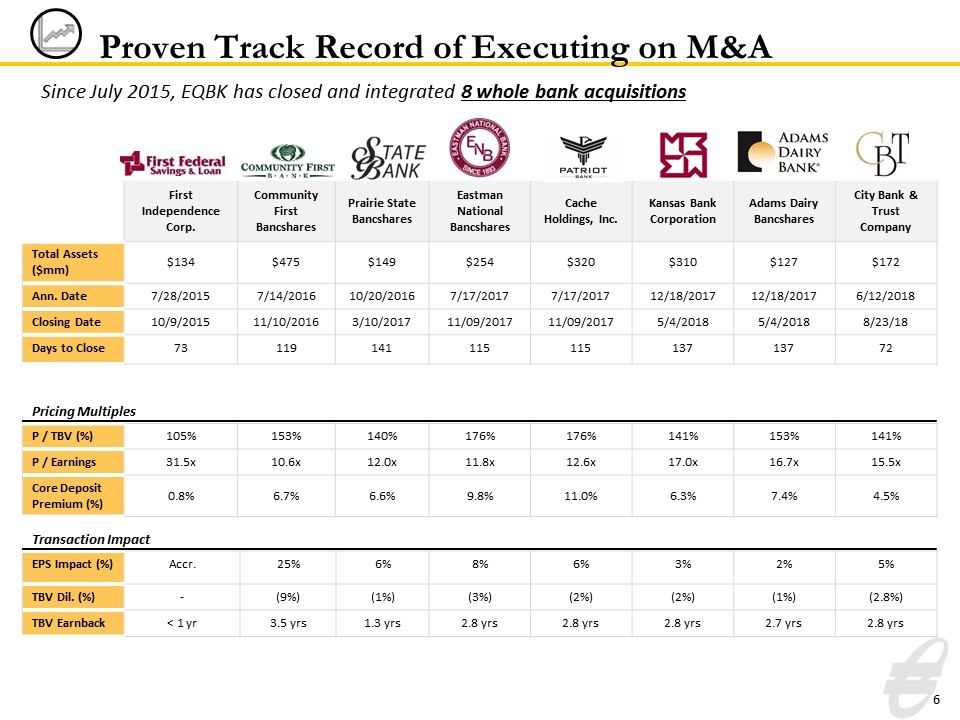

Proven Track Record of Executing on M&A Since July 2015, EQBK has closed and integrated 8 whole bank acquisitions First Independence Corp. Community First Bancshares Prairie State Bancshares Eastman National Bancshares Cache Holdings, Inc. Kansas Bank Corporation Adams Dairy Bancshares City Bank & Trust Company Total Assets ($mm) $134 $475 $149 $254 $320 $310 $127 $172 Ann. Date 7/28/2015 7/14/2016 10/20/2016 7/17/2017 7/17/2017 12/18/2017 12/18/2017 6/12/2018 Closing Date 10/9/2015 11/10/2016 3/10/2017 11/09/2017 11/09/2017 5/4/2018 5/4/2018 8/23/18 Days to Close 73 119 141 115 115 137 137 72 P / TBV (%) 105% 153% 140% 176% 176% 141% 153% 141% P / Earnings 31.5x 10.6x 12.0x 11.8x 12.6x 17.0x 16.7x 15.5x Core Deposit Premium (%) 0.8% 6.7% 6.6% 9.8% 11.0% 6.3% 7.4% 4.5% Pricing Multiples EPS Impact (%) Accr. 25% 6% 8% 6% 3% 2% 5% TBV Dil. (%) - (9%) (1%) (3%) (2%) (2%) (1%) (2.8%) TBV Earnback < 1 yr 3.5 yrs 1.3 yrs 2.8 yrs 2.8 yrs 2.8 yrs 2.7 yrs 2.8 yrs Transaction Impact

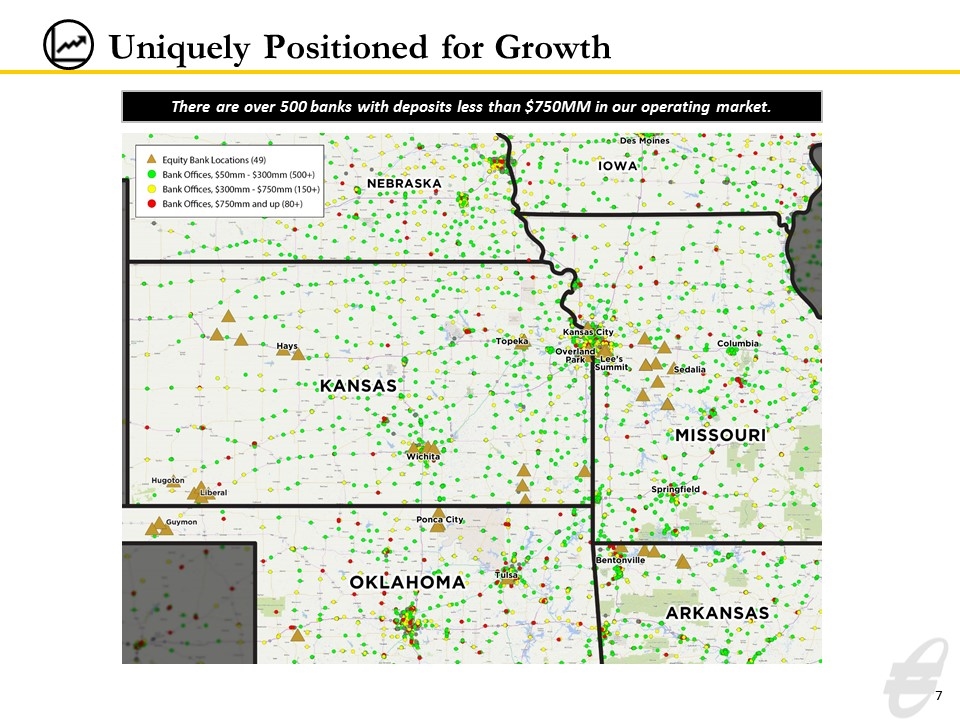

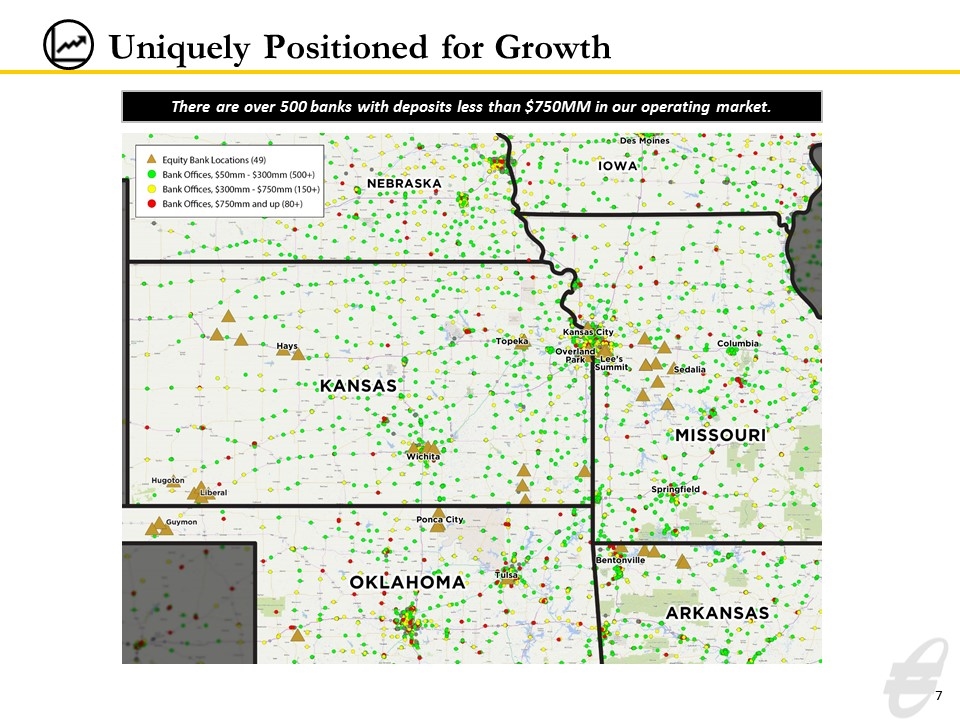

Uniquely Positioned for Growth There are over 500 banks with deposits less than $750MM in our operating market.

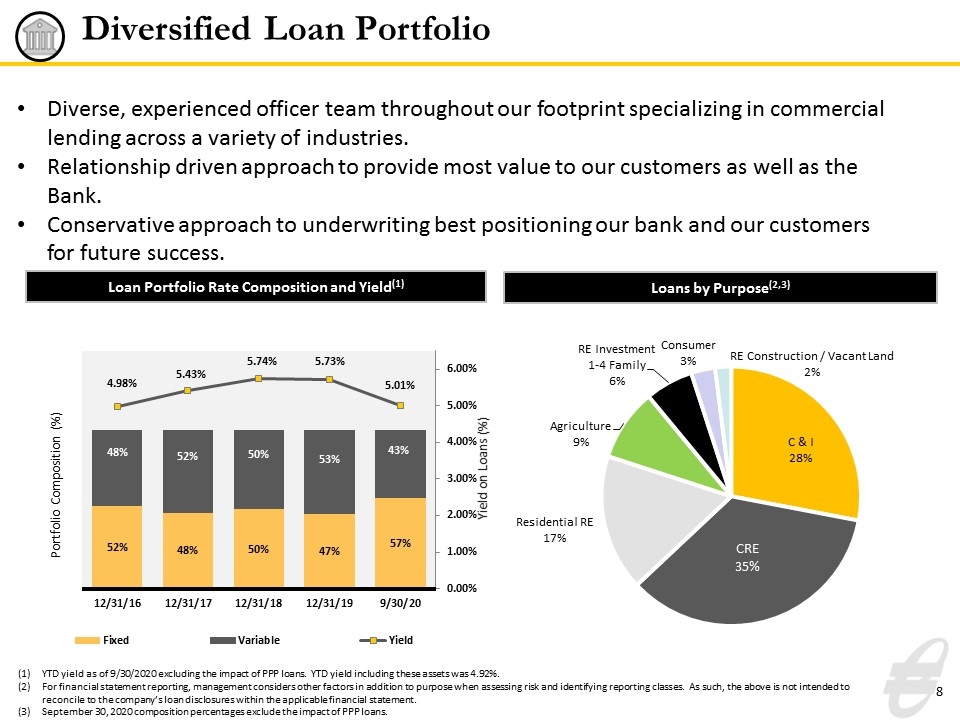

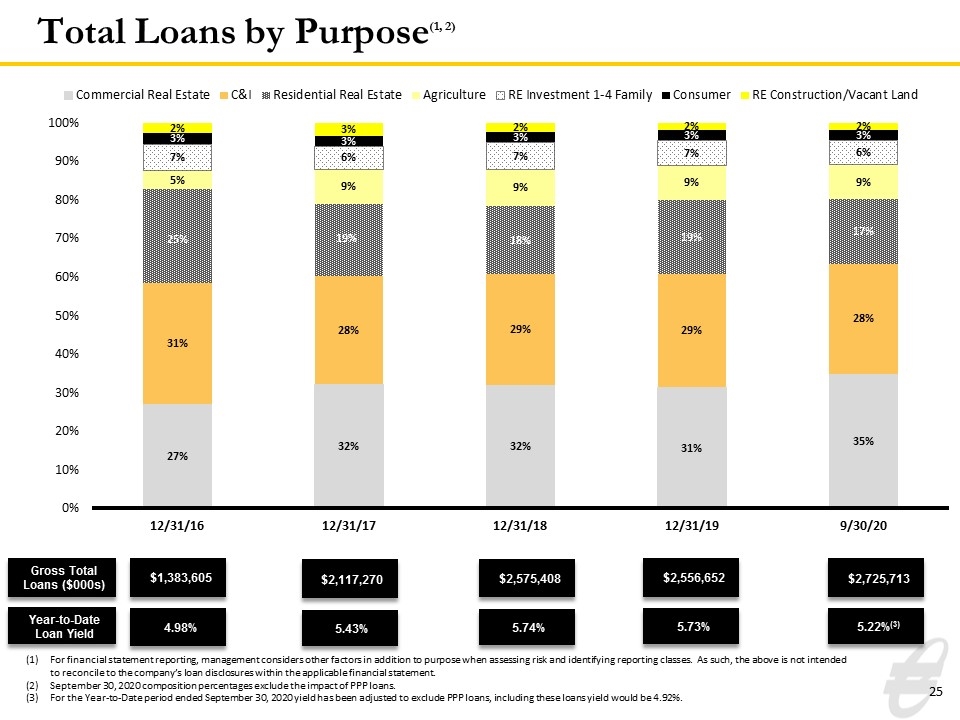

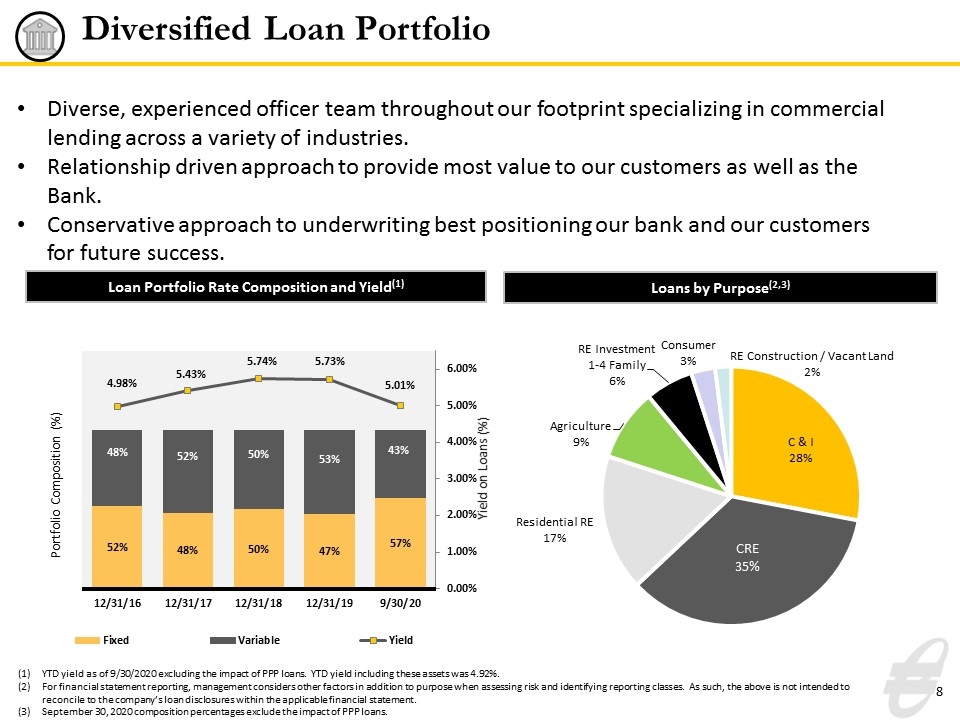

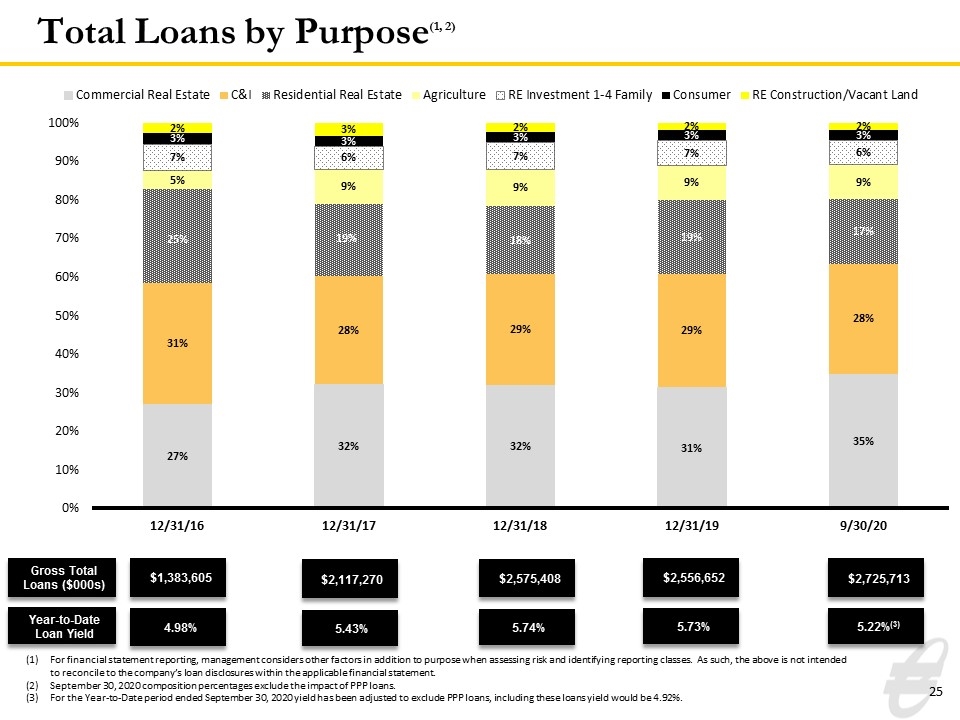

Diversified Loan Portfolio Diverse, experienced officer team throughout our footprint specializing in commercial lending across a variety of industries. Relationship driven approach to provide most value to our customers as well as the Bank. Conservative approach to underwriting best positioning our bank and our customers for future success. Loan Portfolio Rate Composition and Yield(1) Loans by Purpose(2,3) YTD yield as of 9/30/2020 excluding the impact of PPP loans. YTD yield including these assets was 4.92%. For financial statement reporting, management considers other factors in addition to purpose when assessing risk and identifying reporting classes. As such, the above is not intended to reconcile to the company’s loan disclosures within the applicable financial statement. September 30, 2020 composition percentages exclude the impact of PPP loans.

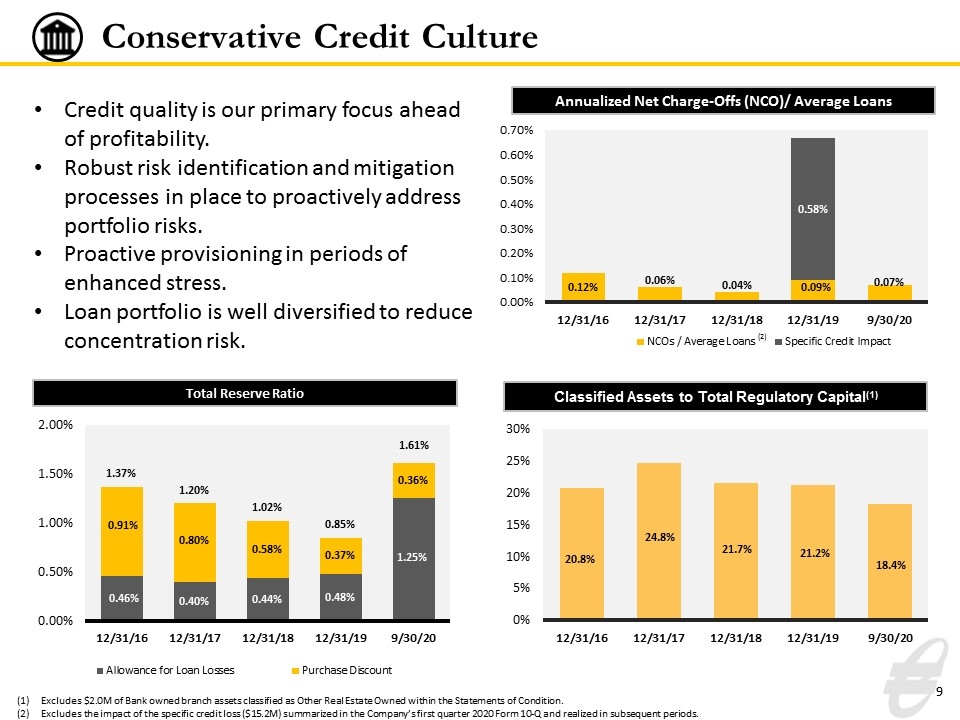

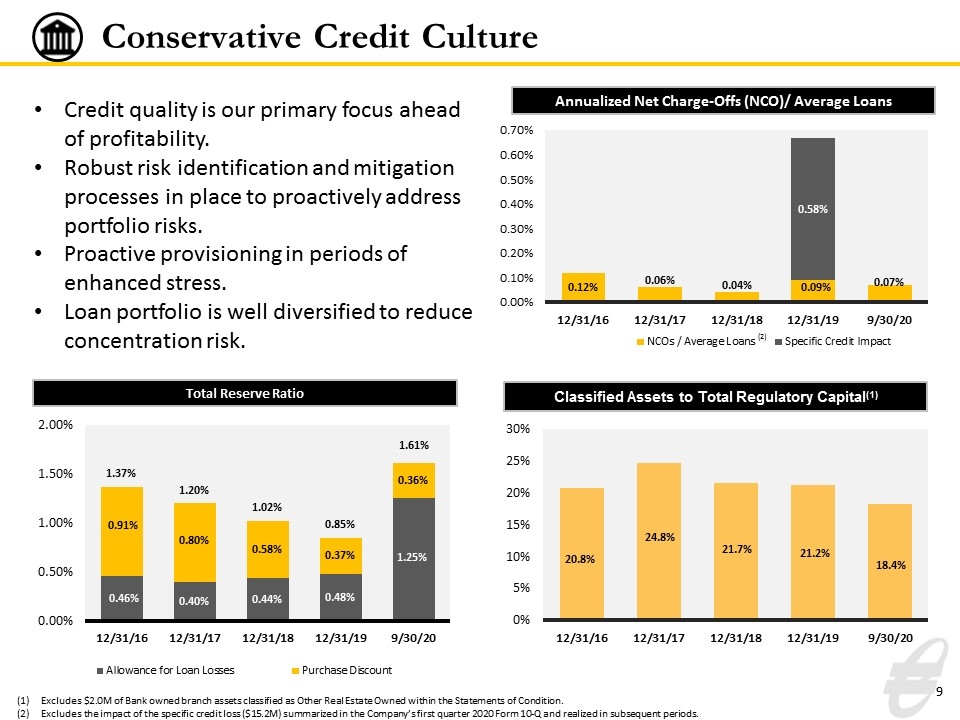

Conservative Credit Culture Annualized Net Charge-Offs (NCO)/ Average Loans ($ in millions) Total Reserve Ratio Classified Assets to Total Regulatory Capital(1) Credit quality is our primary focus ahead of profitability. Robust risk identification and mitigation processes in place to proactively address portfolio risks. Proactive provisioning in periods of enhanced stress. Loan portfolio is well diversified to reduce concentration risk. Excludes $2.0M of Bank owned branch assets classified as Other Real Estate Owned within the Statements of Condition. Excludes the impact of the specific credit loss ($15.2M) summarized in the Company’s first quarter 2020 Form 10-Q and realized in subsequent periods.

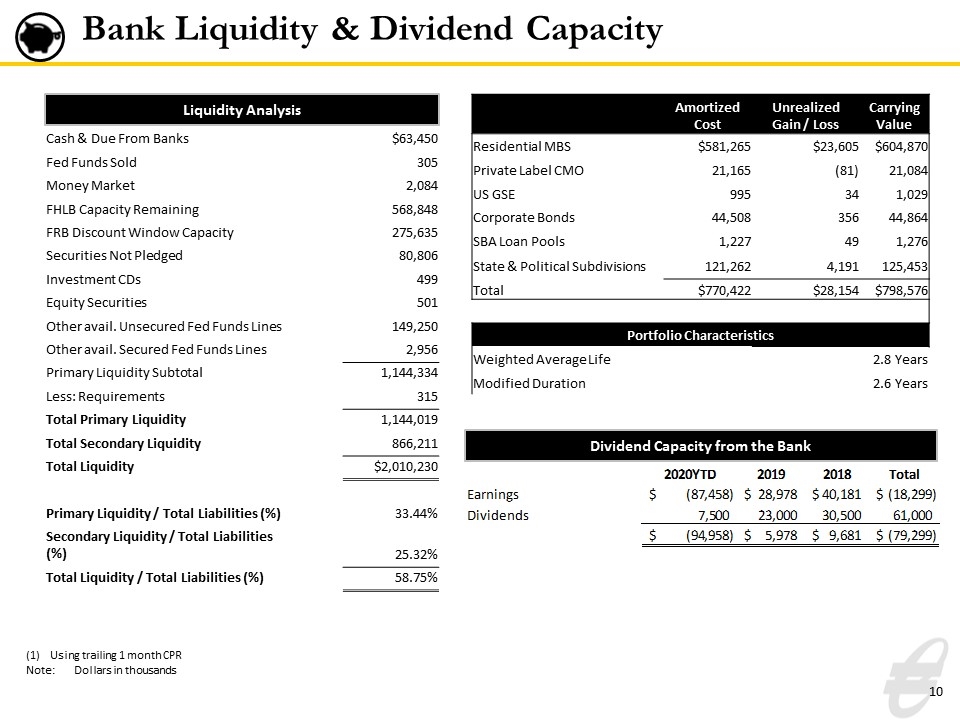

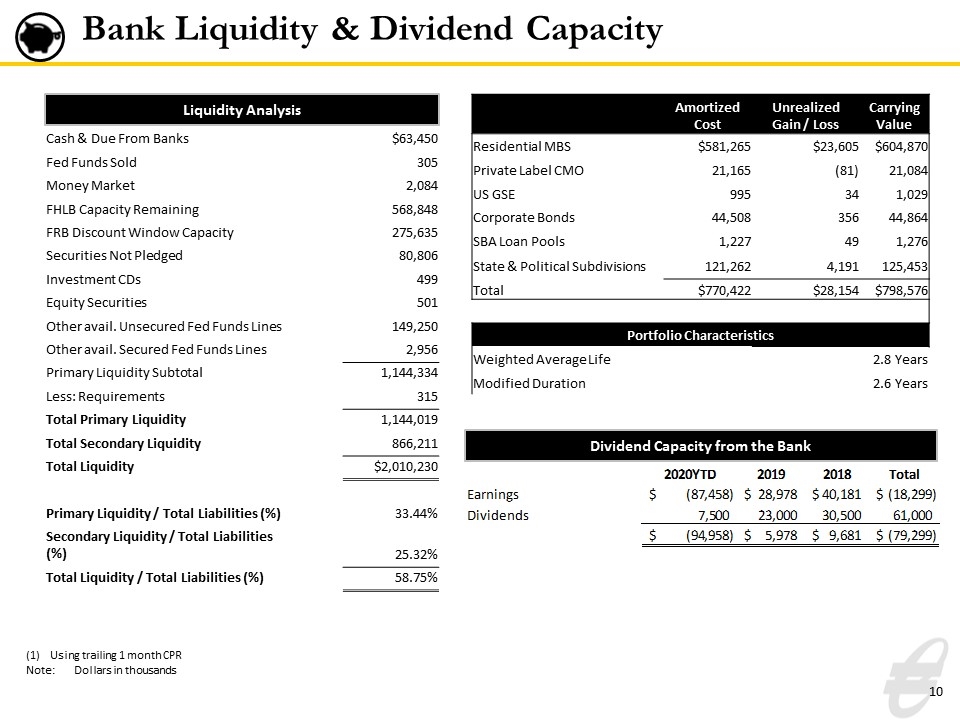

Bank Liquidity & Dividend Capacity Liquidity Analysis Using trailing 1 month CPR Note:Dollars in thousands Dividend Capacity from the Bank Amortized Cost Unrealized Gain / Loss Carrying Value Carrying Value Residential MBS $581,265 $23,605 $604,870 Private Label CMO 21,165 (81) 21,084 US GSE 995 34 1,029 Corporate Bonds 44,508 356 44,864 SBA Loan Pools 1,227 49 1,276 State & Political Subdivisions 121,262 4,191 125,453 Total $770,422 $28,154 $798,576 Portfolio Characteristics Weighted Average Life 2.8 Years Modified Duration 2.6 Years Cash & Due From Banks $63,450 Fed Funds Sold 305 Money Market 2,084 FHLB Capacity Remaining 568,848 FRB Discount Window Capacity 275,635 Securities Not Pledged 80,806 Investment CDs 499 Equity Securities 501 Other avail. Unsecured Fed Funds Lines 149,250 Other avail. Secured Fed Funds Lines 2,956 Primary Liquidity Subtotal 1,144,334 Less: Requirements 315 Total Primary Liquidity 1,144,019 Total Secondary Liquidity 866,211 Total Liquidity $2,010,230 Primary Liquidity / Total Liabilities (%) 33.44% Secondary Liquidity / Total Liabilities (%) 25.32% Total Liquidity / Total Liabilities (%) 58.75% Liquidity Analysis $ in thousands Amortized Cost Gain / Loss Fair Value Carrying Value Residential MBS - AFS Cash & Due From Banks $63,450 Residential MBS - HTM Fed Funds Sold 305 US GSEs Money Market 2084 Corporate Bonds FHLB Capacity Remaining 568848 SBA Loan Pools FRB Discount Window Capacity 275635 State & Political Subdivisions Securities Not Pledged 80806 Total $0 $0 $0 $0 Investment CDs 499 Equity Securities 501 Portfolio Characteristics Other avail. Unsecured Fed Funds Lines 149250 Weighted Average Life Other avail. Secured Fed Funds Lines 2956 Modified Duration Primary Liquidity Subtotal 1144334 Taxable Equivalent Yield1 Less: Requirements 315 Total Primary Liquidity 1144019 Total Secondary Liquidity 866211 Dividend Capacity from the Bank Total Liquidity $2,010,230 2020YTD 2019 2018 Total Primary Liquidity / Total Liabilities (%) 0.33439999999999998 Earnings $,-87,458 $28,978 $40,181 $,-18,299 Secondary Liquidity / Total Liabilities (%) 0.25319999999999998 Dividends 7500 23000 30500 61000 Total Liquidity / Total Liabilities (%) 0.58750000000000002 $,-94,958 $5,978 $9,681 $,-79,299 FHLB Capacity 785177000 FHLB Outstanding 216329000 FHLB Capacity Remaining 568848000 Total AFS Securities 798576 Pledged to FRB -68910 Pledged to Public Funds -588891 Pledged to Repo Agreements -51087 Pledged to BBOK secured Fed Funds -3284 Pledged to Other -5598 AFS Not Pledged 80806 Total HTM Securities Fair Market Value Adjustment HTM Securities Total Market Value HTM Securities FMV HTM pledged to FRB FMV HTM pledged to Public funds FMV HTM pledged to Repo agreements FMV HTM pledged to BBOK secured Fed Funds FMV HTM pledged to Other HTM Securities Not Pledged 0 Total Securities Not Pledged 80806 FRB Discount Window Line Outstanding Available FRB Discount Window 0

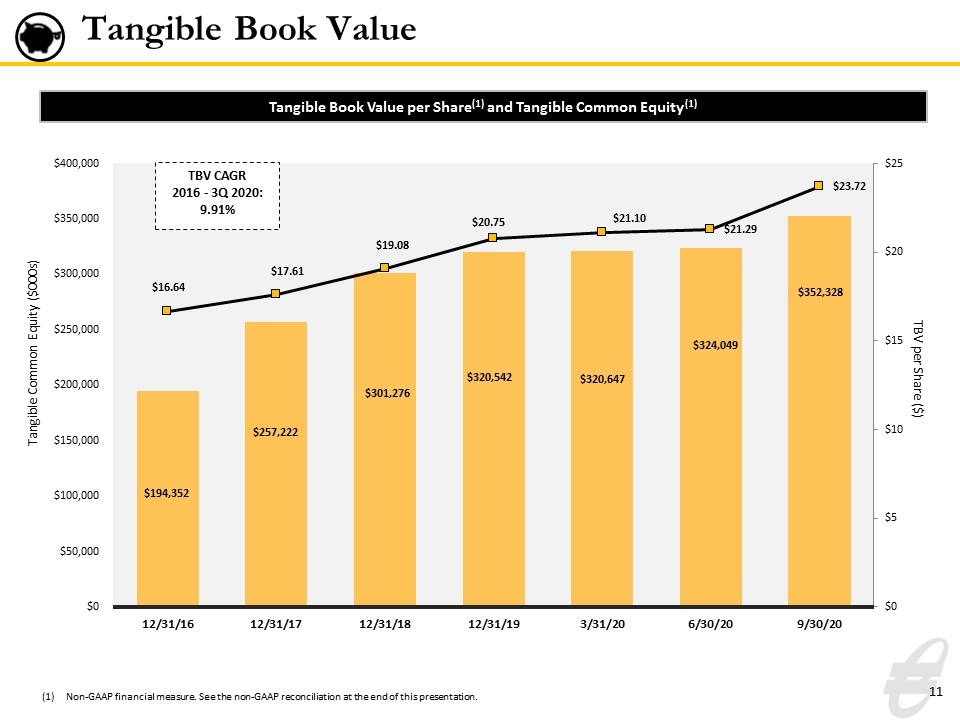

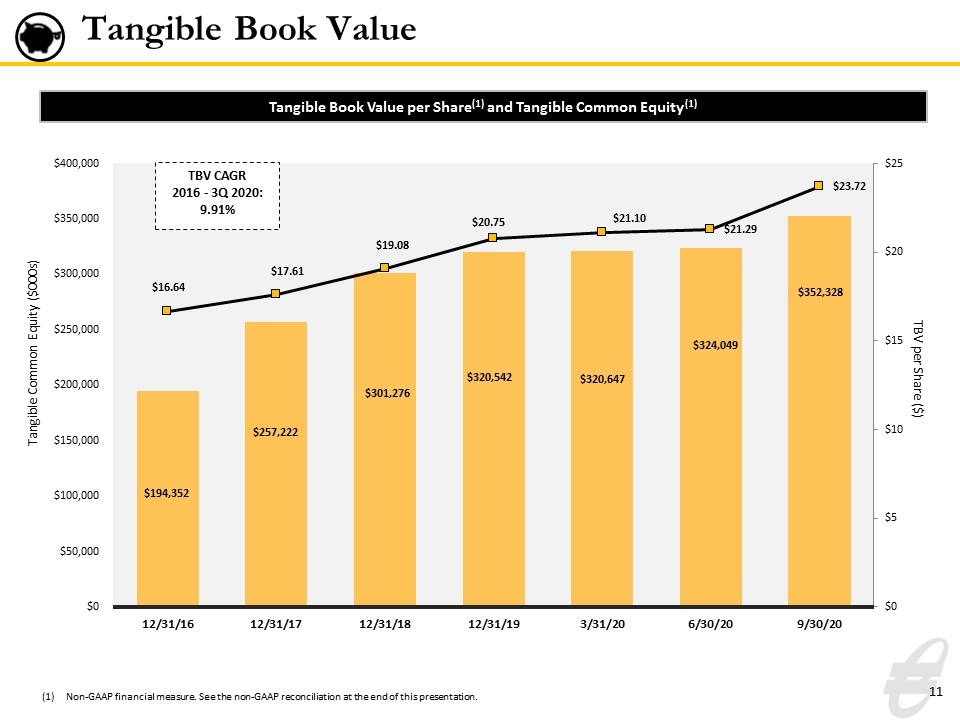

Tangible Book Value Tangible Book Value per Share(1) and Tangible Common Equity (1) TBV CAGR 2016 - 3Q 2020: 9.91% Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation.

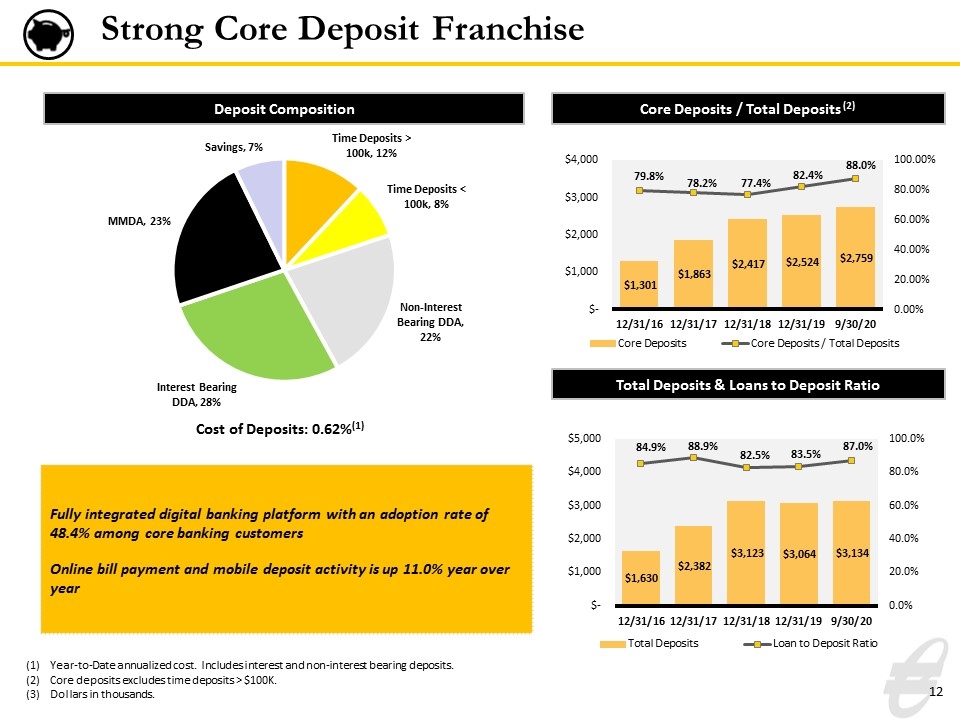

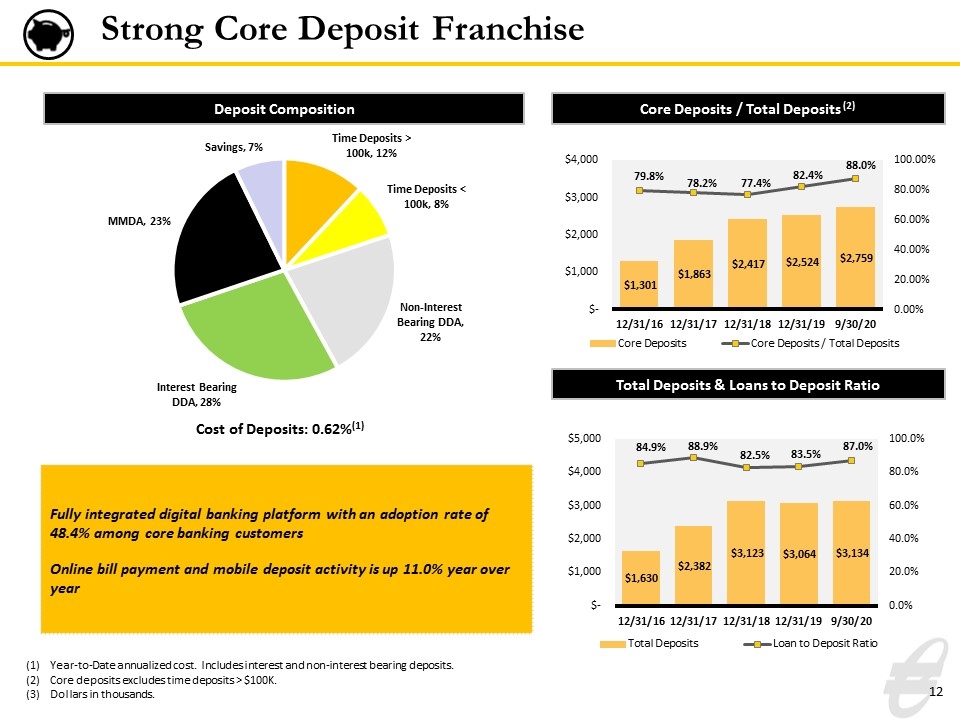

Fully integrated digital banking platform with an adoption rate of 48.4% among core banking customers Online bill payment and mobile deposit activity is up 11.0% year over year Strong Core Deposit Franchise Year-to-Date annualized cost. Includes interest and non-interest bearing deposits. Core deposits excludes time deposits > $100K. Dollars in thousands. Cost of Deposits: 0.62%(1) Deposit Composition Core Deposits / Total Deposits (2) Total Deposits & Loans to Deposit Ratio

Executive Leadership Founded Equity Bank in 2002 2018 EY Entrepreneur of the Year National Finalist 2014 Most Influential CEO, Wichita Business Journal Served as Regional President of Sunflower Bank prior to forming Equity Bank Previously served as Director of Sales and Marketing for Koch Industries Brad Elliott Chairman & CEO Years at Equity: 18 | Years in Banking: 31 Greg Kossover EVP, COO & CFO Became COO in April 2020 Served as CFO from 2013 to 2020 EQBK Board of Directors, 2011-current Previously served as president of Physicians Development Group Previously served as CEO of Value Place, LLC, growing the franchise to more than 150 locations in 25 states Greg Kossover Chief Operating Officer Years at Equity: 7 | Years in Banking: 20 Eric Newell Chief Financial Officer Years in Banking: 18 Craig Anderson President Years at Equity: 2 | Years in Banking: 38 Became President in April 2020 Served as COO from 2018 to 2020 Joined Equity Bank in March 2018 Previously served as President of UMBF Commercial Banking More than 38 years of banking experience, concentrated in commercial lending roles Joined Equity Bank in April 2020 Previously served as CFO at United Bank in Hartford, CT ($7.3bn assets) CFO and head of Treasury at Rockville Bank, Glastonbury, Conn. Analyst for AllianceBernstein and Fitch Began career as examiner with FDIC

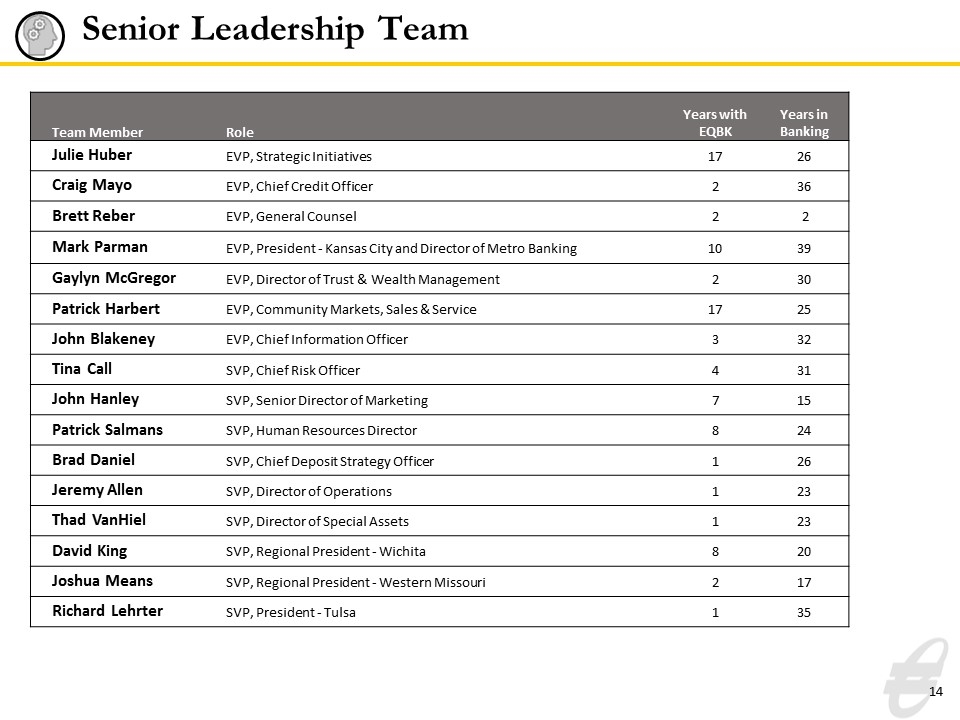

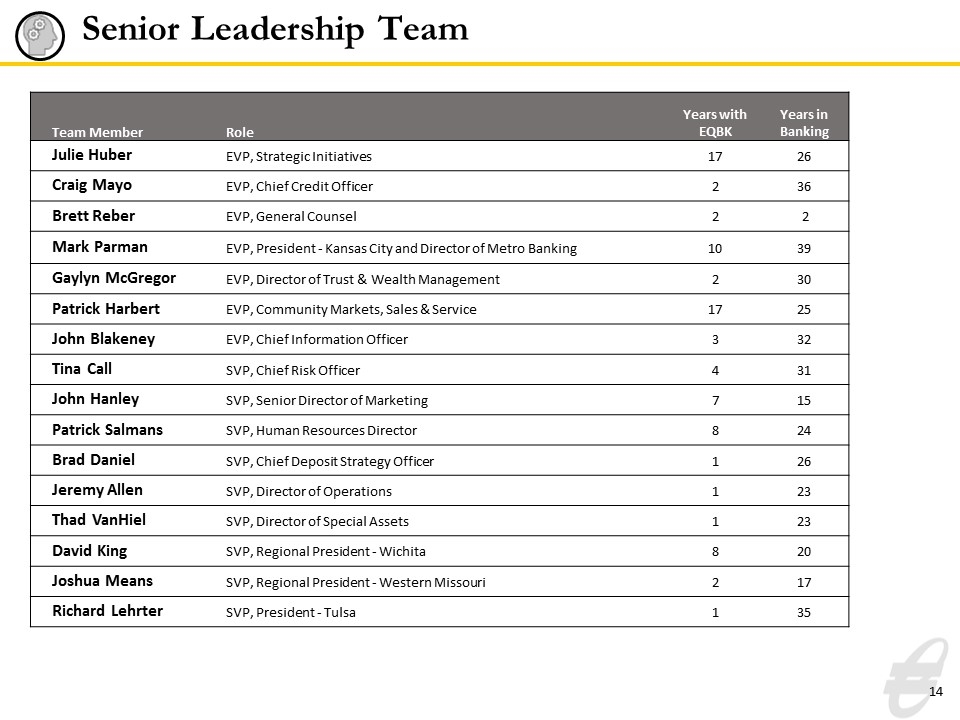

Senior Leadership Team Team Member Role Years with EQBK Years in Banking Julie Huber EVP, Strategic Initiatives 17 26 Craig Mayo EVP, Chief Credit Officer 2 36 Brett Reber EVP, General Counsel 2 2 Mark Parman EVP, President - Kansas City and Director of Metro Banking 10 39 Gaylyn McGregor EVP, Director of Trust & Wealth Management 2 30 Patrick Harbert EVP, Community Markets, Sales & Service 17 25 John Blakeney EVP, Chief Information Officer 3 32 Tina Call SVP, Chief Risk Officer 4 31 John Hanley SVP, Senior Director of Marketing 7 15 Patrick Salmans SVP, Human Resources Director 8 24 Brad Daniel SVP, Chief Deposit Strategy Officer 1 26 Jeremy Allen SVP, Director of Operations 1 23 Thad VanHiel SVP, Director of Special Assets 1 23 David King SVP, Regional President - Wichita 8 20 Joshua Means SVP, Regional President - Western Missouri 2 17 Richard Lehrter SVP, President - Tulsa 1 35

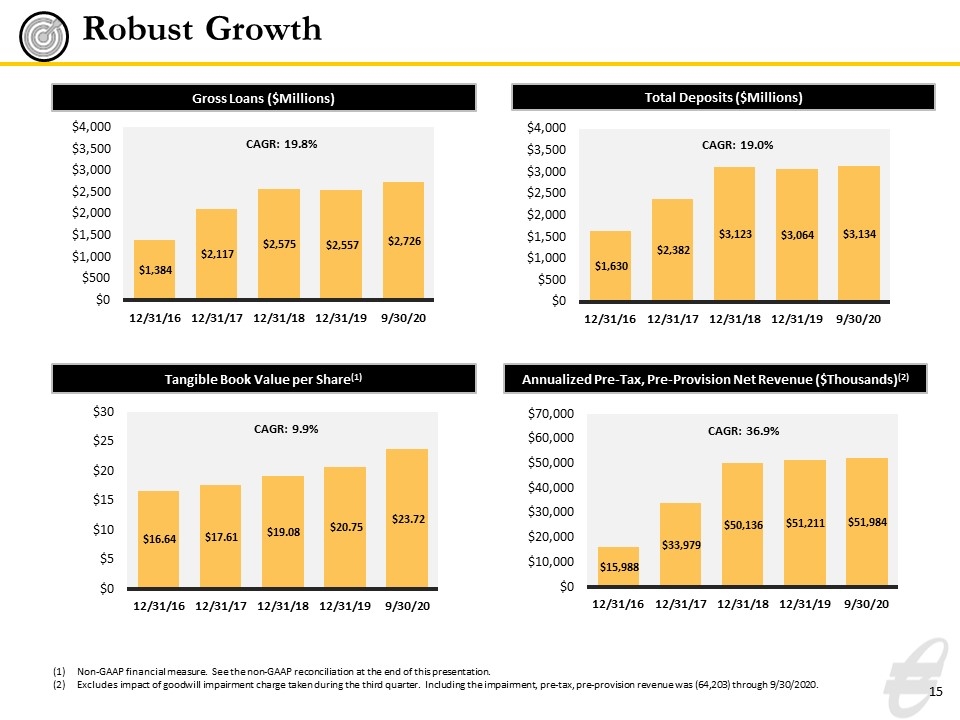

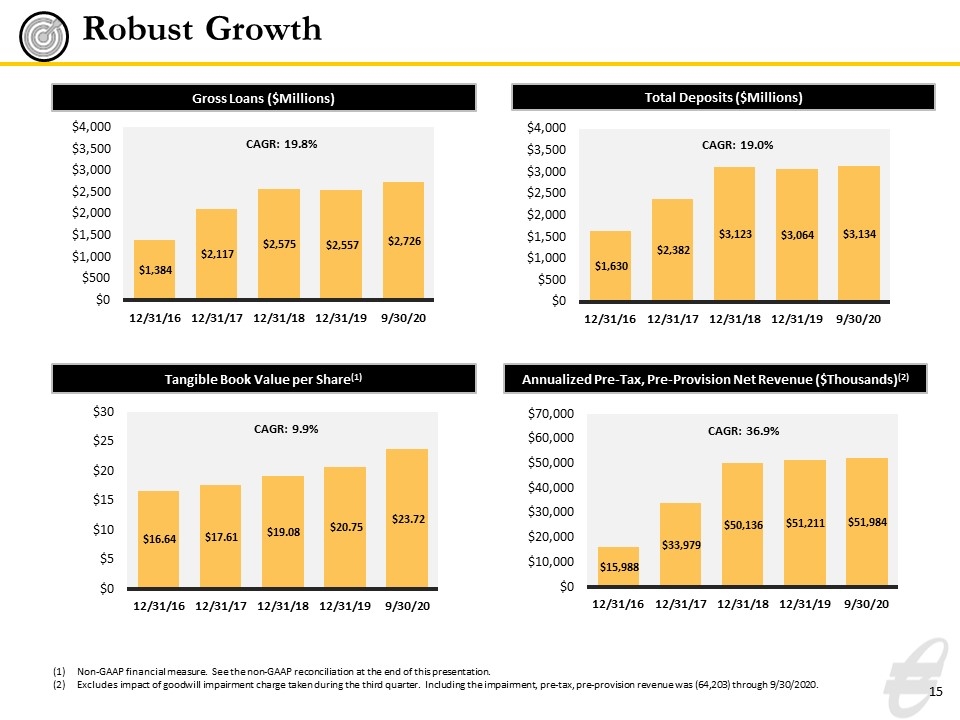

Robust Growth Gross Loans ($Millions) Total Deposits ($Millions) Tangible Book Value per Share(1) Annualized Pre-Tax, Pre-Provision Net Revenue ($Thousands)(2) Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Excludes impact of goodwill impairment charge taken during the third quarter. Including the impairment, pre-tax, pre-provision revenue was (64,203) through 9/30/2020.

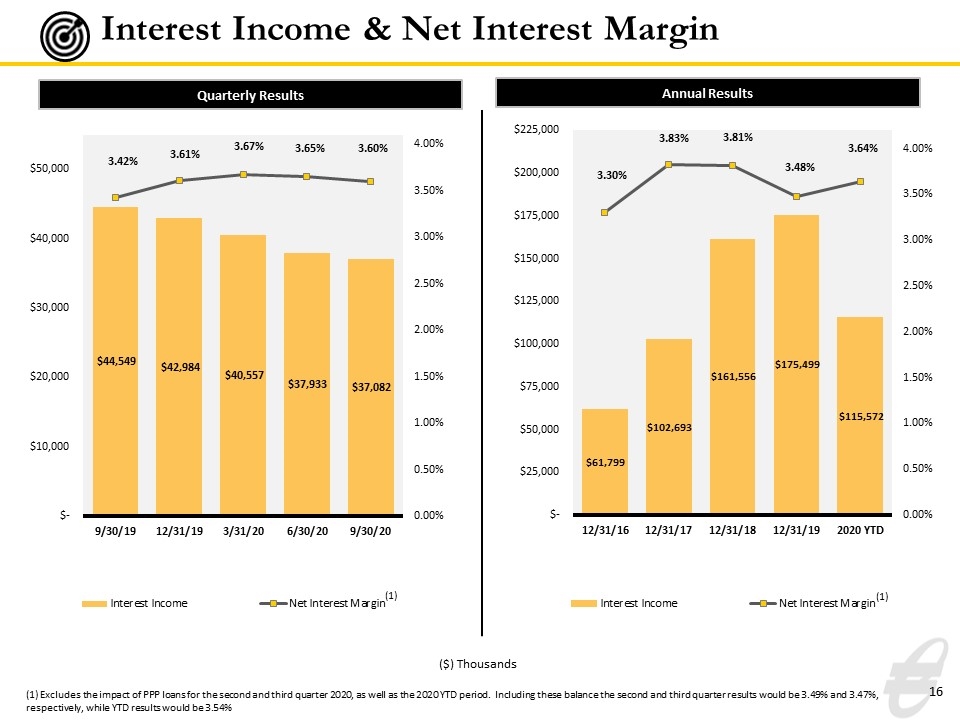

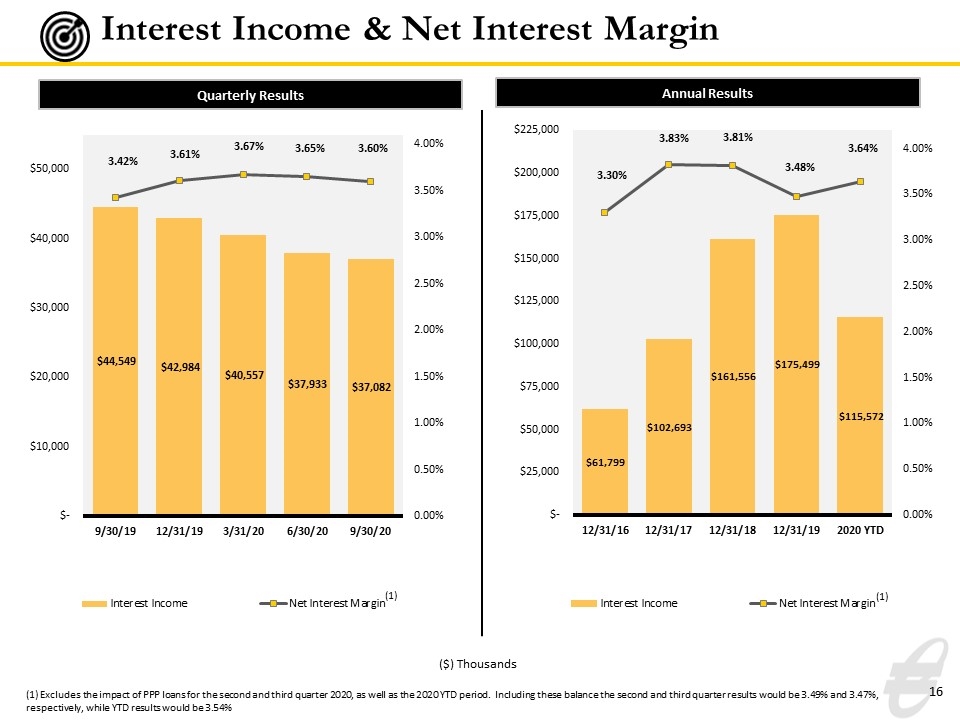

Interest Income & Net Interest Margin ($) Thousands (1) (1) (1) Excludes the impact of PPP loans for the second and third quarter 2020, as well as the 2020 YTD period. Including these balance the second and third quarter results would be 3.49% and 3.47%, respectively, while YTD results would be 3.54% Annual Results

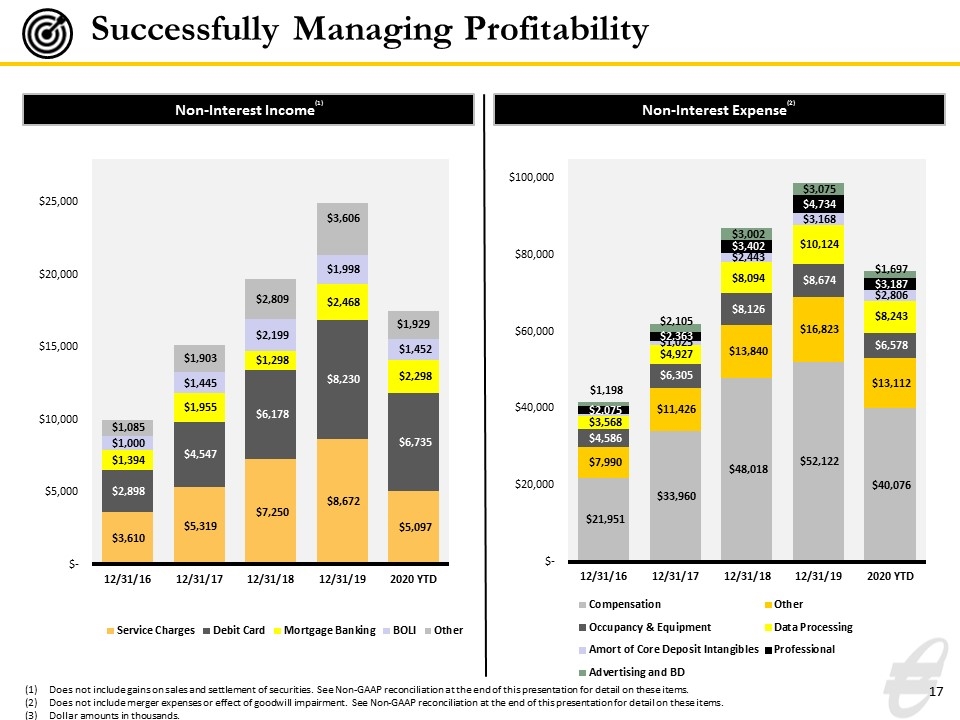

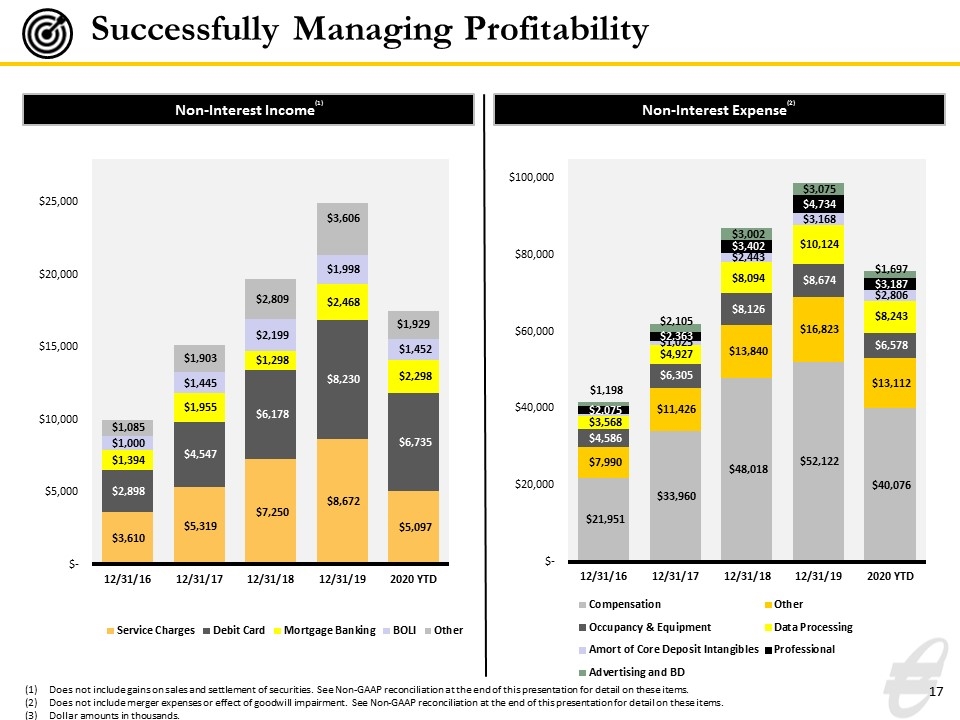

Successfully Managing Profitability Does not include gains on sales and settlement of securities. See Non-GAAP reconciliation at the end of this presentation for detail on these items. Does not include merger expenses or effect of goodwill impairment. See Non-GAAP reconciliation at the end of this presentation for detail on these items. Dollar amounts in thousands. Non-Interest Income(1) Non-Interest Expense(2)

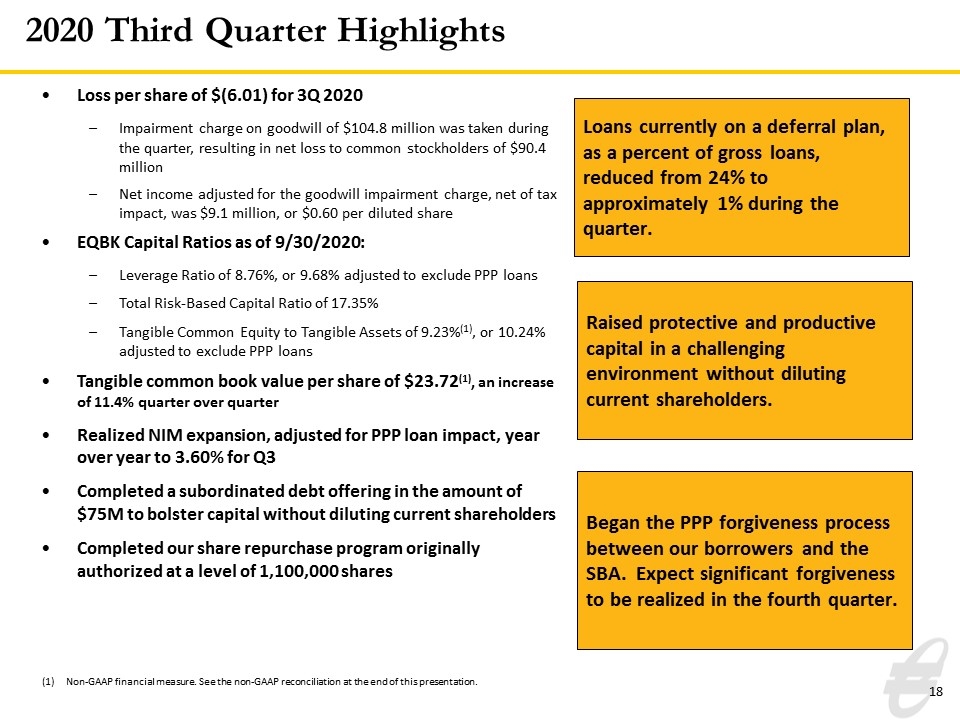

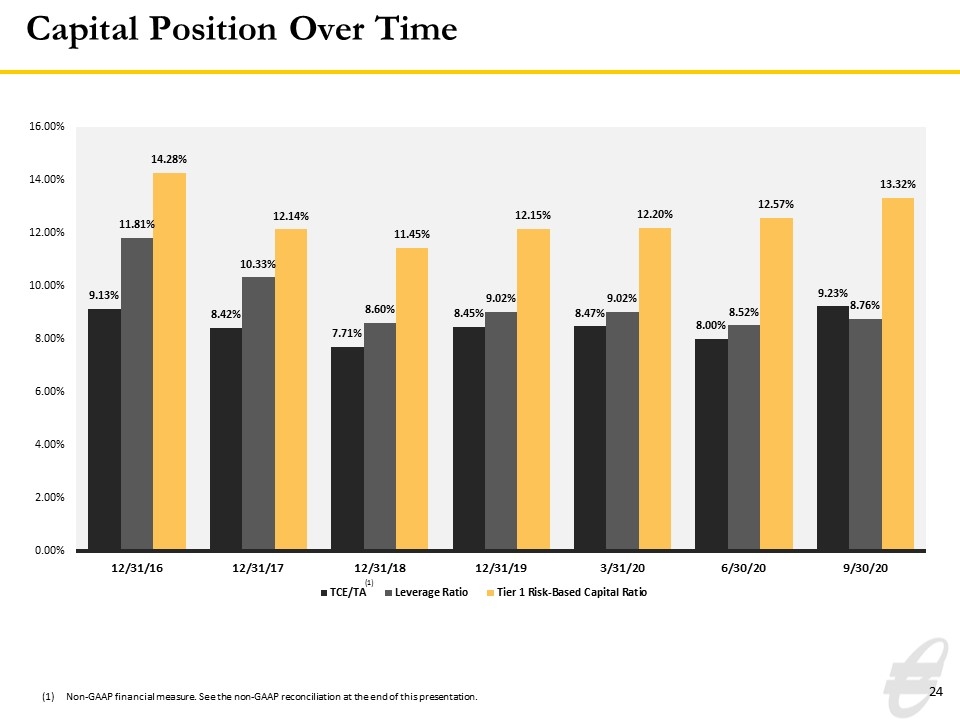

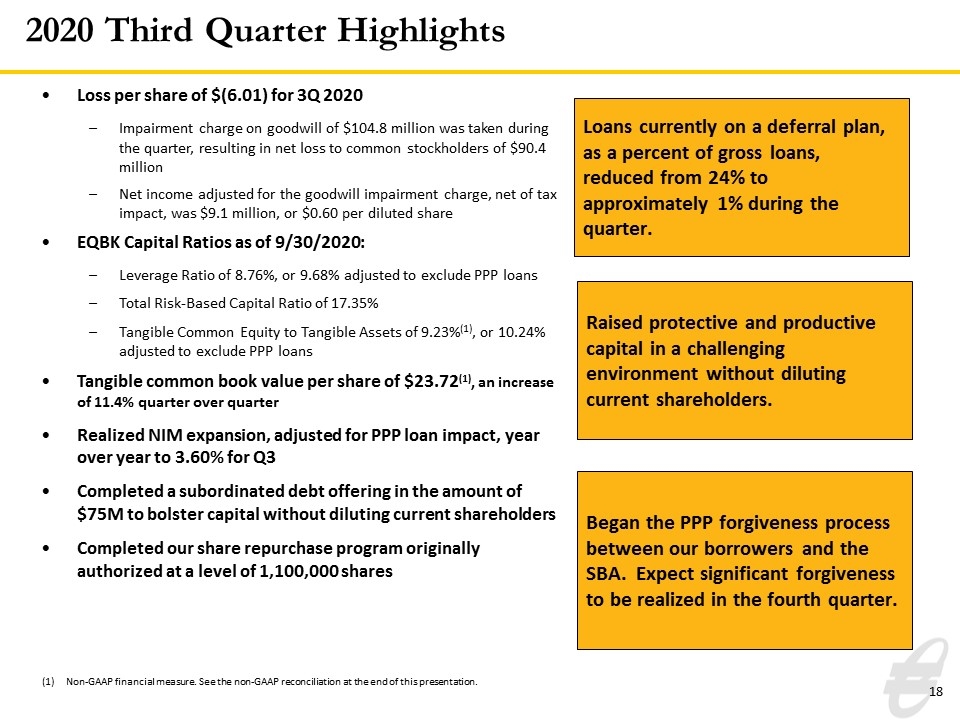

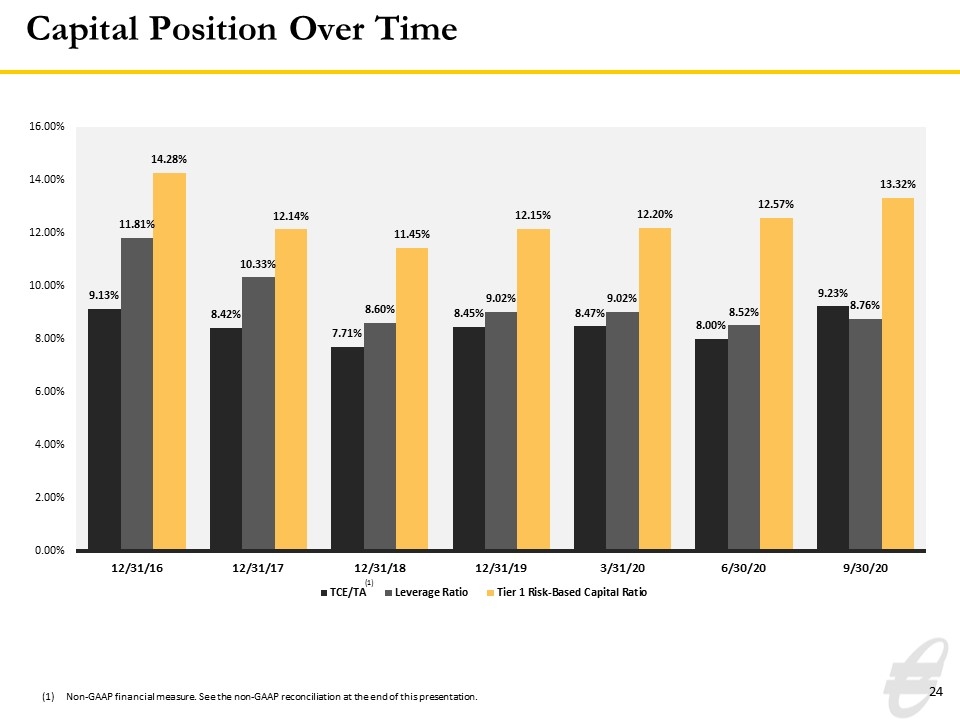

Loss per share of $(6.01) for 3Q 2020 Impairment charge on goodwill of $104.8 million was taken during the quarter, resulting in net loss to common stockholders of $90.4 million Net income adjusted for the goodwill impairment charge, net of tax impact, was $9.1 million, or $0.60 per diluted share EQBK Capital Ratios as of 9/30/2020: Leverage Ratio of 8.76%, or 9.68% adjusted to exclude PPP loans Total Risk-Based Capital Ratio of 17.35% Tangible Common Equity to Tangible Assets of 9.23%(1), or 10.24% adjusted to exclude PPP loans Tangible common book value per share of $23.72(1), an increase of 11.4% quarter over quarter Realized NIM expansion, adjusted for PPP loan impact, year over year to 3.60% for Q3 Completed a subordinated debt offering in the amount of $75M to bolster capital without diluting current shareholders Completed our share repurchase program originally authorized at a level of 1,100,000 shares 2020 Third Quarter Highlights Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Loans currently on a deferral plan, as a percent of gross loans, reduced from 24% to approximately 1% during the quarter. Raised protective and productive capital in a challenging environment without diluting current shareholders. Began the PPP forgiveness process between our borrowers and the SBA. Expect significant forgiveness to be realized in the fourth quarter.

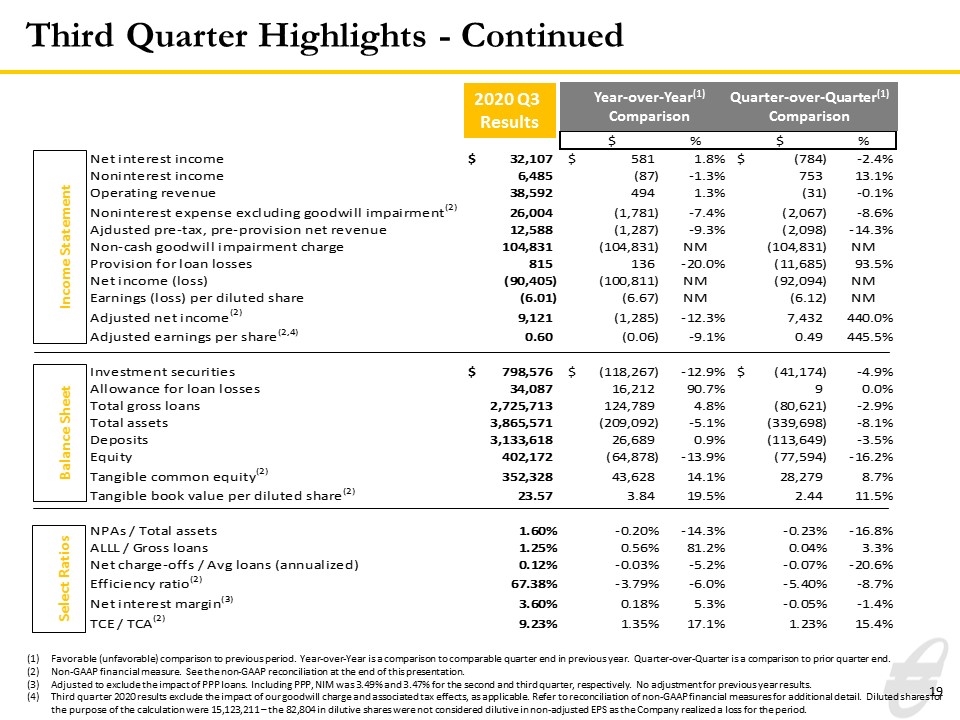

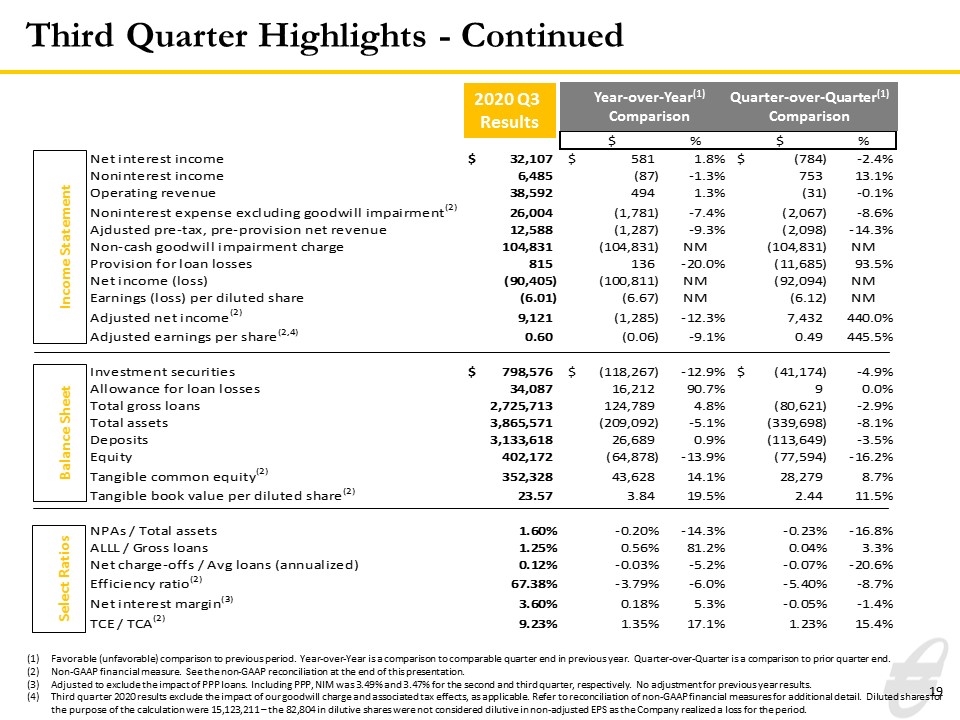

Third Quarter Highlights - Continued Year-over-Year(1) Comparison Quarter-over-Quarter(1) Comparison Income Statement Balance Sheet Select Ratios Favorable (unfavorable) comparison to previous period. Year-over-Year is a comparison to comparable quarter end in previous year. Quarter-over-Quarter is a comparison to prior quarter end. Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Adjusted to exclude the impact of PPP loans. Including PPP, NIM was 3.49% and 3.47% for the second and third quarter, respectively. No adjustment for previous year results. Third quarter 2020 results exclude the impact of our goodwill charge and associated tax effects, as applicable. Refer to reconciliation of non-GAAP financial measures for additional detail. Diluted shares for the purpose of the calculation were 15,123,211 – the 82,804 in dilutive shares were not considered dilutive in non-adjusted EPS as the Company realized a loss for the period. 2020 Q3 Results $ % $ % Net interest income $32,107 $581 1.8% $-,784 -2.4% 32891 31526 Noninterest income 6,485 -87 -1.3% 753 0.13136775994417307 5732 6572 Operating revenue 38,592 494 1.3% -31 .1% $38,623 $38,098 Noninterest expense excluding goodwill impairment(2) 26,004 -1,781 -7.4% -2,067 -8.6% 23937 24223 Ajdusted pre-tax, pre-provision net revenue 12,588 -1,287 -9.3% -2,098 -0.14285714285714285 $14,686 $13,875 Non-cash goodwill impairment charge ,104,831 -,104,831 NM -,104,831 NM 0 0 Provision for loan losses 815 136 -0.20029455081001474 ,-11,685 0.93479999999999996 12500 679 Net income (loss) ,-90,405 -,100,811 NM ,-92,094 NM 1689 10406 Earnings (loss) per diluted share -6.01 -6.67 NM -6.12 NM 0.11 0.66 Adjusted net income(2) 9,121 -1,285 -0.12348645012492793 7,432 4.400236826524571 1689 10406 Adjusted earnings per share(2,4) 0.6 -6.0000000000000053E-2 -9.9% 0.49 4.4545454545454541 0.11 0.66 Investment securities $,798,576 $-,118,267 -0.12899373175123768 $,-41,174 -4.9% 839750 916843 Allowance for loan losses 34,087 16,212 0.906965034965035 9 264100005868889.3% 34078 17875 Total gross loans 2,725,713 ,124,789 4.8% ,-80,621 -2.9% 2806334 2600924 Total assets 3,865,571 -,209,092 -5.1% -,339,698 -8.8% 4205269 4074663 Deposits 3,133,618 26,689 .9% -,113,649 -3.5% 3247267 3106929 Equity ,402,172 ,-64,878 -0.1389101809228134 ,-77,594 -0.16173301150977767 479766 467050 Tangible common equity(2) ,352,328 43,628 0.14132815030774215 28,279 8.7% 324049 308700 Tangible book value per diluted share(2) 23.57 3.84 0.19462747085656359 2.4400000000000013 0.11547562707051592 21.13 19.73 NPAs / Total assets 1.6E-2 -2E-3 -0.14285714285714285 -2.3E-3 -0.16788321167883211 1.37E-2 1.4E-2 ALLL / Gross loans 1.2500000000000001E-2 5.6000000000000008E-3 0.81159420289855089 4.0000000000000105E-4 3.3% 1.21E-2 6.8999999999999999E-3 Net charge-offs / Avg loans (annualized) 1.1999999999999999E-3 -2.9999999999999997E-4 -5.2% -6.9999999999999999E-4 -0.20588235294117649 3.3999999999999998E-3 5.7999999999999996E-3 Efficiency ratio(2) 0.67379999999999995 -3.7899999999999934E-2 -5.9600566126749382 -5.3999999999999937E-2 -8.7% 0.61980000000000002 0.63590000000000002 Net interest margin(3) 3.5999999999999997E-2 1.799999999999996E-3 5.3% -5.0000000000000044E-4 -1.4% 3.6499999999999998E-2 3.4200000000000001E-2 TCE / TCA(2) 9.2299999999999993E-2 1.3499999999999998E-2 0.17131979695431471 1.2299999999999991E-2 0.15374999999999989 0.08 7.8799999999999995E-2

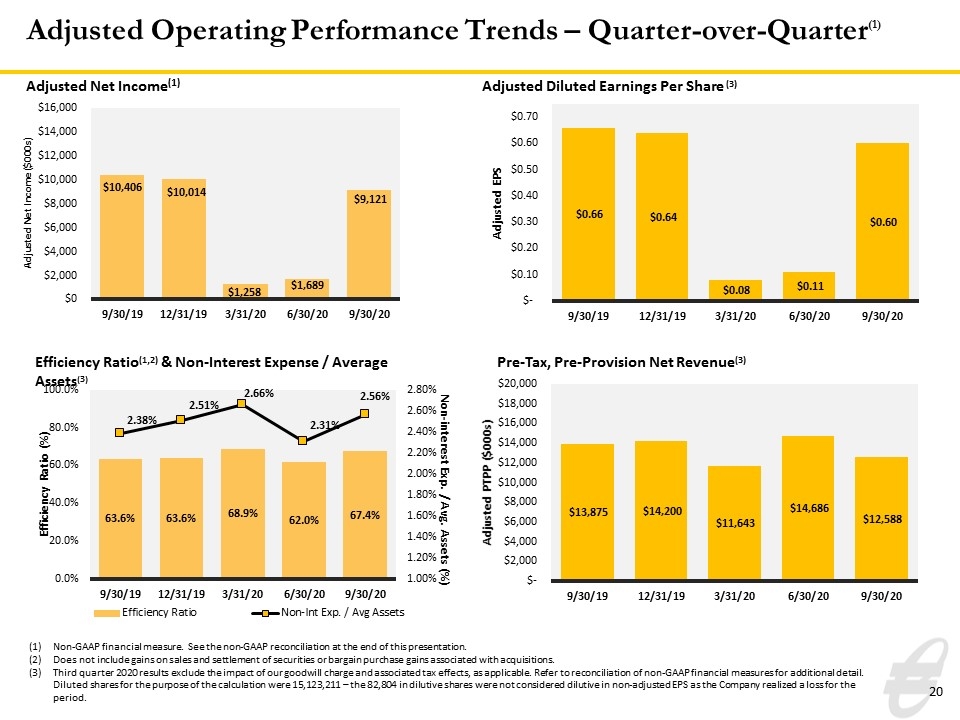

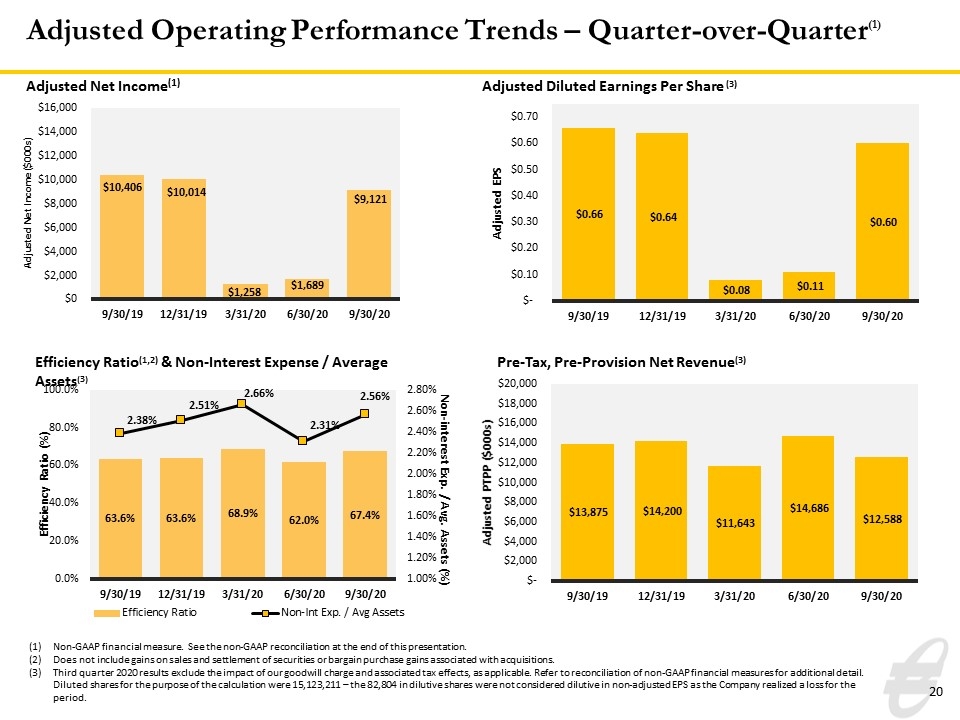

Adjusted Operating Performance Trends – Quarter-over-Quarter(1) Adjusted Diluted Earnings Per Share (3) Efficiency Ratio(1,2) & Non-Interest Expense / Average Assets(3) Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Does not include gains on sales and settlement of securities or bargain purchase gains associated with acquisitions. Third quarter 2020 results exclude the impact of our goodwill charge and associated tax effects, as applicable. Refer to reconciliation of non-GAAP financial measures for additional detail. Diluted shares for the purpose of the calculation were 15,123,211 – the 82,804 in dilutive shares were not considered dilutive in non-adjusted EPS as the Company realized a loss for the period. Adjusted Net Income(1) Pre-Tax, Pre-Provision Net Revenue(3)

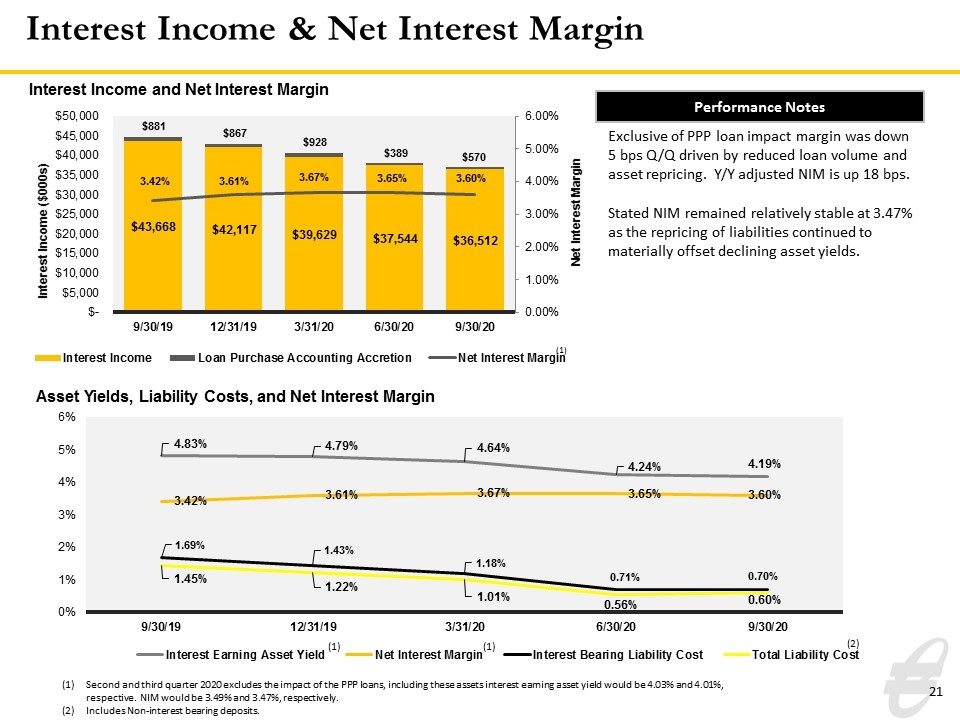

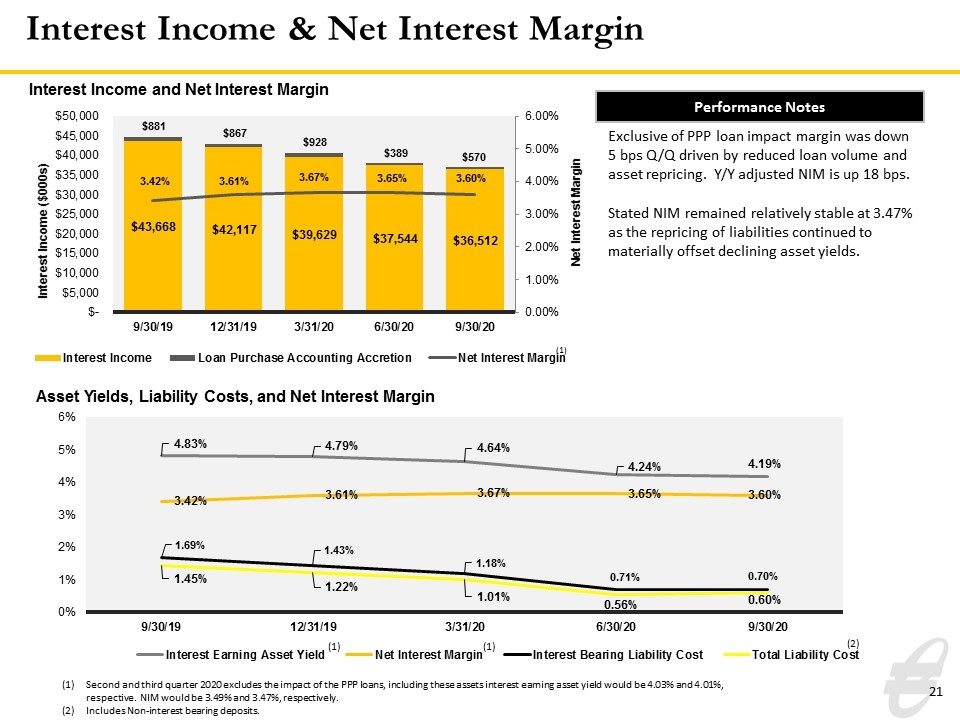

Interest Income & Net Interest Margin Exclusive of PPP loan impact margin was down 5 bps Q/Q driven by reduced loan volume and asset repricing. Y/Y adjusted NIM is up 18 bps. Stated NIM remained relatively stable at 3.47% as the repricing of liabilities continued to materially offset declining asset yields. (2) Second and third quarter 2020 excludes the impact of the PPP loans, including these assets interest earning asset yield would be 4.03% and 4.01%, respective. NIM would be 3.49% and 3.47%, respectively. Includes Non-interest bearing deposits. (1) (1) Performance Notes

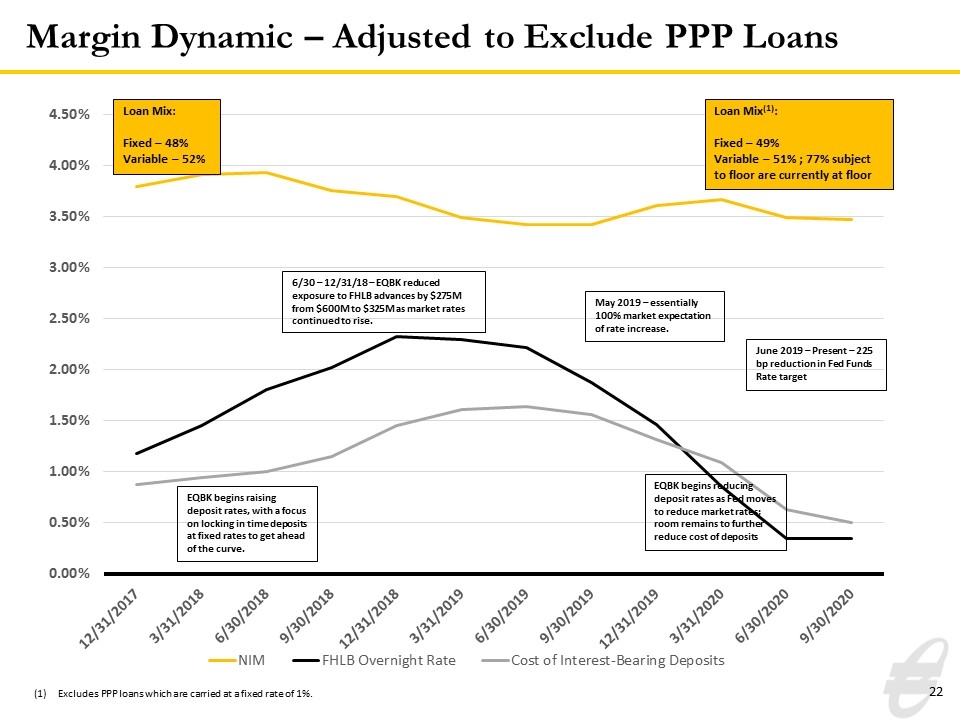

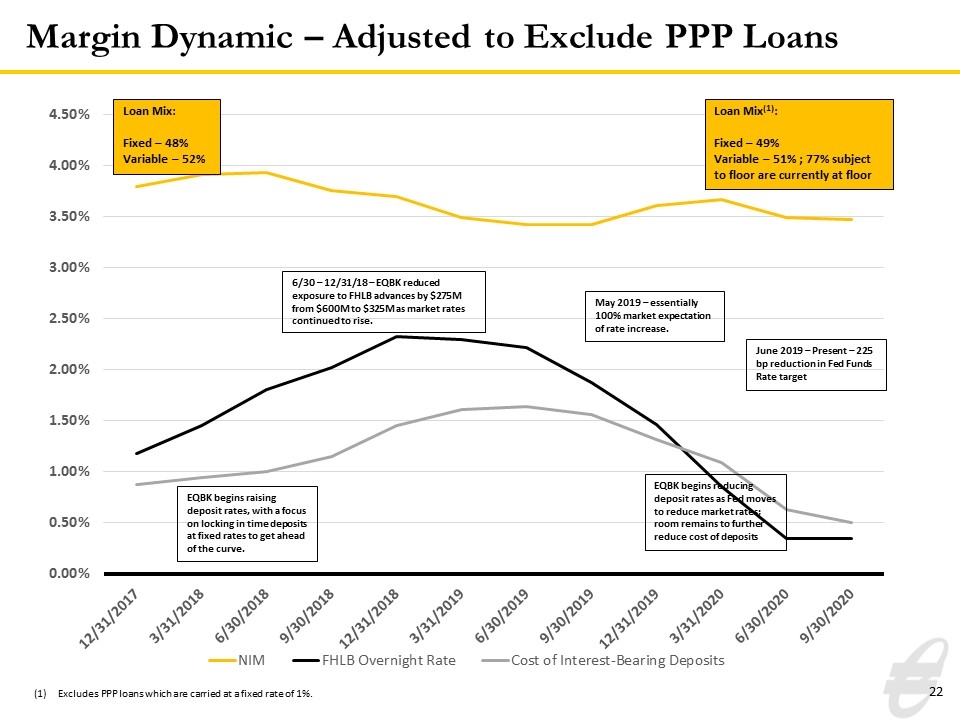

Margin Dynamic – Adjusted to Exclude PPP Loans EQBK begins raising deposit rates, with a focus on locking in time deposits at fixed rates to get ahead of the curve. 6/30 – 12/31/18 – EQBK reduced exposure to FHLB advances by $275M from $600M to $325M as market rates continued to rise. Excludes PPP loans which are carried at a fixed rate of 1%.

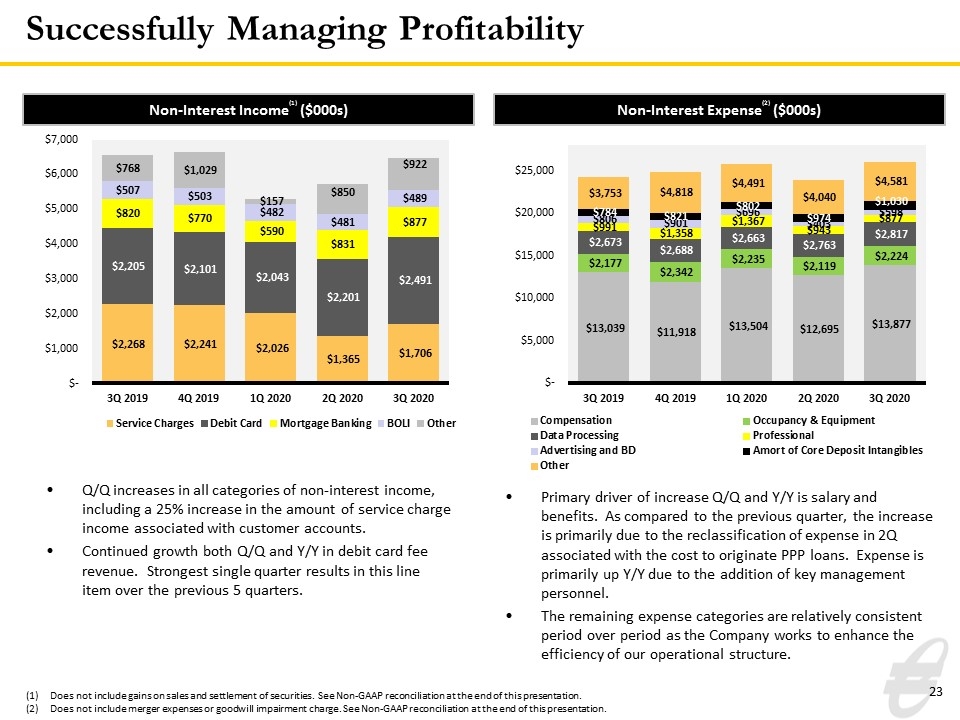

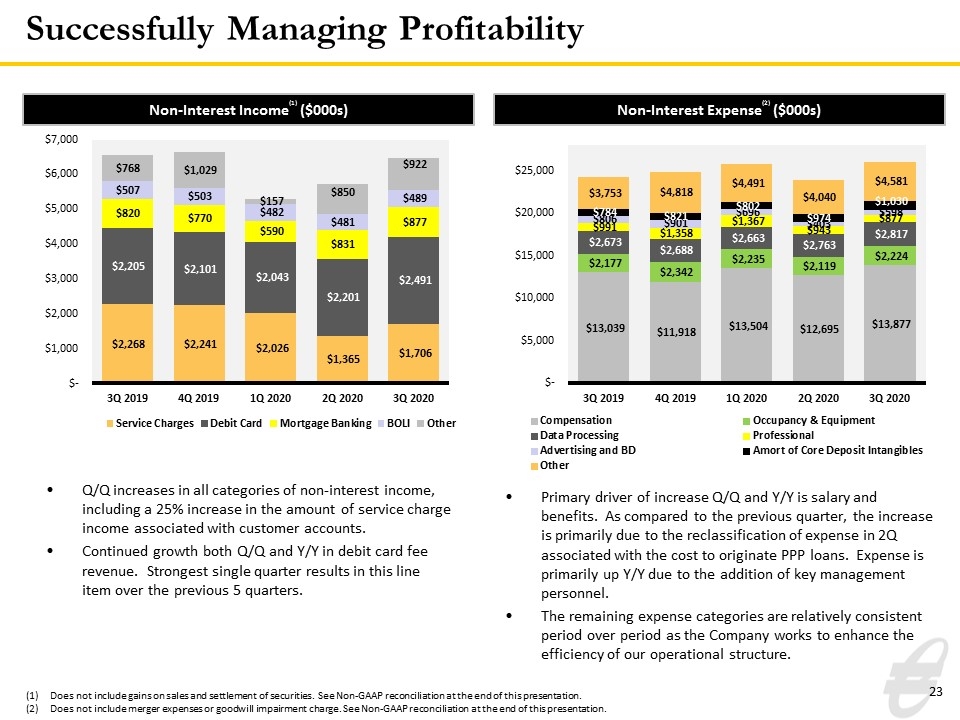

Successfully Managing Profitability Does not include gains on sales and settlement of securities. See Non-GAAP reconciliation at the end of this presentation. Does not include merger expenses or goodwill impairment charge. See Non-GAAP reconciliation at the end of this presentation. Q/Q increases in all categories of non-interest income, including a 25% increase in the amount of service charge income associated with customer accounts. Continued growth both Q/Q and Y/Y in debit card fee revenue. Strongest single quarter results in this line item over the previous 5 quarters. Non-Interest Income(1) ($000s) Non-Interest Expense(2) ($000s) Primary driver of increase Q/Q and Y/Y is salary and benefits. As compared to the previous quarter, the increase is primarily due to the reclassification of expense in 2Q associated with the cost to originate PPP loans. Expense is primarily up Y/Y due to the addition of key management personnel. The remaining expense categories are relatively consistent period over period as the Company works to enhance the efficiency of our operational structure.

Capital Position Over Time Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. (1)

Total Loans by Purpose(1, 2) Gross Total Loans ($000s) $2,575,408 $2,556,652 $1,383,605 $2,117,270 Year-to-Date Loan Yield 4.98% 5.43% 5.74% 5.73% For financial statement reporting, management considers other factors in addition to purpose when assessing risk and identifying reporting classes. As such, the above is not intended to reconcile to the company’s loan disclosures within the applicable financial statement. September 30, 2020 composition percentages exclude the impact of PPP loans. For the Year-to-Date period ended September 30, 2020 yield has been adjusted to exclude PPP loans, including these loans yield would be 4.92%. $2,725,713 5.22%(3)

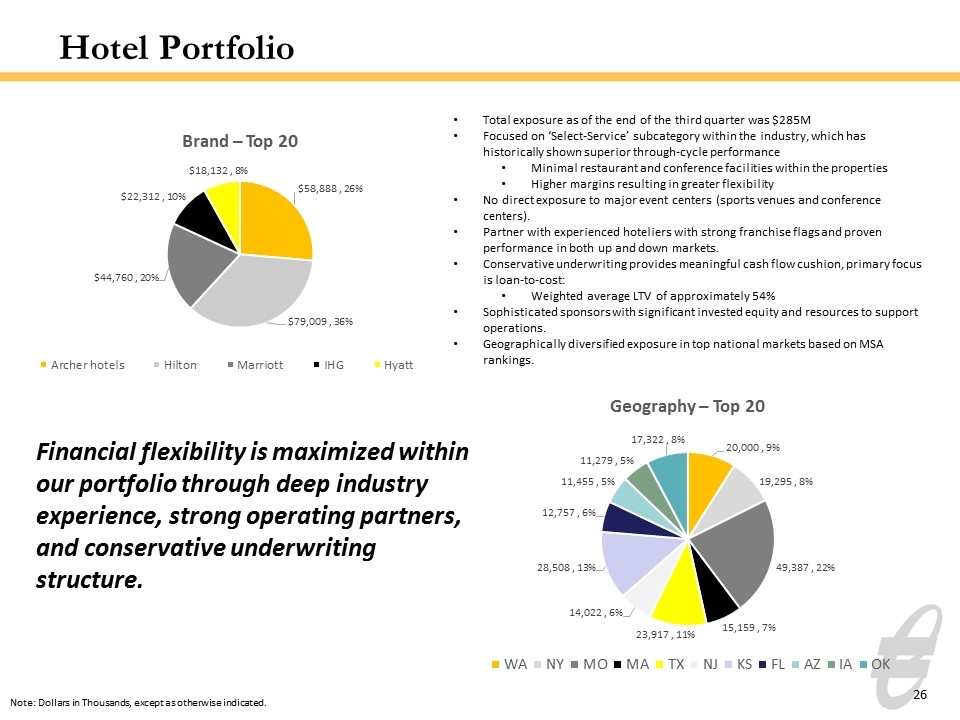

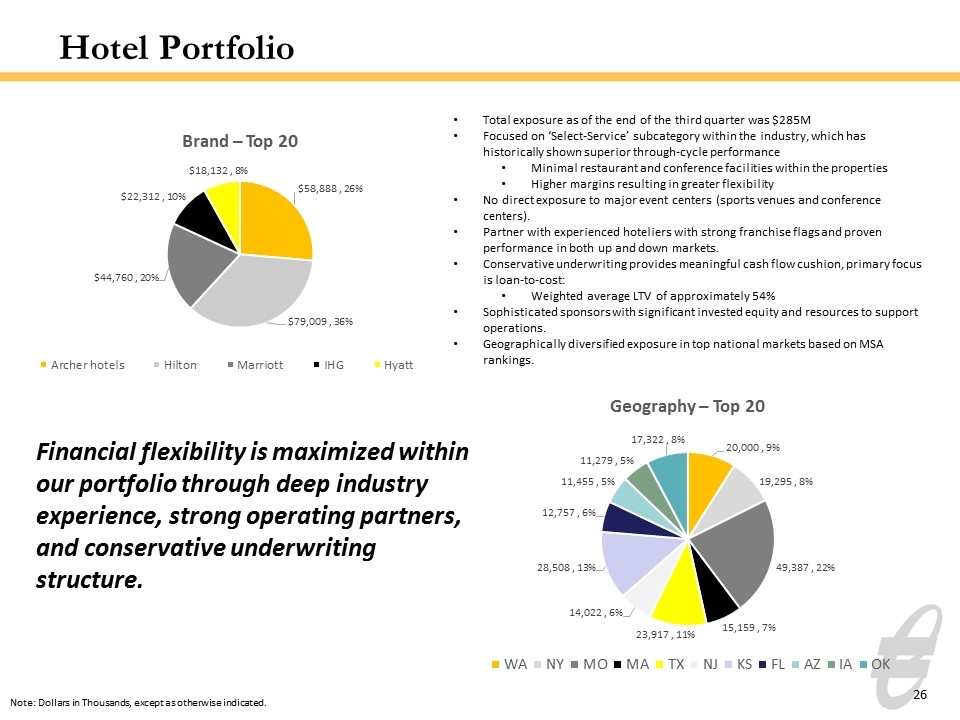

Hotel Portfolio Note: Dollars in Thousands, except as otherwise indicated. Total exposure as of the end of the third quarter was $285M Focused on ‘Select-Service’ subcategory within the industry, which has historically shown superior through-cycle performance Minimal restaurant and conference facilities within the properties Higher margins resulting in greater flexibility No direct exposure to major event centers (sports venues and conference centers). Partner with experienced hoteliers with strong franchise flags and proven performance in both up and down markets. Conservative underwriting provides meaningful cash flow cushion, primary focus is loan-to-cost: Weighted average LTV of approximately 54% Sophisticated sponsors with significant invested equity and resources to support operations. Geographically diversified exposure in top national markets based on MSA rankings. Financial flexibility is maximized within our portfolio through deep industry experience, strong operating partners, and conservative underwriting structure.

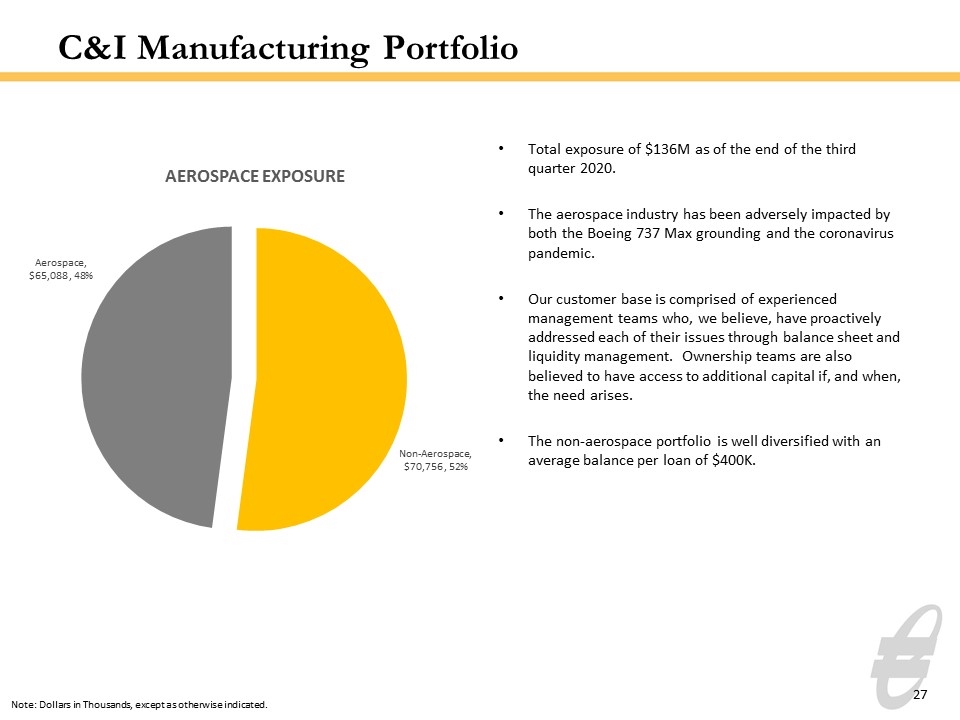

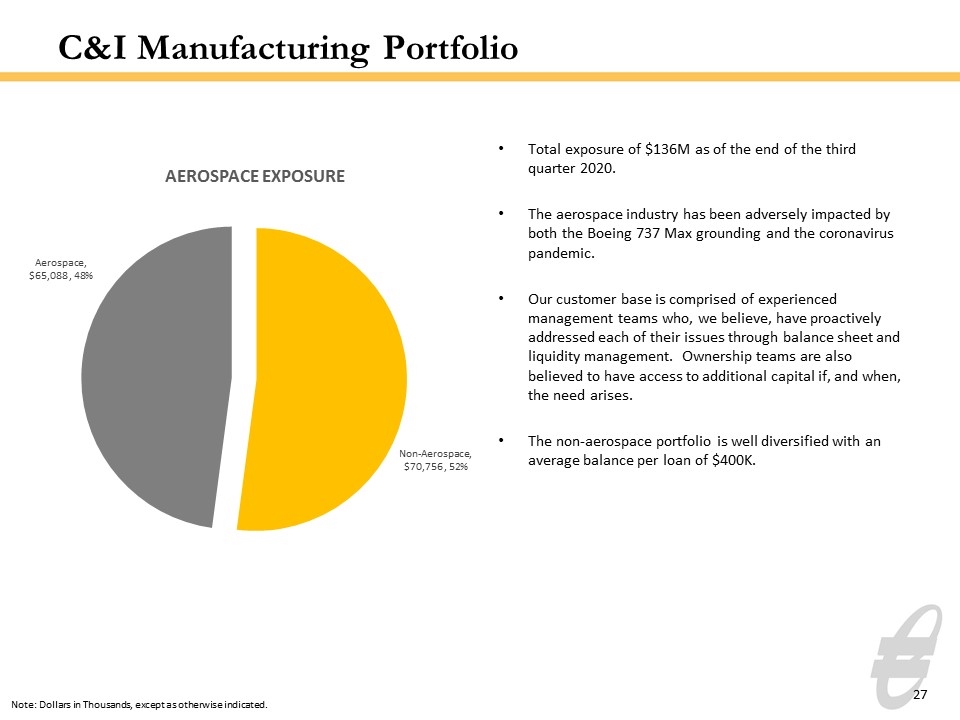

C&I Manufacturing Portfolio Total exposure of $136M as of the end of the third quarter 2020. The aerospace industry has been adversely impacted by both the Boeing 737 Max grounding and the coronavirus pandemic. Our customer base is comprised of experienced management teams who, we believe, have proactively addressed each of their issues through balance sheet and liquidity management. Ownership teams are also believed to have access to additional capital if, and when, the need arises. The non-aerospace portfolio is well diversified with an average balance per loan of $400K. Note: Dollars in Thousands, except as otherwise indicated.

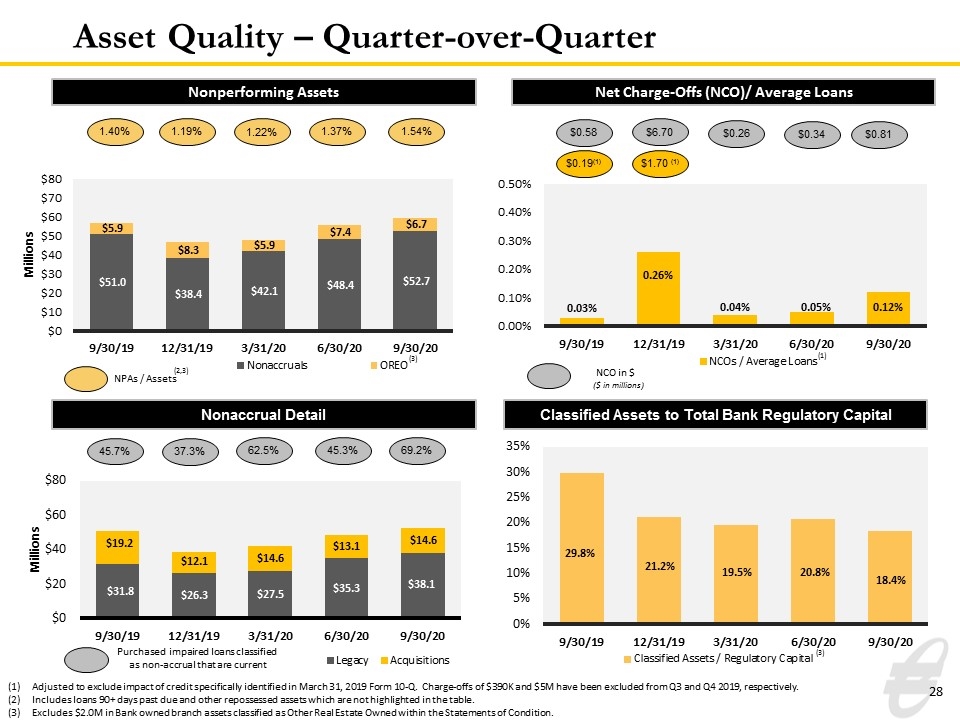

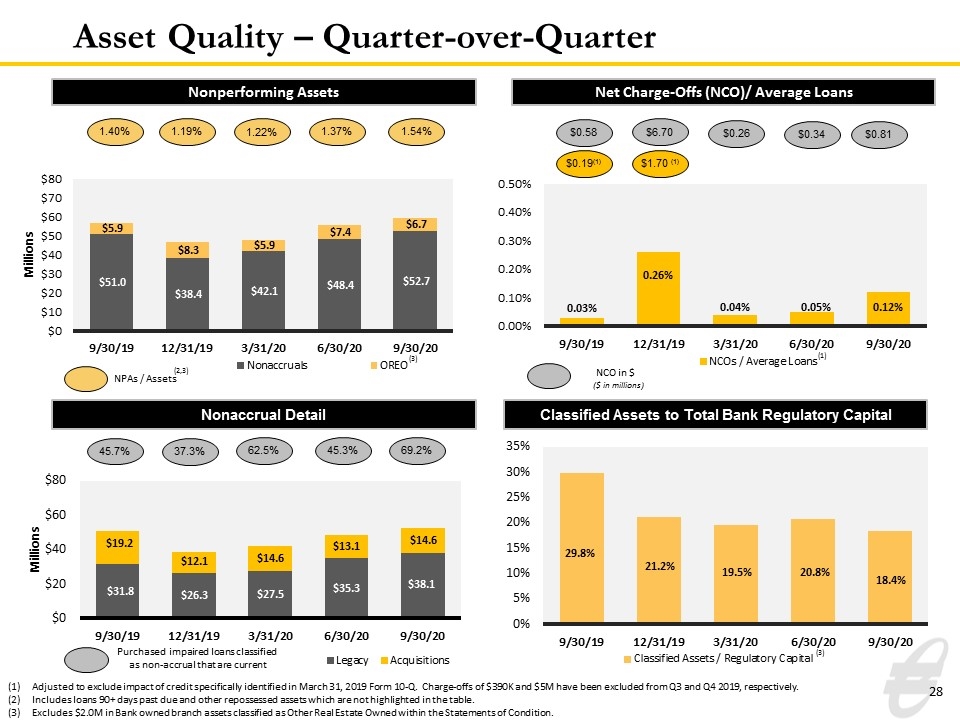

Asset Quality – Quarter-over-Quarter Nonperforming Assets NPAs / Assets 1.40% Net Charge-Offs (NCO)/ Average Loans $0.26 NCO in $ ($ in millions) Nonaccrual Detail Classified Assets to Total Bank Regulatory Capital $0.58 1.19% 1.37% $0.34 45.3% 62.5% 69.2% 1.22% $6.70 Adjusted to exclude impact of credit specifically identified in March 31, 2019 Form 10-Q. Charge-offs of $390K and $5M have been excluded from Q3 and Q4 2019, respectively. Includes loans 90+ days past due and other repossessed assets which are not highlighted in the table. Excludes $2.0M in Bank owned branch assets classified as Other Real Estate Owned within the Statements of Condition. 37.3% 45.7% $1.70 (1) (2,3) $0.19(1) 1.54% $0.81 (3) (3) Purchased impaired loans classified as non-accrual that are current

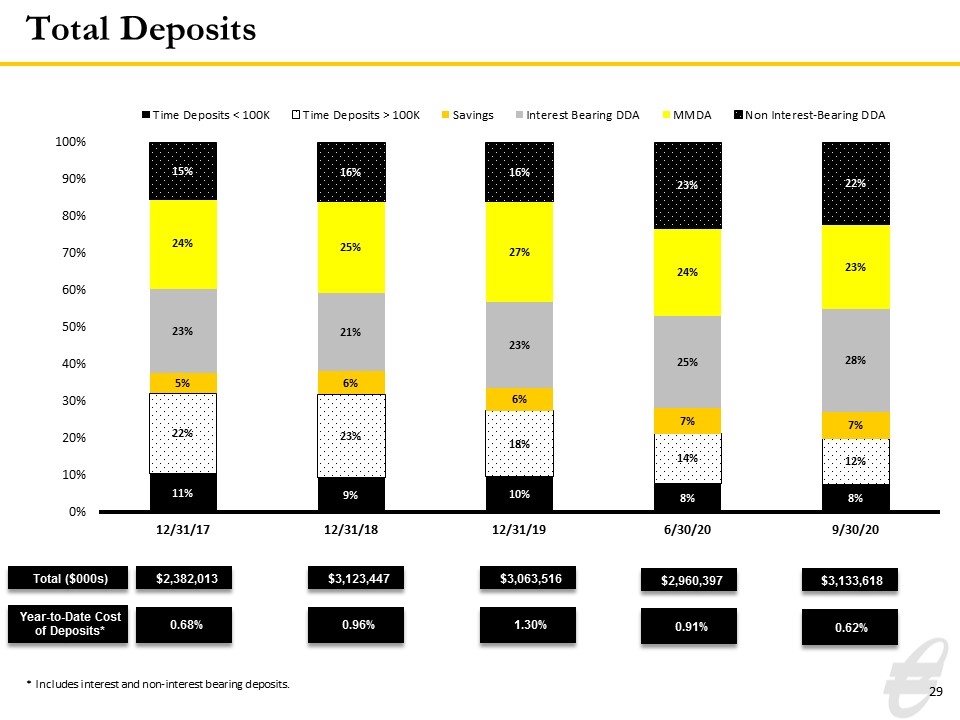

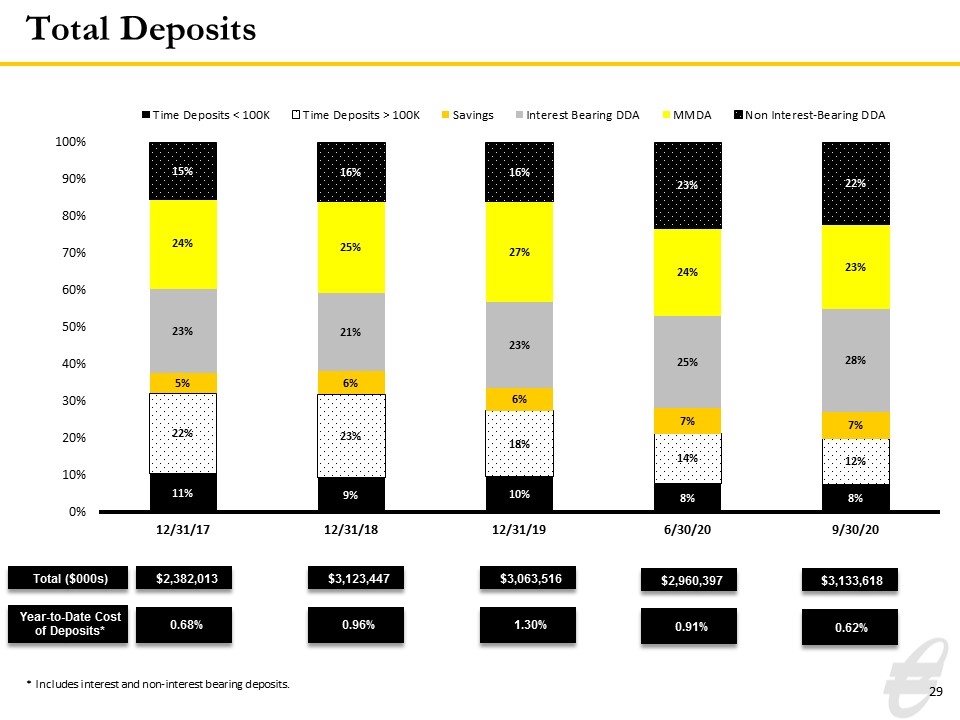

Total Deposits Total ($000s) $3,123,447 $3,063,516 $2,382,013 Year-to-Date Cost of Deposits* 0.68% 0.96% 1.30% * Includes interest and non-interest bearing deposits. $2,960,397 0.91% $3,133,618 0.62%

Appendix

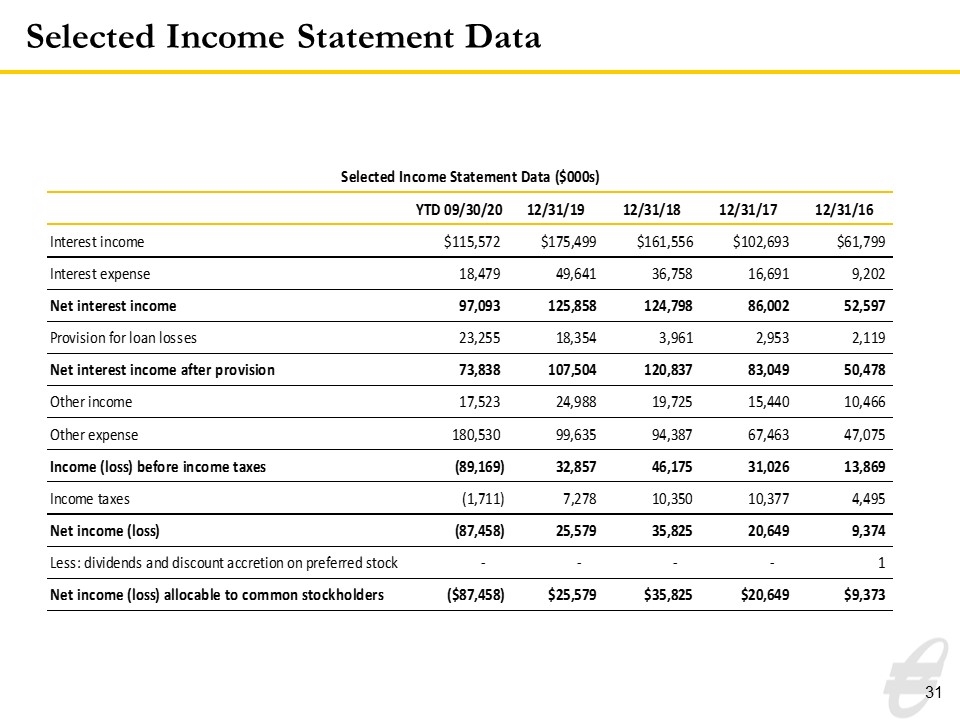

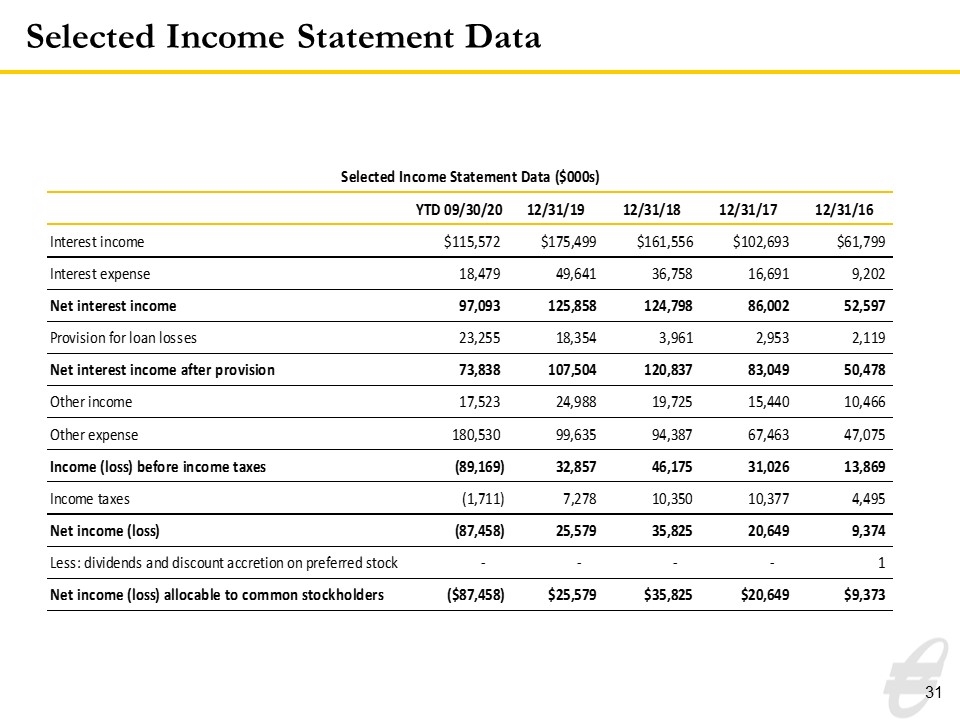

Selected Income Statement Data Selected Income Statement Data ($000s) YTD 09/30/20 12/31/19 12/31/18 12/31/17 12/31/16 12/31/14 2013 Interest income $,115,572 $,175,499 $,161,556 $,102,693 $61,799 $46,794 $46,845 Interest expense 18479 49641 36758 16691 9202 5433 5610 Net interest income 97093 125858 124798 86002 52597 41361 41235 Provision for loan losses 23255 18354 3961 2953 2119 1200 2583 Net interest income after provision 73838 107504 120837 83049 50478 40161 38652 Other income 17523 24988 19725 15440 10466 8674 7892 Other expense 180530 99635 94387 67463 47075 35645 35137 Income (loss) before income taxes -89169 32857 46175 31026 13869 13190 11407 Income taxes -1711 7278 10350 10377 4495 4203 3534 Net income (loss) -87458 25579 35825 20649 9374 8987 7873 Less: dividends and discount accretion on preferred stock 0 0 0 0 1 708 978 Net income (loss) allocable to common stockholders $,-87,458 $25,579 $35,825 $20,649 $9,373 $8,279 $6,895

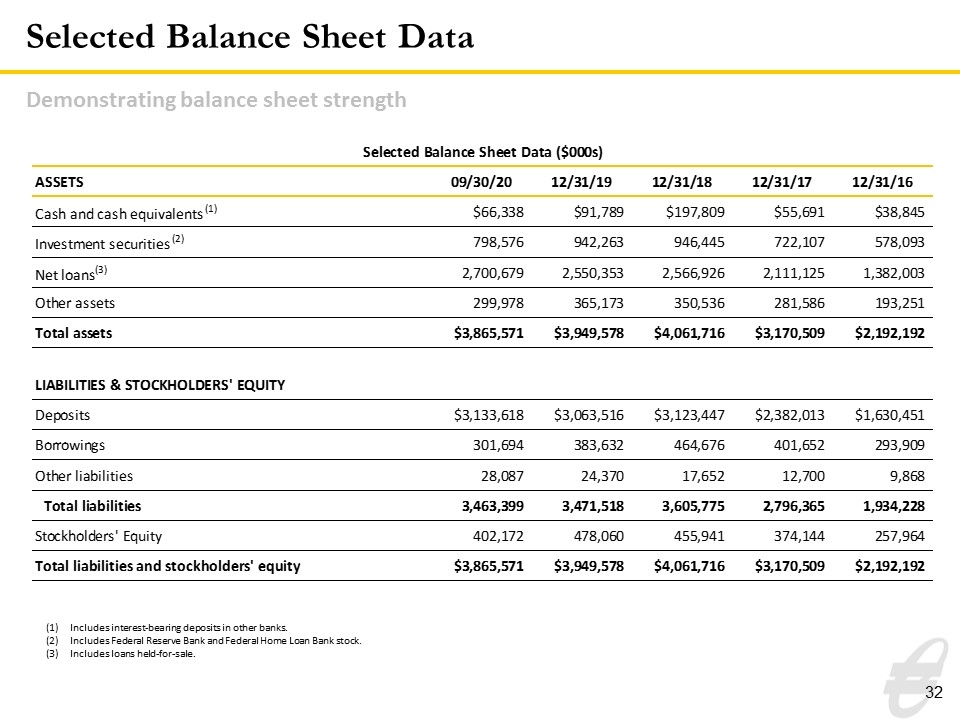

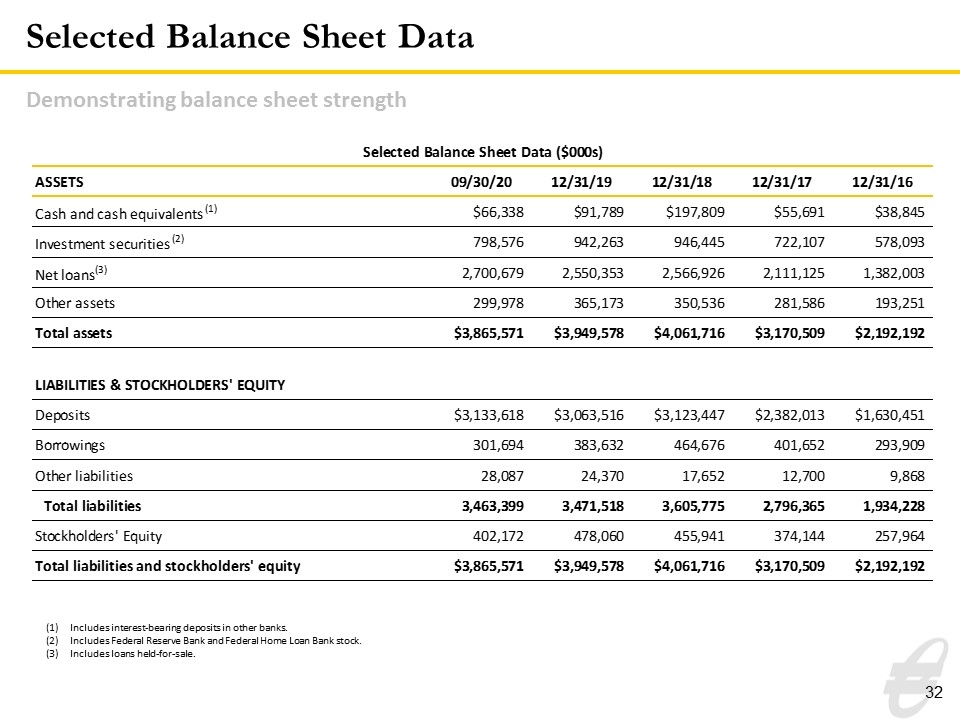

Selected Balance Sheet Data Demonstrating balance sheet strength Includes interest-bearing deposits in other banks. Includes Federal Reserve Bank and Federal Home Loan Bank stock. Includes loans held-for-sale. Selected Balance Sheet Data ($000s) ASSETS 12/31/14 09/30/20 12/31/19 12/31/18 12/31/17 12/31/16 Cash and cash equivalents (1) $37,702 $66,338 $91,789 $,197,809 $55,691 $38,845 Investment securities (2) 318314 798576 942263 946445 722107 578093 Net loans(3) 720810 2700679 2550353 2566926 2111125 1382003 Other assets 97689 299978 365173 350536 281586 193251 Total assets $1,174,515 $3,865,571 $3,949,578 $4,061,716 $3,170,509 $2,192,192 LIABILITIES & STOCKHOLDERS' EQUITY Deposits $,981,177 $3,133,618 $3,063,516 $3,123,447 $2,382,013 $1,630,451 Borrowings 70370 301694 383632 464676 401652 293909 Other liabilities 5239 28087 24370 17652 12700 9868 Total liabilities 1056786 3463399 3471518 3605775 2796365 1934228 Stockholders' Equity 117729 402172 478060 455941 374144 257964 Total liabilities and stockholders' equity $1,174,515 $3,865,571 $3,949,578 $4,061,716 $3,170,509 $2,192,192

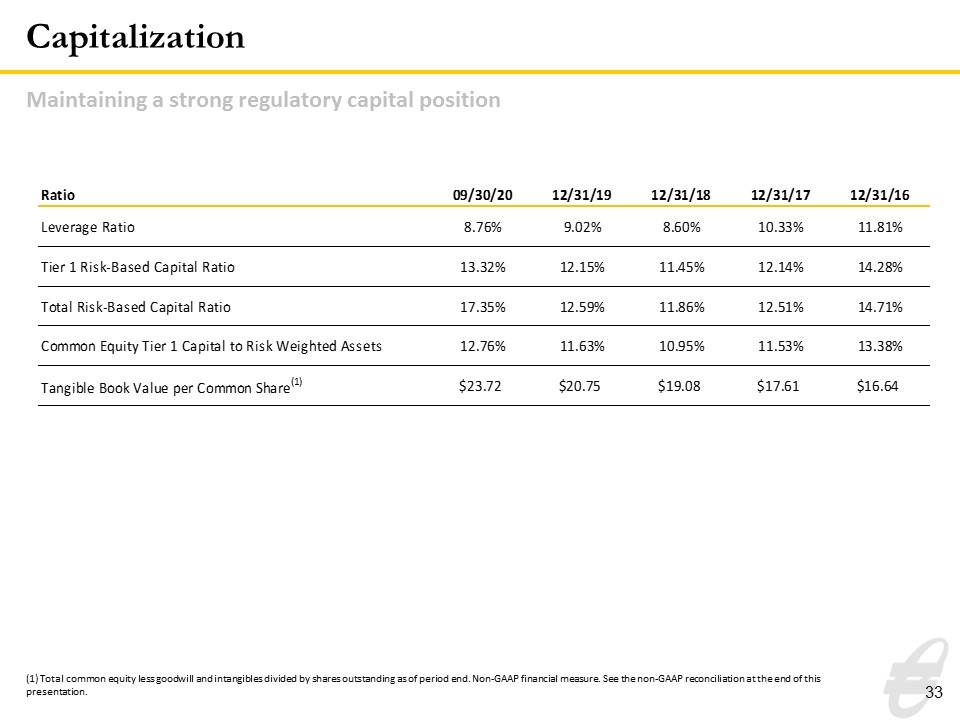

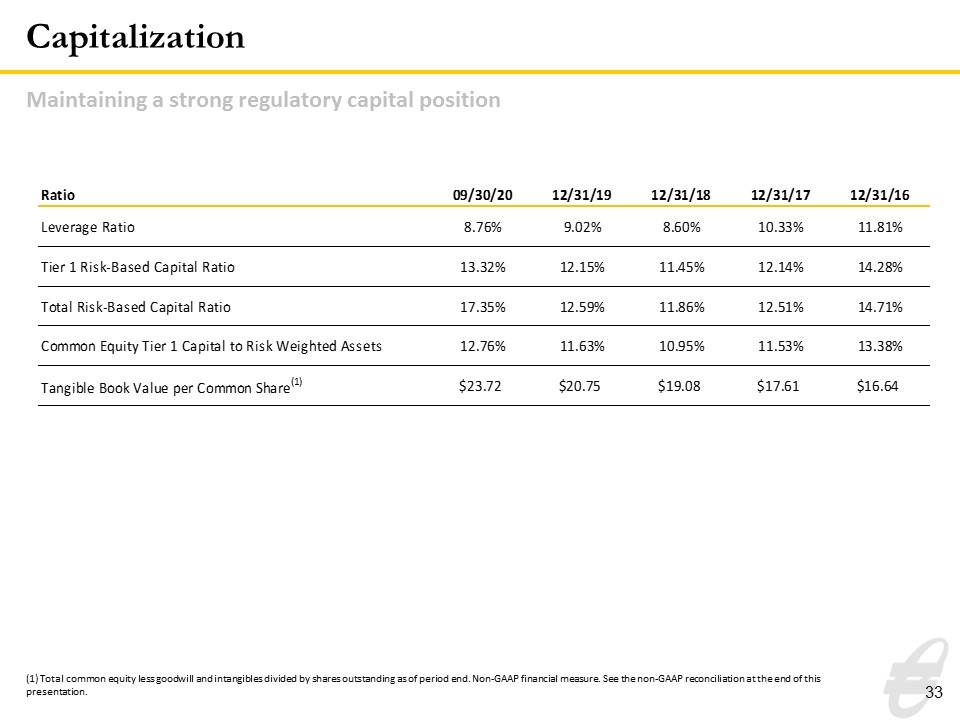

Capitalization (1) Total common equity less goodwill and intangibles divided by shares outstanding as of period end. Non-GAAP financial measure. See the non-GAAP reconciliation at the end of this presentation. Maintaining a strong regulatory capital position Ratio 12/31/14 09/30/20 12/31/19 12/31/18 12/31/17 12/31/16 Leverage Ratio 9.6199999999999994E-2 8.7599999999999997E-2 9.0200000000000002E-2 8.5999999999999993E-2 0.1033 0.1181 Tier 1 Risk-Based Capital Ratio 0.13159999999999999 0.13320000000000001 0.1215 0.1145 0.12139999999999999 0.14280000000000001 Total Risk-Based Capital Ratio 0.1386 0.17349999999999999 0.12590000000000001 0.1186 0.12509999999999999 0.14710000000000001 Common Equity Tier 1 Capital to Risk Weighted Assets NA 0.12759999999999999 0.1163 0.1095 0.1153 0.1338 Tangible Book Value per Common Share(1) $13.54 $23.72 $20.75 $19.079999999999998 $17.61 $16.64

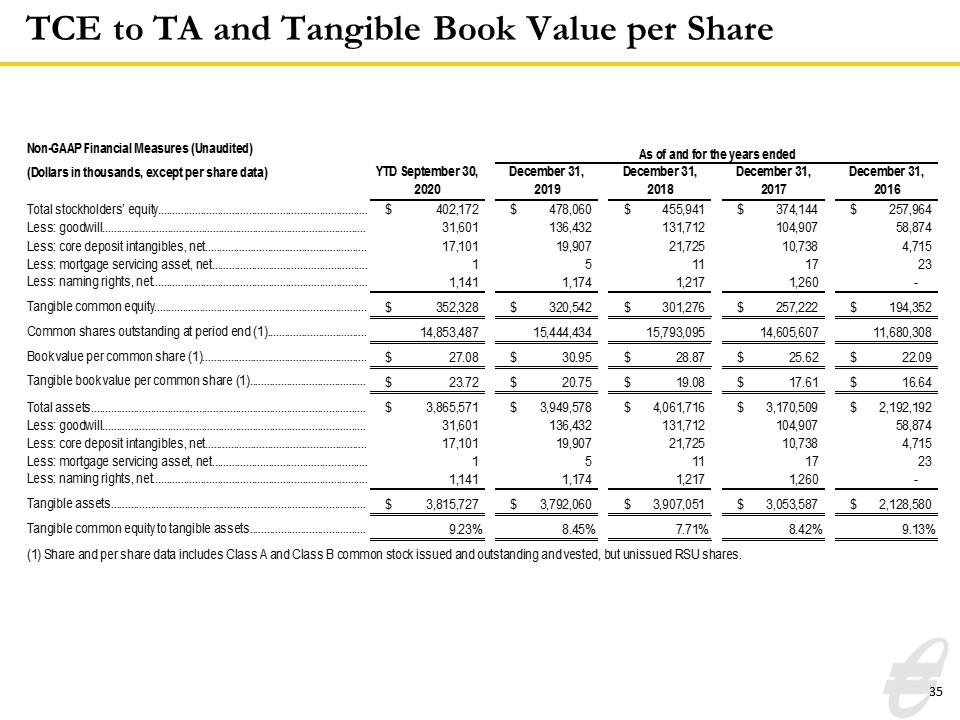

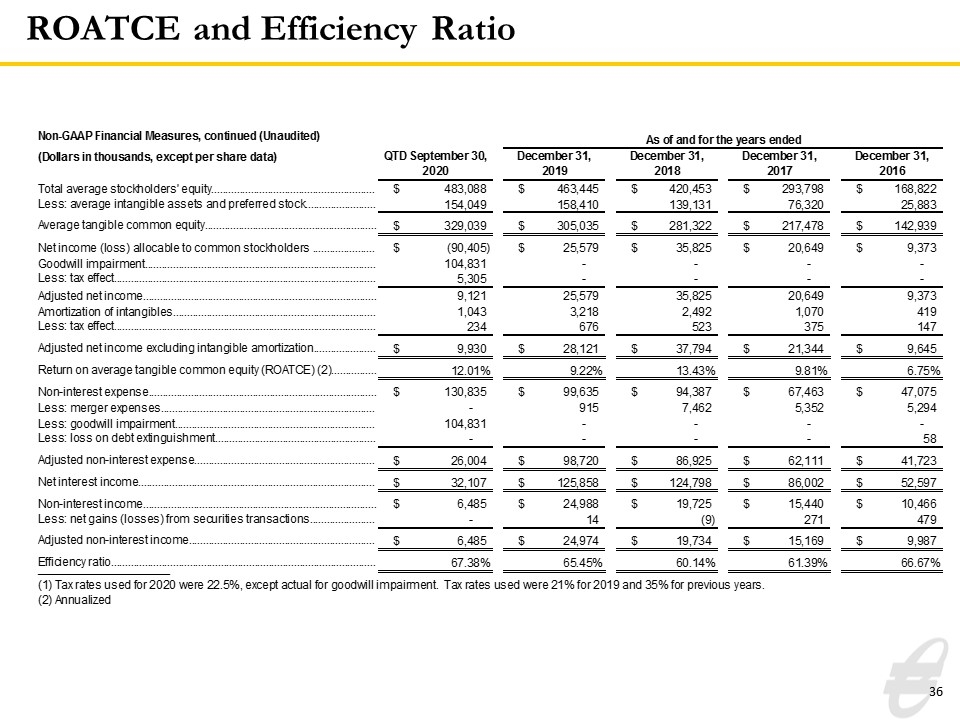

The subsequent tables present non-GAAP reconciliations of the following calculations: Tangible Common Equity (TCE) to Tangible Assets (TA) Ratio Tangible Book Value per Common Share Return on Average Tangible Common Equity (ROATCE) Efficiency Ratio

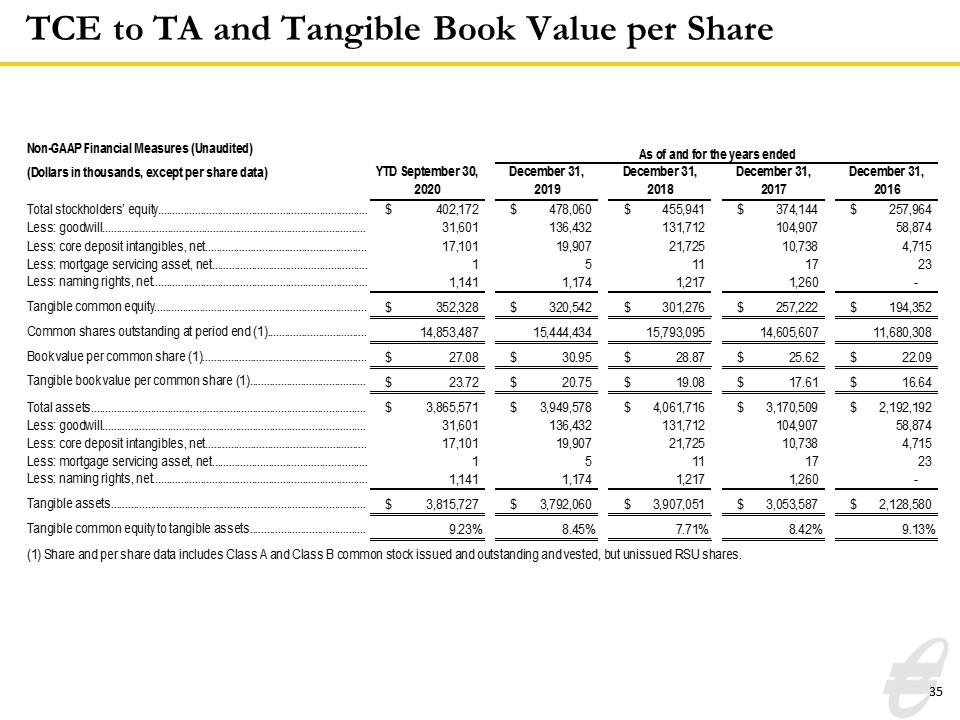

TCE to TA and Tangible Book Value per Share As of and for the years ended Non-GAAP Financial Measures (Unaudited) (Dollars in thousands, except per share data) YTD September 30, 2020 December 31, 2019 December 31, 2018 December 31, 2017 December 31, 2016 December 31,2012 Total stockholders’ equity $,402,172 $,478,060 $,455,941 $,374,144 $,257,964 $,138,169 Less: goodwill 31,601 ,136,432 ,131,712 ,104,907 58,874 18,130 Less: core deposit intangibles, net 17,101 19,907 21,725 10,738 4,715 1,957 Less: mortgage servicing asset, net 1 5 11 17 23 Less: naming rights, net 1,141 1,174 1,217 1,260 0 0 Tangible common equity $,352,328 $,320,542 $,301,276 $,257,222 $,194,352 $86,198 Common shares outstanding at period end (1) 14,853,487 15,444,434 15,793,095 14,605,607 11,680,308 7,431,513 Book value per common share (1) $27.075931732393883 $30.953546112470033 $28.869642080922077 $25.61646359511111 $22.085376515756259 $14.301932863469389 Tangible book value per common share (1) $23.720221386399029 $20.75453202105043 $19.076438152243114 $17.611181787925695 $16.639287251671785 $11.598983948490705 Total assets $3,865,571 $3,949,578 $4,061,716 $3,170,509 $2,192,192 $1,188,850 Less: goodwill 31,601 ,136,432 ,131,712 ,104,907 58,874 18,130 Less: core deposit intangibles, net 17,101 19,907 21,725 10,738 4,715 1,957 Less: mortgage servicing asset, net 1 5 11 17 23 Less: naming rights, net 1,141 1,174 1,217 1,260 0 0 Tangible assets $3,815,727 $3,792,060 $3,907,051 $3,053,587 $2,128,580 $1,168,763 Tangible common equity to tangible assets 9.233574624180399E-2 8.4529780646930688E-2 7.7110843958781192E-2 8.4236014890029326E-2 9.1305941049901806E-2 7.3751479127932701E-2 (1) Share and per share data includes Class A and Class B common stock issued and outstanding and vested, but unissued RSU shares. Non-GAAP Financial Measures, continued (Unaudited) As of and for the three months ended As of and for the three months ended As of and for the three months ended As of and for the three months ended (Dollars in thousands, except per share data) March 31, 2017 March 31, 2017 March 31, 2017 March 31, 2016 December 31,2012 Total average stockholders' equity $,264,736 $,264,736 $,264,736 $,153,929 $,102,032 Less: average intangible assets and preferred stock 65,185 65,185 65,185 20,616 33,653 Average tangible common equity (1) (3) $,199,551 $,199,551 $,199,551 $,133,313 $68,379 Net income allocable to common stockholders (1) 4,864 4,864 4,864 3,439 3,814 Amortization of core deposit intangible 218 218 218 87 192 Less: tax effect of amortization of core deposit intangible (2) -76 -76 -76 -30 -65 Adjusted net income allocable to common stockholders $5,006 $5,006 $5,006 $3,496 $3,941 Return on average tangible common equity (ROATCE) 0.10173895951967722 0.10173895951967722 0.10173895951967722 0.10547234826937482 5.7634653914213428E-2 Non-interest expense $15,226 $15,226 $15,226 $9,689 $22,900 Less: merger expenses 926 926 926 0 1,519 Less: loss on debt extinguishment 0 0 0 58 0 Non-interest expense, excluding merger expenses and loss on debt extinguishment $14,300 $14,300 $14,300 $9,631 $21,381 Net interest income $19,893 $19,893 $19,893 $12,758 $25,570 Non-interest income $3,339 $3,339 $3,339 $2,697 $4,826 Less: net gains on sales and settlement of securities 13 13 13 420 3 Less: net gain on acquisition 0 0 0 0 0 Non-interest income, excluding net gains on sales and settlement of securities and net gain on acquisition $3,326 $3,326 $3,326 $2,277 $4,823 Efficiency ratio 0.61587493001421245 0.61587493001421245 0.61587493001421245 0.64057199866977055 0.70348435495015305 ____________________ (1) Share and per share data includes Class A and Class B common stock issued and outstanding (2) Tax rates used in this calculation were 35% for 2015 and 2014 and 34% for 2013, 2012, and 2011 (3) All periods disclosed were calculated using a simple average of tangible common equity

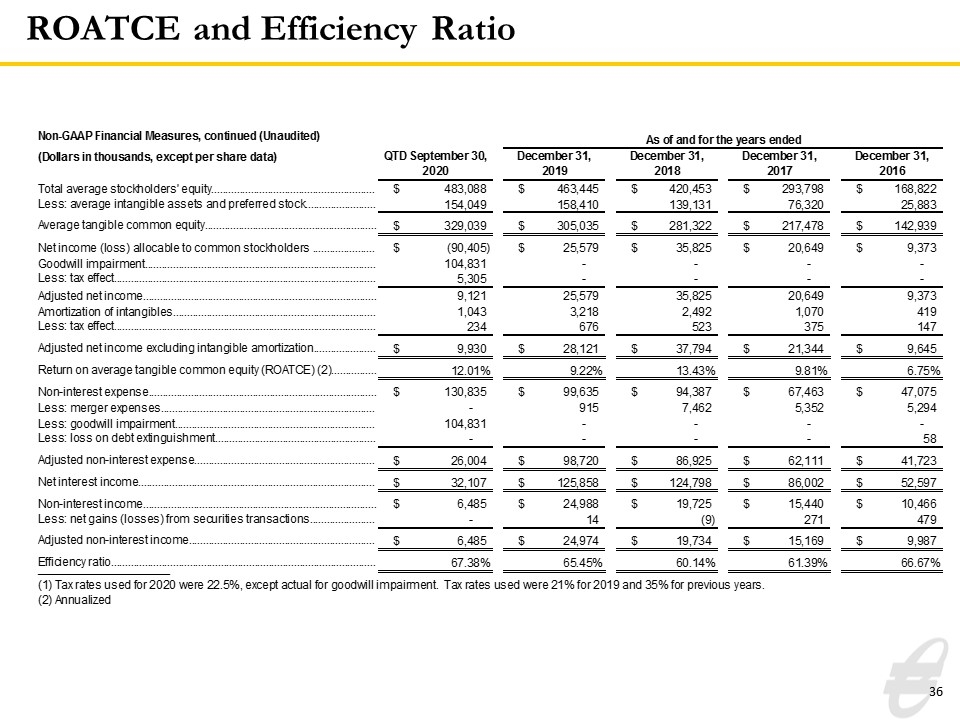

ROATCE and Efficiency Ratio Non-GAAP Financial Measures (Unaudited) Years Ended December 31, (Dollars in thousands, except per share data) Mar. 2018 Mar. 2018 2017 2016 Total stockholders’ equity $,381,487 $,381,487 $,374,144 $,257,964 Less: preferred stock 0 0 0 0 Less: goodwill ,103,412 ,103,412 ,104,907 58,874 Less: core deposit intangibles, net 10,355 10,355 10,738 4,715 Less: mortgage servicing asset, net 16 16 17 23 Less: naming rights, net 1,249 1,249 1,260 0 Tangible common equity $,266,455 $,266,455 $,257,222 $,194,352 Common shares outstanding at period end (1) 14,621,258 14,621,258 14,605,607 11,680,308 Book value per common share $26.091256990335577 $26.091256990335577 $25.61646359511111 $22.085376515756259 Tangible book value per common share $18.223808101874681 $18.223808101874681 $17.611181787925695 $16.639287251671785 Total assets $3,176,062 $3,176,062 $3,170,509 $2,192,192 Less: goodwill ,103,412 ,103,412 ,104,907 58,874 Less: core deposit intangibles, net 10,355 10,355 10,738 4,715 Less: mortgage servicing asset, net 16 16 17 23 Less: naming rights, net 1,249 1,249 1,260 0 Tangible assets $3,061,030 $3,061,030 $3,053,587 $2,128,580 Tangible common equity to tangible assets 8.7047497084314751E-2 8.7047497084314751E-2 8.4236014890029326E-2 9.1305941049901806E-2 (1) Share and per share data includes Class A and Class B common stock issued and outsanding (2) Tax rates used in this calculation were 35% (3) All periods disclosed, except 2018, 2017 and 2016, were calculated using a simple average of tangible common equity Non-GAAP Financial Measures, continued (Unaudited) As of and for the years ended (Dollars in thousands, except per share data) QTD September 30, 2020 December 31, 2019 December 31, 2018 December 31, 2017 December 31, 2016 Total average stockholders' equity $,483,088 $,463,445 $,420,453 $,293,798 $,168,822 Less: average intangible assets and preferred stock ,154,049 ,158,410 ,139,131 76,320 25,883 Average tangible common equity $,329,039 $,305,035 $,281,322 $,217,478 $,142,939 Net income (loss) allocable to common stockholders $,-90,405 $25,579 $35,825 $20,649 $9,373 Goodwill impairment ,104,831 0 0 0 0 Less: tax effect 5,305 0 0 0 0 Adjusted net income 9,121 25,579 35,825 20,649 9,373 Amortization of intangibles 1,043 3,218 2,492 1,070 419 Less: tax effect 234 676 523 375 147 Adjusted net income excluding intangible amortization $9,930 $28,121 $37,794 $21,344 $9,645 Return on average tangible common equity (ROATCE) (2) 0.12005911285526218 9.2189420886127818E-2 0.13434427453238637 9.8143260467725466E-2 6.7476336059437939E-2 Non-interest expense $,130,835 $99,635 $94,387 $67,463 $47,075 Less: merger expenses 0 915 7,462 5,352 5,294 Less: goodwill impairment ,104,831 0 0 0 0 Less: loss on debt extinguishment 0 0 0 0 58 Adjusted non-interest expense $26,004 $98,720 $86,925 $62,111 $41,723 Net interest income $32,107 $,125,858 $,124,798 $86,002 $52,597 Non-interest income $6,485 $24,988 $19,725 $15,440 $10,466 Less: net gains (losses) from securities transactions 0 14 -9 271 479 Adjusted non-interest income $6,485 $24,974 $19,734 $15,169 $9,987 Efficiency ratio 0.67381840796019898 0.65450302323114462 0.60142390612459529 0.61392098526257521 0.66667199284162082 ____________________ (1) Tax rates used for 2020 were 22.5%, except actual for goodwill impairment. Tax rates used were 21% for 2019 and 35% for previous years. (2) Annualized

investor.equitybank.com