UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-21335 |

| |

| Exact name of registrant as specified in charter: | Optimum Fund Trust |

| |

| Address of principal executive offices: | 610 Market Street |

| Philadelphia, PA 19106 |

| |

| Name and address of agent for service: | David F. Connor, Esq. |

| 610 Market Street |

| Philadelphia, PA 19106 |

| |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| |

| Date of fiscal year end: | March 31 |

| |

| Date of reporting period: | March 31, 2021 |

Table of Contents

Item 1. Reports to Stockholders

Annual report

Optimum Fixed Income Fund

Optimum International Fund

Optimum Large Cap Growth Fund

Optimum Large Cap Value Fund

Optimum Small-Mid Cap Growth Fund

Optimum Small-Mid Cap Value Fund

March 31, 2021

Beginning on or about June 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your Fund’s shareholder reports will no longer be sent to you by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker/dealer, bank, or insurance company. Instead, you will be notified by mail each time a report is posted on the website and provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. You may elect to receive paper copies of all future shareholder reports free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at 800 914-0278. If you own these shares through a financial intermediary, you may contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the Optimum Funds or your financial intermediary. |

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and their summary prospectuses, which may be obtained by visiting optimummutualfunds.com/literature or calling 800 914-0278. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Table of Contents

Table of contents

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Funds are governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of March 31, 2021, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Macquarie Investment Management (MIM) is the marketing name for certain companies comprising the asset management division of Macquarie Group. Investment products and advisory services are distributed and offered by and referred through affiliates which include Delaware Distributors, L.P., a registered broker/dealer and member of the Financial Industry Regulatory Authority (FINRA) and Macquarie Investment Management Business Trust (MIMBT), a Securities and Exchange Commission (SEC)-registered investment advisor. Investment advisory services are provided by a series of MIMBT. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

All third-party marks cited are the property of their respective owners.

© 2021 Macquarie Management Holdings, Inc.

Table of Contents

Portfolio management reviews

Optimum Fixed Income Fund

April 6, 2021 (Unaudited)

| Performance review (for the year ended March 31, 2021) | | | | |

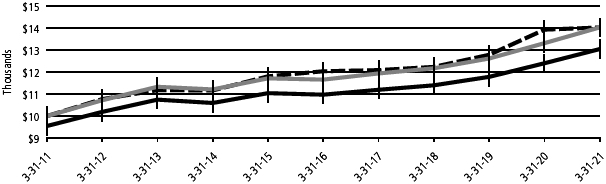

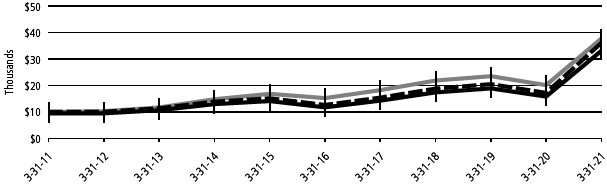

| Optimum Fixed Income Fund (Institutional Class shares) | | 1-year return | | +5.37% |

| Optimum Fixed Income Fund (Class A shares) | | 1-year return | | +5.21% |

| Bloomberg Barclays US Aggregate Index (benchmark) | | 1-year return | | +0.71% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Fixed Income Fund, please see the table on page 18.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Fund objective

The Fund seeks a high level of income and may also seek growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisor

Pacific Investment Management Company LLC (PIMCO)

Market review

Shortly into the Fund’s fiscal year, in the second calendar quarter of 2020, risk appetites began to improve considerably following positive developments that included the easing of COVID-19-related lockdown measures, improving economic data, and continued fiscal and monetary policy support. Global equities rallied, credit spreads tightened considerably, and the US dollar weakened. International government bond yield moves were broadly mixed, with yield curves steepening in some regions, as longer-term rates rose while central bank activity generally anchored short-term rates at low levels. Economic data pointed to recovery under way: Global Purchasing Managers’ Indices (PMIs) improved following sharp declines, unemployment fell from record peaks, and global central banks and policymakers reaffirmed commitments to supportive policy and quantitative easing (QE) measures. Geopolitical tensions also garnered headlines, as social unrest spread across the United States.

Despite an uptick in volatility toward the end of the third calendar quarter of 2020, risk assets broadly gained amid a rebound in economic data, heightened optimism around a potential COVID-19 vaccine, and ongoing global policy support. Risk appetites were generally robust, though concerns regarding the pandemic and the likelihood of US fiscal stimulus contributed to some reversal late in September. Still, global equities rose, credit spreads tightened, and the US dollar weakened relative to other developed market currencies. Although global economic data continued to improve, there were some signs of weakness that underscored the fragile nature of the global economic recovery. US labor market data indicated gradual improvement and core inflation rose, while consumer sentiment lagged and small businesses largely struggled to reopen. Concerns persisted as the global COVID-19 case count surpassed 33 million and deaths surpassed one million during the quarter. US-China tensions re-escalated. Brexit headlines and ongoing US election news added to the political uncertainty.

In the fourth calendar quarter of 2020, vaccine approvals, more policy stimulus, and clarity on US election results bolstered market optimism. Improving US labor market data outpaced expectations, even though total job gains had not yet recovered all the jobs lost in March and April of 2020. US equity markets largely ignored renewed lockdowns and the economic recovery’s decelerating pace. Credit spreads tightened, and the US dollar weakened. Most types of broad credit spreads finished 2020 only modestly wider. Demand concerns continued to plague sectors such as energy. Various other geopolitical topics also made headlines. Joe Biden was affirmed as president, and two runoff elections in Georgia gave Democrats control of the Senate. Also of note, the Trump administration hardened its rhetoric and policy against China, fueling further tensions, and a trade deal between the United Kingdom and the European Union alleviated some lingering Brexit concerns.

The new calendar year started off on uneven footing as market sentiment oscillated between optimism for recovery and uncertainty over the pace of vaccinations and new lockdown restrictions. Adding to volatility, erratic retail trading activity dominated headlines, while some corporate earnings disappointed. Sovereign bond yields climbed and global equities generally rose as markets digested expectations for both higher growth and inflation. Repricing in market expectations for the US Federal Reserve’s rate policy and the Biden administration’s large fiscal support proposal contributed to higher yields. Vaccination programs progressed globally, and winter lockdowns showed signs of slowing COVID-19 infection rates that had surged from holiday gatherings. That said, while the pace of the rollout picked up in the US, the UK, and Israel, supply-related delays and new COVID variants remained sources of concern.

The Fund’s fiscal year contained both one of the most distressed periods in modern economic history and an equally swift market

1

Table of Contents

Portfolio management reviews

Optimum Fixed Income Fund

recovery. The period brought about the greatest pandemic of modern times, featuring market disruptions and economic distress on a scale comparable only to the start of the Great Depression, against the backdrop of immense human suffering and sociopolitical distress. Yet the fiscal year also saw rapid and effective global monetary and fiscal intervention, including support of securities ranging from US Treasurys and agency mortgage-backed securities (MBS) to corporate bonds, exchange-traded funds (ETFs), and trillions of dollars’ worth of global fiscal stimulus implemented mere weeks after the pandemic’s onset.

While the loss of human life was immense, modern technology delivered vaccines with generally high efficacy rates by the end of 2020. More so, despite the significant sociopolitical headwinds, including racial inequities brought to the fore in the US, concern over an orderly handover of power in the White House, and a violent attack on the US Capitol, the political shift in the US delivered an additional $1.9 trillion of American stimulus likely to help lift the global economy. As a result, by March 31, 2021, yield spreads ended near all-time tight levels and interest rates moved significantly above the record lows of the summer of 2020.

Source: Bloomberg, unless noted otherwise.

Fund performance

For the fiscal year ended March 31, 2021, Optimum Fixed Income Fund outperformed its benchmark index, the Bloomberg Barclays US Aggregate Index, with positive results from each of the Fund’s component parts, managed by DMC and PIMCO. The following remarks describe factors that affected relative performance within these respective portions.

DMC

For the fiscal year, DMC’s portion of Optimum Fixed Income Fund outperformed the Fund’s benchmark, the Bloomberg Barclays US Aggregate Index.

DMC believes its portfolio management strategy was well suited for managing a highly volatile environment. By design, during periods of tight spreads and high liquidity, such as before the pandemic, DMC builds a liquid capital reserve of Treasurys, agency MBS, and cash by reducing risks in areas such as high yield, investment grade corporates, and emerging markets debt. Conversely, as COVID-19 struck in March 2020, DMC shifted gears by seeking to capture opportunities in dislocated markets across the entire investable universe.

In its portion of the Fund, DMC initially increased the allocation to investment grade corporate bonds by roughly 10 percentage points, focusing on individual issuers’ liquidity and the ability of their business models to survive the fallout from the pandemic. With further government support and greater clarity around health mitigation strategies, DMC also increased allocations to US dollar-denominated emerging market issuers and high yield issuers. Early in 2021, to help mitigate near-term potential inflationary pressures, DMC increased its Treasury inflation-protected securities (TIPS) exposure by roughly 5.5 percentage points and shifted its duration focus from modest long duration at the pandemic’s peak to modest short duration after interest rates reached historic lows. These strategies collectively benefited from the eventual recovery in spread sectors, increase in inflationary expectations, and rise in interest rates.

As a result, all three major levers of excess return contributed to performance in DMC’s portion of the Fund: sector allocation, yield curve management, and security selection.

Specifically, DMC’s risk management approach to yield curve positioning benefited from the yield curve steepening late in the fiscal year and its shift to a modest short duration from a modest long duration initially benefited from the decline in interest rates and, eventually, the increase in the 10-year US Treasury yield, from 0.5% to 1.7% by fiscal year end.

DMC’s shift to overweight investment grade corporates starting in March 2020, and the subsequent increase in its allocation to high yield and emerging markets debt, were the key contributors to sector returns in DMC’s portion of the Fund. DMC monetized returns in investment grade corporates by the end of 2020 and into 2021 by reducing the allocation by roughly 10 percentage points once spreads returned to near all-time tights, shifting more to agency MBS to increase portfolio liquidity and reduce credit risk. Simultaneously, DMC chose to maintain the higher allocation to high yield and emerging markets debt in its portion of the Fund as it believed these should continue to benefit from the strong reflationary tailwinds early in 2021.

At the security level, key contributors included issuers DMC had identified as well-positioned survivors within COVID-19-affected sectors, such as Delta Air Lines Inc. in the airlines sector. Selection within energy, including Marathon Oil Corp., benefited from the eventual recovery in oil prices combined with issuer resilience and liquidity. DMC continues to hold these securities in its portion of the Fund.

By contrast, certain decisions detracted from performance in DMC’s portion of the Fund. An underweight to agency MBS, as a source of funding for the higher yielding sectors, modestly detracted because the sector produced strong returns while DMC lightened the exposure in its portion of the Fund.

In addition, DMC’s underweight to more defensive segments such as government-related issuers, including agencies and taxable municipal

2

Table of Contents

bonds, detracted from returns because these securities outperformed duration-equivalent Treasurys.

Because of the fiscal year’s timing relative to the pandemic, most issuers outperformed government benchmarks. Thus, the individual detractors in DMC’s portion of the Fund largely were more defensive securities that didn’t experience as full a recovery, such as certain utility securities within corporates. In addition, while DMC takes a diversified approach to security selection within emerging markets, limited exposures to issuers that struggled during the pandemic, such as Republic of Argentina bonds and Aerovias de Mexico SA de CV, modestly detracted from performance in DMC’s portion of the Fund.

During the fiscal year, DMC used a variety of derivatives, including Treasury futures used primarily as a tool to manage yield curve risk. It also used credit default swaps and currency hedges. The use of derivatives added slightly more than 0.50 percentage points to performance for DMC’s portion of the Fund for the fiscal year.

PIMCO

For the fiscal year, PIMCO’s portion of the Fund outperformed its benchmark, the Bloomberg Barclays US Aggregate Index.

Interest rate strategies contributed to performance for PIMCO’s portion of the Fund. US yield curve positioning was beneficial, including an underweight to long-term rates, as intermediate and long-end US Treasury yields rose over the fiscal year. An underweight to front-end rates partially offset this, as short rates fell. Non-US interest rate strategies contributed to performance in PIMCO’s portion of the Fund, including an overweight to Italian duration and short exposure to UK interest rates. An allocation to Canadian duration modestly detracted from performance as Canadian yields rose.

Spread sector strategies added to returns in PIMCO’s portion of the Fund during the fiscal year. Holdings of nonagency mortgages contributed to performance amid broader market stabilization and continued strong fundamentals, while security selection within commercial mortgage-backed securities (CMBS) detracted from performance in PIMCO’s portion of the Fund. Relative value positioning within agency MBS also contributed to performance for PIMCO. An allocation to US TIPS contributed to performance as inflation expectations rose, and holdings of energy-related emerging market quasi-sovereign external debt also aided performance. Credit strategies detracted overall as the negative effect of an underweight to investment grade corporate credit more than offset contributions from an allocation to high yield corporate credit.

Currency strategies were neutral overall for performance in PIMCO’s portion of the Fund. A long-dollar bias relative to a basket of Latin American emerging market currencies detracted from performance, while exposure to the British pound contributed to returns.

At fiscal year end, PIMCO continued to favor US interest rate exposure relative to other developed markets, including the UK. While rates may still drift higher, PIMCO’s management believes much of the move is likely behind us and that the extent of steepening could make the middle of the curve (medium-term bonds) attractive. PIMCO maintained a broad underweight to corporate credit and continued to have a bias toward liquid and high-quality names, while de-emphasizing generic corporate credit exposure. PIMCO continued to favor diversified spread exposure and agency MBS, given their appealing valuations, in PIMCO’s view. It also continued to favor senior positions in mortgage credit given the asset’s inherent fundamental strength and the deleveraging nature. PIMCO is focused on maintaining a high level of liquidity in its portion of the Fund.

PIMCO used several types of derivatives to seek to manage risks associated with market volatility and interest rate risk. However, the use of credit default swaps, forwards, futures, interest rate swaps, options, and swaptions did not have a material impact on performance during the fiscal year within PIMCO’s portion of the Fund.

3

Table of Contents

Portfolio management reviews

Optimum International Fund

April 6, 2021 (Unaudited)

| Performance review (for the year ended March 31, 2021) |

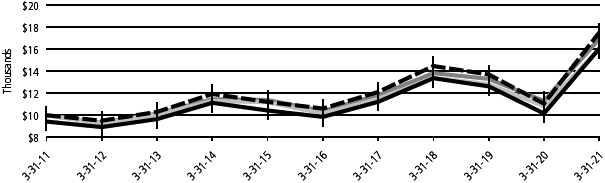

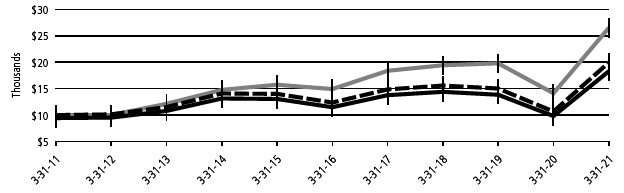

| Optimum International Fund (Institutional Class shares)* | | 1-year return | | +58.48% |

| Optimum International Fund (Class A shares)* | | 1-year return | | +58.04% |

| MSCI ACWI ex USA Index (net) (benchmark) | | 1-year return | | +49.41% |

| MSCI ACWI ex USA Index (gross) (benchmark) | | 1-year return | | +50.03% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum International Fund, please see the table on page 21.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

*Total returns for the report period presented in the table differs from the return in “Financial highlights.” The total returns presented in the above table are calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total returns presented in “Financial highlights” are calculated in the same manner, but also takes into account certain adjustments that are necessary under US generally accepted accounting principles (US GAAP) required in the annual report.

Investment objective

The Fund seeks long-term growth of capital and may also seek income.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Acadian Asset Management LLC (Acadian)

EARNEST Partners LLC (EARNEST)

Market review

The Fund’s fiscal year ended March 31, 2021, began following markets’ most challenging quarter since the depths of the 2008 global financial crisis. In the first quarter of 2020, prior to the start of the Fund’s fiscal year, financial markets had plunged precipitously as investors reacted to the worldwide economic shutdowns imposed to curtail the rapidly spreading COVID-19 pandemic. Worldwide, governments and central banks responded just as rapidly with unprecedented levels of fiscal and monetary stimulus.

Given the sizable fiscal stimulus, economies began to recover during the Fund’s fiscal year, albeit slowly. Broad uncertainty about the speed and scope of recovery persisted throughout the period. Equity investors displayed no hesitancy, however, and markets responded enthusiastically to the monetary support provided by central banks, underscoring an apparent disconnect with economic reality and the true prospects of recovery. Such support, while swift and substantial, may have obscured several downside risks and set expectations that governments will continue to flood economies with aid.

Nonetheless, the arrival of a COVID-19 vaccine in December spurred investor optimism further and encouraged a risk rally into sectors that had been beaten down earlier in the year. Equities were further buoyed by central banks’ commitments to remain accommodative for the foreseeable future, the 11th-hour Brexit deal, and the US election results. Still, global trade dynamics remained in flux, further disrupted by China’s efforts to disentangle itself from global supply chains.

Global equity markets continued to ascend in the first calendar quarter of 2021 as investors gained confidence in the global economy’s ability to adapt to the ongoing coronavirus pandemic. International equity markets, as represented by the MSCI ACWI (All Country World Index) ex USA Index (net), rose 3.5% for the quarter and finished the 12-month period up 49.4%.

As the fiscal year ended, investors were looking beyond the near-term effects of the pandemic, incorporating the global vaccination rollout, continued government stimulus measures, and the adaptability of global businesses into projections of future earnings growth. The decrease in new case numbers, relaxation of business restrictions, and a continued low interest rate environment buoyed retail sales. In the United States, progress on the rollout of vaccinations continued. By the end of the fiscal year, more than 15% of the US population had received a COVID-19 vaccine. Many areas of the economy experienced expanded activity as the government’s stimulus measures supported new purchases of durable goods and home prices reached record highs.

Source: Bloomberg, unless noted otherwise.

Fund performance

For the fiscal year ended March 31, 2021, Optimum International Fund outperformed its benchmark, the MSCI ACWI ex USA Index. Both Acadian’s and EARNEST’s portions of the Fund outperformed the benchmark, generally on the strength of positive stock selection. Acadian’s portion of the Fund benefited from stock selection and an overweight position in South Korea, along with favorable stock selection in the United Kingdom. At the sector level, Acadian’s portion of the Fund benefited from stock selection in the consumer discretionary sector and stock selection and an overweight in the

4

Table of Contents

information technology (IT) sector. Stock selection in Switzerland and the Netherlands detracted from performance in Acadian’s portion of the Fund, as did stock selection and an overweight to the healthcare sector. EARNEST’s portion of the Fund benefited from its allocations to both emerging and developed market countries. On a sector basis, EARNEST’s portion of the Fund benefited from its investments in consumer discretionary, communication services, and materials. Consumer staples and healthcare detracted from performance for EARNEST’s portion of the Fund.

Acadian

Acadian focuses on its disciplined, value-focused, multifactor approach and manages its portion of the Fund with what it views as consistency, objectivity, and appropriate risk controls. Acadian believes that the coronavirus pandemic has created a new set of challenges for global equities and that the current situation is fluid and evolving. In these circumstances, Acadian’s approach is to maintain a calm and measured perspective, removing human emotion. Acadian believes it would be counterproductive to overreact to exceptional conditions by making wholesale changes to its portion of the Fund.

South Korean consumer electronics company LG Electronics Inc. was a leading contributor to performance in Acadian’s portion of the Fund. Shares jumped in December 2020 after the company announced a joint venture with Canadian auto parts maker Magna International Inc. to develop key components for electric cars.

A holding in Australian miner Fortescue Metals Group Ltd. also contributed significantly to performance for Acadian’s portion of the Fund, as the company benefited from rising iron-ore prices.

A position in Swiss pharmaceutical company Roche Holding AG was a significant detractor from performance in Acadian’s portion of the Fund for the fiscal year. Roche is a leading global healthcare company engaged in the development, manufacturing, and marketing of drugs, advanced biologics, and medical devices. Roche generates most of its revenue from the sale of pharmaceuticals. Its diagnostics division is smaller but has been faster growing. While the company’s COVID-19 antibody tests filled a necessary market need, third-quarter drug sales fell short of expectations. Nonetheless, at period end, Acadian maintained a positive view of Roche.

A lack of exposure to Taiwanese chipmaker Taiwan Semiconductor Manufacturing Co. Ltd. proved costly to Acadian’s portion of the Fund. The company benefited over the past year from higher demand for semiconductor chips. At period end, Acadian maintained a positive view of Taiwan Semiconductor, though considered the shares to be overvalued.

EARNEST

As a bottom-up (stock-by-stock), fundamental manager, EARNEST looks beyond the quarter-over-quarter noise of the market and strives to position its portion of the Fund for growth over a full market cycle. As a function of its bottom-up investment process the portfolio continues to express a relative overweight to developed countries.

Barclays PLC, a multinational investment bank and financial services company headquartered in the UK, was a leading contributor to performance in EARNEST’s portion of Fund. Despite year-over-year revenue contraction, recent results indicate Barclays’ performance fared considerably more favorably than consensus estimates. Barclays continued to generate attractive returns in its UK business, and EARNEST believes the company is well positioned to execute its long-term growth strategy.

Eurofins Scientific SE was another leading contributor in EARNEST’s portion of the Fund for the fiscal year. Eurofins Scientific is a healthcare company that offers testing and laboratory services to support clinical trials for discovery pharmaceuticals. During the pandemic, Eurofins Scientific benefited both from increased drug trials as companies raced to find a viable cure and from increased demand for widespread testing.

Banco Bradesco S.A., the second-largest private sector bank in Brazil in terms of total assets, was a significant detractor from performance in EARNEST’s portion of the Fund. The bank offers a variety of traditional services from lending to credit cards to insurance. Headquartered in Brazil, the company has more than 5,000 bank branches worldwide. COVID-19 impaired borrowers’ ability to make loan payments and many investors reacted negatively to bank stocks on the notion that nonperforming loans would increase and ultimately reduce profitability. Banco Bradesco was not immune to this dynamic. Its shares finished the Fund’s fiscal year with an absolute gain but trailed the benchmark’s strong return.

TravelSky Technology Ltd. also detracted from performance in EARNEST’s portion of the Fund. The company is a leading provider of IT and commercial services in China’s air travel and tourism industry. Its clients include airlines, airports, travel agencies, and individual and corporate travel consumers. During the onset of the pandemic, air travel in China fell from 85 million passengers a day to less than 10 million passengers a day. The valuation of the shares contracted to levels that suggested bookings would remain significantly depressed. EARNEST initially purchased the stock at what it viewed as an attractive valuation and, while it appreciated on an absolute basis during the fiscal year, the gain fell short of the benchmark’s return.

5

Table of Contents

Portfolio management reviews

Optimum International Fund

Overall, Optimum International Fund used derivatives, including foreign currency exchange contracts, during the fiscal year. However, these had a minimal effect on performance.

6

Table of Contents

Portfolio management reviews

Optimum Large Cap Growth Fund

April 6, 2021 (Unaudited)

| Performance review (for the year ended March 31, 2021) |

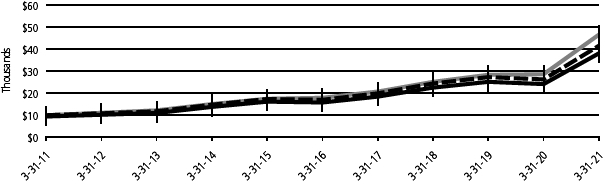

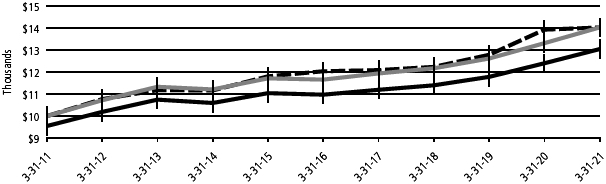

| Optimum Large Cap Growth Fund (Institutional Class shares) | | 1-year return | | +58.11% |

| Optimum Large Cap Growth Fund (Class A shares) | | 1-year return | | +57.75% |

| Russell 1000® Growth Index (benchmark) | | 1-year return | | +62.74% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Large Cap Growth Fund, please see the table on page 24.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Fund objective

The Fund seeks long-term growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisors

ClearBridge Investments, LLC (ClearBridge)

T. Rowe Price Associates, Inc. (T. Rowe Price)

Market review

Following the pandemic-induced, severe selloff in March 2020, US equities staged a remarkable recovery during the Fund’s fiscal year ended March 31, 2021. Equities had sold off suddenly and steeply when investor concern over the spread of COVID-19 was quickly followed by stringent worldwide economic shutdowns. Just as quickly, both governments and central banks around the world responded with unprecedented levels of fiscal and monetary stimulus that had investors flocking back to the markets.

Worldwide, economies were slower to respond. Restrictions on travel, dining, entertainment, and other group gatherings and activities led to severe economic losses. Many governments provided relief to prevent a severe depression from taking hold. In the United States, the initial round of fiscal stimulus – including direct payments to individuals, enhanced unemployment benefits, and a payroll protection program for small businesses – was followed by two additional rounds of relief in December 2020 and March 2021. The availability of a COVID-19 vaccine in November buoyed investors but did little to stimulate the economy given the relatively slow initial rollout. Gradually, however, signs of economic recovery became apparent as restrictions on economic activity were reduced and employment gains were notched.

During the Fund’s fiscal year, the large-cap S&P 500® Index advanced 56.35%, in large part because of the monetary support the US Federal Reserve provided. Growth outperformed value stocks by historically wide margins for the first half of the period, but a cyclical comeback driven by vaccine development and hopes for an economic reopening caused value to rally in the second half of the period. For the fiscal year, the Russell 1000 Growth Index gained 62.74% while the Russell 1000® Value Index rose 56.09%.

Source: Bloomberg, unless noted otherwise.

Fund performance

Optimum Large Cap Growth Fund underperformed its benchmark, the Russell 1000 Growth Index, for the Fund’s fiscal year ended March 31, 2021. Although ClearBridge and T. Rowe Price both generated positive absolute returns in their respective portions of the Fund, each underperformed relative to the benchmark, citing adverse stock selection and, in ClearBridge’s portion of the Fund, adverse sector allocation decisions as well. Stock selection in the information technology (IT) and consumer discretionary sectors and an underweight to IT also detracted from relative performance in Clearbridge’s portion of the Fund. Overall sector selection helped performance for T. Rowe Price’s portion of the Fund, with IT, consumer discretionary, and utilities detracting while communication services, consumer staples, and real estate contributed.

ClearBridge

ClearBridge normally invests in equity securities (or other instruments with similar economic characteristics) of US companies with large market capitalizations. ClearBridge’s core holdings are large-cap companies that it believes to be dominant in their industries owing to product, distribution, or service strength.

IT was the leading sector detractor from performance in ClearBridge’s portion of the Fund for the fiscal year, with two companies in particular responsible. salesforce.com Inc. is a leading software-as-a-service (SaaS) provider of customer relationship management solutions. Negative reaction to the company’s proposed acquisition of messaging platform Slack Technologies Inc. weighed on shares, especially in the fourth quarter of 2020 when investors perceived that salesforce overpaid for this acquisition. Early indications, however, suggest the deal will allow Slack to accelerate its penetration in the enterprise market.

7

Table of Contents

Portfolio management reviews

Optimum Large Cap Growth Fund

Splunk Inc. is a maker of data monitoring, analysis, and security software applications for enterprises. A broad giveback in growth stocks, continued confusion around the company’s shift to a subscription model, which affects revenue recognition, and poor communication about disappointing results late in 2020 hurt the stock. Nevertheless, Splunk remains one of the fastest-growing SaaS businesses with its transition to the cloud well ahead of plan.

An underweight to Apple Inc. also hurt relative performance in the first three quarters of the period. Apple’s size in the benchmark had grown so large that holding a benchmark weight or taking an active position would have invalidated the effort to maintain a diversified portfolio, in ClearBridge’s view.

Partially offsetting those results in the IT sector was NVIDIA Corp., a significant contributor to ClearBridge’s portion of the Fund. NVIDIA is a developer of graphics processing units for use in gaming, visual design, and artificial intelligence. The company delivered strong quarterly results throughout the year and raised earnings guidance primarily because of stronger gaming trends and resilience in data center growth.

The industrials sector was the primary contributor to results, led by strong operating results from United Parcel Service Inc. Under a new CEO, UPS has thrived through the pandemic and become a more efficient business.

The healthcare sector also helped performance for ClearBridge’s portion of the Fund. Thermo Fisher Scientific Inc., which played a key role in virus testing and supplies during the COVID-19 lockdowns, also contributed significantly. Not owning several of the largest biopharmaceutical stocks that underperformed for the year also helped ClearBridge’s portion of the Fund.

T. Rowe Price

T. Rowe Price normally invests in stocks of large-cap companies with one or more of the following characteristics: strong cash flow and an above-average rate of earnings growth, the ability to sustain earnings momentum during economic downturns, and occupation of a lucrative niche in the economy and ability to expand even during times of slow economic growth. As the country and the world work to return to normal, T. Rowe Price continues to monitor several key market themes.

First, T. Rowe Price believes there will be periods of volatility especially because much of the recovery has been priced into markets. Second, politics and the Biden administration’s emerging priorities will likely remain in the spotlight. Third, disruption caused by new technologies will continue, which in turn should create style dispersions among equity classes. Finally, T. Rowe Price is keeping a vigilant eye out for signs of inflation. While it appears almost certain there will be no disinflation in the near term, markets will also no longer have the tailwind of falling rates longer term, although they could remain at historically low levels if the inflation impulse fades.

IT was the leading relative underperformer in T. Rowe Price’s portion of the Fund, due primarily to weak stock choices including Fidelity National Information Services Inc. Despite less exposure to the costs of acquiring new merchants and more exposure to ecommerce relative to its peers, shares of the company underperformed as social distancing measures weighed on merchant-payment volumes.

Consumer discretionary also underperformed owing to weak stock picks such as Alibaba Group Holding Ltd. An overweight position only partially offset this, however. Despite impressive growth and market share gains for its core ecommerce business, shares of Alibaba traded lower due to persistent regulatory pressure on the company that included an antitrust investigation and the cancellation of the Ant Group initial public offering, a company in which Alibaba owns a 33% stake.

An overweight allocation to the utilities sector detracted from relative results. In contrast, communication services contributed as a result of stock selection, including positions in Snap Inc. and Sea Ltd., and an overweight exposure. Shares of Snap gained over the past 12 months due to increased user growth and engagement in response to social distancing measures, as well as higher advertiser demand and a mix shift toward higher-priced advertising solutions. Shares of Sea also traded higher over the past 12 months as both its gaming and ecommerce businesses experienced accelerating growth, aided by coronavirus-related tailwinds reinforcing a shift toward digitalization.

T. Rowe Price’s lack of exposure to the consumer staples sector also aided relative performance, as the defensive sector lagged the market in a risk-on environment. A significant underweight to real estate also contributed to relative returns.

Overall, Optimum Large Cap Growth Fund used derivatives, including foreign currency exchange contracts, during the fiscal year. However, these had a minimal effect on performance.

8

Table of Contents

Portfolio management reviews

Optimum Large Cap Value Fund

April 6, 2021 (Unaudited)

| Performance review (for the year ended March 31, 2021) | | | | |

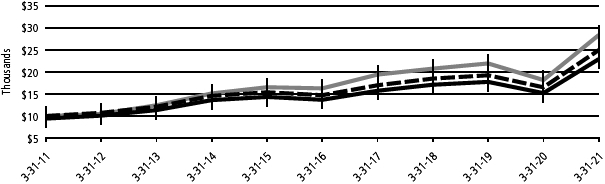

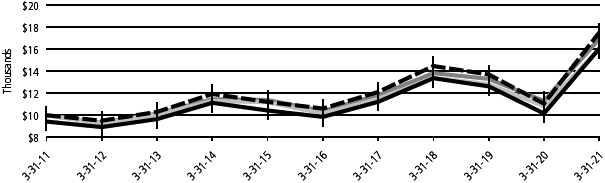

| Optimum Large Cap Value Fund (Institutional Class shares) | | 1-year return | | +51.11% |

| Optimum Large Cap Value Fund (Class A shares) | | 1-year return | | +50.73% |

| Russell 1000® Value Index (benchmark) | | 1-year return | | +56.09% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Large Cap Value Fund, please see the table on page 27.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks long-term growth of capital and may also seek income.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Massachusetts Financial Services Company (MFS)

Rothschild & Co

Market review

Financial markets experienced an extraordinarily sharp selloff early in the Fund’s fiscal year as pandemic-related concerns gripped investors. Governments and central banks responded quickly, however, with unprecedented levels of fiscal and monetary stimulus, promoting an unusually rapid recovery. As the fiscal year ended, it appeared that the global economy experienced the shortest – albeit the deepest and steepest – recession in the postwar period. For the fiscal year ended March 31, 2021, the Fund’s benchmark, the Russell 1000 Value Index gained 56.09%.

Nonetheless, as of fiscal year end, the recovery remains subject to an unusually large degree of uncertainty because of questions about the evolution of new coronavirus variants, what their impacts will be, and how quickly effective vaccines can be manufactured and distributed. It remains to be seen whether enough people will get vaccinated to create so-called herd immunity.

The economic stimulus programs proved largely successful in helping to restore market function, ease volatility, and promote a sustained rebound. In the middle of the fiscal year, the US Federal Reserve adopted a new, flexible, average-inflation-targeting framework, which is expected to keep the federal funds rate low for longer than under its previous model. Due to relatively manageable external liabilities and persistently low inflation, even emerging market countries were able to implement countercyclical policies –a departure from the usual market-dictated response to “risk off” crises.

Oil prices rose late in the Fund’s fiscal year as Saudi Arabia cut production and optimism grew that global growth would increase as vaccines become more widely available. The rally helped support the bonds of shale-oil producers, as their ability to service debt improved. Prices of many raw materials also rebounded strongly as the global manufacturing sector proved quite resilient during the pandemic.

Investors’ focus turned to the threat of inflation resulting from the monumental levels of economic stimulus and the unleashing of pandemic-induced, pent-up demand. In response to these concerns, global government bond yields have risen materially in recent months, and market leadership has shifted from a handful of mega-cap technology companies to a broader array of small-cap and value stocks. At the same time, signs of excess investor enthusiasm have been seen in pockets of the market, such as stocks that are popular with users of online message boards and equities issued by special purpose acquisition companies (SPACs).

Source: Bloomberg, unless noted otherwise.

Fund performance

Optimum Large Cap Value Fund underperformed its benchmark, the Russell 1000 Value Index, for the fiscal year ended March 31, 2021. While Rothschild & Co’s portion of the Fund slightly outperformed the benchmark return, MFS’s portion of the Fund significantly underperformed. Stock selection in the industrials and utilities sectors and an underweight position relative to the benchmark in the consumer discretionary sector detracted from performance in MFS’s portion of the Fund. MFS’s cash position during the period also detracted from performance. Stock selection in information technology and an underweight allocation to both the real estate and communication services sectors benefited MFS’s portion of the Fund. In Rothschild & Co’s portion of the Fund, stock selection was favorable and the primary driver of positive relative performance in the information technology (IT), consumer discretionary, and industrials sectors. Stock selection in the real estate, healthcare, and

9

Table of Contents

Portfolio management reviews

Optimum Large Cap Value Fund

materials sectors detracted from performance in Rothschild & Co’s portion of the Fund, as did a modest cash position.

MFS

MFS has maintained a consistent investment approach since the inception of the strategy it uses to manage its portion of the Fund. For its portion of the Fund, MFS uses a long-term time horizon in making investment decisions. MFS maintains a disciplined investment philosophy and process that is always focused on investing in high-quality companies trading at what it views as inexpensive valuations. MFS continued to assess the impact of significant changes to the global economic outlook and equity markets because of the ongoing pandemic and hopeful signs of recovery.

MFS held an overweight position in global security company Northrop Grumman Corp. that detracted from performance for the fiscal year. The company is engaged in the provision of security services including cybersecurity for computers and communications. Northrop Grumman is also involved in aerospace systems, designing, and producing manned aircraft, spacecraft, and high-energy laser systems., MFS’s position in defense contractor Lockheed Martin Corp., also in the industrials sector, detracted from performance in its portion of the Fund.

In the utilities sector, overweight positions in power provider FirstEnergy Corp., power and natural gas distributor Duke Energy Corp., and retail electric services provider The Southern Co. weighed on relative returns in MFS’s portion of the Fund. The sector suffered significant declines as power consumption flagged during the pandemic while utility companies generally carried relatively high levels of debt. MFS exited its position in First Energy during the fiscal year.

Overweight positions in pharmaceutical company Merck & Co. Inc. and diversified medical products maker Johnson & Johnson also hindered performance in MFS’s portion of the Fund. MFS’s holding in global food company Nestlé S.A. and its lack of a position in The Walt Disney Co. likewise detracted from performance.

In the IT sector, MFS’s portion of the Fund benefited from the timing of its ownership of semiconductor company Texas Instruments Inc. and of semiconductor solutions provider NXP Semiconductors NV, based in the Netherlands.

Within the communications sector, the lack of a position in telecommunications provider AT&T Inc. and an underweight position in telecommunications services provider Verizon Communications Inc. benefited MFS’s portion of the Fund.

Overweight positions in financial services firm Goldman Sachs Group Inc. and global diversified technology and multi-industrial company Johnson Controls International PLC also contributed to performance in MFS’s portion of the Fund. The lack of positions in investment firm Berkshire Hathaway Inc., biotech firm Gilead Sciences Inc., retailer Walmart Inc., and household products maker Procter & Gamble Co. also added to relative performance in MFS’s portion of the Fund.

Rothschild & Co

Rothschild & Co employs an integrated approach that balances quantitative analysis, fundamental research, and risk management guidelines to identify stocks of companies it believes possess attractive relative valuation and an ability to exceed market expectations. Rothschild & Co’s investment process has been stable through many market cycles, maintaining a consistent approach even as economic and market environments fluctuate. That said, the market environment experienced during the most recent fiscal year was largely unprecedented, reflecting the pandemic and the resulting government and central bank fiscal and monetary support. Rothschild & Co believes such environments characterized by volatility can unearth opportunities as pricing inefficiencies develop at the stock level.

In Rothschild & Co’s portion of the Fund, the leading contributors to performance during the fiscal year included infrastructure construction company Quanta Services Inc. The company provides specialized services to electric utilities, cable operators, and telecommunication companies. As such, Rothschild & Co believes the company remains well positioned as the Biden administration pushes for the largest infrastructure bill in decades.

ON Semiconductor Corp. was another leading contributor during the period. With large exposure to cyclical end-markets such as auto, industrials, 5G infrastructure, and cloud computing, ON Semiconductor appears well positioned to benefit from the broad macroeconomic recovery, in Rothschild & Co’s view. The company appointed Hassane El-Khoury as CEO in December 2020. Given his prior success as CEO of Cypress Semiconductor Corp., investors viewed El-Khoury’s appointment favorably. Rothschild & Co believes he will focus his efforts on accelerating revenue growth, rationalizing the manufacturing footprint, and driving margin expansion.

Merck & Co. Inc. was a significant detractor from performance in Rothschild & Co’s portion of the Fund during the fiscal year. Although earnings expectations continued to rise, Merck’s shares suffered from multiple compression. Keytruda, the company’s key oncology asset, has had success in treating lung and other forms of cancer. Unfortunately, this success contributed to product concentration risk, as Keytruda now accounts for nearly 40% of Merck’s revenue. In addition, given the relatively high valuations of acquisition targets, the company has been hesitant to put its strong balance sheet to work to help meaningfully diversify its portfolio. We believe the new

10

Table of Contents

CEO will focus on diversification and help improve the visibility of the company’s inhouse pipeline potential.

Xcel Energy Inc., a regulated utility that has significant operating leverage to renewables investment in the United States, was another significant detractor from performance in Rothschild & Co’s portion of the Fund. As a defensive, yield-oriented stock, Xcel Energy trailed during a risk-on market that favored stocks leveraged to a cyclical recovery. Rothschild & Co continues to hold Xcel Energy in its portion of the Fund, given its view that Xcel has above-average growth prospects relative to peer regulated utilities.

Overall, Optimum Large Cap Value Fund used derivatives, including foreign currency exchange contracts, during the fiscal year. However, these had a minimal effect on performance.

11

Table of Contents

Portfolio management reviews

Optimum Small-Mid Cap Growth Fund

April 6, 2021 (Unaudited)

| Performance review (for the year ended March 31, 2021) | | | | |

| Optimum Small-Mid Cap Growth Fund (Institutional Class shares) | | 1-year return | | +110.06% |

| Optimum Small-Mid Cap Growth Fund (Class A shares) | | 1-year return | | +109.54% |

| Russell 2500TM Growth Index (benchmark) | | 1-year return | | +87.50% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Small-Mid Cap Growth Fund, please see the table on page 30.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks long-term growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Columbus Circle Investors (CCI)

Peregrine Capital Management, LLC (PCM)

Market review

The 12-month period covering the Fund’s fiscal year ended March 31, 2021, was unlike anything investors have seen in modern times. Aggressive fiscal and monetary support in the United States and globally provided a tailwind as financial markets recovered from extreme volatility just before the Fund’s performance period began and the world responded initially to the coronavirus pandemic with widespread shutdowns.

Despite extremely high unemployment rates last spring and unprecedented highs and lows on economic measures such as gross domestic product (GDP), investor optimism grew as the world acclimated to a period full of uncertainty and large swaths of economic disruption.

By the fall and early winter, news of successful vaccine tests and a resolution to the US presidential election were followed by a more proactive approach to dealing with the COVID-19 crisis in the US. This included Congressional passage of additional measures to address economic hardships and advance distribution of the vaccines.

In terms of investment styles, growth stocks, dominated by large technology stocks that benefited from work-from-home trends, performed well early in the 12-month period. However, value and cyclical stocks took leadership as prospects grew for a reopening of the US economy. Overall, small-caps easily outpaced large-caps, as the Russell 2000® Index returned an eye-popping 94.85% versus the Russell 1000® Index’s 60.59% gain for the 12 months ended March 31, 2021.

Source: Bloomberg, unless noted otherwise.

Fund performance

Optimum Small-Mid Cap Growth Fund outperformed its benchmark, the Russell 2500 Growth Index, for the fiscal year. CCI’s portion of the Fund outperformed the benchmark, led by stock selection in the healthcare and consumer discretionary sectors. PCM’s portion of the Fund also outpaced the benchmark, led by stock selection in the industrials and financials sectors.

CCI

CCI uses a growth-oriented investment philosophy of “positive momentum and positive surprise” in which it strives to invest in what it views as good companies getting stronger and in companies whose fundamentals have the potential to exceed investor expectations.

CCI’s portion of the Fund had an excellent year as optimism that increased availability and distribution of COVID-19 vaccines would soon drive a return to normal life combined with the Federal Reserve’s continued accommodative monetary policy to drive strong gains. While CCI was encouraged by the strong start to 2021, the fiscal year was really a tale of two halves. The first half was marked by strong outperformance of secularly driven, positively surprising growth stories, typical of CCI’s investment discipline, that were broadly rewarded for strong fundamentals during the onset of the COVID-19 pandemic, a period of uncertainty where growth was scarce.

The second half of the fiscal year, however, was aided by the addition of several growth stories to CCI’s portfolio that benefited from a broader reopening and improvement of the US economy. CCI was particularly encouraged by the outperformance during this period given the unfavorable backdrop, as expectations for a cyclical rebound drove value to outperform growth across the market capitalization spectrum.

12

Table of Contents

Horizon Therapeutics PLC, a pharmaceutical company focused on treatments for rare and rheumatic diseases, was CCI’s largest contributor for the fiscal year. Tepezza, the first US Food and Drug Administration (FDA)-approved therapy for thyroid eye disease, a debilitating condition with no previous existing treatments, has been an unequivocal success, while Krystexxa, a treatment for uncontrolled gout, continues to show robust demand. In addition, recent share performance was bolstered by a pause in the Phase 2 trial of a competitor’s drug candidate on safety concerns, while the company’s synergistic acquisition of Viela Bio, a biotechnology company with a portfolio of rare autoimmune disease candidates, including commercial drug Uplizna, was received favorably.

SVB Financial Group, a regional bank providing a wide range of financial services targeted primarily to businesses in technology and life sciences was the second largest contributor. The company is reaping the benefits of its differentiated business model as investments in technology firms reach record highs across a variety of industries. It is also one of the most asset-sensitive banks in the country, which CCI thinks positions it well for future interest rate increases.

Avalara Inc., a leading provider of cloud-based tax compliance software, detracted the most from performance for CCI’s portion of the Fund as shares declined despite continued robust fundamentals that supported CCI’s investment thesis. CCI attributes the decline in shares to profit taking in the software group and other highly valued growth stocks, as the market rotated towards cyclical and value shares more likely to benefit from an improvement in the economy during the March quarter. CCI exited its position to fund more attractive ideas.

Amicus Therapeutics Inc., a biotechnology company focused on rare metabolic diseases, also detracted from performance. Shares declined to CCI’s point of sale after Phase 3 data from the PROPEL trial of AT-GAA in Pompe Disease, a condition characterized by severe muscle weakness, missed its primary end point of six-minutes’ walk distance by two meters. Although the study exceeded its secondary end point of forced vital capacity, a measure of respiratory function, which may suggest the drug candidate is still viable, CCI chose to exit its position.

CCI’s portion of the Fund remains most overweight the consumer discretionary sector, including stocks tied to leisure trends that are seen as likely to benefit from consumers looking for experiences outside of their homes after the COVID-19 pandemic. CCI’s portion of the Fund also holds several consumer growth stories tied to economic recovery in the housing and retail markets. Additionally, it continues to be overweight financials, including holdings tied to secular trends within technology and those that will benefit from the recent rise in interest rates. Conversely, CCI remains most underweight healthcare and information technology (IT) stocks, largely because of previously reducing names with, in CCI’s assessment, less favorable risk-reward in favor of more compelling stories in other sectors.

PCM

The industrials and financials sectors were the largest contributors to performance for PCM’s portion of the Fund during the fiscal year. Strength in industrials was broad-based across many of PCM’s holdings in the sector. These stocks sharply recovered from the COVID-19-related market lows of March 2020 due to improved economic visibility and increased likelihood of a large government stimulus and infrastructure bill. In the financial sector, improving economic visibility also drove strong performance of PCM’s bank, capital markets, and insurance holdings in the period.

Technology and consumer discretionary were the largest detractors from performance for PCM’s portion of the Fund. Weakness in technology was driven by PCM’s semiconductor and software holdings, which trailed the larger and more richly valued benchmark names where PCM is underweight due to its valuation discipline. PCM’s underweight to the consumer discretionary sector was also a headwind to performance in the period.

The leading contributor to PCM’s portion of the Fund for the fiscal year was Immunomedics Inc., a biotechnology company focused on the development of antibody-based treatments for various cancers. Following the FDA approval of its product, Trodelvy, the company announced a very strong start to commercialization, which attracted the attention of strategic acquirers looking to bolster their oncology platforms. Gilead Sciences acquired the company for a significant premium in September.

Another contributor to PCM’s portion of the Fund was ASGN Inc., which provides IT staffing services as well as government IT services. After being undeservedly punished during the onset of the COVID-19 pandemic, the stock sharply rebounded during the fiscal year as demand in the company’s core IT staffing and government services businesses proved much more resilient than investors originally thought. The company’s large Fortune 500 clients in the IT staffing business were reluctant to pull back IT-related spending during the pandemic, while the government business provided essential services that saw no negative impact from the pandemic.

The leading detractor from performance in PCM’s portion of the Fund was Strategic Education Inc., a leading provider of online education, targeting masters and post-secondary degrees across a wide variety of specialties. The company had demonstrated a strong track record of topline growth and margin improvement following its formation through the merger of Capella and Strayer Education. However, enrollment growth slowed during the fiscal year as new

13

Table of Contents

Portfolio management reviews

Optimum Small-Mid Cap Growth Fund

students were more reluctant to start a degree program amid the COVID-19-related turmoil. This news, along with a larger acquisition that required equity financing, led the shares to underperform for the period. PCM eliminated the position during the fiscal year.

Another detractor from performance in PCM’s portion of the Fund was Theravance Biopharma Inc., a biopharmaceutical company focused on the development of novel therapeutics in the respiratory and gastrointestinal space. The company’s strong development capabilities have yielded many marketed drugs including Trelegy, a multibillion-dollar chronic obstructive pulmonary disease (COPD) drug marketed by GlaxoSmithKline PLC, where the company receives a royalty which is then used to advance its owned pipeline. However, pipeline delays resulting from the COVID-19 pandemic temporarily pushed back the timing of clinical trial readouts expected in 2020 into the second half of 2021, which caused the stock to underperform for the fiscal year.

PCM’s process focuses on rapidly growing small-cap companies trading at valuations that do not yet reflect that strong growth. PCM is currently most overweight companies in the industrials and financial services sector that it expects to benefit from the anticipated improvement in economic growth and company fundamentals. Conversely, PCM’s portion of the Fund is most underweight the technology and consumer discretionary sectors, where it believes valuations are less attractive.

14

Table of Contents

Portfolio management reviews

Optimum Small-Mid Cap Value Fund

April 6, 2021 (Unaudited)

| Performance review (for the year ended March 31, 2021) | | | | | |

| Optimum Small-Mid Cap Value Fund (Institutional Class shares) | | 1-year return | | +86.63 | % |

| Optimum Small-Mid Cap Value Fund (Class A shares) | | 1-year return | | +86.21 | % |

| Russell 2500™ Value Index (benchmark) | | 1-year return | | +87.47 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Small-Mid Cap Value Fund, please see the table on page 33.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Fund objective

The Fund seeks long-term growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisors

LSV Asset Management (LSV)

Cardinal Capital Management LLC (Cardinal)

The Board of the Trustees of the Fund approved the appointment of Cardinal as a sub-advisor to the Fund during the fiscal year. Cardinal replaced Westwood Management Corp. (Westwood) as a sub-advisor to Optimum Small-Mid Cap Value Fund. Please see the supplement to the Fund’s prospectus, dated October 5, 2020, for more information.

Market review

The stock market transitioned from one extreme to another as spring turned to summer in 2020. The sharp sell-off in March just before the start of the Fund’s fiscal year, driven by the spread of COVID-19, quickly reversed with a strong rally in stocks as monetary and fiscal stimulus were announced and began to find their way to those who desperately needed relief. The unprecedented nature of the pandemic triggered an equally unprecedented response.

In aggregate, the US fiscal and monetary stimulus announced through the fall of 2020 amounted to $9.5 trillion, more than 40% of the country’s annual gross domestic product (GDP). As these programs were announced and implemented, investors began to rotate into the riskiest areas of the market, driven by the belief that there would be additional stimulus should things take a turn for the worse. Macroeconomic data and fundamental results continued to be materially affected by the pandemic while the market climbed higher.

Unemployment peaked at 15% at the end of April. However, the efforts to reopen businesses saw that figure nearly cut in half by October. Similarly, corporate profits began to recover as the summer progressed and companies adapted to the new environment.

Together, these helped push equities swiftly higher as investors projected better times ahead even as the current situation remained highly challenged.

The stock market’s months-long rally accelerated significantly in the fourth quarter of 2020 and into 2021 as the hope for an effective COVID-19 vaccine became a reality. Investors reacted to the vaccine news and the passage of a second stimulus package by investing in a significant amount of small-cap value exchange-traded funds (ETFs), which caused stocks with the smallest market capitalizations, return on equity (ROE), and earnings to outperform. In addition, companies that had been hurt by economic lockdowns saw their stocks rebound sharply, while those that had benefited from people staying at home saw their stock prices lag.

Source: Bloomberg, unless noted otherwise.

Fund performance

Optimum Small-Mid Cap Value Fund slightly underperformed its benchmark, the Russell 2500 Value Index, for the fiscal year ended March 31, 2021. LSV’s portion of the Fund outperformed the benchmark for the fiscal year, benefiting from its deeper value and smaller-size biases. Westwood’s portion of the Fund trailed the benchmark because of poor sector positioning. Favorable stock selection partially offset this, however. Cardinal, which took over from Westwood in mid-October, also underperformed the benchmark because of its relative underexposure to high-flying commodity-sensitive and highly cyclical stocks, which rallied late in the fiscal year.

LSV

The positive impact of LSV’s portion of the Fund relative to the benchmark was evident in both sector and stock selection. LSV’s portfolio was underweight utilities and real estate, the weakest-performing sectors, and overweight consumer discretionary, the strongest-performing sector. Many of LSV’s retail stocks bounced back strongly after big declines in March 2020.

The two biggest contributors to relative performance were Sonic Automotive Inc., the fifth largest auto retailer in the United States,

15

Table of Contents

Portfolio management reviews

Optimum Small-Mid Cap Value Fund

and sporting goods retailer Dick’s Sporting Goods Inc. Both stocks benefited from an improved economic outlook along with positive news on vaccines. LSV’s portion of the Fund continues to own both stocks as LSV believes that valuations remain reasonably compelling. Restaurant company Brinker International Inc. was also a large contributor to relative performance. LSV eventually sold the stock when its valuation profile became less compelling.

The two largest detractors were Piedmont Office Realty Trust Inc., an office real estate investment trust (REIT) that did not keep up with the market, and Huntington Ingalls Industries Inc., America’s largest military ship-building company. Both stocks remain attractively valued by LSV’s model and LSV believes they are well positioned to benefit from the improving economic outlook.

While it is too early to know if an inflection point has been reached where value stocks can have a sustainable rally, prior periods, such as March 2000 and March 2009, indicate that mean reversion can happen swiftly. LSV has advocated for some time now about what it views as the attractive valuations of the quality companies it owns. LSV’s portion of the Fund continues to trade at valuations close to historical lows and the valuation gap between value and growth based on multiple metrics is at its widest level in many years. LSV believes the growth expectations of the deep value companies it owns have been far too pessimistic. These companies are generating cash, paying dividends, buying back stock, have insider buying activity, and no observable deterioration in quality relative to growth stocks.

As the COVID-19 vaccination rollout continues and economic activity picks up, LSV looks for the stocks in its portion of the Fund to continue to benefit, as they have in recent quarters. At the end of the fiscal period, the Fund was overweight information technology, financials, and consumer staples stocks and underweight industrials, real estate, and energy.

Westwood

During the period of time that Westwood was a sub-advisor to the Fund, the relative underperformance of Westwood’s portion of the Fund came from allocation headwinds that favorable selections only partially offset. Sector positioning, including a modest cash position and an underweight in consumer discretionary, detracted given the sharp recovery seen from recent market lows.

Westwood employs a consistent and disciplined approach that seeks to provide attractive long-term, risk-adjusted returns while protecting capital during unfavorable market periods. Westwood’s stock selection is driven by extensive research to identify companies that Westwood believes lie at the intersection of quality and value and possess both attractive valuations and strong prospects for future cash generation and earnings while maintaining strong balance sheets.

Security selection was strongly positive in some of the hardest hit areas of the market earlier in the year, including energy, materials, and consumer discretionary. However, an underweight to consumer discretionary along with a modest cash position more than offset the positives given the sharp rally that unfolded. Energy, which faced both reduced demand from the pandemic as well as oversupply issues, saw increased cooperation from the Organization of the Petroleum Exporting Countries Plus (OPEC+) in balancing the global market and rallied in tandem with crude oil prices. Materials also moved higher on the prospects for a strong recovery in economic activity from the stimulus efforts both in the US and abroad. In contrast, less favorable selections in financials and industrials served as an offset. Several industries and securities that had fared well initially in the pandemic were pressured as investors rotated into those with greater economic sensitivity, and in many cases, the riskiest and most leveraged within those sectors. Given Westwood’s focus on the intersection of quality and value, this created a challenging period for performance overall.

During the period, three standout performers for Westwood’s portion of the Fund were WPX Energy, IAA Inc., and Williams-Sonoma Inc. WPX Energy benefited from the recovery in crude oil prices, with strong management execution, leading to an eventual value-creating merger with another peer energy producer. IAA gained as the firm adapted its business model of auctioning and selling used and salvaged cars to an online format. As driving resumed, this helped bolster demand for its services and saw results far exceed consensus forecasts. Williams-Sonoma shares moved higher as home-bound consumers transitioned their purchasing to its ecommerce platforms at an increasing rate, sending sales markedly higher and boosting its cash generation.

Three detractors from performance for Westwood’s portion of the Fund were Avista Corp., Hudson Pacific Properties Inc., and Washington Federal Inc. Avista saw an increase in bad debt expense, as consumers affected by the pandemic struggled to pay their utility bills, pressuring shares. Additionally, investors rotated away from more defensive areas of the market. Hudson Pacific Properties fell on concerns over reduced long-term demand for its office properties, largely located in San Francisco and the west coast, as more employees work from home. Washington Federal declined as the repricing of its assets was choppier than expected, amid the broader rotation into more asset-sensitive banks within the sector.

16

Table of Contents

Cardinal

Cardinal’s portion of the Fund lagged the benchmark. Cardinal’s focus on owning high-quality businesses and its lower exposure to commodity-sensitive and highly cyclical stocks drove its relative underperformance.

In managing its portion of the Fund’s assets, Cardinal employs a cash-flow-oriented investment process. Cardinal believes that a company’s stock price is ultimately determined by its ability to generate excess cash flow and redeploy that cash to enhance shareholder value. The investment process is based on detailed five-year projections that include an analysis of the company’s financials and interviews with the company’s management. Cardinal looks for companies with significant free cash flow, stable and predictable business models, and competent management.

Stock selection in the materials and industrials sectors was the primary detractor from relative performance. In the materials sector, the share price of consumer goods packaging company Silgan Holdings Inc. lagged the sector’s greater-than-40% increase. Silgan’s business is largely insensitive to raw material prices and has benefited from consumers staying at home.

The share price of agricultural chemical supplier FMC Corp. lagged as its business grew nicely despite pandemic-related headwinds but is unlikely to benefit meaningfully from an acceleration in economic activity, in Cardinal’s view. The company also reported weaker-than-expected quarterly results due to a drought in Brazil, logistics issues related to COVID-19, and customs issues. FMC’s guidance for the first quarter of 2021 was lackluster though it did not materially change expectations for the entire year.

In the industrials sector, the share price of KAR Auction Services Inc., which provides auction and other services to the wholesale used car market, lagged after KAR announced disappointing fourth-quarter results and guidance for 2021. Sharply elevated used car prices caused auto dealers to sell trade-ins and vehicles coming off lease themselves, which reduced KAR’s auction volumes. In addition, an extended pandemic-related moratorium on auto repossessions further reduced volumes. Despite their near-term impact, Cardinal expects both supply constraints will prove transitory.

Stock selection in the healthcare sector and both stock selection and a higher weighting in financials contributed to relative performance. In healthcare, shares of the biopharmaceutical firm Ligand Pharmaceuticals Inc. rose sharply along with other heavily shorted stocks as hedge funds with large short positions in more speculative names were forced to reduce their exposures to other names after experiencing heavy losses. The portfolio managers sold 60% of the position in January and the balance in February as the stock more than doubled and reached Cardinal’s price target. The stock price of healthcare technology solutions provider Change Healthcare Inc. rose after UnitedHealth Group announced an agreement to acquire the company at a 40% premium. The Change position represented more than 3% of the portfolio at the end of 2020. Cardinal began trimming the position at the end of January as it believed a topping bid was unlikely and, although there are provisions in the merger agreement to address antitrust concerns, they exist.

In the financials sector, Cardinal had notably strong relative performance in the diversified financials industry group. The stock prices of the portfolio’s bank holdings outpaced peers and increased more than 70% due to a more optimistic credit outlook and depressed valuations. A notable contributor in financials was the West Coast commercial bank PacWest Bancorp, whose shares rose significantly and outperformed peers after its earnings beat expectations on a lower-than-expected loan loss provision and after it announced a niche lending acquisition. As a result, its recent significant valuation discount started to dissipate.

17

Table of Contents

Performance summaries

Optimum Fixed Income Fund

March 31, 2021 (Unaudited)