SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

WESTERN ASSET GLOBAL HIGH INCOME FUND INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

September 9, 2019

Dear Fellow Stockholder:

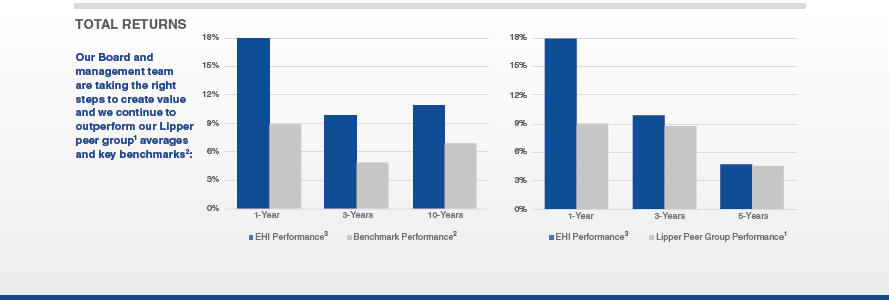

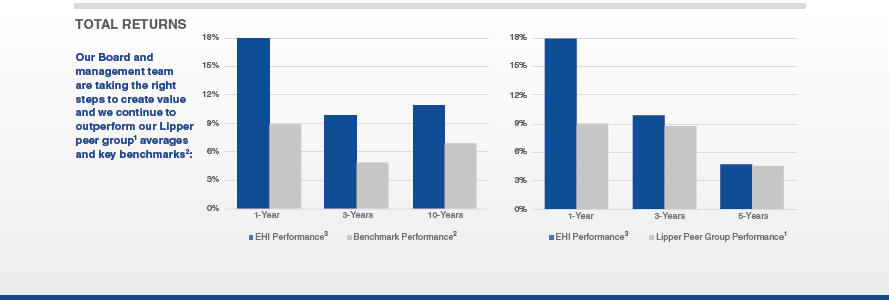

The Western Asset Global High Income Fund Board is focused on our two primary investment objectives of driving high current income and delivering total returns to you, our stockholders. Your Board has a strong track record of working with the Fund’s management team to deliver financial performance and stockholder distributions above the average of our peer group. Over the last year, our Board has taken further steps to improve our financial performance, which has led to1-year returns that are double the average of the Fund’s peer group1.

Ahead of our Annual Meeting of Stockholders on October 25, 2019 (“the Annual Meeting”), you have an important decision to make regarding the future of your investment in Western Asset Global High Income Fund. Saba Capital Management, L.P. (“Saba Capital”), a hedge fund and professional activist investor, is attacking our Fund by nominating two directors to stand for election to the Board and submitting a proposal to alter the structure of our Board.

You are being asked to choose between supporting the Board or Saba Capital’s short-term, self-interested agenda. Your Board has consistently acted in the best interests of stockholders to deliver long-term competitive financial performance and returns. In contrast, through its nominations and proposal, Saba Capital is following the same playbook it has used to attack a number ofclosed-end funds. It is attempting to gain representation on our Board in order to pressure the Board and management team to make decisions to serve their interests to the detriment of all other stockholders.

The Western Asset Global High Income Fund’s Board unanimously recommends that you vote“FOR” our Board Nominees and“AGAINST” Saba Capital’s BoardDe-Classification Proposal by voting the enclosed WHITE Proxy Card.

You may receive materials from Saba Capital asking you to vote a GOLD card. Please note that voting a GOLD card for any reason will not count as a vote in support of the Western Asset Global High Income Fund Board and will revoke any previous vote on a WHITE Proxy Card. If you vote your shares more than once, only your latest-dated proxy card counts.

You control the future of your investment. We urge you to support your Board as it continues to take actions to deliver strong stockholder returns and enhance value for you.

Your Board and Management Team are Delivering Competitive Financial Performance and Strong Stockholder Distributions

The Fund’s Board and management team have a strong track record of delivering competitive financial performance and returns to our stockholders.In fact, we have increased our distribution payout each of the last three quarters, and our Fund’s trailing5-year average annualized yield of 8.79% is above the Lipper peer group1 average of 8.64%. As of June 30, 2019, the Fund’s distribution yield was 7.64% and the Board recently announced a dividend increase that would raise the yield to 7.70% at the June 30 market price.

We Are Proactively Addressing the Discount Between Our Share Price and NAV

While Saba Capital’s main criticism of Western Asset Global High Income Fund is that the Fund trades at a discount to its NAV,closed-end funds trading at a discount to their NAV is an industry-wide phenomenon and a characteristic the whole industry has encountered for years. In fact, nearly 90% of funds within our Lipper peer group1 traded at a discount as of June 30, 2019. Most importantly, our discount has not affected our ability to deliver returns and yield above and beyond our Lipper peer group1.

In any case, our Board regularly monitors the level of the Fund’s market price discount to NAV and takes a balanced approach to capitalizing on opportunities to narrow any discount without compromising the Fund’s ability to achieve its investment objectives. Recently, the Board has approved several actions aimed at reducing the discount, including:

| • | | The repurchase of $7 million in shares over the twelve months ending May 31, 2019 |

| • | | The execution of expense reduction initiatives, including the agreement to voluntarily lower the Fund’s investment management fee by 0.025% until November 30, 2019 |

By implementing these initiatives, Western Asset Global High Income Fund has helped reduce its discount to NAV from approximately 16% in December 2018 to approximately 8% in August 2019.

Your Board’s Nominees Bring Skills and Expertise Critical to Our Fund’s Continued Success

Your Board is comprised of eight highly qualified members, seven of whom are independent, half of whom are women and all of whom have skills and expertise relevant to the Fund’s operations and strategy. Our Board is carefully constructed to ensure that we have the right mix of skills and diverse voices to achieve independent and well-rounded oversight of our strategy.

Our 2019 nominees include our Audit Committee Chair and Compliance Liaison, each of whom serve a necessary function in the oversight and management of the Fund:

Ms. Kamerick has been Chief Financial Officer of such leading companies as Houlihan Lokey, Heidrick & Struggles, Leo Burnett, and BPAmoco Americas. In her roles as CFO and as an experienced Audit Committee Chairman for these funds and for other publicly traded companies, she has overseen the preparation of financial statements. She qualifies as a “financial expert” with the SEC, and fills the requirements of the New York Stock Exchange (“NYSE”) that listed companies maintain at least one director with accounting or financial management expertise. She is an adjunct professor of governance and corporate finance at leading law schools, including University of Chicago and Washington University at St Louis. She is an NACD Board Leadership Fellow. None of Saba Capital’s nominees appear to fulfill the NYSE’s requirements to be a “financial expert”, and therefore their election would remove critical expertise from our Board.

Mr. Agdern brings to the Board significant U.S. and international business, management and legal expertise through his prior experience as a member of Amoco Corporation’s Worldwide Exploration and Production Management Committee, Amoco Chemical Company’s Worldwide Management Company and as Deputy General Counsel of Amoco Corporation. Mr. Agdern has also served as a member of the Advisory Committee of the Dispute Resolution Research Center at the Kellogg Graduate School of Business at Northwestern University. Mr. Agdern’s significant legal and international expertise enables him to fulfill the role of our Compliance Liaison facilitating interactions between the Board and the Fund’s Chief Compliance Officer.

Additionally, our Board regularly evaluates opportunities to add new voices to the Boardroom that will enhance our Board’s relevant expertise and diversity. To that end, the Board undertook an extensive search for new candidates in 2018 and appointed Ms. Nisha Kumar, current CFO and COO of Greenbriar Equity Group, as our newest independent director.

Our Board is open to the addition of new directors who will enhance Board composition. However, we believe Saba Capital’s nominees have a single purpose in standing for election – implementing Saba Capital’s short-term agenda.

Our Board Structure Ensures Our Directors Have the Proper Knowledge to Make the Right Decisions for You

Our Board has a classified structure, which means that we have three groups of directors that serve “staggered” terms so that each director’s term is three years. This structure is an industry-wide common practice amongclosed-end funds. We believe this is because a classified structure is important to maintaining proper oversight and stability in a fund’s operations as it:

We believe that active and independent directors with extensive relevant experience and knowledge of the Fund are critical to facilitating good performance. We are committed to holding our directors accountable and ensuring director independence, and conduct annual evaluations of director independence and an annual self-assessment of the Board’s performance to that end.

Our classified Board structure helps ensure that our Board is well-positioned to make decisions regarding our investment strategy that are in your best interests. Saba Capital’s proposal to declassify our Board is nothing more than an attempt to weaken our Board’s structure and make our Board more vulnerable to future attacks.

Saba Capital is Following Its Standard Strategy to Squeeze Out Short-term Value at Your Expense

Saba Capital is a professional activist hedge fund that has a long history of attackingclosed-end funds just like ours in order to generate a short-term profit for themselves to the detriment of long-term holders. They follow a standard playbook in these situations – nominate directors to the board and force a change in the board’s structure to leave the fund vulnerable and more easily pressured into their demands.

Saba Capital’s demands in most situations are the implementation of initiatives intended to generate a short-term profit, such as large share repurchases or liquidity events, that derail a fund’s ability to continue to enhance value for its stockholders who invest in the fund for long-term, sustainable returns. Additionally, Saba Capital generally exits funds quickly after pressuring the board to implement its short-term “fix”.

Saba Capital has engaged in 16 proxy contests since its inception in 2009 and currently maintains minimal to no holdings in many of the funds it has previously targeted. This includes completely selling out of several funds it targeted in just the last three years. This can potentially leave stockholders like you with shares in a fund that does not have the resources to continue to meet its objectives of high current income and strong total return.

For Saba Capital, Western Asset Global High Income Fund is simply the latest fund that it is targeting for a quick profit. In fact, Saba Capital is currently running similar proxy contests with the same nominees at several other closed-end funds. These nominees seem to have been selected based not on their qualifications, but rather their relationship to Saba Capital. In fact, Saba Capital has routinely nominated each of these individuals in proxy contests with numerous otherclosed-end funds. The Fund is not aware of any of these nominees having been elected by the stockholders of these respective funds. Our Board understands that for our other stockholders, much more is at risk. We are committed to defending the Fund against this attack and preventing Saba Capital from hijacking our Fund at your expense.

The election of Saba Capital’s nominees and the approval of its proposal would facilitate its self-interested agenda and would be detrimental to our Board’s ability to continue to work with management to deliver strong returns that you rely on from Western Asset Global High Income Fund.

Vote The White Proxy Card Today

Your Board has a strong track record of delivering competitive financial performance and strong stockholder returns, and is taking steps to build on this momentum. In contrast, Saba Capital is nominating directors and attempting to weaken our Board structure simply to advance its own agenda at your expense.

Your Vote Is Extremely Important.

Whether or not you plan to attend the Annual Meeting, you have an opportunity to protect the value of your investment by voting on the WHITEProxy Card“FOR” the Western Asset Global High Income Fund Board Nominees and“AGAINST” Saba Capital’s BoardDe-Classification Proposal.

Thank you for your continued support.

Sincerely,

The Western Asset Global High Income Fund Inc. Board of Directors

Notes

| 1 | The Fund’s Lipper peer group refers to the peer group of high-yield, leveredclosed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. |

| 2 | The benchmark is based on a blend, in equal parts, of the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index, the Bloomberg Barclays U.S. Aggregate Index, and the JPMorgan Emerging Markets Bond Index Global (EMBI Global). Additional information about the indexes can be found in the Fund’s annual shareholder report. Additional information about the Fund’s performance and about the history of the Board and the Fund’s management generating strong investor returns is included in the Fund’s Proxy Statement and in the Fund’s annual shareholder report. |

| 3 | The Fund’s performance is based on the price of the Fund’s securities, which are listed for trading on the NYSE. |

Forward Looking Statement

Past performance is no guarantee of future results. The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice.

All investments are subject to risk including the possible loss of principal. All benchmark performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in a benchmark.