SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

WESTERN ASSET GLOBAL HIGH INCOME FUND INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Dear Fellow Stockholder:

The Western Asset Global High Income Fund Board is composed of eight engaged, diverse and highly-qualified directors that have a demonstrated track record of delivering on the Fund’s investment objectives for you, our stockholders. Support the Board that is committed to acting in your best interests and that has overseen the delivery of strong financial performance. Vote “FOR” the Board Nominees and “AGAINST” Saba Capital’s Board De-Classification Proposal on the WHITE Proxy Card today.

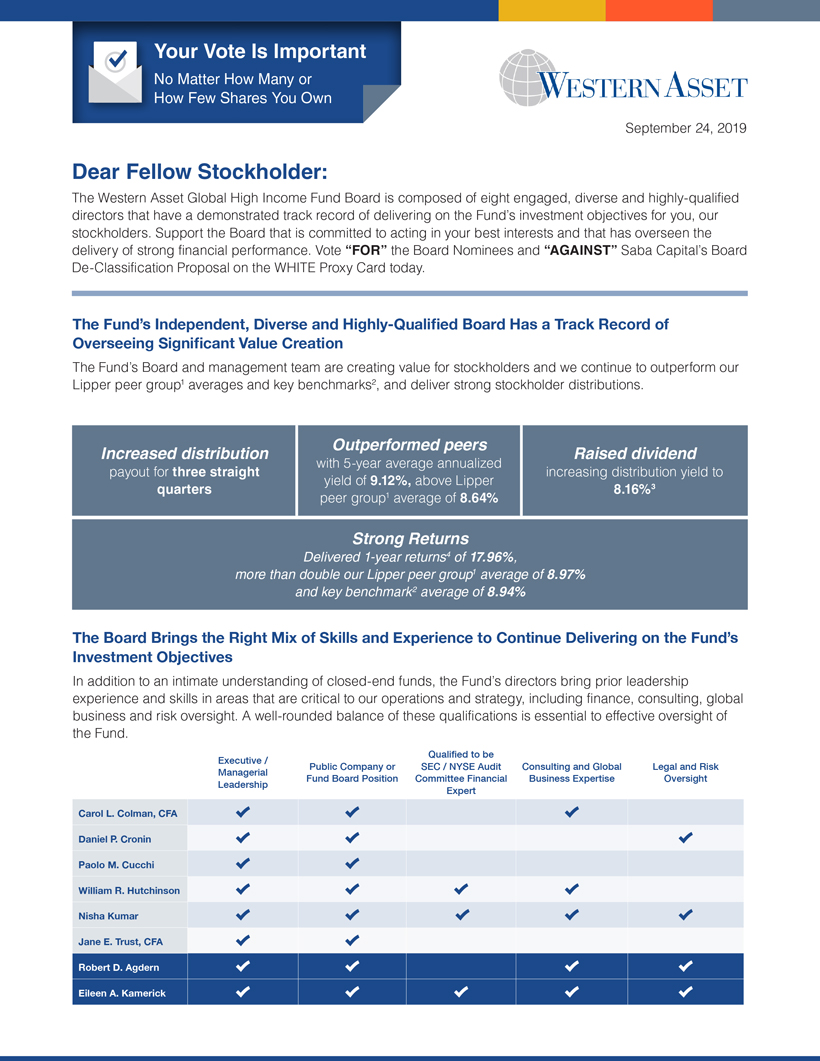

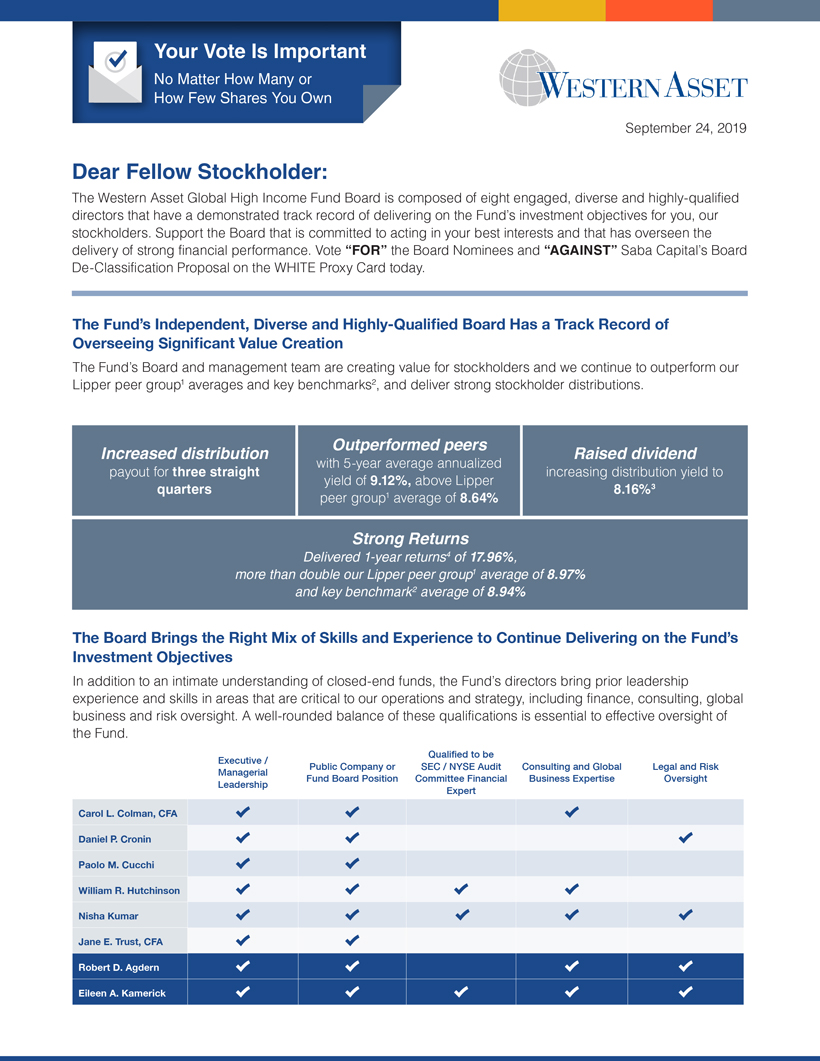

The Fund’s Independent, Diverse and Highly-Qualified Board Has a Track Record of Overseeing Significant Value Creation

The Fund’s Board and management team are creating value for stockholders and we continue to outperform our Lipper peer group1 averages and key benchmarks2, and deliver strong stockholder distributions.

Outperformed peers

Increased distribution Raised dividend

with 5-year average annualized payout for three straight increasing distribution yield to yield of 9.12%, above Lipper quarters 8.16%3 peer group1 average of 8.64%

Strong Returns

Delivered 1-year returns4 of 17.96%, more than double our Lipper peer group1 average of 8.97% and key benchmark2 average of 8.94%

The Board Brings the Right Mix of Skills and Experience to Continue Delivering on the Fund’s Investment Objectives

In addition to an intimate understanding of closed-end funds, the Fund’s directors bring prior leadership experience and skills in areas that are critical to our operations and strategy, including finance, consulting, global business and risk oversight. A well-rounded balance of these qualifications is essential to effective oversight of the Fund.

Executive / Qualified to be

Managerial Public Company or SEC / NYSE Audit Consulting and Global Legal and Risk

Leadership Fund Board Position Committee Financial Business Expertise Oversight

Expert

Carol L. Colman, CFA

Daniel P. Cronin

Paolo M. Cucchi

William R. Hutchinson

Nisha Kumar

Jane E. Trust, CFA

Robert D. Agdern

Eileen A. Kamerick

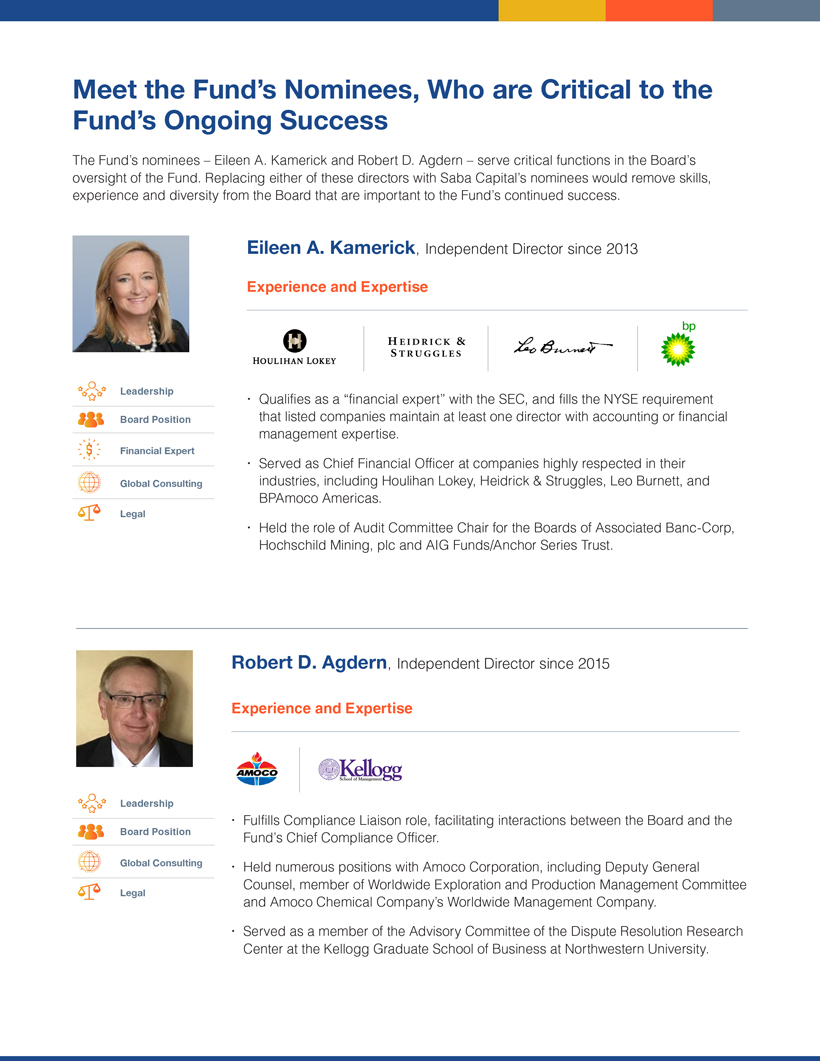

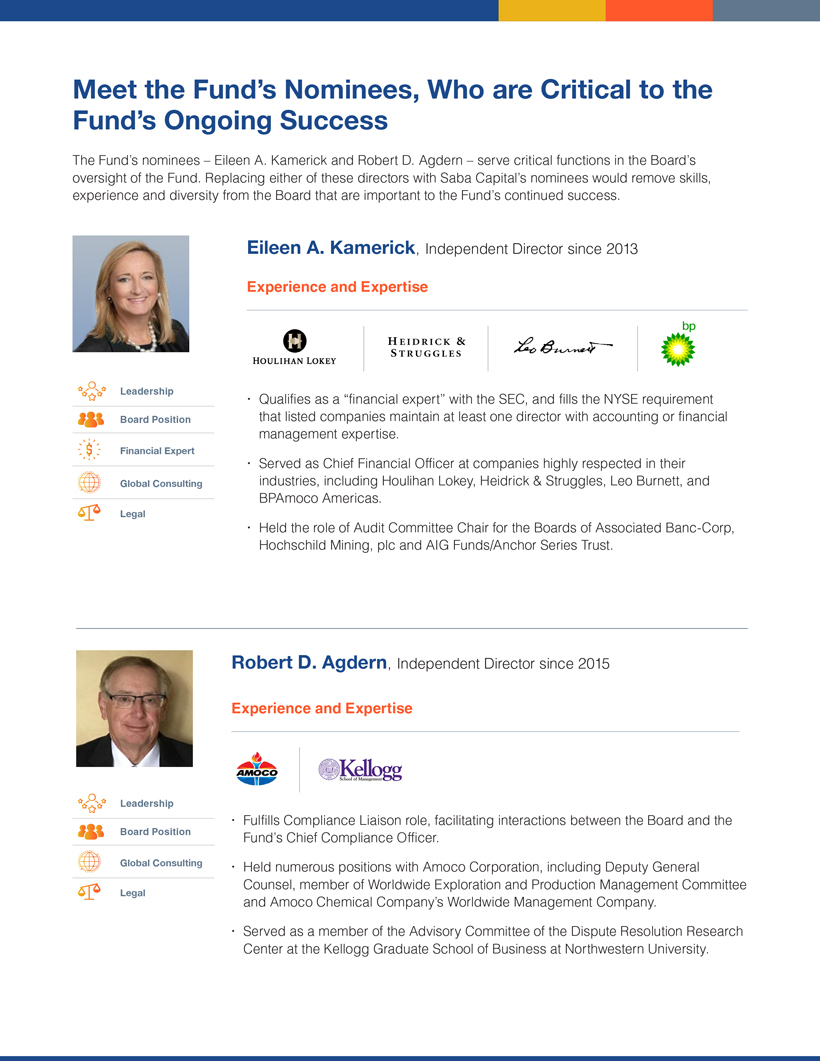

Meet Fund’s the Ongoing Fund’s Success Nominees, Who are Critical to the

The Fund’s nominees – Eileen A. Kamerick and Robert D. Agdern – serve critical functions in the Board’s oversight of the Fund. Replacing either of these directors with Saba Capital’s nominees would remove skills, e perience and diversity from the Board that are important to the Fund’s continued success.

Leadership

Board Position

Financial E pert

Global Consulting

Legal

Eileen A. Kamerick, Independent Director since 2013

E perience and E pertise

Qualifies as a “financial e pert” with the SEC, and fills the NYSE requirement that listed companies maintain at least one director with accounting or financial management e pertise. Served as Chief Financial Officer at companies highly respected in their industries, including Houlihan Lokey, Heidrick & Struggles, Leo Burnett, and BPAmoco Americas. Held the role of Audit Committee Chair for the Boards of Associated Banc-Corp, Hochschild Mining, plc and AIG Funds/Anchor Series Trust.

Robert D. Agdern, Independent Director since 2015

E perience and E pertise

Leadership

Board Position

Global Consulting

Legal

Fulfills Compliance Liaison role, facilitating interactions between the Board and the Fund’s Chief Compliance Officer. Held numerous positions with Amoco Corporation, including Deputy General Counsel, member of Worldwide E ploration and Production Management Committee and Amoco Chemical Company’s Worldwide Management Company. Served as a member of the Advisory Committee of the Dispute Resolution Research Center at the Kellogg Graduate School of Business at Northwestern University.

Saba Capital’s Nominees Would Remove Important Important Skills and Diversity from the Board

Saba Capital’s nominees would decrease the Board’s collective knowledge of the closed end-fund industry, decrease its diversity and remove other critical skills from the Board.

Saba Capital’s nominees have each been routinely nominated by the hedge fund in proxy contests with numerous other closed-end funds, and we believe they are only interested in promoting Saba Capital’s short-term agenda to the detriment of all stockholders.

Your Vote Matters

Vote the WHITE Proxy Card Today

Saba Capital is nominating directors and attempting to weaken the Fund’s Board structure simply to advance its own self-serving, short term agenda. Vote today for the Board nominees who have a proven track record of delivering competitive financial performance and strong stockholder returns.

No matter how many or how few shares you own, your vote is important. Whether you plan to attend the Annual Meeting, you have an opportunity to protect the value of your investment by voting on the WHITE Proxy Card “FOR” the Western Asset Global High Income Fund Board Nominees and “AGAINST” Saba Capital’s Board De-Classification Proposal.

Thank you for your continued support.

Sincerely,

The Western Asset Global High Income Fund Board of Directors

Your Vote is Important, No Matter How

Many or How Few Shares You Own

You can vote by internet, telephone or by signing and dating the WHITE proxy

card and mailing it in the envelope provided.

If you have any questions about how to vote your shares or need additional

assistance, please contact:

Innisfree

Stockholders Call Toll Free: (877) 750-8198

Banks and Brokers Call: (212) 750-5833

REMEMBER:

We urge you NOT to vote using any GOLD proxy card sent to you by Saba Capital, as doing so will

revoke your vote on the WHITE proxy card.

Notes 1 The Fund’s Lipper peer group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally

recognized provider of investment company information.

2 The benchmark is based on a blend, in equal parts, of the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index, the Bloomberg

Barclays U.S. Aggregate Index, and the JPMorgan Emerging Markets Bond Index Global (EMBI Global). Additional information about the indexes can be

found in the Fund’s annual shareholder report. Additional information about the Fund’s performance and about the history of the Board and the Fund’s

management generating strong investor returns is included in the Fund’s Proxy Statement and in the Fund’s annual shareholder report.

3 Yield based on market price as of June 30, 2019.

4 The Fund’s performance is based on the price of the Fund’s securities, which are listed for trading on the NYSE. Forward Looking Statement Past performance is no guarantee of future results. The information provided is not intended to be a forecast of future events, a

guarantee of future results or investment advice.

All investments are subject to risk including the possible loss of principal. All benchmark performance reflects no deduction for fees,

expenses or taxes. Please note that an investor cannot invest directly in a benchmark.