UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

ý QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended September 30, 2007

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

GENERAL STEEL HOLDINGS, INC.

(Name of Issuer in Its Charter)

| NEVADA | | 412079252 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

| | | |

Room 2315, Kun Tai International Mansion Building, Yi No 12, Chao Yang Men Wai Ave., Chao Yang District, Beijing, China | | 100020 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Incorp Services Inc.

6075 S. Eastern Avenue

Suite 1, Las Vegas, Nevada, 89119-3146

Tel: (702) 866-2500

(Name, address and telephone number for Agent for Service)

+ 86 (10) 58797346

(Issuer's telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicated by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

The number of shares of Common Stock outstanding on November 14, 2007 was 34,634,765.

Transitional Small Business Disclosure Format (check one): Yes o No x

Certain financial information included in this quarterly report has been derived from data originally prepared in Renminbi ("RMB"), the currency of the People's Republic of China ("China" or "PRC"). For the purposes of this quarterly report, the balance sheet amounts with the exception of equity at September 30, 2007 were translated at 7.50 RMB to $1.00 USD as compared to 7.80 RMB at December 31, 2006. The equity accounts were stated at their historical rate. The average translation rate of 7.55 RMB for the three months ended September 30, 2007 was applied to income statement accounts.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

GENERAL STEEL HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

AS OF SEPTEMBER 30, 2007 AND DECEMBER 31, 2006

ASSETS | | | | | |

| | | September 30, | | December 31, | |

| | | 2007 | | 2006 | |

| | | (Unaudited) | | | |

| CURRENT ASSETS: | | | | | |

| Cash | | $ | 6,781,439 | | $ | 6,831,549 | |

| Restricted cash | | | 10,073,014 | | | 4,231,523 | |

Accounts receivable, net of allowance for doubtful accounts of $142,694 and $137,132 as of September 30, 2006 and December 31, 2006, respectively | | | 18,522,393 | | | 17,095,718 | |

| Accounts receivable - related parties | | | 12,436,638 | | | - | |

| Notes receivable | | | 14,816,424 | | | 537,946 | |

| Other receivables | | | 2,246,237 | | | 268,784 | |

| Other receivables - related parties | | | 1,334,000 | | | 850,400 | |

| Inventories | | | 74,116,266 | | | 12,489,290 | |

| Advances on inventory purchases | | | 60,350,015 | | | 2,318,344 | |

| Advances on inventory purchases - related parties | | | 24,662,603 | | | - | |

| Prepaid expenses - current | | | 470,166 | | | 46,152 | |

| Total current assets | | | 225,809,195 | | | 44,669,706 | |

| | | | | | | | |

| PLANT AND EQUIPMENT, net | | | 207,347,239 | | | 26,606,594 | |

| | | | | | | | |

| OTHER ASSETS: | | | | | | | |

| Advances on equipment purchases | | | 211,431 | | | - | |

| Prepaid expenses - non current | | | 846,755 | | | 740,868 | |

| Intangible assets - land use right, net of accumulated amortization | | | 21,324,413 | | | 1,804,440 | |

| Total other assets | | | 22,382,599 | | | 2,545,308 | |

| | | | | | | | |

| Total assets | | $ | 455,539,033 | | $ | 73,821,608 | |

| | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | |

| | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | |

| Accounts payable | | $ | 96,096,557 | | $ | 3,001,775 | |

| Accounts payable - related parties | | | 725,131 | | | - | |

| Short term loans - bank | | | 76,267,448 | | | 30,284,686 | |

| Short term loans - others | | | 37,151,900 | | | - | |

| Short term loans - related parties | | | 19,376,350 | | | - | |

| Short term notes payable | | | 41,247,280 | | | 8,153,520 | |

| Other payables | | | 6,650,517 | | | 355,142 | |

| Other payable - related partites | | | 15,461,042 | | | - | |

| Accrued liabilities | | | 7,936,729 | | | 1,064,012 | |

| Customer deposits | | | 50,909,808 | | | 1,093,602 | |

| Deposits due to sales representatives | | | 1,795,297 | | | 2,051,200 | |

| Taxes payable | | | 16,760,169 | | | 5,391,602 | |

| Investment payable | | | 6,403,200 | | | - | |

| Distribution payable to minority shareholder | | | 2,744,676 | | | - | |

| Shares subject to mandatory redemption | | | - | | | 2,179,779 | |

| Total current liabilities | | | 379,526,104 | | | 53,575,318 | |

| | | | | | | | |

| MINORITY INTEREST | | | 36,582,894 | | | 6,185,797 | |

| | | | | | | | |

| SHAREHOLDERS' EQUITY: | | | | | | | |

Preferred stock, $0.001 par value, 50,000,000 shares authorized, 3,092,899 and 0 shares issued and outstanding as of September 30, 2007 and December 31, 2006, respectively | | | 3,093 | | | - | |

Common Stock, $0.001 par value, 200,000,000 shares authorized, 34,564,665 and 32,426,665 shares (including 1,176,665 redeemable shares) issued and outstanding as of September 30, 2007 and December 31, 2006, respectively | | | 34,565 | | | 31,250 | |

| Paid-in-capital | | | 22,857,207 | | | 6,871,358 | |

| Retained earnings | | | 13,154,645 | | | 4,974,187 | |

| Statutory reserves | | | 1,107,010 | | | 1,107,010 | |

| Accumulated other comprehensive income | | | 2,273,515 | | | 1,076,688 | |

| Total shareholders' equity | | | 39,430,035 | | | 14,060,493 | |

| | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 455,539,033 | | $ | 73,821,608 | |

The accompanying notes are an integral part of these statements.

GENERAL STEEL HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME

| FOR THE THREE MONTHS AND NINE MONTHS ENDED SEPTEMBER 30, 2007 AND 2006 |

| (Unaudited) |

| | | Three months ended | | Nine months ended | |

| | | September 30, | | September 30, | |

| | | 2007 | | 2006 | | 2007 | | 2006 | |

| | | | | | | | | | |

| REVENUES | | $ | 345,384,337 | | $ | 46,957,797 | | $ | 504,247,052 | | $ | 96,998,657 | |

| | | | | | | | | | | | | | |

| COST OF SALES | | | 319,494,586 | | | 45,404,450 | | | 468,510,928 | | | 92,486,613 | |

| | | | | | | | | | | | | | |

| GROSS PROFIT | | | 25,889,751 | | | 1,553,347 | | | 35,736,124 | | | 4,512,044 | |

| | | | | | | | | | | | | | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | | | 6,795,307 | | | 605,801 | | | 10,269,918 | | | 2,155,612 | |

| | | | | | | | | | | | | | |

| INCOME FROM OPERATIONS | | | 19,094,444 | | | 947,546 | | | 25,466,206 | | | 2,356,432 | |

| | | | | | | | | | | | | | |

| OTHER EXPENSE, NET | | | 2,916,768 | | | 623,105 | | | 4,378,586 | | | 1,370,798 | |

| | | | | | | | | | | | | | |

INCOME BEFORE PROVISION FOR INCOME TAXES AND MINORITY INTEREST | | | 16,177,676 | | | 324,441 | | | 21,087,620 | | | 985,634 | |

| | | | | | | | | | | | | | |

| PROVISION FOR INCOME TAXES | | | 2,025,389 | | | - | | | 3,359,271 | | | - | |

| | | | | | | | | | | | | | |

| NET INCOME BEFORE MINORITY INTEREST | | | 14,152,287 | | | 324,441 | | | 17,728,349 | | | 985,634 | |

| | | | | | | | | | | | | | |

| LESS MINORITY INTEREST | | | 6,151,792 | | | 144,644 | | | 7,359,688 | | | 466,834 | |

| | | | | | | | | | | | | | |

| NET INCOME | | | 8,000,495 | | | 179,797 | | | 10,368,661 | | | 518,800 | |

| | | | | | | | | | | | | | |

| OTHER COMPREHENSIVE INCOME: | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | 374,568 | | | 222,417 | | | 1,196,827 | | | 405,053 | |

| | | | | | | | | | | | | | |

| COMPREHENSIVE INCOME | | $ | 8,375,063 | | $ | 402,214 | | $ | 11,565,488 | | $ | 923,853 | |

| | | | | | | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF SHARES | | | 32,343,332 | | | 31,250,000 | | | 31,704,912 | | | 31,250,000 | |

| | | | | | | | | | | | | | |

| EARNING PER SHARE, BASIC AND DILUTED | | $ | 0.25 | | $ | 0.01 | | $ | 0.33 | | $ | 0.02 | |

The accompanying notes are an integral part of these statements.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2007 AND 2006

| | | | | | | | | | | | | | | | | Accumulated | | | |

| | | Preferred stock | | Common stock | | | | Retained earnings | | other | | | |

| | | | | | | | | | | Paid-in | | Statutory | | | | comprehensive | | | |

| | | Shares | | Par value | | Shares | | Par value | | capital | | reserves | | Unrestricted | | income | | Totals | |

| | | | | | | | | | | | | | | | | | | | |

| BALANCE, January 1, 2006 | | | - | | $ | - | | | 31,250,000 | | $ | 31,250 | | $ | 6,871,358 | | $ | 840,753 | | $ | 4,207,236 | | $ | 399,188 | | $ | 12,349,785 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | | | | | | | | | | | | | | | | | | | 518,800 | | | | | | 518,800 | |

| Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | | | | | | 405,053 | | | 405,053 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, September 30, 2006, unaudited | | | - | | $ | - | | | 31,250,000 | | $ | 31,250 | | $ | 6,871,358 | | $ | 840,753 | | $ | 4,726,036 | | $ | 804,241 | | $ | 13,273,638 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | | | | | | | | | | | | | | | | | | | 514,408 | | | | | | 514,408 | |

| Adjustment to statutory reserve | | | | | | | | | | | | | | | | | | 266,257 | | | (266,257 | ) | | | | | - | |

| Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | | | | | | 272,447 | | | 272,447 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, December 31, 2006 | | | - | | $ | - | | | 31,250,000 | | $ | 31,250 | | $ | 6,871,358 | | $ | 1,107,010 | | $ | 4,974,187 | | $ | 1,076,688 | | $ | 14,060,493 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | | | | | | | | | | | | | | | | | | | 10,368,661 | | | | | | 10,368,661 | |

Preferred stock issued for acquistion of minority interest, net of dividend distribution to Victory New | | | 3,092,899 | | | 3,093 | | | | | | | | | 8,370,907 | | | | | | (2,188,203 | ) | | | | | 6,185,797 | |

| Conversion of redeemable stock at $1.95/share | | | | | | | | | 1,176,665 | | | 1,177 | | | 2,293,320 | | | | | | | | | | | | 2,294,497 | |

| Common stock issued for service, $1.32/share | | | | | | | | | 18,000 | | | 18 | | | 23,742 | | | | | | | | | | | | 23,760 | |

| Common stock issued by $2.50/share | | | | | | | | | 2,120,000 | | | 2,120 | | | 5,297,880 | | | | | | | | | | | | 5,300,000 | |

| Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | | | | | | 1,196,827 | | | 1,196,827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, September 30, 2007, unaudited | | | 3,092,899 | | $ | 3,093 | | | 34,564,665 | | $ | 34,565 | | $ | 22,857,207 | | $ | 1,107,010 | | $ | 13,154,645 | | $ | 2,273,515 | | $ | 39,430,035 | |

The accompanying notes are an integral part of these statements.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2007 AND 2006

(Unaudited)

| | | 2007 | | 2006 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

| Net income | | $ | 10,368,661 | | $ | 518,800 | |

Adjustments to reconcile net income to cash used in operating activities: | | | | | | | |

| Minority interest | | | 7,359,688 | | | 466,834 | |

| Depreciation | | | 5,491,604 | | | 1,008,036 | |

| Amortization | | | 429,662 | | | 222,400 | |

| (Gain) Loss on disposal of equipment | | | (4,013 | ) | | 28,005 | |

| Stock issued for services | | | 33,332 | | | - | |

| Interest expense accrued on mandatory redeemable stock | | | 114,726 | | | 344,178 | |

| Interest expense accrued on short term loan to related parties | | | 424,580 | | | - | |

| Changes in operating assets and liabilities | | | | | | | |

| Accounts receivable | | | 8,679,486 | | | (9,928,845 | ) |

| Accounts receivable - related parties | | | (12,179,328 | ) | | - | |

| Notes receivable | | | (7,984,262 | ) | | (1,106,993 | ) |

| Other receivables | | | (1,428,924 | ) | | (7,476 | ) |

| Other receivables - related parties | | | (456,000 | ) | | (850,400 | ) |

| Inventories | | | (7,110,388 | ) | | (4,681,528 | ) |

| Advances on inventory purchases | | | (61,418,795 | ) | | 3,737,173 | |

| Advances on inventory purchases-related parties | | | (11,329,255 | ) | | - | |

| Prepaid expenses - current | | | (282,484 | ) | | (86,541 | ) |

| Accounts payable | | | 84,348,627 | | | 145,602 | |

| Accounts payable - related parties | | | 710,128 | | | - | |

| Other payables | | | 4,353,966 | | | 137,713 | |

| Other payable - related parties | | | (63,100,758 | ) | | (980,000 | ) |

| Accrued liabilities | | | 5,182,043 | | | 821,858 | |

| Customer deposits | | | 16,307,900 | | | 64,917 | |

| Taxes payable | | | 10,887,436 | | | 2,611,959 | |

| Net cash used in operating activities | | | (10,602,368 | ) | | (7,534,308 | ) |

| | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

| Cash acquired from subsidiary | | | 680,132 | | | - | |

| Increase in investment payable | | | 6,270,720 | | | - | |

| Increase in short term investment | | | - | | | 37,494 | |

| Notes receivable-related parties | | | - | | | 2,722,629 | |

| Advances on equipment purchases | | | (207,056 | ) | | 1,061,493 | |

| Deposits due to sales representatives | | | (332,087 | ) | | 538,664 | |

| Cash proceeds from sale of equipment | | | 43,652 | | | - | |

| Purchase of equipment | | | (12,159,159 | ) | | (5,299,576 | ) |

| Net cash used in investing activities | | | (5,703,798 | ) | | (939,296 | ) |

| | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | |

| Restriced cash | | | (1,633,346 | ) | | (80,218 | ) |

| Borrowings from related parties | | | 18,550,906 | | | - | |

| Borrowings on short term loans - banks | | | 52,924,877 | | | 21,309,090 | |

| Payments on short term loans - banks | | | (63,199,713 | ) | | (17,497,200 | ) |

| Borrowings on short term loans - others | | | 5,225,600 | | | - | |

| Payments on short term loans - others | | | (1,437,040 | ) | | - | |

| Borrowing on short term notes payable | | | 42,484,128 | | | 6,074,028 | |

| Payment on short term notes payable | | | (40,001,968 | ) | | (6,074,028 | ) |

| Cash received on stock issuance | | | 5,290,428 | | | - | |

| Cash received from shareholder | | | 1,500,000 | | | - | |

| Cash contribution received from minority shareholders | | | 783,840 | | | - | |

| Payment to minority shareholder | | | (4,291,634 | ) | | - | |

| Net cash provided by financing activities | | | 16,196,078 | | | 3,731,672 | |

| | | | | | | | |

| EFFECTS OF EXCHANGE RATE CHANGE IN CASH | | | 59,978 | | | 102,648 | |

| | | | | | | | |

| DECREASE IN CASH | | | (50,110 | ) | | (4,639,284 | ) |

| | | | | | | | |

| CASH, beginning of period | | | 6,831,549 | | | 8,648,373 | |

| | | | | | | | |

| CASH, end of period | | $ | 6,781,439 | | $ | 4,009,089 | |

The accompanying notes are an integral part of these statements.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Note 1 - Background

The Company was established on August 5, 2002. The Company through its 100% owned subsidiary, General Steel Investment Co., Ltd and 70% owned subsidiary, Daqiuzhuang Metal principally engages in the manufacturing of hot rolled carbon and silicon steel sheets which are mainly used on tractors, agricultural vehicles and in other specialty markets. Daqiuzhuang Metal sells its products through both retailers and wholesalers.

On May 18, 2007, General Steel entered into a Purchase Agreement with Victory New Holdings Limited (Victory New), a British Virgin Islands registered company under the control of the Company’s Chairman, CEO and majority shareholder Yu Zu Sheng (aka Henry Yu) to acquire Victory New’s 30% interest in Daqiuzhuang Metal. General Steel agreed to issue to the original shareholder of Victory New an aggregate of 3,092,899 shares of the Company’s Series A Preferred Stock with a fair value of $8,374,000, which have a voting power of 30% of the combined voting power of the Company’s common and preferred stock for the entire life of the Company. As a result of the acquisition, the Company has increased its equity interest in Daqiuzhuang Metal from 70% to 100%, and Daqiuzhuang Metal is a wholly owned subsidiary of the Company. See details in Note 18- Business Combinations.

On April 27, 2007, Daqiuzhuang Metal and Baotou Iron and Steel Group Co., Ltd. ("Baotou Steel") entered into an Amended and Restated Joint Venture Agreement (the "Agreement"), amending the Joint Venture Agreement entered into on September 28, 2005 ("Original Joint Venture Agreement"). The Agreement has increased Daqiuzhuang Metal's ownership interest in the Joint Venture to 80%. The joint venture company’s name is Baotou Steel - General Steel Special Steel Pipe Joint Venture Company Limited, a limited liability company formed under the laws of the People's Republic of China (referred to as “Baotou Steel Pipe Joint Venture”). Baotou Steel Pipe Joint Venture obtained its license on May 25, 2007 and started its normal operation in July 2007. See more discussion in Note 18 - Business combinations.

Baotou Steel Pipe Joint Venture is located at Kundulun District, Baotou City, Inner Mongolia, China. It produces and sells welded steel pipes and primarily serves customers in the oil, gas and petrochemical markets. The current designed production capacity is 100,000 tons of steel pipes and will be increased to 600,000 tons by 2009.

On May 18, 2007, Daqiuzhuang Metal established Yangpu Shengtong Investment Co., Ltd. (referred to as “Yangpu Investment”) and injected registered capital totaling RMB100,000,000 or approximately $13,030,000 into the investment. The total registered capital of Yangpu Investment is RMB110,000,000 or approximately $14,333,000, and Daqiuzhuang Metal has a 99.3% ownership interest in Yangpu Investment.

Qiu Steel Investment Co., Ltd. (referred to as “Qiu Steel Investment”) was founded on June 1, 2006. In June 2007, Yangpu Investment agreed to invest RMB148,000,000 or approximately $19,284,400 through a capital injection and equity transfer with former shareholders. The total registered capital of Qiu Steel is RMB150,000,000 or approximately $19,545,000. As a result of the above mentioned equity transaction, Yangpu Investment acquired 98.7% equity of Qiu Steel Investment. Qiu Steel Investment then becomes a subsidiary of Yangpu Investment and Daqiuzhuang Metal.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Yangpu Investment and Qiu Steel Investment are Chinese registered limited liability companies with a legal structure similar to a limited liability company organized under state laws in the United States of America. Those two companies were formed to acquire other businesses.

On June 15, 2007, General Steel Holdings Inc. and Shaanxi Long Men Iron and Steel (Group) Co., Ltd. (referred to as Long Men Group) signed an agreement to form Shaanxi Long Men Iron and Steel Co., Ltd. (referred to as Long Men Joint Venture). The parties agreed to make the effective date of the transaction June 1, 2007. General Steel Holdings Inc. contributed RMB300 million or approximately $39,450,000 through its subsidiaries, Daqiuzhuang Metal and Qiu Steel Investment., to the Long Men Joint Venture. General Steel and Long Men Group will own 60% and 40% ownership interest in Long Men joint Venture, respectively. The Long Men Joint Venture obtained the business license on June 22, 2007. See more discussion in Note 18 - Business combinations.

Long Men Joint Venture is located in Hancheng city, Shaanxi province. Long Men Joint Venture is the largest integrated steel producer in Shaanxi Province, China that uses iron ore and coke as primary raw materials for steel production. Long Men Joint Venture produces pig iron, crude steel, reinforced bars and high-speed wires. Long Men Joint Venture has annual crude steel production capability of 2.5 million tons. Long Men Joint Venture is also engaged in several other business activities, most of which are related to steel manufacturing. These include the production of coke and the production of iron ore pellets from taconite, transportation services and real estate and hotel operations. These operations are all located in Shaanxi Province, China and primarily serve regional customers in the construction industry.

On September 24, 2007, Long Men Joint Venture further acquired 74.92% ownership interest in Environmental Protection Industry Development Co., Ltd. (“EPID)” for RMB18,080,930, approximately $2,380,000 and a 36% equity interest in Hualong Fire Retardant Materials Co., Ltd., (“Hualong”) for RMB3,287,980, approximately $430,000. The parties agreed to make the effective date of the transaction July 1, 2007.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

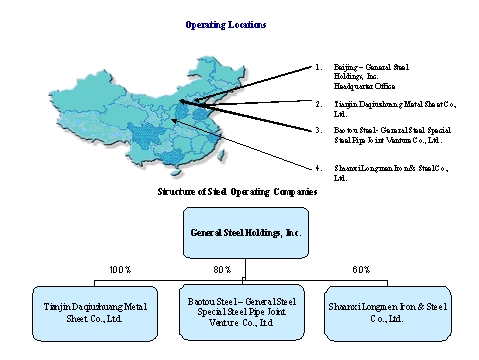

The following table reflects the Company’s current organization structure:

Note 2 - Summary of significant accounting policies

Basis of presentation

The consolidated financial statements of General Steel Holdings, Inc. reflect the activities of the following directly and indirectly owned subsidiaries:

| | | | | Percentage | |

| Subsidiary | | Of Ownership | |

| General Steel Investment Co., Ltd. | | | British Virgin Islands | | | 100.0 | % |

| Victory New Holding, Ltd. | | | British Virgin Islands | | | 100.0 | % |

| Tianjin Daqiuzhuang Metal Sheet Co., Ltd | | | P.R.C. | | | 100.0 | % |

| Baotou Steel Pipe Joint Venture | | | P.R.C. | | | 80.0 | % |

| Yangpu Shengtong Investment Co., Ltd. | | | P.R.C. | | | 99.3 | % |

| Tianjing Qiu Steel Investment Co., Ltd. | | | P.R.C. | | | 98.0 | % |

| Shaanxi Long Men Joint Venture | | | P.R.C. | | | 60.0 | % |

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The accompanying consolidated financial statements include the accounts of all direct and indirectly owned subsidiaries listed above. All material intercompany transactions and balances have been eliminated in the consolidation. The Long Men Joint Venture financial data from June 1, the effective date of the acquisition, to September 30, 2007 is included in the Company’s consolidated financial statements. The financial data of Environmental Protection Industry Development Co., Ltd. and Hualong Fire Retardant Materials Co., Ltd. are included in the Company’s financial statements from July 1 to September 30, 2007.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Revenue recognition

The Company's revenue recognition policies are in compliance with Staff Accounting Bulletin (“SAB”) 104. Sales revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectibility is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are recorded as customer deposits. Sales revenue represents the invoiced value of goods, net of a value-added tax (VAT). All of the Company’s products that are sold in the PRC are subject to a Chinese value-added tax at a rate of 13% to 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of producing the finished product.

Foreign currency translation

The reporting currency of the Company is the US dollar. The Company uses the local currency, Renminbi (RMB), as its functional currency. Assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Translation adjustments amounted to $2,273,515 and $1,076,688 as of September 30, 2007 and December 31, 2006, respectively. Asset and liability amounts at September 30, 2007 and December 31, 2006 were translated at 7.50 RMB to $1.00 USD and 7.80 RMB to $1.00 USD, respectively. Equity accounts were stated at their historical rate. The average translation rates applied to income statement accounts for the nine months ended September 30, 2007 and 2006 were 7.66 RMB and 8.01 RMB, and for the three months ended September 30, 2007 and 2006 were 7.55 RMB and 8.00 RMB, respectively. Cash flows are also translated at average translation rates for the period, therefore, amounts reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Plant and equipment, net

Plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets with 3%-5% residual value. Depreciation expense for the nine months ended September 30, 2007 and 2006 amounted to $5,491,604 and $1,008,036, respectively. Depreciation expense for the three months ended September 30, 2007 and 2006 amounted to $3,347,167 and $459,351, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Estimated useful lives of the assets are as follows:

| | | Estimated Useful Life |

| Buildings | | 10-40 years |

| Machinery and equipment | | 8-30 years |

| Other equipment | | 5-8 years |

| Transportation equipment | | 5-15 years |

Construction in progress represents the costs incurred in connection with the construction of buildings or new additions to the Company’s plant facilities. No depreciation is provided for construction in progress until such time as the assets are completed and are placed into service. Maintenance, repairs and minor renewals are charged directly to expense as incurred. Major additions and betterment to buildings and equipment are capitalized.

Interest incurred during construction is capitalized into construction in progress. All other interest is expensed as incurred. For the nine months ended September 30, 2007 and 2006, interest incurred by the Company was $5,325,281 and $1,344,433, respectively, and capitalized interest for the nine months ended September 30, 2007 and 2006 amounted to $656,471 and $0, respectively.

Plant and equipment consist of the following at:

| | | | September 30, 2007 | | | December 31, 2006 | |

| | | | (unaudited) | | | | |

| Buildings and improvements | | $ | 62,984,397 | | $ | 9,338,865 | |

| Machinery | | | 126,567,039 | | | 22,675,357 | |

| Transportation equipment | | | 4,467,440 | | | 1,019,698 | |

| Other equipment | | | 1,149,103 | | | - | |

| Construction in process | | | 24,889,653 | | | - | |

| Totals | | | 220,057,632 | | | 33,033,920 | |

| Less accumulated depreciation | | | (12,710,393 | ) | | (6,427,326 | ) |

| Totals | | $ | 207,347,239 | | $ | 26,606,594 | |

Long-term assets of the Company are reviewed annually or more often if circumstances dictate, to determine whether their carrying value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. The Company also re-evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. As of September 30, 2007, the Company expects these assets to be fully recoverable.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles of the United States of America requires management to make estimates and assumptions that affect the amounts reported in the combined financial statements and accompanying notes. For example, the Company estimates its potential losses on uncollectible receivables. Management believes that the estimates utilized in preparing its financial statements are reasonable and prudent. Actual results could differ from these estimates.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Cash includes cash on hand and demand deposits in accounts maintained with state owned banks within the People’s Republic of China and Hong Kong. Total cash (including restricted cash balances) in these banks at September 30, 2007 and December 31, 2006 amounted to $16,528,750 and $11,058,636, respectively, of which no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

The Company has five major customers which represented approximately 58% and 31% of the Company’s total sales for the nine months ended September 30, 2007 and 2006, respectively. Five customers accounted for 41% of total accounts receivable as of September 30, 2007.

For the nine months ended September 30, 2007 and 2006, the Company purchased approximately 53% and 95%, respectively, of its raw materials from five major suppliers. There is no accounts payable to these suppliers as of September 30, 2007.

The Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC's economy. The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Restricted cash

The Company has notes payable outstanding with various banks and is required to keep certain amounts on deposit that are subject to withdrawal restrictions, and these amounts were $10,073,014 and $4,231,523 as of September 30, 2007 and December 31, 2006, respectively.

Inventories

Inventories are stated at the lower of cost or market using weighted average method. Inventories consisted of the following:

| | | September 30, 2007 | | December 31, 2006 | |

| | | (unaudited) | | | |

| Supplies | | $ | 1,340,338 | | $ | 1,061,773 | |

| Raw materials | | | 40,918,058 | | | 2,827,127 | |

| Finished goods | | | 31,857,870 | | | 8,600,390 | |

| Totals | | $ | 74,116,266 | | $ | 12,489,290 | |

Raw materials consist primarily of iron ore and coke at Long Men Joint Venture and steel strip at Daqiuzhuang Metal The cost of finished goods includes direct costs of raw materials as well as direct labor used in production. Indirect production costs such as utilities and indirect labor related to production such as assembling, shipping and handling costs are also included in the cost of inventory. The Company reviews its inventory periodically for possible obsolete goods and to determine if any reserves are necessary for potential obsolescence. As of September 30, 2007 and December 31, 2006 the Company believes no reserves are necessary.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Financial instruments

Statement of Financial Accounting Standards No. 107 (SFAS 107), “Disclosures about Fair Value of Financial Instruments” requires disclosure of the fair value of financial instruments held by the Company. SFAS 107 defines the fair value of financial instruments as the amount at which the instrument could be exchanged in a current transaction between willing parties. The Company considers the carrying amount of cash, accounts receivable, other receivables, accounts payable, accrued liabilities and other payables to approximate their fair values because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest.

Intangible assets

All land in the People’s Republic of China is owned by the government and cannot be sold to any individual or company. However, the government grants the user a “land use right” to use the land.

Daqiuzhuang Metal acquired land use rights during the years ended 2000 and 2003 for a total amount of $3,167,483. The land use rights are for 50 years and expire in 2050 and 2053. However, Daqiuzhuang Metal's initial business license had a ten-year term. Therefore management elected to amortize the land use rights over the ten-year business term. Daqiuzhuang Metal became a Sino Joint Venture in 2004 and obtained a new business license for twenty years; however, the Company decided to continue amortizing the land use rights over the original ten-year business term.

Long Men Group contributed land use rights for a total amount of $19,823,885 to the Long Men Joint Venture. The land use rights are for 50 years and expire in 2048 to 2052.

The Company’s land use rights are as follows:

| | | September 30, 2007 | | December 31, 2006 | |

| | | (unaudited) | | | |

| Land use right | | $ | 22,991,368 | | $ | 3,041,733 | |

| Accumulated Amortization | | | (1,666,955 | ) | | (1,237,293 | ) |

| Totals | | $ | 21,324,413 | | $ | 1,804,440 | |

Intangible assets of the Company are reviewed annually to determine whether their carrying value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. The Company also re-evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. As of September 30, 2007, the Company expects these assets to be fully recoverable. Total amortization expense for the nine months ended September 30, 2007 and 2006 amounted to $429,662 and $222,400 respectively. Amortization expense for the three months ended September 30, 2007 and 2006 amounted to $214,288 and $74,561, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Shares subject to mandatory redemption

The Company adopted Statement of Financial Accounting Standards No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity”. FAS 150 established classification and measurement standards for three types of freestanding financial instruments that have characteristics of both liabilities and equity. Instruments within the scope of FAS 150 must be classified as liabilities within the Company’s Consolidated Financial Statements and be reported at settlement date value. The Company issued redeemable stock in September 2005. The amount is presented as a liability on the balance sheet at the fair market value on the date of issuance plus accrued interest at the balance sheet date. As of September 30, 2007, redemption feature on all the shares issued was expired and subsequently the shares were reclassified from liability to equity. See note 14 for details.

Share-based compensation

The Company records stock-based compensation pursuant to Statement of Financial Accounting Standards No. 123 (revised 2004), "Share-Based Payments," ("FAS123R"), which established standards for the accounting for transactions in which an entity exchanges its equity instruments for goods or services. This statement requires companies to measure the cost of services received in exchange for an award of equity instruments based on the grant-date fair value of the award. The cost will be recognized over the period of services rendered.

Income taxes

The Company adopted Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes” (SFAS 109). SFAS 109 requires the recognition of deferred income tax liabilities and assets for the expected future tax consequences of temporary differences between income tax basis and financial reporting basis of assets and liabilities. Provision for income taxes consists of taxes currently due plus deferred taxes. There are no deferred tax amounts at June 30, 2007 and December 31, 2006. The Company adopted FASB Interpretation 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”), as of January 1, 2007. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no effect on the Company’s financial statements.

The charge for taxation is based on the results for the year as adjusted for items, which are non-assessable or disallowed. It is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred tax is accounted for using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis used in the computation of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences, and deferred tax assets are recognized to the extent that it is probable that taxable profit will be available against which deductible temporary differences can be utilized. Deferred tax is calculated using tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited in the income statement, except when it is related to items credited or charged directly to equity, in which case the deferred tax is also dealt with in equity. Deferred tax assets and liabilities are offset when they relate to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Under the Income Tax Laws of PRC, the Company’s subsidiary, Daqiuzhuang Metal, is generally subject to an income tax at an effective rate of 33% (30% state income taxes plus 3% local income taxes) on income reported in the statutory financial statements after appropriate tax adjustments, unless the enterprise is located in a specially designated region where it allows foreign enterprises a two-year income tax exemption and a 50% income tax reduction for the following three years. The Company’s subsidiary, Daqiuzhuang Metal, became a Chinese Sino-foreign joint venture at the time of the merger on October 14, 2004 and it became eligible for the tax benefit. Daqiuzhuang Metal is located in Tianjin Costal Economic Development Zone and under the Income Tax Laws of Tianjin City of PRC, it is eligible for an income tax rate of 24%. Therefore, Daqiuzhuang Metal is exempt from income taxes for the years ended December 31, 2005 and 2006 and is entitled to 50% income tax reduction of the special income tax rate of 24%, which is a rate of 12% for the years ended December 31, 2007, 2008 and 2009.

The Company’s other subsidiary, Long Men Joint Venture, is located in the mid-west region of China. It qualifies for the Go-West tax rebate of 15% tax rate promulgated by the government, therefore income tax is accrued at 15%.

Baotou Steel Pipe Joint Venture is located in Inner Mongolia, is subject to an income tax at an effective rate of 33% (30% state income taxes plus 3% local income taxes)

Beginning January 1, 2008, the new Enterprise Income Tax (“EIT”) law will replace the existing laws for Domestic Enterprises (“DES”) and Foreign Invested Enterprises (“FIEs”). The new standard EIT rate of 25% will replace the 33% rate currently applicable to both DES and FIEs. The two-year tax exemption and three-year 50% tax reduction tax holiday for production-oriented FIEs will be eliminated. The Company is currently evaluating the effect of the new EIT law will have on its financial position.

The provision for income taxes for the nine and three months ended September 30 consisted of the following:

| | | For the nine months ended | | For the three months ended | |

| | | September 30, | | September 30, | |

| | | 2007 | | 2006 | | 2007 | | 2006 | |

| | | (Unaudited) | | | | | | | |

| Provision for China Income Tax | | $ | 3,053,883 | | $ | - | | $ | 1,841,263 | | $ | - | |

| Provision for China Local Tax | | | 305,388 | | | - | | | 184,126 | | | - | |

| Total Provision for Income Taxes | | $ | 3,359,271 | | $ | - | | $ | 2,025,389 | | $ | - | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

The following table reconciles the U.S. statutory rates to the Company’s effective tax rate for the nine months ended September 30:

| | | 2007 | | 2006 | |

| U.S. Statutory rates | | | 34.0 | % | | 34.0 | % |

| Foreign income not recognized in USA | | | (34.0 | ) | | (34.0 | ) |

| China income taxes | | | 33.0 | | | | |

| China income tax exemption | | | (17.1 | ) | | | |

| Total provision for income taxes | | | 15.9 | % | | - | % |

Enterprises or individuals who sell commodities, engage in repair and maintenance or import and export goods in the PRC are subject to a value added tax in accordance with Chinese laws. The value added tax standard rate is 17% of the gross sales price. A credit is available whereby VAT paid on the purchases of semi-finished products or raw materials used in the production of the Company’s finished products can be used to offset the VAT due on sales of the finished product.

VAT on sales and VAT on purchases amounted to $100,209,901 and $70,869,712 for the nine months ended September 30, 2007 and $16,489,771 and 12,139,751, for the nine months ended September 30, 2006, respectively. Sales and purchases are recorded net of VAT collected and paid as the Company acts as an agent for the government. VAT taxes are not impacted by the income tax holiday.

Taxes payable consisted of the following:

| | | September 30, 2007 | | December 31, | |

| | | (unaudited) | | 2006 | |

| VAT taxes payable | | $ | 12,119,622 | | $ | 5,317,466 | |

| Income taxes payable | | | 3,346,150 | | | - | |

| Misc taxes | | | 1,294,397 | | | 74,136 | |

| Totals | | $ | 16,760,169 | | $ | 5,391,602 | |

Shipping and handling

Shipping and Handling for raw materials purchased are included in cost of goods sold. Shipping and handling cost incurred for shipping of finished products to customers are expensed. Shipping and handling expenses for the nine months ended September 30, 2007 and 2006 amounted to $1,360,302 and 153,377 respectively. Shipping and handling for the three months ended September 30, 2007 and 2006 amounted to $987,724 and $82,252, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Recently issued accounting pronouncements

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments” (“FAS 155”), which amends SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” (“FAS 133”) and SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities” (“FAS 140”). FAS 155 provides guidance to simplify the accounting for certain hybrid instruments by permitting fair value remeasurement for any hybrid financial instrument that contains an embedded derivative, as well as, clarifies that beneficial interests in securitized financial assets are subject to FAS 133. In addition, FAS 155 eliminates a restriction on the passive derivative instruments that a qualifying special-purpose entity may hold under FAS 140. FAS 155 is effective for all financial instruments acquired, issued or subject to a new basis occurring after the beginning of an entity’s first fiscal year that begins after September 15, 2006. The adoption of SFAS No. 155 did not have a material effect on the Company’s financial position or results of operations.

In June 2006, the Emerging Issues Task Force (EITF) reached a consensus on EITF No. 06-3, How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (EITF No. 06-3). EITF No. 06-3 permits that such taxes may be presented on either a gross basis or a net basis as long as that presentation is used consistently. The adoption of EITF No. 06-3 on January 1, 2007 did not impact our consolidated financial statements. We present the taxes within the scope of EITF No. 06-3 on a net basis.

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements," which addresses the measurement of fair value by companies when they are required to use a fair value measure for recognition or disclosure purposes under GAAP. SFAS No. 157 provides a common definition of fair value to be used throughout GAAP which is intended to make the measurement of fair value more consistent and comparable and improve disclosures about those measures. SFAS No. 157 will be effective for an entity's financial statements issued for fiscal years beginning after November 15, 2007. The Company is currently evaluating the effect SFAS No. 157 will have on its consolidated financial position, liquidity, or results of operations.

In June 2007, the FASB issued FASB Staff Position No. EITF 07-3, “Accounting for Nonrefundable Advance Payments for Goods or Services Received for use in Future Research and Development Activities” (“FSP EITF 07-3”), which addresses whether nonrefundable advance payments for goods or services that used or rendered for research and development activities should be expensed when the advance payment is made or when the research and development activity has been performed. Management is currently evaluating the effect of this pronouncement on the Company’s financial statements.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications have no effect on net income or cash flows.

Note 3 - Earnings per share

The Company reports earnings per share in accordance with the provisions of SFAS No. 128, "Earnings Per Share." SFAS No. 128 requires presentation of basic and diluted earnings per share in conjunction with the disclosure of the methodology used in computing such earnings per share.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Basic earnings per share is computed by dividing income available to common stockholders by the weighted average common shares outstanding during the period. Diluted earnings per share takes into account the potential dilution that could occur if securities or other contracts to issue common stock were exercised and converted into common stock.

Under SFAS 150 "Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity", entities that have issued mandatory redeemable shares of common stock or entered into forward contracts that require physical settlement by repurchase of a fixed number of the issuer’s equity shares of common stock in exchange for cash shall exclude the common shares that are to be redeemed or repurchased in calculating basic and diluted earnings per share. Thus the 1,176,665 shares described in note 14 have been excluded from the September 30, 2006 earnings per share calculations.

As described in Note 18, the Company issued Victory New an aggregate of 3,092,899 shares of the Company’s Series A Preferred Stock to purchase 30% minority ownership of Daqiuzhuang Metal. The preferred stock cannot be converted to common stock so it is excluded from the earning per share calculation. In addition, since no common stock equivalents existed at September 30, 2007 and 2006, the basic EPS equals the diluted EPS.

| | | For the nine months ended | | For the three months ended | |

| | | September 30, | | September 30, | |

| | | 2007 | | 2006 | | 2007 | | 2006 | |

| | | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) | |

| Net income for basic and diluted earnings per share | | $ | 8,000,495 | | $ | 179,797 | | $ | 10,368,661 | | $ | 518,800 | |

| Weighted average shares outstanding | | | 32,343,332 | | | 31,250,000 | | | 31,704,912 | | | 31,250,000 | |

| Earnings per share, basic and diluted | | $ | 0.25 | | $ | 0.01 | | $ | 0.33 | | $ | 0.02 | |

Note 4 - Supplemental disclosure of cash flow information

Interest paid amounted to $5,981,387 and $1,376,863 for the nine months ended September 30, 2007 and 2006, respectively.

Income tax paid amounted to $124,454 and $0 during the nine months ended September 30, 2007 and 2006.

On February 12, 2007, the Company issued 18,000 shares of common for investor relations services rendered in the amount of $23,742.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

In May 2007, the Company issued 3,092,899 shares of preferred stock with a fair value of $8,374,000 to the former shareholders of Victory New Holdings Inc. to purchase the 30% the minority ownership of Daqiuzhuang Metal.

On September 1, 2007, 1,176,665 shares of redeemable stock was converted into common shares resulting in a reclassification of $2,294,497 from liabilities to equity,

Note 5 - Accounts receivable and allowance for doubtful accounts

The Company conducts its business operations in the People’s Republic of China. Accounts receivable include trade accounts due from the customers. Management believes that the trade accounts are fully collectible as these amounts are being collected throughout the year. Also, management reviews its accounts receivable on a regular basis to determine if the bad debt allowance is adequate and adjusts the allowance when necessary. The allowance for doubtful accounts as of September 30, 2007 and December 31, 2006 amounted to $142,694 and $137,132, respectively.

| | | For the nine months ended | | | |

| Allowance for doubtful accounts | | September 30, 2007 (Unaudited) | | For the year ended December 31, 2006 | |

| Beginning balance | | $ | 137,132 | | $ | 1,371 | |

| Additions | | | - | | | 135,761 | |

| Deductions | | | - | | | - | |

| Exchange rate effect | | | 5,562 | | | - | |

| Ending balance | | $ | 142,694 | | $ | 137,132 | |

Note 6 - Notes receivable

Notes receivable represents trade accounts receivable due from various customers where the customers’ banks have guaranteed the payment of the receivables. This amount is non-interest bearing and is normally paid within three to six months. The Company has the ability to submit their request for payment to the customer’s bank earlier than the scheduled payment date, but will incur an interest charge and a processing fee when it submits the early payment request. The Company had $14,816,424 and $537,946 outstanding as of September 30, 2007 and December 31, 2006, respectively.

Note 7 - Prepaid expenses

Prepaid expenses consisted of the followings:

| | | September 30, 2007 | | December 31, 2006 | |

| | | (unaudited) | | | | | |

| | | Current | | Long-term | | Current | | Long-term | |

| Rent | | $ | 69,548 | | $ | 290,777 | | $ | 46,152 | | $ | 225,523 | |

| Utilities | | | 400,618 | | | - | | | - | | | - | |

| Land use right | | | - | | | 555,978 | | | - | | | 515,345 | |

| Total | | $ | 470,166 | | $ | 846,755 | | $ | 46,152 | | $ | 740,868 | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

The Company’s prepaid expenses include utilities, prepaid rent for the dormitory for its employees and land use rights in order to expand its manufacturing capabilities. As of September 30, 2007 and December 31, 2006, prepaid rent for dormitory amounted to $360,325 and $271,675, respectively, and prepaid rent for land use rights amounted to $555,978 and $515,345, respectively. See note 19 for more details.

Note 8 - Advances on inventory purchases

Advances on inventory purchases are monies deposited or advanced to outside vendors or related parties on future inventory purchases. Due to the high shortage of steel in China, most of the Company’s vendors require a certain amount of money to be deposited with them as a guarantee that the Company will receive its purchases on a timely basis.

This amount is refundable and bears no interest. The Company has a legally binding contract with its vendors for the guarantee deposit, which is to be returned to the Company at the end of the contract. The inventory is normally delivered within one month after the monies have been advanced. The total outstanding amount was $85,012,618 and $2,318,344 as of September 30, 2007 and December 31, 2006, respectively.

Note 9 - Related party transactions

The Company has advances to and from Golden Glister Holdings Limited for short term cash flow purposes. Golden Glister Holdings Limited is incorporated in the territory of the British Virgin Islands which the Company’s Chairman and CEO and majority shareholder, Yu Zuo Sheng (aka Henry Yu) is the majority shareholder. The Company had a payable to Golden Glister of $1,287,600 at September 30, 2007 and a receivable from Golden Glister of $850,400 at December 31, 2006. The payable is non interest bearing and the Company has agreed to pay back the amount on a short term basis in cash.

The Company subleased a portion of its land use rights to Tianjin Jing Qiu Steel Market Company, a related party under common control. The Company’s Chairman, CEO and majority shareholder, Yu Zuo Zheng (aka Henry Yu), is the chairman and the largest shareholder of Jing Qiu Steel Market Company. The total rental income for nine months ended September 30, 2007 and 2006 was $1,200,600 and $0, respectively. Total rental income for the three months ended September 30, 2007 and December 31, 2006 amounted $391,920 and $0, respectively.

The Company’s short term loan of $6,670,000 from Shenzhen Development Bank is personally guaranteed by the Company’s Chairman, CEO, and majority shareholder Yu Zuo Sheng (aka Henry Yu).

The Company acquired the 30% minority ownership of Daqiuzhuang from Victory New which was legally owned by Mr. Yu Zuo Sheng’s mother and under Mr. Yu’s control. See details of acquisition of minority interest in Note 18. The Company has a payable totaling $50,000 to Mrs. Yu which is short term in nature and non interest bearing. The Company is expected to payback this amount in cash.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

The Long Men Joint Venture did not obtain the VAT invoices from the local tax bureau until late July 2007. Before obtaining VAT invoices, all the sales and purchases made by the joint venture were carried out through the Company’s joint venture partner, Long Men Group, and all the sales proceeds and purchase payments were recorded as receivables from or payables to Long Men Group. The total receivable from Long Men Group is $42,815,087 and the total payable to Long Men Group is $55,866,671. The net amount is a payable of $13,051,584 to Long Men Group.

Total related party sales amounted to $147,133,702 for the nine months ended September 30, 2007.

The following charts summarize the related party transactions as of September 30, 2007:

Accounts receivables-related parties

| Subsidiary | | Amount | | Due from | | Term | | Manner of settlement | |

| Daqiuzhuang Metal | | $ | 5,443,724 | | | Tianjin Hengying | | | Short | | | Cash | |

| Daqiuzhuang Metal | | | 6,992,914 | | | Tianjin Dazhan | | | Short | | | Cash | |

| Total | | $ | 12,436,638 | | | | | | | | | | |

Other receivables-related parties

| Subsidiary | | Amount | | Due from | | Term | | Manner of settlement | |

| Tianjin Qiu Steel Investment | | $ | 600,300 | | | Yang Pu Capital Automobile | | | Short | | | Cash | |

| Tianjin Qiu Steel Investment | | | 733,700 | | | Beijing Wendlar | | | Short | | | Cash | |

| Total | | $ | 1,334,000 | | | | | | | | | | |

Advances on inventory purchases- related parties

| Subsidiary | | Amount | | Due from | | Term | | Manner of settlement | |

| Daqiuzhuang Metal and Long Men Joint Venture | | $ | 12,744,965 | | | Tianjin Hengying | | | Short | | | Deliver goods | |

| Daqiuzhuang Metal and Long Men Joint Venture | | | 11,917,638 | | | Tianjin Dazhan | | | Short | | | Deliver goods | |

| Total | | $ | 24,662,603 | | | | | | | | | | |

Short tem loan -related parties

| Subsidiary | | Amount | | Due to | | Term | | Manner of settlement | |

Daqiuzhuang Metal rate of 6.5% | | $ | 14,708,517 | | | Tianjin Dazhan | | | Annual interest rate of 6.5 | % | | Cash | |

| Daqiuzhuang Metal | | | 4,667,833 | | | Tianjin Hengying | | | Annual interest | % | | Cash | |

| Total | | $ | 19,376,350 | | | | | | | | | | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Accounts payable -related parties

| Subsidiary | | Amount | | Due to | | Term | | Manner of settlement | |

| Long Men Joint Venture | | | 725,131 | | | Minority shareholders | | | Short | | | Cash | |

Other payable-related parties

| Subsidiary | | Amount | | Due to | | Term | | Manner of settlement | |

| New Victory | | $ | 50,000 | | | Shareholder | | | Short | | | Cash | |

| Batou Steel Joint Venture | | | 1,067,200 | | | Tianjin Hengying | | | Short | | | Cash | |

| Long Men Joint Venture | | | 13,051,584 | | | Long Men Group | | | Short | | | Cash | |

| General Steel Investment | | | 1,287,600 | | | Golden Glister | | | Short | | | Cash | |

| Yangpu Shengtong | | | 4,658 | | | Beijing Wandler | | | Short | | | Cash | |

| Total | | $ | 15,461,042 | | | | | | | | | | |

Distribution payable to minority shareholder

Dividend payable of $2,744,676 represents dividend owed to the minority interest of Long Men Joint Venture’s subsidiaries, Environmental Protection Industry Development Co., Ltd. and Hualong Fire Retardant Materials

Investment payable

In June 2007, Yangpu Investment and the former shareholders of Qiu Steel Investment entered into an agreement. Pursuant to this agreement, Yangpu Investment will receive 98.7% of the total equity of Qiu Steel Investment by injecting RMB148,000,000 or approximately $19,462,000. As of September 30, 2007, Yangpu Investment had payable amounted to RMB48,000,000 or approximately $6,403,200.

Note 10 - Debt

Short term loans

Short term loans represent amounts due to various banks, other companies and individuals, which are normally due within one year. The loans due to banks can be renewed with the banks. The Company had a total of $132,795,698 (including 19,376,350 related party loans as discussed in note 9) and $30,284,686 short term loans as of September 30, 2007 and December 31, 2006, respectively.

The loans due to banks consisted of the following:

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

DAQIUZHUANG METAL | | | | | |

| | | September 30, 2007 | | December 31, | |

| | | (unaudited) | | 2006 | |

| Loan from China Bank, JingHai Branch, due | | | | | |

| September 2008. Monthly interest only payment at | | | | | |

| 6.732% per annum, secured by equipment | | | | | |

| and property | �� | $ | 1,200,600 | | $ | 1,153,800 | |

| | | | | | | | |

| Loans from Agriculture Bank, DaQiuZhuang Branch, due | | | | | | | |

| various dates from October to April 2008. | | | | | | | |

| Monthly interest only payments ranging from | | | | | | | |

| 7.344% to 7.668% per annum, guaranteed by an | | | | | | | |

| unrelated third party and secured by property and | | | | | | | |

| equipment | | | 10,015,672 | | | 9,625,256 | |

| | | | | | | | |

| Loan from Construction Bank of China, JinHai Branch, due | | | | | | | |

| various dates in Auguest 2008. Monthly interest only | | | | | | | |

| payment at 8.323% per annum, secured by properties | | | 1,467,400 | | | 1,557,630 | |

| | | | | | | | |

| Loans from ShangHai PuFa Bank, due various dates from | | | | | | | |

| July 2007 to March 2008. Monthly interest only | | | | | | | |

| payments ranging from 6.435% to 6.732% per annum, | | | | | | | |

| guaranteed by an unrelated third party | | | 5,336,000 | | | 5,128,000 | |

| | | | | | | | |

| Loan from China Merchants Bank, due | | | | | | | |

| November 2007. Quarterly interest only | | | | | | | |

| payments at floating interest rate,105% of People's Bank | | | | | | | |

| base rate, guaranteed by an unrelated third party. | | | 8,004,000 | | | 7,692,000 | |

| | | | | | | | |

| Loan from ShenZhen Development Bank, due various | | | | | | | |

| dates in March 2008. Monthly interest only | | | | | | | |

| payment at 6.426% to 6.710% per annum, secured by | | | | | | | |

| inventory and guaranteed by CEO of the Company. | | | 6,670,000 | | | 5,128,000 | |

| | | | | | | | |

| Total | | $ | 32,693,672 | | $ | 30,284,686 | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

| | | September 30, 2007 | | December 31, | |

| | | (unaudited) | | 2006 | |

| LONG MEN JOINT VENTURE | | | | | |

| | | | | | |

| Loans from Construction Bank,HanCheng Branch, due various | | | | | |

| dates from October to September, 2008. Monthly interest only | | | | | |

| payments ranging from 6.73% to 8.02% per annum, | | | | | |

| guaranteed by equipment. | | | 3,201,600 | | | - | |

| | | | | | | | |

| Loans from Bank of China,HenCheng Branch, due various | | | | | | | |

| dates from May 2008 to July 2008. Quarterly interest | | | | | | | |

| payments ranging from 6.71% to 6.90% per annum. | | | | | | | |

| guaranteed by an unrelated third party and an related party. | | | 9,338,000 | | | - | |

| | | | | | | | |

| Loans from Credit Cooperatives,due various dates | | | | | | | |

from March 2008 to August 2008. Monthly interest payments by 11.02% per annum. | | | | | | | |

| guaranteed by an unrelated third party. | | | 2,668,000 | | | - | |

| | | | | | | | |

| Loans from HuaXia Bank, due various dates from October | | | | | | | |

| to December 2007. Monthly interest payment ranging from | | | | | | | |

| 5.83% to 7.33% per annum. | | | | | | | |

| guaranteed by epuipment. | | | 5,202,600 | | | - | |

| | | | | | | | |

| Loan from Communication Bank, due October 2007,Quarterly | | | | | | | |

| interest only payments, annual interest rate of 7.34%, | | | | | | | |

| guaranteed by equipment. | | | 3,335,000 | | | - | |

| | | | | | | | |

| Loan from China Merchants Bank,due September 2008, | | | | | | | |

| Monthly interest payments,annual interest rate of 9.13%, | | | | | | | |

| guaranteed by equipment and unrelated third parties. | | | 6,670,000 | | | - | |

| | | | | | | | |

| Loan from China Everbright Bank, due November 2007. Monthly | | | | | | | |

| interest only payments, annual interest rate of 6.12%, | | | | | | | |

| guaranteed by an unrelated third party. | | | 2,668,000 | | | - | |

| | | | | | | | |

| Total - Long men joint venture | | $ | 43,573,776 | | $ | - | |

| Grand totals | | $ | 76,267,448 | | | 30,284,686 | |

Long Men joint venture also has various loans from non related companies and individuals which are due within on year. The loans are unsecured, annual interest rates ranging from 8% to 12%. As of September 30, 2007, these loans outstanding amounted to $37,151,900.

Short term notes payable

Short-term notes payable are lines of credit extended by the banks. When purchasing raw materials, the Company often issues a short term note payable to the vendor. This short term note payable is guaranteed by the bank for its complete face value. The banks usually require the Company to deposit a certain amount of cash at the bank as a guarantee deposit which is classified on the balance sheet as restricted cash.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

The Company had the following short term notes payable outstanding as of September 30, 2007 and December 31, 2006:

| DAQIUZHUANG METAL | | | | | |

| | | September 30, 2007 | | December 31, | |

| | | (unaudited) | | 2006 | |

| China Bank, Jing Hai Branch, various amounts, due | | | | | |

| October 2007, restricted cash required of 50% | | | | | |

| of loan amount, guaranteed by the Company | | $ | 1,547,440 | | $ | 1,487,120 | |

| | | | | | | | |

| Agricultural Bank of China, various amounts, due dates | | | | | | | |

| ranging between October and March 2007, | | | | | | | |

| restricted cash required of 50% of loan amount, | | | | | | | |

| guaranteed by the Company and an unrelated third party | | | 1,600,800 | | | 1,538,400 | |

| | | | | | | | |

| ShangHai PuFa Bank, due November 2007, | | | |

| restricted cash required of 50% of loan balance, | | | | | | | |

| guaranteed by an unrelated third party | | | 5,336,000 | | | 5,128,000 | |

| | | | | | | | |

| Totals - Daqiuzhuang Metal | | $ | 8,484,240 | | $ | 8,153,520 | |

LONG MEN JOINT VENTURE | | | | | |

| | | September 30, 2007 | | December 31, | |

| | | (unaudited) | | 2006 | |

| Communication Bank, due January 2008 | | | | | |

| guaranteed by an unrelated third party. | | $ | 5,202,600 | | $ | - | |

| | | | | | | | |

| China Merchants Bank , various amounts, due | | | | | | | |

| January 2008, guaranteed by an unrelated third party. | | | 6,670,000 | | | - | |

| | | | | | | | |

| China Everbright Bank of China, due January 2008 | | | | | | | |

| ranging between January to August 2007, | | | | | | | |

| restricted cash required of 30% of loan amount, | | | | | | | |

| paid by Long Men Steel Group, | | | | | | | |

| guaranteed by Long Men Steel Group. | | | 2,147,740 | | | - | |

| | | | | | | | |

| Hua Xia Bank, due date ranging between April and October 2007, | | | |

| restricted cash required of 50% of loan amount, | | | | | | | |

| paid by Long Men Steel Group, | | | | | | | |

| guaranteed by Long Men Steel Group. | | | 5,336,000 | | | - | |

| | | | | | | | |

| ShangHai Pudong Development Bank, various amounts, due dates | | | |

| ranging between April to November 2007, | | | | | | | |

| restricted cash required of 60% of loan amount, | | | | | | | |

| paid by Long Men Steel Group, | | | | | | | |

| guaranteed by Long Men Steel Group. | | | 5,069,200 | | | - | |

| | | | | | | | |

| ShangHai PuFa Bank, due various dates from April to September 2007, | | | |

| restricted cash required of 50% of loan balance, | | | | | | | |

| guaranteed by Long Men Steel Group. | | | 8,337,500 | | | - | |

| | | | | | | | |

| Totals | | | 32,763,040 | | | - | |

| | | | | | | | |

| Grand totals | | $ | 41,247,280 | | $ | 8,153,520 | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

Total interest expense net of capitalized interest for the nine months ended September 30, 2007 and 2006 on all debt amounted to $4,284,413 and $1,531,447, respectively. Total interest expense for the three months ended September 30, 2007 and 2006 amounted to $1,994,274 and $537,928, respectively.

Note 11 - Customer deposits

Customer deposits represent amounts advanced by customers on product orders. The product normally is shipped within six months after receipt of the advance payment and the related sale is recognized in accordance with the Company’s revenue recognition policy. As of September 30, 2007 and December 31, 2006 customer deposits including related parties deposits amounted to $50,909,808 and $1,093,602, respectively.

Note 12 - Deposits due to sales representatives

Daqiuzhuang Metal and One of Long Men Joint Venture’s subsidiaries, Yuxin Trading, entered into agreements with various entities to act as the Company’s exclusive sales agent in a specified area. These exclusive sales agents must meet certain criteria and are required to deposit a certain amount of money with the Company. In return the sales agents receive exclusive sales rights to a specified area and discounted prices on products they order. These deposits bear no interest and are required to be returned to the sales agent once the agreement has been terminated. The Company had $1,795,297and $2,051,200 in deposits due to sales representatives outstanding as of September 30, 2007 and December 31, 2006, respectively.

Note 13 - Other expenses and income, net

Other income and expense for the nine months ended September 30, 2007 and 2006 consist of the following:

| | | September 30, 2007 | | September 30, 2006 | |

| | | Three months | | Nine months | | Three months | | Nine months | |

| | | ended | | ended | | ended | | ended | |

| Finance /Interest expense | | $ | 4,276,092 | | $ | 6,673,942 | | $ | 657,697 | | $ | 1,880,668 | |

| Interest income | | | (762,143 | ) | | (851,608 | ) | | (20,874 | ) | | (154,584 | ) |

| Other non-operating income | | | (626,935 | ) | | (1,606,312 | ) | | (15,367 | ) | | (408,240 | ) |

| Other non-operating expense | | | 29,754 | | | 162,564 | | | 1,649 | | | 52,954 | |

| | | $ | 2,916,768 | | $ | 4,378,586 | | $ | 623,105 | | $ | 1,370,798 | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

For the nine months and three months ended September 30, 2007, other non-operating income includes rental income totaling $1,175,760 and $391,920, respectively, which represents land use rights subleased to a related party for one year as discussed in note 8.

During 2005, Daqiuzhuang Metal received an approval from the PRC local government for a two year income tax exemption and a three year 50% reduction in income tax rates. The local Chinese tax authority waived the previously accrued income tax accumulated prior to January 1, 2005 in the amount of $253,250 which was included as other non-operating income during the nine months ended September 30, 2006.

Note 14 - Private offering of redeemable stock

On September 18, 2005, the Company entered into a subscription agreement with certain investors to sell a total of 1,176,665 shares of common stock at $1.50 per share for gross proceeds of $1,765,000, commissions totaled $158,849, leaving net proceeds of $1,606,151. In addition, two warrants are attached to each share of common stock and each warrant gives the warrant holder the right to purchase an additional share of common stock or a total of 2,353,330 of common stock in the future. The warrants can be exercised on the second anniversary date at $2.50 per share and on the third anniversary date at $5.00 per share. The number of shares attached to the warrants will be adjusted due to dividends and changes in the capital stock structure changes. At the option of the investors, the Company may be required to repurchase the 1,176,665 shares of common stock 18 months after the closing date at a per share price of $1.95.

In accordance with Accounting Principles Board Opinion No. 14, the Company determined the fair value of the detachable warrants issued with redeemable stock using the Black-Scholes option pricing model under the following assumptions: risk free interest rate of 3.85%, dividend yield of 0% and volatility of 11%. The estimated value of the warrants was zero.

In accordance with SFAS 150, the Company recorded this stock issuance as a liability in the financial statements due to the mandatory redemption provision. The shares were recorded at fair value on the date of issuance, which was the net cash proceeds, plus any accrued interest up to March 31, 2007. The difference between the net proceeds, $1,606,151, and the redemption amount, $2,294,497, totaling $688,346, was accrued and amortized as interest expense through March 2007.

As of September 30, 2007, put option on all the redeemable shares has expired and all the shares are reclassified into equity.

Note 15 - Shareholders’ equity

On February 12, 2007, the Company issued to Aurelius Consulting Group, Inc.(known to us as RedChip Companies, Inc.) 18,000 shares of common stock as a portion of its compensation for investor relations services rendered in the amount of $23,742. Those shares were valued at the market price at the date of the agreement.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

On September 1, 2007, as discussed in Note 14, 1,176,665 shares of redeemable stock were reclassified from liabilities to common stock upon expiration of the redemption feature.

In September 2007, 2,120,000 shares of warrants were converted to common stock at $2.50 per share for total proceeds of $5,300,000 in cash.

Note 16 - Retirement plan

Regulations in the People’s Republic of China require the Company to contribute to a defined contribution retirement plan for all employees. All Joint Venture employees are entitled to a retirement pension amount calculated based upon their salary at their date of retirement and their length of service in accordance with a government managed pension plan. The PRC government is responsible for the pension liability to the retired staff. It was the first year the Company was required to make contributions to the state retirement plan. The Company is required to contribute 20% of the employees’ monthly salary. Employees are required to contribute 7% of their salary to the plan. Total pension expense incurred by the Company amounted to $1,245,033 and $336,629 for the nine months ended September 30, 2007 and 2006, respectively. Total pension expense incurred amounted to $978,524 and $179,451 for the three months ended September 30, 2007 and 2006, respectively.

Note 17 - Statutory reserves

The laws and regulations of the People’s Republic of China require that before an enterprise distributes profits to its partners, it must first satisfy all tax liabilities, provide for losses in previous years, and make allocations, in proportions determined at the discretion of the board of directors, to the statutory reserves. The statutory reserves include the surplus reserve funds and the enterprise fund and these statutory reserves represent restricted retained earnings.

Surplus reserve fund