UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

Quarterly report under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2008

Commission File Number 333-105903

General Steel Holdings, Inc.

(Exact name of registrant as specified in its charter)

Nevada (State or other Jurisdiction of Incorporation or Organization) | | 412079252 (I.R.S. Employer Identification No.) |

Room 2315, Kun Tai International Mansion Building,

Yi No 12, Chao Yang Men Wai Ave.

Chao Yang District, Beijing, China 100020

(Address of Principal Executive Office, Including Zip Code)

+86(10)58797346

(Registrant's Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act (Check one).

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of August 14, 2008, 35,686,033 shares of common stock, par value $0.001 per share, were issued and outstanding.

Table of Contents

| | | Page |

| Part I: FINANCIAL INFORMATION: | | F-1 |

| | | |

| Item 1. Financial Statements. | | F-1 |

| | | |

| Consolidated Balance Sheets as of June 30, 2008 (Unaudited) and December 31, 2007 | | F-2 |

| | | |

| Consolidated Statements of Operations and Other Comprehensive Income (Loss) (Unaudited) for the Three and Six Months Ended June 30, 2008 and 2007 | | F-3 |

| | | |

| Consolidated Statements of Shareholders’ Equity (Unaudited) | | F-4 |

| | | |

| Consolidated Statements of Cash Flows (Unaudited) for the Six Months Ended June 30, 2008 and 2007 | | F-5 |

| | | |

| Notes to Consolidated Financial Statements (Unaudited) | | F-6 |

| | | |

| Item 2. Management’s Discussion and Analysis of Financial | | |

| Condition and Results of Operations. | | 1 |

| | | |

| Item 3. Quantitative and Qualitative Disclosures About Market Risks. | | 21 |

| | | |

| Item 4. Controls and Procedures | | 22 |

| | | |

| Part II. OTHER INFORMATION | | |

| | | |

| Item 1. Legal Proceedings. | | 22 |

| | | |

| Item 1A. Risk Factors | | 23 |

| | | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | | 32 |

| | | |

| Item 5. Other Information | | 33 |

| | | |

| Item 6—Exhibits | | 33 |

| | | |

| Signatures | | 34 |

ITEM 1. FINANCIAL STATEMENTS

| GENERAL STEEL HOLDINGS INC. AND SUBSIDIARIES |

| |

| CONSOLIDATED BALANCE SHEETS |

| AS OF JUNE 30, 2008 AND DECEMBER 31, 2007 |

| |

| A S S E T S |

| | | June 30, | | December 31, | |

| | | 2008 | | 2007 | |

| | | (Unaudited) | | | |

| CURRENT ASSETS: | | | | | |

| Cash | | $ | 26,910,158 | | $ | 43,713,346 | |

| Restricted cash | | | 101,352,891 | | | 8,391,873 | |

| Accounts receivable, net of allowance for doubtful accounts of $276,101 | | | | | | | |

| and $148,224 as of June 30, 2008 and December 31, 2007, respectively | | | 26,118,539 | | | 11,225,678 | |

| Accounts receivable - related parties | | | 37,126,645 | | | 565,631 | |

| Notes receivable | | | 18,895,361 | | | 4,216,678 | |

| Notes receivable - restricted | | | - | | | 12,514,659 | |

| Short term loan receivable - related parties | | | - | | | 1,233,900 | |

| Other receivables | | | 3,776,407 | | | 1,280,853 | |

| Other receivables - related parties | | | 520,264 | | | 1,913,448 | |

| Dividend receivable | | | 627,042 | | | - | |

| Inventories | | | 137,440,721 | | | 77,928,925 | |

| Advances on inventory purchases | | | 53,566,234 | | | 58,170,474 | |

| Advances on inventory purchases - related parties | | | 19,343,195 | | | 9,944,012 | |

| Prepaid expenses - current | | | 1,499,850 | | | 1,059,866 | |

| Prepaid expenses related party - current | | | 52,524 | | | 49,356 | |

| Deferred tax assets | | | 860,140 | | | 399,751 | |

| Deferred notes issuance cost | | | 5,108,617 | | | 3,564,546 | |

| | | | 433,198,588 | | | 236,172,996 | |

| | | | | | | | |

| PLANT AND EQUIPMENT, net | | | 400,720,970 | | | 218,263,367 | |

| | | | | | | | |

| OTHER ASSETS: | | | | | | | |

| Advances on equipment purchases | | | 95,834 | | | 742,061 | |

| Investment in unconsolidated subsidiaries | | | 9,875,972 | | | 822,600 | |

| Prepaid expenses - non current | | | 534,268 | | | 506,880 | |

| Prepaid expenses related party - non current | | | 236,358 | | | 142,467 | |

| Intangible assets, net of accumulated amortization | | | 24,883,346 | | | 21,756,709 | |

| Total other assets | | | 35,625,778 | | | 23,970,717 | |

| | | | | | | | |

| Total assets | | $ | 869,545,336 | | $ | 478,407,080 | |

| | | | | | | | |

L I A B I L I T I E S A N D S H A R E H O L D E R S' E Q U I T Y |

| | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | |

| Accounts payable | | $ | 159,824,445 | | $ | 102,241,708 | |

| Accounts payable - related parties | | | 8,237,683 | | | 14,302,738 | |

| Short term loans - bank | | | 85,565,694 | | | 93,019,608 | |

| Short term loans - others | | | 72,383,213 | | | 19,156,070 | |

| Short term loans - related parties | | | 7,309,590 | | | 7,317,027 | |

| Short term notes payable | | | 155,708,387 | | | 15,163,260 | |

| Other payables | | | 9,050,597 | | | 3,343,684 | |

| Other payable - related parties | | | 967,165 | | | 2,126,383 | |

| Accrued liabilities | | | 10,728,642 | | | 5,248,863 | |

| Customer deposits | | | 137,476,284 | | | 37,872,698 | |

| Customer deposits - related parties | | | 5,690,541 | | | 9,211,736 | |

| Deposits due to sales representatives | | | 2,181,205 | | | 3,068,298 | |

| Taxes payable | | | 32,288,459 | | | 27,576,240 | |

| Investment payable | | | 7,003,200 | | | 6,580,800 | |

| Distribution payable to minority shareholder | | | 2,381,458 | | | 2,820,803 | |

| Total current liabilities | | | 696,796,563 | | | 349,049,916 | |

| | | | | | | | |

| NOTES PAYABLE, net of debt discount of $32,933,400 | | | 7,066,600 | | | 5,440,416 | |

| | | | | | | | |

| DERIVATIVE LIABILITIES | | | 53,599,177 | | | 28,483,308 | |

| | | | | | | | |

| Total liabilities | | | 757,462,340 | | | 382,973,640 | |

| | | | | | | | |

| MINORITY INTEREST | | | 67,349,806 | | | 42,044,266 | |

| | | | | | | | |

| SHAREHOLDERS' EQUITY: | | | | | | | |

| Preferred stock, $0.001 par value, 50,000,000 shares authorized, 3,092,899 shares | | | | | | | |

| issued and outstanding | | | 3,093 | | | 3,093 | |

| Common Stock, $0.001 par value, 200,000,000 shares authorized, 34,948,765 and | | | | | | | |

| 34,634,765 shares issued and outstanding | | | | | | | |

| as of June 30, 2008 and December 31, 2007, respectively | | | 34,949 | | | 34,635 | |

| Paid-in-capital | | | 26,192,979 | | | 23,429,153 | |

| Retained earnings | | | (44,539 | ) | | 22,686,590 | |

| Statutory reserves | | | 4,280,688 | | | 3,632,325 | |

| Contribution receivable | | | (959,700 | ) | | (959,700 | ) |

| Accumulated other comprehensive income | | | 15,225,720 | | | 4,563,078 | |

| Total shareholders' equity | | | 44,733,190 | | | 53,389,174 | |

| | | | | | | | |

| Total liabilities and shareholders' equity | | $ | 869,545,336 | | $ | 478,407,080 | |

The accompanying notes are an integral part of these statements.

| GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES |

| |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME (LOSS) |

| FOR THE THREE MONTHS AND SIX MONTHS ENDED JUNE 30, 2008 AND 2007 |

| (UNAUDITED) |

| | | Three months ended | | Six months ended | |

| | | June 30, | | June 30, | |

| | | 2008 | | 2007 | | 2008 | | 2007 | |

| | | | | | | | | | |

| REVENUES | | $ | 277,514,917 | | $ | 121,254,744 | | $ | 456,007,084 | | $ | 158,862,715 | |

| | | | | | | | | | | | | | |

| REVENUES - RELATED PARTIES | | | 109,514,019 | | | - | | | 222,587,851 | | | - | |

| | | | | | | | | | | | | | |

| TOTAL REVENUES | | | 387,028,936 | | | 121,254,744 | | | 678,594,935 | | | 158,862,715 | |

| | | | | | | | | | | | | | |

| COST OF SALES | | | 259,734,698 | | | 113,141,376 | | | 426,449,361 | | | 149,016,342 | |

| | | | | | | | | | | | | | |

| COST OF SALES - RELATED PARTIES | | | 104,425,433 | | | - | | | 216,294,654 | | | - | |

| | | | | | | | | | | | | | |

| TOTAL COST OF SALES | | | 364,160,131 | | | 113,141,376 | | | 642,744,015 | | | 149,016,342 | |

| | | | | | | | | | | | | | |

| GROSS PROFIT | | | 22,868,805 | | | 8,113,368 | | | 35,850,920 | | | 9,846,373 | |

| | | | | | | | | | | | | | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | | | 9,503,221 | | | 2,844,411 | | | 16,036,042 | | | 3,474,611 | |

| | | | | | | | | | | | | | |

| INCOME FROM OPERATIONS | | | 13,365,584 | | | 5,268,957 | | | 19,814,878 | | | 6,371,762 | |

| | | | | | | | | | | | | | |

| OTHER EXPENSE (INCOME), NET | | | | | | | | | | | | | |

| Interest income | | | (877,099 | ) | | (57,810 | ) | | (1,457,417 | ) | | (89,465 | ) |

| Interest/finance expense | | | 6,289,868 | | | 1,756,992 | | | 12,276,375 | | | 2,397,850 | |

| Change in fair value of derivative liabilities | | | 27,786,632 | | | - | | | 25,115,869 | | | - | |

| Other nonoperating (income) expense, net | | | (649,871 | ) | | (458,040 | ) | | (1,019,142 | ) | | (846,567 | ) |

| Total other expense, net | | | 32,549,530 | | | 1,241,142 | | | 34,915,685 | | | 1,461,818 | |

| | | | | | | | | | | | | | |

| INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES | | | | | | | | | | | | | |

| AND MINORITY INTEREST | | | (19,183,946 | ) | | 4,027,815 | | | (15,100,807 | ) | | 4,909,944 | |

| | | | | | | | | | | | | | |

| PROVISION FOR INCOME TAXES | | | | | | | | | | | | | |

| Current | | | 1,292,890 | | | 1,206,612 | | | 1,959,246 | | | 1,333,882 | |

| Deferred | | | (206,100 | ) | | - | | | (422,633 | ) | | - | |

| Total provision for income taxes | | | 1,086,790 | | | 1,206,612 | | | 1,536,613 | | | 1,333,882 | |

| | | | | | | | | | | | | | |

| NET INCOME (LOSS) BEFORE MINORITY INTEREST | | | (20,270,736 | ) | | 2,821,203 | | | (16,637,420 | ) | | 3,576,062 | |

| | | | | | | | | | | | | | |

| LESS MINORITY INTEREST | | | 4,000,490 | | | 927,902 | | | 5,445,346 | | | 1,207,896 | |

| | | | | | | | | | | | | | |

| NET INCOME (LOSS) | | | (24,271,226 | ) | | 1,893,301 | | | (22,082,766 | ) | | 2,368,166 | |

| | | | | | | | | | | | | | |

| OTHER COMPREHENSIVE INCOME: | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | 6,339,703 | | | 374,568 | | | 10,662,642 | | | 598,119 | |

| | | | | | | | | | | | | | |

| COMPREHENSIVE INCOME (LOSS) | | $ | (17,931,523 | ) | $ | 2,267,869 | | $ | (11,420,124 | ) | $ | 2,966,285 | |

| | | | | | | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF SHARES | | | | | | | | | | | | | |

| Basic | | | 34,928,576 | | | 31,444,665 | | | 34,883,740 | | | 31,444,665 | |

| Diluted | | | 34,928,576 | | | 31,444,665 | | | 34,883,740 | | | 31,444,665 | |

| | | | | | | | | | | | | | |

| EARNING PER SHARE | | | | | | | | | | | | | |

| Basic | | $ | (0.695 | ) | $ | 0.060 | | $ | (0.633 | ) | $ | 0.075 | |

| Diluted | | $ | (0.695 | ) | $ | 0.060 | | $ | (0.633 | ) | $ | 0.075 | |

The accompanying notes are an integral part of these statements.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

| | | Preferred stock | | Common stock | | | | Retained earnings | | | | | | | |

| | | | | Par | | | | Par | | Paid-in | | Statutory | | | | Subscriptions | | comprehensive | | | |

| | | Shares | | value | | Shares | | value | | capital | | reserves | | Unrestricted | | receivable | | income | | Totals | |

| | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, January 1, 2007 | | | - | | $ | - | | | 31,250,000 | | $ | 31,250 | | $ | 6,871,358 | | $ | 1,107,010 | | $ | 4,974,187 | | $ | - | | $ | 1,076,688 | | $ | 14,060,493 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | | | | | | | | | | | | | | | | | | | 2,368,166 | | | | | | | | | 2,368,166 | |

| Preferred stock issued for acquistion of minority interest , | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| net of dividend distribution to Victory New | | | 3,092,899 | | | 3,093 | | | | | | | | | 8,370,907 | | | | | | (2,188,203 | ) | | | | | | | | 6,185,797 | |

| Common stock issued for conversion of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| redeemable stock, $1.95/share | | | | | | | | | 176,665 | | | 177 | | | 344,328 | | | | | | | | | | | | | | | 344,505 | |

| Common stock issued for service, $1.32/share | | | | | | | | | 18,000 | | | 18 | | | 23,742 | | | | | | | | | | | | | | | 23,760 | |

| Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 598,119 | | | 598,119 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, June 30, 2007, unaudited | | | 3,092,899 | | $ | 3,093 | | | 31,444,665 | | $ | 31,445 | | $ | 15,610,335 | | $ | 1,107,010 | | $ | 5,154,150 | | $ | - | | $ | 1,674,807 | | $ | 23,580,840 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | | | | | | | | | | | | | | | | | | | 20,057,755 | | | | | | | | | 20,057,755 | |

| Adjustment to statutory reserve | | | | | | | | | | | | | | | | | | 2,525,315 | | | (2,525,315 | ) | | | | | | | | - | |

| Registered Capital to be received from | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Baotou Steel by 05/21/09 | | | | | | | | | | | | | | | | | | | | | | | | (959,700 | ) | | | | | (959,700 | ) |

| Conversion of redeemable stock, $1.95 | | | | | | | | | 1,000,000 | | | 1,000 | | | 1,948,992 | | | | | | | | | | | | | | | 1,949,992 | |

| Conversion of warrants, $2.50 | | | | | | | | | 2,120,000 | | | 2,120 | | | 5,297,880 | | | | | | | | | | | | | | | 5,300,000 | |

| Common stock issued for compensation, $8.16 | | | | | | | | | 70,100 | | | 70 | | | 571,946 | | | | | | | | | | | | | | | 572,016 | |

| Foreign currency translation gain | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,888,271 | | | 2,888,271 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, December 31, 2007 | | | 3,092,899 | | $ | 3,093 | | | 34,634,765 | | $ | 34,635 | | $ | 23,429,153 | | $ | 3,632,325 | | $ | 22,686,590 | | $ | (959,700 | ) | $ | 4,563,078 | | $ | 53,389,174 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | | | | | | | | | | | | | | | | | | | (22,082,766 | ) | | | | | | | | (22,082,766 | ) |

| Adjustment to statutory reserve | | | | | | | | | | | | | | | | | | 648,363 | | | (648,363 | ) | | | | | | | | - | |

| Common stock issued for compensation, $7.16 | | | | | | | | | 76,600 | | | 77 | | | 548,379 | | | | | | | | | | | | | | | 548,456 | |

| Common stock issued for compensation, $10.43 | | | | | | | | | 150,000 | | | 150 | | | 1,564,350 | | | | | | | | | | | | | | | 1,564,500 | |

| Common stock issued for compensation, $6.66 | | | | | | | | | 87,400 | | | 87 | | | 581,997 | | | | | | | | | | | | | | | 582,084 | |

| Common stock transferred by CEO for compensation, $6.91 | | | | | | | | | | | | | | | 69,100 | | | | | | | | | | | | | | | 69,100 | |

| Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | | | | | | | | | 10,662,642 | | | 10,662,642 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE, June 30, 2008, unaudited | | | 3,092,899 | | $ | 3,093 | | | 34,948,765 | | $ | 34,949 | | $ | 26,192,979 | | $ | 4,280,688 | | $ | (44,539 | ) | $ | (959,700 | ) | $ | 15,225,720 | | $ | 44,733,190 | |

The accompanying notes are an integral part of these statements.

| GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES |

| |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| FOR THE SIX MONTHS ENDED JUNE 30, 2008 AND 2007 |

| (UNAUDITED) |

| | | 2008 | | 2007 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

| Net (loss) income | | $ | (22,082,766 | ) | $ | 2,368,166 | |

| Adjustments to reconcile net income (loss) to cash | | | | | | | |

| provided by (used in) operating activities: | | | | | | | |

| Minority interest | | | 5,445,346 | | | 1,207,896 | |

| Depreciation | | | 8,868,941 | | | 1,979,184 | |

| Amortization | | | 444,670 | | | 194,830 | |

| Loss on disposal of equipment | | | - | | | 118,528 | |

| Stock issued for services and compensation | | | 1,199,640 | | | 23,760 | |

| Interest expense accrued on mandatory redeemable stock | | | - | | | 114,726 | |

| Amortization of deferred note issuance cost | | | 20,429 | | | - | |

| Amortization of discount on convertible notes | | | 1,626,184 | | | - | |

| Change in fair value of derivative instrument | | | 25,115,869 | | | - | |

| Deferred tax assets | | | (422,633 | ) | | - | |

| Changes in operating assets and liabilities | | | | | | | |

| Accounts receivable | | | (13,657,403 | ) | | 499,590 | |

| Accounts receivable - related parties | | | (21,068,625 | ) | | - | |

| Notes receivable | | | (13,961,704 | ) | | (212,753 | ) |

| Other receivables | | | (1,219,840 | ) | | (152,646 | ) |

| Other receivables - related parties | | | 1,471,397 | | | (814,100 | ) |

| Loan receivable | | | 1,276,560 | | | - | |

| Inventories | | | (44,931,442 | ) | | (843,369 | ) |

| Advances on inventory purchases | | | 33,110,981 | | | 248,632 | |

| Advances on inventory purchases - related parties | | | (8,517,117 | ) | | (25,403,755 | ) |

| Prepaid expense - current | | | (245,115 | ) | | (111,573 | ) |

| Prepaid expense - non current | | | 11,443 | | | - | |

| Prepaid expense - non current - related parties | | | (82,388 | ) | | - | |

| Accounts payable | | | 1,188,213 | | | 14,049,429 | |

| Accounts payable - related parties | | | 1,440,412 | | | - | |

| Other payables | | | (2,250,089 | ) | | 808,677 | |

| Other payable - related parties | | | (1,208,217 | ) | | (13,990,128 | ) |

| Accrued liabilities | | | 2,598,366 | | | 7,981,708 | |

| Dividends payable | | | (391,165 | ) | | - | |

| Customer deposits | | | 90,831,063 | | | 771,354 | |

| Customer deposits - related parties | | | (3,998,027 | ) | | 7,247,099 | |

| Taxes payable | | | (4,147,173 | ) | | 14,610,931 | |

| Net cash provided by operating activities | | | 36,465,810 | | | 10,696,186 | |

| | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | |

| Cash acquired from subsidiary | | | 1,256,385 | | | 426,387 | |

| Increase in investment payable | | | - | | | 6,226,080 | |

| Deposits due to sales representatives | | | (1,053,872 | ) | | (355,405 | ) |

| Proceeds from short term investment | | | 2,340,360 | | | - | |

| Advance on equipment purchases | | | 674,550 | | | (1,941,624 | ) |

| Equipment purchases | | | (93,010,997 | ) | | (1,350,225 | ) |

| Cash proceeds from sale of equipment | | | - | | | 39,442 | |

| Intangible assets purchases | | | (186,623 | ) | | - | |

| Payment to original shareholders | | | (7,092,000 | ) | | - | |

| Net cash (used in) provided by investing activities | | | (97,072,197 | ) | | 3,044,655 | |

| | | | | | | | |

| CASH FLOWS FINANCING ACTIVITIES: | | | | | | | |

| Restricted cash | | | (55,759,041 | ) | | (5,188,741 | ) |

| Notes receivable- restricted | | | 12,947,333 | | | - | |

| Borrowings on short term loans - bank | | | 27,141,084 | | | 25,727,979 | |

| Payments on short term loans - bank | | | (41,610,454 | ) | | (30,165,358 | ) |

| Borrowings on short term loans - related parties | | | 7,106,184 | | | 25,942,000 | |

| Borrowings on short term loan - others | | | 42,641,359 | | | - | |

| Payments on short term loans - others | | | (33,772,944 | ) | | - | |

| Borrowings on short term notes payable | | | 109,642,320 | | | 13,437,956 | |

| Payments on short term notes payable | | | (26,325,504 | ) | | (8,249,556 | ) |

| Cash contribution received from minority shareholders | | | - | | | 778,260 | |

| Net cash provided by financing activities | | | 42,010,337 | | | 22,282,540 | |

| | | | | | | | |

| EFFECTS OF EXCHANGE RATE CHANGE IN CASH | | | 1,792,862 | | | 1,449,773 | |

| | | | | | | | |

| INCREASE (DECREASE) IN CASH | | | (16,803,188 | ) | | 37,473,154 | |

| | | | | | | | |

| CASH, beginning of period | | | 43,713,346 | | | 6,831,549 | |

| | | | | | | | |

| CASH, end of period | | $ | 26,910,158 | | $ | 44,304,703 | |

The accompanying notes are an integral part of these statements.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Note 1 - Background

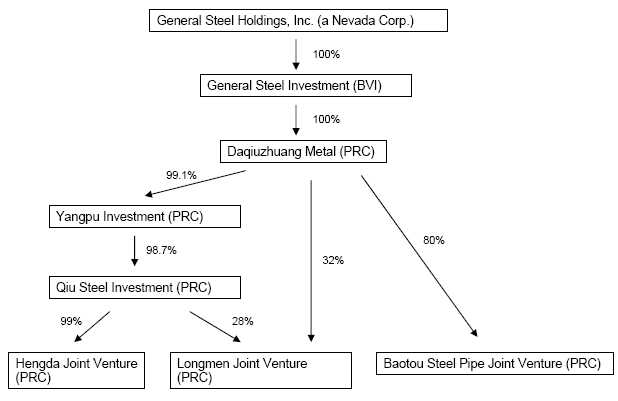

General Steel Holdings, Inc. (the “Company”) was incorporated on August 5, 2002 in the state of Nevada. The Company through its 100% owned subsidiary, General Steel Investment operates a portfolio of Chinese steel companies serving various industries. The Company presently has four production subsidiaries: Daqiuzhuang Metal, Baotou Steel - General Steel Special Steel Pipe Joint Venture Co., Ltd., (“Baotou Steel Pipe Joint Venture”), Shaanxi Longmen Iron and Steel Co., Ltd. (“Longmen Joint Venture”), and Maoming Hengda Steel Group Co., Ltd. The Company’s main products include rebar, hot-rolled carbon and silicon sheets and spiral-weld pipes.

The following table reflects the Company’s current organization structure:

On April 27, 2007, Daqiuzhuang Metal and Baotou Iron and Steel Group Co., Ltd. ("Baotou Steel") entered into an Amended and Restated Joint Venture Agreement (the "Agreement"), amending the September 28, 2005 Joint Venture Agreement ("Original Joint Venture Agreement") which established Baotou Steel Pipe Joint Venture, a PRC limited liability company. The Agreement increased Daqiuzhuang Metal's ownership interest in the Joint Venture to 80%. Baotou Steel Pipe Joint Venture obtained its business license from the PRC on May 25, 2007 and started its normal operation in July 2007. See more discussion in Note 19 - Business combinations.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Baotou Steel Pipe Joint Venture is located in Kundulun District, Baotou city, Inner Mongolia, China. It produces and sells spiral welded steel pipes and primarily serves customers in the oil, gas and petrochemical markets.

On May 18, 2007, General Steel entered into a Purchase Agreement with Victory New Holdings Limited (“Victory New”), a British Virgin Islands registered company under the control of the Company’s Chairman, CEO and majority shareholder, Zuosheng Yu (aka Henry Yu), to acquire Victory New’s 30% interest in Tianjin Daqiuzhuang Metal Sheet Co. Ltd. (“Daqiuzhuang Metal”). General Steel agreed to issue to Victory New an aggregate of 3,092,899 shares of Series A preferred stock with a fair value of $8,374,000, and voting power of 30% of the combined voting power of General Steel’s common and preferred stock while outstanding. As a result of the acquisition, Daqiuzhuang Metal is a wholly owned subsidiary of the Company. See details in Note 19 - Business combinations.

On May 18, 2007, Daqiuzhuang Metal established Yangpu Shengtong Investment Co., Ltd. (“Yangpu Investment”) and injected registered capital totaling $13,030,000 (RMB110,000,000), into the investment. The total registered capital of Yangpu Investment is $14,333,000 (RMB111,000,000), and Daqiuzhuang Metal has a 99.1% ownership interest in Yangpu Investment. The rest of Yangpu Investment is indirectly owned by Zuosheng Yu, our Chairman and CEO.

Qiu Steel Investment Co., Ltd. (“Qiu Steel Investment”) was founded on June 1, 2006. In June 2007, Yangpu Investment agreed to invest RMB148,000,000, or approximately $19,284,400, through a capital injection and equity transfer with former shareholders. The total registered capital of Qiu Steel Investment is $19,545,000 (RMB150,000,000). As a result of the above mentioned equity transaction, Yangpu Investment acquired 98.7% equity of Qiu Steel Investment making Qiu Steel Investment a subsidiary of Yangpu Investment and Daqiuzhuang Metal. The rest of Qiu Steel Investment is indirectly owned by Zuosheng Yu, our Chairman and CEO.

Yangpu Investment and Qiu Steel Investment are Chinese registered limited liability companies formed to acquire other businesses.

On June 15, 2007, General Steel and Shaanxi Longmen Iron and Steel (Group) Co., Ltd., a PRC limited liability company (“Longmen Group”), formed Longmen Joint Venture effective June 1, 2007. General Steel contributed RMB300 million or approximately $39,450,000 through its subsidiaries, Daqiuzhuang Metal and Qiu Steel Investment, to the Longmen Joint Venture. General Steel and Longmen Group own a 60% and 40% ownership interest, respectively, in Longmen Joint Venture. The Longmen Joint Venture obtained its business license from the PRC on June 22, 2007. See more discussion in Note 19 - Business combinations.

Longmen Joint Venture is located in Hancheng city, Shaanxi province, China. Longmen Joint Venture is the largest integrated steel producer in Shaanxi province that uses iron ore and coke as primary raw materials for steel production. Longmen Joint Venture produces pig iron, crude steel, reinforced bars and high-speed wire. Longmen Joint Venture is also engaged in several other business activities, most of which are related to steel manufacturing. These include the production of coke and the production of iron ore pellets from taconite, transportation services and real estate and hotel operations. These operations are all located in Hancheng city and primarily serve regional customers in the construction industry.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

On September 24, 2007, Longmen Joint Venture acquired 74.92% ownership interest in Environmental Protection Industry Development Co., Ltd., a PRC limited liability company (“EPID”) engaging in recycling steel production waste, for $2,380,000 (RMB18,080,930), and a 36% equity interest in Hualong Fire Retardant Materials Co., Ltd., a PRC limited liability company (“Hualong”) engaging in producing fire retardant material for steel production, for $430,000 (RMB3,287,980). The parties agreed to make the effective date of the transaction July 1, 2007.

On January 14, 2008, the Company through Longmen Joint Venture, completed its acquisition of a controlling interest in Hancheng Tongxing Metallurgy Co., Ltd. (“Tongxing”). The joint venture contributed its land use right of 217,487 square meters (approximately 53 acres) with appraised value of approximately $4.1 million (RMB30,227,333). Pursuant to the agreement, the land will be converted into shares valued at approximately $3.1 million (RMB22,744,419), providing the Joint Venture stake of 22.76% ownership in Tongxing and making it Tongxing’s largest and controlling shareholder. The parties agreed to make the effective date of the transaction January 1, 2008. The acquisition is accounted for as acquisition under common control. See more detail in Note 19 - Business combinations.

On June 25, 2008, the Company and Tianjin Qiu Steel Investment (“Qiu Steel Investment”) entered into an equity purchase agreement (the “Purchase Agreement”) with Maoming Hengda Steel Group Limited (the “Henggang”), in which the Company contributed $7.1 million (RMB 50 million) through its subsidiary, Qiu Steel, to Henggang original shareholders in exchange for 99% of the equity of Henggang. The acquisition was completed and became effective June 30, 2008. See Note 19 - Business combinations. Henggang is a steel products processor located in Maoming city, Guangdong province, in China’s southern coastal region. Production capacity at the facility is 1.8 million tons annually, with the majority of production focused on high-speed wire, an industrial steel product used in construction. The facility has been operating at approximately 10% of production capacity due to a redirection of corporate focus by the previous owners.

Note 2 - Summary of significant accounting policies

Basis of presentation

The consolidated financial statements of the Company reflect the activities of the following directly and indirectly owned subsidiaries:

| | | | | | Percentage |

| Subsidiary | | Of Ownership |

| General Steel Investment Co., Ltd. | | British Virgin Islands | | 100.0% |

| Tianjin Daqiuzhuang Metal Sheet Co., Ltd | | P.R.C. | | 100.0% |

| Baotou Steel - General Steel Special Steel Pipe Joint Venture Co., Ltd. | | P.R.C. | | 80.0% |

| Yangpu Shengtong Investment Co., Ltd. | | P.R.C. | | 99.1% |

| Qiu Steel Investment Co., Ltd. | | P.R.C. | | 98.7% |

| Shaanxi Longmen Iron and Steel Co. Ltd. | | P.R.C. | | 60.0% |

| Maoming Hengda Steel Group Co., Ltd. | | P.R.C. | | 99.0% |

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The accompanying consolidated financial statements include the accounts of all directly and indirectly owned subsidiaries listed above. All material intercompany transactions and balances have been eliminated in the consolidation.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Management has included all normal recurring adjustments considered necessary to give a fair presentation of operating results for the periods presented. Interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with information included in the 2007 annual report filed on Form 10-K.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles of the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Significant accounting estimates reflected in the Company’s financial statements include the useful lives of and impairment for property, plant and equipment, potential losses on uncollectible receivables and the fair value of the conversion feature and warrants associated with the note payable. Actual results could differ from these estimates.

Concentration of risks

The Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC's economy. The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in North America and Western Europe. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Cash includes cash on hand and demand deposits in accounts maintained with state owned banks within the People’s Republic of China and Hong Kong. Total cash (including restricted cash balances) in these banks on June 30, 2008 and December 31, 2007 amounted to $127,766,130 and $53,817,485, respectively, of which no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

The Company had five major customers, which represented approximately 33.7%, and 40.4% of the Company’s total sales for the three months ended June 30, 2008 and 2007, respectively, and approximately 42.1%, and 37% of the Company’s total sales for the six months ended June 30, 2008 and 2007, respectively. Five customers accounted for 58.7% and 0% of total accounts receivable as of June 30, 2008, and December 31, 2007, respectively.

The purchase of raw materials from five major suppliers represent approximately 29% and 69.6% of Company’s total purchase for the three months ended June 30, 2008 and 2007, respectively, and 44% and 76% of the Company’s total purchase for the six months ended June 30, 2008 and 2007. Five vendors accounted for 1.35% and 11% of total accounts payable as of June 30, 2008 and December 31, 2007, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Revenue recognition

The Company's revenue recognition policies are in compliance with Staff Accounting Bulletin (“SAB”) 104. Sales revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectability is reasonably assured. Payments received before all of the relevant criteria for revenue recognition are recorded as customer deposits. Sales revenue represents the invoiced value of goods, net of value-added tax (VAT). All of the Company’s products sold in the PRC are subject to a Chinese value-added tax at a rate of 13% to 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of producing the finished product.

Foreign currency translation and other comprehensive income

The reporting currency of the Company is the US dollar. The Company uses the local currency, Renminbi (RMB), as its functional currency. Assets and liabilities are translated at the unified exchange rate as quoted by the People’s Bank of China at the end of the period. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of shareholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Translation adjustments resulting from this process are included in accumulated other comprehensive income and amounted to $6,339,703 and $374,568 for the three months ended June 30, 2008 and 2007, respectively and $10,662,642 and $598,119 for the six months ended June 30, 2008 and December 31, 2007, respectively. The balance sheet amounts, with the exception of equity at June 30, 2008 and December 31, 2007 were translated at 6.85 RMB and 7.29 RMB to $1.00 USD, respectively. The equity accounts were stated at their historical rate. The average translation rates applied to income statement accounts for the six months ended June 30, 2008 and 2007 were 7.05 RMB, and 7.71 RMB, respectively. Cash flows are also translated at average translation rates for the period, therefore, amounts reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Financial instruments

SFAS 107, “Disclosures about Fair Value of Financial Instruments” requires disclosure of the fair value of financial instruments held by the Company. SFAS 107 defines the fair value of financial instruments as the amount at which the instrument could be exchanged in a current transaction between willing parties.

The Company considers the carrying amount of cash, accounts receivable, other receivables, accounts payable, accrued liabilities, and long term debts to approximate their fair values because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest.

The Company also analyzes all financial instruments with features of both liabilities and equity under SFAS 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity,” SFAS No 133, “Accounting for Derivative Instruments and Hedging Activities” and EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock.” The convertible preferred shares issued in 2005 and the convertible note issued in 2007 did not require bifurcation or result in liability accounting. Additionally, the Company analyzes registration rights agreements associated with any equity instruments issued to determine if penalties triggered for late filing should be accrued under FSP EITF 00-19-2, “Accounting for Registration Payment Arrangements.”

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Derivative Instrument

In December 2007, the Company issued convertible notes totaling $40,000,000 (“Notes”) and 1,154,958 warrants. Both the warrants and the conversion option embedded in the Notes meet the definition of a derivative instrument in SFAS 133, “Accounting for Derivative Instruments and Hedging Activities.” Therefore these instruments are accounted for as derivative liabilities and marked-to-market each reporting period. The change in the value of the derivative liabilities is charged against or credited to income.

Fair value measurements

The Company adopted SFAS 157, “Fair Value Measurements” on January 1, 2008. SFAS 157 defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. The three levels are defined as follow:

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

Level 3 inputs to the valuation methodology are unobservable and significant to the fair value.

The Company’s investment in unconsolidated subsidiaries amounted to $9,875,972 as of June 30, 2008. Since there is no quoted or observable market price for the fair value of similar long term investment, the Company then used the level 3 inputs for its valuation methodology. The determination of the fair value was based on the capital investment that the Company contributed. The carrying value of the long term investments approximated the fair value as of June 30, 2008.

In 2007, the Company issued convertible notes in the aggregate principal amount of $40,000,000 and warrants to purchase 1,154,958 shares of common stock of the Company. Pursuant to SFAS 133 and EITF 00-19, the Company determined that both the warrants and the conversion option embedded in the Notes meet the definition of a derivative instrument and must be carried as a liability and marked to market for each reporting period. As of June 30, 2008, the Company reevaluated the derivative liabilities using Cox Rubenstein Binomial Model, defined in SFAS 157 as level 3 inputs, and recorded the changes in earnings. As a result, the derivative liability is carried on the balance sheet at its fair value.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

As of June 30, 2008, the carrying value of the convertible notes amounted to $7,066,600. The Company determined the fair value of the convertible notes using the level three inputs to the Binomial Model and determined that the fair value amounted to approximately $54 million due to the increase in the Company’s common stock price.

| | | Carrying Value as of June 30, 2008 | | Fair Value Measurements at June 30, 2008 Using Fair Value Hierarchy | |

Assets | | | | | | Level 1 | | | Level 2 | | | Level 3 | |

| | | | | | | | | | | | | | |

| Long term investments | | $ | 9,875,972 | | | | | | | | $ | 9,875,972 | |

| | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Derivative liabilities | | $ | 53,599,177 | | | | | | | | $ | 53,599,177 | |

| Convertible notes payable | | $ | 7,066,600 | | | | | | | | $ | 7,066,600 | |

Except for the derivative liabilities, the Company did not identify any other assets or liabilities that are required to be presented on the balance sheet at fair value in accordance with SFAS 157.

Cash and cash equivalents

Cash and cash equivalents include cash on hand and demand deposits in banks with maturities of less than three months.

Restricted cash

The Company has notes payable outstanding with various banks and is required to keep certain amounts on deposit that are subject to withdrawal restrictions.

Accounts receivable and allowance for doubtful accounts

The Company conducts its business operations in the People’s Republic of China. Accounts receivable include trade accounts due from the customers. An allowance for doubtful account is established and recorded based on managements’ assessment of the credit history and relationship with the customers. Management reviews its accounts receivable on a regular basis to determine if the bad debt allowance is adequate, and adjusts the allowance when necessary.

Notes receivable

Notes receivable represents trade accounts receivable due from various customers where the customers’ banks have guaranteed the payment of the receivables. This amount is non-interest bearing and is normally paid within three to six months. The Company has the ability to submit request for payment to the customer’s bank earlier than the scheduled payment date, but will incur an interest charge and a processing fee. The Company had $18,895,361 and $4,216,678 of notes receivable outstanding as of June 30, 2008 and December 31, 2007, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Restricted notes receivable represents notes pledged as collateral for short term loans from banks. As of June 30, 2008 and December 31, 2007, restricted notes receivable amounted to $0 and $12,514,659, respectively.

Inventories

Inventories are stated at the lower of cost or market using weighted average method.

Shipping and handling

Shipping and handling for raw materials purchased are included in cost of goods sold. Shipping and handling cost incurred for shipping of finished products to customers are included in selling expenses. Shipping and handling expenses related to purchases of material and sales of finished goods for the three months ended June 30, 2008 and 2007 amounted to $919,220 and $352,753, respectively. Shipping and handling for the six months ended June 30, 2008 and 2007 amounted to $1,622,292 and $372,578, respectively.

Intangible assets

All land in the People’s Republic of China is owned by the government and. However, the government grants “land use right” to use the land.

Daqiuzhuang Metal acquired land use rights during the years ended 2000 and 2003 for a total of $3,167,483. These land use rights are for 50 years and expire in 2050 and 2053. However, Daqiuzhuang Metal's initial business license had a ten-year term. Therefore, management elected to amortize the land use rights over the ten-year business term. Daqiuzhuang Metal became a Sino-Foreign Joint Venture in 2004, and obtained a new business license for twenty years; however, the Company decided to continue amortizing the land use rights over the original ten-year business term.

Longmen Group contributed land use rights for a total amount of $19,823,885 to the Longmen Joint Venture. The land use rights are for 50 years and expire in 2048 to 2052. Heng Gang has land use rights of $2,037,560 for 50 years and expire in 2054.

Plant and equipment, net

Plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets with 3%-5% residual value.

Construction in progress represents the costs incurred in connection with the construction of buildings or new additions to the Company’s plant facilities. No depreciation is provided for construction in progress until such time as the assets are completed and are placed into service. Maintenance, repairs and minor renewals are charged directly to expense as incurred. Major additions and betterment to buildings and equipment are capitalized. Interest incurred during construction is capitalized into construction in progress. All other interest is expensed as incurred.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Long lived assets

Long lived assets, including plant, equipment and intangible assets are reviewed annually or more often if necessary, to determine whether their carrying value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. The Company also re-evaluates the periods of depreciation and amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. As of June 30, 2008, the Company expects these assets to be fully recoverable.

Investments in unconsolidated subsidiaries

Investee companies over which the Company has the ability to exercise significant influence, but does not have a controlling interest is accounted for using the equity method. Significant influence is generally considered to exist when the Company has an ownership interest in the voting stock of the investee of between 20% and 50%, and other factors, such as representation on the investee's Board of Directors, voting rights and the impact of commercial arrangements, are considered in determining whether the equity method of accounting is appropriate. In December 2007, the Company acquired 27% of ownership interest in Xian Delong Powder Engineering Materials Co., Ltd., through its 74.92% owned subsidiary, Environmental Protection Industry Development Co., Ltd., for $875,400. This investment is accounted for by the equity method.

The Company’s newly acquired subsidiary, Hancheng Tongxing Metallurgy Co., Ltd. invested in several companies from 2004 to 2007; investments in these unconsolidated subsidiaries totaled $9,000,572 as of June 30, 2008. Since Tongxing does not have the ability to exercise control or significant influence over the investee companies, the investments have been recorded under the cost method.

| Investees | | Years invested | | Amount invested | | % owned | |

| Shanxi Daxigou Mining Co.,Ltd | | | 2004 | | $ | 729,500 | | | 11 | |

| Shanxi Xinglong Thermoelectric Co.,Ltd | | | 2004-2007 | | | 4,832,208 | | | 37.6 | |

| Shanxi Longgang Group Baoji roll-forming steel Co.,Ltd | | | 2005 | | | 612,780 | | | 23.81 | |

| Shanxi Longgang Group Xian steel Co.,Ltd | | | 2005 | | | 145,900 | | | 10 | |

| Shanxi Longgang Group Co.,Ltd | | | 2003-2004 | | | 1,889,405 | | | 3.8 | |

| Huashan Metallurgical Equipment Co. Ltd. | | | 2003 | | | 72,950 | | | 25 | |

| Hejin Liyuan Washing Coal Co.Ltd. | | | 2006 | | | 218,850 | | | 38 | |

| Hancheng Jinma Coking Co.Ltd. | | | 2006 | | | 498,979 | | | 40 | |

| Total | $ | 9,000,572 | | | | |

Total investment in unconsolidated subsidiaries amounted to $9,875,972 and $822,600 as of June 30, 2008 and December 31, 2007, respectively.

Short-term notes payable

Short-term notes payable are lines of credit extended by banks. When purchasing raw materials, the Company often issues a short-term note payable to the vendor. This short-term note payable is guaranteed by the bank for its complete face value. The banks usually require the Company to deposit a certain amount of cash at the bank as a guarantee deposit, which is classified on the balance sheet as restricted cash. The total outstanding amounts of short-term notes payable were $155,708,387 and $15,163,260 as of June 30, 2008 and December 31, 2007, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Earnings per share

The Company reports earnings per share in accordance with the provisions of SFAS 128, "Earnings Per Share." SFAS 128 requires presentation of basic and diluted earnings per share in conjunction with the disclosure of the methodology used in computing such earnings per share.

Basic earnings per share are computed by dividing income available to common stockholders by the weighted average common shares outstanding during the period. Diluted earnings per share takes into account the potential dilution that could occur if securities or other contracts to issue common stock were exercised and converted into common stock.

Income taxes

Deferred income taxes are recognized for temporary differences between the tax bases of assets and liabilities and their reported amounts in the financial statements, net operating loss carry forwards and credits, by applying enacted statutory tax rates applicable to future years. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Current income taxes are provided for in accordance with the laws of the relevant taxing authorities.

The Company reports income taxes pursuant to SFAS 109, “Accounting for Income Taxes”. SFAS 109 requires the recognition of deferred income tax liabilities and assets for the expected future tax consequences of temporary differences between income tax basis and financial reporting basis of assets and liabilities. Provision for income taxes consists of taxes currently due plus deferred taxes. The Company adopted FASB Interpretation 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”), as of January 1, 2007. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no effect on the Company’s financial statements.

The charge for taxation is based on the results for the year as adjusted for items, which are non-assessable or disallowed. It is calculated using tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred tax is accounted for using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis used in the computation of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences. Deferred tax assets are recognized to the extent that it is probable that taxable profit will be available against which deductible temporary differences can be utilized. Deferred tax is calculated using tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited in the income statement, except when it is related to items credited or charged directly to equity, in which case the deferred tax is also dealt with in equity. Deferred tax assets and liabilities are offset when they relate to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Share-based compensation

The Company accounts for equity instruments issued in exchange for the receipt of goods or services from other than employees in accordance with SFAS 123R, “Accounting for Stock-Based Compensation,” and the conclusions reached by EITF 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring or in Conjunction with Selling Goods or Services.” Costs are measured at the estimated fair market value of the consideration received or the estimated fair value of the equity instruments issued, whichever is more reliably determinable. The value of equity instruments issued for consideration other than employee services is determined on the earlier of a performance commitment or completion of performance by the provider of goods or services as defined by EITF 96-18.

Minority interest

Minority interest consists of the interest of minority shareholders in the subsidiaries of the Company. As of June 30, 2008 and December 31, 2007, minority interest amounted to $67,349,806 and $42,044,266, respectively.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications have no effect on net income or cash flows.

Recently issued accounting pronouncements

In February 2007, the FASB issued SFAS 159, The Fair Value Option for Financial Assets and Financial Liabilities—including an amendment of FASB Statement No. 115 (“FAS 159”). SFAS 159 permits companies to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at fair value. The objective of SFAS 159 is to provide opportunities to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply hedge accounting provisions. SFAS 159 also establishes presentation and disclosure requirements designed to facilitate comparisons between companies that choose different measurement attributes for similar types of assets and liabilities. SFAS 159 will be effective in the first quarter of fiscal 2009. The Company chose not to elect the option to measure the fair value of eligible financial assets and liabilities

In December 2007, the FASB issued SFAS 160, “Noncontrolling Interests in Consolidated Financial Statements - an amendment of Accounting Research Bulletin No. 51”, which establishes accounting and reporting standards for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income attributable to the parent and to the noncontrolling interest, changes in a parent’s ownership interest and the valuation of retained non-controlling equity investments when a subsidiary is deconsolidated. The Statement also establishes reporting requirements that provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the non-controlling owners. SFAS 160 is effective for fiscal years beginning after December 15, 2008. The Company has not determined the effect that the application of SFAS 160 will have on its consolidated financial statements.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

In December 2007, Statement of Financial Accounting Standards 141(R), Business Combinations, was issued. SFAS 141R replaces SFAS 141, Business Combinations. SFAS 141R retains the fundamental requirements in SFAS 141 that the acquisition method of accounting (which SFAS 141 called the purchase method) be used for all business combinations and for an acquirer to be identified for each business combination. SFAS 141R requires an acquirer to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, measured at their fair values as of that date, with limited exceptions. This replaces SFAS 141’s cost-allocation process, which required the cost of an acquisition to be allocated to the individual assets acquired and liabilities assumed based on their estimated fair values. SFAS 141R also requires the acquirer in a business combination achieved in stages (sometimes referred to as a step acquisition) to recognize the identifiable assets and liabilities, as well as the noncontrolling interest in the acquiree, at the full amounts of their fair values (or other amounts determined in accordance with SFAS 141R). SFAS 141R applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. An entity may not apply it before that date. The Company is currently evaluating the impact that adopting SFAS No. 141R will have on its financial statements.

In March 2008, the FASB issued SFAS 161, “Disclosures about Derivative Instruments and Hedging Activities - an amendment of FASB Statement No. 133”, which changes the disclosure requirements for derivative instruments and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance and cash flows. SFAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The Company is currently evaluating the impact that adopting SFAS No. 161 will have on its financial statements.

In April 2008, the FASB issued 142-3 “Determination of the useful life of Intangible Assets”, which amends the factors a company should consider when developing renewal assumptions used to determine the useful life of an intangible asset under SFAS142. This Issue is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. SFAS 142 requires companies to consider whether renewal can be completed without substantial cost or material modification of the existing terms and conditions associated with the asset. FSP 142-3 replaces the previous useful life criteria with a new requirement—that an entity consider its own historical experience in renewing similar arrangements. If historical experience does not exist then the Company would consider market participant assumptions regarding renewal including 1) highest and best use of the asset by a market participant, and 2) adjustments for other entity-specific factors included in SFAS 142. The Company is currently evaluating the impact that adopting SFAS No.142-3 will have on its financial statements

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles.” This Statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements of nongovernmental entities that are presented in conformity with generally accepted accounting principles (GAAP) in the United States (the GAAP hierarchy). The Company is currently evaluating the impact that adopting SFAS No. 162 will have on its financial statements.

In May 2008, the FASB issued SFAS No. 163, “Accounting for Financial Guarantee Insurance Contracts, an interpretation of FASB Statement No. 60.” The scope of this Statement is limited to financial guarantee insurance (and reinsurance) contracts, as described in this Statement, issued by enterprises included within the scope of Statement 60. Accordingly, this Statement does not apply to financial guarantee contracts issued by enterprises excluded from the scope of Statement 60 or to some insurance contracts that seem similar to financial guarantee insurance contracts issued by insurance enterprises (such as mortgage guaranty insurance or credit insurance on trade receivables). This Statement also does not apply to financial guarantee insurance contracts that are derivative instruments included within the scope of FASB Statement No. 133, “Accounting for Derivative Instruments and Hedging Activities.” This Statement will not have and impact on the Company’s financial statements.

In June 2008, the FASB issued Emerging Issues Task Force Issue 07-5 “Determining whether an Instrument (or Embedded Feature) is indexed to an Entity’s Own Stock” (“EITF No. 07-5”). This Issue is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Early application is not permitted. Paragraph 11(a) of Statement of Financial Accounting Standard No 133 “Accounting for Derivatives and Hedging Activities” (“SFAS 133”) specifies that a contract that would otherwise meet the definition of a derivative but is both (a) indexed to the Company’s own stock and (b) classified in stockholders’ equity in the statement of financial position would not be considered a derivative financial instrument. EITF No.07-5 provides a new two-step model to be applied in determining whether a financial instrument or an embedded feature is indexed to an issuer’s own stock and thus able to qualify for the SFAS 133 paragraph 11(a) scope exception. This standard will triggered liability accounting on all options and warrants exercisable at strike prices denominated in any currency other than the functional currency of the operating entity in China (Renminbi).. The Company is currently evaluating the impact that adopting EITF 07-5 will have on its financial statements.

In June 2008, FASB issued EITF Issue No. 08-4, “Transition Guidance for Conforming Changes to Issue No. 98-5 (“EITF No. 08-4”)”. The objective of EITF No.08-4 is to provide transition guidance for conforming changes made to EITF No. 98-5, “Accounting for Convertible Securities with Beneficial Conversion Features or Contingently Adjustable Conversion Ratios”, that result from EITF No. 00-27 “Application of Issue No. 98-5 to Certain Convertible Instruments”, and SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity”. This Issue is effective for financial statements issued for fiscal years ending after December 15, 2008. Early application is permitted. The Company is currently evaluating the impact that adopting EITF 08-4 will have on its financial statements.

Note 3 - Accounts receivable and allowance for doubtful accounts

Accounts receivable, including related party receivables, net of allowance for doubtful accounts consists of the following:

| | | June 30, 2008 (Unaudited) | | December 31, 2007 | |

| | | | | | | | |

| Accounts receivable | | $ | 63,521,285 | | $ | 11,939,533 | |

| Less: allowance for doubtful accounts | | | 276,101 | | | 148,224 | |

| Net accounts receivable | | $ | 63,245,184 | | $ | 11,791,309 | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Movement of allowance for doubtful accounts is as follows:

| | | June 30, 2008 (Unaudited) | | December 31, 2007 | |

| | | | | | | | |

| Beginning balance | | $ | 148,224 | | $ | 137,132 | |

| Charge to expense | | | - | | | 751 | |

| Written-off | | | - | | | - | |

| Addition from acquistion | | | 118,373 | | | | |

| Exchange rate effect | | | 9,504 | | | 10,341 | |

| Ending balance | | $ | 276,101 | | $ | 148,224 | |

Note 4 - Inventory

Inventory consists of the following:

| | | June 30, 2008 (Unaudited) | | December 31, 2007 |

| Supplies | $ | 2,004,737 | $ | 1,829,551 |

| Raw materials | | 49,494,808 | | 42,919,783 |

| Work in process | | - | | 82,439 |

| Finished goods | | 85,941,176 | | 33,097,152 |

| Total | $ | 137,440,721 | $ | 77,928,925 |

Raw materials consist primarily of iron ore and coke at Long Men Joint Venture, steel strip at Daqiuzhuang Metal and billet at Henggang. Work in process primarily consists of pig iron and other semi-finished products. The cost of finished goods includes direct costs of raw materials as well as direct labor used in production. Indirect production costs such as utilities and indirect labor related to production such as assembling, shipping and handling costs are also included in the cost of inventory. The Company reviews its inventory periodically for possible obsolete goods and to determine if any reserves are necessary for potential obsolescence. As of June 30, 2008 and December 31, 2007, the Company believes no reserves are necessary.

Note 5 - Advances on inventory purchases

Advances on inventory purchases are monies deposited or advanced to outside vendors or related parties on future inventory purchases. Due to the high shortage of steel in China, most of the Company’s vendors require a certain amount of money to be deposited with them as a guarantee that the Company will receive its purchases on a timely basis.

This amount is refundable and bears no interest. The Company has legally binding contracts with its vendors, which required the deposit to be returned to the Company when the contract ends. The inventory is normally delivered within one month after the monies have been advanced. The total outstanding amount, including advances to related parties, was $72,909,429 and $68,114,486 as of June 30, 2008 and December 31, 2007, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Note 6 - Plant and equipment, net

Plant and equipment consist of the following:

| | | June 30, 2008 | | December 31, 2007 | |

| | | (Unaudited) | | | |

| Buildings and improvements | | $ | 101,977,092 | | $ | 71,265,004 | |

| Machinery | | | 215,867,977 | | | 134,716,437 | |

| Transportation equipment | | | 6,705,210 | | | 4,232,556 | |

| Other equipment | | | 8,554,685 | | | 1,310,489 | |

| Construction in process | | | 118,175,370 | | | 24,574,027 | |

| Totals | | | 451,280,334 | | | 236,098,513 | |

| Less accumulated depreciation | | | (50,559,364 | ) | | (17,835,146 | ) |

| Totals | | $ | 400,720,970 | | $ | 218,263,367 | |

Long Men JV is in the process of constructing two blast furnaces and a sintering system. All the costs related to the construction have been capitalized as construction in progress amounted to $116,520,168 as of June 30, 2008. The remaining balance in construction in progress is from Henggang.

Depreciation, including amounts in cost of sales, for the three months ended June 30, 2008 and 2007 amount to $4,369,068 and $1,417,475, respectively, and for the six months ended June 30, 2008 and 2007, amounted to $8,868,941 and $1,979,184, respectively.

Note 7 - Intangible assets

The Company’s intangible assets are as follows:

| | | June 30, 2008 | | December 31, 2007 | |

| | | (Unaudited) | | | |

| Land use right | | $ | 27,091,190 | | $ | 23,629,059 | |

| Software | | | 293,818 | | | 71,978 | |

| Accumulated Amortization | | | (2,501,662 | ) | | (1,944,328 | ) |

| Total | | $ | 24,883,346 | | $ | 21,756,709 | |

Total amortization expense for the three months ended June 30, 2008 and 2007 amounted to $239,524 and $118,306, respectively, and for six months ended June 30, 2008 and 2007, amounted to $444,670 and $194,830, respectively.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

Note 8 - Debt

Short term loans

Short term loans represent amounts due to various banks, other companies and individuals, and related parties normally due within one year. The loans due to banks can be renewed with the banks. The Company had short term loans from related parties totaling $7,317,027 as of December 31, 2007, and $7,309,590 as of June 30, 2008.

The loans due to banks consisted of the following:

DAQIUZHUANG METAL | | | | | |

| | | June 30, 2008 (Unaudited) | | December 31, 2007 | |

| Loan from China Bank, JingHai Branch, due | | | | | | | |

| September 2008. Quarterly interest only payment at | | | | | | | |

| 7.29% per annum, secured by equipment | | $ | 1,021,300 | | $ | 959,700 | |

| | | | | | | | |

| Loans from Agriculture Bank, DaQiuZhuang Branch, due | | | | | | | |

| various dates from September 2008 to April 2009. | | | | | | | |

| Quarterly interest only payments ranging from | | | | | | | |

| 8.424% to 8.964% per annum, guaranteed by an | | | | | | | |

| unrelated third party and secured by equipment | | | 10,954,172 | | | 10,293,468 | |

| | | | | | | | |

| Loan from Construction Bank of China, JinHai Branch, due | | | | | | | |

| August 2008. Monthly interest only payment at 8.55% | | | | | | | |

per annum, guaranteed by an unrelated third party and secured by equipment | | | 1,604,900 | | | 1,508,100 | |

| | | | | | | | |

| Loans from ShangHai PuFa Bank, due various dates from | | | | | | | |

| July 2008 to March 2009. Quarterly interest only payments | | | | | | | |

| ranging from 7.22% to 8.964% per annum, guaranteed | | | | | | | |

| by an unrelated third party | | | 4,377,000 | | | 4,113,000 | |

| | | | | | | | |

| Loan from China Merchants Bank, due | | | | | | | |

| November 2008. Quarterly interest only payments | | | | | | | |

| at floating interest rate,105% of People's Bank base rate | | | | | | | |

| of 7.29% to 7.85%, guaranteed by an unrelated third party. | | | 8,754,000 | | | 8,226,000 | |

| | | | | | | | |

| Loan from ShenZhen Development Bank, due | | | | | | | |

| January 2009. Monthly interest only payment | | | | | | | |

| at 7.47% per annum, secured by | | | | | | | |

| inventory and guaranteed by CEO of the Company. | | | 7,295,000 | | | 6,855,000 | |

| | | | | | | | |

| Total Daqiuzhuang Metal | | $ | 34,006,372 | | $ | 31,955,268 | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

LONG MEN JOINT VENTURE | | | | | | | |

| | | | June 30, 2008 (Unaudited) | | |

December 31, 2007 | |

| | | | | | | | |

Loans from Construction Bank, due various dates from September to October 2008. Monthly interest only payments at 8.02% per annum, guaranteed by equipment. | | $ | 4,684,849 | | $ | 20,633,550 | |

| | | | | | | | |

| Loans from Construction Bank, due various dates | | | | | | | |

| from September to June 2009. Monthly interest | | | | | | | |

| only payments at 8.20% per annum, | | | | | | | |

| guaranteed by equipment . | | | 4,960,600 | | | - | |

| | | | | | | | |

| Loans from Agriculture Bank, due various dates | | | | | | | |

| in May 2008. Monthly interest only payments at 7.12% | | | | | | | |

| guaranteed by Bankers’ Acceptance Bill. | | | - | | | 3,989,610 | |

| | | |

| Loans from Bank of China, HanCheng Branch, due |

July 2008. Quarterly interest payments 6.90% per annum, guaranteed by a related third party. | | | 5,836,000 | | | 9,597,000 | |

| | | | | | | | |

| Loans from Credit Cooperatives, due various dates |

| from July 2008 to February 2009. Monthly interest | | | | | | | |

| payments by 11.02% per annum, guaranteed | | | | | | | |

| by a subsidiary. | | | 2,918,000 | | | 2,742,000 | |

| | | |

| Loans from HuaXia Bank, due in November 2008. |

| Monthly interest payment at 8.74% per annum, | | | | | | | |

| guaranteed by equipment. | | | 5,836,000 | | | 13,819,680 | |

| | | | | | | | |

| Loan from Communication Bank, due October 2008, Quarterly |

| interest only payments, annual interest rate of 8.02%, | | | | | | | |

| guaranteed by equipment. | | | 3,647,500 | | | 3,427,500 | |

| | | |

| Loan from China Merchants Bank, due September 2008, |

| Monthly interest payments, annual interest rate of 9.13%, | | | | | | | |

guaranteed by a related third party and secured by land use rights and buildings. | | | 7,295,000 | | | 6,855,000 | |

| | | | | | | | |

Loan from China Minsheng Bank, due February 2009, Quarterly interest payments, annual interest rate of 7.47%, guaranteed by a related third party and secured by equipment. | | | 14,590,000 | | | - | |

| | | | | | | | |

| Total Longmen Joint Venture | | $ | 49,767,949 | | $ | 61,064,340 | |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

| BAOTOU STEEL PIPE JOINT VENTURE | | | | | | | |

| | | | June 30, 2008 (Unaudited) | | | December 31, 2007 | |

Loan from China Merchants Bank Co., Ltd., due April 2009, Monthly interest payments, annual interest rate of 12%, Guaranteed by a related party and secured by Equipments. | | | 332,373 | | | - | |

| | | | | | | | |

| Total Baotou Steel Pipe Joint Venture | | $ | 332,373 | | $ | - | |

| MAOMING HENGDA STEEL GROUP CO., LTD. | | | | | |

| | | June 30, 2008 (Unaudited) | | December 31, 2007 | |

| | | | | | |

Maoming Hengda Steel Group Co., Ltd. | | | | | |

Loan from China Merchants Bank, due September, 2009. Months interest payments, annual interest rate of 7.47%, guaranteed by related parties. | | 1,459,000 | | - | |

| | | | | | | | |

| Total Maoming Hengda Steel Group Co., Ltd. | | | 1,459,000 | | | - | |

| | | | | | | | |

| Grand totals | | $ | 85,565,694 | | $ | 93,019,608 | |

The Company had various loans from unrelated companies and individuals. The balances amounted to $72,383,213 and $19,156,070 as of June 30, 2008 and December 31, 2007, respectively. Out of the $72,383,213 current period balance, $32,135,464 carries no interest, and the remaining $40,247,749 carries annual interest rates ranging from 8% to 12%. All prior year balances of $19,156,070 are subject to interest rates ranging from 8% to 12%. All short term loans from unrelated companies and individuals are unsecured loans.

The Company borrowed short term loan from two of its related parties, Tianjin Da Zhan and Tianjin Heng yin amounting $3,924,710 and $3,384,880 to fund the Heng Gang acquisition. The loan carries 10% annual interest, and the interest starts accrual on July 1, 2008.

Short term notes payable

Short term notes payable are lines of credit extended by the banks. When purchasing raw materials, the Company often issues a short term note payable to the vendor funded with draws on the lines of credit. This short term note payable is guaranteed by the bank for its complete face value. The banks usually do not charge interest on these notes but require the Company to deposit a certain amount of cash at the bank as a guarantee deposit which is classified on the balance sheet as restricted cash.

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

(UNAUDITED)

The Company had the following short term notes payable:

DAQIUZHUANG METAL | | | | | |

| | | June 30, 2008 | | December 31, | |

| | | | (Unaudited) | | | 2007 | |

| China Bank, Jing Hai Branch, due March 2008, | | | | | | | |

| restricted cash required of 50% of loan amount, | | | | | | | |

| guaranteed by the Company | | $ | - | | $ | 1,588,040 | |

| | | | | | | | |

Agricultural Bank of China, various amounts, due April 2009, restricted cash required of 60% of loan amount, | | | | | | | |

| guaranteed by Buildings and improvements. | | | 1,750,800 | | | 1,232,100 | |

| | | | | | | | |

| ShangHai PuFa Bank, various amounts, | | | |

| due October 2008, | | | | | | | |

| restricted cash required of 50% of loan balance, | | | | | | | |

| guaranteed by an unrelated third party | | | 5,836,000 | | | 5,488,120 | |

Total Daqiuzhuang Metal | | $ | 7,586,800 | | $ | 8,308,260 | |

LONGMEN JOINT VENTURE | | | | | |

| | | | | | |

Agricultural Bank of China, various amounts, due dates ranging between August to December 2008, restricted cash required of 100% of loan amount. | | | 12,401,500 | | | - | |

| | | | | | | | |

China Bank, various amounts, due dates ranging between July to October,2008, restricted cash required of 100% of loan amount. | | | 2,188,500 | | | - | |

| | | | | | | | |

Credit Cooperatives, due August 2008, restricted cash required of 100% of loan amount. | | | 1,459,000 | | | - | |

| | | | |

| ShangHai Pudong Development Bank, various amounts, | | | |

| due dates ranging between September to October 2008, | | | | | | | |

| restricted cash required of 60% of loan amount, | | | | | | | |