UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

GI DYNAMICS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

| | | |

GI DYNAMICS, INC.

320 Congress Street, Floor 3

Boston, MA 02210

December 2, 2019

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of GI Dynamics, Inc. (“GI Dynamics,” the “Company,” “we,” “us” or “our”) to be held on December 16, 2019, at 5:00 p.m., United States Eastern Standard Time (“EST”), which is December 17, 2019, at 9:00 a.m., Australian Eastern Daylight Time (“AEDT”), at the corporate offices of GI Dynamics, 320 Congress Street, Floor 3, Boston, MA 02210. The attached notice of Special Meeting and accompanying proxy statement describe the business which the Company will conduct at the Special Meeting and provides information about us that you should consider when you vote your shares of common stock. Unless otherwise indicated, all dollar amounts in the attached Notice of Special Meeting and accompanying proxy statement are in U.S. Dollars.

At the Special Meeting, the Company will ask stockholders to (i) approve an amendment to the Company’s amended and restated certificate of incorporation to increase the number of authorized shares of the Company’s common stock from 50,000,000 to 75,000,000; (ii) approve equity grants to each of the Company’s non-executive directors; (iii) approve the conversion feature of the August 2019 Note with a face value of $4,596,893 that has been issued to Crystal Amber Fund Limited, an existing stockholder and related party, on the terms and conditions set out in the accompanying proxy statement; (iv) approve the issuance of a warrant to Crystal Amber Fund Limited, an existing stockholder and related party, which will entitle Crystal Amber Fund Limited to subscribe for 229,844,650 CHESS Depositary Interests of the Company (representing 4,596,893 shares of the Company’s common stock), on the terms and conditions set out in the accompanying proxy statement; and (v) authorize the adjournment of the Special Meeting, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of any of the foregoing proposals.

All stockholders and holders of the Company’s CHESS Depositary Interests (“CDIs”) are invited to attend the Special Meeting in person or via telephone and the Company hopes you will be able to attend the Special Meeting. Whether or not you expect to attend the Special Meeting, you are urged to vote or submit your proxy card or CDI Voting Instruction Form as soon as possible so that your shares of common stock (or shares of common stock underlying your CDIs) can be voted at the Special Meeting in accordance with your instructions. When you have finished reading the proxy statement, the Company encourage you to vote promptly. You may vote your shares of common stock (or direct CHESS Depositary Nominees Pty Ltd (“CDN”) to vote if you hold your shares of common stock in the form of CDIs) by following the instructions on the enclosed proxy card or the CDI Voting Instruction Form. Internet voting is available as described in the enclosed materials. The Company encourages you to vote by proxy so that your shares of common stock will be represented and voted at the meeting, whether or not you can attend. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

Thank you for your ongoing support. The Company looks forward to seeing you at the Special Meeting.

| | Sincerely, |

| | |

| | Scott Schorer |

| | President and Chief Executive Officer |

GI DYNAMICS, INC.

320 Congress Street, Floor 3

Boston, MA 02110

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 17, 2019 (AEDT)

DECEMBER 16, 2019 (EST)

To GI Dynamics stockholders:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders of GI Dynamics, Inc. (“GI Dynamics” or the “Company”), a Delaware corporation, will be held on December 16, 2019, at 5:00 p.m., EST (which is on December 17, 2019, at 9:00 a.m., AEDT) at the Company’s corporate offices located at 320 Congress Street, Floor 3, Boston, MA 02210, for the following purposes (the term ASX throughout this proxy statement refers to the Australian Securities Exchange):

| 1. | To approve an amendment to the Company’s amended and restated certificate of incorporation to increase the number of authorized shares of its common stock from 50,000,000 to 75,000,000; |

| 2. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 30,000 stock options to purchase 30,000 shares of the Company’s common stock to Timothy J. Barberich, a non-executive director, on the terms and conditions set out in the accompanying proxy statement; |

| 3. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 30,000 stock options to purchase 30,000 shares of the Company’s common stock to Daniel J. Moore, a non-executive director, on the terms and conditions set out in the accompanying proxy statement; |

| 4. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 30,000 stock options to purchase 30,000 shares of the Company’s common stock to Oern R. Stuge, M.D., a non-executive director, on the terms and conditions set out in the accompanying proxy statement; |

| 5. | For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 30,000 stock options to purchase 30,000 shares of the Company’s common stock to Juliet Thompson, a non-executive director, on the terms and conditions set out in the accompanying proxy statement; |

| 6. | For the purposes of ASX Listing Rule 10.11 and for all other purposes, to approve, conditional on the approval of Proposal 7, the conversion feature of a convertible promissory note with a face value of $4,596,893 that was issued on August 21, 2019 to Crystal Amber Fund Limited, an existing stockholder and related party on the terms and conditions set out in the accompanying proxy statement; |

| 7. | For the purposes of ASX Listing Rule 10.11 and for all other purposes, to approve, conditional on the approval of Proposal 6, the issuance of a warrant to Crystal Amber Fund Limited, an existing stockholder and related party, which will entitle Crystal Amber Fund Limited to subscribe for 229,844,650 CHESS Depositary Interests (representing 4,596,893 shares of the Company’s common stock), on the terms and conditions set out in the accompanying proxy statement; |

| 8. | To authorize an adjournment of the Special Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of any of Proposals 1 through 7; and |

| 9. | To transact such other business as may be properly brought before the Special Meeting and any adjournment or postponements thereof. |

The Company’s Board of Directors recommends a vote “FOR” Proposals 1 through 9 (inclusive), except for Timothy J. Barberich with respect to Proposal 2 only; Daniel J. Moore with respect to Proposal 3 only; Oern R. Stuge, M.D. with respect to Proposal 4 only; and Juliet Thompson with respect to Proposal 5 only, all of who abstain from making a recommendation in relation to those proposals due to their personal interest in the relevant proposal.

You are entitled to notice of and to vote at the Special Meeting only if you were a GI Dynamics stockholder as of 4:30 p.m. United States Eastern Daylight Time (“EDT”) on October 31, 2019 (which was 7:30 a.m. Australian Eastern Daylight Time (“AEDT”) on November 1, 2019), the record date for the Special Meeting (the “Record Date”). The owners of common stock as of the Record Date are entitled to vote at the Special Meeting and any adjournments or postponements of the meeting. Record holders of CDIs as of the close of business on the Record Date are entitled to receive notice of and to attend the Special Meeting or any adjournment or postponement of the meeting and may instruct the Company’s CDI Depositary, CHESS Depositary Nominees Pty Ltd (“CDN”), to vote the shares of common stock underlying their CDIs by following the instructions on the enclosed CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au. Doing so permits CDI holders to instruct CDN to vote on behalf of the CDI holders at the Special Meeting in accordance with the instructions received via the CDI Voting Instruction Form or online. A list of stockholders of record will be available at the Special Meeting and, during the 10 days prior to the Special Meeting, during ordinary business hours at the Company’s corporate offices located at 320 Congress Street, Floor 3, Boston, MA 02210.

The proxy statement that accompanies and forms part of this Notice of Special Meeting provides information in relation to each of the matters to be considered at the Special Meeting. The Notice of Special Meeting and the proxy statement should be read in their entirety. If a stockholder or a holder of the Company’s CDIs is in doubt as to how they should vote at the Special Meeting, they should seek advice from their legal counsel, accountant or other professional adviser prior to voting.

All stockholders and holders of the Company’s CDIs are cordially invited to attend the Special Meeting. Whether you plan to attend the Special Meeting or not, you are requested to complete, sign, date, and return the enclosed proxy card or CDI Voting Instruction Form as soon as possible so that your shares (or the shares of common stock underlying your CDIs) can be voted at the Special Meeting in accordance with the instructions on the proxy card.

| | BY ORDER OF THE BOARD OF DIRECTORS, |

| | |

| | Charles R. Carter |

| | Chief Financial Officer and Secretary |

| | Boston, Massachusetts |

December 2, 2019

TABLE OF CONTENTS

GI DYNAMICS, INC.

320 Congress Street, Floor 3

Boston, MA 02110

PROXY STATEMENT FOR THE GI DYNAMICS

2019 SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 16, 2019 (EST)

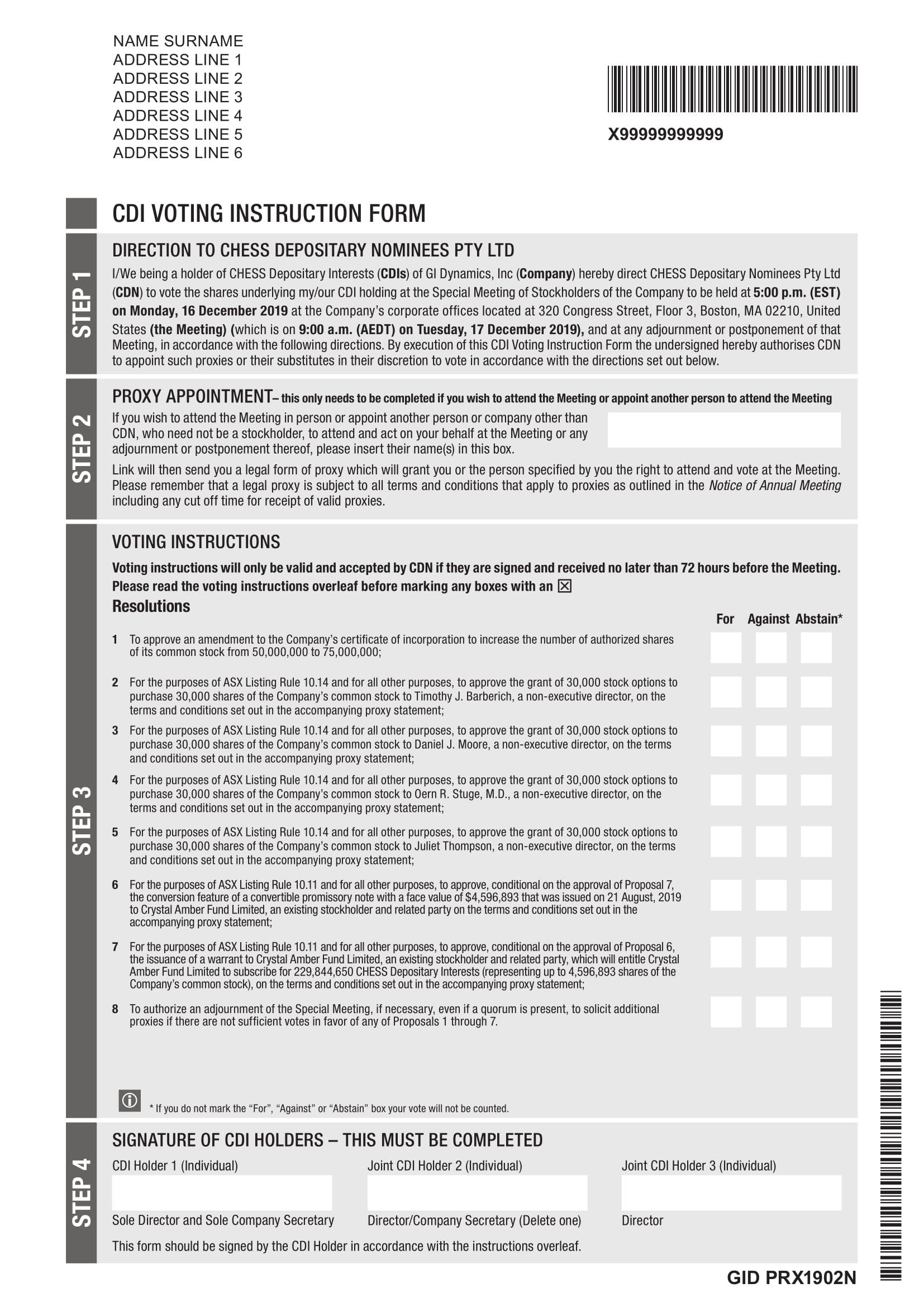

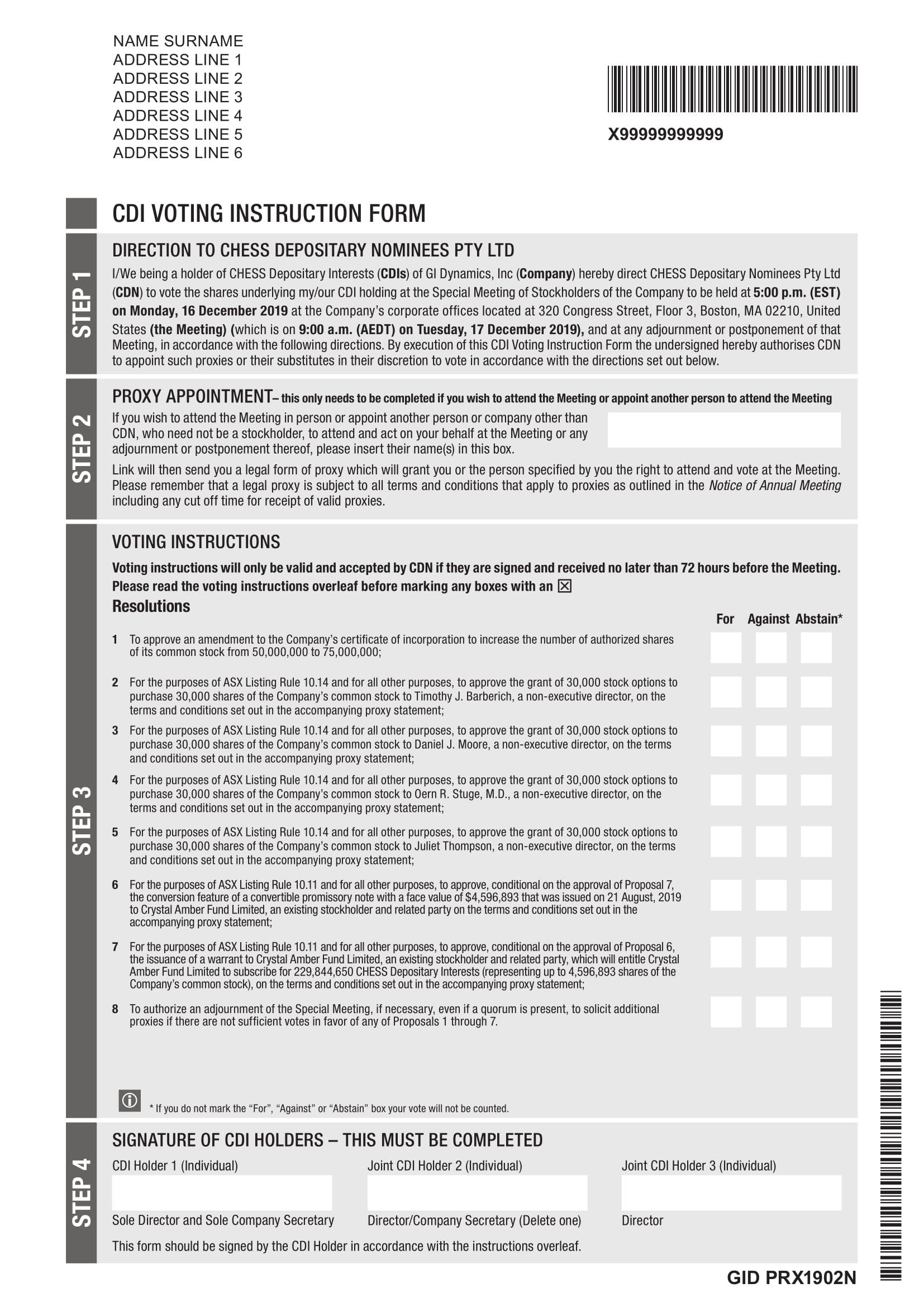

This proxy statement and the enclosed proxy card and CDI Voting Instruction Form are being mailed to stockholders and CDI holders on or about December 2, 2019 and are furnished in connection with the solicitation of proxies by the Board of Directors of GI Dynamics, Inc. (“GI Dynamics” or the “Company”) for use at a special meeting of stockholders (the “Special Meeting”) to be held on December 16, 2019, at 5:00 p.m., EST (which is on December 17, 2019, at 9:00 a.m., AEDT) at the corporate offices of GI Dynamics located at 320 Congress Street, Floor 3, Boston, MA 02210, and at any adjournments or postponements thereof.

IMPORTANT: To ensure that your shares of common stock are represented at the Special Meeting, please vote your shares of common stock (or, for CDI holders, direct CDN to vote your CDIs) via the Internet or by marking, signing, dating, and returning the enclosed proxy card or CDI Voting Instruction Form to the address specified. If you attend the Special Meeting, you may choose to vote in person even if you have previously voted your shares of common stock, except that CDI holders may only instruct CDN to vote on their behalf by completing and signing the CDI Voting Instruction Form or voting online at www.linkmarketservices.com.au and may not vote in person.

IMPORTANT INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

This proxy statement summarizes the information you need to know to vote at the Special Meeting. You do not need to attend the Special Meeting to vote your shares of common stock or CDIs. Instead, if you hold shares of common stock you may vote your shares of common stock by marking, signing, dating and returning the enclosed proxy card or as otherwise described in this proxy statement. If you hold CDIs, you may vote your CDIs by signing and returning the enclosed CDI Voting Instruction Form. Unless otherwise indicated, all dollar amounts in this proxy statement are in U.S. Dollars.

Why is the Company Soliciting My Proxy?

The Board of Directors of GI Dynamics is soliciting your proxy to vote at the Special Meeting that will be held on December 16, 2019, at 5:00 p.m., EST (which is on December 17, 2019, at 9:00 a.m., AEDT) at the corporate offices of GI Dynamics located at 320 Congress Street, Floor 3, Boston, MA 02210 and any adjournments of the Special Meeting. This proxy statement, along with the accompanying Notice of 2019 Special Meeting of Stockholders, summarizes the purposes of the Special Meeting and the information you need to know to vote at the Special Meeting.

If you held shares of the Company’s common stock at 7:30 a.m. on the Record Date of November 1, 2019 AEDT, which is 4:30 p.m. on October 31, 2019 EDT, you are invited to attend the Special Meeting and vote on the proposals described in this proxy statement. Those persons holding CDIs are entitled to receive notice of and to attend the Special Meeting and may instruct CDN to vote at the Special Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

The Company has sent you this proxy statement, the Notice of 2019 Special Meeting of Stockholders and the proxy card or CDI Voting Instruction Form because you owned shares of GI Dynamics’ common stock or CDIs on the Record Date. The Company intends to commence distribution of these proxy materials to stockholders on or about December 2, 2019.

Who Can Vote?

If you were a holder of GI Dynamics common stock on the Record Date, either as a stockholder of record or as the beneficial owner of shares held in street name, you may vote your shares at the Special Meeting. As of the Record Date, there were 73,631 shares of common stock and 1,715,752,345 CDIs outstanding and entitled to vote. The Company’s common stock is the Company’s only class of voting stock. Each stockholder has one vote for each share of common stock held as of the Record Date. Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. As summarized below, there are some distinctions between shares held of record and those owned beneficially and held in street name.

You do not need to attend the Special Meeting to vote your shares (or shares underlying your CDIs). Shares represented by valid proxies or, for CDI holders, by valid CDI Voting Instruction Forms, received in time for the Special Meeting and not revoked prior to the Special Meeting, will be voted at the Special Meeting. For instructions on how to change or revoke your proxy, see “May I Change My Vote or Revoke My Proxy?” below.

What Does It Mean To Be A “Stockholder Of Record?”

You are a “stockholder of record” if your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer and Trust Company. As a stockholder of record, you have the right to grant your voting proxy directly to GI Dynamics or to vote in person at the Special Meeting. If you received printed proxy materials, the Company has enclosed or sent a proxy card for you to use. You may also vote by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?” Holders of CDIs are entitled to receive notice of and to attend the Special Meeting and may direct CDN to vote at the Special Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

What Does It Mean To Beneficially Own Stock In “Street Name?”

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, or other similar organization. While the Company does not believe that any shares of common stock are held by brokers, banks, trustees or other nominees as of the Record Date, if you do own shares in street name, the proxy materials were forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee or nominee how to vote your shares, and you are also invited to attend the Special Meeting. If you hold your shares in street name and do not provide voting instructions to your broker, bank, trustee or nominee, your shares will not be voted on any proposals on which your broker, bank, trustee or nominee does not have discretionary authority to vote (a “broker non-vote”).

Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the meeting. If you do not wish to vote in person or you will not be attending the Special Meeting, you may vote by proxy or by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?”

How Do I Vote My Shares of GI Dynamics Common Stock?

Whether you plan to attend the Special Meeting or not, the Company urges you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your shares of common stock in the manner you indicate. You may specify whether your shares of common stock should be voted for, against, or abstain with respect to all of the Proposals to be voted on at the Special Meeting. Voting by proxy will not affect your right to attend the Special Meeting. If your shares of common stock are registered directly in your name through the Company’s stock transfer agent, American Stock Transfer and Trust Company, or you have stock certificates registered in your name, you may vote:

| ● | By mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares of common stock voted, they will be voted as recommended by the Company’s Board of Directors. The proxy card must be received prior to the Special Meeting. |

| ● | By Internet. Follow the instructions attached to the proxy card to vote by Internet. |

| ● | In person at the meeting. If you attend the Special Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Special Meeting. |

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 9:00 a.m. on Sunday December 15, 2019 AEDT (which is 5:00 p.m. on Saturday December 14, 2019 EST).

If your shares of common stock are held in “street name” (held in the name of a broker, bank, trustee or nominee), you must provide the broker, bank, trustee or nominee with instructions on how to vote your shares of common stock and can do so as follows:

| ● | By mail. Follow the instructions you receive from your broker, bank, trustee or nominee explaining how to vote your shares of common stock. |

| ● | By Internet or by telephone. Follow the instructions you receive from your broker, bank, trustee or nominee to vote by Internet or telephone. |

| ● | In person at the meeting. Contact the broker, bank, trustee or nominee that holds your shares of common stock to obtain a broker’s proxy card and bring it with you to the Special Meeting. You will not be able to vote at the Special Meeting unless you have a proxy card from your broker, bank, trustee or nominee. |

How Do I Vote If I Hold CDIs?

Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. Those persons holding CDIs are entitled to receive notice of and to attend the Special Meeting and any adjournment or postponement thereof, and may direct CDN to vote their underlying shares of common stock at the Special Meeting by voting online at www.linkmarketservices.com.au, or by returning the CDI Voting Instruction Form to Link Market Services Limited, the agent the Company designated for the collection and processing of voting instructions from the Company’s CDI holders, so that it is received by Link Market Services Limited no later than 9:00 a.m. AEDT on Saturday December 14, 2019 (which is 5:00 p.m. EST on Friday December 13, 2019) in accordance with the instructions on such form. Doing so permits CDI holders to instruct CDN to vote on their behalf in accordance with their written directions.

Alternatively, CDI holders have the following options in order to vote at the Special Meeting:

| ● | informing GI Dynamics that they wish to nominate themselves or another person to be appointed as CDN’s proxy for the purposes of attending and voting at the Special Meeting; or |

| ● | converting their CDIs into a holding of shares of GI Dynamics common stock and voting these at the meeting (however, if thereafter the former CDI holder wishes to sell their investment on the ASX, it would be necessary to convert shares of common stock back into CDIs). This must be done prior to the Record Date for the Special Meeting. |

Holders of CDIs must comply with one of the instructions above if they wish to vote at the Special Meeting.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Company’s Board of Directors (with Timothy J. Barberich abstaining from making a recommendation on Proposal 2; Daniel J. Moore abstaining from making a recommendation on Proposal 3; Oern R. Stuge, M.D. abstaining from making a recommendation on Proposal 4; and Juliet Thompson abstaining from making a recommendation on Proposal 5, due to their personal interests in the proposals) recommends that you vote as follows:

| | 1. | “FOR” approving an amendment to the Company’s amended and restated certificate of incorporation to increase the number of authorized shares of its common stock from 50,000,000 to 75,000,000; |

| | 2. | “FOR” approving the grant of 30,000 stock options to Timothy. J Barberich, a non-executive director of the Company; |

| | 3. | “FOR” approving the grant of 30,000 stock options to Daniel J. Moore, a non-executive director of the Company; |

| | 4. | “FOR” approving the grant of 30,000 stock options to Oern R. Stuge, M.D., a non-executive director of the Company; |

| | 5. | “FOR” approving the grant of 30,000 stock options to Juliet Thompson, a non-executive director of the Company; |

| | 6. | “FOR”approving the conversion feature of a convertible promissory note issued to Crystal Amber Fund Limited, an existing stockholder and related party, with a face value of $4,596,893; |

| | 7. | “FOR”approving the issuance of a warrant to Crystal Amber Fund Limited that will entitle Crystal Amber Fund Limited to subscribe for 229,844,650 CHESS Depositary Interests (representing 4,596,893 shares of the Company’s common stock) upon issuance; and |

| | 8. | “FOR”adjourning the Special Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of any of proposals 1 through 7. |

If any other matter is presented at the Special Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with the proxy’s best judgment. At the time this proxy statement was first made available, the Company knew of no matters that needed to be acted on at the Special Meeting, other than those discussed in this proxy statement.

May I Change My Vote or Revoke My Proxy?

If you are a stockholder of record and give the Company your proxy, you may change your vote or revoke your proxy at any time before the Special Meeting in any one of the following ways:

| ● | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| ● | by re-voting by Internet as instructed above; |

| ● | by notifying the Company’s corporate secretary in writing at GI Dynamics, Inc., 320 Congress Street, Boston, MA 02210, U.S.A., Attention: Corporate Secretary, before the Special Meeting that you have revoked your proxy; or |

| ● | by attending the Special Meeting in person, revoking your proxy and voting in person. Attending the Special Meeting in person will not in and of itself revoke a previously submitted proxy. You must specifically request at the Special Meeting that it be revoked. |

Your most current vote, whether by Internet or proxy card, is the one that will be counted.

If you are a beneficial owner and hold shares of common stock through a broker, bank or other nominee, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also change your vote or revoke your voting instructions in person at the Special Meeting if you obtain a signed proxy from the broker, bank or other nominee giving you the right to vote the shares of common stock.

If you are a holder of CDIs and you direct CDN to vote by completing the CDI Voting Instruction Form, you may revoke those directions by delivering to Link Market Services Limited a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent which notice must be received by Link Market Services Limited no later than 9:00 a.m. AEDT on Sunday December 15, 2019 (which is 5:00 p.m. EST on Saturday December 14, 2019).

Where Can I find the Voting Results of the Special Meeting?

The preliminary voting results will be announced at the Special Meeting. In accordance with the requirements of ASX Listing Rule 3.13.2, the Company will disclose to ASX the voting results of the Special Meeting immediately after the meeting and will also report the results on a current report on Form 8-K filed with the U.S. Securities and Exchange Commission.

How Do I Attend the Special Meeting?

Admission to the Special Meeting in person is limited to the Company’s stockholders or holders of CDIs, one member of their respective immediate families, or their named representatives. The Company reserves the right to limit the number of immediate family members or representatives who may attend the meeting. Stockholders of record, holders of CDIs of record, immediate family member guests, and representatives will be required to present government-issued photo identification (e.g., driver’s license or passport) to gain admission to the Special Meeting.

To register to attend the Special Meeting, please contact the Company’s Investor Relations department as follows:

| ● | by e-mail at investor@gidynamics.com; |

| ● | by phone at +1 781-357-3250 in the U.S or at +61 2 9325 9046 in Australia; |

| ● | by fax to +1 781-357-3301; or |

| ● | by mail to Investor Relations at 320 Congress Street, Boston, MA 02210. |

Please include the following information in your request:

| ● | your name and complete mailing address; |

| ● | whether you require special assistance at the Special Meeting; |

| ● | if you will be naming a representative to attend the Special Meeting on your behalf, the name, complete mailing address, and telephone number of that individual; |

| ● | proof that you own GI Dynamics shares of common stock or hold CDIs as of the Record Date (such as a letter from your bank, broker, or other financial institution; a photocopy of a current brokerage or other account statement; or, a photocopy of a holding statement); and |

| ● | the name of your immediate family member guest, if one will accompany you. |

Please be advised that no cameras, recording equipment, electronic devices, large bags, briefcases, or packages will be permitted in the Special Meeting.

You need not attend the Special Meeting in order to vote.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, the votes the shares represent will not be counted if you do not vote as described above under “How Do I Vote My Shares of GI Dynamics Common Stock?” While the Company does not believe that any shares of common stock are held by brokers, banks, trustees or other nominees as of the Record Date, if your shares are held in street name and you do not provide voting instructions to the broker, bank or other nominee that holds your shares as described above, the broker, bank or other nominee that holds your shares has the authority to vote your unvoted shares only with respect to so-called “routine” matters where they have discretionary voting authority over your shares. Only Proposal 1 is a “routine” matter. Accordingly, the broker, bank or other nominee will have discretionary authority to vote only on Proposal 1.

We encourage you to provide voting instructions to your broker, bank or other nominee. This ensures your shares will be voted at the Special Meeting and in the manner you desire. If your broker, bank or other nominee cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker, bank or other nominee chooses not to vote on a matter for which it does have discretionary voting authority, a “broker non-vote” will be reported.

Subject to voting exclusion statements for a proposal, the vote required to approve each proposal and the manner in which votes are counted is set forth below. Information on voting exclusion statements is set out in the additional information provided for each proposal, if applicable.

| Proposal 1: Approve an Amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the authorized share capital | | The affirmative vote of a majority in voting power of the Company’s outstanding shares of common stock (including the underlying shares represented by CDIs) is required to approve the amendment to the Company’s Amended and Restated certificate of incorporation to increase its authorized shares from 50,000,000 to 75,000,000. Abstentions will have the same effect as a vote against this proposal. |

| | | |

| Proposals 2-5: Approve Non-Executive Director Stock Option Grants | | The affirmative vote of a majority of the votes cast for each of these respective proposals is required to approve the grant to each respective non-executive director of the stock options described in this proxy statement. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares. As a result, any shares not voted by a customer will be treated as broker non-votes. Broker non-votes will have no effect on the results of these votes. |

| | | |

| Proposal 6: Approve the conversion feature of a convertible promissory note with a principal value of $4,596,893 issued to Crystal Amber Fund Limited | | The affirmative vote of a majority of the votes cast for this proposal is required for approval of this Proposal 6. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares. As a result, any shares not voted by a customer will be treated as broker non-votes. Broker non-votes will have no effect on the results of this vote. |

| | | |

| Proposal 7: Approve the issuance of a warrant to Crystal Amber Fund Limited | | The affirmative vote of a majority of the votes cast for this proposal is required for approval of this Proposal 7. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares. As a result, any shares not voted by a customer will be treated as broker non-votes. Broker non-votes will have no effect on the results of this vote. |

| | | |

| Proposal 8: Approve the adjournment of the Special Meeting to solicit additional proxies if there are not sufficient votes in favor of any of Proposals 1 through 7 | | The affirmative vote of a majority of the votes cast for this proposal is required for the approval of this Proposal 9. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares. As a result, any shares not voted by a customer will be treated as broker non-votes. Broker non-votes will have no effect on the results of this vote. |

What Constitutes a Quorum for the Special Meeting?

The presence, in person or by proxy, of the holders of one-third of the voting power of all outstanding shares of the Company’s common stock entitled to vote at the Special Meeting is necessary to constitute a quorum at the Special Meeting. Votes of stockholders of record who are present at the Special Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists. If there is no quorum, the chairman of the Special Meeting or the holders of a majority of shares of common stock (including underlying shares represented by CDIs) present at the Special Meeting, either in person or by proxy, may adjourn the Special Meeting to solicit additional proxies and reconvene the Special Meeting at a later date.

Could Other Matters Be Decided at the Special Meeting?

The Company is currently unaware of any matters to be raised at the Special Meeting other than those referred to in this proxy statement. If other matters are properly presented for consideration at the Special Meeting and you are a stockholder of record and have submitted your proxy, the persons named in your proxy will have the discretion to vote on those matters for you.

Electronic Delivery of Future Stockholder Communications

Most stockholders and CDI holders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail. If you are a stockholder or CDI holder of record, you can choose this option and save the Company the cost of producing and mailing these documents by going to www.linkmarketservices.com.au, accessing your account information and following the instructions provided.

PROPOSAL 1 – APPROVE AN AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 50,000,000 SHARES TO75,000,000 SHARES

The Company’s amended and restated certificate of incorporation (“Certificate”) currently authorizes it to issue up to 50,000,000 shares of common stock, $0.01 par value, no shares of Class B common stock and 500,000 shares of preferred stock, $0.01 par value. The Company’s Board of Directors has unanimously resolved to adopt, subject to stockholder approval, an amendment to the Certificate to increase the authorized number of shares of common stock by 25,000,000 shares from 50,000,000 to 75,000,000 shares. The full text of Article Fourth of our Certificate, as proposed to be amended, is as follows:

“The total number of shares of all classes of stock which the Corporation shall have the authority to issue is Seventy-Five Million Five Hundred Thousand (75,500,000) shares, consisting of Seventy-Five Million (75,000,000) shares of common stock, par value $0.01 per share (the “Common Stock”), Zero (0) shares of Class B Common Stock, par value $0.01 per share (the “Class B Common Stock”), and Five Hundred Thousand (500,000) shares of preferred stock, par value $0.01 per share (the “Preferred Stock”).”

The form of amendment to the Certificate to effect the authorized share increase is attached as Annexure A to this proxy statement.

Background

The Company may issue shares of common stock to the extent such shares have been authorized under the Certificate.

As of the Record Date, of the 50,000,000 shares of common stock currently authorized, 34,388,678 shares of common stock were outstanding, in addition to the following:

| ● | 5,616 shares of common stock authorized for issuance under the Company’s 2003 Omnibus Stock Plan, of which 5,616 shares of common stock are underlying outstanding options having a weighted average exercise price of $7.95 per share; |

| ● | 3,481,024 shares of common stock authorized for issuance under the Company’s 2011 Employee, Director and Consultant Equity Incentive Plan, of which 3,266,158 shares of common stock are underlying outstanding options having a weighted average exercise price of $1.34 per share; |

| ● | 28,532 shares of common stock issuable upon the exercise of outstanding warrants to purchase common shares, having a weighted average exercise price of $0.64 per share; |

| ● | 1,574,803 shares of common stock issuable for a portion of a warrant exercised on October 31, 2019 but not issued until November 4, 2019 |

| ● | 634,814 shares of common stock issuable upon the exercise of a remaining outstanding warrant to purchase 31,740,743 CDIs, having an exercise price of $0.0127 per CDI. |

Based on the above capitalization information, 9,886,533 shares of currently authorized common stock remain unissued and unreserved and available for future issuance as of the Record Date.

Purpose of the Amendment

The Company’s Board of Directors has determined that it would be in its best interests to increase the number of authorized shares of common stock in order to provide the Company with the flexibility to pursue all finance and corporate opportunities involving its common stock, which may include private or public offerings of equity securities, and to provide appropriate equity incentives for its employees over time, without the need to obtain additional stockholder approvals. The Company currently has an agreement with Crystal Amber Fund Ltd., a related party for ASX purposes due to the size of its ownership stake in the Company, that includes the potential drawdown of a Convertible Note and issuance of a Warrant as detailed in the August 2019 Securities Purchase Agreement and referred to in Proposals 6 and 7, respectively. Should the Convertible Note be drawn down for the maximum amount (i.e. $4,596,893) and stockholders approve the Convertible Note conversion feature (pursuant to Proposal 6) and the issuance of the warrants, 9,193,786 shares of common stock will need to be reserved for issuance. The total outstanding and issued or reserved shares of common stock would then total 49,307,253 shares.

Beyond the August 2019 Securities Purchase Agreement, there are currently no formal proposals or agreements that would require an increase in our authorized shares of common stock. As stated in our quarterly report for the period ended September 30, 2019, the Company will need to secure financing no later than February 2020, in order to continue its operations and this may require the Company to issue a material number of new shares of common stock.

Each additional authorized share of common stock would have the same rights and privileges as each share of currently authorized common stock.

Potential Adverse Effects of the Amendment

The Board desires to have the additional shares of common stock available to provide flexibility to use our common stock for business and financial purposes in the future as well to have sufficient shares of common stock available to provide appropriate equity incentives for our employees. The issuance of additional shares of common stock in the future will have the effect of diluting earnings per share, voting power and common shareholdings of stockholders. It could also have the effect of making it more difficult for a third party to acquire control of the Company. The shares of common stock will be available for issuance by the Board for proper corporate purposes, including but not limited to, stock dividends, acquisitions, financings and equity compensation plans. Our Board believes the increase in authorized share capital is in the best interests of the Company and its stockholders and recommends that the stockholders approve the increase in authorized share capital.

No Appraisal Rights

Under applicable Delaware law, the Company’s stockholders are not entitled to appraisal rights with respect to the proposed amendment to the Certificate.

Procedure for Effecting the Amendment

If the proposed amendment is approved and adopted by the stockholders at the Special Meeting, it will become effective upon filing with the Secretary of State of the State of Delaware. Subject to the discretion of the Board of Directors, which could elect to abandon the amendment at any time before or after stockholder approval, the Company expects to file the certificate of amendment with the Secretary of State of the State of Delaware as soon as practicable following stockholder approval.

Vote Required and Board of Directors Recommendation

The affirmative vote of the holders of a majority in voting power of the outstanding shares of common stock (including the underlying shares represented by CDIs) entitled to a vote at the Special Meeting is required for approval of this proposal. If you “abstain” or otherwise do not vote on the proposal, it has the same effect as a vote against the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” AMENDING THE AMENDED AND RESTATED Certificate of Incorporation TO IncreasE the Number of AUTHORIZED Shares OF COMMON STOCK FROM 50,000,000 SHARES to75,000,000shares.

PROPOSALS 2 THROUGH 5: APPROVAL OF GRANTS OF STOCK OPTIONS

TO NON-EXECUTIVE DIRECTORS

Background

As part of the Company’s overall compensation program, the Company’s non-executive directors receive, subject to stockholder approval being obtained pursuant to the ASX Listing Rules, a significant portion of their annual compensation in the form of long-term incentive equity-based awards.

On October 29, 2019, the Company’s Board of Directors approved, subject to obtaining stockholder approval at this Special Meeting, the grant of stock options representing the right to purchase 30,000 shares of the Company’s common stock (collectively, the “NED Options”) to each of Timothy J. Barberich, Daniel J. Moore, Oern R. Stuge, M.D. and Juliet Thompson, the Company’s non-executive directors (the “Non-Executive Directors”) pursuant to the Company’s 2011 Employee, Director and Consultant Equity Incentive Plan (“2011 Plan”).

As of October 29, 2019, the fair market value of a share of common stock issuable upon exercise of a NED Option was $1.34 based upon the closing price of the Company’s CDIs on the ASX and the Australian Reserve Bank exchange rate for U.S. Dollars per Australian Dollars on October 29, 2019. As of October 29, 2019, the 2011 Plan had a total of 214,866 shares of common stock reserved for potential future issuance for employees, consultants and directors. Proposals 2 through 5 provide for the issuance of the NED Options to the Non-Executive Directors, which, in aggregate, constitute approximately 3.5% of the total number of shares of common stock reserved in the 2011 Plan for potential future issuance.

Approvals

ASX Listing Rule 10.14 provides that a company must not permit a director to acquire securities under an employee incentive scheme without the prior approval of stockholders. Accordingly, stockholder approval is now being sought for the purposes of ASX Listing Rule 10.14 and for all other purposes for the grant of the NED Options to the Non-Executive Directors as described below.

Proposals 2 through 5 (inclusive) are each standalone proposals and each Proposal is not conditional on the other Proposals being approved. Accordingly, if any of the Proposals 2 through 5 is not approved it will not affect the approval of any of the other Proposals 2 through 5.

Principal Terms of NED Options

For the purposes of ASX Listing Rules 10.14 and 10.15A the Company provides the following information:

If Proposals 2 through 5 (inclusive) are approved by stockholders, the NED Options will be issued to the Non-Executive Directors as soon as practicable after this Special Meeting and, in any case, no later than three years after this Special Meeting.

The NED Options to be issued to the Non-Executive Directors will be issued on the following terms and conditions:

| (a) | Grant Price: There is no consideration payable for the grant of the NED Options. |

| (i) | The exercise price of each share of common stock available under the NED Options is $1.34, based upon the closing price of the Company’s CDIs on the ASX and the Australian Reserve Bank exchange rate for U.S. Dollars per Australian Dollars on October 29, 2019, being the date of approval by the Board to grant the NED Options to the Non-Executive Directors (conditional on stockholder approval). |

| (ii) | The NED Options will be immediately exercisable upon issue (subject to repurchase rights if exercised prior to vesting) and may be exercised at any time prior to their lapsing. |

| (i) | The NED Options will vest in full on the first anniversary of the date of grant. |

| (ii) | Any shares of common stock which are received on exercise of NED Options exercised prior to their vesting will be subject to a repurchase right by the Company until fully vested at the lesser of cost or fair market value. |

| (iii) | All NED Options will vest in full upon a change in control event (as defined in the Non- Executive Directors’ respective Option Agreement issued under the 2011 Plan). |

| (iv) | There are no performance conditions or other requirements attached to the NED Options other than the requirement that each Non-Executive Director must continue to be a director of the Company at the relevant vesting date. |

| (d) | Lapsing of NED Options: |

The following portion of the NED Options held by the relevant Non-Executive Director will lapse in the following circumstances:

| (i) | the portion of the NED Options that have been exercised or otherwise settled; |

| (ii) | the portion of the NED Options that remain unvested on the date the relevant Non-Executive Director ceases to be a director of the Company (other than in connection with a change in control event); |

| (iii) | the portion of the NED Options of the relevant Non-Executive Director that have not been exercised by the tenth anniversary of the date of their grant; or |

| (iv) | in the event the relevant Non-Executive Director ceases to be a director within 12 months following a change in control event, including a change in 50% or more of the total voting power of the Company’s securities, a merger or sale of assets, or a change in the composition of the Board of Directors, as a result of which fewer than a majority of the directors are Incumbent Directors (as defined in the Non- Executive Directors’ respective Option Agreement issued under the 2011 Plan), the portion of the NED Options held by the relevant Non-Executive Director that have not been exercised will lapse 12 months after such cessation of services as a director. |

As further required by ASX Listing Rule 10.15A, the following additional information is provided in relation to Proposals 2 through 5 (inclusive):

| ● | The maximum aggregate number of common shares underlying the NED Options that may be issued by the Company under Proposals 2 through 5 (inclusive) is 120,000 shares of common stock, consisting of 30,000 shares of common stock underlying the NED Options to be issued to each Non-Executive Director. |

| ● | Upon exercise, the NED Options will entitle the Non-Executive Director to receive up to 30,000 shares of common stock at the exercise price per NED Option as set out above. |

| ● | No loans have been or will be made by the Company to the Non-Executive Director in connection with the acquisition of the NED Options or exercise of the NED Options. |

| ● | No person referred to in ASX Listing Rule 10.14 has received securities under the 2011 Plan since stockholder approval was last obtained under ASX Listing Rule 10.14 at the 2018 Annual Meeting. |

| ● | All Directors of the Company, being Daniel J. Moore, Oern R. Stuge, M.D., Timothy J. Barberich and Juliet Thompson, are entitled to participate in the 2011 Plan. |

| ● | Details of any securities issued to directors under the 2011 Plan will be published in each annual report of the Company relating to a period in which securities have been issued, and that approval for the issue of the securities was obtained under ASX Listing Rule 10.14. Any additional persons who become entitled to participate in the 2011 Plan after approval of Proposals 2 through 5 and who are not named in this proxy statement will not participate until approval is obtained under ASX Listing Rule 10.14. |

Benefits on Grant Approval Table

The Non-Executive Directors are the only persons for whom an award is proposed under Proposals 2 through 5. The number of shares subject to the NED Options, and the estimated grant date fair value, is shown below. Approval of Proposals 2 through 5 will not result in the issuance of shares to other employees or executive officers.

| Name and Position | | Dollar

Value ($) | | | Number of

Shares

Subject to

Award | |

| | | | | | | |

| Scott Schorer, President and Chief Executive Officer | | | - | | | | - | |

| | | | | | | | | |

| Brian Callahan, Former Chief Compliance Officer | | | - | | | | - | |

| | | | | | | | | |

| Charles R. Carter, Chief Financial Officer and Secretary | | | - | | | | - | |

| | | | | | | | | |

| Executive Group Total | | | - | | | | - | |

| | | | | | | | | |

| Non-Executive Director Group Total | | | 136,187 | (1) | | | 120,000 | |

| | | | | | | | | |

| Non-Executive Officer Employee Group | | | - | | | | - | |

| (1) | This amount represents the aggregate grant date fair value for the NED Options computed in accordance with the provisions of FASB ASC Topic 718. Assumptions used in calculating the grant date fair value are below: |

| | Expected volatility | 134 | % |

| | Expected term (simplified method, in years) | 4.5 | |

| | Risk-free interest rate | 2.09 | % |

| | Expected dividend yield | 0 | % |

Voting Exclusion Statement

The Company will disregard any votes cast on each of Proposals 2 through 5 (inclusive) by any director of the Company or any associate of a director of the Company. However, the Company need not disregard a vote if:

| ● | it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card; or |

| ● | it is cast by the person chairing the meeting as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card to vote as the proxy decides. |

Vote Required and Board of Directors Recommendation

The affirmative vote of the majority of votes cast for Proposals 2 through 5 is required for approval of each applicable proposal.

THE BOARD OF DIRECTORS (EXCLUDING TIMOTHY J. BARBERICH (IN RESPECT OF PROPOSAL 2); DANIEL J. MOORE (IN RESPECT OF PROPOSAL 3); OERN R. STUGE, M.D. (IN RESPECT OF PROPOSAL 4); AND JULIET THOMPSON (IN RESPECT TO PROPOSAL 5), EACH OF WHOM DOES NOT MAKE A RECOMMENDATION WITH RESPECT TO THE PROPOSAL IN PARENTHESIS AFTER HIS OR HER NAME DUE TO HIS OR HER INTEREST IN THE PROPOSAL) RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSALS 2 THROUGH 5 (INCLUSIVE).

PROPOSAL 6 — APPROVAL OF THE CONVERSION FEATURE OF A SENIOR UNSECURED CONVERTIBLE PROMISSORY NOTE

ISSUED TO CRYSTAL AMBER FUND LIMITED

Background

On August 21, 2019, the Company issued and sold to Crystal Amber Fund Limited (“Crystal Amber”) a senior unsecured convertible promissory note in an aggregate principal amount of up to $4,596,893, or such lesser amount as may be set forth at the Company’s sole discretion in a notice delivered by the Company to Crystal Amber (the “August 2019 Note”). The Company has provided written notice to Crystal Amber requesting the full draw amount of $4,596,893 under the August 2019 Note to be funded on December 6, 2019. In conjunction with the sale of the August 2019 Note, and subject to obtaining stockholder approval for its issue, the Company has agreed to issue to Crystal Amber a warrant (the “August 2019 Warrant”) to purchase 229,844,650 CDIs (or common stock) as set forth in the August 2019 Warrant and described in more detail in Proposal 7. Crystal Amber is the Company’s largest stockholder and a related party for ASX purposes due to the size of its ownership stake in the Company. A copy of the securities purchase agreement that was entered into in relation to these arrangements (“August 2019 Purchase Agreement”) and the August 2019 Note are set out in Annexure B to this proxy statement.

The August 2019 Note provides that the Company, if listed on the ASX and required by the rules of the ASX, will seek stockholder approval to allow the August 2019 Note to be converted, at Crystal Amber’s election, into that number of CDIs (or a corresponding number of shares of common stock) determined by dividing the entire unpaid principal amount of the August 2019 Note, together with any interest accrued but unpaid thereon, by $0.02 per CDI (the “Conversion Right”). The conversion price is subject to adjustment as fully described in the August 2019 Note.

The rules of the ASX prevent Crystal Amber from exercising the Conversion Right unless and until the Conversion Right is approved by the stockholders of the Company. Accordingly, stockholder approval is now being sought so that Crystal Amber may exercise the right to convert the August 2019 Note into CDIs or shares of common stock of the Company, in accordance with the terms of the August 2019 Note and the Conversion Right.

Based on the Company’s election to draw down the August 2019 Note for the maximum amount (i.e. $4,596,893), if stockholders approve the conversion feature of the August 2019 Note pursuant to this Proposal, and Crystal Amber then converted the August 2019 Note on the date it is funded (and assuming no conversion price adjustment), the August 2019 Note would entitle Crystal Amber to be issued 229,844,650 CDIs (representing 4,596,893 shares of common stock) (calculated by dividing $4,596,893 by $0.02, subject to rounding), which on issue would, in the aggregate, represent 13.4% of the Company’s issued and outstanding common stock on a fully diluted basis as of the Record Date and would result in Crystal Amber’s percentage share ownership increasing on a fully diluted basis from 72.3% to 75.6% (based on its holding as of October 31, 2019).

Any securities issued upon conversion of the August 2019 Note will be subject to a restriction on sale for a period of 12 months after their issue, except as permitted by the Corporations Act 2001 (Cth).

The CDIs or shares of the Company’s common stock issued upon conversion of the August 2019 Note will be fully paid and will, in all respects, rank pari passu with the fully paid CDIs or shares of the Company’s common stock on issue on the relevant conversion date.

If stockholder approval of the Conversion Right is not received, Crystal Amber will become entitled to receive an amount in cash equal to 110% of the outstanding face value amount of the August 2019 Note, plus all unpaid interest, on or before the date that is 6 months after the date on which this Proposal is not approved by our stockholders. If stockholder approval is not obtained for the Conversion Right, the Company may not have the cash resources to repay the amounts due under the August 2019 Note as they become due. The failure to repay the outstanding balance of the August 2019 Note as required would trigger Crystal Amber’s right to declare the August 2019 Note in default. As a result, unless we are able to obtain alternative financing, which may not be available to us on as favorable terms or at all, then assuming the maximum amount was outstanding under the August 2019 Note, we may be forced to consider a possible winding up or dissolution of our business.

Use of Proceeds

The Company plans to use the net proceeds from the August 2019 Note to provide funding for the Company’s ongoing general operating and working capital needs and to assist with the initiation of patient enrollment for STEP-1 (United States) and I-STEP (India with Apollo Sugar) clinical studies and for continuing work towards securing a CE Mark for EndoBarrier.

ASX Listing Rules

ASX Listing Rule 10.11 prohibits, subject to certain exceptions, a company from issuing or agreeing to issue equity securities to a related party without stockholder approval. Crystal Amber is considered to be a related party because as of October 31, 2019 it owned approximately 72.3% of the Company’s issued capital and, if Crystal Amber has the right to convert the August 2019 Note into CDIs, the Company will be viewed as having issued an equity security to Crystal Amber for the purposes of ASX Listing Rules. Stockholder approval is now being sought under this Proposal 6, for the purposes of ASX Listing Rule 10.11 and for all other purposes, to permit Crystal Amber to have the right of conversion under the August 2019 Note and to be issued CDIs or shares of the Company’s common stock upon such conversion.

As stockholder approval is being sought under ASX Listing Rule 10.11, approval under ASX Listing Rule 7.1 is not required in accordance with ASX Listing Rule 7.2 (Exception 14). If this proposal is approved by our stockholders, the issuance of any CDIs or shares of common stock on conversion of the August 2019 Note will be excluded from the calculation of the number of securities that can be issued by the Company in the 12-month period following such conversion under ASX Listing Rule 7.1, therefore providing the Company with flexibility to issue securities in the next 12 months should the Board consider it is in the interests of the Company and its stockholders to do so.

In accordance with ASX Listing Rule 10.13, the following information is provided in relation to this proposal:

| ● | the August 2019 Note was issued to Crystal Amber, a related party of the Company, as detailed above; |

| ● | there is only one note and it has an issue price of up to $4,596,893; |

| ● | the maximum number of CDIs that may be issued on conversion of the August 2019 Note will be determined by dividing the total amount drawn down (which is $4,596,893) (plus all accrued but unpaid interest at the conversion date) by $0.02, subject to any adjustment to that price as further described in the August 2019 Note; and |

| ● | the full set of the terms and conditions of the August 2019 Note are set out in the August 2019 Securities Purchase Agreement and the August 2019 Note, copies of which are provided in Annexure B. |

Consequences if this Proposal 6 is Approved but Proposal 7 is Not Approved

Proposals 6 and 7 are interconditional. As a result, if this Proposal 6 is approved but Proposal 7 is not approved, this proposal will be of no effect and Crystal Amber will be entitled to receive an amount in cash equal to 110% of the outstanding principal amount of the August 2019 Note plus all unpaid interest (if any) to satisfy the Company’s obligations under the August 2019 Note. This payment must be made on or before the date that is 6 months after the date on which this Proposal 6 is not approved by stockholders (or is deemed of no effect). If this proposal is not approved, Proposal 7 will be withdrawn and not put to stockholders for a vote.

If stockholders do not approve Proposals 6 and 7, Crystal Amber will not be able to convert the outstanding balance of the August 2019 Note, Crystal Amber will be entitled to receive an amount in cash equal to 110% of the outstanding principal amount of the August 2019 Note plus all unpaid interest to satisfy the Company’s obligations under the August 2019 Note and the Company will not be entitled to issue the August 2019 Warrant (discussed in detail in Proposal 7). Unless we are able to obtain alternative financing to pay the amounts due under the August 2019 Note as they become due, which may not be available to us on as favorable terms, or at all, we may be forced to consider a possible winding up or dissolution of our business.

Voting Exclusion Statement

The Company will disregard any votes cast on Proposal 6 by Crystal Amber, or its nominee, or any associate of those persons. However, the Company need not disregard a vote if:

| ● | it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card; or |

| ● | it is cast by the person chairing the Special Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy card to vote as the proxy decides. |

Vote Required and Board of Directors Recommendation

The affirmative vote of the majority of votes cast for Proposal 6 is required for approval.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 6 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL 6.

PROPOSAL 7 — APPROVAL OF THE ISSUANCE OF A WARRANT TO CRYSTAL AMBER FUND

LIMITED TO SUBSCRIBE FOR 229,844,650 CDIs

Background

As described in Proposal 6 above, in August 2019 the Company entered into the August 2019 Securities Purchase Agreement with, and issued the August 2019 Note to, Crystal Amber. The Company has provided written notice to Crystal Amber requesting the full draw amount of $4,596,893 under the August 2019 Note be funded on December 6, 2019. In addition, as further consideration for Crystal Amber’s agreement to subscribe for the August 2019 Note, and subject to obtaining stockholder approval of this proposal, the Company agreed to issue to Crystal Amber a warrant (the “August 2019 Warrant”), which will entitle Crystal Amber to subscribe for 229,844,650 CDIs or, if the Company is no longer listed on ASX at the time of Crystal Amber’s exercise of the August 2019 Warrant, the number of shares of the Company’s common stock into which the CDIs can be converted.

A copy of the August 2019 Warrant that the Company is proposing to issue is set out in Annexure C to this proxy statement.

Terms of the Warrant

If issued, the August 2019 Warrant will be exercisable by Crystal Amber at any time, in whole or in part and on multiple occasions, on or after the date of its issuance until the date that is five years from the date of issuance (unless exercised in full earlier) at which point it lapses. The August 2019 Warrant will not be quoted on ASX. Shares of the Company’s common stock or CDIs issued pursuant to an exercise of the August 2019 Warrant will be fully paid and rank, from the date of exercise, equally with the existing shares of common stock and CDIs of the Company in all respects.

The initial exercise price of each CDI that may be purchased under the August 2019 Warrant will be $0.02 (the “Initial Exercise Price”). The Initial Exercise Price will be subject to adjustment as fully described below and in the August 2019 Warrant. Based on the full draw of the August 2019 Note, Crystal Amber would be issued a Warrant to purchase229,844,650CDIs, subject to stockholder approval. If the Warrant was exercised in full on the date of the Special Meeting (and assuming the Company’s issued capital does not change), it would entitle Crystal Amber to be issued229,844,650CDIs, representing 13.4% of the Company’s issued and outstanding common stock on a fully diluted basis as of the Record Date and would result in Crystal Amber’s percentage share ownership increasing on a fully diluted basis from 72.3% to 75.6% (based on its holding as of October 31, 2019). If, as provided in Proposal 6, the August 2019 Note was also converted at the same time as the August 2019 Warrant to its maximum extent (i.e. 229,844,650 CDIs), Crystal Amber’s shareholding percentage on a fully diluted basis, as of the Record Date, would increase to 78.1% (based on its holding as of October 31, 2019, the August 2019 Note Conversion CDIs, and the 2019 Warrant exercise CDIs).

If the Company issues equity securities at a price lower than the Initial Exercise Price prior to the exercise of the August 2019 Warrant then, subject to certain exclusions, the Initial Exercise Price will be adjusted to the lowest such price (in US dollars) to ensure the economic value of the August 2019 Warrant is not adversely affected. For example, if the Company issued CDIs at the equivalent of $0.01 to an investor, Crystal Amber’s Initial Exercise Price would be reduced from $0.02 to $0.01. As a result, if the August 2019 Warrant was issued, on exercising the August 2019 Warrant in full (assuming there had been no earlier exercise of the August 2019 Warrant) Crystal Amber would be entitled to purchase229,844,650CDIs at an exercise price per CDI equal to $0.01 rather than $0.02.

There are no participating rights or entitlements inherent in the August 2019 Warrant and Crystal Amber will not be entitled to participate in new issues of capital that may be offered to stockholders (except where Crystal Amber has exercised the August 2019 Warrant before the record date to participate in such new issue).

If there is a bonus issue to the holders of CDIs after the date of issue of the August 2019 Warrant, the number of CDIs over which the August 2019 Warrant would be exercisable would be increased by the number of CDIs which Crystal Amber would have received if it had exercised the August 2019 Warrant before the record date for the bonus issue.

Additionally, if there is a pro rata issue (except a bonus issue) of securities to any holder of CDIs or shares of common stock after the date of issue of the August 2019 Warrant, the then applicable exercise price for each CDI under the August 2019 Warrant will be reduced in accordance with the formula set out in ASX Listing Rule 6.22.2.

Any securities issued upon exercise of the August 2019 Warrant will be subject to a sale restriction for a period of 12 months after their issue, except as permitted by the Corporations Act 2001 (Cth).

Use of Proceeds

The Company intends to use the net proceeds raised from any exercise of the August 2019 Warrant to provide funding for the Company’s ongoing general operating and working capital needs and to assist with the initiation of patient enrollment for STEP-1 (United States) and I-STEP (India with Apollo Sugar) clinical studies and for continuing work towards securing a CE Mark for EndoBarrier.

ASX Listing Rules

We are seeking approval from our stockholders for the issuance of the August 2019 Warrant and the subsequent issue of CDIs or common stock to Crystal Amber upon the exercise of the August 2019 Warrant.

ASX Listing Rule 10.11 prohibits, subject to certain exceptions, a company from issuing or agreeing to issue equity securities to a related party without stockholder approval. Crystal Amber is considered to be a related party because as of October 31, 2019 it owned approximately 72.3% of the Company’s issued capital. Therefore stockholder approval is now being sought under this Proposal 7, for the purposes of ASX Listing Rule 10.11 and for all other purposes, to permit the Company to issue to Crystal Amber the August 2019 Warrant and any CDIs or shares of common stock on subsequent exercise of the August 2019 Warrant.

As stockholder approval is being sought under ASX Listing Rule 10.11, approval under ASX Listing Rule 7.1 is not required in accordance with ASX Listing Rule 7.2 (Exception 14). If Proposal 7 is approved, the August 2019 Warrant will be excluded from the calculation of the number of securities that can be issued by the Company in the 12-month period following the date of issue of the August 2019 Warrant under ASX Listing Rule 7.1, therefore providing the Company with flexibility to issue securities in the next 12 months should the Board consider it is in the interests of the Company and its stockholders to do so.

In accordance with ASX Listing Rule 10.13, the following information is provided in relation to this Proposal 7:

| ● | the August 2019 Warrant will be issued to Crystal Amber, a related party of the Company as detailed above; |

| | | |

| ● | the August 2019 Warrant has a nil issue price. The exercise price (described above) will be payable in cash or may be settled by cashless exercise by the surrender of CDIs or common stock that may otherwise be issued on exercise under the August 2019 Warrant; |

| | | |

| ● | the maximum number of CDIs that may be issued on exercising the August 2019 Warrant is229,844,650; |

| | | |

| ● | if approved, the August 2019 Warrant is intended to be issued within five days from the date of this Special Meeting but in any event will be issued no later than one month from the date of this Special Meeting; and |

| | | |

| ● | the full set of terms and conditions on which the August 2019 Warrant will be issued are set out in the August 2019 Securities Purchase Agreement and August 2019 Warrant, copies of which are provided in Annexures B and C, respectively. |

Interconditionality of Proposal 7 with Proposal 6

Proposals 6 and 7 are interconditional. As a result, if Proposal 6 is not approved at the Special Meeting, Proposal 7 will be withdrawn and not put to stockholders for approval.

As noted in Proposal 6, if stockholders do not approve Proposals 6 and 7, Crystal Amber will not be able to convert the outstanding balance of the August 2019 Note, Crystal Amber will be entitled to receive an amount in cash equal to 110% of the outstanding face value amount of the August 2019 Note plus all unpaid interest to satisfy the Company’s obligations under the August 2019 Note and the Company will not be entitled to issue the August 2019 Warrant (discussed in this Proposal 7). Unless we are able to obtain alternative financing to pay the amounts due under the August 2019 Note as they become due, which may not be available to us on as favorable terms, or at all, we may be forced to consider a possible winding up or dissolution of our business.

Voting Exclusion Statement

The Company will disregard any votes cast on Proposal 7 by Crystal Amber Fund Limited, or its nominee, or any associate of those persons. However, the Company need not disregard a vote if:

| ● | it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card; or |

| | | |

| ● | it is cast by the person chairing the Special Meeting as a proxy for a person who is entitled to vote, in accordance with a direction on the proxy card to vote as the proxy decides. |

Vote Required and Board of Directors Recommendation

The affirmative vote of the majority of votes cast for Proposal 7 is required for approval.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 7 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL 7.

PROPOSAL 8: ADJOURNMENT OF THE MEETING

Our stockholders and CDI holders are being asked to consider and vote upon an adjournment of the Special Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of any of Proposals 1 through 7.

The affirmative vote of a majority of the votes cast for this proposal is required for approval.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE TO APPROVE THE ADJOURNMENT OF THE SPECIAL MEETING, EVEN IF A QUORUM IS PRESENT, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES TO APPROVE ANY OF PROPOSALS 1 THROUGH 7.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of October 31, 2019, information regarding beneficial ownership of our common stock, and common stock held as CDIs, by the following:

| ● | each person, or group of affiliated persons, who is known by us to beneficially own 5% or more of any class of our voting securities; |

| ● | each of our named executive officers; and |

| ● | all current directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC. Beneficial ownership generally includes voting or investment power of a security and includes shares underlying options, warrants or other convertible securities that are currently exercisable or convertible or exercisable or convertible within 60 days of October 31, 2019. This table is based on information supplied by officers, directors and principal stockholders. Except as otherwise indicated, we believe that the beneficial owners of the CDIs and common stock listed below, based on the information each of them has given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply.

Percentage of ownership is based on 34,388,678 shares of outstanding common stock, or common stock equivalent CDIs, outstanding on October 31, 2019. Unless otherwise indicated, we deem shares and CDIs subject to options and warrants that are exercisable within 60 days of October 31, 2019, to be outstanding and beneficially owned by the person holding the options for the purpose of computing percentage ownership of that person, but we do not treat them as outstanding for the purpose of computing the ownership percentage of any other person.

Because CDIs represent one-fiftieth of a share of our common stock, converting the number of CDIs owned by the person holding them into the equivalent number of shares of common stock may result in fractional shares of common stock. In the following table, the number of shares of common stock owned by each beneficial owner is rounded down to the nearest whole share of common stock.

Unless otherwise indicated in the table, the address of each of the individuals named below is: c/o GI Dynamics, Inc., 320 Congress Street, Boston, MA 02210, U.S.A.

| Name and Address of Beneficial Owner | | | | Number of

Shares of

Common

Stock | | | Percentage of

Common

Stock | |

| 5% Stockholders | | | | | | | | |

| Crystal Amber Fund Limited | | (1) | | | 26,753,186 | | | | 73.1 | % |

| Richard Cashin | | (2) | | | 3,987,294 | | | | 10.9 | % |

| | | | | | | | | | | |

| Directors and Executive Officers | | | | | | | | | | |

| Daniel J. Moore | | (3) | | | 6,500 | | | | * | |

| Timothy J. Barberich | | (4) | | | 76,074 | | | | * | |

| Oern R. Stuge, M.D. | | (5) | | | 30,000 | | | | * | |

| Juliet Thompson | | (6) | | | 30,000 | | | | * | |

| Scott W. Schorer | | (7) | | | 1,890,145 | | | | 5.2 | % |

| Charles Carter | | (8) | | | 385,226 | | | | 1.1 | % |

| All directors and executive officers as a group (6 persons) | | | | | 2,417,945 | | | | 6.6 | % |

| (1) | Based upon our corporate records and upon the information provided by Crystal Amber Fund Limited (“CAFL”), in a Notice of Change of Interests of Substantial Holder (Form 604) filed with the ASX on October 7, 2019, reporting as of October 7, 2019. The address for CAFL is P.O. Box 286, Floor 2, Trafalgar Court, Les Banques, St Peter Port, Guernsey GY14LY U.K. Includes 5,855,129 shares outstanding (held as CDIs) and 2,209,618 shares of common stock underlying warrants to purchase CDIs exercisable within 60 days of October 31, 2019. Excludes shares that may be issued in the future upon the conversion of the August 2019 Note and exercise of the August 2019 Warrant, if approved by the stockholders of the Company. |

| (2) | Based on our corporate records. The address for Mr. Cashin is c/o One Equity Partners, 510 Madison Avenue, 19th Floor, New York, NY 10022. |

| (3) | Includes 1,000 shares and 5,500 shares subject to options exercisable within 60 days of October 31, 2019. Excludes grant contemplated in this proxy statement. |

| (4) | Includes 62,074 shares and 14,000 shares subject to options exercisable within 60 days of October 31, 2019. Excludes grant contemplated in this proxy statement. |

| (5) | Includes 27,492 shares subject to options exercisable within 60 days of October 31, 2019. Excludes grant contemplated in this proxy statement. |

| (6) | Includes 22,494 shares subject to options exercisable within 60 days of October 31, 2019. Excludes grant contemplated in this proxy statement. |

| (7) | Includes 426,657 shares subject to options exercisable within 60 days of October 31, 2019. |