UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

GI DYNAMICS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

GI DYNAMICS, INC.

320 Congress Street, Floor 3

Boston, MA 02210

[File Date] 2020

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of GI Dynamics, Inc. (“GI Dynamics” or the “Company”) to be held on [US Mtg Date] 2020, at 5:00 p.m., United States Eastern Daylight Time (“EDT”) which is [AUS Mtg Date] 2020, at 8:00 a.m., Australian Eastern Standard Time (“AEST”). As a result of the public health and travel guidance and concerns due to COVID-19, the Special Meeting will be held virtually via telephone and internet audio streaming. You may, vote and submit questions during the Special Meeting via telephone [accessible through ●]. The attached Notice of Special Meeting and accompanying proxy statement describe the business which the Company will conduct at the Special Meeting and provides information about GI Dynamics that you should consider when you vote your shares of common stock. Unless otherwise indicated, all dollar amounts in the attached Notice of Special Meeting and accompanying proxy statement are in U.S. Dollars. Any references to A$ are to Australian dollars.

At the Special Meeting, the Company will ask stockholders to (i) approve the delisting of the Company from the Official List of the Australian Securities Exchange (the “ASX”) on a date that is not less than one month from the date on which the delisting is approved by stockholders for the purposes of ASX Listing Rule 17.11 and for all other purposes, and that the Company’s Board of Directors be authorized to do all things reasonably necessary to give effect to the delisting of the Company from the Official List of the ASX; and (ii) authorize the adjournment of the Special Meeting, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of the foregoing Proposal.

All stockholders and holders of the Company’s CDIs are invited to virtually attend the Special Meeting and the Company hopes you will be able to virtually attend the Special Meeting. Whether or not you expect to virtually attend the Special Meeting, you are urged to vote or submit your proxy card or CDI Voting Instruction Form as soon as possible so that your shares of common stock (or shares of common stock underlying your CDIs) can be voted at the Special Meeting in accordance with your instructions. When you have finished reading the proxy statement, the Company encourages you to vote promptly. You may vote your shares of common stock (or direct CHESS Depositary Nominees Pty Ltd (“CDN”) to vote if you hold your shares of common stock in the form of CDIs) by following the instructions on the enclosed proxy card or the CDI Voting Instruction Form. Internet voting is available as described in the enclosed materials. The Company encourages you to vote by proxy so that your shares of common stock will be represented and voted at the meeting, whether or not you can virtually attend. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

Thank you for your ongoing support.

| | Sincerely, |

| | |

| | Scott Schorer |

| | President and Chief Executive Officer |

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

GI DYNAMICS, INC.

320 Congress Street, Floor 3

Boston, MA 02110

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [AUS Mtg Date] 2020 (AEST)

[US Mtg Date] 2020 (EDT)

To GI Dynamics stockholders:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders of GI Dynamics, Inc. (“GI Dynamics” or the “Company”), a Delaware corporation, will be held virtually on [US Mtg Date] 2020, at 5:00 p.m., EDT (which is on [AUS Mtg Date] 2020, at 8:00 a.m., AEST) via telephone and internet audio streaming, [accessible through ●], for the following purposes (the term “ASX” throughout the accompanying proxy statement refers to the Australian Securities Exchange):

| | 1. | To approve the delisting of the Company from the Official List of the ASX on a date that is not less than one month from the date on which the delisting is approved by stockholders for the purposes of ASX Listing Rule 17.11 and for all other purposes, and that the Company’s Board of Directors be authorized to do all things reasonably necessary to give effect to the delisting of the Company from the Official List of the ASX; and |

| | 2. | To authorize an adjournment of the Special Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1; and |

| | | |

| | 3. | To transact such other business as may be properly brought before the Special Meeting and any adjournment or postponements thereof. |

The Company’s Board of Directors recommends a vote “FOR” Proposals 1 and 2.

You are entitled to notice of and to vote at the Special Meeting only if you were a GI Dynamics stockholder as of 4:30 p.m. United States Eastern Daylight Time on 21 April 2020 (which is 7:30 a.m. on 22 April 2020 AEST), the record date for the Special Meeting (the “Record Date”). The owners of common stock as of the Record Date are entitled to vote via telephone at the Special Meeting and any adjournments or postponements of the meeting. Record holders of CDIs as of the close of business on the Record Date are entitled to receive notice of and to virtually attend the Special Meeting or any adjournment or postponement of the meeting and may instruct the Company’s CDI Depositary, CHESS Depositary Nominees Pty Ltd (“CDN”), to vote the shares of common stock underlying their CDIs by following the instructions on the enclosed CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au. Doing so permits CDI holders to instruct CDN to vote on behalf of the CDI holders at the Special Meeting in accordance with the instructions received via the CDI Voting Instruction Form or online. A list of stockholders of record will be available on request during the 10 days prior to the Special Meeting. Requests may be made by email to coporatesecretary@gidynamics.com or by phone to +1 781.357.3263.

The proxy statement that accompanies and forms part of this Notice of Special Meeting provides information in relation to each of the matters to be considered at the Special Meeting. The Notice of Special Meeting and the proxy statement should be read in their entirety. If a stockholder or a holder of the Company’s CDIs is in doubt as to how they should vote at the Special Meeting, they should seek advice from their legal counsel, accountant, or other professional adviser prior to voting.

All stockholders and holders of the Company’s CDIs are cordially invited to virtually attend the Special Meeting. Whether you plan to virtually attend the Special Meeting or not, you are requested to complete, sign, date, and return the enclosed proxy card or CDI Voting Instruction Form as soon as possible so that your shares (or the shares of common stock underlying your CDIs) can be voted at the Special Meeting in accordance with the instructions on the proxy card.

| | BY ORDER OF THE BOARD OF DIRECTORS, |

| | |

| | Charles R. Carter |

| | Chief Financial Officer, Secretary, and Treasurer |

| | Boston, Massachusetts |

[File Date] 2020

TABLE OF CONTENTS

PRELIMINARY PROXY STATEMENT — SUBJECT TO COMPLETION

GI DYNAMICS, INC.

320 Congress Street, Floor 3

Boston, MA 02110

PROXY STATEMENT FOR THE GI DYNAMICS

2020 SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON [US Mtg Date] 2020 (EDT)

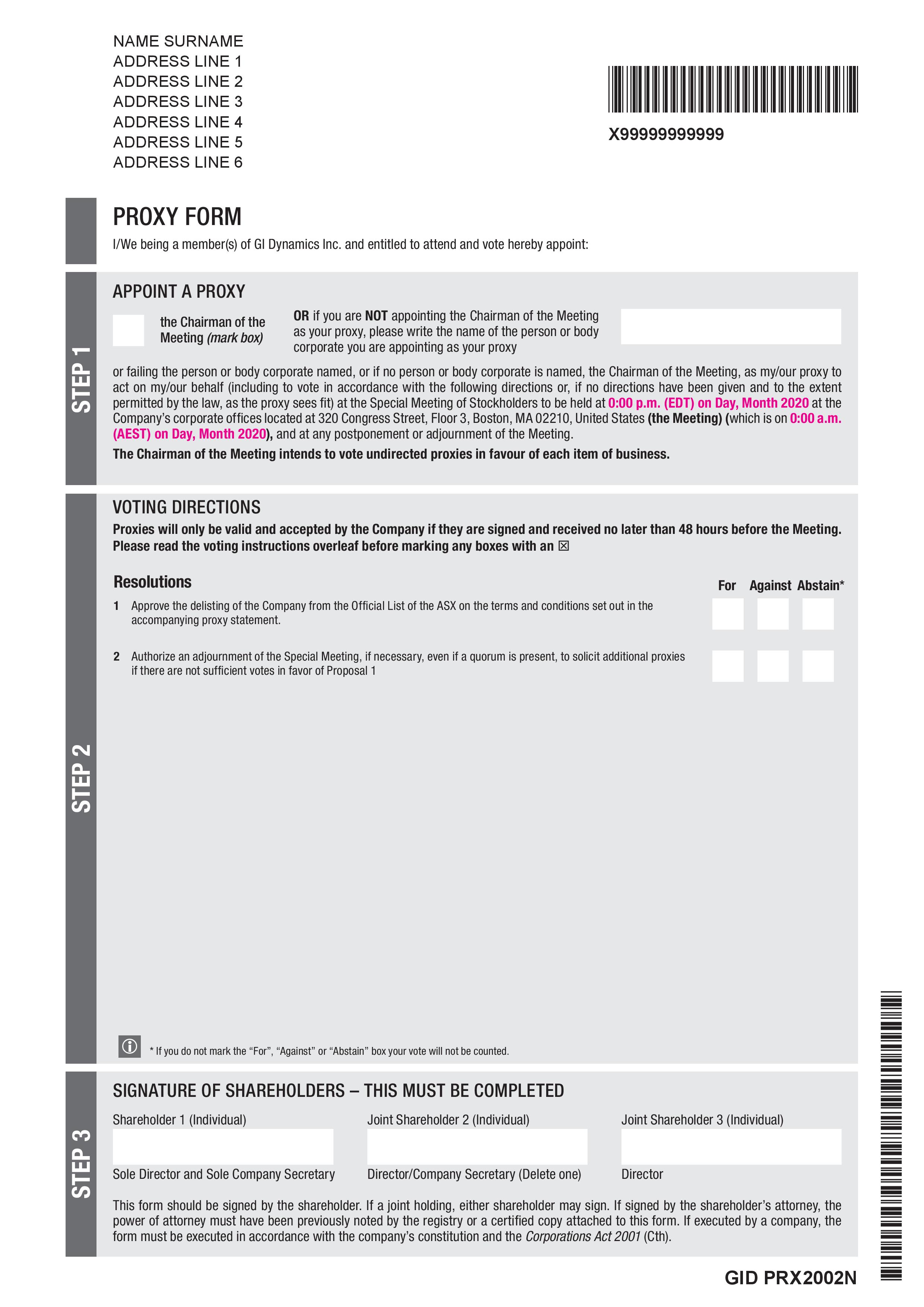

This proxy statement and the enclosed proxy card and CDI Voting Instruction Form are being mailed to stockholders and CDI holders on or about [Mailing Date] 2020 and are furnished in connection with the solicitation of proxies by the Board of Directors of GI Dynamics, Inc. (“GI Dynamics” or the “Company”) for use at a special meeting of stockholders (the “Special Meeting”) to be held on [US Mtg Date] 2020, at 5:00 p.m., EDT (which is on [AUS Mtg Date] 2020, at 8:00 a.m., AEST). As a result of the public health and travel guidance and concerns due to COVID-19, the Special Meeting will be held virtually. You may vote and submit questions during the Special Meeting via telephone [accessible through ●].

IMPORTANT: To ensure that your shares of common stock are represented at the Special Meeting, please vote your shares of common stock (or, for CDI holders, direct CDN to vote your CDIs) via the Internet or by marking, signing, dating, and returning the enclosed proxy card or CDI Voting Instruction Form to the address specified. If you attend the Special Meeting virtually, you may choose to vote via telephone [accessible through ●] even if you have previously voted your shares of common stock, except that CDI holders may only instruct CDN to vote on their behalf by completing and signing the CDI Voting Instruction Form or voting online at www.linkmarketservices.com.au and may not vote virtually at the Special Meeting.

IMPORTANT INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

This proxy statement summarizes the information you need to know to vote at the Special Meeting. You do not need to virtually attend the Special Meeting to vote your shares of common stock or CDIs. Instead, if you hold shares of common stock you may vote your shares of common stock by marking, signing, dating and returning the enclosed proxy card or as otherwise described in this proxy statement. If you hold CDIs, you may vote your CDIs by signing and returning the enclosed CDI Voting Instruction Form. Unless otherwise indicated, all dollar amounts in this proxy statement are in U.S. Dollars. The Company will pay the cost of soliciting proxies.

Why is the Company Soliciting My Proxy?

The Board of Directors of GI Dynamics (the “Board”) is soliciting your proxy to vote at the Special Meeting that will be held on [US Mtg Date] 2020, at 5:00 p.m., EDT (which is on [AUS Mtg Date] 2020, at 8:00 a.m., AEST) and any adjournments of the Special Meeting. As a result of the public health and travel guidance and concerns due to COVID-19, the Special Meeting will be held virtually. You may vote and submit questions during the Special Meeting via telephone, [accessible through ●]. This proxy statement, along with the accompanying Notice of 2020 Special Meeting of Stockholders, summarizes the purposes of the Special Meeting and the information you need to know to vote at the Special Meeting.

If you held shares of the Company’s common stock at 7:30 a.m. on 22 April 2020, AEST, which is 4:30 p.m. on 21 April 2020 (EDT) (the “Record Date”), you are invited to virtually attend the Special Meeting and telephonically vote on the Proposals described in this proxy statement. Those persons holding CDIs are entitled to receive notice of and to virtually attend the Special Meeting and may instruct CDN to vote at the Special Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

The Company has sent you this proxy statement, the Notice of 2020 Special Meeting of Stockholders and the proxy card or CDI Voting Instruction Form because you owned shares of GI Dynamics’ common stock or CDIs on the Record Date. The Company intends to commence distribution of these proxy materials to stockholders on or about [AUS Mailing Date] 2020, which is [US Mailing Date] 2020.

Who Can Vote?

If you were a holder of GI Dynamics common stock on the Record Date, either as a stockholder of record or as the beneficial owner of shares held in street name, you may vote your shares at the Special Meeting. As of the Record Date, there were 36,598,296 shares of common stock (representing 1,829,914,800 CDIs if all shares of common stock were held as CDIs) outstanding and entitled to vote. The Company’s common stock is the Company’s only class of voting stock. Each stockholder has one vote for each share of common stock held as of the Record Date. Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. As summarized below, there are some distinctions between shares held of record and those owned beneficially and held in street name.

You do not need to virtually attend the Special Meeting to vote your shares (or shares underlying your CDIs). Shares represented by valid proxies or, for CDI holders, by valid CDI Voting Instruction Forms, received in time for the Special Meeting and not revoked prior to the Special Meeting, will be voted at the Special Meeting. For instructions on how to change or revoke your proxy, see “May I Change My Vote or Revoke My Proxy?” below.

What Does It Mean To Be A “Stockholder Of Record?”

You are a “stockholder of record” if your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer and Trust Company. As a stockholder of record, you have the right to grant your voting proxy directly to GI Dynamics or to vote telephonically at the Special Meeting. If you received printed proxy materials, the Company has enclosed or sent a proxy card for you to use. You may also vote by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?” Holders of CDIs are entitled to receive notice of and to virtually attend the Special Meeting and may direct CDN to vote at the Special Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.linkmarketservices.com.au.

What Does It Mean To Beneficially Own Stock In “Street Name?”

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker-dealer, trust, or other similar organization. While the Company does not believe that any shares of common stock are held by brokers, banks, trustees or other nominees as of the Record Date, if you do own shares in street name, the proxy materials were forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee or nominee how to vote your shares, and you are also invited to virtually attend the Special Meeting. If you hold your shares in street name and do not provide voting instructions to your broker, bank, trustee or nominee, your shares will not be voted on any Proposals on which your broker, bank, trustee or nominee does not have discretionary authority to vote (a “broker non-vote”).

Since a beneficial owner is not the stockholder of record, you may not vote your shares telephonically at the Special Meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the meeting. If you do not wish to vote telephonically or you will not be virtually attending the Special Meeting, you may vote by proxy or by Internet, as described below under the heading “How Do I Vote My Shares of GI Dynamics Common Stock?”

How Do I Vote My Shares of GI Dynamics Common Stock?

Whether you plan to virtually attend the Special Meeting or not, the Company urges you to vote by proxy. If you vote by proxy, the individuals named on the proxy card, or your “proxies,” will vote your shares of common stock in the manner you indicate. You may specify whether your shares of common stock should be voted for, against, or abstain with respect to all of the Proposals to be voted on at the Special Meeting. Voting by proxy will not affect your right to virtually attend the Special Meeting. If your shares of common stock are registered directly in your name through the Company’s stock transfer agent, American Stock Transfer and Trust Company, or you have stock certificates registered in your name, you may vote:

| | ● | By mail. Complete and mail the enclosed proxy card in the enclosed postage prepaid envelope. Your proxy will be voted in accordance with your instructions. If you sign the proxy card but do not specify how you want your shares of common stock voted, they will be voted as recommended by the Board. The proxy card must be received prior to the Special Meeting. |

| | ● | By Internet. Follow the instructions attached to the proxy card to vote by Internet. |

| | ● | Virtually at the meeting. If you attend the Special Meeting virtually, you may vote via telephone [accessible through ●]. |

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 8:00 a.m. on [AUS Mtg Date -1] 2020 AEST (which is 5:00 p.m. on [US Mtg Date -1] 2020 EDT).

If your shares of common stock are held in “street name” (held in the name of a broker, bank, trustee or nominee), you must provide the broker, bank, trustee or nominee with instructions on how to vote your shares of common stock and can do so as follows:

| | ● | By mail. Follow the instructions you receive from your broker, bank, trustee or nominee explaining how to vote your shares of common stock. |

| | ● | By Internet or by telephone. Follow the instructions you receive from your broker, bank, trustee or nominee to vote by Internet or telephone. |

| | ● | Virtually at the meeting. Contact the broker, bank, trustee or nominee that holds your shares of common stock to obtain a broker’s proxy card and have it with you during the Special Meeting. You will not be able to telephonically vote at the Special Meeting unless you have a proxy card with [identity authentication ●] from your broker, bank, trustee or nominee. |

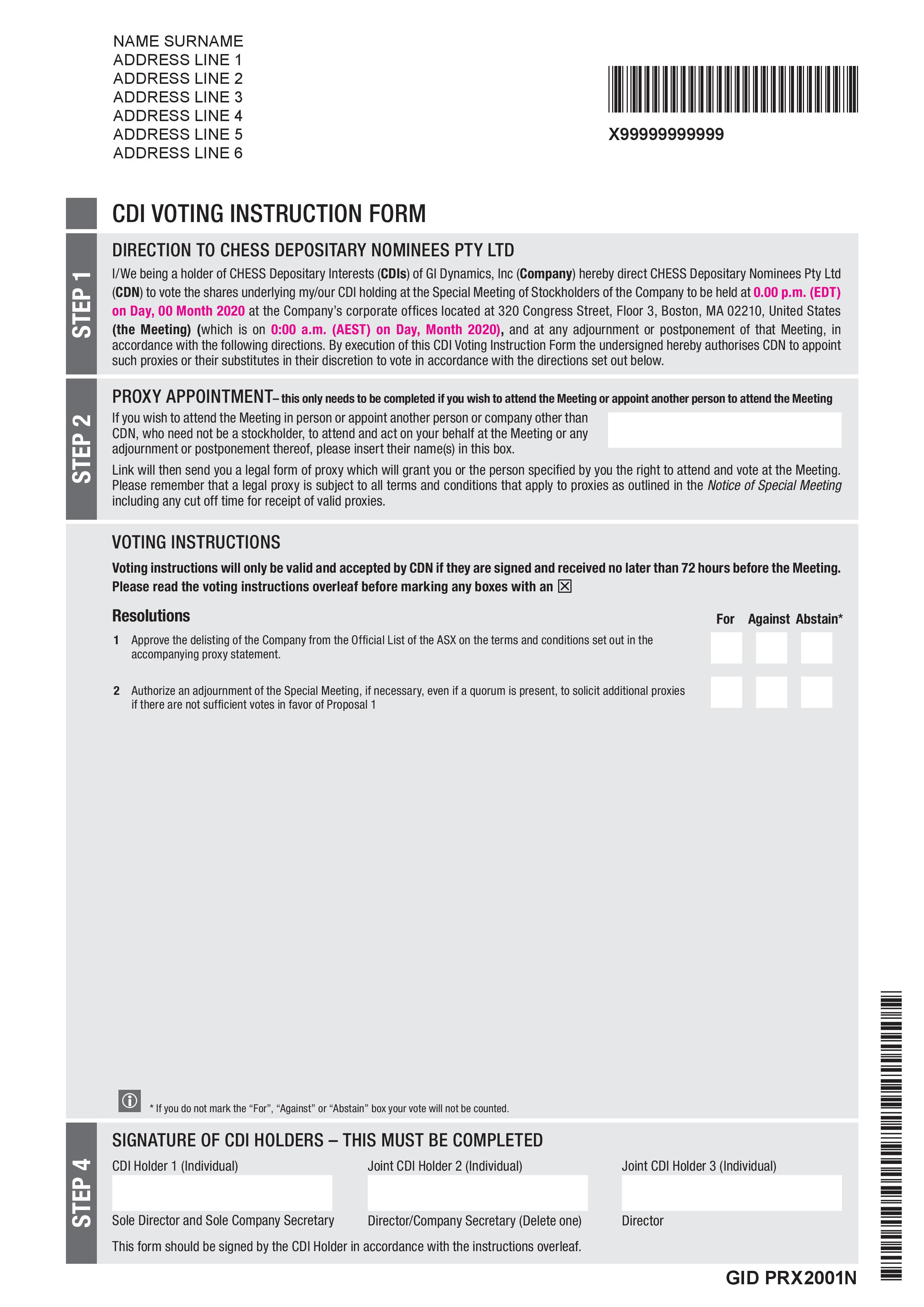

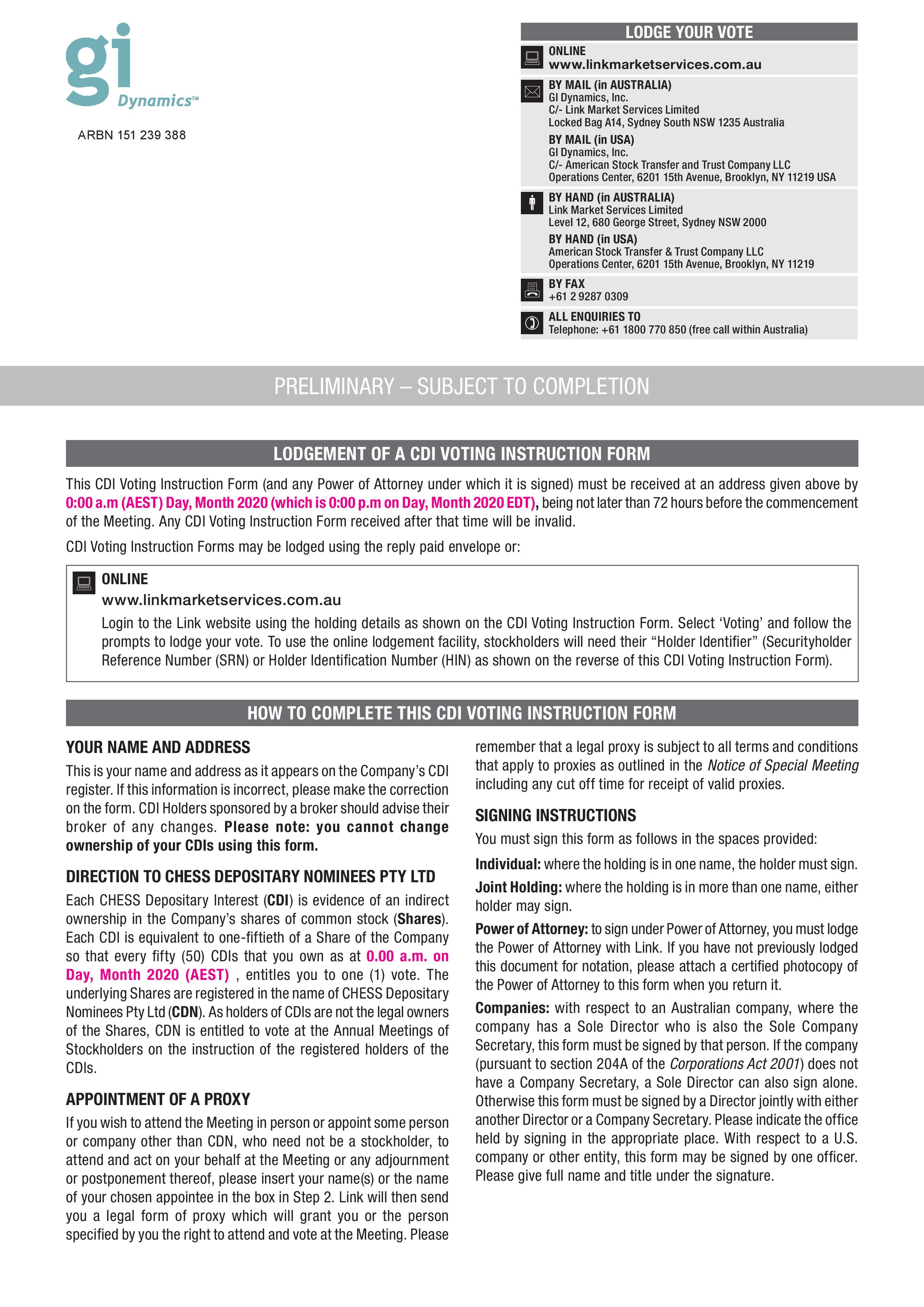

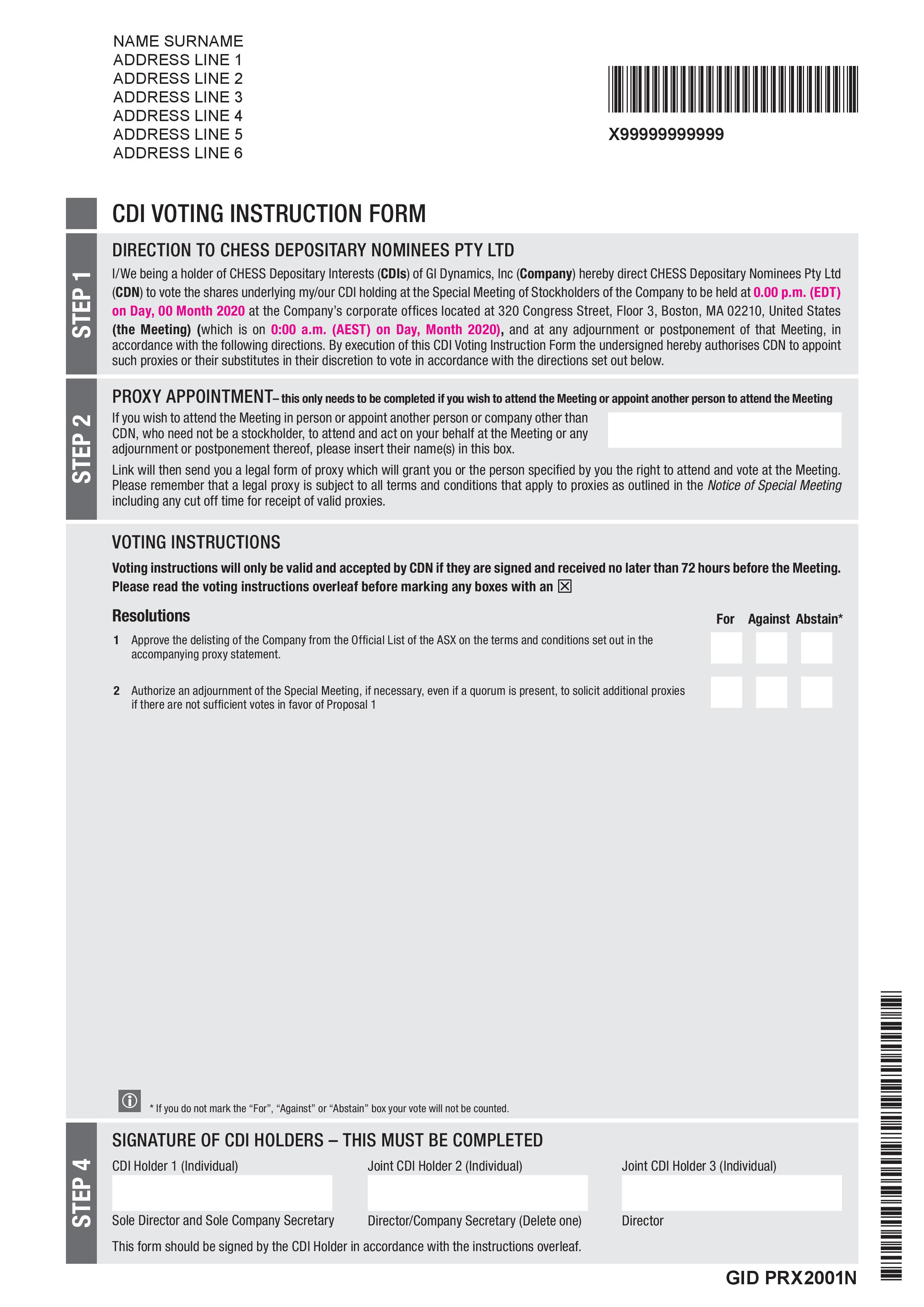

How Do I Vote If I Hold CDIs?

Each CDI holder is entitled to direct CDN to vote one vote for every fifty (50) CDIs held by such holder. Those persons holding CDIs are entitled to receive notice of and to virtually attend the Special Meeting and any adjournment or postponement thereof, and may direct CDN to vote their underlying shares of common stock at the Special Meeting by voting online at www.linkmarketservices.com.au, or by returning the CDI Voting Instruction Form to Link Market Services Limited, the agent the Company designated for the collection and processing of voting instructions from the Company’s CDI holders, so that it is received by Link Market Services Limited no later than 8:00 a.m. AEST on [AUS Mtg Date – 1 day] 2020 (which is 5:00 p.m. EDT on [US Mtg Date – 1 day] 2020) in accordance with the instructions on such form. Doing so permits CDI holders to instruct CDN to vote on their behalf in accordance with their written directions.

Alternatively, CDI holders have the following options in order to vote at the Special Meeting:

| | ● | informing GI Dynamics that they wish to nominate themselves or another person to be appointed as CDN’s proxy for the purposes of attending and voting at the Special Meeting; or |

| | ● | converting their CDIs into a holding of shares of GI Dynamics common stock and voting these telephonically at the meeting (however, if thereafter the former CDI holder wishes to sell their investment on the ASX, it would be necessary to convert shares of common stock back into CDIs). This must have been done prior to the Record Date for the Special Meeting. |

Holders of CDIs must comply with one of the instructions above if they wish to vote at the Special Meeting.

How Does the Board Recommend That I Vote on the Proposals?

The Company’s Board recommends that you vote as follows:

| | 1. | “FOR” the approval of the delisting of the Company from the Official List of the ASX; and |

| | | |

| | 2. | “FOR” adjourning the Special Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1. |

If any other matter is presented at the Special Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with the proxy’s best judgment. At the time this proxy statement was first made available, the Company knew of no matters that needed to be acted on at the Special Meeting, other than those discussed in this proxy statement.

May I Change My Vote or Revoke My Proxy?

If you are a stockholder of record and give the Company your proxy, you may change your vote or revoke your proxy at any time before the Special Meeting in any one of the following ways:

| | ● | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| | ● | by re-voting by Internet as instructed above; |

| | ● | by notifying the Company’s corporate secretary in writing at GI Dynamics, Inc., 320 Congress Street, Boston, MA 02210, U.S.A., Attention: Corporate Secretary, before the Special Meeting that you have revoked your proxy; or |

| | ● | by virtually attending the Special Meeting, revoking your proxy and voting telephonically. Virtual attendance at the Special Meeting will not in and of itself revoke a previously submitted proxy. You must specifically request during the Special Meeting that it be revoked. |

Your most current vote, whether by Internet or proxy card, is the one that will be counted.

If you are a beneficial owner and hold shares of common stock through a broker, bank or other nominee, you may submit new voting instructions by contacting your broker, bank or other nominee.

If you are a holder of CDIs and you direct CDN to vote by completing the CDI Voting Instruction Form, you may revoke those directions by delivering to Link Market Services Limited a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent which notice must be received by Link Market Services Limited no later than 8:00 a.m. AEST on [AUS Mtg Date – 1 day] 2020 (which is 5:00 p.m. EDT on [US Mtg Date – 1 day] 2020).

Where Can I find the Voting Results of the Special Meeting?

The preliminary voting results will be announced at the Special Meeting. In accordance with the requirements of ASX Listing Rule 3.13.2, the Company will disclose to ASX the voting results of the Special Meeting immediately after the meeting and will also report the results on a current report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”).

How Do I Virtually Attend the Special Meeting?

As a result of the public health and travel guidance and concerns due to COVID-19, the Special Meeting will be held virtually. You may vote and submit questions during the Special Meeting via telephone [accessible through ●].

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, the votes the shares represent will not be counted if you do not vote as described above under “How Do I Vote My Shares of GI Dynamics Common Stock?” While the Company does not believe that any shares of common stock are held by brokers, banks, trustees or other nominees as of the Record Date, if your shares are held in street name and you do not provide voting instructions to the broker, bank or other nominee that holds your shares as described above, the broker, bank or other nominee that holds your shares has the authority to vote your unvoted shares only with respect to so-called “routine” matters where they have discretionary voting authority over your shares. The Company does not believe that any of the Proposals being voted upon at the Special Meeting are “routine” matters. Accordingly, the broker, bank or other nominee will not have discretionary authority to vote on any of the Proposals.

The Company encourages you to provide voting instructions to your broker, bank, or other nominee. This ensures your shares will be voted at the Special Meeting and in the manner you desire. If your broker, bank or other nominee cannot vote your shares on a Proposal at the Special Meeting because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker, bank or other nominee chooses not to vote on a matter for which it does have discretionary voting authority, a “broker non-vote” will be reported.

The vote required to approve each Proposal and the manner in which votes are counted is set forth below.

| Proposal 1: Approve the delisting of the Company from the Official List of the ASX | | The affirmative vote of at least 75% of the votes cast in respect of this Proposal is required to approve the delisting of the Company from the Official List of the ASX. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the approval of the proposed delisting. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| | | |

| Proposal 2: Approve the adjournment of the Special Meeting to solicit additional proxies if there are not sufficient votes in favor of Proposal 1 | | The affirmative vote of a majority of the votes cast is required for the approval of this Proposal 2. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares. As a result, any shares not voted by a customer will be treated as broker non-votes. Broker non-votes will have no effect on the results of this vote. |

What Constitutes a Quorum for the Special Meeting?

The presence, virtually or by proxy, of the holders of one-third of the voting power of all outstanding shares of the Company’s common stock entitled to vote at the Special Meeting is necessary to constitute a quorum at the Special Meeting. Votes of stockholders of record who are present at the Special Meeting virtually or by proxy, abstentions, and broker non-votes are counted for the purposes of determining whether a quorum exists. If there is no quorum, the chairman of the Special Meeting or the holders of a majority of shares of common stock (including underlying shares represented by CDIs) present at the Special Meeting, either virtually or by proxy, may adjourn the Special Meeting to solicit additional proxies and reconvene the Special Meeting at a later date.

Could Other Matters Be Decided at the Special Meeting?

The Company is currently unaware of any matters to be raised at the Special Meeting other than those referred to in this proxy statement. If other matters are properly presented for consideration at the Special Meeting and you are a stockholder of record and have submitted your proxy, the persons named in your proxy will have the discretion to vote on those matters for you.

Electronic Delivery of Future Stockholder Communications

Most stockholders and CDI holders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail. If you are a stockholder or CDI holder of record, you can choose this option and save the Company the cost of producing and mailing these documents by going to www.linkmarketservices.com.au, accessing your account information and following the instructions provided.

PROPOSAL 1 — APPROVAL OF THE DELISTING OF THE COMPANY FROM THE OFFICIAL LIST

OF THE ASX

Background

Given the financial position of the Company and the fact that it is still currently at a clinical development and pre-commercialisation stage, the Board of Directors of the Company (the “Board”) has been considering for some time whether it is in the best interests of the Company and its stockholders to remain listed on the Official List of the ASX (the “Official List”). Additionally, Crystal Amber Fund Limited (“Crystal Amber”), the Company’s largest stockholder, together with the second largest stockholder of the Company (who collectively hold approximately 80% of the Company’s outstanding common stock), have both independently expressed to the Company their belief that the Company should consider a delisting from the Official List.

As stockholders are aware, the Company has for a number of years been heavily reliant on Crystal Amber for the funding required to carry on the Company’s business, resulting in an overconcentrated position. In alignment with Crystal Amber, the Company has for an extended period of time been actively seeking to raise funds from other additional investors to balance ownership, but has had only limited success in attracting new investors. In seeking to raise additional capital, the Company has encountered a number of challenges ranging from potential investors having investment restrictions that preclude them from investing in any listed entities, restrictions that preclude them from investing in listed entities that are in the pre-commercial, development stage, to restrictions that preclude them from investing in a U.S. incorporated company that is not listed on a U.S. based stock exchange, such as the Nasdaq Stock Market LLC or the New York Stock Exchange.

Certain potential investors have also indicated that they may be interested in investing in the Company if it were not listed on the ASX. In this respect, the Company is currently in non-binding discussions with a potential investor regarding an equity investment in the Company (the “Potential Financing”) and this investor has informed the Company that if any investment was to occur it would be conditional on the Company no longer being listed on the ASX and the securities that would need to be issued to it would need to contain certain preferential terms for the investor (which would be unusual and potentially not possible to implement in an ASX-listed company environment). While the Company is continuing discussions with this potential investor there is no guarantee that any such investment will actually be completed even if the Company were to be delisted from the Official List. The requirement of the investor that the Company be an unlisted company is, in the Board’s experience, consistent with the approach that many potential investors have been adopting. As a result, remaining listed on the ASX is currently proving to be incompatible with the requirements of those investors that are interested in investing in GI Dynamics as a clinical development stage company, and without the necessary funding the Company will be unable to continue to carry on business.

As a result, for the reasons set out above and later in this section of the proxy statement, the Company has sought the in-principle advice of ASX in relation to a possible delisting of the Company from the Official List under ASX Listing Rule 17.11 (the “Delisting”). ASX has now provided its in principle advice and has confirmed that it is likely to agree to the removal of the Company from the Official List provided the Company satisfies all of the conditions that are set out below.

Conditions to Delisting

As is its usual practice, ASX has imposed a requirement under Listing Rule 17.11 and Guidance Note 33 “Removal of Entities from ASX Official List” for the Company to obtain stockholder approval if it wishes to delist from the Official List. The ASX has imposed the following conditions in connection with the obtaining of stockholder approval and the filing of a formal delisting application:

| 1. | “The request for removal of GID from the official list of ASX is approved by a special resolution of shareholders of GID (which requires a vote of no less than 75% of the shares of common stock, including the underlying shares represented by CDIs, present virtually or by proxy at this Special Meeting). |

| 2. | The notice of meeting seeking shareholder approval for GID’s removal from the Official List must include a statement, in form and substance satisfactory to ASX, setting out: |

| (a) | a timetable of key dates, including the time and date at which GID will be removed from ASX if that approval is given; and |

| (b) | that if shareholders wish to sell their shares on ASX, they will need to do so before GID is removed from the official list of ASX; and if they do not, details of the processes that will exist after GID is removed from the official list to allow a shareholder to dispose of their holdings and how they can access those processes. |

| 3. | The removal shall not take place any earlier than one month after security holder approval is obtained. |

| 4. | GID releases the full terms of this decision to the market upon making a formal application to ASX to remove it from the official list of ASX.” |

In accordance with the conditions imposed by the ASX, the Company is seeking, under this Proposal 1, stockholder approval for the proposed Delisting. This notice of Special Meeting contains the required information described above.

Final Delisting Advice

As the in-principle advice provided by ASX was in line with the Company’s expectations, the Company is anticipating that it will lodge a final delisting application with ASX seeking removal of the Company from the Official List pursuant to ASX Listing Rule 17.11 on or about the date of this proxy statement. The Company will release an announcement on ASX confirming when this has occurred.

Effect of the Approval

In the event that (i) the final delisting application is approved by ASX and (ii) stockholders approve the Delisting at the Special Meeting, the Company will be delisted from the ASX on a date that is one month after the date on which stockholder approval for the Delisting is obtained at the Special Meeting (“Delisting Date”). Should stockholder approval be obtained for this Proposal 1, then the Company will be committed to the delisting process and will delist on the Delisting Date.

To assist stockholders in considering this Proposal, a broad overview of the reasons in favor of pursuing a Delisting, the advantages and disadvantages of a Delisting, the intentions of the Company post-Delisting (should it occur), the consequences of Delisting and details of how the Company would be regulated if a Delisting were to occur are set out below.

Timing for Delisting

The timetable for the Delisting is set out below

| Event | | Proposed Date |

| Date of Proxy Statement and Notice of Special Meeting | | [●] May 2020 |

| Date of Special Meeting | | [●] June 2020 |

| Trading Suspension Date | | [●] June 2020 |

| Delisting Date | | [●] June 2020 |

Trading of Securities

In the event that a Delisting occurs, stockholders that wish to sell their CDIs on ASX will need to do so before the time at which the Company’s CDIs are suspended from trading on the Official List (the “Trading Suspension Date”).

If CDI holders do not sell their CDIs prior to the Trading Suspension Date, their CDIs will need to be converted to shares of common stock in the Company. Details of the process to convert CDIs to common stock are set out in more detail below.

Intentions for the Company following the Delisting

If a Delisting is to occur, the Board’s current view on the future intentions for the Company are as follows:

| ● | Corporate Form:The Company will operate as a U.S. (Delaware) incorporated corporation, which is subject to the reporting requirements of the SEC’s rules and regulations pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended. |

| ● | Continuation of current business plan: The Board plans to continue to pursue the Company’s stated business objectives, including raising the capital required to allow it to (i) seek to attain CE mark designation for EndoBarrier; (ii) fully fund and complete the I-Step study in India with Apollo Sugar; and (iii) fully fund and complete the STEP-1 study in the United States. |

| ● | Management: There are no plans to make any material changes to the management of the Company prior to or subsequent to Delisting. |

| ● | Board: There are no plans to make any changes to the Board of the Company prior to Delisting. Subsequent to Delisting, it is anticipated that the Board will be re-constituted to reflect a board structure more appropriate for a private company. Such re-constitution will be subject to separate stockholder approval of the Company’s Certificate of Incorporation and Bylaws. Certain current Directors of the Board may be selected to remain on the Board with those not nominated or declining the nomination resigning. In addition, if the Potential Financing or any other form of financing were to occur, the relevant investor will likely require certain of its representatives to be appointed to the Board (depending on its percentage ownership of the Company). |

| ● | Funding: As has been announced by the Company on a number of occasions, the Company will need to raise additional funds to implement its business plan and to continue to carry on business. If the necessary funds are not raised, the Company may need to cease business operations and be wound up. As a result: |

| o | Prior to Delisting, given the Company’s need for immediate funding, it may seek to issue a convertible note or a debt instrument to one or more investors as an interim measure before seeking to secure a larger amount of equity funding, which may include the Potential Financing. There is no guarantee, however, that the Company will be able to secure any form of debt or equity funding and if this was to occur it may be required to cease business operations and be wound up. |

| o | Post Delisting, the Company will actively seek to secure debt and/or equity funding. As mentioned above, the Company is currently in non-binding discussions with a potential investor regarding a potential equity investment in the Company (i.e. the Potential Financing) but any investment would be on the basis that the Company is no longer listed on the ASX and the securities that would be issued to the investor would need to contain certain preferential terms for the investor. Again, there is no guarantee that the Company will be able to secure any form of debt or equity funding (including the Potential Financing) and if this was to occur it may be required to cease business operations and be wound up. |

Should additional funding be secured, then the issuance of new shares, which may be in an existing class of securities or a new class of securities, will be highly dilutive to existing stockholders. A new class of securities, if issued, may have special rights attached to them, including rights to Board seats, preferential rights on dividends, preferential rights on a liquidity event, including a sale of the Company, and/or enhanced voting or negative control rights over the Company. In addition, holders of a new class of securities may require the Company to agree to provide such holders with information rights, a right to participate in future offerings and other protective provisions. The Company may also issue convertible securities such as warrants that will be convertible into common stock or a new class of preferred stock in accordance with the agreed terms, which again may on conversion be highly dilutive to existing stockholders and provide the convertible security holders with preferential rights both before and after conversion.

| o | In addition to seeking new funding, the Company is also in discussions with Crystal Amber in relation to potentially restructuring the debt owed to Crystal Amber under the Senior Secured Convertible Note issued on 15 June 2017 (as amended, the “June 2017 Note”) and the Unsecured Convertible Note issued on 21 August 2019 (the “August 2019 Note”). Such restructuring may include terms that modify the existing interest rates, maturity dates and conversion mechanics; however, there is no guarantee that the Company will be able to agree to a debt restructuring with Crystal Amber. |

In the event that new funding is secured prior to the Delisting of the Company, the Company will make requisite regulatory filings and issue a detailed announcement to the market setting out the nature of the proposed fundraising and the terms of the securities that have been agreed. Similarly, the Company will also make requisite regulatory filings and issue an announcement to the market setting out any agreement reached with Crystal Amber regarding any revised debt arrangements. Given the Company’s funding initiatives, there is the possibility that the Company will file an additional proxy statement and notice of special meeting prior to the Delisting Date in order to approve the terms of any new fundraising. Subject to the terms of such fundraising, stockholders may need to approve amendments to the Company’s certificate of incorporation and bylaws in accordance with Delaware law. As it is highly likely that completion of the Delisting will be a condition precedent to the closing of any substantial fundraising, the Company currently intends to hold any further special meeting that may be required after the Company has been delisted from the Official List. As a result, while a proxy statement may be issued at the time the Company is still listed on ASX, the ASX Listing Rules in relation to the issue of securities and other related matters would not apply to the approvals being sought by the Company in any special meeting that is held after Delisting.

As noted above, the Company will provide an update to stockholders on any material fundraising and the process for its completion should terms be agreed.

Reasons that support a Delisting

In the Board’s view there are a number of reasons that support a Delisting of the Company, including:

| ● | Ongoing fundraising required to support strategic aims:The Company is currently focused on three strategic priorities comprised of seeking to (i) regain commercial approval in CE mark applicable countries and selectively execute a commercial launch; (ii) achieve an Indian clinical development and commercial launch within two years; and (iii) conduct U.S. clinical development and filing of a regulatory application to permit commercialization of EndoBarrier in the United States. The development timelines for these activities are relatively long and the Company will need toraise significant funds over the next 12 months to accomplish all three strategic objectives. As mentioned above, the Company has been in recent years reliant on its majority stockholder, Crystal Amber, for the necessary funding but has in recent times been seeking to identify alternative sources of capital. In searching for alternative capital, the Company has encountered a number of challenges as noted above including in particular the preference of investors that the Company become a private unlisted company. An example of this is the Potential Financing that the Company is currently seeking to negotiate where one of the key conditions of any investment would be the Delisting of the Company.

|

| ● | Support of major stockholders:Both Crystal Amber, as the largest stockholder, and the Company’s second largest stockholder (who together hold approximately 80% of the outstanding common stock of the Company) believe the Company should become an unlisted company. |

| ● | Misalignment of development stage of the Company relative to its listing status: In searching for alternative capital, a number of investors have expressed interest, yet cannot invest in the Company due to fund investment restrictions. Numerous life sciences focused investors that invest in pre-commercial, clinical development stage companies cannot or choose not to invest in exchange listed (public) entities, regardless of which exchange the relevant company is listed. |

| ● | Costs: The Company incurs significant direct and indirect costs in complying with the filing and reporting requirements imposed on it as a result of being listed on ASX, which is particularly burdensome for the Company given its limited cash reserves. Professional fees of lawyers and accountants, printing, mailing, and other costs incurred by the Company in complying with ASX reporting and compliance requirements are substantial. Compliance with these requirements requires significant additional expenditures, including fees for compliance planning, assessment, documentation and testing, as well as a significant investment of time and energy by the Company’s management and employees. If the Company’s ASX reporting obligations cease, the Company would only incur these expenses as they relate to SEC reporting obligations. These costs are ongoing, comprising a significant element of corporate overhead expenses, and are difficult to reduce without Delisting. The Company estimates that the costs of remaining listed on ASX are at least $300,000 per annum. |

| ● | Liquidity:The Board believes that the current liquidity of the Company’s CDIs is insufficient to provide security holders with a reasonable avenue in which to trade their CDIs now or in the foreseeable future, given the current stage of the Company’s operations and the significant stockholding and debt security holding of its major stockholder, Crystal Amber. The Board believes Delisting would therefore provide the other benefits noted in this proxy statement without the loss of an active, liquid market. |

| ● | Valuation: The Board has observed the fluctuations in the quoted price of the Company’s CDIs and has noted that the value attributed to a CDI has been largely independent of news flow, even when positive news has been released. This has caused the Board to raise the question as to whether the market is fairly valuing the Company. Undervaluation causes the placement of significant equity to investors at the current market price to be more dilutive to existing stockholders than if the Company was, in the Board’s opinion, more fairly valued. The Board believes that being an unlisted company would allow a more objective and independent appraisal of valuation with reduced concerns in relation to undervaluation contributed to by an illiquid public market. Informal discussions held by the Company’s management with potential investors have supported this view, with these entities indicating that they would be more interested in investing in the Company if it were not listed and at a potentially higher valuation than its current listed valuation. |

| ● | Amplified volatility: The fractional cent trading price of the Company’s CDIs and the limited liquidity combine to cause artificially amplified volatility tied to small lot trades rather than news or operational status. The trade of a very small number of CDIs can cause a price fluctuation, and given the fractional nature of the pricing (limited to one-tenth of one Australian cent), each trade can have a larger impact than would otherwise be expected (e.g. a one-tenth of a cent price fluctuation from $0.003 would result in a 50% drop to $0.002 or a 33% increase to $0.004). |

| ● | Current nexus with Australia:The Company is not currently conducting any clinical trials in Australia. Its current clinical trials and studies are due to occur in the U.S. and India. In addition, the majority of the recent investment in the Company has come from investors based in the United Kingdom and the U.S. (i.e., non-Australian based investment). As a result, the Company no longer has any tangible nexus with Australia from an operational perspective, which undermines the basis for retaining a listing on ASX. |

| ● | Management time and effort:While SEC reporting obligations would remain, a significant portion of the Company’s management time is dedicated to incremental ASX listing related matters, which time could be directed elsewhere if the Company were not listed on ASX. |

| | ● | Future Prospect of Initial Public Offering: If successful in achieving the Company’s strategic objectives set out above (of which there can be no guarantee), then, as an unlisted company, the Board believes the Company will be in a position to create a more diversified share register and improve its prospects of achieving more sustainable funding for the Company. This would allow the Company to progress its business plan and, if successful, allow it to re-renter the public trading markets (via a suitable securities exchange) in a position of strength for its stockholders or otherwise seek a trade sale at an appropriate time. |

Advantages and disadvantages and risks of removal from the Official List

The Board has considered the potential advantages, disadvantages and risks associated with a Delisting.

Advantages

The key advantages of a Delisting reflect the reasons set out above that support a Delisting.

Disadvantages and risks

The Board has considered the potential disadvantages and risks associated with a Delisting, which include the following:

| ● | Future Funding:The Company will require additional future funding in order to continue to operate its business and while the Board believes that being an unlisted company will increase the Company’s ability to secure additional funding, there is currently no certainty as to the terms on which the Potential Financing or any other funding may be provided and, accordingly, there can be no certainty as to if and when any funding may be obtained or the terms of such funding. If there is a significant delay in obtaining future funding, this will impact greatly on the Company’s ability to continue to operate as a going concern. Following Delisting, the Company will also be unable to secure additional financing from certain investors that are restricted from making investments in securities that are not listed for trading on an exchange. |

| ● | Preferred Stock: Following Delisting, new investors are likely to require that they be issued with preferred stock. If preferred stock were to be issued it is likely that its terms would need to be approved by stockholders given that the Company’s Certificate of Incorporation and Bylaws would need to be amended. If preferred stock were issued, the holders of common stock would no longer have the same rights and preferences as all other investors as they do in a listed company environment. Preferred stock may have special rights attached to it, including rights to Board seats, preferential rights on dividends or on a liquidity event, including a sale of the Company, and/or enhanced voting or negative control rights over the Company. |

| ● | Liquidity: If the Delisting proceeds, it will directly impact the liquidity that would have otherwise been available to CDI holders as the CDIs will no longer be capable of being traded on the ASX, although at present the market for trading in the Company’s CDIs is very illiquid. In addition, given the illiquid market for the CDIs on the ASX many CDI holders may find it difficult to divest their CDI holdings on ASX prior to the notified suspension date or, even if such sale is possible, the price may not be favorable to CDI holders. After Delisting, stockholders wishing to trade their shares of common stock will be entitled to transfer their shares off-market to a willing third-party purchaser in accordance with the Company’s Bylaws and applicable securities laws. Such third-party market may not, however, be liquid and stockholders will be personally responsible for sourcing potential purchasers of their shares, which may prove difficult particularly for non-U.S. based stockholders or smaller stockholders. |

| ● | Regulation after Delisting: If the Delisting proceeds, the ASX Listing Rules will no longer apply to the Company. In particular, CDI holders will no longer have the protections afforded to them by the ASX Listing Rules in respect of various matters including: |

| o | disclosure of price sensitive information under the ASX continuous disclosure regime and the regular disclosure of financial information in respect of the Company, with the exception of information required to be disclosed under the rules and regulations of the SEC so long as the Company remains subject to the reporting requirements of the Exchange Act; |

| o | restrictions on the issue of securities such as the inability to issue over 15% (or in some cases 25%) of the Company's capital in a 12-month period without stockholder approval; |

| o | making significant changes to the Company’s activities; |

| o | the requirement to obtain stockholder approval for certain transactions with related parties of the Company, including directors and significant stockholders; and |

| o | the requirement to comply (or to explain non-compliance) with the ASX Corporate Governance Principles and Recommendations. |

However, the Company will continue to be bound by the requirements of Delaware General Corporation Law which include, subject to the Company’s Certificate of Incorporation and Bylaws, stockholder approval requirements for matters such as:

| ● | amendments to the Company’s Certificate of Incorporation; |

| ● | election and removal of directors; |

| ● | entry into fundamental corporate transactions, including, with certain exceptions, a dissolution, merger, consolidation or sale of all or substantially all of the assets of a corporation; |

| ● | a stockholder of a company participating in certain merger and consolidation transactions may, under certain circumstances, be entitled to appraisal rights, such as having a court determine the fair value of the stock or requiring the company to pay such value in cash; |

| ● | adoption of certain anti-takeover measures; and |

| ● | establishment of stock plans and the making of amendments to such plans. |

In addition, the Company will continue to file reports with the SEC pursuant to Section 13(a) of the Exchange Act until such time as the Company is no longer required to do so.

| ● | Dilution: Following Delisting, the Company will no longer be subject to the constraints on the issue of new shares without stockholder approval under the ASX Listing Rules, and existing stockholders may be significantly diluted as a result of any future funding. |

| ● | Sales due to investment mandate restrictions:Certain CDI holders or other security holders may be required to divest their holdings of CDIs prior to Delisting as their investment mandates do not permit them to continue to hold shares in an unlisted company. There is no guarantee that such holders will be able to exit their holdings at a price which they consider acceptable or which is above the price at which they acquired the CDIs. The requirement to sell such holdings may also have an adverse impact on the price at which CDIs trade on ASX prior to Delisting. |

Consequences of Delisting

On or just prior to the Delisting Date, the Company’s CDIs will be suspended from trading on the ASX. As detailed above, stockholders will have at least one month’s notice from the date on which stockholders approve the Delisting in which to sell their CDIs on market (to the extent they are able to do so) prior to the Company being Delisted.

As detailed above, once the Company is Delisted it will no longer be subject to the ASX Listing Rules. It will also no longer be a disclosing entity for the purposes of theCorporations Act 2001 (Cth) and it will therefore not be required to continuously disclose information, including financial information, to stockholders following the Delisting, with the exception of information required to be disclosed under the rules and regulations of the SEC so long as the Company remains subject to the reporting requirements of the Exchange Act.

In addition:

| ● | Share numbers and share capital:The Company has 36,598,296 shares of common stock (equal to 1,829,914,800 CDIs if all shares of common stock were held as CDIs) on issue as at the date of this proxy statement. The Delisting will, of itself, have no impact on the number of underlying shares of common stock on issue but upon Delisting the Company’s CDIs will no longer be tradable on the ASX and CDI holders will need to convert their CDI holdings into shares of common stock. |

| ● | Assets and liabilities:The Board considers that the Delisting will not adversely alter the Company's current financial position. The Board believes, however, that the Delisting will result in substantial cost savings for the Company. |

| ● | Control of the Company: As the Delisting does not result in the cancellation or transfer of any CDIs (other than CDIs representing fractional entitlements), it would (all other matters being equal) not impact the immediate control of the Company. If the Potential Financing were to occur, it is currently anticipated that the new investor may hold over 50% of the voting rights in the Company. |

| ● | Impact on creditors:Having regard to the Company’s current, anticipated and contingent financial obligations, the Board has assessed that the Delisting will not of itself adversely impact the rights of the Company’s creditors or the current cash position. |

| ● | Disclosure of CDI trading price:The price of the Company’s CDIs and trading history will no longer be available on the ASX website or newspapers and stock ticker services. |

| ● | ASX Listing Rule compliance:The ASX Listing Rules will cease to apply to the Company and it will be primarily regulated under Delaware General Corporation Law and the rules and regulations of the SEC. |

| ● | Limitation under investment mandates:Certain institutional stockholders or CDI holders may be required under their investment mandates to only invest in listed companies. Accordingly, prior to or following the Delisting, such stockholders or CDI holders may be required to transfer their investment to a vehicle that permits investment in unlisted entities or may be required to divest their holding either on-market prior to the Delisting Date (once such date has been determined and is notified) or off-market. |

Trading of CDIs and converting CDIs to Shares

Should the Delisting be approved by stockholders, CDI holders will be able to trade their CDIs on ASX between the date of approval being obtained and the date the Company’s securities are suspended from trading which is expected to be [date] (“Trading Suspension”). There are currently no plans for the Company to operate a share buy-back or similar facility.

Shortly after the Trading Suspension, CHESS Depositary Nominees will automatically terminate the trust under which the shares of common stock are currently held and legal title to the underlying shares of common stock will be transferred to CDI holders via the Company’s share registry so that CDI holders will instead hold the full legal and beneficial title to one share of common stock for every 50 CDIs held at the date of Delisting. Upon completion of the conversion, new holding statements will be sent to holders of common stock outlining the number of shares of common stock held.

After converting their CDI holding to a holding of shares of common stock, stockholders will be entitled to transfer their shares off-market to a willing third-party purchaser in accordance with the Company’s bylaws (and applicable securities laws). Such a third-party market may not be liquid and stockholders will be personally responsible for sourcing potential purchasers of their shares. It may therefore be very difficult for stockholders to sell any of their shares.

Fractional Shares

If the conversion of CDIs to shares of common stock results in the creation of a fractional share, the Company currently intends that it will round the fractional share down to the nearest whole number and pay an amount in cash to the CDI holder that is equal to the number of remaining CDIs multiplied by the CDI price (which will be calculated on the basis of the VWAP over the 5 trading days immediately prior to Delisting). The Company will confirm this process prior to the date of the Special Meeting.

No Going Private Transaction

Notwithstanding the lack of a trading market following the Delisting, the Board does not intend for the Delisting to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act and the implementation of the Delisting will not cause the Company to go private within the meaning of Rule 13e-3 as the numbers of holders of record is expected to be greater than 500 after taking into account the cash out of stockholders that hold only a fractional share.

Forward looking statements

This Proposal 1 contains forward looking statements. All statements that address events or developments that the Company expects or anticipates will or may occur in the future are forward looking. These forward looking statements are based on the Board’s belief and expectations based on information currently available to the Board and management. The Company believes that these forward looking statements are reasonable as and when made. However, stockholders should not place undue reliance on any such forward looking statements which are inherently uncertain. The Company does not undertake any obligation to publicly update or revise any forward looking statements whether as a result of new information, future events or otherwise except as required by law or the ASX Listing Rules. Forward looking statements are subject to certain risks and uncertainties that could cause actual results, events and developments to differ materially from the Company’s historical experience, or present expectations, or projections.

Approval

The Company is seeking the approval of all stockholders, for the purposes of ASX Listing Rule 17.11 and for all other purposes, to approve the delisting of the Company from the Official List of the ASX on a date that is not less than one month from the date on which stockholders approve the Delisting and that the Directors of the Company be authorized to do all things reasonably necessary to give effect to the delisting of the Company from the Official List of the ASX.

If this Proposal 1 is passed, the Company will be able to proceed with the Delisting and the consequences that are outlined above will follow.

Consequences if this Proposal 1 is not approved

If this Proposal 1 is not approved then, unless a subsequent proposed delisting is approved by the stockholders or ASX determines that the Company’s securities should no longer be listed, the Delisting will not proceed and the Company’s securities will remain listed on the Official List of ASX. A further consequence of this Proposal 1 not being approved would be the termination of the current discussions of the Company in respect of the Potential Financing, which are based on the Company being delisted. If these discussions are terminated, the Company will be required to seek additional funding from new or existing investors or otherwise wind the Company down.

Vote Required

Under ASX Listing Rule 17.11, Proposal 1 is required to be passed as a “special resolution” for the purposes of the ASX Listing Rules, which means that it must be approved by at least 75% of the votes cast by stockholders present and entitled to vote on Proposal 1.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 1 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 1.

PROPOSAL 2: ADJOURNMENT OF THE MEETING

The Company’s stockholders and CDI holders are being asked to consider and vote upon an adjournment of the Special Meeting, if necessary, even if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1.

The affirmative vote of the holders of a majority of the shares present virtually or represented by proxy at the Special Meeting and entitled to vote is required for approval.

THE BOARD OF DIRECTORS HAS DETERMINED THAT PROPOSAL 2 IS IN THE BEST INTERESTS OF THE COMPANY AND UNANIMOUSLY RECOMMENDS A VOTE TO APPROVE THE ADJOURNMENT OF THE SPECIAL MEETING, EVEN IF A QUORUM IS PRESENT, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES TO APPROVE PROPOSAL 1.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of 21 April 2020, information regarding beneficial ownership of GI Dynamics common stock, and common stock held as CDIs, by the following:

| | ● | each person, or group of affiliated persons, who is known by the Company to beneficially own more than 5% of any class of the Company’s voting securities; |

| | ● | each of the Company’s directors; |

| | ● | each of the Company’s named executive officers; and |

| | ● | all current directors and executive officers as a group. |

Beneficial ownership is determined according to the rules of the SEC. Beneficial ownership generally includes voting or investment power of a security and includes shares underlying options, warrants or other convertible securities that are currently exercisable or convertible or exercisable or convertible within 60 days of 21 April 2020. This table is based on information supplied by officers, directors, and principal stockholders. Except as otherwise indicated, the Company believes that the beneficial owners of the CDIs and common stock listed below, based on the information each of them has given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply.

Percentage of ownership is based on 36,598,296 shares of outstanding common stock, or common stock equivalent CDIs, outstanding on 21 April 2020. Unless otherwise indicated, the Company deems shares of common stock and CDIs subject to options and warrants that are exercisable within 60 days of 21 April 2020 or notes immediately convertible, to be outstanding and beneficially owned by the person holding the options or warrants for the purpose of computing percentage ownership of that person, but the Company does not treat them as outstanding for the purpose of computing the ownership percentage of any other person.

Because CDIs represent one-fiftieth of a share of GI Dynamics common stock, converting the number of CDIs owned by the person holding them into the equivalent number of shares of common stock may result in fractional shares of common stock. In the following table, the number of shares of common stock owned by each beneficial owner is rounded down to the nearest whole share of common stock.

Unless otherwise indicated in the table, the address of each of the individuals named below is: c/o GI Dynamics, Inc., 320 Congress Street, Boston, MA 02210, U.S.A.

| Name and Address of Beneficial Owner | | | | | Number of

Shares of

Common

Stock | | | Percentage of

Common

Stock | |

| More than 5% Stockholders | | | | | | | | | |

| Crystal Amber | | | (1) | | | | 31,350,079 | | | | 78.9 | % |

| Richard Cashin | | | (2) | | | | 3,987,294 | | | | 10.9 | % |

| | | | | | | | | | | | | |

| Directors and Executive Officers | | | | | | | | | | | | |

| Daniel J. Moore | | | (3) | | | | 6,500 | | | | * | |

| Oern R. Stuge, M.D. | | | (4) | | | | 30,000 | | | | * | |

| Juliet Thompson | | | (5) | | | | 27,492 | | | | * | |

| Praveen Tyle, Ph.D. | | | (6) | | | | 0 | | | | * | |

| Scott W. Schorer | | | (7) | | | | 751,106 | | | | * | |

| Charles Carter | | | (6) | | | | 0 | | | | * | |

| All directors and executive officers as a group (7 persons) | | | | | | | 815,098 | | | | * | |

| (1) | Based upon the Company’s corporate records and upon the information provided by Crystal Amber Fund Limited, (“CAFL”), in a Notice of Change of Interests of Substantial Holder (Form 604) filed with the ASX on 3 February 2020, reporting as of 3 February 2020. The address for CAFL is P.O. Box 286, Floor 2, Trafalgar Court, Les Banques, St Peter Port, Guernsey GY14LY U.K. Includes 4,596,893 shares of common stock underlying warrants to purchase CDIs immediately exercisable as of 6 March 2020. Excludes shares that may be issued in the future upon the conversion of the 2017 Note or August 2019 Note. |

| (2) | Based on the Company’s corporate records. The address for Mr. Cashin is c/o One Equity Partners, 510 Madison Avenue, 19th Floor, New York, NY 10022. |

| (3) | Includes 1,000 shares and 5,500 shares subject to options exercisable within 60 days of 21 April 2020. |

| (4) | Includes 30,000 shares subject to options exercisable within 60 days of 21 April 2020. |

| (5) | Includes 27,492 shares subject to options exercisable within 60 days of 21 April 2020. |

| (6) | Includes 0 shares subject to options exercisable within 60 days of 21 April 2020. |

| (7) | Includes 501,106 shares subject to options exercisable within 60 days of 6 March 2020 and granted and outstanding performance stock units totaling 250,000. |

STOCKHOLDER PROPOSALS FOR THE 2020 ANNUAL MEETING

The Company’s bylaws require advance notice of business to be brought before a stockholders’ meeting, including nominations of persons for election as directors. To be timely, notice to the Company’s corporate secretary must be received at the Company’s principal executive offices not fewer than 45 days and not more than 75 days prior to the anniversary date of the preceding year’s annual meeting and must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters. Therefore, to be presented at the Company’s 2020 Annual Meeting, such a proposal must be received by the Company on or after 15 April 2020 (EDT) but no later than 15 May 2020 (EDT). If the date of the 2020 Annual Meeting is advanced by more than 30 days, or delayed by more than 30 days, from the anniversary date of the 2019 Annual Meeting, notice must be received no earlier than the 90th day prior to such annual meeting and not later than the close of business on the later of the 60th day prior to such annual meeting or, if the first public announcement of the date of such annual meeting is fewer than 50 days prior to the date of such annual meeting, the 10th day following the day on which the public announcement of the date of such meeting is first made. Proposals that are not received in a timely manner will not be voted on at the 2020 Annual Meeting.

WHERE YOU CAN FIND MORE INFORMATION

The Company is required to file annual, quarterly and current reports and other information with the SEC. The Company’s SEC filings are also available to the public at the SEC’s website at www.sec.gov. You also may obtain free copies of the documents in the Company files with the SEC by going to the GI Dynamics website atwww.gidynamics.com. The information provided on the GI Dynamics website is not part of this proxy statement and is not incorporated by reference.

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for the Company.

A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from one or more of the affected stockholders. Once you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent to the practice. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement please notify your broker or the Company’s Corporate Secretary at 320 Congress Street, Floor 3, Boston, MA 02210 or at (781) 357-3263. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request “householding” of their communications should contact their broker.