| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21416 |

| |

| John Hancock Tax-Advantaged Dividend Income Fund |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Salvatore Schiavone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| |

| Date of fiscal year end: | October 31 |

| |

| Date of reporting period: | April 30, 2014 |

ITEM 1. REPORTS TO STOCKHOLDERS.

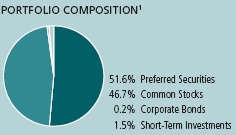

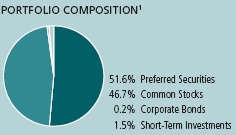

Portfolio summary

| | | | |

| Top 10 Issuers (27.2% of Total Investments on 4-30-14)1,2 | |

|

| PPL Corp. | 3.2% | | Integrys Energy Group, Inc. | 2.8% |

| |

|

| MetLife, Inc. | 2.8% | | ONEOK, Inc. | 2.5% |

| |

|

| Spectra Energy Corp. | 2.8% | | Morgan Stanley | 2.5% |

| |

|

| Wells Fargo & Company | 2.8% | | SCE Trust | 2.5% |

| |

|

| Interstate Power & Light Company | 2.8% | | American Electric Power Company, Inc. | 2.5% |

| |

|

| |

| |

| Sector Composition1,3 | | | | |

|

| Utilities | 50.7% | | Telecommunication Services | 6.0% |

| |

|

| Financials | 33.9% | | Industrials | 0.2% |

| |

|

| Energy | 7.7% | | Short-Term Investments | 1.5% |

| |

|

1 As a percentage of total investments on 4-30-14.

2 Cash and cash equivalents not included.

3 Sector investing is subject to greater risks than the market as a whole. Because the fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 6 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Fund’s investments

As of 4-30-14 (unaudited)

| | |

| | Shares | Value |

| |

| Common Stocks 69.5% (46.7% of Total Investments) | | $597,150,974 |

|

| (Cost $416,032,045) | | |

| | | |

| Energy 11.4% | | 98,145,561 |

| | | |

| Oil, Gas & Consumable Fuels 11.4% | | |

|

| BP PLC, ADR | 187,500 | 9,491,251 |

|

| Chevron Corp. (Z) | 40,000 | 5,020,800 |

|

| ConocoPhillips (Z) | 120,000 | 8,917,200 |

|

| ONEOK, Inc. | 515,000 | 32,558,300 |

|

| Royal Dutch Shell PLC, ADR | 79,000 | 6,220,460 |

|

| Spectra Energy Corp. (Z) | 905,000 | 35,937,550 |

| | | |

| Telecommunication Services 3.6% | | 30,556,425 |

| | | |

| Diversified Telecommunication Services 2.8% | | |

|

| AT&T, Inc. (Z) | 390,000 | 13,923,000 |

|

| Verizon Communications, Inc. (Z) | 214,160 | 10,007,697 |

| | | |

| Wireless Telecommunication Services 0.8% | | |

|

| Vodafone Group PLC, ADR | 174,545 | 6,625,728 |

| | | |

| Utilities 54.5% | | 468,448,988 |

| | | |

| Electric Utilities 22.8% | | |

|

| American Electric Power Company, Inc. (Z) | 590,000 | 31,747,900 |

|

| Duke Energy Corp. (Z) | 310,000 | 23,091,900 |

|

| FirstEnergy Corp. (Z) | 630,000 | 21,262,500 |

|

| Northeast Utilities (Z) | 657,500 | 31,073,450 |

|

| OGE Energy Corp. (Z) | 540,000 | 20,158,200 |

|

| Pinnacle West Capital Corp. | 50,000 | 2,797,500 |

|

| PPL Corp. (Z) | 500,000 | 16,670,000 |

|

| The Southern Company (Z) | 375,000 | 17,186,250 |

|

| UIL Holdings Corp. (Z) | 510,000 | 18,732,300 |

|

| Xcel Energy, Inc. (Z) | 405,000 | 12,907,350 |

| | | |

| Gas Utilities 5.2% | | |

|

| AGL Resources, Inc. | 100,550 | 5,429,700 |

|

| Atmos Energy Corp. | 570,000 | 29,092,800 |

|

| Northwest Natural Gas Company (Z) | 85,000 | 3,762,950 |

|

| ONE Gas, Inc. | 173,015 | 6,328,888 |

| | | |

| Multi-Utilities 26.5% | | |

|

| Alliant Energy Corp. (Z) | 160,000 | 9,356,800 |

|

| Ameren Corp. (Z) | 555,000 | 22,927,050 |

|

| Black Hills Corp. (Z) | 440,000 | 25,410,000 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 7 |

| | |

| | Shares | Value |

| | | |

| Multi-Utilities (continued) | | |

|

| Dominion Resources, Inc. (Z) | 400,000 | $29,016,000 |

|

| DTE Energy Company (Z) | 250,000 | 19,535,000 |

|

| Integrys Energy Group, Inc. (Z) | 485,000 | 29,720,800 |

|

| National Grid PLC, ADR (Z) | 230,000 | 16,343,800 |

|

| NiSource, Inc. | 785,000 | 28,511,200 |

|

| Public Service Enterprise Group, Inc. (Z) | 170,000 | 6,964,900 |

|

| TECO Energy, Inc. | 500,000 | 8,980,000 |

|

| Vectren Corp. (Z) | 775,000 | 31,441,750 |

| |

| |

| Preferred Securities 76.8% (51.6% of Total Investments) | | $660,398,306 |

|

| (Cost $653,868,694) | | |

| | | |

| Financials 50.4% | | 433,281,663 |

| | | |

| Banks 18.8% | | |

|

| Barclays Bank PLC, Series 5, 8.125% (Z) | 505,000 | 13,084,550 |

|

| BB&T Corp., 5.625% | 600,000 | 14,010,000 |

|

| BB&T Corp. (Callable 11-1-17), 5.200% (Z) | 480,000 | 10,560,000 |

|

| BB&T Corp. (Callable 6-1-18), 5.200% | 263,900 | 5,808,439 |

|

| HSBC Holdings PLC, 8.000% (Z) | 325,000 | 8,775,000 |

|

| HSBC Holdings PLC, 8.125% (Z) | 50,000 | 1,308,500 |

|

| HSBC USA, Inc., 6.500% | 19,500 | 497,055 |

|

| PNC Financial Services Group, Inc., 5.375% (Z) | 470,000 | 10,659,600 |

|

| PNC Financial Services Group, Inc. (6.125% to | | |

| 5-1-22, then 3 month LIBOR + 4.067%) | 40,000 | 1,074,400 |

|

| Royal Bank of Scotland Group PLC, Series L, | | |

| 5.750% (Z) | 855,000 | 19,015,200 |

|

| Santander Finance Preferred SAU, Series 1, | | |

| 6.410% (Z) | 15,500 | 390,135 |

|

| Santander Finance Preferred SAU, Series 10, | | |

| 10.500% (Z) | 277,000 | 7,251,860 |

|

| Santander Holdings USA, Inc., Series C, | | |

| 7.300% | 110,000 | 2,785,200 |

|

| U.S. Bancorp, 5.150% (Z) | 1,000,000 | 22,620,000 |

|

| U.S. Bancorp (6.500% to 1-15-22, then | | |

| 3 month LIBOR + 4.468%) (Z) | 296,000 | 8,539,600 |

|

| Wells Fargo & Company, 8.000% | 1,207,000 | 35,642,710 |

| | | |

| Capital Markets 11.0% | | |

|

| Morgan Stanley, 7.125% | 300,000 | 8,190,000 |

|

| Morgan Stanley, 6.625% | 957,915 | 23,947,875 |

|

| State Street Corp., 5.250% (Z) | 1,040,000 | 24,492,000 |

|

| State Street Corp., 5.900% | 25,000 | 649,000 |

|

| The Bank of New York Mellon Corp., | | |

| 5.200% (Z) | 510,000 | 11,974,800 |

|

| The Goldman Sachs Group, Inc., 5.950% (Z) | 860,000 | 19,926,200 |

|

| The Goldman Sachs Group, Inc., Series B, | | |

| 6.200% (Z) | 215,000 | 5,304,050 |

| | | |

| Consumer Finance 2.4% | | |

|

| HSBC Finance Corp., Depositary Shares, | | |

| Series B, 6.360% (Z) | 700,000 | 17,493,000 |

|

| SLM Corp., Series A, 6.970% (Z) | 74,000 | 3,657,080 |

| | |

| 8 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

| | |

| | Shares | Value |

| | | |

| Diversified Financial Services 13.3% | | |

|

| Bank of America Corp., 6.375% (Z) | 139,000 | $3,504,190 |

|

| Bank of America Corp., 6.625% (Z) | 355,000 | 9,098,650 |

|

| Bank of America Corp., Depositary Shares, | | |

| Series D, 6.204% (Z) | 230,000 | 5,736,200 |

|

| Citigroup, Inc., Depositary Shares, Series AA, | | |

| 8.125% | 270,400 | 7,984,912 |

|

| Deutsche Bank Contingent Capital Trust II, | | |

| 6.550% (Z) | 310,000 | 8,153,000 |

|

| Deutsche Bank Contingent Capital Trust III, | | |

| 7.600% (Z) | 797,893 | 21,942,058 |

|

| ING Groep NV, 6.200% (Z) | 109,100 | 2,753,684 |

|

| ING Groep NV, 7.050% (Z) | 150,000 | 3,861,000 |

|

| JPMorgan Chase & Company, 5.450% | 240,000 | 5,428,800 |

|

| JPMorgan Chase & Company, 5.500% | 980,000 | 22,236,200 |

|

| JPMorgan Chase & Company, 6.700% | 30,000 | 760,800 |

|

| RBS Capital Funding Trust VII, 6.080% (Z) | 983,000 | 22,599,170 |

| | | |

| Insurance 4.6% | | |

|

| Aegon NV, 6.500% | 96,512 | 2,455,265 |

|

| MetLife, Inc., Series B, 6.500% (Z) | 1,415,000 | 35,969,300 |

|

| Prudential Financial, Inc., 5.750% | 40,000 | 983,200 |

| | | |

| Real Estate Investment Trusts 0.2% | | |

|

| Ventas Realty LP, 5.450% | 63,000 | 1,540,980 |

| | | |

| Thrifts & Mortgage Finance 0.1% | | |

|

| Federal National Mortgage Association, | | |

| Series S, 8.250% (I) | 60,000 | 618,000 |

| | | |

| Industrials 0.4% | | 3,103,750 |

| | | |

| Machinery 0.4% | | |

|

| Stanley Black & Decker, Inc., 5.750% (Z) | 125,000 | 3,103,750 |

| | | |

| Telecommunication Services 5.4% | | 46,628,660 |

| | | |

| Diversified Telecommunication Services 3.7% | | |

|

| Qwest Corp., 6.125% | 730,000 | 16,760,800 |

|

| Qwest Corp., 7.375% (Z) | 366,000 | 9,775,860 |

|

| Qwest Corp., 7.500% (Z) | 120,000 | 3,201,600 |

|

| Verizon Communications, Inc., 5.900% | 73,000 | 1,833,030 |

| | | |

| Wireless Telecommunication Services 1.7% | | |

|

| Telephone & Data Systems, Inc., 5.875% | 340,000 | 7,429,000 |

|

| Telephone & Data Systems, Inc., 6.625% | 30,000 | 746,100 |

|

| Telephone & Data Systems, Inc., 6.875% (Z) | 243,000 | 6,121,170 |

|

| United States Cellular Corp., 6.950% (Z) | 30,000 | 761,100 |

| | | |

| Utilities 20.6% | | 177,384,233 |

| | | |

| Electric Utilities 18.3% | | |

|

| Alabama Power Company, Class A, 5.300% (Z) | 197,550 | 4,984,186 |

|

| Duke Energy Corp., 5.125% | 240,000 | 5,683,200 |

|

| Duquesne Light Company, 6.500% | 427,000 | 21,243,250 |

|

| Entergy Arkansas, Inc., 4.560% | 9,388 | 866,337 |

|

| Entergy Arkansas, Inc., 6.450% | 135,000 | 3,341,250 |

|

| Entergy Mississippi, Inc., 4.920% | 8,190 | 788,032 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 9 |

| | | | | |

| | | | | Shares | Value |

| Electric Utilities (continued) | | | | | |

|

| Entergy Mississippi, Inc., 6.250% | | | | 197,500 | $5,184,375 |

|

| Gulf Power Company, 5.600% | | | | 80,391 | 7,311,803 |

|

| Interstate Power & Light Company, 5.100% | | | | 1,460,000 | 35,244,400 |

|

| Mississippi Power Company, 5.250% | | | | 267,500 | 6,730,300 |

|

| NextEra Energy Capital Holdings, Inc., 5.000% | | | | 110,000 | 2,355,100 |

|

| NextEra Energy Capital Holdings, Inc., 5.125% | | | | 70,000 | 1,560,300 |

|

| NextEra Energy Capital Holdings, Inc., | | | | | |

| 5.700% (Z) | | | | 230,000 | 5,662,600 |

|

| PPL Capital Funding, Inc., 5.900% | | | | 1,010,000 | 24,341,000 |

|

| SCE Trust I, 5.625% | | | | 140,000 | 3,313,800 |

|

| SCE Trust II, 5.100% (Z) | | | | 1,315,000 | 28,627,550 |

| | | | | | |

| Multi-Utilities 2.3% | | | | | |

|

| BGE Capital Trust II, 6.200% (Z) | | | | 250,000 | 6,297,500 |

|

| DTE Energy Company, 5.250% | | | | 165,000 | 3,844,500 |

|

| DTE Energy Company, 6.500% (Z) | | | | 175,000 | 4,525,500 |

|

| Integrys Energy Group, Inc., 6.000% | | | | 217,000 | 5,479,250 |

| |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| |

| Corporate Bonds 0.4% (0.2% of Total Investments) | | $3,210,000 |

|

| (Cost $3,000,000) | | | | | |

| | | | | | |

| Utilities 0.4% | | | | | 3,210,000 |

| Southern California Edison Company | | | | | |

| (6.250% to 2-1-22, then 3 month LIBOR + | | | | | |

| 4.199%) (Q) | 6.250 | | 02-01-22 | $3,000,000 | 3,210,000 |

| |

| | | | | Par value | Value |

| |

| Short-Term Investments 2.2% (1.5% of Total Investments) | | $18,842,000 |

|

| (Cost $18,842,000) | | | | | |

| | | | | | |

| Repurchase Agreement 2.2% | | | | | 18,842,000 |

| | | |

| Repurchase Agreement with State Street Corp. dated 4-30-14 at | | |

| 0.000% to be repurchased at $18,842,000 on 5-1-14, collateralized | | |

| by $19,370,000 U.S. Treasury Notes, 1.375% due 12-31-18 (valued | | |

| at $19,224,725, including interest) | | | | $18,842,000 | 18,842,000 |

| |

| Total investments (Cost $1,091,742,739)† 148.9% | $1,279,601,280 |

|

| |

| Other assets and liabilities, net (48.9%) | | | | ($420,328,147) |

|

| |

| Total net assets 100.0% | | | | | $859,273,133 |

|

The percentage shown for each investment category is the total value the category as a percentage of the net assets of the fund.

| | |

| 10 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

Notes to Schedule of Investments

ADR American Depositary Receipts

LIBOR London Interbank Offered Rate

(I) Non-income producing security.

(Q) Perpetual bonds have no stated maturity date. Date shown as maturity date is next call date.

(Z) A portion of this security is segregated as collateral pursuant to the Committed Facility Agreement. Total collateral value at 4-30-14 was $718,475,853.

† At 4-30-14, the aggregate cost of investment securities for federal income tax purposes was $1,099,129,038. Net unrealized appreciation aggregated $180,472,242, of which $211,515,950 related to appreciated investment securities and $31,043,708 related to depreciated investment securities.

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 11 |

FINANCIAL STATEMENTSFinancial statements

Statement of assets and liabilities 4-30-14 (unaudited)

This Statement of assets and liabilities is the fund’s balance sheet. It shows the value of what the fund owns, is due and owes. You’ll also find the net asset value for each common share.

| |

| Assets | |

|

| Investments, at value (Cost $1,091,742,739) | $1,279,601,280 |

| Cash | 905 |

| Cash segregated at custodian for swap contracts | 1,260,000 |

| Receivable for investments sold | 405,711 |

| Dividends and interest receivable | 2,096,776 |

| Swap contracts, at value | 293,958 |

| Other receivables and prepaid expenses | 36,233 |

| | |

| Total assets | 1,283,694,863 |

| |

| Liabilities | |

|

| Credit facility agreement payable | 418,900,000 |

| Payable for investments purchased | 1,072,600 |

| Payable for fund shares repurchased | 593,367 |

| Written options, at value (Premium received $1,956,025) | 1,702,275 |

| Swap contracts, at value | 1,830,364 |

| Interest payable | 222,691 |

| Payable to affiliates | |

| Accounting and legal services fees | 34,698 |

| Other liabilities and accrued expenses | 65,735 |

| | |

| Total liabilities | 424,421,730 |

| | |

| Net assets | $859,273,133 |

| |

| Net assets consist of | |

|

| Paid-in capital | $693,085,190 |

| Undistributed net investment income | 11,925,340 |

| Accumulated net realized gain (loss) on investments, written options and | |

| swap agreements | (32,313,282) |

| Net unrealized appreciation (depreciation) on investments, written options | |

| and swap agreements | 186,575,885 |

| | |

| Net assets | $859,273,133 |

| |

| Net asset value per share | |

|

| Based on 37,088,986 shares of beneficial interest outstanding — unlimited | |

| number of shares authorized with no par value | $23.17 |

| | |

| 12 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

FINANCIAL STATEMENTS

Statement of operations For the six-month period ended 4-30-14

(unaudited)

This Statement of operations summarizes the fund’s investment income earned, expenses incurred in operating the fund and net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $37,026,876 |

| Interest | 93,750 |

| Less foreign taxes withheld | (100,008) |

| | |

| Total investment income | 37,020,618 |

| |

| Expenses | |

|

| Investment management fees | 4,471,230 |

| Accounting and legal services fees | 108,762 |

| Transfer agent fees | 14,096 |

| Trustees’ fees | 22,411 |

| Printing and postage | 56,729 |

| Professional fees | 49,428 |

| Custodian fees | 42,728 |

| Stock exchange listing fees | 19,296 |

| Interest expense | 1,361,259 |

| Other | 24,426 |

| | |

| Total expenses | 6,170,365 |

| | |

| Net investment income | 30,850,253 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on | |

| Investments | 17,124,355 |

| Written options | (1,301,915) |

| Swap contracts | (793,874) |

| | |

| | 15,028,566 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | 69,785,774 |

| Written options | 353,437 |

| Swap contracts | 698,477 |

| | |

| | 70,837,688 |

| | |

| Net realized and unrealized gain | 85,866,254 |

| | |

| Increase in net assets from operations | $116,716,507 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 13 |

FINANCIAL STATEMENTSStatements of changes in net assets

These Statements of changes in net assets show how the value of the fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of fund share transactions.

| | |

| | Six months | |

| | ended | Year |

| | 4-30-14 | ended |

| | (Unaudited) | 10-31-13 |

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $30,850,253 | $49,047,019 |

| Net realized gain | 15,028,566 | 30,798,314 |

| Change in net unrealized appreciation (depreciation) | 70,837,688 | (29,746,844) |

| | | |

| Increase in net assets resulting from operations | 116,716,507 | 50,098,489 |

| | | |

| Distributions to shareholders | | |

| From net investment income | (24,170,996) | (44,599,437) |

| | | |

| From fund share transactions | | |

| Repurchased | (8,422,418) | (3,496,915) |

| | | |

| Total increase | 84,123,093 | 2,002,137 |

| |

| Net assets | | |

|

| Beginning of period | 775,150,040 | 773,147,903 |

| | | |

| End of period | $859,273,133 | $775,150,040 |

| | | |

| Undistributed net investment income | $11,925,340 | $5,246,083 |

| |

| Share activity | | |

|

| Shares outstanding | | |

| Beginning of period | 37,541,388 | 37,734,746 |

| Shares repurchased | (452,402) | (193,358) |

| | | |

| End of period | 37,088,986 | 37,541,388 |

| | |

| 14 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

FINANCIAL STATEMENTS

Statement of cash flows

This Statement of cash flows shows cash flow from operating and financing activities for the period stated.

| |

| | For the |

| | six month |

| | period ended |

| | 4-30-14 |

| | (unaudited) |

| Cash flows from operating activities | |

|

| Net increase in net assets from operations | $116,716,507 |

| Adjustments to reconcile net increase in net assets from operations to net | |

| cash provided by operating activities: | |

| Long-term investments purchased | (55,665,251) |

| Long-term investments sold | 76,899,378 |

| Increase in short-term investments | (17,506,000) |

| Decrease in cash segregated at custodian for swap contracts | 660,000 |

| Increase in receivable for investments sold | (405,711) |

| Decrease in dividends and interest receivable | 80,042 |

| Increase in unrealized appreciation/depreciation of swap contracts | (698,477) |

| Increase in other receivables and prepaid expenses | (13,062) |

| Increase in payable for investments purchased | 1,072,600 |

| Decrease in payable for written options | (440,925) |

| Decrease in payable to affiliates | (6,852) |

| Decrease in other liabilities and accrued expenses | (4,852) |

| Decrease in due to custodian | (138,751) |

| Decrease in interest payable | (12,339) |

| Net change in unrealized (appreciation) depreciation on investments | (69,785,774) |

| Net realized gain on investments | (17,124,355) |

| | |

| Net cash provided by operating activities | $33,626,178 |

|

| Cash flows from financing activities | |

| Repurchase of common shares | ($8,422,418) |

| Distributions to common shareholders | (24,170,996) |

| Decrease in payable for fund shares repurchased | (1,031,859) |

| | |

| Net cash used in financing activities | ($33,625,273) |

| | |

| Net increase in cash | $905 |

| |

| Cash at beginning of period | — |

| | |

| Cash at end of period | $905 |

| | |

| Supplemental disclosure of cash flow information: | |

|

| Cash paid for interest | $1,373,598 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 15 |

Financial highlights

The Financial highlights show how the fund’s net asset value for a share has changed during the period.

| | | | | | | |

| COMMON SHARES | | | | | | | |

| Period ended | 4-30-141 | 10-31-13 | 10-31-12 | 10-31-11 | 10-31-10 | 10-31-092 | 12-31-08 |

| |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning | | | | | | | |

| of period | $20.65 | $20.49 | $18.27 | $16.58 | $12.87 | $12.48 | $19.99 |

| Net investment income3 | 0.834 | 1.30 | 1.20 | 1.20 | 1.10 | 0.88 | 1.13 |

| Net realized and unrealized | | | | | | | |

| gain (loss) on investments | 2.31 | 0.03 | 2.20 | 1.60 | 3.69 | 0.56 | (7.07) |

| Distributions to Auction | | | | | | | |

| Preferred Shares (APS)* | — | — | — | — | — | — | (0.15) |

| Total from | | | | | | | |

| investment operations | 3.14 | 1.33 | 3.40 | 2.80 | 4.79 | 1.44 | (6.09) |

| Less distributions to | | | | | | | |

| common shareholders | | | | | | | |

| From net investment income | (0.65) | (1.18) | (1.18) | (1.12) | (1.09) | (0.83) | (0.99) |

| From net realized gain | — | — | — | — | — | — | (0.15) |

| From tax return of capital | — | — | — | — | — | (0.23) | (0.44) |

| Total distributions | (0.65) | (1.18) | (1.18) | (1.12) | (1.09) | (1.06) | (1.58) |

| Anti-dilutive impact of | | | | | | | |

| repurchase plan | 0.035 | 0.015 | — | 0.015 | 0.015 | 0.015 | 0.165 |

| Net asset value, end of period | $23.17 | $20.65 | $20.49 | $18.27 | $16.58 | $12.87 | $12.48 |

| Per share market value, end | | | | | | | |

| of period | $20.72 | $18.34 | $19.07 | $16.64 | $15.41 | $11.35 | $10.30 |

| Total return at net asset | | | | | | | |

| value (%)6,7 | 16.098 | 7.28 | 19.64 | 18.16 | 39.49 | 15.348 | (29.97) |

| Total return at market | | | | | | | |

| value (%)6 | 16.898 | 2.37 | 22.25 | 15.79 | 47.01 | 23.248 | (35.46) |

| |

| Ratios and supplemental data | | | | | | | |

|

| Net assets applicable to | | | | | | | |

| common shares, end of | | | | | | | |

| period (in millions) | $859 | $775 | $773 | $690 | $630 | $493 | $480 |

| Ratios (as a percentage of | | | | | | | |

| average net assets): | | | | | | | |

| Expenses before reductions | 1.5910 | 1.59 | 1.65 | 1.779 | 2.03 | 2.2610 | 2.29 |

| Expenses net of fee waivers | | | | | | | |

| and credits11 | 1.5910 | 1.59 | 1.62 | 1.569 | 1.86 | 2.0110 | 1.99 |

| Net investment income | 7.234,10 | 6.29 | 6.19 | 6.98 | 7.37 | 9.4410 | 7.02 |

| Portfolio turnover (%) | 5 | 23 | 12 | 16 | 20 | 21 | 29 |

| |

| Senior securities | | | | | | | |

|

| Total debt outstanding end of | | | | | | | |

| period (in millions) (Note 8) | $419 | $419 | $390 | $344 | $311 | $253 | $267 |

| Asset coverage per $1,000 | | | | | | | |

| of debt12 | $3,051 | $2,850 | $2,981 | $3,005 | $3,030 | $2,946 | $2,797 |

| | |

| 16 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

* Auction Preferred Shares (APS).

1 Six months ended 4-30-14. Unaudited.

2 For the ten-month period ended 10-31-09. The fund changed its fiscal year end from December 31 to October 31.

3 Based on the average daily shares outstanding.

4 Net investment income (loss) per share and ratio of net investment income (loss) to average net assets reflect a special dividend received by the fund which amounted to $0.15 and 0.71% (unannualized), respectively.

5 The repurchase plan was completed at an average repurchase price of $18.62, $18.09, $15.28, $13.80, $10.29 and $14.92, respectively, for 452,402 shares, 193,358 shares, 276,671 shares, 302,900 shares, 173,600 shares and 3,589,570 shares, respectively. The repurchases for the periods ended 4-30-14, 10-31-13, 10-31-11, 10-31-10, 10-31-09 and 12-31-08 were $8,422,418, $3,496,915, $4,227,969, $4,178,919, $1,786,938 and $53,556,991, respectively, and had a $0.03, $0.01, $0.01, $0.01, $0.01 and $0.16 NAV impact, respectively.

6 Total return based on net asset value reflects changes in the fund’s net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the fund’s shares traded during the period.

7 Total returns would have been lower had certain expenses not been reduced during the applicable periods.

8 Not annualized.

9 Includes non-recurring litigation fees which represent 0.02% and 0.14% of average net assets for the years ended 10-31-11 and 10-31-10, respectively. Insurance recovery expense reduction for the year ended 10-31-11 represents 0.11% of average net assets.

10 Annualized.

11 Expenses net of fee waivers and credits excluding interest expense were 1.24%, 1.23%, 1.17%, 1.03%, 1.22%, 1.14% (annualized) and 1.12% for the periods ended 4-30-14, 10-13-13, 10-31-12, 10-31-11, 10-31-10, 10-31-09 and 12-31-08, respectively.

12 Asset coverage equals the total net assets plus borrowings divided by the borrowings of the fund outstanding at period end. As debt outstanding changes, level of invested assets may change accordingly. Asset coverage ratio provides a measure of leverage.

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 17 |

Notes to financial statements

(unaudited)

Note 1 — Organization

John Hancock Tax-Advantaged Dividend Income Fund (the fund) is a closed-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act).

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In order to value the securities, the fund uses the following valuation techniques: Equity securities held by the fund are valued at the last sale price or official closing price on the exchange where the security was acquired or most likely will be sold. In the event there were no sales during the day or closing prices are not available, the securities are valued using the last available bid price. Debt obligations are valued based on the evaluated prices provided by an independent pricing vendor or from broker-dealers. Independent pricing vendors utilize matrix pricing which takes into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data, as well as broker supplied prices. Options listed on an exchange are valued at the mean of the most recent bid and ask prices from the exchange where the option was acquired or most likely will be sold. Swaps are valued using evaluated prices obtained from an independent pricing vendor. Foreign securities are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing vendor. Securities that trade only in the over-the-counter (OTC) market are valued using bid prices. Certain short-term securities with maturities of 60 days or less at the time of purchase are valued at amortized cost. Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the fund’s Pricing Committee following procedures established by the Board of Trustees. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

| |

| 18 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

The following is a summary of the values by input classification of the fund’s investments as of April 30, 2014, by major security category or type:

| | | | |

| | | | | LEVEL 3 |

| | | | LEVEL 2 | SIGNIFICANT |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | VALUE AT 4-30-14 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Common Stocks | | | | |

| Energy | $98,145,561 | $98,145,561 | — | — |

| Telecommunication | | | | |

| Services | 30,556,425 | 30,556,425 | — | — |

| Utilities | 468,448,988 | 468,448,988 | — | — |

| Preferred Securities | | | | |

| Financials | 433,281,663 | 433,281,663 | — | — |

| Industrials | 3,103,750 | 3,103,750 | — | — |

| Telecommunication | | | | |

| Services | 46,628,660 | 44,795,630 | $1,833,030 | — |

| Utilities | 177,384,233 | 159,892,436 | 17,491,797 | — |

| Corporate Bonds | | | | |

| Utilities | 3,210,000 | — | 3,210,000 | — |

| Short-Term Investments | 18,842,000 | — | 18,842,000 | — |

| |

|

| Total Investments in | | | | |

| Securities | $1,279,601,280 | $1,238,224,453 | $41,376,827 | — |

| Other Financial | | | | |

| Instruments: | | | | |

| Written Options | ($1,702,275) | ($1,702,275) | — | — |

| Interest Rate Swaps | ($1,536,406) | — | ($1,536,406) | — |

Repurchase agreements. The fund may enter into repurchase agreements. When the fund enters into a repurchase agreement, it receives collateral that is held in a segregated account by the fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest.

Repurchase agreements are typically governed by the terms and conditions of the Master Repurchase Agreement and/or Global Master Repurchase Agreement (collectively, MRA). Upon an event of default, the non-defaulting party may close out all transactions traded under the MRA and net amounts owed. Absent an event of default, the MRA does not result in an offset of the reported amounts of assets and liabilities in the Statement of assets and liabilities. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline or the counterparty may have insufficient assets to pay back claims resulting from close-out of the transactions. Collateral received by the fund for repurchase agreements is disclosed in the Fund’s investments as part of the caption related to the repurchase agreement.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Dividend income

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 19 |

is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income, net of withholding taxes, is recorded when the fund becomes aware of the dividends. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Foreign taxes. The fund may be subject to withholding tax on income and/or capital gains or repatriation taxes imposed by certain countries in which the fund invests. Taxes are accrued based upon investment income, realized gains or unrealized appreciation.

Overdrafts. Pursuant to the custodian agreement, the fund’s custodian may, in its discretion, advance funds to the fund to make properly authorized payments. When such payments result in an overdraft, the fund is obligated to repay the custodian for any overdraft, including any costs or expenses associated with the overdraft. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

Expenses. Within the John Hancock group of funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Federal income taxes. The fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

Under the Regulated Investment Company Modernization Act of 2010, the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Any losses incurred during those taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

For federal income tax purposes, as of October 31, 2013, the fund has a capital loss carryforward of $40,618,921 available to offset future net realized capital gains, which expires on October 31, 2017.

As of October 31, 2013, the fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The fund generally declares and pays dividends monthly and capital gain distributions, if any, annually.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax

| |

| 20 | Tax-Advantaged Dividend Income Fund | Semiannual report |

differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sale loss deferrals and derivative transactions.

Statement of cash flows. Information on financial transactions that have been settled through the receipt and disbursement of cash is presented in the Statement of cash flows. The cash amount shown in the Statement of cash flows is the amount included in the fund’s Statement of assets and liabilities and represents the cash on hand at the fund’s custodian and does not include any short-term investments or cash segregated at the custodian for swap contracts.

Note 3 — Derivative instruments

The fund may invest in derivatives in order to meet its investment objective. Derivatives include a variety of different instruments that may be traded in the OTC market, on a regulated exchange or through a clearing facility. The risks in using derivatives vary depending upon the structure of the instruments, including the use of leverage, optionality, the liquidity or lack of liquidity of the contract, the creditworthiness of the counterparty or clearing organization and the volatility of the position. Some derivatives involve risks that are potentially greater than the risks associated with investing directly in the referenced securities or other referenced underlying instrument. Specifically, the fund is exposed to the risk that the counterparty to an OTC derivatives contract will be unable or unwilling to make timely settlement payments or otherwise honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction.

Certain options and swaps are typically traded through the OTC market and may be regulated by the Commodity Futures Trading Commission (the CFTC). Derivative counterparty risk is managed through an ongoing evaluation of the creditworthiness of all potential counterparties and, if applicable, designated clearing organizations. The fund attempts to reduce its exposure to counterparty risk for derivatives traded in the OTC market, whenever possible, by entering into an International Swaps and Derivatives Association (ISDA) Master Agreement with each of its OTC counterparties. The ISDA gives each party to the agreement the right to terminate all transactions traded under the agreement if there is certain deterioration in the credit quality or contractual default of the other party, as defined in the ISDA. Upon an event of default or a termination of the ISDA, the non-defaulting party has the right to close out all transactions and to net amounts owed.

As defined by the ISDA, the fund may have collateral agreements with certain counterparties to mitigate counterparty risk on OTC derivatives. Subject to established minimum levels, collateral for OTC transactions is generally determined based on the net aggregate unrealized gain or loss on contracts with a particular counterparty. Collateral pledged to the fund is held in a segregated account by a third-party agent or held by the custodian bank for the benefit of the fund and can be in the form of cash or debt securities issued by the U.S. government or related agencies; collateral posted by the fund for OTC transactions is held in a segregated account at the fund’s custodian and is noted in the accompanying Fund’s investments, or if cash is posted, on the Statement of assets and liabilities. The fund’s maximum risk of loss due to counterparty risk is equal to the asset value of outstanding contracts offset by collateral received.

Certain options are traded or cleared on an exchange or central clearinghouse. Exchange-traded or cleared transactions generally present less counterparty risk to a fund than OTC transactions. The exchange or clearinghouse stands between the fund and the broker to the contract and therefore, credit risk is generally limited to the failure of the exchange or clearinghouse and the clearing member.

Options. There are two types of options, put options and call options. Options are traded either OTC or on an exchange. A call option gives the purchaser of the option the right to buy (and the seller the obligation to sell) the underlying instrument at the exercise price. A put option gives the purchaser of the option the right to sell (and the writer the obligation to buy) the underlying

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 21 |

instrument at the exercise price. Writing puts and buying calls may increase the fund’s exposure to changes in the value of the underlying instrument. Buying puts and writing calls may decrease the fund’s exposure to such changes. Risks related to the use of options include the loss of premiums, possible illiquidity of the options markets, trading restrictions imposed by an exchange and movements in underlying security values, and for written options, potential losses in excess of the amounts recognized on the Statement of assets and liabilities. In addition, OTC options are subject to the risks of all OTC derivatives contracts.

When the fund purchases an option, the premium paid by the fund is included in the Fund’s investments and subsequently “marked-to-market” to reflect current market value. If the purchased option expires, the fund realizes a loss equal to the cost of the option. If the fund enters into a closing sale transaction, the fund realizes a gain or loss, depending on whether proceeds from the closing sale are greater or less than the original cost. When the fund writes an option, the premium received is included as a liability and subsequently “marked-to-market” to reflect the current market value of the option written. Premiums received from writing options that expire unexercised are recorded as realized gains. Premiums received from writing options which are exercised or are closed are added to or offset against the proceeds or amount paid on the transaction to determine the realized gain or loss. If a put option on a security is exercised, the premium received reduces the cost basis of the securities purchased by the fund.

During the six months ended April 30, 2014, the fund wrote option contracts to hedge against anticipated changes in securities markets and to generate potential income. The following tables summarize the fund’s written options activities during the six months ended April 30, 2014 and the contracts held at April 30, 2014.

| | |

| | NUMBER OF | PREMIUMS |

| | CONTRACTS | RECEIVED |

|

| Outstanding, beginning of period | 1,030 | $2,043,513 |

| Options written | 5,930 | 10,510,054 |

| Option closed | (4,290) | (9,059,144) |

| Options expired | (1,655) | (1,538,398) |

| Outstanding, end of period | 1,015 | $1,956,025 |

| | | | | | |

| | EXERCISE | | EXPIRATION | NUMBER OF | | |

| OPTIONS | PRICE | | DATE | CONTRACTS | PREMIUM | VALUE |

|

| Calls | | | | | | |

| Russell 2000 Index | $1,130 | | May 2014 | 525 | $1,317,378 | ($842,625) |

| S&P 500 Index | 1,930 | | May 2014 | 260 | 38,529 | (35,100) |

| S&P 500 Index | 1,855 | | May 2014 | 230 | 600,118 | (824,550) |

| Total | | | | 1,015 | $1,956,025 | ($1,702,275) |

Interest rate swaps. Interest rate swaps represent an agreement between the fund and a counterparty to exchange cash flows based on the difference between two interest rates applied to a notional amount. The payment flows are usually netted against each other, with the difference being paid by one party to the other. The fund settles accrued net interest receivable or payable under the swap contracts at specified, future intervals. Swap agreements are privately negotiated in the OTC market or may be executed on a registered commodities exchange (centrally cleared swaps). Swaps are marked-to-market daily and the change in value is recorded as unrealized appreciation/depreciation of swap contracts. A termination payment by the counterparty or the fund is recorded as realized gain or loss, as well as the net periodic payments received or paid by the fund. The value of the swap will typically impose collateral posting obligations on the party that is considered out-of-the-money on the swap.

| |

| 22 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Entering into swap agreements involves, to varying degrees, elements of credit, market and documentation risk that may amount to values that are in excess of the amounts recognized on the Statement of assets and liabilities. Such risks involve the possibility that there will be no liquid market for the swap, or that a counterparty may default on its obligation or delay payment under the swap terms. The counterparty may disagree or contest the terms of the swap. Market risks may also accompany the swap, including interest rate risk. The fund may also suffer losses if it is unable to terminate or assign outstanding swaps or reduce its exposure through offsetting transactions.

During the six months ended April 30, 2014, the fund used interest rate swaps in anticipation of rising interest rates. The following table summarizes the interest rate swap contracts held as of April 30, 2014.

| | | | | | |

| | US NOTIONAL | | PAYMENTS MADE | PAYMENTS RECEIVED | MATURITY | MARKET |

| COUNTERPARTY | AMOUNT | | BY FUND | BY FUND | DATE | VALUE |

|

| Morgan Stanley | $86,000,000 | | Fixed 1.4625% | 3-Month LIBOR (a) | Aug 2016 | ($1,830,364) |

| Capital Services | | | | | | |

| Morgan Stanley | 86,000,000 | | Fixed 0.8750% | 3-Month LIBOR (a) | Jul 2017 | 293,958 |

| Capital Services | | | | | | |

| Total | $172,000,000 | | | | | ($1,536,406) |

(a) At 4-30-14, the 3-month LIBOR rate was 0.2234%.

No interest rate swap positions were entered into or closed during the six months ended April 30, 2014.

Fair value of derivative instruments by risk category

The table below summarizes the fair value of derivatives held by the fund at April 30, 2014 by risk category:

| | | | |

| | | FINANCIAL | ASSET | LIABILITY |

| | STATEMENT OF ASSETS AND | INSTRUMENTS | DERIVATIVES | DERIVATIVES |

| RISK | LIABILITIES LOCATION | LOCATION | FAIR VALUE | FAIR VALUE |

|

| Equity contracts | Payable for written options, | Written options | — | ($1,702,275) |

| | at value | | | |

| Interest rate contracts | Swap contracts, at value | Interest rate | $293,958 | (1,830,364) |

| | | swaps | | |

| Total | | | $293,958 | ($3,532,639) |

Effect of derivative instruments on the Statement of operations

The table below summarizes the net realized gain (loss) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six months ended April 30, 2014:

| | | | |

| | STATEMENT OF | | SWAP | |

| RISK | OPERATIONS LOCATION | WRITTEN OPTIONS | CONTRACTS | TOTAL |

|

| Equity contracts | Net realized gain (loss) | ($1,301,915) | — | ($1,301,915) |

| Interest rate | Net realized gain (loss) | — | ($793,874) | (793,874) |

| contracts | | | | |

| Total | | ($1,301,915) | ($793,874) | ($2,095,789) |

The table below summarizes the net change in unrealized appreciation (depreciation) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six months ended April 30, 2014:

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 23 |

| | | | |

| | STATEMENT OF | | SWAP | |

| RISK | OPERATIONS LOCATION | WRITTEN OPTIONS | CONTRACTS | TOTAL |

|

| Equity contracts | Change in unrealized | $353,437 | — | $353,437 |

| | appreciation | | | |

| | (depreciation) | | | |

| Interest rate | Change in unrealized | — | $698,477 | 698,477 |

| contracts | appreciation | | | |

| | (depreciation) | | | |

| Total | | $353,437 | $698,477 | $1,051,914 |

Note 4 — Guarantees and indemnifications

Under the fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into contracts with service providers that contain general indemnification clauses. The fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 5 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Advisor) serves as investment advisor for the fund. The Advisor is an indirect, wholly owned subsidiary of Manulife Financial Corporation (MFC).

Management fee. The fund has an investment management agreement with the Advisor under which the fund pays a daily management fee to the Advisor equivalent, on an annual basis, to 0.75% of the fund’s average daily managed assets (net assets plus borrowings under the Credit Facility Agreement) (see Note 8). The Advisor has a subadvisory agreement with John Hancock Asset Management a division of Manulife Asset Management (US) LLC, an indirectly owned subsidiary of MFC and an affiliate of the Advisor, and a subadvisory agreement with Analytic Investors, LLC. The fund is not responsible for payment of the subadvisory fees.

Accounting and legal services. Pursuant to a service agreement, the fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These accounting and legal services fees incurred for the six months ended April 30, 2014 amounted to an annual rate of 0.02% of the fund’s average daily managed assets.

Trustee expenses. The fund compensates each Trustee who is not an employee of the Advisor or its affiliates. Each independent Trustee receives from the fund and the other John Hancock closed-end funds an annual retainer. In addition, Trustee out-of-pocket expenses are allocated to each fund based on its net assets relative to other funds within the John Hancock group of funds complex.

Note 6 — Fund share transactions

In December 2007, the Board of Trustees approved a share repurchase plan, which was subsequently reviewed and approved by the Board of Trustees each year in December. Under the current share repurchase plan, the fund may purchase in the open market up to 10% of its outstanding common shares as of December 31, 2013. The current share repurchase plan will remain in effect between January 1, 2014 and December 31, 2014.

During the six months ended April 30, 2014 and the year ended October 31, 2013, the fund repurchased 1.21% and 0.51%, respectively, of its common shares outstanding under the repurchase plan. The weighted average discount per share on these repurchases amount to 11.15%

| |

| 24 | Tax-Advantaged Dividend Income Fund | Semiannual report |

for the six months ended April 30, 2014 and 11.97% for the year ended October 31, 2013. Shares repurchased and corresponding dollar amounts are included on the Statement of changes in net assets. The anti-dilutive impacts of these share repurchases are included on the Financial highlights.

Note 7 — Leverage risk

The fund utilizes a Credit Facility Agreement (CFA) to increase its assets available for investment. When the fund leverages its assets, common shareholders bear the fees associated with the CFA and have potential to benefit or be disadvantaged from the use of leverage. The Advisor’s fee is also increased in dollar terms from the use of leverage. Consequently, the fund and the Advisor may have differing interests in determining whether to leverage the fund’s assets. Leverage creates risks that may adversely affect the return for the holders of common shares, including:

• the likelihood of greater volatility of net asset value and market price of common shares;

• fluctuations in the interest rate paid for the use of the credit facility;

• increased operating costs, which may reduce the fund’s total return;

• the potential for a decline in the value of an investment acquired through leverage, while the fund’s obligations under such leverage remains fixed; and

• the fund is more likely to have to sell securities in a volatile market in order to meet asset coverage or other debt compliance requirements.

To the extent the income or capital appreciation derived from securities purchased with funds received from leverage exceeds the cost of leverage, the fund’s return will be greater than if leverage had not been used, conversely, returns would be lower if the cost of the leverage exceeds the income or capital appreciation derived.

In addition to the risks created by the fund’s use of leverage, the fund is subject to the risk that it would be unable to timely, or at all, obtain replacement financing if the CFA is terminated. Were this to happen, the fund would be required to de-leverage, selling securities at a potentially inopportune time and incurring tax consequences. Further, the fund’s ability to generate income from the use of leverage would be adversely affected.

Note 8 — Credit Facility Agreement

The fund has entered into a CFA with Credit Suisse Securities (USA) LLC (CSSU), pursuant to which the fund borrows money to increase its assets available for investment. In accordance with the 1940 Act, the fund’s borrowings under the CFA will not exceed 33 1/3% of the fund’s managed assets (net assets plus borrowings) at the time of any borrowing.

The fund pledges a portion of its assets as collateral to secure borrowings under the CFA. Such pledged assets are held in a special custody account with the fund’s custodian. The amount of assets required to be pledged by the fund is determined in accordance with the CFA. The fund retains the benefits of ownership of assets pledged to secure borrowings under the CFA. Interest charged is at the rate of three month LIBOR (London Interbank Offered Rate) plus 0.41% and is payable monthly. As of April 30, 2014, the fund had borrowings of $418,900,000, at an interest rate of 0.63%, which is reflected in the Credit facility agreement payable on the Statement of assets and liabilities. During the six months ended April 30, 2014, the average borrowings under the CFA and the effective average interest rate were $418,900,000 and 0.63%, respectively.

The fund may terminate the CFA with CSSU at any time. If certain asset coverage and collateral requirements or other covenants are not met, the CFA could be deemed in default and result in termination. Absent a default or facility termination event, CSSU is generally required to provide the fund with 270 calendar days’ notice before terminating or amending the CFA.

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 25 |

Note 9 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, amounted to $55,665,251 and $76,899,378, respectively, for the six months ended April 30, 2014.

Note 10 — Industry or sector risk

The fund generally invests a large percentage of its assets in one or more particular industries or sectors of the economy. If a large percentage of the fund’s assets are economically tied to a single or small number of industries or sectors of the economy, the fund will be less diversified than a more broadly diversified fund, and it may cause the fund to underperform if that industry or sector underperforms. In addition, focusing on a particular industry or sector may make the fund’s net asset value more volatile. Further, a fund that invests in particular industries or sectors is particularly susceptible to the impact of market, economic, regulatory and other factors affecting those industries or sectors.

| |

| 26 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Additional information

Unaudited

Investment objective and policy

The fund is a closed-end, diversified management investment company, common shares of which were initially offered to the public on February 25, 2004 and are publicly traded on the New York Stock Exchange (the NYSE). The fund’s investment objective is to provide a high level of after-tax total return from dividend income and gains and capital appreciation.

Under normal market conditions, the fund will invest at least 80% of its assets (net assets plus any borrowings for investment purposes) in dividend-paying common and preferred securities that the Advisor believes at the time of acquisition are eligible to pay dividends which, for individual shareholders, qualify for U.S. federal income taxation at rates applicable to long-term capital gains, which are currently taxed to noncorporate taxpayers at a maximum rate of 20% (15% or 0% for individuals in certain tax brackets) (tax-advantaged dividends). Tax-advantaged dividends generally include dividends from domestic corporations and dividends from foreign corporations that meet certain specified criteria. The fund generally can pass the tax treatment of tax-advantaged dividends it receives through to its common shareholders. The fund may write (sell) covered call index options on up to 30% of the value of the fund’s total assets.

Dividends and distributions

During the six months ended April 30, 2014, distributions from net investment income totaling $0.6485 per share were paid to shareholders. The dates of payments and the amounts per share were as follows:

| | | | | | | | |

| | INCOME | | | | | | | |

| PAYMENT DATE | DISTRIBUTIONS | | | | | | | |

| | | | | | | |

| November 29, 2013 | $0.0985 | | | | | | | |

| December 19, 2013 | 0.1100 | | | | | | | |

| January 31, 2014 | 0.1100 | | | | | | | |

| February 28, 2014 | 0.1100 | | | | | | | |

| March 31, 2014 | 0.1100 | | | | | | | |

| April 30, 2014 | 0.1100 | | | | | | | |

| Total | $0.6485 | | | | | | | |

Shareholder communication and assistance

If you have any questions concerning the fund, we will be pleased to assist you. If you hold shares in your own name and not with a brokerage firm, please address all notices, correspondence, questions or other communications regarding the fund to the transfer agent at:

Computershare

P.O. Box 30170

College Station, TX 77842-3170

Telephone: 800-852-0218

If your shares are held with a brokerage firm, you should contact that firm, bank or other nominee for assistance.

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 27 |

Shareholder meeting

The fund held its Annual Meeting of Shareholders on February 18, 2014. The following proposal was considered by the shareholders:

Proposal: Election of four (4) Trustees to serve for a three-year term ending at the 2017 Annual Meeting of Shareholders. Each Trustee was re-elected by the fund’s shareholders and the votes cast with respect to each Trustee are set forth below.

| | |

| | VOTES FOR | VOTES WITHHELD |

|

| Independent Trustees | | |

| William H. Cunningham | 30,136,336.829 | 725,956.041 |

| Grace K. Fey | 30,197,622.828 | 664,670.042 |

| Hassell H. McClellan | 30,184,262.302 | 678,030.568 |

| Gregory A. Russo | 30,150,903.398 | 711,389.472 |

Trustees whose term of office continued after the Annual Meeting of Shareholders because they were not up for election are: Charles L. Bardelis, Craig Bromley, Peter S. Burgess, Theron S. Hoffman, Deborah C. Jackson, James M. Oates, Steven R. Pruchansky and Warren A. Thomson.

| |

| 28 | Tax-Advantaged Dividend Income Fund | Semiannual report |

More information

| | |

| Trustees | Officers | Investment advisor |

| James M. Oates, | Andrew G. Arnott | John Hancock Advisers, LLC |

| Chairperson | President | |

| Steven R. Pruchansky, | | Subadvisors |

| Vice Chairperson | John J. Danello# | John Hancock Asset Management |

| Charles L. Bardelis* | Senior Vice President, Secretary | a division of Manulife Asset |

| Craig Bromley† | and Chief Legal Officer | Management (US) LLC |

| Peter S. Burgess* | | |

| William H. Cunningham | Francis V. Knox, Jr. | Analytic Investors, LLC |

| Grace K. Fey | Chief Compliance Officer | |

| Theron S. Hoffman* | | Custodian |

| Deborah C. Jackson | Charles A. Rizzo | State Street Bank and |

| Hassell H. McClellan | Chief Financial Officer | Trust Company |

| Gregory A. Russo | | |

| Warren A. Thomson† | Salvatore Schiavone | Transfer agent |

| | Treasurer | Computershare Shareowner |

| *Member of the | Services, LLC |

| Audit Committee | | |

| †Non-Independent Trustee | | Legal counsel |

| #Effective 5-29-14 | | K&L Gates LLP |

| | | |

| | | Stock symbol |

| | | Listed New York Stock |

| | Exchange: HTD |

For shareholder assistance refer to page 27

| | |

| You can also contact us: | | |

| | 800-852-0218 | Regular mail: |

| | jhinvestments.com | Computershare |

| | | P.O. Box 30170 |

| | | College Station, TX 77842-3170 |

The fund’s proxy voting policies and procedures, as well as the fund’s proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) website at sec.gov or on our website.

The fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The fund’s Form N-Q is available on our website and the SEC’s website, sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 800-SEC-0330 to receive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our website at jhinvestments.com or by calling 800-852-0218.

The report is certified under the Sarbanes-Oxley Act, which requires closed-end funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

| |

| Semiannual report | Tax-Advantaged Dividend Income Fund | 29 |

| |

| PRESORTED |

| STANDARD |

| U.S. POSTAGE |

| PAID |

| MIS |

800-852-0218

800-231-5469 TDD

800-843-0090 EASI-Line

jhinvestments.com

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable at this time.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable at this time.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable at this time.

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Not applicable.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

(a) Not applicable.

(b)

| | | | |

| | | | Total number of | Maximum number of |

| | Total number of | | shares purchased | shares that may yet |

| | shares | Average price | as part of publicly | be purchased under |

| Period | purchased | per share | announced plans* | the plans |

|

| Nov-13 | 173,696 | $18.215 | 173,696 | 3,406,421 |

|

| Dec-13 | 86,024 | 17.261 | 259,720 | 3,728,167* |

|

| Jan-14 | 21,700 | 18.536 | 281,420 | 3,706,467 |

|

| Feb-14 | 70,125 | 19.305 | 351,545 | 3,636,342 |

|

| Mar-14 | 72.231 | 19.719 | 423,776 | 3,564,111 |

|

| Apr-14 | 28,626 | 20.728 | 452,402 | 3,535,485 |

|

| Total | 452,402 | $18.617 | | |

|

*In December 2007, the Trustees approved a share repurchase plan, which has been subsequently reviewed and approved by the Board of Trustees each year in December. Under the current share repurchase plan, the Fund may purchase in the open market up to 10% of its outstanding common shares as of December 31, 2013. The plan renewed by the Board in December 2013 will remain in effect between January 1, 2014 and December 31, 2014.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The registrant has adopted procedures by which shareholders may recommend nominees to the registrant’s Board of Trustees. A copy of the procedures is filed as an exhibit to this Form N-CSR. See attached “John Hancock Funds – Nominating, Governance and Administration Committee Charter. ”

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c)(1) Submission of Matters to a Vote of Security Holders is attached. See attached “John Hancock Funds – Nominating, Governance and Administration Committee Charter. ”

(c)(2) Contact person at the registrant.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

| John Hancock Tax-Advantaged Dividend Income Fund |

| |

| |

| By: | /s/ Andrew Arnott |

| | ___________________ |

| | Andrew Arnott |

| | President |

| |

| |

| Date: | June 5, 2014 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| |

| By: | /s/ Andrew Arnott |

| | ___________________ |

| | Andrew Arnott |

| | President |

| |

| |

| Date: | June 5, 2014 |

| |

| |

| |

| By: | /s/ Charles A. Rizzo |

| | ___________________ |

| Charles A. Rizzo |

| | Chief Financial Officer |

| |

| |

| Date: | June 5, 2014 |