REGAN TOTAL RETURN INCOME FUND

INSTITUTIONAL CLASS (RCIRX)

INVESTOR CLASS (RCTRX)

SEMI ANNUAL REPORT TO SHAREHOLDERS

MARCH 31, 2023

TABLE OF CONTENTS

| Regan Total Return Income Fund |

| Performance Summary |

| March 31, 2023 (Unaudited) |

| |

Investment Returns

For the period ended March 31, 2023

| | | | | | | Annualized |

| | | 6-Months | | 1-Year | | Since Inception* |

| Regan Total Return Income Fund | | | | | | |

| Institutional Class | | 2.76% | | 0.25% | | 6.20% |

| Investor Class | | 2.62% | | -0.06% | | 5.93% |

| Bloomberg Barclays U.S. Aggregate Bond Index(1) | | 4.89% | | -4.78% | | -4.65% |

| * | Inception date on October 1, 2020. |

| (1) | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based fixed-income index that includes government Treasury securities, corporate bonds, mortgage-backed securities, asset-backed securities and munis to simulate the universe of bonds in the market. |

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call 1.800.44.REGAN or visit the Fund’s website at www.reganfunds.com.

The gross expense ratios as stated in the prospectus dated January 31, 2023 are 1.68% and 1.41% for the Investor Class and Institutional Class, respectively. The net expense ratios are 1.55% and 1.31% for the Investor Class and Institutional Class, respectively, with contractual fee waivers through January 31, 2024.

| Regan Total Return Income Fund |

| Expense Example |

| March 31, 2023 (Unaudited) |

| |

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2022 to March 31, 2023 (the “period”).

Actual Expenses

The “Actual Fund Return” lines in the table below provide information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the corresponding line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table with the lines titled “Hypothetical 5% Return” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the information in the lines titled “Hypothetical 5% Return” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

Expenses Paid During the Period

| | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period |

| Regan Total Return Income Fund | | | | |

| Institutional Class | | | | |

| Actual Fund Return(1) | $1,000.00 | $1,027.60 | 1.30% | $6.57 |

| Hypothetical 5% Return(2) | $1,000.00 | $1,018.50 | 1.29% | $6.49 |

| Investor Class | | | | |

| Actual Fund Return(1) | $1,000.00 | $1,026.20 | 1.55% | $7.83 |

| Hypothetical 5% Return(2) | $1,000.00 | $1,017.30 | 1.53% | $7.70 |

| (1) | Expenses are equal to each of the Funds’ annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 182/365. The expense ratios reflect an expense waiver. The returns assume all dividends and distributions were reinvested. |

| (2) | Expenses are equal to each of the Funds’ annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 182/365. The expense ratios reflect an expense waiver. The returns assume all dividends and distributions were reinvested. |

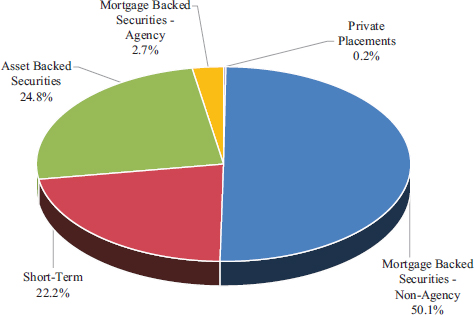

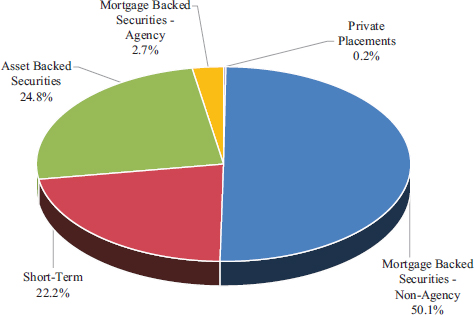

| Regan Total Return Income Fund |

| Allocation of Portfolio Holdings |

| (Calculated as a percentage of Total Investments) |

| March 31, 2023 (Unaudited) |

| * | Short-Term Investments consist of amounts held in money market funds and US Treasury Bills. |

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | | | |

| ASSET BACKED SECURITIES — 24.7% | | | | | | | | |

| Ace Securities Corp. | | | | | | | | |

| Series 2004-RM2, Class M3, 5.715% (1 Month LIBOR USD + 0.870%), 01-25-2035 (2)(a) | | $ | 54,193 | | | $ | 52,757 | |

| Series 2006-ASAP5, Class A2D, 5.365% (1 Month LIBOR USD + 0.520%), 10-25-2036 (2) | | | 1,980,456 | | | | 674,076 | |

| Series 2006-ASAP6, Class A2D, 5.285% (1 Month LIBOR USD + 0.440%), 12-26-2036 (2) | | | 2,712,532 | | | | 941,100 | |

| Series 2006-ASL1, Class A, 5.125% (1 Month USD LIBOR + 0.280%), 02-25-2036 (2) | | | 285,902 | | | | 38,603 | |

| Series 2006-HE4, Class A2B, 5.065% (1 Month LIBOR USD + 0.220%), 10-25-2036 (2) | | | 2,274,636 | | | | 852,349 | |

| Series 2007-D1, Class A4, 6.930%, 02-25-2038 (3)(4) | | | 735,929 | | | | 570,694 | |

| Aegis Asset Backed Securities Trust | | | | | | | | |

| Series 2004-2, Class M3, 7.245% (1 Month LIBOR USD + 2.400%), 06-26-2034 (2) | | | 154,448 | | | | 136,740 | |

| American Home Mortgage Investment Trust | | | | | | | | |

| Series 2007-A, Class 4A, 5.745% (1 Month USD LIBOR + 0.900%), 07-25-2046 (2)(3) | | | 112,837 | | | | 29,254 | |

| Angel Oak Mortgage Trust | | | | | | | | |

| Series 2020-5, Class A3, 2.041%, 05-25-2065 (1)(3) | | | 20,536 | | | | 18,649 | |

| Series 2020-5, Class A1, 1.373%, 05-25-2065 (1)(3) | | | 18,688 | | | | 16,875 | |

| Series 2021-3, Class A1, 1.068%, 05-25-2066 (1)(3) | | | 5,308,723 | | | | 4,363,551 | |

| Series 2021-4, Class A1, 1.035%, 01-20-2065 (1)(3) | | | 1,785,375 | | | | 1,430,822 | |

| Series 2021-5, Class A1, 0.951%, 07-25-2066 (1)(3) | | | 946,753 | | | | 777,935 | |

| Argent Securities Inc. | | | | | | | | |

| Series 2006-W4, Class A2D, 5.385% (1 Month USD LIBOR + 0.540%), 05-25-2036 (2) | | | 285,679 | | | | 68,991 | |

| Series 2006-W5, Class A2B, 5.045% (1 Month LIBOR USD + 0.200%), 06-25-2036 (2) | | | 315,178 | | | | 84,583 | |

| Banc of America Funding Corporation | | | | | | | | |

| Series 2016-R2, Class 1A2, 8.495%, 05-02-2033 (1)(3) | | | 1,588,110 | | | | 1,553,437 | |

| BankAmerica Manufactured Housing Contract Trust | | | | | | | | |

| Series 1997-1, Class B1, 6.940%, 09-25-2023 | | | 600,000 | | | | 157,374 | |

| Series 1998-2, Class B1, 7.331%, 12-10-2025 (1) | | | 2,077,312 | | | | 421,814 | |

| Bayview Commercial Asset Trust | | | | | | | | |

| Series 2005-3, Class B2, 6.475% (1 Month LIBOR USD + 2.445%), 11-25-2035 (2)(3) | | | 285,598 | | | | 258,802 | |

| Bayview Financial AcqusitionTrust | | | | | | | | |

| Series 2006-C, Class 2A3, 5.266% (1 Month LIBOR USD + 0.435%), 11-28-2036 (2) | | | 1,152,227 | | | | 966,937 | |

| Bear Stearns Asset Backed Securities Trust | | | | | | | | |

| Series 2007-SD1, Class 22A1, 3.846%, 10-25-2036 (1) | | | 909,419 | | | | 534,107 | |

| BRAVO Residential Funding Trust | | | | | | | | |

| Series 2021-HE1, Class A1, 5.310% (SOFR30A + 0.750%), 01-27-2070 (2)(3) | | | 608,071 | | | | 600,371 | |

| CDC Mortgage Capital Trust | | | | | | | | |

| Series 2002-HE1, Class A, 5.465% (1 Month LIBOR USD + 0.620%), 01-25-2033 (2) | | | 8,423 | | | | 8,256 | |

| Chase Funding Mortgage Loan Asset-Backed CTFS | | | | | | | | |

| Series 2003-5, Class 1M2, 5.641%, 09-25-2032 (1) | | | 84,946 | | | | 69,798 | |

| Chec Loan trust | | | | | | | | |

| Series 2004-2, Class M3, 6.720% (1 Month USD LIBOR + 1.875%), 04-25-2034 (2) | | | 457,071 | | | | 455,746 | |

| Citigroup Mortgage Loan Trust Inc | | | | | | | | |

| Series 2014-12, Class 2A5, 3.111%, 02-25-2037 (1)(3) | | | 2,489,396 | | | | 1,771,005 | |

| COLT 2021-1 Mortgage Loan Trust | | | | | | | | |

| Series 2021-1, Class A1, 0.910%, 06-25-2066 (1)(3) | | | 363,455 | | | | 292,411 | |

| Conseco Finance Corp. | | | | | | | | |

| Series 1995-5, Class B2, 7.650%, 09-15-2026 (1) | | | 3,859,471 | | | | 377,520 | |

| Conseco Finance Securitizations Corp. | | | | | | | | |

| Series 1999-6, Class A1, 7.360%, 06-01-2030 (1)(3) | | | 8,717,676 | | | | 3,198,602 | |

| Series 2002-1, Class M2, 9.546%, 12-01-2032 (1) | | | 1,951,594 | | | | 1,783,997 | |

| Series 2002-2, Class M2, 9.163%, 03-01-2033 (1) | | | 1,684,600 | | | | 1,541,168 | |

| Conseco Financial Corp | | | | | | | | |

| Series 1996-6, Class B1, 8.000%, 09-15-2027 (1) | | | 1,307,021 | | | | 1,225,622 | |

| Series 1996-8, Class B1, 7.950%, 11-15-2026 (1) | | | 1,680,958 | | | | 1,588,263 | |

| Series 1997-4, Class M1, 7.220%, 02-15-2029 (1) | | | 137,750 | | | | 137,586 | |

| Series 1997-5, Class B1, 6.970%, 05-15-2029 (1) | | | 846,379 | | | | 789,729 | |

| Series 1998-3, Class M1, 6.860%, 03-01-2030 (1) | | | 2,476,818 | | | | 2,300,721 | |

| Series 1998-8, Class M1, 6.980%, 09-01-2029 (1) | | | 3,335,746 | | | | 3,014,188 | |

| Series 1999-4, Class A7, 7.410%, 01-01-2030 | | | 2,381,616 | | | | 1,020,121 | |

| Series 1999-5, Class A6, 7.500%, 03-01-2030 (1) | | | 5,099,430 | | | | 2,015,006 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | | | |

| Countrywide Asset-Backed Certificates | | | | | | | | |

| Series 2004-6, Class 1A1, 5.385% (1 Month LIBOR USD + 0.540%), 12-25-2034 (2) | | $ | 810,565 | | | $ | 759,631 | |

| Series 2006-1, Class AF6, 5.526%, 05-25-2036 (1) | | | 36,502 | | | | 34,238 | |

| Series 2006-15, Class A6, 5.826%, 08-25-2046 (1) | | | 146,720 | | | | 146,192 | |

| Series 2006-9, Class 1AF6, 5.989%, 08-25-2046 (1) | | | 175,417 | | | | 170,124 | |

| Series 2007-6, Class 2A3, 5.065% (1 Month USD LIBOR + 0.220%), 07-25-2034 (2) | | | 167,259 | | | | 171,612 | |

| Series 2007-SEA2, Class 2A1, 6.345% (1 Month LIBOR USD + 1.500%), 07-25-2037 (2)(3) | | | 3,686,406 | | | | 2,512,549 | |

| Countrywide Home Equity Loan Trust | | | | | | | | |

| Series 2004-B, Class 2A, 4.904% (1 Month USD LIBOR + 0.220%), 02-15-2029 (2) | | | 542,018 | | | | 480,039 | |

| Credit Suisse Mortgage Trust | | | | | | | | |

| Series 2007-1, Class 5A4, 6.000%, 02-25-2037 | | | 510,999 | | | | 307,042 | |

| Series 2007-1, Class 5A13, 6.000%, 02-25-2037 | | | 1,715,955 | | | | 1,020,802 | |

| Series 2007-1, Class 1A6A, 5.863%, 02-25-2037 (1) | | | 1,340,104 | | | | 314,526 | |

| Series 2007-1, Class 5A14, 6.000%, 02-25-2037 | | | 918,986 | | | | 547,073 | |

| Series 2015-1R, Class 6A1, 4.795% (1 Month USD LIBOR + 0.280%), 05-28-2037 (2)(3)(a) | | | 191,183 | | | | 184,071 | |

| Series 2019-RPL1, Class A1A, 3.650%, 07-25-2058 (1)(3) | | | 811,886 | | | | 767,502 | |

| Series 2021-NQM4, Class A1, 1.101%, 05-25-2066 (1)(3) | | | 833,313 | | | | 678,291 | |

| Series 2021-NQM6, Class A1, 1.174%, 07-25-2066 (1)(3) | | | 507,941 | | | | 407,455 | |

| Series 2021-NQM7, Class A3, 2.064%, 10-25-2066 (1)(3) | | | 235,761 | | | | 191,668 | |

| Credit-Based Asset Servicing and Securitization | | | | | | | | |

| Series 2004-CB7, Class AF5, 3.773%, 10-25-2034 (4)(a) | | | 29,904 | | | | 26,091 | |

| Series 2006-CB8, Class A1, 5.125% (1 Month USD LIBOR + 0.280%), 10-25-2036 (2) | | | 83,035 | | | | 70,039 | |

| Series 2007-RP1, Class A, 4.927% (1 Month USD LIBOR + 0.310%), 04-25-2037 (2)(3) | | | 123,027 | | | | 100,000 | |

| Ellington Financial Mortgage Trust | | | | | | | | |

| Series 2021-1, 1 Class A3, .106%, 02-25-2066 (1)(3) | | | 482,505 | | | | 395,845 | |

| EquiFirst Mortgage Loan Trust | | | | | | | | |

| Series 2004-1, Class 2A3, 5.645% (1 Month LIBOR USD + 0.800%), 01-25-2034 (2) | | | 512,869 | | | | 482,203 | |

| First Franklin Mtg Loan Asset Backed Certificates | | | | | | | | |

| Series 2006-FF11, Class 2A3, 5.145% (1 Month LIBOR USD + 0.300%), 08-25-2036 (2) | | | 367,682 | | | | 336,336 | |

| Series 2006-FF18, Class A2C, 5.005% (1 Month LIBOR USD + 0.160%), 12-26-2037 (2) | | | 596,847 | | | | 519,539 | |

| First Horizon Alternative Mortgage Securities | | | | | | | | |

| Series 2006-AA8, Class 2A1, 4.410%, 01-25-2037 (1) | | | 238,673 | | | | 135,958 | |

| Fremont Home Loan Trust | | | | | | | | |

| Series 2004-C, Class M2, 5.895% (1 Month USD LIBOR + 1.050%), 08-25-2034 (2) | | | 197,013 | | | | 189,096 | |

| Series 2006-B, Class 2A2, 5.045% (1 Month USD LIBOR + 0.200%), 08-25-2036 (2) | | | 79,564 | | | | 25,985 | |

| Series 2006-3, Class 1A1, 5.125% (1 Month USD LIBOR + 0.280%), 02-25-2037 (2) | | | 63,162 | | | | 48,299 | |

| GCAT | | | | | | | | |

| Series 2021-NQM2, Class A2, 1.242%, 05-25-2066 (1)(3) | | | 399,784 | | | | 325,508 | |

| Series 2021-NQM6, Class A1, 1.855%, 08-25-2066 (1)(3) | | | 841,503 | | | | 710,190 | |

| Series 2021-NQM7, Class A1, 1.915%, 08-25-2066 (1)(3) | | | 1,676,499 | | | | 1,476,319 | |

| GMAC Mortgage Corporation Loan Trust | | | | | | | | |

| Series 2007-HE3, Class 2A1, 7.000%, 09-25-2037 (1) | | | 172,211 | | | | 151,919 | |

| Greenpoint Manufactured Housing | | | | | | | | |

| Series 1999-5, Class M1B, 8.290%, 12-15-2029 (1) | | | 20,526 | | | | 20,367 | |

| Series 1999-5, Class M2, 9.230%, 12-15-2029 (1) | | | 55,984 | | | | 48,749 | |

| Series 2000-3, Class IA, 8.450%, 06-20-2031 (1) | | | 2,284,530 | | | | 1,153,203 | |

| GS Mortgage Securities Corp. | | | | | | | | |

| Series 2015-7R, Class A, 4.812% (1 Month USD LIBOR + 0.150%), 09-28-2037 (2)(3) | | | 22,338 | | | | 22,172 | |

| GSAMP Trust | | | | | | | | |

| Series 2003-SEA, Class A1, 5.645% (1 Month LIBOR USD + 0.800%), 02-25-2033 (2) | | | 58,482 | | | | 56,318 | |

| Series 2006-S1, Class A1, 5.125% (1 Month USD LIBOR + 0.280%), 11-25-2035 (2) | | | 6,564,089 | | | | 684,703 | |

| Series 2006-S5, Class A1, 1.804% (1 Month LIBOR USD + 0.180%), 09-25-2036 (2) | | | 18,570,655 | | | | 223,988 | |

| Series 2006-S5, Class A2, 6.158%, 09-25-2036 (4) | | | 6,187,543 | | | | 82,592 | |

| GSRPM Mortgage Loan Trust | | | | | | | | |

| Series 2004-1, Class B1, 8.595% (1 Month LIBOR USD + 3.750%), 09-25-2042 (2)(3) | | | 55,220 | | | | 54,925 | |

| Home Equity Asset Trust | | | | | | | | |

| Series 2002-2, Class A3, 5.425% (1 Month USD LIBOR + 0.580%), 12-27-2032 (2) | | | 94,405 | | | | 84,191 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | | | |

| HSI Asset Securitization Corporation Trust | | | | | | | | |

| Series 2007-HE2, Class 2A1, 4.955% (1 Month USD LIBOR + 0.110%), 04-27-2037 (2) | | $ | 180,935 | | | $ | 91,492 | |

| Imperial Fund Mortgage Trust | | | | | | | | |

| Series 2021-NQM2, Class A3, 1.516%, 09-25-2056 (1)(3) | | | 294,934 | | | | 229,766 | |

| Series 2022-NQM6, Class A1, 6.819%, 10-25-2067 (3)(4) | | | 38,453 | | | | 38,632 | |

| IndyMac Residential Asset Backed Trust | | | | | | | | |

| Series 2005-A, Class M5, 5.970% (1 Month LIBOR USD + 1.125%), 03-25-2035 (2) | | | 229,448 | | | | 228,294 | |

| Series 2006-C, Class 2A, 5.105% (1 Month USD LIBOR + 0.260%), 08-25-2036 (2) | | | 72,934 | | | | 67,629 | |

| Series 2007-A, Class 2A2, 5.035% (1 Month USD LIBOR + 0.190%), 04-25-2037 (2)(a) | | | 33,007 | | | | 19,969 | |

| Series 2007-A, Class 1A, 5.065% (1 Month LIBOR USD + 0.220%), 04-25-2037 (2) | | | 302,553 | | | | 223,271 | |

| Series 2007-A, Class 2A4B, 5.295% (1 Month LIBOR USD + 0.450%), 04-25-2037 (2) | | | 3,710,580 | | | | 1,387,651 | |

| Lehman ABS Manufactured Housing Contract Trust | | | | | | | | |

| Series 2001-B, Class M2, 7.170%, 04-15-2040 (1) | | | 2,843,688 | | | | 2,017,585 | |

| Long Beach Mortgage Loan Trust | | | | | | | | |

| Series 2004-2, Class A1, 5.285% (1 Month LIBOR USD + 0.440%), 06-25-2034 (2) | | | 374,035 | | | | 347,775 | |

| Series 2006-A, Class A1, 5.025% (1 Month USD LIBOR + 0.180%), 05-25-2036 (2) | | | 979,624 | | | | 22,272 | |

| MASTR Asset Backed Securities Trust | | | | | | | | |

| Series 2002-NC1, Class M4, 8.445% (1 Month LIBOR USD + 3.600%), 10-25-2032 (2) | | | 1,407,262 | | | | 1,160,953 | |

| Series 2006-FRE2, Class A5, 5.325% (1 Month USD LIBOR + 0.480%), 03-25-2036 (2) | | | 255,167 | | | | 175,573 | |

| Series 2006-AM2, Class A3, 5.185% (1 Month LIBOR USD + 0.340%), 06-25-2036 (2) | | | 602,342 | | | | 521,678 | |

| Series 2006-NC2 A3, Class A3, 5.065% (1 Month LIBOR USD + 0.220%), 08-25-2036 (2) | | | 1,002,642 | | | | 383,614 | |

| Series 2006-NC2 A5, Class A5, 5.325% (1 Month LIBOR USD + 0.480%), 08-25-2036 (2) | | | 457,658 | | | | 175,123 | |

| MASTR Specialized Loan Trust | | | | | | | | |

| Series 2007-01, Class A, 5.215% (1 Month LIBOR USD + 0.370%), 01-25-2037 (2)(3) | | | 650,190 | | | | 256,269 | |

| Merrill Lynch Mortgage Investors Trust | | | | | | | | |

| Series 2006-RM3, Class A1B, 5.225% (1 Month USD LIBOR + 0.380%), 06-25-2037 (2) | | | 5,939,596 | | | | 179,878 | |

| Metlife Securitization Trust | | | | | | | | |

| Series 2020-INV1, Class A2A, 2.500%, 05-25-2050 (1)(3) | | | 34,800 | | | | 28,765 | |

| MFRA Trust | | | | | | | | |

| Series 2020-NQM2, Class A3, 1.947%, 04-25-2065 (1)(3) | | | 99,378 | | | | 90,234 | |

| Series 2021-INV1, 1 Class A2, .057%, 01-25-2056 (1)(3) | | | 314,402 | | | | 277,262 | |

| Morgan Stanley Capital Inc | | | | | | | | |

| Series 2003-NC8, Class B1, 10.245% (1 Month USD LIBOR + 5.400%), 09-25-2033 (2) | | | 119,173 | | | | 117,537 | |

| Series 2004-WMC3, Class M3, 5.715% (1 Month USD LIBOR + 0.870%), 01-25-2035 (2) | | | 148,263 | | | | 158,847 | |

| Series 2005-HE1, Class M2, 5.550% (1 Month LIBOR USD + 0.705%), 12-25-2034 (2) | | | 282,834 | | | | 249,110 | |

| Series 2006-HE6, Class A2FP, 4.965% (1 Month LIBOR USD + 0.120%), 09-25-2036 (2)(a) | | | 163,956 | | | | 52,466 | |

| Series 2007-HE1, Class A2C, 4.995% (1 Month LIBOR USD + 0.150%), 11-25-2036 (2) | | | 554,934 | | | | 309,680 | |

| Morgan Stanley Mortgage Loan Trust | | | | | | | | |

| Series 2007-1XS, Class 2A4A, 6.584%, 09-25-2046 (4) | | | 5,897,590 | | | | 1,673,687 | |

| New Century Home Equity Loan Trust | | | | | | | | |

| Series 2004-4, Class M2, 5.640% (1 Month LIBOR USD + 0.795%), 02-25-2035 (2)(a) | | | 110,627 | | | | 96,854 | |

| New Residential Mortgage Loan Trust | | | | | | | | |

| Series 2021-NQM3, Class A3, 1.516%, 11-25-2056 (1)(3) | | | 372,460 | | | | 303,505 | |

| Series 2022-NQM1, Class A1, 2.277%, 04-25-2061 (1)(3) | | | 521,969 | | | | 444,250 | |

| Nomura Home Equity Loan Inc | | | | | | | | |

| Series 2006-AF1, Class A1, 6.032%, 10-25-2036 (4) | | | 1,480,836 | | | | 356,288 | |

| Nomura Resecuritization Trust | | | | | | | | |

| Series 2015-10R, Class 1A2, 5.306%, 12-25-2036 (1)(3) | | | 1,242,626 | | | | 1,010,160 | |

| Novastar Home Equity Loan | | | | | | | | |

| Series 2006-3, Class A2C, 5.165% (1 Month LIBOR USD + 0.320%), 10-25-2036 (2) | | | 1,829,150 | | | | 988,892 | |

| Series 2006-5, Class A2B, 5.085% (1 Month USD LIBOR + 0.240%), 11-25-2036 (2) | | | 999,517 | | | | 332,933 | |

| Oakwood Mortgage Investors Inc. | | | | | | | | |

| Series 1997-A, Class B1, 7.450%, 05-15-2027 (1) | | | 86,023 | | | | 84,019 | |

| Series 2002-C M1, Class M1, 6.890%, 11-15-2032 (1) | | | 1,363,615 | | | | 1,325,332 | |

| Oakwood Mortgage Investors, Inc. | | | | | | | | |

| Series 2001-D A2, 5.260%, 12-15-2024 (1) | | | 1,165,090 | | | | 528,798 | |

| Series 2001-D, Class A4, 6.930%, 09-15-2031 (1) | | | 2,187,241 | | | | 1,191,675 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | | | |

| Option One Mortgage Loan Trust | | | | | | | | |

| Series 2005-QS11, Class 1A1, 5.820%, 03-25-2037 (4) | | $ | 371,743 | | | $ | 325,447 | |

| Series 2007-1, Class 1A1, 4.985% (1 Month LIBOR USD + 0.140%), 01-25-2037 (2) | | | 590,347 | | | | 385,510 | |

| Series 2007-FXD1, Class 3A4, 5.860%, 01-25-2037 (4) | | | 1,762,336 | | | | 1,668,427 | |

| OWNIT Mortgage Loan Asset-Backed Certificates | | | | | | | | |

| Series 2006-6, Class A2C, 5.165% (1 Month USD LIBOR + 0.320%), 09-25-2037 (2) | | | 1,532,950 | | | | 732,404 | |

| RAAC Series | | | | | | | | |

| Series 2007-RP4, Class A, 5.195% (1 Month LIBOR USD + 0.350%), 06-25-2037 (2)(3) | | | 670,873 | | | | 596,997 | |

| RBSSP Resecuritization Trust | | | | | | | | |

| Series 2010-9, Class 7A6, 6.000%, 05-27-2037 (1)(3) | | | 1,025,900 | | | | 511,073 | |

| Renaissance Home Equity Loan Trust | | | | | | | | |

| Series 2002-3, Class A, 5.605% (1 Month LIBOR USD + 0.760%), 12-25-2032 (2) | | | 368,923 | | | | 334,438 | |

| Series 2003-4, Class M2F, 6.244%, 03-25-2034 (4) | | | 216,324 | | | | 194,714 | |

| Series 2004-1, Class M4, 7.545% (1 Month USD LIBOR + 2.700%), 05-25-2034 (2) | | | 239,243 | | | | 172,372 | |

| Series 2004-2, Class M1, 6.414%, 07-25-2034 (4) | | | 406,398 | | | | 350,964 | |

| Residential Funding Mortgage Securities II | | | | | | | | |

| Series 2006-HI5, Class A4, 6.200%, 12-25-2036 (4) | | | 8,137,043 | | | | 1,712,624 | |

| ResMAE Mortgage Loan Trust | | | | | | | | |

| Series 2006-1, Class A2B, 5.145% (1 Month LIBOR USD + 0.300%), 02-25-2036 (2)(3) | | | 2,969,366 | | | | 1,001,040 | |

| Series 2006-1, Class A2C, 5.245% (1 Month LIBOR USD + 0.400%), 02-25-2036 (2)(3) | | | 5,843,178 | | | | 1,970,691 | |

| Securitized Asset Backed Receivables LLC Trust | | | | | | | | |

| Series 2006-FR4, Class A2A, 5.005% (1 Month LIBOR USD + 0.160%), 08-25-2036 (2) | | | 367,746 | | | | 115,512 | |

| Series 2006-WM2, Class A2B, 4.965% (1 Month LIBOR USD + 0.120%), 09-25-2036 (2) | | | 628,086 | | | | 423,596 | |

| Security National Mortgage Loan Trust | | | | | | | | |

| Series 2006-3A, Class A3, 6.330%, 01-25-2037 (1)(3) | | | 337,455 | | | | 150,877 | |

| Specialty Underwriting & Residential Finance | | | | | | | | |

| Series 2006-BC3, Class A2C, 5.145% (1 Month LIBOR USD + 0.300%), 06-25-2037 (2) | | | 85,679 | | | | 48,809 | |

| Structured Asset Securities Corporation | | | | | | | | |

| Series 2006-S3, Class A1, 5.105% (1 Month USD LIBOR + 0.260%), 09-25-2036 (2) | | | 1,034,275 | | | | 344,394 | |

| Series 2006-BC6, Class A1, 5.005% (1 Month LIBOR USD + 0.160%), 01-25-2037 (2) | | | 356,751 | | | | 330,867 | |

| UCFC Manufactured Housing Contract | | | | | | | | |

| Series 1996-1, Class M, 7.900%, 01-15-2028 (1) | | | 28,385 | | | | 25,104 | |

| Verus Securitization Trust | | | | | | | | |

| Series 2021-2, Class A2, 1.288%, 02-25-2066 (1)(3) | | | 367,574 | | | | 310,740 | |

| Series 2021-3, Class A2, 1.283%, 06-25-2066 (1)(3) | | | 668,684 | | | | 553,882 | |

| Series 2021-6, Class A1, 1.630%, 10-25-2066 (1)(3) | | | 2,691,528 | | | | 2,216,131 | |

| Series 2023-1, Class A1, 5.850%, 12-25-2067 (3)(4) | | | 34,634 | | | | 34,331 | |

| WAMU Asset-Backed Certificates | | | | | | | | |

| Series 2007-HE4, Class 2A2, 4.975% (1 Month USD LIBOR + 0.130%), 07-25-2047 (2) | | | 319,594 | | | | 190,090 | |

| Washington Mutual Asset-Backed Certificates | | | | | | | | |

| Series 2007-HE1, Class 2A1, 4.905% (1 Month USD LIBOR + 0.060%), 11-25-2036 (2) | | | 1,544,330 | | | | 550,287 | |

| Conseco Finance Securitizations Corp. | | | | | | | | |

| Series 2000-4, Class A6, 8.310%, 05-01-2032 (1) | | | 660,851 | | | | 133,751 | |

| Option One Mortgage Loan Trust | | | | | | | | |

| Series 2006-3, Class 1A1, 4.985% (1 Month LIBOR USD + 0.140%), 02-25-2037 (2) | | | 996,721 | | | | 660,839 | |

| Residential Asset Securities Corporation | | | | | | | | |

| Series 2005-KS10, Class M2, 5.505% (1 Month LIBOR USD + 0.660%), 11-25-2035 (2) | | | 32,155 | | | | 31,974 | |

| TOTAL ASSET BACKED SECURITIES | | | | | | | | |

| (Cost $89,574,510) | | | | | | $ | 85,482,513 | |

| | | | | | | | | |

| MORTGAGE BACKED SECURITIES — NON AGENCY — 50.0% | | | | | | | | |

| Adjustable Rate Mortgage Trust | | | | | | | | |

| Series 2004-4, Class 3A1, 3.993%, 03-25-2035 (1)(a) | | | 37,313 | | | | 34,981 | |

| Series 2005-5, Class 2A1, 3.359%, 09-25-2035 (1)(a) | | | 50,374 | | | | 39,695 | |

| Series 2005-6A, Class 2A1, 5.465% (1 Month LIBOR USD + 0.620%), 11-25-2035 (2) | | | 91,848 | | | | 35,362 | |

| Series 2005-10, Class 1A1, 4.178%, 01-25-2036 (1) | | | 116,889 | | | | 101,760 | |

| Series 2006-1, Class 1A1, 3.825%, 03-25-2036 (1) | | | 87,255 | | | | 70,755 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Agate Bay Mortgage Trust | | | | | | | | |

| Series 2015-4, Class A5, 3.000%, 06-25-2045 (1)(3)(a) | | $ | 362,186 | | | $ | 337,739 | |

| Series 2015-6, Class A3, 3.500%, 09-25-2045 (1)(3) | | | 405,800 | | | | 364,730 | |

| American Home Mortgage Assets | | | | | | | | |

| Series 2006-2, Class 1A1, 4.098% (12 Month US Treasury Average + 0.960%), 09-25-2046 (2) | | | 530,740 | | | | 443,126 | |

| Series 2007-3, Class 11A1, 5.265% (1 Month USD LIBOR + 0.420%), 06-25-2037 (2) | | | 175,396 | | | | 159,113 | |

| American Home Mortgage Investment Trust | | | | | | | | |

| Series 2004-3, Class MH1, 4.115% (1 Month LIBOR USD + 0.900%), 10-25-2034 (2) | | | 80,264 | | | | 68,216 | |

| Series 2007-1, Class GIOP, 2.078%, 05-25-2047 | | | 5,848,349 | | | | 784,577 | |

| Series 2007-2, Class 11A1, 5.305% (1 Month USD LIBOR + 0.460%), 03-25-2047 (2) | | | 949,521 | | | | 366,901 | |

| Series 2007-2, Class 12A1, 5.385% (1 Month LIBOR USD + 0.540%), 03-25-2047 (2) | | | 1,064,459 | | | | 401,728 | |

| Angel Oak Mortgage Trust | | | | | | | | |

| Series 2020-4, Class A1, 1.469%, 05-25-2065 (1)(3) | | | 264,292 | | | | 237,431 | |

| ASG Resecuritization Trust | | | | | | | | |

| Series 2011-2, Class M52, 5.750%, 02-28-2036 (3) | | | 811,375 | | | | 743,307 | |

| Banc of America Alternative Loan Trust | | | | | | | | |

| Series 2005-11, Class 1CB5, 5.500%, 12-25-2035 | | | 171,462 | | | | 152,656 | |

| Series 2005-J 2A1, Class 1CB1, 5.245% (1 Month LIBOR USD + 0.400%), 11-25-2035 (2) | | | 603,466 | | | | 498,608 | |

| Series 2006-5, Class CB7, 6.000%, 06-25-2046 | | | 250,427 | | | | 219,709 | |

| Series 2006-7, Class A4, 6.498%, 10-25-2036 (4) | | | 854,565 | | | | 246,599 | |

| Series 2007-1, Class 1A1, 3.929%, 04-25-2023 (1)(a) | | | 324,299 | | | | 253,763 | |

| Series 2007-2, Class 1A1, 5.500%, 06-25-2037 | | | 741,463 | | | | 627,311 | |

| Banc of America Funding Corporation | | | | | | | | |

| Series 2004-2, Class 1CB1, 5.750%, 09-20-2034 | | | 306,062 | | | | 303,800 | |

| Series 2005-3, Class 1A10, 5.250%, 06-25-2035 | | | 340,084 | | | | 299,537 | |

| Series 2005-6, Class 1A3, 5.750%, 10-25-2035 | | | 1,276,872 | | | | 1,002,881 | |

| Series 2005-6, Class 1A8, 6.000%, 10-25-2035 | | | 365,344 | | | | 291,702 | |

| Series 2005-8, Class 1A1, 5.500%, 01-25-2036 | | | 257,644 | | | | 209,177 | |

| Series 2005-B, Class 2A1, 3.409%, 04-20-2035 (1) | | | 51,514 | | | | 44,689 | |

| Series 2005-E, Class 8A1, 4.568% (12 Month US Treasury Average + 1.430%), 06-20-2035 (2) | | | 1,034,618 | | | | 721,891 | |

| Series 2006-4, Class A11, 6.000%, 07-25-2036 | | | 232,139 | | | | 166,493 | |

| Series 2006-G, Class 3A3, 7.441% (12 Month LIBOR USD + 1.750%), 07-20-2036 (2) | | | 21,538 | | | | 20,841 | |

| Series 2007-4, Class 3A1, 5.215% (1 Month USD LIBOR + 0.370%), 06-25-2037 (2) | | | 168,911 | | | | 130,808 | |

| Series 2007-8, Class 4A1, 6.000%, 08-25-2037 (a) | | | 87,410 | | | | 62,498 | |

| Series 2007-C, Class 7A4, 5.201% (1 Month LIBOR USD + 0.440%), 05-20-2047 (2)(a) | | | 295,830 | | | | 242,580 | |

| Series 2008-R4, Class 1A4, 5.067% (1 Month LIBOR USD + 0.450%), 07-25-2037 (2)(3)(a) | | | 311,957 | | | | 188,734 | |

| Banc of America Mortgage Securities | | | | | | | | |

| Series 2003-H, Class 2A2, 4.038%, 09-25-2033 (1) | | | 870,361 | | | | 790,176 | |

| Series 2004-D, Class 2A2, 3.042%, 05-25-2034 (1) | | | 65,586 | | | | 60,146 | |

| Series 2005-3, Class 2A3, 5.500%, 03-25-2035 | | | 649,747 | | | | 565,233 | |

| Series 2005-8, Class A12, 5.500%, 09-25-2035 | | | 1,163,439 | | | | 1,004,735 | |

| Series 2005-E, Class 3A1, 3.648%, 06-25-2035 (1) | | | 228,147 | | | | 192,938 | |

| Series 2005-F, Class 2A2, 3.933%, 07-25-2035 (1) | | | 250,321 | | | | 223,124 | |

| Series 2005-J, Class 2A1, 3.841%, 11-25-2035 (1) | | | 51,364 | | | | 44,014 | |

| Series 2006-2, Class A2, 6.000% (1 Month LIBOR USD + 6.000%), 07-25-2046 (2) | | | 282,318 | | | | 244,431 | |

| Series 2006-2, Class A3, 5.445% (1 Month LIBOR USD + 0.600%), 07-25-2046 (2) | | | 869,984 | | | | 674,090 | |

| Series 2007-2, Class A7, 5.500%, 05-25-2037 | | | 79,535 | | | | 60,351 | |

| Series 2007-3, Class 1A1, 6.000%, 09-25-2037 | | | 471,717 | | | | 409,688 | |

| Bayview Commercial Asset Trust | | | | | | | | |

| Series 2006-1A, Class B1, 6.420% (1 Month USD LIBOR + 1.575%), 04-25-2036 (2)(3) | | | 191,527 | | | | 172,030 | |

| BCAP LLC Trust | | | | | | | | |

| Series 2008-IND2, Class A2, 3.457%, 04-25-2038 (1) | | | 975,330 | | | | 724,349 | |

| Bear Stearns Adjustable Rate Mortgage Trust | | | | | | | | |

| Series 2003-4, Class 3A1, 3.566%, 07-25-2033 (1)(a) | | | 65,068 | | | | 57,585 | |

| Series 2003-6, Class 1B1, 3.834%, 08-25-2033 (1) | | | 259,636 | | | | 198,190 | |

| Series 2006-4, Class 2A1, 3.857%, 10-25-2036 (1)(a) | | | 162,590 | | | | 121,536 | |

| Series 2007-2, Class 4A1, 6.180% (1 Year CMT Rate + 2.200%), 12-25-2046 (2) | | | 924,219 | | | | 754,806 | |

| Bear Stearns Alt-A Trust | | | | | | | | |

| Series 2004-5, Class M, 4.121%, 06-25-2034 (1) | | | 528,794 | | | | 431,124 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Series 2005-7, Class 23A1, 3.588%, 09-25-2035 (1) | | $ | 253,664 | | | $ | 106,371 | |

| Series 2005-9, Class 26A1, 3.613%, 11-25-2035 (1) | | | 503,704 | | | | 327,928 | |

| Series 2006-5, Class 2A2, 3.841%, 08-25-2036 (1) | | | 1,263,563 | | | | 635,586 | |

| Bear Stearns Asset Backed Securities Trust | | | | | | | | |

| Series 2007-AC4, Class A2, 10.341% (1 Month USD LIBOR + 27.300%), 05-25-2037 (2) | | | 645,295 | | | | 605,803 | |

| Series 2007-AC5 A-2, 6.000%, 07-25-2037 | | | 5,637,758 | | | | 1,775,150 | |

| Charlie Mac | | | | | | | | |

| Series 2004-1, Class A8, 5.395% (1 Month USD LIBOR + 0.550%), 08-25-2034 (2) | | | 31,799 | | | | 28,453 | |

| Chase Mortgage Finance Corporation | | | | | | | | |

| Series 2004-S2, Class 2A4, 5.500%, 02-25-2034 | | | 241,331 | | | | 231,235 | |

| Series 2005-A1, Class 3A1, 3.939%, 12-25-2035 (1) | | | 119,057 | | | | 98,522 | |

| Series 2007-S1, Class A1, 5.445% (1 Month USD LIBOR + 0.600%), 02-25-2037 (2) | | | 6,455,759 | | | | 1,961,387 | |

| Series 2007-A1, Class 11M1, 3.713%, 03-25-2037 (1) | | | 116,866 | | | | 104,871 | |

| Series 2007-S3, Class 1A1, 5.445% (1 Month LIBOR USD + 0.600%), 05-25-2037 (2) | | | 3,473,994 | | | | 1,146,212 | |

| Series 2007-A3, Class 1A7, 4.180%, 12-25-2037 (1) | | | 143,923 | | | | 114,742 | |

| ChaseFlex Trust | | | | | | | | |

| Series 2007-1, Class 2A6, 6.000%, 02-25-2037 | | | 1,894,459 | | | | 740,211 | |

| Series 2007-3, Class 1A2, 5.305% (1 Month USD LIBOR + 0.460%), 07-25-2037 (2) | | | 885,795 | | | | 264,685 | |

| Series 2007-M1, Class 1A1, 5.145% (1 Month USD LIBOR + 0.300%), 08-25-2037 (2) | | | 339,936 | | | | 297,237 | |

| Chevy Chase Mortgage Funding Corp. | | | | | | | | |

| Series 2003-4, Class A1, 5.525% (1 Month LIBOR USD + 0.680%), 10-25-2034 (2)(3) | | | 170,372 | | | | 156,589 | |

| Series 2004-3, Class A1, 5.095% (1 Month LIBOR USD + 0.250%), 08-27-2035 (2)(3) | | | 320,886 | | | | 284,204 | |

| Series 2005-1A, Class A2, 5.045% (1 Month USD LIBOR + 0.200%), 01-25-2036 (2)(3) | | | 368,809 | | | | 320,714 | |

| Series 2005-2A, Class A2, 5.075% (1 Month USD LIBOR + 0.230%), 05-25-2036 (2)(3) | | | 146,487 | | | | 122,524 | |

| Series 2006-1, Class A1, 4.995% (1 Month LIBOR USD + 0.150%), 12-25-2046 (2)(3)(a) | | | 472,785 | | | | 366,881 | |

| Series 2006-2, Class A2, 5.025% (1 Month LIBOR USD + 0.180%), 04-25-2047 (2)(3)(a) | | | 529,384 | | | | 413,979 | |

| Series 2006-4A, Class A2, 5.025% (1 Month USD LIBOR + 0.180%), 11-25-2047 (2)(3) | | | 67,642 | | | | 50,163 | |

| CHNGE Mortgage Trust 2022-1 | | | | | | | | |

| Series 2022-1, Class A1, 3.007%, 01-25-2067 (1)(3) | | | 158,904 | | | | 141,939 | |

| CIM Trust | | | | | | | | |

| Series 2019-INV1, Class A2, 5.617% (1 Month LIBOR USD + 1.000%), 02-25-2049 (2)(3) | | | 235,413 | | | | 224,894 | |

| Citicorp Mortgage Securities Inc. | | | | | | | | |

| Series 2006-3 1A4, Class 1A4, 6.000%, 06-25-2036 | | | 1,457,447 | | | | 1,273,234 | |

| Series 2006-4 1A4, Class 1A4, 6.000%, 08-25-2036 | | | 1,113,029 | | | | 1,001,116 | |

| Series 2007-5, Class 1A9, 6.000%, 06-25-2037 | | | 61,328 | | | | 52,563 | |

| Citigroup Mortgage Loan Trust Inc | | | | | | | | |

| Series 2004-2, Class 1A1, 6.500%, 09-25-2033 (3) | | | 311,546 | | | | 293,522 | |

| Series 2005-7, Class 2A3A, 3.621%, 11-25-2035 (1) | | | 136,396 | | | | 88,930 | |

| Series 2005-9, Class 1A1, 5.105% (1 Month LIBOR USD + 0.260%), 10-25-2035 (2) | | | 1,045,778 | | | | 836,476 | |

| Series 2005-9, Class 21A2, 5.500%, 10-25-2035 | | | 181,829 | | | | 173,510 | |

| Series 2006-AR1, Class 2A1, 6.380% (1 Month USD LIBOR + 2.400%), 03-25-2036 (2) | | | 59,780 | | | | 53,268 | |

| Series 2006-WF1, Class A2C, 4.605%, 03-25-2036 (4) | | | 434,485 | | | | 208,820 | |

| Series 2007-10, Class 2A4A, 3.734%, 09-25-2037 (1) | | | 182,272 | | | | 159,031 | |

| Series 2007-10, Class 22AA, 3.890%, 09-25-2037 (1) | | | 32,066 | | | | 27,289 | |

| Series 2007-9, Class 3A1, 6.500%, 06-25-2037 (3) | | | 624,108 | | | | 520,400 | |

| Series 2007-AR1, Class A4, 5.265% (1 Month USD LIBOR + 0.420%), 01-25-2037 (2) | | | 5,929,947 | | | | 1,060,844 | |

| Series 2007-OPX1, Class A2, 5.045% (1 Month USD LIBOR + 0.200%), 01-25-2037 (2) | | | 1,274,933 | | | | 587,888 | |

| Series 2021-INV2, Class A3A, 2.500%, 05-25-2051 (1)(3) | | | 342,742 | | | | 277,354 | |

| CitiMortgage Alternative Loan Trust | | | | | | | | |

| Series 2006-A1, Class 1A5, 5.500%, 04-25-2036 | | | 234,129 | | | | 209,992 | |

| Series 2006-A7, Class 1A9, 5.495% (1 Month LIBOR USD + 0.650%), 12-25-2036 (2) | | | 318,987 | | | | 253,747 | |

| Series 2006-A7, Class 1A1, 6.000%, 12-25-2036 (2) | | | 417,096 | | | | 350,757 | |

| Series 2006-A7, Class 1A12, 6.000%, 12-25-2036 | | | 363,674 | | | | 310,549 | |

| Series 2007-A5, Class 1A3, 5.345% (1 Month LIBOR USD + 0.500%), 05-25-2037 (2) | | | 319,170 | | | | 252,946 | |

| Series 2007-A6, Class 1A3, 6.000%, 06-25-2037 | | | 821,051 | | | | 708,674 | |

| Countrywide Alternative Loan Trust | | | | | | | | |

| Series 2003-J2, Class M, 6.000%, 10-25-2033 | | | 178,397 | | | | 165,139 | |

| Series 2004-28CB, Class 2A5, 5.245% (1 Month USD LIBOR + 0.400%), 01-25-2035 (2) | | | 183,796 | | | | 173,276 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Series 2004-34T1, Class A2, 5.500%, 02-25-2035 (a) | | $ | 384,563 | | | $ | 311,496 | |

| Series 2005-17, Class 2A1, 5.325% (1 Month LIBOR USD + 0.480%), 07-25-2035 (2) | | | 785,418 | | | | 610,256 | |

| Series 2005-19CB, Class A2, 6.280% (1 Month USD LIBOR + 16.940%), 06-25-2035 (2) | | | 69,709 | | | | 58,507 | |

| Series 2005-2, Class 2A1, 4.516%, 03-25-2035 (1) | | | 88,596 | | | | 74,405 | |

| Series 2005-24, Class 4A2, 5.378% (1 Month LIBOR USD + 0.600%), 07-20-2035 (2)(a) | | | 498,883 | | | | 291,847 | |

| Series 2005-27, Class 1A6, 6.075% (1 Month LIBOR USD + 1.230%), 08-25-2035 (2) | | | 475,940 | | | | 368,168 | |

| Series 2005-38, Class A3, 5.545% (1 Month LIBOR USD + 0.700%), 09-25-2035 (2)(a) | | | 213,453 | | | | 172,897 | |

| Series 2005-42CB, Class A2, 5.495% (1 Month LIBOR USD + 0.650%), 10-25-2035 (2) | | | 954,302 | | | | 601,129 | |

| Series 2005-42CB, Class A4, 5.500% (1 Month LIBOR USD + 0.680%), 10-25-2035 (2) | | | 1,260,315 | | | | 796,360 | |

| Series 2005-42CB, Class A1, 5.500% (1 Month LIBOR USD + 0.680%), 10-25-2035 (2) | | | 3,390,451 | | | | 2,142,337 | |

| Series 2005-49CB, Class A7, 5.500%, 11-25-2035 | | | 678,933 | | | | 462,463 | |

| Series 2005-51, Class 3A2A, 4.428% (12 Month US Treasury Average + 1.290%), 11-20-2035 (2) | | | 832,327 | | | | 669,553 | |

| Series 2005-57CB, Class 3A3, 5.500%, 12-25-2035 | | | 189,477 | | | | 101,172 | |

| Series 2005-70CB, Class A4, 5.500%, 12-25-2035 | | | 263,336 | | | | 181,854 | |

| Series 2005-76, Class 2A1, 4.138% (12 Month US Treasury Average + 1.000%), 02-25-2036 (2)(a) | | | 23,844 | | | | 17,979 | |

| Series 2005-J1, Class 2A1, 5.500%, 02-25-2025 | | | 11,655 | | | | 11,297 | |

| Series 2005-J10, Class 1A4, 5.475% (1 Month LIBOR USD + 0.630%), 10-25-2035 (2) | | | 1,248,793 | | | | 785,276 | |

| Series 2005-J10, Class 1A13, 5.500% (1 Month LIBOR USD + 0.700%), 10-25-2035 (2) | | | 353,028 | | | | 222,069 | |

| Series 2005-J10, Class 1A9, 5.500% (1 Month LIBOR USD + 0.700%), 10-25-2035 (2) | | | 1,200,763 | | | | 755,330 | |

| Series 2005-J8, Class 1A5, 5.500%, 07-25-2035 | | | 155,955 | | | | 118,742 | |

| Series 2006-17T1, Class A1, 6.250%, 06-25-2036 | | | 863,866 | | | | 366,085 | |

| Series 2006-24CB, Class A19, 5.345% (1 Month LIBOR USD + 0.500%), 08-25-2036 (2) | | | 1,851,415 | | | | 841,243 | |

| Series 2006-24CB, Class A13, 5.195% (1 Month USD LIBOR + 0.350%), 08-25-2036 (2) | | | 493,750 | | | | 219,696 | |

| Series 2006-24CB, Class A22, 6.000%, 08-25-2036 | | | 451,230 | | | | 260,978 | |

| Series 2006-24CB, Class A9, 6.000%, 08-25-2036 | | | 591,028 | | | | 341,833 | |

| Series 2006-26CB, Class A20, 5.195% (1 Month LIBOR USD + 0.350%), 09-25-2036 (2) | | | 1,576,864 | | | | 647,643 | |

| Series 2006-32CB, Class A3, 6.000%, 11-25-2036 | | | 368,805 | | | | 231,580 | |

| Series 2006-34, Class A5, 6.250%, 11-25-2046 | | | 809,107 | | | | 409,020 | |

| Series 2006-39CB, Class 2A1, 5.295% (1 Month LIBOR USD + 0.450%), 01-25-2037 (2) | | | 4,006,489 | | | | 502,615 | |

| Series 2006-40T1, Class 2A4, 6.000%, 12-25-2036 | | | 2,163,048 | | | | 643,717 | |

| Series 2006-41CB, Class 1A7, 6.000%, 01-25-2037 | | | 312,931 | | | | 178,758 | |

| Series 2006-46, Class A2, 5.365% (1 Month LIBOR USD + 0.520%), 02-25-2047 (2) | | | 453,833 | | | | 170,883 | |

| Series 2006-8T1, Class 1A4, 6.000%, 04-25-2036 (a) | | | 73,903 | | | | 32,702 | |

| Series 2006-HY13, Class 4A1, 3.973%, 02-25-2037 (1) | | | 506,292 | | | | 417,993 | |

| Series 2006-J1, Class 2A1, 7.000%, 02-25-2036 | | | 957,459 | | | | 116,376 | |

| Series 2006-J2, Class A2, 0.655% (1 Month LIBOR USD + 5.500%), 04-25-2036 (2) | | | 2,221,955 | | | | 265,124 | |

| Series 2006-J5, Class 1A5, 6.500%, 09-25-2036 | | | 242,007 | | | | 138,663 | |

| Series 2007-11T1, Class A35, 5.175% (1 Month LIBOR USD + 0.330%), 05-25-2037 (2) | | | 3,278,109 | | | | 1,142,003 | |

| Series 2007-16CB, Class 2A2, 14.206% (1 Month LIBOR USD + 54.583%), 08-25-2037 (2) | | | 733,607 | | | | 1,142,902 | |

| Series 2007-16CB, Class 1A5, 5.245% (1 Month LIBOR USD + 0.400%), 08-25-2037 (2) | | | 1,595,758 | | | | 1,037,947 | |

| Series 2007-16CB, Class 1A2, 5.245% (1 Month USD LIBOR + 0.400%), 08-25-2037 (2) | | | 1,074,286 | | | | 698,572 | |

| Series 2007-17CB, Class 1A10, 7.612% (1 Month LIBOR USD + 29.900%), 08-25-2037 (2) | | | 730,488 | | | | 739,462 | |

| Series 2007-22, Class 2A16, 6.500%, 09-25-2037 | | | 1,087,224 | | | | 457,135 | |

| Series 2007-24, Class A6, 5.845% (1 Month USD LIBOR + 1.000%), 10-25-2037 (2) | | | 226,230 | | | | 56,032 | |

| Series 2007-24, Class A7, 1.155% (1 Month USD LIBOR + 6.000%), 10-25-2037 (2) | | | 226,230 | | | | 32,879 | |

| Series 2007-25, Class 1A2, 6.500%, 11-25-2037 | | | 1,266,384 | | | | 637,239 | |

| Series 2007-2CB, Class 2A1, 5.445% (1 Month LIBOR USD + 0.600%), 03-25-2037 (2) | | | 315,486 | | | | 137,129 | |

| Series 2007-3T1, Class 1A2, 5.345% (1 Month USD LIBOR + 0.500%), 04-25-2037 (2) | | | 1,730,231 | | | | 581,092 | |

| Series 2007-9T1, Class 1A4, 5.345% (1 Month USD LIBOR + 0.500%), 05-25-2037 (2) | | | 1,194,967 | | | | 454,269 | |

| Series 2007-9T1, Class 1A5, 0.655% (1 Month USD LIBOR + 5.500%), 05-25-2037 (2) | | | 1,194,967 | | | | 122,552 | |

| Series 2007-J1, Class 2A6, 5.445% (1 Month USD LIBOR + 0.600%), 03-25-2037 (2) | | | 1,886,915 | | | | 569,179 | |

| Series 2007-OA2, Class 1A1, 3.978% (1 Month USD LIBOR + 0.840%), 03-25-2047 (2) | | | 340,193 | | | | 274,622 | |

| Series 2007-OH1, Class A1D, 5.055% (1 Month LIBOR USD + 0.210%), 04-25-2047 (2) | | | 80,595 | | | | 60,551 | |

| Countrywide Alternative Loan Trust Resecuritization | | | | | | | | |

| Series 2008-2R, Class 4A1, 6.250%, 08-25-2037 (1) | | | 1,203,114 | | | | 645,697 | |

| Countrywide Home Loans | | | | | | | | |

| Series 2003-48, Class 2A3, 4.202%, 10-25-2033 (1) | | | 401,221 | | | | 192,997 | |

| Series 2004-25, Class 2A1, 5.525% (1 Month LIBOR USD + 0.680%), 02-25-2035 (2) | | | 565,920 | | | | 466,633 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Series 2004-J3, Class A7, 5.500%, 05-25-2034 | | $ | 243,540 | | | $ | 235,100 | |

| Series 2005-15, Class A5, 5.500%, 08-25-2035 | | | 480,682 | | | | 280,618 | |

| Series 2005-16, Class A28, 5.500%, 09-25-2035 | | | 1,942,829 | | | | 1,262,744 | |

| Series 2005-17, Class 1A8, 5.500%, 09-25-2035 | | | 701,896 | | | | 639,008 | |

| Series 2005-19, Class 2A1, 5.195% (1 Month USD LIBOR + 0.350%), 08-25-2035 (2) | | | 337,819 | | | | 72,519 | |

| Series 2005-2, Class 2A1, 5.485% (1 Month LIBOR USD + 0.640%), 03-25-2035 (2) | | | 124,465 | | | | 109,192 | |

| Series 2005-21, Class A2, 5.500%, 10-25-2035 | | | 193,857 | | | | 118,285 | |

| Series 2005-25, Class A17, 5.500%, 11-25-2035 | | | 402,165 | | | | 209,395 | |

| Series 2005-31, Class 2A1, 3.209%, 01-25-2036 (1) | | | 219,809 | | | | 173,145 | |

| Series 2005-HYB10, Class 5A1, 3.914%, 02-20-2036 (1) | | | 1,225,996 | | | | 928,805 | |

| Series 2005-HYB8, Class 4A1, 3.867%, 12-20-2035 (1) | | | 148,452 | | | | 122,349 | |

| Series 2005-J3, Class 1A3, 6.000% (1 Month LIBOR USD + 1.350%), 09-25-2035 (2) | | | 1,390,827 | | | | 975,969 | |

| Series 2006-10, Class 1A11, 5.850%, 05-25-2036 | | | 174,562 | | | | 84,336 | |

| Series 2007-1, Class A2, 6.000%, 03-25-2037 | | | 1,423,108 | | | | 718,585 | |

| Series 2007-10, Class A6, 6.000%, 07-25-2037 | | | 399,962 | | | | 89,757 | |

| Series 2007-17, Class 1A1, 6.000%, 10-25-2037 | | | 313,889 | | | | 239,971 | |

| Series 2007-20, Class A1, 6.500%, 01-25-2038 (a) | | | 122,750 | | | | 56,219 | |

| Series 2007-3, Class A16, 6.000%, 04-25-2037 | | | 517,614 | | | | 272,267 | |

| Series 2007-HY1, Class 1A1, 3.752%, 04-25-2037 (1) | | | 492,471 | | | | 431,109 | |

| Credit Suisse First Boston Mortgage Securities | | | | | | | | |

| Series 2001-28, Class 1A1, 5.495% (1 Month LIBOR USD + 0.650%), 11-25-2031 (2) | | | 108,078 | | | | 62,894 | |

| Series 2002-18, Class 2A1, 7.500%, 06-25-2032 | | | 100,982 | | | | 92,129 | |

| Series 2002-9, Class 1A1, 7.000%, 03-25-2032 | | | 910,853 | | | | 838,891 | |

| Series 2004-6, Class 4A12, 5.245% (1 Month USD LIBOR + 0.400%), 10-25-2034 (2) | | | 129,382 | | | | 119,373 | |

| Series 2005-10, Class 10A3, 6.000%, 11-25-2035 | | | 197,147 | | | | 56,860 | |

| Series 2005-10, Class 6A7, 5.500%, 11-25-2035 | | | 253,869 | | | | 113,000 | |

| Series 2005-11, Class 8A5, 6.000%, 12-25-2035 (a) | | | 125,295 | | | | 92,091 | |

| Series 2005-11, Class 1A1, 6.500%, 12-25-2035 | | | 1,144,050 | | | | 597,709 | |

| Series 2005-11, Class 3A5, 5.500%, 12-25-2035 | | | 196,868 | | | | 86,153 | |

| Series 2005-4, Class 2A4, 5.500%, 06-25-2035 | | | 559,227 | | | | 421,380 | |

| Series 2005-7, Class 2A2, 5.145% (1 Month USD LIBOR + 0.300%), 08-25-2035 (2) | | | 1,070,360 | | | | 438,990 | |

| Series 2005-8, Class 5A1, 6.200% (1 Month LIBOR USD + 19.525%), 09-25-2035 (2) | | | 950,129 | | | | 507,100 | |

| Series 2005-9, Class 3A1, 6.000%, 10-25-2035 | | | 3,073,584 | | | | 1,016,828 | |

| Series 2005-9, Class 4A1, 6.200% (1 Month LIBOR USD + 19.525%), 10-25-2035 (2) | | | 472,878 | | | | 472,702 | |

| Series 2005-9, Class 1A3, 5.250%, 10-25-2035 | | | 177,266 | | | | 159,669 | |

| Credit Suisse Mortgage Trust | | | | | | | | |

| Series 2006-2, Class 2A3, 6.000%, 03-25-2036 (a) | | | 72,895 | | | | 28,137 | |

| Series 2006-2, Class 6A8, 5.750%, 03-25-2036 | | | 214,224 | | | | 115,107 | |

| Series 2006-3, Class 1A4B, 6.664%, 04-25-2036 (4) | | | 2,008,353 | | | | 138,867 | |

| Series 2006-3, Class 1A3, 6.810%, 04-25-2036 (4) | | | 9,650,000 | | | | 674,881 | |

| Series 2006-6, Class 1A12, 6.000%, 07-25-2036 | | | 1,879,758 | | | | 992,792 | |

| Series 2006-6, Class 1A8, 6.000%, 07-25-2036 | | | 1,258,753 | | | | 666,058 | |

| Series 2006-6, Class 2A4, 6.500%, 07-25-2036 | | | 4,500,307 | | | | 1,306,354 | |

| Series 2007-3, Class 1A2, 5.587%, 04-25-2037 (1) | | | 3,343,751 | | | | 779,767 | |

| Series 2007-4, Class 2A2, 6.000%, 06-25-2037 | | | 102,673 | | | | 60,073 | |

| Series 2007-4R, Class 1A1, 5.494%, 10-26-2036 (1)(3) | | | 74,405 | | | | 63,145 | |

| Series 2007-5, Class 3A19, 6.000%, 08-25-2037 | | | 230,390 | | | | 176,105 | |

| Series 2013-6, Class 2A1, 3.500%, 08-25-2043 (1)(3) | | | 623,948 | | | | 543,458 | |

| Series 2013-6, Class 1A1, 2.500%, 07-25-2028 (1)(3) | | | 46,736 | | | | 43,581 | |

| CSAB Mortgage Backed Trust | | | | | | | | |

| Series 2006-1, Class A3, 5.325% (1 Month USD LIBOR + 0.480%), 06-25-2036 (2) | | | 5,011,249 | | | | 850,046 | |

| Series 2007-1, Class 4A1, 5.195% (1 Month LIBOR USD + 0.350%), 05-25-2037 (2) | | | 8,179,712 | | | | 964,316 | |

| CSAB Mortgage-Backed Trust | | | | | | | | |

| Series 2007-1, Class 1A1A, 5.898%, 05-25-2037 (1) | | | 2,166,357 | | | | 553,059 | |

| Deephaven Residential Mortgage Trust | | | | | | | | |

| Series 2021-2, Class A1, 0.899%, 04-25-2066 (1)(3) | | | 371,796 | | | | 317,706 | |

| Series 2021-2, Class A2, 1.209%, 04-25-2066 (1)(3) | | | 325,509 | | | | 278,895 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Deutsche Alt-A Securities INC Mortgage Loan Trust | | | | | | | | |

| Series 2003-1 A1, Class A1, 5.500%, 09-25-2033 | | $ | 426,082 | | | $ | 426,368 | |

| Series 2005-4 A5, Class A5, 5.500%, 09-25-2035 (1) | | | 73,385 | | | | 64,942 | |

| Series 2006-AR5, Class 1A1, 5.105% (1 Month LIBOR USD + 0.260%), 10-25-2036 (2) | | | 946,574 | | | | 297,919 | |

| Series 2007-AR2, Class A4, 5.115% (1 Month LIBOR USD + 0.270%), 03-25-2037 (2) | | | 28,014 | | | | 29,476 | |

| Series 2007-BAR1, Class A4, 5.325% (1 Month LIBOR USD + 0.480%), 03-25-2037 (2) | | | 7,517,050 | | | | 484,574 | |

| Series 2007-OA5, Class A1A, 5.045% (1 Month LIBOR USD + 0.200%), 08-25-2047 (2)(a) | | | 194,509 | | | | 158,136 | |

| Deutsche Alt-B Securities INC Mortgage Loan Trust | | | | | | | | |

| Series 2006-AB2, Class A3, 6.270%, 06-25-2036 (1) | | | 1,178,000 | | | | 991,535 | |

| Deutsche Mortgage Securities, Inc. | | | | | | | | |

| Series 2004-1, Class 3A5, 6.160%, 09-25-2033 (4) | | | 35,450 | | | | 33,577 | |

| Series 2004-5, Class A4B, 6.125%, 07-25-2034 (4) | | | 40,161 | | | | 38,468 | |

| Series 2006-PR1, Class 5AF1, 5.234% (1 Month USD LIBOR + 0.550%), 04-15-2036 (2)(3) | | | 489,808 | | | | 385,442 | |

| Ellington Financial Mortgage Trust | | | | | | | | |

| Series 2020-1, Class A1, 2.006%, 05-25-2065 (1)(3) | | | 22,510 | | | | 21,466 | |

| First Horizon Alternative Mortgage Securities | | | | | | | | |

| Series 2005-FA6, Class A7, 5.500%, 09-25-2035 | | | 816,402 | | | | 455,761 | |

| Series 2005-AA10, Class 2A1, 4.135%, 12-25-2035 (1) | | | 155,311 | | | | 120,861 | |

| Series 2005-AA11, Class 2A1, 4.147%, 01-25-2036 (1) | | | 412,210 | | | | 218,241 | |

| Series 2006-FA2, Class 1A6, 6.000%, 05-25-2036 | | | 349,981 | | | | 155,565 | |

| First Horizon Mortgage Pass-Through Trust | | | | | | | | |

| Series 2005-AR3, Class 2A1, 3.875%, 08-25-2035 (1) | | | 184,533 | | | | 124,466 | |

| FirstKey Mortgage Trust | | | | | | | | |

| Series 2015-1, Class A3, 3.500%, 03-25-2045 (1)(3) | | | 54,151 | | | | 49,122 | |

| Flagstar Mortgage Trust | | | | | | | | |

| Series 2018-6RR, Class 2A4, 4.000%, 10-25-2048 (1)(3) | | | 131,822 | | | | 127,186 | |

| FWD Securitization Trust | | | | | | | | |

| Series 2020-INV1, Class A3, 2.440%, 01-25-2050 (1)(3) | | | 271,849 | | | | 245,876 | |

| Galton Funding Mortgage Trust | | | | | | | | |

| Series 2019-2, Class A21, 4.000%, 06-25-2059 (1)(3) | | | 73,728 | | | | 70,391 | |

| GCAT | | | | | | | | |

| Series 2021-NQM3, Class A1, 1.091%, 05-25-2066 (1)(3) | | | 748,261 | | | | 610,263 | |

| Series 2021-CM2, Class A1, 2.352%, 08-25-2066 (1)(3) | | | 359,242 | | | | 324,937 | |

| GMAC Mortgage Corporation Loan Trust | | | | | | | | |

| Series 2005-AR4, Class 2A2, 4.111%, 07-19-2035 (1) | | | 124,719 | | | | 87,948 | |

| GSAA Home Equity Trust | | | | | | | | |

| Series 2005-14, Class A1, 5.545% (1 Month LIBOR USD + 0.700%), 12-25-2035 (2) | | | 770,008 | | | | 317,999 | |

| Series 2005-14, Class 2A3, 5.545% (1 Month LIBOR USD + 0.700%), 12-25-2035 (2)(a) | | | 360,013 | | | | 292,330 | |

| Series 2006-10, Class AF3, 5.985%, 06-25-2036 (1) | | | 988,124 | | | | 260,786 | |

| Series 2006-11, Class 2A1, 5.025% (1 Month LIBOR USD + 0.180%), 07-25-2036 (2) | | | 483,419 | | | | 105,215 | |

| Series 2007-5, Class 2A1A, 5.085% (1 Month LIBOR USD + 0.240%), 05-25-2037 (2)(a) | | | 288,190 | | | | 244,097 | |

| GSMPS Mortgage Loan Trust | | | | | | | | |

| Series 2005-RP1, Class 1AF, 5.195% (1 Month LIBOR USD + 0.350%), 01-25-2035 (2)(3)(a) | | | 34,594 | | | | 28,661 | |

| Series 2005-RP3, Class 1AF, 5.195% (1 Month USD LIBOR + 0.350%), 09-25-2035 (2)(3) | | | 497,294 | | | | 420,763 | |

| Series 2006-RP1, Class 1AF2, 5.195% (1 Month LIBOR USD + 0.350%), 01-25-2036 (2)(3) | | | 646,115 | | | | 521,727 | |

| GSR Mortgage Loan Trust | | | | | | | | |

| Series 2004-2F, Class 1A4, 5.500%, 01-25-2034 | | | 29,432 | | | | 28,844 | |

| Series 2005-1F, Class 4A1, 5.145% (1 Month USD LIBOR + 0.300%), 01-25-2035 (2) | | | 355,347 | | | | 322,755 | |

| Series 2005-6F, Class 3A11, 5.145% (1 Month LIBOR USD + 0.300%), 07-25-2035 (2) | | | 636,123 | | | | 486,540 | |

| Series 2005-9F, Class 1A6, 5.500%, 12-25-2035 | | | 383,356 | | | | 317,570 | |

| Series 2005-AR5, Class 2A3, 3.765%, 10-25-2035 (1) | | | 24,247 | | | | 13,638 | |

| Series 2005-AR6, Class B1, 4.184%, 09-25-2035 (1) | | | 93,482 | | | | 79,465 | |

| Series 2006-10F, Class 4A1, 5.195% (1 Month LIBOR USD + 0.350%), 01-25-2037 (2) | | | 1,692,630 | | | | 235,738 | |

| Series 2006-3F, Class 2A3, 5.750%, 03-25-2036 | | | 423,045 | | | | 389,211 | |

| Series 2006-4F, Class 4A2, 2.305% (1 Month LIBOR USD + 7.150%), 05-25-2036 (2) | | | 9,550,098 | | | | 1,144,551 | |

| Series 2006-7F, Class 4A2, 6.500%, 08-25-2036 | | | 1,731,836 | | | | 634,244 | |

| Series 2006-AR1, Class 3A1, 3.664%, 01-25-2036 (1) | | | 60,758 | | | | 65,128 | |

| Series 2006-AR2, Class 3A1, 4.253%, 04-25-2036 (1) | | | 541,307 | | | | 357,126 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Series 2006-OA1, Class 2A2, 5.365% (1 Month LIBOR USD + 0.520%), 08-25-2046 (2) | | $ | 3,306,688 | | | $ | 871,354 | |

| Series 2007-AR2, Class 1A1, 3.163%, 05-25-2037 (1) | | | 879,929 | | | | 485,573 | |

| Series 2007-OA1, Class 2A3A, 5.155% (1 Month USD LIBOR + 0.310%), 05-25-2037 (2) | | | 452,453 | | | | 315,321 | |

| HarborView Mortgage Loan Trust | | | | | | | | |

| Series 2004-8, Class 2A3, 5.581% (1 Month LIBOR USD + 0.820%), 11-19-2034 (2) | | | 267,616 | | | | 222,976 | |

| Series 2004-8, Class 2A4A, 5.561% (1 Month USD LIBOR + 0.800%), 11-19-2034 (2) | | | 283,721 | | | | 257,941 | |

| Series 2005-14, Class 3A1A, 4.373%, 12-19-2035 (1) | | | 53,971 | | | | 50,346 | |

| Series 2005-14, Class 4A1A, 3.796%, 12-19-2035 (1) | | | 1,443,134 | | | | 764,583 | |

| Series 2005-16, Class 1A1A, 5.261% (1 Month USD LIBOR + 0.500%), 01-19-2036 (2) | | | 6,272,503 | | | | 1,855,750 | |

| Series 2005-16, Class 3A1A, 5.261% (1 Month LIBOR USD + 0.500%), 01-19-2036 (2) | | | 2,180,261 | | | | 1,323,021 | |

| Series 2006-4, Class 1A2A, 5.141% (1 Month LIBOR USD + 0.380%), 05-19-2046 (2) | | | 735,508 | | | | 368,096 | |

| Series 2006-5, Class 2A1A, 5.121% (1 Month USD LIBOR + 0.360%), 07-19-2046 (2) | | | 1,569,342 | | | | 805,955 | |

| Series 2006-8, Class 1A1, 4.978% (1 Month LIBOR USD + 0.400%), 07-21-2036 (2) | | | 786,508 | | | | 400,120 | |

| Series 2007-4, Class 2A1, 4.981% (1 Month LIBOR USD + 0.440%), 07-19-2047 (2) | | | 364,816 | | | | 325,145 | |

| HSI Asset Loan Obligation | | | | | | | | |

| Series 2007-WF1, Class A1, 4.965% (1 Month USD LIBOR + 0.120%), 12-25-2036 (2) | | | 812,319 | | | | 261,944 | |

| Impac CMB Trust | | | | | | | | |

| Series 2004-6, Class 2A, 6.060%, 10-25-2034 (4) | | | 199,597 | | | | 196,869 | |

| Series 2004-11, Class 2A1, 5.505% (1 Month USD LIBOR + 0.660%), 03-25-2035 (2) | | | 33,839 | | | | 30,835 | |

| Series 2005-5, Class A1, 5.485% (1 Month LIBOR USD + 0.320%), 08-25-2035 (2) | | | 498,881 | | | | 441,641 | |

| Impac Secured Assets Corp. | | | | | | | | |

| Series 2005-2, Class A2D, 5.705% (1 Month USD LIBOR + 0.860%), 03-25-2036 (2) | | | 52,025 | | | | 39,948 | |

| Series 2007-3, Class A1A, 5.065% (1 Month USD LIBOR + 0.220%), 09-25-2037 (2) | | | 172,293 | | | | 144,470 | |

| IndyMac IMJA Mortgage Loan Trust | | | | | | | | |

| Series 2007-A1, Class A3, 6.000%, 08-25-2037 | | | 2,734,808 | | | | 1,149,516 | |

| IndyMac IMSC Mortgage Loan Trust | | | | | | | | |

| Series 2007-F3, Class 2A1, 6.500%, 09-25-2037 | | | 26,640 | | | | 16,159 | |

| IndyMac INDA Mortgage Loan Trust | | | | | | | | |

| Series 2006-AR2, Class 1A1, 3.576%, 09-25-2036 (1)(a) | | | 262,321 | | | | 150,048 | |

| Series 2007-AR1, Class 1A1, 3.551%, 03-25-2037 (1) | | | 190,045 | | | | 151,996 | |

| IndyMac INDX Mortgage Loan Trust | | | | | | | | |

| Series 2005-AR11, Class A4, 3.465%, 08-25-2035 (1) | | | 712,399 | | | | 549,330 | |

| Series 2005-AR5, Class 1A1, 3.239%, 05-25-2035 (1) | | | 774,716 | | | | 607,177 | |

| Series 2005-AR5, Class 4A1, 3.232%, 05-25-2035 (1) | | | 277,690 | | | | 195,584 | |

| Series 2006-AR19, Class 4A1, 3.321%, 08-25-2036 (1) | | | 1,251,948 | | | | 1,040,077 | |

| Series 2006-AR37, Class 1A1, 3.885%, 02-25-2037 (1) | | | 80,502 | | | | 63,330 | |

| Series 2006-AR5, Class 2A1, 3.149%, 05-25-2036 (1) | | | 1,549,361 | | | | 1,289,311 | |

| Series 2007-AR21IP, Class 1A2, 3.873%, 11-25-2036 (1) | | | 206,728 | | | | 178,951 | |

| Series 2007-AR9, Class 2A1, 3.255%, 06-25-2037 (1) | | | 21,896 | | | | 12,569 | |

| J.P. Morgan Alternative Loan Trust | | | | | | | | |

| Series 2006-A2, Class 3A1, 3.231%, 05-25-2036 (1) | | | 781,351 | | | | 439,974 | |

| Series 2006-A6, Class 2A6, 3.399%, 11-25-2036 (1) | | | 938,185 | | | | 712,537 | |

| Series 2006-S1, Class 3A5, 5.730%, 03-25-2036 (1) | | | 58,915 | | | | 57,206 | |

| Series 2006-S3, Class A5, 6.920%, 08-25-2036 (4) | | | 1,103,529 | | | | 854,333 | |

| Series 2007-A2, Class 2A1, 4.200%, 05-25-2037 (1) | | | 178,441 | | | | 144,418 | |

| JP Morgan Alternative Loan Trust | | | | | | | | |

| Series 2006-A4, Class A8, 3.532%, 09-25-2036 (1) | | | 10,705 | | | | 11,247 | |

| JP Morgan Mortgage Trust | | | | | | | | |

| Series 2004-A1, Class 5A1, 4.240%, 02-25-2034 (1) | | | 70,652 | | | | 67,890 | |

| Series 2004-A3, Class 1A1, 3.319%, 07-25-2034 (1) | | | 28,815 | | | | 25,316 | |

| Series 2005-A1, Class 3A4, 3.859%, 02-25-2035 (1) | | | 37,136 | | | | 34,232 | |

| Series 2005-A2, Class 2A1, 3.580%, 04-25-2035 (1) | | | 86,826 | | | | 68,618 | |

| Series 2005-A8, Class 1A1, 3.902%, 11-25-2035 (1) | | | 1,160,750 | | | | 932,175 | |

| Series 2006-A4, Class 5A1, 3.633%, 06-25-2036 (1) | | | 142,840 | | | | 103,166 | |

| Series 2007-A1, Class 5A6, 3.999%, 07-25-2035 (1) | | | 156,127 | | | | 143,910 | |

| Series 2007-S1, Class 2A22, 5.750%, 03-25-2037 | | | 310,855 | | | | 134,909 | |

| Series 2007-S3, Class 1A18, 5.345% (1 Month USD LIBOR + 0.500%), 08-25-2037 (2) | | | 870,790 | | | | 305,264 | |

| Series 2014-IVR6, Class 2A4, 5.682%, 08-25-2044 (1)(3) | | | 25,145 | | | | 25,045 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Series 2016-2, Class A1, 6.005%, 06-25-2046 (1)(3) | | $ | 19,575 | | | $ | 18,099 | |

| Series 2017-4, Class A3, 3.500%, 11-25-2048 (1)(3) | | | 6,641 | | | | 6,088 | |

| Series 2019-INV1, Class A11, 5.567% (1 Month LIBOR USD + 0.950%), 09-25-2049 (2)(3) | | | 17,496 | | | | 16,751 | |

| Series 2020-LTV1, Class A11, 5.617% (1 Month LIBOR USD + 1.000%), 06-25-2050 (2)(3) | | | 54,546 | | | | 53,417 | |

| Lehman Mortgage Trust | | | | | | | | |

| Series 2006-2, Class 1A1, 5.898%, 04-25-2036 (1) | | | 108,903 | | | | 71,957 | |

| Series 2006-3, Class 1A10, 6.000%, 07-25-2036 | | | 1,281,087 | | | | 642,199 | |

| Series 2006-7, Class 2A5, 1.705% (1 Month LIBOR USD + 6.550%), 11-25-2036 (2) | | | 7,991,628 | | | | 950,351 | |

| Series 2006-9, Class 1A2, 5.445% (1 Month LIBOR USD + 0.600%), 01-25-2037 (2) | | | 1,193,093 | | | | 633,508 | |

| Series 2007-1, Class 2A3, 1.785% (1 Month USD LIBOR + 6.630%), 02-25-2037 (2) | | | 8,546,573 | | | | 935,801 | |

| Series 2007-10, Class 2A1, 6.500%, 01-25-2038 | | | 1,166,483 | | | | 351,879 | |

| Series 2007-3, Class 1A2, 1.855% (1 Month LIBOR USD + 6.700%), 04-25-2037 (2)(a) | | | 1,421,443 | | | | 194,453 | |

| Series 2007-3, Class 1A3, 5.145% (1 Month USD LIBOR + 0.300%), 04-25-2037 (2) | | | 1,471,701 | | | | 352,776 | |

| Series 2007-5, Class 1A3, 5.750%, 06-25-2037 | | | 441,125 | | | | 398,064 | |

| Series 2007-6, Class 1A7, 6.000%, 07-25-2037 | | | 539,523 | | | | 484,922 | |

| Series 2007-7, Class 1A1, 5.345% (1 Month USD LIBOR + 0.500%), 08-25-2037 (2) | | | 737,529 | | | | 380,718 | |

| Series 2008-2, Class 1A1, 6.000%, 03-25-2038 (a) | | | 174,172 | | | | 54,429 | |

| Series 2008-4, Class A1, 5.225% (1 Month LIBOR USD + 0.380%), 01-25-2037 (2) | | | 3,659,088 | | | | 1,084,681 | |

| Lehman XS Trust | | | | | | | | |

| Series 2006-10N, Class 2A1, 5.085% (1 Month LIBOR USD + 0.240%), 05-25-2036 (2)(a) | | | 220,149 | | | | 196,637 | |

| Series 2007-6, Class 1A1, 6.521% (1 Month USD LIBOR + 1.250%), 05-25-2037 (2) | | | 561,819 | | | | 430,477 | |

| MASTR Adjustable Rate Mortgages Trust | | | | | | | | |

| Series 2004-4, Class 2A3, 3.664%, 05-25-2034 (1) | | | 209,451 | | | | 189,819 | |

| Series 2005-6, Class 7A1, 3.721%, 06-25-2035 (1) | | | 315,299 | | | | 272,898 | |

| Series 2005-6, Class 5A1, 2.871%, 07-25-2035 (1) | | | 168,331 | | | | 141,158 | |

| Series 2005-7, Class 3A1, 3.483%, 09-25-2035 (1) | | | 356,938 | | | | 217,496 | |

| Series 2006-2, Class 2A1, 4.162%, 04-25-2036 (1) | | | 59,675 | | | | 32,877 | |

| Series 2006-OA1, Class 1A1, 5.055% (1 Month LIBOR USD + 0.210%), 04-25-2046 (2) | | | 172,881 | | | | 146,168 | |

| Series 2007-2, Class A1, 5.145% (1 Month LIBOR USD + 0.300%), 03-25-2047 (2) | | | 1,018,373 | | | | 863,312 | |

| MASTR Alternative Loan Trust | | | | | | | | |

| Series 2003-4, Class 3A1, 6.000%, 06-25-2033 | | | 18,813 | | | | 18,692 | |

| Series 2004-8, Class 1A1, 6.500%, 09-25-2034 | | | 29,016 | | | | 29,153 | |

| Series 2004-13, Class 10A3, 5.750%, 01-25-2035 | | | 496,947 | | | | 406,291 | |

| Series 2005-4, Class 5A1, 6.000%, 05-25-2035 | | | 646,287 | | | | 560,139 | |

| Series 2006-3, Class 2A2, 6.750%, 07-25-2036 | | | 1,065,181 | | | | 394,300 | |

| Series 2007-1, Class 2A7, 6.000%, 10-25-2036 | | | 983,524 | | | | 305,244 | |

| MASTR Alternative Loans Trust | | | | | | | | |

| Series 2003-6, Class 3A3, 6.000%, 09-25-2033 | | | 44,659 | | | | 42,471 | |

| Series 2004-12, Class 2A1, 6.500%, 12-25-2034 | | | 59,850 | | | | 57,921 | |

| MASTR Asset Securitization Trust | | | | | | | | |

| Series 2004-4, Class 1A7, 5.250%, 12-26-2033 | | | 237,103 | | | | 207,290 | |

| MASTR Resecuritization Trust | | | | | | | | |

| Series 2008-1, Class A1, 6.000%, 09-27-2037 (1)(3)(a) | | | 470,221 | | | | 312,109 | |

| Mello Mortgage Capital Acceptance Trust | | | | | | | | |

| Series 2021-INV2, Class A4, 2.500%, 08-25-2051 (1)(3) | | | 45,748 | | | | 39,313 | |

| Merrill Lynch Mortgage Backed Securities Trust | | | | | | | | |

| Series 2007-2, Class 1A1, 7.430% (1 Month USD LIBOR + 2.400%), 08-25-2036 (2) | | | 434,426 | | | | 374,249 | |

| MFRA Trust | | | | | | | | |

| Series 2020-NQM3, Class A1, 1.014%, 01-26-2065 (1)(3) | | | 19,389 | | | | 16,820 | |

| Series 2021-INV2, Class A1, 1.906%, 11-25-2056 (1)(3) | | | 165,932 | | | | 141,114 | |

| MLCC Mortgage Investors Inc | | | | | | | | |

| Series 2006-3, Class 2A1, 3.739%, 10-25-2036 (1) | | | 742,370 | | | | 626,848 | |

| Morgan Stanley Capital Inc | | | | | | | | |

| Series 2006-16AX, Class 1A, 5.185% (1 Month LIBOR USD + 0.340%), 11-25-2036 (2) | | | 2,961,283 | | | | 536,966 | |

| Morgan Stanley Mortgage Loan Trust | | | | | | | | |

| Series 2004-11AR, Class 1A2A, 5.155% (1 Month LIBOR USD + 0.310%), 01-25-2035 (2) | | | 90,735 | | | | 78,766 | |

| Series 2004-5AR, Class 2A, 3.543%, 07-25-2034 (1) | | | 32,258 | | | | 28,638 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Series 2005-10, Class 1A1, 5.545% (1 Month LIBOR USD + 0.700%), 12-25-2035 (2) | | $ | 310,582 | | | $ | 194,765 | |

| Series 2005-10, Class 1A5, 5.750%, 12-25-2035 | | | 30,509 | | | | 21,975 | |

| Series 2005-4, Class 4A, 4.637%, 08-25-2035 (1) | | | 36,346 | | | | 18,153 | |

| Series 2005-7, Class 7A6, 5.500%, 11-25-2035 | | | 141,441 | | | | 129,872 | |

| Series 2005-9AR, Class 2A, 4.134%, 12-25-2035 (1) | | | 347,492 | | | | 311,397 | |

| Series 2006-12XS, Class A4, 6.512%, 10-25-2036 (4) | | | 4,111,561 | | | | 976,677 | |

| Series 2006-17XS, Class A6, 6.077%, 10-25-2046 (4) | | | 1,989,580 | | | | 490,870 | |

| Series 2006-3AR, Class 2A3, 3.886%, 03-25-2036 (1) | | | 731,296 | | | | 473,455 | |

| Series 2006-7, Class 3A, 5.154%, 06-25-2036 (1) | | | 104,255 | | | | 69,279 | |

| Series 2007-10XS, Class A19, 6.000%, 02-25-2047 (1) | | | 549,283 | | | | 227,866 | |

| Series 2007-11AR, Class 2A3, 2.724%, 06-25-2037 (1)(a) | | | 449,147 | | | | 235,802 | |

| Series 2007-14AR, Class 3A3, 3.815%, 10-25-2037 (1) | | | 320,547 | | | | 287,598 | |

| Series 2007-7AX, Class 1A, 5.285% (1 Month LIBOR USD + 0.440%), 04-25-2037 (2) | | | 2,088,280 | | | | 513,542 | |

| Morgan Stanley ReRemic Trust | | | | | | | | |

| Series 2013-R3, Class 6B2, 3.489%, 12-29-2036 (1)(3) | | | 352,528 | | | | 293,241 | |

| MortgageIT Trust | | | | | | | | |

| Series 2005-1, Class 2A, 5.912% (1 Month LIBOR USD + 1.250%), 02-25-2035 (2) | | | 65,351 | | | | 61,214 | |

| New Residential Mortgage Loan Trust | | | | | | | | |

| Series 2019-NQM4, Class A2, 2.644%, 09-25-2059 (1)(3) | | | 210,846 | | | | 192,796 | |

| NMLT Trust | | | | | | | | |

| Series 2021-INV1, Class A1, 1.185%, 05-25-2056 (1)(3) | | | 1,878,769 | | | | 1,559,593 | |

| Nomura Asset Acceptance Corporation | | | | | | | | |

| Series 2005-WF1, Class 1A1, 5.653%, 03-25-2035 (1) | | | 24,972 | | | | 24,623 | |

| Series 2007-1, Class 1A1A, 5.995%, 03-25-2047 (4) | | | 835,245 | | | | 787,394 | |

| Series 2007-2, Class A1B, 6.017%, 04-25-2047 (1) | | | 1,236,292 | | | | 1,045,063 | |

| Series A-5, Class A5, 6.757%, 06-25-2036 (4) | | | 941,500 | | | | 261,817 | |

| Oceanview Mortgage Loan Trust | | | | | | | | |

| Series 2020-1, Class A1A, 1.733%, 05-31-2050 (1)(3) | | | 461,691 | | | | 415,161 | |

| Onslow Bay Financial LLC | | | | | | | | |

| Series 2021-INV2, Class A3, 2.500%, 10-25-2051 (1)(3) | | | 530,418 | | | | 429,224 | |

| Series 2021-NQM2, Class A1, 1.101%, 05-25-2061 (1)(3) | | | 3,964,312 | | | | 3,127,297 | |

| PHH Alternative Mortgage Trust | | | | | | | | |

| Series 2007-2, Class 3A1, 6.000%, 05-25-2037 | | | 264,356 | | | | 230,767 | |

| PHHMC Mortgage Pass Through Certificates | | | | | | | | |

| Series 2007-3, Class A3, 4.281%, 06-18-2037 (1) | | | 7,828 | | | | 7,376 | |

| Prime Mortgage Trust | | | | | | | | |

| Series 2005-4, Class 2A9, 5.500%, 10-25-2035 | | | 80,087 | | | | 73,011 | |

| Series 2006-1, Class 3A1, 5.195% (1 Month LIBOR USD + 0.350%), 06-25-2036 (2) | | | 1,615,193 | | | | 1,110,640 | |

| Series 2006-DR1, Class 2A2, 6.000%, 05-25-2035 (3) | | | 483,841 | | | | 396,355 | |

| PRKCM Trust | | | | | | | | |

| Series 2021-AFC2, Class A1, 2.071%, 11-25-2056 (1)(3) | | | 427,698 | | | | 354,633 | |

| RAAC Series | | | | | | | | |

| Series 2004-SP3, Class AI4, 5.739%, 09-25-2034 (4) | | | 361,286 | | | | 354,701 | |

| Series 2005-SP1, Class 1A1, 5.000%, 09-25-2034 | | | 135,858 | | | | 124,664 | |

| RBSGC Mortgage Pass Through Certificates | | | | | | | | |

| Series 2008-A, Class A1, 5.500%, 11-25-2035 (1)(3) | | | 258,733 | | | | 218,432 | |

| RBSSP Resecuritization Trust | | | | | | | | |

| Series 2009-12, Class 17A2, 3.990%, 10-26-2035 (1)(3) | | | 598,076 | | | | 563,671 | |

| Series 2009-12, Class 9A2, 3.852%, 03-26-2036 (1)(3) | | | 380,656 | | | | 335,573 | |

| Residential Accredit Loans, Inc. | | | | | | | | |

| Series 2005-QA9, Class CB11, 3.902%, 08-25-2035 (1) | | | 122,841 | | | | 103,181 | |

| Series 2005-QS10, Class 3A3, 5.500%, 08-25-2035 | | | 780,656 | | | | 576,878 | |

| Series 2005-QS11, Class A3, 0.155% (1 Month LIBOR USD + 5.000%), 07-25-2035 (2) | | | 398,207 | | | | 18,910 | |

| Series 2005-QS13, Class 2A3, 5.750%, 09-25-2035 | | | 2,170,503 | | | | 1,858,251 | |

| Series 2005-QS14, Class 3A3, 6.000%, 09-25-2035 | | | 393,110 | | | | 342,899 | |

| Series 2005-QS5, Class A1, 5.245% (1 Month LIBOR USD + 0.400%), 04-25-2035 (2) | | | 1,771,593 | | | | 1,365,514 | |

| Series 2005-QS7, Class A1, 5.500%, 06-25-2035 | | | 395,941 | | | | 328,353 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Series 2006-QS1, Class A5, 5.755% (1 Month LIBOR USD + 0.910%), 01-25-2036 (2) | | $ | 456,735 | | | $ | 322,102 | |

| Series 2006-QS12, Class 2A7, 5.495% (1 Month LIBOR USD + 0.650%), 09-25-2036 (2) | | | 358,539 | | | | 243,130 | |

| Series 2006-QS13, Class 1A10, 6.000%, 09-25-2036 | | | 550,294 | | | | 414,957 | |

| Series 2006-QS2, Class 1A2, 5.345% (1 Month LIBOR USD + 0.500%), 02-25-2036 (2) | | | 420,660 | | | | 302,992 | |

| Series 2006-QS2, Class 1A17, 5.325% (1 Month LIBOR USD + 0.480%), 02-25-2036 (2) | | | 552,768 | | | | 397,766 | |

| Series 2006-QS2, Class 1A7, 6.000%, 02-25-2036 (a) | | | 271,920 | | | | 41,876 | |

| Series 2006-QS4, Class A8, 8.000% (1 Month USD LIBOR + 5,143.000%), 04-25-2036 (2) | | | 70,026 | | | | 60,457 | |

| Series 2007-QS1, Class 1A5, 5.395% (1 Month LIBOR USD + 0.550%), 01-25-2037 (2) | | | 3,189,099 | | | | 2,204,873 | |

| Series 2007-QS1, Class 2A2, 5.205% (1 Month LIBOR USD + 0.360%), 01-25-2037 (2) | | | 659,494 | | | | 433,924 | |

| Series 2007-QS5, Class A1, 5.500%, 03-25-2037 | | | 623,575 | | | | 475,673 | |

| Series 2007-QS8, Class A3, 5.445% (1 Month USD LIBOR + 0.600%), 06-25-2037 (2) | | | 292,000 | | | | 198,675 | |

| Residential Asset Securitization Trust | | | | | | | | |

| Series 2005-A15, Class 2A12, 6.000%, 02-25-2036 | | | 738,948 | | | | 336,568 | |

| Series 2005-A15, Class 4A1, 6.000%, 02-25-2036 | | | 2,286,563 | | | | 766,434 | |

| Series 2006-A10, Class A4, 6.500%, 09-25-2036 | | | 525,327 | | | | 190,931 | |

| Series 2006-A10, Class A5, 6.500%, 09-25-2036 | | | 983,295 | | | | 357,379 | |

| Series 2006-A2, Class A11, 6.000%, 01-25-2046 | | | 1,713,205 | | | | 741,351 | |

| Series 2006-A2, Class A7, 6.000%, 05-25-2036 | | | 858,239 | | | | 369,641 | |

| Series 2006-A7CB, Class 2A5, 5.095% (1 Month USD LIBOR + 0.250%), 07-25-2036 (2) | | | 427,194 | | | | 75,351 | |

| Series 2006-A8, Class 2A2, 6.750%, 08-25-2036 | | | 2,000,659 | | | | 623,994 | |

| Series 2006-A8, Class 3A8, 5.595% (1 Month LIBOR USD + 0.750%), 08-25-2036 (2) | | | 507,492 | | | | 205,794 | |

| Series 2007-A3, Class 1A1, 5.295% (1 Month USD LIBOR + 0.450%), 04-25-2037 (2) | | | 2,012,457 | | | | 770,662 | |

| Residential Asset Securitization Trust 2005-A12 | | | | | | | | |

| Series 2005-A12, Class A3, 5.500%, 11-25-2035 | | | 1,931,783 | | | | 1,050,400 | |

| Residential Asset Securitization Trust 2005-A9 | | | | | | | | |

| Series 2005-A9, Class A3, 5.500%, 07-25-2035 | | | 2,439,131 | | | | 1,516,330 | |

| Residential Asset Securitization Trust 2006-A8 | | | | | | | | |

| Series 2006-A8, Class 2A3, 6.000%, 08-25-2036 | | | 911,918 | | | | 252,820 | |

| Series 2006-A8, Class 2A4, 6.500%, 08-25-2036 | | | 633,926 | | | | 190,395 | |

| Residential Asset Securitization Trust 2007-A2 | | | | | | | | |

| Series 2007-A2, Class 1A6, 6.000%, 04-25-2037 | | | 1,595,125 | | | | 934,007 | |

| Residential Funding Mtg Sec I | | | | | | | | |

| Series 2006-S12, Class 3A7, 5.750%, 12-25-2036 | | | 136,728 | | | | 115,817 | |

| Series 2007-S6, Class 2A4, 6.000%, 06-25-2037 | | | 1,421,721 | | | | 1,071,728 | |

| Series 2007-SA3, Class 2A1, 4.524%, 07-25-2037 (1) | | | 518,977 | | | | 401,525 | |

| Series 2007-SA4, Class 3A1, 4.849%, 10-25-2037 (1) | | | 117,029 | | | | 82,932 | |

| Salomon Brothers Mortgage Securities VII | | | | | | | | |

| Series 1997-HUD1, Class A4, 3.071%, 12-25-2030 (1)(a) | | | 225,370 | | | | 135,357 | |

| Sequoia Mortgage Trust | | | | | | | | |

| Series 2007-3, Class 2BA1, 3.314%, 07-20-2037 (1) | | | 885,174 | | | | 661,710 | |

| Series 2013-5, Class A1, 2.500%, 05-25-2043 (1)(3) | | | 234,489 | | | | 200,256 | |

| Series 2013-9, Class AP, , 07-25-2043 (3) | | | 250,828 | | | | 178,370 | |

| Series 2014-1, Class 2A5, 4.000%, 04-25-2044 (1)(3) | | | 99,887 | | | | 95,144 | |

| Series 2015-3, Class A1, 3.500%, 07-25-2045 (1)(3) | | | 524,272 | | | | 474,806 | |

| Series 2018-CH3, Class A2, 4.000%, 08-25-2048 (1)(3) | | | 260,224 | | | | 252,396 | |

| Series 2018-CH3, Class A19, 4.500%, 08-25-2048 (1)(3)(a) | | | 29,301 | | | | 26,371 | |

| Small Business Administration Pools | | | | | | | | |

| Series 510847, 7.575% (PRIME + 0.075%), 09-25-2037 (2)(a) | | | 72,948 | | | | 76,459 | |

| Starwood Mortgage Residential Trust | | | | | | | | |

| Series 2020-3, Class A1, 1.486%, 04-25-2065 (1)(3) | | | 236,891 | | | | 221,629 | |

| Structured Adjustable Rate Mortgage Loan Trust | | | | | | | | |

| Series 2005-17, Class 5A1, 4.697%, 08-25-2035 (1) | | | 512,318 | | | | 298,445 | |

| Series 2005-18, Class 1A1, 3.635%, 09-25-2035 (1) | | | 698,590 | | | | 496,188 | |

| Series 2005-20, Class 1A1, 4.928%, 10-25-2035 (1) | | | 543,151 | | | | 487,135 | |

| Series 2005-23, Class 3A1, 4.115%, 01-25-2036 (1) | | | 94,637 | | | | 56,991 | |

| Series 2007-3, Class 2A1, 3.587%, 04-25-2037 (1) | | | 330,064 | | | | 295,773 | |

| Series 2007-7, Class 1A1, 5.445% (1 Month LIBOR USD + 0.600%), 08-25-2037 (2) | | | 37,817 | | | | 30,840 | |

The accompanying notes are an integral part of these financial statements.

Regan Total Return Income Fund

Schedule of Investments

March 31, 2023 (Unaudited)

| | | Principal

Amount | | | Value | |

| | | | | | | |

| Structured Asset Mortgage Investments Inc | | | | | | | | |

| Series 2006-AR3, Class 3A1, 5.305% (1 Month LIBOR USD + 0.460%), 02-25-2036 (2) | | $ | 666,848 | | | $ | 514,806 | |

| Series 2006-AR3, Class 22A1, 3.448%, 05-25-2036 (1) | | | 435,332 | | | | 231,817 | |

| Series 2006-AR3, Class 21A1, 5.245% (1 Month LIBOR USD + 0.400%), 05-25-2036 (2) | | | 868,794 | | | | 661,142 | |

| Series 2006-AR5, Class 3A1, 5.265% (1 Month LIBOR USD + 0.420%), 05-25-2036 (2) | | | 2,000,424 | | | | 854,990 | |

| Structured Asset Securities Corporation | | | | | | | | |

| Series 2003-37A, Class 2A, 3.933%, 12-25-2033 (1) | | | 49,283 | | | | 44,855 | |

| Suntrust Adjustable Rate Mortgage Loan Trust | | | | | | | | |

| Series 2007-2, Class 2A1, 4.102%, 04-25-2037 (1) | | | 170,401 | | | | 99,756 | |

| Series 2007-4, Class 2A1, 3.653%, 10-25-2037 (1) | | | 141,905 | | | | 108,003 | |

| TBW Mortgage Backed Pass Through Certificates | | | | | | | | |

| Series 2006-3, Class 2A1, 6.500%, 07-25-2036 | | | 878,625 | | | | 330,614 | |

| Terwin Mortgage Trust | | | | | | | | |

| Series 2004-19HE, Class A1, 5.585% (1 Month LIBOR USD + 0.740%), 10-25-2034 (2)(3) | | | 453,347 | | | | 421,266 | |

| Thornburg Mortgage Securities Trust | | | | | | | | |

| Series 2005-1, Class A2, 3.673%, 04-25-2045 (1) | | | 198,686 | | | | 185,947 | |