The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

Soundwatch Hedged Equity ETF

Notes to Financial Statements

April 30, 2023 (Unaudited)

NOTE 1 – Organization

The Soundwatch Hedged Equity ETF (the “Fund”), formerly Soundwatch Hedged Equity Fund, is a diversified series of Trust for Advised Portfolios (the “Trust”). The Trust was organized on August 28, 2003, as a Delaware Statutory Trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end investment management company. Soundwatch Capital, LLC (the “Adviser”) serves as the investment manager to the Fund. The investment objective of the Fund is to provide long-term capital appreciation.

On October 24, 2022, the Soundwatch Hedged Equity Fund (the “Target Fund”) was reorganized into the Soundwatch Hedged Equity ETF (the “Acquiring ETF”) (the “Reorganization”).

The Reorganization was accomplished by a tax-free exchange of shares (with an exception for fractional mutual fund shares) of the Acquiring ETF for shares of the Target Fund of equivalent aggregate net asset value.

Fees and expenses incurred to affect the Reorganization were borne by the Adviser. The management fee of the Acquiring ETF is lower than the management fee of the Target Fund and, therefore, the Acquiring ETF is expected to experience lower overall expenses as compared to the Target Fund. The Reorganization did not result in a material change to the Target Fund’s investment portfolios as compared to those of the Acquiring ETF. There are no material differences in accounting policies of the Target Fund as compared to those of the Acquiring ETF.

The Acquiring ETF did not purchase or sell securities following the Reorganization for purposes of realigning its investment portfolio. Accordingly, the acquisition of the Target Fund did not affect the Acquiring ETF’s portfolio turnover ratios for the period ended October 31, 2022.

NOTE 2 – Share Transactions

The shares of the Fund are principally listed and traded on the NASDAQ Stock Market. The market price of the Fund may be below, at, or above its net asset value (“NAV”).

The Fund issues and redeems shares on a continuous basis at NAV only in aggregated lots of 25,000 shares, each lot called a “Creation Unit.” Creation Unit transactions are conducted in exchange for the deposit or delivery of a designated basket of in-kind securities and/or cash. Because securities sold short (there are other certain restricted securities that cannot be transacted in-kind where a broker is restricted in the security) are not currently eligible for in-kind transfers, they will be substituted with cash in the purchase or redemption of Creation Units of the Fund. The Fund will not accept (or offer) securities sold short in the creation or redemption of its shares. The Fund may charge an additional variable fee for creations and redemptions in cash, to offset brokerage and impact expenses associated with a cash transaction. Except when aggregated in Creation Units, shares of the Fund are not redeemable securities. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System (“Clearing Process”) of the National Securities Clearing Corporation (“NSCC”) or (ii) a participant in the Depository Trust Company (“DTC”) and, in each case, must have executed a Participant Agreement with the Funds’ distributor, Quasar Distributors, LLC (the “Distributor”). Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem shares directly from the Fund. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees. Once created, shares generally will trade in the secondary market in amounts less than a Creation Unit and at market prices that change throughout the day.

NOTE 3 – Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for investment companies. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards

Soundwatch Hedged Equity ETF

Notes to Financial Statements (Continued)

April 30, 2023 (Unaudited)

Board Accounting Standards Codification Topic 946. The presentation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the period reported. Actual results may differ from those estimates.

(a) Securities Valuation – All equity securities that are traded on a national securities exchange, except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”), are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on NASDAQ will be valued at the NASDAQ Official Closing Price (“NOCP”).

Exchange traded options are valued at the composite mean price, which calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is principally traded. On the last trading day prior to expiration, expiring options may be priced at intrinsic value. When reliable market quotations are not readily available or a pricing service does not provide a valuation (or provides a valuation that in the judgment of the Adviser does not represent the security’s fair value) or when, in the judgment of the Adviser, events have rendered the market value unreliable, a security is fair valued in good faith by the Adviser under procedures approved by the Board.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized into three broad levels and described below:

Level 1 - quoted prices in active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value.

Level 2 - observable inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3 - significant unobservable inputs, including the Fund’s own assumptions in determining the fair value of investments.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to fair value the Fund’s investments in each category investment type as of April 30, 2023:

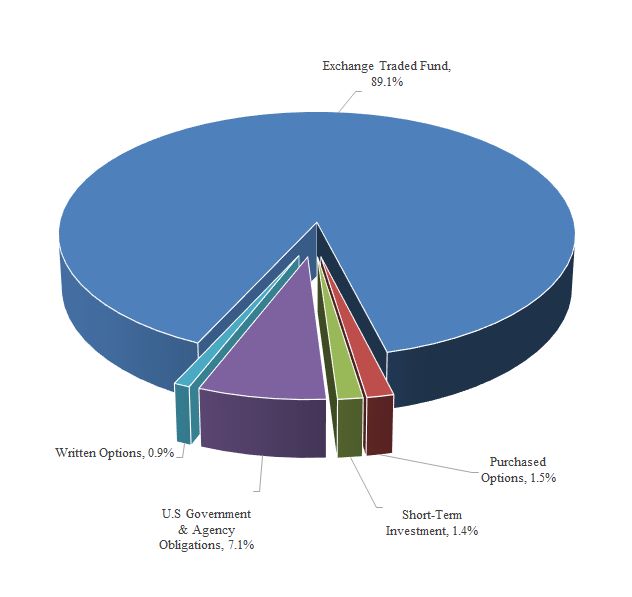

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Exchange Traded Fund | | $ | 93,555,840 | | | $ | - | | | $ | - | | | $ | 93,555,840 | |

| Purchased Options | | | - | | | | 1,604,015 | | | | - | | | | 1,604,015 | |

| Short-Term Investment | | | 1,498,046 | | | | - | | | | - | | | | 1,498,046 | |

| U.S. Government & Agency Obligations | | | - | | | | 7,414,758 | | | | - | | | | 7,414,758 | |

| Total | | $ | 95,053,886 | | | $ | 9,018,773 | | | $ | - | | | $ | 104,072,659 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Written Options | | $ | - | | | $ | (893,815 | ) | | $ | - | | | $ | (893,815 | ) |

| Total | | $ | - | | | $ | (893,815 | ) | | $ | - | | | $ | (893,815 | ) |

See the Schedule of Investments for further detail of investment classifications.

Soundwatch Hedged Equity ETF

Notes to Financial Statements (Continued)

April 30, 2023 (Unaudited)

(b) Derivatives – The Fund invests in certain derivatives, as detailed below, to meet its investment objectives.

The Fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of risks, such as liquidity risk, interest rate risk, market risk, credit risk and management risk. They also involve the risk of mispricing or improper valuation and the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. The Fund could lose more than the principal amount invested by investing in a derivative instrument. Also, suitable derivative transactions may not be available in all circumstances and there can be no assurance that the Fund will engage in these transactions to reduce exposure to other risks when that would be beneficial.

The Fund may also utilize certain financial instruments and investment techniques for risk management or hedging purposes. There is no assurance that such risk management and hedging strategies will be successful, as such success will depend on, among other factors, the Adviser’s ability to predict the future correlation, if any, between the performance of the instruments utilized for hedging purposes and the performance of the investments being hedged.

The following provides more information on specific types of derivatives and activity in the Fund. The use of derivative instruments by the Fund for the six months ended April 30, 2023 was related to the use of purchased and written options. The Fund systematically writes (sells) equity index and/or ETF call options, covered calls and option spreads to generate additional income. A portion of the proceeds is used to systematically purchase a series of protective equity index and/or ETF put options or put spreads to reduce the negative impact of stock market declines on long-term performance.

As the seller of an index call option, the Fund receives cash (the “premium”) from the purchaser. The purchaser of an index call option has the right to any appreciation in the value of the index over a fixed price (the “exercise price”) on a certain date in the future (the “expiration date”). If the purchaser does not exercise the option, the Fund retains the premium. If the purchaser exercises the option, the Fund pays the purchaser the difference between the value of the index and the exercise price of the option. The premium, the exercise price and the value of the index determine the gain or loss realized by the Fund as the seller of the index call option.

The Fund also buys index and/or ETF put options in an attempt to protect the Fund from a significant market decline that may occur over a short period of time. The value of an index and/or ETF put option generally increases as stock prices (and the value of the index) decrease and decreases as those stocks (and the index) increase. A put spread is an option spread strategy that is created when equal number of put options are bought and sold simultaneously. Under certain market conditions, the selling of call options, including covered call options, or option spreads and purchasing of protective put options or put spreads may limit the upside returns of the Fund.

Soundwatch Hedged Equity Fund

| Statement of Assets and Liabilities Location |

| Assets |

| Risk Exposure Category | Investments (1) |

| Equity | $ 1,604,015 |

| Total | $ 1,604,015 |

| Liabilities |

| Risk Exposure Category | Written Options |

| Equity | $ (893,815) |

| Total | $ (893,815) |

| (1) | Includes purchased options |

Soundwatch Hedged Equity ETF

Notes to Financial Statements (Continued)

April 30, 2023 (Unaudited)

The following table sets forth the Fund’s realized and unrealized gain (loss), as reflected in the Statement of Operations, by primary risk exposure and by type of derivative contract for the six months ended April 30, 2023:

Amount of Realized Gain (Loss) on Derivatives

| Risk Exposure Category | Investments (1) | Written Options |

Equity | $ (6,082,119) | $ 4,170,465 |

Total | $ (6,082,119) | $ 4,170,465 |

Change in Unrealized Appreciation (Depreciation) on Derivatives

| Risk Exposure Category | Investments(1) | Written Options |

Equity | $ 1,692,291 | $ 1,572,845 |

Total | $ 1,692,291 | $ 1,572,845 |

| (1) | Includes purchased options |

The Fund had outstanding purchased and written option contracts as listed on the Schedule of Investments as of April 30, 2023. For the period ended April 30, 2023, the month-end average number of purchased and written option contracts for the Fund was 320 and (530), respectively.

(c) Federal Income Taxes - The Fund has elected to be taxed as a Regulated Investment Companies (“RIC”) under the U.S. Internal Revenue Code of 1986, as amended, and intends to maintain this qualification and to distribute substantially all of the net taxable income to its shareholders. Therefore, no provision is made for federal income taxes. Due to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement and federal income tax purpose, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains and losses are recorded by the Fund.

As of and during the period ended April 30, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or tax penalties. The Fund’s federal and state income tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

(d) Distributions to Shareholders –Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Indemnifications – In the normal course of business, the Fund enters into contracts that contain a variety of representations, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

(f) Use of Estimates – The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

(g) Security Transactions and Investment Income – The Fund records security transactions based on trade date. Realized gains and losses on sales of securities are reported based on identified cost of securities delivered. Dividend income and expense are recognized on the ex-dividend date, and interest income and expense are recognized on an accrual basis.

Soundwatch Hedged Equity ETF

Notes to Financial Statements (Continued)

April 30, 2023 (Unaudited)

(h) Options Trading – The Fund maintains an account with Interactive Brokers LLC (“IB”) for options trading. The cash balance maintained at IB is reported as Deposits at broker for option trading on the Statement of Assets and Liabilities. Securities pledged as collateral for this account are denoted on the Schedule of Investments.

The Fund may earn or pay interest on this account based on the cash balance and value of open option contracts. The Fund earns interest income if the cash balance and value of purchased options exceeds the value of written options and pays interest expense if the value of written options exceeds the cash balance and value of purchased options. For the six months ended April 30, 2023, the Fund paid interest expense totaling $393 as included on the Statement of Operations.

NOTE 4 – Investment Management Agreement and Other Transactions with Affiliates

The Trust has an agreement with the Adviser to furnish investment advisory services to the Fund. Effective under the terms of this agreement, the Fund pays the Adviser a monthly fee based on the average daily net assets at an annual rate of 0.60%. Advisory fee is accrued daily and paid monthly. The management fee is a unitary fee, whereby the Adviser has agreed to pay substantially all expenses of the Fund, including the cost of transfer agency, custody, fund administration, legal, audit and other services. The Adviser is not responsible for, and the Fund will bear the cost of, (i) interest expense, (ii) taxes, (iii) brokerage expenses and other expenses connected with the execution of portfolio securities transactions, (iv) dividends and expenses associated with securities sold short, (v) non-routine expenses and fees, and (vi) expenses paid by the Trust under any plan adopted pursuant to Rule 12b-1 under the 1940 Act. Prior to the Reorganization, the annual rate of the management fee paid by the Target Fund was 0.66% of the average daily net assets.

The Adviser has contractually agreed to waive 0.10% of its unitary management fee to reduce the unitary management fee to 0.50% (the “Fee Waiver”). The Fee Waiver will remain in effect through at least February 28, 2024, and may be terminated only by the Board. The Fee Waiver is not subject to recoupment by the Adviser. Prior to the Reorganization, the Adviser had contractually agreed to waive a portion or all of its management fees and pay Target Fund expenses (excluding taxes, leverage expense, brokerage commissions, acquired fund fees and expenses, interest expense and dividends paid on short sales or extraordinary expenses) in order to limit the Total Annual Fund Operating Expenses to 0.66% of average daily net assets of the Fund’s Institutional Class (the “Expense Cap”). The Expense Cap had previously been lowered from 0.95% to 0.90%, effective November 15, 2018; from 0.90% to 0.85%, effective December 15, 2018; and to the current rate of 0.66%, effective March 1, 2019. Amounts previously waived by the Adviser under the Expense Cap are not subject to recoupment.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”) serves as the administrator, fund accountant and transfer agent to the Fund. The officers of the Trust are employees of Fund Services. U.S. Bank, N.A. serves as the Fund’s custodian. Quasar Distributors, LLC (“Quasar”), serves as the Fund’s distributor and principal underwriter. For the period ended April 30, 2023, there were no fees incurred by the Fund from the service providers described above as the Adviser bore all such costs.

NOTE 5 – Purchases and Sales of Securities

The cost of purchases and the proceeds from sales of investment securities (excluding in-kind purchases and redemptions and short-term investments) for the period ended April 30, 2023, were as follows:

| Purchases………………………………………………………………………………………………… | | $ | 928,067 | |

| Sales……………………………………………………………………………………………………… | | $ | 433,508 | |

| | | | | |

The cost of in-kind purchases and the proceeds from in-kind redemptions for the period ended April 30, 2023, were as follows:

| In-Kind Purchases……………………………………………………………………………………...... | | $ | 1,456,910 | |

| In-Kind Sales…………………………………………………………………………………………….. | | $ | 2,013,766 | |

Soundwatch Hedged Equity ETF

Notes to Financial Statements (Continued)

April 30, 2023 (Unaudited)

NOTE 6 – Federal Income Tax Information

At October 31, 2022, the components of accumulated earnings (deficit) for income tax purposes were as follows:

| | | Investments | | | Written Options | | | Total | |

| Cost of Investments……………………………………….……… | | $ | 57,168,660 | | | $ | (3,849,030 | ) | | $ | 53,319,630 | |

| Gross Unrealized Appreciation…………………………….…….. | | | 35,479,996 | | | | - | | | | 35,479,996 | |

| Gross Unrealized Depreciation………………………….……….. | | | (2,682,993 | ) | | | - | | | | (2,682,993 | ) |

| Net Unrealized Appreciation (Depreciation) on Investments……. | | | 32,797,003 | | | | - | | | | 32,797,003 | |

| | | | | | | | | | | | | |

| Undistributed ordinary income…………………………………... | | | 498,266 | | | | - | | | | 498,266 | |

| Undistributed long-term capital gains…………………................. | | | - | | | | - | | | | - | |

| Total distributable earnings………………………………………. | | | 498,266 | | | | - | | | | 498,266 | |

| | | | | | | | | | | | | |

| Other accumulated loss ……..…………………............................ | | | (12,322,951 | ) | | | - | | | | (12,322,951 | ) |

| Total accumulated gain (loss) ……………………….................... | | $ | 20,972,318 | | | $ | - | | | $ | 20,972,318 | |

The difference between book basis and tax basis unrealized appreciation/depreciation is attributable in part to the tax deferral of losses on wash sales and mark-to-markets.

During the fiscal year ended October 31, 2022, the Fund utilized capital loss carryforward of $3,491,696.

At October 31, 2022, the Fund had capital loss carryforwards, which reduce the Fund’s taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal tax. Pursuant to the Internal Revenue Code, the character of such capital loss carryforwards is as follows:

| | Not Subject to Expiration | |

| Short-Term | Long-Term | Total |

| $ (7,771,008) | $ (4,551,943) | $ (12,322,951) |

The tax character of distributions paid during the six months ended April 30, 2023 and the fiscal year ended October 31, 2022 were as follows:

| | | Six Months Ended April 30, 2023 | | | Year Ended October 31, 2022 | |

| Distributions Paid From: | | | | | | |

| Ordinary Income | | $ | 860,967 | | | $ | 561,873 | |

| Total Distributions Paid | | $ | 860,967 | | | $ | 561,873 | |

Soundwatch Hedged Equity ETF

Notes to Financial Statements (Continued)

April 30, 2023 (Unaudited)

NOTE 7 – Underlying Investments in Other Investment Companies

The Fund currently invests a portion of its assets in iShares Core S&P 500 ETF (“IVV”). The Fund may redeem its investment from IVV at any time if the Adviser determines that it is in the best interest of the Fund and its shareholders to do so. The performance of the Fund may be directly affected by the performance of IVV. The expense ratio of IVV is 0.03% of net assets as reflected in the most current prospectus. The financial statements of IVV, including its portfolio of investments, can be found at the Securities and Exchange Commission’s (SEC) website www.sec.gov and should be read in conjunction with the Fund’s financial statements. As of April 30, 2023, the percentage of the Fund’s net assets invested in IVV was 90.5%.

NOTE 8 – Subsequent Events

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure

through the date the financial statements were available to be issued. The Fund has determined that there were no subsequent

events that would need to be disclosed in the Fund’s financial statements.

Note 9 – Change in Independent Registered Public Accounting Firm

BBD, LLP ("BBD") served as the independent registered public accounting firm for the Fund to audit the financial statements for the fiscal year ended October 31, 2022. On March 13, 2023, BBD sent a letter of cessation to the SEC indicating that BBD would no longer be serving as auditor. This letter was sent as a result of the Investment Management Group of BBD being acquired by Cohen & Company, Ltd ("Cohen").

The Trust engaged Cohen on April 4, 2023, as the independent registered public accounting firm to audit the Fund’s financial statements for the fiscal year ending October 31, 2023.

The report of BBD on the financial statements of the Fund for the fiscal year ended October 31, 2022, contained no adverse opinion or disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope, or accounting principle.

In connection with the Fund’s audit for the fiscal year ended October 31, 2022, there have been no disagreements, if not resolved to the satisfaction of BBD, that would have caused them to make reference thereto in their report on the financial statements for such period.

Soundwatch Hedged Equity ETF

Additional Information

April 30, 2023 (Unaudited)

Quarterly Portfolio Schedule

The Fund files its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available without charge by visiting the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Proxy Voting

You may obtain a description of the Fund’s proxy voting policy and voting records, without charge, upon request by contacting the Fund directly at (888) 244-4601 or on the EDGAR Database on the SEC’s website at www.sec.gov. The Fund files its proxy voting records annually as of June 30 with the SEC on Form N-PX. The Fund’s Form N-PX is available without charge by visiting the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Privacy Notice

The Fund collects non-public information about you from the following sources:

• Information we receive about you on applications or other forms;

• Information you give us orally; and/or

• Information about your transactions with us or others.

We do not disclose any non-public personal information about our customers or former customers without the customer’s authorization, except as permitted by law or in response to inquiries from governmental authorities. We may share information with affiliated and unaffiliated third parties with whom we have contracts for servicing the Fund. We will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibilities. We maintain physical, electronic and procedural safeguards to guard your non-public personal information and require third parties to treat your personal information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared by those entities with unaffiliated third parties.