UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

MARSHALL EDWARDS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

MARSHALL EDWARDS, INC.

Proxy Statement

To the Stockholders of Marshall Edwards, Inc.:

Marshall Edwards, Inc. (“Marshall Edwards”) has entered into an asset purchase agreement (the “Asset Purchase Agreement”) with Novogen Limited (“Novogen”), Marshall Edwards’ majority stockholder, and Novogen’s wholly-owned subsidiary Novogen Research Pty Ltd. under which Marshall Edwards will purchase from Novogen certain assets used in or generated under or in connection with the discovery, development, manufacture and marketing of intellectual property and products based on the field of isoflavonoid technology and on compounds known as isoflavones, including those related to the drug candidates Phenoxodiol, Triphendiol, NV-143 and NV-128 (collectively, the “Isoflavone-related Assets”), in exchange for shares of Marshall Edwards’ Series A Convertible Preferred Stock, which transaction is referred to herein as the “Isoflavone Transaction”. The Isoflavone Transaction cannot be completed without the approval of the Marshall Edwards stockholders and the Novogen shareholders as described herein.

Marshall Edwards is holding its annual meeting of stockholders in order to obtain the stockholder approvals necessary to complete the Isoflavone Transaction and certain other matters, including the election of directors. At Marshall Edwards’ annual meeting, which will be held at 10:00 a.m., local time, on Wednesday, April 13, 2011 at the offices of Morgan, Lewis & Bockius LLP, located at 101 Park Avenue, New York, New York 10178, unless postponed or adjourned to a later date, Marshall Edwards will ask its stockholders to, among other things, approve the transactions contemplated by the Asset Purchase Agreement, including the issuance of Marshall Edwards’ Series A Convertible Preferred Stock, as described in the accompanying proxy statement.

In the Isoflavone Transaction, Marshall Edwards will issue 1,000 shares of Series A Convertible Preferred Stock, each of which will be convertible into 4,827 shares of Marshall Edwards common stock or, in the event Marshall Edwards reaches certain development milestones on the terms described in the accompanying proxy statement, any uncoverted shares of Marshall Edwards Series A Convertible Preferred Stock will each be convertible into 9,654 shares of Marshall Edwards common stock, as further described in the accompanying proxy statement.

Marshall Edwards’ common stock is traded on the Nasdaq Global Market under the trading symbol “MSHL”. Novogen’s ordinary shares are traded on the Australian Stock Exchange under the trading symbol “NRT” and its American Depositary Shares are traded on the Nasdaq Capital Market under the trading symbol “NVGN”.

Each of Marshall Edwards’ board of directors, upon the recommendation of a special committee of the Marshall Edwards board of directors formed solely for the purpose of evaluating and negotiating the Isoflavone Transaction, and Novogen’s board of directors has approved the Isoflavone Transaction and concluded that it is fair to and in the best interests of their respective stockholders.

Marshall Edwards’ board of directors recommends that its stockholders vote “FOR” the Isoflavone Transaction and each of the other proposals contained in this proxy statement. The approval of both (i) holders of a majority of the shares of Marshall Edwards common stock eligible to vote and (ii) holders of a majority of the shares of Marshall Edwards common stock outstanding (other than shares held by Novogen) eligible to vote are required in order to approve the Isoflavone Transaction. Immediately after the execution of the Asset Purchase Agreement, pursuant to the terms of a voting agreement (the “Voting Agreement”), dated as of December 21, 2010, by and between Marshall Edwards and Novogen, Novogen, in its capacity as majority stockholder of Marshall Edwards, executed a written consent approving the Asset Purchase Agreement and the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock. In addition to this approval, the Isoflavone Transaction cannot be completed without the approval of the holders of a majority of the shares of Marshall Edwards’ common stock, other than shares held by Novogen, entitled to vote and the approval of the Novogen shareholders.

We cannot complete the Isoflavone Transaction unless the above proposals related thereto are approved.

More information about Marshall Edwards, Novogen and the proposed Isoflavone Transaction is contained in the accompanying proxy statement. Marshall Edwards urges you to read the accompanying proxy statement carefully and in its entirety. IN PARTICULAR, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DISCUSSED UNDER “RISK FACTORS” BEGINNING ON PAGE 16.

Marshall Edwards strongly supports the Isoflavone Transaction and the other proposals presented to its stockholders for their approval as described in this proxy statement, and Marshall Edwards enthusiastically recommends that its stockholders vote in favor of such proposals.

Bryan R.G. Williams

Non-Executive Chairman

Marshall Edwards, Inc.

This proxy statement is dated March 15, 2011 and is first being mailed to stockholders of Marshall Edwards on or about March 16, 2011.

MARSHALL EDWARDS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 13, 2011

To the Stockholders of Marshall Edwards, Inc.:

On behalf of the board of directors of Marshall Edwards, Inc., a Delaware corporation, Marshall Edwards is pleased to deliver the accompanying proxy statement in connection with the asset purchase agreement between Marshall Edwards and Novogen Limited, the election of directors and the other matters described below. The annual meeting of stockholders of Marshall Edwards will be held on April 13, 2011 at 10:00 a.m., local time, at the offices of Morgan, Lewis & Bockius LLP, located at 101 Park Avenue, New York, New York 10178, for the following purposes:

1. To consider and vote upon a proposal to approve the issuance of Marshall Edwards Series A Convertible Preferred Stock under the Asset Purchase Agreement, dated as of December 21, 2010, between Marshall Edwards and Novogen, its majority shareholder, and Novogen Research Pty Limited, pursuant to which Marshall Edwards will purchase from Novogen certain assets used in or generated under or in connection with the discovery, development, manufacture and marketing of intellectual property and products based on the field of isoflavonoid technology and on compounds known as isoflavones, including those related to the drug candidates Phenoxodiol, Triphendiol, NV-143 and NV-128, in exchange for newly issued shares of Marshall Edwards Series A Convertible Preferred Stock. Marshall Edwards refers to the Asset Purchase Agreement as the Asset Purchase Agreement.

2. To elect two directors to hold office until the annual meeting of stockholders in fiscal 2014 and until their respective successors have been duly elected and qualified.

3. To consider and vote upon a proposal to adopt an advisory resolution that the compensation paid to Marshall Edwards’ named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the “Compensation Discussion and Analysis,” compensation tables and narrative analysis, be approved in all respects (a “Say-on-Pay” vote).

4. To consider and vote upon a proposal to adopt an advisory resolution relating to the timing of future Say-on-Pay votes.

5. To consider and vote upon a proposal to ratify the appointment of BDO USA, LLP as Marshall Edwards’ independent registered public accounting firm for the fiscal year ending June 30, 2011.

6. To consider and act on such matters as may properly come before the Annual Meeting and any adjournment thereof.

A special committee consisting exclusively of independent directors of Marshall Edwards has received an opinion from Oracle Capital Advisors, LLC, financial advisor to Marshall Edwards’ special committee, that the assets to be acquired by Marshall Edwards and the consideration to be issued by Marshall Edwards therefor are fair from a financial point of view to Marshall Edwards, excluding Novogen, and to the Marshall Edwards stockholders, excluding Novogen. Upon the recommendation of the special committee, the board of directors of Marshall Edwards has approved the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock, comprising Proposal No. 1 above and has also approved each of the other proposals referred to above. Marshall Edwards’ board of directors recommends that its stockholders vote “FOR” each of the proposals referred to above.Marshall Edwards cannot complete the Isoflavone Transaction unless Proposal No. 1 above is approved.

The proposals are described in more detail in this proxy statement, which Marshall Edwards encourages you to read carefully and in its entirety before voting. A copy of the Asset Purchase Agreement is attached as Annex A to this proxy statement.

The close of business on March 8, 2011 has been fixed as the record date for determining those holders of Marshall Edwards common stock entitled to receive notice of and vote at the annual meeting. Accordingly, only record holders of Marshall Edwards common stock at the close of business on that date are entitled to notice of and to vote at the annual meeting and at any adjournments or postponements thereof.

All holders of Marshall Edwards common stock are cordially invited to attend the annual meeting in person. You may revoke your proxy in the manner described in this proxy statement at any time before it is voted at the annual meeting.

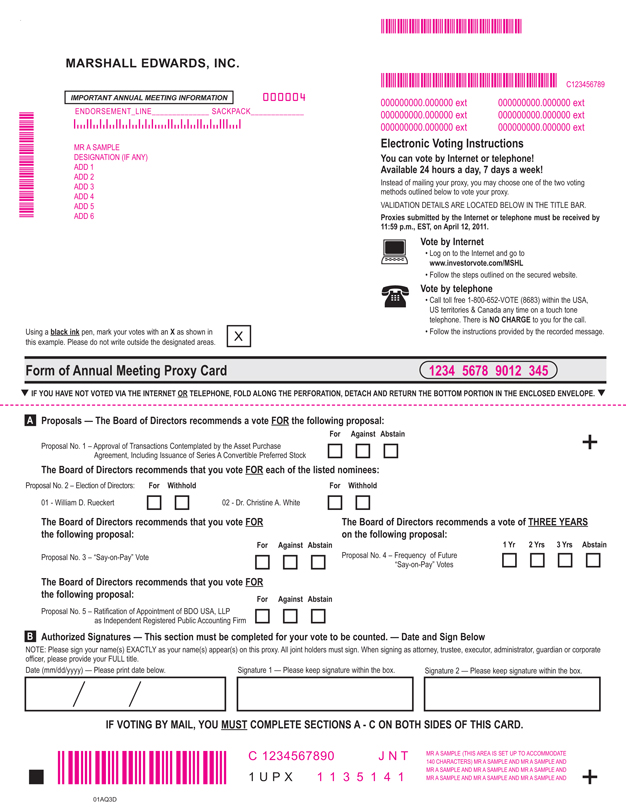

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting to be Held on April 13, 2011:Marshall Edwards’ Proxy Statement, 2010 Annual Report and Form of Proxy Card are also available athttps://materials.proxyvote.com/572322

Your vote is important regardless of the number of shares of common stock you own. Whether or not you expect to attend the annual meeting, please complete, date, sign and promptly return the enclosed proxy card in the enclosed postage paid envelope so that your shares of common stock may be represented and voted at the annual meeting.

By order of the board of directors,

Thomas M. Zech

Secretary

Marshall Edwards, Inc.

March 15, 2011

MARSHALL EDWARDS PROXY STATEMENT TABLE OF CONTENTS

i

| Page | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 64 | ||||

| 66 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 75 | ||||

| 75 | ||||

| 76 | ||||

| 76 | ||||

| 78 | ||||

| 78 | ||||

| 78 | ||||

| 79 | ||||

| 79 | ||||

| 80 | ||||

| 80 | ||||

| 80 | ||||

| 80 | ||||

| 82 | ||||

| 83 | ||||

| 84 | ||||

| 85 | ||||

| 86 | ||||

| 86 | ||||

| 86 | ||||

| 86 | ||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| 89 | ||||

| 89 | ||||

ii

| Page | ||||

| 89 | ||||

| 91 | ||||

| 91 | ||||

| 94 | ||||

| 95 | ||||

| 95 | ||||

| 96 | ||||

| 96 | ||||

| 98 | ||||

| 98 | ||||

| 99 | ||||

Quantitative and Qualitative Disclosures about Marshall Edwards’ Market Risk | 100 | |||

| 101 | ||||

| 101 | ||||

| 103 | ||||

| 105 | ||||

The Amended and Restated Manufacturing License and Supply Agreement | 106 | |||

| 107 | ||||

| 108 | ||||

| 110 | ||||

| 110 | ||||

| 111 | ||||

| 111 | ||||

| 111 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT OF MARSHALL EDWARDS | 116 | |||

| 118 | ||||

| 118 | ||||

| 119 | ||||

| 120 | ||||

MARSHALL EDWARDS PROPOSAL NOS. 3 AND 4—ADVISORY VOTES ON EXECUTIVE COMPENSATION | 122 | |||

| 124 | ||||

| 127 | ||||

INDEX TO MARSHALL EDWARDS, INC. CONSOLIDATED FINANCIAL STATEMENTS | F-1 | |||

ANNEX A – ASSET PURCHASE AGREEMENT | A-1 | |||

ANNEX B – VOTING AGREEMENT | B-1 | |||

ANNEX C – REPORT OF GRANT THORNTON CORPORATE FINANCE PTY LTD | C-1 | |||

ANNEX D – OPINION OF ORACLE CAPITAL ADVISORS, LLC | D-1 | |||

iii

QUESTIONS AND ANSWERS ABOUT THE MARSHALL EDWARDS ANNUAL MEETING OF

STOCKHOLDERS AND THE MATTERS TO BE CONSIDERED

The following questions and answers address briefly some questions you may have regarding the matters to be considered at the Marshall Edwards annual meeting, including the Isoflavone Transaction and the election of directors. Please refer to the more detailed information contained elsewhere in this document and the annexes to this document.

All information contained in this document concerning Novogen (Marshall Edwards’ majority stockholder) has been supplied by Novogen and has not been independently verified by Marshall Edwards.

Q: Why am I receiving this proxy statement?

A: Marshall Edwards and Novogen have entered into the Asset Purchase Agreement, pursuant to which, subject to the satisfaction of certain conditions contained in the Asset Purchase Agreement, Novogen has agreed to sell the Isoflavone-related Assets to Marshall Edwards in exchange for shares of Series A Convertible Preferred Stock of Marshall Edwards. A copy of the Asset Purchase Agreement is attached to this document as Annex A.

In order to complete the Isoflavone Transaction, Marshall Edwards stockholders must approve the transactions contemplated by the Asset Purchase Agreement, including the issuance of shares of Marshall Edwards Series A Convertible Preferred Stock as consideration in the Isoflavone Transaction. Pursuant to Nasdaq rules, stockholder approval is required when the issuance may equal or exceed 20% of the outstanding shares of a company’s common stock prior to the transaction. Under the Asset Purchase Agreement, it is also a condition to the completion of the Isoflavone Transaction that the transactions contemplated thereby, including the issuance of the Marshall Edwards Series A Convertible Preferred Stock, be approved by the holders of a majority of the shares of Marshall Edwards common stock outstanding on the record date, other than shares held by Novogen.

Marshall Edwards stockholders are also being asked to vote on the other proposals described below.

Novogen will also be holding a meeting of its shareholders at which its shareholders will be asked to consider and approve the transactions contemplated by the Asset Purchase Agreement. The Isoflavone Transaction cannot be completed without the approval of the Novogen shareholders.

Q: On what matters are Marshall Edwards stockholders being asked to vote at the annual meeting of Marshall Edwards stockholders?

A: Marshall Edwards stockholders are being asked to vote on:

| (1) | the approval of the transactions contemplated by the Asset Purchase Agreement, including the issuance of 1,000 shares of Marshall Edwards Series A Convertible Preferred Stock as consideration in the Isoflavone Transaction; |

| (2) | the election of two directors to hold office until the annual meeting of stockholders in fiscal 2014 and until their respective successors have been duly elected and qualified; |

| (3) | a proposal to adopt an advisory resolution that the compensation paid to Marshall Edwards’ named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the “Compensation Discussion and Analysis,” compensation tables and narrative analysis, be approved in all respects (a “Say-on-Pay” vote); |

| (4) | a proposal to adopt an advisory resolution relating to the timing of future Say-on-Pay votes; |

| (5) | the ratification of the appointment of BDO USA, LLP as Marshall Edwards’ independent registered public accounting firm for the fiscal year ending June 30, 2011; and |

| (6) | any other such other business as may properly come before the Marshall Edwards annual meeting or any adjournment, postponement or continuation thereof. |

1

Q: How does the Marshall Edwards board of directors recommend that Marshall Edwards stockholders vote on the matters to be considered at the Marshall Edwards annual meeting?

A: A special committee of the Marshall Edwards board of directors, consisting exclusively of independent directors of Marshall Edwards, received an opinion from Oracle Capital Advisors, LLC, financial advisor to the special committee, that the assets to be received by Marshall Edwards and the consideration to be issued by Marshall Edwards therefor are fair from a financial point of view to Marshall Edwards, other than Novogen, and to the Marshall Edwards stockholders other than Novogen. Upon the recommendation of the special committee, the Marshall Edwards board of directors (i) has approved the Asset Purchase Agreement and the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock; (ii) determined that the transactions contemplated by the Asset Purchase Agreement are fair to, advisable and in the best interests of Marshall Edwards and its stockholders; and (iii) recommends that Marshall Edwards stockholders vote in favor of the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock.

The Marshall Edwards board of directors has approved the transactions contemplated by the Asset Purchase Agreement, including the issuance of shares of Marshall Edwards Series A Convertible Preferred Stock as consideration in the Isoflavone Transaction, and recommends that Marshall Edwards stockholders vote:

| (1) | “FOR” the approval of the transactions contemplated by the Asset Purchase Agreement, including the issuance of 1,000 shares of Marshall Edwards Series A Convertible Preferred Stock; |

| (2) | “FOR” the election of two directors to hold office until the annual meeting of stockholders in fiscal 2014 and until their respective successors have been duly elected and qualified; |

| (3) | “FOR” the proposal to adopt an advisory resolution that the compensation paid to Marshall Edwards’ named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the “Compensation Discussion and Analysis,” compensation tables and narrative analysis, be approved in all respects; |

| (4) | “FOR” a proposal to adopt an advisory resolution establishing future Say-on-Pay votes every three years; and |

| (5) | “FOR” the ratification of the appointment of BDO USA, LLP as Marshall Edwards’ independent registered public accounting firm for the fiscal year ending June 30, 2011. |

Q: What will happen in the Isoflavone Transaction?

A: In the Isoflavone Transaction, Marshall Edwards will purchase from Novogen the Isoflavone-related Assets in exchange for 1,000 shares of Marshall Edwards Series A Convertible Preferred Stock. For a more detailed description of the Series A Convertible Preferred Stock please see “Description of Marshall Edwards Capital Stock—Preferred Stock—Series A Convertible Preferred Stock.” Upon consummation of the Isoflavone Transaction, all license agreements, which principally relate to the Isoflavone-related Assets, by and between Marshall Edwards and Novogen and their respective affiliates will be terminated.

Although no determination has been made, among the various strategic alternatives currently being contemplated by Novogen are possible distributions of Marshall Edwards securities held by Novogen, including the shares of common stock issuable upon the conversion of the Series A Convertible Preferred Stock to be issued in the Isoflavone Transaction. Novogen may, however, elect not to, or may be unable, to pursue or consummate any such transaction.

Q: What vote of stockholders is required to approve the transactions contemplated by the Asset Purchase Agreement?

A: At Marshall Edwards, the vote of both (i) holders of a majority of the shares of Marshall Edwards common stock entitled to vote at the annual meeting and (ii) holders of a majority of the shares of Marshall Edwards common stock entitled to vote, other than shares held by Novogen, are required in order to approve the

2

Isoflavone Transaction and the issuance of Marshall Edwards Series A Convertible Preferred Stock pursuant to the Asset Purchase Agreement. Immediately after the execution of the Asset Purchase Agreement, pursuant to the terms of a voting agreement (the “Voting Agreement”), dated as of December 21, 2010, entered into by and between Marshall Edwards and Novogen, Novogen, in its capacity as majority stockholder of Marshall Edwards, executed a written consent approving the Asset Purchase Agreement and the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock. In addition to this approval, the Isoflavone Transaction cannot be completed without the approval of the holders of a majority of the shares of Marshall Edwards’ common stock, other than shares held by Novogen, entitled to vote and the approval of the stockholders of Novogen.

At Novogen, the approval of the transactions contemplated by the Asset Purchase Agreement, including the sale of the Isoflavone-related Assets, by the holders of a majority of the Novogen ordinary shares, including those held through American Depositary Shares, present in person or represented by proxy at the Novogen extraordinary general meeting is required to complete the Isoflavone Transaction.

Marshall Edwards cannot complete the Isoflavone Transaction unless (i) Marshall Edwards stockholders vote to approve the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock, and (ii) Novogen shareholders vote to approve the transactions contemplated by the Asset Purchase Agreement, including the sale of the Isoflavone-related Assets.

Q: When and where is the Marshall Edwards shareholder meeting?

A: The Marshall Edwards annual meeting will be held at the offices of Morgan, Lewis & Bockius LLP, located at 101 Park Avenue, New York, New York 10178, on April 13, 2011, at 10:00 a.m. local time.

Q: Who is entitled to vote at the Marshall Edwards annual meeting?

A: Stockholders of record as of the close of business on March 8, 2011, the record date for the Marshall Edwards annual meeting, are entitled to receive notice of and to vote at the Marshall Edwards annual meeting. On the record date, approximately 7,391,186 shares of Marshall Edwards common stock, held by approximately 105 stockholders of record were outstanding and entitled to vote at the annual meeting. You may vote all shares you owned as of the close of business on the record date. All shares of Marshall Edwards common stock are entitled to one vote per share.

Q: If my shares are held in “street name” by my broker, bank or other nominee, will it vote my shares for me?

A: Yes, but only if you provide instructions to your broker, bank or other nominee on how to vote. You should follow the proxy submission instructions provided by your nominee regarding how to instruct it to vote your shares. Without those instructions, your shares will not be voted.

Q: How do I cause my shares to be voted without attending the annual meeting?

A: If you hold shares in your name as the stockholder of record, then you received this proxy statement and a proxy card from Marshall Edwards. To submit a proxy by mail, complete, sign and date the proxy card and return it in the postage-paid envelope provided. If you hold shares in street name through a broker, bank or other nominee, then you received this proxy statement from your nominee, along with the nominee’s form of proxy submission instructions. In either case, you may submit a proxy for your shares by mail without attending the annual meeting.

Q: What does it mean if I get more than one proxy card or form of proxy submission instructions?

A: If you have shares of Marshall Edwards common stock that are registered differently or are in more than one account, you will receive more than one proxy card or form of proxy submission instructions. Please follow the directions for submitting a proxy on each of the proxy cards or form of proxy submission instructions you receive to ensure that all of your shares are voted.

3

Q: How do I vote in person at the annual meeting?

A: If you hold Marshall Edwards shares in your name as the stockholder of record, you may vote those shares in person at the Marshall Edwards annual meeting by giving Marshall Edwards a signed proxy card or ballot before voting is closed. If you want to do that, please bring proof of identification with you to the annual meeting. Even if you plan to attend the annual meeting, we recommend that you submit a proxy card for your shares in advance as described above, so your vote will be counted even if you later decide not to attend.

If you hold shares in street name through a broker, bank or other nominee, you may vote those shares in person at the annual meeting only if you obtain and bring with you a signed proxy from your nominee giving you the right to vote the shares. To do this, you should contact your nominee.

Q: Can I change my vote?

A: After you submit a proxy card for your shares, you may change your vote at any time before voting is closed at the Marshall Edwards annual meeting. If you hold shares in your name as the stockholder of record, you should write to the Marshall Edwards corporate secretary at its principal executive offices at the address set forth below, stating that you want to revoke your proxy and that you need another proxy card. Attendance at the Marshall Edwards annual meeting will not by itself constitute revocation of a proxy. If you hold your shares in street name through a broker, bank or other nominee, you should follow your nominee’s proxy submission instructions. If you attend the Marshall Edwards annual meeting you may vote by ballot as described above, which will cancel your previous vote. Your last proxy submission or vote, as the case may be, before voting is closed at the meeting is the vote that will be counted.

Q: What is a quorum for the shareholder meeting?

A: The presence, in person or by proxy, of the holders of one-third of the shares of the Marshall Edwards common stock issued and outstanding and entitled to vote at the Marshall Edwards annual meeting will constitute a quorum. If a quorum is not present at the Marshall Edwards annual meeting, Marshall Edwards expects that the meeting will be adjourned or postponed to solicit additional proxies. Abstentions and broker non-votes will be counted towards a quorum.

Q: Who will bear the cost of this solicitation?

A: Marshall Edwards will pay the cost, if any, of soliciting proxies from its shareholders. Marshall Edwards will, upon request, reimburse stockholders who are brokers, banks or other nominees for their reasonable expenses in sending proxy materials to the beneficial owners of the shares they hold of record. Marshall Edwards will each solicit proxies by mail and may also solicit them in person or by telephone, e-mail, facsimile or other electronic means of communication.

Q: What should I do now?

A: You should carefully read and consider the information contained in this joint proxy statement/prospectus. You should then complete and sign your proxy card and return it in the enclosed envelope so that your shares will be represented at the Marshall Edwards annual meeting. You may also vote in person at the Marshall Edwards annual meeting or through the other means described in this proxy statement.

Q: When do you expect the Isoflavone Transaction to be completed?

A: The Isoflavone Transaction is expected to close after the respective shareholder meetings of Novogen and Marshall Edwards early in the second quarter of 2011.

4

Q: Where can I find additional information about Marshall Edwards, Novogen and the Isoflavone Transaction?

A: Marshall Edwards files annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission, which we refer to as the “SEC,” under the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act.” Novogen also files annual reports and other information with the SEC under the Exchange Act. You may read and copy these reports and other information filed by Marshall Edwards and Novogen at the Public Reference Section of the SEC, Room 1580, 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The SEC also maintains an Internet website that contains reports, proxy statements and other information about issuers, like Marshall Edwards and Novogen, who file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval system. The Internet address of this site ishttp://www.sec.gov.

Q: Whom should I call with questions?

A: For questions about the Isoflavone Transaction or any of the proposals to be considered at the shareholder meeting of Marshall Edwards, or if you need additional copies of this document or the enclosed proxy you should contact:

Marshall Edwards, Inc.

11975 El Camino Real, Suite 101

San Diego, California 92130

Tel: (858) 792-6300

Attn: Investor Relations

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting to be Held on April 13, 2011:

Marshall Edwards’ Proxy Statement, 2010 Annual Report and Form of Proxy Card are also available at

https://materials.proxyvote.com/572322

5

This summary highlights selected information from this document and may not contain all of the information that may be important to you. You are urged to read this entire document carefully, including the Asset Purchase Agreement attached as Annex A and the other documents to which you are referred herein. For more information, please see the section titled, “Where You Can Find More Information” in this document.

Novogen Limited

140 Wicks Road

North Ryde, New South Wales 2113

Australia

Tel: 61-2-9878-0088

Novogen Limited, a public company limited by shares, was incorporated in March 1994 under the jurisdiction of the laws of New South Wales, Australia. Novogen is registered and operates under the Australian Corporations Act. Novogen has its registered office at 140 Wicks Rd, North Ryde, New South Wales 2113. Its telephone number and other contact details are: Phone 61-2-9878-0088; Fax 61-2-9878-0055; and website, www.novogen.com (the information contained in the website does not form part of this document). Novogen’s ordinary shares are listed on the ASX under the symbol “NRT” and its American Depositary Receipts (“ADRs”), each representing five ordinary shares, trade on the Nasdaq Capital Market under the symbol “NVGN”. Novogen’s agent in the U.S. for ADRs is The Bank of New York Mellon, 101 Barclay Street 22W New York, N.Y. 10286.

Marshall Edwards, Inc.

11975 El Camino Real, Suite 101

San Diego, California 92130

Tel: 858-792-6300

Marshall Edwards, including its wholly-owned subsidiary Marshall Edwards Pty Ltd, is a development stage company incorporated in December 2000 as a wholly-owned subsidiary of Novogen Limited. Marshall Edwards’ common stock is listed on the Nasdaq Global Market under the symbol “MSHL”. As of the date of this document, Novogen owns approximately 71.3% of the outstanding shares of Marshall Edwards’ common stock.

Marshall Edwards’ business purpose is the development and commercialization of drugs for the treatment of cancer.

Summary of the Isoflavone Transaction (see page 35)

If the Isoflavone Transaction is completed, Novogen will sell to Marshall Edwards and Marshall Edwards will acquire from Novogen the Isoflavone-related Assets, which include certain assets used in or generated under or in connection with the discovery, development, manufacture and marketing of intellectual property and products based on the field of isoflavonoid technology and on compounds known as isoflavones, including those related to the drug candidates Phenoxodiol, Triphendiol, NV 143 and NV-128, and Marshall Edwards will issue 1,000 shares of its Series A Convertible Preferred Stock to Novogen. For a more detailed description of the Isoflavone-related Assets, please see “The Asset Purchase Agreement.” Each share of the Series A Convertible Preferred Stock will be convertible at any time, and from time to time, into 4,827 shares of Marshall Edwards common stock without the payment of additional consideration by the holder. In the event a Phase II clinical trial involving any of the isoflavone technology acquired by Marshall Edwards pursuant to the Asset Purchase Agreement has achieved a statistically significant result (p=0.05 or less) or a first patient is enrolled in a Phase III clinical trial involving such technology, whichever is earlier, each share of the Series A Convertible Preferred

6

Stock not already converted may be converted into 9,654 shares of Marshall Edwards common stock. For a more detailed description of the Series A Convertible Preferred Stock please see “Description of Marshall Edwards Capital Stock—Preferred Stock—Series A Convertible Preferred Stock.”

The Isoflavone-related Assets comprise all of Novogen’s assets related to isoflavonoid technology, other than certain assets related to soy and red clover compounds. Marshall Edwards currently licenses various of these assets from Novogen for use in the clinical development and commercialization of its drug candidates Phenoxodiol, Triphendiol, NV-143 and NV-128, for the treatment of cancer. These currently licensed assets comprise substantially all of the assets and technology Marshall Edwards currently uses in its cancer treatment development efforts. Upon consummation of the Isoflavone Transaction, all license agreements between Novogen and Marshall Edwards relating to the Isoflavone-related Assets will be terminated.

The closing of the Isoflavone Transaction will occur no later than the fifth business day after the last of the conditions to the Isoflavone Transaction has been satisfied or waived, or at another time as Marshall Edwards and Novogen agree. It is anticipated that the consummation of the Isoflavone Transaction will occur after the respective Novogen and Marshall Edwards stockholder meetings, sometime in the second calendar quarter of 2011. However, because the Isoflavone Transaction is subject to a number of conditions, neither Novogen nor Marshall Edwards can predict exactly when the closing will occur or if it will occur at all. For a more complete description of the Isoflavone Transaction, please see the section entitled “The Isoflavone Transaction” in this document.

Although no determination has been made, among the various strategic alternatives which may be contemplated by Novogen are possible distributions of Marshall Edwards securities held by Novogen, including the shares of common stock issuable upon the conversion of the Series A Convertible Preferred Stock to be issued in the Isoflavone Transaction, to the Novogen shareholders. No distribution of Marshall Edwards securities held by Novogen will be made unless the Novogen board of directors first determines to make such distribution and Novogen shareholders subsequently approve such distribution in the form determined by the Novogen board of directors. Novogen may, however, elect not to, or may be unable, to pursue or consummate any such transaction.

Reasons for the Isoflavone Transaction

Novogen’s Reasons for the Isoflavone Transaction (see page 41)

Novogen’s board of directors has determined that it is in the interest of Novogen to consummate the transactions contemplated by the Asset Purchase Agreement, including the Isoflavone Transaction. In reaching such determination, the Novogen board of directors consulted with its financial and legal advisors, considered Novogen’s prospects, including the uncertainties and risks facing it, and considered the interests of the holders of Novogen ordinary shares. The Novogen board of directors also considered a variety of factors that it believed weighed in favor of the Isoflavone Transaction, including the following material factors (which are not listed in any relative order of importance):

| • | financial terms of the Isoflavone Transaction; |

| • | prospects of the Isoflavone-related Assets and strategic alternatives; |

| • | benefits of consolidating all of the Novogen Group’s drug development activities into Marshall Edwards, including potentially superior possibilities of capital raising by Marshall Edwards to fund necessary further development of drug candidates; |

| • | simplification of the relationship with Marshall Edwards by removing the license agreements between Novogen and Marshall Edwards and transferring direct ownership of the Isoflavone-related Assets to Marshall Edwards; and |

| • | certain terms of the Asset Purchase Agreement. |

7

The Novogen board of directors weighed these factors against a number of other material factors identified in its deliberations as potentially weighing negatively against the Isoflavone Transaction, including the following factors (which are not listed in any relative order of importance):

| • | the risk that the potential benefits sought in the Isoflavone Transaction might not be realized; |

| • | the transaction costs associated with the Isoflavone Transaction; |

| • | potential impact on liquidity of Novogen ordinary shares and future takeovers or other transactions involving Novogen or its assets; |

| • | risks relating to liquidity of Marshall Edwards securities and performance and prospects of Marshall Edwards; |

| • | certain terms of the Asset Purchase Agreement; and |

| • | the possibility that the Isoflavone Transaction might not be consummated despite the parties’ efforts or that the closing of the Isoflavone Transaction may be unduly delayed. |

As discussed in “The Isoflavone Transaction—Novogen’s Reasons for the Isoflavone Transaction,” after consideration of these material factors, the Novogen board of directors determined such risks could be mitigated or managed by Novogen, were reasonably acceptable under the circumstances or in light of the anticipated benefits, and that, overall, these risks were significantly outweighed by the potential benefits of the Isoflavone Transaction. Grant Thornton Corporate Finance, as independent expert, has prepared a written report, attached as Annex C to this document, addressed to Novogen’s shareholders that concludes that the proposed Isoflavone Transaction is fair and reasonable to Novogen shareholders that are not associated with Novogen.

Despite the reasons for the Isoflavone Transaction, there are risks related to the Isoflavone Transaction, as discussed under the heading “Risk Factors—Risks Related to the Isoflavone Transaction” immediately following this summary, and these risks may cause Novogen not to realize the full benefits of the Isoflavone Transaction, and could adversely affect Novogen’s business, financial condition and results of operations.

This discussion of factors considered by the Novogen board of directors is not intended to be exhaustive, but is intended to summarize the material factors considered by the Novogen board of directors. In view of the wide variety of factors considered, the Novogen board of directors did not find it practicable to quantify or otherwise assign relative weights to the specific factors considered. However, after taking into account all of the factors set forth above, the Novogen board of directors agreed that the Asset Purchase Agreement and the transactions contemplated thereby, including the Isoflavone Transaction, were in the best interests of Novogen.

Marshall Edwards’ Reasons for the Isoflavone Transaction (see page 42)

A special committee consisting exclusively of independent directors of Marshall Edwards has received an opinion from Oracle Capital Advisors, LLC (“Oracle”), financial advisor to Marshall Edwards’ special committee, that the Isoflavone-related Assets to be acquired by Marshall Edwards and the consideration to be issued by Marshall Edwards therefor are fair from a financial point of view to Marshall Edwards, excluding Novogen, and to the Marshall Edwards stockholders, excluding Novogen. Upon the recommendation of the special committee, the board of directors of Marshall Edwards has approved the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock. Marshall Edwards’ board of directors has recommended that its stockholders vote for the approval of the Isoflavone Transaction.

In reaching its determination and recommendation, the Marshall Edwards special committee and board of directors consulted with their financial and legal advisors, considered Marshall Edwards’ prospects, including the

8

uncertainties and risks facing it, the attributes of and prospects for the Isoflavone-related Assets and considered the interests of the holders of Marshall Edwards common stock (other than Novogen). The Marshall Edwards special committee and board of directors also considered a variety of factors that it believed weighed in favor of the Isoflavone Transaction, including the following material factors (which are not listed in any relative order of importance):

| • | financial terms of the Isoflavone Transaction; |

| • | prospects of the Isoflavone-related Assets; |

| • | elimination of license agreement milestone and royalty payments relating to the Isoflavone-related Assets; |

| • | potential expansion of potential future products; |

| • | potential improvement in licensing opportunities; and |

| • | certain provisions of the Asset Purchase Agreement. |

In addition to the above-mentioned benefits, the Marshall Edwards special committee and board of directors also considered the following factors in the course of its deliberations:

| • | expected impact of the announcement of the Isoflavone Transaction in the market and on business operations of Marshall Edwards; and |

| • | reports from management, financial advisors and others as to the results of the due diligence investigation of the Isoflavone Transaction; |

The Marshall Edwards special committee and board of directors weighed these factors against a number of other material factors identified in its deliberations as potentially weighing negatively against the Isoflavone Transaction, including the following factors (which are not listed in any relative order of importance):

| • | the risk that the potential benefits sought in the Isoflavone Transaction might not be realized; |

| • | the transaction costs associated with the Isoflavone Transaction; |

| • | the continuing role of Novogen as controlling stockholder and the known and potential conflicts of interests of certain of the directors and executive officers of Novogen and Marshall Edwards; |

| • | certain terms of the Asset Purchase Agreement; |

| • | the assumption by Marshall Edwards of the full cost of patent and trademark related fees if the Isoflavone Transaction is consummated; |

| • | the fact that Marshall Edwards currently has no plans for development of other potential products included in the Isoflavone-related Assets; |

| • | the possibility that the Isoflavone Transaction might not be consummated despite the parties’ efforts or that the closing of the Isoflavone Transaction may be unduly delayed; and |

| • | the possibility that Marshall Edwards stockholders may experience substantial dilution of their ownership interest upon the conversion of the Series A Convertible Preferred Stock. |

As discussed in “The Isoflavone Transaction—Marshall Edwards’ Reasons for the Isoflavone Transaction,” after consideration of these material factors, the Marshall Edwards special committee and board of directors determined such risks could be mitigated or managed by Marshall Edwards, were reasonably acceptable under the circumstances or in light of the anticipated benefits, and that, overall, these risks were significantly outweighed by the potential benefits of the Isoflavone Transaction.

9

Despite the reasons for the Isoflavone Transaction, there are risks related to the Isoflavone Transaction, as discussed under the heading “Risk Factors—Risks Related to the Isoflavone Transaction” immediately following this summary, and these risks may cause Marshall Edwards not to realize the full benefits of the Isoflavone Transaction, and could adversely affect Marshall Edwards’ business, financial condition and results of operations.

This discussion of factors considered by the Marshall Edwards special committee and board of directors is not intended to be exhaustive, but is intended to summarize the material factors considered by the Marshall Edwards special committee and board of directors. In view of the wide variety of factors considered, the Marshall Edwards special committee and board of directors did not find it practicable to quantify or otherwise assign relative weights to the specific factors considered. However, after taking into account all of the factors set forth above, the Marshall Edwards special committee and board of directors agreed that the Asset Purchase Agreement and the transactions contemplated thereby were in the best interests of Marshall Edwards and the Marshall Edwards stockholders.

Overview of the Asset Purchase Agreement (see page 54)

On December 21, 2010, Marshall Edwards entered into an Asset Purchase Agreement with Novogen and Novogen Research Pty Limited (the “Seller”), a wholly-owned subsidiary of Novogen, pursuant to which Marshall Edwards agreed to purchase the Isoflavone-related Assets in exchange for shares of Marshall Edwards’ Series A Convertible Preferred Stock.

Under the terms of the Asset Purchase Agreement, Marshall Edwards will also assume certain liabilities of Novogen that are related to the Isoflavone-related Assets. Marshall Edwards will only assume liabilities, obligations, and commitments arising after the closing of the Isoflavone Transaction under or in connection with the Isoflavone-related Assets (and excluding any liabilities arising from any action of Novogen taken on or prior to closing).

Purchase Price

As consideration for the Isoflavone-related Assets, Marshall Edwards will issue to Novogen 1,000 shares of Marshall Edwards Series A Convertible Preferred Stock and will assume certain liabilities related to the Isoflavone-related Assets.

Conditions to Completion of the Isoflavone Transaction

Marshall Edwards’ and Novogen’s obligations to complete the Isoflavone Transaction are subject to customary conditions. In addition, Marshall Edwards’ obligation to complete the Isoflavone Transaction is subject to the condition that Novogen has wired $50,000 to Marshall Edwards to cover fees associated with effecting transfers on the public record of intellectual property listed in Novogen’s name to Marshall Edwards. The obligations of both Marshall Edwards and Novogen to complete the Isoflavone Transaction are also subject to (i) the approval of the holders of a majority of the shares of Marshall Edwards’ common stock, other than shares held by Novogen, entitled to vote and (ii) the approval of the stockholders of Novogen.

Termination

The Asset Purchase Agreement may be terminated at any time prior to the closing date:

| • | by mutual written consent of the parties; |

| • | by either party, if the other party is in material breach of any representation, warranty or covenant in the Asset Purchase Agreement and has not cured such breach within ten days of receiving written notice of the breach; |

10

| • | by either party upon written notice to the other party if the closing has not occurred on or prior to March 31, 2011, unless such party’s breach was the cause of or resulted in the failure of the closing to occur on or before such date; |

| • | by either party if a governmental entity has issued an order, decree or ruling; has enacted, issued, promulgated, enforced or entered any law, rule, regulation, judgment, decree, order or award; or taken any other action (or failed to take an action), in any case having the effect of permanently restraining, enjoining or otherwise prohibiting or making illegal the transactions contemplated by the Asset Purchase Agreement, if the order, decree, ruling or other action is final and nonappealable; and |

| • | by either party if Novogen’s stockholders do not approve the Isoflavone Transaction at the extraordinary general meeting; or |

| • | by either party if Marshall Edwards’ stockholders do not approve the Isoflavone Transaction at the annual meeting. |

On March 1, 2011, Marshall Edwards and Novogen executed an amendment to the Asset Purchase Agreement extending the date on which the Asset Purchase Agreement is terminable by either party if the closing has not occurred to May 31, 2011.

Expenses and Reimbursement (see page 57)

Under the terms of the Asset Purchase Agreement, Novogen has agreed to reimburse Marshall Edwards up to $150,000 for all amounts above $37,000 incurred by Marshall Edwards in connection with the preparation and filing of this document, including registration and filing fees, printing expenses, communications and delivery expenses, and fees and disbursements of Marshall Edwards’ counsel and other persons retained by Marshall Edwards in connection with the preparation and filing of this document.

Except for the reimbursement by Novogen for costs associated with the preparation and filing of this document and the amount payable at closing by Novogen to Marshall Edwards to cover patent recordation fees (each as discussed under the section entitled “The Asset Purchase Agreement”), Marshall Edwards and Novogen are each responsible for their own respective costs and expenses incurred by them in connection with the Isoflavone Transaction. However, the parties have agreed that Marshall Edwards will be responsible for any transfer taxes that are payable in connection with the Isoflavone Transaction.

Voting Agreement (see page 60)

On December 21, 2010, Marshall Edwards and Novogen entered into the Voting Agreement, pursuant to which Novogen agreed to vote its shares of Marshall Edwards common stock in favor of approval of the Asset Purchase Agreement and the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock. Immediately after the execution of the Asset Purchase Agreement, pursuant to the terms of the Voting Agreement, Novogen, in its capacity as majority stockholder of Marshall Edwards, executed a written consent approving the Asset Purchase Agreement and the transactions contemplated by the Asset Purchase Agreement, including the issuance of the Series A Convertible Preferred Stock. In addition to this approval, the Isoflavone Transaction cannot be completed without (i) the approval of the holders of a majority of the shares of Marshall Edwards’ common stock, other than shares held by Novogen, entitled to vote and (ii) the approval of the stockholders of Novogen.

Report of Novogen’s Independent Expert (see page 44)

In connection with the proposed Asset Purchase, Grant Thornton Corporate Finance, as independent expert, delivered a written report to Novogen’s shareholders that the proposed Asset Purchase is fair and reasonable to Non-Associated Shareholders. The full text of Grant Thornton Corporate Finance’s written report, dated January 31, 2011, is attached to this document as Annex C. Novogen encourages you to read this report carefully and in its entirety for a description of the procedures followed, assumptions made, matters considered and limitations on the review undertaken. Grant Thornton Corporate Finance’s report is addressed to Novogen shareholders.

11

Opinion of Marshall Edwards’ Financial Advisor (see page 45)

In connection with the proposed Isoflavone Transaction, Oracle, as financial advisor to the special committee of Marshall Edwards’ board of directors, delivered a written opinion to the special committee that the assets to be acquired by Marshall Edwards and the consideration to be issued by Marshall Edwards therefor are fair, from a financial point of view, to Marshall Edwards, excluding Novogen, and Marshall Edwards’ stockholders, excluding Novogen. The full text of Oracle’s written opinion, dated December 21, 2010, is attached to this document as Annex D. Marshall Edwards encourages you to read this opinion carefully and in its entirety for a description of the procedures followed, assumptions made, matters considered and limitations on the review undertaken. Oracle’s opinion is addressed to the special committee of Marshall Edwards’ board of directors and does not constitute a recommendation to any stockholder as to how to vote on any matters relating to the Isoflavone Transaction.

Interests of Certain Directors, Officers and Affiliates of Novogen and Marshall Edwards (see page 52)

In considering the recommendation of Novogen’s board of directors with respect to the proposed Isoflavone Transaction, you should be aware that some of Novogen’s directors and executive officers have certain interests in the proposed Isoflavone Transaction that may differ from the interests of Novogen’s shareholders generally. Novogen’s board of directors was aware of these interests and considered them, among other factors, in approving and recommending the Isoflavone Transaction. In considering the recommendations of Marshall Edwards’ board of directors with respect to the proposed Isoflavone Transaction, you should be aware that some of Marshall Edwards’ directors and executive officers have certain interests in the proposed Isoflavone Transaction that may differ from the interests of Marshall Edwards’ shareholders generally. Marshall Edwards’ board of directors was aware of these interests and considered them, among other factors, in approving and recommending the Isoflavone Transaction.

Certain Tax Consequences to Shareholders (see page 53)

The Isoflavone Transaction in itself should not have Australian or U.S. federal income tax consequences for shareholders of Novogen and Marshall Edwards. A subsequent distribution by Novogen of Marshall Edwards securities held by Novogen, including the shares of common stock issuable upon the conversion of the Series A Convertible Preferred Stock to be issued in the Isoflavone Transaction, may have consequences to both shareholders of Novogen that are subject to U.S. federal income tax and those subject to Australian income tax. The tax treatment of such a distribution would depend on the form of such distribution, Novogen’s circumstances and the Novogen shareholder’s own tax circumstances. In general, however, such a distribution is likely to be treated for U.S. federal income tax and Australian income tax purposes in the same manner as a distribution of cash, reflecting the then-value of such Marshall Edwards securities, to such holders. As discussed above, there is no current commitment to make any such distribution of Marshall Edwards securities to Novogen’s shareholders and such distribution may never occur.

Anticipated Accounting Treatment (see page 53)

The Isoflavone Transaction is between entities under common control. Accordingly, Marshall Edwards will record the assets and liabilities acquired as a result of the Isoflavone Transaction at their historical carrying amounts, as originally recorded by Novogen, which were zero ($0). If pro forma effect were given to the Isoflavone Transaction, the impact on the statement of operations of Marshall Edwards for the year ended June 30, 2010 would be to reduce operating expenses relating to license fees by $1,500,000 and there would be no impact on the statement of operations for the six months ended December 31, 2010. There would be no impact on the balance sheet of Marshall Edwards as of December 31, 2010. If pro forma effect were given to the Isoflavone Transaction, there would be no impact on Novogen’s statement of financial position as of December 31, 2010 and no impact on Novogen’s statement of comprehensive income for the year and six months

12

ended June 30, 2010 and December 31, 2010 respectively, as the transaction is between entities under common control and would eliminate on consolidation.

No Regulatory Approval Required for the Isoflavone Transaction (see page 53)

Novogen and Marshall Edwards are not aware of any governmental or regulatory approval required for completion of the Isoflavone Transaction, other than the effectiveness of the registration statement of which this document is a part, compliance with applicable corporate laws of Australia with respect to Novogen and the State of Delaware with respect to Marshall Edwards, and compliance with U.S. state securities laws. If any governmental approvals or actions are required, Novogen and Marshall Edwards intend to try to obtain them. We cannot assure you, however, that we will be able to obtain any such approvals or actions.

No Appraisal Rights in Connection with the Isoflavone Transaction (see page 53)

Appraisal rights are not available to either Marshall Edwards or Novogen shareholders in connection with the Isoflavone Transaction or any of the other proposals to be considered at the respective meetings of stockholders described in this document.

In evaluating the Asset Purchase Agreement and the Isoflavone Transaction, as well as the other proposals to be considered at the Marshall Edwards annual meeting, you should carefully read this document in its entirety and especially consider the factors discussed in the section entitled “Risk Factors” on page 16 and the report of Oracle set forth as Annex D to this document.

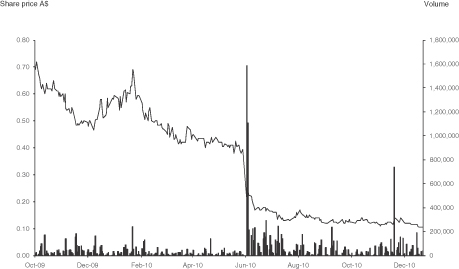

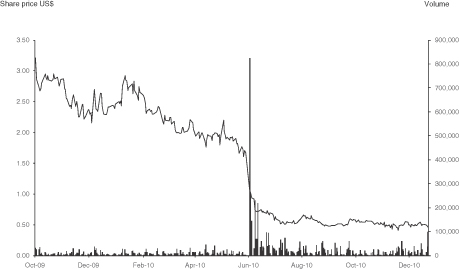

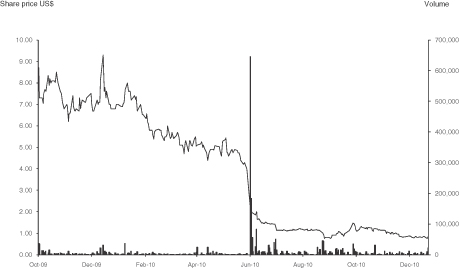

Market Price Information (see page 15)

Marshall Edwards’ common stock is listed on the Nasdaq Global Market under the trading symbol “MSHL”. On December 21, 2010, the last full trading day prior to the public announcement of the proposed Isoflavone Transaction, Marshall Edwards common stock closed at $0.77 per share. On March 7, 2011, Marshall Edwards common stock closed at $1.82 per share. The Marshall Edwards Series A Convertible Preferred Stock is a new issue of securities, which is not listed on any securities exchange and Marshall Edwards has no obligation or intent to do so.

Novogen’s ordinary shares are listed on the Australian Stock Exchange under the trading symbol “NRT” and Novogen’s ADRs are listed on the Nasdaq Capital Market under the trading symbol “NVGN”. On December 21, 2010, the last full trading day prior to the public announcement of the proposed Isoflavone Transaction, Novogen’s ordinary shares closed at AUD 0.12 per share and its ADRs, each of which represents five ordinary shares, closed at $0.48 per share. On March 7, 2011, Novogen’s ordinary shares closed at AUD 0.15 per share and its ADRs closed at $0.72 per share.

You should obtain current market quotations.

13

MARSHALL EDWARDS SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table sets forth selected historical consolidated financial data of Marshall Edwards for the periods presented below. The selected consolidated financial data as of June 30, 2010 and 2009 and for each of the years in the three-year period ended June 30, 2010 have been derived from Marshall Edwards’ audited consolidated financial statements included elsewhere in this document. The summary consolidated financial data as of December 31, 2010 and for the six months ended December 31, 2010 and December 31, 2009 have been derived from Marshall Edwards’ unaudited consolidated financial statements included elsewhere in this document. Marshall Edwards’ unaudited consolidated financial statements include all adjustments, which include only normal and recurring adjustments, necessary to present fairly the data included therein.

Marshall Edwards’ historical results are not necessarily indicative of the results of operations for future periods, and its results of operations for the six-month period ended December 31, 2010 are not necessarily indicative of the results that may be expected for the fiscal year ending June 30, 2011. You should read the following selected consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this document and Marshall Edwards’ consolidated financial statements and related notes included elsewhere in this document.

(In thousands, except share data) | Six Months Ended December 31, | Fiscal Year Ended June 30, | ||||||||||||||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||||||||||

Revenues | $ | 106 | $ | 49 | $ | 84 | $ | 228 | $ | 674 | $ | 645 | $ | 446 | ||||||||||||||

Operating expenses: | ||||||||||||||||||||||||||||

Research and development | (1,436 | ) | (1,494 | ) | (4,031 | ) | (7,777 | ) | (9,325 | ) | (5,761 | ) | (3,427 | ) | ||||||||||||||

License fees | — | (1,500 | ) | (1,500 | ) | (2,000 | ) | (1,000 | ) | (5,000 | ) | (3,000 | ) | |||||||||||||||

Selling, general and administrative | (2,497 | ) | (896 | ) | (2,448 | ) | (1,630 | ) | (2,756 | ) | (3,703 | ) | (1,404 | ) | ||||||||||||||

Total operating expenses | (3,933 | ) | (3,890 | ) | (7,979 | ) | (11,407 | ) | (13,081 | ) | (14,464 | ) | (7,831 | ) | ||||||||||||||

Loss from operations | (3,827 | ) | (3,841 | ) | (7,895 | ) | (11,179 | ) | (12,407 | ) | (13,819 | ) | (7,385 | ) | ||||||||||||||

Income tax expense | — | — | (1 | ) | (1 | ) | (3 | ) | (1 | ) | (1 | ) | ||||||||||||||||

Net loss arising during development stage | (3,827 | ) | (3,841 | ) | (7,896 | ) | (11,180 | ) | (12,410 | ) | (13,820 | ) | (7,386 | ) | ||||||||||||||

Net loss per common share: | ||||||||||||||||||||||||||||

Basic and diluted(1) | $ | (0.52 | ) | $ | (0.52 | ) | $ | (1.07 | ) | $ | (1.53 | ) | $ | (1.82 | ) | $ | (2.20 | ) | $ | (1.30 | ) | |||||||

Weighted average number of common shares outstanding(1) | 7,346,324 | 7,346,324 | 7,346,324 | 7,307,184 | 6,830,257 | 6,317,937 | 5,693,800 | |||||||||||||||||||||

Balance Sheet Data (at period end): | ||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 5,827 | $ | 12,814 | $ | 9,031 | $ | 19,067 | $ | 19,743 | $ | 16,158 | $ | 10,054 | ||||||||||||||

Prepaid expenses and other current assets | 193 | 45 | 102 | 289 | 235 | 132 | 341 | |||||||||||||||||||||

Plant and equipment, net | 45 | — | 3 | — | — | — | — | |||||||||||||||||||||

Total assets | 6,065 | 12,859 | 9,136 | 19,356 | 19,978 | 16,290 | 10,395 | |||||||||||||||||||||

Accounts payable | 768 | 394 | 529 | 736 | 1,130 | 1,197 | 420 | |||||||||||||||||||||

Accrued expenses | 1,043 | 852 | 925 | 3,186 | 1,884 | 984 | 638 | |||||||||||||||||||||

Amount due to related company | 452 | 241 | 301 | 221 | 429 | 332 | 202 | |||||||||||||||||||||

Total stockholders’ equity | 3,802 | 11,372 | 7,381 | 15,213 | 16,535 | 13,777 | 9,135 | |||||||||||||||||||||

Book value per common share(1) | $ | 0.52 | $ | 1.55 | $ | 1.00 | $ | 2.08 | $ | 2.42 | $ | 2.18 | $ | 1.60 | ||||||||||||||

| (1) | Adjusted retrospectively to reflect the March 2010 1-for-10 reverse stock split. |

14

MARKET PRICE AND DIVIDEND INFORMATION

The following tables set forth for the period indicated the high and low sale prices of Marshall Edwards’ common stock as reported by the Nasdaq Global Market.

Common Stock | Nasdaq Global Market | |||||||

| High $ | Low $ | |||||||

Year Ended June 30, 2009 | ||||||||

First Quarter | 33.20 | 11.20 | ||||||

Second Quarter | 20.80 | 3.00 | ||||||

Third Quarter | 9.80 | 2.50 | ||||||

Fourth Quarter | 13.40 | 3.80 | ||||||

Year Ended June 30, 2010 | ||||||||

First Quarter | 17.40 | 4.80 | ||||||

Second Quarter | 10.26 | 6.20 | ||||||

Third Quarter | 9.00 | 4.60 | ||||||

Fourth Quarter | 5.60 | 1.22 | ||||||

Year Ending June 30, 2011 | ||||||||

First Quarter | 1.55 | 0.71 | ||||||

Second Quarter | 1.40 | 0.73 | ||||||

Third Quarter | 3.48 | 0.97 | ||||||

(through March 2, 2011) | ||||||||

As of December 31, 2010, there were 7,346,324 shares of Marshall Edwards common stock outstanding and 103 holders of record of Marshall Edwards common stock. This number was derived from Marshall Edwards shareholder records and does not include beneficial owners of Marshall Edwards common stock whose shares are held in the name of various dealers, clearing agencies, banks, brokers and other fiduciaries.

Marshall Edwards has never declared or paid any cash dividends on its common stock and does not anticipate paying any cash dividends in the foreseeable future. Marshall Edwards currently intends to retain future earnings, if any, to fund the expansion and growth of its business. Payments of any future cash dividends will be at the discretion of Marshall Edwards’ board of directors after taking into account various factors, including its financial condition, operating results, current and anticipated cash needs, plans for expansion and other factors that its board of directors deems relevant.

15

In addition to the other information contained in this document, including the matters addressed under the heading “Forward-Looking Statements” beginning on page 28 of this document, you should carefully consider the following risk factors in deciding whether to vote in favor of the proposals described in this document.

Risks Related to the Isoflavone Transaction

Marshall Edwards and Novogen will incur significant transaction and asset purchase-related costs in connection with the Isoflavone Transaction.

Marshall Edwards and Novogen expect to incur a number of non-recurring costs associated with the Isoflavone Transaction including legal, accounting and other transaction fees and other costs related to the Isoflavone Transaction, anticipated to be between $700,000 and $825,000. Some of these costs are payable regardless of whether the Isoflavone Transaction is completed. Neither Marshall Edwards nor Novogen can provide any assurances that the benefits of the Isoflavone Transaction to either company will exceed these costs.

Marshall Edwards stockholders may not realize a benefit from the Isoflavone Transaction commensurate with the ownership dilution they will experience in connection with the Isoflavone Transaction.

If Marshall Edwards is unable to realize the strategic and financial benefits currently anticipated from the Isoflavone Transaction, Marshall Edwards stockholders may experience substantial dilution of their ownership interest upon the conversion of the Series A Convertible Preferred Stock, which may be converted at any time and from time to time without the payment of any additional consideration into an aggregate of 4,827,000 shares of common stock or 9,654,000 shares of common stock in certain circumstances, without receiving any commensurate benefit. Although in the Asset Purchase Agreement Novogen has made certain representations and warranties regarding its intellectual property rights in respect of the Isoflavone-related Assets, its indemnification obligations in respect of these representations and warranties are limited and expire on June 30, 2011 and may not be sufficient to compensate Marshall Edwards for the loss of any such intellectual property rights being acquired in the Isoflavone Transaction.

Novogen will cease to receive license fees and other payments under its license agreements with Marshall Edwards that will be terminated upon consummation of the Isoflavone Transaction.

Marshall Edwards has licensed the intellectual property in the Phenoxodiol technology and the anti-cancer compounds Triphendiol, NV-143 and NV-128 from Novogen, which intellectual property is fundamental to Marshall Edwards’ operations and is being acquired by Marshall Edwards in the Isoflavone Transaction, and entered into certain service agreements with Novogen under which it has certain license fee and other payment obligations to Novogen. Upon consummation of the Isoflavone Transaction, these licenses, and consequently Marshall Edwards’ payment obligations thereunder, will be terminated. There can be no assurance that the value Novogen realizes from the Marshall Edwards Series A Convertible Preferred Stock and the Marshall Edwards common stock issuable upon conversion thereof will exceed the benefits of the Isoflavone-related Assets and the license fees and other payments which Marshall Edwards was obligated to make under the agreements to be terminated upon consummation of the Isoflavone Transaction.

The sale of the Isoflavone-related Assets will substantially reduce the amount of assets directly owned by Novogen.

After the consummation of the sale of the Isoflavone-related Assets, Novogen will retain its interests in Glycotex, its consumer health business and its right to isoflavonoid technology relating to soy and red clover compounds, as well as its interests in Marshall Edwards; however, its directly-owned total assets will be substantially reduced. As a result, Novogen may find it more difficult to raise the capital necessary to fund its

16

development programs. In addition, Novogen continually explores opportunities to maximize value to its stakeholders and, in this regard, may contemplate additional transactions that involve the spin-off or sale of one or more businesses, transfers of various assets or other features which could further reduce Novogen’s direct assets.

Some of Marshall Edwards’ and Novogen’s officers and directors have conflicts of interest that may influence them to support or approve the Isoflavone Transaction.

Certain officers and directors of Marshall Edwards and Novogen participate in arrangements that provide them with interests in the Isoflavone Transaction that are different from yours. These interests, among others, may influence the officers and directors of Marshall Edwards and Novogen to support or approve the Isoflavone Transaction. For a more detailed discussion see “The Isoflavone Transaction—Interests of Certain Directors, Officers and Affiliates of Novogen and Marshall Edwards” on page 52.

The fairness opinion obtained by Marshall Edwards from its financial advisor and the independent expert’s report obtained by Novogen from its independent expert will not reflect changes in circumstances between signing the Asset Purchase Agreement and completion of the Isoflavone Transaction.

Marshall Edwards and Novogen have not obtained an updated opinion or report as of the date of this document from Oracle, Marshall Edwards’ financial advisor, or Grant Thornton Corporate Finance, the Novogen independent expert. Changes in the operations and prospects of Marshall Edwards or Novogen or the Isoflavone- related Assets, general market and economic conditions and other factors which may be beyond the control of Marshall Edwards or Novogen, and on which the fairness opinion and independent expert report were based, may alter the value of Marshall Edwards or Novogen or the Isoflavone-related Assets and other elements of the Isoflavone Transaction, or the prices of Marshall Edwards common stock or Novogen ordinary shares by the time the Isoflavone Transaction is completed. The opinion and report are based on the information in existence on the date delivered and will not be updated as of the time the Isoflavone Transaction will be completed. Because Marshall Edwards and Novogen currently do not anticipate asking the financial advisor or independent expert, respectively, to update their opinion or report, as applicable, the Oracle opinion given at the time the Asset Purchase Agreement was signed and the Grant Thornton Corporate Finance report dated January 31, 2011 do not address the fairness of the Isoflavone Transaction consideration, from a financial point of view, at the time of the respective shareholder meetings or at the time the Isoflavone Transaction is completed. For a description of the opinion that Marshall Edwards received from its financial advisor and the independent expert report addressed to Novogen shareholders, please refer to “The Isoflavone Transaction—Opinion of Marshall Edwards’ Financial Advisor” beginning on page 45 and “The Isoflavone Transaction—Report of Novogen’s Independent Expert” beginning on page 44. For a description of the factors considered by the boards of directors of Marshall Edwards and Novogen in determining to approve the Isoflavone Transaction, please refer to “The Isoflavone Transaction—Novogen’s Reasons for the Isoflavone Transaction” beginning on page 41 and “The Isoflavone Transaction—Marshall Edwards’ Reasons for the Isoflavone Transaction” beginning on page 42.

Marshall Edwards stockholders’ ownership percentage will be diluted upon the conversion of the Series A Convertible Preferred Stock in the Isoflavone Transaction.

In connection with the Isoflavone Transaction, Marshall Edwards will issue to Novogen shares of Marshall Edwards Series A Convertible Preferred Stock. As a result of the subsequent conversion of these shares of Marshall Edwards Series A Convertible Preferred Stock, Marshall Edwards stockholders will own a smaller percentage of Marshall Edwards after the Isoflavone Transaction than they held in Marshall Edwards prior to the Isoflavone Transaction. Based on the number of shares of Marshall Edwards common stock outstanding as of the date of this document and assuming conversion of all shares of Series A Convertible Preferred Stock and, Marshall Edwards stockholders, other than Novogen, will own approximately 17.3% of the Marshall Edwards common stock compared to 28.7% immediately prior to the Isoflavone Transaction upon such conversion. In addition, in the event Marshall Edwards reaches certain development milestones on the terms described herein, any unconverted shares of Marshall Edwards Series A Convertible Preferred Stock will each be convertible into 9,654 shares of Marshall Edwards common stock.

17

The market price of Marshall Edwards common stock may decline as a result of the Isoflavone Transaction.

The market price of Marshall Edwards common stock may decline as a result of the Isoflavone Transaction for a number of reasons including if:

| • | Marshall Edwards does not achieve the perceived benefits of the Isoflavone Transaction as rapidly or to the extent anticipated by financial or industry analysts; |

| • | the effect of the Isoflavone Transaction on Marshall Edward’s business and prospects is not consistent with the expectations of financial or industry analysts; or |

| • | investors react negatively to the effect on Marshall Edward’s business and prospects from the Isoflavone Transaction. |

Holders of Marshall Edwards Series A Convertible Preferred Stock are not entitled to any rights with respect to Marshall Edwards common stock, but are subject to all changes made with respect to Marshall Edwards common stock.

Holders of Marshall Edwards Series A Convertible Preferred Stock are not entitled to any rights with respect to Marshall Edwards common stock (including, without limitation, voting rights and rights to receive any dividends or other distributions on the common stock), but are subject to all changes to the common stock that might be adopted by the holders of the common stock to curtail or eliminate any of the powers, preferences or special rights of the common stock, or impose new restrictions or qualifications upon the common stock. Holders of the Series A Convertible Preferred Stock will not be entitled to any rights as a holder of common stock until the close of business on the conversion date.

There are restrictions on transfers of the Marshall Edwards Series A Convertible Preferred Stock and the Marshall Edwards common stock issuable upon conversion thereof.