Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

MARSHALL EDWARDS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

October 28, 2011

To the Stockholders of Marshall Edwards, Inc.:

You are cordially invited to attend the 2011 Annual Meeting of the Stockholders of Marshall Edwards, Inc., a Delaware corporation. The annual meeting, which will be held at 10:00 a.m. (Pacific Time), on Thursday, December 1, 2011 at the offices of Marshall Edwards, Inc., located at 11975 El Camino Real, Suite 101, San Diego, CA 92130, unless postponed or adjourned to a later date. I look forward to meeting with as many of our stockholders as possible.

At the Annual Meeting, we will discuss each item of business described in the Notice of Annual Meeting and proxy statement and report on Marshall Edward’s business. You will also have an opportunity to ask questions.

On behalf of our employees and Board of Directors, I would like to express our appreciation for your continued interest in Marshall Edwards, Inc.

Sincerely,

Bryan R.G. Williams

Non-Executive Chairman

Marshall Edwards, Inc.

This proxy statement is dated October 28, 2011 and is first being mailed to stockholders of Marshall Edwards on or about October 31, 2011.

Table of Contents

MARSHALL EDWARDS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 1, 2011

To the Stockholders of Marshall Edwards, Inc.:

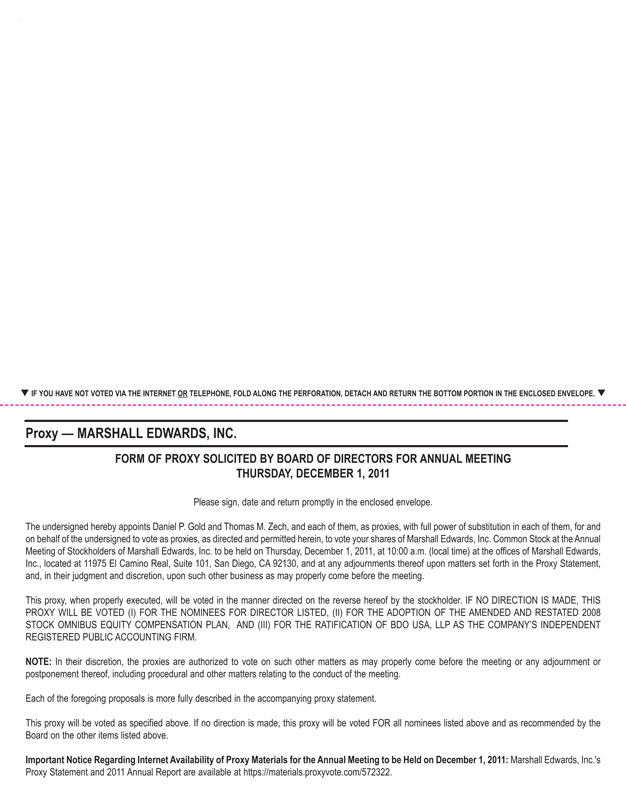

On behalf of the Board of Directors of Marshall Edwards, Inc., a Delaware corporation, Marshall Edwards is pleased to deliver the accompanying proxy statement in connection with the annual meeting of stockholders of Marshall Edwards which will be held on Thursday, December 1, 2011 at 10:00 a.m., local time, at the offices of Marshall Edwards, Inc., located at 11975 El Camino Real, Suite 101, San Diego, CA 92130, for the following purposes:

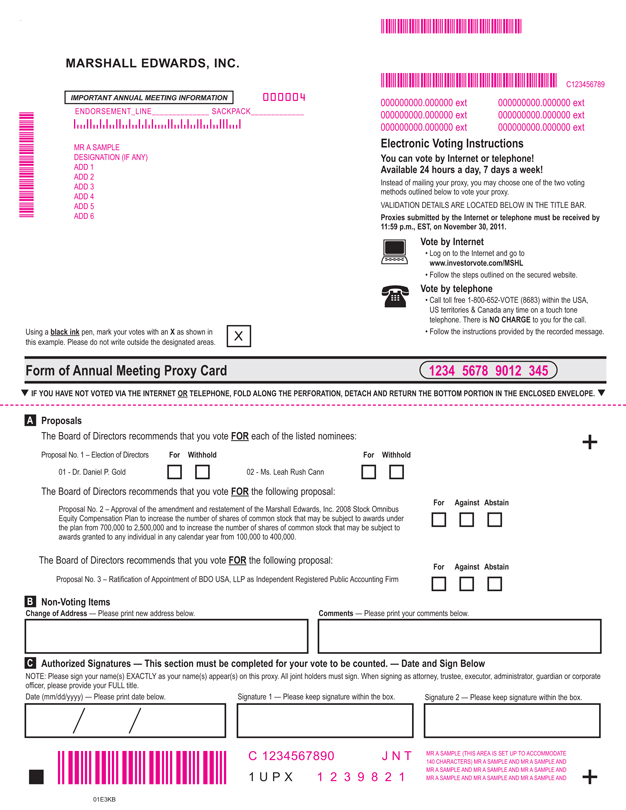

1. To elect two directors to our Board of Directors to serve until the expiration of their term in fiscal year 2015 and until their respective successors are elected and qualified or until their earlier resignation or removal;

2. To approve the amendment and restatement of the Marshall Edwards, Inc. 2008 Stock Omnibus Equity Compensation Plan to increase the number of shares of common stock that may be subject to awards under the plan from 700,000 to 2,500,000 and to increase the number of shares of common stock that may be subject to awards granted to any individual in any calendar year from 100,000 to 400,000;

3. To ratify the appointment of BDO USA LLP, an independent registered public accounting firm, as our independent auditors for the fiscal year ending June 30, 2012; and

4. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The proposals are described in more detail in this proxy statement, which Marshall Edwards encourages you to read carefully and in its entirety before voting.

The close of business on October 21, 2011 has been fixed as the record date for determining those holders of Marshall Edwards common stock entitled to receive notice of and vote at the annual meeting. Accordingly, only record holders of Marshall Edwards common stock at the close of business on that date are entitled to notice of and to vote at the annual meeting and at any adjournments or postponements thereof.

All holders of Marshall Edwards common stock are cordially invited to attend the annual meeting in person. You may revoke your proxy in the manner described in this proxy statement at any time before it is voted at the annual meeting.

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting to be Held on December 1, 2011:Marshall Edwards’ Proxy Statement, 2011 Annual Report and Form of Proxy Card are also available athttps://materials.proxyvote.com/572322.

Your vote is important regardless of the number of shares of common stock you own. Whether or not you expect to attend the annual meeting, please complete, date, sign and promptly return the enclosed proxy card in the enclosed postage paid envelope so that your shares of common stock may be represented and voted at the annual meeting.

By order of the Board of Directors,

Thomas M. Zech

Secretary and Chief Financial Officer

Marshall Edwards, Inc.

October 28, 2011

Table of Contents

MARSHALL EDWARDS PROXY STATEMENT TABLE OF CONTENTS

| Page | ||||

| 1 | ||||

| 4 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

Attendance of Directors at Board Meetings and Shareholder Meetings | 10 | |||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 24 | ||||

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PROPOSAL NO. 3) | 26 | |||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT OF MARSHALL EDWARDS | 34 | |||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

Delivery of this Proxy Statement to Multiple Stockholders with the Same Address | 37 | |||

ANNEX A – AMENDED AND RESTATED 2008 STOCK OMNIBUS EQUITY COMPENSATION PLAN | A-1 | |||

Table of Contents

MARSHALL EDWARDS, INC.

11975 El Camino Real, Suite 101

San Diego, CA 92130

THE ANNUAL MEETING OF MARSHALL EDWARDS STOCKHOLDERS

To Be Held on Thursday, December 1, 2011, at 10:00 a.m. (Pacific Time)

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on December 1, 2011

The proxy statement, form of proxy card, and annual report to security holders are available athttps://materials.proxyvote.com/572322.

Information Concerning Solicitation and Voting

In this proxy statement, “Marshall Edwards”, “we”, “us”, and “our” refer to Marshall Edwards, Inc., unless the context otherwise provides.

General

Marshall Edwards is furnishing this proxy statement to holders of Marshall Edwards common stock in connection with the solicitation of proxies by the Marshall Edwards Board of Directors for use at the Marshall Edwards annual meeting to be held on December 1, 2011 and at any adjournment or postponement thereof. This proxy statement is first being mailed to the stockholders of Marshall Edwards on or about October 31, 2011.

Date, Time and Place

The annual meeting of Marshall Edwards stockholders will be held on December 1, 2011, at the offices of Marshall Edwards, Inc., located at 11975 El Camino Real, Suite 101, San Diego, CA 92130, commencing at 10:00 a.m. local time.

Purposes of the Marshall Edwards Annual Meeting

The purposes of the Marshall Edwards annual meeting are:

| (1) | To elect two directors to the Board of Directors to serve until the annual meeting of stockholders in 2015, and until their respective successors are elected and qualified or until their earlier resignation or removal; |

| (2) | To approve the amendment and restatement of the Marshall Edwards, Inc. 2008 Stock Omnibus Equity Compensation Plan to increase the number of shares of common stock that may be subject to awards under the plan from 700,000 to 2,500,000 and to increase the number of shares of common stock that may be subject to awards granted to any individual in any calendar year from 100,000 to 400,000; |

| (3) | To ratify the appointment of BDO USA, LLP as Marshall Edwards’ independent registered public accounting firm for the fiscal year ending June 30, 2012; and |

| (4) | Any other such other business as may properly come before the Marshall Edwards annual meeting or any adjournment, postponement or continuation thereof. |

Record Date; Shares of Common Stock Outstanding and Entitled to Vote

Marshall Edwards has fixed the close of business on October 21, 2011 as the record date for determination of the holders of Marshall Edwards common stock entitled to notice of and to attend and vote at the Marshall

1

Table of Contents

Edwards annual meeting or any adjournment or postponement thereof. There were approximately 102 holders of record of Marshall Edwards common stock at the close of business on the record date. At the close of business on the record date, 11,814,025 shares of Marshall Edwards common stock were issued and outstanding. Each share of Marshall Edwards common stock entitles the holder thereof to one vote at the Marshall Edwards annual meeting on all matters properly presented at the Marshall Edwards annual meeting. See the section titled, “Security Ownership of Certain Beneficial Owners and Management of Marshall Edwards” in this proxy statement for information regarding persons known to the management of Marshall Edwards to be the beneficial owners of more than 5% of the outstanding shares of Marshall Edwards common stock.

Voting and Revocation of Proxies

The proxy accompanying this proxy statement is solicited on behalf of the Board of Directors of Marshall Edwards for use at the Marshall Edwards annual meeting.

If you are a stockholder of record of Marshall Edwards as of the record date referred to above, you may vote in person at the Marshall Edwards annual meeting or vote by proxy using the enclosed proxy card. For questions on how to attend the annual meeting or vote in person, please contact Marshall Edwards at 858-792-6300. Whether or not you plan to attend the Marshall Edwards annual meeting, Marshall Edwards urges you to vote by proxy to ensure your vote is counted. You may still attend the Marshall Edwards annual meeting and vote in person if you have already voted by proxy.

| • | To vote in person: |

| • | If you hold Marshall Edwards shares in your name as the stockholder of record, you may vote those shares in person at the Marshall Edwards annual meeting by giving Marshall Edwards a signed proxy card or ballot before voting is closed. If you want to do that, please bring proof of identification with you to the annual meeting. Even if you plan to attend the annual meeting, we recommend that you submit a proxy card for your shares in advance as described above, so your vote will be counted even if you later decide not to attend. |

| • | If you hold shares in street name through a broker, bank or other nominee, you may vote those shares in person at the annual meeting only if you obtain and bring with you a signed proxy from your nominee giving you the right to vote the shares. To do this, you should contact your nominee. |

| • | To vote using the proxy card, simply mark, sign and date your proxy card and return it promptly in the postage-paid envelope provided. If you return your signed proxy card to Marshall Edwards before the Marshall Edwards annual meeting, Marshall Edwards will vote your shares as you direct. |

| • | To vote over the telephone, dial the toll-free number on your proxy card or voting instruction form using a touch-tone phone and follow the recorded instructions. You will be asked to provide Marshall Edwards number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Eastern Time on November 30, 2011 to be counted. |

| • | To vote on the Internet, go to the website on the proxy card or voting instruction form to complete an electronic proxy card. You will be asked to provide Marshall Edwards number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Eastern Time on November 30, 2011 to be counted. |

If your Marshall Edwards shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy card from the institution that holds your shares and follow the instructions included on that proxy card regarding how to instruct your broker to vote your Marshall Edwards shares. If you do not give instructions to your broker, your broker can vote your Marshall Edwards shares with respect to “discretionary” items but not with respect to “non-discretionary” items. The proposals relating to the election of directors and the amendment and restatement of the 2008 Stock Omnibus Equity Compensation Plan are non-discretionary items. On non-discretionary items, for which you do not give your broker instructions, the Marshall Edwards shares will be treated as broker non-votes.

2

Table of Contents

All properly executed proxies that are not revoked will be voted at the Marshall Edwards annual meeting and at any adjournments or postponements of the Marshall Edwards annual meeting in accordance with the instructions contained in the proxy. If a holder of Marshall Edwards common stock executes and returns a proxy and does not specify otherwise, the shares represented by that proxy will be voted “FOR” Marshall Edwards Proposal No. 1 electing each nominee to Marshall Edwards’ Board of Directors; “FOR” Marshall Edwards Proposal No. 2 to approve the amendment and restatement of the Marshall Edwards, Inc. 2008 Stock Omnibus Equity Compensation Plan to increase the number of shares of common stock that may be subject to awards under the plan from 700,000 to 2,500,000 and to increase the number of shares of common stock that may be subject to awards granted to any individual in any calendar year from 100,000 to 400,000; and “FOR” Marshall Edwards Proposal No. 3 ratifying the appointment of BDO USA, LLP as Marshall Edwards’ independent registered public accounting firm for the fiscal year ending June 30, 2012.

Marshall Edwards stockholders of record may change their vote at any time before their proxy is voted at the Marshall Edwards annual meeting in one of three ways. First, a stockholder of record of Marshall Edwards can send a written notice to the Secretary of Marshall Edwards stating that the stockholder would like to revoke its proxy. Second, a stockholder of record of Marshall Edwards can submit new proxy instructions either on a new proxy card, by telephone or via the Internet. Third, a stockholder of record of Marshall Edwards can attend the Marshall Edwards annual meeting and vote in person. Attendance alone will not revoke a proxy. If a stockholder of record of Marshall Edwards has instructed a broker to vote its shares of Marshall Edwards common stock, the stockholder must follow directions received from its broker to change those instructions.

Quorum and Vote of Marshall Edwards Stockholders Required

A quorum of stockholders is necessary to hold a valid meeting. The presence, in person or by proxy, of the holders of one-third of the shares of the Common Stock issued and outstanding and entitled to vote at the Marshall Edwards annual meeting will constitute a quorum. If a quorum is not present at the Marshall Edwards annual meeting, Marshall Edwards expects that the meeting would be adjourned or postponed to solicit additional proxies. Abstentions and broker non-votes will be counted towards a quorum.

For Proposal No. 1, the affirmative vote of a plurality of the votes cast is required to elect a director when a quorum is present. “Votes cast” excludes abstentions and any broker non-votes. Accordingly, abstentions and broker non-votes (shares held by brokers that do not have discretionary authority to vote on the matter and have not received voting instructions from their clients) will have no effect on the election of directors.

For Proposal Nos. 2 and 3, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the proposal will be required for approval. An abstention with respect to these Proposals will not be voted. Accordingly, an abstention will have the effect of a negative vote. Broker non-votes on a proposal are not counted or deemed present or represented for determining whether stockholders have approved the proposal.

At the record date for the Marshall Edwards annual meeting, the directors and executive officers of Marshall Edwards owned less than 1% of the outstanding shares of Marshall Edwards common stock entitled to vote at the Marshall Edwards annual meeting.

Solicitation of Proxies

In addition to solicitation by mail, the directors, officers, employees and agents of Marshall Edwards may solicit proxies from Marshall Edwards’ stockholders by personal interview, telephone, telegram or otherwise. Arrangements will also be made with brokerage firms and other custodians, nominees and fiduciaries who are record holders of Marshall Edwards common stock for the forwarding of solicitation materials to the beneficial owners of Marshall Edwards common stock. Marshall Edwards will pay the cost of reimbursing its applicable brokers, custodians, nominees and fiduciaries for the reasonable out-of-pocket expenses they incur in connection with the forwarding of solicitation materials.

3

Table of Contents

ELECTION OF DIRECTORS (PROPOSAL NO. 1)

Marshall Edwards’ Board of Directors has nominated Daniel P. Gold and Leah Rush Cann to serve as directors for a term to expire at the annual meeting of stockholders to be held in fiscal 2015 and until their respective successors have been elected and qualified. Each of them has consented to be named herein and to serve if elected. Marshall Edwards does not know of anything that would preclude any nominee from serving if elected. If any nominee becomes unable to stand for election as a director at the Annual Meeting, an event not anticipated by the Board of Directors, the proxy may be voted for a substitute designated by the Board of Directors. The identity and a brief biography of each nominee for director are set forth below. The Marshall Edwards Board of Directors has determined that Ms. Cann is an independent director within the meaning of the listing standards of the Nasdaq Capital Market.

Marshall Edwards’ restated certificate of incorporation and amended and restated bylaws provide that the authorized number of directors shall be determined by a resolution of the Board of Directors, but shall be between two and nine. On October 20, 2011, the Board of Directors increased the authorized number of directors from five to six, and appointed Charles V. Baltic III to fill the vacancy created as a result of the increase. Mr. Baltic was appointed to serve a term that will expire at the annual meeting of shareholders to be held in fiscal 2013. Under Marshall Edwards’ restated certificate of incorporation and amended and restated bylaws, Marshall Edwards’ Board of Directors is divided into three classes, with the classes serving three-year staggered terms. Each class contains one-third (or if that number is not a whole number, the whole number nearest one-third) of the directors, with members of each class holding office for a three-year term. With the appointment of Mr. Baltic to the Board of Directors, currently there are two directors whose terms expire at the annual meeting to be held in fiscal 2013, two directors whose terms expire at the annual meeting to be held in fiscal 2014 and two directors whose terms expire at the Annual Meeting.

Dr. Gold and Ms. Cann are members of the class of directors whose term expires at the Annual Meeting.

Nominees

The following table sets forth information as of September 30, 2011, regarding the nominees.

Name | Age | Positions Held with Company | ||||

Daniel P. Gold | 57 | President, Chief Executive Officer and Director | ||||

Leah Rush Cann | 51 | Director | ||||

Business Experience of Nominees

Daniel P. Gold, PhD, age 57, President, Chief Executive Officer and Director

Dr. Gold has been President, Chief Executive Officer and a director of Marshall Edwards since April 2010. From October 2009 to April 2010, Dr. Gold was Managing Partner of Theragence, Inc., a service provider that focuses on optimizing biopharmaceutical product development, which he co-founded. From July 2008 to May 2009, Dr. Gold was President and Chief Executive Officer of Prospect Therapeutics, a clinical stage, oncology focused biotechnology company. From January 2000 to May 2009, Dr. Gold was Chief Scientific Officer of Favrille, Inc., a biopharmaceutical company that focused on the development and commercialization of immunotherapies for the treatment of cancer and other diseases of the immune system, which he founded. Dr. Gold currently serves on the Board of Trustees of the Hope Funds for Cancer Research. Dr. Gold was a member of the Executive Council of the Sabin Cancer Vaccine Consortium from 2004 to 2006 and a member of the board of directors of the San Diego chapter of the Leukemia and Lymphoma Society from 1998 to 2003. Dr. Gold received a Bachelor’s degree in biology from University of California Los Angeles and received a Doctorate degree from Tufts University in Pathology/Immunology.

4

Table of Contents

Ms. Leah Rush Cann, age 51, Director

Ms. Cann has been a director of Marshall Edwards and chairperson of the Audit Committee since March 2009. Ms. Cann is the President of Leah Rush Cann Research and Consulting, LLC, a cancer –consulting organization which she founded in 2003. She was a research scientist with Memtec Corporation from 1984 to 1986. Ms. Cann was a research analyst with CIBC Oppenheimer from 1992 to 1999. From 1999 to 2000, she was a health care analyst with Cadence Capital, an asset manager based in Boston, Massachusetts. Ms. Cann was a senior biotechnology analyst with Wachovia Securities from 2000 to 2003. In both 1995 and 1996, The Wall Street Journal recognized Ms. Cann as an All-Star analyst. Ms. Cann received a B.A. in art history and chemistry and an M.B.A from Stetson University. She was a post-baccalaureate at the College of William and Mary and a post-graduate at Columbia University. Ms. Cann has been a trustee and member of several committees of International House in New York City for more than 10 years. She is a trustee and the chairman of the Executive Committee of the Hope Funds for Cancer Research, which she helped found in 2006.

VOTE REQUIRED

Assuming a quorum is met, each nominee for director must receive a plurality of the votes cast by holders of the shares of common stock represented in person or by proxy at the Annual Meeting to be elected as a director. Votes may be cast in favor or withheld. Votes that are withheld and broker non-votes, if any, will be counted for purposes of determining the presence or absence of a quorum, but will have no effect on the election of the director.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF DR. GOLD AND MS. CANN AS DIRECTORS OF MARSHALL EDWARDS.

5

Table of Contents

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Set forth below are the names and certain biographical information regarding Marshall Edwards’ directors who are not being considered for re-election at the Annual Meeting.

Name | Age | Positions Held | Expiration of Term | |||||

Bryan R.G. Williams | 62 | Director (Chairman) | Fiscal 2013 Annual Meeting of Stockholders | |||||

William D. Rueckert | 58 | Director | Fiscal 2014 Annual Meeting of Stockholders | |||||

Christine A. White | 59 | Director | Fiscal 2014 Annual Meeting of Stockholders | |||||

Charles V. Baltic III | 50 | Director | Fiscal 2013 Annual Meeting of Stockholders | |||||

Professor Bryan Williams, age 62, Director

Professor Bryan Williams has been a director of Marshall Edwards since March 2006. Professor Williams has been the non-executive Chairman of the Board of Directors since November 2006. Since January 1, 2006, Professor Williams has been the director of the Monash Institute of Medical Research in Melbourne, Australia. From 1991 to 2005, Professor Williams was Chairman of the Department of Cancer Biology, Lerner Research Institute, The Cleveland Clinic Foundation, Cleveland, Ohio. From 1993 to 2005, Professor Williams was Professor, Department of Genetics at Case Western Reserve University, Cleveland, Ohio. From 1998 to 2005, Professor Williams was an Associate Director of the Case Comprehensive Cancer Center in Cleveland, Ohio. He is an Honorary Fellow of the Royal Society of New Zealand.

William D. Rueckert, age 57, Director

Mr. Rueckert has been a director of Marshall Edwards since April 2011. Mr. Rueckert was previously a director of Marshall Edwards, Inc. between March 2007 and March 2009. Mr. Rueckert has been a director of Novogen since March 2009 and was elected Chairman of the Novogen Board of Directors on October 18, 2010. Mr. Rueckert is the Managing Member of Oyster Management Group LLC an investment fund specializing in community banks. From 1991 to 2006 he was President and Director of Rosow & Company, a private investment firm based in Connecticut. Mr. Rueckert has been President and Director of Eastern Capital Development, LLC from 1999 to 2005, treasurer of Moore & Munger, Inc., a company with interests in the petroleum and resort development industries, from 1988 until 1990, and was President of United States Oil Company, a publicly traded oil exploration business, from 1981 to 1988. Among his many civic associations, Mr. Rueckert is Director and President of the Cleveland H. Dodge Foundation, a private philanthropic organization in New York City, and Chairman of the Board of the Trustees of Teachers College, Columbia University.

Christine A. White M.D., age 59, Director

Dr. White has been a director of Marshall Edwards since August 2010. Dr. White served in various senior positions with Biogen Idec from 1996 to 2005, most recently as Senior Vice President, Global Medical Affairs, where she played an integral role in the development, and commercialization of oncology drugs Rituxan® and Zevalin® and oversaw Oncology, Neurology and Dermatology Global Medical Affairs. Previously, she served as the Director of Clinical Oncology Research at the Sidney Kimmel Cancer Center in San Diego from 1994 to 1996, and was a clinical oncologist and Medical Director of Oncology Research at Scripps Memorial Hospitals in La Jolla and Encinitas, California, from 1984 to 1995, most recently as Chairman, Department of Medicine. Dr. White serves as a member of the board of directors of Arena Pharmaceuticals, a clinical-stage pharmaceutical company. Within the past five years, Dr. White also served as a member of the board of directors of Genoptix Inc., a medical diagnostics company, until its acquisition by Novartis, Monogram Biosciences, a life sciences company, until its acquisition by LabCorp, and Pharmacyclics, a pharmaceutical company. Dr. White serves as on the Scientific Advisory Board of Areva Med LLC. She earned her B.A. in Biology and M.D. from the University of Chicago and is Board certified in both Internal Medicine and Medical Oncology.

6

Table of Contents

Charles V. Baltic III, age 50, Director

Mr. Baltic has been a director of Marshall Edwards since October 2011. Mr. Baltic has been a Managing Director and Co-Head of Healthcare at Needham & Company LLC since 2009. Prior to joining Needham, Mr. Baltic was a Managing Director and head of the biotechnology practice at CRT Capital Group from 2006 to 2008. From 2001 to 2006, he served as a Managing Director in Healthcare Investment Banking at Wachovia Securities. Prior to Wachovia, he was with Healthcare Investment Banking at Cowen and Company for six years, ultimately serving as a Director in life sciences. Prior to beginning his investment banking career in 1996, Mr. Baltic practiced corporate and securities law with Dewey Ballantine, representing numerous healthcare and securities clients. Mr. Baltic earned his B.A and J.D. degrees from Georgetown University and an M.B.A. degree in finance from the Wharton School of the University of Pennsylvania. Mr. Baltic is also a founding Trustee and past Chair of the Development Committee and current Chair of the Programs Committee of the non-profit Hope Funds for Cancer Research. Mr. Baltic is a former Director of MedVantage Inc., which was acquired by Blues Plans Inc., a consortium of the Blues Plans of Massachusetts, North Carolina, Florida, Arkansas and Illinois

Information about the Board of Directors and its Committees

The Board of Directors has responsibility for the overall corporate governance of Marshall Edwards.

Marshall Edwards is a “controlled company” within the meaning given to that term by the Nasdaq Stock Market (“Nasdaq”) because Novogen owns more than 50% of Marshall Edwards’ voting power. As a controlled company, Marshall Edwards is exempt from the requirement that its Board of Directors be composed of a majority of independent directors, however, a majority of the members of the Board of Directors are independent in accordance with Nasdaq requirements.

The Board has established an Audit Committee to oversee Marshall Edwards’ financial matters and a Compensation Committee to review the performance of executive directors and their compensation.

The Audit Committee of the Board of Directors has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee is responsible for overseeing financial and accounting activities. The Audit Committee’s responsibilities include the annual appointment of independent auditors and the review of the scope of audit and non-audit assignments and related fees, the accounting principles used in financial reporting, internal auditing and Marshall Edwards’ internal control procedures. The members of the Audit Committee are Ms. Leah Cann (chairperson), Professor Bryan Williams and Dr. Christine A. White, each of whom Marshall Edwards’ Board of Directors has determined is independent as defined by applicable Nasdaq and SEC rules. The Board of Directors has also determined that Ms. Cann is an “audit committee financial expert” as defined by SEC rules. Marshall Edwards has adopted an Audit Committee Charter which is posted on its website atwww.marshalledwardsinc.com. The Audit Committee held four meetings during the fiscal year ended June 30, 2011.

The Compensation Committee acts on behalf of the Board to fulfill the Board’s responsibilities to oversee Marshall Edwards’ compensation policies, plans and programs, reviews and determines the compensation to be paid to Marshall Edwards’ executive officers and executive directors, and oversees preparation and review of the Committee’s report and disclosure set forth under the caption “Compensation Disclosure and Analysis” included in Marshall Edwards’ annual proxy statement in accordance with applicable rules and regulations of the SEC. The Compensation Committee has the sole power to retain compensation consultants and to determine the scope of the associated engagements. The Compensation Committee also has the power to make recommendations to the full Board of Directors concerning the allocation of stock options to directors and employees. The

7

Table of Contents

compensation and terms of appointment of non-executive directors are set by the full Board of Directors. The Board of Directors has adopted a written charter for the Compensation Committee, which is available on our website atwww.marshalledwardsinc.com. Dr. Christine A. White has served as the Chair of the Compensation Committee since July 2011. The other members of the Compensation Committee as of September 30, 2011 were Professor Bryan Williams and Mr. William Rueckert. The Board of Directors has determined that each member of the Compensation Committee is independent as defined by applicable Nasdaq rules. The Compensation Committee did not meet during the fiscal year ended June 30, 2011. However, the Compensation Committee did discharge its duties and responsibilities through its interaction with the full Board of Directors during the fiscal year ended June 30, 2011 and met in July 2011 to review the performance of the Company’s executives to determine incentive compensation related to fiscal year 2011 and to determine adjustments to base compensation for fiscal year 2012.

As a “controlled company”, Marshall Edwards is not subject to the Nasdaq rules requiring (i) Board of Director nominations to be selected, or recommended for the Board’s selection, by either a nominating committee comprised solely of independent directors or by a majority of the independent directors on the Board of Directors and (ii) each Nasdaq-listed company to have a formal written charter or resolutions by the Board of Directors addressing the nominating process. Accordingly, during the fiscal year ended June 30, 2011, Marshall Edwards did not have a separately established Nominating Committee. The Board of Directors does not believe that any marked efficiencies or enhancements would be achieved by the creation of a separate Nominating Committee.

The duties and responsibilities typically delegated to a nominating committee are included in the responsibilities of the entire Board of Directors. The Board of Directors identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. If any member of the Board of Directors does not wish to continue in service or if the Board of Directors decides not to re-nominate a member for re-election, the Board will consider all qualified director candidates identified by members of the Board, by senior management and stockholders. Stockholders who would like to propose an independent director candidate for consideration by the Board of Directors at next year’s annual meeting of stockholders may do so by submitting the candidate’s name, resume and biographical information to the attention of Thomas M. Zech, Secretary, Marshall Edwards, Inc., 11975 El Camino Real, Suite 101, San Diego, California 92130, no later than the deadline for submission of stockholder proposals set forth in Marshall Edwards’ proxy statement to be delivered to stockholders in connection with Marshall Edwards’ next annual meeting of stockholders. All proposals for nomination received by the Secretary of Marshall Edwards will be presented to the Board of Directors for consideration.

The Board of Directors reviews each director candidate’s biographical information and assesses each candidate’s independence, skills and expertise based on a variety of factors, including the following criteria:

| • | Whether the candidate has exhibited behavior that indicates he or she is committed to the highest ethical standards. |

| • | Whether the candidate has had broad business, governmental, non-profit or professional experience that indicates that the candidate will be able to make a significant and immediate contribution to the Board of Directors’ discussion and decision-making. |

| • | Whether the candidate will be able to devote sufficient time and energy to the performance of his or her duties as a director. |

Application of these factors requires the exercise of judgment by members of the Board of Directors and cannot be measured in a quantitative way. The Board of Directors generally values the broad business experience and independent business judgment in the health care, life sciences and other fields of each member. Specifically, with respect to Professor Williams, the Board relies on his experience in basic and pre-clinical cancer research. Ms. Cann is qualified for the Board based on her business experience in the health care field and her status as an

8

Table of Contents

“audit committee expert.” Dr. White is qualified for the Board based on her business and medical experience in the health care field, including oncology research. Mr. Rueckert is qualified for the Board based on his business experience in the investment industry. Mr. Baltic is qualified for the Board as a result of his business experience in the health care investment banking industry.

Marshall Edwards’ Board of Directors has determined the independence of each director in accordance with the elements of independence set forth in the Nasdaq listing standards. Based upon information solicited from each director, Marshall Edwards’ Board of Directors has determined that each of Mr. William Rueckert, Dr. Christine White, Professor Bryan Williams, Ms. Leah Cann and Mr. Charles V. Baltic III have no material relationship with Marshall Edwards and are “independent” within the meaning of Nasdaq’s director independence standards, as currently in effect. In making the foregoing determinations, the Board of Directors has considered both the objective tests set forth in the Nasdaq independence standards and subjective measures with respect to each director necessary to determine that no relationships exist that would interfere with the exercise of independent judgment by each such director in carrying out the responsibilities of a director. In the case of Mr. Rueckert, the Board’s subjective determination included consideration of his role as non-executive chairman of the board of directors of Novogen. Dr. Daniel P. Gold, as President and Chief Executive Officer of Marshall Edwards, is not considered independent in accordance with Nasdaq’s requirements.

Stockholder Communications with the Board of Directors

Marshall Edwards’ stockholders may communicate with the Board of Directors, including non-executive directors or officers, by sending written communications addressed to such person or persons in care of Marshall Edwards, Inc., 11975 El Camino Real, Suite 101, San Diego, California, 92130. All communications will be compiled by the Secretary and submitted to the addressee. If the Board of Directors modifies this process, the revised process will be posted on Marshall Edwards’ website.

Compensation Committee Interlocks and Insider Participation

For the fiscal year ended June 30, 2011, the members of the Compensation Committee were, Professor Bryan Williams, Dr. Christine A. White, Mr. Philip Johnston (through April 13, 2011) and Mr. William D. Rueckert (beginning April 13, 2011). All of the Compensation Committee members during the fiscal year ended June 30, 2011 were non-employee directors and not former officers. No member of the Compensation Committee had any relationships requiring disclosure by Marshall Edwards pursuant to the SEC’s rules requiring disclosure of certain relationships and related party transactions. No executive officer of Marshall Edwards has served on the Compensation Committee of any other entity that has, or has had, one or more executive officers serving as a member of Marshall Edwards’ Board of Directors.

Marshall Edwards’ certificate of incorporation and by-laws provide that the number of directors will be set by resolution of the board, but shall be between two and nine. Marshall Edwards currently has six directors.

Under Marshall Edwards’ certificate of incorporation and by-laws, directors are to be elected at the annual general meeting for a term of three years unless the director is removed, retires or the office is vacated earlier. Marshall Edwards’ board is divided into three classes with respect to the term of office, with the terms of office of one class expiring each successive year. This classified board provision could discourage a third party from making a tender offer for Marshall Edwards’ shares or attempting to obtain control of Marshall Edwards. It could also delay stockholders who do not agree with the policies of the Board of Directors from removing a majority of the Board of Directors for two years.

A director may resign at any time. The resignation is effective on Marshall Edwards’ receipt of notice. Any or all directors may be removed with or without cause by a resolution of stockholders entitled to vote to elect directors. Vacancies from resignation or removal or expansion of the size of the board may be filled by resolution of a majority of directors then in office or by a sole remaining director, and any director so appointed shall serve for the remainder of the full term of the class of directors in which the vacancy occurred.

9

Table of Contents

Attendance of Directors at Board Meetings and Shareholder Meetings

During the fiscal year ended June 30, 2011, the Board of Directors held a total of seven meetings, and each director attended at least 75% of the total number of meetings of the Board of Directors and of the meetings of each committee of the Board of Directors on which such director served. The Board of Directors also acted from time to time by unanimous written consent.

All directors are expected to attend Marshall Edwards’ annual meetings of stockholders. All directors then in office attended the previous annual meeting of stockholders held in April 2011.

Marshall Edwards has adopted a Code of Business and Ethics policy that applies to Marshall Edwards’ directors and employees (including Marshall Edwards’ principal executive officer, principal financial officer and chief medical officer), and has posted the text of Marshall Edwards’ policy on its website at www.marshalledwardsinc.com.

The Company’s executive officers are appointed by the Board of Directors and serve at the discretion of the Board of Directors. Set forth below are the names and certain biographical information regarding Marshall Edwards’ executive officers as of June 30, 2011.

Daniel P. Gold, age 57, President and Chief Executive Officer

See “Directors” above for biographical information regarding Dr. Gold.

Thomas M. Zech, age 60, Chief Financial Officer and Secretary

Mr. Zech has been Chief Financial Officer of Marshall Edwards since June 2010. From May 2009 to June 2010, Mr. Zech was a consultant, providing finance and accounting advisory services to life science and technology companies. Until November 2008, Mr. Zech served as Vice President, Finance and Chief Financial Officer at Pacira Pharmaceuticals Inc., a specialty pharmaceutical company, which was the successor company to SkyePharma Inc. acquired in March 2007, from SkyePharma PLC. He transitioned to Pacira Pharmaceuticals from SkyePharma Inc., where he joined in 1999 as Controller and Corporate Secretary. Previously he held senior finance positions at Stratagene, Advanced Tissue Sciences, Allied Holdings and Psicor. Mr. Zech earned his bachelor’s degree in accounting from Lawrence Technological University and his MBA with a concentration in finance from the University of Detroit.

Robert D. Mass, MD, age 57, Chief Medical Officer

Dr. Mass has more than 20 years of experience as a medical oncologist in both clinical practice and clinical drug development. He held a number of leadership positions at Genentech from 1998 to 2009, most recently as Head of Medical Affairs, BioOncology, a position created to strategically integrate and optimize all of the non-sponsored clinical programs within the company’s oncology portfolio. He also served on the Executive Development Review Committee at Genentech, which was responsible for the review and approval of all sponsored clinical programs across the company’s therapeutic portfolio. Previously he served as clinical science leader for Herceptin from 1999 to 2002, Tarceva from 2002 to 2003, and Avastin, currently the leading oncology therapeutic worldwide, from 2003 to 2007. Prior to joining Genentech, he practiced Hematology and Medical Oncology from 1988 to 1998. After leaving Genentech, Dr. Mass served as a consultant for several oncology companies, including, since October 2010, Marshall Edwards. Dr. Mass earned his bachelor’s degree in economics from Tufts University and his medical degree from Oregon Health & Science University. He completed his residency training in Internal Medicine and a fellowship in Hematology and Medical Oncology at the University of California-San Francisco and is certified by the American Board of Internal Medicine in both Internal Medicine and Medical Oncology.

10

Table of Contents

Compensation Discussion and Analysis

As discussed below, since beginning to directly compensate its executive officers with the appointment of Dr. Gold in April 2010, and the subsequent appointments of Mr. Zech in June 2010 and Dr. Mass in June 2011, we have instituted a compensation program based on subjective evaluation of an individual executive’s performance of his or her responsibilities and contribution to achieving our clinical, operational and financial objectives, including achievement of written goals and objectives. Although the same factors and compensation elements are applied to each of our named executive officers, the compensation of our Chief Executive Officer reflects his leadership role and critical decision-making responsibility and significant duties. The Compensation Committee has been delegated the authority to approve the compensation of executives, including that of our Chief Executive Officer. The discussion below focuses on the principles we applied in connection with approving compensation packages in the course of the recruitment of our current Chief Executive Officer, Chief Financial Officer, and Chief Medical Officer and which we anticipate applying in the future.

Objectives of Compensation Program

We recognize that our employees are a critical asset. Consequently, a key objective of our compensation program, including our executive compensation program, is to attract, retain and motivate qualified, talented and diverse professionals who are enthusiastic about our mission. We seek to achieve these goals by rewarding successful performance by our executives and Marshall Edwards, while aligning the interest of our executives with those of our stockholders, by including long-term equity as a component of their compensation.

General

We view each component of executive compensation as related but distinct, and we review total compensation of our executive officers to ensure that our overall compensation goals are met. We have not historically engaged in competitive benchmarking. We do attempt to establish compensation, and determine the appropriate level for each compensation component, at levels comparable to companies with which we compete and other companies who employ similarly skilled personnel, consistent with our recruiting and retention goals, our view of internal equity and consistency, our overall performance and other considerations we deem relevant. Except as described below, we have not adopted any formal or informal policies or guidelines for allocating compensation between long-term and current compensation, between cash and non-cash compensation or among different forms of non-cash compensation. Instead, the Compensation Committee, in consultation with and upon recommendation of our Chief Executive Officer, approves what it believes to be the appropriate level and mix of the various compensation components primarily focused on the particular goals of applicable executives and employees in a particular year. We seek to reward our executive officers based on a number of factors, including our operating results, individual performance, prior-period compensation, and the achievement of individual and corporate goals focused on the development of new products. Our executive compensation program is designed to recognize those executives that contribute to the achievement of our business objectives, to reward those individuals fairly over time, to retain those individuals who continue to perform at or above the levels that we expect and to closely align the compensation of those individuals with our performance on both a short-term and long-term basis. While we have identified below the particular compensation objective each element of executive compensation serves, we believe that each element of compensation, to a greater or lesser extent, serves each of the objectives of our executive compensation program. We provide our executives the opportunity to be rewarded through equity ownership if Marshall Edwards performs well over time, while maintaining base salaries at levels comparable with those paid by comparably-sized public companies in our geographic area.

In the future, we expect our Compensation Committee to continue to maintain policies and guidelines for executive compensation, which align our executive officers’ interests with those of our stockholders, by incentivizing and rewarding performance.

11

Table of Contents

Our Board of Directors intends to perform, at least annually, a review of executive officers’ overall compensation packages, including the grant of equity compensation, including vesting schedules, to determine whether they provide adequate incentives and motivation and whether they adequately compensate executive officers relative to the market. In evaluating the market for attracting and retaining qualified executives, the Board of Directors relies upon its collective experience in our industry and through independent sources, when available, compares our compensation plans to similar companies. In addition, the Compensation Committee considers recommendations from the Chief Executive Officer, who bases such recommendations, in part, on discussions with other members of management. The Compensation Committee did not retain a compensation consultant for the fiscal year ended June 30, 2011.

The primary elements of our executive compensation program are:

| • | base salary; |

| • | incentive cash bonuses; |

| • | long-term equity incentives; and |

| • | other benefits. |

Base Salary. We fix executive officer base compensation at a level that we believe, based on the collective industry experience of our Board of Directors and Compensation Committee, best enables us to hire and retain individuals in a competitive environment and reward individual performance according to satisfactory levels of contribution to our overall business goals. Base salary is used to recognize the experience, skills, knowledge and responsibilities required of all of our employees, including executives. When establishing base salaries, the Compensation Committee, together with the Chief Executive Officer, considers a variety of factors, including seniority, responsibility, tenure with Marshall Edwards, the ability to replace the individual, and relative pay among executives in the respective geography.

Incentive Cash Bonuses. Annual cash bonuses are discretionary in nature but are tied to the achievement of specific results. For the fiscal year ended June 30, 2011, we provided discretionary performance bonuses to employees, including executives, to recognize individual performance or the achievement of important business objectives, such as achievement of certain drug development milestones, as well as operational and financial performance. We do expect to consider awarding bonuses for each of our executive officers, payable either in whole or in part, depending on the extent to which the employee’s actual performance contributed towards the overall results of the company. We expect our Chief Executive Officer to propose executive bonus allocations to the Compensation Committee, which has ultimate approval authority. In making judgments for each individual executive, the Board of Directors uses actual results, its own expertise, experience past practice and the individual’s responsibilities and contribution to our actual results for the year by reference to pre-established goals or targets. No one element of an individual’s performance of his responsibilities or the resulting contribution to our overall results has a material impact on the decision-making process with respect to that individual. In our employment agreements, we have agreed that Dr. Gold, Mr. Zech, and Dr. Mass may receive bonuses of up to 40%, 20% and 20%, respectively, of their base salary. For the fiscal year ended June 30, 2011, the Compensation Committee awarded incentive cash bonuses of $120,000 to Dr. Gold and $50,000 to Mr. Zech in recognition of meeting or exceeding individual performance goals and the achievement of specific business objectives.

Long-Term Incentive Program. We believe that long-term performance is achieved through an equity ownership culture that encourages performance by our executive officers through the use of stock and stock-based awards. We utilize stock options to ensure that our executive officers have a continuing stake in our long-term success. Because our executive officers are awarded stock options with an exercise price equal to or greater than the fair market value of our common stock on the date of grant, the determination of which is discussed below, these options will have value to the executive officers only if the market price of our common stock

12

Table of Contents

increases after the date of grant. Typically, our stock option grants vest at the rate of 25% after the first year, or similar period, of service with the remainder vesting over the subsequent 36 months. Authority to make any form of equity grants to executive officers has been delegated by the Board of Directors to the Compensation Committee. In determining the size of stock option grants to executive officers, the Compensation Committee considers our performance compared to our strategic goals, individual performance against the individual’s objectives, experience, the extent to which shares subject to previously granted awards are vested and the recommendations of our Chief Executive Officer and other members of management. We do not have any program, plan or obligation that requires us to grant equity compensation on specified dates. We have implemented policies to ensure that equity awards are granted at fair market value on the date that the grant action occurs.

Stock Options and Equity Awards. Our 2008 Stock Omnibus Equity Compensation Plan authorizes us to grant options to purchase shares of our common stock and restricted shares of our common stock to employees, executive officers, and independent directors, which is described in further detail under Proposal No. 2 included elsewhere in this document. During the year ended June 30, 2010, we granted options to (1) Dr. Gold to purchase 220,390 shares of our common stock, with 110,195 options having an exercise price of $5.05 per share and 110,195 options having an exercise price of $1.86 per share and (2) to Mr. Zech to purchase 73,463 shares of our common stock having an exercise price of $1.52 per share, each in connection with joining the company. During the year ended June 30, 2011, we granted options to Dr. Mass to purchase 177,620 shares of our common stock having an exercise price of $1.28 per share in connection with joining the company. Twenty-five percent of the options vest on the first anniversary of the effective date of Dr. Gold’s, Mr. Zech’s, and Dr. Mass’s respective employment agreement, with the remaining seventy-five percent vesting in equal monthly installments over the following 36 months. The options granted to Dr. Gold and Dr. Mass were not granted pursuant to the terms of the 2008 Stock Omnibus Equity Compensation Plan. The Compensation Committee will consider, as part of its annual compensation review and from time to time, the extent to which additional option or other equity awards are appropriate in order to further align the interests of our key employees, including our executive officers, with those of our stockholders. In August 2011, the Compensation Committee approved additional grants to Dr. Gold and Mr. Zech of options to purchase 100,000 and 26,537 shares of common stock, respectively.

Other Benefits. We also provide our executive officers a variety of benefits that are available generally to all salaried employees. Executive officers are eligible to participate in all of our employee benefit plans, such as medical, and vision plans, in each case on the same basis as other employees, subject to applicable laws. We also provide vacation and other paid holidays to all employees, including executive officers, which are comparable to those provided at peer companies.

13

Table of Contents

Compensation of Executive Officers

The table below sets forth, for the fiscal years ended June 30, 2011 and 2010, the compensation of our named executive officers. Prior to Dr. Gold and Mr. Zech joining the company in April and June 2010, respectively, the services of our principal executive officer and principal financial officer, who comprised all of our executive officers during such periods, were provided to us by Novogen pursuant to the Services Agreement described in this proxy statement under the heading “Certain Relationships and Related Transactions.” Accordingly, we did not directly pay such officers for their services.

Name and | Year | Salary(1) ($) | Bonus ($) | Stock Awards ($) | Option Awards(2) ($) | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||||

Daniel P. Gold |

| 2011 2010 | (3) | $ $ | 400,000 81,818 | (4) | $ | 120,000 | (5) |

| — — |

| $ | — 662,272 |

|

| — — |

|

| — — |

|

| — — |

| $ $ | 520,000 744,090 |

| |||||||||

Thomas Zech |

| 2011 2010 | (6) | $ $ | 250,000 8,522 | (7) | $ | 50,000 | (8) | — | $ | — 97,706 |

|

| — — |

|

| — — |

|

| — — |

| $ $ | 300,000 106,228 |

| |||||||||||

Robert Mass | 2011 | (9) | $ | 7,292 | (10) | — | (11) | — | $ | 197,158 | — | — | — | $ | 204,450 | |||||||||||||||||||||

| (1) | In accordance with SEC rules, the compensation described in this table does not include various health and welfare or other benefits received by our named executive officers that we available generally to all of our regular, full-time employees, as well as certain perquisites and other benefits received by our named executive officers that in the aggregate, were less than $10,000 for any officer. |

| (2) | Represents the aggregate grant date fair value of options granted in accordance with Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, Topic 718, “Stock Compensation,” formerly SFAS 123R. For the relevant assumptions used in determining these amounts, refer to Note 6 to our audited consolidated financial statements included in our annual report on Form 10-K as filed with the SEC on September 28, 2011. |

| (3) | Dr. Gold’s employment with Marshall Edwards began on April 23, 2010. |

| (4) | Pro rated for the portion of the fiscal year during which Dr. Gold was employed by Marshall Edwards. Dr. Gold’s employment agreement provides for an annual salary of $400,000, subject to upward adjustment at the discretion of the Compensation Committee of the Board of Directors. For the fiscal year ending July 30, 2012, Dr. Gold’s annual salary was increased to $440,000. |

| (5) | Dr. Gold is eligible for a bonus of up to 40% of his base salary, dependent upon the achievement of certain milestones established by the Board of Directors. |

| (6) | Mr. Zech’s employment with Marshall Edwards began on June 18, 2010. |

| (7) | Pro rated for the portion of the fiscal year during which Mr. Zech was employed by Marshall Edwards. Mr. Zech’s employment agreement provides for an annual salary of $250,000, subject to upward adjustment at the discretion of the Compensation Committee of the Board of Directors. For the fiscal year ending July 30, 2012, Mr. Zech’s annual salary was increased to $265,000. |

| (8) | Mr. Zech is eligible for a bonus of up to 20% of his base salary, dependent upon the achievement of certain milestones established by the Board of Directors. |

| (9) | Dr. Mass’s employment with Marshall Edwards began on June 1, 2011. |

| (10) | Pro rated for the portion of the fiscal year during which Dr. Mass was employed by Marshall Edwards. Dr. Mass’s employment agreement provides for an annual salary of $350,000. Dr. Mass works a 25% part-time schedule. Prior to Dr. Mass’s employment with Marshall Edwards, he acted as a consultant, for which Marshall Edwards paid Dr. Mass $47,250 in consulting fees during the fiscal year ended June 30, 2011. |

| (11) | Dr. Mass is eligible for a bonus of up to 20% of his base salary, dependent upon the achievement of certain milestones established by the Board of Directors. |

14

Table of Contents

We adopted the Marshall Edwards, Inc. 2008 Stock Omnibus Equity Compensation Plan effective December 9, 2008. The table below sets forth the awards granted by us under the 2008 Stock Omnibus Equity Compensation Plan for the fiscal year ended June 30, 2011, as well as the awards granted outside of such plan.

Name | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards | All Other Stock Awards: Number of Shares of Stocks or Units (#) | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards(4) | |||||||||||||||||||||||||||||||||||||

| Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||||||||||||||||||||||||||||||||||||

Daniel P. Gold President, Chief Executive Officer and Director | April 23, 2010 | (1)(3) | — | — | — | — | — | — | — | 110,195 | $ | 5.05 | $ | 482,654 | ||||||||||||||||||||||||||||||

Daniel P. Gold President, Chief Executive Officer and Director | June 7, 2010 | (1)(3) | — | — | — | — | — | — | — | 110,195 | $ | 1.86 | $ | 179,618 | ||||||||||||||||||||||||||||||

Thomas Zech | June 18, 2010 | (2) | — | — | — | — | — | — | — | 73,463 | $ | 1.52 | $ | 97,706 | ||||||||||||||||||||||||||||||

Robert Mass | June 1, 2011 | (3) | — | — | — | — | — | — | — | 177,620 | $ | 1.28 | $ | 197,158 | ||||||||||||||||||||||||||||||

| (1) | Pursuant to the terms of Dr. Gold’s employment letter, dated April 23, 2010, and as approved by the Compensation Committee of the Board of Directors on the same date, Dr. Gold received options to purchase 220,390 shares of our common stock in two separate tranches. The first tranche of options to purchase 110,195 shares of our common stock was granted to Dr. Gold upon his appointment as President and Chief Executive Officer on April 23, 2010. The second tranche of options to purchase 110,195 shares of our common stock was granted to Dr. Gold and separately approved by the Compensation Committee on June 7, 2010, which date was no later than thirty (30) days following the public release of our Ovature study results, in accordance with Dr. Gold’s employment letter. |

| (2) | Granted pursuant to the 2008 Stock Omnibus Equity Compensation Plan. |

| (3) | Not granted pursuant to the 2008 Stock Omnibus Equity Compensation Plan. |

| (4) | See “Results of Operations – Critical Accounting Estimates” under “Marshall Edwards’ Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Form 10-K filed on September 28, 2011 for a discussion of the assumptions made in the valuation of these options. |

15

Table of Contents

Outstanding Equity Awards at Fiscal Year-End

As of June 30, 2011, the following equity awards were outstanding:

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) (h) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested (#) | |||||||||||||||||||||||||||

Daniel P. Gold |

| 32,141 — |

| 78,054 | (1) | — | $ | 5.05 | April 22, 2015 | — | — | — | — | |||||||||||||||||||||||

| 32,141 | 78,054 | (1) | — | $ | 1.86 | June 6, 2015 | — | — | — | — | ||||||||||||||||||||||||||

Thomas Zech | 18,366 | 55,097 | (2) | — | $ | 1.52 | June 17, 2015 | — | — | — | — | |||||||||||||||||||||||||

Robert Mass | — | 177,620 | (3) | — | $ | 1.28 | June 1, 2016 | — | — | — | — | |||||||||||||||||||||||||

| (1) | Twenty-five percent of the options vested on April 23, 2011; the remaining seventy-five percent of the options vest in equal monthly installments over the following 36 months. |

| (2) | Twenty-five percent of the options vested on June 18, 2011; the remaining seventy-five percent of the options vest in equal monthly installments over the following 36 months. |

| (3) | Twenty-five percent of the options will vest on June 1, 2012; the remaining seventy-five percent of the options will vest in equal monthly installments over the following 36 months. |

Option Exercises and Stock Vested

During the fiscal year ended June 30, 2011, there were no exercises of stock options, stock appreciation rights and similar instruments, and no vesting of stock, including restricted stock, restricted stock units and similar instruments for any of our named executive officers.

Other than a 401(k) plan available to all employees and to which we have not made any contributions on behalf of any employee, we do not currently, and did not during the fiscal year ended June 30, 2011, have in place any plan that provides for payments or other benefits at, following or in connection with retirement of any executive officer.

Employment Agreement between Daniel P. Gold and Marshall Edwards

In connection with Dr. Gold’s appointment as President and Chief Executive Officer, we entered into an Employment Letter Agreement, dated April 23, 2010 with Dr. Gold (the “Gold Employment Letter”). The Gold Employment Letter provides for an annual base salary of $400,000, subject to upward adjustment at the discretion of the Compensation Committee of the Board of Directors. Dr. Gold will also have the opportunity to earn an annual cash bonus in an amount up to a maximum of 40% of the base salary based on his achievement of milestones established by the Compensation Committee of the Board of Directors.

Pursuant to the terms of the Gold Employment Letter, Dr. Gold also received options to purchase 220,390 shares of our common stock in two separate tranches. The first tranche of options to purchase 110,195 shares of our common stock was granted to Dr. Gold upon his appointment as President and Chief Executive Officer on

16

Table of Contents

April 23, 2010, with an exercise price per share equal to the closing price of our common stock on April 23, 2010. The second tranche of options to purchase 110,195 shares of our common stock was granted to Dr. Gold on June 7, 2010, which date was within thirty (30) days following the public release of our Ovature study results in accordance with the terms of the Gold Employment Letter. Of Dr. Gold’s options, 25% will vest one year from the effective date of the Gold Employment Letter and, thereafter, the remaining 75% of Dr. Gold’s options will vest in equal monthly installments over the following thirty-six (36) months. In the event of a Change in Control of Marshall Edwards, as defined in the Gold Employment Letter, Dr. Gold’s options will become fully vested. In addition, during the 12-month period following the Effective Date, Dr. Gold’s equity interest in us will be protected against further dilution. If an event occurs during this 12-month period that reduces the level of Dr. Gold’s equity interest in us (as a percentage of our outstanding common stock), the Board of Directors shall take such actions as may be necessary, as determined by the Board of Directors in its sole discretion, to restore Dr. Gold’s equity interest in us to the level as in effect before such event.

Dr. Gold may terminate his employment at any time and for any reason, upon providing three (3) months advance notice to us. Dr. Gold may terminate his employment with Good Reason (as defined in the Gold Employment Letter) by providing us with notice within sixty (60) days of the event giving rise to the Good Reason (and we do not cure the Good Reason event within thirty (30) days after receiving notice). We have the right to terminate the Gold Employment Letter with or without Cause (as defined in the Gold Employment Letter) at any time. If Dr. Gold’s employment is terminated by us without Cause or by Dr. Gold for Good Reason, Dr. Gold will be entitled to (i) a lump sum payment in an amount equal to twelve (12) months of his base salary and (ii) accelerated vesting of his options such that Dr. Gold will be vested in the same number of options as if he had continued to be employed by us for an additional twelve (12) months. The Gold Employment Letter contains confidentiality provisions.

Employment Agreement between Thomas M. Zech and Marshall Edwards

In connection with Mr. Zech’s appointment as Chief Financial Officer, we entered into an Employment Letter, dated June 18, 2010, with Mr. Zech (the “Zech Employment Letter”). The Zech Employment Letter provides for an annual base salary of $250,000, subject to upward adjustment at the discretion of the Compensation Committee of the Board of Directors. Mr. Zech will also have the opportunity to earn an annual cash bonus in an amount up to a maximum of 20% of the base salary based on his achievement of milestones established by the Board of Directors.

Pursuant to the terms of the Zech Employment Letter, Mr. Zech also received options to purchase 73,463 shares of our common stock, with an exercise price per share equal to the closing price of our common stock on June 18, 2010, pursuant to the terms and conditions of the Zech Employment Letter, the applicable stock option grant agreement and the 2008 Stock Omnibus Equity Compensation Plan. Of Mr. Zech’s options, 25% will vest one year from the effective date of the Zech Employment Letter and, thereafter, the remaining 75% of Mr. Zech’s options will vest in equal monthly installments over the following thirty-six (36) months. In the event of a Change in Control of Marshall Edwards, as defined in the Zech Employment Letter, Mr. Zech’s options will become fully vested.

Mr. Zech may terminate his employment at any time other than for Good Reason (as defined in the Zech Employment Letter), upon providing two (2) months advance notice to us. Mr. Zech may terminate his employment with Good Reason by providing us with notice within sixty (60) days of the event giving rise to the Good Reason (and we do not cure the Good Reason event within thirty (30) days after receiving notice). We have the right to terminate the Zech Employment Letter with or without Cause (as defined in the Zech Employment Letter) at any time. If Mr. Zech’s employment is terminated by us without Cause or by Mr. Zech for Good Reason, Mr. Zech will be entitled to (i) a lump sum payment in an amount equal to twelve (12) months of his base salary and (ii) accelerated vesting of his options such that Mr. Zech will be vested in the same number of options as if he had continued to be employed by us for an additional twelve (12) months. The Zech Employment Letter contains confidentiality provisions.

17

Table of Contents

Employment Agreement between Robert Mass and Marshall Edwards

In connection with Dr. Mass’s appointment as Chief Medical Officer, we entered into an Employment Letter, dated June 1, 2011, with Dr. Mass (the “Mass Employment Letter”). The Mass Employment Letter provides for an annual base salary of $350,000, subject to upward adjustment at the discretion of the Compensation Committee of the Board of Directors. Dr. Mass will also have the opportunity to earn an annual cash bonus in an amount up to a maximum of 20% of the base salary based on his achievement of milestones established by the Board of Directors.Dr. Mass works a reduced hours schedule and is currently paid at a rate of 25% of his annual base salary.

Pursuant to the terms of the Mass Employment Letter, Dr. Mass also received options to purchase 177,620 shares of our common stock, with an exercise price per share equal to the closing price of our common stock on June 1, 2011, pursuant to the terms and conditions of the Mass Employment Letter and the applicable stock option grant agreement. Of Dr. Mass’s options, 25% will vest one year from the effective date of the Mass Employment Letter and, thereafter, the remaining 75% of Dr. Mass’s options will vest in equal monthly installments over the following thirty-six (36) months. In the event of a Change in Control of Marshall Edwards, as defined in the Mass Employment Letter, Mr. Mass’s options will become fully vested. In addition, during the 12-month period following the Effective Date, Dr. Mass’s equity interest in us will be protected against further dilution. If an event occurs during this 12-month period that reduces the level of Dr. Mass’s equity interest in us (as a percentage of our outstanding common stock), the Board of Directors shall take such actions as may be necessary, as determined by the Board of Directors in its sole discretion, to restore Dr. Mass’s equity interest in us to the level as in effect before such event.

Dr. Mass may terminate his employment at any time other than for Good Reason (as defined in the Mass Employment Letter), upon providing two (2) months advance notice to us. Dr. Mass may terminate his employment with Good Reason by providing us with notice within sixty (60) days of the event giving rise to the Good Reason (and we do not cure the Good Reason event within thirty (30) days after receiving notice). We have the right to terminate the Mass Employment Letter with or without Cause (as defined in the Mass Employment Letter) at any time. If Dr. Mass’s employment is terminated by us without Cause or by Dr. Mass for Good Reason, Dr. Mass will be entitled to (i) a lump sum payment in an amount equal to twelve (12) months of his base salary and (ii) accelerated vesting of his options such that Dr. Mass will be vested in the same number of options as if he had continued to be employed by us for an additional twelve (12) months. The Mass Employment Letter contains confidentiality provisions.

Potential Payments Upon Termination or Change in Control

Each of Dr. Gold’s, Mr. Zech’s and Dr. Mass’s employment agreement provides for certain severance payments upon the applicable employee’s termination by us other than for cause or by the applicable employee for good reason, as such terms are defined in the respective employment agreement. Upon such a termination of employment, we will: (i) make a payment to the applicable employee in lieu of notice in an amount equal to twelve months of such employee’s base salary (as in effect at the time of such employee’s termination from employment), and (ii) accelerate the vesting of the applicable employee’s options so that such employee will be vested in the same number of shares of common stock subject to the options as if such employee had continued to be employed by us for an additional twelve months. Such payment and additional option vesting will be conditional upon the execution of a customary release of claims in favor of us and our affiliates, in a form prescribed by us. The payment in lieu of notice will be paid to the applicable employee in a single lump sum payment as soon as administratively practicable after the maximum review and revocation period for the release agreement as may be required under applicable law, if any, or such earlier date as determined in our sole discretion, but in no event more than 60 days after the applicable employee’s termination of employment. If their employment had been terminated in accordance with the foregoing provisions on June 30, 2011, Dr. Gold, Mr. Zech and Dr. Mass would have been entitled to payments in the amount of $400,000, $250,000 and $87,500, respectively, and the vesting of options to purchase 55,104, 18,360 and 44,405 shares of our common stock, respectively.

18

Table of Contents

In the event of a change in control of Marshall Edwards, as defined in the 2008 Stock Omnibus Equity Compensation Plan, unless the Compensation Committee of the Board of Directors determines otherwise, all of the options granted to Dr. Gold, Mr. Zech and Dr. Mass will accelerate and become fully exercisable effective upon the date of the change in control. As of June 30, 2011, the exercise price of all executive officers’ outstanding options exceeded the closing price per share of our common stock.