UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14A-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

HIGHLAND HOSPITALITY CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

8405 Greensboro Drive, Suite 500

McLean, Virginia 22102

To Our Stockholders:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of Highland Hospitality Corporation (the “Company”) to be held on Thursday, May 19, 2005, at 10:00 a.m. at the Sheraton Annapolis Hotel, 173 Jennifer Road, Annapolis, Maryland 21401. At the meeting, stockholders will consider and vote on a proposal to re-elect all seven incumbent directors to the Company’s Board of Directors. The stockholders will also transact such other business, if any, which may be properly brought before the 2005 Annual Meeting of Stockholders.

If you were a stockholder at the close of business on March 25, 2005, you may vote at the 2005 Annual Meeting of Stockholders. Whether or not you plan to attend the meeting, please take the time to vote by completing and mailing the enclosed proxy card to us in the envelope provided.

We look forward to seeing you at the meeting.

James L. Francis

President and Chief Executive Officer

McLean, Virginia

April 4, 2005

8405 Greensboro Drive, Suite 500

McLean, Virginia 22102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, MAY 19, 2005

The 2005 Annual Meeting of Stockholders of Highland Hospitality Corporation will be held at the Sheraton Annapolis Hotel, 173 Jennifer Road, Annapolis, Maryland 21401, 10:00 a.m., local time, on Thursday, May 19, 2005. At the meeting, stockholders will consider and vote on a proposal to re-elect all seven incumbent directors to the Company’s Board of Directors. The stockholders will also transact such other business, if any, which may be properly brought before the 2005 Annual Meeting of Stockholders.

The Board of Directors has set the close of business on March 25, 2005 as the record date to determine the stockholders entitled to notice of and to vote at the meeting or any adjournment or postponement thereof.

BYORDEROFTHE BOARDOF DIRECTORS,

Tracy M. J. Colden

Executive Vice President, General Counsel and Secretary

McLean, Virginia

April 4, 2005

Please promptly complete, date, sign and return the enclosed proxy card whether or not you plan to attend the meeting.

8405 Greensboro Drive, Suite 500

McLean, Virginia 22102

PROXY STATEMENT

FOR

2005 ANNUAL MEETING OF STOCKHOLDERS

THURSDAY, MAY 19, 2005

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Highland Hospitality Corporation for the 2005 Annual Meeting of Stockholders to be held on Thursday, May 19, 2005 at 10:00 a.m. at the Sheraton Annapolis Hotel, 173 Jennifer Road, Annapolis, Maryland 21401.

Who Can Vote

Stockholders of record on March 25, 2005 may attend and vote at the 2005 Annual Meeting of Stockholders or have their votes by proxy counted if they do not attend in person. On that date, there were 40,067,444 shares of common stock outstanding and entitled to vote. Each share is entitled to one vote. The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the 2005 Annual Meeting of Stockholders will constitute a quorum to conduct business. Shares represented by proxies received but marked as abstentions, if any, will be included in the calculation of the number of shares considered to be present at the meeting. Shares held in a broker’s account that are not voted by the broker or other nominee (“broker non-votes”) will be treated as shares present at the meeting for purposes of determining the presence of a quorum, but will not be treated as shares present and entitled to vote with respect to those matters for which no vote is cast.

This proxy statement and the enclosed proxy card are first being mailed to stockholders on or about April 12, 2005.

Voting Procedures

You may grant a proxy by completing, signing and mailing the enclosed proxy card to us in the envelope provided. Shares represented by proxies will be voted as directed by the stockholder. Unless you direct otherwise, if you grant a proxy, your shares will be voted FOR all nominees to serve on the Board. Proxies submitted by mail must be received on or before May 18, 2005.

If a stockholder is a corporation or partnership, the accompanying proxy card must be signed in the full corporate or partnership name by a duly authorized person. If the proxy card is signed pursuant to a power of attorney or by an executor, administrator, trustee or guardian, the signer’s full title must be given and a certificate or other evidence of appointment must be furnished. If shares are owned jointly, each joint owner must sign the proxy card.

Any proxy duly given pursuant to this solicitation may be revoked by the stockholder, at any time prior to voting, by written notice to the Company’s Secretary, by a later-dated proxy either signed and returned by mail, or by attending the 2005 Annual Meeting of Stockholders and voting in person. Attendance at the 2005 Annual Meeting of Stockholders will not in and of itself constitute a revocation of a proxy.

Important Notice Regarding Delivery of Stockholder Documents

In order to reduce our printing and postage costs, stockholders of common stock who share a single address are being sent only one copy of this proxy statement and the Company’s 2004 Annual Report unless we received contrary instructions from any stockholder at that address. However, if any stockholder residing at such an address wishes to receive a separate copy of this proxy statement or the Company’s 2004 Annual Report, he or she may contact the Company’s Secretary at Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102. Any such stockholder may also contact the Secretary using the above contact information if he or she would like to receive separate proxy statements and Annual Reports in the future. If you are receiving multiple copies of the Company’s Annual Report and proxy statement, you may request that one copy of the proxy statement and the Company’s Annual Report be sent to your address in the future by contacting the Company’s Secretary.

Cost of Soliciting Proxies

The cost of soliciting proxies will be borne by the Company. We have hired the firm of MacKenzie Partners, Inc., 156 Fifth Avenue, New York, New York 10010, to assist in the solicitation of proxies on behalf of our Board. MacKenzie Partners has agreed to perform these services for a fee of $7,000, plus certain reimbursable expenses. In addition to the solicitation of proxies by mail, certain of the officers and employees of the Company, without extra compensation, may solicit proxies personally, by telephone or other means. The Company also will request that brokerage houses, nominees, custodians and fiduciaries forward soliciting materials to the beneficial owners of stock held of record and will reimburse them for forwarding the materials.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors unanimously recommends that the Company’s stockholders vote “FOR” the re-election of each of the persons nominated to serve as a director.

Seven directors will be elected at the 2005 Annual Meeting of Stockholders to serve until the 2006 Annual Meeting of Stockholders. All directors are to hold office for a term of one year or until their respective successors shall be duly elected. Each of the nominees identified below is a current member of our Board. For the election to the Board of a nominee pursuant to Proposal 1, a plurality of the shares present and voting must vote FOR that nominee. Unless you direct otherwise, if you grant a proxy, your shares will be voted FOR all nominees to serve on the Board.

The principal occupations and business experience of the nominees are described below.

NOMINEES FOR DIRECTOR

| | |

| Bruce D. Wardinski | | Mr. Wardinski, 44, the non-executive Chairman of the Board, has served as the President and Chief Executive Officer of Barceló Crestline Corporation since June 2002. From 1998 to 2002, he served as the Chairman of the Board, Chief Executive Officer and President of Crestline Capital Corporation and, from 1996 to 1998, as Senior Vice President and Treasurer of Host Marriott Corporation. He currently serves on the board of directors of ServiceSource Inc., a not-for-profit advocacy group representing people with disabilities, and on the board of directors of eStara, Inc. He is Chairman of the ServiceSource Foundation. |

| |

| James L. Francis | | Mr. Francis, 43, is our President and Chief Executive Officer. Mr. Francis served as the Chief Operating Officer, Chief Financial Officer and Treasurer of Barceló Crestline Corporation from June 2002 until the completion of our initial public offering and as Executive Vice President and Chief Financial Officer of Crestline Capital Corporation from December 1998 to June 2002. From June 1997 to December 1998, Mr. Francis held the position of Assistant Treasurer and Vice President Corporate Finance for Host Marriott Corporation. |

| |

| Francisco L. Borges | | Mr. Borges, 53, has been a director since the completion of our initial public offering in December 2003. Since December 2003, he has been Chairman, Chief Executive Officer and a Managing Partner of Landmark Partners. Prior to December 2003, he was President, Chief Executive Officer and a Managing Partner of Landmark Partners. Prior to joining Landmark, Mr. Borges served in several capacities with the Financial Guaranty Insurance Company, including his appointment in 1995 as President of FGIC Government Services, Inc. Prior to this appointment, he served for two years as Managing Director of FGIC’s public finance department. Mr. Borges is a board member and Treasurer of the NAACP and is a member of the board of directors and the investment committees for the Hartford Foundation for Public Giving and the University of Connecticut Foundation. |

| |

| W. Reeder Glass | | Mr. Glass, 63, has been a director since the completion of our initial public offering in December 2003. He has been a partner at the law firm of Holland & Knight LLP since 1980 and is currently serving on the board of directors of Barceló Crestline Corporation. He has also acted as counsel for numerous real estate developers engaged in the acquisition, financing and development of large planned unit developments, hotels, mixed-use developments and other commercial and residential projects. He is a member of the Florida and Georgia state bars. |

3

| | |

| |

| Thomas A. Natelli | | Mr. Natelli, 45, has been a director since the completion of our initial public offering in December 2003. Since 1987, Mr. Natelli has served as the President and Chief Executive Officer of Natelli Communities, a privately held real estate investment and development company. Mr. Natelli currently serves on the board of FBR National Bank and Trust and the Montgomery County Chamber of Commerce. He also serves as chairman of the board of directors of eStara, Inc. and as chairman of the board of trustees of Suburban Health Care System and chairman of the board of trustees of Suburban Hospital. |

| |

| Margaret A. Sheehan | | Ms. Sheehan, 45, has been a director since the completion of our initial public offering in December 2003. She has been a partner at the law firm of Alston & Bird LLP since 2000. Ms. Sheehan concentrates her practice on counseling financial institutions on all matters relating to the development and offering of investment products and services. She also specializes in representing private investment companies, and is an expert on fund structures and offerings for real estate funds, private equity funds, hedge funds and fund of funds. Ms. Sheehan is admitted to the District of Columbia and New York State bars, and is a member of the American Bar Association and Women in Housing and Finance. |

| |

| William L. Wilson | | Mr. Wilson, 64, has been a director since the completion of our initial public offering in December 2003. From 1999 until 2002, Mr. Wilson served as an independent board member of Crestline Capital Corporation. Mr. Wilson has been the Principal-in-Charge of Synterra, Ltd., a site architectural and construction management firm, since 1972. Mr. Wilson has been the Principal-in-Charge of Synterra Partners, a hotel and resort planning, development and management firm since 1995. Mr. Wilson currently serves on the board of directors of the City of Philadelphia Art Commission, the board of trustees of the Pennsylvania School for the Deaf, the board of overseers of the University of Pennsylvania School of Design, and the board of directors of the Philadelphia Zoo. |

4

THE BOARD OF DIRECTORS AND COMMITTEES

Board of Directors

Our Board is composed of seven directors and is not classified. Each director, upon election or re-election at an annual meeting, will serve a one-year term. The Board held eight meetings during 2004 and each of the directors attended at least 75% of the meetings of the Board and each committee of the Board on which he or she served.

The corporate governance listing standards adopted by the New York Stock Exchange (“NYSE”) include a requirement that a majority of directors of NYSE-listed companies be “independent.” For a director to be “independent” under these rules, the board of directors must affirmatively determine that the director has no material relationship with us, either directly or as a partner, stockholder, or officer of an organization that has a relationship with us. In addition, the NYSE has set certain independence tests which, if not met by a director, preclude the board from determining that director to be independent.

To further assist our Board in evaluating the materiality of relationships for purposes of assessing the independence of incumbent directors and director nominees, our Board has adopted objective standards as permitted by the NYSE rules. The objective standards our Board has adopted may be found in our Principles of Corporate Governance, which are posted on our website atwww.highlandhospitality.com. The objective standards do not override the NYSE’s rules on independence. A relationship that is not disqualifying under the NYSE standards will nevertheless be further evaluated against our objective standards in determining a director’s independence.

Our Board has determined that four of the Board’s six current non-management members, a majority of the Board, are “independent” directors for the purposes of the NYSE’s rules, as none of these four directors has any relationships with the Company. The Board has determined that Messrs. Wardinski and Glass do not qualify as independent directors. Mr. Wardinski serves as the President and Chief Executive Officer of Barceló Crestline Corporation (“Barceló Crestline”), the sponsor of our initial public offering in December 2003. In connection with our initial public offering, we entered into a strategic alliance agreement with Barceló Crestline pursuant to which, among other things, we agreed to offer Barceló Crestline a right of first refusal to serve as manager of all of our hotel properties and Barceló Crestline obtained the right to designate one director for election to our Board. Barceló Crestline is currently the manager of ten of our hotel properties. We consider our strategic alliance with Barceló Crestline to be a material relationship and, accordingly, neither Mr. Wardinski nor Mr. Glass, who is being nominated for re-election as Barceló Crestline’s designee on our Board, is an independent director.

Rules of the Securities and Exchange Commission (“SEC”) impose additional independence requirements for all members of the Audit Committee. All three members of the Company’s Audit Committee, Messrs. Borges and Natelli and Ms. Sheehan, qualify as “independent” under these SEC rules.

Consistent with the NYSE’s corporate governance listing standards, our Principles of Corporate Governance call for the non-management directors to meet in regularly scheduled executive sessions without management. The Principles of Corporate Governance provide that so long as the Chairman of the Board is not an employee of the Company, the Chairman shall serve as the presiding director at the executive sessions. Mr. Wardinski presided at the executive session held in 2004 and will preside at any executive sessions held in 2005. Additionally, the Board will hold at least one annual executive session comprised of independent directors only. The Nominating and Corporate Governance Committee Charter provides that the chairman of such committee shall serve as the presiding director at these sessions. Ms. Sheehan, as chairman of the Nominating and Corporate Governance Committee, will preside at these sessions in 2005. Interested parties may communicate their concerns directly with either the full Board, Mr. Wardinski, Ms. Sheehan, the non-management directors as a group, or the independent directors as a group by writing to either the Board of Directors, Mr. Wardinski, Ms. Sheehan, the Non-Management Directors or the Independent Directors, c/o Highland Hospitality Corporation,

5

8405 Greensboro Drive, Suite 500, McLean, Virginia 22102. The Company’s policy on director attendance at annual meetings and the number of directors who attended last year’s annual meeting may be found on the Company’s website atwww.highlandhospitality.com.

Board Committees

The Board conducts its business through meetings of the Board and three committees: the Audit Committee, the Compensation Policy Committee and the Nominating and Corporate Governance Committee. Each committee is composed entirely of independent directors, as required by the rules of the NYSE.

Compensation Policy Committee

Our Compensation Policy Committee consists of Messrs. Wilson, who serves as Chairman, and Borges and Ms. Sheehan. The primary functions of the Compensation Policy Committee are to discharge the Board’s responsibilities relating to compensation of our directors and executive officers, and to administer and implement our 2003 Omnibus Stock Incentive Plan and any other equity-based plans. The Compensation Policy Committee met three times during 2004. The Compensation Policy Committee charter is posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Compensation Policy Committee charter without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Messrs. Wilson and Natelli and Ms. Sheehan, who serves as Chairman. The primary functions of the Nominating and Corporate Governance Committee are to:

| | • | | develop criteria for use in selecting nominees to our Board and identify and recommend to our Board qualified director candidates; |

| | • | | consider and recommend to our Board the size and composition of the Board and its committees; |

| | • | | monitor the Company’s human resources practices; and |

| | • | | monitor our performance in meeting our obligations of fairness in internal and external matters, and develop and recommend our principles of corporate governance and practices. |

The Nominating and Corporate Governance Committee charter sets forth certain criteria for the Committee to consider in evaluating potential director nominees. In order for the Board to have a substantial degree of independence from management, a majority of directors must be independent of management, in both fact and appearance, and must satisfy the independence criteria of the NYSE. The Committee considers the directors’ skills, knowledge, perspective, broad business judgment and leadership, relevant lodging industry-specific or regulatory affairs knowledge, business creativity and vision, experience, age and diversity, all in the context of an assessment of the perceived needs of the Board at that time, and monitors the mix of skills and experience of directors in order to assure that the Board has the necessary tools to perform its oversight function effectively. The Committee evaluates potential candidates against these requirements and objectives. For those director candidates that appear upon first consideration to meet the Committee’s criteria, the Committee will engage in further research to evaluate their candidacy.

The Nominating and Corporate Governance Committee will consider timely written suggestions from stockholders. Stockholders wishing to suggest a candidate for director nomination for the 2006 Annual Meeting of Stockholders should mail their suggestions to Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Secretary. Suggestions must be received by the Company’s Secretary no later than January 9, 2006. The manner in which director nominee candidates suggested in accordance with this policy are evaluated shall not differ from the manner in which candidates recommended by other sources are evaluated.

6

The Nominating and Corporate Governance Committee met three times during 2004. The Nominating and Corporate Governance Committee charter is posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Nominating and Corporate Governance Committee charter without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

Compensation of Directors

The Chairman of our Board is paid a fee of $250,000 annually. Each of our directors (other than Messrs. Wardinski and Francis) who does not serve as the chairman of one of our committees is paid a director’s fee of $20,000 annually. Each director who serves as a committee chairman, other than our Audit Committee chairman, is paid a director’s fee of $25,000 annually. The director who serves as our Audit Committee chairman is paid a director’s fee of $30,000 annually. Each director, other than our Chairman and Mr. Francis, is also paid $1,500 per Board or committee meeting attended (or $500 per telephonic meeting), except that committee chairpersons are paid $2,500 per committee meeting attended. Directors who are officers or employees receive no additional compensation as directors. In addition, we reimburse all directors for reasonable out-of-pocket expenses incurred in connection with their services on the Board.

Effective with the completion of our initial public offering, we granted our Chairman a restricted common stock award for 175,000 shares of restricted common stock, which vest at the rate of one-third of the number of shares of restricted common stock on each of the first three annual anniversary dates of the completion of our initial public offering. The vesting of those shares of restricted common stock will accelerate if the Chairman’s service as a director terminates for death or disability, by reason of the failure of the Chairman to be re-nominated by our Board or re-elected by the stockholders (other than his voluntary withdrawal from the Board or a removal for cause and in accordance with our charter) or by reason of a change in control of our Company. Each of our other directors who is not an officer or employee received an initial grant of 5,000 vested shares of common stock concurrent with the completion of our initial public offering, received a grant of an additional 2,000 vested shares of common stock at the time of the meeting of the Board immediately following our 2004 Annual Meeting of Stockholders and, assuming each continues service on the Board, will receive a grant of an additional 2,000 vested shares of common stock at the time of the meetings of the Board immediately following our 2005 Annual Meeting of Stockholders and each subsequent annual meeting of our stockholders.

Principles of Corporate Governance

Pursuant to the NYSE’s corporate governance listing standards, we have adopted Principles of Corporate Governance that address a number of topics, including, among others, director independence and qualification standards, director orientation and continuing education and director compensation. Our Nominating and Corporate Governance Committee will review the Principles of Corporate Governance on a regular basis, and the Board will review any proposed additions or amendments to the Principles of Corporate Governance. The Principles of Corporate Governance are posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Principles of Corporate Governance without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

Code of Business Conduct and Ethics

The Company has also adopted a Code of Business Conduct and Ethics that applies to each of our directors, officers and employees. The Code sets forth our policies and expectations on a number of topics, including, among others, compliance with laws, (including insider trading compliance), preservation of confidential information relating to our business and that of our clients, conflicts of interest, and reporting of illegal or unethical behavior. The Code of Business Conduct and Ethics is posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Code of Business Conduct and Ethics without

7

charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations. Any additions or amendments to the Code, and any waivers of it for the benefit of executive officers or directors, also will be posted on the Corporate Governance page of our website.

Whistleblower Policy and Procedures

We have implemented “whistleblower” procedures by establishing formal procedures for the receipt, retention and handling by the Audit Committee of complaints and concerns from employees relating to questionable accounting, internal controls and auditing matters, compliance with legal and regulatory requirements or retaliation against employees who report such concerns or complaints on a confidential, anonymous basis. As discussed in the Policy, we have made a voicemail box telephone number and email address available for reporting such concerns and complaints. A designee of the Audit Committee is charged with reviewing each report and determining with the full Audit Committee whether further investigation is warranted.

The Audit Committee will review the Policy on a regular basis, and propose or adopt additions or amendments to the Policy as appropriate. The voicemail box telephone number and email address for reporting such concerns or complaints are posted on our website atwww.highlandhospitality.com.

8

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board. The primary functions of the Audit Committee are to make recommendations concerning the engagement of the independent registered public accounting firm, review with the independent registered public accounting firm the plans and results of the audit engagement, approve all professional services provided by the independent registered public accounting firm, review the independence of the independent registered public accounting firm, evaluate the range of audit and non-audit fees, review the adequacy of the Company’s internal controls and monitor the Company’s procedures and policies for compliance with the rules for taxation as a real estate investment trust under Sections 856-860 of the Internal Revenue Code of 1986, as amended. The Audit Committee operates under a formal written charter that has been adopted by the Board.

The Audit Committee members are not professional accountants or auditors, and their role is not intended to duplicate or certify the activities of management and the independent registered public accounting firm, nor can the Audit Committee certify that the independent registered public accounting firm is “independent” under applicable rules. The Audit Committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and the independent registered public accounting firm on the basis of the information it receives, discussions with management and the independent registered public accounting firm, and the experience of the Audit Committee’s members in business, financial and accounting matters. In fulfilling its oversight responsibilities, the Audit Committee meets at least quarterly with the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, the overall quality of the Company’s financial reporting and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards.

The Audit Committee reviewed the audited financial statements for the year ended December 31, 2004 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. In addition, the Audit Committee has received from the independent registered public accounting firm the written disclosures required by Independence Standards Board Opinion No. 1 and discussed with the independent registered public accounting firm their independence, as well as the matters required to be discussed by Statement on Auditing Standards No. 61 and No. 90. The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit, and has reviewed and discussed with that firm, the third party that provides the Company’s internal audit function and management, management’s assessment of the effectiveness of the Company’s internal controls over financial reporting and the independent registered public accounting firm’s audit of management’s assessment and the effectiveness of those internal controls.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s 2004 Annual Report on Form 10-K for filing with the SEC and the Board approved that recommendation.

The Audit Committee consists of Messrs. Borges, who serves as Chairman, and Natelli, and Ms. Sheehan. Each of the Audit Committee members is independent as defined by the NYSE listing standards. Our Audit Committee Charter provides that the Audit Committee shall have a designated “audit committee financial expert” at all times. Our Board has determined that Mr. Borges qualifies as an “audit committee financial expert” under the SEC rules. Pursuant to the Audit Committee charter, the Audit Committee has also established a “Whistleblower Policy” which is described above. The Audit Committee met nine times during 2004. The Audit Committee charter is posted on the Company’s website atwww.highlandhospitality.com. You may also obtain a copy of the Audit Committee charter without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

9

The following is a summary of the fees billed to the Company by KPMG LLP, the Company’s independent registered public accounting firm, for professional services rendered for the years ended December 31, 2004 and 2003.

| | | | | | |

| | | 2004

| | 2003(1)

|

Audit Fees (2) | | $ | 571,000 | | $ | 534,000 |

Audit-Related Fees | | | — | | | — |

Tax Fees (3) | | | 101,000 | | | 59,600 |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total Fees | | $ | 672,000 | | $ | 593,600 |

| (1) | Amounts for year ended December 31, 2003 include fees billed prior to and in connection with the Company’s initial public offering in December 2003. |

| (2) | Audit Fees consist of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements that are normally provided by KPMG LLP in connection with statutory and regulatory filings and engagements, acquisitions and dispositions, comfort letters and SEC registration statements. For 2004, audit fees also include the audit of (a) management’s assessment of internal control over financial reporting and (b) the effectiveness of internal control over financial reporting, as required under Section 404 of the Sarbanes-Oxley Act of 2002. |

| (3) | Tax Fees consist of fees billed for professional services for tax compliance, tax advice and tax planning. |

The Audit Committee or its Chairman pre-approve all services rendered by the Company’s independent registered public accounting firm. The Audit Committee has determined that the provision by KPMG LLP of services described under “Audit-Related Fees,” “Tax Fees” and “All Other Fees” is compatible with maintaining KPMG LLP’s independence from management and the Company.

A representative of KPMG LLP will be present at the 2005 Annual Meeting of Stockholders and will be permitted to make a statement if he or she desires to do so and be available to respond to appropriate questions.

Submitted by:

Audit Committee

Francisco L. Borges (Chairman)

Thomas A. Natelli

Margaret A. Sheehan

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The information presented below regarding beneficial ownership of common stock has been presented in accordance with the rules of the SEC and is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership of common stock includes any shares to which a person, directly or indirectly, has or shares voting power or investment power and any shares as to which a person has the right to acquire such voting or investment power within 60 days through the exercise of any stock option or other right.

The following table sets forth certain information regarding the beneficial ownership of common stock by (i) each person, other than directors and executive officers, known by us to be the beneficial owner of more than 5% of our common stock, (ii) each of our directors, (iii) each of our named executive officers and (iv) all of our directors and executive officers as a group as of March 4, 2005. Unless otherwise indicated, all shares are owned directly and the indicated person has sole voting and investment power.

| | | | | |

Name of Officer or Director

| | Shares

Owned (1)

| | Percentage of

Shares Owned(2)

| |

Eubel Brady & Suttman Asset Management, Inc.(3) | | 4,475,043 | | 11.17 | % |

Awad Asset Management, Inc.(4) | | 3,234,529 | | 8.07 | % |

A. Alex Porter(5) | | 2,999,900 | | 7.49 | % |

Cramer Rosenthal McGlynn, LLC(6) | | 2,262,850 | | 5.65 | % |

Bruce D. Wardinski | | 475,001 | | 1.19 | % |

James L. Francis | | 229,812 | | * | |

Tracy M.J. Colden | | 101,380 | | * | |

Douglas W. Vicari | | 98,288 | | * | |

Patrick W. Campbell(7) | | 96,282 | | * | |

Terrence P. O’Leary | | 40,001 | | * | |

W. Reeder Glass | | 7,000 | | * | |

Francisco L. Borges | | 7,000 | | * | |

William L. Wilson | | 23,666 | | * | |

Margaret A. Sheehan | | 7,000 | | * | |

Thomas A. Natelli | | 17,000 | | * | |

All directors and executive officers as a group (11 persons

including those named above)(7) | | 1,102,430 | | 2.75 | % |

| * | Represents less than 1% of the number of shares of common stock of the Company. |

| (1) | Unless otherwise indicated, the named stockholders have sole voting power with respect to all shares shown as being beneficially owned by them. |

| (2) | Percentage of ownership is based on 40,067,444 shares of common stock issued and outstanding as of March 4, 2005, and includes both registered and unregistered shares of our common stock. |

| (3) | As reported on Amendment No. 1 to Schedule 13G filed March 9, 2005. The address for Eubel Brady & Suttman Asset Management, Inc. is 7777 Washington Village Drive, Suite 210, Dayton, OH 45459. |

| (4) | As reported on Schedule 13G/A filed January 27, 2005. The address for Awad Asset Management, Inc. is 250 Park Avenue, 2nd Floor, New York, NY 10177. |

| (5) | As reported on Schedule 13G/A filed February 14, 2005. Pursuant to a joint filing agreement, A. Alex Porter and Paul Orlin have reported beneficial ownership of 2,999,900 shares, and pursuant to the same agreement Geoffrey Hulme and Jonathan W. Friedland have reported beneficial ownership of 2,882,700 shares. The address for each of Messrs. Porter, Orlin, Hulme and Friedland is 666 5th Avenue, 34th Floor, New York, New York 10103. |

| (6) | As reported on Schedule 13G filed February 11, 2005. The address for Cramer Rosenthal McGlynn, LLC is 520 Madison Avenue, New York, NY 10022. |

| (7) | Includes 4,000 shares as to which Mr. Campbell may be deemed to share voting and investment power. |

11

SUMMARY COMPENSATION TABLE

The table below shows the total compensation paid or accrued during the years ended December 31, 2003 and 2004 for James L. Francis, our President and Chief Executive Officer, and each of our four other most highly compensated executive officers. We commenced operations on December 19, 2003 upon completion of our initial public offering and accordingly only a nominal amount of salary, and no bonuses, were paid to our executive officers in 2003. The only significant compensation paid in 2003 to our executive officers, other than Mr. O’Leary who joined the Company in March 2004, consisted of restricted stock awards made to each of them at the time of our initial public offering. No options were granted to any executive officers in 2003 or 2004, nor are any expected to be granted in 2005, as we use grants of restricted stock awards in lieu of options to provide long-term incentives to management.

| | | | | | | | | | | | |

| | | | | 2004 Annual Compensation

| | Long-Term

Compensation

| | |

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual Compensation

($)

| | Restricted Stock

Award(s) ($)(1)

| | All Other

Compensation($)(2)

|

James L. Francis, | | 2004 | | 415,000 | | 486,000 | | — | | — | | 16,600 |

President and Chief

Executive Officer | | 2003 | | — | | — | | — | | 2,720,000 | | — |

| | | | | | |

Patrick W. Campbell, | | 2004 | | 240,000 | | 161,000 | | — | | — | | 9,600 |

Executive Vice President and Chief Investment Officer | | 2003 | | — | | — | | — | | 1,185,000 | | — |

| | | | | | |

Tracy M.J. Colden, | | 2004 | | 235,000 | | 158,000 | | — | | — | | 9,400 |

Executive Vice President, General Counsel and Secretary | | 2003 | | — | | — | | — | | 1,185,000 | | — |

| | | | | | |

Douglas W. Vicari, | | 2004 | | 235,000 | | 158,000 | | — | | — | | 9,300 |

Executive Vice President,

Chief Financial Officer and Treasurer | | 2003 | | — | | — | | — | | 1,185,000 | | — |

| | | | | | |

Terrence P. O’Leary, (3) | | 2004 | | 128,000 | | 58,000 | | — | | 442,800 | | 5,127 |

Senior Vice President, Asset Management | | | | | | | | | | | | |

| (1) | The amounts shown reflect the values of shares of restricted common stock granted in December 2003 to Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, respectively, based on the initial public offering price, and of shares of restricted common stock granted to Mr. O’Leary on March 29, 2004, based on the closing price per share of our common stock of $11.07, as reported on the New York Stock Exchange. In each case, subject to continued service to us, the restrictions on each executive officer’s shares will lapse at the rate of one-third of the number of shares of restricted common stock per year commencing on the first anniversary of the dates of the grants with restrictions on an additional one-third of the number of shares of restricted common stock lapsing on each of the second and third anniversaries of the dates of the grants. Accelerated vesting may occur in accordance with the employment agreements in effect for Messrs. Francis, Campbell and Vicari and Ms. Colden if, during the term of his or her employment agreement with us, the executive officer terminates for death or disability or is terminated by us without cause or the executive officer resigns for good reason. Under those agreements, an accelerated lapse of each executive officer’s restrictions will also occur if during the 10-day business period following a change in control of our Company, the executive officer resigns for any reason. The executive officers will be entitled to vote and receive distributions with respect to shares of restricted common stock. As of December 31, 2004, based on the closing price per share of our common stock of $11.24, as reported on the New York Stock Exchange, Mr. Francis held 181,333 shares of unvested restricted stock with a market value of $2,038,183; each of Mr. Campbell, Ms. Colden and Mr. Vicari held 79,000 shares of unvested restricted stock with a market value of $887,960; and Mr. O’Leary held 40,000 shares of unvested restricted stock with a market value of $449,600. |

12

| (2) | For 2004, this column includes (a) matching contributions of $8,200 for each of Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, and $5,127 for Mr. O’Leary under the Company’s 401(k) plan; and (b) matching contributions of $8,400, $1,400, $1,200 and $1,100 for Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, respectively, under the Company’s Executive Deferred Compensation Plan. |

| (3) | Mr. O’Leary joined the Company on March 1, 2004. |

Employment Agreements

We entered into employment agreements, effective December 19, 2003, with Messrs. Francis, Campbell and Vicari and Ms. Colden that initially provided for annual salaries of $415,000 for Mr. Francis, $240,000 for Mr. Campbell, $235,000 for Mr. Vicari and $235,000 for Ms. Colden, in each case subject to annual increase as determined by the Compensation Policy Committee. Upon review of the Company’s 2004 performance by the Compensation Policy Committee, the annual salaries of Messrs. Francis, Campbell and Vicari and Ms. Colden were increased to $430,000, $245,000, $245,000, and $245,000, respectively, for 2005. In addition, the employment agreements provide them severance benefits if their employment ends under certain circumstances.

The agreements have an initial term of three years, with respect to Mr. Francis, and two years, with respect to Messrs. Campbell and Vicari and Ms. Colden, beginning on December 19, 2003. The term of the agreements will be extended for an additional year, on each anniversary of the effective date of our initial public offering, unless either party gives six months’ prior notice that the term will not be extended. The terms of each were extended in December 2004.

Each of these executives will be entitled to receive benefits under the agreements if we terminate the executive’s employment without cause or the executive resigns with good reason or if there is a change in control of our Company during the term of the agreements and, within one year after the change in control, we terminate the executive’s employment without cause or the executive resigns with good reason or within 10 business days following the change in control the executive resigns for any reason. Under these scenarios, each of the executives is entitled to receive (1) any accrued but unpaid salary and bonuses, (2) vesting as of the executive’s last day of employment of any unvested stock options or restricted common stock previously issued to the executive, (3) payment of the executive’s life, health and disability insurance coverage for a period of two years, in the case of Mr. Francis, and one year, in the case of Messrs. Campbell and Vicari and Ms. Colden, but in each case with an additional year with respect to termination relating to a change in control, following the executive’s termination, and (4) a severance payment calculated as described below. In the event of a change in control of our Company, each of the executives will be eligible to receive payments to compensate the executive for the additional taxes, if any, imposed on the executive under Section 4999 of the Internal Revenue Code by reason of receipt of excess parachute payments.

With respect to termination relating to a change of control, the severance payment is equal to three times, in the case of Mr. Francis, or two times, in the case of Messrs. Campbell and Vicari and Ms. Colden, current salary plus three times, in the case of Mr. Francis, or two times, in the case of Messrs. Campbell and Vicari and Ms. Colden, the higher of (1) the average of all bonuses paid to them during the three prior years or (2) the most recent bonus paid to the executive.

With respect to termination by us without cause, or by the executive for good reason, the severance payment is equal to two times, in the case of Mr. Francis, or one times, in the case of Messrs. Campbell and Vicari and Ms. Colden, current salary plus one times the higher of (1) the average of all bonuses paid to them during the three prior years or (2) the most recent bonus paid to the executive.

The employment agreements contain customary non-competition covenants that apply during the term and for one year after the term of each executive’s employment with our Company.

Section 16(a) Beneficial Ownership Reporting Compliance

We believe that all of our current directors and executive officers reported on a timely basis all transactions required to be reported by Section 16(a) during 2004.

13

COMPARISON OF STOCKHOLDER RETURN

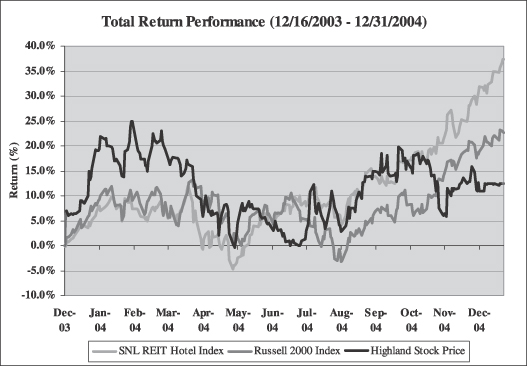

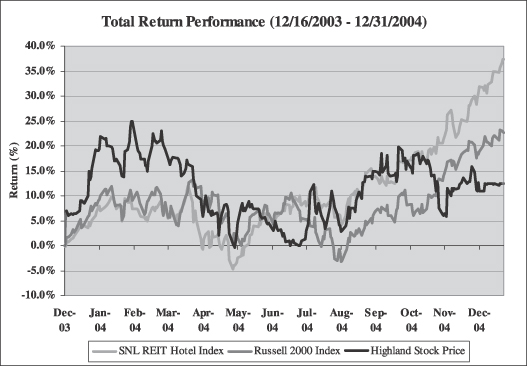

The following graph compares the performance of the Company’s common stock during the period beginning on December 16, 2003 to December 31, 2004 with SNL REIT Hotel Index, prepared by SNL Financial, LLC, and the Russell 2000 Index.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, with a median market capitalization of approximately $395 million. The SNL Hotel REIT Index is currently comprised of 15 publicly traded hotel REITs, organized for purposes substantially similar to that of the Company.

| | | | | | | | | |

Stock/Index

| | Base

12/16/2003

| | Year End

12/31/2003

| | Year End

12/31/2004

| | % Return

| |

SNL REIT Hotel | | 100.00 | | 103.61 | | 137.44 | | 37.44 | % |

Russell 2000 | | 100.00 | | 103.64 | | 122.64 | | 22.64 | % |

HIH | | 100.00 | | 109.00 | | 112.40 | | 12.40 | % |

14

CERTAIN RELATIONSHIPS AND TRANSACTIONS

Highland Hospitality Corporation is a self-administered real estate investment trust focused primarily on investing in the United States within the upscale full-service, premium limited-service and extended stay lodging segments. Over time, Highland Hospitality Corporation may also pursue investment opportunities in certain lodging segments outside of the United States. The Company currently owns 18 hotel properties with an aggregate of 5,143 rooms.

Transactions With Barceló Crestline Corporation

Bruce D. Wardinski, our Chairman of the Board, is also the President and Chief Executive Officer of Barceló Crestline. W. Reeder Glass has been designated by Barceló Crestline to serve on our Board. Mr. Glass is also a director of Barceló Crestline.

Repayment of Start-up Expenses

Prior to our inception at the time of our initial public offering, and for a period of time thereafter while our organizational logistics were pending, Barceló Crestline advanced approximately $6.2 million of funds to us for payment of our start-up expenses and cash outlays needed for our acquisitions of our initial hotel properties. During 2004, we repaid these advances in full from the proceeds of our initial public offering.

Purchase of Initial Hotels

In December 2003, we acquired Barceló Crestline’s equity interest in Portsmouth Hotel Associates, LLC, which leases the Portsmouth Renaissance hotel and conference center, Sugar Land Hotel Associates, L.P., which owns the Sugar Land Marriott hotel, and A/H-BCC Virginia Beach Hotel, LLC, which owns the Hilton Garden Inn Virginia Beach Town Center hotel, in exchange for limited partnership units of Highland Hospitality, L.P. and the repayment of all outstanding debt on these hotel properties.

The 43,010 units issued to Barceló Crestline in exchange for its equity interests in Sugar Land Hotel Associates, L.P. had a value of $430,100, based on the initial public offering price of our common stock. The 142,688 units issued to Barceló Crestline in exchange for its interests in A/H-BCC Virginia Beach Hotel, LLC had a value of approximately $1.4 million, based on the initial public offering price of our common stock. The 344,152 units issued to Barceló Crestline in exchange for its equity interest in Portsmouth Hotel Associates, LLC had a value of approximately $3.4 million, based on the initial public offering price of our common stock.

We have also agreed to pay Barceló Crestline up to $1.8 million (in the form of units in our operating partnership, valued at the market price for our common stock at the time of payment as described below) as additional consideration for its interest in the Sugar Land Marriott hotel if the Sugar Land Marriott hotel exceeds certain agreed-upon operating results over the 36-month period following our acquisition of the hotel, allowing Barceló Crestline to potentially recoup its cash investment.

Strategic Alliance Agreement

In December 2003, entered into a seven-year strategic alliance agreement with Barceló Crestline pursuant to which (i) Barceló purchased 1,250,000 shares of our common stock (having a value of $12.5 million based on the initial public offering price for our common stock) directly from us in a private transaction concurrently with the closing of our initial public offering at a price per share equal to the initial public offering price, less an amount equal to the underwriting discount, (ii) Barceló Crestline agreed to refer to us (on an exclusive basis) hotel acquisition opportunities in the United States presented to Barceló Crestline or its subsidiaries other than opportunities that relate to third party management arrangements offered to Barceló Crestline, (iii) unless a majority of our independent directors in good faith concludes for valid business reasons that another management

15

company should manage a hotel owned by us, we agree to offer Barceló Crestline or its subsidiaries the right to manage hotel properties we acquire in the United States, unless the hotel is encumbered by a management agreement that would extend beyond the date of our acquisition of the hotel and a termination fee is payable to terminate the existing management agreement (unless Barceló Crestline pays such termination fee) and (iv) we agreed to grant Barceló Crestline the right to designate one nominee for election to our Board at each meeting of our stockholders at which directors are to be elected.

Management Agreements

A wholly owned subsidiary of Barceló Crestline has entered into management agreements with us to manage ten of our properties. Each management agreement generally provides for a monthly base management fee of 2.0% to 3.5% of all gross revenues generated by the property that Barceló Crestline manages, plus an annual incentive management fee for each hotel equal to 15.0% of the amount by which operating profit for the hotel for the fiscal year exceeds 11.0% of our investment in the hotel, up to a total amount of combined base and incentive fees of 4.5% of gross revenues. During 2004, we paid Barceló Crestline approximately $1.6 million in management fees for these services.

Overhead and Cost-sharing Arrangement

Since our inception, we have had an overhead and cost-sharing arrangement with Barceló Crestline whereby we have shared Barceló Crestline’s office space and related furniture, fixtures and equipment and certain support services, including human resources and information technology functions, in exchange for a monthly reimbursement of the estimated value to us from this sharing arrangement. During 2004, we paid Barceló Crestline approximately $292,500 under this arrangement.

16

REPORT OF THE COMPENSATION POLICY COMMITTEE

Prior to the completion of our initial public offering of common stock on December 19, 2003, our Board was composed of Mr. Wardinski and Mr. Francis. Their objective was to attract, retain and motivate highly qualified executive officers who would serve as the Company’s initial executive management team and contribute to growth in stockholder value over time. To accomplish this objective, the Board entered into employment agreements, which are discussed above under the heading “Employment Agreements,” intended to provide strong financial incentives to the Company’s executive officers, at a reasonable cost to the Company and its stockholders. Compensation consists principally of base salary, performance bonuses and awards of shares of restricted common stock under the Company’s 2003 Omnibus Stock Incentive Plan. The restricted common stock awards granted to the Company’s executive officers are intended to incentivize the executive officers to work towards achieving long-term operational and financial goals that will ultimately be reflected in stock value and the vesting schedule for restricted common stock awards is intended to facilitate executive retention.

The Compensation Policy Committee of the Board assumed responsibility for executive officer compensation matters following the completion of the Company’s initial public offering.

Section 162(m) of the Internal Revenue Code generally sets a limit of $1.0 million on the amount of annual compensation paid to an executive officer (other than certain enumerated categories of compensation, including performance-based compensation) that may be deducted by a publicly-held company. It is the policy of the Board and the Compensation Policy Committee to seek to qualify executive compensation for deductibility to the extent that such policy is consistent with the Company’s overall objectives and executive compensation policy. None of the Company’s executive officers received compensation in 2004 in excess of the limits imposed under Section 162(m).

2004 Executive Officer Compensation

During 2004, the Company’s compensation for its executive officers consisted principally of base salary and performance bonuses. In addition, Mr. O’Leary was awarded a grant of 40,000 shares of restricted common stock when he joined the Company in March 2004. Except in Mr. O’Leary’s case, the base salary amounts for each of our executive officers are provided for in each executive officer’s employment agreement. In setting these base salaries and that of Mr. O’Leary, the Board used an evaluation process considering the officer’s position, level and scope of responsibility and an independent compensation study of base salaries of other executive officers prepared by an independent compensation consulting firm. The Board also sought to set base salaries at levels that, in the opinion of the members of the Board, provided competitive base compensation while allowing a significant portion of each executive officer’s total compensation to be derived from incentive pay in the form of the awards of restricted common stock and performance bonuses. The number of shares of restricted common stock granted to each individual was determined based on a number of factors, including the individual’s degree of responsibility, ability to affect future Company performance and consideration of the independent compensation study.

Following discussion with Mr. Francis, the Committee awarded performance bonuses for 2004 to the Company’s executive officers (other than Mr. Francis) pursuant to criteria previously approved by the Committee in January 2004. These criteria related to the performance of the executive officers in meeting individual business objectives set at that time and the performance of the Company during 2004 in achieving its financial goals relating to the Company’s funds from operations (FFO) and growth in its hotel portfolio. For 2004, the criteria were weighted 40% on the executive’s attainment of his or her individual business objectives, 40% on the Company’s FFO performance for the year, and 20% on the Company’s success in meeting its portfolio growth objectives.

Because the Company has invested nearly all of the proceeds from its initial public offering in its hotel portfolio, the Committee and the Board have determined that they will use only the officers’ success in meeting their individual business objectives (weighted 25%) and the Company’s FFO performance (weighted 75%) as criteria for 2005 bonus awards, until either of them determines that other criteria are more appropriate.

17

2004 Chief Executive Officer Compensation

During 2003, the Board entered into an employment agreement with Mr. Francis, the Company’s President and Chief Executive Officer. The employment agreement provided Mr. Francis a base salary for 2004 at an annual rate of $415,000, subject to annual increase by the Compensation Policy Committee; Mr. Francis will receive a base salary of $430,000 for 2005. In the view of the Board, the initial base salary provided to Mr. Francis under his employment agreement was roughly comparable to the average base salary awarded by comparable companies to their chief executive officers. For 2004, the Compensation Policy Committee determined that the restricted stock grant awarded to Mr. Francis at the time of our initial public offering in December 2003 provided adequate long-term incentive so no additional restricted stock was awarded. Mr. Francis’ short-term incentive compensation for 2004 included an annual performance bonus, calculated on the basis of the same criteria as were applied to other executive officers, as addressed above, of $486,000.

Submitted by:

Compensation Policy Committee

William L. Wilson (Chairman)

Francisco L. Borges

Margaret A. Sheehan

Compensation Policy Committee Interlocks and Insider Participation

There are no interlock relationships as defined in the applicable SEC rules.

Equity Compensation Plan Information

The table below sets forth the following information as of the end of the Company’s 2004 fiscal year for (i) compensation plans previously approved by the Company’s stockholders and (ii) compensation plans not previously approved by the Company’s stockholders:

| | (1) | the number of securities to be issued upon the exercise of outstanding options, warrants and rights; |

| | (2) | the weighted-average exercise price of such outstanding options, warrants and rights; |

| | (3) | other than securities to be issued upon the exercise of such outstanding options, warrants and rights, the number of securities remaining available for future issuance under the plans. |

| | | | | | |

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

| | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column(a))

|

| | | (a) | | (b) | | (c) |

Equity compensation plans approved by stockholders(1) | | — | | — | | 1,049,989 |

Equity compensation plans not approved by stockholders | | — | | — | | — |

| | | | | | |

|

Total | | | | | | 1,049,989 |

| (1) | The equity compensation plan approved by stockholders is the Company’s 2003 Omnibus Stock Incentive Plan. |

18

OTHER MATTERS

Incorporation by Reference

To the extent that this proxy statement is incorporated by reference into any other filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, the sections of this proxy statement entitled “Report of the Compensation Policy Committee,” “Report of the Audit Committee” (to the extent permitted by the rules of the SEC) and “Comparison of Stockholder Return” will not be deemed incorporated, unless specifically provided otherwise in such filing.

Other Matters

As of the date of this proxy statement, the Board does not intend to present any matter for action at the 2005 Annual Meeting of Stockholders other than as set forth in the Notice of Annual Meeting. If any other matters properly come before the meeting, it is intended that the holders of the proxies will act in accordance with their best judgment.

Stockholder Proposals for 2006 Annual Meeting of Stockholders

To be eligible for inclusion in the proxy materials for the Company’s 2006 Annual Meeting of Stockholders, stockholder proposals must be received at the Company’s principal executive offices, Attention: Secretary, by December 6, 2005. A stockholder who wishes to present a proposal at the Company’s 2006 Annual Meeting of Stockholders, but who does not request that the Company solicit proxies for the proposal, must submit the proposal to the Company’s principal executive offices, Attention: Secretary, no earlier than December 14, 2005 and no later than January 13, 2006.

Annual Report

A copy of our 2004 Annual Report is enclosed. You may also obtain a copy of our 2004 Annual Report on Form 10-K without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations. Our 2004 Annual Report on Form 10-K is also available through the Company’s website atwww.highlandhospitality.com. The Company’s 2004 Annual Report and its 2004 Annual Report on Form 10-K are not proxy soliciting material.

|

BY ORDEROFTHE BOARDOF DIRECTORS |

|

Tracy M.J. Colden Executive Vice President, General Counsel and Secretary |

April 4, 2005

19

DETACH PROXY CARD HERE

HIGHLAND HOSPITALITY CORPORATION

PROXY

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF STOCKHOLDERS

ON MAY 19, 2005, 10:00 A.M.

The undersigned appoints each of James L. Francis and Tracy M.J. Colden, or either of them, as Proxies. Each shall have the power to appoint a substitute. Each is authorized to represent and vote, as designated on the reverse side, all shares of Highland Hospitality Corporation Common Stock held of record by the undersigned on March 25, 2005, at the Annual Meeting of Stockholders to be held on May 19, 2005, or any adjournment or postponement thereof. The Board of Directors recommends voting FOR Proposal 1.

| | |

| | | HIGHLAND HOSPITALITY CORPORATION |

| CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | 8405 GREENSBORO DRIVE, SUITE 500 MCLEAN, VIRGINIA 22102 |

Please Detach Here

You Must Detach This Portion of the Proxy Card

Before Returning it in the Enclosed Envelope

| x | Votes must be indicated (x) |

in black or blue ink.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 1. This proxy when properly executed will be voted in the manner directed herein by the undersigned stockholder. If no instruction is indicated, such proxy will be voted “FOR” Proposal 1, and at the discretion of the Proxies on any other matter that may properly come before the meeting or any adjournment or postponement thereof.

| | | | | | | | | | | | | | | | |

| | |

(1) Election of Directors NOMINEES: Bruce D. Wardinski, James L. Francis, Francisco L. Borges, W. Reeder Glass, Thomas A. Natelli, Margaret A. Sheehan, William L. Wilson | | FOR all nominees listed ¨ | | The proposal is fully explained in the enclosed Notice of Annual Meeting of Stockholders and Proxy Statement. |

| | |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the “Exceptions” box and write that nominee’s name in the space provided below.) | | WITHHOLD AUTHORITY to vote for all nominees listed ¨ | | To vote your proxy please mark by placing an “X” in the appropriate box, sign and date the Proxy. |

| | |

| | | *EXCEPTIONS ¨ | | NOTE: Please sign exactly as name appears on the certificate or certificates representing shares to be voted by this proxy, as shown on the label above. When signing as executor, administrator, trustee, or guardian, please give full title as such. If a corporation, please sign full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person(s). |

| | |

| *Exceptions | | | | DATED: , 2005 |

| | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

|

| | | | | | | | | | | | | SIGNATURE |

| | | | | | |

| | | | | | | | | | | | |

|

| | | | | | | | | | | | | SIGNATURE IF HELD JOINTLY |

| | | | | | |

| | | | | | | | | | | | | (Please sign, date and return this proxy card in the enclosed envelope.) |

| | | | | | |

| | | | | | | | | | | | | I will attend the Annual Meeting.¨ |