UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14A-6(e)(2)) |

x | | Definitive Proxy Statement | | | | |

¨ | | Definitive Additional Materials | | | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | | | |

HIGHLAND HOSPITALITY CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | ¨ | Fee paid previously with preliminary materials. |

| | ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

8405 Greensboro Drive, Suite 500

McLean, Virginia 22102

To Our Stockholders:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of Highland Hospitality Corporation (the “Company”) to be held on Tuesday, May 23, 2006, at 10:00 a.m. at The Melrose Hotel, 2430 Pennsylvania Avenue, N.W., Washington, D.C. 20037.

The matters to be considered at the 2006 Annual Meeting of Stockholders are described in detail in the accompanying materials. Your Board of Directors believes that these proposals are in the best interests of the Company and its stockholders and recommends that you vote in favor of them.

If you were a stockholder at the close of business on March 31, 2006, you may vote at the 2006 Annual Meeting of Stockholders. Whether or not you plan to attend the meeting, please take the time to vote by completing and mailing the enclosed proxy card to us in the envelope provided.

We look forward to seeing you at the meeting.

James L. Francis

President and Chief Executive Officer

McLean, Virginia

April 7, 2006

8405 Greensboro Drive, Suite 500

McLean, Virginia 22102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, MAY 23, 2006

The 2006 Annual Meeting of Stockholders of Highland Hospitality Corporation will be held at The Melrose Hotel, 2430 Pennsylvania Avenue, N.W., Washington, D.C. 20037, 10:00 a.m., local time, on Tuesday, May 23, 2006 for the following purposes:

(1) to elect all eight incumbent directors to the Company’s Board of Directors;

(2) to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2006;

(3) to amend and restate the 2003 Omnibus Stock Incentive Plan; and

(4) to transact such other business, if any, which may be properly brought before the 2006 Annual Meeting of Stockholders.

The Board of Directors has set the close of business on March 31, 2006 as the record date to determine the stockholders entitled to notice of and to vote at the 2006 Annual Meeting of Stockholders or any adjournment or postponement thereof.

BYORDEROFTHE BOARDOF DIRECTORS,

Tracy M.J. Colden

Executive Vice President, General Counsel and Secretary

McLean, Virginia

April 7, 2006

Please promptly complete, date, sign and return the enclosed proxy card whether or not you plan to attend the meeting.

8405 Greensboro Drive, Suite 500

McLean, Virginia 22102

PROXY STATEMENT

FOR

2006 ANNUAL MEETING OF STOCKHOLDERS

TUESDAY, MAY 23, 2006

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Highland Hospitality Corporation for the 2006 Annual Meeting of Stockholders to be held on Tuesday, May 23, 2006 at 10:00 a.m. at The Melrose Hotel, 2430 Pennsylvania Avenue, N.W., Washington, D.C. 20037.

Highland Hospitality Corporation is a self-advised real estate investment trust focused primarily on investing in upscale full-service, premium limited-service, and extended-stay properties located in major convention, business, resort and airport markets in the United States. As of March 31, 2006, we owned 26 hotel properties with 8,206 rooms located in 13 states, Washington, DC, and Mexico. Substantially all of our assets are held by, and all of our operations are conducted through, Highland Hospitality, L.P., our operating partnership.

Who Can Vote

Stockholders of record on March 31, 2006 may attend and vote at the 2006 Annual Meeting of Stockholders or have their votes by proxy counted if they do not attend in person. On that date, there were 59,719,992 shares of common stock outstanding and entitled to vote. Each share is entitled to one vote. The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the 2006 Annual Meeting of Stockholders will constitute a quorum to conduct business. Shares represented by proxies received but marked as abstentions, if any, will be included in the calculation of the number of shares considered to be present at the meeting. Shares held in a broker’s account that are not voted by the broker or other nominee will be treated as shares present at the meeting for purposes of determining the presence of a quorum, but will not be treated as shares present and entitled to vote with respect to those matters for which no vote is cast.

This proxy statement and the enclosed proxy card are first being mailed to stockholders on or about April 13, 2006.

Voting Procedures

You may grant a proxy by completing, signing and mailing the enclosed proxy card to us in the envelope provided. Shares represented by proxies will be voted as directed by the stockholder. Unless you direct otherwise, if you grant a proxy, your shares will be voted FOR all three proposals. Proxies submitted by mail must be received on or before May 22, 2006.

If a stockholder is a corporation or partnership, the accompanying proxy card must be signed in the full corporate or partnership name by a duly authorized person. If the proxy card is signed pursuant to a power of attorney or by an executor, administrator, trustee or guardian, the signer’s full title must be given and a certificate or other evidence of appointment must be furnished. If shares are owned jointly, each joint owner must sign the proxy card.

Any proxy duly given pursuant to this solicitation may be revoked by the stockholder, at any time prior to voting, by written notice to the Company’s Secretary, by a later-dated proxy either signed and returned by mail, or by attending the 2006 Annual Meeting of Stockholders and voting in person. Attendance at the 2006 Annual Meeting of Stockholders will not in and of itself constitute a revocation of a proxy.

Important Notice Regarding Delivery of Stockholder Documents

In order to reduce our printing and postage costs, holders of common stock who share a single address are being sent only one copy of this proxy statement and the Company’s 2005 Annual Report unless we received contrary instructions from any stockholder at that address. However, if any stockholder residing at such an address wishes to receive a separate copy of this proxy statement or the Company’s 2005 Annual Report, he or she may contact the Company’s Secretary at Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102. Any such stockholder may also contact the Secretary using the above contact information if he or she would like to receive separate proxy statements and Annual Reports in the future. If you are receiving multiple copies of the Company’s Annual Report and proxy statement, you may request that one copy of the proxy statement and the Company’s Annual Report be sent to your address in the future by contacting the Company’s Secretary.

Cost of Soliciting Proxies

The cost of soliciting proxies will be borne by the Company. We have hired the firm of MacKenzie Partners, Inc., 156 Fifth Avenue, New York, New York 10010, to assist in the solicitation of proxies on behalf of our Board. MacKenzie Partners has agreed to perform these services for a fee of $7,000, plus certain reimbursable expenses. In addition to the solicitation of proxies by mail, certain of the officers and employees of the Company, without extra compensation, may solicit proxies personally, by telephone or other means. The Company also will request that brokerage houses, nominees, custodians and fiduciaries forward soliciting materials to the beneficial owners of stock held of record and will reimburse them for forwarding the materials.

2

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors unanimously recommends that the Company’s stockholders vote “FOR” the election of each of the persons nominated to serve as a director.

Eight directors will be elected at the 2006 Annual Meeting of Stockholders to serve until the 2007 Annual Meeting of Stockholders. All directors are to hold office for a term of one year or until their respective successors shall be duly elected. Each of the nominees identified below is a current member of our Board. For the election to the Board of a nominee pursuant to Proposal 1, a plurality of the shares present and voting must vote FOR that nominee. Shares held in a brokerage account that are not voted, if any, will have no effect on the outcome of the vote on the election of directors. Unless you direct otherwise, if you grant a proxy, your shares will be voted FOR all nominees to serve on the Board.

The principal occupations and business experience of the nominees are described below.

NOMINEES FOR DIRECTOR

| | |

Bruce D. Wardinski | | Mr. Wardinski, 45, the non-executive Chairman of the Board of Directors of the Company, has served as the President and Chief Executive Officer of Barceló Crestline Corporation since June 2002. From 1998 to 2002, he served as the Chairman of the Board, Chief Executive Officer and President of Crestline Capital Corporation and, from 1996 to 1998, as Senior Vice President and Treasurer of Host Marriott Corporation. He currently serves on the board of directors of eStara, Inc. and is the Chairman of the ServiceSource Foundation. |

| |

John M. Elwood | | Mr. Elwood, 51, has been a director since January 31, 2006. He has been a Principal of the True North Management Group, LLC, a private equity platform for debt and equity investments in the real estate section, since 2004. From 1998 to 2004, Mr. Elwood was a private investor and established Good Hand Farm, a certified organic produce farm. From 1997 until 1998, Mr. Elwood served as the President of Prime Hospitality Corp., a publicly traded hotel management, development and franchising company. He served as Executive Vice President and Chief Financial Officer of Prime Hospitality Corp. from 1992 until 1997. Mr. Elwood currently serves as a chairman of the board of World Harvest Mission and CAMP Youth Development. |

| |

James L. Francis | | Mr. Francis, 44, is our President and Chief Executive Officer. Mr. Francis served as the Chief Operating Officer, Chief Financial Officer and Treasurer of Barceló Crestline Corporation from June 2002 until the completion of our initial public offering and as Executive Vice President and Chief Financial Officer of Crestline Capital Corporation from December 1998 to June 2002. From June 1997 to December 1998, Mr. Francis held the position of Assistant Treasurer and Vice President Corporate Finance for Host Marriott Corporation. |

| |

W. Reeder Glass | | Mr. Glass, 64, has been a director since the completion of our initial public offering in December 2003. He has been a partner at the law firm of Holland & Knight LLP since 1980 and is currently serving on the board of directors of Barceló Crestline Corporation. He has also acted as counsel for numerous real estate developers engaged in the acquisition, financing and development of large planned unit developments, hotels, mixed-use developments and other commercial and residential projects. He is a member of the Florida and Georgia state bars. |

3

| | |

John W. Hill | | Mr. Hill, 51, has been a director since January 31, 2006. He has been Chief Executive Officer of The Federal City Council, a not-for-profit, non partisan organization dedicated to the improvement of Washington, DC, since 2004. Mr. Hill served as the Chief Executive Officer of In2Books, Inc. from 2002 until 2004. From 1999 until 2002, he was a partner with Andersen, LLP. Mr. Hill currently serves in the boards of several not-for-profit organizations, including the DC Children and Youth Investment Trust Corporation, the DC Public Library Board of Trustees, the DC Shakespeare Theatre Board, the National Minority Aids Council and the Mayor’s Blue Ribbon Commission to Revitalize the DC Public Library. |

| |

Thomas A. Natelli | | Mr. Natelli, 46, has been a director since the completion of our initial public offering in December 2003. Since 1987, Mr. Natelli has served as the President and Chief Executive Officer of Natelli Communities, a privately held real estate investment and development company. Mr. Natelli currently serves on the board of FBR National Trust. He also serves as chairman of the board of directors of eStara, Inc. and as chairman of the board of trustees of Suburban Health Care System and chairman of the board of trustees of Suburban Hospital. |

| |

Margaret A. Sheehan | | Ms. Sheehan, 46, has been a director since the completion of our initial public offering in December 2003. She has been a partner at the law firm of Alston & Bird LLP since 2000. Ms. Sheehan concentrates her practice on counseling financial institutions on all matters relating to the development and offering of investment products and services. She also specializes in representing private investment companies, and is an expert on fund structures and offerings for real estate funds, private equity funds, hedge funds and fund of funds. Ms. Sheehan is admitted to the District of Columbia and New York State bars, and is a member of the American Bar Association and Women in Housing and Finance. |

| |

William L. Wilson | | Mr. Wilson, 65, has been a director since the completion of our initial public offering in December 2003. From 1999 until 2002, Mr. Wilson served as an independent board member of Crestline Capital Corporation. Mr. Wilson has been the Principal-in-Charge of Synterra, Ltd., a site architectural and construction management firm, since 1972. Mr. Wilson has been the Principal-in-Charge of Synterra Partners, a hotel and resort planning, development and management firm since 1995. Mr. Wilson currently serves on the board of directors of the City of Philadelphia Art Commission, the board of trustees of the Pennsylvania School for the Deaf, the board of overseers of the University of Pennsylvania School of Design, and the board of directors of the Philadelphia Zoo. |

4

THE BOARD OF DIRECTORS AND COMMITTEES

Board of Directors

Our Board is composed of eight directors and is not classified. Each director, upon election or re-election at an annual meeting, will serve a one-year term. The Board held nine meetings during 2005 and each of the directors attended at least 75% of the meetings of the Board and each committee of the Board on which he or she served.

The corporate governance listing standards adopted by the New York Stock Exchange (“NYSE”) include a requirement that a majority of directors of NYSE-listed companies be “independent.” For a director to be “independent” under these rules, the board of directors must affirmatively determine that the director has no material relationship with us, either directly or as a partner, stockholder, or officer of an organization that has a relationship with us. In addition, the NYSE has set certain independence tests which, if not met by a director, preclude the board from determining that director to be independent.

To further assist our Board in evaluating the materiality of relationships for purposes of assessing the independence of incumbent directors and director nominees, our Board has adopted objective standards as permitted by the NYSE rules. The objective standards do not override the NYSE’s rules on independence. A relationship that is not disqualifying under the NYSE standards will nevertheless be further evaluated against our objective standards in determining a director’s independence. The objective standards provide that the Board shall not consider a director independent if either the director, or any immediate family member of the director, has:

(1) been employed in any capacity by or, in the case of an immediate family member, been employed as an executive officer of, the Company or our operating partnership in any of the past three years;

(2) received more than $100,000 per year in direct compensation from the Company or our operating partnership, other than for director or committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service) in any of the past three years;

(3) been affiliated with or employed by, or, in the case of an immediate family member, been affiliated with or employed in a professional capacity by, a present or former internal or external auditor of the Company or our operating partnership in any of the past three years;

(4) been employed as an executive officer of another company where any of the Company’s present executives serve on such other company’s compensation committee in any of the past three years;

(5) been an executive officer or employee of or, in the case of an immediate family member, an executive officer of, another company that makes payments to, or receives payments from, the Company or our operating partnership for property or services in an amount which, in any single fiscal year, exceeds the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues in any of the past three years; and

(6) served (in the case of the director only) as an executive officer of a charitable organization to which the contributions by the Company or our operating partnership in any single fiscal year exceeded the greater of $1,000,000 or 2% of such charitable organization’s consolidated gross revenues in any of the past three fiscal years.

The Board shall also review all other commercial or charitable relationships between the Company or our operating partnership and a director (or an immediate family member of the director), a related entity, or any other entity in which such related entity possesses a 10% or greater equity or voting interest or otherwise controls

5

such other entity. Relationships made in the ordinary course of business and on substantially the same terms as those for comparable transactions with other business partners of the Company shall be deemed not to be material.

Our Board has determined that five of the Board’s eight current members, a majority of the Board, are “independent” directors for the purposes of the NYSE’s rules, as none of these five directors have any relationships with the Company. The Board has determined that Messrs. Wardinski and Glass do not qualify as independent directors. Mr. Wardinski serves as the President and Chief Executive Officer of Barceló Crestline Corporation (“Barceló Crestline”), the sponsor of our initial public offering in December 2003. In connection with our initial public offering, we entered into a strategic alliance agreement with Barceló Crestline pursuant to which, among other things, we agreed to offer Barceló Crestline a right of first refusal to serve as manager of all of our hotel properties and Barceló Crestline obtained the right to designate one director for election to our Board. Barceló Crestline is currently the manager of 13 of our hotel properties. We consider our strategic alliance with Barceló Crestline to be a material relationship and, accordingly, neither Mr. Wardinski nor Mr. Glass, who is being nominated for re-election as Barceló Crestline’s designee on our Board, is an independent director.

Rules of the Securities and Exchange Commission (“SEC”) impose additional independence requirements for all members of the Audit Committee. All three members of the Company’s Audit Committee, Messrs. Elwood, Hill and Natelli, qualify as “independent” under these SEC rules.

Consistent with the NYSE’s corporate governance listing standards, our Principles of Corporate Governance call for the non-management directors to meet in regularly scheduled executive sessions without management. The Principles of Corporate Governance provide that so long as the Chairman of the Board is not an employee of the Company, the Chairman shall serve as the presiding director at the executive sessions. Mr. Wardinski presided at the one executive session held in 2005 and will preside at any executive sessions held in 2006. Additionally, during 2005 the Board held three executive sessions comprised of independent directors only. The Nominating and Corporate Governance Committee Charter provides that the chairman of such committee shall serve as the presiding director at these sessions. Ms. Sheehan, as chairman of the Nominating and Corporate Governance Committee, will preside at these sessions in 2006. Interested parties may communicate their concerns directly with either the full Board, Mr. Wardinski, Ms. Sheehan, the non-management directors as a group, or the independent directors as a group by writing to either the Board of Directors, Mr. Wardinski, Ms. Sheehan, the Non-Management Directors or the Independent Directors, c/o Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102. The Company’s policy on director attendance at annual meetings and the number of directors who attended last year’s annual meeting may be found on the Company’s website atwww.highlandhospitality.com.

Board Committees

The Board conducts its business through meetings of the Board and three committees: the Audit Committee, the Compensation Policy Committee and the Nominating and Corporate Governance Committee. Each committee is composed entirely of independent directors, as required by the rules of the NYSE.

Compensation Policy Committee

Our Compensation Policy Committee consists of Messrs. Wilson, who serves as Chairman, Elwood (appointed January 31, 2006) and Hill (appointed January 31, 2006) and Ms. Sheehan. During 2005, Francisco L. Borges served as a member of the Compensation Policy Committee. The primary functions of the Compensation Policy Committee are to discharge the Board’s responsibilities relating to compensation of our directors and executive officers, and to administer and implement our 2003 Omnibus Stock Incentive Plan. The Compensation Policy Committee met three times during 2005. The Compensation Policy Committee charter is posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Compensation Policy Committee charter without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

6

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Ms. Sheehan, who serves as Chairman, and Messrs. Natelli and Wilson. The primary functions of the Nominating and Corporate Governance Committee are to:

| | • | | develop criteria for use in selecting nominees to our Board and identify and recommend to our Board qualified director candidates; |

| | • | | consider and recommend to our Board the size and composition of the Board and its committees; |

| | • | | monitor the Company’s human resources practices; and |

| | • | | monitor our performance in meeting our obligations of fairness in internal and external matters, and develop and recommend our principles of corporate governance and practices. |

The Nominating and Corporate Governance Committee charter sets forth certain criteria for the Committee to consider in evaluating potential director nominees. In order for the Board to have a substantial degree of independence from management, a majority of directors must be independent of management, in both fact and appearance, and must satisfy the independence criteria of the NYSE. The Committee considers the directors’ skills, knowledge, perspective, broad business judgment and leadership, relevant lodging industry-specific or regulatory affairs knowledge, business creativity and vision, experience, age and diversity, all in the context of an assessment of the perceived needs of the Board at that time, and monitors the mix of skills and experience of directors in order to assure that the Board has the necessary tools to perform its oversight function effectively. The Committee evaluates potential candidates against these requirements and objectives. For those director candidates that appear upon first consideration to meet the Committee’s criteria, the Committee will engage in further research to evaluate their candidacy.

The Nominating and Corporate Governance Committee will consider timely written suggestions from stockholders. Stockholders wishing to suggest a candidate for director nomination for the 2007 Annual Meeting of Stockholders should mail their suggestions to Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Secretary. Suggestions must be received by the Company’s Secretary no later than January 15, 2007. The manner in which director nominee candidates suggested in accordance with this policy are evaluated will not differ from the manner in which candidates recommended by other sources are evaluated.

The Nominating and Corporate Governance Committee met two times during 2005. The Nominating and Corporate Governance Committee charter is posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Nominating and Corporate Governance Committee charter without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

Compensation of Directors

The Chairman of our Board is paid a fee of $250,000 annually. Each of our directors (other than Messrs. Wardinski and Francis) who does not serve as the chairman of one of our committees is paid a director’s fee of $20,000 annually. Each director who serves as a committee chairman, other than our Audit Committee chairman, is paid a director’s fee of $25,000 annually. The director who serves as our Audit Committee chairman is paid a director’s fee of $30,000 annually. Each director, other than our Chairman and Mr. Francis, is also paid $1,500 per Board or committee meeting attended (or $500 per telephonic meeting), except that committee chairpersons are paid $2,500 per committee meeting attended. Directors who are officers or employees receive no additional compensation as directors. In addition, we reimburse all directors for reasonable out-of-pocket expenses incurred in connection with their services on the Board.

7

Effective with the completion of our initial public offering, we granted our Chairman a restricted common stock award for 175,000 shares of restricted common stock, which vest at the rate of one-third of the number of shares of restricted common stock on each of the first three annual anniversary dates of the completion of our initial public offering. The vesting of those shares of restricted common stock will accelerate if the Chairman’s service as a director terminates for death or disability, by reason of the failure of the Chairman to be re-nominated by our Board or re-elected by the stockholders (other than his voluntary withdrawal from the Board or a removal for cause and in accordance with our charter) or by reason of a change in control of the Company. Each of our other non-employee directors serving at the time of our 2005 Annual Meeting of Stockholders received a grant of 2,000 vested shares of common stock at the time of the meeting of the Board immediately following that Annual Meeting of Stockholders. Assuming each of our current non-employee directors (other than our Chairman) continues service on the Board, each will receive a grant of an additional 2,000 vested shares of common stock at the time of the meetings of the Board immediately following our 2006 Annual Meeting of Stockholders and each subsequent annual meeting of our stockholders.

Principles of Corporate Governance

Pursuant to the NYSE’s corporate governance listing standards, we have adopted Principles of Corporate Governance that address a number of topics, including, among others, director independence and qualification standards, director orientation and continuing education and director compensation. Our Nominating and Corporate Governance Committee will review the Principles of Corporate Governance on a regular basis, and the Board will review any proposed additions or amendments to the Principles of Corporate Governance. The Principles of Corporate Governance are posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Principles of Corporate Governance without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

Code of Business Conduct and Ethics

The Company has also adopted a Code of Business Conduct and Ethics that applies to each of our directors, officers and employees. The Code sets forth our policies and expectations on a number of topics, including, among others, compliance with laws, (including insider trading compliance), preservation of confidential information relating to our business and that of our clients, conflicts of interest, and reporting of illegal or unethical behavior. The Code of Business Conduct and Ethics is posted on our website atwww.highlandhospitality.com. You may also obtain a copy of the Code of Business Conduct and Ethics without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations. Any additions or amendments to the Code, and any waivers of it for the benefit of executive officers or directors, also will be posted on the Corporate Governance page of our website.

Whistleblower Policy and Procedures

We have implemented “whistleblower” procedures by establishing formal procedures for the receipt, retention and handling by the Audit Committee of complaints and concerns from employees relating to questionable accounting, internal controls and auditing matters, compliance with legal and regulatory requirements or retaliation against employees who report such concerns or complaints on a confidential, anonymous basis. As discussed in the whistleblower policy, we have made a voicemail box telephone number and email address available for reporting such concerns and complaints. A designee of the Audit Committee is charged with reviewing each report and determining with the full Audit Committee whether further investigation is warranted.

The Audit Committee will review the whistleblower policy on a regular basis and propose or adopt additions or amendments to the policy as appropriate. The voicemail box telephone number and email address for reporting such concerns or complaints are posted on our website atwww.highlandhospitality.com.

8

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board. The primary functions of the Audit Committee are to make recommendations concerning the engagement of the independent registered public accounting firm (“KPMG”), review with KPMG the plans and results of the audit engagement, approve all professional services provided by KPMG, review the independence of KPMG, evaluate the range of audit and non-audit fees, review the adequacy of the Company’s internal controls and monitor the Company’s procedures and policies for compliance with the rules for taxation as a real estate investment trust under Sections 856-860 of the Internal Revenue Code of 1986, as amended. The Audit Committee operates under a formal written charter that has been adopted by the Board.

The Audit Committee members are not professional accountants or auditors, and their role is not intended to duplicate or certify the activities of management and KPMG, nor can the Audit Committee certify that KPMG is “independent” under applicable rules. The Audit Committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and KPMG on the basis of the information it receives, discussions with management and KPMG, and the experience of the Audit Committee’s members in business, financial and accounting matters. In fulfilling its oversight responsibilities, the Audit Committee meets at least quarterly with KPMG, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, the overall quality of the Company’s financial reporting and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards.

The Audit Committee reviewed the audited financial statements for the year ended December 31, 2005 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. In addition, the Audit Committee has received from KPMG the written disclosures required by Independence Standards Board Opinion No. 1 and discussed with KPMG their independence, as well as the matters required to be discussed by Statement on Auditing Standards No. 61 and No. 90. The Audit Committee discussed with KPMG the overall scope and plans for their audit, and has reviewed and discussed with that firm, the third party that provides the Company’s internal audit function and management, management’s assessment of the effectiveness of the Company’s internal controls over financial reporting and KPMG’s audit of management’s assessment and the effectiveness of those internal controls.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s 2005 Annual Report on Form 10-K for filing with the SEC and the Board approved that recommendation.

The Audit Committee currently consists of Messrs. Elwood, who has served as Chairman since January 31, 2006, Hill (appointed January 31, 2006) and Natelli. During 2005, Ms. Sheehan served as a member of the Audit Committee. Each of the Audit Committee members is independent as defined by the NYSE listing standards. Our Audit Committee Charter provides that the Audit Committee shall have a designated “audit committee financial expert” at all times. Our Board has determined that each of Messrs. Elwood and Hill qualifies as an “audit committee financial expert” under the SEC rules. Pursuant to the Audit Committee charter, the Audit Committee has also established a “Whistleblower Policy” which is described above. The Audit Committee met six times during 2005. The Audit Committee charter is posted on the Company’s website atwww.highlandhospitality.com. You may also obtain a copy of the Audit Committee charter without charge by writing to: Highland Hospitality Corporation, 8405 Greensboro Drive, Suite 500, McLean, Virginia 22102, Attn: Investor Relations.

9

The following is a summary of the fees billed to the Company by KPMG for professional services rendered for the years ended December 31, 2005 and 2004.

| | | | | | |

| | | 2005 | | 2004 |

Audit Fees(1) | | $ | 629,000 | | $ | 571,000 |

Audit-Related Fees | | | — | | | — |

Tax Fees(2) | | | 116,000 | | | 101,000 |

All Other Fees | | | — | | | — |

| | | | | | |

Total Fees | | $ | 745,000 | | $ | 672,000 |

| (1) | Audit Fees consist of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements that are normally provided by KPMG in connection with statutory and regulatory filings and engagements, the audit of management’s assessment of internal control over financial reporting and the effectiveness of internal control over financial reporting, acquisitions and dispositions, comfort letters and SEC registration statements. |

| (2) | Tax Fees consist of fees billed for professional services for tax compliance, tax advice and tax planning. |

The Audit Committee or its Chairman pre-approve all services rendered by KPMG. The Audit Committee has determined that the provision by KPMG of services described under “Audit-Related Fees” and “Tax Fees” is compatible with maintaining KPMG’s independence from management and the Company.

Submitted by:

Audit Committee

John M. Elwood (Chairman)

John W. Hill

Thomas A. Natelli

10

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF KPMG LLP

AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FOR 2006

The Board of Directors unanimously recommends that the Company’s stockholders vote “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2006.

The Audit Committee has appointed KPMG as the Company’s independent registered public accounting firm for 2006. A representative of KPMG is expected to be present at the 2006 Annual Meeting of Stockholders. The representative will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions from stockholders.

Stockholder ratification of the appointment of KPMG as our independent registered public accounting firm is not required by our bylaws or otherwise. The Audit Committee, pursuant to its charter and the corporate governance rules of the NYSE, has sole responsibility for the appointment of the Company’s independent registered public accounting firm.

Vote Required for Approval of Proposal 2

Ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for 2006 requires the affirmative vote of a majority of the votes cast on the proposal at the 2006 Annual Meeting of Stockholders by the stockholders entitled to vote. If this appointment is not ratified, the Audit Committee may re-consider the appointment. Even if the selection is ratified, the Audit Committee, in its discretion, may appoint a different independent registered public accounting firm at any time during the year if it determines that such change would be in the best interests of the Company and its stockholders.

11

PROPOSAL 3

APPROVAL OF THE 2003 OMNIBUS STOCK INCENTIVE PLAN, AS AMENDED AND RESTATED

The Board of Directors unanimously recommends that the stockholders vote FOR the proposal to approve the amendment and restatement of the 2003 Omnibus Stock Incentive Plan.

Vote Required for Approval of Proposal 3

Approval of the proposal to approve the 2003 Omnibus Stock Incentive Plan, as Amended and Restated, will require a majority of votes cast at a meeting of stockholders duly called and at which a quorum is present. If a stockholder, present in person or by proxy, abstains from voting, the stockholder’s shares will not be voted. An abstention from voting has the same legal effect as a vote “against” the proposal. If a stockholder holds shares in a broker’s account and has given specific voting instructions, the shares will be voted in accordance with those instructions. If no voting instructions are given, the stockholder’s shares will not be voted with respect to the proposal and will not be counted in determining the number of shares entitled to vote on the proposal.

Introduction

We are asking stockholders to approve the 2003 Omnibus Stock Incentive Plan, as Amended and Restated (the “Plan”) so that we (i) may increase the aggregate number of shares of common stock that may be issued under the Plan, (ii) may extend the period during which we may grant certain awards that qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code (“Section 162(m)”) until the stockholders meeting in 2011, and (iii) may extend the term of the Plan until 2016. Except as noted below, the material terms of the Plan as currently in effect are not affected by the amendment and restatement. If the amendment and restatement of the Plan is not approved, the aggregate number of shares of common stock that may be issued under the Plan will not be increased, certain awards will continue to qualify as “performance-based compensation” only if made prior to the stockholders meeting in 2009, and the current term of the Plan will expire on December 15, 2013.

We have established the Plan for the purpose of recruiting and retaining our and our affiliates’ executive officers, employees, directors and consultants. The Plan authorizes the issuance of options to purchase shares of common stock and the grant of restricted common stock awards, stock appreciation rights, deferred shares, performance shares and performance units. Section 162(m) limits a corporation’s income tax deduction for compensation paid to each executive officer to $1 million per year unless the compensation results from an award exempt from the limitation of Section 162(m) or the compensation qualifies as performance-based compensation. Compensation resulting from restricted stock awards granted to our officers at the time of our initial public offering is covered by a transition rule and is exempt from the limitations of Section 162(m). Among the requirements for a grant under the Plan to qualify as performance-based compensation, the Plan must have been approved by the Company’s stockholders. Stock options and stock appreciation rights granted under the Plan are treated as performance-based compensation and are exempt from the deduction disallowance rule of Section 162(m). Other awards of compensation under the Plan may also be exempt from the deduction disallowance rule of Section 162(m) as performance-based compensation, provided that the performance objectives (described below) used by us for establishing the performance goals for determining a participant’s right or amount of a performance-based award are approved by the stockholders at least once every five years. Approval of the Plan as amended and restated will extend the current period until the stockholders meeting in 2011.

We are asking you to approve the amendment and restatement of Plan as described below.

Set forth below is a summary of the material terms of the Plan. All statements herein are intended only to summarize the Plan and are qualified in their entirety by reference to the Plan itself, which is attached as Appendix A. For a more complete description of the terms of the Plan, you should read the Plan.

12

Summary of the 2003 Omnibus Stock Incentive Plan, as Amended and Restated

Administration. Administration of the Plan is carried out by the Compensation Policy Committee of the Board of Directors. The Compensation Policy Committee may delegate a portion of its authority under the Plan to another committee of the Board, but it may not delegate its authority with respect to awards to individuals subject to Section 16 of the Securities Exchange Act of 1934. As used in this summary, the term “administrator” means the Compensation Policy Committee or its delegate.

Eligibility. Our officers and employees and those of our operating partnership and other subsidiaries are eligible to participate in the Plan. As of March 31, 2006, approximately five officers and four employees were eligible to participate in the Plan. Our directors and other persons that provide consulting services to us and our subsidiaries are also eligible to participate in the Plan. The term “subsidiary” is used in the summary to refer to both corporate subsidiaries and other entities, such as partnerships and limited liability companies, for which we directly or indirectly control at least 50% of the equity and any other entity in which we have a material equity interest and which is designated as an “affiliate” by the Compensation Policy Committee.

Maximum Shares and Award Limits. Under the Plan as amended and restated, the maximum number of shares of common stock that may be subject to stock options, stock awards, deferred shares or performance shares and covered by stock appreciation rights is increased from 2,002,000 to 5,002,000. No one participant may receive awards for more than 500,000 shares of common stock in any one calendar year. The maximum number of performance units that may be granted to a participant in any one calendar year is 750,000 for each full or fractional year included in the performance period for the award granted during the calendar year. These limitations, and the terms of outstanding awards, will be adjusted without the approval of our stockholders as the administrator determines is appropriate in the event of a stock dividend, stock split, reclassification of stock or similar events. If an option terminates, expires or becomes unexercisable, or shares of common stock subject to a stock award, grant of performance shares, grant of deferred shares or stock appreciation right are forfeited, the shares subject to such option, stock award, grant of performance shares, grant of deferred shares or stock appreciation right are available under the first sentence of this paragraph for future awards under the Plan. In addition, shares that are issued under any type of award under the Plan and that are repurchased or reacquired by us at the participant’s original purchase price for those shares are also available under the first sentence of this paragraph for future awards under the Plan.

Stock Options. The Plan provides for the grant of both options intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code (the “Code”) and options that are not intended to so qualify. Options intended to qualify as incentive stock options may be granted only to persons who are our employees or are employees of our subsidiaries that are treated as corporations for federal income tax purposes. No participant may be granted incentive stock options that are exercisable for the first time in any calendar year for common stock having a total fair market value (determined as of the option grant), in excess of $100,000.

The administrator will select the participants who are granted options and, consistent with the terms of the Plan, will prescribe the terms of each option, including the vesting rules for such option. The option exercise price cannot be less than the common stock’s fair market value on the date the option is granted, and in the event a participant is deemed to be a 10% owner of the Company or one of its subsidiaries, the exercise price of an incentive stock option cannot be less than 110% of the common stock’s fair market value on the date the option is granted. The Plan prohibits repricing of an outstanding option, and therefore, the administrator may not, without the consent of the stockholders, lower the exercise price or grant another stock award to replace an outstanding option. This limitation does not, however, prevent adjustments resulting from stock dividends, stock splits, reclassifications of stock or similar events. The option price may be paid in cash or, with the administrator’s consent, by surrendering shares of common stock, or a combination of cash and shares of common stock. Options may be exercised in accordance with requirements set by the administrator. The maximum period in which an option may be exercised will be fixed by the administrator but cannot exceed ten years, and in the event a participant is deemed to be a 10% owner of the Company or one of its corporate

13

subsidiaries, the maximum period for an incentive stock option granted to such participant cannot exceed five years. Options generally will be non-transferable except in the event of the participant’s death, but the administrator may allow the transfer of non-qualified stock options through a gift or domestic relations order to the participant’s family members.

Unless provided otherwise in a participant’s stock option agreement and subject to the maximum exercise period for the option, an option generally will cease to be exercisable upon the earlier of three months following the participant’s termination of service with us or our affiliate or the expiration date under the terms of the participant’s stock option agreement. The right to exercise an option will expire immediately upon termination if the termination is for “cause” or a voluntary termination any time after an event that would be grounds for termination for cause. Upon death or disability, the option exercise period is extended to the earlier of one year from the participant’s termination of service or the expiration date under the terms of the participant’s stock option agreement.

Stock Awards and Performance-Based Compensation. The administrator also will select the participants who are granted restricted common stock awards and, consistent with the terms of the Plan, will establish the terms of each stock award. A restricted common stock award may be subject to payment by the participant of a purchase price for shares of common stock subject to the award, and a stock award may be subject to vesting requirements or transfer restrictions or both, if so provided by the administrator. Those requirements may include, for example, a requirement that the participant complete a specified period of service or that certain performance objectives be achieved. The performance objectives may be based on the individual performance of the participant, our performance or the performance of our affiliates, subsidiaries, divisions, departments or functions in which the participant is employed or has responsibility. In the case of a performance objective for an award intended to qualify as performance based compensation under Section 162(m), the objectives are limited to specified levels of and increases in our or a business unit’s return on equity; total earnings; earnings per share; earnings growth; return on capital; return on assets; economic value added; earnings before interest and taxes; earnings before interest, taxes, depreciation and amortization; sales growth; gross margin return on investment; increase in the fair market value of the shares; share price (including but not limited to growth measures and total stockholder return); net operating profit; cash flow (including, but not limited to, operating cash flow and free cash flow); cash flow return on investments (which equals net cash flow divided by total capital); internal rate of return; increase in net present value or expense targets. Transfer of the shares of common stock subject to a stock award normally will be restricted prior to vesting.

Stock Appreciation Rights. The administrator also will select the participants who receive stock appreciation rights under the Plan. A stock appreciation right entitles the participant to receive a payment of up to the amount by which the fair market value of a share of common stock on the date of exercise exceeds the base value for a share of common stock as established by the administrator at the time of grant of the award. A stock appreciation right will be exercisable at such times and subject to such conditions as may be established by the administrator. A stock appreciation right may be granted either alone or in tandem with other awards under the Plan. The amount payable upon the exercise of a stock appreciation right may be settled in cash or by the issuance of shares of common stock.

Deferred Shares. The Plan also authorizes the grant of deferred shares, i.e., the right to receive a future delivery of shares of common stock, if certain conditions are met. The administrator will select the participants who are granted awards of deferred shares and will establish the terms of each grant. The conditions established for earning the grant of deferred shares may include, for example, a requirement that certain performance objectives, such as those described above, be achieved.

Performance Shares and Performance Units. The Plan also permits the grant of performance shares and performance units to participants selected by the administrator. A performance share is an award designated in a specified number of shares of common stock that is payable in whole or in part, if and to the extent certain performance objectives are achieved. A performance unit is a cash bonus equal to $1.00 per unit awarded that is payable in whole or in part, if and to the extent certain performance objectives are achieved. The performance

14

objectives will be prescribed by the administrator for grants intended to qualify as performance based compensation under Section 162(m) and will be stated with reference to the performance objectives described above. A grant of performance units may be settled by payment of cash, shares of common stock or a combination of cash and shares and may grant to the participant or reserve to the administrator the right to elect among these alternatives.

Amendment and Termination. No awards may be granted under the Plan after the tenth anniversary of the adoption of the Plan or, if the amendment and restatement is approved, the tenth anniversary of adoption of the amendment and restatement. The Board of Directors may amend or terminate the Plan at any time, but an amendment will not become effective without the approval of our stockholders (within 12 months of the date such amendment is adopted by the Board of Directors) if it increases the aggregate number of shares of common stock that may be issued under the Plan, changes the class of employees eligible to receive incentive stock options or stockholder approval is required by any applicable law, regulation or rule, including any rule of the NYSE. No amendment or termination of the Plan will affect a participant’s rights under outstanding awards without the participant’s consent. The amendment and restatement of the Plan will extend the expiration date from December 15, 2013 to March 7, 2016.

Other Matters

All future awards under the Plan will be discretionary and therefore are not determinable at this time.

On April 4, 2006, the closing price of the Company’s common stock on the New York Stock Exchange was $12.55 per share.

Federal Income Tax Aspects of the Plan

This is a brief summary of the federal income tax aspects of awards that may be made under the Plan based on existing U.S. federal income tax laws. This summary provides only the basic tax rules. It does not describe a number of special tax rules, including the alternative minimum tax, various elections that may be applicable under certain circumstances and the consequences of issuing an award that fails to comply with the payment date rules applicable to nonqualified deferred compensation under Section 409A of the Code. The tax consequences of awards under the Plan depend upon the type of award and if the award is to an executive officer, whether the award qualifies as performance-based compensation under Section 162(m) of the Code.

Incentive Stock Options. The recipient of an incentive stock option generally will not be taxed upon grant of the option. Federal income taxes are generally imposed only when the shares of stock from exercised incentive stock options are disposed of, by sale or otherwise. The amount by which the fair market value of the stock on the date of exercise exceeds the exercise price is, however, included in determining the option recipient’s liability for the alternative minimum tax. If the incentive stock option recipient does not sell or dispose of the stock until more than one year after the receipt of the stock and two years after the option was granted, then, upon sale or disposition of the stock, the difference between the exercise price and the market value of the stock as of the date of exercise will be treated as a capital gain, and not ordinary income. If a recipient fails to hold the stock for the minimum required time, at the time of the disposition of the stock, the recipient will recognize ordinary income in the year of disposition in an amount equal any excess of the market value of the common stock on the date of exercise (or, if less, the amount realized or disposition of the shares) over the exercise price paid for the shares. Any further gain (or loss) realized by the recipient generally will be taxed as short-term or long-term gain (or loss) depending on the holding period. The Company will not receive a tax deduction for incentive stock options that are taxed to a recipient as capital gains; however, the Company will receive a tax deduction if the sale of the stock does not qualify for capital gains tax treatment.

Nonqualified Stock Options. The recipient of stock options not qualifying as incentive stock options generally will not be taxed upon the grant of the option. Federal income taxes are generally due from a recipient of nonqualified stock options when the stock options are exercised. The difference between the exercise price of

15

the option and the fair market value of the stock purchased on such date is taxed as ordinary income. Thereafter, the tax basis for the acquired stock is equal to the amount paid for the stock plus the amount of ordinary income recognized by the recipient. The Company will take a tax deduction equal to the amount of ordinary income realized by the option recipient by reason of the exercise of the option.

Other Awards. The payment of other awards under the Plan will generally be treated as ordinary compensation income at the time of payment or, in the case of restricted common stock subject to a vesting requirement, at the time substantial vesting occurs. A recipient who receives restricted shares which are not substantially vested, may, within 30 days of the date the shares are transferred, elect in accordance with Section 83(b) of the Code to recognize ordinary compensation income at the time of transfer of the shares. The amount of ordinary compensation income is equal to the amount of any cash and the amount by which the then fair market value of any common stock received by the participant exceeds the purchase price, if any, paid by the participant. Subject to the application of Section 162(m), the Company will receive a tax deduction for the amount of the compensation income.

Section 162(m). Section 162(m) would render non-deductible to the Company certain compensation in excess of $1,000,000 in any year to certain executive officers of the Company unless such excess is “performance-based compensation” (as defined in the Code) or is otherwise exempt from Section 162(m), such as under the transition rule described above. Options and stock appreciation rights granted under the Plan are designed to qualify as performance-based compensation. Performance units and performance shares which are based on the performance objectives contained in the Plan are also intended to qualify as performance-based compensation. As described above with respect to restricted common stock and deferred shares, the administrator may condition such awards on attainment of one or more performance goals that are intended to qualify such awards as performance-based compensation.

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The information presented below regarding beneficial ownership of common stock has been presented in accordance with the rules of the SEC and is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership of common stock includes any shares to which a person, directly or indirectly, has or shares voting power or investment power and any shares as to which a person has the right to acquire such voting or investment power within 60 days through the exercise of any stock option or other right.

The following table sets forth certain information regarding the beneficial ownership of common stock by (i) each person, other than directors and executive officers, known by us to be the beneficial owner of more than 5% of our common stock, (ii) each of our directors, (iii) each of our named executive officers and (iv) all of our directors and executive officers as a group as of March 31, 2006. Unless otherwise indicated, all shares are owned directly and the indicated person has sole voting and investment power.

| | | | | |

Name of Officer or Director | | Shares

Owned(1) | | Percentage of

Shares Owned(2) | |

Columbia Wanger Asset Management, L.P.(3) | | 4,632,000 | | 7.76 | % |

Eubel Brady & Suttman Asset Management, Inc.(4) | | 3,763,680 | | 6.30 | % |

A. Alex Porter(5) | | 3,083,000 | | 5.16 | % |

Bruce D. Wardinski | | 475,001 | | * | |

James L. Francis | | 218,371 | | * | |

Patrick W. Campbell(6) | | 75,563 | | * | |

Tracy M.J. Colden | | 83,877 | | * | |

Terrence P. O’Leary | | 31,415 | | * | |

Douglas W. Vicari | | 81,153 | | * | |

John M. Elwood | | 0 | | * | |

W. Reeder Glass | | 9,000 | | * | |

John W. Hill | | 0 | | * | |

Thomas A. Natelli | | 19,000 | | * | |

Margaret A. Sheehan | | 9,000 | | * | |

William L. Wilson | | 25,666 | | * | |

All directors and executive officers as a group (12 persons

including those named above)(6) | | 1,028,046 | | 1.72 | % |

| * | Represents less than 1% of the number of shares of common stock of the Company. |

| (1) | Unless otherwise indicated, the named stockholders have sole voting power with respect to all shares shown as being beneficially owned by them. |

| (2) | Percentage of ownership is based on 59,719,992 shares of common stock issued and outstanding as of March 31, 2006, and includes both registered and unregistered shares of our common stock. |

| (3) | As reported on Schedule 13G filed February 14, 2006. The address for Columbia Wanger Asset Management, L.P. is 227 West Monroe Street, Suite 3000, Chicago, IL 60606. |

| (4) | As reported on Amendment No. 2 to Schedule 13G filed February 14, 2006. The address for Eubel Brady & Suttman Asset Management, Inc. is 7777 Washington Village Drive, Suite 210, Dayton, OH 45459. |

| (5) | As reported on Amendment No. 3 to Schedule 13G filed February 10, 2006. Pursuant to a joint filing agreement, A. Alex Porter, Paul Orlin, Geoffrey Hulme and Jonathan W. Friedland have reported beneficial ownership of 3,083,000 shares. The address for each of Messrs. Porter, Orlin, Hulme and Friedland is 666 5th Avenue, 34th Floor, New York, New York 10103. |

| (6) | Includes 8,000 shares as to which Mr. Campbell may be deemed to share voting and investment power. |

17

SUMMARY COMPENSATION TABLE

The table below shows the total compensation paid or accrued during the years ended December 31, 2003, 2004 and 2005 for James L. Francis, our President and Chief Executive Officer, and each of our four other most highly compensated executive officers. We commenced operations on December 19, 2003 upon completion of our initial public offering and accordingly only a nominal amount of salary, and no bonuses, were paid to our executive officers in 2003. The only significant compensation paid in 2003 to our executive officers, other than Mr. O’Leary who joined the Company in March 2004, consisted of restricted stock awards made to each of them at the time of our initial public offering. No options were granted to any executive officers in 2003, 2004 or 2005, nor are any expected to be granted in 2006, as we use grants of restricted stock awards in lieu of options to provide long-term incentives to management.

| | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-Term

Compensation | | |

Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Other Annual

Compensation

($) | | Restricted Stock

Award(s) ($)(1) | | All Other

Compensation($)(2) |

James L. Francis, President and Chief

Executive Officer | | 2005 | | 430,000 | | 430,000 | | — | | — | | 36,600 |

| | 2004 | | 415,000 | | 486,000 | | — | | — | | 16,600 |

| | 2003 | | — | | — | | — | | 2,720,000 | | — |

| | | | | | |

Patrick W. Campbell, Executive Vice President and Chief Investment Officer | | 2005 | | 245,000 | | 122,000 | | — | | — | | 9,800 |

| | 2004 | | 240,000 | | 161,000 | | — | | — | | 9,600 |

| | 2003 | | — | | — | | — | | 1,185,000 | | — |

| | | | | | |

Tracy M.J. Colden, Executive Vice President, General Counsel and Secretary | | 2005 | | 245,000 | | 122,000 | | — | | — | | 16,100 |

| | 2004 | | 235,000 | | 158,000 | | — | | — | | 9,400 |

| | 2003 | | — | | — | | — | | 1,185,000 | | — |

| | | | | | | | | | | | |

| | | | | | |

Douglas W. Vicari, Executive Vice President,

Chief Financial Officer and Treasurer | | 2005 | | 245,000 | | 131,000 | | — | | — | | 9,800 |

| | 2004 | | 235,000 | | 158,000 | | — | | — | | 9,300 |

| | 2003 | | — | | — | | — | | 1,185,000 | | — |

| | | | | | | | | | | | |

| | | | | | |

Terrence P. O’Leary,(3) Senior Vice President, Asset Management | | 2005 | | 165,000 | | 51,000 | | — | | — | | 7,100 |

| | 2004 | | 128,000 | | 58,000 | | — | | 442,800 | | 5,127 |

| | | | | | | | | | | | |

| (1) | The amounts shown reflect the values of shares of restricted common stock granted in December 2003 to Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, respectively, based on the initial public offering price, and of shares of restricted common stock granted to Mr. O’Leary on March 29, 2004, based on the closing price per share of our common stock of $11.07, as reported on the New York Stock Exchange on December 30, 2005. In each case, subject to continued service to us, the restrictions on each executive officer’s shares will lapse at the rate of one-third of the number of shares of restricted common stock per year commencing on the first anniversary of the dates of the grants with restrictions on an additional one-third of the number of shares of restricted common stock lapsing on each of the second and third anniversaries of the dates of the grants. Accelerated vesting may occur in accordance with the employment agreements in effect for Messrs. Francis, Campbell and Vicari and Ms. Colden if, during the term of his or her employment agreement with us, the executive officer terminates for death or disability or is terminated by us without cause or the executive officer resigns for good reason. Under those agreements, an accelerated lapse of each executive officer’s restrictions will also occur if during the 10-day business period following a change in control of the Company, the executive officer resigns for any reason. The executive officers will be entitled to vote and receive distributions with respect to shares of restricted common stock. As of December 30, 2005, based on the closing price per share of our common stock of $11.05, as reported on the New York Stock Exchange, Mr. Francis held 90,666 shares of unvested restricted stock with a market value |

18

| | of $1,001,859; each of Mr. Campbell, Ms. Colden and Mr. Vicari held 39,500 shares of unvested restricted stock with a market value of $436,475; and Mr. O’Leary held 26,667 shares of unvested restricted stock with a market value of $294,659. |

| (2) | For 2004, this column includes (a) matching contributions of $8,200 for each of Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, and $5,127 for Mr. O’Leary under the Company’s 401(k) plan; and (b) matching contributions of $8,400, $1,400, $1,200 and $1,100 for Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, respectively, under the Company’s Executive Deferred Compensation Plan. For 2005, this column includes (a) matching contributions of $8,400 for each of Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, and $7,100 for Mr. O’Leary under the Company’s 401(k) plan; and (b) matching contributions of $28,200, $1,400, $7,700 and $1,400 for Mr. Francis, Mr. Campbell, Ms. Colden and Mr. Vicari, respectively, under the Company’s Executive Deferred Compensation Plan. |

| (3) | Mr. O’Leary joined the Company on March 1, 2004. |

Employment Agreements

We entered into employment agreements, effective December 19, 2003, with Messrs. Francis, Campbell and Vicari and Ms. Colden that initially provided for annual salaries of $415,000 for Mr. Francis, $240,000 for Mr. Campbell, $235,000 for Mr. Vicari and $235,000 for Ms. Colden, in each case subject to annual increase as determined by the Compensation Policy Committee. Upon review of the Company’s 2005 performance by the Compensation Policy Committee, the annual salaries of Messrs. Francis, Campbell and Vicari and Ms. Colden were increased to $447,200, $254,800, $254,800, and $254,800, respectively, for 2006. In addition, the employment agreements provide them severance benefits if their employment ends under certain circumstances. Mr. Vicari’s employment agreement further provides for the reimbursement, up to $25,000 annually, of reasonable travel and lodging expenses relating to Mr. Vicari’s regular commute between the Company’s office and his home.

The agreements have an initial term of three years, with respect to Mr. Francis, and two years, with respect to Messrs. Campbell and Vicari and Ms. Colden, beginning on December 19, 2003. The term of the agreements are extended for an additional year, on each anniversary of the effective date of our initial public offering, unless either party gives six months’ prior notice that the term will not be extended. The terms of each were extended in December 2004 and 2005. As a result of these extensions the agreement with Mr. Francis currently extends through December 18, 2008 and the agreements with Messrs. Campbell and Vicari and Ms. Colden extend through December 18, 2007.

Each of these executives will be entitled to receive benefits under the agreements if we terminate the executive’s employment without cause or the executive resigns with good reason or if there is a change in control of the Company during the term of the agreements and, within one year after the change in control, we terminate the executive’s employment without cause or the executive resigns with good reason or within 10 business days following the change in control the executive resigns for any reason. Under these scenarios, each of the executives is entitled to receive (1) any accrued but unpaid salary and bonuses, (2) vesting as of the executive’s last day of employment of any unvested stock options or restricted common stock previously issued to the executive, (3) payment of the executive’s life, health and disability insurance coverage for a period of two years, in the case of Mr. Francis, and one year, in the case of Messrs. Campbell and Vicari and Ms. Colden, but in each case with an additional year with respect to termination relating to a change in control, following the executive’s termination, and (4) a severance payment calculated as described below. In the event of a change in control of the Company, each of the executives will be eligible to receive payments to compensate the executive for the additional taxes, if any, imposed on the executive under Section 4999 of the Internal Revenue Code by reason of receipt of excess parachute payments.

With respect to termination relating to a change of control, the severance payment is equal to three times, in the case of Mr. Francis, or two times, in the case of Messrs. Campbell and Vicari and Ms. Colden, current salary

19

plus three times, in the case of Mr. Francis, or two times, in the case of Messrs. Campbell and Vicari and Ms. Colden, the higher of (1) the average of all bonuses paid to them during the three prior years or (2) the most recent bonus paid to the executive.

With respect to termination by us without cause, or by the executive for good reason, the severance payment is equal to two times, in the case of Mr. Francis, or one times, in the case of Messrs. Campbell and Vicari and Ms. Colden, current salary plus one times the higher of (1) the average of all bonuses paid to them during the three prior years or (2) the most recent bonus paid to the executive.

The employment agreements contain customary non-competition covenants that apply during the term and for one year after the term of each executive’s employment with the Company.

Section 16(a) Beneficial Ownership Reporting Compliance

We believe that all of our current directors and executive officers reported on a timely basis all transactions required to be reported by Section 16(a) during 2005.

20

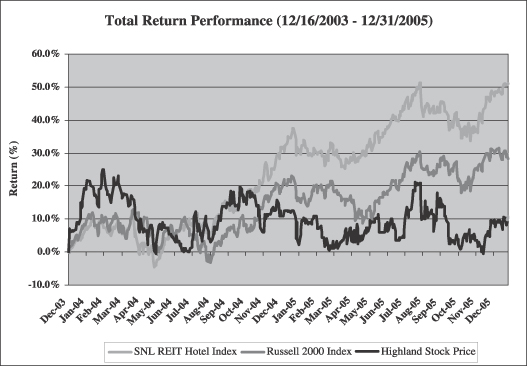

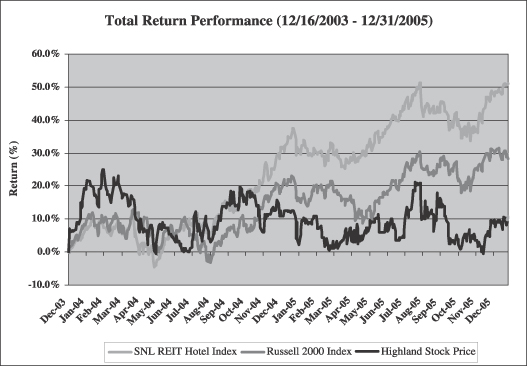

COMPARISON OF STOCKHOLDER RETURN

The following graph compares the performance of the Company’s common stock during the period beginning on December 16, 2003 to December 31, 2005 with SNL REIT Hotel Index, prepared by SNL Financial, LLC, and the Russell 2000 Index.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, with a median market capitalization of approximately $395 million. The SNL Hotel REIT Index is currently comprised of 15 publicly traded hotel REITs, organized for purposes substantially similar to that of the Company.

| | | | | | | | | | | |

Stock/Index | | Base

12/16/2003 | | Year End

12/31/2003 | | Year End

12/31/2004 | | Year End

12/31/2005 | | % Return | |

SNL REIT Hotel | | 100.00 | | 103.61 | | 137.44 | | 150.91 | | 50.91 | % |

Russell 2000 | | 100.00 | | 103.64 | | 122.64 | | 128.22 | | 28.22 | % |

HIH | | 100.00 | | 109.00 | | 112.40 | | 110.50 | | 10.50 | % |

21

CERTAIN RELATIONSHIPS AND TRANSACTIONS

Transactions With Barceló Crestline Corporation

Bruce D. Wardinski, our Chairman of the Board, is also the President and Chief Executive Officer of Barceló Crestline. W. Reeder Glass has been designated by Barceló Crestline to serve on our Board. Mr. Glass is also a director of Barceló Crestline.

Purchase of Hotels

In December 2003, we acquired Barceló Crestline’s equity interest in Portsmouth Hotel Associates, LLC, which leases the Portsmouth Renaissance hotel and conference center, Sugar Land Hotel Associates, L.P., which owns the Sugar Land Marriott hotel, and A/H-BCC Virginia Beach Hotel, LLC, which owns the Hilton Garden Inn Virginia Beach Town Center hotel, in exchange for limited partnership units of Highland Hospitality, L.P. and the repayment of all outstanding debt on these hotel properties.

The 43,010 units issued to Barceló Crestline in exchange for its equity interests in Sugar Land Hotel Associates, L.P. had a value of $430,100, based on the initial public offering price of our common stock. The 142,688 units issued to Barceló Crestline in exchange for its interests in A/H-BCC Virginia Beach Hotel, LLC had a value of approximately $1.4 million, based on the initial public offering price of our common stock. The 344,152 units issued to Barceló Crestline in exchange for its equity interest in Portsmouth Hotel Associates, LLC had a value of approximately $3.4 million, based on the initial public offering price of our common stock.

We have also agreed to pay Barceló Crestline up to $1.8 million (in the form of units in our operating partnership, valued at the market price for our common stock at the time of payment as described below) as additional consideration for its interest in the Sugar Land Marriott hotel if the Sugar Land Marriott hotel exceeds certain agreed-upon operating results over the 36-month period following our acquisition of the hotel, allowing Barceló Crestline to potentially recoup its cash investment.

On February 4, 2005, the Company acquired the 196-room Sheraton Annapolis hotel in Annapolis, Maryland for approximately $18.4 million. The entity that sold the hotel is owned 33.3% by Barceló Corporación Empresarial, S.A. (“Barceló”), which is the parent company of Barceló Crestline.

Strategic Alliance Agreement

In December 2003, entered into a seven-year strategic alliance agreement with Barceló Crestline pursuant to which (i) Barceló purchased 1,250,000 shares of our common stock (having a value of $12.5 million based on the initial public offering price for our common stock) directly from us in a private transaction concurrently with the closing of our initial public offering at a price per share equal to the initial public offering price, less an amount equal to the underwriting discount, (ii) Barceló Crestline agreed to refer to us (on an exclusive basis) hotel acquisition opportunities in the United States presented to Barceló Crestline or its subsidiaries other than opportunities that relate to third party management arrangements offered to Barceló Crestline, (iii) unless a majority of our independent directors in good faith concludes for valid business reasons that another management company should manage a hotel owned by us, we agree to offer Barceló Crestline or its subsidiaries the right to manage hotel properties we acquire in the United States, unless the hotel is encumbered by a management agreement that would extend beyond the date of our acquisition of the hotel and a termination fee is payable to terminate the existing management agreement (unless Barceló Crestline pays such termination fee) and (iv) we agreed to grant Barceló Crestline the right to designate one nominee for election to our Board at each meeting of our stockholders at which directors are to be elected.

Management Agreements