Exhibit 1.2

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this announcement, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

| | |

| |  |

| (Stock Code: 2383) | | (Stock Code: 8282) |

| DISCLOSEABLE TRANSACTION | | DISCLOSEABLE TRANSACTION |

JOINT ANNOUNCEMENT

Proposed acquisition of the entire issued share capital of

Gainfirst Asia Limited

The respective boards of directors of TOM Group and TOM Online are pleased to announce that TOM Group and TOM Online, through their subsidiary, TOM Online Media, will acquire the Sale Shares (representing the entire issued share capital of Gainfirst as at the date of this announcement and as at Completion) at an aggregate consideration of not more than RMB600 million (approximately HK$582.52 million).

The Acquisition constitutes a discloseable transaction of TOM Group under Chapter 14 of the Main Board Listing Rules. A circular containing further details of the Acquisition will be dispatched to the shareholders of TOM Group as soon as practicable.

The Acquisition also constitutes a discloseable transaction of TOM Online under Chapter 19 of the GEM Listing Rules. A circular containing further details of the Acquisition will be dispatched to the shareholders of TOM Online as soon as practicable.

1

THE AGREEMENT

| | | | |

| Date: | | 12 June 2006 |

| | |

| Parties | | | | |

| |

| Purchaser: | | TOM Online Media |

| | |

| Vendors: | | (1) | | Grandmetro |

| | (2) | | Valuenet |

| | |

| Other parties: | | (1) | | Ms. Sun |

| | (2) | | Mr. Wang |

Assets to be acquired

The Sale Shares, representing 100% of the issued share capital of Gainfirst as at the date of this announcement and as at Completion.

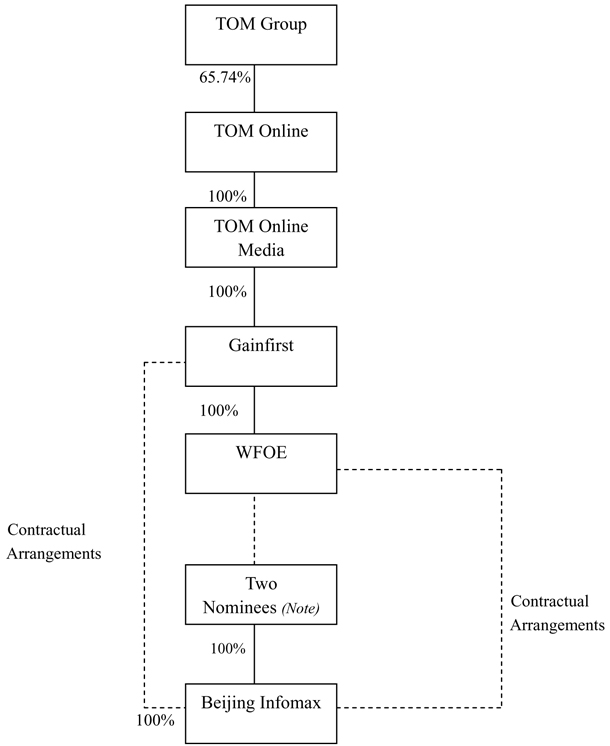

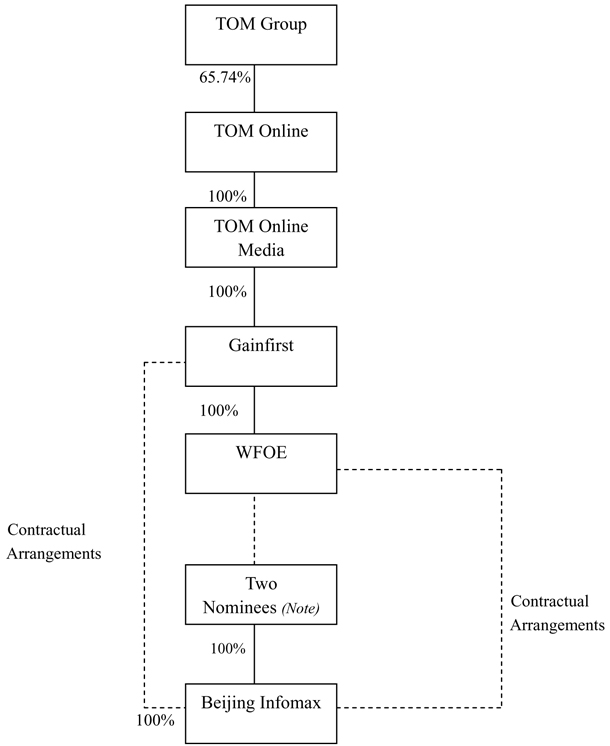

WFOE is a wholly-owned subsidiary to be established by Gainfirst.

Under the Contractual Arrangements (as described below), Gainfirst and WFOE will be able to enjoy the economic interest in Beijing Infomax. Subject to confirmation by the auditors of TOM Online, Beijing Infomax will be accounted for as a wholly-owned subsidiary of TOM Online.

WFOE

Gainfirst will establish WFOE in Beijing, the PRC. The corporate structure of WFOE is as follows:

| | |

| (a) Registered capital: | | US$100,000 (approximately HK$780,000) |

| |

| (b) Shareholder: | | Gainfirst (100%) |

| |

| (c) Scope of business: | | research, development and sale of computer software; providing technology consultation and services in respect of computers and the sale of self-manufactured products. |

Transfer of equity interest in Beijing Infomax

Ms. Sun and Mr. Wang will transfer all of their respective equity interest in Beijing Infomax to the Two Nominees at an aggregate consideration of RMB10 million (approximately HK$9.71 million) (being part of the Consideration) no later than the fifteenth Business Day after completion of the Registration, which completion shall occur no later than the fifth Business Day after Completion.

2

Consideration

| 1. | The Consideration comprises three instalments as described below, the aggregate amount of which will not be more than RMB600 million (approximately HK$582.52 million). |

| 2. | The first instalment is a sum in HK$ or US$ equivalent to RMB150 million (approximately HK$145.63 million) (the “First Instalment”), which will be paid in cash within 15 Business Days after the Registration, which Registration shall be completed no later than the fifth Business Day after the date of Completion. A sum of RMB10 million (approximately HK$9.71 million) of the First Instalment will be allocated as the consideration to be paid by the Two Nominees to Ms. Sun and Mr. Wang for the transfer of equity interest in Beijing Infomax. |

| 3. | The second instalment (the “Second Instalment”) is an amount in HK$ or US$ equivalent to the amount calculated by the following formula: |

A = (B – C + D) × E1 – F

where:

| | A = | the amount of the Second Instalment (in RMB) |

| | B = | the amount of the audited combined after-tax profit (in RMB) under the US GAAP of the Gainfirst Group for the year ending 31 December 2006 |

| | C = | the amount of the balance of accounts receivable as at 31 December 2006 (in RMB) minus the amount of provision for doubtful accounts receivable as at 31 December 2006 (in RMB) (if any) |

| | D = | the amount of accounts receivable as at 31 December 2006 (in RMB) which has been collected during the period from 1 January 2007 to 30 June 2007 |

| | E1 = | 2.5 if (B – C + D) is less than RMB35 million or 3.5 if (B – C + D) is equal to or more than RMB35 million |

| | F = | the amount of the First Instalment (i.e., RMB150,000,000) |

If A is greater than 0, the Second Instalment will be paid by TOM Online Media in cash on or before 21 July 2007.

TOM Online Media will not be required to pay the Second Instalment if A is equal to or less than 0.

3

| 4. | The final instalment (the “Final Instalment”) is an amount in HK$ or US$ equivalent to the amount calculated by the following formula: |

W = (H – I + Y) × J + (B – C + X) × E2 –Z

where:

B and C have the same meanings as defined in the formula for the calculation of the Second Instalment above.

| | W = | the amount of the Final Instalment (in RMB) |

| | H = | the amount of the audited combined after-tax profit (in RMB) under the US GAAP of the Gainfirst Group for the year ending 31 December 2007 |

| | I = | the amount of the balance of accounts receivable as at 31 December 2007 (in RMB) minus the amount of provision for doubtful accounts receivable as at 31 December 2007 (in RMB) (if any) |

| | Y = | the amount of accounts receivable as at 31 December 2007 (in RMB) which has been collected during the period from 1 January 2008 to 30 June 2008 |

| | J = | 3 if (H – I) is less than RMB65 million or 4 if (H – I) is equal to or more than RMB65 million |

| | X = | the amount of accounts receivable as at 31 December 2006 (in RMB) which has been collected during the period from 1 January 2007 to 30 June 2008 |

| | E2 = | 2.5 if (B – C + X) is less than RMB35 million or 3.5 if (B – C + X) is equal to or more than RMB35 million |

| | Z = | the aggregate amount paid by TOM Online Media up to the Final Instalment, i.e., |

| | (i) | if A is equal to or greater than 0, then Z = F + A; |

| | (ii) | if A is less than 0, then Z = F. |

If W is greater than 0, the Final Instalment will be paid by TOM Online Media in cash on or before 21 July 2008.

TOM Online Media will not be required to pay the Final Instalment if W is equal to or less than 0.

The Consideration was reached at after arm’s length negotiations between the Vendors and TOM Online Media and being a price acceptable to the Vendors and TOM Online Media with reference to the past, present and future performance and the strategic value of the Gainfirst Group (as mentioned in the section headed “Reasons for entering into the Agreement” below).

The Consideration will be funded by the internal resources of TOM Online.

4

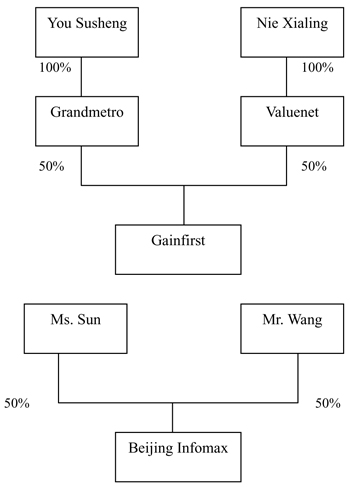

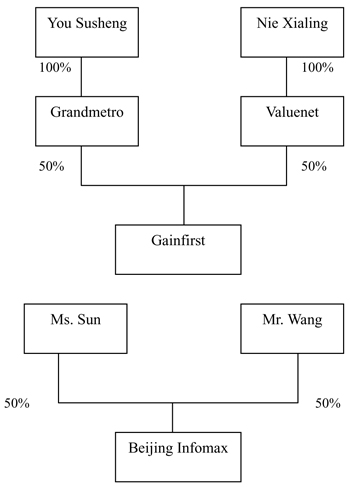

Structure charts of Gainfirst and Beijing Infomax immediately before Completion

5

Structure chart of the Gainfirst Group immediately after Completion

| Note: | Upon Completion, Beijing Infomax will be accounted for as a wholly-owned subsidiary of TOM Online and a non wholly-owned subsidiary of TOM Group (subject to confirmation by the auditors of TOM Online). Notwithstanding the aforesaid, each of the Two Nominees and his/her associates (which do not include Beijing Infomax) will be deemed as connected persons of TOM Online and TOM Group by virtue of his/her being a substantial shareholder of a subsidiary of TOM Online and TOM Group, respectively. Any transaction (other than the Contractual Arrangements) between any of the Two Nominees or his/her associates and any member of the TOM Online or TOM Group will be deemed a connected transaction of TOM Online and/or TOM Group and subject to the requirements of Chapter 20 of the GEM Listing Rules and Chapter 14A of the Main Board Listing Rules, respectively. |

6

Conditions Precedent

Completion is conditional upon, among other things, the following conditions (“Conditions”) having been fulfilled or waived on or before 7 July 2006 (or such other date as the parties to the Agreement may agree):

| 1. | a PRC legal opinion opining on the legality of the establishment of WFOE and the transactions contemplated under the Agreement (including the Contractual Arrangements) having been issued by such PRC legal counsel approved by TOM Online Media; |

| 2. | an employment contract in such form and substance satisfactory to TOM Online Media having been duly executed between WFOE and each member of the management team and other essential staff members (including Ms. Sun and Mr. Wang) of WFOE; |

| 3. | the Contractual Arrangements in such form and substance satisfactory to TOM Online Media having been duly entered into by the relevant parties; |

| 4. | the 2005 annual review of the national license for value-added services <<  >> and the telecom and information services license << >> and the telecom and information services license << >> currently held by Beijing Infomax having been passed; >> currently held by Beijing Infomax having been passed; |

| 5. | the board of directors of TOM Online Media and the board of directors and/or shareholders of TOM Online (if required under the GEM Listing Rules) having approved on terms of the Agreement and the transactions contemplated thereunder; |

| 6. | the board of directors and/or the shareholders of TOM Group (if required under the Main Board Listing Rules) having approved on the terms of the Agreement and the transactions contemplated thereunder; and |

| 7. | TOM Online Media having been satisfied with the result of the due diligence exercise carried out by it on the assets and liabilities, business and prospects of the Gainfirst Group. |

Completion

Completion will take place on the date on which the last of the Conditions is fulfilled (or waived) or such other date as the parties may agree.

7

Contractual Arrangements

As PRC regulations currently restrict foreign ownership of companies engaged in the provision of the telecommunications value-added services (such as Beijing Infomax). To comply with the relevant PRC regulations, TOM Online Media will not have direct equity interest in Beijing Infomax but it will designate the Two Nominees to acquire the entire equity interest in Beijing Infomax. Prior to Completion, the following contractual arrangements (“Contractual Arrangements”) have been/will be entered into between the relevant parties:

| (a) | an exclusive technical and consultancy services agreement to be entered into between TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) and Beijing Infomax, under which TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) will provide certain technical and consultancy services to Beijing Infomax. Beijing Infomax will pay TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) service fees on a monthly basis, which fees will be an amount equal to 65% of the total number of subscribers of the month multiplied by the net average charge per subscriber for that month (after deduction of business tax). The former exclusive technical and consultancy services agreement has been entered into between TOM WFOE and Beijing Infomax on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter exclusive technical and consultancy services agreement; |

| (b) | a business operation agreement to be entered into between TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment), Beijing Infomax and the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration), under which TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) agreed to act as a guarantor for any obligations undertaken by Beijing Infomax and in return for which, Beijing Infomax will pledge to TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) their accounts receivable and assets. No consideration is payable under the aforesaid business operation agreement. The former business operation agreement has been entered into between TOM WFOE, Ms. Sun and Mr. Wang on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter business operation agreement; |

| (c) | an exclusive option agreement to be entered into between TOM WFOE (before the establishment of WFOE) or Gainfirst (after the establishment of WFOE) and each of the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration), pursuant to which the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration) will grant an exclusive right to TOM WFOE (before the establishment of WFOE) or Gainfirst (after the establishment of WFOE) to purchase all or part of the shareholders’ equity interest in Beijing Infomax at an aggregate exercise price of RMB10,000,000. The option is exercisable at the discretion of TOM WFOE or Gainfirst. The former exclusive option agreement has been entered into between TOM WFOE, Ms. Sun and Mr. Wang on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter exclusive option agreement; |

8

| (d) | an equity pledge agreement to be entered into between TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) and each of the shareholders of Beijing Infomax (before completion of the Registration, it refers to Ms. Sun and Mr. Wang; after completion of the Registration, it refers to the Two Nominees), pursuant to which the shareholders of Beijing Infomax will pledge their respective interest in Beijing Infomax to TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) for the performance of Beijing Infomax’s payment obligations under the aforesaid exclusive technical and consulting services agreement. No consideration is payable under the aforesaid equity pledge agreement. The former equity pledge agreement has been entered into between TOM WFOE, Ms. Sun and Mr. Wang on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter equity pledge agreement; |

| (e) | a transfer agreement of the equity interest in Beijing Infomax to be entered into between Ms. Sun, Mr. Wang and the Two Nominees whereby Ms. Sun, Mr. Wang will transfer their respective equity interest in Beijing Infomax to the Two Nominees at an aggregate consideration of RMB10 million (approximately HK$9.71 million); |

| (f) | an irrevocable power of attorney to be entered into between the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration) in favour of the two designated persons as designated by TOM WFOE before completion of the Registration or by WFOE after completion of the Registration so that the two designated persons have full power and authority to exercise all of the shareholder’s rights with respect to the shareholders’ interests in Beijing Infomax. The former irrevocable power of attorney has been executed by each of Ms. Sun and Mr. Wang on 1 June 2006 and they will lapse on the effective date (i.e., the date of completion of the Registration) of the latter irrevocable power of attorney to be executed by the Two Nominees; and |

| (g) | a loan agreement to be entered into between Gainfirst and the Two Nominees so that loans (the aggregate amount of which will be equal to the amount of the registered capital of Beijing Infomax (i.e., RMB10 million)) will be provided by Gainfirst to the Two Nominees for the exclusive purpose of Beijing Infomax’s business operations. |

9

As a result of the Contractual Arrangements, the TOM Online Group will be able to govern the financial and operating policies of Beijing Infomax and enjoy all of the economic benefits of the Gainfirst Group.

INFORMATION ON GAINFIRST

Gainfirst is a company incorporated in the BVI with limited liability. As at the date hereof, Gainfirst is owned as to 50% by Grandmetro and 50% by Valuenet. TOM Online Media will acquire the entire issued share capital of Gainfirst upon the terms and subject to the conditions set out in the Agreement. Pursuant to the Agreement, Gainfirst will establish WFOE in Beijing, the PRC. Under the Contractual Arrangements, Gainfirst and WFOE will be able to enjoy the economic interest in Beijing Infomax. Subject to confirmation by the auditors of TOM Online, Beijing Infomax will be accounted for as a wholly-owned subsidiary of TOM Online. As Gainfirst is dormant since its incorporation, therefore no financial information for the past two years is available.

INFORMATION ON BEIJING INFOMAX

Beijing Infomax is a domestic company established in the PRC on 27 February 2003. The amount of the current registered capital of Beijing Infomax is RMB10 million (approximately HK$9.71 million), which has been fully paid up. Beijing Infomax is primarily engaged in the telecommunication value-added services and the research and development on computer software. Before Completion and at the date of this announcement, Beijing Infomax is held as to 50% by Ms. Sun and 50% by Mr. Wang, respectively. Ms. Sun and Mr. Wang will transfer their respective equity interest in Beijing Infomax to the Two Nominees pursuant to the Agreement.

Based on the unaudited management account prepared in accordance with US GAAP of Beijing Infomax, the unaudited profit both before and after tax of Beijing Infomax for the year ended 31 December 2004 were approximately RMB6.01 million and approximately RMB6.01 million, respectively. Based on the unaudited management account prepared in accordance with US GAAP of Beijing Infomax, the unaudited profit both before and after tax of Beijing Infomax for the year ended 31 December 2005 were approximately RMB6.9 million and approximately RMB6.9 million, respectively. The unaudited net asset of Beijing Infomax as at 31 December 2005 was approximately RMB11.57 million.

REASONS FOR ENTERING INTO THE AGREEMENT

Beijing Infomax is a wireless Internet service provider focusing on delivering entertainment content to users via SMS and other wireless Internet services in cooperation with major TV broadcasters in China. Beijing Infomax has an exclusive relationship with China’s national broadcaster CCTV2 for the provision of wireless Internet services. Though the Acquisition, TOM Online intends to further strengthen its leading market position in the wireless internet sector in terms of market share and distribution channels.

10

The Acquisition is expected to create significant synergies between Beijing Infomax and TOM Online in the coming years. TOM Online has a proven track record in integrating TV and wireless media to inform and entertain Chinese consumers. With the addition of Beijing Infomax’s relationships with CCTV2 and other TV broadcasters and TOM Online’s leading position in the wireless Internet sector, TOM Online believes there are significant synergies in product diversification, operational efficiency and content sharing that can be gained through the Acquisition.

The Acquisition is in line with the statement of business objectives of TOM Online as disclosed in its prospectus dated 2 March 2004. The directors of TOM Online believe that the Acquisition will enable TOM Online to enlarge its market share in the wireless Internet market and increase its revenues from wireless Internet services.

The directors of both TOM Group and TOM Online consider that the Agreement is entered into on normal commercial terms in the ordinary and usual course of business of TOM Group and TOM Online, respectively, and that the terms of the Agreement are fair and reasonable and in the interests of TOM Group and TOM Online so far as the respective shareholders of TOM Group and TOM Online are concerned.

If there is any material change to the terms of the Agreement (including the Contractual Arrangements), TOM Group and TOM Online will re-comply with the relevant requirements of the Main Board Listing Rules and the GEM Listing Rules, respectively.

DISCLOSEABLE TRANSACTION OF TOM GROUP

The Acquisition constitutes a discloseable transaction of TOM Group under Chapter 14 of the Main Board Listing Rules. A circular containing further details of the Acquisition will be dispatched to the shareholders of TOM Group as soon as practicable.

DISCLOSEABLE TRANSACTION OF TOM ONLINE

The Acquisition constitutes a discloseable transaction of TOM Online under Chapter 19 of the GEM Listing Rules. A circular containing further details of the Acquisition will be dispatched to the shareholders of TOM Online as soon as practicable.

GENERAL

TOM Group (HKSE stock code: 2383) is listed on the Main Board of the Stock Exchange. A leading Chinese-language media group in the Greater China region, the Group has diverse business interests in five key areas: Internet (TOM Online) (Hong Kong GEM stock code: 8282, Nasdaq stock symbol: TOMO), outdoor media, publishing, sports, television and entertainment across markets in Mainland China, Taiwan and Hong Kong.

11

TOM Online is an internet company in the PRC providing value-added multimedia products and services. It delivers its products and services from its Internet portal to its users both through their mobile phones and through its websites. Its primary business activities include wireless value-added services, online advertising and commercial enterprise solutions.

DEFINITIONS

| | |

| “Acquisition” | | the proposed acquisition by TOM Online Media of the entire issued share capital of Gainfirst from the Vendors in accordance with the terms and conditions of the Agreement |

| |

| “Agreement” | | a conditional sale and purchase agreement entered into on 12 June 2006 between TOM Online Media, the Vendors, Ms. Sun and Mr. Wang in respect of the Acquisition |

| |

| “Beijing Infomax” | |  (Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of this announcement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively (Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of this announcement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively |

| |

| “associates” | | has the same meaning as ascribed to it under the Main Board Listing Rules or the GEM Listing Rules |

| |

| “Business Day” | | a day (excluding Saturday) on which banks are generally open for business in the PRC |

| |

| “BVI” | | the British Virgin Islands |

| |

| “Completion” | | completion of the Acquisition upon the terms and subject to the conditions set out in the Agreement |

| |

| “Consideration” | | the consideration for the Acquisition |

| |

| “Gainfirst” | | Gainfirst Asia Limited, a company incorporated in the BVI and whose principal business is investment holding, which is independent from the Directors, chief executive, substantial shareholders or management shareholders of TOM Group and TOM Group or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online. As at the date hereof, Gainfirst is owned as to 50% by Grandmetro and 50% by Valuenet |

12

| | |

| “Gainfirst Group” | | Gainfirst, WFOE and Beijing Infomax |

| |

| “GEM” | | the Growth Enterprise Market of the Stock Exchange |

| |

| “GEM Listing Rules” | | the Rules Governing the Listing of Securities on GEM |

| |

| “Grandmetro” | | Grandmetro Group Limited, a company incorporated in the BVI and is wholly-owned by You Susheng ( ), whose principal business is investment holding. Grandmetro and You Susheng ( ), whose principal business is investment holding. Grandmetro and You Susheng ( ) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online ) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online |

| |

| “HK$” | | Hong Kong dollars |

| |

| “Main Board Listing Rules” | | the Rules Governing the Listing of Securities on the Stock Exchange |

| |

| “Mr. Wang” | | Wang Yutian ( ), who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online ), who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online |

| |

| “Ms. Sun” | | Sun Weijing ( ), who holds 50% of the equity interest in Beijing Infomax. Mr. Sun is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online ), who holds 50% of the equity interest in Beijing Infomax. Mr. Sun is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online |

| |

| “PRC” | | the People’s Republic of China |

13

| | |

| “Registration” | | registration of the transfer of equity interest in Beijing Infomax between Ms. Sun and Mr. Wang and the Two Nominees with the competent administration for industry and commerce in the PRC |

| |

| “RMB” | | Renminbi |

| |

| “Sale Shares” | | the entire issued share capital of Gainfirst as at the date of this announcement and as at Completion |

| |

| “Stock Exchange” | | The Stock Exchange of Hong Kong Limited |

| |

| “TOM Group” | | TOM Group Limited, a company incorporated in the Cayman Islands with limited liability and whose shares are listed on the Main Board |

| |

| “TOM Online” | | TOM Online Inc., a company incorporated in the Cayman Islands with limited liability and whose shares are listed on GEM |

| |

| “TOM Online Group” | | TOM Online and its subsidiaries |

| |

| “TOM Online Media” | | TOM Online Media Group Limited, a company incorporated in the BVI, which is a wholly-owned subsidiary of TOM Online and a non wholly-owned subsidiary of TOM Group |

| |

| “TOM WFOE” | | Beijing Lahiji Technology Development Limited (  ), an indirect wholly-owned subsidiary of TOM Online and an indirect non wholly-owned subsidiary of TOM Group ), an indirect wholly-owned subsidiary of TOM Online and an indirect non wholly-owned subsidiary of TOM Group |

| |

| “Two Nominees” | | Zhang Yingnan ( ) and Chang Cheng( ) and Chang Cheng( ), the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of TOM Online Group and not connected persons (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online prior to Completion ), the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of TOM Online Group and not connected persons (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online prior to Completion |

| |

| “US$” | | United States dollars |

| |

| “US GAAP” | | the accounting principles generally accepted in the United States of America |

14

| | |

| “Valuenet” | | Valuenet Holdings Limited, a company incorporated in the BVI and is wholly-owned by Nie Xialing ( ), whose principal business is investment holding. Valuenet and Nie Xialing ( ), whose principal business is investment holding. Valuenet and Nie Xialing ( ) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online ) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online |

| |

| “Vendors” | | Grandmetro and Valuenet |

| |

| “WFOE” | | a wholly foreign owned enterprise to be established by Gainfirst in Beijing, the PRC |

HK$1 = RMB1.03

US$1 = HK$7.8

| | |

| By Order of the Board | | By Order of the Board |

| TOM GROUP LIMITED | | TOM ONLINE INC. |

| Pessy Yu | | Pessy Yu |

| Company Secretary | | Company Secretary |

Hong Kong, 12 June 2006

As at the date hereof, the directors of TOM Group are:

| | | | |

| Executive Directors: | | Non-executive Directors: | | Independent non-executive Directors: |

| Ms. Tommei Tong | | Mr. Frank Sixt (Chairman) | | Mr. Henry Cheong |

| Ms. Angela Mak | | Ms. Debbie Chang | | Ms. Anna Wu |

| | Mrs. Susan Chow | | Mr. James Sha |

| | Mr. Edmond Ip | | |

| | Mrs. Angelina Lee | | |

| | Mr. Wang Lei Lei | | |

As at the date hereof, the directors of TOM Online are:

| | | | |

| Executive Directors: | | Non-executive Directors: | | Independent non-executive Directors: |

| Mr. Wang Lei Lei | | Mr. Frank Sixt (Chairman) | | Mr. Gordon Kwong |

| Mr. Jay Chang | | Ms. Tommei Tong (Vice Chairman) | | Mr. Ma Wei Hua |

| Mr. Peter Schloss | | | | Dr. Lo Ka Shui |

| Ms. Elaine Feng | | Ms. Angela Mak | | |

| Mr. Fan Tai | | | | |

| Mr. Wu Yun | | Alternate Director: | | |

| | Mrs. Susan Chow | | |

| | (Alternate to Mr. Frank Sixt) | | |

15

This announcement, for which the directors of TOM Online collectively and individually accept full responsibility, includes particulars given in compliance with the GEM Listing Rules for the purpose of giving information with regard to TOM Online. The directors of TOM Online, having made all reasonable enquiries, confirm that, to the best of their knowledge and belief: (i) the information contained in this announcement is accurate and complete in all material respects and not misleading; (ii) there are no other matters the omission of which would make any statements in this announcement misleading; and (iii) all opinions expressed in this announcement have been arrived at after due and careful consideration and are founded on bases and assumptions that are fair and reasonable.

This announcement will remain on the GEM website at www.hkgem.com on the “Latest Company Announcements” page for at least 7 days from the date of its posting and on the website of TOM Online at www.tom.com.

* for identification purpose

16

>> and the telecom and information services license <<

>> and the telecom and information services license << >> currently held by Beijing Infomax having been passed;

>> currently held by Beijing Infomax having been passed; (Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of this announcement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively

(Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of this announcement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively ), whose principal business is investment holding. Grandmetro and You Susheng (

), whose principal business is investment holding. Grandmetro and You Susheng ( ) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online

) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online ), who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online

), who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online ), who holds 50% of the equity interest in Beijing Infomax. Mr. Sun is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online

), who holds 50% of the equity interest in Beijing Infomax. Mr. Sun is independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group or TOM Online

), an indirect wholly-owned subsidiary of TOM Online and an indirect non wholly-owned subsidiary of TOM Group

), an indirect wholly-owned subsidiary of TOM Online and an indirect non wholly-owned subsidiary of TOM Group ) and Chang Cheng(

) and Chang Cheng( ), the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of TOM Online Group and not connected persons (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online prior to Completion

), the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of TOM Online Group and not connected persons (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online prior to Completion ), whose principal business is investment holding. Valuenet and Nie Xialing (

), whose principal business is investment holding. Valuenet and Nie Xialing ( ) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online

) are independent of and not connected with any of the directors, chief executives, substantial shareholders or management shareholders of TOM Group and TOM Online or any of their respective associates and not a connected person (as defined in the Main Board Listing Rules and the GEM Listing Rules) of TOM Group and TOM Online