G2 Ventures, Inc.

No. 2, Baowang Road, Baodi Economic Development Zone,

Tianjin, PRC 300180

December 23, 2010

John Reynolds

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street NE

Washington, DC 20549

Form 8-K

Filed on October 7, 2010

File: 333-108715

Dear Mr. Reynolds:

This letter responds to certain comments of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) contained in the letter from the Staff to G2 Ventures, Inc. (the “Company”) dated November 5, 2010.

For your convenience, we have included each of the Staff’s comments in italics before each of the Company’s responses. References in this letter to “we,” “our” or “us” mean the Company or its advisors, as the context may require.

Entry into a Material Definitive Agreement, page 5

Staff Comment 1.We note your short descriptions of your VIE agreements on pages five and seven. Please revise to provide a description of all of the material terms of these agreements.

Response:The Company will file an amendment to its Current Report on Form 8-K (the “8-K Amendment”) to enhance its disclosure to describe all of the material terms of the VIE Agreements. SeeExhibit A for the text of the revised disclosure.

Staff Comment 2.We note your disclosure on page six that you entered into the VIE arrangements because “it was not feasible for us to acquire PRC companies for cash pursuant to PRC laws and regulations. . .” Please revise the appropriate places in the current report to clearly describe the regulatory regime that made it more feasible for the Company to use the VIE arrangements instead of cash.

Response:The 8-K Amendment will enhance the Company’s disclosure to describe the regulatory regime that made it more feasible for the Company to use the VIE arrangements. SeeExhibit A for the text of the revised disclosure.

Staff Comment 3.The disclosure on page 5 indicates that the Consulting Services Agreement provides Junhe Consulting with the right to “advise, consult, manage and operate Joway Group.” However, exhibit 10.2 states that Junhe Consulting will provide advice and assistance. Please reconcile the disclosure.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 2

Response:The 8-K Amendment will reconcile the disclosure to the terms of Exhibit 10.2. See our response to Staff Comment 1 above.

Staff Comment 4.Please provide a discussion of the consideration provided to the shareholders of Joway Group for entering into the VIE agreements. In addition, we note that Zhang Jinghe signed these agreements for both parties to the transaction. Please disclose whether Joway Group and Junhe Consulting were under common control at the time these agreements were entered into. Please also provide a more detailed discussion of the reasons for these agreements. We also note that Zhang Jinghe signed the Share Exchange Agreement on behalf of G2 Ventures. Please explain his relationship with G2 Ventures and/or Crystal Globe at or prior to entering into these agreements.

Response:The 8-K Amendment will enhance the Company’s disclosure to include a discussion of the consideration provided to the shareholders of Joway Group and to clarify Zhang Jinghe’s relationship with G2 Ventures and Crystal Globe at or prior to entering into these agreements. See Exhibit A for the text of the revised disclosure.

Staff Comment 5.Please disclose the material terms of the option agreement. We note that the purchase price of the equity interest is equal to the capital paid in by the transferors. Please clarify the amount of capital paid by the shareholders of the Joway Group.

Response:The 8-K Amendment will disclose the material terms of the option agreement. See our response to Staff Comment 1 above. The amount of paid-in capital of Joway Group is RMB 50 million (approximately USD $7.52 million). SeeExhibit A for the text of the revised disclosure.

Staff Comment 6.Please clarify the role of Lionel Even Liu and Crystal Globe Ltd. For example, please clarify whether Mr. Liu and/or Crystal Globe Ltd. were involved with the founding, operation or ownership of the Joway Group or any of its operating subsidiaries, directly or indirectly. Also, please clarify whether Mr. Liu has any role other than as an investor. Lastly, please disclose any relationships, connections or agreements between Crystal Globe and Zhang Jinghe.

Response:The disclosure under the heading Corporate Structure and History shall be revised to clarify Mr. Liu’s and Crystal Globe’s relationship to the Joway Group and its subsidiaries. SeeExhibit A for the text of the revised disclosure.

Corporate Structure and History, page 6

Staff Comment 7.Please provide a clear discussion of the various transactions in your corporate history, including a discussion of the relationships between the entities at the time of the transactions.

Response: See our response to Staff Comment 6 above.

Staff Comment 8.Please revise to disclose the July 9, 2010, July 25, 2010, and July 28, 2010 transactions where the Joway Group purchased minority interests of Joway Decoration, Joway Technology, and Shengtang Trading from Chen Jingyun and Wang Aiying, as described on pages F-6 and

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 3

F-7 of your fiscal year end financial statements. Also, please clarify the role of Chen Jingyum and Wang Aiying as to the Company or its subsidiaries. We note that you lease property from Mr. Aiying according to Exhibit 10.9. Further, please file the agreements related to these stock purchases as exhibits, pursuant to Item 601 of Regulation S-K.

Response:We will file the agreements pursuant to which the Joway Group acquired the minority interests of Joway Decoration, Joway Technology, and Shengtang Trading. Jingyun Chen is General Manager and Executive Director of Joway Technology and Joway Decoration. Aiying Wang currently is not in any significant role in the Company nor its subsidiaries, but a staff member of Shengtang Trading.

Staff Comment 9.Please provide the basis for your belief on page seven that the terms of the VIE Agreements are no less favorable than what could be obtained from third parties or remove. It appears that these transactions were all related party transactions.

Response:As these transactions were related-party transactions, the Company will remove the statement that the terms of the VIE Agreements are no less favorable than what could be obtained from third parties.

Staff Comment 10.We note the statement that PRC counsel believes that your conduct of business through these agreements complies with existing PRC laws, rules and regulations. Please provide the consent of counsel for this statement. Also, clarify whether counsel provided you with an opinion. If so, please file as an exhibit.

Response:The Company’s PRC counsel issued an opinion dated October 1, 2010 that opines, among other things, that the consummation of the contractual arrangements set forth in the VIE Agreements will not violate any provision of applicable PRC Law. A copy of the legal opinion will be filed as an exhibit to the 8-K Amendment, together with the consent of counsel.

Staff Comment 11.We note the disclosure on page eight that you received a certificate of approval on September 9, 2010 from the local PRC government regarding the foreign ownership of Junhe Consulting by Dynamic Elite. Please disclose the regulations under which such approval was obtained.

Response:The certificate of approval did not cite the specific regulations under which such approval was granted, however, we believe such approval was granted pursuant to the Law of the People’s Republic of China on Wholly Foreign-Owned Enterprises (adopted April 12, 1986 at the 4th Sess. of the 6th National People’s Congress and as amended on October 31, 2000). We will cite this regulation in the 8-K Amendment.

Description of Business, page 9

Staff Comment 12.Please provide us supplementally with copies of the sources cited throughout the business section, including the Niwa Institute for Immunology study referred to on page nine. In addition, we note that the courses cited discuss the tourmaline gemstone; however, we note that you purchase liquid tourmaline for use in your product. Please clarify whether there are any studies relating to the benefits of liquid tourmaline.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 4

Response:We will provide the SEC supplementally with copies of sources cited for the benefits of tourmaline.

Staff Comment 13.Please clarify whether you have a website. If so, please provide the web address.

Response:The Company is in the process of constructing a new company website, and we will provide that in SEC filings when it is completed.

Staff Comment 14.In addition, we note that one of your principal suppliers has a website where it refers to itself as Joway Group. See,http://en.joway.cn/page/html/index.php. Please disclose all material connections between the two companies and discuss any confusion that may be created due to both companies using the name “Joway Group.”

Response:This URL belongs to the Company and used to be the Company’s website. However, it has been abandoned since the Company is currently constructing a new Company website. See Answer to Staff Comment 13 above.

Staff Comment 15.We note your disclosure on page 9 regarding the specific benefits of tourmaline and that tourmaline has “powerful health benefits.” Please revise to provide the basis for these statements. For example, please indicate whether any scientific studies have been performed concerning the health benefits of tourmaline or would otherwise support these health claims. We note other claims made elsewhere in this section. Please provide the basis for those statements. We may have further comment.

Response: See our response to Staff Comment 12 above.

Staff Comment 16.We note the Percentage of Sales column for your “Top Ten Customers in 2008” table on page 13. Some of the percentages do not appear to be accurate. Please revise accordingly.

Response:We have revised our disclosure in the 8-K amendment to correct this table. A copy of our revised disclosure is set forth inExhibit B.

Staff Comment 17.We note the disclosure on page 16 that approximately 72% of sales were made through franchise stores. Please disclose that material terms of the franchise arrangements and file that standard franchise agreement as an exhibit.

Response:We will file the standard franchise agreement as an exhibit to the 8-K Amendment. In addition, we will revise our disclosure in the 8-K Amendment to disclose the material terms of our franchise agreements as follows:

The Company enters into franchising agreements to develop retail outlets for the Company's products. The agreements provide that franchisees will sell Company products exclusively. In exchange the Company provides them with geographic exclusivity, discounted product, training and support. The agreements also require franchisees to adhere to certain standards of product merchandising, promotion and presentment. The agreements also require franchisees to charge certain minimum sales prices, and prohibit them from selling competitor’s products. The agreements do not require any initial franchise fees from the franchisees, nor do they require the franchisees to pay continuing royalties. The agreements do

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 5

not require the franchisees to purchase any minimum levels of product, but do require that they make at least one purchase during each year. The Company does not act to manage the franchisees’ levels of product. Franchisees hold periodic conferences, assisted by the Company’s marketing department, to promote product awareness and the introduction of new products. The franchising agreements are generally for terms of three years and are renewable at the mutual agreement of both parties. The franchising agreements are cancelable at the Company’s discretion if franchisees violate the terms of the agreements.

Staff Comment 18.We note your discussion regarding China’s “Eleventh Five-Year Plan (2006-2010)” concerning China’s efforts to support the PRC healthcare industry. Please clarify the relevance of this disclosure, including whether any of these initiatives would involve the purchasing or subsidizing the use of tourmaline healthcare products. It is unclear whether your products are used, endorsed, or supported by the traditional healthcare industry, such as hospitals, medical doctors, research centers, etc. If not, then please remove this disclosure or revise to provide a more focused discussion of the industry relating to your health products.

Response:We will revise our disclosure in the 8-K Amendment to remove this discussion.

Staff Comment 19.Please clarify whether your marketing efforts, and those of your franchisees, are directed directly towards the end user, or intermediaries like healthcare professionals like doctors, hospitals, or other healthcare facilities.

Response:We will revise our disclosure in the 8-K Amendment to clarify the focus of our marketing efforts as follows:

Our primary marketing strategies are directed towards both our franchisees and end users, and the marketing efforts of our franchisees are directed towards end users. The Company assists franchisees on monthly product introduction seminars, which are open to both our franchisees and to the general public. We also host an annual conference, which is open to both our franchisees and to the general public. For example, in 2009, in connection with our annual conference we sponsoredan episode of Our Chinese Heart, a well-known international original Chinese song concert series hosted by China Central Television, which was broadcasted internationally.

Staff Comment 20.Please provide the basis for your belief that you are one of the first few Chinese tourmaline health product companies who possess leading tourmaline particle attachment technology or remove.

Response:We will revise our disclosure in the 8-K Amendment to remove this statement.

Staff Comment 21.Please clarify your competitive position in your industry, as required by Item 101(h)(4)(iv) of Regulation S-K.

Response:We will revise our disclosure in the 8-K Amendment to clarify the Company’s competitive position in the industry.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 6

Staff Comment 22.Please revise to clarify how the State Food and Drug Administration regulates tourmaline related healthcare products and whether any of your products require approval before you can sell your products. Provide the disclosure required by Items 101(h)(4)(viii) and (xi) of Regulation S-K.

Response:The PRC State Food and Drug Administration is responsible for (i) regulating the research and development, manufacturing, distribution and utilization of drugs; (ii) supervising and coordinating the safety management of food, health food and cosmetics; and (iii) investigating serious accidents with respect to the foregoing. The products we manufacture are not regulated by the SFDA as they are not drugs, diet supplements or food consumed by humans. There are no existing laws or regulations in China governing the manufacture and sale of tourmaline health care products such as those sold by the Company nor are there any inspection requirements applicable to our products.

We act as a distributor for two products—Xin-Nao-Ling Fish Oil Soft GelandZhi-Li-Bao Fish Oil Soft Gel, which are subject to SFDA regulation. These two products are manufactured by Penglai Huakang Healthcare Industries, Ltd. which has obtained the necessary manufacturing licenses and certifications from the SFDA.

Staff Comment 23.Please discuss the costs and effects of compliance with environmental laws, as required by Item 101(h)(4)(xi) of Regulation S-K.

Response:The major environmental regulations applicable to the Company’s PRC operations are the PRC Environmental Protection Law, the PRC Law on the Prevention and Control of Water Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Air Pollution and its Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste Pollution, and the PRC Law on the Prevention and Control of Noise Pollution. To date the cost and effect on the Company to comply with these environmental laws have been minimal. We have obtained ISO 14001 International Environmental Management System Certification.

Risk Factors, page 29

We note that you conduct substantially all of your operations outside of the United States. In order to enhance our understanding of how you prepare your financial statements and assess your internal control over financial reporting, we ask that you provide us with information that will help us answer the following questions:

How do you maintain your books and records and prepare your financial statements?

Staff Comment 24.If you maintain your books and records in accordance with U.S. GAAP, describe the controls you maintain to ensure that the activities you conduct and the transactions you consummate are recorded in accordance with U.S. GAAP.

Response:The Company maintains its books and records in accordance with PRC GAAP. See our response to Staff Comment 25 below.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 7

Staff Comment 25.If you do not maintain your books and records in accordance with U.S. GAAP, tell us what basis of accounting you use and describe the process you go through to convert your books and records to U.S. GAAP for SEC reporting. Describe the controls you maintain to ensure that you have made all necessary and appropriate adjustments in your conversions and disclosures.

Response:Under PRC law, our operating companies in China are required to maintain their books and records in accordance with PRC GAAP.

We do not retain an outside accounting firm or consultant to prepare our financial statements or to evaluate our internal controls over financial reporting. Our CFO is responsible for supervising the preparation of our financial statements under PRC GAAP and for reviewing such financial statements to ensure their accuracy and completeness. In addition, he is responsible for reviewing the adjustments made to the financial statements to convert them into U.S. GAAP for SEC reporting requirements. Our CFO and CEO are responsible for evaluating the effectiveness of our internal controls over financial reporting.

Our Chief Financial Officer is a PRC certified public accountant, and is knowledgeable in both U.S. GAAP and PRC GAAP. In addition, between September 2005 and August 2009, our CFO was employed as a senior financial manager in the financial department of Tiens Biotech, Inc., a U.S. listed company, where he assisted in the preparation of financial statements and the conversion of the financial statements prepared under PRC GAAP into U.S. GAAP.

Finally, after our Chief Financial Officer has reviewed the converted financial statements, Sherb &Co, our independent auditor reviews them for compliance with U.S. GAAP and SEC reporting requirements.

Staff Comment 26.We would like to understand more about the background of the people who are primarily responsible for preparing and supervising the preparation of your financial statements and evaluating the effectiveness of your internal control over financial reporting and their knowledge of U.S. GAAP and SEC rules and regulations. Do not identify people by name, but for each person, please tell us:

| | a) | What role he or she takes in preparing your financial statements and evaluating the effectiveness of your internal control; |

| | b) | What relevant education and ongoing training he or she had related to U.S. GAAP; |

| | c) | The nature of his or her contractual or other relationship to you; |

| | d) | Whether he or she holds and maintains any professional designations such as Certified Public Accountant (U.S.) or Certified Management Accountant; and |

| | e) | About his or her professional experience, including experience in preparing and/or auditing financial statements prepared in accordance with U.S. GAAP and evaluating effectiveness of internal control over financial reporting. |

Response: See our Response to Staff Comment 24 above.

Staff Comment 27.If you retain an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, please tell us:

| | a) | The name and address of the accounting firm or organization; |

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 8

| | b) | The qualifications of their employees who perform the services for your company; |

| | c) | How and why they are qualified to prepare your financial statements or evaluate your internal control over financial reporting; |

| | d) | How many hours they spent last year performing these services for your; and |

| | e) | The total amount of fees you paid to each accounting firm or organization in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Response: See our Response to Staff Comment 24 above.

Staff Comment 28.If you retain individuals who are not your employees and are not employed by an accounting firm or other similar organization to prepare your financial statements or evaluate your internal control over financial reporting, do not provide us with their names, but please tell us:

| | a) | Why you believe they are qualified to prepare your financial statements or evaluate your internal control over financial reporting; |

| | b) | How many hours they spent last year performing these services for you; and |

| | c) | The total amount of fees you paid to each individual in connection with the preparation of your financial statements and in connection with the evaluation of internal control over financial reporting for the most recent fiscal year end. |

Response: See our Response to Staff Comment 24 above.

Staff Comment 29.We note based on your disclosure on page 56 that you have not established an audit committee. Please describe the extent of the Board of Directors’ knowledge of U.S. GAAP and internal control over financial reporting.

Response:As of the date of this response, our Board of Directors consists of a sole director whose experience in U.S. GAAP and SEC reporting requirements is limited. We are in the process of establishing an audit committee. However, as we described above, our Chief Financial Officer is knowledgeable and experienced in U.S. GAAP and financial reporting requirements applied to a U.S. public company with four years’ experience working as a senior financial manager in an AMEX listed company.

Management’s Discussion and Analysis and Plan of Operation, page 42

Staff Comment 30.The Management’s Discussion and Analysis section is one of the most critical aspects of your disclosure. As such, we request that you revise this section to provide a more detailed executive overview to discuss the events, trends, and uncertainties that management views as most critical to your future revenues, financial position, liquidity, plan of operations, and results of operations, to the extent known and foreseeable. To assist you in this regard, please refer to the Commission Guidance Regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations. Release Nos. 33-8350 (December 19, 2003) athttp://www.sec.gov/rules/interp/33-8350.htm. This guidance is intended to elicit more meaningful disclosure in MD&A in a number of areas, including the overall presentation and focus of MD&A, with general emphasis on the discussion and analysis of known trends, demands, commitments, events and uncertainties, and specific guidance on disclosures about liquidity, capital resources, and critical accounting.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 9

Response: We will revise our MD&A disclosure in the 8-K Amendment to provide a more detailed executive overview as set forth in Exhibit C.

Staff Comment 31.Please provide a more detailed analysis as to the reasons for the changes in the financial statement results for each period being compared and quantify if available.

Response:We will revise our disclosure in the 8-K Amendment to provide a more detailed analysis as to the reasons for the changes in our financial statement results for each period being compared, including quantifying the changes, if available. See our response to Staff Comment 30 above.

Results of Operations, page 42

Staff Comment 32.Please revise the analysis of your operating results for each period to describe and quantify underlying material activities that generated income statement variances between periods. For example, provide additional detail explaining the change in revenues related to the increase in the number of products sold compared to changes in product pricing. Your revised disclosure should also provide additional detail explaining the relationship between your financial statement line items such as the variances in costs of goods sold and gross profit as a percentage of revenues. Please ensure to separately quantify the effect of each causal factor you cite as an underlying reason for material changes in your financial statement amounts.

Response:We will revise our disclosure in the 8-K Amendment to describe and quantify underlying material activities that generated income statement variances between periods. See our response to Staff Comment 30 above.

Staff Comment 33.In connection with the preceding comment, please revise the disclosure explaining your operating results to provide additional information regarding changes along segmental lines. For example, your revised disclosure should provide sufficient detail for an investor to understand the factors which resulted in the increase in revenue for your Healthcare Knitgoods segment during the six month period ended June 30, 2010.

Response:We will revise our disclosure in the 8-K Amendment to provide additional information regarding changes along segmental lines. See our response to Staff Comment 30 above.

Liquidity and Capital Resources, page 46

General

Staff Comment 34.Please revise your disclosures to include a more detailed analysis of the components of your statements of cash flows (i.e., operating, investing, and financing activities) that explains the significant year-to-year variations in the line items and the resulting impact on your capital position in each period for which financial statements are provided. For example, please explain the change in inventory during the six months ended June 30, 2010 with a focus on management’s assessment of the increase in finished goods.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 10

Response:We will revise our disclosure in the 8-K Amendment to include a more detailed analysis of the components of our statements of cash flows, including an explanation of the significant year-to-year variations in the line items and the resulting impact on our capital position in each period for which financial statements are provided. See our response to Staff Comment 30 above.

Staff Comment 35.Please revise this section to clarify whether further loans from Mr. Jinghe Zhang, pursuant to the loan agreements at Exhibits 10.7 and 10.8, are at his discretion. Further, please revise to clarify whether Mr. Zhang could demand repayment at any time. Your discussion should address whether the Company has sufficient liquidity in the next 12 months should Mr. Zhang demand immediate repayment and no longer wishes to provide future loans to the Company or any of its operating units.

Response:We will revise this section to clarify whether further loans from Mr. Jinghe Zhang, pursuant to the loan agreements at Exhibits 10.7 and 10.8, are at his discretion. In addition, we will revise this section to clarify whether Mr. Zhang could demand repayment at any time and whether the Company has sufficient liquidity in the next 12 months should Mr. Zhang demand immediate repayment and no longer wish to provide future loans to the Company or any of its operating units. See our response to Staff Comment 30 above.

Staff Comment 36.Please revise to provide a more detailed description of the trust investment product purchased by Si Changlong on the behalf of the Company. Further, please file any agreements between CITIC and Si Changlong as a material exhibits, pursuant to Item 601 of Regulation S-K.

Response:The CITIC trust investment matured in August 2010 and the Company received the cash proceeds consisting of principal and interest in August 2010. Therefore, this investment is no longer in existence.

Directors and Executive Officers, Promoters and Control Persons, page 55

Staff Comment 37.Please disclose the period during which Mr. Zhang has served as a director.

Response:We will revise our disclosure to indicate the period during which Mr. Zhang has served as a director.

Staff Comment 38.On page 55, you indicate that Mr. Jinghe Zhang was the chairman and general manager of Shenyang Joway from January 2005 to May 2007. On page 62, you disclose Mr. Zhang is the control person of Shenyang Joway. Please revise to clarify Mr. Zhang’s current role with Shenyang Joway.

Response: We will revise our disclosure to clarify Mr. Zhang’s current role with Shenyang Joway.

Staff Comment 39.Under Rule 405 of Regulation C, an executive officer of a subsidiary may be an executive officer of a registrant if he or she performs policy making functions. Please revise to clarify whether Yanli Feng, Jingyun Chen, or any other executive officer of a subsidiary would be considered an executive officer. If so, please revise your registration statement accordingly, including the disclosures required by Items 401, 402, and 404 of Regulation S-K. If not, please supplementally provide us with your analysis.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 11

Response:We will revise our disclosure to clarify whether Yanli Feng, Jingyun Chen, or any other executive officer of a subsidiary would be considered an executive officer.

Staff Comment 40.We note that your Code of Ethics for Financial Executives only applies to your “Financial Executives.” Please revise to clarify who is subject to your code of ethics.

Response:We have revised our disclosure to clarify the Financial Executives to whom our Code of Ethics applies.

Executive Compensation, page 59

Staff Comment 41.Please revise the summary compensation table for Mr. Kepler to comply with the requirements set forth in Item 402(n) of Regulation S-K.

Response:We have revised the summary compensation table for Mr. Kepler to comply with the requirements set forth in Item 402(n) of Regulation S-K as follows:

Staff Comment 42.Please revise to clarify that the compensation figures and discussion includes all compensation, including any from Junhe Consulting or Dynamic Elite.

Response:We have revised our disclosure to clarify that the compensation figures and discussion includes all compensation, including any from Junhe Consulting or Dynamic Elite.

Staff Comment 43.We note your disclosure on page 60 that you intend to implement a “comprehensive compensation program,” that “will be comparable to the programs of our peer companies.” Please revise to discuss in greater detail the planned comprehensive compensation program.

Response:At this time, the Company has not established the terms of its compensation program. Therefore, the Company will remove this statement in the 8-K Amendment.

Certain Relationships and Related Transactions, page 62

Staff Comment 44.Please advise us why you have not included descriptions of your VIE agreements in this section, pursuant to Item 404 of Regulation S-K.

Response:We will revise our disclosure to include a cross-reference to the description of the VIE agreements in the Certain Relationships and Related Transactions section of the 8-K Amendment.

Staff Comment 45.Please revise to include the Trademark Licensing Agreement between G2 Ventures and Shenyang Joway, since this entity is affiliated with Mr. Zhang. Also, include disclosure regarding the supply agreements with Shenyang Joway.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 12

Response:We will revise our disclosure to include a description of the Trademark Licensing Agreement between G2 Ventures, entered through its Chinese operation entity Joway Group, and Shenyang Joway.

Staff Comment 46.Please revise to include your prior loans from Mr. Gust Kepler, as described on page 22 of your Form 10-K on March 1, 2010, and when they were repaid.

Response:We will revise our disclosure to include a description of the prior loans from Mr. Gust Kepler and when they were paid.

Staff Comment 47.Please revise to disclose any compensation paid to Mr. Changlong Si for his involvement with the CITIC investment.

Response:No compensation was paid to Mr. Changlong Si in connection with the CITIC investment. We will revise our disclosure to clarify this issue.

Market Price of and Dividends on the Registrants Common Equity and Related Stockholders Matters, page 64

Staff Comment 48.Please provide the disclosure required by Item 201(a) of Regulation S-K.

Response:We will revise our disclosure to provide the disclosure required by Item 201(a) of Regulation S-K.

Description of Securities, page 67

Staff Comment 49.We note your disclosure that “[a]ll of the outstanding shares of common stock are fully paid and nonassessable.” Please remove the statement or attribute such statement to counsel and file the opinion as an exhibit. Such statement is a legal conclusion, which the company is not able to make.

Response:We will amend the disclosure in the 8-K Amendment to remove this statement.

Staff Comment 50.We note your disclosure concerning your dividend and liquidation rights on page 67. The articles of incorporation and bylaws filed with your original Form SB-2 registration statement on September 11, 2003 do not reference these provisions. Please revise to clarify whether your dividend and liquidation provisions, as disclosed, are pursuant to a provision of Texas law or whether you will amend your articles and bylaws to reflect your current business post-revers merger.

Response:We will revise the disclosure to clarify that the dividend and liquidation rights are pursuant to Texas law and not to specific provisions set forth in the Company’s Articles of Incorporation or Bylaws.

Indemnification of Directors and Officers, page 67

Staff Comment 51.Please revise this section to provide disclosure of the general effect of any statutes, charter provisions, bylaws, contract or other arrangements under which any controlling

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 13

persons, director or office of the registrant is insured or indemnified in any manner against liability which he may incur in his capacity as such, as required by Item 792 of Regulation S-K. This discussion should include a description of the indemnification provisions in your governing documents, a description of the relevant sections of the Texas Business Corporation Act, and whether you believe such indemnification provisions cover violation of securities laws.

Response: We will amend our disclosure to add the following:

“Art. 2.02-1 of the Texas Business Corporation Act (TBCA) allows a corporation to indemnify any officer, director, employee or agent who is a party or is threatened to be made a party to a litigation by reason of the fact that he or she is or was an officer, director, employee or agent of the corporation, or is or was serving at the request of the corporation as an officer, director, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys' fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by such director or officer, or only for reasonable expenses actually incurred in connection with the proceeding if the person is found liable on the basis that personal benefit was improperly received by him or is found liable to the corporation, if:

| | • | | there was no breach by the officer, director, employee or agent of his or her fiduciary duties to the corporation involving intentional or willful misconduct; or |

| | • | | the officer, director, employee or agent acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. |

Article Twelve of our Articles of Incorporation provides that the Company shall indemnify and hold harmless directors, officers, employees, and agents of the Company, and may purchase and may maintain liability insurance for such persons, as and to the extent permitted by the TBCA.

Unregistered Sales of Equity Securities, page 67

Staff Comment 52.We note your disclosure that your sale of unregistered securities to Crystal Globe was made “pursuant to Section 4(2) of the Act and/or Regulation D.” Please revise this section to specify which exemption under Regulation D was relied upon. See Item 701(d) of regulation S-K. In addition, we note that no Form D was filed. Please advise.

Response:The sale of unregistered securities to Crystal Globe was made pursuant to Regulation S. We will revise our disclosure in the 8-K Amendment to correct this inaccuracy.

Changes in Registrant’s Certifying Accountant, page 68

Staff Comment 53.It appears that the report issued by your former independent accountant on your two most recent fiscal years’ financial statements (i.e. for the fiscal years ended December 31, 2009 and 2008) included a going concern modification. Please revise your disclosure accordingly. Refer to Item 304(a)(1)(ii) of Regulation S-K.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 14

Response:We will amend our disclosure in the 8-K Amendment to discuss the going concern modification.

Staff Comment 54.Please file an updated letter from your former independent accountant as an Exhibit 16 to your amended Form 8-K. This letter should reflect their agreement or disagreement with the disclosures provided in your amended filing pursuant to Item 304 of Regulation S-K.

Response:We will file an updated letter from Turner Stone & Co., LLP, our former independent accountant, as Exhibit 16 to our amended Form 8-K, reflecting their agreement with the disclosures provided in our amended filing pursuant to Item 304 of Regulation S-K.

Consolidated Financial Statements

Notes to Consolidated Financial Statements

Note 1- Organization, page F-6

Staff Comment 55.It appears that the operations of Tianjin Joway Shengshi Group Co., Ltd. are included for all periods presented in Dynamic Elite’s financial statements yet the contractual agreements with Tianjin Junhe Enterprise Management Consulting Co., Ltd. were not entered into until September 2010. Please revise your disclosure explaining your basis for the financial statement presentation provided in your filing and cite the specific authoritative literature you utilized to support your accounting treatment. We may have additional comments upon our review of your revised disclosure.

Response:The Company has included the financial statements of Tianjin Joway Shengshi Group Co., Ltd. (the “Joway Group”) for all periods presented because Joway Group is the operating company. Accordingly, the financial statements of Joway Group are the financial statements that are meaningful to readers going forward. Dynamic Elite International Limited (“Dynamic Elite”) is a holding company with little or no financial substance of its own. Likewise, Tianjin Junhe Enterprise Management Consulting Co., Ltd (“Management Consulting”), the WFOE subsidiary of Dynamic Elite, was formed to obtain contractual control of the operating entities and has little financial substance of its own.

Dynamic Elite, the ultimate parent of the operating entities, was formed on June 2, 2010. Management Consulting, the entity providing the mechanism for Dynamic Elite to consolidate the operating entities, was formed on September 15, 2010. The contractual agreements through which the control relationship was affected were entered into on September 16, 2010.

The transaction whereby Dynamic Elite obtained control of the operating entities has been accounted for as a reorganization of entities under common control. Under ASC 250, this type of accounting change is classified as a change in reporting entity. ASC 250 requires all historical financial statements to be retrospectively adjusted when there is a change in reporting entity. Generally, this retrospective adjustment is made when financial statements are presented that include the period in which the change occurred.

However, it is our belief that the presentation that is the most meaningful to current readers is the structure that the Company will have going forward. We note that the SEC Division of Corporation

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 15

Finance, Financial Reporting Manual, Section 13400 provides that if a change in the reporting entity occurs after the date of the financial statements but at or after the effectiveness of an initial registration statement, consolidated financial statements may be presented as the primary financial statements. We believe that the Current Report on Form 8-K filed with the SEC in connection with this transaction is analogous to an initial registration statement in that financial statements of the operating entity are being presented for public reliance for the first time. As a result, we believe that the financial statements as filed provide the most relevant presentation to the readers that will shortly be relying on them.

Note 2 - Summary of Significant Accounting Policies

Basis of Consolidation, page F-9

Staff Comment 56.We note that the separate activities of each of the wholly owned subsidiaries of Tianjin Joway Shengshi Group Co., Ltd. May indicate that each of these entities is a business and therefore would not be considered variable interest entities under FASB ASC 810-10-15-17(d). It appears that these entities would be consolidated as they are controlled by contract. Please provide a detailed analysis of the guidance provided in FASB ASC 810-10-15-19 through 810-10-15-22.

Response: The company acknowledges the validity of the Commission’s position, and has performed an analysis to determine if the contractual agreements conform to the conditions for consolidation by contract under ASC 810-10-15. The analysis concludes that the criteria are met and consolidation by contract is the correct accounting. The analysis is attached asExhibit D.

Staff Comment 57.We note from your disclosure on F-6 that a portion of the ownership interests in each of Joway Group’s three subsidiaries (i.e., Liaoning Joway Technology Engineering Co., Ltd., Tianjin Joway Decoration Engineering Co., Ltd., and Tianjin Oriental Shengtang Import & Export Trading Co., Ltd.) were held by third parties unto July 2010. However, it does not appear that non-controlling interest are separately presented in your financial statements for each of the periods preceding your acquisitions of the equity held by the non-controlling interest holders (i.e., each of the financial statements presented in your filing). Please revise or advise. Refer to FASB ASC 810-10-45-15 through 810-10-45-15-21.

Response:The Company has quantified the impact of presenting the minority interests for all periods, and has concluded that they are both quantitatively and qualitatively immaterial. The analysis is attached asExhibit E.

Cash and Cash Equivalents, page F-11

Staff Comment 58.Please revise your policy to clarify, if true, that all amounts presented as cash equivalents per your balance sheet represent highly liquid investments with an original maturity of three months or less. Refer to FASB ASC 230-10-20.

Response:We have revised our disclosure to clarify that the Company’s policy is that highly liquid financial instruments with an original maturity of three months or less are considered to be cash equivalents. The original disclosure erroneously stated six months or less. In fact, the Company had no cash equivalents at any point during the period of the financial statements presented. Accordingly, the Company has revised the description of the cash line in the balance sheet and statement of cash flows to eliminate the reference to cash equivalents.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 16

Revenue Recognition, page F-13

Staff Comment 59.Please revise to describe your revenue-producing activities and the related revenue recognition policies. Please ensure your revised revenue recognition policy discloses how each of the four criteria per SAB Topic 13 specifically applies to each of your revenue streams (i.e., sales to franchise customers, sales to non-franchise customers, etc.).

Response:The Company has revised the disclosure of its revenue recognition policies, as follows:

The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the purchase price is fixed or determinable and collectability is reasonably assured.

With respect to sales of product to both franchisee and non-franchisee customers, the Company prepares product shipments upon the receipt of a customer’s purchase order. Sales prices are based on fixed price lists that are different depending on whether the price list is for a franchisee customer or for non-franchisee customers. The Company recognizes revenue when the product is shipped. The Company does not sell product to any customers with a right of return as defined in ASC 605-15-25-4. Sales are presented net of value added tax (VAT).

For Tourmaline Wellness House sales, the Company recognizes revenue under the completed contract method. Customers contact the Company with requests to construct a Wellness House. The Company and the customer enter into a contract, at which time the customer pays a deposit of at least one-half of the sales price. A contract is considered complete when all significant costs have been incurred and the project has been accepted by the customer. The contracts have a place for the customer to sign indicating their acceptance of the completed Wellness House. At this time the customer will also pay any remaining balance on the contract. The Company recognizes the full contract revenue at this point. Contract costs consist primarily of materials and labor costs. The construction period of a Wellness House generally does not exceed five days.

Staff Comment 60.It appears that your disclosure stating that you do not offer your customers the right of return is not consistent with the disclosure per page 12 of your filing which states that you accept returns of defective products. Please revise to provide consistent disclosure regarding your return policy. Your revised disclosure should also provide your consideration of the guidance per FASB ASC 605-15-25-1 through 605-15-25-4.

Response:The Company does not give customers the type of right-of-return defined in ASC 605-15-25-4. The disclosure on page 12 was simply referring to the Company’s normal commercial practice of allowing for the return of goods that do not conform to the customer’s order due to some occasional error in packaging or shipment. This is not the type of return to which ASC 605-15-25-1 to 4 is directed, as stated at ASC 605-15-25-1.f.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 17

Staff Comment 61.We note that your wellness house products carry a one-year warranty. Please revise to disclose the accounting policy for your warranty obligations. Refer to FASB ASC 460-10-25-5 through FASB ASC 460-10-25-7.

Response:The costs incurred by the Company with respect to this warranty provision have historically been immaterial, and the Company does not expect that they will be material in the future. The Company has quantified these costs for each of the periods presented, and in no period did such costs exceed $9,000.

Note 10 - Income Taxes, page F-21

Staff Comment 62.Please revise to provide the income tax disclosures required for public entities by FASB ASC 740-10-50.

Response:The Company has revised its disclosure to provide the income tax disclosures required by ASC 740-10-50. Please see the income tax disclosures set forth in attachedExhibit F. The Company will comply with the disclosure requirements of ASC 740-10-50 in all future filings.

Note 14 - Franchise Revenues, page F-23

Staff Comment 63.Please revise to provide additional detail regarding the typical arrangements with your franchise agreements. For example, please disclose whether your franchisees are required to purchase a set amount of inventory and explain your involvement in managing inventory levels for your franchisees.

Response:The Company has expanded the disclosure of the franchise arrangements in Footnote 14 to add additional information concerning these arrangements. The revised disclosure is as follows:

The Company enters into franchising agreements to develop retail outlets for the Company's products. The agreements provide that franchisees will sell Company products exclusively. In exchange the Company provides them with geographic exclusivity, discounted product, training and support. The agreements also require franchisees to adhere to certain standards of product merchandising, promotion and presentment. The agreements also require franchisees to charge certain minimum sales prices, and prohibit them from selling competitor’s products. The agreements do not require any initial franchise fees from the franchisees, nor do they require the franchisees to pay continuing royalties. The agreements do not require the franchisees to purchase any minimum levels of product, but do require that they make at least one purchase during each year. The Company does not act to manage the franchisees’ levels of product. Franchisees hold periodic conferences, assisted by the Company’s marketing department, to promote product awareness and the introduction of new products. The franchising agreements are generally for terms of three years and are renewable at the mutual agreement of both parties. The franchising agreements are cancelable at the Company’s discretion if franchisees violate the terms of the agreements.

John Reynolds

Assistant Director

Securities and Exchange Commission

December , 2010

Page 18

Exhibits

Staff Comment 64.Exhibits 10.11, 10.12, and 10.13 do not appear to be completed documents, as certain terms are missing. Please revise to file the complete documents. Also, please confirm that these are the only agreements with your suppliers that accounted for more than 10% of your revenues.

Response:Exhibits 10.11, 10.12 and 10.13 as filed are complete documents. We hereby confirm that these are the only agreements with suppliers that accounted for more than 10% of our revenues.

We urge all persons who are responsible for the accuracy and adequacy of the disclosure in the filing to be certain that the filing includes the information the Securities Exchange Act of 1934 and all applicable Securities Act rules require. Since the company and its management are in possession of all facts relating to a company’s disclosure, they are responsible for the accuracy and adequacy of the disclosures they have made.

| | | | |

| | | | Sincerely, |

| | |

| | | | /s/ Jinghe Zhang |

| | | | Jinghe Zhang |

| | | | Chief Executive Officer |

| |

| Enclosures | | |

| CC: | | Alisande Rozynko | | |

| | The Crone Law Group | | |

EXHIBIT A

CORPORATE STRUCTURE AND HISTORY

Corporate History

G2 Ventures, Inc.

We were originally formed as a Texas corporation on March 21, 2003 to acquire most of the assets and certain liabilities of and succeed to the business of G2 Companies, Inc., (formerly Hartland Investment, Inc.), as an independent recording company and artist management company. The acquisition of G2 Companies, Inc. was consummated on April 1, 2003.

On May 13, 2008, through a registered offering, we sold 1,284,574 shares of our common stock raising an aggregate of $128,457, before costs of the Offering. Our common stock began trading on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “GTVI” on September 11, 2009.

Prior to the Share Exchange Transaction, we were a development stage music recording, production and artist management company that had limited operations, primarily due to our inability to raise sufficient capital.

PRC Operating Entities

Joway Group. On May 17, 2007, Jinghe Zhang, Si Lijun and Song Baogang founded Tianjin Joway Textile Co., Ltd. as a limited liability company under the laws of the PRC. On November 24, 2009, the company changed its name to Tianjin Joway Shengshi Group Co., Ltd. (“Joway Group”). The registered capital of the Joway Group is RMB 50,000,000 and its term of operation will expire on May 16, 2022. Mr. Jinghe Zhang is the Executive Director and General Manager of Joway Group. On July 1, 2010, Si Lijun transferred 4% of the equity interest in Joway Group to Jinghe Zhang. As a result, Mr. Zhang owns 99% of the equity interest in Joway Group. Baogang Song owns the remaining 1% of the equity interest of Joway Group. Joway Group owns 100% equity interest in each of Joway Technology, Joway Decoration, and Shengtang Trading.

Joway Technology. Joway Technology was incorporated under the laws of the PRC on March 28, 2007, with a registered capital of RMB 1,100,000. Its term of operation expires on March 27, 2017. It was formed to engage in intelligent engineering design and construction, development and sales of electronics, water filters, and other similar products. Prior to July 25, 2010, Joway Group held 90.91% of Joway Technology. On July 25, 2010 the Joway Group acquired the remaining 9.09% of Joway Technology from Chen Jingyun.

Joway Decoration. Joway Decoration was incorporated by Joway Group under the PRC laws on April 22, 2009, with a registered capital of RMB 2,000,000. Its term of operation expires on April 21, 2019. It was formed to engage in the business of intelligent electric heating project design and construction, development and sales of electronics technology and water filters, and the manufacture and sales of wood products. Prior to July 9, 2010, the Joway Group owned 90% of Joway Decoration. On July 9, 2010, the Joway Group entered into a share acquisition agreement with Chen Jingyun to acquire the remaining 10% of the shares of Joway Decoration.

Shengtang Trading. Shengtang Trading was incorporated by Joway Group under the PRC laws on September 18, 2009, with a registered capital of RMB 2,000,000. Its term of operation expires on September 17, 2029. It was formed to engage in the business of the import and export of merchandise and technology; knitwear, biochemistry (excluding toxic chemicals and drugs), and wholesale and retail sale of hardware. Prior to July 28, 2010, the Joway Group owned 95% of Shengtang. On July 28, 2010, the Joway Group entered into a share acquisition agreement with Wang Aiying to acquire the remaining 5% of the shares of Shengtang.

Jingyun Chen is currently a General Manager of Joway Technology and Joway Decoration. Aiying Wang currently is an employee of Joway Group but does not hold any management position.

Reorganization of PRC Entities; Variable Interest Entity Arrangement

In 2010, the shareholders of the Joway Group determined to reorganize the Joway Group with the ultimate goal of consummating a reverse merger with a U.S. publicly traded company. To this end, on June 2, 2010, at the request of Mr. Zhang, Mr. Lionel Even Liu founded Dynamic Elite International Limited, a limited liability company organized under the laws of the British Virgin Islands and on September 15, 2010, established a wholly-owned subsidiary of Dynamic Elite — Tianjin Junhe Management Consulting Co., Ltd. (“Junhe Consulting”), as a wholly foreign owned entity (WOFE) under the laws of the PRC for the purposes of acquiring the Joway Group and engaging in the manufacture and distribution of tourmaline products in China. On September 9, 2010, the local PRC government issued a certificate of approval pursuant to the Law of the People’s Republic of China on Wholly Foreign-Owned Enterprises (adopted April 12, 1986 at the 4th Sess. of the 6th National People’s Congress and as amended on October 31,

2000) approving the foreign ownership of Junhe Consulting by Dynamic Elite. Jinghe Zhang was appointed as the Executive Director of Junhe Consulting. Lionel Even Liu is a businessman and a friend of Mr. Zhang. In addition, Mr. Liu founded Crystal Globe Limited, a BVI company to hold 100% of the shares of Dynamic Elite.

PRC law, however, requires that in an acquisition of a PRC company by a non-PRC investor, the purchase price paid by the foreign investors for the PRC company be based on the appraised value of the equity interest or assets to be sold and must be paid in cash, except for transactions involving public companies listed on senior stock exchanges.

Dynamic Elite did not have sufficient cash to pay the appraised value of the equity interest or assets of the Joway Group. Alternatively, the shareholders of the Joway Group and Dynamic Elite determined to enter into a series of contractual agreements which would enable Dynamic Elite to gain control of the Joway Group and consolidate into its financial statements the results, assets and liabilities of Joway Group and its subsidiaries without triggering the regulatory requirements of PRC law.

As a result, on September 16, 2010, Dynamic Elite through its wholly-owned subsidiary Junhe Consulting entered into a series of agreements with the Joway Group and its shareholders (the “VIE Agreements”). On September 16, 2010, the date of the VIE Agreements, Zhang Jinghe was the controlling shareholder of the Joway Group and the executive director of Junhe Consulting. As a result, the Joway Group and Junhe Consulting were under the common control of Zhang Jinghe who signed the following agreements on behalf of both parties:

| | • | | a Consulting Services Agreement; |

| | • | | an Operating Agreement; |

| | • | | a Voting Rights Proxy Agreement; |

| | • | | an Option Agreement; and |

| | • | | an Equity Pledge Agreement. |

Consulting Agreement

Under the Consulting Agreement, Joway Group retained Junhe Consulting to (i) provide general advice and assistance relating to the management and operation of Joway Group’s business; (ii) provide general advice and assistance with respect to employment and staffing issues, including recruiting and training of management personnel, administrative personnel and other staff, establishing an efficient payroll management system, and relocation assistance; (iii) provide business development advice and assistance; and (iv) such other advice and assistance as may be agreed upon by the parties. In return, Joway Group agreed to pay Junhe Consulting quarterly a consulting fee in an amount equal to all of Joway Group’s net income for that quarter within fifteen (15) days after receipt of Joway Group’s quarterly financial statements. Joway Group shall cause the owners of Joway Group to pledge their equity interests in Joway Group to Junhe Consulting to secure the payment of the foregoing consulting fee.

Joway Group is subject to a number of covenants typical for this type of transaction, including the obligation to provide monthly, quarterly and annual reports, and other information requested by Junhe Consulting. In addition, Joway Group is subject to a number of negative covenants, including the agreement that it will not (i) issue, purchase or redeem any equity or debt, or equity or debt securities, (ii) create, incur, assume or suffer to exist any liens upon any of its property or assets (except certain enumerated liens), (iii) wind up, liquidate or dissolve its affairs or enter into any transaction of merger or consolidation, or sale of all or substantially all of its assets; (iv) declare or pay any dividends, (v) incur, assume or suffer to exist any indebtedness, (other than certain enumerated exceptions); (vi) lend money or credit or make advances to any Person, or purchase or acquire any stock, obligations or securities of, or any other interest in, or make any capital contribution to, any other Person, except receivables in the ordinary course of business; (vii) enter into any transaction or series of related transactions, whether or not in the ordinary course of business, with any of its affiliates or related parties, other than on terms and conditions substantially as favorable to Joway Group as would be obtainable in a comparable arm’s-length transaction; (viii) make any expenditure for fixed or capital assets (including, without limitation, expenditures for maintenance and repairs which are capitalized in accordance with generally accepted accounting principles in the PRC and capitalized lease obligations) during any quarterly period which exceeds the aggregate the amount contained in the budget; (ix) amend or modify or change its Articles of Association or business license, or any agreement entered into by it, with respect to its capital stock, or enter into any new agreement with respect to its capital stock; or (x) engage (directly or indirectly) in any business other than those types of business prescribed within the business scope of its business license.

The Consulting Agreement may be terminated by Junhe Consulting for any reason at any time. In addition, the Consulting Agreement may be terminated by Junhe Consulting by written notice in the event of a material breach by Joway Group which, in the case of breach of a non-financial obligation, has not been remedied within fourteen (14) days following the receipt of such written notice. Either party may terminate the Consulting Agreement by written notice to the other party if (i) the other party becomes bankrupt or

insolvent or is the subject of proceedings or arrangements for liquidation or dissolution or ceases to carry on business or becomes unable to pay its debts as they become due; (ii) if the operations of Junhe Consulting are terminated; or (iii) if circumstances arise which materially and adversely affect the performance or the objectives of the Consulting Agreement.

Operating Agreement

Under the Operating Agreement, Junhe Consulting agreed to guarantee Joway Group’s performance of contracts, agreements or transactions with third parties in consideration for the pledge by Joway Group to Junhe Consulting of all of Joway Group’s assets. In addition, Joway Group and its shareholders agreed that Joway Group would not, without the prior written consent of Junhe Consulting, enter into any transactions which may materially affect the assets, obligations, rights or the operations of Joway Group (excluding transactions entered into in the ordinary course of business and the lien obtained by relevant counter parties due to such agreements), including transactions involving (i) the borrowing of money or assumption of any debt; (ii) the sale or purchase from any third party any asset or right, including, but not limited to, any intellectual property rights; (iii) the provision of any guarantees to any third parties using its assets or intellectual property rights; or (iv) the assignment of any business agreements to any third party. Joway Group and its shareholders also agreed to appoint to the Joway Group’s board of directors, and Joway Group’s General Manager, Chief Financial Officer, and other senior officers those persons recommended or selected by Junhe Consulting.

Voting Rights Proxy Agreement

Under the Proxy Agreement, the Shareholders irrevocably granted to Junhe Consulting, for the maximum period of time permitted by law, all of their voting rights as shareholders of Joway Group. In addition, the Shareholders agreed not to transfer their equity interest in Joway Group to any third party (other than Junhe Consulting or a designee of Junhe Consulting). The Proxy Agreement may not be terminated without the unanimous consent of all Parties, except Junhe Consulting, which may terminate the Proxy Agreement with or without cause on thirty (30) days prior written notice.

Option Agreement

Under the Option Agreement, the Shareholders irrevocably granted to Junhe Consulting or its designee an exclusive option to purchase at any time, to the extent permitted under PRC Law, all or a portion of the Shareholders’ Equity Interest in Joway Group for a price equal to the capital paid in by the Shareholders on a pro rata basis in accordance with the percentage of the Shareholders’ Equity Interest acquired, subject to applicable PRC laws and regulations.

Equity Pledge Agreement

Under the Equity Pledge Agreement, the Shareholders pledged all of their right, title and interest in their equity interests in Joway Group to Junhe Consulting to guarantee Joway Group’s performance of its obligations under the Consulting Services Agreement. The pledge expires two (2) years after the satisfaction by Joway Group of all of its obligations under the Consulting Services Agreement. During the term of the Equity Pledge Agreement, Junhe Consulting is entitled to vote, control, sell, or dispose of the Pledged Collateral in the event the Company does not perform its obligations under the Consulting Services Agreement. In addition, Junhe Consulting is entitled to collect any and all dividends declared or paid in connection with the Pledged Collateral.

The description of the VIE Agreements contained in this Current Report on Form 8-K/A is qualified in its entirety by reference to the complete text of the VIE Agreements, copies of which are filed as Exhibits 10.2, 10.3, 10.4, 10.5, and 10.6 to the Company’s Current Report on Form 8-K filed with the SEC on October 7, 2010, each of which is incorporated herein by reference.

Through these contractual arrangements, we have the ability to substantially influence the daily operations and financial affairs of Joway Group and to receive, through our subsidiaries, all of its profits. As a result, we are considered the primary beneficiary of Joway Group and its operations, and Joway Group and its subsidiaries are deemed to be our variable interest entities. Accordingly, we are able to consolidate into our financial statements the results, assets and liabilities of Joway Group and its subsidiaries.

Call Option Agreement

As part of the reorganization of the Joway Group, Mr. Liu and the shareholders of the Joway Group entered into a Call Option Agreement, pursuant to which the shareholders of the Joway Group have the right to purchase up to 100% of the shares of Crystal Globe at an aggregate price equal of $20,000 over the next three years. In addition, the Option Agreement also provides that Mr. Liu shall not dispose any of the shares of Crystal Globe without consent of Mr. Zhang and Mr. Song. Upon the consummation of the Share Exchange Transaction, Crystal Globe became the principal shareholder of G2 Ventures, Inc. and Mr. Zhang and Mr. Song became indirect beneficial owners of the shares in G2 Ventures held by Crystal Globe pursuant to this Call Option Agreement.

Share Exchange Transaction

On September 28, 2010, Mr. Kepler, the former sole executive officer, director and majority stockholder of G2 Ventures, sold all of his 3,300,000 shares of common stock in G2 Ventures (representing approximately 69% of the issued and outstanding capital stock of G2 Ventures) to Crystal Globe. In connection with the sale, Mr. Kepler resigned as our sole officer and director and appointed Jinghe Zhang as our new President, Chief Executive Officer and sole director and Yuan Huang as our new Chief Financial Officer, Secretary and Treasurer on that date.

On October 1, 2010, G2 Ventures, Dynamic Elite and Crystal Globe, the sole shareholder of Dynamic Elite entered into and consummated a Share Exchange Agreement pursuant to which G2 Ventures issued Crystal Globe 15,215,426 restricted shares of its common stock in exchange for all of the issued and outstanding capital stock of Dynamic Elite. As of result of the Share Exchange Transaction, Crystal Globe holds a total of 18,515,426 shares of our common stock or approximately 92.58% of our total and issued shares of common stock and is our single largest shareholder. On October 1, 2010, the date the Share Exchange Agreement was signed, Zhang Jinghe was the Chief Executive Officer of G2 Ventures and signed the Share Exchange Agreement on behalf of G2 Ventures.

As described above, because of our acquisition of Dynamic Elite, we now control, through Junhe Consulting, the PRC Operating Entities under the VIE Agreements and are now involved in the manufacture and sale of tourmaline-related healthcare products.

In connection with the Share Exchange Transaction, AllbrightLaw Offices, our PRC counsel, opined that the conduct of business through the VIE Agreements is not in violation of existing PRC laws, rules and regulations.

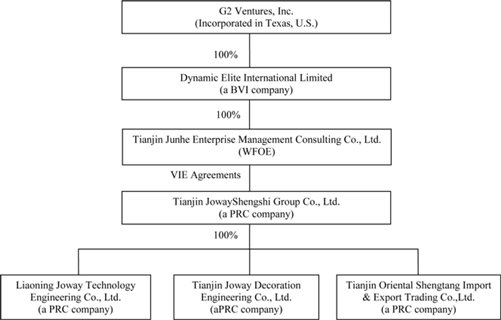

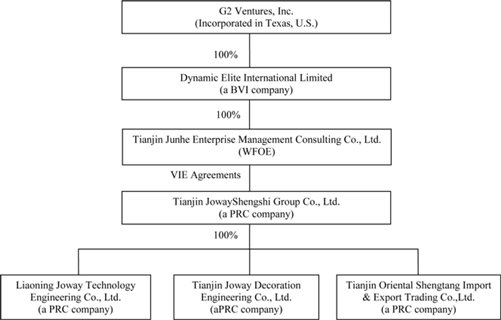

All of our business operations are conducted through our PRC Operating Entities. The chart below sets forth our corporate structure.

EXHIBIT B

| | | | | | | | | | | | | | | | | | |

| Top Ten Customers in 2008 | |

| | | | | |

No. | | Name | | Amount

(RMB) | | | Amount

(US$) | | | Products Sold | | | Percentage

of Sales | |

| 1 | | Shenyang New City Riverside Health Center | | | 270,419 | | | | 39,826 | | | | Wellness House | | | | 9.2 | % |

| 2 | | Chenghong Wei | | | 168,600 | | | | 24,831 | | | | Wellness House | | | | 5.7 | % |

| 3 | | Xiaoyun Zhu | | | 165,000 | | | | 24,300 | | | | Wellness House | | | | 5.6 | % |

| 4 | | Yanmei Feng | | | 165,000 | | | | 24,300 | | | | Wellness House | | | | 5.6 | % |

| 5 | | Youfeng Lu | | | 162,620 | | | | 23,950 | | | | Wellness House | | | | 5.5 | % |

| 6 | | Shenyang Shifa Special Rubber Co., Ltd. | | | 157,000 | | | | 23,122 | | | | Wellness House | | | | 5.3 | % |

| 7 | | Weichun Zhou | | | 156,000 | | | | 22,975 | | | | Wellness House | | | | 5.3 | % |

| 8 | | Lijuan Gu | | | 140,000 | | | | 20,619 | | | | Wellness House | | | | 4.8 | % |

| 9 | | Xudong Wang | | | 137,500 | | | | 20,250 | | | | Wellness House | | | | 4.7 | % |

| 10 | | Runmei Zhang | | | 133,430 | | | | 19,651 | | | | Wellness House | | | | 4.5 | % |

| Total | | | | | 1656,139 | | | | 243,824 | | | | | | | | 56.3 | % |

Note: the exchange rate in the above table is 6.8 while the exchange rate in financial statement is 6.96225.

EXHIBIT C

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following discussion should be read in conjunction with our consolidated financial statements and notes to those consolidated financial statements, included elsewhere in this prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Risk factors” and elsewhere in this prospectus.

FORWARD-LOOKING STATEMENTS:

Certain statements made in this report may constitute “forward-looking statements on our current expectations and projections about future events.” These forward-looking statements involve known or unknown risks, uncertainties and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases you can identify forward-looking statements by some words such as “may,” “should,” “potential,” “continue,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” and similar expressions. These statements are based on our current beliefs, expectations, and assumptions and are subject to a number of risks and uncertainties. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These forward-looking statements are made as of the date of this report, and we assume no obligation to update these forward-looking statements whether as a result of new information, future events, or otherwise, other than as required by law. In light of these assumptions, risks, and uncertainties, the forward-looking events discussed in this report might not occur and actual results and events may vary significantly from those discussed in the forward-looking statements.

Overview

We research, develop, manufacture and market tourmaline products, including healthcare knit goods, daily healthcare and personal care products, and activated water machine and wellness house products. We conduct operations in Tianjin, China and distribute most of our products to more than 200 franchisees in China. Our franchisees, in turn, sell the products to their customers.

All of our operations are conducted through Joway Group and its three subsidiaries, Joway Technology, Joway Decoration and Shengtang Trading. Joway Group engages in manufacturing and distributing tourmaline healthcare knit goods, daily healthcare and personal care products. Joway Technology and Joway Decoration engage in manufacturing and distributing activated water machine and wellness house products. Shengtang Trading engages in purchasing raw materials, which it sells to Joway Group and Joway Decoration.

Prior to 2009, the wellness house and activated water machine segment had been the principal source of our revenue and operating income. In 2007, we began to diversify our business and commenced the construction of our manufacturing center in Baodi, Tianjin for healthcare knit products and daily healthcare and personal care products. We began selling our healthcare knit products and our daily healthcare and personal care products in December 2008.

Beginning in 2009, our healthcare knit products segment became our principal revenue contributing segment. During 2009 and the first half of 2010, revenues from healthcare knit products were $1.7 million, or 55.4% of total revenues and $1.4 million, or 62% of total revenues, respectively. In fiscal 2011 and beyond, we plan to develop more varieties of healthcare knit products and we believe that this segment will continue to be our principal revenue contributing segment in 2011.

In 2009 and the first half of 2010 approximately 16% and 20.6% of our revenue, respectively, were derived from the daily healthcare and personal care products segment. Sales of daily healthcare and personal care products increased gradually, from approximately $247,932 during the last six months of 2009 to approximately $478,320 for the first six months of 2010. We are currently conducting research on the feasibility of a tourmaline diet supplement which we believe could provide significant marketing opportunities for the company if it is successfully developed.

During fiscal 2008 the wellness house and activated water machine segment provided most of the Company’s revenues. This segment contributed 96.5% of revenue during that year. During 2007, in the early stages of the Company’s operations, this was the Company’s only segment. With the Company’s subsequent emphasis on expanding the healthcare knit goods segment and daily healthcare and personal care segment, the percent of revenue derived from the wellness house and activated water machine segment declined to 28.5% and 17.4%, respectively, for the year of 2009 and the first half year of 2010, despite an increase in segment sales. In 2010, the model of our wellness house for family use was increased from 2 kinds to 5 kinds to meet customer demand. We intend to develop more models of our wellness house for family use in the future.

Commencing in 2009, we fostered a franchise network to which we distribute our healthcare knit goods, daily healthcare products and personal care products. Through these franchisees, we opened our tourmaline market in healthcare knit goods segment and daily healthcare and personal care segment, especially healthcare knit goods segment. As of June 30, 2010, our franchisees amounted to 219. During 2010 and beyond, we intend to continue expanding the amount of our franchisees and put more emphasis on the development of our existing franchisees.

Results of Operations

The following table sets forth certain information regarding our results of operations.

| | | | | | | | | | | | | | | | |

| | | For the six months ended June 30, | | | For the year ended December 31, | |

| | | 2010 | | | 2009 | | | 2009 | | | 2008 | |

| | | (Unaudited) | | | (Unaudited) | | | (Audited) | | | (Audited) | |

REVENUES | | $ | 2,323,841 | | | $ | 984,456 | | | $ | 3,109,059 | | | $ | 422,612 | |

COGS | | | 639,488 | | | | 448,437 | | | | 1,164,683 | | | | 303,854 | |