Joway Health Industries Group Inc. (f/k/a G2 Ventures, Inc.)

16th Floor, Tianjin Global Zhiye Square, 309 Nanjing Road

Nankai District, Tianjin, PRC

June 10, 2011

John Reynolds

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street NE

Washington, DC 20549

Form 8-K

Filed on October 7, 2010

File: 333-108715

Dear Mr. Reynolds:

This letter responds to certain comments of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) contained in the letter from the Staff to Joway Health Industries Group Inc. (formerly G2 Ventures, Inc.) (the “Company”) dated April 13, 2011.

For your convenience, we have included each of the Staff’s comments in italics before each of the Company’s responses. References in this letter to “we,” “our” or “us” mean the Company or its advisors, as the context may require.

Form 8-K filed with Correspondence on February 28, 2011

General

Staff Comment 1.We reissue comment one of our letter dated January 28, 2011. Please provide an amended Form 8-K to address our comments and incorporate your previous responses you have made in a draft format. Also, please include the exhibits that you represent in your response letters that will be filed with an amended Form 8-K/A.

Response: We have filed an amended Form 8-K/A (the “8-K/A”) and incorporated where applicable the information contained in the following responses to the Comments of the Staff.

Entry into a Material Definitive Agreement, page 3

Staff Comment 2. We note your responses to comments three and five of our letter dated January 28, 2011 regarding the indirect ownership of Crystal Globe and partially reissue the comments. Please revise to provide clear disclosure as to the ownership of Crystal Globe and Dynamic Elite. You state that Mr. Liu formed these companies but do not specifically clarify who was the controlling shareholder before and/or after the transactions. In this regard, we note that the disclosure provided in your supplemental response to comment 21 is clearer than the disclosure in the proposed changes to the Form 8-K. In addition, clarify whether Mr. Zhang had any ownership or control, directly or indirectly, of Crystal Globe and Dynamic Elite before the transactions. Please revise this section and footnote four of your beneficial ownership table to clarify the individuals that have indirect ownership of Crystal Globe,

John Reynolds

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

June 10, 2011

Page 2

and thus, control of your operating subsidiaries, as it appears that Mr. Zhang is the ultimate beneficial owner and control person and therefore the shares should be included in the table for Mr. Zhang or advise as to why you believe disclosure is not required.

Response:We have revised the description under Item 1.01 Entry into a Material Definitive Agreement of the 8-K/A to clarify the ownership of Crystal Globe and Dynamic Elite both before and after the Reverse Merger. We have also revised the table set forth under the section titled “Security Ownership of Certain Beneficial Owners and Management” to describe the indirect ownership of Crystal Globe.

Corporate Structure and History, page 4

Staff Comment 3.We note your response to comment six of our letter dated January 28, 2011. Please revise to disclose the material terms of the July 25, 2010 and July 28, 2010 share acquisition agreements with Chen Jingyum and Wang Aiying to sell their shares to the Joway Group.

Response:The share transfer agreements entered into with Chen Jingyun and Wang Aiying are very short and simplistic documents. Our response letter dated February 28, 2011 contains an accurate description of all of the material terms contained in those agreements. In addition, we have included these agreements as exhibits to the 8-K/A.

Description of Business, page 11

Staff Comment 4.We reissue comment eight of our letter dated January 28, 2011. We are unable to locate the supplemental table as stated in your response letter dated February 28, 2011.

Response:We will submit the supplemental information by EDGAR as Exhibit A.

Staff Comment 5.We reissue comment 13 of our letter dated November 5, 2010. Please clarify whether you have a website. If so, please provide the address.

Response: We currently do not have a website for the public company.

Staff Comment 6.We are unable to find the revisions you provided in response to comment 17 of our letter dated November 5, 2010 with regard to the material terms of your franchise agreement. The draft language you provided in your response letter dated December 23, 2010 is not in the business discussion. Further, you previously indicated that you would file a form franchise agreement, but you have not yet provided such document and the exhibits index does not reflect a franchise agreement.

Response:A description of the material terms of our standard franchise agreement is set forth on page 19 of the 8-K/A which is the same language set forth in our response letter dated December 23, 2010. In addition, we have filed a form of our franchise agreement as Exhibit No. 10.20 to the Company’s Annual Report on Form 10-K filed on April 14, 2011 and have incorporated this exhibit by reference into the 8-K/A.

Staff Comment 7.We note your revisions in response to comment 20 of our letter dated November 5, 2010 that the Company “believes it is the leading manufacturer and distributor of

John Reynolds

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

June 10, 2011

Page 3

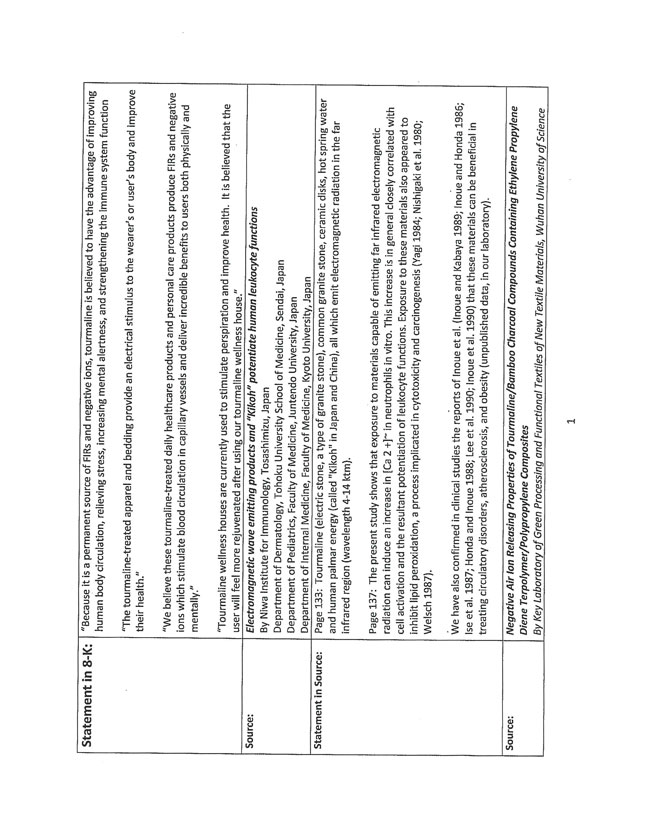

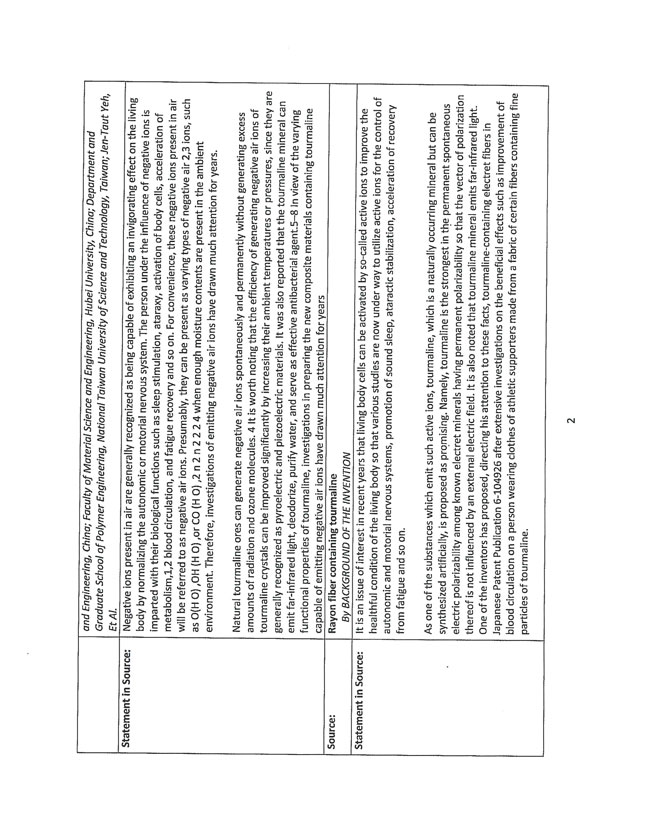

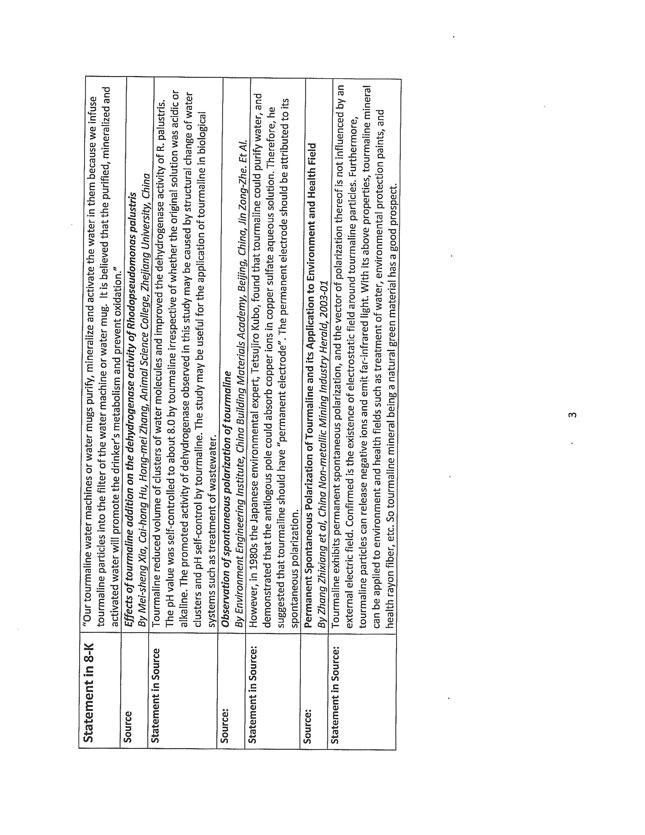

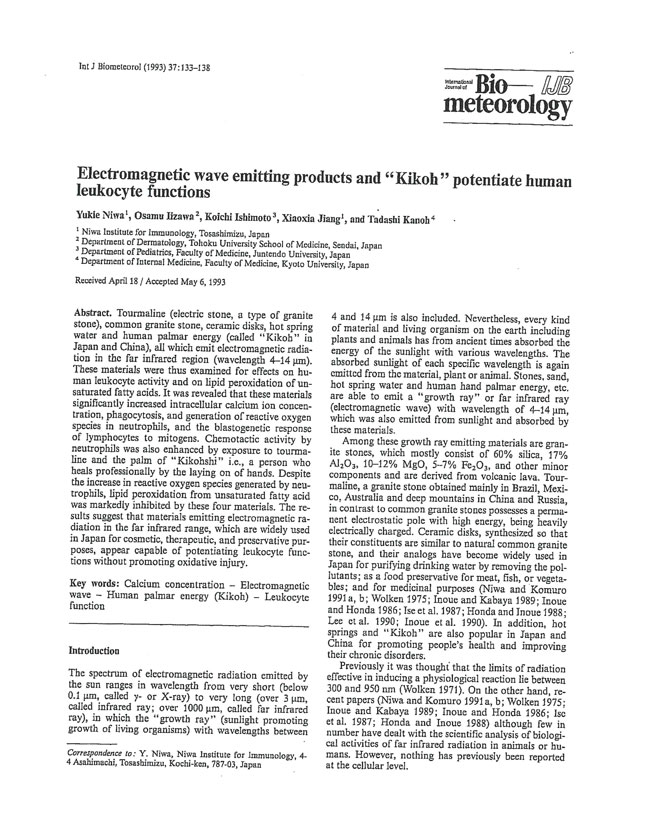

tourmaline healthcare-related products in the PRC” and that “we have the most matured tourmaline particle attachment technology in the PRC.” Please provide the basis for these statements or remove.

Response: We have removed both statements from the disclosure in our 8-K/A.

Staff Comment 8.We note your response to comment nine of our letter dated January 28, 2011, and we reissue it in part. Please revise to briefly describe the business of Shenyang Joway and its similarities and relationships with the Joway Group. Also, please advise us whether Shenyang Joway uses the Joway Group name as part of its business.

Response: Shenyang Joway is a company established by Jinghe Zhang, the Company’s Chief Executive Officer in 2005, who owns 70% of the company. Shenyang Joway is currently not an operating company. All transactions between Joway Group and Shenyang Joway have been disclosed in the 8-K/A under the section titled “Certain Relationships and Related Transactions—Other Related Transactions among Chinese Operating Entities.”

Shenyang Joway does not use the Joway Group name in its business. However, Shenyang Joway did license to Joway Group the right to use certain trademarks owned by Shenyang Joway. A copy of the licensing agreement was previously filed as Exhibit 10.15 to the 8-K.

Risk Factors, page 36

Staff Comment 9.We note your response to comment 15 of our letter dated January 28, 2011 and the related revisions to your filing. As noted in our prior comment, please confirm to us that you will evaluate the factors outlined in your revised risk factor disclosure in concluding on the effectiveness of disclosure controls and procedures under Item 307 of Regulation S-K and internal control over financial reporting under Item 308 of Regulation S-K in the future.

Response:We confirm that in connection with our future filings we will evaluate the factors outlined in our revised risk factor disclosure in concluding the effectiveness of disclosure controls and procedures under Item 307 of Regulation S-K and internal control over financial reporting under Item 308 of Regulation S-K.

Executive Compensation, page 67

Staff Comment 10.We note your response to comment 42 of our letter dated November 5, 2010, and we reissue it. Please revise to clarify that the compensation figures and discussion includes all compensation, including any from Junhe Consulting and/or Dynamic Elite. In addition, there should only be one summary compensation table providing the disclosure required by Item 402(n) of Regulation S-K.

Response:

We have revised the disclosure in the 8-K/A under the section titled Executive Compensation to clarify that the compensation figures and discussion includes all compensation, including any from any of the Company’s subsidiaries. In addition, the Company has revised the Summary Compensation Table in accordance with the requirements of Item 402(n) of Regulation S-K.

John Reynolds

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

June 10, 2011

Page 4

Market Price of and Dividends on the Registrants Common Equity and Related Stockholder Matters, page 76

Staff Comment 11.We reissue comment 48 of our letter dated November 5, 2010. Please provide the market price information required by Item 201(a)(1)(iii) of Regulation S-K. Although thinly traded, we note that the stock has been quoted on the OTC Bulletin Board under the stock symbol GVTI.

Response:

We have revised the section in the 8-K/A titled “Market Price of and Dividends on the Registrants Common Equity and Related Stockholder Matters” to conform to Item 201(a)(1)(iii) of Regulation S-K to the extent we are able to do so. Please note that we were unable to locate quotations for the Company’s common stock prior to March 2010.

Dynamic Elite International Limited Consolidated Financial Statements

General

Staff Comment 12.Please amend your Form 8-K to include updated interim financial statements of Dynamic Elite International Limited for the nine months ended September 30, 2010 and 2009. Refer to Exchange Act Rules 13a-1 and 13a-13.

Response:We have revised the 8-K/A to include interim financial statements of Dynamic Elite International Limited for the nine months ended September 30, 2010 and 2009.

Exhibits

Staff Comment 13.We note your responses to comments 10 and 17 of our letter dated November 5, 2010, and comments 17 and 22 of our letter dated January 28, 2011 in which you indicate you will file various documents as exhibits to your amended Form 8-K/A. Please file these documents, as we are unable to clear these comments unless we are able to review these exhibits. Please also note that we may have additional substantive comments regarding the disclosure in the Form 8-K once we review these exhibits.

Response:We have filed the agreements and other documents referred to in our prior response as exhibits to the 8-K/A.

Staff Comment 14.We note your response to comment 22 of our letter dated January 28, 2011 that the other exhibit 10.13, the agreements are complete. Please clarify whether these are forms of the agreement or whether these are the executed agreement. If these are the executed agreement, we note that exhibits 10.11, 10.12 and 10.13 are also missing the quantity and amount, and therefore the exhibits should be filed in their entirety. If these are forms of the agreement, please advise and explain why the executed agreements are not filed.

Response:The agreements originally filed as Exhibits 10.11 and 10.12 are forms of agreements referred to as “framework contracts” under the applicable Chinese legal terminology. Framework contracts are

John Reynolds

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

June 10, 2011

Page 5

agreements in which the parties set out the basic rights and obligations for a specific transaction, but leave out the variable terms, which are determined in supplemental documents once the actual transaction occurs. These specific agreements have been supplemented by various order lists. We have refiled these exhibits to include the order lists which supplement the original agreements. In addition, the agreement filed as Exhibit 10.13 is an executed contract with a cross reference to a price and quantity list. We have refiled this exhibit to include the price and quantity list.

The Company acknowledges that it is responsible for the accuracy and adequacy of the disclosure in its filings pursuant to the Securities Exchange Act of 1934 and that such filings include the information the Securities Exchange Act of 1934 and all applicable Securities Act rules require.

|

| Sincerely, |

|

| /s/ Jinghe Zhang |

| Jinghe Zhang |

| Chief Executive Officer |

Enclosures

The Crone Law Group

Exhibit A