UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21439

Fidelity Rutland Square Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Stephen D. Fisher, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

|

|

Date of reporting period: | February 28, 2010 |

Item 1. Reports to Stockholders

PAS Core Income Fund of Funds®

Offered exclusively to certain clients of Strategic Advisers, Inc. - not available for sale to the general public

Annual Report

February 28, 2010

Strategic Advisers, Inc.

A Fidelity Investments Company

Contents

Performance | How the fund has done over time. | |

Management's Discussion | The manager's review of fund performance, strategy and outlook. | |

Shareholder Expense Example | An example of shareholder expenses. | |

Investment Changes | A summary of major shifts in the fund's investments over the past six months. | |

Investments | A complete list of the fund's investments with their market values. | |

Financial Statements | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. | |

Notes | Notes to the financial statements. | |

Report of Independent Registered Public Accounting Firm |

| |

Trustees and Officers |

| |

Distributions |

| |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2010 | Past 1 | Life of |

PAS Core Income Fund of Funds | 20.54% | 7.50% |

A From September 27, 2007.

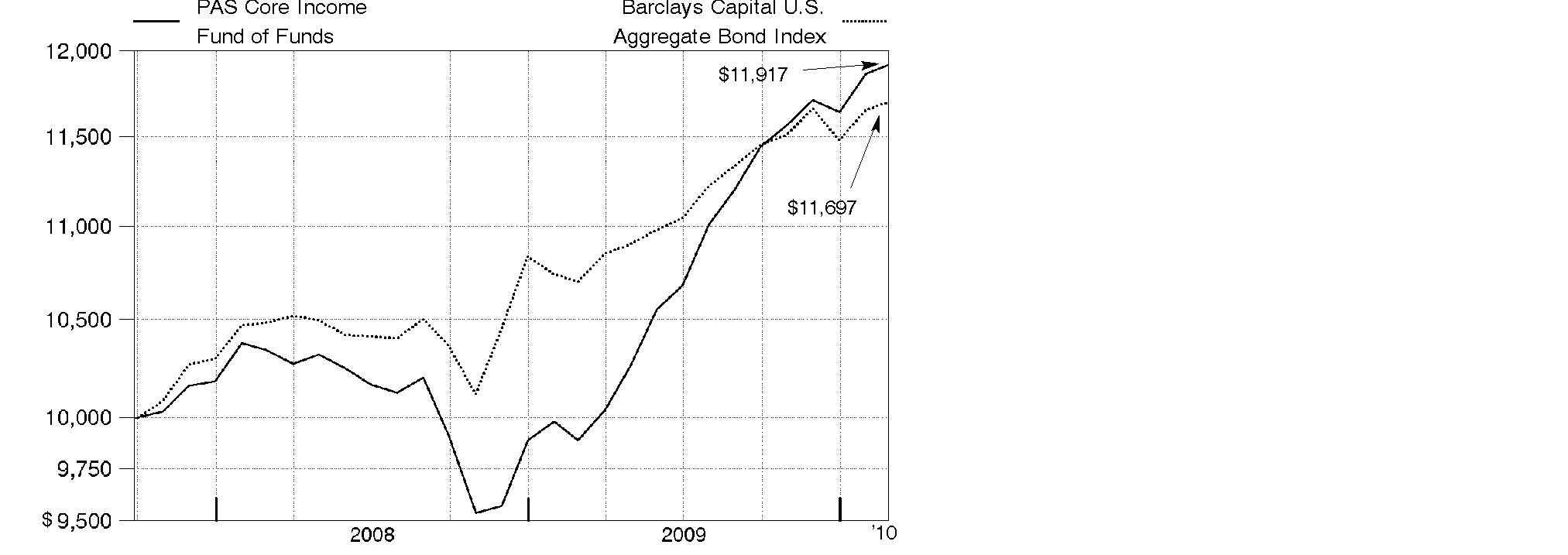

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in PAS Core Income Fund of Funds on September 27, 2007, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Barclays Capital U.S. Aggregate Bond Index performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Market Recap: Taxable bonds posted strong returns for the year ending February 28, 2010, as evidenced by the 9.32% gain of the Barclays Capital U.S. Aggregate Bond Index, a broad measure of the domestic investment-grade debt universe. However, various segments of the market generated significantly divergent results. Asset-backed securities (ABS) and corporate bonds led the way, scoring some of their best one-year returns in a generation, as investors increasingly flocked to these bonds' historically high yields and depressed prices amid an improving economy and stabilizing credit markets. The Barclays Capital U.S. Fixed-Rate ABS Index climbed 20.82%, just ahead of the Barclays Capital U.S. Credit Bond Index's advance of 20.38%. In contrast, U.S. Treasuries eked out only a modest gain in response to slack investor demand, the specter of higher interest rates and heavy supply as the U.S. government issued historic amounts of new debt. Government-backed agency securities fared a bit better, constrained by investors' diminished appetite for bonds with lower perceived credit risk, but helped by the Federal Reserve Board's purchases of agency debt. The Barclays Capital U.S. Agency Bond Index gained 4.12%. Mortgage-backed securities (MBS), bolstered largely by the government purchase programs and less pessimism about the housing market, rose 6.67%, as measured by the Barclays Capital U.S. MBS Index.

Comments from Gregory Pappas, Portfolio Manager of PAS Core Income Fund of Funds®: The Fund advanced 20.54% during the past year, significantly outperforming the Barclays Capital U.S. Aggregate Bond Index. Signs of improvement in the credit markets early in the period sparked a massive rotation to riskier market sectors by a majority of active fund managers. Seeking to capitalize on this risk-driven environment, I invested outside of the benchmark in more-volatile high-yield and emerging-markets bond funds, which paid off nicely. During the first half of the period, to benefit from the Fed's purchases of government-agency MBS, I increased the Fund's MBS exposure via holdings such as PIMCO Mortgage-Backed Securities Fund and TCW Total Return Bond Fund. Top contributors included Fidelity Total Bond Fund, driven primarily by its weighting in high-yield and investment-grade corporate bonds; PIMCO Total Return Fund, due to its government-mortgage stake; and Western Asset Core Plus Bond Portfolio, which benefited from its emphasis on corporate bonds and commercial and residential mortgage debt. To help manage the Fund's risk, by period end I had reduced the fund's MBS exposure and trimmed its high-yield and emerging-markets bond fund investments. Some funds mentioned in this report were not held at period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2009 to February 28, 2010).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying affiliated and unaffiliated mutual funds (the Underlying Funds), the Fund also indirectly bears its proportionate share of the expenses of the Underlying Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying affiliated and unaffiliated mutual funds (the Underlying Funds), the Fund also indirectly bears its proportionate share of the expenses of the Underlying Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Annual Report

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

|

|

|

| Expenses Paid |

Actual | .00% | $ 1,000.00 | $ 1,063.70 | $ .00 |

Hypothetical (5% return per year before expenses) |

| $ 1,000.00 | $ 1,024.79 | $ .00 |

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the Underlying Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Annual Report

Investment Changes (Unaudited)

The information in the following tables is based on the direct investments of the Fund. |

Top Ten Fund Holdings as of February 28, 2010 |

| % of fund's investments | % of fund's investments |

PIMCO Total Return Fund Administrative Class | 28.9 | 29.5 |

Fidelity Total Bond Fund | 18.8 | 19.5 |

Fidelity Investment Grade Bond Fund | 12.1 | 12.0 |

Fidelity Intermediate Bond Fund | 8.1 | 6.7 |

Metropolitan West Total Return Bond Fund Class M | 7.7 | 10.7 |

Western Asset Core Plus Bond Portfolio | 7.1 | 6.8 |

T. Rowe Price New Income Fund Advisor Class | 6.2 | 0.3 |

Fidelity U.S. Bond Index Fund | 4.2 | 0.0 |

Prudential Short-Term Corporate Bond Fund, Inc. Class A | 2.0 | 0.0 |

Loomis Sayles Bond Fund Retail Class | 1.6 | 3.0 |

| 96.7 |

Asset Allocation (% of fund's investments) | |||||||

As of February 28, 2010 | As of August 31, 2009 | ||||||

| Intermediate-Term |

|  | Intermediate-Term |

| ||

| Short-Term Funds 2.0% |

|  | Short-Term Funds 0.0% |

| ||

| High Yield |

|  | High Yield |

| ||

| Sector Funds 0.5% |

|  | Sector Funds 1.0% |

| ||

Asset allocations in the pie charts reflect the categorizations of assets as defined by Morningstar as of the reporting dates indicated above. |

Annual Report

Investments February 28, 2010

Showing Percentage of Total Value of Investment in Securities

Fixed-Income Funds - 98.0% | |||

| Shares

|

| Value |

High Yield Fixed-Income Funds - 1.3% | |||

Fidelity Focused High Income Fund (a) | 2,048,234 | $ 18,741,343 | |

Fidelity New Markets Income Fund (a) | 1,058,455 | 15,961,503 | |

TOTAL HIGH YIELD FIXED-INCOME FUNDS | 34,702,846 | ||

Intermediate-Term Bond Funds - 96.2% | |||

Fidelity Intermediate Bond Fund (a) | 20,692,017 | 213,541,617 | |

Fidelity Investment Grade Bond Fund (a) | 44,642,824 | 319,196,192 | |

Fidelity Total Bond Fund (a) | 46,986,064 | 498,522,143 | |

Fidelity U.S. Bond Index Fund (a) | 9,897,590 | 110,754,029 | |

Loomis Sayles Bond Fund Retail Class | 3,205,619 | 43,115,581 | |

Metropolitan West Total Return Bond Fund Class M | 20,127,516 | 204,093,015 | |

PIMCO Total Return Fund Administrative Class | 69,678,325 | 765,764,796 | |

T. Rowe Price New Income Fund Advisor Class | 17,602,373 | 164,934,235 | |

Westcore Plus Bond Fund | 3,736,762 | 39,497,575 | |

Western Asset Core Plus Bond Portfolio | 18,122,521 | 187,749,313 | |

TOTAL INTERMEDIATE-TERM BOND FUNDS | 2,547,168,496 | ||

Sector Funds - 0.5% | |||

Fidelity Real Estate Income Fund (a) | 1,492,409 | 14,058,490 | |

TOTAL FIXED-INCOME FUNDS (Cost $2,511,073,511) | 2,595,929,832 | ||

Short-Term Funds - 2.0% | |||

|

|

|

|

Prudential Short-Term Corporate Bond Fund, Inc. Class A | 4,462,937 | 51,279,147 | |

TOTAL INVESTMENT IN SECURITIES - 100% (Cost $2,562,305,799) | $ 2,647,208,979 | ||

Legend |

(a) Affiliated company |

Affiliated Underlying Funds |

Information regarding fiscal year to date income earned by the Fund from investments in affiliated Underlying Funds is as follows: |

Fund | Income Earned |

Fidelity Focused High Income Fund | $ 1,066,350 |

Fidelity Intermediate Bond Fund | 3,468,126 |

Fidelity Investment Grade Bond Fund | 7,219,208 |

Fidelity Mortgage Securities Fund | 78,990 |

Fidelity Municipal Income Fund | 189,794 |

Fidelity New Markets Income Fund | 738,430 |

Fidelity Real Estate Income Fund | 610,516 |

Fidelity Total Bond Fund | 12,978,550 |

Fidelity U.S. Bond Index Fund | 820,954 |

Total | $ 27,170,918 |

Additional information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds is as follows: |

Fund | Value, | Purchases | Sales | Value, |

Fidelity Focused High Income Fund | $ 2,526,043 | $ 15,097,217 | $ 1,208,223 | $ 18,741,343 |

Fidelity Intermediate Bond Fund | - | 208,038,907 | - | 213,541,617 |

Fidelity Investment Grade Bond Fund | 84,517,679 | 216,046,296 | 144,414 | 319,196,192 |

Fidelity Mortgage Securities Fund | 10,227,808 | 78,552 | 10,372,387 | - |

Fidelity Municipal Income Fund | 6,605,826 | 3,783,519 | 10,653,177 | - |

Fidelity New Markets Income Fund | - | 15,856,075 | 1,208,223 | 15,961,503 |

Fidelity Real Estate Income Fund | 998,816 | 11,054,515 | 1,208,223 | 14,058,490 |

Fidelity Total Bond Fund | 165,243,912 | 299,973,075 | 264,758 | 498,522,143 |

Fidelity U.S. Bond Index Fund | - | 110,439,390 | - | 110,754,029 |

Total | $ 270,120,084 | $ 880,367,546 | $ 25,059,405 | $ 1,190,775,317 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Income Tax Information |

At February 28, 2010, the fund had a capital loss carryforward of approximately $5,269,698 all of which will expire on February 28, 2017. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

| February 28, 2010 | |

|

|

|

Assets | ||

Investment in securities, at value - See accompanying schedule: |

| |

Unaffiliated Underlying Funds (cost $1,408,631,118) | $ 1,456,433,662 |

|

Affiliated Underlying Funds (cost $1,153,674,681) | 1,190,775,317 |

|

Total Investments (cost $2,562,305,799) |

| $ 2,647,208,979 |

Receivable for fund shares sold | 3,771,754 | |

Total assets | 2,650,980,733 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 2,443,590 | |

Payable for fund shares redeemed | 1,329,866 | |

Distributions payable | 13,366 | |

Total liabilities | 3,786,822 | |

|

|

|

Net Assets | $ 2,647,193,911 | |

Net Assets consist of: |

| |

Paid in capital | $ 2,570,733,059 | |

Undistributed net investment income | 356,971 | |

Accumulated undistributed net realized gain (loss) on investments | (8,799,299) | |

Net unrealized appreciation (depreciation) on investments | 84,903,180 | |

Net Assets, for 257,113,602 shares outstanding | $ 2,647,193,911 | |

Net Asset Value, offering price and redemption price per share ($2,647,193,911 ÷ 257,113,602 shares) | $ 10.30 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended February 28, 2010 | |

|

|

|

Investment Income |

|

|

Dividends from underlying funds: |

|

|

Unaffiliated |

| $ 42,821,407 |

Affiliated |

| 27,170,918 |

Interest |

| 34 |

Total income |

| 69,992,359 |

|

|

|

Expenses | ||

Management fee | $ 3,565,467 | |

Independent trustees' compensation | 19,597 | |

Total expenses before reductions | 3,585,064 | |

Expense reductions | (3,585,064) | - |

Net investment income (loss) | 69,992,359 | |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares: | ||

Unaffiliated | 4,266,238 |

|

Affiliated | 156,927 |

|

Realized gain distributions from underlying funds: |

|

|

Unaffiliated | 5,724,668 |

|

Affiliated | 1,632,060 | 11,779,893 |

Change in net unrealized appreciation (depreciation) on underlying funds | 150,653,948 | |

Net gain (loss) | 162,433,841 | |

Net in net assets resulting from operations | $ 232,426,200 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 69,992,359 | $ 39,366,734 |

Net realized gain (loss) | 11,779,893 | (5,159,639) |

Change in net unrealized appreciation (depreciation) | 150,653,948 | (71,051,595) |

Net in net assets resulting | 232,426,200 | (36,844,500) |

Distributions to from net investment income | (70,122,296) | (38,581,532) |

Distributions to from net realized gain | (5,754,796) | (9,365,342) |

Total distributions | (75,877,092) | (47,946,874) |

Share transactions | 1,971,896,368 | 526,310,343 |

Reinvestment of distributions | 75,683,208 | 47,788,423 |

Cost of shares redeemed | (285,227,731) | (507,726,800) |

Net increase (decrease) in net assets resulting from share transactions | 1,762,351,845 | 66,371,966 |

Total increase (decrease) in net assets | 1,918,900,953 | (18,419,408) |

|

|

|

Net Assets | ||

Beginning of period | 728,292,958 | 746,712,366 |

End of period (including undistributed net investment income of $356,971 and undistributed net investment income of $486,907, respectively) | $ 2,647,193,911 | $ 728,292,958 |

Other Information Shares | ||

Sold | 198,017,148 | 55,678,520 |

Issued in reinvestment of distributions | 7,604,701 | 5,103,062 |

Redeemed | (29,234,500) | (54,087,499) |

Net increase (decrease) | 176,387,349 | 6,694,083 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended February 28, | 2010 | 2009 | 2008 F |

Selected Per-Share Data |

|

|

|

Net asset value, beginning of period | $ 9.02 | $ 10.09 | $ 10.00 |

Income from Investment Operations |

|

|

|

Net investment income (loss) D | .488 | .509 | .207 |

Net realized and unrealized gain (loss) | 1.326 | (.950) | .132 |

Total from investment operations | 1.814 | (.441) | .339 |

Distributions from net investment income | (.504) | (.499) | (.222) H |

Distributions from net realized gain | (.030) | (.130) | (.027) H |

Total distributions | (.534) | (.629) | (.249) |

Net asset value, end of period | $ 10.30 | $ 9.02 | $ 10.09 |

Total Return B, C | 20.54% | (4.41)% | 3.42% |

Ratios to Average Net Assets G |

|

|

|

Expenses before reductions | .25% | .26% | .25% A |

Expenses net of contractual waivers | .00% | .00% | .00% A |

Expenses net of all reductions | .00% | .00% | .00% A |

Net investment income (loss) | 4.93% | 5.35% | 4.92% A |

Supplemental Data |

|

|

|

Net assets, end of period (000 omitted) | $ 2,647,194 | $ 728,293 | $ 746,712 |

Portfolio turnover rate E | 10% | 38% | 19% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Amounts do not include the portfolio activity of the underlying funds.

F For the period September 27, 2007 (commencement of operations) to February 29, 2008.

G Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts contractually reimbursed by the investment adviser and do not represent the amount paid by the Fund during periods when reimbursements occur. Expenses net of contractual waivers reflect expenses after reimbursement by the investment adviser. Expenses net of all reductions represent the net expenses paid by the Fund. Fees and expenses of the Underlying Funds are not included in the Fund's annualized ratios. The Fund indirectly bears its proportionate share of the expenses of the Underlying Funds.

H The amount shown reflects certain reclassifications related to book to tax differences.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended February 28, 2010

1. Organization.

PAS Core Income Fund of Funds (the Fund) is a fund of Fidelity Rutland Square Trust (the trust), an open-end management investment company organized as a Delaware statutory trust. Until December 3, 2009, the trust operated under Section 10(d) of the Investment Company Act of 1940. The Fund invests in affiliated and unaffiliated mutual funds (the Underlying Funds). The Fund's investments in the Underlying Funds were not subject to front-end sales charges or contingent deferred sales charges. The Fund is offered exclusively to clients of Strategic Advisers, Inc. (Strategic Advisers), an affiliate of Fidelity Management & Research Company (FMR).

2. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The Fund's Schedule of Investments lists each of the Underlying Funds as an investment of the Fund but does not include the underlying holdings of each Underlying Fund. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses independent pricing services approved by the Board of Trustees to value its investments. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below.

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows. Investments in the Underlying Funds are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy. If an unaffiliated Underlying Fund's NAV is unavailable, shares of that fund may be valued by another method that the Board of Trustees believes reflects fair value in accordance with the Board's fair value pricing policies and is categorized as Level 2 in the hierarchy.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities

Annual Report

Notes to Financial Statements - continued

2. Significant Accounting Policies - continued

Investment Transactions and Income - continued

sold are determined on the basis of identified cost. Dividend and realized gain distributions from the Underlying Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned. Interest income includes coupon interest.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses associated with the Underlying Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Underlying Funds' expenses through the impact of these expenses on each Underlying Fund's NAV. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. As of February 28, 2010, the Fund did not have any unrecognized tax benefits in the accompanying financial statements. A Fund's federal tax return is subject to examination by the Internal Revenue Service (IRS) for a period of three years.

Dividends are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to the short-term gain distributions from the Underlying Funds, capital loss carryforwards, and losses deferred due to wash sales and excise tax regulations.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 81,922,856 |

Gross unrealized depreciation | (1,126,755) |

Net unrealized appreciation (depreciation) | $ 80,796,101 |

|

|

Tax Cost | $ 2,566,412,878 |

Annual Report

2. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-based components of distributable earnings as of period end were as follows:

Undistributed ordinary income | $ 934,449 |

Capital loss carryforward | $ (5,269,698) |

Net unrealized appreciation (depreciation) | $ 80,796,101 |

The tax character of distributions paid was as follows:

| February 28, 2010 | February 28, 2009 |

Ordinary Income | $ 75,877,092 | $ 47,946,874 |

3. Purchases and Sales of Investments.

Purchases and sales of securities (including the Underlying Fund shares), other than short-term securities, aggregated $1,911,062,122 and $147,251,401, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. Strategic Advisers provides the Fund with investment management related services. For these services, the Fund pays a monthly management fee to Strategic Advisers. The management fee is computed at an annual rate of .25% of the Fund's average net assets. Strategic Advisers, either itself or through an affiliated company, pays all other expenses of the Fund with certain exceptions such as interest expense and independent Trustees' compensation.

Strategic Advisers has contractually agreed to waive its management fee until September 30, 2012.

Strategic Advisers has entered into an administration agreement with FMR under which FMR provides management and administrative services (other than investment advisory services) necessary for the operation of the Fund. FMR also contracts with other Fidelity companies to perform the services necessary for the operation of the Fund. Under this agreement, Strategic Advisers agrees to pay FMR a monthly administration fee. The Fund does not pay any fees for these services.

Annual Report

Notes to Financial Statements - continued

5. Expense Reductions.

In addition to waiving its management fee, Strategic Advisers has contractually agreed to reimburse the Fund until September 30, 2012 to the extent that annual operating expenses exceed .00% of average net assets. Some expenses, for example interest expense, are excluded from this reimbursement. During the period, this waiver and reimbursement reduced the Fund's expenses by $3,585,064.

6. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

7. Proposed Reorganization.

The Boards of Trustees of Fidelity Rutland Square Trust and Fidelity Rutland Square Trust II have approved the Agreement and Plan of Reorganization between the Fund, a fund of Rutland Square Trust, and Strategic Advisers Core Income Fund, a fund of Rutland Square Trust II. The Agreement provides for the transfer of all the assets and the assumption all of the liabilities of the Fund in exchange solely for the number of equivalent shares of Strategic Advisers Core Income Fund having the same aggregate net asset value as the outstanding shares of the Fund, on the day the reorganization is effective.

A meeting of the shareholders of the Fund is expected to be held on August 9, 2010 to vote on the reorganization. If approved by shareholders the reorganization is expected to take place as soon as practicable after shareholder approval. The reorganization is expected to qualify as a tax-free transaction with no gains or loss recognized by the Fund or its shareholders.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Rutland Square Trust and the Shareholders of PAS Core Income Fund of Funds:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of PAS Core Income Fund of Funds (a fund of Fidelity Rutland Square Trust) at February 28, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the periods then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the PAS Core Income Fund of Funds' management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at February 28, 2010 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

April 16, 2010

Annual Report

Trustees and Officers

The Trustees, Members of the Advisory Board, and executive officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Each of the Trustees oversees 15 funds advised by Strategic Advisers or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. The executive officers and Advisory Board Members hold office without limit in time, except that any officer and Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

Experience, Skills, Attributes, and Qualifications of the Fund's Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates ("Statement of Policy"). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee may also engage professional search firms to help identify potential Independent Trustee candidates with experience, qualifications, attributes, and skills consistent with the Statement of Policy. Additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, may be considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Annual Report

Board Structure and Oversight Function. Roger T. Servison is an interested person (as defined in the 1940 Act) and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Ralph F. Cox serves as the lead Independent Trustee and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity funds are overseen by different Boards of Trustees. The fund's Board oversees asset allocation funds dedicated to Strategic Advisers' discretionary asset management programs, as well as the Fidelity enhanced index funds. Other boards oversee Fidelity's investment-grade bond, money market, and asset allocation funds and Fidelity's equity and high income funds. The fund may invest in Fidelity funds overseen by such other Boards. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues.

The Trustees primarily operate as a full Board, but also operate in committees, to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board has charged Strategic Advisers and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through Strategic Advisers, its affiliates and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. Board oversight of different aspects of the fund's activities is exercised primarily through the full Board, but also through the Audit Committee. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer ("CCO"), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate. The responsibilities of each committee, including their oversight responsibilities, are described further under "Standing Committees of the Fund's Trustees."

Annual Report

Trustees and Officers - continued

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-3455.

Interested Trustees*:

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation and Other Relevant Experience+ | |

Roger T. Servison (64) | |

| Year of Election or Appointment: 2005 Mr. Servison is Chairman of the Board of Trustees. Mr. Servison serves as President of Strategic New Business Development for Fidelity Investments and serves as a Director of Strategic Advisers. Previously, he oversaw Fidelity Investments Life Insurance Company (2005-2006) and Strategic Advisers (2005-2007). Mr. Servison also served as President and a Director of Fidelity Brokerage Services (Japan), LLC (1994-2004). |

* Trustees have been determined to be "Interested Trustees" by virtue of, among other things, their affiliation with the trust or various entities under common control with Strategic Advisers.

+ The information above includes each Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each Trustee's qualifications to serve as a Trustee, which led to the conclusion that each Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Age; Principal Occupation and Other Relevant Experience+ | |

Peter C. Aldrich (65) | |

| Year of Election or Appointment: 2005 Mr. Aldrich is a Director of the National Bureau of Economic Research and a Director of the funds of BlackRock Realty Group (2006-present). Mr. Aldrich is a Member of the Boards of Trustees of the Museum of Fine Arts Boston and Massachusetts Eye and Ear Infirmary. |

Ralph F. Cox (77) | |

| Year of Election or Appointment: 2005 Mr. Cox is President of RABAR Enterprises (management consulting for the petroleum industry). Mr. Cox is a Director of CH2M Hill Companies (engineering) and Abraxas Petroleum (exploration and production). Mr. Cox is a member of the Advisory Boards of Texas A&M University and the University of Texas at Austin. Mr. Ralph F. Cox and Mr. Howard E. Cox, Jr. are not related. |

+ The information above includes each Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each Trustee's qualifications to serve as a Trustee, which led to the conclusion that each Trustee should serve as a Trustee for the fund.

Advisory Board Members and Executive Officers:

Correspondence intended for each Advisory Board Member and executive officer may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation | |

Howard E. Cox, Jr. (66) | |

| Year of Election or Appointment: 2006 Member of the Advisory Board of Fidelity Rutland Square Trust. Mr. Cox is a Member of the Advisory Board of Devonshire Investors (2009-present). Mr. Cox serves as a Partner of Greylock (venture capital) and a Director of Stryker Corporation (medical products and services). Mr. Cox is a Member of the Secretary of Defense's Business Board of Directors (2008-present). Mr. Howard E. Cox, Jr. and Mr. Ralph F. Cox are not related. |

Karen Kaplan (50) | |

| Year of Election or Appointment: 2006 Member of the Advisory Board of Fidelity Rutland Square Trust. Ms. Kaplan is President of Hill Holliday (advertising and specialized marketing, 2007-present). Ms. Kaplan is a Director of Delta Dental of Massachusetts (2004-present), President of the Massachusetts Women's Forum (2008-present), Vice Chair of the Board of the Massachusetts Society for the Prevention of Cruelty to Children (2006-present), and Director of the Executive Committee of the Greater Boston Chamber of Commerce (2006-present). Previously, Ms. Kaplan served as Treasurer of the Massachusetts Women's Forum and Director of United Way of Massachusetts Bay (2004-2006), a Director of ADVO (direct mail marketing, 2003-2007), and as a Director of Tweeter Home Entertainment Group (2006-2007). |

Stephen D. Fisher (47) | |

| Year of Election or Appointment: 2007 Secretary and Chief Legal Officer of the fund. Mr. Fisher is a Senior Vice President, Deputy General Counsel of Fidelity Investments. |

Kenneth B. Robins (40) | |

| Year of Election or Appointment: 2010 President and Treasurer of the fund. Mr. Robins also serves as President and Treasurer of other Fidelity Equity and High Income Funds (2008-present) and Assistant Treasurer of other Fidelity Fixed Income and Asset Allocation Funds (2009-present). Mr. Robins is an employee of Fidelity Investments (2004-present). Previously, Mr. Robins served as Deputy Treasurer of the Fidelity funds (2005-2008) and Treasurer and Chief Financial Officer of The North Carolina Capital Management Trust: Cash and Term Portfolios (2006-2008). |

Laura M. Doherty (40) | |

| Year of Election or Appointment: 2009 Chief Compliance Officer of the fund. Ms. Doherty also serves as Senior Vice President of the Office of the Chief Compliance Officer (2008-present). Previously, Ms. Doherty served as a Vice President in Fidelity's Corporate Audit department (1998-2008). |

Holly C. Laurent (55) | |

| Year of Election or Appointment: 2008 Anti-Money Laundering (AML) Officer of the fund. Ms. Laurent also serves as AML Officer of the Fidelity funds (2008-present) and is an employee of Fidelity Investments. Previously, Ms. Laurent was Senior Vice President and Head of Legal for Fidelity Business Services India Pvt. Ltd. (2006-2008), and Senior Vice President, Deputy General Counsel and Group Head for FMR LLC (2005-2006). |

Nicholas E. Steck (45) | |

| Year of Election or Appointment: 2009 Chief Financial Officer of the fund. Mr. Steck serves as Senior Vice President of Fidelity Pricing and Cash Management Services (2008-present) and is an employee of Fidelity Investments. During the period 2002 to 2009, Mr. Steck served as a Compliance Officer of FMR, Fidelity Investments Money Management, Inc., FMR LLC, Fidelity Research & Analysis (U.K.) Inc., Fidelity Management & Research (Hong Kong) Limited, and Fidelity Management & Research (Japan) Inc. |

Paul M. Murphy (62) | |

| Year of Election or Appointment: 2009 Assistant Treasurer of the fund. Mr. Murphy serves as Assistant Treasurer of other Fidelity funds (2007-present) and is an employee of FMR. Previously, Mr. Murphy served as Chief Financial Officer of the Fidelity Funds (2005-2006), Vice President and Associate General Counsel of FMR (2007) and Senior Vice President of Fidelity Pricing and Cash Management Services (FPCMS) (1994-2007). |

James R. Rooney (51) | |

| Year of Election or Appointment: 2007 Assistant Treasurer of the fund. Mr. Rooney is an employee of FMR and also serves as Assistant Treasurer of other Strategic Advisers funds (2007-present). Previously, Mr. Rooney was a Vice President with Wellington Management Company, LLP (2001-2007) and an employee of Strategic Advisers (2007-2009). |

Margaret A. Carey (36) | |

| Year of Election or Appointment: 2009 Assistant Secretary of the fund. Ms. Carey is also Assistant Secretary of The North Carolina Capital Management Trust: Cash and Term Portfolio (2008-present) and is an employee of Fidelity Investments (2004-present). |

Annual Report

Distributions (Unaudited)

A total of 2.87% of the dividends distributed during the fiscal year was derived from interest on U.S. Government securities which is generally exempt from state income tax.

The fund will notify shareholders in January 2011 of amounts for use in preparing 2010 income tax returns.

Annual Report

Board Approval of Investment Advisory Contracts and Management Fees

PAS Core Income Fund of Funds

Each year the Board of Trustees, including the Independent Trustees (together, the Board), votes at an in-person meeting on the renewal of the management contract and administration agreement (together, the Advisory Contracts) for the fund. The Board, assisted by the advice of counsel, requests and considers a broad range of information throughout the year.

The Board meets regularly four times per year and considers at each of its meetings factors that it believes are relevant to its annual consideration of the renewal of the fund's Advisory Contracts, including the services and support provided to the fund and its shareholders. While the full Board or the Independent Trustees, as appropriate, act on all major matters, a portion of the activities of the Board (including certain of those described herein) may be conducted through committees.

At its September 2009 meeting, the Board of Trustees, including the Independent Trustees, unanimously determined to renew the fund's Advisory Contracts. In reaching its determination, the Board considered all factors it believed relevant, including, but not limited to, (i) the nature, extent, and quality of the services to be provided to the fund and its shareholders (including the investment performance of the fund); (ii) the competitiveness of the fund's management fee and total expenses; (iii) the total costs of the services to be provided by and the profits, if any, to be realized by Strategic Advisers, Inc. (Strategic Advisers or SAI) and its affiliates from the relationship with the fund; (iv) the extent to which economies of scale would be realized as the fund grows; and (v) whether fee levels reflect these economies of scale, if any, for the benefit of fund shareholders.

In considering whether to renew the Advisory Contracts for the fund, the Board ultimately reached a determination, with the assistance of counsel and through the exercise of its business judgment, that the renewal of the Advisory Contracts and the compensation to be received by Strategic Advisers under the fund's management contract is consistent with Strategic Advisers' fiduciary duty under applicable law. The Board's decision to renew the Advisory Contracts was not based on any single factor noted above, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings throughout the year.

In its deliberations, the Board did not identify any particular information that was all-important or controlling.

Nature, Extent, and Quality of Services Provided. The Board considered staffing within the investment adviser, Strategic Advisers, and the administrator, Fidelity Management & Research Company (FMR), including the backgrounds of the fund's investment personnel and the fund's investment objectives and disciplines. The Independent Trustees also had discussions with senior management of Fidelity's investment operations and investment groups. The Board considered the structure of the portfolio manager compensation program and whether this structure provides appropriate incentives.

Annual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

Resources Dedicated to Investment Management and Support Services. The Board reviewed the size, education, and experience of Strategic Advisers' investment staff, their use of technology, and Strategic Advisers' and FMR's approach to recruiting, training, and retaining portfolio managers and other research, advisory, and management personnel. The Board noted that Strategic Advisers' analysts have access to a variety of technological tools and market and securities data that enables them to perform both quantitative and qualitative analysis and to specialize in various disciplines.

Shareholder and Administrative Services. The Board considered (i) the nature, extent, quality, and cost of advisory, administrative, and shareholder services performed by Strategic Advisers and its affiliates under the Advisory Contracts and under separate agreements covering transfer agency and pricing and bookkeeping services for the fund; (ii) the nature and extent of Strategic Advisers' supervision of third party service providers; and (iii) the resources devoted to, and the record of compliance with, the fund's compliance policies and procedures.

Investment Performance. The Board considered whether the fund has operated in accordance with its investment objective, as well as its record of compliance with its investment restrictions. It also reviewed the fund's absolute investment performance, as well as the fund's relative investment performance measured against (i) a broad-based securities market index, and (ii) a peer group of mutual funds. Because the fund had been in existence less than three years, the following table, which reflects information considered by the Board, shows, for the one-year period ended March 31, 2009, the fund's total return, the total return of a broad-based securities market index ("benchmark"), and the median total return of a peer group of mutual funds identified by Strategic Advisers as having an investment objective similar to that of the fund.

Fund-specific performance results reviewed by the Board are discussed below, though due to the passage of time, they are likely to differ from performance results for more recent periods, including those shown elsewhere in this report.

Annual Report

PAS Core Income Fund of Funds

Total Return % for the One-Year Period Ended March 31, 2009 vs. Barclays Capital Aggregate Bond Index and SAI General Intermediate Peer Group Median

Total Returns | 1 YEAR |

PAS Core Income Fund of Funds (FPCIX) | -2.27% |

Barclays Capital Aggregate Bond Index | 3.13% |

Difference | -5.40% |

|

|

SAI General Intermediate Peer Group Median* | -3.43% |

Difference | 1.16% |

|

|

Morningstar Intermediate-Term Bond Median | -3.52% |

Difference | 1.25% |

|

|

% of SAI Peers Beaten by FPCIX | 57% |

% of SAI Peers Beaten by Barclays Capital Aggregate Bond Index | 88% |

|

|

* For inclusion in SAI's General Intermediate Peer Group, constituents generally have a minimum $300M in assets and a minimum 3-year life-of-fund, and also are generally included in Morningstar's Intermediate Bond category, but this is not a requirement for inclusion in the peer group. SAI may occasionally make exceptions to these guidelines. | |

The Board reviewed the fund's relative investment performance against its peer group and observed that the fund out-performed 57% of its peers in the SAI General Intermediate Peer Group for the one-year period. The Board considered that the investment performance of the fund was lower than its benchmark for the one-year period shown. The Board also considered that in light of the fund's relatively recent commencement of operations, a more comprehensive analysis of the fund's performance will be possible after the fund has completed an additional year of operations.

Based on its review, and giving particular weight to the nature and quality of the resources dedicated by Strategic Advisers and FMR to maintain and improve relative performance and factoring in recent market events, the Board concluded that the nature, extent, and quality of the services provided to the fund will continue to benefit the fund's shareholders.

Competitiveness of Management Fee and Total Fund Expenses. The Board considered the amount and nature of fees paid by shareholders to Strategic Advisers. The Board considered Strategic Advisers' contractual commitment to waive its management fee and reimburse other fund expenses (excluding interest, taxes, brokerage commissions, extraordinary expenses, and acquired fund fees and expenses) through March 31, 2012, which Strategic Advisers estimated would result in the fund having a net operating expense ratio of zero for that period. The Board also considered that Strategic Advisers proposed to extend the fund's fee waiver and expense reimbursement arrangement until September 30, 2012.

Annual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

Based on its review, the Board concluded that the fund's management fee and the total expenses of the fund (giving effect to the fund's fee waiver and expense reimbursement arrangements) were fair and reasonable in light of the services that the fund and its shareholders receive and the other factors considered.

Costs of the Services and Profitability. The Board considered information regarding the revenues earned and expenses incurred by Strategic Advisers and its affiliates attributable to the business of developing, marketing, distributing, managing, administering and servicing the fund and its shareholders.

Strategic Advisers presented information to the Board on its profitability for managing the fund. Strategic Advisers calculates the profitability for the fund using a series of detailed revenue and cost allocation methodologies. Strategic Advisers noted that it employs the same corporate reporting of revenues and expenses as those used by other Fidelity funds.

The Board concluded that the costs of the services provided by and the profits realized by Strategic Advisers and its affiliates in connection with the operation of the fund were not relevant to the renewal of the fund's Advisory Contracts because the fund does not pay management fees and Strategic Advisers pays all other expenses of the fund, with limited exceptions.

Possible Fall-Out Benefits. The Board considered information regarding the potential of direct and indirect benefits to Strategic Advisers and its affiliates from their relationships with the fund, including non-advisory fee compensation paid to affiliates of Strategic Advisers, if any. The Board considered the receipt of these benefits in light of Strategic Advisers' and its affiliates' profitability and other considerations described above. The Board noted that Strategic Advisers did not calculate potential fall-out benefit revenue because Strategic Advisers did not believe that the management of the fund had resulted in significant quantifiable fall-out benefits to the businesses of Strategic Advisers and its affiliates.

Possible Economies of Scale. The Board concluded that the realization of economies of scale was not relevant to the renewal of the fund's Advisory Contracts because the fund does not pay management fees and Strategic Advisers pays all other expenses of the fund, with limited exceptions.

Conclusion. Based on its evaluation of all of the considerations noted above, and after considering all material factors, the Board ultimately concluded that the advisory fee structures are fair and reasonable and that the fund's Advisory Contracts should be renewed.

Annual Report

Investment Adviser

Strategic Advisers, Inc.

Boston, MA

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Service Agents

Fidelity Investments Institutional

Operations Company, Inc.

Boston, MA

Fidelity Service Company, Inc.

Boston, MA

Custodian

The Bank of New York Mellon

New York, NY

PCI-ANN-0410 1.851417.102

PAS Income Opportunities Fund of Funds®

Offered exclusively to certain clients of Strategic Advisers, Inc. - not available for sale to the general public

Annual Report

February 28, 2010

Strategic Advisers, Inc.

A Fidelity Investments Company

Contents

Performance | How the fund has done over time. | |

Management's Discussion | The manager's review of fund performance, strategy and outlook. | |

Shareholder Expense Example | An example of shareholder expenses. | |

Investment Changes | A summary of major shifts in the fund's investments over the past six months. | |

Investments | A complete list of the fund's investments with their market values. | |

Financial Statements | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. | |

Notes | Notes to the financial statements. | |

Report of Independent Registered Public Accounting Firm |

| |

Trustees and Officers |

| |

Distributions |

| |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

PAS Income Opportunities Fund of Funds

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2010 | Past 1 | Life of |

PAS Income Opportunities Fund of Funds | 52.61% | 4.64% |

A From September 27, 2007.

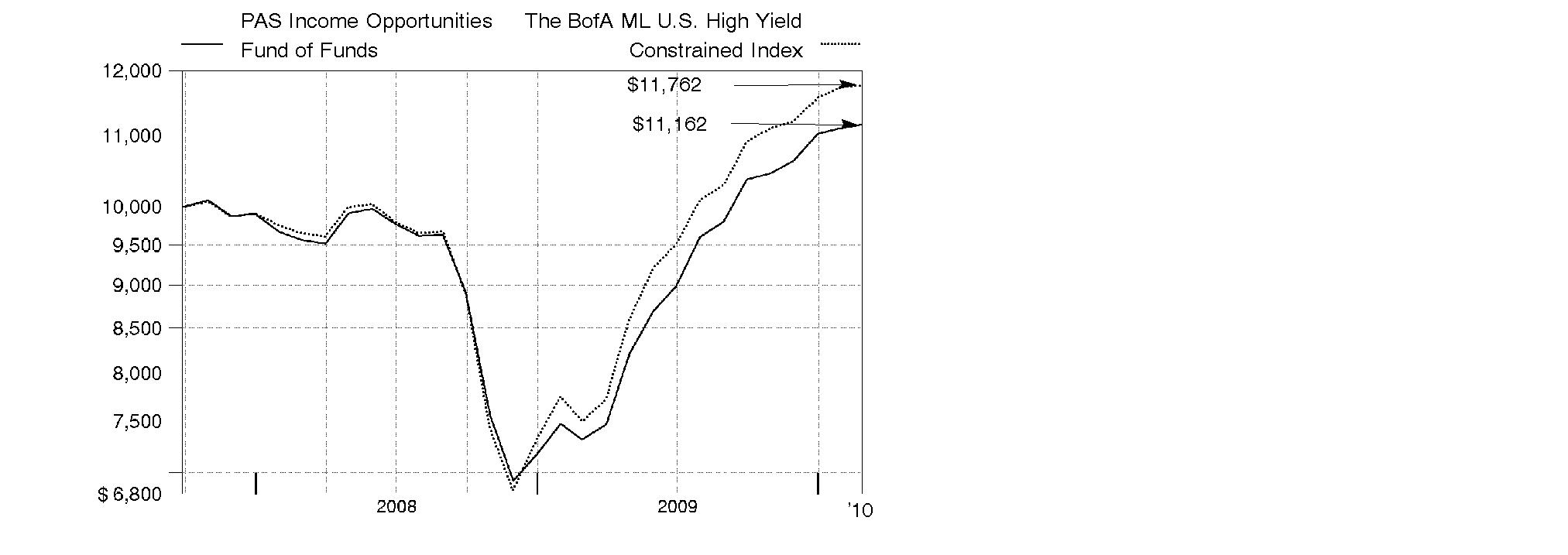

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in PAS Income Opportunities Fund of Funds on September 27, 2007, when the fund started. The chart shows how the value of your investment would have changed, and also shows how The BofA Merrill Lynch U.S. High Yield Constrained IndexSM performed over the same period.

Annual Report

Management's Discussion of Fund Performance

Market Recap: High-yield bonds and other credit-sensitive sectors of the fixed-income markets staged a remarkable recovery during the year ending February 28, 2010, coming back from the brink of disaster thanks to unprecedented rescue efforts by governments around the world. One of the most stunning aspects of this recovery was the complete about-face in investors' appetite for risk, moving from an all-out flight from risk in 2008 and early 2009 to a wholehearted embrace of it later in the period. This extraordinary change in investor sentiment was driven in large part by signs of growing positive momentum in U.S. and global economies. Early in the period, as the credit crisis stabilized and marketplace liquidity improved, high-yield issuers began refinancing outstanding debt, thereby repairing their balance sheets and reassuring investors that the extreme level of default priced into the market was not going to occur. As refinancing accelerated, aided by robust demand, lower-quality CCC-rated high-yield bonds rebounded faster than other market segments and led the sector's performance for the balance of the period. The BofA Merrill Lynch US High Yield Constrained IndexSM registered one of its best 12-month performances on record, returning 56.92%.

Comments from Gregory Pappas, Portfolio Manager of PAS Income Opportunities Fund of Funds®: The Fund returned 52.61% during the year, trailing its benchmark, the BofA Merrill Lynch index. At the beginning of the period, the managers of many underlying funds were emphasizing higher-quality high-yield bonds and were unable to shift gears quickly enough to keep pace as the lower-quality-driven rally unfolded. Also, even modest levels of cash in an underlying fund placed a considerable drag on relative returns. The Fund's primary detractors - T. Rowe Price High Yield Fund, MainStay High Yield Corporate Bond Fund, Fidelity® High Income Fund and Fidelity Advisor High Income Fund - each underperformed the benchmark by a significant margin, with Fidelity High Income Fund producing the best absolute return from that group. MainStay High Yield Corporate Bond Fund was a particular disappointment because, prior to this period, the fund had a history of outperforming in rising markets. However, its management was skeptical of the risk rally and, therefore, kept the fund defensively positioned. Top contributor Fidelity Capital & Income Fund - also the Fund's largest holding - beat the index by increasing its allocations to lower-rated bonds and individual equities. Fidelity Advisor High Income Advantage Fund outperformed by investing in a variety of out-of-index segments, including leveraged loans, equities and convertible securities.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2009 to February 28, 2010).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying affiliated and unaffiliated mutual funds (the Underlying Funds), the Fund also indirectly bears its proportionate share of the expenses of the Underlying Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying affiliated and unaffiliated mutual funds (the Underlying Funds), the Fund also indirectly bears its proportionate share of the expenses of the Underlying Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Annual Report

|

|

|

| Expenses Paid |

Actual | .00% | $ 1,000.00 | $ 1,139.30 | $ .00 |

Hypothetical (5% return per year before expenses) |

| $ 1,000.00 | $ 1,024.79 | $ .00 |

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the Underlying Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Annual Report

Investment Changes (Unaudited)

The information in the following tables is based on the direct investments of the Fund. |

Top Fund Holdings as of February 28, 2010 |

| % of fund's | % of fund's investments |

Fidelity Capital & Income Fund | 30.4 | 29.5 |

T. Rowe Price High Yield Fund Advisor Class | 22.9 | 23.3 |

Fidelity High Income Fund | 13.0 | 12.4 |

MainStay High Yield Corporate Bond Fund Class A | 10.6 | 11.6 |

BlackRock High Yield Bond Portfolio Investor A Class | 6.2 | 5.3 |

Fidelity Advisor High Income Fund Institutional Class | 5.4 | 5.6 |

Goldman Sachs High Yield Fund Class A | 4.9 | 4.5 |

Fidelity Advisor High Income Advantage Fund Institutional Class | 4.7 | 4.8 |

PIMCO High Yield Fund Administrative Class | 1.9 | 2.1 |

| 100.0 |

Asset Allocation (% of fund's investments) | |||||||

As of February 28, 2010 | As of August 31, 2009 | ||||||

| High Yield |

|  | High Yield |

| ||

| Bank Loan Funds 0.0% |

|  | Bank Loan Funds 0.9% |

| ||

Asset allocations in the pie charts reflect the categorizations of assets as defined by Morningstar as of the reporting dates indicated above. |

Annual Report

Investments February 28, 2010

Showing Percentage of Total Value of Investment in Securities

Fixed-Income Funds - 100.0% | |||

Shares | Value | ||

High Yield Fixed-Income Funds - 100.0% | |||

BlackRock High Yield Bond Portfolio Investor A Class | 6,703,586 | $ 47,729,536 | |

Fidelity Advisor High Income Advantage Fund Institutional Class (a) | 4,181,737 | 36,255,661 | |

Fidelity Advisor High Income Fund Institutional Class (a) | 5,216,184 | 41,885,958 | |

Fidelity Capital & Income Fund (a) | 27,118,711 | 233,492,098 | |

Fidelity High Income Fund (a) | 11,793,910 | 99,776,479 | |

Goldman Sachs High Yield Fund Class A | 5,441,082 | 37,597,878 | |

MainStay High Yield Corporate Bond Fund Class A | 14,413,759 | 81,437,737 | |

PIMCO High Yield Fund Administrative Class | 1,660,650 | 14,729,963 | |

T. Rowe Price High Yield Fund Advisor Class | 27,476,212 | 175,847,757 | |

TOTAL FIXED-INCOME FUNDS (Cost $735,310,901) | 768,753,067 | ||

TOTAL INVESTMENT IN SECURITIES - 100% (Cost $735,310,901) | $ 768,753,067 | ||

Legend |

(a) Affiliated company |

Affiliated Underlying Funds | |

Information regarding fiscal year to date income earned by the Fund from investments in affiliated Underlying Funds is as follows: | |

Fund | Income Earned |

Fidelity Advisor High Income Advantage Fund Institutional Class | $ 1,887,908 |

Fidelity Advisor High Income Fund Institutional Class | 2,615,703 |

Fidelity Capital & Income Fund | 13,806,503 |

Fidelity Floating Rate High Income Fund | 126,582 |

Fidelity High Income Fund | 5,900,333 |

Fidelity New Markets Income Fund | 204,088 |

Total | $ 24,541,117 |

Additional information regarding the Fund's fiscal year to date purchases and sales of the affiliated Underlying Funds is as follows: |

Fund | Value, | Purchases | Sales | Value, |

Fidelity Advisor High Income Advantage Fund Institutional Class | $ 14,813,293 | $ 10,710,126 | $ 1,447,035 | $ 36,255,661 |

Fidelity Advisor High Income Fund Institutional Class | 10,382,470 | 28,186,152 | 3,956,969 | 41,885,958 |

Fidelity Capital & Income Fund | 112,453,524 | 67,579,257 | 18,879,080 | 233,492,098 |

Fidelity Floating Rate High Income Fund | 12,233,182 | 569,012 | 14,063,438 | - |

Fidelity High Income Fund | 54,774,032 | 41,715,107 | 19,054,282 | 99,776,479 |

Fidelity New Markets Income Fund | - | 8,953,019 | 10,271,437 | - |

Total | $ 204,656,501 | $ 157,712,673 | $ 67,672,241 | $ 411,410,196 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Income Tax Information |

At February 28, 2010, the fund had a capital loss carryforward of approximately $1,319,950 all of which will expire on February 28, 2017. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

| February 28, 2010 | |

Assets | ||

Investment in securities, at value - See accompanying schedule: |

| |

Unaffiliated Underlying Funds (cost $353,976,058) | $ 357,342,871 |

|

Affiliated Underlying Funds (cost $381,334,843) | 411,410,196 |

|

Total investments (cost $735,310,901) |

| $ 768,753,067 |

Receivable for fund shares sold | 1,126,285 | |

Total assets | 769,879,352 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 602,274 | |

Payable for fund shares redeemed | 513,747 | |

Distributions payable | 10,592 | |

Total liabilities | 1,126,613 | |

|

|

|

Net Assets | $ 768,752,739 | |

Net Assets consist of: |

| |

Paid in capital | $ 739,386,854 | |

Undistributed net investment income | 173,677 | |

Accumulated undistributed net realized gain (loss) on investments | (4,249,958) | |

Net unrealized appreciation (depreciation) on investments | 33,442,166 | |

Net Assets, for 83,607,524 shares outstanding | $ 768,752,739 | |

Net Asset Value, offering price and redemption price per share ($768,752,739 ÷ 83,607,524 shares) | $ 9.19 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

| Year ended February 28, 2010 | |

Investment Income |

|

|