UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21439

Fidelity Rutland Square Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Stephen D. Fisher, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

| |

Date of reporting period: | February 28, 2007 |

Item 1. Reports to Stockholders

PAS International Fund of FundsSM

Managed exclusively for clients of

Strategic Advisers, Inc. - not available

for sale to the general public

Annual Report

February 28, 2007

Strategic Advisers, Inc.

A Fidelity Investments Company

Contents

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The managers' review of fund performance, strategy and outlook. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their

market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and

changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

To view a fund's proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

PAS International Fund of Funds

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average annual total returns take PAS International Fund of FundsSM's cumulative total return and show you what would have happened if PAS International Fund of Funds shares had performed at a constant rate each year. These numbers will be reported once the fund is a year old.

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in PAS International Fund of Funds on March 23, 2006, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Morgan Stanley Capital InternationalSM Europe, Australasia, Far East (MSCI® EAFE®) Index performed over the same period.

Annual Report

PAS International Fund of Funds

Management's Discussion of Fund Performance

Comments from Wilfred Chilangwa and Geoffrey Stein, Portfolio Managers of PAS International Fund of FundsSM

Many foreign stock markets enjoyed broad-based advances during the 12-month period that ended February 28, 2007, spurred higher by better-than-expected corporate earnings, improving economies and robust merger-and-acquisition activities. For the 12 months overall, the Morgan Stanley Capital InternationalSM Europe, Australasia, Far East (MSCI ® EAFE ®) Index - a performance measure of developed stock markets outside the United States and Canada - rose 21.25%. That strong return easily trumped the overall results of the U.S. equity market, as the Dow Jones Wilshire 5000 Composite IndexSM, the broadest measure of U.S. stock performance, increased a solid, but less potent, 12.15%. The European component of the MSCI EAFE, which represented roughly two-thirds of the index, firmly anchored the index's overall rise with its gain of 26.29%, helped in part by favorable currency movements. Every country component of Europe, in fact, turned in solid double-digit returns during the period. Meanwhile, Japan - the world's second-largest economy and second-largest component of the index - posted a more modest advance, climbing only 7.00% for the 12 months, largely due to the relative weakness of the yen and a general slowing of domestic consumer spending.

PAS International Fund of Funds produced a solid absolute return of 17.53% for the period from its inception on March 23, 2006, through February 28, 2007, compared with the slightly higher 18.89% advance of the MSCI EAFE index during the same period. A variety of factors led to this modest underperformance. Given the strong performance of international equities during the period, any cash held by the underlying funds was a drag on performance, as their U.S. dollar-denominated cash positions were negatively impacted by the dollar's general weakness relative to overseas currencies. An overall underweighting of the strong performing utilities sector and unfavorable security selection in the Japanese financials sector within the underlying funds also hurt. Among the funds that detracted were William Blair International Growth Fund; Morgan Stanley Institutional Fund - International Equity Portfolio; Causeway International Value Fund; and BlackRock Pacific Fund. On the upside, relative performance was helped by favorable stock selection across major regions among funds such as SSgA International Stock Selection Fund and Goldman Sachs Structured International Equity Fund. In addition, overweighted positions in areas such as international real estate, through funds such as Morgan Stanley Institutional Fund - International Real Estate Portfolio, and overexposure to emerging markets, through funds such as GMO Emerging Countries Fund, were a big help.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

PAS International Fund of Funds

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2006 to February 28, 2007).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

September 1, 2006 | Ending

Account Value

February 28, 2007 | Expenses Paid

During Period *

September 1, 2006

to February 28, 2007 |

Actual | $ 1,000.00 | $ 1,119.40 | $ .00 |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,024.79 | $ .00 |

* Expenses are equal to the Fund's annualized expense ratio of .00%; multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the underlying funds in which the fund invests are not included in the fund's annualized expense ratio.

Annual Report

PAS International Fund of Funds

Investment Changes

The information in the following tables is based on the direct investments of the Fund. |

Top Ten Fund Holdings as of February 28, 2007 |

| % of fund's

investments | % of fund's investments

6 months ago |

SSgA International Stock Selection Fund Institutional Class | 15.8 | 10.1 |

Goldman Sachs Structured International Equity Fund Class A | 15.4 | 17.5 |

Causeway International Value Fund Investor Class | 13.3 | 14.9 |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio Class B | 11.9 | 14.1 |

MFS Research International Fund Class A | 8.0 | 8.4 |

AIM International Growth Fund Class A | 5.0 | 5.7 |

William Blair International Growth Fund Class N | 4.9 | 6.2 |

Henderson International Opportunities Fund Class A | 4.4 | 5.0 |

Harbor International Fund Investor Class | 4.0 | 4.5 |

BlackRock Pacific Fund, Inc. Investor Class A | 4.0 | 4.3 |

| 86.7 | |

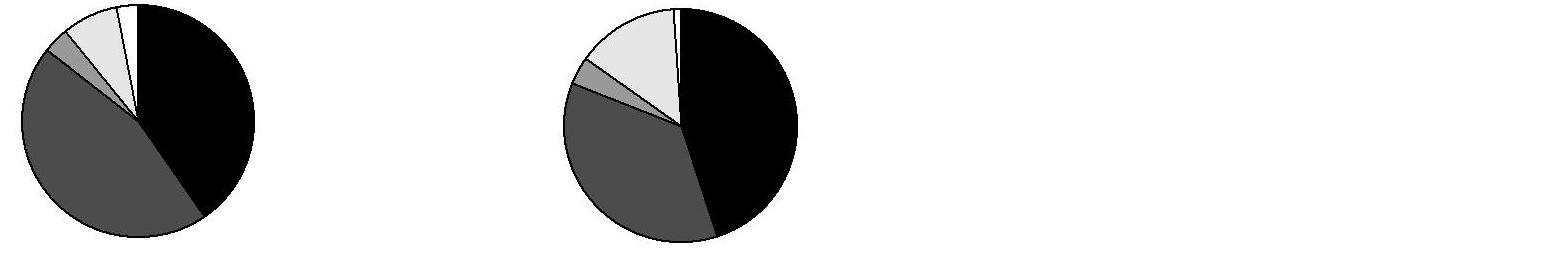

Asset Allocation (% of fund's investments) |

As of February 28, 2007 | As of August 31, 2006 |

| Foreign Large Blend Funds 33.3% | |  | Foreign Large

Blend Funds 28.1% | |

| Foreign Large Growth Funds 9.9% | |  | Foreign Large

Growth Funds 11.9% | |

| Foreign Large Value Funds 47.5% | |  | Foreign Large

Value Funds 51.0% | |

| Other 9.3% | |  | Other 9.0% | |

| | |  | | |

Asset allocations in the pie charts reflect the categorizations of assets as defined by Morningstar as of the reporting dates indicated above. |

Annual Report

PAS International Fund of Funds

Investments February 28, 2007

Showing Percentage of Total Value of Investment in Securities

Equity Funds - 100.0% |

| Shares | | Value |

Foreign Large Blend Funds - 33.3% |

GE Institutional International Equity Fund Service Class | 462,488 | | $ 7,700,431 |

Henderson International Opportunities Fund Class A | 463,708 | | 11,166,088 |

Julius Baer International Equity Fund II Class A | 333,294 | | 5,042,740 |

MFS Research International Fund Class A | 1,056,236 | | 20,374,785 |

SSgA International Stock Selection Fund Institutional Class | 2,911,885 | | 40,533,443 |

Thornburg International Value Fund Class A | 7,548 | | 214,351 |

TOTAL FOREIGN LARGE BLEND FUNDS | | 85,031,838 |

Foreign Large Growth Funds - 9.9% |

AIM International Growth Fund Class A | 433,727 | | 12,829,644 |

William Blair International Growth Fund Class N | 451,678 | | 12,606,345 |

TOTAL FOREIGN LARGE GROWTH FUNDS | | 25,435,989 |

Foreign Large Value Funds - 47.5% |

Causeway International Value Fund Investor Class | 1,729,640 | | 34,073,911 |

Goldman Sachs Structured International Equity Fund Class A | 2,608,924 | | 39,264,309 |

Harbor International Fund Investor Class | 168,141 | | 10,325,564 |

MFS International Value Fund Class A | 241,699 | | 7,359,740 |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio Class B | 1,480,634 | | 30,397,407 |

TOTAL FOREIGN LARGE VALUE FUNDS | | 121,420,931 |

Foreign Small Mid Growth Funds - 0.0% |

MFS International New Discovery Fund Class A | 42 | | 1,161 |

Neuberger Berman International Fund Trust Class | 299 | | 7,996 |

TOTAL FOREIGN SMALL MID GROWTH FUNDS | | 9,157 |

|

| Shares | | Value |

Other - 9.3% |

BlackRock Pacific Fund, Inc. Investor Class A | 347,046 | | $ 10,258,686 |

GMO Emerging Countries Fund Class M | 395,059 | | 6,281,438 |

Matthews Pacific Tiger Fund | 9,623 | | 224,022 |

Morgan Stanley Institutional Fund, Inc. - International Real Estate Portfolio Class B | 146,046 | | 5,174,407 |

ProFunds UltraJapan Investor Class | 35,171 | | 1,763,452 |

TOTAL OTHER | | 23,702,005 |

TOTAL EQUITY FUNDS (Cost $241,247,833) | 255,599,920 |

TOTAL INVESTMENT IN SECURITIES - 100% (Cost $241,247,833) | $ 255,599,920 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

PAS International Fund of Funds

Financial Statements

Statement of Assets and Liabilities

| February 28, 2007 |

| | |

Assets | | |

Investment in unaffiliated securities, at value (cost $241,247,833) - See accompanying schedule | | $ 255,599,920 |

Cash | | 10 |

Receivable for fund shares sold | | 481,692 |

Total assets | | 256,081,622 |

| | |

Liabilities | | |

Payable for investments purchased | $ 281,043 | |

Payable for fund shares redeemed | 200,649 | |

Total liabilities | | 481,692 |

| | |

Net Assets | | $ 255,599,930 |

Net Assets consist of: | | |

Paid in capital | | $ 231,165,349 |

Undistributed net investment income | | 283,706 |

Accumulated undistributed net realized gain (loss) on investments | | 9,798,788 |

Net unrealized appreciation (depreciation) on investments | | 14,352,087 |

Net Assets, for 22,548,375 shares outstanding | | $ 255,599,930 |

Net Asset Value, offering price and redemption price per share ($255,599,930 ÷ 22,548,375 shares) | | $ 11.34 |

Statement of Operations

| For the period March 23, 2006 (commencement of operations) to February 28, 2007 |

| | |

Investment Income | | |

Dividends from underlying funds | | $ 3,059,826 |

Interest | | 128 |

Total income | | 3,059,954 |

| | |

Expenses | | |

Management fee | $ 419,450 | |

Independent trustees' compensation | 20,799 | |

Total expenses before reductions | 440,249 | |

Expense reductions | (440,249) | - |

Net investment income (loss) | | 3,059,954 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | (226,921) | |

Realized gain distributions from underlying funds | 16,005,319 | 15,778,398 |

Change in net unrealized appreciation (depreciation) on underlying funds | | 14,352,087 |

Net gain (loss) | | 30,130,485 |

Net increase (decrease) in net assets resulting from operations | | $ 33,190,439 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| For the period March 23, 2006 (commencement

of operations) to February 28, 2007 |

Increase (Decrease) in Net Assets | |

Operations | |

Net investment income (loss) | $ 3,059,954 |

Net realized gain (loss) | 15,778,398 |

Change in net unrealized appreciation (depreciation) | 14,352,087 |

Net increase (decrease) in net assets resulting from operations | 33,190,439 |

Distributions to shareholders from net investment income | (2,776,248) |

Distributions to shareholders from net realized gain | (5,979,610) |

Total distributions | (8,755,858) |

Share transactions

Proceeds from sales of shares | 264,129,682 |

Reinvestment of distributions | 8,648,760 |

Cost of shares redeemed | (41,613,093) |

Net increase (decrease) in net assets resulting from share transactions | 231,165,349 |

Total increase (decrease) in net assets | 255,599,930 |

| |

Net Assets | |

Beginning of period | - |

End of period (including undistributed net investment income of $283,706) | $ 255,599,930 |

Other Information Shares | |

Sold | 25,633,799 |

Issued in reinvestment of distributions | 768,779 |

Redeemed | (3,854,203) |

Net increase (decrease) | 22,548,375 |

Financial Highlights

Period ended February 28, | 2007 F |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 10.00 |

Income from Investment Operations | |

Net investment income (loss) D | .18 |

Net realized and unrealized gain (loss) | 1.57 |

Total from investment operations | 1.75 |

Distributions from net investment income | (.13) |

Distributions from net realized gain | (.28) |

Total distributions | (.41) |

Net asset value, end of period | $ 11.34 |

Total Return B, C | 17.53% |

Ratios to Average Net Assets G | |

Expenses before expense reductions | .26% A |

Expenses net of contractual waivers | .00% A |

Expenses net of all reductions | .00% A |

Net investment income (loss) | 1.83% A |

Supplemental Data | |

Net assets, end of period (000 omitted) | $ 255,600 |

Portfolio turnover rate E | 16% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Amounts do not include the portfolio activity of the Underlying Funds.

F For the period March 23, 2006 (commencement of operations) to February 28, 2007.

G Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts contractually reimbursed by the investment adviser and do not represent the amount paid by the Fund during periods when reimbursements occur. Expenses net of contractual waivers reflect expenses after reimbursement by the investment adviser. Expenses net of all reductions represent the net expenses paid by the Fund. Fees and expenses of the Underlying Funds are not included in the Fund's annualized ratios. The Fund indirectly bears its proportionate share of the expenses of the Underlying Funds.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended February 28, 2007

1. Organization.

PAS International Fund of Funds (the Fund) is a fund of Fidelity Rutland Square Trust (the trust), an open-end management investment company organized as a Delaware statutory trust. The Fund invests in unaffiliated mutual funds (the Underlying Funds) and operates under Section 10(d) of the Investment Company Act of 1940. The Fund's investments in the Underlying Funds were not subject to front end sales charges or contingent deferred sales charges. The Fund is offered exclusively to clients of Strategic Advisers, Inc. (Strategic Advisers), an affiliate of Fidelity Management and Research Company (FMR). The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The Fund's Schedule of Investments lists each of the Underlying Funds as an investment of the Fund but does not include the underlying holdings of each Underlying Fund.

2. Significant Accounting Policies.

The following summarizes the significant accounting policies of the Fund:

Security Valuation. Net asset value (NAV) per share is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Investments in the Underlying Funds are valued at their net asset value each business day. If an Underlying Fund's net asset value is unavailable, shares of that fund may be valued by another method that the Board of Trustees believes reflects fair value in accordance with the Board's fair value pricing policies. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend and realized gain distributions from the Underlying Funds, if any, are recorded on the ex-dividend date and are automatically reinvested. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the Underlying Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Underlying Funds' expenses through the impact of these expenses on each Underlying Fund's net asset value. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to short-term gain distributions from the Underlying Funds and losses deferred due to wash sales.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

Unrealized appreciation | $ 17,506,512 |

Unrealized depreciation | (3,154,483) |

Net unrealized appreciation (depreciation) | 14,352,029 |

Undistributed ordinary income | 742,869 |

Undistributed long-term capital gain | 9,339,684 |

| |

Cost for federal income tax purposes | $ 241,247,891 |

Annual Report

2. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax character of distributions paid was as follows:

| February 28, 2007 |

Ordinary Income | $ 5,552,496 |

Long-term Capital Gains | 3,203,362 |

Total | $ 8,755,858 |

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective on the last business day of the semiannual reporting period for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management is currently evaluating the impact, if any, the adoption of FIN 48 will have on the Fund's net assets, results of operations and financial statement disclosures.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

3. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

4. Purchases and Sales of Investments.

Purchases and redemptions of the Underlying Fund shares aggregated $269,252,955 and $27,778,200, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Strategic Advisers provides the Fund with investment management related services. For these services, the Fund pays a monthly management fee to Strategic Advisers. The management fee is computed at an annual rate of .25% of the Fund's average net assets. Strategic Advisers, either itself or through an affiliated company, pays all other expenses of the Fund with certain exceptions such as interest expense and independent Trustees' compensation.

Strategic Advisers has contractually agreed to waive its management fee until March 31, 2010.

Other Transactions. Strategic Advisers has entered into an administration agreement with FMR under which FMR provides management and administrative services (other than investment advisory services) necessary for the operation of the Fund. FMR also contracts with other Fidelity companies to perform the services necessary for the operation of the Fund. Under this agreement, Strategic Advisers agrees to pay FMR a monthly administration fee. The Fund does not pay any fees for these services.

6. Expense Reductions.

In addition to waiving its management fee, Strategic Advisers has contractually agreed to reimburse the Fund until March 31, 2010 to the extent that annual operating expenses exceed .00% of average net assets. Some expenses, for example interest expense, are excluded from this reimbursement. During the period, this waiver and reimbursement reduced the Fund's expenses by $440,249.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Rutland Square Trust and the Shareholders of PAS International Fund of Funds:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of PAS International Fund of Funds (a fund of Fidelity Rutland Square Trust) at February 28, 2007, the results of its operations for the period indicated, the changes in its net assets for the period indicated and the financial highlights for the period indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the PAS International Fund of Funds' management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at February 28, 2007 by correspondence with the custodian, provides a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

April 24, 2007

Annual Report

Trustees and Officers

The Trustees, Members of the Advisory Board, and executive officers of the Trust and PAS International, as applicable, are listed below. The Board of Trustees governs PAS International and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee PAS International's activities, review contractual arrangements with companies that provide services to PAS International, and review PAS International's performance. Except for Mr. Howard E. Cox, Jr. and Ms. Karen Kaplan, each of the Trustees oversees ten funds advised by Strategic Advisers or an affiliate. Mr. Cox and Ms. Kaplan oversee five funds advised by Strategic Advisers or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. The executive officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-3455.

Interested Trustees*:

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Roger T. Servison (61) |

| Year of Election or Appointment: 2005 Mr. Servison is Chairman of the Board of Trustees. Mr. Servison serves as President of Strategic New Business Development for Fidelity Investments (1995-present), and oversees Fidelity Investments Life Insurance Company (FILI) and Strategic Advisers (May 2005-present). He also serves as President and a Director of Fidelity Brokerages Services (Japan), LLC (1996-present), a Director of Fidelity Investments Asia Funding Corp. (2000-present), and a Director of Strategic Advisers (1999-present). Previously, he served as President of Fidelity Investments Retail Marketing Company and Fidelity Brokerage Services, Inc. (1991-1995), President of Monarch Capital (1990-1991), Senior Vice President of Fidelity Capital (1989-1990), Senior Vice President of Fidelity's New Business Development Group (1987-1989), and Senior Vice President of Fidelity Brokerage Services (1980-1987); and he served as a Director of FBSI Investments, Inc. (1993-2003), FMR Brokerage Holdings, Inc. (1999-2003), and Fidelity Partners Management Corp. (1997-2003). |

Abigail P. Johnson (45) |

| Year of Election or Appointment: 2005 Ms. Johnson serves as President of Fidelity Employer Services Company (FESCO) (2005-present). She is President and a Director of Fidelity Investments Money Management, Inc. (2001-present), FMR Co., Inc. (2001-present), and a Director of FMR Corp. Previously, Ms. Johnson served as President and a Director of FMR (2001-2005), a Trustee of other investment companies advised by FMR (2001-2005), Senior Vice President of the Fidelity funds (2001-2005), and managed a number of Fidelity funds. |

Richard A. Spillane Jr. (56) |

| Year of Election or Appointment: 2005 Mr. Spillane serves as President of Strategic Advisers (2005-present). Previously, he served as Executive Vice President and Head of Global Investment Strategy for Fidelity Investments (2002-2005), Senior Vice President of FMR's Income Growth and International Groups (1997-2002) and Head of U.S. equities (2001-2002). Mr. Spillane serves as Director of Empire Fidelity Investments Life Insurance Company (2000-present), Vice Chairman of Fidelity's Political Action Committee (2001-present), and a Member of the Board of Fidelity Investments Life Insurance Company (2000-present). Mr. Spillane also serves as Chairman of the Board of Xaverian Brothers High School (1998-present). Mr. Spillane is a Chartered Financial Analyst (1985-present). |

* Trustees have been determined to be "Interested Trustees" by virtue of, among other things, their affiliation with the trust or various entities under common control with FMR.

Annual Report

Trustees and Officers - continued

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustees) may be sent to PAS International, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Age; Principal Occupation |

Peter C. Aldrich (62) |

| Year of Election or Appointment: 2005 From January 1997 through December 2004, Mr. Aldrich was Chairman and Managing Member of AEIGIS, LLC. (foreign private investment). From 1999 through December 2004, he was Faculty Chairman of The Research Council on Global Investment of The Conference Board (business and professional education non-profit). From 1998 through December 2004, Mr. Aldrich was Managing Member of Poseidon, LLC (foreign private investment). Previously, he was Co-Chairman of AEW Capital Management, L.P., a real estate investment advisor (1997-1998), and a founder and Managing Partner of Aldrich, Eastman & Waltch, Inc., a real estate investment advisor (1981-1996). Mr. Aldrich serves as a Member of the Board of the National Bureau of Economic Research (1994), a Member of the Board of Zipcar, Inc. (car sharing, 2002), and a Member of the Board of the Museum of Fine Arts Boston (2003). |

Ralph F. Cox (74) |

| Year of Election or Appointment: 2005 Mr. Ralph Cox is President of RABAR Enterprises (management consulting for the petroleum industry, 1998-present). Previously, he was President of Greenhill Petroleum Corporation (petroleum exploration and production). Until March 1990, Mr. Cox was President and Chief Operating Officer of Union Pacific Resources Company (exploration and production). He is a Director of CH2M Hill Companies (engineering), and Abraxas Petroleum (petroleum exploration and production, 1999). In addition, he is a member of advisory boards of Texas A&M University and the University of Texas at Austin. Mr. Ralph Cox and Mr. Howard Cox are not related. |

Advisory Board Member and Executive Officers:

Correspondence intended for each Advisory Board Member and executive officer may be sent to 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Howard E. Cox, Jr. (63) |

| Year of Election or Appointment: 2006 Member of the Advisory Board of PAS International. Mr. Howard Cox is as a Partner of Greylock, a national venture capital firm, with which he has been associated since 1971. Prior to joining Greylock, Mr. Cox served in the Office of the Secretary of Defense (1968-1971). He is currently a Director of Stryker Corporation (medical products and services). He has previously served on the boards of numerous public and private companies, including: The Boston Globe, American Medical Systems (acquired by Pfizer), AMISYS (acquired by McKessonHBOC ), APPEX (acquired by EDS), Arbor (acquired by Extendicare), BMR Financial Group, Centene, Checkfree, Cogito Data Systems, Compdent (acquired by APPS), Execucom, HPR (acquired by McKessonHBOC), ISSCO (acquired by Computer Associates), Landacorp, Lunar (acquired by GE), Multimate, Rehab Systems (acquired by Novacare), Share Development (acquired by United Healthcare), United Publishers (acquired by NYNEX), VHA Long Term Care (acquired by ServiceMaster), and Vincam (acquired by ADP). Mr. Cox is a Director and former Chairman of the National Venture Capital Association. Mr. Howard Cox and Mr. Ralph Cox are not related. |

Karen Kaplan (47) |

| Year of Election or Appointment: 2006 Member of the Advisory Board of PAS International. Ms. Kaplan is President of Hill, Holliday, Connors, Cosmopulos Inc., a subsidiary of The Interpublic Group of Companies, Inc. (group of advertising and specialized marketing and communication services companies). She has been with Hill, Holliday, Connors, Cosmopulos Inc. since 1982. Ms. Kaplan is Vice President of the Massachusetts Women's Forum and Vice Chair of the Board of the Massachusetts Society for the Prevention of Cruelty to Children. She serves as a Director of the Executive Committee of the Greater Boston Chamber of Commerce, a Member of the President's Council of the United Way of Massachusetts Bay, serves on the Advisory Council of the Urban Improv, and a Member of the Board of Mentors of Community Servings. Ms. Kaplan also serves as a Director of ADVO (direct mail marketing services), Tweeter Home Entertainment Group, and Delta Dental Plan of Massachusetts. |

Eric D. Roiter (58) |

| Year of Election or Appointment: 2006 Chief Legal Officer of PAS International. He also serves as Secretary of other Fidelity funds; Vice President, General Counsel, and Secretary of FMR Co., Inc. (2001-present) and FMR; Assistant Secretary of Fidelity Management & Research (U.K.) Inc. (2001-present), Fidelity Research & Analysis Company (2001-present), and Fidelity Investments Money Management, Inc. (2001-present). Mr. Roiter is an Adjunct Member, Faculty of Law, at Boston College Law School (2003-present). Previously, Mr. Roiter served as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (1998-2005). |

Stephen D. Fisher (44) |

| Year of Election or Appointment: 2007 Secretary of PAS International. Mr. Fisher previously served as Vice President and Director of Fidfunds Mutual Limited (1998-2003) and is a Senior Vice President, Deputy General Counsel of FMR. |

Mark Osterheld (51) |

| Year of Election or Appointment: 2006 President and Treasurer of PAS International. Previously, Mr. Osterheld served as Assistant Treasurer of other Fidelity funds (2002) and was an employee of FMR. |

Charles V. Senatore (52) |

| Year of Election or Appointment: 2006 Chief Compliance Officer of PAS International. He also serves as Senior Vice President and Chief Compliance Officer for the Fidelity Risk Oversight Group (2003-present). Before joining Fidelity Investments, Mr. Senatore served as Co-Head of Global Compliance (2002-2003), Head of Private Client Compliance (2000-2002), and Head of Regulatory Affairs (1999-2000) at Merrill Lynch. Mr. Senatore serves as a Member of the SIFMA Compliance and Legal Division Executive Committee (2004-present), a Member of the SIFMA Self Regulation and Supervisory Practices Committee (2004-present), and a Member of the New York Stock Exchange Compliance Advisory Committee (2000-2003; 2005-present). He previously served as a Member (2001-2003) and Chair (2003) of the NASD's District 10 Business Committee in New York. |

R. Stephen Ganis (40) |

| Year of Election or Appointment: 2006 Anti-Money Laundering (AML) officer of PAS International. Mr. Ganis also serves as AML officer of other Fidelity funds (2006- present) and FMR Corp. (2003-present). Before joining Fidelity Investments, Mr. Ganis practiced law at Goodwin Procter, LLP (2000-2002). |

Kathleen A. Tucker (48) |

| Year of Election or Appointment: 2006 Chief Financial Officer of PAS International. She also serves as Senior Vice President of Accounting and Pricing Operations for Fidelity Pricing & Cash Management Services (1999-present). Previously, Ms. Tucker worked at PricewaterhouseCoopers LLP (1981-1999), where she was most recently a partner in the investment management practice. |

Peter L. Lydecker (53) |

| Year of Election or Appointment: 2006 Assistant Treasurer of PAS International. Mr. Lydecker also serves as Assistant Treasurer of other Fidelity funds (2004) and is an employee of FMR. |

Annual Report

Distributions

The Board of Trustees of PAS International Fund of Funds voted to pay on April 16, 2007, to shareholders of record at the opening of business on April 13, 2007, a distribution of $.44 per share derived from capital gains realized from sales of portfolio securities and a dividend of $.01 per share from net investment income.

The fund hereby designates as capital gain dividends with respect to the taxable year ended February 28, 2007, $12,543,046, or, if subsequently determined to be different, the net capital gain of such year.

The fund designates 51% of the dividends distributed in December during the fiscal year as amounts which may be taken into account as a dividend for the purposes of the maximum rate under section 1(h)(11) of the Internal Revenue Code.

The fund will notify shareholders in January 2008 of amounts for use in preparing 2007 income tax returns.

Annual Report

Annual Report

Annual Report

Annual Report

Investment Adviser

Strategic Advisers, Inc.

Boston, MA

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Service Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

Bank of New York

New York, NY

FOI-ANN-0407 458889.1.0

1.824709.100

PAS Small Cap Fund of Funds®

Managed exclusively for clients of

Strategic Advisers, Inc. - not available

for sale to the general public

Annual Report

February 28, 2007

Strategic Advisers, Inc.

A Fidelity Investments Company

Contents

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The managers' review of fund performance, strategy and outlook. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over

the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their

market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and

changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

To view a fund's proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

PAS Small Cap Fund of Funds

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2007 | Past 1

year | Life of

FundA |

PAS Small Cap Fund of Funds | 6.86% | 12.83% |

A From June 23, 2005

$10,000 Over Life of Fund

Let's say hypothetically that $10,000 was invested in PAS Small Cap Fund of Funds on June 23, 2005, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Russell 2000® Index performed over the same period.

Annual Report

PAS Small Cap Fund of Funds

Management's Discussion of Fund Performance

Comments from Catherine Pena and Geoffrey Stein, Portfolio Managers of PAS Small Cap Fund of Funds®

A rosy year for stocks wilted just prior to the end of the 12-month period ending February 28, 2007. On the day prior to the period's close, the Dow Jones Industrial AverageSM plunged 416 points and the Standard & Poor's 500SM Index lost roughly 3.5% of its value, plummeting nearly 50 points and marking the benchmark's worst single-day performance since the day the market reopened after the 9/11 terrorist attacks. Though investors were obviously rattled by the development, it was only the 22nd-biggest decline for the S&P 500® in 20 years, and it could not overshadow how well stocks performed for the 12 months overall. For much of the past year, investors grew confident that the economy would not fall into a recession, and they bid up most broad-based stock indexes for six consecutive months from August through January. Overall for the year ending February 28, 2007, the S&P 500 was up 11.97%, the Dow advanced 14.24%, the Russell 2000® Index gained 9.87% and the NASDAQ Composite® Index rose 6.66%.

PAS Small Cap Fund of Funds produced a total return of 6.86% for the 12-month period that ended February 28, 2007, compared with a gain of 9.87% for its benchmark, the Russell 2000 Index. The fund's slight bias toward small-cap growth funds generally held back its overall return during a period when the small-cap value category performed significantly better than small-cap growth. Relative to the benchmark, the underlying funds that were underweighted in certain pockets of the financials sector - particularly in the robust real estate investment trust (REIT) segment - held back performance, as did those funds that were overexposed to the especially volatile energy sector. Among the detractors were such holdings as Hennessy Cornerstone Growth Fund, Hennessy Cornerstone Growth II Fund and Oberweis Emerging Growth Fund. On the upside, the fund's relative performance was helped by favorable stock selection within several of the underlying funds, including BlackRock Funds Small Cap Growth Equity Fund, Oppenheimer Main Street Small Cap Fund and Buffalo Small Cap Fund.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

PAS Small Cap Fund of Funds

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2006 to February 28, 2007).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

September 1, 2006 | Ending

Account Value

February 28, 2007 | Expenses Paid

During Period*

September 1, 2006 to

February 28, 2007 |

Actual | $ 1,000.00 | $ 1,112.00 | $ .00 |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,024.79 | $ .00 |

* Expenses are equal to the Fund's annualized expense ratio of .00%; multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the underlying funds in which the fund invests are not included in the fund's annualized expense ratio.

Annual Report

PAS Small Cap Fund of Funds

Investment Changes

The information in the following tables is based on the direct investments of the Fund.

Top Ten Fund Holdings as of February 28, 2007 |

| % of fund's investments | % of fund's investments 6 months ago |

Oppenheimer Main Street Small Cap Fund Class A | 12.7 | 13.1 |

Buffalo Small Cap Fund | 7.1 | 3.3 |

BlackRock Funds Small Cap Growth Equity Fund Investor Class A | 6.5 | 7.0 |

RS Partners Fund Class A | 6.3 | 9.5 |

William Blair Small Cap Growth Fund Class N | 6.1 | 3.6 |

Laudus Rosenberg U.S. Discovery Fund Investor Class | 6.0 | 5.7 |

Westport Select Cap Fund Class R | 5.3 | 6.7 |

Baron Small Cap Fund | 5.0 | 4.6 |

Keeley Small Cap Value Fund, Inc. | 4.4 | 7.3 |

Perritt MicroCap Opportunities Fund | 3.7 | 4.6 |

| 63.1 | |

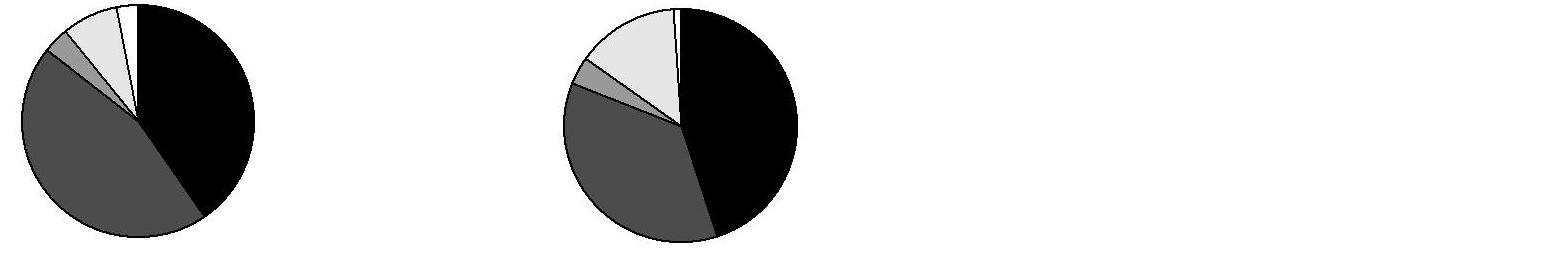

Asset Allocation (% of fund's investments) |

As of February 28, 2007 | As of August 31, 2006 |

| Small Blend Funds 40.3% | |  | Small Blend Funds 45.2% | |

| Small Growth

Funds 45.2% | |  | Small Growth

Funds 36.0% | |

| Small Value Funds 3.6% | |  | Small Value Funds 3.8% | |

| Mid-Cap Blend

Funds 7.7% | |  | Mid-Cap Blend

Funds 14.2% | |

| Other 3.2% | |  | Other 0.8% | |

Asset allocations in the pie charts reflect the categorizations of assets as defined by Morningstar as of the reporting dates indicated above. |

Annual Report

PAS Small Cap Fund of Funds

Investments February 28, 2007

Showing Percentage of Total Value of Investment in Securities

Equity Funds - 100.0% |

| Shares | | Value |

Small Blend Funds - 40.3% |

AIM Trimark Small Companies Fund Class A | 532,128 | | 8,412,943 |

CRM Small Cap Value Fund Investor Class | 1,025 | | 26,464 |

Hennessy Cornerstone Growth II Fund | 153,679 | | 4,618,050 |

ICM Small Co. Portfolio Institutional Class | 216 | | 8,326 |

ING Small Company Fund Class A | 191,479 | | 3,167,069 |

Keeley Small Cap Value Fund, Inc. | 507,798 | | 13,390,628 |

Laudus Rosenberg U.S. Discovery Fund Investor Class | 944,159 | | 18,165,627 |

Managers Special Equity Fund Managers Class | 36 | | 3,069 |

Neuberger Berman Genesis Fund Trust Class | 143 | | 6,963 |

Oppenheimer Main Street Small Cap Fund Class A | 1,701,055 | | 38,511,897 |

Perritt MicroCap Opportunities Fund | 362,814 | | 11,395,978 |

ProFunds Ultra Small Cap Fund Investor Class | 178,068 | | 5,703,524 |

RS Partners Fund Class A | 531,634 | | 19,144,128 |

TOTAL SMALL BLEND FUNDS | | 122,554,666 |

Small Growth Funds - 45.2% |

Baron Growth Fund | 81,415 | | 4,132,604 |

Baron Small Cap Fund | 644,118 | | 15,168,973 |

BlackRock Funds Small Cap Growth Equity Fund Investor Class A (a) | 985,225 | | 19,822,731 |

Buffalo Small Cap Fund | 770,036 | | 21,414,711 |

Champlain Small Company Fund Advisor Class | 184,943 | | 2,333,986 |

Franklin Small Cap Growth Fund II

Class A | 2,549 | | 32,374 |

Harbor Small Cap Growth Fund Investor Class | 746,246 | | 9,619,114 |

ING Small Cap Opportunities Fund

Class A (a) | 131,726 | | 4,162,545 |

Munder Micro-Cap Equity Fund Class A | 105,124 | | 4,701,154 |

Oberweis Emerging Growth Fund | 162,307 | | 4,382,277 |

Old Mutual Copper Rock Emerging Growth Portfolio Class A (a) | 198,049 | | 2,354,803 |

Old Mutual Emerging Growth Fund

Class Z (a) | 336,697 | | 5,228,912 |

Royce Value Plus Fund, Service Class | 675,041 | | 9,801,594 |

RS Emerging Growth Fund Class A (a) | 3,661 | | 132,405 |

RS Smaller Co. Growth Fund Class A | 354,528 | | 7,593,994 |

|

| Shares | | Value |

Turner Small Cap Growth Fund Class I (a) | 267,117 | | 7,893,304 |

William Blair Small Cap Growth Fund Class N | 734,510 | | 18,678,581 |

TOTAL SMALL GROWTH FUNDS | | 137,454,062 |

Small Value Funds - 3.6% |

American Beacon Small Cap Value Fund PlanAhead Class | 233 | | 5,045 |

HighMark Small Cap Value Fund Class A | 462,080 | | 8,132,600 |

Perritt Emerging Opportunities Fund | 180,842 | | 2,703,594 |

TOTAL SMALL VALUE FUNDS | | 10,841,239 |

Mid-Cap Blend Funds - 7.7% |

Hennessy Cornerstone Growth Fund | 400,210 | | 7,351,851 |

Westport Select Cap Fund Class R | 633,937 | | 16,038,618 |

TOTAL MID-CAP BLEND FUNDS | | 23,390,469 |

Other - 3.2% |

FBR Small Cap Financial Fund | 264,260 | | 7,264,515 |

The Information Age Fund Class A | 147,928 | | 2,356,497 |

TOTAL OTHER | | 9,621,012 |

TOTAL EQUITY FUNDS (Cost $295,861,071) | 303,861,448 |

TOTAL INVESTMENT IN SECURITIES - 100% (Cost $295,861,071) | $ 303,861,448 |

Legend |

(a) Non-income producing |

See accompanying notes which are an integral part of the financial statements.

Annual Report

PAS Small Cap Fund of Funds

Financial Statements

Statement of Assets and Liabilities

| February 28, 2007 |

| | |

Assets | | |

Investment in unaffiliated securities, at value (cost $295,861,071) - See accompanying schedule | | $ 303,861,448 |

Cash | | 7 |

Receivable for investments sold | | 400,000 |

Receivable for fund shares sold | | 616,510 |

Total assets | | 304,877,965 |

| | |

Liabilities | | |

Payable for investments purchased | $ 811,415 | |

Payable for fund shares redeemed | 205,094 | |

Total liabilities | | 1,016,509 |

| | |

Net Assets | | $ 303,861,456 |

Net Assets consist of: | | |

Paid in capital | | $ 284,832,500 |

Undistributed net investment income | | 102,099 |

Accumulated undistributed net realized gain (loss) on investments | | 10,926,480 |

Net unrealized appreciation (depreciation) on investments | | 8,000,377 |

Net Assets, for 25,814,951 shares outstanding | | $ 303,861,456 |

Net Asset Value, offering price and redemption price per share ($303,861,456 ÷ 25,814,951 shares) | | $ 11.77 |

Statement of Operations

| Year ended February 28, 2007 |

| | |

Investment Income | | |

Dividends from underlying funds | | $ 446,550 |

| | |

Expenses | | |

Management fee | $ 658,026 | |

Independent trustees' compensation | 24,640 | |

Total expenses before reductions | 682,666 | |

Expense reductions | (682,666) | - |

Net investment income (loss) | | 446,550 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | (1,306,831) | |

Realized gain distributions from underlying funds | 15,847,545 | 14,540,714 |

Change in net unrealized appreciation (depreciation) on underlying funds | | 3,992,662 |

Net gain (loss) | | 18,533,376 |

Net increase (decrease) in net assets resulting from operations | | $ 18,979,926 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended

February 28,

2007 | For the period

June 23, 2005

(commencement

of operations) to February 28, 2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 446,550 | $ 17,631 |

Net realized gain (loss) | 14,540,714 | 4,215,623 |

Change in net unrealized appreciation (depreciation) | 3,992,662 | 4,007,715 |

Net increase (decrease) in net assets resulting from operations | 18,979,926 | 8,240,969 |

Distributions to shareholders from net investment income | (242,280) | - |

Distributions to shareholders from net realized gain | (6,798,719) | (1,150,943) |

Total distributions | (7,040,999) | (1,150,943) |

Share transactions

Proceeds from sales of shares | 127,319,945 | 240,524,097 |

Reinvestment of distributions | 6,971,513 | 1,112,499 |

Cost of shares redeemed | (72,940,141) | (18,155,410) |

Net increase (decrease) in net assets resulting from share transactions | 61,351,317 | 223,481,186 |

Total increase (decrease) in net assets | 73,290,244 | 230,571,212 |

| | |

Net Assets | | |

Beginning of period | 230,571,212 | - |

End of period (including undistributed net investment income of $102,099 and undistributed net investment income of $17,631, respectively) | $ 303,861,456 | $ 230,571,212 |

Other Information Shares | | |

Sold | 11,291,206 | 21,966,570 |

Issued in reinvestment of distributions | 599,781 | 104,264 |

Redeemed | (6,459,874) | (1,686,996) |

Net increase (decrease) | 5,431,113 | 20,383,838 |

Financial Highlights

|

| |

Years ended February 28, | 2007 | 2006 F |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 11.31 | $ 10.00 |

Income from Investment Operations | | |

Net investment income (loss) D | .02 | - H |

Net realized and unrealized gain (loss) | .75 | 1.46 |

Total from investment operations | .77 | 1.46 |

Distributions from net investment income | (.01) | - |

Distributions from net realized gain | (.30) | (.15) |

Total distributions | (.31) | (.15) |

Net asset value, end of period | $ 11.77 | $ 11.31 |

Total Return B, C | 6.86% | 14.69% |

Ratios to Average Net Assets G | | |

Expenses before expense reductions | .26% | .37% A |

Expenses net of contractual waivers | .00% | .00% A |

Expenses net of all reductions | .00% | .00% A |

Net investment income (loss) | .17% | .03% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $ 303,861 | $ 230,571 |

Portfolio turnover rate E | 27% | 10% A |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower had certain expenses not been reduced during the periods shown. D Calculated based on average shares outstanding during the period. E Amounts do not include the portfolio activity of the Underlying Funds. F For the period June 23, 2005 (commencement of operations) to February 28, 2006. G Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts contractually reimbursed by the investment adviser and do not represent the amount paid by the Fund during periods when reimbursements occur. Expenses net of contractual waivers reflect expenses after reimbursement by the investment adviser. Expenses net of all reductions represent the net expenses paid by the Fund. Fees and expenses of the Underlying Funds are not included in the Fund's annualized ratios. The Fund indirectly bears its proportionate share of the expenses of the Underlying Funds. H Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended February 28, 2007

1. Organization.

PAS Small Cap Fund of Funds (the Fund) is a fund of Fidelity Rutland Square Trust (the trust), an open-end management investment company organized as a Delaware statutory trust. The Fund invests in unaffiliated mutual funds (the Underlying Funds) and operates under Section 10(d) of the Investment Company Act of 1940. The Fund's investments in the Underlying Funds were not subject to front end sales charges or contingent deferred sales charges. The Fund is offered exclusively to clients of Strategic Advisers, Inc. (Strategic Advisers), an affiliate of Fidelity Management and Research Company (FMR). The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The Fund's Schedule of Investments lists each of the Underlying Funds as an investment of the Fund but does not include the underlying holdings of each Underlying Fund.

2. Significant Accounting Policies.

The following summarizes the significant accounting policies of the Fund:

Security Valuation. Net asset value (NAV) per share is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Investments in the Underlying Funds are valued at their net asset value each business day. If an Underlying Fund's net asset value is unavailable, shares of that fund may be valued by another method that the Board of Trustees believes reflects fair value in accordance with the Board's fair value pricing policies.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend and realized gain distributions from the Underlying Funds, if any, are recorded on the ex-dividend date and are automatically reinvested.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the Underlying Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Underlying Funds' expenses through the impact of these expenses on each Underlying Fund's net asset value. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to short-term gain distributions from the Underlying Funds and losses deferred due to wash sales.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

Unrealized appreciation | $ 13,152,208 |

Unrealized depreciation | (5,155,057) |

Net unrealized appreciation (depreciation) | 7,997,151 |

Undistributed ordinary income | 102,099 |

Undistributed long-term capital gain | 10,929,706 |

| |

Cost for federal income tax purposes | $ 295,864,297 |

The tax character of distributions paid was as follows:

| February 28, 2007 | February 28, 2006 |

Ordinary Income | $ 1,453,675 | $ 997,484 |

Long-term Capital Gains | 5,587,324 | 153,459 |

Total | $ 7,040,999 | $ 1,150,943 |

Annual Report

2. Significant Accounting Policies - continued

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective on the last business day of the semiannual reporting period for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management is currently evaluating the impact, if any, the adoption of FIN 48 will have on the Fund's net assets, results of operations and financial statement disclosures.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

3. Purchases and Sales of Investments.

Purchases and redemptions of the Underlying Fund shares aggregated $142,886,414 and $72,231,406, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. Strategic Advisers provides the Fund with investment management related services. For these services, the Fund pays a monthly management fee to Strategic Advisers. The management fee is computed at an annual rate of .25% of the Fund's average net assets. Strategic Advisers, either itself or through an affiliated company, pays all other expenses of the Fund with certain exceptions such as interest expense and independent Trustees' compensation.

Strategic Advisers has contractually agreed to waive its management fee until March 31, 2010.

Other Transactions. Strategic Advisers has entered into an administration agreement with FMR under which FMR provides management and administrative services (other than investment advisory services) necessary for the operation of the Fund. FMR also contracts with other Fidelity companies to perform the services necessary for the operation of the Fund. Under this agreement, Strategic Advisers agrees to pay FMR a monthly administration fee. The Fund does not pay any fees for these services.

5. Expense Reductions.

In addition to waiving its management fee, Strategic Advisers has contractually agreed to reimburse the Fund until March 31, 2010 to the extent that annual operating expenses exceed .00% of average net assets. Some expenses, for example interest expense, are excluded from this reimbursement. During the period, this waiver and reimbursement reduced the Fund's expenses by $682,666.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Rutland Square Trust and the Shareholders of PAS Small Cap Fund of Funds:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of PAS Small Cap Fund of Funds (a fund of Fidelity Rutland Square Trust) at February 28, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the periods indicated and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the PAS Small Cap Fund of Funds' management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at February 28, 2007 by correspondence with the custodian, provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

PricewaterhouseCoopers LLP

Boston, Massachusetts

April 23, 2007

Annual Report

Trustees and Officers

The Trustees, Members of the Advisory Board, and executive officers of the Trust and PAS Small Cap, as applicable, are listed below. The Board of Trustees governs PAS Small Cap and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee PAS Small Cap's activities, review contractual arrangements with companies that provide services to PAS Small Cap, and review PAS Small Cap's performance. Except for Mr. Howard E. Cox, Jr. and Ms. Karen Kaplan, each of the Trustees oversees ten funds advised by Strategic Advisers or an affiliate. Mr. Cox and Ms. Kaplan oversee five funds advised by Strategic Advisers or an affiliate.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. The executive officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund's Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-3455.

Interested Trustees*:

Correspondence intended for each Trustee who is an interested person may be sent to Fidelity Investments, 82 Devonshire Street, Boston, Massachusetts 02109.

Name, Age; Principal Occupation |

Roger T. Servison (61) |