UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-21471 |

Nuveen Tax-Advantaged Total Return Strategy Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Closed-End Funds | |

| | | | | | |

| | | | | | | Annual Report December 31, 2016 |

| | | |

| | | | | | |

| | | | | | | |

| JTA | | | | | | |

| Nuveen Tax-Advantaged Total Return Strategy Fund | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| |

| | Life is Complex |

| |

| | Nuveen makes things e-simple. It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready – no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. |

| | |

| | Free e-Reports right to your e-mail! |

| |

| | www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account. |

| |

| or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

The past year saw a striking shift in the markets’ tone. The start of 2016 was beset by China’s economic woes, growing recession fears in the U.S. and oil prices sinking to lows not seen in more than a decade. World stock markets plunged, while bonds and other safe-haven assets rallied. But, by the end of the year, optimism had taken root. Economic outlooks were more upbeat, commodity prices stabilized, equity markets rebounded and bonds retreated. Despite the initial shocks of the Brexit referendum in the U.K. and Donald Trump’s win in the U.S. presidential election, and the uncertainties posed by the implications of these votes, sentiment continued to swing toward the positive as 2016 ended.

In between the year’s turbulent start and exuberant end, markets were soothed by improving economic data out of China, as the government’s stimulus measures appeared to be working, and a recovery in the energy and commodity-related sectors. The U.S. Federal Reserve backed off its more aggressive projections from the beginning of the year, only raising the fed funds rate once during the year, in December. The central banks in Europe and Japan maintained their accommodative stances. Global economic growth remained lackluster overall, as the pace of U.S. growth remained consistently mediocre. China appeared to moderate its slowdown and low growth in Europe and Japan persisted.

Will 2017 be the year of accelerating global growth and rising inflation that the markets are expecting? President Trump’s business-friendly, pro-growth agenda has been well received by the markets, but the policy details and the timeline have yet to take shape. Furthermore, there could be potential downside risks if “Trumponomics” were to trigger a steeper rise in inflation or a trade war. Outside the U.S., political dynamics in Europe are also in flux this year, with Brexit negotiations ongoing and elections in Germany, France and the Netherlands, and possibly a snap election in Italy.

Given the slate of policy unknowns and the range of possible outcomes, we believe volatility will remain a fixture this year. In this environment, Nuveen remains committed to both managing downside risks and seeking upside potential. If you’re concerned about how resilient your investment portfolio might be, we encourage you to talk to your financial advisor. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

February 23, 2017

Portfolio Managers’

Comments

Nuveen Tax-Advantaged Total Return Strategy Fund (JTA)

The Fund features portfolio management by two affiliates of Nuveen, LLC. The Fund’s investments in dividend-paying common and preferred stocks and call options written are managed by NWQ Investment Management Company, LLC (NWQ), while the Fund’s investments in senior corporate loans and other debt instruments are managed by Symphony Asset Management LLC (Symphony). James T. Stephenson, CFA, Managing Director of NWQ, along with Thomas J. Ray, CFA, and Susi Budiman, CFA, manage the NWQ portion of the Fund. The Symphony team is led by Gunther Stein, who serves as the firm’s Chief Investment Officer and Chief Executive Officer.

On December 21, 2016, a secondary blended benchmark change for the Nuveen Tax Advantaged Total Return Strategy Fund (JTA) was approved. Effective December 31, 2016, the new secondary Blended Benchmark consists of 72% MSCI World Index; 8% BofA/Merrill Lynch DRD (dividends received deduction) Eligible Preferred Securities Index; and 20% Credit Suisse First Boston (CSFB) Leveraged Loan Index

Here the portfolio management team reviews economic and market conditions, their management strategies and the performance of the Fund for the twelve-month reporting period ended December 31, 2016.

What factors affected the U.S. economy and domestic and global markets during the twelve-month reporting period ended December 31, 2016?

The restrained pace of growth that has defined the U.S. economic recovery since 2009 continued in the twelve-month reporting period. In the four calendar quarters of 2016, growth averaged below 2% (annualized), as measured by real gross domestic product (GDP), which is the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. Weakness was more pronounced in the first half of the reporting period, as GDP growth averaged below 1.5% in the first two quarters. Although a short-term jump in exports contributed to a more robust gain of 3.5% in the third quarter, the drop in exports that followed widened the trade deficit, which dampened economic activity to a 1.9% annualized rate in the last three months of 2016, as reported by the “advance” estimate of the Bureau of Economic Analysis.

Consumers, whose purchases comprise the largest component of the U.S. economy, benefited from employment growth and firming wages over the twelve-month reporting period. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 4.7% in December 2016 from 5.0% in December 2015 and job gains averaged slightly above 200,000 per month for the past twelve months. Consumer spending surged in the second quarter of 2016, then decelerated somewhat in the second half of the reporting period. Moreover, as the cost of gasoline and rents climbed over 2016, inflation ticked higher. The Consumer Price Index (CPI) rose 2.1% over the twelve-month reporting period ended

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Portfolio Managers’ Comments (continued)

December 2016 on a seasonally adjusted basis, as reported by the U.S. Bureau of Labor Statistics. The core CPI (which excludes food and energy) increased 2.2% during the same period, slightly above the Federal Reserve’s (Fed) unofficial longer term inflation objective of 2.0%.

The housing market was another bright spot in the economy. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.6% annual gain in November 2016 (most recent data available at the time this report was prepared) (effective July 26, 2016, the S&P/Case-Shiller U.S. National Home Price Index was renamed the S&P CoreLogic Case-Shiller U.S. National Home Price Index). The 10-City and 20-City Composites reported year-over-year increases of 4.5% and 5.3%, respectively.

Business spending weakened in the first half of 2016 but modestly improved over the remainder of the year. Early in the reporting period, the energy sector’s slump, financial market turbulence and a murky outlook on U.S. and global growth weighed on business sentiment and dampened spending. However, business confidence improved in the second half of the year, as oil prices stabilized, recession fears diminished and the election of Donald Trump stoked expectations for new pro-growth fiscal policy.

Other market-moving events during the reporting period included a spike in volatility in January and February 2016 triggered by deteriorating sentiment about China’s economy, another sharp downturn in oil prices and concerns about central bank policy both in the U.S. and around the world. The Brexit referendum in June 2016 also caught investors off guard. In response, U.K. sterling fell to 30-year lows and global equities tumbled while perceived safe-haven assets such as gold, the U.S. dollar and government bonds saw large inflows. However, the markets stabilized fairly quickly post-Brexit vote, buoyed by reassurances from global central banks and a perception that the temporary price rout presented an attractive buying opportunity. Following a relatively calm July and August 2016, volatility resumed in the final months of the reporting period. Investors worried whether central banks were reaching the limits of their effectiveness as global growth continues to stagnate. The health of the European banking sector came into question, renewing concerns about the potential to trigger a wider crisis. Political uncertainty increased leading up to the November U.S. presidential election, and Trump’s unexpected win contributed to an initial sell-off across global markets. However, after digesting the “shock,” U.S. equities rallied strongly and global developed market stocks pared their losses, while emerging markets, fixed income and gold remained lower through the end of the reporting period.

Stocks moved sharply higher immediately following the U.S. elections on expectations the incoming Trump administration will focus on domestic policies that will benefit business and the economy. This was in sharp contrast to consensus thought that a Trump win would lead to an immediate panic sell-off in the markets. (Dow futures initially sold off 800 points when it emerged that had he won the election). The Russell 1000® Value Index appreciated 7.1% in the thirty-six trading days after the November election, bringing its total return to 17.3%. A major catalyst for the rally was speculation that President-elect Trump will bring about tax reform, broad deregulation and boost fiscal spending (infrastructure) that will spur higher economic growth. This resulted in a major leadership change in the market as investors purchased banks and industrials and moved away from stable, dividend paying stocks including real estate investment trusts (REITs), utilities, pharmaceuticals and consumer staples. The Russell value indexes outperformed growth for the reporting period, while small caps significantly surpassed their large and midcap counterparts as smaller companies are generally more levered to the domestic economy and more likely to benefit from potential tax relief given higher effective rates.

Overseas, the Japanese market was strong with the Nikkei 225 Index surging 16.2% higher for the fourth quarter, driven partially by a decline in the yen and an increase in interest rates. The index was up a mere 0.4% for the full reporting period, however. The outlook for Japan looks more promising than it has been in several years as the yen has weakened, economic conditions at home and abroad are improving and corporate profits are beginning to accelerate. Europe’s economy is also gaining ground, although political risks remain on the horizon with elections in France, Italy, Germany and the Netherlands taking place in 2017. Economic growth could be hurt if there is greater power going to populist parties (U.K effect), and France and the Netherlands may vote to exit the European Union.

The investment grade corporate bond market (as measured by the BofA/Merrill Lynch U.S. Corporate Index) returned 5.96% for the reporting period 2016, although the fourth quarter was the worst quarterly return since the second quarter of 2013, driven by the increase in Treasury rates. High Yield bonds (as measured by the BofA/Merrill Lynch U.S. High Yield Index) finished the reporting period up 17.49%. By ratings, CCC rated securities was the best performer, returning 36.46%. Single B rated securities were the next best performer, returning 16.94%. BB’s underperformed for the reporting period, returning 13.22% respectively. Total new issue activity for the year was $286 billion, slightly lower versus the previous year’s total of $293 billion as the high yield primary market faced a more volatile backdrop. The BofA/Merrill Lynch Fixed Rate Preferred Securities Index returned 2.32% for the reporting period. Recapping 2016, the preferred market experienced a dramatic sell off in February 2016 triggered by several factors: oil touching $26 a barrel triggering recession concerns, worries about Deutsche Bank being unable to make interest payments on its hybrid securities, volatility spiking and Treasury yields moving lower. The market quickly recovered with preferreds catching a bid from large inflows into preferred exchange traded funds (ETFs) and demand from overseas and retail accounts. The rally tapered off in September 2016, as yields on preferreds became historically low and unattractive to institutional buyers. November’s election result was the next catalyst to push preferreds prices lower. Like other incoming producing assets including REITs and high dividend yield stocks, preferreds sold off with Treasury yields as markets reacted to the election of Donald Trump.

The loan market finished a strong year in which the asset class was positive for nine of the twelve months. The market was boosted by increased demand as the reality of rising rates was more evident and the London Interbank Offered Rate (LIBOR) returned to a level where much of the asset class was once again floating as floors were broadly crested. While technicals were certainly supportive to the asset class late in the reporting period, the outlook for loans remains constructive with default rates anticipated to remain benign, and fundamentals continuing to be supportive. The broad leveraged loan market, as represented by the Credit Suisse Leveraged Loan Index, produced returns of 9.86% for the reporting period. Loan mutual funds reported an inflow of $10.5 billion during the fourth quarter to finish the reporting period net positive $6.9 billion. Collateralized loan obligation (CLO) issuance totaled $57.8 billion for the quarter and $111.8 billion for 2016. Fourth quarter new issuance was $194.1 billion, driven by refinancing and repricing related activity, bringing the total to $485.4 billion, the largest annual total since 2013. The par-weighted U.S. default rate decreased to 1.49% in December, and remains below the long-term average default rate.

What key strategies were used to manage the Fund during this twelve-month reporting period ended December 31, 2016?

The Fund is designed to seek a high level of after-tax total return consisting primarily of tax-advantaged dividend income and capital appreciation. In an effort to achieve this, the Fund invests at least 60% in common stocks whose dividends may be eligible for favorable income tax treatment. The Fund also invests to a more limited extent in preferred stocks, which can range from a minimum of 5% to a maximum of 20%, that are eligible to pay tax-advantaged dividends, as well as 20% in senior loans and other debt instruments.

NWQ Key Strategies

For the common and preferred equity portion of the Fund’s portfolio, NWQ continued to employ an opportunistic, bottom-up strategy that focused on identifying undervalued companies possessing favorable risk/reward characteristics as well as what it thought were emerging catalysts that could unlock value or improve profitability. These catalysts included management changes, restructuring efforts, recognition of hidden assets and/or a positive change in the underlying fundamentals. We also focused on downside risk management and paid a great deal of attention to a company’s balance sheet and cash flow statement, not just the income statement. NWQ believes that cash flow analysis offers a more objective picture of a company’s financial position than an evaluation based on earnings alone.

Portfolio Managers’ Comments (continued)

Within the global equity income strategy managed by NWQ, up to 70% of the Fund’s managed assets can be invested in non-U.S. issues of any currency, including up to 20% in emerging market countries. JTA’s investment objective is to achieve a high level of after-tax total return, consisting primarily of tax-advantaged dividend income and capital appreciation. The Fund focuses on obtaining a dividend yield at least 100 basis points (bps) above the MSCI World Index and employs a value based approach in our bottom up analysis. NWQ looks for attractive absolute valuation, positive risk/reward with downside risk management and catalysts that can drive a positive revaluation of companies.

For the global equity portion of the Fund’s portfolio, NWQ’s global, value based strategy gives them plenty of opportunities to find not only attractive valuations, but high yields and a diversified portfolio. The Fund currently is overweight European equities. NWQ also believes the market underestimates the inherent operating leverage in many European companies due to the length of time they have had to rationalize their cost structures. All that is needed is some slightly positive growth to see meaningful advances in earnings. Global financials also remain a target rich opportunity. NWQ focuses on companies with strong balance sheets on the cusp of returning significant amounts of cash to shareholders.

While economic concerns and persistently stubborn low interest rates have weighed on the names, NWQ feels the risk/reward is heavily skewed to the upside. Balance sheets are improved, riskier businesses have been exited and valuations remain low. NWQ has found a variety of compelling opportunities across banks, insurance and services in numerous geographies. For the preferred securities portion of the Fund’s portfolio, NWQ reviews the specific characteristics of the preferred stocks available for investment and evaluate the effect on holding such an investment. These characteristics might include price, yield, issuer, rating, liquidity premium/discount and any other potential issues that can affect the value of the position. Additionally, because the preferred market is concentrated both by issuer and industry, attention is focused on the diversification of the Fund.

Symphony Key Strategies

In the senior loan and other debt portion of the Fund’s portfolio, Symphony continued to manage and monitor senior loan market risks. The overall macroeconomic backdrop during the reporting period remained supportive of the leveraged loan asset class. The Fund’s capital remained invested in issuers with strong credit profiles among non-investment grade debt, while offering attractive current income and yield. Fundamentally, Symphony feels that many of these companies have stable businesses, good asset coverage for senior debt holders and could perform well in a stable to slow growth environment.

How did the Fund perform during this twelve-month reporting period ended December 31, 2016?

The table in the Performance Overview and Holding Summaries section of this report provides total returns for the one-year, five-year and ten-year periods ended December 31, 2016. The Fund’s total returns at net asset value (NAV) are compared with the performance of a corresponding market index. For the twelve-month reporting period ended December 31, 2016, the Fund’s common share at NAV underperformed the S&P 500® Index and both its new and old secondary Blended Benchmarks.

NWQ

The equity portion of the Fund’s portfolio, managed by NWQ, contributed most to the Fund’s underperformance versus its blended benchmark given weakness in its health care and consumer staples sector holdings. Positive stock selection in producer durables and financial services sector contributed to performance. Geographically, the Fund’s investments in the United States, Brazil and Belgium helped performance, while investments in the U.K., Israel and France detracted. NWQ’s global, value based strategy provided opportunities to find not only attractive valuations, but high yields and a diversified portfolio.

Individual holdings that positively contributed to performance included financial services sector holding Unum Group. The company provides disability insurance products in the U.S. and the U.K. The accident and health insurer’s two largest operating segments, Unum U.S. and Colonial Life, reported increased operating income and better than expected

third quarter results, despite some weakness in its U.K. segment. Time Warner Inc. contributed positively to performance during the reporting period as the company agreed to a takeover offer from AT&T. It had long been part of our thesis that Time Warner Inc., the only major media company with a single class shareholder structure, and irreplaceable assets such as HBO and Warner Bros. would be an important part of a consolidating media landscape. While the spread to the deal price remains wide, NWQ believes continued improving fundamentals at Time Warner and its positive positioning to any change in domestic tax policy limits downside should a deal not go through. Lastly, Latin American airliner, Copa Holdings SA, rebounded strongly in 2016 as both Latin American economies and their underlying currencies strengthened significantly in the second half of the year. NWQ believed that excluding Venezuela, normal system operating margins for Copa were in the 17% range. After bottoming at mid-single digit margins in the second quarter of 2016, the company capped off 2016 with an operating margin guide of 15-17% for 2017, to which the stock reacted positively.

Positions that detracted from performance include health care holdings Teva Pharmaceutical Industries Limited. Teva encountered several negative catalysts during the reporting period, including the delayed acquisition of Allergan’s generics business, the likely loss of Copaxone patent exclusivity in 2017, an investigation into generic pricing and greater than expected price declines in its generics business. French utility holding Veolia Environment S.A. detracted from performance as third quarter earnings came in below expectations. Revenues contracted slightly versus expectations of an expansion as lower power prices and currency headwinds muted growth. Going forward NWQ believes the market will focus more on free cash flow, which is only marginally impacted by these factors. Lastly, Aviva PLC detracted from performance. Aviva is a British multi-national insurance company headquartered in London. During the reporting period, the company came under pressure from fears of the impact of Brexit.

The Fund’s preferred stock holdings positively contributed to performance. Several holdings positively contributed including the preferred stock holdings of SLM Corporation, Cobank Agricultural Credit Bank and HSBC Holdings PLC. The preferred stock of SLM Corporation which engages in the origination, servicing and administration of educational loans, continued to rebound during the reporting period. Cobank preferred stock was positively impacted by approved bylaws amendments and preferred stock revolver which increased the cap from $1.5 billion to $2.5 billion and provide shareholder authorization for the bank to issue preferred stock on an as needed basis up to the new limit through December 31, 2026. Lastly, the preferred stock of HSBC also positively contributed to performance. HSBC’s capital ratio rose to well above the average of the European bank sector, giving support to their preferreds.

Specific holdings that detracted were the preferred stock holdings of Charles Schwab Corporation, Bank of America Corporation and JPMorgan Chase & Company. The preferred market began the reporting period with large inflows into preferred ETFs and demand from overseas and retail accounts. However, the rally tapered off in September 2016 as yields on preferreds became historically low and unattractive to institutional buyers. In fact, the indiscriminate buying by preferred ETFs drove a significant portion of the preferred market to trade at negative yield-to-calls. The historically low, and in several cases negative yields, left little support for preferreds prices once the ETF inflows slowed down. November’s election result was the next catalyst to push preferreds prices lower. Like other incoming producing assets including REITs and high dividend yield stocks, preferreds sold off with Treasury yields as markets reacted to the election of Donald Trump. These factors contributed to these positions selling off during the reporting period.

The Fund also writes call options on individual stocks, while investing in these same stocks, to enhance returns while foregoing some upside potential. The effect on performance for the reporting period was negligible.

Symphony

The senior loan and other debt instruments portion of the Fund’s portfolio, managed by Symphony, contributed positively to total return performance during the reporting period. All our sectors positively contributed to performance, in particular the consumer discretionary and information technology sectors.

Portfolio Managers’ Comments (continued)

The Fund’s position in the term loans of energy sector holding Fieldwood Energy LLC contributed to performance. The loans performed well during the reporting period after the oil exploration and energy company launched a multi-pronged transaction that would provide it with two years of reprieve from the borrowing base redetermination process. Also positively contributing were the loans of information technology holding BMC Software, Inc. The loans contributed nicely to returns as the market’s increased confidence in the company’s ability to deliver positive earnings and draw increased revenue from recent new products helped boost prices during the reporting period. Additionally, performance was benefited by the loan of Communications Sales & Leasing Inc., a REIT that is engaged in the acquisition and construction of mission critical communications infrastructure and is a leading provider of wireless infrastructure solutions for the communications industry. The telecommunications firm performed well as the company announced their first planned acquisition and noted a robust merger and acquisition (M&A) pipeline, which was well received by the market.

Those specific loans that detracted from performance included positions in health care sector holding Millennium Laboratories, Inc. a health care service company. Also detracting from performance was our consumer discretionary holding, Cumulus Media, Inc., a large broadcasting company. The company’s desire to enter into a deleveraging transaction with debt holders that would be advantageous to the firm long term, but was viewed as disadvantageous to current holders was frowned upon by market participants late in the reporting period and the loans experienced weakness. Lastly, energy sector holding Southcross Holdings Borrower LP loans detracted. Southcross Energy Partners, L.P. is a master limited partnership that provides natural gas gathering and processing services company. It also sources, purchases, transports and sells natural gas. Southcross implemented several key initiatives during the third quarter that are expected to reduce operating expenses and lower future capital expenditure requirements. These initiatives include the planned shut-down and sale of two of its processing facilities and the reconfiguration of assets at the Lone Star processing facility. Despite these efforts, the loans sold off during the reporting period.

Fund

Leverage

IMPACT OF THE FUND’S LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the return of the Fund relative to its comparative benchmarks was the Fund’s use of leverage through the use of bank borrowings. The Fund uses leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return for common shareholders. However, use of leverage also can expose common shareholders to additional volatility. For example, as the prices of securities held by the Fund decline, the negative impact of these valuation changes on common share NAV and common shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance common share returns during periods when the prices of securities held by the Fund generally are rising. The Fund’s use of leverage had a negative impact on performance during this reporting period.

The Fund continued to utilize forward starting interest rate swap contracts to partially hedge its future interest cost of leverage, which as mentioned previously, is through the use of bank borrowings. The swap contracts had a negative impact on performance during this reporting period.

As of December 31, 2016, the Fund’s percentages of leverage are as shown in the accompanying table.

| | | | |

| | | JTA | |

Effective Leverage* | | | 30.37 | % |

Regulatory Leverage* | | | 30.37 | % |

| * | Effective leverage is the Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of the Fund. The Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily In connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of the Fund’s effective leverage ratio. Both of these are part of the Fund’s capital structure. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUND’S REGULATORY LEVERAGE

Bank Borrowings

As noted above, the Fund employs leverage through the use of bank borrowings. The Fund’s bank borrowing activities are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| January 1, 2016 | | | Draws | | | Paydowns | | | December 31, 2016 | | | Average Balance

Outstanding | | | | | | Draws | | | Paydowns | | | February 28, 2017 | |

| | $82,400,000 | | | | $400,000 | | | | $(6,000,000) | | | | $76,800,000 | | | | $76,889,344 | | | | | | | | $ — | | | | $ — | | | | $76,800,000 | |

Refer to Notes to Financial Statements, Note 9 – Borrowing Arrangements for further details.

Common Share

Information

DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of December 31, 2016, the Fund’s fiscal and tax year end, and may differ from previously issued distribution notifications. The Fund’s distribution levels may vary over time based on the Fund’s investment activities and portfolio investment value changes.

The Fund has adopted a managed distribution program. The goal of the Fund’s managed distribution program is to provide shareholders relatively consistent and predictable cash flow by systematically converting its expected long-term return potential into regular distributions. As a result, regular distributions throughout the year will likely include a portion of expected long-term and/or short-term gains (both realized and unrealized), along with net investment income.

Important points to understand about Nuveen fund managed distributions are:

| • | | The Fund seeks to establish a relatively stable common share distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about the Fund’s past or future investment performance from its current distribution rate. |

| • | | Actual common share returns will differ from projected long-term returns (and therefore the Fund’s distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value. |

| • | | Each period’s distributions are expected to be paid from some or all of the following sources: |

| | • | | net investment income consisting of regular interest and dividends, |

| | • | | net realized gains from portfolio investments, and |

| | • | | unrealized gains, or, in certain cases, a return of principal (non-taxable distributions). |

| • | | A non-taxable distribution is a payment of a portion of the Fund’s capital. When the Fund’s returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when the Fund’s returns fall short of distributions, it will represent a portion of your original principal unless the shortfall is offset during other time periods over the life of your investment (previous or subsequent) when the Fund’s total return exceeds distributions. |

| • | | Because distribution source estimates are updated throughout the current fiscal year based on the Fund’s performance, these estimates may differ from both the tax information reported to you in the Fund’s 1099 statement, as well as the ultimate economic sources of distributions over the life of your investment. |

The following table provides information regarding the Fund’s distributions and total return performance over various time periods. This information is intended to help you better understand whether the Fund’s returns for the specified time periods were sufficient to meet its distributions.

Data as of December 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per Share

Regular Distribution | | | | | | | | | | | | | | | | | | Annualized Total

Return on NAV | |

Inception

Date | | Latest

Quarter | | | Total

Current

Year | | | Total

Current Year

Investment

Income | | | Total

Current Year

Net

Realized

Gain/Loss | | | Current

Unrealized

Gain/Loss | | | Current

Distribution

Rate on

NAV2,3 | | | Actual

Full Year

Distribution

Rate on

NAV2,3 | | | 1-Year | | | 5-Year | |

1/2004 | | | $0.2480 | | | | $1.0120 | | | | $0.4663 | | | | $0.1737 | | | | $1.1577 | | | | 7.80% | | | | 7.96% | | | | 5.10% | | | | 10.92% | |

| 1 | Current distribution per share, annualized, divided by the NAV per share on the stated date. |

| 2 | Actual total per share distributions made during the full fiscal year, divided by the NAV per share on the stated date. |

| 3 | Each distribution rate represent a “managed distribution” rate. For this fund, at least in the just completed fiscal year, distributions were predominately comprised of sources other than net investment income, as shown in the table immediately below. |

The following table provides of the Fund’s distribution sources, as of December 31, 2016.

The amounts and sources of distributions reported in this notice are for financial reporting purposes and are not being provided for tax reporting purposes. The actual amounts and character of the distributions for tax reporting purposes will be reported to shareholders on Form 1099-DIV which will be sent to shareholders shortly after calendar year-end. More details about the Fund’s distributions and the basis for these estimates are available on www.nuveen.com/cef.

Data as of December 31, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year | | | Fiscal Year | |

| Source of Distribution | | | Per Share Amounts | |

Net

Investment

Income | | | Realized

Gains | | | Return of

Capital1 | | | Distributions | | | Net

Investment

Income | | | Realized

Gains | | | Return of

Capital1 | |

| | 64.55% | | | | 0.00% | | | | 35.45% | | | | $1.0120 | | | | $0.6533 | | | | $0.0000 | | | | $0.3587 | |

| 1 | Return of Capital and may represent unrealized gains, return of shareholder’s principal, or both. In certain circumstances, all or a portion of the return of capital may be characterized as ordinary income under federal tax law. The acutal tax characterization will be provided to shareholders on Form 1099-DIV shortly after claendar year-end. |

COMMON SHARE REPURCHASES

During August 2016, the Fund’s Board of Trustees reauthorized an open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of December 31, 2016, and since the inception of the Fund’s repurchase program, the Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| | | | |

| | | JTA | |

Common shares cumulatively repurchased and retired | | | 122,745 | |

Common shares authorized for repurchase | | | 1,385,000 | |

During the current reporting period, the Fund did not repurchase any of its outstanding common shares.

OTHER COMMON SHARE INFORMATION

As of December 31, 2016, and during the current reporting period, the Fund’s common share price was trading at a premium/(discount) to its common share NAV as shown in the accompanying table.

| | | | |

| | | JTA | |

Common share NAV | | | $12.72 | |

Common share price | | | $11.32 | |

Premium/(Discount) to NAV | | | (11.01 | )% |

12-month average premium/(discount) to NAV | | | (10.22 | )% |

Risk

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Tax-Advantaged Total Return Strategy (JTA)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Common stock returns often have experienced significant volatility. Adjustable Rate Senior Loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk. Lower credit debt securities may be more likely to fail to make timely interest or principal payments. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. For these and other risks, including tax risk, please see the Fund’s web page at www.nuveen.com/JTA.

THIS PAGE INTENTIONALLY LEFT BLANK

JTA

Nuveen Tax-Advantaged Total Return Strategy Fund

Performance Overview and Holding Summaries as of December 31, 2016

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of December 31, 2016

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

| JTA at Common Share NAV | | | 5.10% | | | | 10.92% | | | | 0.94% | |

| JTA at Common Share Price | | | 5.85% | | | | 12.09% | | | | 0.07% | |

| Blended Benchmark (new) | | | 7.84% | | | | 10.34% | | | | 4.57% | |

| Blended Benchmark (old) | | | 12.81% | | | | 11.08% | | | | 4.91% | |

| S&P 500® Index | | | 11.96% | | | | 14.66% | | | | 6.95% | |

Average Annual Total Returns as of December 31, 20161

(including retained gain tax credit/refund)

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

| JTA at Common Share NAV | | | 5.10% | | | | 10.92% | | | | 1.01% | |

| JTA at Common Share Price | | | 5.85% | | | | 12.09% | | | | 0.15% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

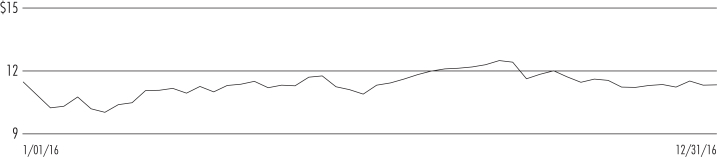

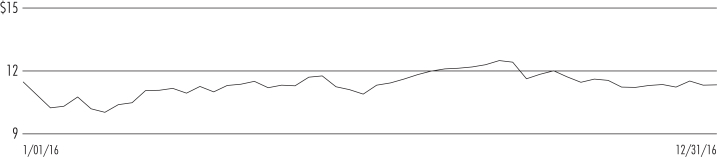

Common Share Price Performance — Weekly Closing Price

| 1 | The Fund elected to retain a portion of its realized long-term capital gains for the tax year ended December 31, 2007 and pay required federal corporate income taxes on these amounts. These standardized total returns include the economic benefit to common shareholders of record of this tax credit/refund. The Fund had no retained capital gains for the tax years ended December 31, 2008 through December 31, 2016. |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 92.6% | |

| Convertible Preferred Securities | | | 6.6% | |

| $25 Par (or similar) Retail Preferred | | | 7.6% | |

| Variable Rate Senior Loan Interests | | | 27.5% | |

| Corporate Bonds | | | 0.7% | |

| $1,000 Par (or similar) Institutional Preferred | | | 7.2% | |

Repurchase Agreements | | | 1.2% | |

| Other Assets Less Liabilities | | | 0.2% | |

Net Assets Plus Borrowings | | | 143.6% | |

| Borrowings | | | (43.6)% | |

Net Assets | | | 100% | |

Portfolio Credit Quality

(% of total fixed-income investments)

| | | | |

| A | | | 1.6% | |

| BBB | | | 25.2% | |

| BB or Lower | | | 56.3% | |

| N/R (not rated) | | | 16.9% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)2

| | | | |

| Banks | | | 13.0% | |

| Insurance | | | 9.0% | |

| Pharmaceuticals | | | 7.6% | |

| Media | | | 7.1% | |

| Software | | | 5.6% | |

| Capital Markets | | | 4.9% | |

| Diversified Telecommunication Services | | | 4.8% | |

| Food Products | | | 3.2% | |

| Industrial Conglomerates | | | 3.1% | |

| Chemicals | | | 2.8% | |

| Air Freight & Logistics | | | 2.7% | |

| Electric Utilities | | | 2.2% | |

| Multi-Utilities | | | 2.1% | |

| Oil, Gas & Consumable Fuels | | | 2.1% | |

| Food & Staples Retailing | | | 1.9% | |

| Tobacco | | | 1.9% | |

| Automobiles | | | 1.8% | |

| Communications Equipment | | | 1.8% | |

| Semiconductors & Semiconductor Equipment | | | 1.8% | |

| Other | | | 19.8% | |

| Repurchase Agreements | | | 0.8% | |

Total | | | 100% | |

Top Five Issuers

(% of total investments)2

| | | | |

| Oracle Corporation | | | 2.6% | |

GlaxoSmithKline PLC | | | 2.5% | |

Nippon Telegraph and Telephone Corporation | | | 2.4% | |

Teva Pharmaceutical Industries Limited | | | 2.3% | |

Unum Group | | | 2.3% | |

Country Allocation3

(% of total investments)2

| | | | |

| United States | | | 59.6% | |

| Germany | | | 8.6% | |

| United Kingdom | | | 7.4% | |

| Switzerland | | | 4.4% | |

| Netherlands | | | 3.3% | |

| Japan | | | 3.3% | |

| Other | | | 13.4% | |

Total | | | 100% | |

| 2 | Excluding investments in derivatives. |

| 3 | Includes 0.7% (as a percentage of total investments) in emerging market countries. |

Report of

Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Tax-Advantaged Total Return Strategy Fund:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Nuveen Tax-Advantaged Total Return Strategy Fund (the “Fund”) as of December 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, the statement of cash flows for the year then ended, and the financial highlights for each of the years in the three-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the periods presented through December 31, 2013 were audited by other auditors whose report dated February 27, 2014 expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2016, by correspondence with the custodian and brokers or other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of December 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, its cash flows for the year then ended, and the financial highlights for each of the years in the three-year period then ended, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Chicago, Illinois

February 28, 2017

JTA

| | |

Nuveen Tax-Advantaged Total Return Strategy Fund | | |

Portfolio of Investments | | December 31, 2016 |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | | | | Value | |

| | | | | |

| | | | LONG-TERM INVESTMENTS – 142.2% (99.2% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | | |

| | | | COMMON STOCKS – 92.6% (64.4% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Air Freight & Logistics – 3.9% | | | | | | | | | | | | |

| | | | | |

| | 152,200 | | | Deutsche Post AG, (2) | | | | | | | | | | | | | | $ | 4,991,404 | |

| | 15,800 | | | United Parcel Service, Inc., Class B, (3), (4) | | | | | | | | | | | | | | | 1,811,312 | |

| | | | Total Air Freight & Logistics | | | | | | | | | | | | | | | 6,802,716 | |

| | | | | |

| | | | Automobiles – 1.6% | | | | | | | | | | | | |

| | | | | |

| | 37,200 | | | Daimler AG, (2) | | | | | | | | | | | | | | | 2,765,820 | |

| | | | | |

| | | | Banks – 10.4% | | | | | | | | | | | | |

| | | | | |

| | 8,325,000 | | | Bank of Ireland, (2), (5) | | | | | | | | | | | | | | | 2,053,192 | |

| | 67,500 | | | CIT Group Inc., (3) | | | | | | | | | | | | | | | 2,880,900 | |

| | 90,500 | | | Citigroup Inc., (3) | | | | | | | | | | | | | | | 5,378,415 | |

| | 316,000 | | | ING Groep N.V, (3) | | | | | | | | | | | | | | | 4,455,600 | |

| | 40,100 | | | JPMorgan Chase & Co. | | | | | | | | | | | | | | | 3,460,229 | |

| | | | Total Banks | | | | | | | | | | | | | | | 18,228,336 | |

| | | | | |

| | | | Capital Markets – 5.7% | | | | | | | | | | | | |

| | | | | |

| | 167,500 | | | Ares Capital Corporation | | | | | | | | | | | | | | | 2,762,075 | |

| | 514,000 | | | Deutsche Boerse AG, (2) | | | | | | | | | | | | | | | 4,084,758 | |

| | 203,000 | | | UBS Group AG, (2) | | | | | | | | | | | | | | | 3,173,996 | |

| | | | Total Capital Markets | | | | | | | | | | | | | | | 10,020,829 | |

| | | | | |

| | | | Chemicals – 3.1% | | | | | | | | | | | | |

| | | | | |

| | 273,500 | | | CVR Partners LP | | | | | | | | | | | | | | | 1,643,735 | |

| | 67,000 | | | Dow Chemical Company | | | | | | | | | | | | | | | 3,833,740 | |

| | | | Total Chemicals | | | | | | | | | | | | | | | 5,477,475 | |

| | | | | |

| | | | Communications Equipment – 2.5% | | | | | | | | | | | | |

| | | | | |

| | 84,600 | | | Cisco Systems, Inc. | | | | | | | | | | | | | | | 2,556,612 | |

| | 316,000 | | | Ericsson, (3) | | | | | | | | | | | | | | | 1,842,280 | |

| | | | Total Communications Equipment | | | | | | | | | | | | | | | 4,398,892 | |

| | | | | |

| | | | Diversified Financial Services – 1.4% | | | | | | | | | | | | |

| | | | | |

| | 299,000 | | | Challenger Limited, (2) | | | | | | | | | | | | | | | 2,415,892 | |

| | | | | |

| | | | Diversified Telecommunication Services – 4.7% | | | | | | | | | | | | |

| | | | | |

| | 141,500 | | | Nippon Telegraph and Telephone Corporation, ADR, (3) | | | | | | | | | | | | | | | 5,952,905 | |

| | 173,400 | | | Telefonica Brasil SA, (2) | | | | | | | | | | | | | | | 2,343,204 | |

| | | | Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 8,296,109 | |

| | | | | |

| | | | Electric Utilities – 1.2% | | | | | | | | | | | | |

| | | | | |

| | 705,000 | | | EDP – Energias de Portugal, S.A., (2) | | | | | | | | | | | | | | | 2,145,700 | |

| | | | | |

| | | | Electrical Equipment – 1.1% | | | | | | | | | | | | |

| | | | | |

| | 29,700 | | | Eaton PLC, (3) | | | | | | | | | | | | | | | 1,992,573 | |

| | | | | |

| | | | Equity Real Estate Investment Trusts – 1.9% | | | | | | | | | | | | |

| | | | | |

| | 43,500 | | | Apartment Investment & Management Company, Class A | | | | | | | | | | | | | | | 1,977,075 | |

| | 86,000 | | | Paramount Group Inc. | | | | | | | | | | | | | | | 1,375,140 | |

| | | | Total Equity Real Estate Investment Trusts | | | | | | | | | | | | | | | 3,352,215 | |

| | | | | |

| | | | Food & Staples Retailing – 2.2% | | | | | | | | | | | | |

| | | | | |

| | 48,500 | | | CVS Health Corporation, (3) | | | | | | | | | | | | | | | 3,827,135 | |

| | | | |

| JTA | | Nuveen Tax-Advantaged Total Return Strategy Fund | | |

| | Portfolio of Investments (continued) | | December 31, 2016 |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | | | | Value | |

| | | | | |

| | | | Food Products – 2.3% | | | | | | | | | | | | |

| | | | | |

| | 443,000 | | | Orkla ASA, (2), (3) | | | | | | | | | | | | | | $ | 3,995,860 | |

| | | | | |

| | | | Health Care Providers & Services – 0.0% | | | | | | | | | | | | |

| | | | | |

| | 10,108 | | | Millenium Health LLC, (5) | | | | | | | | | | | | | | | 11,793 | |

| | | | | |

| | | | Hotels, Restaurants & Leisure – 0.8% | | | | | | | | | | | | |

| | | | | |

| | 21,400 | | | Cedar Fair LP, (4) | | | | | | | | | | | | | | | 1,373,880 | |

| | | | | |

| | | | Household Durables – 1.3% | | | | | | | | | | | | |

| | | | | |

| | 140,700 | | | Sekisui House, Ltd., (2) | | | | | | | | | | | | | | | 2,337,631 | |

| | | | | |

| | | | Industrial Conglomerates – 4.0% | | | | | | | | | | | | |

| | | | | |

| | 60,000 | | | General Electric Company, (4) | | | | | | | | | | | | | | | 1,896,000 | |

| | 103,000 | | | Philips Electronics, (3) | | | | | | | | | | | | | | | 3,148,710 | |

| | 16,100 | | | Siemens AG, Sponsored ADR, (2) | | | | | | | | | | | | | | | 1,971,283 | |

| | | | Total Industrial Conglomerates | | | | | | | | | | | | | | | 7,015,993 | |

| | | | | |

| | | | Insurance – 11.1% | | | | | | | | | | | | |

| | | | | |

| | 81,000 | | | Ageas, (2) | | | | | | | | | | | | | | | 3,201,671 | |

| | 226,000 | | | Allinaz S.E, (2), (3) | | | | | | | | | | | | | | | 3,724,480 | |

| | 50,600 | | | CNA Financial Corporation, (4) | | | | | | | | | | | | | | | 2,099,900 | |

| | 213,000 | | | Swiss Re AG, (2) | | | | | | | | | | | | | | | 5,060,880 | |

| | 130,000 | | | Unum Group, (3) | | | | | | | | | | | | | | | 5,710,900 | |

| | | | Total Insurance | | | | | | | | | | | | | | | 19,797,831 | |

| | | | | |

| | | | Media – 6.5% | | | | | | | | | | | | |

| | | | | |

| | 104,000 | | | Interpublic Group of Companies, Inc., (3) | | | | | | | | | | | | | | | 2,434,640 | |

| | 2,099 | | | Metro-Goldwyn-Mayer, (2), (5) | | | | | | | | | | | | | | | 187,861 | |

| | 89,000 | | | National CineMedia, Inc. | | | | | | | | | | | | | | | 1,310,970 | |

| | 193,000 | | | ProSiebenSat.1 Media AG, (2) | | | | | | | | | | | | | | | 1,850,870 | |

| | 33,800 | | | Time Warner Inc., (3) | | | | | | | | | | | | | | | 3,262,714 | |

| | 3,958 | | | Tribune Media Company | | | | | | | | | | | | | | | 138,451 | |

| | 3,184 | | | Tribune Media Company, (6) | | | | | | | | | | | | | | | — | |

| | 989 | | | Tronc, Inc., (5) | | | | | | | | | | | | | | | 13,717 | |

| | 66,000 | | | Viacom Inc., Class B, (3) | | | | | | | | | | | | | | | 2,316,600 | |

| | | | Total Media | | | | | | | | | | | | | | | 11,515,823 | |

| | | | | |

| | | | Mortgage Real Estate Investment Trusts – 1.2% | | | | | | | | | | | | |

| | | | | |

| | 101,000 | | | Colony Financial Inc. | | | | | | | | | | | | | | | 2,045,250 | |

| | | | | |

| | | | Multiline Retail – 0.9% | | | | | | | | | | | | |

| | | | | |

| | 21,400 | | | Target Corporation, (3) | | | | | | | | | | | | | | | 1,545,722 | |

| | | | | |

| | | | Multi-Utilities – 2.9% | | | | | | | | | | | | |

| | | | | |

| | 305,000 | | | Veolia Environment S.A., ADR, (2) | | | | | | | | | | | | | | | 5,182,515 | |

| | | | | |

| | | | Oil, Gas, & Consumable Fuels – 3.0% | | | | | | | | | | | | |

| | | | | |

| | 37,900 | | | Phillips 66, (3) | | | | | | | | | | | | | | | 3,274,939 | |

| | 9 | | | Southcross Holdings Borrower LP, (5) | | | | | | | | | | | | | | | 3,090 | |

| | 39,300 | | | Total SA, Sponsored ADR | | | | | | | | | | | | | | | 2,003,121 | |

| | | | Total Oil, Gas, & Consumable Fuels | | | | | | | | | | | | | | | 5,281,150 | |

| | | | | |

| | | | Pharmaceuticals – 7.6% | | | | | | | | | | | | |

| | | | | |

| | 151,500 | | | AstraZeneca PLC, (3) | | | | | | | | | | | | | | | 4,138,980 | |

| | 167,000 | | | GlaxoSmithKline PLC, (3) | | | | | | | | | | | | | | | 6,431,170 | |

| | 97,000 | | | Roche Holdings AG, Sponsored ADR, (2), (3) | | | | | | | | | | | | | | | 2,767,410 | |

| | | | Total Pharmaceuticals | | | | | | | | | | | | | | | 13,337,560 | |

| | | | | |

| | | | Road & Rail – 1.3% | | | | | | | | | | | | |

| | | | | |

| | 22,400 | | | Union Pacific Corporation, (3) | | | | | | | | | | | | | | | 2,322,432 | |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | | | | Value | |

| | | | | |

| | | | Semiconductors & Semiconductor Equipment – 1.3% | | | | | | | | | | | | |

| | | | | |

| | 138,000 | | | Infineon Technologies AG, (2) | | | | | | | | | | | | | | $ | 2,387,051 | |

| | | | | |

| | | | Software – 6.0% | | | | | | | | | | | | |

| | | | | |

| | 63,500 | | | Microsoft Corporation, (3), (4) | | | | | | | | | | | | | | | 3,945,890 | |

| | 170,000 | | | Oracle Corporation | | | | | | | | | | | | | | | 6,536,500 | |

| | | | Total Software | | | | | | | | | | | | | | | 10,482,390 | |

| | | | | |

| | | | Tobacco – 2.7% | | | | | | | | | | | | |

| | | | | |

| | 109,800 | | | Imperial Brands PLC, (2) | | | | | | | | | | | | | | | 4,781,790 | |

| | | | Total Common Stocks (cost $143,480,817) | | | | | | | | | | | | | | | 163,138,363 | |

| | | | | |

| Shares | | | Description (1) | | Coupon | | | | | | Ratings (7) | | | Value | |

| | | | |

| | | | CONVERTIBLE PREFERRED SECURITIES – 6.6% (4.6% of Total Investments) | | | | | | | | | | | | | |

| | | | | |

| | | | Banks – 0.6% | | | | | | | | | | | | |

| | | | | |

| | 525 | | | Bank of America Corporation | | | 7.250% | | | | | | | | BB+ | | | $ | 612,570 | |

| | 425 | | | Wells Fargo & Company, Convertible Bond | | | 7.500% | | | | | | | | BBB | | | | 505,750 | |

| | | | Total Banks | | | | | | | | | | | | | | | 1,118,320 | |

| | | | | |

| | | | Diversified Telecommunication Services – 1.3% | | | | | | | | | | | | |

| | | | | |

| | 32,800 | | | Frontier Communications Corporation | | | 11.125% | | | | | | | | N/R | | | | 2,331,424 | |

| | | | | |

| | | | Electric Utilities – 1.4% | | | | | | | | | | | | |

| | | | | |

| | 47,100 | | | Great Plains Energy Inc. | | | 7.000% | | | | | | | | N/R | | | | 2,383,260 | |

| | | | | |

| | | | Pharmaceuticals – 3.3% | | | | | | | | | | | | |

| | | | | |

| | 9,018 | | | Teva Pharmaceutical Industries Limited, (2) | | | 7.000% | | | | | | | | N/R | | | | 5,837,351 | |

| | | | Total Convertible Preferred Securities (cost $15,030,133) | | | | | | | | | | | | | | | 11,670,355 | |

| | | | | |

| Shares | | | Description (1) | | Coupon | | | | | | Ratings (7) | | | Value | |

| | | | |

| | | | $25 PAR (OR SIMILAR) RETAIL PREFERRED – 7.6% (5.3% of Total Investments) | | | | | | | | | | | | | |

| | | | | |

| | | | Banks – 2.1% | | | | | | | | | | | | |

| | | | | |

| | 12,020 | | | Boston Private Financial Holdings Inc. | | | 6.950% | | | | | | | | N/R | | | $ | 300,981 | |

| | 4,625 | | | Cobank Agricultural Credit Bank, (2) | | | 6.250% | | | | | | | | BBB+ | | | | 469,004 | |

| | 3,250 | | | Cobank Agricultural Credit Bank, (2) | | | 6.125% | | | | | | | | BBB+ | | | | 316,875 | |

| | 14,122 | | | Fifth Third Bancorp. | | | 6.625% | | | | | | | | Baa3 | | | | 385,954 | |

| | 7,700 | | | First Republic Bank of San Francisco | | | 7.000% | | | | | | | | BBB– | | | | 209,517 | |

| | 4,450 | | | HSBC Holdings PLC | | | 8.000% | | | | | | | | Baa1 | | | | 114,810 | |

| | 15,000 | | | Huntington BancShares Inc. | | | 6.250% | | | | | | | | Baa3 | | | | 379,500 | |

| | 7,850 | | | KeyCorp Preferred Stock | | | 6.125% | | | | | | | | Baa3 | | | | 205,356 | |

| | 12,300 | | | People’s United Financial, Inc. | | | 5.625% | | | | | | | | BB+ | | | | 317,955 | |

| | 14,544 | | | Regions Financial Corporation | | | 6.375% | | | | | | | | Ba1 | | | | 385,852 | |

| | 3,821 | | | TCF Financial Corporation | | | 7.500% | | | | | | | | BB– | | | | 97,818 | |

| | 18,400 | | | U.S. Bancorp. | | | 6.500% | | | | | | | | A3 | | | | 520,536 | |

| | 1,300 | | | Zions Bancorporation | | | 7.900% | | | | | | | | BB– | | | | 33,306 | |

| | | | Total Banks | | | | | | | | | | | | | | | 3,737,464 | |

| | | | | |

| | | | Capital Markets – 1.1% | | | | | | | | | | | | |

| | | | | |

| | 11,400 | | | Charles Schwab Corporation | | | 6.000% | | | | | | | | BBB | | | | 288,078 | |

| | 3,775 | | | Charles Schwab Corporation | | | 5.950% | | | | | | | | BBB | | | | 94,337 | |

| | 20,850 | | | Ladenburg Thalmann Financial Services Inc. | | | 8.000% | | | | | | | | N/R | | | | 501,234 | |

| | 24,175 | | | Morgan Stanley | | | 7.125% | | | | | | | | Ba1 | | | | 680,043 | |

| | 16,200 | | | Stifel Financial Corporation | | | 6.250% | | | | | | | | BB– | | | | 402,732 | |

| | | | Total Capital Markets | | | | | | | | | | | | | | | 1,966,424 | |

| | | | |

| JTA | | Nuveen Tax-Advantaged Total Return Strategy Fund | | |

| | Portfolio of Investments (continued) | | December 31, 2016 |

| | | | | | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | Coupon | | | | | | Ratings (7) | | | Value | |

| | | | | |

| | | | Consumer Finance – 1.2% | | | | | | | | | | | | |

| | | | | |

| | 9,200 | | | Capital One Financial Corporation | | | 6.700% | | | | | | | | Baa3 | | | $ | 238,832 | |

| | 3,800 | | | Discover Financial Services | | | 6.500% | | | | | | | | BB– | | | | 97,584 | |

| | 56,500 | | | GMAC Capital Trust I | | | 8.125% | | | | | | | | B+ | | | | 1,435,100 | |

| | 7,130 | | | SLM Corporation, Series A | | | 6.970% | | | | | | | | Ba3 | | | | 365,056 | |

| | | | Total Consumer Finance | | | | | | | | | | | | | | | 2,136,572 | |

| | | | | |

| | | | Diversified Financial Services – 0.1% | | | | | | | | | | | | |

| | | | | |

| | 8,100 | | | KKR Financial Holdings LLC | | | 7.375% | | | | | | | | BBB | | | | 210,276 | |

| | | | | |

| | | | Electric Utilities – 0.4% | | | | | | | | | | | | |

| | | | | |

| | 3,035 | | | Alabama Power Company, (2) | | | 6.500% | | | | | | | | A3 | | | | 79,289 | |

| | 1,300 | | | Alabama Power Company, (2) | | | 6.450% | | | | | | | | A3 | | | | 33,109 | |

| | 5,000 | | | Gulf Power Company, (2) | | | 6.450% | | | | | | | | Baa1 | | | | 507,482 | |

| | | | Total Electric Utilities | | | | | | | | | | | | | | | 619,880 | |

| | | | | |

| | | | Food Products – 0.4% | | | | | | | | | | | | |

| | | | | |

| | 14,600 | | | CHS Inc. | | | 7.100% | | | | | | | | N/R | | | | 387,046 | |

| | 11,205 | | | CHS Inc. | | | 6.750% | | | | | | | | N/R | | | | 294,467 | |

| | | | Total Food Products | | | | | | | | | | | | | | | 681,513 | |

| | | | | |

| | | | Insurance – 1.7% | | | | | | | | | | | | |

| | | | | |

| | 14,089 | | | Allstate Corporation | | | 6.750% | | | | | | | | BBB– | | | | 363,214 | |

| | 13,300 | | | Arch Capital Group Limited | | | 6.750% | | | | | | | | BBB | | | | 334,761 | |

| | 4,000 | | | Aspen Insurance Holdings Limited | | | 7.401% | | | | | | | | BBB– | | | | 99,960 | |

| | 19,210 | | | Aspen Insurance Holdings Limited | | | 7.250% | | | | | | | | BBB– | | | | 488,318 | |

| | 13,193 | | | Axis Capital Holdings Limited | | | 6.875% | | | | | | | | BBB | | | | 332,596 | |

| | 19,050 | | | Endurance Specialty Holdings Limited | | | 6.350% | | | | | | | | BBB– | | | | 486,918 | |

| | 19,101 | | | Maiden Holdings Limited | | | 8.250% | | | | | | | | BB | | | | 492,806 | |

| | 9,600 | | | National General Holding Company | | | 7.500% | | | | | | | | N/R | | | | 240,768 | |

| | 8,035 | | | National General Holding Company | | | 7.500% | | | | | | | | N/R | | | | 199,348 | |

| | | | Total Insurance | | | | | | | | | | | | | | | 3,038,689 | |

| | | | | |

| | | | Thrifts & Mortgage Finance – 0.4% | | | | | | | | | | | | |

| | | | | |

| | 4,631 | | | Astoria Financial Corporation | | | 6.500% | | | | | | | | Ba2 | | | | 116,331 | |

| | 24,550 | | | Federal Agricultural Mortgage Corporation | | | 6.875% | | | | | | | | N/R | | | | 632,163 | |

| | | | Total Thrifts & Mortgage Finance | | | | | | | | | | | | | | | 748,494 | |

| | | | | |

| | | | Wireless Telecommunication Services – 0.2% | | | | | | | | | | | | |

| | | | | |

| | 11,000 | | | United States Cellular Corporation | | | 7.250% | | | | | | | | Ba1 | | | | 279,510 | |

| | | | Total $25 Par (or similar) Retail Preferred (cost $12,975,259) | | | | | | | | | | | | | | | 13,418,822 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon (8) | | | Maturity (9) | | | Ratings (7) | | | Value | |

| | | | |

| | | | VARIABLE RATE SENIOR LOAN INTERESTS – 27.5% (19.3% of Total Investments) (8) | | | | | | | | | | | | | |

| | | | | |

| | | | Aerospace & Defense – 1.2% | | | | | | | | | | | | |

| | | | | |

| $ | 610 | | | B/E Aerospace, Inc., Term Loan B | | | 3.893% | | | | 12/16/21 | | | | BB+ | | | $ | 613,721 | |

| | 1,000 | | | Leidos Holdings, Inc., Term Loan B | | | 3.520% | | | | 8/16/23 | | | | BBB– | | | | 1,010,250 | |

| | 498 | | | Transdigm, Inc., Extend Term Loan F | | | 3.770% | | | | 6/07/23 | | | | Ba2 | | | | 502,889 | |

| | 2,108 | | | Total Aerospace & Defense | | | | | | | | | | | | | | | 2,126,860 | |

| | | | | |

| | | | Airlines – 0.6% | | | | | | | | | | | | |

| | | | | |

| | 500 | | | American Airlines, Inc., Term Loan B | | | 3.250% | | | | 12/14/23 | | | | BB+ | | | | 502,969 | |

| | 481 | | | Delta Air Lines, Inc., Term Loan B1 | | | 3.250% | | | | 10/18/18 | | | | Baa2 | | | | 486,965 | |

| | 981 | | | Total Airlines | | | | | | | | | | | | | | | 989,934 | |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon (8) | | | Maturity (9) | | | Ratings (7) | | | Value | |

| | | | | |

| | | | Automobiles – 1.0% | | | | | | | | | | | | |

| | | | | |

| $ | 574 | | | Chrysler Group LLC, Term Loan B | | | 3.500% | | | | 5/24/17 | | | | BBB– | | | $ | 576,041 | |

| | 1,113 | | | Formula One Group, Term Loan, First Lien | | | 5.068% | | | | 7/30/21 | | | | B | | | | 1,125,767 | |

| | 1,687 | | | Total Automobiles | | | | | | | | | | | | | | | 1,701,808 | |

| | | | | |

| | | | Building Products – 0.5% | | | | | | | | | | | | |

| | | | | |

| | 292 | | | Gates Global LLC, Term Loan | | | 4.250% | | | | 7/06/21 | | | | B+ | | | | 292,620 | |

| | 500 | | | Quikrete Holdings, Inc., Initial Term Loan, First Lien | | | 4.000% | | | | 11/15/23 | | | | BB- | | | | 505,625 | |

| | 792 | | | Total Building Products | | | | | | | | | | | | | | | 798,245 | |

| | | | | |

| | | | Chemicals – 0.9% | | | | | | | | | | | | |

| | | | | |

| | 672 | | | US Coatings Acquisition, Term Loan B, (WI/DD) | | | TBD | | | | TBD | | | | N/R | | | | 680,136 | |

| | 199 | | | Mineral Technologies, Inc., Term Loan B2 | | | 4.750% | | | | 5/07/21 | | | | BB+ | | | | 201,863 | |

| | 777 | | | Univar, Inc., Term Loan B, First Lien | | | 4.250% | | | | 7/01/22 | | | | BB– | | | | 783,475 | |

| | 1,648 | | | Total Chemicals | | | | | | | | | | | | | | | 1,665,474 | |

| | | | | |

| | | | Commercial Services & Supplies – 0.6% | | | | | | | | | | | | |

| | | | | |

| | 995 | | | West Corporation, Refinanced Term Loan B12 , (WI/DD) | | | TBD | | | | TBD | | | | BB | | | | 998,324 | |

| | | | | |

| | | | Communications Equipment – 0.2% | | | | | | | | | | | | |

| | | | | |

| | 267 | | | CommScope, Inc., Tranche 5, Term Loan B, First Lien | | | 3.270% | | | | 12/29/22 | | | | BB+ | | | | 270,206 | |

| | | | | |

| | | | Consumer Finance – 0.5% | | | | | | | | | | | | |

| | | | | |

| | 894 | | | First Data Corporation, Term Loan, First Lien | | | 3.756% | | | | 3/24/21 | | | | BB | | | | 903,710 | |

| | | | | |

| | | | Containers & Packaging – 1.0% | | | | | | | | | | | | |

| | | | | |

| | 429 | | | Berry Plastics Holding Corporation, Term Loan H | | | 3.750% | | | | 10/01/22 | | | | BB | | | | 432,961 | |

| | 1,273 | | | Reynolds Group Holdings, Inc., Term Loan, First Lien | | | 4.250% | | | | 2/06/23 | | | | B+ | | | | 1,288,906 | |

| | 1,702 | | | Total Containers & Packaging | | | | | | | | | | | | | | | 1,721,867 | |

| | | | | |

| | | | Diversified Consumer Services – 0.3% | | | | | | | | | | | | |

| | | | | |

| | 37 | | | Hilton Hotels Corporation, Term Loan B1 | | | 3.500% | | | | 10/26/20 | | | | BBB– | | | | 37,422 | |

| | 504 | | | Hilton Hotels Corporation, Series B2, Term Loan | | | 3.256% | | | | 10/25/23 | | | | BBB– | | | | 510,401 | |

| | 541 | | | Total Diversified Consumer Services | | | | | | | | | | | | | | | 547,823 | |

| | | | | |

| | | | Diversified Financial Services – 0.6% | | | | | | | | | | | | |

| | | | | |

| | 744 | | | MGM Growth Properties, Term Loan B | | | 3.520% | | | | 4/25/23 | | | | BB+ | | | | 751,004 | |

| | 265 | | | WideOpenWest Finance LLC, New Term Loan B | | | 4.500% | | | | 8/18/23 | | | | B1 | | | | 267,218 | |

| | 1,009 | | | Total Diversified Financial Services | | | | | | | | | | | | | | | 1,018,222 | |

| | | | | |

| | | | Diversified Telecommunication Services – 0.9% | | | | | | | | | | | | |

| | | | | |

| | 522 | | | Intelsat Jackson Holdings, S.A., Tranche B2, Term Loan | | | 3.750% | | | | 6/30/19 | | | | B1 | | | | 506,192 | |

| | 1,000 | | | Verizon Communications, Inc., Term Loan | | | 2.005% | | | | 7/31/19 | | | | N/R | | | | 1,001,042 | |

| | 1,522 | | | Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 1,507,234 | |

| | | | | |

| | | | Electric Utilities – 0.3% | | | | | | | | | | | | |

| | | | | |

| | 407 | | | Texas Competitive Electric Holdings LLC, Exit Term Loan B | | | 5.000% | | | | 8/04/23 | | | | BB+ | | | | 410,960 | |

| | 93 | | | Texas Competitive Electric Holdings LLC, Exit Term Loan C | | | 5.000% | | | | 8/04/23 | | | | BB+ | | | | 94,105 | |

| | 500 | | | Total Electric Utilities | | | | | | | | | | | | | | | 505,065 | |

| | | | | |

| | | | Energy Equipment & Services – 0.1% | | | | | | | | | | | | |

| | | | | |

| | 149 | | | Drill Rigs Holdings, Inc., Tranche B1, Term Loan | | | 6.000% | | | | 3/31/21 | | | | Caa2 | | | | 97,656 | |

| | | | | |

| | | | Equity Real Estate Investment Trusts – 0.3% | | | | | | | | | | | | |

| | | | | |

| | 539 | | | Communications Sales & Leasing, Inc., Term Loan B | | | 4.500% | | | | 10/24/22 | | | | BB+ | | | | 546,171 | |

| | | | | |

| | | | Food & Staples Retailing – 0.5% | | | | | | | | | | | | |

| | | | | |

| | 869 | | | Albertson’s LLC, Term Loan B4 | | | 3.770% | | | | 8/25/21 | | | | BB | | | | 859,974 | |

| | | | |

| JTA | | Nuveen Tax-Advantaged Total Return Strategy Fund | | |

| | Portfolio of Investments (continued) | | December 31, 2016 |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon (8) | | | Maturity (9) | | | Ratings (7) | | | Value | |

| | | | | |

| | | | Food Products – 0.6% | | | | | | | | | | | | |

| | | | | |

| $ | 520 | | | Jacobs Douwe Egberts, Term Loan B | | | 3.250% | | | | 7/04/22 | | | | BB | | | $ | 523,646 | |

| | 585 | | | US Foods, Inc., Term Loan B | | | 3.770% | | | | 6/27/23 | | | | BB– | | | | 590,995 | |

| | 1,105 | | | Total Food Products | | | | | | | | | | | | | | | 1,114,641 | |

| | | | | |

| | | | Health Care Equipment & Supplies – 1.0% | | | | | | | | | | | | |

| | | | | |

| | 1,316 | | | Acelity, Term Loan F | | | 5.000% | | | | 8/03/18 | | | | Ba3 | | | | 1,321,587 | |

| | 427 | | | Sterigenics International, Inc., Term Loan B | | | 4.250% | | | | 5/16/22 | | | | B1 | | | | 429,933 | |

| | 1,743 | | | Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 1,751,520 | |

| | | | | |

| | | | Health Care Providers & Services – 1.6% | | | | | | | | | | | | |

| | | | | |

| | 250 | | | Community Health Systems, Inc., Term Loan G | | | 3.750% | | | | 12/31/19 | | | | BB– | | | | 242,600 | |

| | 500 | | | Community Health Systems, Inc., Term Loan H | | | 4.000% | | | | 1/27/21 | | | | BB– | | | | 484,387 | |

| | 810 | | | DaVita HealthCare Partners, Inc., Tranche B, Term Loan | | | 3.520% | | | | 6/24/21 | | | | BBB– | | | | 819,983 | |

| | 500 | | | Envision Healthcare Corporation, Term Loan B, First Lien | | | 4.000% | | | | 12/01/23 | | | | BB– | | | | 504,688 | |

| | 57 | | | HCA, Inc., Term Loan B6, First Lien | | | 4.020% | | | | 3/17/23 | | | | BBB– | | | | 57,231 | |

| | 504 | | | HCA, Inc., Term Loan B7, First Lien | | | 3.520% | | | | 2/15/24 | | | | BBB– | | | | 510,538 | |

| | 333 | | | Millennium Laboratories, Inc., Term Loan B, First Lien | | | 7.500% | | | | 12/21/20 | | | | CCC+ | | | | 168,030 | |

| | 2,954 | | | Total Health Care Providers & Services | | | | | | | | | | | | | | | 2,787,457 | |

| | | | | |

| | | | Hotels, Restaurants & Leisure – 1.5% | | | | | | | | | | | | |

| | | | | |

| | 1,036 | | | Burger King Corporation, Term Loan B | | | 3.750% | | | | 12/10/21 | | | | Ba3 | | | | 1,046,765 | |

| | 1,140 | | | Seaworld Parks and Entertainment, Inc., Term Loan B2 | | | 3.248% | | | | 5/14/20 | | | | BB– | | | | 1,127,189 | |

| | 498 | | | YUM Brands, Term Loan B | | | 3.486% | | | | 6/16/23 | | | | BBB– | | | | 504,711 | |

| | 2,674 | | | Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 2,678,665 | |

| | | | | |

| | | | Household Products – 0.2% | | | | | | | | | | | | |

| | | | | |

| | 346 | | | Spectrum Brands, Inc., Term Loan B, First Lien | | | 3.330% | | | | 6/23/22 | | | | BB+ | | | | 350,269 | |

| | | | | |

| | | | Independent Power & Renewable Electric Producers – 0.3% | | | | | | | | | | | | |

| | | | | |

| | 500 | | | Dynegy, Inc., Term Loan B | | | 5.000% | | | | 6/27/23 | | | | BB | | | | 506,965 | |

| | | | | |

| | | | Internet and Direct Marketing Retail – 0.3% | | | | | | | | | | | | |

| | | | | |

| | 479 | | | Travelport LLC, Term Loan B | | | 5.000% | | | | 9/02/21 | | | | B+ | | | | 484,249 | |

| | | | | |

| | | | Internet Software & Services – 0.4% | | | | | | | | | | | | |

| | | | | |

| | 819 | | | Tibco Software, Inc., Term Loan B | | | 6.500% | | | | 12/04/20 | | | | B1 | | | | 823,182 | |

| | | | | |

| | | | IT Services – 0.5% | | | | | | | | | | | | |

| | | | | |