Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 333-07654

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The exchange offer will commence only (1) following approval of a final offer document by the SpanishComisión Nacional del Mercado de Valores (CNMV) and publication thereof and (2) on or after the date on which Gas Natural SDG, S.A. (Gas Natural) files a Registration Statement on Form F-4 with the U.S. Securities and Exchange Commission (SEC) relating to the exchange offer.

Investors in ordinary shares of Endesa, S.A. (Endesa) should not subscribe for any securities referred to herein except on the basis of the final approved and published offer document that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. Investors and security holders may obtain a free copy of such final offer document (once it is approved and published) at the registered offices of Gas Natural, Endesa, the CNMV or the Spanish Stock Exchanges.

Investors in American Depositary Shares of Endesa and U.S. holders of ordinary shares of Endesa are urged to read the U.S. prospectus and tender offer statement regarding the exchange offer, when it becomes available, because it will contain important information. The U.S. prospectus and tender offer statement will be filed with the SEC as part of its Registration Statement on Form F-4. Investors and security holders may obtain a free copy of the U.S. prospectus and tender offer statement (when available) and other documents filed by Gas Natural with the SEC at the SEC’s website at www.sec.gov. A free copy of the U.S. prospectus and tender offer statement (when available) may also be obtained for free from Gas Natural.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

This communication is for distribution only to persons who (i) have professional experience in matters relating to investments or (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc”) of The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or (iii) are persons falling within Article 47 of The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“financial journalists”) (all such persons together being referred to as “relevant persons”). This communication is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this communication relates is available only to relevant persons and will be engaged in only with relevant persons.

This communication, which has not been and will not be submitted to the French Autorité des marchés financiers, is made available in France only to qualified investor (investisseurs qualifiés) and/or to a restricted circle of investors (cercle restraint d’investisseurs), provided in each case that such investors are acting for their own account, and/or to persons providing portfolio management financial services (personnes fournissant le service d’investissement de gestion de portefeuille pour compte de tiers), all as defined and in accordance with Article L. 411-2 of the French Code monétaire et financier and Decreee no. 2005-1007 dated 2 August 2005.

* * *

The following is a communication from Gas Natural SDG, S.A. related to a presentation in connection with the offer by Gas Natural SDG for 100% of the share capital of Endesa.

Creating a leading, fully integrated global energy group November 2005 * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * |

2 Disclaimer and Important Legal Information This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The exchange offer will be made only (1) following approval of a final offer document by the Spanish Comisión Nacional del Mercado de Valores (CNMV) and publication thereof and (2) on or after the date on which Gas Natural SDG, S.A. files a Registration Statement on Form F-4 with the U.S. Securities and Exchange Commission (SEC) relating to the exchange offer. Investors in ordinary shares of Endesa, S.A. should not subscribe for any securities referred to herein except on the basis of the final approved and published offer document that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. Investors and security holders may obtain a free copy of such final offer document (once it is approved and published) at the registered offices of Gas Natural, Endesa, the CNMV or the Spanish Stock Exchanges. Investors in American Depositary Shares of Endesa and U.S. holders of ordinary shares of Endesa are urged to read the U.S. prospectus and tender offer statement regarding the exchange offer, when it becomes available, because it will contain important information. The U.S. prospectus and tender offer statement will be filed with the SEC as part of its Registration Statement on Form F-4. Investors and security holders may obtain a free copy of the U.S. prospectus and tender offer statement (when available) and other documents filed by Gas Natural with the SEC at the SEC’ s website at www.sec.gov. A free copy of the U.S. prospectus and tender offer statement (when available) may also be obtained for free from Gas Natural. These materials may contain forward-looking statements based on management’ s current expectations or beliefs. These forward-looking statements relate to, among other things: These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward- looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information. This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited. This communication is for distribution only to persons who (i) have professional experience in matters relating to investments or (ii) are persons falling within Article 49(2)(a) to (d) ("high net worth companies, unincorporated associations, etc" ) of The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or (iii) are persons falling within Article 47 of The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (" financial journalists") (all such persons together being referred to as "relevant persons"). This communication is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this communication relates is available only to relevant persons and will be engaged in only with relevant persons. This communication, which has not been and will not be submitted to the French Autorité des marchés financiers, is made available in France only to qualified investor (investisseurs qualifiés) and/or to a restricted circle of investors (cercle restraint d'investisseurs), provided in each case that such investors are acting for their own account, and/or to persons providing portfolio management financial services (personnes fournissant le service d'investissement de gestion de portefeuille pour compte de tiers), all as defined and in accordance with Article L. 411-2 of the French Code monétaire et financier and Decreee no. 2005-1007 dated 2 August 2005. management strategies; synergies and cost savings; integration of the businesses; market position; expected gas and electricity mix and volume increases; planned asset disposals and capital expenditures; net debt levels and EBITDA and earnings per share growth; dividend policy; and timing and benefits of the offer and the combined company. |

3 Process update Strong financial rationale Conclusions A leading, fully integrated global energy group Fostering an efficient market Agenda |

4 Process update Strong financial rationale Conclusions A leading, fully integrated global energy group Fostering an efficient market |

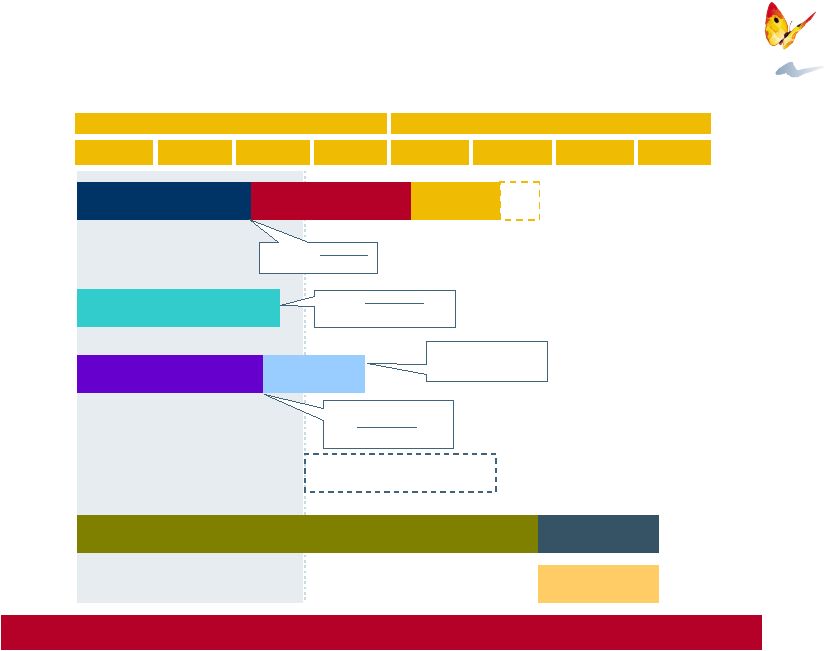

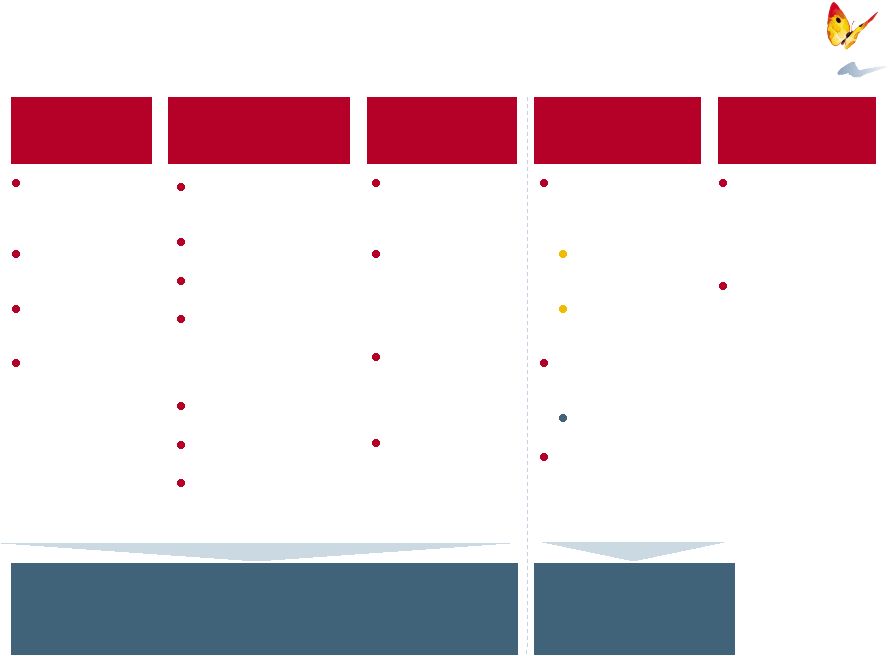

5 Transaction is on track Completion expected as early as April 2006 2005 September October November December 2006 January February March April Competition (Function XV) “Competition Defence Service” (SDC) “Competition Defence Tribunal” (TDC) Council of Ministers Spanish Competition Authorities Regulated activities (Function XIV) CNE Secretary General of Energy Golden Share CNMV Suspension Acceptance Period CNMV US Acceptance Period SEC SDC has finalized review European Commission European Competition Authorities EU has confirmed full Spanish jurisdiction CNE (XIV) has authorized the offer As per our presentation on September 6th CNE (XV) is not binding |

6 Key transaction milestones Some key milestones have already been completed Key completed steps SDC Finished its review on November 7th Referred the file to the TDC as expected CNE Approved transaction under its Function XIV (impact on regulated activities) on November 8th European Commission Denied Italy and Portugal’s claims for EU review on October 27th Denied Endesa’s claim for community dimension on November 15th Key pending steps Golden Share Authorisation request to be filed with the Secretary of Energy TDC / CNE Both preparing non-binding competition reports for the Ministry of Economy Council of Ministers Binding decision, including proposed remedies, expected in first half of February 2006 CNMV / SEC Filings on track Acceptance period expected to open in February 2006 |

7 The European Commission has confirmed the Spanish competition dimension of the transaction On October 28 th , the Commission rejected Portugal and Italy’s request for EU review On November 15 th , it rejected Endesa’s claim and declared that the transaction fell outside the Commission’s competition competence Confirmed that Endesa’s 2004 definitive and audited accounts were the correct starting point for the application of the two thirds turnover criteria Declared that other adjustments proposed by Endesa to its audited accounts were not justified under the provisions of the Merger Regulation and of the Commission Notice on calculation of turnover |

8 Process update Strong financial rationale Conclusions A leading, fully integrated global energy group Fostering an efficient market |

9 A leading, fully integrated global energy group Benefiting from gas and power convergence Optimising the generation portfolio Leveraging on gas procurement Strengthening the international business With proven ability to deliver Integrating management of gas and electricity customers |

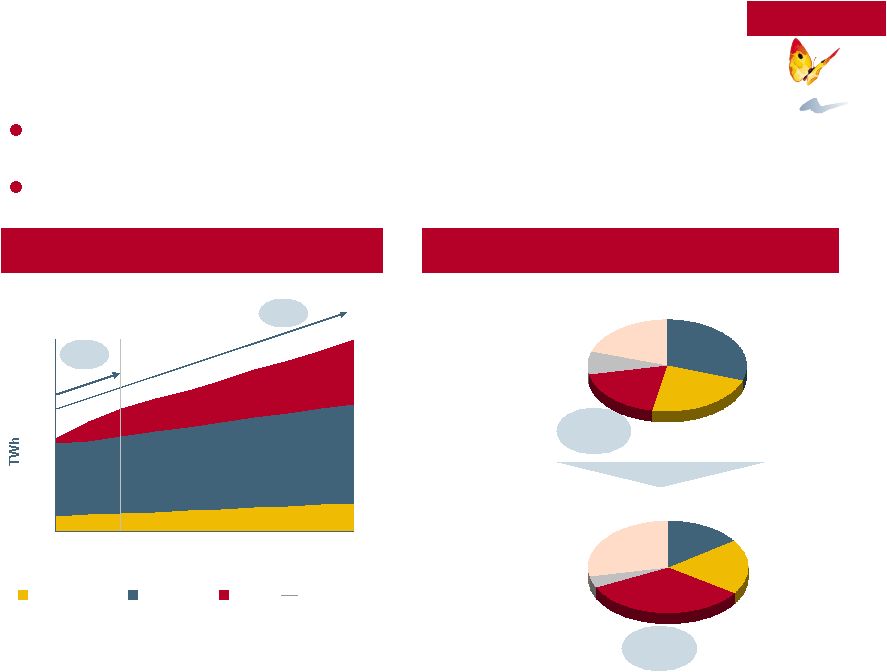

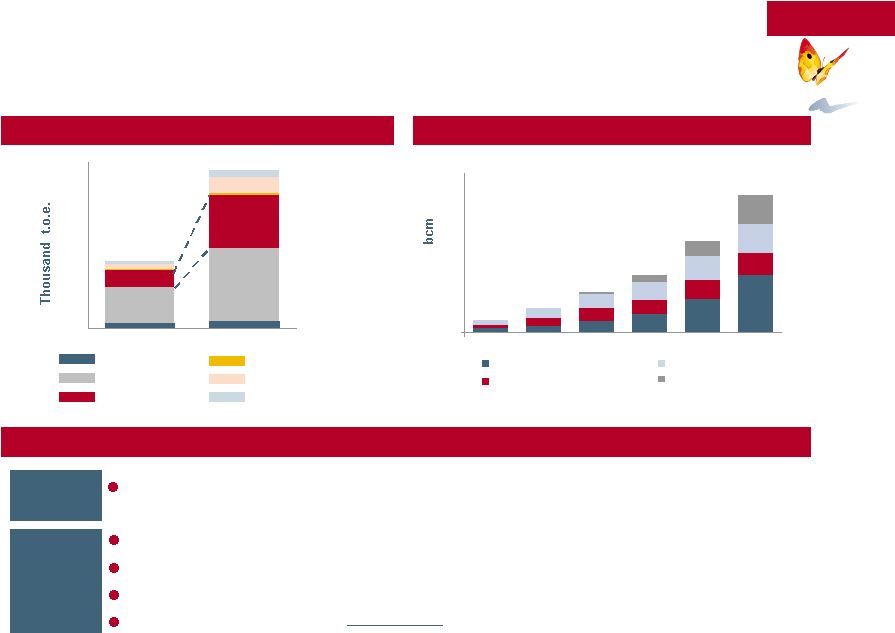

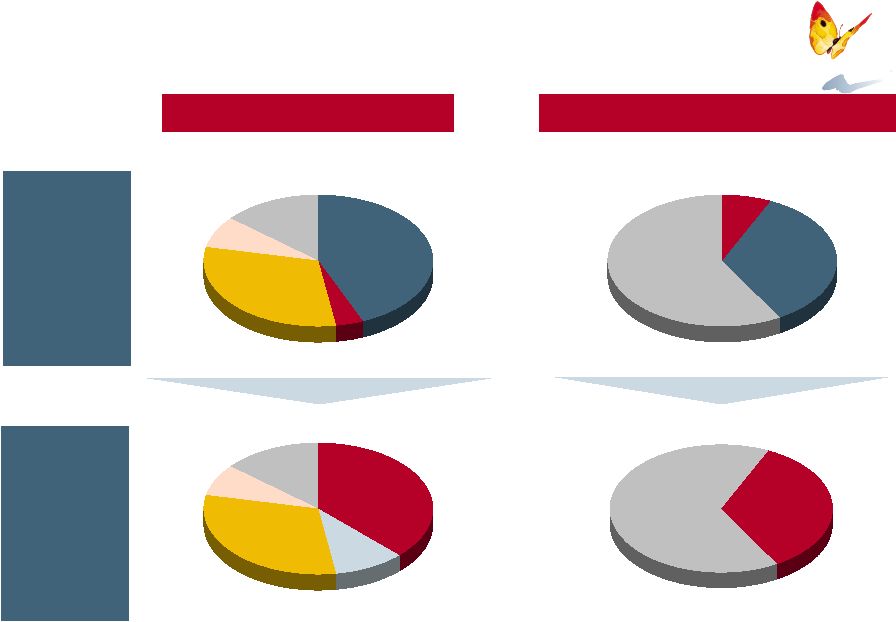

10 Gas 33% Gas 19% Coal 15% Nuclear 19% Fuel 4% Renewables + Hydro 28% Coal 30% Nuclear 23% 20% Fuel 8% Strong gas demand growth in Spain boosted by power generation CAGR Residential Industrial CCGT 2002 2004 2006 2008 2010 0 100 200 300 400 500 2004 2011 9% CAGR 16% Source: Boletín Trimestral de Coyuntura Energética 4 Quarter 2004, Spanish National Energy Plan 2002–2011 Nota: 1 Power generation, including Mainland and CHP/Renewables Historical data 2003 2005 2007 2009 2011 The Spanish gas market is expected to show one of the highest growth patterns in Europe… … mostly attributable to the expected growth in CCGTs Source: Spanish National Energy Plan 2002–2011 and Gas Natural analysis Expected total gas demand Sources of power generation (production)¹ Renewables + Hydro Benefiting from gas and power convergence |

11 Solid rationale for gas and power integration In spite of strong growth of gas-powered generation, from 6,000 MW in 2004 to an expected 24,000 MW of installed capacity in 2008 ... ... gas and power integration in Spain is still at an early stage, compared with other European markets The combination of Gas Natural and Endesa would create a truly integrated gas and power company Source: REE, Annual Reports, Interim Results Presentations 1 Percentage over total mainland installed capacity including special regime 2 Includes Viesgo, HidroCantábrico and others 3 Excluding 3 bcm supplied by Gas Natural Total capacity GW % total¹ 2.8 Gas Natural Endesa Unión Fenosa Iberdrola 1.2 1.2 1.6 34 14 14 19 Other² 1.5 18 22.5 7.1 20.2 1.7 33 10 29 2 17.0 25 Gas contracts (bcm) 6.0 6.2 2.8 3 23.0 GW % total¹ CCGT 8.3 100 68.5 100 TOTAL Benefiting from gas and power convergence |

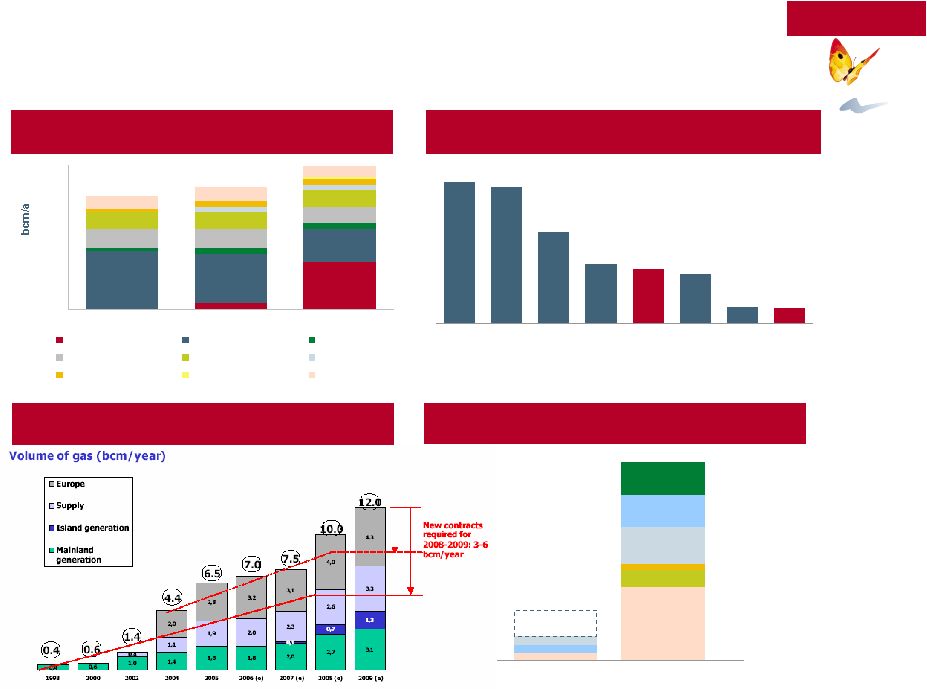

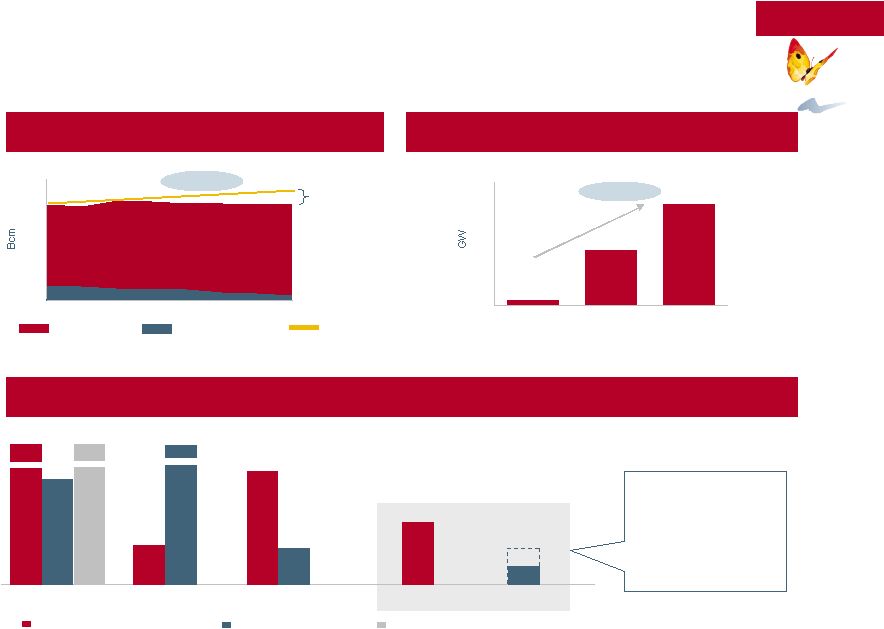

12 Critical mass, flexibility and diversity of origins are key for an efficient gas procurement and supply business Source: Wood Mackenzie 0 100 200 300 400 500 2000 2005 2010 Other imports Production Trinidad&Tobago Russia Norway Nigeria Lybia Egypt Algeria 60 58 39 25 23 21 6 7 E.ON GDF RWE Centrica Gas Natural¹ Suez Iberdrola Endesa² Source: Annual Reports 2004, company presentations 1 Excluding 7 bcm in Latin America 2 As of 2005, includes 3 bcm from Gas Natural Estimated gas supply in Europe Volume of gas procurement of key European players (bcm) Endesa´s natural gas requirements (bcm) Gas Natural Endesa Algeria Norway Libya Nigeria Qatar Trinidad&Tobago 6 23 Gas Natural Nigeria Qatar Algeria Source: Endesa’s Presentation: “Strategy for the supply of fuels”, As Pontes 8 July 2005 Note: Data as of 2005. Source: Endesa’s Presentation: “Strategy for the supply of fuels”, As Pontes 8 July 2005. Gas Natural data Gas procurement signed contracts (bcm) Leveraging on gas procurement |

13 Rasgas (Qatar) 1 bcma 2005-2026 Endesa currently lacks flexibility and diversification in its gas procurement and supply business Currently, Endesa has limited destination flexibility for its contracted gas, which is mostly used for Spanish demand ... Source: Endesa’s Presentation: “Strategy for the supply of fuels”, As Pontes 8 July 2005 Notes: 1 Possibility to reroute 1 bcma from Rasgas to Italy under terms to be negotiated Endesa gas supply contracts Uses Sources Spain 6 bcma¹ ... and considers that the diversification, flexibility and ability to take advantage of opportunities derived from critical mass or arbitrage are essential parts of the gas procurement strategy Leveraging on gas procurement Gas Natural 3 bcma 2004-2018 NLNC (Nigeria) 1 bcma 2004-2020 Sonatrach (Algeria) 1 bcma 2004-2020 |

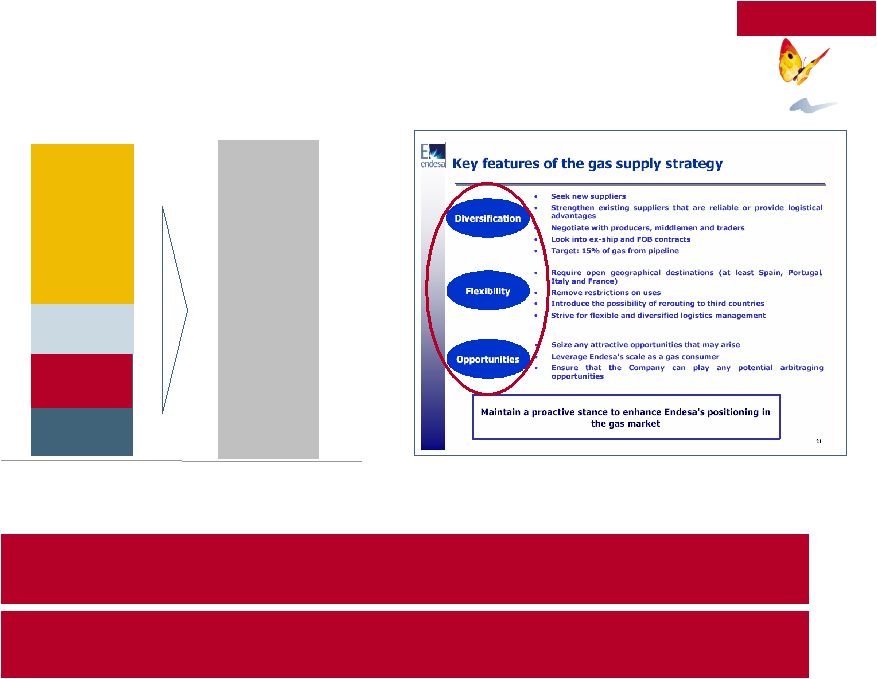

14 Gas Natural improves Endesa’s procurement with a flexible and well-diversified portfolio of gas supply contracts… Qatar 16% Argelia 37% Lybia 2% Nigeria 19% Trinidad & Tobago 17% Norway 9% FOB / CIF Source: Gas Natural data Gas sources Natural gas / LNG Diversified Diversified portfolio at origin Reduction in country risk Security of supply through the combination of natural gas and LNG, with different entry points Ability to arbitrage price differences between different markets, both geographical and in terms of product (gas or power generation) Flexibility guaranteed by one of the largest fleets of methane tankers in the Atlantic Access to new markets Reduces risk of take or pay contracts Flexible NG 37% LNG 63% FOB 62% CIF 38% Leveraging on gas procurement |

15 Together with Repsol YPF, one of the largest LNG fleets in the Atlantic Gas Natural has time- charter contracts with 8 methane tankers Long term contracts New 138,000 m³ tanker under construction Different tankers’ size allows for origin and destination flexibility Japan, Korea US Nigeria Norway France Libya Algeria Persian Gulf Consolidated Markets Developing Markets Gas Natural’s assets and activities position the Group in an advantageous situation to fully benefit from global opportunities … as well as a solid natural gas wholesale & trading business 2 small <45,000m³ 3 medium < 90,000m³ 3 large >90,000m³ Additional opportunities arising from LNG and methane tankers of Repsol YPF Puerto Rico TT Italy International wholesale and LNG trading, maximising margins and minimizing ToP risk Leveraging on gas procurement |

16 Equity gas is becoming a key advantage in the gas business The strategy of the major European players is to partially satisfy their gas requirements with equity gas Key European players’ equity gas position Endesa acknowledges limited size and capabilities to find equity gas Source: Endesa’s Presentation: “Strategy for the supply of fuels”, As Pontes 8 July 2005 Source: Wood Makenzie, company reports Company Position (bcm) Target equity gas (% total) GDF 90 15 RWE 62 n.a. Centrica 54 35 - 45 E.ON 20 15 - 20 Leveraging on gas procurement |

17 ~15% equity gas target Access to the entire value chain Protection against increasing prices scenarios Optimisation of gas procurement basket Facilitated by the agreement with Repsol YPF Gassi Touil Gas Natural position Gassi Chergui Gas Natural can provide Endesa with equity gas Other projects 7% of equity gas to be achieved from projects under development Leveraging on gas procurement |

18 The agreement with Repsol YPF will enhance the Group’s position Access to gas reserves Commercialisation and access to new wholesale markets together with Repsol YPF Flexibility and arbitrage between markets Resources optimisation in the midstream business Value chain integration Participation in future Repsol YPF´s LNG projects Access to reserves Global LNG demand Scale in procurement and commercialisation Risk management Arbitrage Project integration Access to markets Fleet optimisation Contract ownership Priority to Gas Natural’s markets Autonomy of Gas Natural’s markets Leveraging on gas procurement |

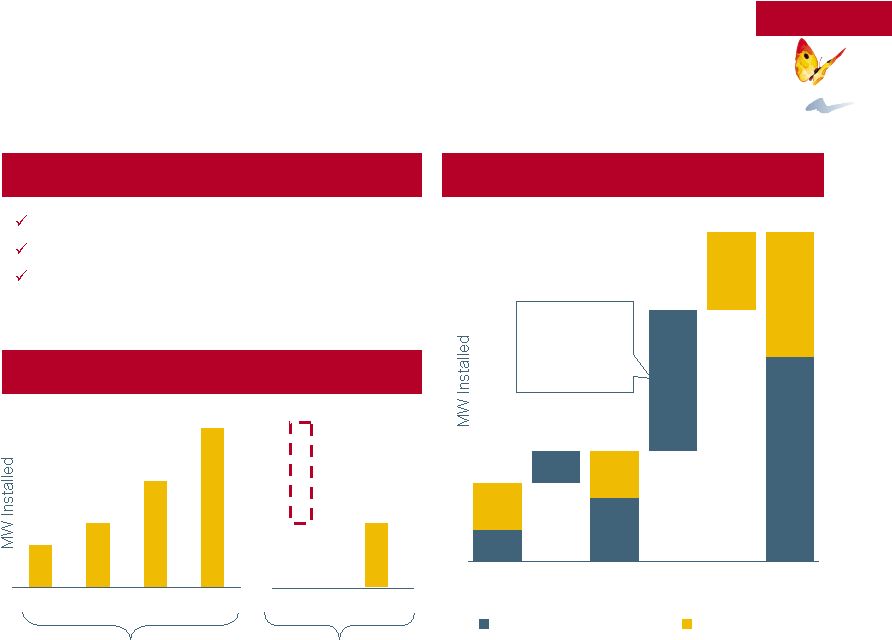

19 Know-how to build and operate CCGT plants Competitive gas supplies Combined target of 8,400 MW of capacity by 2009 Source: Company estimates Note: Data presented post proposed disposals 1 Excludes CCGT not in operation 2 Includes Guadaira Gas Natural contributes immediate CCGT capacity 800 800 1,600 3,600 5,200 1,200 1,200 3,200 2,000² 2004 2005E 2009E Gas Natural Sites Endesa Sites Gas Natural’s CCGT capabilities Endesa’s 2001 CCGT strategic plan vs. actual Evolution of combined CCGT portfolio¹ 800 1,200 2,000 3,000 2002 2003 2004 2005 1,200 2005 Plan not completed 1,800 2001 CCGT plan 2005 actual Source: Endesa’s presentation to financial analysts (12/03/01) and As Pontes presentation (8/07/05) Cartagena (1,200 MW) to come on stream in early 2006 Optimising the generation portfolio |

20 Optimising the combined generation portfolio 1 to supply the Spanish market Generation mix in Spain 2006E 4 Source: REE and Gas Natural estimates Notes: 1 Peninsular installed capacity 2 Before agreed asset disposals 3 Pro forma after asset disposals 4 Includes Endesa, Gas Natural, Iberdrola, HC, Unión Fenosa, and Viesgo Agreement with Iberdrola for selected asset disposals Coal Hydro Nuclear CCGT CHP/Renewables Fuel 0% 20% 40% 60% 80% 100% 28% 27% 18% 12% 9% 6% 15% 26% 18% 25% 13% 3% 18% 27% 12% 21% 15% 7% Proforma post disposals 2006E 3 Endesa 2006E 2 Reduction in coal and increase in CCGTs and renewables Combined generation mix in line with the sector Optimising the generation portfolio |

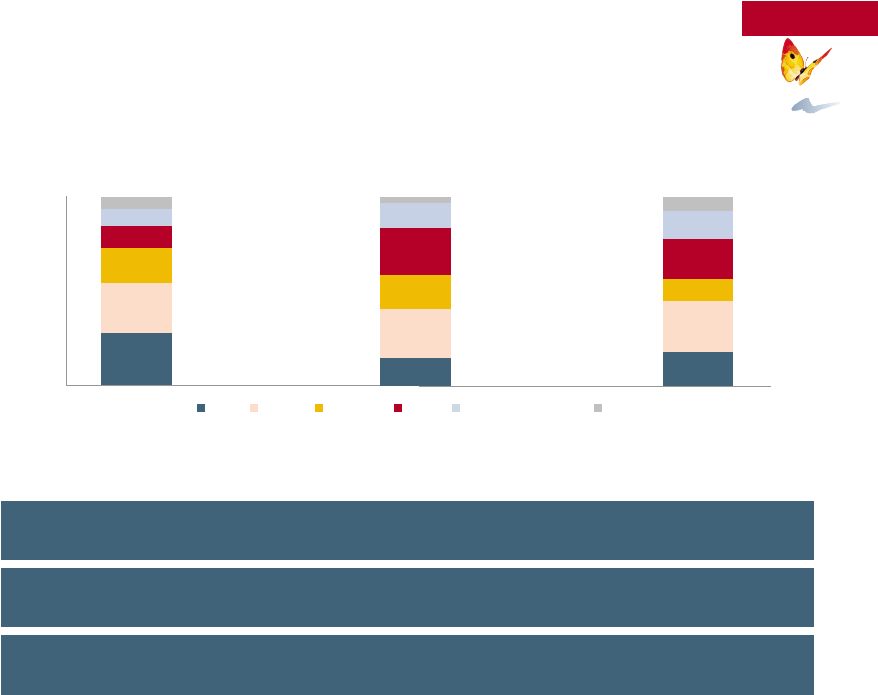

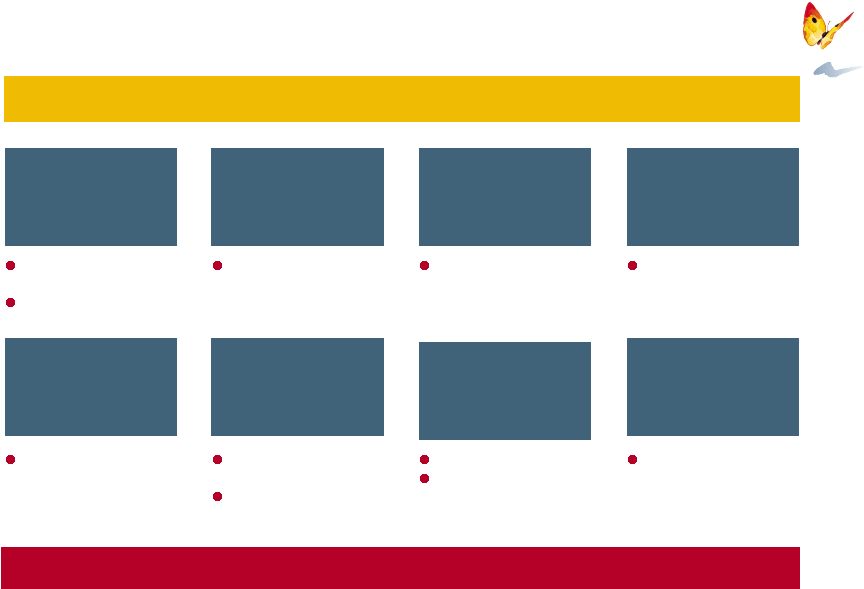

21 Combined management of gas and electricity Combined management of gas and electricity distribution networks UK SSE Holland Nuon, Essent Belgium Suez Denmark Dong Germany E.ON, RWE, EnBW Italy ENEL, municipalities Austria PVN, EVN, ESTAG Combined management of gas and electricity clients Clients (Mill.)¹ Gas Power Multiple examples in Europe A strategic priority for the main European utilities E.ON RWE Suez New Group Centrica GdF 2.0 31.5 7.8 25.1 10.2 20.8 2.1 5.6 9.3 21.9 11.8 6.0 15.2 1.0² Enel Source: Annual reports, analyst presentations Notes: 1 Global clients 2 2007 target Integrating management of gas and electricity customers |

22 In Italy, gas and power convergence is consolidating Source: Edison 2004 results presentation (31/3/05) Contracted gas Domestic production Demand 2004 2005 2006 2007 2008 2009 2010 2011 Growing gas demand and need to increase imports Source: Eni presentation (1/3/05) Significant CCGT development 0 5 10 15 20 25 30 2002 2005E 2010E CAGR 46% 20 40 60 80 100 0 CAGR 2% Italy’s largest operators are developing a combined gas and power strategy Installed capacity (GW) Gas clients (m) Electricity clients (m) 42.0 6.4 4 Enel Endesa Gas Natural 29.5 9.5 Edison 0.7 0.0 ² 0.7 5 3.3 Eni 5.3 ³ 2.0 ¹ Source: Annual Reports and company presentations Notes: Data as of 2004 1 Objective to achieve 20% of the market in the medium term 2 Liberalised customers 3 Italgas Piu has a dual-fuel strategy with its customers 4 Assumes 100% of Endesa Italia 5 2008 target The combined entity would obtain a balanced gas and power strategic position deficit Strengthening the international business |

23 Maintaining a strong foothold in Italy to benefit from gas and power convergence LNG infrastructure Regasification plants Taranto, Trieste Monfalcone, Livorno Generation plants Approx. 4,000 MW following asset disposals Mostly CCGTs Electricity customers Leverage the position in generation and gas to gain presence in the liberalised market Gas customers Brancato, Nettis and Smedigas 275,000 customers in 3Q05 700,000 customers targeted for 2008 Optimised presence with a clear strategy Strengthening the international business |

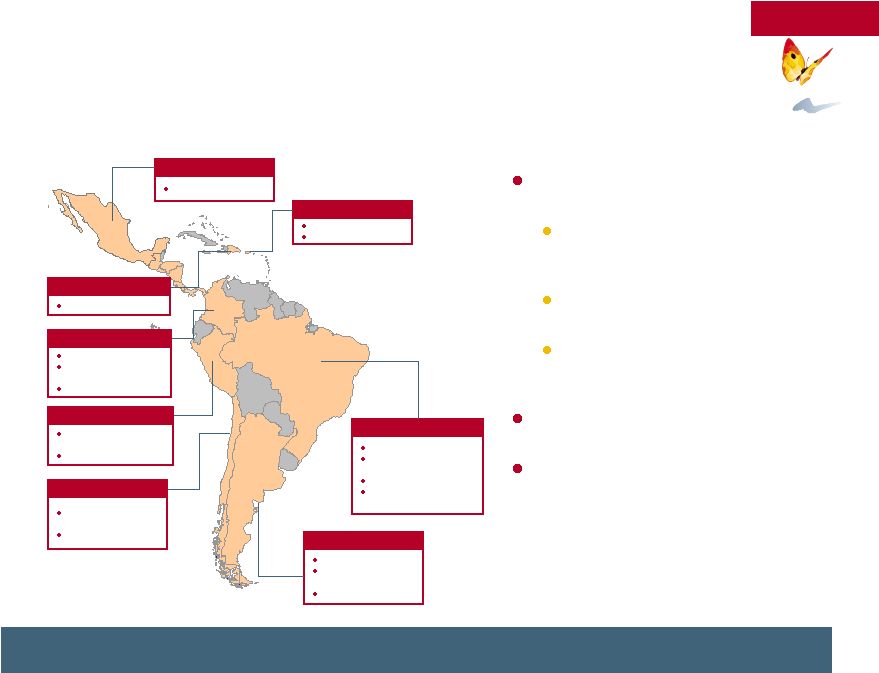

24 Power generation Industry Other Net exports 0 100 200 300 400 500 1980 1990 2002 2010 2020 2030 Source: International Energy Agency (World Energy Outlook 2004) Source: International Energy Agency Other renewables Coal Fuel Gas Nuclear Hydro 1.000 0 200 400 600 800 2001 2030 Gas balance in LatAm Demand by fuel-type in LatAm Opportunity to leverage Gas Natural’s know-how to develop a profitable gas and power business in LatAm Endesa’s new projects in LatAm LNG CCGTs International auction of LNG procurement into Chile Etevensa plant– Peru¹ Santa Rosa plant– Peru¹ Fortaleza – Brazil² San Isidro II– Chile³ 500 MW 125 MW 319 MW 377 MW ~1,300 MW Source: Press releases and various sources Notes: 1 Conversion to CCGT of existing plants 2 Recently built 3 Construction of new plant in Chile Strengthening the international business |

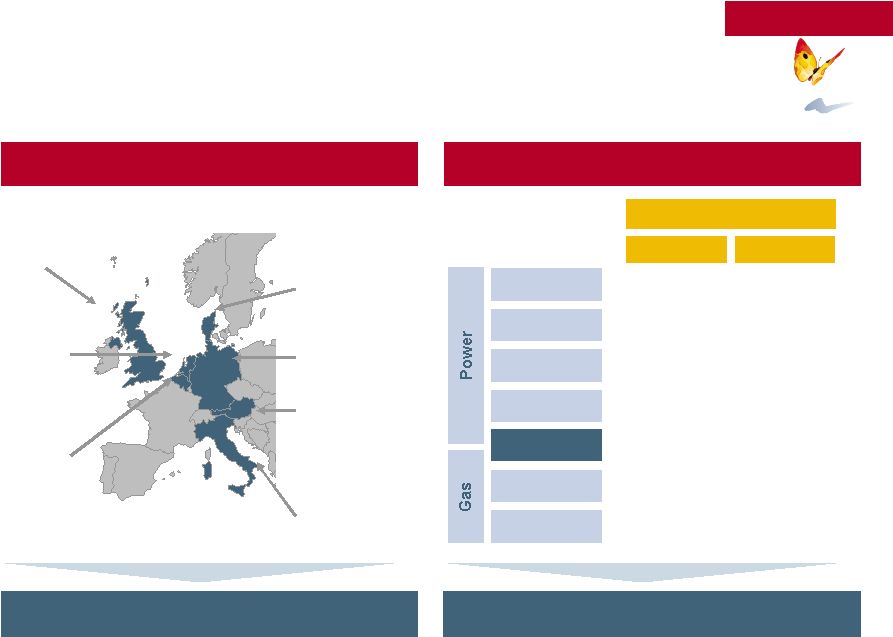

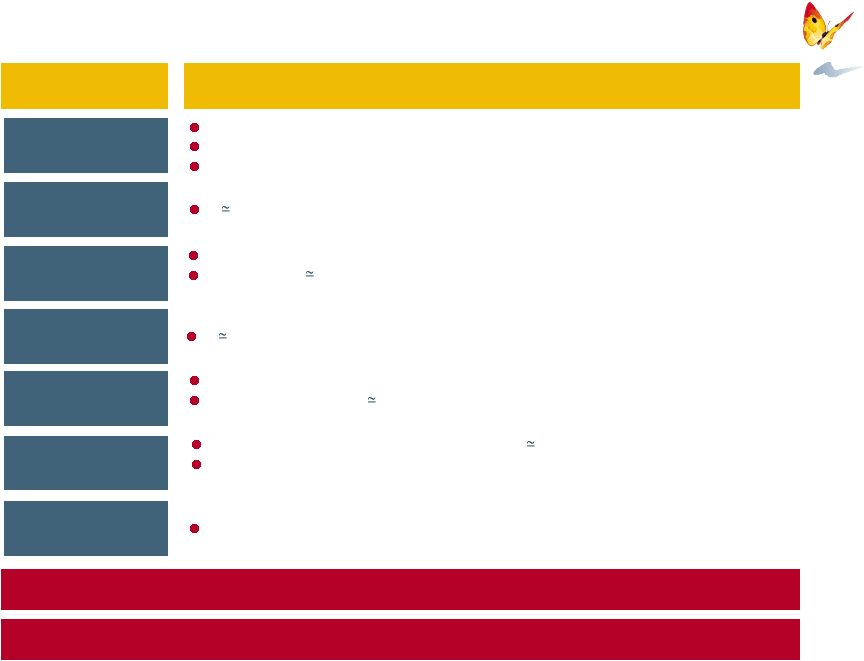

25 Combination to trigger step change in value creation in LatAm Strong portfolio to lead the way for balanced growth Extract value where there is a client base and business overlap Achieve scale and extract synergies from customer base and gas/power integration Benefit from large gas purchase capacity Maximize efficiency of current CCGT portfolio and develop new generation Explore new opportunities (distribution of gas, electricity and CCGT generation) Potential to participate in equity gas to fully benefit from integration along the value chain Strengthening the international business Note: As of 2004. Customers accounted for on a consolidated basis, capacity presented on an attributable capacity basis; map only shows selected assets Source: Company estimates Colombia 1.5m gas customers 2m electricity customers 2,609MW Peru 0.9m electricity customers 1,436MW Chile 1.4m electricity customers 4,477MW Argentina 1.3m gas customers 2.1m electricity customers 4,492MW Brazil 0.7m gas customers 4.4m electricity customers 1,039MW 2,000MW interconnection capacity Mexico 1.1m gas customers Puerto Rico 271MW Regasification plant Dominican Republic 29MW |

26 Gas Natural Flexible and competitive gas sourcing on global basis Access to equity gas, with partnership with Repsol YPF Endesa Long-standing track record in operating generation assets The management teams of both companies will continue to play a key role Unique track record in gas distribution build-out and operation Highly customer-focused business Successful CCGT build-up strategy Strong LNG management capabilities Early mover into high growth markets Proactive expansion into LatAm has established Endesa as leader Successful track record in Italy, including repowering plants Strong electricity distribution operator Gas Natural and Endesa´s core skills and asset positions are complementary With proven ability to deliver |

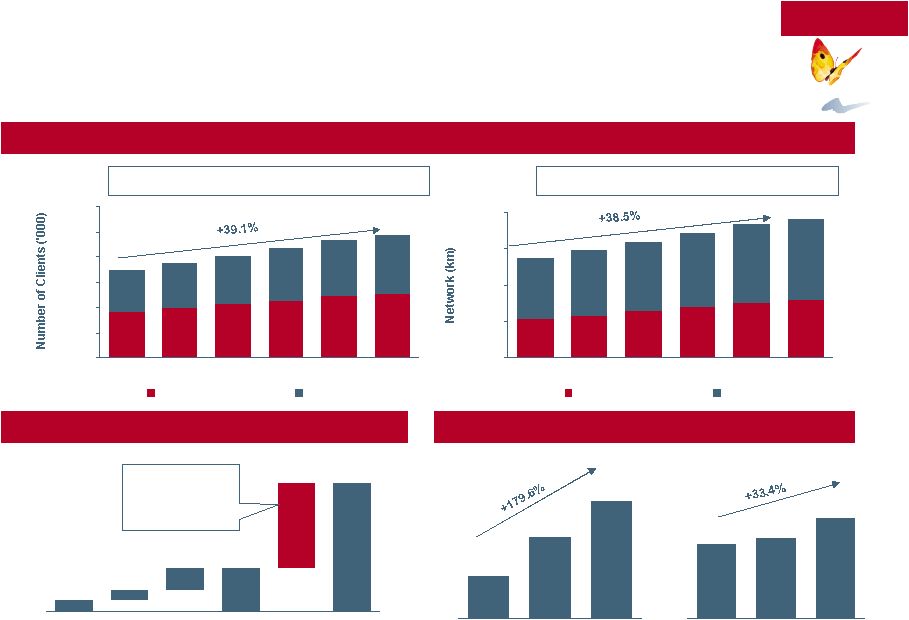

27 A smooth transition is expected, based on Gas Natural’s track record ... Source: Gas Natural and CNE June-July 2005 Monthly Bulletin Note: 1 Excludes CCGTs not in operation 3,609 3,910 4,197 4,505 4,831 5,033 3,381 3,628 3,908 4,690 4,505 4,225 0 2,000 4,000 6,000 8,000 10,000 12,000 2000 2001 2002 2003 2004 9M 2005 Spain ('000) LatAm ('000) Gas distribution Average yearly Spain 284,000 clients additions LatAm 265,500 Average Km Spain 32,961 of network LatAm 49,316 26,529 28,829 31,648 34,701 37,534 39,146 42,079 45,066 47,926 55,868 51,204 54,120 0 25,000 50,000 75,000 100,000 2000 2001 2002 2003 2004 9M 2005 Spain (km) LatAm (km) Evolution of CCGT Portfolio¹ (MW) 400 800 3,200 4,800 1,600 400 San Roque Besós Arrúbal Today 2005 2008 Target 2008 2,075 4,042 5,802 2002 2003 2004 3,873 4,164 5,168 2002 2003 2004 Generation Sales Historical power performance (GWh) – Cartagena (1,200 MW) to come on stream in early 2006 With proven ability to deliver |

28 ...and value creation for the shareholders Source: Datastream as of 02-Sep-2005 Note: 1 Electrabel share price performance is affected by Suez offer on the stock 39.8% 30.2% 25.3% 24.6% 13.7% 40.2% 15.1% 26.1% 72.3% 65.4% 43.1% 29.7% 35.1% 13.9% 17.0% 16.5% 112.1% 95.6% 68.4% 54.3% 48.8% 45.3% 29.0% 13.0% 2.2% (19.2)% (35.7)% (14.8)% (13.1)% 5.1% Electrabel¹ Iberdrola E.ON RWE Gas Natural Scottish Power Unión Fenosa ENEL Endesa EDP Dividends Share Appreciation/Depreciation Shareholders’ returns over the last five years With proven ability to deliver |

29 Process update Strong financial rationale Conclusions A leading, fully integrated global energy group Fostering an efficient market |

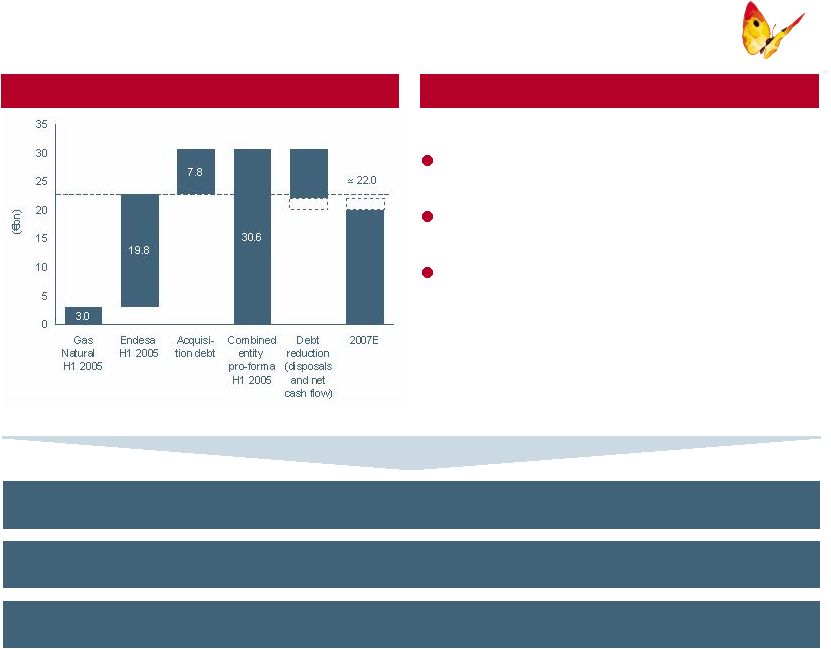

30 Source: Gas Natural’s estimates Net debt evolution Financial update Strong capital structure Objective of “A” rating Ability to invest in core regulated and non-regulated activities unaffected by transaction Agreement with Iberdrola expected to result in fast disposal Syndication of €7.8bn acquisition facility successfully completed CNE approval highlights soundness of financial structure of the transaction Quality of assets to be disposed evident from the level of interest received from potential buyers |

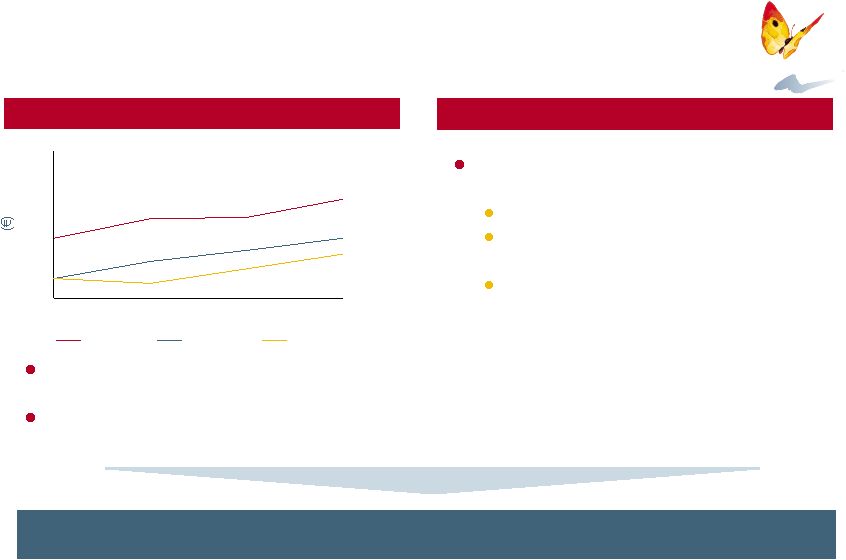

31 1.5 1.9 2.3 2.7 2006E 2007E 2008E 2009E New Group Gas Natural Endesa Positive financial impact Notes: 1 Company estimates based on IBES EPS projections of €1.66 (2006) and €1.62 (2007), and a long-term growth rate of 7.2% used for 2008 and 2009 for Endesa. Based on IBES EPS projections of €1.66 (2006) and €1.80 (2007), and a long-term growth rate of 5.0% used for 2008 and 2009 for Gas Natural; after planned disposals under Gas Natural-Iberdrola’s agreement 2 Assuming Endesa’s shareholders reinvest cash received in Gas Natural shares at the undisturbed price as of 2 September 2005, and no tax consequences of the sale of the Endesa shares 3 New Group will have discretion to change its dividend policy at any time, and shareholders may not receive amount forecasted Expected dividend impact Expected earnings impact Positive impact expected for shareholders of New Group Expected significant EPS accretion from year one for Gas Natural and Endesa’s shareholders 1,2 New Group EPS assumes estimated synergies of ~€350m in 2008 Shareholders expected to benefit from dividends accretion due to Expected earnings ¹ Expected dividend growth in line with net income growth Maintain dividend payout target of 52-55% by 2008 ³ |

32 Estimated costs reduction potential of ~€350 million in 2008 These synergies account for ~7% of New Group’s EBIT in line with comparable transactions These estimated efficiency gains will be reinvested in quality of service improvement Integration of the Board of Directors and Executive Committee Integration of the Corporate and Support functions Optimization of the office space of both companies Reduction of operating costs associated to Corporate and Support functions Call centre and commercial management platforms integration Marketing and Advertising purchases integration Benefits from economies of scale in billing Overlaps optimization in the retail distribution channel and migration to Gas Natural's indirect distribution model Sale forces and support staff integration Electricity dispatching integration Support staff to international commercialization integration Integration of redundant development projects between companies Unification of the Data Processing Centers and optimization of external support services Maintenance costs reduction due to the elimination of redundant applications Stronger purchasing power due to higher volumes and optimization of HW and SW purchasing processes Distribution activities in areas with overlap among both companies will allow Joint development of administrative tasks "Insourcing" of some of the activities currently outsourced Reduction in non network- specific procurement costs Civil work, location rentals, etc. Implementation of Gas Natural's "best practices" in Endesa's distribution network Corporate ~€85m Commercialization ~€175m Information systems ~€90m Distribution ~€75m Reasonable synergy estimates amount to ~€350 million Source: Boston Consulting Group, Company estimates Additional savings of ~€30m in LatAm have been estimated on a preliminary basis, but have not been included Potential revenue synergies have not been included LatAm & revenue synergies |

33 Process update Strong financial rationale Conclusions A leading, fully integrated global energy group Fostering an efficient market |

34 Expected €3.5 bn deficit for 2005 Tariff deficit The Spanish electricity sector suffers from regulatory uncertainty Key electricity sector issues New regulatory framework to be passed within the next months CTCs (Stranded Costs) Kyoto Extra-peninsular Market power in generation Commercialization Distribution €3.7 bn still to be settled >100 ton/year, only 88 ton allowed by NAP Emission rights price tripled YTD No regulation in place Unbalanced generation mixes White book Mismatch with pool prices unsustainable Underemunerated Underinvested Tariff structure Tariffs are not additive as fuel costs are not passed through |

35 44% of expected €3.5 bn sector deficit for 2005 Tariff deficit Endesa faces several important regulatory challenges 55% of the €2.6 bn sector pending amount of unrecovered CTCs Endesa has the greatest regulatory exposure in the sector Sector issue Impact on Endesa Endesa is the largest CO2 emitter in Spain Allocated CO2 rights 20% lower than requested. Prices have tripled year to date Endesa is the only player exposed Mismatch in prices between pool and commercialization not sustainable Endesa has 35% of electricity commercialization Endesa’s new business plan is based on a tailor-made regulatory framework, different from past proposals Largest player by output in ordinary regime Pricing power in different pool segments as a result of the generation mix Endesa´s generation mix biased towards coal Endesa is Spain’s largest distributor with a 38% share Endesa operates 5 out of the 9 regional distributors with the lowest quality levels CTCs Kyoto Extra-peninsular Market power in generation Commercialization Distribution |

36 Endesa’s earnings are highly dependent on the resolution of important regulatory issues 9M 05 EBITDA Source: Endesa’s 9M 2005 results 4,399 (1,104) (110) 3,185 Tariff deficit Extra-Peninsular compensation 28% of 9M 2005 EBITDA directly exposed to regulatory risk … … however, Endesa has taken a controversial stance in this regard 28% of 9M05 EBITDA pending resolution Adjusted 9M 05 EBITDA Endesa’s new business plan contemplates a significant increase in EBITDA which is mostly based on regulatory assumptions |

37 Re-balanced generation mix increases competition in each of the pool-price- setting periods Alignment of coal and CCGT generation with other producers fosters competition in both peak and base load hours Decreased coal exposure aligns market share with other producers CO2 allocation burden shared with key competitors The transaction balances the generation market 2,000 4,000 6,000 Gas Natural New Group³ Iberdrola³ HC UF Viesgo Endesa 50% 28% Coal plants - 2004 market shares 1,2 CCGTs - 2004 market shares 1,2 500 1,000 1,500 2,000 2,500 3,000 Endesa Iberdrola HC UF Other Gas Natural 4 19% New Group 34% 14% Source: Source: Companies reports and REE Notes: 1 Peninsular capacity 2 Includes Endesa, Gas Natural, Iberdrola, HC, Unión Fenosa and Viesgo 3 Dotted line indicates position post OPA and assets disposals to Iberdrola 4 Gas Natural market share includes Arrúbal 800 MW that started operations in the first quarter of 2005 Greater competition should help achieve: A system with additive tariffs Elimination of tariff deficit Increase in distribution remuneration Efficient extra-peninsular remuneration system |

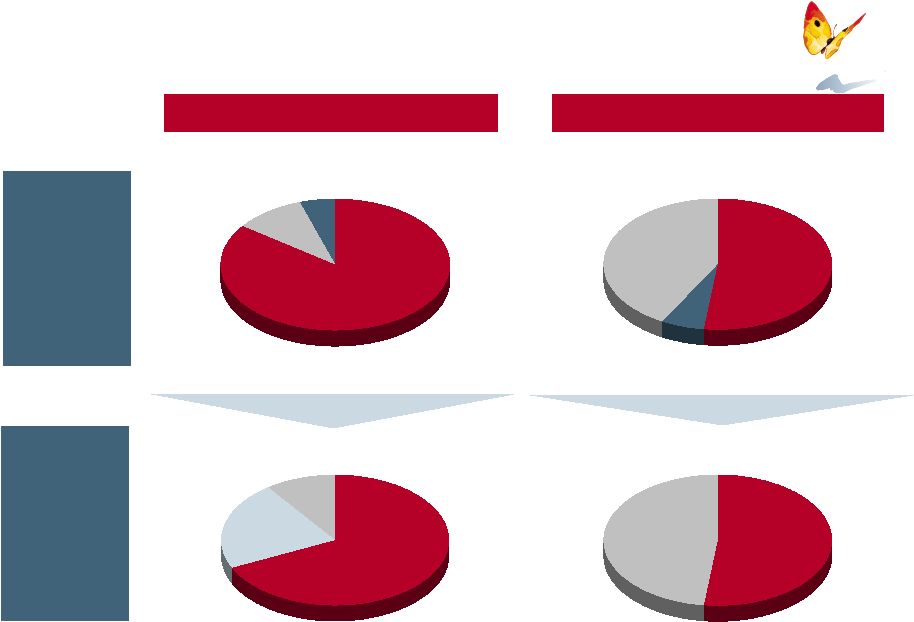

38 The transaction fosters an efficient electricity market Electricity production (GWh) Electricity supply (GWh) Sources: REE, CNE and Gas Natural estimates Note: Peninsular Ordinary Regime. Data for 2004 Before the transaction After the transaction Gas Natural + Endesa 35% Others 65% Gas Natural 7% Endesa 35% Others 58% Gas Natural 3% Endesa 44% Iberdrola 31% Fenosa 14% HidroCantábrico 8% Assets sold to Iberdrola 9% Gas Natural + Endesa 38% Iberdrola 31% Fenosa 14% HidroCantábrico 8% (35% of total demand in 2004) |

39 Different regulatory situation in the gas and power markets Gas Natural has proven ability to help to achieve energy policy targets while creating value for its shareholders Gas procurement = 25% of system costs Full pass-through Gas Procurement / Generation Distribution Supply Electricity Generation = 66% of recognized system costs No pass-through of generation costs (tariff deficit) Stable remuneration to incentivise investments Returns in line with level of activity Insufficient remuneration No consensus for new regulation The liberalized market accounts for 82% of total demand The liberalized market accounts for 34% of total demand Source: Company estimates and CNE 1 Gas transport (including regasification) accounts for 28% of the gas tariff. Power transport accounts for 5% of the electricity tariff. Neither company has significant transport assets |

40 The transaction also fosters an efficient gas market Gas distribution (customers) Gas supply (GWh) Assets sold to Iberdrola 22% NaturCorp 10% Endesa 5% Gas Natural 85% Gas Natural + Endesa 68% NaturCorp 10% Source: CNE Note: Data as of 2004 Gas Natural 52% Endesa 6% Before the transaction After the transaction Others 42% Gas Natural + Endesa 52% Others 48% (80% of total demand in 2004) |

41 Process update Strong financial rationale Conclusions A leading, fully integrated global energy group Fostering an efficient market |

42 Creating an integrated energy group: a platform to create value 33.5 32.9 31.2 31.0 27.7 22.3 15.2 10.0 9.2 8.2 0 5 10 15 20 25 30 35 Note: 1 Listed companies only (before transaction announcement), excluding state- owned companies, presented on consolidated basis; includes only gas and electricity customers. Source: Company estimates 2 Post proposed disposals under Gas Natural-Iberdrola agreement 10.0 Ranking by number of customers (million) 1 17.4 Transaction is on track and completion expected by March / April 2006 Sound strategic rationale from gas and power convergence Expected smooth integration and proven ability to deliver Solid capital structure and strong financial rationale Addressing Endesa’s regulatory challenges Fostering an efficient energy market in Spain |

INVESTOR RELATIONS DEPARTMENT Av. Portal de l’Àngel, 20 08002 BARCELONA (Spain) telf. 34 934 025 891 fax 34 934 025 896 e-mail: relinversor@gasnatural.com website: www.gasnatural.com Thank you |