Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 333-07654

In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a preliminary prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by holders located in the United States and for Endesa ADSs held by holders wherever located. At the appropriate time, Gas Natural will file a Statement on Schedule TO with the SEC. Holders of Endesa ADSs and U.S. holders of Endesa ordinary shares are urged to read the registration statement, the preliminary U.S. prospectus and the related exchange offer materials, the final U.S. prospectus and Statement on Schedule TO (when available), and any other relevant documents filed with the SEC, as well as any amendments and supplements to those documents, because they will contain important information. Investors and security holders may obtain free copies of the registration statement, the preliminary U.S. prospectus and related exchange offer materials, and the final prospectus and Statement on Schedule TO (when available), as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov and will receive information at the appropriate time on how to obtain transaction-related documents for free from Gas Natural or its duly designated agent.

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that Gas Natural expects to send to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. The Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) may not be sold, nor may offers to buy be accepted, in the United States prior to the time that the registration statement becomes effective. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is a press release issued by Gas Natural SDG, S.A. relating to its 2005 results. Please note that the following is a translation of a Spanish press release; in case of discrepancies, the Spanish version will prevail.

2

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

NET PROFIT INCREASED BY 16.7%

TO €749.2 MILLION IN 2005

1.- HIGHLIGHTS

| • | | Net profit totalled €749.2 million, a 16.7% increase on the previous year. |

| • | | Consolidated EBITDA increased steadily in the year, rising 16.1% in the fourth quarter. Electricity in Spain and gas distribution in Latin America were the main growth drivers, enabling EBITDA to grow by 13.7% to €1,518.8 million in 2005. |

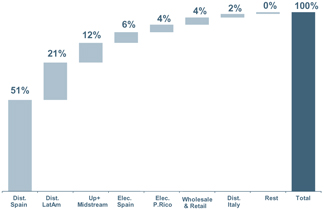

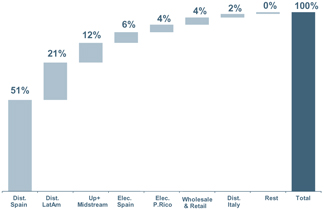

| • | | EBITDA in the gas distribution business in Spain (€777.8 million) increased by 7.7% on 2004 and represented 51.2% of total Group EBITDA. |

| • | | The gas distribution business in Latin America continued to grow rapidly; EBITDA increased by 39.0% to €316.7 million. |

| • | | GAS NATURAL had 10.2 million gas distribution connections in 2005, representing a year-on-year increase of 615,000 (6.4%). |

| • | | Electric power sales totalled 8,904 GWh, 53.5% more than in 2004. GAS NATURAL has a 4.0% share of the Spanish market in electricity from non-renewable sources. |

| • | | EBITDA in the electricity business in Spain (generation and supply) reached €89.8 million, double the figure reported in 2004. |

| • | | Investment in tangible fixed assets totalled €1,125.4 million in 2005, an 18.9% increase year-on-year, due to investment in power generation in Spain, which accounted for 39.6% of the total. |

| • | | The remuneration for regulated gas distribution activities in Spain for 2006 was published on 27 December 2005, in line with the framework approved in February 2002. For GAS NATURAL, this means a 5.6% increase to €1,052.0 million. |

| • | | On 6 February 2006, after analysing the conditions imposed by the Spanish Cabinet, the Board of Directors of GAS NATURAL resolved to continue with the tender offer for 100% of Endesa. |

| • | | On 24 February 2006, the Spanish Cabinet approved a number of regulatory changes relating to the energy sector. They include two draft laws that amend the Hydrocarbon Law and the Electricity Sector Law and transpose the EU Directives on common rules for the internal markets in electricity and gas. It also approved a decree-law aimed at reducing the large tariff deficit in the Spanish electricity system and another to amend the powers of the National Energy Commission. |

| • | | On 27 February 2006, the CNMV (Spain’s securities market regulator) approved GAS NATURAL’s tender offer for Endesa. |

| • | | The Board of Directors of GAS NATURAL intends to propose to the Shareholders’ Meeting a gross dividend of €0.84/share out of 2005 earnings (an 18.3% increase), representing a 50.2% pay-out. An interim dividend of €0.31/share was paid on 10 January 2006 and the remaining €0.53/share would be paid in July 2006. |

2

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

TENDER OFFER FOR ENDESA

On 5 September, the Board of Directors of GAS NATURAL unanimously resolved to make a tender offer for 100% of Endesa.

Additionally, GAS NATURAL and Iberdrola signed an agreement, conditional upon the success of the takeover, under which certain assets of the company resulting from the acquisition of Endesa by GAS NATURAL would be sold to Iberdrola. The transaction would take place on an arm’s-length basis at prices to be determined by a number of independent investment banks.

On 6 February 2006, after analysing the twenty conditions imposed by the Spanish Cabinet, the Board of Directors of GAS NATURAL resolved to continue with the tender offer for 100% of Endesa.

GAS NATURAL believes that the deal’s strategic, industrial and financial advantages are compatible with meeting the Spanish Cabinet’s conditions regarding economic concentration.

Applying the conditions to GAS NATURAL’s project enables it to maintain the deal’s strategic logic as designed initially. The deal’s industrial and financial advantages are also intact: capitalise on the opportunity offered by convergence of gas and electricity; have flexible, competitive gas supplies; have a diversified generating portfolio; manage gas and electricity customers comprehensively; have an attractive business mix and investment profile; and take advantage of synergy potential.

On 21 February 2006, German company E.ON filed with the CNMV an application to present a tender offer for 100% of the shares of Endesa, subject to certain conditions.

On 27 February 2006, after the last regulatory hurdle had been cleared and the company had decided to proceed, the CNMV approved the tender offer for Endesa.

3

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

2.- MAIN AGGREGATES

2.1.-Main financial aggregates

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 2,744.1 | | 1,831.6 | | 49.8 | | Net sales | | 8,526.6 | | 6,266.2 | | 36.1 |

| 398.0 | | 342.7 | | 16.1 | | EBITDA | | 1,518.8 | | 1,335.3 | | 13.7 |

| 246.5 | | 209.3 | | 17.8 | | Operating income | | 968.6 | | 861.6 | | 12.4 |

| 220.3 | | 190.3 | | 15.8 | | Net profit | | 749.2 | | 642.0 | | 16.7 |

| | | | | | | | | | | | | |

| — | | — | | — | | Average number of shares (million) | | 447.8 | | 447.8 | | — |

| | | | | | | | | | | | | |

| 0.89 | | 0.77 | | 16.1 | | EBITDA per share (€) | | 3.39 | | 2.98 | | 13.7 |

| 0.49 | | 0.42 | | 15.8 | | Net profit per share (€) | | 1.67 | | 1.43 | | 16.7 |

| — | | — | | — | | Dividend per share (€) | | 0.84 | | 0.71 | | 18.3 |

| | | | | | | | | | | | | |

| 355.8 | | 322.9 | | 10.2 | | Tangible investments | | 1,125.4 | | 946.3 | | 18.9 |

| — | | — | | — | | Net financial debt (at 31/12) | | 3,615.2 | | 2,649.6 | | 36.4 |

| | | | | | | | | | | | | |

2.2.-Ratios

| | | | | | |

| | | 2005 | | | 2004 | |

ROACE1 | | 12.5 | % | | 13.3 | % |

ROE2 | | 15.0 | % | | 14.6 | % |

| | | | | | |

Leverage3 | | 38.5 | % | | 35.6 | % |

EBITDA/Net financial result | | 6.9 | x | | 8.7 | x |

Net debt/EBITDA | | 2.4 | x | | 2.0 | x |

| | | | | | |

PER | | 14.1 | x | | 15.9 | x |

EV/EBITDA | | 9.4 | x | | 9.6 | x |

| | | | | | |

Share performance and balance sheet at 31 December.

| 1 | Operating income/Average operating capital (Net tangible and intangible assets - Revenues linked to fixed assets to be distributed + Other fixed assets + Goodwill +Non-financial working capital) |

| 2 | Net profit/ Average equity |

| 3 | Net financial debt/(Net financial debt + Equity + Minority interest) |

4

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

2.3.-Main physical aggregates

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | | | 2005 | | 2004 | | % |

| 112,967 | | 106,950 | | 5.6 | | Gas distribution (GWh): | | 422,912 | | 385,655 | | 9.7 |

| | | | | | |

| 68,728 | | 65,443 | | 5.0 | | Spain: | | 254,774 | | 228,954 | | 11.3 |

| 14,287 | | 13,724 | | 4.1 | | Tariff gas sales | | 51,121 | | 51,449 | | -0.6 |

| 54,441 | | 51,719 | | 5.3 | | TPA | | 203,653 | | 177,505 | | 14.7 |

| | | | | | |

| 43,436 | | 40,854 | | 6.3 | | Latin America: | | 165,408 | | 155,346 | | 6.5 |

| 25,673 | | 22,422 | | 14.5 | | Tariff gas sales | | 99,891 | | 92,097 | | 8.5 |

| 17,763 | | 18,432 | | -3.6 | | TPA | | 65,517 | | 63,249 | | 3.6 |

| | | | | | |

| 803 | | 653 | | 23.0 | | Italy: | | 2,730 | | 1,355 | | — |

| 785 | | 658 | | 19.3 | | Tariff gas sales | | 2,652 | | 1,315 | | — |

| 18 | | -5 | | — | | TPA | | 78 | | 40 | | 95.0 |

| | | | | | | | | | | | | |

| 93,998 | | 79,995 | | 17.5 | | Gas supply (GWh): | | 317,555 | | 288,055 | | 10.2 |

| 77,961 | | 66,188 | | 17.8 | | Spain | | 271,880 | | 243,510 | | 11.7 |

| 16,037 | | 13,807 | | 16.2 | | International | | 45,675 | | 44,545 | | 2.5 |

| | | | | | |

| 36,838 | | 32,836 | | 12.2 | | Gas transportation - EMPL (GWh) | | 145,923 | | 115,637 | | 26.2 |

| | | | | | | | | | | | | |

| 1,427 | | 1,422 | | 0.3 | | Distribution network (km): | | 100,150 | | 95,155 | | 5.2 |

| 465 | | 917 | | -49.3 | | Spain | | 39,611 | | 37,534 | | 5.5 |

| 895 | | 447 | | — | | Latin America | | 56,763 | | 54,120 | | 4.9 |

| 67 | | 58 | | 15.5 | | Italy | | 3,776 | | 3,501 | | 7.9 |

| | | | | | | | | | | | | |

| 181 | | 165 | | 9.7 | | Increase in distribution connections, (‘000) | | 615 | | 619 | | -0.8 |

| 100 | | 91 | | 9.9 | | Spain | | 325 | | 326 | | -0.3 |

| 68 | | 69 | | -1.4 | | Latin America | | 253 | | 280 | | -9.6 |

| 14 | | 5 | | — | | Italy | | 37 | | 13 | | — |

| | | | | | | | | | | | | |

| — | | — | | — | | Distribution connections, (‘000) (at 31/12): | | 10,179 | | 9,565 | | 6.4 |

| — | | — | | — | | Spain | | 5,134 | | 4,808 | | 6.8 |

| — | | — | | — | | Latin America | | 4,757 | | 4,505 | | 5.6 |

| — | | — | | — | | Italy | | 288 | | 252 | | 14.3 |

| | | | | | | | | | | | | |

| — | | — | | — | | Contracts per customer in Spain (at 31/12) | | 1.47 | | 1.37 | | 7.3 |

| | | | | | | | | | | | | |

| 2,615 | | 2,014 | | 29.8 | | Electricity generated (GWh): | | 10,466 | | 7,272 | | 43.9 |

| 2,192 | | 1,642 | | 33.5 | | Spain | | 8,904 | | 5,802 | | 53.5 |

| 423 | | 372 | | 13.7 | | Puerto Rico | | 1,562 | | 1,470 | | 6.3 |

| | | | | | | | | | | | | |

| 1,200 | | 53 | | — | | Installed capacity (MW): | | 3,373 | | 1,145 | | — |

| 1,200 | | 53 | | — | | Spain | | 3,102 | | 874 | | — |

| — | | — | | — | | Puerto Rico | | 271 | | 271 | | — |

| | | | | | | | | | | | | |

| — | | — | | — | | Employees (at 31/12) | | 6,717 | | 6,697 | | 0.3 |

| | | | | | | | | | | | | |

5

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

3.- ANALYSIS OF CONSOLIDATED RESULTS

3.1.-Changes in group size

The main changes in consolidated group size in 2005 with respect to 2004 are as follows:

| • | | The acquisition, in August 2004, of Smedigas (Italy), which has been fully consolidated since 1 August 2004. |

| • | | The acquisition, in September 2004, of Nettis (Italy), which has been fully consolidated since 14 September 2004. |

| • | | The acquisition of additional stakes in CEG and CEG Rio (Brazil), which have been fully consolidated since 1 July 2004 (proportionately consolidated prior to that date). |

| • | | The acquisition of holdings in a number of wind farm companies: SINIA XXI (consolidated since 1 November 2004) and DERSA (consolidated since 1 April 2005). |

| • | | Deconsolidation of Naturgas Energía Group effective February 2004. |

| • | | Deconsolidation of Enagás effective 1 October 2005 |

3.2.-International Financial Reporting Standards (IFRS)

The accompanying financial information was prepared in accordance with International Financial Reporting Standards (IFRS).

The 2004 information was prepared in accordance with IFRS for the purposes of comparison with the 2005 information prepared in accordance with IFRS.

The impact on the main line-items in 2004 is as follows:

(unaudited)

| | | | |

(€ Mn) | | 2004 IFRS | | 2004 Spanish

GAAP |

Operating income | | 861.6 | | 898.7 |

EBITDA4 | | 1,335.3 | | 1,362.5 |

Net income | | 642.0 | | 633.9 |

Shareholders’ equity5 | | 4,790.7 | | 4,899.6 |

Net financial debt6 | | 2,649.6 | | 2,573.6 |

| | | | |

| 4 | Operating income + Depreciation & amortisation + Operating provisions. |

| 5 | Capital + Reserves + Minority interest. |

| 6 | Financial debt - Cash & cash equivalents. |

6

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

3.3.-Analysis of results

3.3.1- Net sales

Net sales totalled €8,526.6 million in 2005, a 36.1% increase on 2004, due basically to increased business activity by GAS NATURAL, particularly gas supply for power generation in Spain (growth in volume and high natural gas prices) and expansion of the business in Latin America.

3.3.2.- EBITDA and operating income

EBITDA amounted to €1,518.8 million in 2005, a 13.7% increase on 2004.

Contribution to EBITDA by business

Gas distribution overall (Spain, Latin America and Italy) accounts for 73.9% of GAS NATURAL’s EBITDA. Gas distribution in Spain is the main source of EBITDA (51.2%).

EBITDA in 2005 also increased due to growth in the electricity business in Spain, which accounts for 5.9% of the total.

Upstream and Midstream activities together accounted for 11.6% of the total. This figure increased significantly due to the expansion of the Maghreb-Europe gas pipeline’s capacity (operational since February 2005).

An 18.7% increase in depreciation and amortisation charges due to capital expenditure mainly in electricity generation and gas distribution grids, to allocation of certain consolidation goodwill to amortisatible assets, and to the consolidation of acquired companies, coupled with a similar amount of working capital provisions, led to a 12.4% increase in operating income to €968.6 million.

3.3.3.- Financial results

The breakdown of financial results is as follows:

(unaudited)

| | | | | | | | |

| 4Q05 | | 4Q04 | | (€ Mn) | | 2005 | | 2004 |

| -59.7 | | -49.6 | | Cost of net financial debt | | -217.1 | | -160.7 |

| -2.2 | | — | | Exchange differences in Argentina | | 0.2 | | -2.3 |

| -1.0 | | -2.0 | | Rest of exchange differences (net) | | -4.8 | | 3.0 |

| 8.9 | | 3.9 | | Capitalized interest | | 23.4 | | 14.8 |

| -1.5 | | -0.1 | | Other financial (expenses)/revenues | | -22.9 | | -8.4 |

| | | | | | | | | |

| -55.5 | | -47.8 | | Net financial result | | -221.2 | | -153.6 |

| | | | | | | | | |

7

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

The net financial expense in the period amounted to €221.2 million, compared with €153.6 million in 2004, due to the increase in net financial debt mainly as a result of the acquisitions made in 2H04 (additional stakes in CEG and CEG Rio, Smedigas, Nettis and wind farm companies) and April 2005 (DERSA), as well as the consolidation of their debt.

The “Exchange differences in Argentina” caption reflects exchange differences booked at Gas Natural BAN on its dollar-denominated debt. This effect was slightly positive in the year, despite unfavourable performance by the Argentinean peso (3.01 pesos to the dollar, compared with 2.96 at 2004 year-end), as a result of hedges for loans in dollars.

In 2005, Gas Natural BAN hedged part of its financing against currency and interest rate risk. A total of $58 million was hedged at an exchange rate of 2.8720 pesos to the dollar. As a result, Gas Natural BAN partially reduced the exposure of its debt to the dollar.

Gas Natural Mexico arranged a 3-year loan for MXN 1,000 million with Instituto de Crédito Oficial (ICO) to finance its investments, thus commencing institutional financing in local currency.

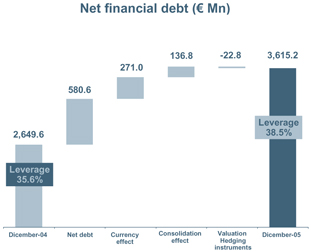

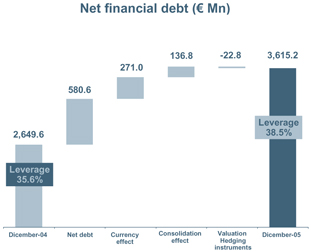

The figure shows GAS NATURAL’s consolidated net debt and indebtedness between 31 December 2004 and 31 December 2005. At the latter date, debt amounted to €3,615.2 million, i.e. a debt/equity ratio of 38.5%, compared with 35.6% at 2004 year-end.

The figure displays the various factors affecting the variation in GAS NATURAL’s net debt, which led to an increase of €965.6 million in 2005, of which €370.1 million was added in the fourth quarter.

The €580.6 million increase in net debt is due basically to debt in Spain as a result of the acquisition of DERSA and investments in tangible assets.

The impact of exchange rate fluctuations on debt in currencies other than the euro led to a €271.0 million increase in net debt in the period.

The main new feature is that, as a result of applying IFRS, GAS NATURAL’s hedges were recognised at fair value; therefore, net financial debt decreased by €22.8 million with respect to 31 December 2004.

8

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

The breakdown of the net financial debt by currency at 31 December 2005, in absolute and relative terms, is as follows:

(unaudited)

| | | | |

(€ Mn) | | 31/12/05 | | % |

EUR | | 1,918.8 | | 53.1 |

USD | | 711.2 | | 19.7 |

MXN | | 414.5 | | 11.5 |

BRL | | 400.1 | | 11.1 |

COP | | 62.8 | | 1.7 |

USD – Argentina | | 59.6 | | 1.6 |

Other currencies | | 48.2 | | 1.3 |

| | | | |

Total net financial debt | | 3,615.2 | | 100.0 |

| | | | |

Net dollar-denominated financial debt (excluding Argentina) relates mainly to EMPL, the company which manages the Maghreb-Europe gas pipeline, and to EcoEléctrica, whose accounts and cash flow are in dollars. The “Other currencies” item includes net debt in Argentinean pesos and Moroccan dirhams.

Latin American companies’ debt is in local currency, except Argentina, where 55% of net debt is in dollars.

A total of 51% of consolidated debt is at floating interest rates and the other 49% at fixed rates. Over 53% of debt matures as from 2009.

The current credit rating of GAS NATURAL’s short- and long-term debt is as follows:

| | | | | | |

Agency | | Long term | | Short term | | Outlook |

Moody’s | | A2 | | P-1 | | Review for possible downgrade |

Standard & Poor’s | | A+ | | A-1 | | Negative creditwatch |

Fitch | | A+ | | F1 | | Rating watch negative |

On 6 September 2005, as a result of the tender offer for Endesa, the agencies put the ratings under review.

3.3.4.- Equity income

The main items in this account relate to results from minority stakes in gas distribution companies in Spain (Gas Aragón and Gas Natural de Álava), wind power companies, and Enagás (equity-accounted between January and September 2005). The Enagás stake was reclassified on 1 October 2005 as available-for-sale financial assets.

Stakes in associated companies yielded €34.4 million in 2005 (€61.2 million in 2004). This change is due mainly to the reduction of the stake in Enagás and its deconsolidation on 1 October 2005 and to the deconsolidation of Naturgas Energía Group in February 2004.

Enagás contributed €30.3 million to the equity-accounted affiliates line-item in 2005.

9

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

3.3.5.- Capital gain on disposal of non-current assets

Disposals of non-current assets provided a net gain of €286.4 million in 2005, compared with €162.3 million in 2004. This result is due basically to the divestment in 2005 of 13.3% of Enagás. The company sold 12.5% of Enagás in 2004.

The net capital gains on the sale of Enagás totalled €247.9 million in 2005, compared with €144.5 million in 2004.

GAS NATURAL is obliged to reduce its stake in Enagás to 5% by 31 December 2006. At 31 December 2005, it owned 12.8% of Enagás.

3.3.6.- Corporate income tax

The corporate income tax expense totalled €241.3 million, i.e. an effective tax rate of 22.6%, compared with 24.9% in 2004.

The difference with respect to the general tax rate was due to tax credits, equity-accounted affiliates, tax loss carryforwards, and different tax systems applied to companies operating outside Spain.

3.3.7.- Minority interest

The main items in this account are the minority shareholders of EMPL (owned 72.6% by GAS NATURAL), the subgroup of subsidiaries in Colombia (owned 59.1%), Gas Natural BAN (owned 50.4%), Gas Natural Mexico (owned 86.8%), Brazilian companies CEG (owned 54.2%) and CEG Rio (owned 59.6%), as well as gas distribution companies in Spain.

In July, 12.4% of CEG Rio was sold to Petrobras, which reduced GAS NATURAL’s stake from 72.0% to 59.6%; this holding is still fully consolidated and the sale resulted in an increase in the minority interest item.

Income attributed to minority interests in 2005 amounted to €77.7 million, a €24.7 million increase due mainly to a higher contribution from EMPL and the Latin American subsidiaries, particularly as a result of the inclusion of minority interests in Brazil from 1 July 2004.

3.4.-Investments

Investments totalled €1,483.7 million, slightly lower than in 2004, because an 18.9% increase in tangible fixed assets was offset by a reduction in financial investments (acquisition of holdings in companies). The sizeable volume of financial investments in 2004 included acquisitions in Italy and an increase in the Group’s interests in Brazil, whereas acquisitions in 2005 were confined basically to DERSA.

The breakdown of investments by type is as follows:

(unaudited)

| | | | | | |

(€ Mn) | | 2005 | | 2004 | | % |

Capital expenditure | | 1,125.4 | | 946.3 | | 18.9 |

Investments in intangible assets | | 62.6 | | 62.5 | | 0.2 |

Financial investments | | 295.7 | | 494.7 | | -40.2 |

| | | | | | |

Total investments | | 1,483.7 | | 1,503.5 | | -1.3 |

| | | | | | |

10

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

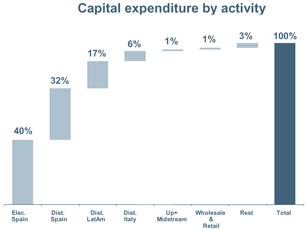

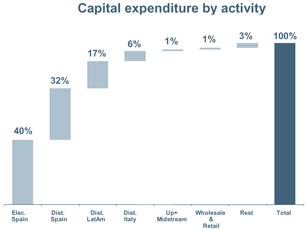

Capital expenditure totalled €1,125.4 million, an 18.9% increase, basically because of ongoing development of GAS NATURAL’s programme to generate power using combined cycle plants in Spain and to expand gas distribution.

The breakdown of capital expenditure by line of business is as follows:

(unaudited)

| | | | | | |

(€ Mn) | | 2005 | | 2004 | | % |

Gas distribution: | | 611.4 | | 512.7 | | 19.3 |

Spain | | 354.2 | | 365.8 | | -3.2 |

Latin America | | 190.7 | | 121.2 | | 57.3 |

Italy | | 66.5 | | 25.7 | | — |

| | | | | | |

Electricity: | | 449.8 | | 379.5 | | 18.5 |

Spain | | 446.0 | | 373.5 | | 19.4 |

Puerto Rico | | 3.8 | | 6.0 | | -36.7 |

| | | | | | |

Gas: | | 33.5 | | 33.8 | | -0.9 |

Up + Midstream | | 17.2 | | 24.9 | | -30.9 |

Wholesale & Retail | | 16.3 | | 8.9 | | 83.1 |

| | | | | | |

Rest | | 30.7 | | 20.3 | | 51.2 |

| | | | | | |

Total capital expenditure | | 1,125.4 | | 946.3 | | 18.9 |

| | | | | | |

In 2005, 39.6% of investment in tangible fixed assets related to the electricity business in Spain, specifically to complete the construction of the Arrúbal combined cycle plant (800 MW), to develop the three combined cycle units at Cartagena (1,200 MW), and to commence construction of another two units at Plana del Vent (800 MW).

Investment in gas distribution in Spain, which accounted for another 31.5% of the total, was allocated to acquiring new customers: the distribution grid was extended by close to 2,100 km in 2005 (5.5% growth).

Capital expenditure in gas distribution in Latin America amounted to €190.7 million, a 57.3% increase. The investment in Mexico was similar to 2004 due basically to the slowdown in grid construction there. Brazil is now the main destination of company investments in the region because of the change in consolidated group structure; Brazil accounted for 65.1% of investment in the area.

11

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

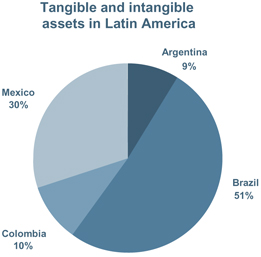

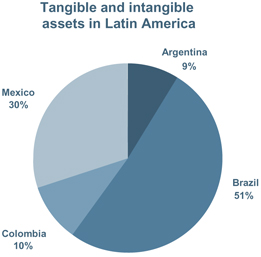

Net intangible and tangible fixed assets increased by €1,430.2 million to €8,904.6 million at 31 December 2005. The breakdown of this figure by line of business is as follows:

(unaudited)

| | | | |

(€ Mn) | | 31/12/05 | | % |

Gas distribution: | | 5,633.2 | | 63.3 |

Spain | | 3,463.7 | | 38.9 |

Latin America | | 1,773.0 | | 19.9 |

Italy | | 396.5 | | 4.5 |

| | | | |

Electricity: | | 2,146.7 | | 24.1 |

Spain | | 1,911.1 | | 21.5 |

Puerto Rico | | 235.6 | | 2.6 |

| | | | |

Gas: | | 935.5 | | 10.5 |

Up + Midstream | | 836.0 | | 9.4 |

Wholesale & Retail | | 99.5 | | 1.1 |

| | | | |

Rest | | 189.2 | | 2.1 |

| | | | |

Total net tangible and intangible assets | | 8,904.6 | | 100.0 |

| | | | |

Overall intangible and tangible fixed assets included construction in progress worth €904.5 million, of which €740.2 million relate to the electricity business and €94.6 million to Latin America.

Gas distribution accounts for 63.3% of GAS NATURAL’s assets.

Intangible and tangible fixed assets in Latin America amount to €1,773.0 million (19.9% of the consolidated total) and relate to gas distribution assets.

The figure shows the asset breakdown by country, where Brazil accounts for 51% of the total.

3.5.-Goodwill

International Financial Reporting Standards (IFRS) do not allow goodwill to be amortised. Nevertheless, goodwill must be reviewed to detect any impairment. In accordance with available estimates, the projected attributable revenues assure the recovery of GAS NATURAL’s net assets and goodwill.

12

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

Goodwill in consolidation on the balance sheet at 31 December 2005 amounted to €456.2 million and is detailed below by country:

(unaudited)

| | |

(€ Mn) | | 31/12/05 |

Puerto Rico | | 143.4 |

Italy | | 135.0 |

Spain | | 118.4 |

Mexico | | 37.6 |

Brazil | | 21.8 |

| | |

Total | | 456.2 |

| | |

The increase in goodwill in Spain in 2005 is due to the acquisition of DERSA.

3.6.-Shareholders’ equity

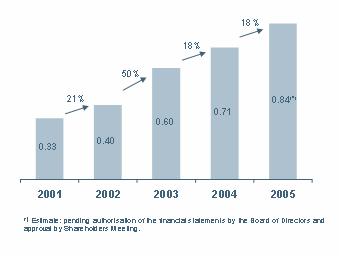

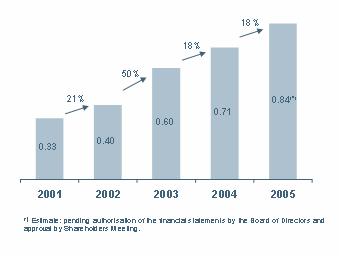

The Shareholders’ Meeting on 20 April 2005 voted to increase the dividend by 18.3% and pay €0.71 per share out of 2004 earnings; €0.27 per share were paid on 11 January 2005 and the remaining €0.44 per share were paid on 1 July 2005. This figure represents a payout of 49.5% of reported 2004 profit under IFRS.

The Board of Directors of GAS NATURAL intends to propose to the Shareholders’ Meeting an 18.3% increase in the dividend and pay €0.84/share out of 2005 earnings, of which €0.31/share were paid in January 2006.

Dividend Performance (€/share)

The proposed supplementary dividend of €0.53/share represents a 20.5% increase on last year.

The Board of Directors’ proposal would increase the pay-out from 49.5% to 50.2%, in line with the 2008 target of 52%-55%.

At 31 December 2005, shareholders’ equity totalled €5,765.7 million, having increased by 20.4% in the year. Of that total, €5,410.9 million is attributable to GAS NATURAL, an 18.4% increase.

13

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

The next table shows the main amounts and changes in the shareholder’s equity items:

(unaudited)

| | | | | | | | | | | | |

(€ Mn) | | Capital | | Reserves -

valuation

adjustments | | Accumulated

gains and

other

reserves | | Exchange

differences | | Minority

interest | | Equity |

Balance at 31 December 2004 | | 447.8 | | 17.5 | | 4,127.1 | | -21.2 | | 219.5 | | 4,790.7 |

Valuation adjustments | | — | | 295.7 | | — | | — | | — | | 295.7 |

Exchange differences | | — | | — | | — | | 132.1 | | 38.0 | | 170.1 |

Period profit | | — | | — | | 749.2 | | — | | 77.7 | | 826.9 |

Dividend | | — | | — | | -335.8 | | — | | -52.2 | | -388.0 |

Other items | | — | | — | | -1.5 | | — | | 71.8 | | 70.3 |

Balance at 31 December 2005 | | 447.8 | | 313.2 | | 4,539.0 | | 110.9 | | 354.8 | | 5,765.7 |

| | | | | | | | | | | | |

The valuation adjustments relate basically to the deconsolidation of Enagás.

4.- ANALYSIS OF RESULTS BY ACTIVITY

The criteria used to assign amounts to the activities are as follows:

| | • | | The margin on intercompany transactions is allocated on the basis of the final destination of the sale, in terms of market. |

| | • | | All revenues and expenses relating directly and exclusively to a business line are allocated directly to it. |

| | • | | Corporate expenses and revenues are assigned on the basis of their use by the individual business lines. |

4.1.-Distribution in Spain

This area includes gas distribution, regulated-rate supply, third-party access and secondary transportation, as well as the distribution activities in Spain that are charged for outside the regulated remuneration (meter rentals, customer connections, etc.).

4.1.1.- Results

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 567.9 | | 489.7 | | 16.0 | | Net sales | | 1,993.4 | | 1,820.8 | | 9.5 |

| -275.4 | | -197.0 | | 39.8 | | Purchases | | -784.6 | | -685.6 | | 14.4 |

| -17.4 | | -12.2 | | 42.6 | | Personnel costs. net | | -75.9 | | -76.9 | | -1.3 |

| -80.6 | | -100.4 | | -19.7 | | Other expenses/income | | -355.1 | | -336.1 | | 5.7 |

| | | | | | | | | | | | | |

| 194.5 | | 180.1 | | 8.0 | | EBITDA | | 777.8 | | 722.2 | | 7.7 |

| | | | | | | | | | | | | |

| -68.8 | | -66.3 | | 3.8 | | Charge for depreciation and amortisation | | -256.3 | | -245.2 | | 4.5 |

| 2.1 | | -12.3 | | — | | Variation in operating provisions | | -4.2 | | -17.7 | | -76.3 |

| | | | | | | | | | | | | |

| 127.8 | | 101.5 | | 25.9 | | Operating income | | 517.3 | | 459.3 | | 12.6 |

| | | | | | | | | | | | | |

14

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

Net sales in gas distribution business in Spain totalled €1,993.4 million, 9.5% more than in 2004.

EBITDA amounted to €777.8 million, up 7.7% on the figure reported in 2004, in line with the increase in regulated remuneration in 2005.

The reduction in personnel expenses was due to the fact that capitalised in-house work on fixed assets was higher in 2005, and this figure is stated net in the consolidated income statement under IFRS.

As a result of a 4.5% increase in depreciation and amortisation charges and of lower provisions, operating income increased by 12.6%.

4.1.2.- Main aggregates

The main aggregates in gas distribution in Spain were as follows:

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | | | 2005 | | 2004 | | % |

| 68,728 | | 65,443 | | 5.0 | | Gas activity sales (GWh): | | 254,774 | | 228,954 | | 11.3 |

| | | | | | |

| 14,287 | | 13,724 | | 4.1 | | Tariff gas sales | | 51,121 | | 51,449 | | -0.6 |

| 8,375 | | 8,882 | | -5.7 | | Residential | | 26,639 | | 31,204 | | -14.6 |

| 3,719 | | 3,110 | | 19.6 | | Industrial | | 13,303 | | 12,678 | | 4.9 |

| 2,193 | | 1,732 | | 26.6 | | Electricity | | 11,179 | | 7,567 | | 47.7 |

| | | | | | |

| 54,441 | | 51,719 | | 5.3 | | TPA | | 203,653 | | 177,505 | | 14.7 |

| | | | | | | | | | | | | |

| 465 | | 917 | | -49.3 | | Distribution network (km) | | 39,611 | | 37,534 | | 5.5 |

| | | | | | | | | | | | | |

| 100 | | 91 | | 9.9 | | Change in distribution connections (‘000) | | 325 | | 326 | | -0.3 |

| | | | | | | | | | | | | |

| — | | — | | — | | Distribution connections (000) (at 31/12) | | 5,134 | | 4,808 | | 6.8 |

| | | | | | | | | | | | | |

Regulated gas sales in Spain, which encompass regulated-rate gas distribution and supply as well as third-party access (TPA), amounted to 254,774 GWh, i.e. up 11.3% on 2004.

Gas sales to the regulated residential market decreased by 14.6% due to progressive customer migration to the liberalised segment (to GAS NATURAL’s supply company and to rivals). The liberalised gas market now represents 83% of the total, up from 80% one year ago. Nevertheless, the sale of gas for industrial use rose 4.9% and sales for power generation increased very significantly with respect to 2004 due to low precipitation in the period and the use of the regulated market to supply conventional power plants; as a result, total regulated-rate gas sales were in line with 2004.

Third-party access (TPA) increased by 14.7% to 203,653 GWh, of which 93,327 GWh related to services to third parties, and the remaining 110,326 GWh to GAS NATURAL, which is the main operator in the liberalised gas market.

The distribution grid was extended by close to 2,100 km in 2005 to 39,611 km, a year-on-year increase of 5.5%. In 2005, the number of municipalities connected to the gas grid was increased by 49 to 814.

GAS NATURAL’s number of individual supply points continued to grow rapidly, increasing by 325,000 in 2005. At 31 December 2005, there were a total of 5,134,000 gas distribution connections in Spain, a 6.8% increase on 2004.

15

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

On 30 September 2005, the Board of Directors of GAS NATURAL approved plans to spin off its gas distribution and transportation businesses en bloc into its subsidiaries Gas Natural Distribución SDG and Gas Natural Transporte SDG, respectively. That spin-off was done through capital increases at both companies, subscribed with the non-monetary contribution of assets and liabilities of Gas Natural SDG in the distribution and transportation activities. In exchange for the non-monetary contributions, Gas Natural Distribución SDG issued shares worth €1.1 billion and Gas Natural Transporte SDG issued shares worth €52 million, all of which were subscribed by Gas Natural SDG.

That spin-off of regulated and deregulated businesses was done to comply with Spanish and EU regulations, which require that regulated activities be legally separated from liberalised activities.

On 8 November 2005, the CNE (Spain’s energy regulator) authorised GAS NATURAL’s ownership restructuring.

On 30 December 2005, Ministerial Order ITC 4099/2005 was published, updating the remuneration for 2006 for the regulated gas activities in Spain, in line with the framework approved in February 2002.

The Order assigns €1,052 million to GAS NATURAL as remuneration for distribution in 2006, i.e. a 5.6% increase on 2005. This increase is due to projected growth in GAS NATURAL’s activity in 2006, the projection of the hydrocarbon price index (IPH), and the fact that the efficiency factors remained unchanged.

The historical remuneration for secondary transportation was updated in line with 85% of the IPH and the addition of new infrastructure, to €18.5 million.

4.2.-Distribution in Latin America

This division involves gas distribution in Argentina, Brazil, Colombia and Mexico.

4.2.1.- Results

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 414.2 | | 303.2 | | 36.6 | | Net sales | | 1,419.6 | | 1,027.4 | | 38.2 |

| -258.3 | | -195.2 | | 32.3 | | Purchases | | -896.7 | | -652.9 | | 37.4 |

| -15.3 | | -2.9 | | — | | Personnel costs. net | | -53.1 | | -30.2 | | 75.8 |

| -43.8 | | -39.5 | | 10.9 | | Other expenses/income | | -153.1 | | -116.5 | | 31.4 |

| | | | | | | | | | | | | |

| 96.8 | | 65.6 | | 47.6 | | EBITDA | | 316.7 | | 227.8 | | 39.0 |

| | | | | | | | | | | | | |

| -24.3 | | -4.8 | | — | | Charge for depreciation and amortisation | | -77.6 | | -47.3 | | 64.1 |

| -3.8 | | -2.7 | | 40.7 | | Variation in operating provisions | | -10.2 | | -5.0 | | — |

| | | | | | | | | | | | | |

| 68.7 | | 58.1 | | 18.2 | | Operating income | | 228.9 | | 175.5 | | 30.4 |

| | | | | | | | | | | | | |

Gas distribution earnings increased significantly in Latin America in 2005. Net sales totalled €1,419.6 million, a 38.2% increase.

EBITDA amounted to €316.7 million, 39.0% more than in 2004. EBIT increased by 30.4% year-on-year due to faster growth in impairment charges as a result of investments.

16

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

The increase in EBITDA of €88.9 million in 2005 is due to:

| | • | | Improved EBITDA in all countries (€41.0 million) due mainly to a 6.5% increase in revenues and new tariffs in Colombia, Mexico and Brazil. |

| | • | | A larger consolidation scope in Brazil, which contributed €25.8 million to EBITDA. |

| | • | | Appreciation by local currencies, contributing €22.1 million to EBITDA. |

Excluding changes in consolidation and the currency effect, EBITDA grew 18.0%.

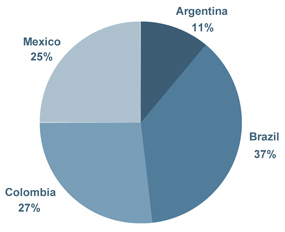

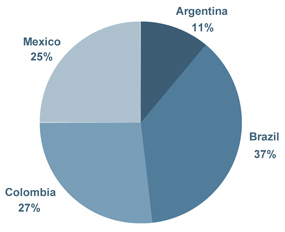

EBITDA in Latin America, by country

The figure shows EBITDA in Latin America, by country.

Brazil is the largest Latin American contributor to consolidated EBITDA due to the increase in the stake in GAS NATURAL companies and to fast organic growth.

In Latin America, net financial debt amounted to €985.9 million at 31 December 2005, including dollar-denominated loans in Argentina amounting to $81.5 million.

4.2.2.- Main aggregates

The main physical aggregates in gas distribution in Latin America are as follows:

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | | | 2005 | | 2004 | | % |

| 43,436 | | 40,854 | | 6.3 | | Gas activity sales (GWh): | | 165,408 | | 155,346 | | 6.5 |

| 25,673 | | 22,422 | | 14.5 | | Tariff gas sales | | 99,891 | | 92,097 | | 8.5 |

| 17,763 | | 18,432 | | -3.6 | | TPA | | 65,517 | | 63,249 | | 3.6 |

| | | | | | | | | | | | | |

| 895 | | 447 | | — | | Distribution network (km) | | 56,763 | | 54,120 | | 4.9 |

| | | | | | | | | | | | | |

| 68 | | 69 | | -1.4 | | Change in distribution connections (‘000) | | 253 | | 280 | | -9.6 |

| | | | | | | | | | | | | |

| — | | — | | — | | Distribution connections (000) (at 31/12) | | 4,757 | | 4,505 | | 5.6 |

| | | | | | | | | | | | | |

Sales in the gas activity in Latin America, which include both gas sales and TPA (third-party access) services, totalled 165,408 GWh, a 6.5% increase year-on-year.

Brazil increase sales by 16.2% and Colombia by 14.9%, based on growth in all markets.

The automotion fuel market performed notably in the four countries, rising 16.6% overall in 2005, and this trend is expected to continue as a result of the prices of replacement fuels.

17

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

The distribution grid was extended by 2,643 km to 56,763 km in 2005, a year-on-year increase of 4.9%. The development of new grids was lower than in previous years since the commercial goal is to saturate the existing grid.

There were a total of 4,757,000 gas distribution connections at 31 December 2005. GAS NATURAL’s number of individual distribution connections continued to grow rapidly, rising by 253,000 year-on-year.

The main physical aggregates by country in 2005 are as follows:

| | | | | | | | | | |

| | | Argentina | | Brazil | | Colombia | | Mexico | | Total |

Gas activity sales (GWh) | | 69,359 | | 43,280 | | 11,197 | | 41,572 | | 165,408 |

Change vs. 2004 (%) | | 3.7 | | 16.2 | | 14.9 | | 0.3 | | 6.5 |

| | | | | | | | | | |

Distribution network (km at 31/12/05) | | 21,237 | | 5,005 | | 15,488 | | 15,033 | | 56,763 |

Change vs. 31/12/04 (km) | | 307 | | 769 | | 832 | | 735 | | 2,643 |

| | | | | | | | | | |

Distribution connections (‘000 at 31/12/05) | | 1,289 | | 745 | | 1,614 | | 1,109 | | 4,757 |

Change vs. 31/12/04 (‘000) | | 32 | | 54 | | 119 | | 48 | | 253 |

| | | | | | | | | | |

Highlights:

| | • | | In Argentina, as a result of renewed commercial activity, there was a net increase of 32,000 distribution connections in 2005 (vs. 27,000 in 2004) and 3.7% growth in gas sales; the residential-commercial market rose by 6.2% and the unit margin also improved. Gas sales decreased by 10.1% in 1H05 whereas they increased by 10.7% in 2H05, so annual growth was 0.6%. |

On 20 July 2005, Gas Natural BAN and representatives of Argentina’s Economy & Production and Federal Planning, Public Investment & Services Ministries signed a memorandum agreement which, among other items, established a tariff increase based on the future tariff framework equivalent to a 27% increase in the company’s distribution margin, applicable as from November 2005.

The memorandum agreement has passed through various legislative and executive stages and is pending signature of the corresponding decree by Argentina’s President in order to apply it retroactively from November 2005.

| | • | | In Brazil, GAS NATURAL achieved the largest single increase in the number of supply points since it commenced operations. As in 2004, there was double-digit sales growth in 2005 (16.2%). There was considerable growth in sales to electricity power plants due to lower precipitation and for the automotion fuel sector (sales expanded considerably in southern São Paulo). |

| | • | | Double-digit growth in Colombia is being driven by the reactivation of the country’s economy. Sales grew 14.9% and the customer base increased by over 119,000 to 1,614,000 supply points. Monthly vehicle conversion figures reached a record of 1,900. |

| | • | | In Mexico, sales grew slightly faster than in 2004, despite a significant increase in the cost of gas, which is indexed to southern US prices. The Mexican government is implementing measures to palliate that effect: since 15 April 2005, it has offered residential customers with an average monthly consumption of under 60 m3 a subsidy which reduces gas bills by 28%; this will initially be in force until 30 September 2006. |

18

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

On 16 July 2004, GAS NATURAL acquired Enron’s stakes in CEG and CEG Rio, thus increasing its stake in those companies to 54.2% and 72.0%, respectively. Accordingly, these companies have been fully consolidated since 1 July 2004 (they were proportionately consolidated in 1H04). In July 2005, Petrobras exercised a call option on 12.4% of CEG Rio.

4.3.-Distribution in Italy

This area refers to gas distribution in Italy.

4.3.1.- Results

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 26.7 | | 33.8 | | -21.0 | | Net sales | | 124.2 | | 63.1 | | 96.8 |

| -21.3 | | -25.5 | | -16.5 | | Purchases | | -76.9 | | -38.4 | | — |

| -1.4 | | -2.4 | | -41.7 | | Personnel costs. net | | -11.1 | | -5.3 | | — |

| 4.8 | | 3.3 | | 45.5 | | Other expenses/income | | -8.9 | | 4.5 | | — |

| | | | | | | | | | | | | |

| 8.8 | | 9.2 | | -4.3 | | EBITDA | | 27.3 | | 23.9 | | 14.2 |

| | | | | | | | | | | | | |

| -3.1 | | -4.6 | | -32.6 | | Charge for depreciation and amortisation | | -20.9 | | -13.0 | | 60.8 |

| -0.5 | | -0.4 | | 25.0 | | Variation in operating provisions | | 0.0 | | -0.4 | | — |

| | | | | | | | | | | | | |

| 5.2 | | 4.2 | | 23.8 | | Operating income | | 6.4 | | 10.5 | | -39.0 |

| | | | | | | | | | | | | |

Gas distribution in Italy contributed €27.3 million in EBITDA (+14.2%), evidencing that GAS NATURAL’s operations in that country are gaining in strength.

Performance in 2005, especially 2H05, was affected by expansion into the regions of Reggio Calabria and Catania (which led to greater investment and higher depreciation and amortisation charges) and by higher operating expenses.

4.3.2.- Main aggregates

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | | | 2005 | | 2004 | | % |

| 803 | | 653 | | 23.0 | | Gas activity sales (GWh): | | 2,730 | | 1,355 | | — |

| 785 | | 658 | | 19.3 | | Tariff gas sales | | 2,652 | | 1,315 | | — |

| 18 | | -5 | | — | | TPA | | 78 | | 40 | | 95.0 |

| | | | | | | | | | | | | |

| 67 | | 58 | | 15.5 | | Distribution network (km) | | 3,776 | | 3,501 | | 7.9 |

| | | | | | | | | | | | | |

| — | | — | | — | | Distribution connections (000) (at 31/12) | | 288 | | 252 | | 14.3 |

| | | | | | | | | | | | | |

Gas distribution in Italy totalled 2,730 GWh, a considerable increase on 2004 due to strengthening of operations in Italy following the acquisition of Smedigas and Nettis in the second half of 2004.

Commercial activity was reinforced in 2005: the number of supply points increased by 36,000 due to rapid expansion in Palermo (+18,000 supply points), Catania (+11,000) and Reggio Calabria (+7,000). The company expects to exceed that growth figure in 2006 and add 39,000 new supply points.

19

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

4.4.-Electricity in Spain

This area includes power generation in Spain (combined cycle plants, wind farms and cogeneration), trading via electricity purchases in the wholesale market, and the supply of electricity in the liberalised market in Spain.

4.4.1.- Results

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 251.1 | | 159.1 | | 57.8 | | Net sales | | 925.8 | | 474.9 | | 94.9 |

| -229.5 | | -134.5 | | 70.6 | | Purchases | | -788.2 | | -390.1 | | — |

| -2.0 | | -1.9 | | 5.3 | | Personnel costs. net | | -6.6 | | -6.7 | | -1.5 |

| -6.6 | | -9.8 | | -32.7 | | Other expenses/income | | -41.2 | | -33.8 | | 21.9 |

| | | | | | | | | | | | | |

| 13.0 | | 12.9 | | 0.8 | | EBITDA | | 89.8 | | 44.3 | | — |

| | | | | | | | | | | | | |

| -13.1 | | -4.4 | | — | | Charge for depreciation and amortisation | | -43.8 | | -16.8 | | — |

| 0.0 | | 0.8 | | — | | Variation in operating provisions | | -1.1 | | 1.1 | | — |

| | | | | | | | | | | | | |

| -0.1 | | 9.3 | | — | | Operating income | | 44.9 | | 28.6 | | 57.0 |

| | | | | | | | | | | | | |

Net electricity sales totalled €925.8 million.

The power generation business continues to be favoured by high pool prices, which remained high in 4Q05, averaging over €55.73/MWh in 2005. GAS NATURAL now has 15 power plants operating under the special regime (renewables/cogeneration) in the wholesale market.

Electricity supply was negatively impacted by having to compete with the regulated tariff.

The combination of these factors led to €89.8 million in EBITDA in 2005, double the figure reported in 2004.

4.4.2.- Main aggregates

The key figures of GAS NATURAL’s electricity activities in Spain are as follows:

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | | | 2005 | | 2004 | | % |

| 1,200 | | 53 | | — | | Installed capacity (MW): | | 3,102 | | 874 | | — |

| 1,200 | | — | | — | | CCGT | | 2,800 | | 800 | | — |

| — | | 51 | | — | | Wind | | 279 | | 51 | | — |

| — | | 2 | | — | | Cogeneration | | 23 | | 23 | | — |

| | | | | | | | | | | | | |

| 2,192 | | 1,642 | | 33.5 | | Electricity generated (GWh): | | 8,904 | | 5,802 | | 53.5 |

| 1,955 | | 1,592 | | 22.8 | | CCGT | | 8,234 | | 5,672 | | 45.2 |

| 197 | | 24 | | — | | Wind | | 528 | | 24 | | — |

| 40 | | 26 | | 53.8 | | Cogeneration | | 142 | | 106 | | 34.0 |

| | | | | | | | | | | | | |

| -2,256 | | 86 | | — | | Contracted electricity (GWh/year) | | 1,688 | | 4,942 | | -65.8 |

| | | | | | | | | | | | | |

| 1,497 | | 1,363 | | 9.8 | | Electricity sales (GWh): | | 6,296 | | 4,457 | | 41.3 |

| 646 | | 291 | | — | | Residential | | 2,028 | | 657 | | — |

| 851 | | 1,072 | | -20.6 | | Industrial | | 4,268 | | 3,800 | | 12.3 |

| | | | | | | | | | | | | |

20

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

A total of 8,904 GWh were generated and sold to the wholesale market in 2005, i.e. 53.5% more than in 2004.

The combined cycle plants generated 8,234 GWh. This output, measured at plant busbars, represents 118% of the electricity supplied to customers by GAS NATURAL. GAS NATURAL had a 4.0% share of the “ordinary regime” power generation market in 2005.

The plants attained 5,152 equivalent hours of operation at full load in 2005, representing a load factor of over 58%.

The business of electricity supply in the liberalised market continued to be penalised by high prices in the fourth quarter (the highest so far this year) since it had to compete with the regulated tariff (which is considerably lower), so losses are incurred when the tariff is lower than the market cost.

Therefore, a large number of supply companies are optimising their customer portfolio in the liberalised market since customers are returning to the regulated market. In 2005, GAS NATURAL’s portfolio of electricity contracts increased from 4,942 GWh/year to 1,688 GWh/year, and the process accelerated in 4Q05.

Retail electricity sales increased by 41.3% on 2004. The largest increase in electricity sales was to the residential market, where customer numbers stand at over 475,000.

From an economic standpoint, and until tariffs start reflecting real market costs, the only way to reduce the negative impact of the supply activity is to reduce the share of the liberalised market. GAS NATURAL had a share of approximately 7.4% of the liberalised market in electricity in 2005.

GAS NATURAL has 2,800 MW of operational combined cycle power production capacity, another 800 MW under construction (Plana del Vent) and more than 1,200 MW at an advanced stage of permit obtainment (including the Malaga and Barcelona projects), all in line with the objective of having 4,800 MW of CCGT capacity by 2008.

In April 2005, through subsidiary Gas Natural Corporación Eólica, GAS NATURAL acquired 100% of Desarrollo de Energías Renovables (DERSA). DERSA, which has 433 MW of gross installed wind power capacity (228 MW of net attributable capacity) and over 1,200 MW of wind power capacity under development, now forms part of GAS NATURAL’s wind power assets, which currently total 608 MW of gross installed capacity, with an average 46% stake. The construction of 112 MW (68 MW of net attributable capacity) is expected to be completed in the first quarter of 2006. The wind power projects are located in the following regions: Galicia, Cantabria, Castilla y León, Navarra, La Rioja, Aragón, Cataluña, Andalucía and Castilla-La Mancha. The acquisition of DERSA, and other companies in November 2004, reinforces GAS NATURAL’s position as one of the leading renewable energy companies, specifically wind power. The net wind power capacity of investees attributable to GAS NATURAL was 528 GWh in 2005.

GAS NATURAL’s wind power plants managed by the Power Control Centre generated nearly 300 GWh in 2005. That energy is currently sold to the Spanish electricity market and the final price of that sale is received as revenues.

The move into wind power complements GAS NATURAL’s decision in 1999 to commence power generation by developing combined cycle plants. GAS NATURAL’s strategy is to have a balanced, competitive, environmentally-friendly generation mix in line with the Kyoto Protocol’s objectives, and to reinforce its position as one of Spain’s leading electricity companies.

On 27 August 2004, Royal Decree Law 5/2004 was approved; it regulates the greenhouse gas emission trading rights in order to comply with the Kyoto Convention and Protocol obligations. That Royal Decree applies to facilities whose carbon dioxide emissions may potentially exceed the limits established for their activity and capacity; GAS NATURAL is affected as owner of public service

21

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

electricity production installations with over 20 MW of nominal thermal capacity (its combined cycle units).

On 21 January 2005, the Spanish Cabinet approved the final individual allocation of greenhouse gas emission rights for 2005-2007; GAS NATURAL was allocated 14,119 thousands of tonnes of CO2.

The rights allocated per year in 2005, 2006 and 2007 are as follows:

| | | | | | |

(Mt CO2) | | 2005 | | 2006 | | 2007 |

Emission rights | | 3,592 | | 4,6747 | | 5,8537 |

| | | | | | |

No emission rights were acquired or sold in 2005.

GAS NATURAL recognises the emission rights it has been allocated without consideration at their nominal value. If GAS NATURAL does not have sufficient rights to meet its emission quotas, the deficit is recognised at the fair value of the rights on the date of presenting the financial statements. Nevertheless, since emissions are lower than the rights received, no provision was recorded for this item.

4.5.-Electricity in Puerto Rico

GAS NATURAL has been operating in Puerto Rico since October 2003, when it acquired 47.5% of EcoEléctrica and the exclusive right to import gas to the island, plus an operation, maintenance and fuel management contract.

4.5.1.- Results

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 36.5 | | 28.5 | | 28.1 | | Net sales | | 133.2 | | 117.9 | | 13.0 |

| -16.9 | | -12.7 | | 33.1 | | Purchases | | -59.4 | | -50.3 | | 18.1 |

| -0.7 | | -0.5 | | 40.0 | | Personnel costs. net | | -2.7 | | -2.5 | | 8.0 |

| -1.2 | | -2.7 | | -55.6 | | Other expenses/income | | -8.9 | | -11.3 | | -21.2 |

| | | | | | | | | | | | | |

| 17.7 | | 12.6 | | 40.5 | | EBITDA | | 62.2 | | 53.8 | | 15.6 |

| | | | | | | | | | | | | |

| -4.2 | | -3.6 | | 16.7 | | Charge for depreciation and amortisation | | -16.3 | | -16.2 | | 0.6 |

| -1.1 | | -1.0 | | 10.0 | | Variation in operating provisions | | -2.4 | | -3.1 | | -22.6 |

| | | | | | | | | | | | | |

| 12.4 | | 8.0 | | 55.0 | | Operating income | | 43.5 | | 34.5 | | 26.1 |

| | | | | | | | | | | | | |

GAS NATURAL’s activities in Puerto Rico provided US$76.9 million in EBITDA, 16.3% more than in 2004.

| 7 | Pending transfer to GAS NATURAL. |

22

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

4.5.2.- Main aggregates

EcoEléctrica has a regasification plant (capacity: 115,000 m3) and a CCGT (540 MW). The CCGT, the first investor-owned gas-fired power plant in Puerto Rico, is located in Peñuelas, to the south of the island, and produces 15%-17% of the island’s total electricity needs.

EcoEléctrica generated 3,124 GWh net (1,562 GWh attributable to GAS NATURAL), with a load factor of over 70%, i.e. considerably better than the 66% registered in 2004. The moving average availability in 2005 was above the figure guaranteed in the long-term power purchase agreement.

4.6.-Gas

4.6.1.- Upstream + Midstream

This area includes the development of integrated LNG projects, maritime transportation, and the operation of the Maghreb-Europe gas pipeline.

4.6.1.1- Results

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 76.5 | | 55.9 | | 36.9 | | Net sales | | 262.0 | | 214.9 | | 21.9 |

| -17.3 | | -11.5 | | 50.4 | | Purchases | | -52.1 | | -42.5 | | 22.6 |

| -0.7 | | -0.8 | | -12.5 | | Personnel costs, net | | -2.5 | | -2.5 | | 0.0 |

| -7.9 | | -17.9 | | -55.9 | | Other expenses/income | | -31.8 | | -25.5 | | 24.7 |

| | | | | | | | | | | | | |

| 50.6 | | 25.7 | | 96.9 | | EBITDA | | 175.6 | | 144.4 | | 21.6 |

| | | | | | | | | | | | | |

| -12.7 | | -11.5 | | 10.4 | | Charge for depreciation and amortisation | | -48.2 | | -47.9 | | 0.6 |

| 0.2 | | 2.0 | | -90.0 | | Variation in operating provisions | | 0.3 | | 2.0 | | -85.0 |

| | | | | | | | | | | | | |

| 38.1 | | 16.2 | | — | | Operating income | | 127.7 | | 98.5 | | 29.6 |

| | | | | | | | | | | | | |

Net sales in the Upstream + Midstream business totalled €262.0 million, a 21.9% increase.

EBITDA amounted to €175.6 million in 2005, 21.6% more than in 2004 despite lower utilisation of the gas tanker ships in the year (78% vs. 90% in 2004), which was partly offset by the higher contribution from the Maghreb gas pipeline, which carried a larger volume of gas following its recent capacity increase.

Additionally, commencement of development of the integrated LNG projects led to start-up expenses that were not capitalised

4.6.1.2.- Main aggregates

The main aggregates in international gas transportation are as follows:

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | | | 2005 | | 2004 | | % |

| 36,838 | | 32,836 | | 12.2 | | Gas transportation-EMPL (GWh): | | 145,923 | | 115,637 | | 26.2 |

| 8,931 | | 7,101 | | 25.8 | | Portugal | | 35,287 | | 28,251 | | 24.9 |

| 27,907 | | 25,735 | | 8.4 | | GAS NATURAL | | 110,636 | | 87,386 | | 26.6 |

| | | | | | | | | | | | | |

23

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

The gas transportation activity conducted in Morocco through companies EMPL and Metragaz represented a total volume of 145,923 GWh in 2005, a 26.2% increase as a result of the expansion of capacity. Of that figure, 110,636 GWh were transported for GAS NATURAL through Sagane and 35,287 GWh for Portuguese company Transgas.

In April, GAS NATURAL and Repsol YPF reached an agreement in the area of exploration, production, liquefaction, transportation, trading and wholesale marketing of liquefied natural gas (LNG).

In exploration, production and liquefaction (Upstream), the agreement envisages joint ventures to develop new projects, in which Repsol YPF will be the operator and own 60% of the assets, and GAS NATURAL will have a 40% stake.

In transportation, trading and wholesale supply (Midstream), the Repsol-Gas Natural LNG joint venture was created for LNG transportation and wholesale supply, owned 50% each, whose chairman will be appointed alternately by the two partners and whose CEO will be proposed by GAS NATURAL.

The joint venture has developed an exploration project in Gassi Chergui (Algeria) and an integrated project to explore, produce and supply LNG in Gassi Touil (Algeria), which includes building an LNG plant in Arzwe with a capacity of 5.2 bcm per year that can be extended in the future with a second train.

In 2005, a technical team comprising drilling, geoscience and engineering professionals was created for the Gassi Touil project, the geology models were completed, the drilling and operation campaign was planned and the seismic studies commenced. Investment in the project totals €11.4 million.

GAS NATURAL filed an application with the Italian Industry Ministry for permission to develop projects to build two regasification plants in Italy (Trieste and Taranto). The two projects are similar, consisting of two tanks with a capacity of 150,000 m3 and a regasification capacity of 8 bcm per year each.

4.6.2.-Wholesale & Retail

This area includes wholesale and retail gas supply in Spain and other countries, and the supply of other related products and services in Spain.

The wholesale sales to other distributors correspond to those made to Enagás for the regulated gas distribution market.

4.6.2.1- Results

(unaudited)

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | (€ Mn) | | 2005 | | 2004 | | % |

| 2,056.8 | | 1,155.8 | | 78.0 | | Net sales | | 5,774.3 | | 3,952.3 | | 46.1 |

| -1,998.2 | | -1,104.6 | | 80.9 | | Purchases | | -5,608.9 | | -3,781.6 | | 48.3 |

| -5.9 | | -3.7 | | 59.5 | | Personnel costs, net | | -23.4 | | -19.2 | | 21.9 |

| -29.6 | | -9.8 | | — | | Other expenses/income | | -80.8 | | -44.5 | | 81.6 |

| | | | | | | | | | | | | |

| 23.1 | | 41.2 | | -43.9 | | EBITDA | | 61.2 | | 107.0 | | -42.8 |

| | | | | | | | | | | | | |

| -1.4 | | -2.3 | | -39.1 | | Charge for depreciation and amortisation | | -5.2 | | -2.5 | | — |

| -3.3 | | -5.7 | | -42.1 | | Variation in operating provisions | | -10.5 | | -10.0 | | 5.0 |

| | | | | | | | | | | | | |

| 18.4 | | 33.2 | | -44.6 | | Operating income | | 45.5 | | 94.5 | | -51.9 |

| | | | | | | | | | | | | |

Net sales in the gas supply business totalled €5,774.3 million, a 46.1% increase on 2004.

24

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

EBITDA amounted to €61.2 million in 2005, compared with €107.0 million in 2004.

As a result of the significant increase in gas demand in Spain due to a particularly cold winter, which made it necessary to buy additional gas on the spot market in a context of high international gas prices, average real prices were considerably higher than the raw material cost recognised in the tariff.

Since the supply price is indexed to the tariff with a discount, that situation led to an additional cost that was not passed on to the liberalised market and, therefore, hurt supply margins.

As a result of applying the new economic and contractual conditions to the industrial gas customers, supply margins are improving both quantitatively and qualitatively.

On 27 October 2005, the Industry Ministry issued Order ITC 3321/2005, amending the formula for calculating the raw material cost envisaged for 2005. The Order acknowledged the additional cost arising on gas supplies to the regulated market as a result of the following factors:

| | • | | Demand in 2005 is above the projection made in 2004 for calculating the costs of gas supplies to the regulated market. |

| | • | | The difference, for the amount of gas above projections, between the actual cost of gas on the international markets and the regulatory raw material cost. |

Order ITC 3321/2005 estimates an additional cost of €83.0 million, and this figure will be corrected subsequently using the final sales and cost figures for 2005.

Under Order ITC 4101/2005, dated 27 December, which also establishes the natural gas tariffs for 2006, the raw material cost calculation structure includes the supply cost expected in the winter months (in line with that recognised in Order ITC 3321/2005, dated 27 October), improving price formation in the liberalised market

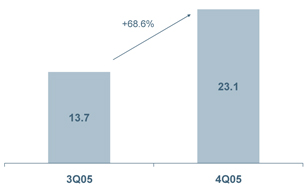

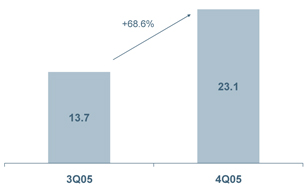

Ebitda performance (€ Mn)

The tariffs for large consumers (over 100 GWh/year), thermal plants and interruptible customers, were eliminated, so they have to buy gas in the liberalised market; there will be a transition period of 3-12 months until those tariffs are finally eliminated.

As a result of measures adopted to favour liberalisation and of the recognition of raw material costs, plus the commercial policy applied by GAS NATURAL, EBITDA performed very positively in the last two quarters of 2005, as shown in the graph.

25

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

4.6.2.2.- Main aggregates

The main aggregates in the procurement and supply activity are as follows:

| | | | | | | | | | | | |

| 4Q05 | | 4Q04 | | % | | | | 2005 | | 2004 | | % |

| 93,998 | | 79,995 | | 17.5 | | Gas supply (GWh): | | 317,555 | | 288,055 | | 10.2 |

| | | | | | |

| 77,961 | | 66,188 | | 17.8 | | Spain: | | 271,880 | | 243,510 | | 11.7 |

| 15,697 | | 17,407 | | -9.8 | | Regulated market | | 59,985 | | 61,364 | | -2.2 |

| 62,264 | | 48,781 | | 27.6 | | Liberalized market: | | 211,895 | | 182,146 | | 16.3 |

| 49,459 | | 38,545 | | 28.3 | | GAS NATURAL | | 165,197 | | 138,973 | | 18.9 |

| 12,805 | | 10,236 | | 25.1 | | Supply to third parties | | 46,698 | | 43,173 | | 8.2 |

| | | | | | |

| 16,037 | | 13,807 | | 16.2 | | International: | | 45,675 | | 44,545 | | 2.5 |

| 11,001 | | 10,381 | | 6.0 | | USA | | 32,202 | | 36,033 | | -10.6 |

| 5,036 | | 3,426 | | 47.0 | | Supply Europe | | 13,473 | | 8,512 | | 58.3 |

| | | | | | | | | | | | | |

| — | | — | | — | | Multiutility contracts (at 31/12) | | 2,249,137 | | 1,727,147 | | 30.2 |

| | | | | | | | | | | | | |

| — | | — | | — | | Contracts per customer (at 31/12) | | 1.47 | | 1.37 | | 7.3 |

| | | | | | | | | | | | | |

A total of 317,555 GWh of natural gas was supplied wholesale, i.e. 10.2% more than in 2004; 271,880 GWh were sold in the Spanish market (+11.7%) and the other 45,675 GWh were sold in other countries (+2.5%).

Wholesale gas supplies for the regulated market are sold to Enagás which, in addition to inventory management, supplies the gas to distribution companies, both those in the GAS NATURAL group and third parties; the total amount decreased by 2.2% to 59,985 GWh despite greater market opening, basically because certain power plants and industrial customers abandoned the liberalised market and took shelter in the regulated market.

Sales to the liberalised market amounted to 211,895 GWh, a 16.3% increase on 2004. Of those sales, 165,197 GWh were to end customers of GAS NATURAL, mainly in the industrial market, as well as to CCGTs and households.

GAS NATURAL sold 46,698 GWh of gas for supply to the liberalised market by other supply companies (an 8.2% increase), basically under medium- and long-term contracts.

Despite a sharp increase in gas supply in Europe (+58.3%), international wholesale gas supplies increased just 2.5% due to the absence of spot transactions in 2005 as the Spanish market’s demand in the winter prevented gas being allocated to other countries.

In GAS NATURAL’s multi-utility area, close to 128,000 gas maintenance contracts were added in 2005, making a total of over 1,282,000 contracts in force at 31 December 2005.

GAS NATURAL continues to develop products and services based on off-line and on-line marketing channels. At 31 December 2005, GAS NATURAL had 113 franchise centres, one company-owned centre and 763 associated centres—a powerful sales network that is unmatched in Spain.

At 31 December 2005, the Group had over 2,249,000 product and service contracts other than for gas sales, which includes financial services and the sale of electricity; this represents a 30.2% increase on 31 December 2004; consequently, there were 1.47 contracts per customer in Spain, in line with the company’s strategic objective of 2 contracts per customer by 2008.

26

| | |

GAS NATURAL Fourth quarter 2005 results | | |

| |  |

Because of marketing efforts, the number of homes with gas heating increased by 35,300, and 56,000 appliances were sold, including over 13,400 air conditioners.

On 23 January 2006, GAS NATURAL carried out an institutional campaign in the media aimed at all the company’s stakeholders in order to highlight its brand values and reaffirm its corporate commitments. The “Joining energies together” campaign highlights the role of GAS NATURAL’s customers, shareholders, employees and suppliers in building a solid, profitable future.

The campaign was geared towards the main television and radio channels in Spain.

27

| | |

GAS NATURAL Significant events and other disclosures | | |

| |  |

Summarised below are the significant events and other disclosures to the CNMV from 1 January 2005 to this date:

| • | | Salvador Gabarró, Chairman of GAS NATURAL, will propose the appointment of Rafael Villaseca as CEO at the next Board of Directors meeting (disclosed 13 January 2005). |

| • | | At the proposal of Repsol YPF, the Board of Directors of GAS NATURAL appoints Rafael Villaseca as CEO. At the same meeting, the Board approved the appointment of Guzmán Solana and Nemesio Fernández-Cuesta as proprietary directors nominated by Repsol YPF in place of Ramón Blanco and Miguel Ángel Remón, respectively, and the appointment of Carlos Kinder as proprietary director in place of Fernando Ramírez, at the proposal of “la Caixa”, and of Miquel Valls as independent director, based on a joint proposal by “la Caixa” and Repsol YPF. After the appointment of the new directors, the composition of the Board of Directors committees was changed (disclosed 28 January 2005). |

| • | | Notice of the proposed dividend out of 2004 earnings that the Board of Directors is to propose to the Ordinary Shareholders’ Meeting, implying a total of €0.71 per share, 18% more than in 2004 (disclosed 1 March 2005). |

| • | | GAS NATURAL commences electricity supply in the Canary Islands (disclosed 10 March 2005). |

| • | | Remittal of the 2004 Annual Corporate Governance Report (disclosed 4 April 2005). |

| • | | Notice of Ordinary Shareholders’ Meeting to be held on 20 April 2005, with the documentation placed at the shareholders’ disposal (disclosed 4 April 2005). |

| • | | Remittal of the presentation to be made at the press conference before the Ordinary Shareholders’ Meeting (disclosed 20 April 2005). |

| • | | Remittal of the presentation on the impact of adaptation to International Financial Reporting Standards (IFRS) (disclosed 20 April 2005). |

| • | | GAS NATURAL acquires Desarrollo de Energías Renovables (DERSA), which has a strong presence in the Spanish wind energy market and a considerable portfolio of wind farms under development (disclosed 20 April 2005). |

| • | | Announcement that all the items on the Agenda of the Ordinary Shareholders’ Meeting dated 20 April 2005 were passed, including most notably the amendment to the Shareholders’ Meeting Regulation and Bylaws to reduce to 100 the minimum number of shares required to attend the Shareholders’ Meeting, and the implementation of distance voting and proxy-granting. The Meeting also approved the appointment of Fernando Ramírez as proprietary director nominated by Repsol YPF in place of Gregorio Villalabeitia, and the appointment of Jaime Vega de Seoane as independent director, based on a joint proposal by Repsol YPF and “la Caixa” (disclosed 20 April 2005). |

| • | | Notification of the change in the Audit and Control Committee whereby Fernando Ramírez took the place of Gregorio Villalabeitia (disclosed 27 April 2005). |

| • | | GAS NATURAL and Repsol YPF sign an agreement for the liquefied natural gas business (disclosed 29 April 2005). |

| • | | GAS NATURAL announces a change in its organisation structure to adapt to the strategic growth challenges. The new Group structure is based on four divisions: Gas Supply, Gas Management, |

28

| | |

GAS NATURAL Significant events and other disclosures | | |

| |  |

| | Wholesale Demand and Retail Demand, apart from centralised corporate functions (disclosed 24 May 2005). |

| • | | GAS NATURAL arranges a loan from Instituto de Crédito Oficial for 1,000 million Mexican pesos (€75 million) to finance the investment plan in Mexico in the coming years (disclosed 7 June 2005). |

| • | | Remittal of the press advertisement announcing the payment of the supplementary dividend (disclosed 28 June 2005). |

| • | | The Board of Directors of GAS NATURAL approves the appointment of José Arcas Romeu as independent director (disclosed 30 June 2005). |

| • | | GAS NATURAL to invest €42.0 million in building a 50 MW wind farm in Guadalajara, Spain (disclosed 26 July 2005). |

| • | | GAS NATURAL and Repsol YPF constitute a joint venture for the liquefied natural gas business (disclosed 2 August 2005). |

| • | | GAS NATURAL launches a tender offer for 100% of Endesa (disclosed 5 September 2005). |

| • | | GAS NATURAL issues a press release about the tender offer for 100% of Endesa (disclosed 5 September 2005). |

| • | | GAS NATURAL agrees to sell assets to Iberdrola after the acquisition of Endesa (disclosed 5 September 2005). |

| • | | GAS NATURAL files a presentation on the tender offer for 100% of Endesa (disclosed 6 September 2005). |

| • | | GAS NATURAL files the presentation from the press conference about the tender offer (disclosed 6 September 2005). |

| • | | GAS NATURAL notifies the Competition Watchdog of the concentration operation resulting from the tender offer for Endesa shares (12 September 2005). |

| • | | GAS NATURAL files a presentation on the agreement with Iberdrola (disclosed 16 September 2005). |

| • | | GAS NATURAL asks that the markets be allowed to decide freely and transparently on the tender offer for Endesa (disclosed 19 September 2005). |

| • | | GAS NATURAL comments on the EU Tribunal decision on the concentration transaction in the Portuguese market, which sets a favourable precedent for the integration of Endesa and GAS NATURAL (disclosed 21 September 2005). |

| • | | GAS NATURAL identifies over 25 Spanish and foreign institutions interested in financing the tender offer (disclosed 26 September 2005). |

| • | | GAS NATURAL files with the National Energy Commission (CNE) the documentation it requested in order to analyse the tender offer for Endesa, in line with its function no. 14 (disclosed 28 September 2005). |

29

| | |

GAS NATURAL Significant events and other disclosures | | |

| |  |

| • | | The Board of Directors of GAS NATURAL approves plans to spin off its gas distribution and secondary transportation businesses en bloc into its subsidiaries Gas Natural Distribución SDG and Gas Natural Transporte SDG, respectively (disclosed 30 September 2005). |

| • | | The Chairman of GAS NATURAL announces that the new Group formed by Endesa and GAS NATURAL will grant Andalucía a more important role (disclosed 30 September 2005). |

| • | | The Chairman of GAS NATURAL announces that the new Group formed by Endesa and GAS NATURAL will have an international headquarters in Santiago, Chile (disclosed 4 October 2005). |

| • | | GAS NATURAL considers that the new targets presented by Endesa’s current management team are not realistic, rigorous or credible (disclosed 5 October 2005). |

| • | | GAS NATURAL reiterates that the tender offer for Endesa will not affect investments planned for Galicia (disclosed 7 October 2005). |