Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 333-07654

In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a preliminary prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by holders located in the United States and for Endesa ADSs held by holders wherever located. At the appropriate time, Gas Natural will file a Statement on Schedule TO with the SEC. Holders of Endesa ADSs and U.S. holders of Endesa ordinary shares are urged to read the registration statement, the preliminary U.S. prospectus and the related exchange offer materials, the final U.S. prospectus and Statement on Schedule TO (when available), and any other relevant documents filed with the SEC, as well as any amendments and supplements to those documents, because they will contain important information. Investors and security holders may obtain free copies of the registration statement, the preliminary U.S. prospectus and related exchange offer materials, and the final prospectus and Statement on Schedule TO (when available), as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov and will receive information at the appropriate time on how to obtain transaction-related documents for free from Gas Natural or its duly designated agent.

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that Gas Natural expects to send to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. The Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) may not be sold, nor may offers to buy be accepted, in the United States prior to the time that the registration statement becomes effective. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is a presentation by Gas Natural SDG, S.A. relating to its 2005 results and its offer by Gas Natural SDG for 100% of the share capital of Endesa.

2

1 In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a preliminary prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by holders located in the United States and for Endesa ADSs held by holders wherever located. At the appropriate time, Gas Natural will file a Statement on Schedule TO with the SEC. Holders of Endesa ADSs and U.S. holders of Endesa ordinary shares are urged to read the registration statement, the preliminary U.S. prospectus and the related exchange offer materials, the final U.S. prospectus and Statement on Schedule TO (when available), and any other relevant documents filed with the SEC, as well as any amendments and supplements to those documents, because they will contain important information. Investors and security holders may obtain free copies of the registration statement, th e preliminary U.S. prospectus and related exchange offer materials, and the final prospectus and Statement on Schedule TO (when available), as well as other relevant documents filed wi th the SEC, at the SEC’s website at www.sec.gov and will receive information at the appropriate time on how to obtain transaction-related documents for free from Gas Natural or its duly designated agent. This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that Gas Natural expects to send to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. The Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) may not be sold, nor may offers to buy be accepted, in the United States prior to th e time that the registration statement becomes effective. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things: • management strategies; • synergies and cost savings; • integration of the businesses; • market position; • expected gas and electricity mix and volume increases; • planned asset disposals and capital expenditures; • net debt levels and EBITDA and earnings per share growth; • dividend policy; and • timing and benefits of the offer and the combined company. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding- looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information. This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited. Disclaimer and Important Legal Information |

1. Gas Natural 2005 highlights 2. Analysis of 2005 results 3. 2006 outlook and conclusions 4. Regulatory update 5. Creating a leading, fully integrated, global energy group Agenda |

Gas Natural 2005 highlights |

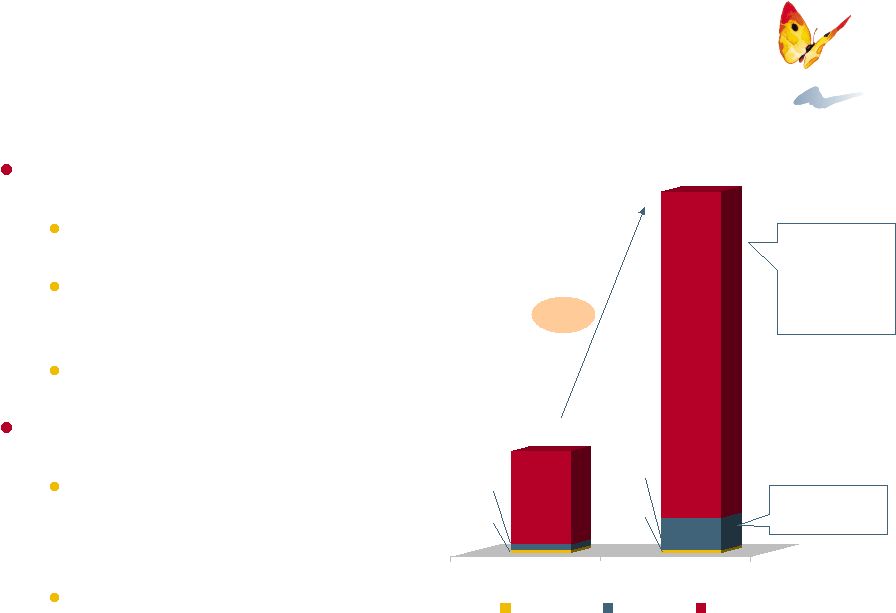

4 New generation capacity additions and the adaptation of the electricity supply portfolio account for a significant increase in the contribution of the electricity business Positive trends shown in 2005 expected to fully materialize in 2006, boosting growth and profitability Delivering the targets set in our 2004-2008 Strategic Plan Net profit grows by 16.7% to €749 million Refocusing of the Spanish gas supply business in the context of the advances made towards the full liberalisation of the gas sector Strong growth in the distribution business in Spain and internationally based on demand growth and efficiency gains Note: 2005 figures are preliminary, unaudited and have not yet been formulated by GAS NATURAL’s Board of Directors |

5 Market situation Improved prospects for the gas supply business in Spain International gas prices significantly higher than regulated tariff Some competitors reducing their presence in the market Regulated tariffs to incorporate estimated gas purchase prices Tariffs for large consumers removed, in line with EU requirements Adapting the gas industrial portfolio to new market conditions (renewals and new contracts) Improving margins Focusing on the profitability of the supply business Liberalisation developments GAS NATURAL’s actions |

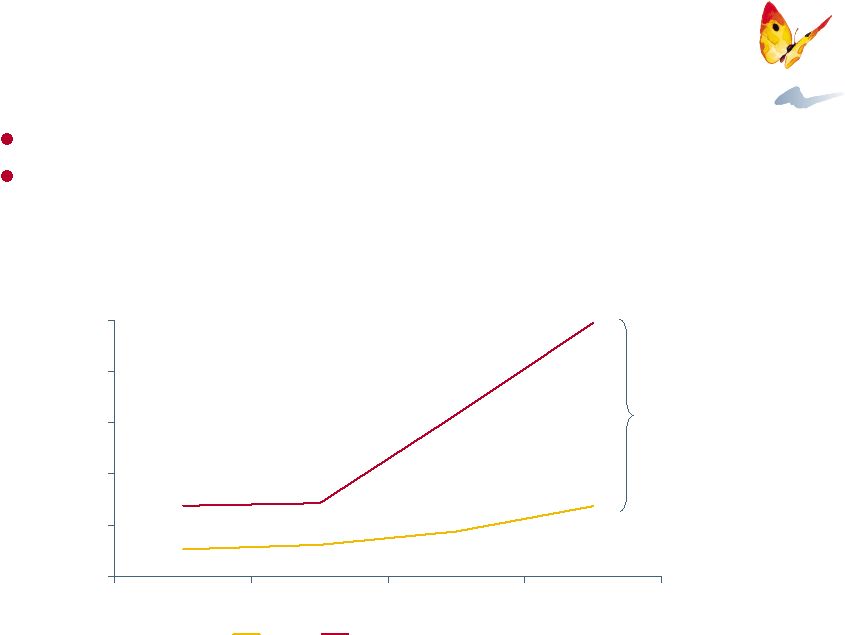

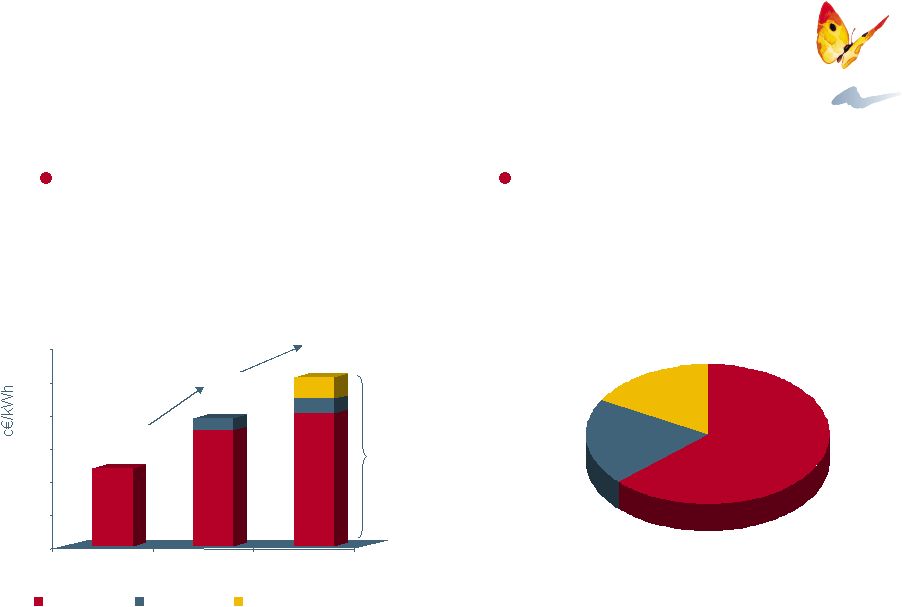

6 2% 1% 1% 1% 1.0 1.5 2.0 2.5 3.0 3.5 Q1 Q2 Q3 Q4 CMP Henry Hub Gas prices have increased substantially in 2005 Source: 2005 ITC Orders 104/3321/4104, Ministry of Industry Evolution of 2005 average prices (c€/kWh) The gap has sharply widened in the second half of 2005 Gas prices have stayed above regulated prices (CMP) throughout 2005 Some competitors are reducing their presence in the Spanish market |

7 1.0 1.2 1.4 1.6 1.8 2.0 2.2 Jul-05 Oct-05 Jan-06 2005 CMP 2005 Spot Estimated 2006 Spot and others Liberalised¹ 20% Recognition of estimated spot purchases in the cost of gas Moving towards the liberalisation of the Spanish gas sector Gas tariff (CMP) Market liberalisation 1.47 1.77 2.02 +21% +14% Regulated 17% Fully liberalised² 63% 2006 CMP Source: Gas Natural estimates. Data as of 31/12/05 Note: 1 Can elect to switch back to regulated tariff 2 Cannot elect to switch back to regulated tariff Source: 2005 ITC Orders 104/3321/4104, Ministry of Industry Removal of tariffs for customers consuming > 100 GWh/year, representing 63% of the market Liberalisation (in volumes) |

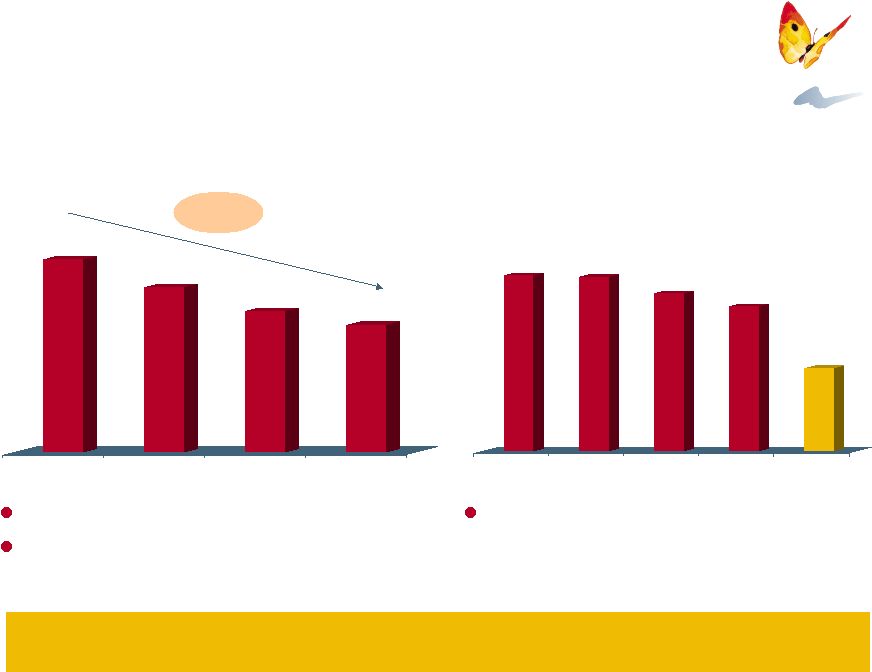

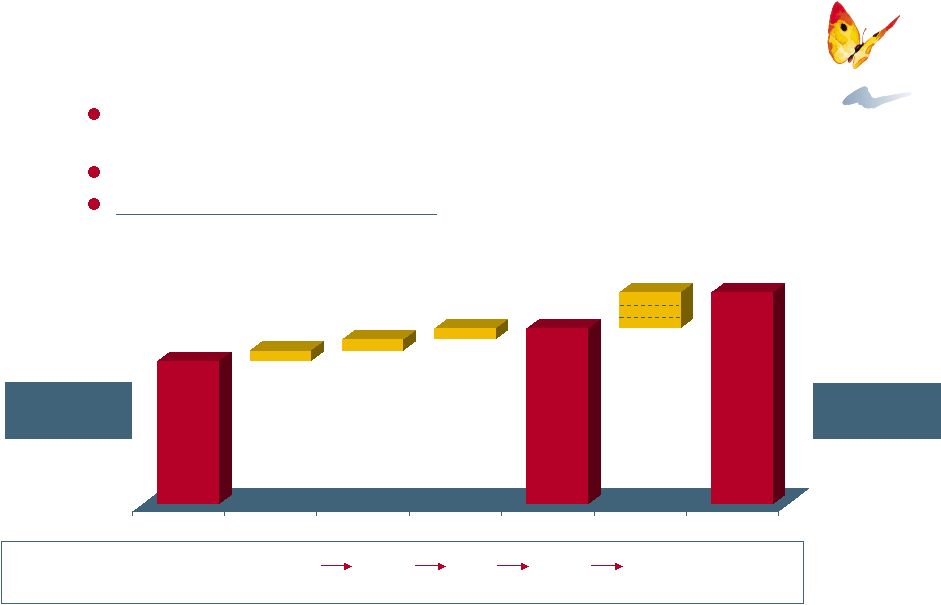

8 10.8 10.7 9.7 8.9 5.1 Q1 Q2 Q3 Q4 As of Dec 2005 Adapting the gas portfolio to new market conditions 107.7 103.7 100.3 98.3 Q1 Q2 Q3 Q4 2005 gas industrial portfolio (TWh/y) -14% yoy GAS NATURAL average tariff discounts (wholesale) (%) A significant part of our industrial contracts expired by December, which has helped to bring the average discount down by year-end Average contract length 12-18 months Contract renewals and new contracts taking into account current market conditions Combined non-recurring margin and volume effect on 2005 EBITDA of over €180 million |

9 Prices and tariffs Improved prospects for the electricity business in Spain Pool prices have doubled to 56 €/MWh (average) Implicit generation cost in 2005 tariff of 32 €/MWh Incumbents enjoy large market power Regulated suppliers to recover tariff deficit Suppliers to the liberalised market bear the difference Adapting the supply portfolio to new market conditions Long in generation Supply portfolio management and new generation capacity expected to boost electricity business contribution Retail market GAS NATURAL’s actions Government has announced a regulatory review |

10 4.7 4.4 3.9 1.7 Q1 Q2 Q3 Q4 Adapting the electricity supply portfolio to new market conditions 2005 electricity industrial portfolio (TWh/y) -65% yoy 2005 Spanish electricity prices Source: Bloomberg, BOE (€/MWh) 25 30 35 40 45 50 55 60 65 1Q 2Q 3Q 4Q Implicit tariff Pool price ~ 30 €/MWh |

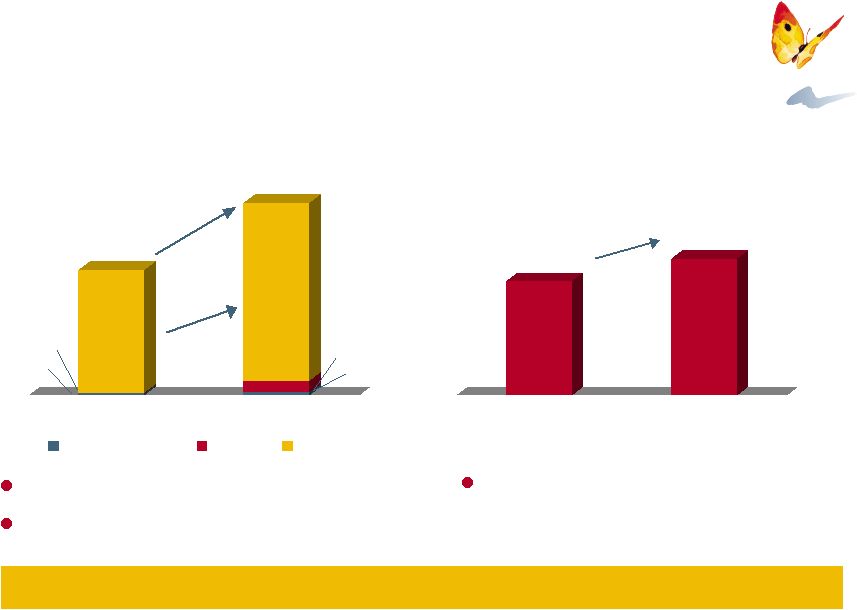

11 2004 2005 Cogen Wind CCGT 874 3,102 279 23 23 51 800 2,800 GAS NATURAL’s generation capacity in Spain has more than tripled in 2005 Capacity build-out in line with our 2004-2008 Strategic Plan 2,000 MW of new CCGT capacity, reaching 2,800 MW Cartagena plant under final commissio- ning in late December (no EBITDA contribution in 2005) Wind installed capacity boosted by the acquisition of DERSA (228 MW) Additional portfolio in advanced stage of planning and development CCGT portfolio in various stages of permitting and development remain in line with 2004-2008 Strategic Plan to allow us to reach 4,800 MW by 2008 1,200 MW of gross wind capacity under development Installed Capacity (MW) 3.5x New CCGTs: Arrúbal (800 MW) Cartagena (1,200 MW) DERSA (228 MW) |

12 2004 2005 Force Majeure Qatar Commercial losses2 EBITDA excl. non recurring³ 4.5x 2.0x 2005 electricity results have been affected by non-recurring items Q4 05 generation output reduced due to force majeure in Qatar Portfolio adaptation intended to eliminate commercial shortfall in 2006 44 90 ~ 40 ~ 70 ~ 200 Spain electricity EBITDA (€m) Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors 2 Commercial losses attributable to portfolio restructured during 2005. Non-recurring going forward 3 Does not include Cartagena CCGT contribution nor first quarter contribution from DERSA (acquired in April 2005) EBITDA doubled despite non-recurring items of ~ €110 million EBITDA EBITDA EBITDA¹ |

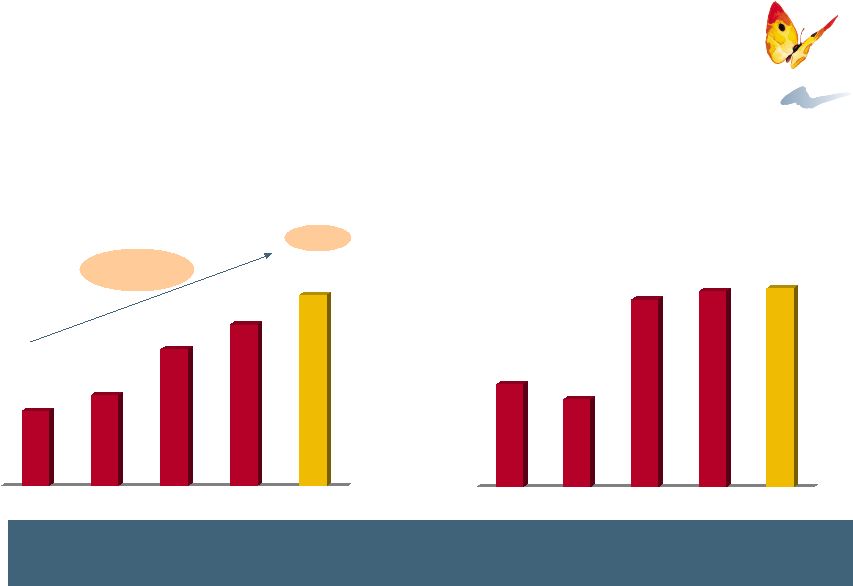

13 (+7.3%) (+5.6%) 809 877 928 996 1,052 4 Spanish gas distribution business continues to grow at a steady pace Stable regulatory regime, allowing for target gas network growth and liberalisation of the sector 5.1 million connections and 39,611 Km of network, penetration¹ of 47% EBITDA of €778 million (+7.7%)² Penetration¹ 54% Penetration¹ 42% Network growth (thousand connection points) Regulated Remuneration to Distribution (€m) 2008 2003 (+8.4%) (+5.8%) Note: 1 Based on potential households in municipalities with natural gas 2 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors 3 Target as per GAS NATURAL 2004-2008 Strategic Plan 4 For 2006 Dec 02 2005 06-08E 2004 4,174 +308 (+7.4%) +326 (+7.3%) +325 (+6.8%) 5,134 ~6,200 +350 p.a. 2003 Dec 05 Dec 08 3 3 |

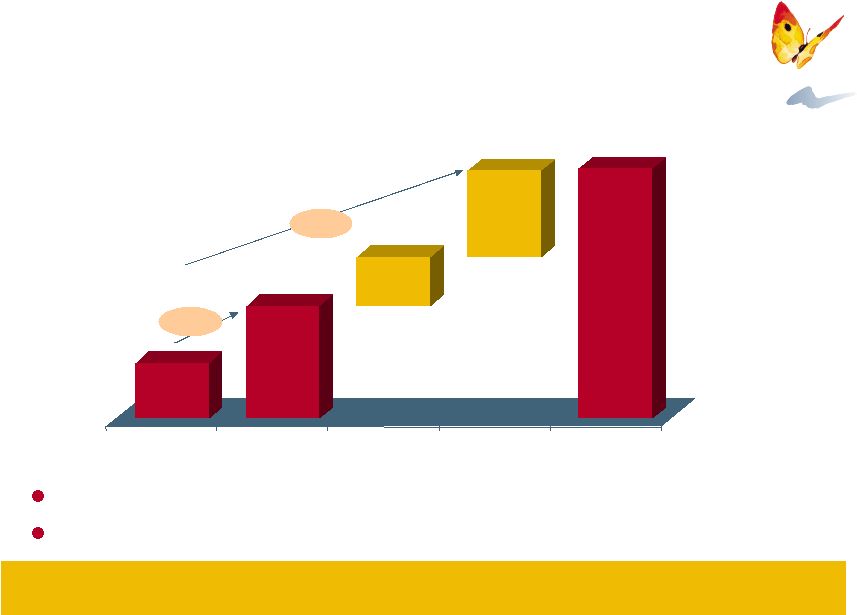

14 1,436 1,586 1,725 1,834 602 1,979 906 2001 2002 2003 2004 2005 LatAm Italy +8.3% CAGR 65 73 83 97 Q1 Q2 Q3 Q4 +39% yoy International gas distribution contributes to growth LatAm: accelerating growth throughout the year Italy: consolidating our presence 6.5% demand growth in 2005 4.8 million connections (+5.6%) and 56,763km of network EBITDA increased by €89 million (+39%)¹ 288,000 connections (+14.3%) and 3,776km of network Consolidation of Smedigas Group and Nettis Group EBITDA of €27 million (+14.2%)¹ 2005 LatAm EBITDA (€m)¹ 2001 – 2005 customers per employee +50.5% Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors |

15 Note: 1 2004 and 2005 figures under IFRS. Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors FY05 Net Sales EBITDA Operating Income Net Income Average no. of Shares (million) EBITDA per Share (€) Net Income per Share (€) Investments: Tangible & Intangible Financial & Other Net Debt (as of 31/12) 8,526.6 1,518.8 968.6 749.2 447.8 3.39 1.67 1,483.7 1,188.0 295.7 3,615.2 FY04 6,266.2 1,335.3 861.6 642.0 447.8 2.98 1.43 1,503.5 1,008.8 494.7 2,649.6 36.1 13.7 12.4 16.7 - 13.7 16.7 -1.3 17.8 -40.2 36.4 Change (%) FY05 results snapshot¹ Strong financial performance, in line with 2004-2008 Strategic Plan, despite difficult operating and market conditions (€ million) |

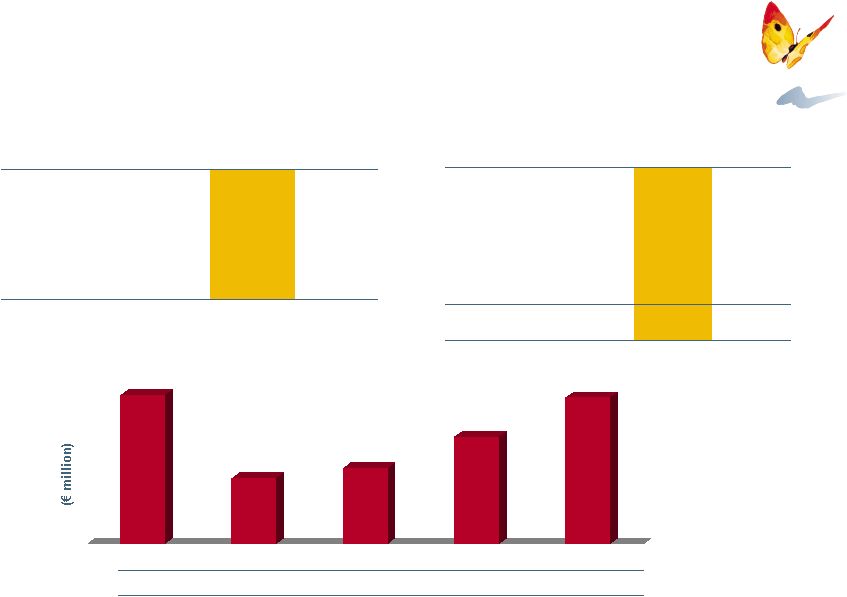

16 3,677 1,627 1,869 2,650 3,615 2001 2002 2003 2004 2005 Leverage 49.0% 28.0% 29.3% 35.6% 38.5% 2005 2004 Leverage ² 38.5% 35.6% EBITDA/Net Interest 6.9x 8.7x Net Debt/EBITDA 2.4x 2.0x Financial ratios Net Debt and leverage Debt facilities as of December 31, 2005³ Lines of Credit Loans Capital Markets Cash Placements Total 539 2,696 581 - 3,816 648 - 2,450 201 3,299 Drawn Undrawn Note: 1 2004 and 2005 figures under IFRS. 2004 and 2005 figures under IFRS. Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors 2 Defined as Net Debt / (Net Debt + Total Equity) 3 Does not include any financing in relation to the offer for Endesa FY05 results snapshot¹ Solid capital structure (€ million) |

17 Sustained increase in shareholder remuneration via higher dividend FY05 results snapshot¹ Dividend per share² 0.33 0.40 0.60 0.71 0.84 2001 2002 2003 2004 2005 (€ / share) Payout Ratio ² +26.3% CAGR 26.0 22.2 47.3 49.5 50.2 2001 2002 2003 2004 2005 Above the commitment made in our Strategy Plan 2004 - 2008 +18.3% Note: 1 2004 and 2005 figures under IFRS. Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors 2 Financial year of results against which dividends are declared 3 Estimated, pending the formulation of the Annual Accounts by the Board of Directors and its approval by the AGM (%) 3 3 |

19 (€ million) FY04 Gas Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Supply Up + Midstream Wholesale & Retail Other Total EBITDA 973.9 722.2 227.8 23.9 98.1 44.3 53.8 251.4 144.4 107.0 11.9 1,335.3 FY05 1,121.8 777.8 316.7 27.3 152.0 89.8 62.2 236.8 175.6 61.2 8.2 1,518.8 15.2 7.7 39.0 14.2 54.9 102.7 15.6 -5.8 21.6 -42.8 -31.1 13.7 % Double-digit EBITDA growth in line with 2004 – 2008 Strategic Plan EBITDA breakdown¹ 147.9 55.6 88.9 3.4 53.9 45.5 8.4 -14.6 31.2 -45.8 -3.7 183.5 (€m) Change Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors |

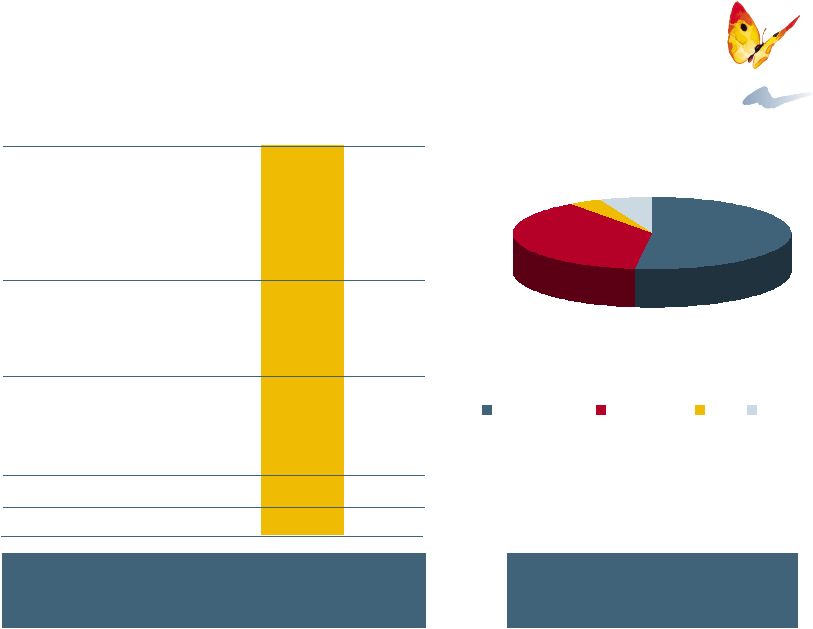

20 52% 38% 4% 6% Distribution Electricity Gas Other By Activity Investments set basis for future profit growth Investments (Tangible & Intangible) (€ million) FY05 FY04 Gas Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Supply Up + Midstream Wholesale & Retail Other Total 618.8 354.2 196.8 67.8 450.9 447.1 3.8 43.4 27.1 16.3 74.9 1,188.0 523.6 369.3 127.4 26.9 381.6 375.6 6.0 41.5 32.6 8.9 62.1 1,008.8 82% of Investments in Euro Investments breakdown¹ Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors |

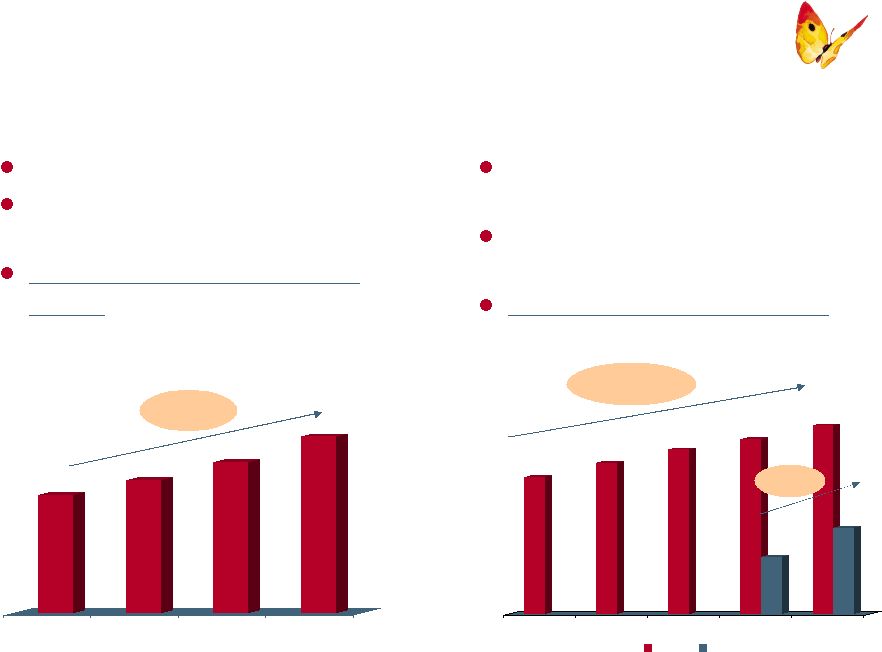

21 Gas distribution in Spain Operating figures TPA increase by +14.7% as a result of increased liberalisation Regulated sales fell less than expected due to the higher than usual sales to conventional thermal generation 51,449 177,505 51,121 203,653 FY04 FY05 Tariff Sales (GWh) TPA Sales (GWh) -0.6% +14.7% FY05 results analysis by activity¹ Historical EBITDA (€m) +5.5% 37,534 39,611 228,954 254,774 Network (km) +8.6% CAGR EBITDA has been consistently growing by over €50 million per annum Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors 660 177,505 722 203,653 778 FY03 FY04 FY05 |

22 Argentina Brazil Colombia Mexico €79.7m (+20.0%) 4,505 4,757 FY04 FY05 Connections (thousands) High growth in sales in Brazil (+16.2%) and Colombia (+14.9%) in all segments Argentina confirms recovery path: Q4 sales grew by +10.7% Mexico shows resilient sales growth (+5.6%) despite US-linked gas prices Network (km) +5.6% FY05 results analysis by activity¹ Operating figures Gas distribution in LatAm +6.5% 155,346 165,408 +4.9% 54,120 56,763 2005 EBITDA contribution and growth by country (Total €316.7 million) Gas sales (GWh) €35.4m (-2.5%) €86.6m (+42.1%) €115.0m (+79.1%) Very significant and balanced EBITDA growth of €89 million (+39%) Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors |

23 FY05 results analysis by activity¹ Electricity Electricity production in Spain (GWh) Electricity production³ in Puerto Rico (GWh) 118% coverage of supply in Spain² 4% market share in electricity generation 5,672 8,234 FY04 FY05 Cogeneration Wind CCGT 5,802 8,904 +45.2% 528 142 24 106 Puerto Rico production increased as a result of higher load factor in 2005 (over 70%) Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors 2 Defined as total electricity generated by CCGT plants divided by total electricity commercialised 3 Attributable to GAS NATURAL 1,470 1,562 FY04 FY05 +6.3% +53.5% EBITDA of €152 million (+54.9%) |

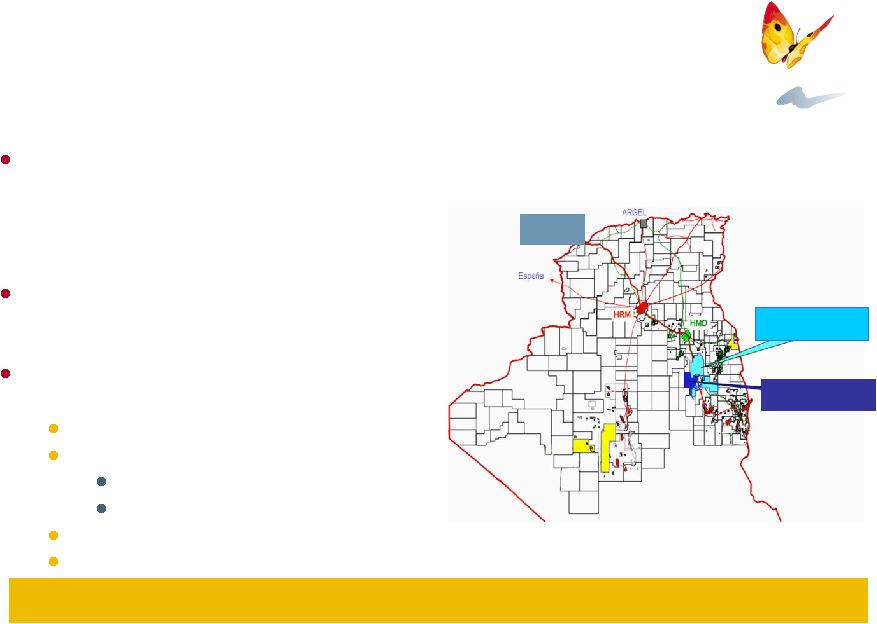

24 FY05 results analysis by activity¹ Up + Midstream Considering potential participation in other Up + Midstream projects Significant increase in EMPL contribution due to higher volume transported: 145,923 GWh (+26.2%) Midstream JV established during 2005 Gassi Touil project in full development phase Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors 2 Data for total project EMPL MIDSTREAM JV GASSI TOUIL² Gassi Touil Project Overview Approx. reserves of 170 bcm for train 1 Production ~ 5.6 bcm LNG per year ~ 38,000 barrels/day Second train optional First LNG cargo expected in 4Q 2009 Arzew Gassi Touil – R.Nouss Gassi Chergui |

25 1.7 million eligible residential gas customers Commercial network: 877 points of sale (own, franchised and associated) GAS NATURAL continues to enjoy the benefits of a strong and well-established brand all over Spain 1.3 million maintenance contracts 1.47 contracts per customer as of December 31, 2005, in line with 2004-2008 Strategic Plan (plan calls for >2 contracts per customer by 2008) 0.5 million residential electricity customers 83% residential gas customers retained FY05 results analysis by activity¹ Multiproduct Offer in Spain Note: 1 Preliminary unaudited 2005 figures not yet formulated by GAS NATURAL’s Board of Directors |

2006 outlook and conclusions |

27 Distribution business expected to continue to deliver solid growth on the back of remuneration increases and positive developments in LatAm 2006 outlook Positive trends shown in 2005 expected to improve GAS NATURAL’s profitability in 2006 Significant growth expected in the main business areas Improved gas procurement mix and new conditions in the gas supply market in Spain expected to have a significant effect in 2006 Profitability of the generation business expected to be boosted by addition of Cartagena CCGT and new very competitive gas intake |

28 Gas procurement and supply optimization Combined 2005 non-recurring negative effect of over €180 million, plus additional potential growth Gas shortages expected to continue to affect international gas markets New attractive gas contract from Qatar 2006 regulated tariff incorporates effects of expected gas prices Gas industrial portfolio to continue to adjust to new market conditions Prices set at early 2000 1 bcm/year, free destination, low correlation to commodity prices |

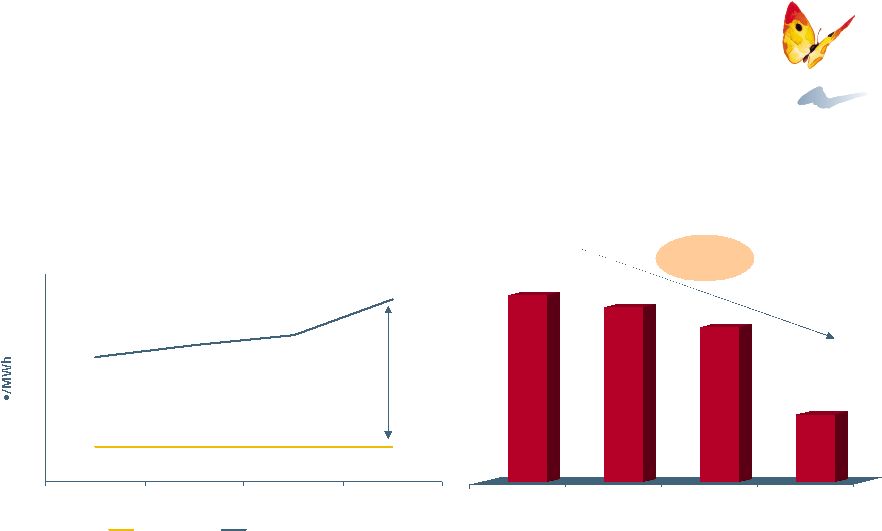

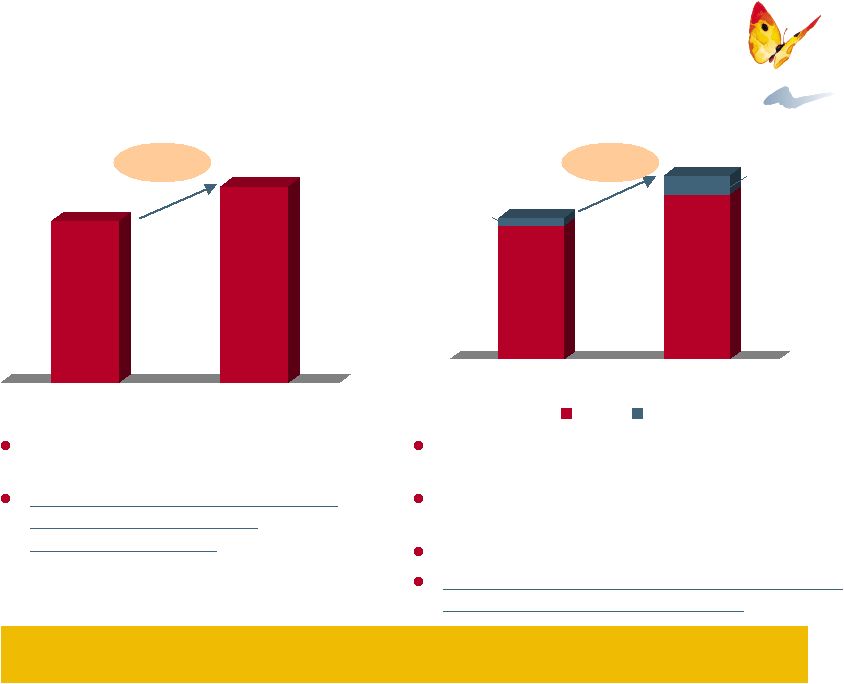

29 27 606 57 1,155 Jan-05 Jan-06 Wind CCGT Cartagena is the largest CCGT gas plant in Spain (estimated peninsular market share of 3.5%), with an efficiency rate of 57% Very competitive gas from Trinidad 1.6 bcm/year, indexed to pool prices Full year contribution of DERSA (acquired in April 05), and additional capacity of >40MW in 2006 Coverage of supply estimated at 465% in 2006 ¹ 2005 non-recurring effects and restructuring of supply portfolio resulted in over €110 million of commercial losses Electricity in Spain Significant increase in profitability Production in January (GWh) 74.8 €/MWh Pool Price² 43.2 €/MWh 633 1,212 1.7x Note: 1 Defined as total electricity generated by CCGT plants divided by total electricity commercialised 2 Average monthly price. Source: Bloomberg Competitive gas cost, increase in production and restructured supply portfolio expected to have a material impact on EBITDA 1.9x |

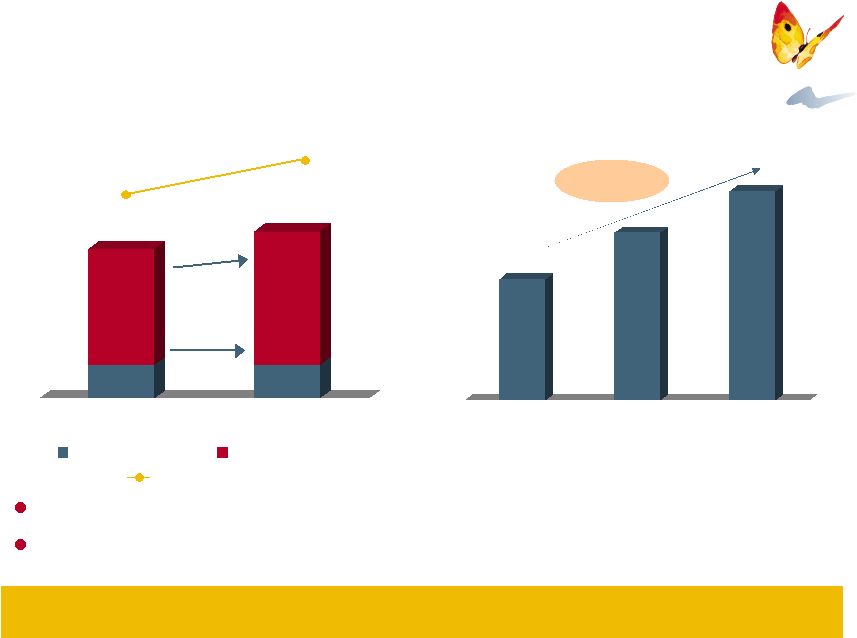

30 2005 2008E LatAm Italy 5.1 6.2 2005 2008E Distribution Gas connections in Spain (mill.) +22% International gas connections (mill.) Volume growth expected to continue 2005 trend Distribution tariffs in Argentina to grow over 20% ending effect of pesification Focus on portfolio profitability in Mexico Business activity and related EBITDA in 2006 expected to grow in line with 2005 Solid growth profile 6.6 5.0 2006 Spanish gas remuneration increased 5.6% to €1,052 million Future EBITDA growth expected at levels similar to historical remuneration growth +32% 4.8 5.9 0.7 0.3 1 1 Note: 1 GAS NATURAL 2004-2008 Strategic Plan Distribution EBITDA has grown above €130 million per annum since 2003 |

31 Conclusions Strong financial performance in 2005 despite difficult operating conditions and market environment We continue to deliver above the targets set in our 2004-2008 Strategic Plan Double-digit growth in EBITDA, Net Income, and dividend based on cash generation Positive trends shown in 2005 expected to materialize in 2006, boosting growth and profitability |

33 New legislation has been passed to address some of the challenges of the Spanish electricity sector Incumbents enjoy significant market power Pool prices do not reflect the cost of generation As a result, a large tariff deficit is being generated Lack of transparency and limited progress in sector liberalization Discrimination against new entrants in the liberalised market (non- recognition of tariff deficit) Lack of effective supervisory powers for the CNE Measures adopted New market rules aimed at eliminating tariff deficit Increase transparency and fully liberalize market Provide more supervisory powers to the CNE 1 2 3 According to the White Book and the Ministry of Industry: |

34 Legislation to correct the tariff deficit problem Royal Decree Law 3/2006 Incumbents (vertically integrated generators) Special Regime GN / others POOL Regulated market (2/3) Liberalised market (1/3) €56 / MWh €38 / MWh¹ Tariff deficit generated (€3.6bn) POOL €42.35 / MWh Sales to the regulated market now receive a price of €42.35² Incumbents (vertically integrated generators) Special Regime GN / others Regulated market (2/3) Liberalised market (1/3) Linked to Tariff 2005 2006 following new regulation³ Notes: 1 Average implicit price of purchases by distributors 2 Technically electricity continues to be sold through the pool, although the matching mechanism is similar to a physical bilateral contract 3 Pending OMEL rules and mechanisms to be defined from 3/3/06 Market prices of CO2 rights received for free will be discounted from: tariff deficit, from 1/1/06 to 3/3/06 (for incumbents only) pool prices, from 3/3/06 onwards for everybody Linked to Tariff |

35 Increase transparency and market liberalisation Regulated tariffs to disappear by 2011 Legal and functional separation of distribution and commercialization Creation of the “Supplier of Last Resort”, appointed by the Government, to commercialize electricity to certain domestic and SME customers, as a guarantee of supply in a fully liberalised market Creation of a “Supplier Switching Office” to increase data transparency and facilitate effective competition Creation of an Energy System Technical Management Oversight Committee to ensure security of supply Draft law to reform the electricity market, adapting EU directives into Spanish law Key measures adopted End of transitory period by 2011 |

36 Moving forward to complete gas sector liberalisation Regulated tariffs to disappear by 2008 Legal and functional separation of distribution and commercialization Creation of the “Supplier of Last Resort”, appointed by the Government, to commercialize gas to certain domestic and SME customers, as a guarantee of supply in a fully liberalised market Creation of a “Supplier Switching Office” to increase data transparency and facilitate effective competition Creation of an Energy System Technical Management Oversight Committee to ensure security of supply Draft law to reform the gas market, adapting EU directives into Spanish law Key measures adopted Full liberalisation by 2008 Gas sector liberalisation is working – no need to apply structural changes |

37 Provide more supervisory powers to the CNE CNE must authorise transactions involving regulated assets or assets subject to administrative oversight (distribution and transportation, nuclear generation, domestic coal generation, extrapeninsular, etc) Authorisation can be denied to protect these activities from significant risk, to protect the general public interest, and to guarantee adequate gas and power security of supply In the case of a tender offer, the CNE must grant authorisation before the offer can be cleared by the CNMV New CNE role to apply to all ongoing transactions unless they have already been cleared by the CNE Royal Decree Law 4/2006 New CNE role in acquisitions |

Creating a leading, fully integrated, global energy group |

39 Combined management of clients and networks More flexible and competitive gas procurement More balanced and competitive generation portfolio Attractive business mix and investment profile Global integrated energy leader in high-growth markets Sizeable synergies The Board of Directors has decided to move forward with the offer for Endesa A unique strategic, industrial and financial rationale |