QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by Registranto |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

TELEWEST GLOBAL, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Telewest Global, Inc.

1105 North Market Street, Suite 1300

Wilmington

Delaware 19801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 9, 2005

To The Holders of Common Stock:

The annual meeting of stockholders of Telewest Global, Inc. will be held at 10:00 a.m., local time, on May, 9, 2005, at the offices of Fried, Frank, Harris, Shriver & Jacobson LLP, One New York Plaza, New York, New York 10004-1980 for the following purposes:

- 1.

- To elect two Class I Directors to hold office until the annual meeting of stockholders that is to be held in 2008 and until their respective successors are duly elected and qualify;

- 2.

- To ratify the appointment by the Audit Committee of KPMG Audit Plc as independent auditors for the year ending December 31, 2005;

- 3.

- To approve the Telewest Global, Inc. Long-Term Incentive Plan; and

- 4.

- To transact any other business that may properly be brought before the meeting or any adjournments or postponements of that meeting.

Holders of our common stock as of the close of business on April 1, 2005 will be entitled to notice of, and to vote at, the annual meeting and at any adjournments or postponements thereof. A list of the stockholders entitled to vote at the meeting will be available at our principal executive offices at 160 Great Portland Street, London W1W 5QA, UK at least ten days prior to the meeting and will also be available for inspection at the meeting.

Whether or not you plan to attend the meeting in person, you are urged to complete the enclosed proxy and return it in the postage-paid envelope provided. You may revoke your proxy at any time before it is exercised by delivering a subsequent proxy or by notifying the inspectors of election in writing of such revocation. You may also revoke your proxy by attending the annual meeting and voting in person. The Company will pay the cost of solicitation of proxies.

Our annual report for 2004 is being mailed together with this proxy material.

By order of the Board of Directors,

Anthony (Cob) W. P. Stenham

Chairman

April 11, 2005

TABLE OF CONTENTS

| PROXY STATEMENT | | 1 |

| PROPOSAL 1 ELECTION OF DIRECTORS | | 1 |

| | Class I Director Nominees | | 2 |

| | Continuing Class II Directors | | 2 |

| | Continuing Class III Directors | | 3 |

| | Stockholder Approval | | 4 |

| | Recommendation of the Board of Directors | | 4 |

| PROPOSAL 2 RATIFICATION OF THE APPOINTMENT BY THE AUDIT COMMITTEE OF KPMG AUDIT PLC AS OUR INDEPENDENT AUDITORS | | 4 |

| | Stockholder Approval | | 5 |

| | Recommendation of the Board of Directors | | 5 |

| PROPOSAL 3 APPROVAL OF TELEWEST GLOBAL, INC. LONG-TERM INCENTIVE PLAN | | 5 |

| | Summary of the LTIP | | 5 |

| | Stockholder Approval | | 7 |

| | Securities Authorized for Issuance Under Equity Compensation Plans | | 7 |

| | Recommendation of the Board of Directors | | 7 |

| CORPORATE GOVERNANCE | | 8 |

| | Meetings of the Board of Directors | | 8 |

| | Compensation of Directors | | 8 |

| | Standing Committees of the Board of Directors | | 8 |

| | Audit Committee | | 8 |

| | Compensation Committee | | 9 |

| | Compensation Committee Interlocks and Insider Participation | | 9 |

| | Executive and Nominating Committee | | 9 |

| | Strategic Development and Finance Committee | | 10 |

| | Stockholder Communications with the Board of Directors | | 10 |

| EXECUTIVE OFFICERS AND EXECUTIVE COMPENSATION | | 11 |

| | Executive Officers | | 11 |

| | Summary Compensation | | 12 |

| | Option/SAR Grants in the Last Fiscal Year | | 14 |

| | Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | | 14 |

| | Compensation and Employee Benefit Plans | | 15 |

| | Employment Agreements and Severance Arrangements | | 17 |

| COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION | | 20 |

| | Executive Compensation Philosophy | | 20 |

| | Principal Elements of Executive Compensation | | 20 |

| | Compensation of the Acting Chief Executive Officer | | 21 |

| | Section 162(m) of the Internal Revenue Code | | 22 |

| AUDIT COMMITTEE REPORT | | 23 |

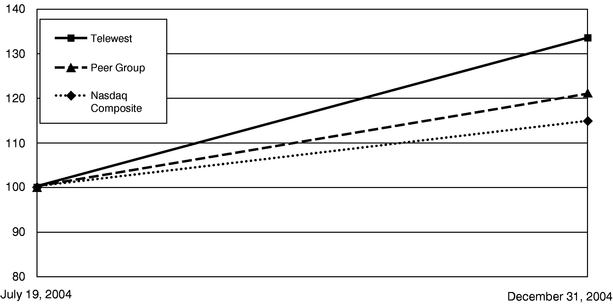

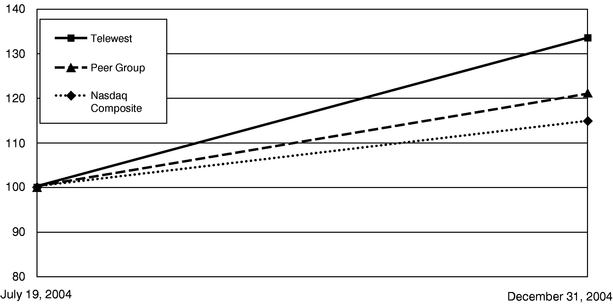

| STOCK PERFORMANCE GRAPH | | 24 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 25 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 27 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 28 |

| STOCKHOLDER PROPOSALS | | 30 |

| FORM 10-K | | 31 |

| OTHER BUSINESS | | 31 |

| APPENDIX A AUDIT COMMITTEE CHARTER | | A-1 |

| APPENDIX B EXECUTIVE AND NOMINATING COMMITTEE CHARTER | | B-1 |

| APPENDIX C TELEWEST GLOBAL, INC. LONG-TERM INCENTIVE PLAN | | C-1 |

In this Proxy Statement, the terms "we", "us," "our," "the Company" and "Telewest" refer to Telewest Global, Inc. and its subsidiaries as a combined entity, except where the context requires otherwise. The terms "Telewest Communications" and "our predecessor" refer to Telewest Communications plc and its subsidiaries as a combined entity, except where the context requires otherwise.

Telewest Global, Inc.

1105 North Market Street, Suite 1300

Wilmington

Delaware 19801

PROXY STATEMENT

This Proxy Statement, which was first mailed to shareholders on or about April 11, 2005, is being furnished in connection with the solicitation of proxies by our board of directors for use at our annual meeting of stockholders to be held at 10:00 a.m., local time, on May, 9, 2005, at the offices of Fried, Frank, Harris, Shriver & Jacobson LLP, One New York Plaza, New York, New York 10004-1980 and at any adjournments or postponements of that meeting. The purposes of the annual meeting are set forth in the accompanying notice of annual meeting of stockholders.

In order to conduct business at the annual meeting, the holders of a majority of our outstanding shares of common stock entitled to vote at the meeting must be present in person or represented by proxy.The board of directors urges you to complete, date and sign the proxy and return it immediately in the postage-paid envelope provided to ensure a quorum and to avoid expense and delay.

The board of directors recommends a vote "FOR" each of the following proposals: (i) the re-election of Barry R. Elson and Michael J. McGuiness as Class I Directors, (ii) the ratification of the appointment by our Audit Committee of KPMG Audit Plc as our independent auditors to audit our financial statements for the year ending December 31, 2005, and (iii) the approval of the Telewest Global, Inc. Long-Term Incentive Plan.

Holders of our common stock as at the close of business on April 1, 2005 will be entitled to vote at the annual meeting and at any adjournments or postponements thereof. At the close of business on April 1, 2005, 245,080,629 shares of our common stock were outstanding and entitled to vote at the annual meeting. Each share of our common stock is entitled to one vote.

You retain the right to revoke your proxy at any time before it is exercised by executing and delivering another proxy dated as of a later date or by notifying the inspectors of election in writing. You may also revoke your proxy by voting in person at the meeting. The cost of soliciting proxies will be borne by us. Some of our officers, directors and regular employees, none of whom will receive additional compensation therefor, may solicit proxies in person or by telephone, internet or other means. As is customary, we will, upon request, reimburse brokerage firms, banks, trustees, nominees and other persons for their out-of-pocket expenses in forwarding proxy materials to their principals.

PROPOSAL 1

ELECTION OF DIRECTORS

Our amended and restated certificate of incorporation provides that our directors are divided into three classes, each of which serves a staggered three-year term. At each annual meeting of stockholders, successors to the class of directors whose term expires at that annual meeting will be elected for a three-year term. Our Class I Directors are Barry R. Elson, Donald S. La Vigne and Michael J. McGuiness and their terms will terminate on the date of this year's annual meeting of stockholders. Our Class II Directors are Marnie S. Gordon, Michael Grabiner and Steven R. Skinner and their terms will terminate on the date of our 2006 annual meeting of stockholders. Our Class III Directors are William J. Connors, John H. Duerden and Anthony (Cob) W. P. Stenham and their terms will terminate on the date of our 2007 annual meeting of stockholders.

1

On March 29, 2005, pursuant to Article V of our amended and restated certificate of incorporation, our board of directors reduced the number of our directors from nine to eight, and the number of Class I Directors from three to two, effective as of the annual meeting.

Messrs. Elson and McGuiness, whose terms expire at the annual meeting, are each nominated for re-election at the annual meeting and, if re-elected, their new terms of office will expire at the annual meeting of stockholders to be held in 2008, or until their successors are elected and qualify. Due to the reduction in Board size, Mr. La Vigne is not standing for re-election and will step down from the Board at the conclusion of the annual meeting.

If, prior to re-election at the annual meeting, one or more of the nominees for director is unable to serve for any reason or if a vacancy otherwise exists on our board of directors, the holders of proxies solicited reserve the right to nominate and vote for any other person or persons of their choice.

Information regarding the nominees for re-election at the meeting, including business experience during the past five years, is as follows:

Class I Director Nominees

Barry R. Elson (63)

Mr. Elson became Chairman and a director of Telewest on November 26, 2003. Mr. Elson resigned as Chairman, although not as a director, and was appointed Acting Chief Executive Officer of Telewest Communications on February 18, 2004. Mr. Elson was also appointed to his current position of Acting Chief Executive Officer of Telewest Global, Inc. on March 2, 2004 with effect from February 18, 2004. Mr. Elson has been a senior executive in the broadband-telephony-video industry for 18 years, almost 14 of those with Cox Communications in Atlanta where he rose through a series of senior line operating positions to be Executive Vice President of Operations with a company-wide $1.4 billion profit and loss responsibility. From 1997 to 2000, he was President of Conectiv Enterprises and Corporate Executive Vice President of Conectiv, a diversifying $4.2 billion energy company in the middle Atlantic states. Most recently, he was Chief Operating Officer of Urban Media, a Silicon Valley venture capital backed building centric CLEC start-up with nationwide operations, and President of Pilot Associates, a management consulting/coaching firm specializing in the broadband-telephony-video industry for Wall Street clients.

Michael J. McGuiness (41)

Mr. McGuiness became a director of Telewest on November 26, 2003. Mr. McGuiness is a Portfolio Manager for W. R. Huff Asset Management Co., LLC, an investment adviser and private equity boutique, and a large independent manager in the High Yield market. Mr. McGuiness has worked for W.R. Huff Asset Management since June 1994. Mr. McGuiness serves on the Board of Directors and is a member of the Finance Committee of Sirius Satellite Radio, Inc. Mr. McGuiness is a Chartered Financial Analyst.

Information regarding directors not standing for re-election at the meeting, including business experience during the past five years, is as follows:

Continuing Class II Directors

Marnie S. Gordon (39)

Ms. Gordon became a director of Telewest on November 26, 2003. Ms. Gordon has been a director of Thermadyne Holdings Corporation, a manufacturer of cutting and welding products, since June 2003 and the chair of its Audit Committee since October 2003. From April 1998 through

2

January 2001, Ms. Gordon was a director at Angelo, Gordon & Co., an investment management firm specializing in non-traditional assets. Ms. Gordon is a Chartered Financial Analyst.

Michael Grabiner (54)

Mr. Grabiner became a director of Telewest on September 8, 2004. Mr. Grabiner joined Apax Partners Ltd in February 2002 and was appointed a Director of Apax Partners Ltd in February 2004. From 1996 to 2001, he served as Chief Executive Officer of Energis plc, a leading telecommunications company in the UK. He served in various positions at BT plc between 1973 and 1996, among others as Director of BT Europe, Director of Global Customer Service and Director of Quality and Organization. He currently holds additional directorships in several privately held companies.

Steven R. Skinner (62)

Mr. Skinner became a director of Telewest on November 26, 2003. From March 1997 through June 2003, Mr. Skinner served as President and Chief Operating Officer and a director of Triton PCS, one of the leading wireless service carriers in the Southeast of the United States. Mr. Skinner is also a director of Lightship Telecom, an integrated communications provider serving New England. Mr. Skinner was also the co-founder of Triton PCS and prior to January 1997, until the company was sold in 2000, was the co-founder and vice chairman of the advisory board of Triton Cellular Partners LP, a company that specialized in acquiring and managing rural cellular companies.

Continuing Class III Directors

Anthony (Cob) W. P. Stenham (73)

Mr. Stenham became Chairman of Telewest on March 2, 2004 effective as of February 19, 2004 and in his capacity as Chairman serves as an executive officer of Telewest. Mr. Stenham has served as non-executive Chairman of Telewest Communications since December 1999 and previously served as a non-executive director and deputy Chairman from November 1994 until December 1999. From 1992 to 2003 he was a non-executive director of Standard Chartered plc and from 1990 to 1997 he was Chairman of Arjo Wiggins Appleton plc and a managing director of Bankers Trust Company from 1986 to 1990. Mr. Stenham also currently serves as non-executive Chairman of Ashtead Group plc, IFonline Group plc and Whatsonwhen Limited.

William J. Connors (34)

Mr. Connors became a director of Telewest on November 26, 2003. Mr. Connors is a Portfolio Manager for W.R. Huff Asset Management Co., LLC and Chief Investment Officer of WRH Global Securities, LP. He has worked with W.R. Huff Asset Management since 1992. Mr. Connors serves on the Board of Directors of Impsat Fiber Networks, Inc. He is a Chartered Financial Analyst.

John H. Duerden (64)

Mr. Duerden became a director of Telewest on November 26, 2003. Mr. Duerden has served as President, Invensys Controls, a division of Invensys plc (a global automation, controls and process solutions group) since November 2004. Previously, Mr. Duerden served as the Chief Operating Officer, Development Division, of Invensys plc from September 2002 to November 2004. From May 2001 through September 2002, Mr. Duerden was Chief Executive Officer of Xerox Engineering Systems, Inc., a wholly owned subsidiary of Xerox Corporation. In August 2000, Mr. Duerden accepted the positions of Chief Executive Officer and Managing Director of Lernout & Hauspie Speech Products, a financially troubled speech and language solutions company. Mr Duerden served in these positions until January 2001, a period during which he supervised Lernout & Hauspie's voluntary filing of a Chapter 11 bankruptcy petition. From August 1995 through May 2000, Mr. Duerden was

3

Chairman, Chief Executive Officer and President of Dictaphone Corporation, a company that provides medical dictation systems, communications recording and quality monitoring systems. From June 1990 through April 1995, Mr. Duerden was President and Chief Operations Officer of Reebok International, the athletic footwear and apparel company.

Stockholder Approval

Directors are elected by a plurality of the votes cast by the holders of shares of our common stock present in person or represented by proxy at the annual meeting and entitled to vote.If you sign and return the enclosed proxy card, unless you indicate otherwise the proxy holders identified by us on that card intend to vote the shares they represent "FOR" the re-election of each of Messrs. Elson and McGuiness. In tabulating the vote, abstentions from voting and broker non-votes will be disregarded and will have no effect on the outcome of the vote.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The board of directors recommends that stockholders vote "FOR" the re-election of Barry R. Elson and Michael J. McGuiness as Class I Directors.

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT BY THE AUDIT COMMITTEE OF KPMG AUDIT PLC AS OUR INDEPENDENT AUDITORS

Subject to ratification by the stockholders, the Audit Committee has reappointed KPMG Audit Plc as independent auditors to audit our financial statements for the year ending December 31, 2005.

Representatives of KPMG Audit Plc are expected to be present at the annual meeting and will have an opportunity to make a statement if they so desire and are expected to be available to respond to appropriate questions.

We provide in the table below an analysis of the fees charged to us and to our predecessor, Telewest Communications, by KPMG Audit Plc in respect of audit and audit-related services and by KPMG LLP in respect of tax services for each of the fiscal years ended December 31, 2004 and December 31, 2003.

| | For the Years Ended December 31,

|

|---|

| | 2004

| | 2003

|

|---|

| | (£)

| | (£)

|

|---|

| Audit Fees | | 1,050,000 | | 1,118,000 |

| Audit-related Fees | | 912,000 | | 740,000 |

| Tax Fees | | 1,435,850 | | 1,194,378 |

| All other Fees | | — | | — |

Audit Fees. Audit Fees represent the aggregate services provided to us and to Telewest Communications by KPMG Audit Plc for professional services rendered for the audit of the annual financial statements and review of financial statements included in our quarterly and annual reports, involving accounting consultations on matters addressed during the audit and interim review. These fees also include services that are provided in connection with statutory and regulatory filings.

Audit-Related Fees. Audit-Related Fees represent the aggregate fees charged for assurance and related services provided to us and Telewest Communications by KPMG Audit Plc that are related to the audit or review of financial statements, including other accounting consultations.

4

Tax Fees. Tax Fees represent the aggregate fees charged for professional services provided to us and Telewest Communications by KPMG LLP for tax compliance, tax advice and tax planning.

The Audit Committee determines whether to approve audit services and permitted non-audit services performed by the independent auditors. The Audit Committee approved all of the audit and permitted non-audit services performed by KPMG Audit Plc and KPMG LLP in respect of Telewest Global, Inc. during 2004. Telewest Communications' Audit Committee was responsible for the approval of services performed by KPMG Audit Plc and KPMG LLP in respect of Telewest Communications in 2003 and 2004.

We have adopted pre-approval policies and procedures for non-audit services provided by accounting firms including our independent auditors, under which the group financial controller must pre-approve the appointment of any accounting firm to provide non-audit services. Any non-audit service assignments in excess of £25,000 also require the approval of the chief financial officer, who consults with the chairman of the Audit Committee in respect of any pre-approved assignment over £50,000. Any assignment over £100,000 requires competitive tender.

Any service to be provided by the company's independent auditors that is outside the agreed scope of the statutory audit, including tax services, must be separately pre-approved by the Audit Committee or be entered into pursuant to the above pre-approval policies or procedures.

Stockholder Approval

The ratification of KPMG Audit Plc as our independent auditors for fiscal year 2005 will require the affirmative vote of the holders of a majority of our outstanding shares of common stock present at the annual meeting in person or represented by proxy and entitled to vote.If you sign and return the enclosed proxy card, unless you indicate otherwise the proxy holders identified by us on that card intend to vote the shares they represent "FOR" the ratification of the appointment by the Audit Committee of KPMG Audit Plc as our independent auditors for the year ending December 31, 2005. For the purposes of determining whether the affirmative vote of a majority of the votes cast at the meeting and entitled to vote has been obtained, abstentions will be included in, and broker non-votes will be excluded from, the number of shares present and entitled to vote.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The board of directors recommends that stockholders vote "FOR" the ratification of the appointment by the Audit Committee of KPMG Audit Plc as our independent auditors for the year ending December 31, 2005.

PROPOSAL 3

APPROVAL OF TELEWEST GLOBAL, INC. LONG-TERM INCENTIVE PLAN

The board of directors is asking stockholders to approve the Telewest Global, Inc. Long-Term Incentive Plan (the "LTIP"). The Compensation Committee approved and adopted the definitive form of the LTIP on April 1, 2005, subject to stockholder approval.

Summary of the LTIP

A summary of the LTIP is set forth below. This summary is qualified in its entirety by reference to the full text of the LTIP which is attached to this proxy statement as Appendix C.

5

Purpose

The purpose of the LTIP is to enhance our ability to attract, motivate, reward and retain key employees, to strengthen their commitment to our success and to align their interests with those of our shareholders.

Eligible Employees

Participation in the LTIP will be limited to key management employees selected by the Compensation Committee. If a participant leaves employment for any reason prior to the payment date, he or she will not receive a bonus payment and his or her share will be forfeited to Telewest. Currently, there are 21 proposed participants in the LTIP.

Performance Objectives

The LTIP provides for the creation of a bonus pool if Telewest meets certain performance objectives with respect to the 3-year period ending December 31, 2007. The performance objectives under the LTIP are set in relation to simple cash flow (defined as EBITDA less capital expenditures) during the measurement period.

Permissible Awards

Generally, payments will be made under the LTIP on or prior to March 15, 2008. Bonus payments will be made at the discretion of the Compensation Committee in cash and/or in shares of common stock (subject to a maximum of 1,000,000 shares of common stock issuable in aggregate pursuant to the LTIP). If payments are to be paid in the form of shares of common stock, then the number of such shares shall be determined by dividing the portion of the payment to be so paid by the arithmetic mean of the fair market value of a share of common stock for the trading days in December of 2007.

The market value of a share of our common stock on April 1, 2005 was $17.68.

Plan Benefits

All of our executive officers, as well as certain other members of our senior management, have been selected to be participants in the LTIP. However, because the amount of the bonus pool under the LTIP depends on the extent to which the performance goals are achieved, it is not possible to determine the amount of compensation that may be payable to any participant in the LTIP.

Administration

The plan is administered by the Compensation Committee, which has the full authority to establish the rules and regulations relating to the LTIP, interpret the LTIP, select participants in the LTIP, determine the performance objectives, calculate the total amount of the bonus pool and amounts to be received by participants in the plan and to take all other actions necessary or appropriate for the proper administration of the plan.

Acceleration Events

The Compensation Committee has the sole and absolute discretion to determine the effect of an "acceleration event" on the plan. The effect of an acceleration event may include termination of the plan without making payments thereunder even if performance objectives have been met. The definition of "acceleration event" has the same meaning as under our 2004 Stock Incentive Plan which is described in detail under "Compensation and Employee Benefit Plans—Telewest 2004 Stock Incentive Plan."

6

Amendment or Termination

The Compensation Committee may amend or terminate the LTIP at any time in its discretion but, except as permitted in connection with an acceleration event, the amendment or termination of the LTIP may not affect the rights of any LTIP participant as of the date of such action. The Compensation Committee may not, however, increase the maximum number of shares issuable pursuant to the LTIP without shareholder approval.

Stockholder Approval

The approval of the LTIP will require the affirmative vote of the holders of a majority of our outstanding shares of common stock present at the annual meeting in person or represented by proxy and entitled to vote.If you sign and return the enclosed proxy card, unless you indicate otherwise the proxy holders identified by us on that card intend to vote the shares they represent "FOR" the approval of the LTIP. For the purposes of determining whether the affirmative vote of a majority of the votes cast at the meeting and entitled to vote has been obtained, abstentions will be included in, and broker non-votes will be excluded from, the number of shares present and entitled to vote.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information as of December 31, 2004 regarding the number of shares of our common stock that may be issued upon the exercise of options, warrants and rights under Telewest's existing equity compensation plans.

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a)

| | Weighted-average exercise price of outstanding options, warrants and rights ($)

(b)

| | Number of securities remaining available for issuance under equity compensation plans (excluding securities reflected in column (a) and footnote (1))

(c)

|

|---|

| Equity compensation plans approved by security holders | | 9,477,426 | (1) | $ | 12.38 | | 14,696,946 |

Equity compensation plans not approved by security holders |

|

— |

|

|

— |

|

— |

| |

Total |

|

9,477,426 |

|

$ |

12.38 |

|

14,696,946 |

- (1)

- Does not include an aggregate 325,628 shares of restricted stock awarded under the Telewest 2004 Stock Incentive Plan.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The board of directors recommends that stockholders vote "FOR" the approval of the Telewest Global, Inc. Long-Term Incentive Plan.

7

CORPORATE GOVERNANCE

Meetings of the Board of Directors

During the year ended December 31, 2004, the board of directors held eleven meetings. Each director attended, in aggregate, 75% or more of all board meetings held during the period for which he or she was a director and all meetings of committees of which he or she was then a member, other than Mr. Skinner and Mr. Grabiner.

Compensation of Directors

Non-employee directors receive an annual fee of $60,000, plus $500 per board or committee meeting held by telephone and $1,000 per board or committee meeting held in person.

In addition to the fees paid to them as directors, committee chairmen, other than the chairman of the Audit Committee, receive an annual fee of $12,500 and each other committee member receives an annual fee of $6,500. The chairman of the Audit Committee receives an annual fee of $30,000.

We reimburse our directors for out-of-pocket expenses incurred in connection with meetings of our board of directors and committees of the board of directors. Our directors who are our employees do not receive additional compensation for their service as a member of our board of directors.

In addition, we granted each non-employee director an initial grant of options to purchase 229,688 shares of our common stock. These options vest upon the first meeting of stockholders occurring after the date of grant (or, if earlier, upon a change of control) and have an exercise price of $13.70 per share (subject to adjustment in certain circumstances).

Standing Committees of the Board of Directors

The standing committees of our board of directors are the Audit Committee, Compensation Committee, Executive and Nominating Committee, and Strategic Development and Finance Committee.

Audit Committee

The Audit Committee operates under a charter adopted by our board of directors. A copy of the Audit Committee charter is attached to this Proxy Statement as Appendix A. The Audit Committee oversees our accounting and financial reporting processes and audits of our financial statements and assists the board of directors to oversee:

- •

- the integrity of our financial statements and the appropriateness of our accounting policies and procedures;

- •

- the external auditor's qualifications and independence;

- •

- the performance of our internal audit function and external auditor; and

- •

- the sufficiency of the external auditor's review of our financial statements.

The current members of our Audit Committee are Marnie S. Gordon (Chair), Michael Grabiner and Donald S. La Vigne, who are independent in accordance with the requirements of section 10A(m) (3) (B) of the Securities Exchange Act of 1934, as amended, and the rules promulgated by the Securities and Exchange Commission ("SEC") thereunder, and as required by the Audit Committee charter and the listing standards of the National Association of Securities Dealers, Inc. The Board expects to fill the vacancy created by Mr. La Vigne's departure by appointing one of the continuing directors who meets those independence criteria.

8

Ms Gordon is a financial expert as defined in the rules promulgated by the SEC and the Nasdaq National Market, Inc.

The Audit Committee held seven meetings during the fiscal year ended December 31, 2004.

Compensation Committee

The Compensation Committee has the overall responsibility for approving and evaluating our director and officer compensation plans, policies and programs. The Compensation Committee reviews and approves on an annual basis our corporate goals and objectives with respect to the compensation of the Chief Executive Officer and the evaluation process and compensation structure for our other officers. The Compensation Committee evaluates, at least once a year, the Chief Executive Officer's annual compensation, and also is responsible for reviewing our incentive compensation and other stock-based plans and recommending changes to those plans to the board of directors. The Compensation Committee is responsible for administering our 2004 Stock Incentive Plan and, in this capacity, approving all equity grants to executive officers and management.

Our Compensation Committee members are William J. Connors, John H. Duerden and Donald S. La Vigne, who are independent as required under the listing standards of the National Association of Securities Dealers, Inc. The Board expects to fill the vacancy created by Mr. La Vigne's departure by appointing one of the continuing directors who meets those independence criteria.

The Compensation Committee held four meetings during the fiscal year ended December 31, 2004.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee members during fiscal year 2004 were William J. Connors, John H. Duerden and Donald S. La Vigne. The members of the Compensation Committee have not been at any time during fiscal year 2004, or at any other time, officers or employees of ours.

No executive officer of Telewest, other than Barry R. Elson and Anthony (Cob) W. P. Stenham, served as a member of our board of directors during fiscal year 2004. No executive officer of Telewest served during fiscal year 2004 as a member of the board of directors or the compensation committee of any entity that had one or more executive officers serving as a member of our board of directors or the Compensation Committee.

Executive and Nominating Committee

The Executive and Nominating Committee discharges the duties of the board of directors, to the maximum extent provided by law, when it is impracticable for the full board of directors to meet and take action, as well as when the board of directors has specifically delegated the authority to take certain actions. The Executive and Nominating Committee may also make recommendations to the board of directors regarding our management, operations, strategy and business.

The Executive and Nominating Committee, acting exclusively through its independent members, also establishes the qualifications, desired background, and selection criteria for members of our board of directors in accordance with relevant rules and law and makes recommendations to our board of directors with regard to committee assignments. In addition, the independent members of the Executive and Nominating Committee make recommendations to our board of directors concerning all nominees for board membership, including the re-election of existing Board members.

Our Executive and Nominating Committee members are William J. Connors, Michael J. McGuiness, Steven R. Skinner and Anthony (Cob) W. P. Stenham (Mr. Stenham serving ex officio for all functions other than nominations). All of the members of the Executive and Nominating Committee participating in nominating decisions are independent as required under the listing standards of the

9

National Association of Securities Dealers, Inc. The Executive and Nominating Committee operates under a charter adopted by our board of directors, a copy of which is attached to this proxy statement as Appendix B. The Executive and Nominating Committee held one meeting during the fiscal year ended 2004.

The Executive and Nominating Committee uses a variety of methods to identify candidates for membership on the board of directors, including recommendations from the current board members or management, or nominations from stockholders. Additionally, from time to time the Executive and Nominating Committee may receive information regarding prospective candidates for membership on the board of directors from professional search firms.

In evaluating nominees, the Executive and Nominating Committee generally considers a number of factors, including:

- •

- the current size and composition of the board, including the current number of independent directors and whether there is a vacancy on the board;

- •

- business expertise and skills;

- •

- a high level of integrity;

- •

- educational and professional background;

- •

- industry knowledge and experience that bear on our business;

- •

- commitments to other businesses and responsibilities; and

- •

- independence from us and our management.

Stockholders may also recommend a person to be a director by writing to the Secretary at 160 Great Portland Street, London W1W 5QA, UK. Your letter should include the information and be sent within the time-frames specified in our by-laws, a copy of which can be obtained from the Secretary.

Strategic Development and Finance Committee

The Strategic Development and Finance Committee is responsible for overseeing our financing, investment and strategic acquisition activities. The Strategic Development and Finance Committee reviews our finances and makes recommendations to our board of directors and senior management regarding significant capital markets activities such as equity and debt issuances, debt refinancings and other changes to our capital structure. The Strategic Development and Finance Committee also advises our board of directors and members of senior management on matters such as long-range financial and strategic planning, material acquisitions and dispositions, joint ventures and strategic alliances. Our Strategic Development and Finance Committee members are Michael J. McGuiness, Marnie S. Gordon, Steven R. Skinner and Anthony (Cob) W. P. Stenham (Mr. Stenham serving ex officio).

The Strategic Development and Finance Committee held three meetings during the fiscal year ended December 31, 2004.

Stockholder Communications with the Board of Directors

We generally encourage stockholders, employees and members of the public to communicate to management and the board of directors by writing to: Telewest Global, Inc., 1105 North Market Street, Suite 1300, Wilmington, Delaware 19801 Attn: Secretary. Each communication should specify the applicable addressees to be contacted as well as the general topic of communication. We will initially receive and process communications before forwarding them to the addressee. We generally will not forward to the directors any communication that we determine to be primarily commercial in nature or that requests general information about Telewest.

10

To further stockholder communications with the board of directors, it is our policy that directors should make every effort to attend the annual meeting of stockholders. This will be our first annual meeting since we became publicly held.

EXECUTIVE OFFICERS AND EXECUTIVE COMPENSATION

Executive Officers

A description of our executive officers who are not directors, including business experience during the past five years, follows. For certain biographical information concerning Mr. Elson please see "Class I Director Nominees" and for certain biographical information regarding Mr. Stenham see "Continuing Class III Directors."

Stephen S. Cook (45)

Mr. Cook was appointed Vice President, Group Strategy Director and General Counsel of Telewest on November 26, 2003. Mr. Cook has served as a director of Telewest Communications and as Group Strategy Director of Telewest Communications since April 2000 following the completion of the merger with Flextech. Mr. Cook has also served as General Counsel of Telewest Communications since August 2000. From October 1998 to April 2000, Mr. Cook served as General Counsel, Company Secretary and as an executive director of Flextech. Between April 1995 and October 1998, Mr. Cook was a partner with Wiggin and Co., Flextech's principal legal advisers, and a non-executive director of SMG plc from March 2000 until November 2002. Mr. Cook was a partner at the law firm of McGrigor Donald from May 1993 until April 1995.

Neil R. Smith (40)

Mr. Smith was appointed Vice President and Chief Financial Officer of Telewest on November 26, 2003. Mr. Smith has served as Group Finance Director of Telewest Communications since September 1, 2003. Prior to that, Mr. Smith served as Deputy Group Finance Director of Telewest Communications from September 2002 to September 2003. Mr. Smith had previously served as Finance Director, Consumer Sales Division of Telewest Communications from August 2000 to September 2002, having joined Telewest Communications as Group Financial Controller in July 2000. Prior to that, Mr. Smith was Deputy Finance Director at Somerfield plc, a UK based food retailer, where Mr. Smith worked in many corporate finance roles since 1994.

Eric J. Tveter (46)

Mr. Tveter was appointed President and Chief Operating Officer of Telewest in July 2004 and served as President and Chief Operating Officer of Telewest Communications from June 2004 through the completion of the financial restructuring. Prior to that, Mr. Tveter was Chief Operating Officer of MasTec, Inc., a telecommunications infrastructure solutions provider, from July 2002 to March 2004. Prior to joining MasTec, Inc., Mr. Tveter was an executive with Comcast Corporation, Time Warner Communications, Cablevision Systems Corporation's Lightpath business unit, and Metromedia International Group, Inc. where he held various key roles in the industries served by MasTec, Inc.

11

Summary Compensation

The following table discloses compensation received by our Acting Chief Executive Officer, our former Chief Executive Officer, and our four other most highly paid executive officers who were serving as executive officers as of December 31, 2004. We refer to these executives collectively as named executive officers. Compensation paid prior to July 15, 2004 reflects amounts paid by our predecessor, Telewest Communications.

| | Annual compensation

| | Long-term compensation

|

|---|

Name and principal position

| | Year

| | Salary (£)

| | Bonus (£)(4)

| | Other annual

compensation (£)(5)

| | Restricted

share

awards (£)(6)

| | Securities

underlying

options/

SARs (#)(7)

| | All

other

compensation (£)(8)

|

|---|

Anthony (Cob) W. P. Stenham

(Chairman of the Board) | | 2004

2003

2002 | | 412,188

175,000

175,000 | | 243,000

—

— | | 38,284

18,157

21,316 | | 134,563

—

— | | 1,592,500

—

— | | —

—

— |

Barry R. Elson(1)

(Acting Chief Executive Officer) |

|

2004 |

|

172,925 |

|

108,696 |

|

23,331 |

|

1,830,842 |

|

980,000 |

|

5,027 |

Charles J. Burdick(2)

(Former President and Chief Executive Officer) |

|

2004

2003

2002 |

|

270,833

500,000

400,000 |

|

—

180,000

160,000 |

|

67,786

97,464

76,789 |

|

—

—

— |

|

—

—

— |

|

510,813

19,817

14,513 |

Stephen S. Cook

(Vice President, Group Strategy Director and General Counsel) |

|

2004

2003

2002 |

|

375,550

370,000

350,000 |

|

205,794

133,200

140,000 |

|

87,816

89,818

84,164 |

|

89,711

—

— |

|

210,192

—

— |

|

—

—

— |

Neil R. Smith

(Vice President and Chief Financial Officer) |

|

2004

2003

2002 |

|

256,250

210,417

175,000 |

|

141,750

191,000

55,500 |

|

46,446

64,110

46,904 |

|

89,711

—

— |

|

288,256

—

— |

|

20,250

19,710

27,931 |

Eric J. Tveter(3)

(President and Chief Operating Officer) |

|

2004 |

|

123,518 |

|

146,739 |

|

101,120 |

|

— |

|

600,000 |

|

5,564 |

- (1)

- Mr. Elson was appointed Acting Chief Executive Officer of Telewest Communications on February 18, 2004 and Acting Chief Executive Officer of Telewest on March 2, 2004 with effect from February 18, 2004. Mr. Elson resigned as Chairman of the board of Telewest on March 2, 2004 but not as a director of that board. Mr. Elson received £47,554 during 2003 and £203,125 during 2004 in consulting fees for services rendered to Telewest Communications. Mr. Elson's compensation has been converted from US dollars using an average exchange rate of £1 = $1.84.

- (2)

- Mr. Burdick resigned as Group Managing Director and as a director of Telewest Communications and as a director, President and Chief Executive Officer of Telewest effective as of February 18, 2004. In compensation for the termination of his employment he was paid salary, company pension contributions and car allowance until the date of the completion of the financial restructuring and a lump sum payment of £500,000, equal to one year's salary. He also received £1,000 for certain amendments to his service agreement, £1,000 in legal fees incurred in connection with his termination of employment, and was provided with medical benefits coverage for 12 months following termination of his employment.

- (3)

- Mr. Tveter's salary has been converted from US dollars using an average exchange rate of £1 = $1.84.

- (4)

- For executives other than Mr. Elson, a portion of these bonuses was paid in shares of restricted stock. See "Compensation Committee Report on Executive Compensation—Annual bonus."

- (5)

- The amounts of personal benefits for 2004 that represent more than 25% of "Other Annual Compensation" include (i) a car benefit in the amount of £17,209 and the provision of a chauffeur in the amount of £15,479 for Mr. Stenham, (ii) a cash pension supplement in the amount of £23,203 for Mr. Elson, (iii) a cash pension allowance in the sum of £75,756 for Mr. Cook, (iv) a cash pension supplement in the amount of £31,000 and a car allowance in the amount of £12,800 for Mr. Smith, and (v) a housing allowance in the amount of £60,660 for Mr. Tveter.

- The amounts of personal benefits for 2003 that represent more than 25% of "Other Annual Compensation" include (i) a cash pension allowance in the amount of £74,000 for Mr. Cook (ii) a cash pension supplement in the amount of £80,289 for Mr. Burdick and (iii) a re-location allowance in the amount of £19,531 and a cash pension supplement in the amount of £22,373 for Mr. Smith.

- The amounts of personal benefits for 2002 that represent more than 25% of "Other Annual Compensation" include (i) a car benefit in the amount of £17,778 for Mr. Stenham (ii) a cash pension supplement in the amount of £58,150 for Mr. Burdick, (iii) a cash pension allowance in the sum of £70,000 for Mr. Cook and (iv) a cash pension supplement in the amount of £15,646 and a relocation allowance in the amount of £19,524 for Mr. Smith.

- (6)

- The number of and value of aggregated restricted stock holdings at the end of the last fiscal year (net of any consideration paid by the named executive officer), calculated based on the $17.58 per share stock price as of December 31, 2004 are: (i) Mr. Stenham, 18,007 shares ($316,563), (ii) Mr. Elson, 245,000 shares ($4,307,100), (iii) Mr. Cook, 12,005 shares ($211,048), (iv) Mr. Smith, 12,005 shares ($211,048). Of these shares,

12

Messrs. Stenham, Cook and Smith held time-based restricted stock and Mr. Elson held only performance-based restricted stock. All of the time-based restricted stock vested on January 19, 2005. Mr. Elson's performance-based restricted stock was scheduled to vest in three equal annual instalments if applicable performance goals were satisfied. However, in connection with the execution of definitive employment and equity agreements with Mr. Elson, this award has been replaced with a cash-based award. See "Employment Agreements and Severance Arrangements—Barry R. Elson." Messrs. Stenham, Elson, Cook and Smith are entitled to receive dividends in respect of these shares of restricted stock but any such dividends may not be paid until the shares of restricted stock on which the dividends are payable have vested.

- (7)

- Stock Appreciation Rights (SARs) are rights granted to an employee to receive a bonus equal to the appreciation in the value of the company's stock for a predetermined number of shares over a specific period. None of the named executive officers had been granted SARs at the fiscal year end.

- (8)

- All Other Compensation reflects (i) contributions by Telewest up to the pensions earnings cap to a personal pension arrangement for Mr. Elson, (ii) a special payment of £500,000 as compensation for the termination of his employment for Mr. Burdick and (iii) contributions by Telewest up to the pensions earnings cap to Telewest's contributory pension scheme for Mr. Tveter and Mr. Smith.

13

Option/SAR Grants in the Last Fiscal Year

The following table represents stock option grants made to the named executive officers of Telewest during the year ended December 31, 2004:

Individual grants

| |

| | Potential realizable value at assumed annual rates of stock price appreciation for option term

|

|---|

Name

| | Number of

securities

underlying

options/SARs

granted (#)(1)

| | Percent of

total

options/SARs

granted to

employees in

fiscal year

| | Exercise

or base

price

($/Sh)

| | Market price

on date of

the grant

(if greater

than

exercise or

base price)

($/Sh)

| | Expiration

date

| | 0% ($)

| | 5% ($)

| | 10% ($)

|

|---|

| Anthony (Cob) W. P. Stenham | | 1,225,000

367,500 | | 15.57

4.67 | %

% | $

$ | 13.70

0.01 | |

$ | —

13.70 | | July 18, 2014

July 18, 2014 | | —

5,031,075 | | 10,572,975

8,202,968 | | 26,684,175

13,036,328 |

| Barry R. Elson(2) | | 980,000 | | 12.45 | % | $ | 13.70 | | | — | | July 18, 2014 | | — | | 8,458,380 | | 21,347,340 |

| Charles J. Burdick(3) | | — | | — | | | — | | | — | | — | | — | | — | | — |

| Stephen S. Cook | | 180,180

15,006

15,006 | | 2.29

0.19

0.19 | %

%

% | $

$

$ | 13.70

0.01

0.01 | |

$

$ | —

13.70

12.14 | | July 18, 2014

July 18, 2014

July 18, 2014 | | —

205,432

182,023 | | 1,555,134

334,949

311,540 | | 3,924,861

532,308

508,898 |

| Neil R. Smith | | 234,234

54,022 | | 2.98

0.69 | %

% | $

$ | 13.70

0.01 | |

$ | —

13.70 | | July 18, 2014

July 18, 2014 | | —

739,561 | | 2,021,674

1,205,825 | | 5,102,319

1,916,322 |

| Eric J. Tveter | | 500,000

100,000 | | 6.35

1.27 | %

% | $

$ | 13.70

0.01 | |

$ | —

13.70 | | July 18, 2014

July 18, 2014 | | —

1,369,000 | | 4,315,500

2,232,100 | | 10,891,500

3,547,300 |

- (1)

- The material terms of these options are set forth below in the description of each named executive officer's employment agreement.

- (2)

- Mr. Elson was appointed Acting Chief Executive Officer of Telewest Communications on February 18, 2004 and Acting Chief Executive Officer of Telewest on March 2, 2004 with effect from February 18, 2004.

- (3)

- Mr. Burdick resigned as Group Managing Director and as a director of Telewest Communications and as a director, President and Chief Executive Officer of Telewest effective as of February 18, 2004.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Telewest

The following table provides information concerning the exercises of options to purchase our common stock during the year ended December 31, 2004 by the named executive officers and the value of unexercised options to purchase our common stock held by each of the named executive officers as of December 31, 2004.

| |

| |

| | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year-End (#)

| |

| |

|

|---|

| |

| |

| | Value of Unexercised in-the-Money Options/SARs at Fiscal Year-End ($)

|

|---|

| | Shares

Acquired on

Exercise

(#)

| |

|

|---|

Name

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Anthony (Cob) W. P. Stenham | | — | | — | | — | | 1,592,500 | | — | | 27,996,150 |

| Barry R. Elson(1) | | — | | — | | 245,000 | | 735,000 | | 4,307,100 | | 12,921,300 |

| Charles J. Burdick(2) | | — | | — | | — | | — | | — | | — |

| Stephen S. Cook | | — | | — | | — | | 210,192 | | — | | 3,695,175 |

| Neil R. Smith | | — | | — | | — | | 288,256 | | — | | 5,067,540 |

| Eric J. Tveter | | — | | — | | 125,000 | | 475,000 | | 2,197,500 | | 8,350,500 |

- (1)

- Mr. Elson was appointed Acting Chief Executive Officer of Telewest Communications on February 18, 2004 and Acting Chief Executive Officer of Telewest on March 2, 2004 with effect from February 18, 2004.

- (2)

- Mr. Burdick resigned as Group Managing Director and as a director of Telewest Communications and as a director, President and Chief Executive Officer of Telewest effective as of February 18, 2004.

14

Telewest Communications

All of Telewest Communications' outstanding options and share awards were accelerated in connection with its financial restructuring. Telewest Communications ensured that holders of options and share awards who exercised those awards by July 5, 2004 received its shares in time to receive Telewest shares as part of the financial restructuring. Those holders who did not exercise their option and share awards by July 5, 2004 still received shares of Telewest Communications but did not necessarily receive such shares in time to ensure they were entitled to receive shares of Telewest in connection with the financial restructuring.

At the time of the financial restructuring, Mr. Burdick received 325 Telewest shares in respect of Telewest Communications options and share awards that he exercised prior to July 5, 2004.

All of Telewest Communications' outstanding options lapsed before December 31, 2004.

Compensation and Employee Benefit Plans

Telewest 2004 Stock Incentive Plan

The Telewest 2004 Stock Incentive Plan (the "Plan") was adopted by our board of directors on June 2, 2004 and approved by Telewest Communications, our then sole stockholder, on July 5, 2004. The Plan is intended to encourage stock ownership by employees, directors and independent contractors of Telewest and its divisions and subsidiary and parent corporations and other affiliates, so that they may acquire or increase their proprietary interest in Telewest, and to encourage such employees, directors and independent contractors to remain in the employ or service of Telewest or its affiliates and to put forth maximum efforts for the success of the business.

The Plan provides for the grant of Incentive Stock Options, Nonqualified Stock Options, Restricted Stock, Restricted Stock Units and Share Awards (each as defined in the Plan). Incentive Stock Option grants are intended to qualify under Section 422 of the Internal Revenue Code. The aggregate number of shares of our common stock that may be subject to option grants or awards under the Plan is 24,500,000, subject to adjustment upon the occurrence of certain enumerated corporate transactions. An individual may not be granted options to purchase or be awarded more than 4,000,000 shares of our common stock in any one fiscal year. The Plan is designed so that option grants are able to comply with the requirements for "performance-based" compensation under Section 162(m) of the Internal Revenue Code and the conditions for exemption from the short-swing profit recovery rules of Rule 16b-3 under the Securities Exchange Act of 1934, as amended.

The Compensation Committee of our board of directors, or any other committee appointed by our board of directors, administers the Plan and generally has the right to grant options or make awards to eligible individuals, to determine the terms and conditions of all grants and awards, include vesting schedules and exercise price (where appropriate), and to amend, suspend or terminate the Plan at any time. Each grant or award made pursuant to the Plan will be evidenced by an award agreement, which will state the terms and conditions of the grant or award as determined by the Compensation Committee.

Persons eligible to receive grants or awards under the Plan include employees, directors and independent contractors of Telewest and its divisions and subsidiary and parent corporations and other affiliates. The term of an Incentive Stock Option under the Plan may not exceed 10 years from the date of the grant and the term of a Non-Qualified Stock Option may not exceed 11 years from the date of the grant.

Unless otherwise set forth in an employee's, director's or independent contractor's respective award agreement, under the Plan all outstanding options or Restricted Stock or Restricted Stock Units

15

become immediately exercisable, lose all restriction or become fully vested upon the occurrence of an "acceleration event." An acceleration event generally means:

- •

- the acquisition of 30% or more of our voting capital stock, excluding stock purchases directly from us;

- •

- the replacement of a majority of our board of directors or their approved successors;

- •

- the consummation of a merger or consolidation of us or one of our subsidiaries with another entity, other than:

- •

- a transaction in which our stockholders continue to hold 50% or more of the voting power of the successor; or

- •

- various recapitalizations;

- •

- the consummation of a sale of all or most of our assets, other than a sale to an entity of which more than 50% of its voting power is held by shareholders of Telewest; or

- •

- stockholder approval of our liquidation or dissolution.

Under the terms of the Plan, in the event of a transaction affecting our capitalization, the Compensation Committee of our board of directors shall proportionately adjust the aggregate number of shares available for options and awards, the aggregate number of options and awards that may be granted to any person in any calendar year, the number of such shares covered by outstanding options and awards, and the exercise price of outstanding options to reflect any increase or decrease in the number of issued shares so as to, in the Compensation Committee's judgment and sole discretion, prevent the diminution or enlargement of the benefits intended by the Plan. The Compensation Committee has not made any determination at this time whether any such adjustments will be made.

In general, the vesting of equity awards granted to our employees will not accelerate upon the occurrence of an acceleration event so long as, in connection with the acceleration event, the grantee receives an offer of continued employment with substantially similar compensation and employee benefits. In addition, with respect to key individuals, including Mr. Stenham, Mr. Elson, Mr. Cook, Mr. Smith and Mr. Tveter, 50% of the unvested portion of such person's equity award will vest upon the occurrence of an acceleration event, and the remaining 50% will vest if such person is not offered continued employment with substantially similar compensation and employee benefits.

Telewest 2004 Bonus Scheme

All employees who were not covered by a local or commission based scheme were eligible to participate in the Telewest 2004 Bonus Scheme. The scheme offered employees an opportunity to receive a bonus equal to a percentage of their base salary. The percentages paid were up to 54% for senior executives and ranged from 5.4% to 54% for all other employees. Bonus payments were based on achieving certain set performance targets for the year ended December 31, 2004 and were paid in March 2005. Bonus payments were generally paid in cash. Some of our senior executives also received an element of their bonus payment in shares of restricted stock which will vest on the second anniversary of their entitlement date. The number of shares of restricted stock that were issued are equal to the cash amount of the bonus divided by the market price for our stock on January 20, 2005. Bonus entitlements for Anthony (Cob) W. P. Stenham, Barry R. Elson, Stephen S. Cook, Neil R. Smith and Eric J. Tveter under the Telewest 2004 Bonus Scheme are reflected in the Summary Compensation Table.

Telewest 2005 Bonus Scheme

All employees who are not covered by a local or commission based scheme are eligible to participate in the Telewest 2005 Bonus Scheme (the "2005 Plan"). The 2005 Plan establishes

16

performance criteria and target bonus amounts for all plan participants (including Telewest's executive officers) with respect to their fiscal year 2005 bonuses. The performance criteria for Telewest's executive officers consist of simple cash flow (on which 50% of the bonus will be based), net subscriber additions (on which 25% of the bonus will be based) and EBITDA (on which 25% of the bonus will be based). For this purpose, "simple cash flow" is defined as EBITDA less capital expenditures during the relevant measurement period. The performance criteria for other participants in the 2005 Plan consist of these and other performance goals that the Compensation Committee determined were appropriate to Telewest's different business units.

Under the 2005 Plan, the target bonus amount for each of Telewest's executive officers is 50% of base salary. An executive officer will earn 100% of the applicable target bonus amount if Telewest's performance meets the performance criteria and up to a maximum of 200% of the applicable target bonus amount at higher levels of Telewest's performance. The Compensation Committee has also established thresholds below which no bonuses will be payable. The performance criteria provide that the expense associated with bonuses payable is taken into account in determining whether the simple cash flow and EBITDA performance goals have been met.

Telewest Long-Term Incentive Plan

We have submitted for stockholder approval a Long-Term Incentive Plan in which certain of our executive officers and members of senior management are proposed to participate. See "Proposal 3: Approval of Telewest Global, Inc. Long-Term Incentive Plan."

Employment Agreements and Severance Arrangements

Anthony (Cob) W. P. Stenham. Telewest entered into an agreement with Mr. Stenham relating to his role as Chairman of our Board on July 19, 2004. Pursuant to that agreement, Mr. Stenham is entitled to:

- •

- a payment in the amount such that when added to the fee earned in respect of the period of service on the board of directors from February 18, 2004 through the completion of the financial restructuring, he would have been paid at an annual rate of £450,000 in respect of such period;

- •

- base compensation of £450,000 per annum;

- •

- a bonus opportunity equivalent to that available to other members of the senior leadership team;

- •

- substantially the same medical benefits as provided to other members of the senior leadership team;

- •

- 1,225,000 options vesting in arrears, subject to ratable acceleration upon the satisfaction of performance goals measured annually over a five-year period, at an exercise price of $13.70 per share (subject to adjustment in certain circumstances); and

- •

- 367,500 options vesting in arrears, subject to ratable acceleration upon the satisfaction of performance goals measured annually over a five-year period, at an exercise price of $0.01 per share.

Under the terms of the agreement, Mr. Stenham's engagement may be terminated immediately at any time, provided that Mr. Stenham is entitled to a severance payment of £450,000 if such termination is without cause.

Barry R. Elson. Telewest Communications entered into a letter agreement with Barry R. Elson, dated February 13, 2004. Pursuant to the letter agreement with Telewest Communications, Mr. Elson agreed to act as Acting Chief Executive Officer of Telewest Communications through the effective date of Telewest Communications' financial restructuring (July 15, 2004) in return for $5,000 for each day that he performed services for Telewest Communications.

17

Mr. Elson also entered into a letter agreement with Telewest, dated February 18, 2004. Pursuant to that letter agreement, Mr. Elson agreed to serve as Acting Chief Executive Officer and a member of the board of directors of Telewest through April 19, 2005; the nine-month anniversary of the effective date of Telewest Communications' financial restructuring. Through the effective date of the financial restructuring, Mr. Elson was compensated in accordance with the terms of this letter agreement with Telewest Communications. On July 9, 2004, the Compensation Committee of our board of directors approved a compensation package that would entitle Mr. Elson from the effective date of the financial restructuring through the nine-month anniversary of that date to:

- •

- an annual base salary of $700,000 plus an annual bonus of up to $200,000 in cash or stock dependent on his meeting various targets to be set by the Compensation Committee;

- •

- 245,000 fully vested options and 735,000 options vesting in arrears, subject to ratable acceleration upon the satisfaction of performance goals measured annually over a five-year period, at an exercise price of $13.70 per share (subject to adjustment in certain circumstances);

- •

- 245,000 shares of restricted stock vesting in arrears, subject to ratable acceleration upon the satisfaction of performance goals measured annually over a three-year period, to be held by us in escrow until the earlier of the one-year anniversary of the final vesting date and the termination of his employment; and

- •

- a severance payment equal to $58,333 per month during which he serves as Acting Chief Executive Officer up to a maximum of $700,000, payable upon termination without cause if Telewest does not offer continued employment as Chief Executive Officer or at the nine-month anniversary of the effective date of the financial restructuring.

In April 2005, the Company and Mr. Elson entered into an employment agreement and equity agreements evidencing this compensation package. The delay between the approval of the compensation package and the execution of definitive documentation was occasioned in part by Mr. Elson's spending a portion of 2004 in the US on medical leave, but primarily because of the complexity of the US and UK tax and accounting principles involved in Mr. Elson's employment. These principles necessitated providing Mr. Elson with a cash-based award instead of the award of restricted stock described above. This cash-based award consists of a grant of 245,000 stock appreciation rights that will vest on a quarterly basis over a four-year period beginning in July 2004 and ending in July 2008. In July 2008 (or upon Mr. Elson's termination of employment, if earlier), Mr. Elson will receive cash equal to the fair market value of a share of our common stock for each vested stock appreciation right.

In addition, in January 2005, the Compensation Committee determined that the 735,000 options held by Mr. Elson would vest in arrears on a quarterly basis over a five-year period commencing in July 2004 with no performance conditions. As of April 1, 2005, this option was vested as to 73,500 shares and remained unvested as to 661,500 of these shares.

Currently, the Company is still considering whether it intends to appoint Mr. Elson as permanent Chief Executive Officer. However, until that decision is made, Mr. Elson has indicated his willingness to continue to serve as the Company's Acting Chief Executive Officer subject to all of the rights and obligations under his employment agreement, including Mr. Elson's right to terminate his employment for any reason and receive the severance pay and benefits specified in his employment agreement.

Charles J. Burdick. Charles J. Burdick resigned as Group Managing Director and as a director of Telewest Communications and as a director, President and Chief Executive Officer of Telewest effective as of February 18, 2004. In connection with his resignation, Telewest Communications agreed to pay Mr. Burdick his current salary and benefits until the earlier of the completion of the financial restructuring and December 31, 2004, at which point Telewest Communications agreed to pay Mr. Burdick a lump sum equal to one year's salary. In addition, Telewest Communications agreed to

18

pay to Mr. Burdick's legal advisors up to £1,000 in legal fees incurred in connection with his termination of employment, and to pay Mr. Burdick £1,000 for certain amendments to his existing service agreement. On July 14, 2004 the Compensation Committee of our board of directors awarded Mr. Burdick a bonus of £180,000 in respect of 2003.

Stephen S. Cook. Flextech plc entered into an employment agreement with Stephen S. Cook dated October 21, 1998. Mr. Cook's employment agreement was subsequently transferred to Telewest Communications Group Limited on June 22, 2000. The employment agreement was amended on July 17, 2003 and November 26, 2004, and remains in effect unless terminated by either party giving the other party not less than 12 months' notice. Mr. Cook's current basic annual salary is £381,100 and he is entitled to a performance-based bonus at the sole discretion of the Compensation Committee, a company car or cash allowance in lieu thereof, private medical insurance (for himself and for his family), life assurance cover equal to four times his basic annual salary and income protection insurance. A cash sum of 20% of Mr. Cook's gross basic annual salary is paid to him to use for his personal pension arrangements (this payment is subject to a personal contribution of 4% of his gross basic annual salary to a personal pension scheme).

Neil R. Smith. Telewest Communications Group Limited entered into an employment agreement with Neil R. Smith dated March 6, 2000. The employment agreement was amended on September 24, 2002, August 25, 2003 and October 18, 2004 and remains in effect unless terminated by either party giving the other party not less than 12 months' notice. Mr. Smith's current basic annual salary is £315,000 and he is entitled to a performance-based bonus at the sole discretion of the Compensation Committee, company car or cash allowance in lieu thereof, private medical insurance (for himself and for his family), life assurance cover equal to four times his basic annual salary and income protection insurance. Pension contributions are made to a contributory pension scheme of 20% of his gross basic annual salary up to the earnings cap and an additional cash sum of 20% of his gross basic annual salary above the earnings cap is paid to him for his personal pension arrangements (these payments are subject to a personal contribution of 10% of his gross basic annual salary to the scheme).

Eric J. Tveter. Eric J. Tveter entered into an employment agreement with Telewest dated as of July 19, 2004 in which he agreed to serve as President and Chief Operating Officer of Telewest. The employment agreement terminates on December 31, 2007 but is subject to automatic renewal for one-year periods unless either party provides 60 days' prior written notice that the employment term shall not be extended. Pursuant to that employment agreement, Mr. Tveter is entitled to:

- •

- an annual base salary of $500,000 plus an annual bonus of up to $500,000 in cash or stock dependent on his meeting various targets set by the Board;

- •

- 100,000 fully vested options and 400,000 options vesting in arrears, subject to ratable acceleration upon the satisfaction of performance goals measured annually over a five-year period, at an exercise price of $13.70 per share (subject to adjustment in certain circumstances);

- •

- options to purchase 100,000 shares of common stock at an exercise price of $0.01 per share, 25,000 of which vested at December 31, 2004 and the remaining 75,000 will vest in arrears, subject to ratable acceleration upon the satisfaction of performance goals measured annually over a three-year period, to be held in escrow by us until the earlier of the one-year anniversary of the final vesting date and the date of the termination of his employment;

- •

- expatriate benefits, including housing, transportation and education allowances and tax-equalization benefits; and

- •

- one-year's salary and benefits, and a bonus for any completed year in the event that he terminates his employment for good reason or Telewest terminates his employment without cause.

19

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Our Compensation Committee determines the compensation of the Company's executive officers and certain other members of senior management and oversees the administration of our incentive compensation (including equity compensation) programs. During 2004, the Compensation Committee met four times and its members were William J. Connors, John H. Duerden and Donald S. La Vigne.

Executive Compensation Philosophy

The Compensation Committee has established an executive compensation philosophy that provides executive officers and certain other members of senior management with a combination of cash and equity based benefits in order to:

- •

- attract, motivate, reward and retain highly talented executives by providing them with compensation packages that are competitive with the Company's peers;

- •

- link management rewards directly to the achievement of high levels of individual, operational and financial performance through the establishment of short-term and long-term performance goals; and

- •

- align the interests of our executive officers and certain other members of senior management with those of our stockholders by tying compensation to the performance of our common stock through awards of stock-based compensation.

In furtherance of this philosophy, the Compensation Committee intends to evaluate each year the components of our executive compensation program and the individual performance of our executive officers.

Principal Elements of Executive Compensation

The principal elements of our executive compensation program are base salary, annual bonuses and long-term equity compensation. We also generally provide our employees (including our executive officers) with medical, pension and other benefits. It is the Compensation Committee's policy to set overall compensation at approximately upper quartile levels within a selected group of corporations, comparable by reference to sector, complexity and size. To this end, management obtains survey data from each of Hewitt Bacon & Woodrow, and Towers Perrin and presents that data to the Compensation Committee. The Compensation Committee retains the discretion to provide greater or lesser levels of compensation if it determines that doing so is in the best interests of the Company and its stockholders.

Base salary

The Compensation Committee has set base salaries for the Company's executive officers based on its review of peer survey data and individual skills, performance and background. The Compensation Committee intends to review salaries at least annually.

Annual bonus

The Company maintains an annual bonus program for its employees, including its executive officers. The performance goals for our executive officers' 2004 annual bonuses were based on simple cash flow (defined as EBITDA minus capital expenditures), fault rate and net subscriber additions. These performance goals were established by Telewest Communications prior to the consummation of its financial restructuring, and the Compensation Committee deemed it appropriate to continue this program following the financial restructuring. Based on these goals, our executive officers became entitled to bonuses at 108% of target, which corresponds to approximately 54% of base salary. The

20