UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

ý | Soliciting Material Pursuant to §240.14a-12 |

|

TELEWEST GLOBAL, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

Filed by Telewest Global, Inc.

Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

This filing consists of certain communications made in connection with the announcement of an Agreement and Plan of Merger among Telwest Global, Inc., NTL Incorporated and Merger Sub Inc., dated as of October 2, 2005, which were included in an issue of “the facts”, an internal publication for employees.

2

Searchable text section of graphics shown above

[GRAPHIC]

[LOGO]

THE facts

[GRAPHIC]

THE facts

It’s the start of a new era...

[GRAPHIC]

KEY POINTS

ntl and Telewest have agreed a framework to combine our two businesses.

The combined company will offer broadband, TV and telephony services to more than 12 million homes and provide consistent products and services for business and wholesale customers across the UK.

The agreement still needs to be approved by our shareholders and we have several months of work ahead to satisfy various regulatory, legal and other conditions before the deal can be closed.

Until then, ntl and Telewest will remain two separate companies and it’s business as usual for all of us.

[GRAPHIC]

Dear everyone,

The agreement to bring together ntl and Telewest is the start of a new era for cable in the UK. Finally, we’ll be able to combine all the franchises and operations that were created so many years ago. And, for the first time in cable’s history, we’ll be able to compete on more equal terms with the likes of BT and Sky.

We now start what could be several months of working through various legal, regulatory and other conditions that have to be satisfied before we can close the deal and become one company. We’ll also plan in detail how we’ll bring the companies together.

However, until the deal is closed, ntl and Telewest are separate companies and it’s important that we stay focused on our customers and our usual day-to-day activities.

I know the next few months will bring uncertainty for many of you and I understand it’s only natural to wonder what all this will mean for your job. However, while we will do our best to respond to as many of your questions as soon as we can, in reality it will probably be some time before we can provide specific answers.

Although we are committed to keeping you updated on key decisions as they emerge, you will nevertheless probably see journalists speculating and giving their own opinions in the coming weeks and months. But opinion and speculation are not the same as fact. And you’ll get the facts from us as we progress over the next few months.

We aim to create the UK’s premier entertainment and communications company offering broadband, digital TV and telephony services to more than half the UK population.

We will build on the relationships that already exist between us. With almost five million customers between us, both ntl and Telewest are already well-known and successful companies in our own rights.

Together, we are stronger.

Best regards,

Simon Duffy

Chief Executive, ntl

2

Together Stronger

[GRAPHIC]

[GRAPHIC]

Dear everyone,

I am confident that bringing ntl and Telewest together is a great opportunity for our colleagues, customers and shareholders.

This transaction will create one of the UK’s leading entertainment, information and communication companies with unrivalled expertise and an appetite for growth, service excellence and employee engagement.

I believe that, as a result, we will be able to challenge our main competitors as never before – focusing our energies on developing new products and services, driving change within our industry and shaping the markets in which we operate.

Together we are stronger. This is not simply a question of adding two companies together, but an opportunity to create a new one, with a new future – drawing on the best of both.

However, we must stay focused on our customers and not be distracted. Until the transaction is completed, we will continue to operate as separate companies.

It will continue to be business as usual and our relentless focus on enhancing the customer experience will create a solid platform from which the new company can build.

I think that we can be rightly proud of our achievements over the past few years. Both ntl and Telewest have come through challenging periods and emerged as healthy companies at the forefront of the communications sector in the UK.

They complement each other in many respects and both bring huge amounts of value to this transaction.

Your ongoing commitment is critical to our future success; we value your loyalty and welcome your positive contribution.

Together, we are stronger.

Best regards,

Cob Stenham

Chairman, Telewest

CONTENTS

3

So… what happens next?

ntl and Telewest have agreed a framework to combine our two businesses but the agreement is subject to shareholder approval and there are various important legal, regulatory and other conditions that have to be satisfied before the deal can be closed.

It’s impossible to tell how long this might take. And until all the conditions are satisfied and the deal is closed, ntl and Telewest will remain two separate companies.

Does this mean something could happen to stop the companies coming together? Well yes, in theory. We hope it won’t but there are a lot of things to be worked through in the coming months so it’s not 100 per cent certain that everything will go as planned.

THE REGULATORY PART OF THE PROCESS

We’ve formally submitted detailed information about the deal and about both companies to the Office of Fair Trading (OFT).The OFT can approve the transaction or refer it to the Competition Commission for a more detailed investigation.

Both organisations are interested in the amount of competition in the market. So the OFT will refer us if it feels the deal might reduce competition. We don’t believe it will. Telewest and ntl operate in different franchise areas and there isn’t a single household in the country that is connected to the networks of both companies.

‘Until all the conditions are satisfied... we will remain two separate companies’

4

How two can become one

KEY POINTS

A team of people drawn from both ntl and Telewest will start planning how we’ll bring the companies together when the deal closes.

We won’t do things ‘the ntl way’ or ‘the Telewest way’. This is an opportunity not just to get the best from both companies but also to see whether we can improve on current best practice. We’ll make the best decisions for the company, our customers and our people.

With so much detailed planning work to be done, it’s too early to answer many of the questions you’ll probably have about the network, products, systems, office locations and, of course, jobs. We’ve set out some of the key questions below, but at this stage the answer to many of them, unfortunately, is ‘we don’t know yet’.

What will the company be called?

It’s too early to say yet. This is one of the things we’ll be looking at.

Who will lead the combined company?

Under the terms of the agreement, we have so far announced the following appointments to the leadership team, which we intend to take effect when the deal closes:

Chairman

Jim Mooney (ntl)

Deputy Chairman

Cob Stenham (Telewest)

Chief Executive Officer (CEO)

Simon Duffy (ntl)

Chief Operating Officer (COO)

Neil Berkett (new)

Chief Financial Officer (CFO)

Jacques Kerrest (ntl)

Deputy CFO

Neil Smith (Telewest)

Chief Technology Officer (CTO)

Howard Watson (Telewest)

Managing Director, Networks

Steve Upton (ntl)

Chief Information Officer (CIO)

Mike Riddle (new)

These appointments will not take effect until the deal is closed. Until then, we are still separate companies and there is no change to our existing senior management teams.

5

Where will the head office be?

It’s too early to say yet. Currently ntl is based in Hook, Hampshire and Telewest is based in Woking, Surrey, and at Great Portland Street, London.

Will we combine call centres or buildings between the two companies?

That’s another area where it’s too early to be precise, but it is quite likely that there will be some rationalisation.

Will we have a single set of products and prices?

Yes. Ultimately we want a common set of services and prices for all our customers.

What will happen where both companies are currently developing similar products – such as video on demand?

In some cases, we’re already working together on similar products as separate companies and we’ll continue to do so.

How will we integrate the ntl and Telewest networks?

That is an issue both network teams will examine carefully over the next few months.

Will we have a single billing and customer management system?

We are addressing this issue. We would like to move to a single system and we are working towards a goal of making our billing systems more efficient.

Are there instances where ntl has outsourced parts of its business that Telewest is still handling itself, and vice versa? What will happen in these cases?

Yes, there are instances of both these scenarios. We will be open-minded in considering how we should move forward in each case.

Will we start seeing more national advertising and high profile marketing when the two companies are brought together?

Probably. As a single company with a bigger network range, it would become more cost effective.

‘Ultimately, we want a common set of services and prices for all our customers’

6

What will the papers say?

ntl and Telewest are both very successful companies in their own right. We provide not just entertainment services, such as the night’s viewing of Coronation Street, calling up a pizza delivery and sharing holiday photos with friends by email but also access to emergency services in a crisis, education facilities for our youngsters, vital communications links for Government departments and highly efficient networks for other large internet service providers.

There has been speculation in the press about ntl and Telewest coming together for probably as long as any of us can remember. So now we’ve announced this agreement, we can expect lots of media attention as we move forward.

There will be news stories about announcements we make, interviews, features and profiles. You will probably see journalists commenting and giving their opinion about the deal and speculating about how we might bring the two companies together or make financial savings.

Remember to keep what you read in perspective. There is a difference between rumour, speculation and fact. Journalists do their best but they don’t always have all the facts. Whenever there is any new factual information that we’re able to share, we will share it with you ourselves.

“I read about the news in the press before I heard from the company. Why?”

The press were guessing we were about to announce over the weekend before we actually made the announcement at 9am on Monday 3 October. But the response from both companies to any questions during that time was a simple ‘no comment’.

We announced the agreement to employees, the media and the financial markets at exactly the same time on Monday morning. Because ntl and Telewest are public companies, we’re not legally allowed to communicate to staff before we send out the press release. But we always make important announcements at exactly the same time inside and outside the company.

We used several different ways of communicating the news to reach people as quickly as we could, including face-to-face briefings, emails, the intranet, text messages, a recorded voicemail message left for field-based staff and letters to people on maternity, adoption or long-term sick leave.

7

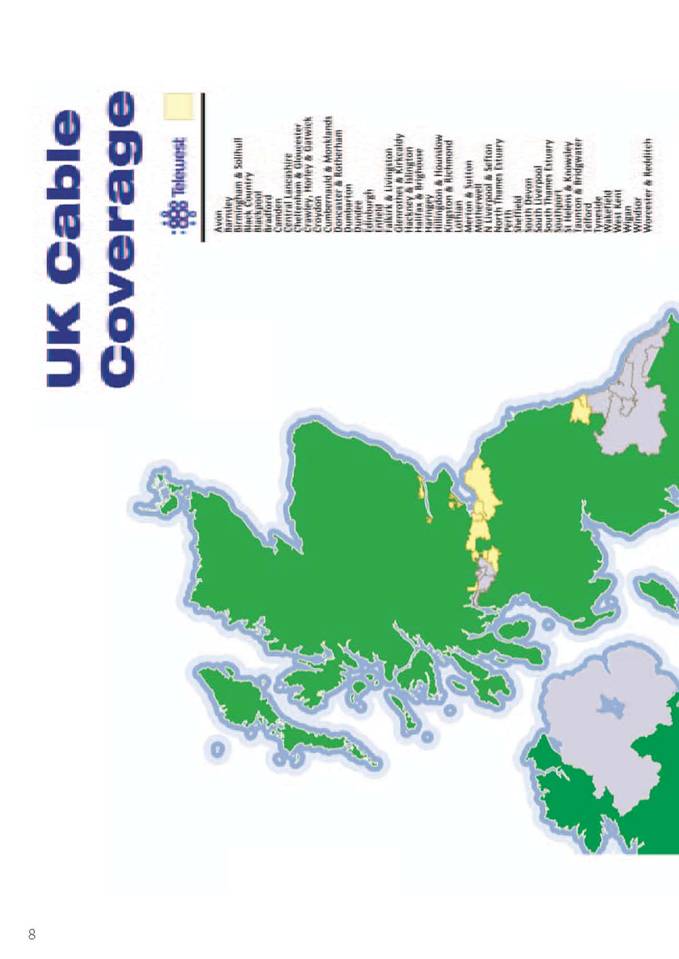

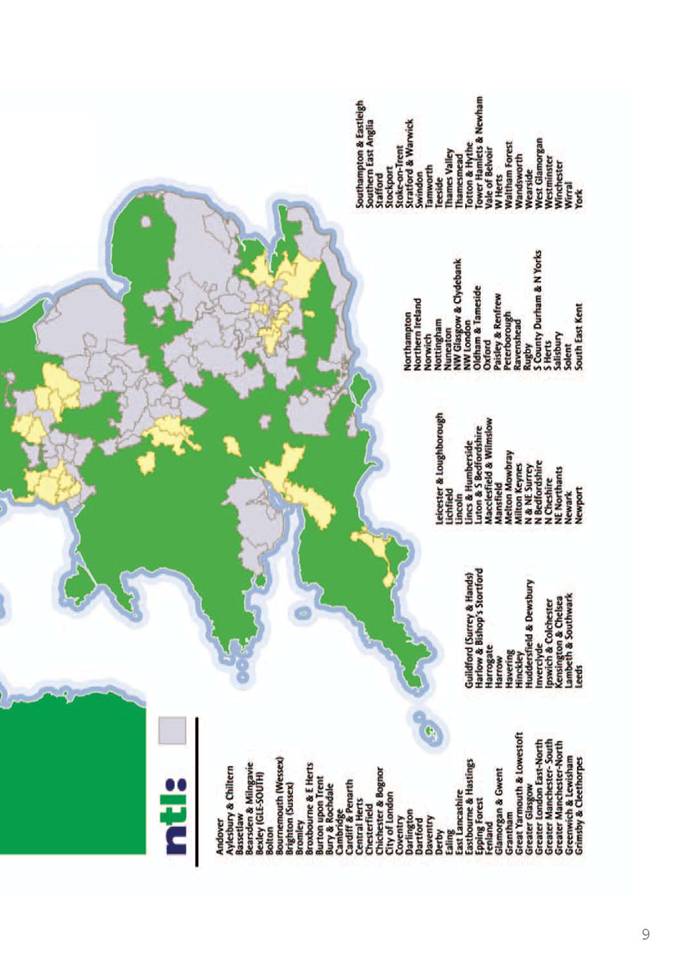

UK cable coverage

[GRAPHIC]

8

A UK success story

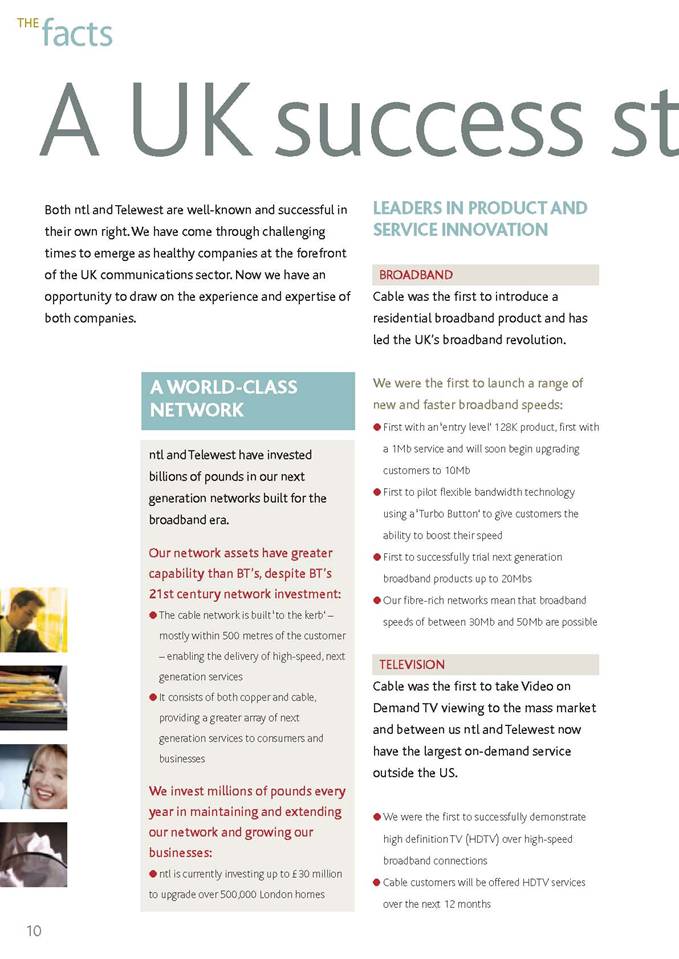

Both ntl and Telewest are well-known and successful in their own right. We have come through challenging times to emerge as healthy companies at the forefront of the UK communications sector. Now we have an opportunity to draw on the experience and expertise of both companies.

A WORLD-CLASS NETWORK

ntl and Telewest have invested billions of pounds in our next generation networks built for the broadband era.

Our network assets have greater capability than BT’s, despite BT’s 21st century network investment:

• The cable network is built ‘to the kerb’ – mostly within 500 metres of the customer – enabling the delivery of high-speed, next generation services

• It consists of both copper and cable, providing a greater array of next generation services to consumers and businesses

We invest millions of pounds every year in maintaining and extending our network and growing our businesses:

• ntl is currently investing up to £30 million to upgrade over 500,000 London homes

LEADERS IN PRODUCT AND SERVICE INNOVATION

BROADBAND

Cable was the first to introduce a residential broadband product and has led the UK’s broadband revolution.

We were the first to launch a range of new and faster broadband speeds:

• First with an ‘entry level’ 128K product, first with a 1Mb service and will soon begin upgrading customers to 10Mb

• First to pilot flexible bandwidth technology using a ‘Turbo Button’ to give customers the ability to boost their speed

• First to successfully trial next generation broadband products up to 20Mbs

• Our fibre-rich networks mean that broadband speeds of between 30Mb and 50Mb are possible

TELEVISION

Cable was the first to take Video on Demand TV viewing to the mass market and between us ntl and Telewest now have the largest on-demand service outside the US.

• We were the first to successfully demonstrate high definition TV (HDTV) over high-speed broadband connections

• Cable customers will be offered HDTV services over the next 12 months

10

TELEPHONE

Cable pioneered free calling options (free cable to cable calls) and customer choice.

• We led the way in packaging telephony by offering a wide range of options including unlimited 24/7, unlimited weekend and evening call packages and international calling plans to cut the cost of calling abroad

MAKING THE DIFFERENCE IN THE COMMUNITY

We build networks for local communities. We’re successfully delivering:

• A broadband community network in Cambridgeshire linking more than 300 council buildings

• Content delivery network for the Scottish Executive linking over 3,000 schools in Scotland

• Learning grid in Hertfordshire reaching almost 600 schools

• Interactive network in Shoreditch, London, delivering education, entertainment, information and community support to all households

We support community initiatives across the country including:

• Providing broadband, PC equipment and internet services for community groups and charities including Wokingham’s Centre for Parents and the Norwich Schools’ Newspaper awards

• Supporting learning skills to improve IT and internet literacy among the over 50s

• Supporting Peterborough City Council’s ‘reading voyage’ initiative – encouraging school children to read six books in six weeks during their summer holidays

• Promoting healthy living with Scotland’s Health at Work initiative

• Helping West Midlands Police to improve communications within the force. This gives officers and support staff high speed access to network applications that are critical to its day-to-day operations

• Working with West Midlands Fire to introduce a high-speed communications network to connect fire stations across the region. The move provides critical support to help the service cover the region’s 2.5 million people

We have made a proactive commitment to combat child abuse online and make the internet safer by design, by:

• Working with the Internet Watch foundation and blocking access to all child abuse image newsgroups

• Investing in systems designed to prevent and detect internet fraud

• Offering customers free internet security and increased protection from spam, email-borne and website-based viruses, and other malicious messaging attacks

11

How we’ll shape up together

A STRONG COMBINATION

The combined company will offer broadband, TV and telephony services to more than 12.5 million homes across the U.K. We will be the country’s second largest communications company and its triple-play champion, reaching more than 50 per cent of UK households through our cable network. We would be in the FTSE 100 if we were listed on the London Stock Exchange.

A GREAT FUTURE FOR OUR CUSTOMERS

Between us, ntl and Telewest have nearly five million customers – and we can offer them an exciting future. Thanks to our high bandwidth network, we can deliver next generation products like high definition TV and ultra highspeed broadband through a single cable into the home. In the future, you’ll be able play online games globally, as well as choose from hundreds of TV channels and listen to radio stations from around the world on the net. Video conferencing will move out of the office and into the home, so you can see your family while you talk to them. Video emailing to friends, using home security products through the TV, working from home with full business-like internet support services – all this will be as commonplace as calling other local cable customers for free, like we do today.

[GRAPHIC]

[GRAPHIC]

A great offering for business and residential customers... a Telewest customer carries out a spot of TV banking (left), while the Heathrow Terminal 5 development is a high-profile business project for ntl.

12

ntl: AT A GLANCE | | TELEWEST: AT A GLANCE |

| | |

THE NUMBERS | | THE NUMBERS |

| | |

• The UK’s largest cable operator and its leading provider of broadband services • Around 3.3 million residential telephone, TV and internet customers, taking six million services • Available to 34% of the UK • Invested £9 billion in the UK’s largest privately-funded network for the broadband era • Core network is more than 10,800 kilometres long • The UK’s largest consumer broadband provider with more than 1.6 million subscribers • Business division provides voice, data and managed solutions to businesses, public sector organisations and wholesale customers, including Heathrow Terminal 5, Hertfordshire County Council, Tesco and Orange. | | • The UK’s second largest cable operator and its fourth largest provider of broadband services • More than 1.8 million residential telephone, TV and internet customers, taking 3.8 million services • Available to 20% of the UK • Invested over £4 billion in its network • Business division supplies voice and data communication products to the public and private sector markets • Content division, Flextech, has six wholly-owned TV channels and three free-to-air channels. It is the BBC’s partner in UK TV. Together, they are the largest supplier of basic channels to the UK pay television market. |

| | |

THE PRODUCTS | | THE PRODUCTS |

| | |

• BROADBAND

3Mb; 2Mb; 1Mb

Coming soon: 10Mb as standard • TELEPHONE

Talk Unlimited 24: free UK, national calls 24/7

Phone & surf: unlimited 24 hour internet surfing and free national off peak calls

Talk Unlimited: free off peak local and national calls

Talk Unlimited Local: free off peak local calls

5p Talk Plan: Local and national evening and weekend calls for 5p for the first 60 minutes • TELEVISION

Family pack: over 150 Digital TV and radio channels

Base pack: over 100 Digital TV and radio channels

Select pack: over 35 channels | | • BROADBAND

10Mb Broadband Elite; 4Mb Broadband Complete;

2Mb Broadband • TELEPHONE

Talk Unlimited: Unlimited local and national calls anytime

Talk Evening and Weekends: Unlimited local and national weekend and evening calls

Talk Weekends: Unlimited local and national weekend calls • TELEVISION

Supreme: Over 100 channels including 15 most watched

Essential: Over 70 channels including 15 most watched

Starter: Over 35 channels including five of the most watched |

13

What this means for you

REMEMBER...

It’s business as usual for now

We have a lot of work ahead of us before the deal can be closed. It could take months.

Expect plenty of press coverage

Journalists may speculate or give their own opinions about how we’ll bring the companies together. But speculation and opinion are different from fact. You’ll get the facts from us.

What do I need to do differently?

Absolutely nothing at all. Until the deal is closed we are still two separate companies and nothing will change. It’s business as usual.

Will my job be safe when we become one company?

It’s far too early to be sure how we would combine the two companies. It’s only human to feel uncertain about it but it’s important to keep things in perspective. This is not like merging two banks which have branches on the same high street. ntl and Telewest serve different franchise areas. And a strong, highprofile business that wants to offer the best products in the market will need skilled, professional people to succeed.

But we must want to make financial savings by bringing both companies together?

Yes, we do, and we should acknowledge there may be fewer jobs in some areas. There will also be opportunities as we grow the business.

14

Assuming it goes ahead, how will I benefit?

You’ll become part of an exciting, high-profile business with the career opportunities and investment in development and training you’d expect from such a major employer.

What does this mean for my bonus?

There’s no change to the 2005 bonus scheme. The targets will remain the same and, assuming we meet them, payments will be made as planned. Beyond that, it’s too early to say yet.

What does it mean for my company pension?

At present, there is no change to your pension arrangements. If there are plans to change this at any stage in the future we would of course follow the proper consultation process.

Will my terms and conditions change?

It’s too early to say yet. We review and benchmark our terms and conditions every year in any case to make sure they are competitive in the industry and we’d certainly want them to stay competitive in the future.

I own ntl/Telewest shares. What will happen to them?

If you own any Telewest shares, you will need to wait for communication from Telewest at the appropriate time. If you own ntl shares, there is no change.

Will we have a new employee offer including discounted products in each other’s franchise areas?

It’s too soon to say yet, but it’s something we’ll be looking into.

‘A strong, high-profile business will need skilled, professional people to succeed’

15

[LOGO]

THE facts

If you have any questions about the

information in this publication – or any

other aspect of the deal – please speak

to your line manager.

Alternatively, ntl employees can email

ntltelewest.questions@ntl.com and

Telewest employees can email

questions@telewest.co.uk

Don’t forget to keep checking the

intranet for the latest updates.

ADDITIONAL NOTICES: As you know, both ntl Incorporated (“ntl”) and Telewest Global, Inc. (“Telewest”) are US companies with securities listed on Nasdaq. As such, United States securities laws require us to include the following additional notices in these materials.

ADDITIONAL INFORMATION AND WHERE TO FIND IT: This information may be deemed to be solicitation material in respect of the proposed merger of ntl Incorporated (“ntl”) and Telewest Global, Inc. (“Telewest”). In connection with the proposed merger, ntl and Telewest will file a joint proxy statement / prospectus with the U.S. Securities and Exchange Commission (the “SEC”). INVESTORS AND SECURITY HOLDERS OF ntl AND TELEWEST ARE ADVISED TO READ THE JOINT PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final joint proxy statement / prospectus will be mailed to stockholders of ntl and Telewest. Investors and security holders may obtain a free copy of the joint proxy statement / prospectus, when it becomes available, and other documents filed by Ntl and Telewest with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the joint proxy statement / prospectus, when it becomes available, and each company’s other filings with the SEC may also be obtained from the respective companies. Free copies of Ntl’s filings may be obtained by directing a request to Ntl Incorporated, 909 Third Avenue, Suite 2863, New York, New York 10022, Attention: Investor Relations. Free copies of Telewest’s filings may be obtained by directing a request to Telewest Global, Inc., 160 Great Portland Street, London W1W 5QA, United Kingdom, Attention: Investor Relations. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, not shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

PARTICIPANTS IN THE SOLICITATION: ntl, Telewest and their respective directors, executive officers and other members of their management and employees may be deemed to be soliciting proxies from their respective stockholders in favour of the merger. Information regarding ntl’s directors and executive officers is available in ntl’s proxy statement for its 2005 annual meeting of stockholders, which was filed with the SEC on April 5, 2005. Information regarding Telewest’s directors and executive officers is available in Telewest’s proxy statement for its 2005 annual meeting of stockholders, while was filed with the SEC on April 11, 2005. Additional information regarding the interests of such potential participants will be included in the joint proxy statement / prospectus and the other relevant documents filed with the SEC when they become available.

FORWARD LOOKING STATEMENTS: This information may contain certain statements regarding the proposed transaction between ntl and Telewest, benefits and synergies of the transaction, future opportunities for the combined company and products and other statements regarding Telewest’s or Ntl’s future expectations, beliefs, goals or prospects. Such statements constitute forward-looking statements as that term is defined in the U.S. Private Securities Litigation Reform Act of 1995. When used in this document, the words “believe”, “anticipate”, “should”, “intend”, “plan”, “will”, “expects”, “estimates”, “projects”, “positioned”, “strategy”, and similar expressions or statements that are not historical facts, in each case as they relate to ntl and Telewest, the management of either such company or the proposed transaction, are intended to identify those expressions or statements as forward-looking statements. In addition to the risks and uncertainties noted in this document, there are certain factors, risks and uncertainties that could cause actual results to differ materially from those anticipated by some of the statements made, many of which are beyond the control of ntl and Telewest. These include: (1) the failure to obtain and retain expected synergies from the proposed transaction, (2) rates of success in executing, managing and integrating key acquisitions, including the proposed acquisition, (3) the ability to achieve business plans for the combined company, (4) the ability to manage and maintain key customer relationships, (5) delays in obtaining, or adverse conditions contained in, any regulatory or third-party approvals in connection with the proposed acquisition, (6) availability and cost of capital, (7) the ability to manage regulatory, tax and legal matters, and to resolve pending matters within current estimates, (8) other similar factors, and (9) the risk factors summarized and explained in our Form 10-K. For additional information concerning factors that could cause actual results to materially differ from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.