UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

ý | Soliciting Material Pursuant to §240.14a-12 |

|

TELEWEST GLOBAL, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

Filed by Telewest Global, Inc.

Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

This filing consists of certain communications made in connection with the announcement of an Agreement and Plan of Merger among Telwest Global, Inc., NTL Incorporated and Merger Sub Inc., dated as of October 2, 2005.

| �� | Tuesday 8 November 2005

Telewest managers G1+

This announcement will be sent

to all Telewest colleagues in 24

hours

Please find attached a PowerPoint

presentation for use in team

meetings and briefings |

| | Quick link

Merger News Oneline |

Dear colleague

It has now been a month since we announced our plans to combine ntl & Telewest to create the UK’s second largest communications company and leading triple play service provider.

Each month we will provide an update to cover:

• progress in the merger planning process

• key developments and milestones

• specific issues and questions that have arisen

These monthly updates will also contain links to Oneline where you will find additional information.

We may not be able to answer all of your questions but we are committed to making information available as soon as decisions have been made – either through ‘THE facts’ monthly email merger update or through interim email announcements.

Progress in the last month

The week after we announced the proposed merger we held a management conference for around 180 senior leaders from both organisations.

The purpose of this conference was to bring together the leaders of both businesses for the first time, to outline how the merger planning process will work and how we will work together to achieve a successful integration.

There has been a great deal of work done over the last month to agree how we will bring our two businesses together to achieve the targets we have set ourselves. We have made a fast start and it is

important that we maintain that momentum.

The merger planning process

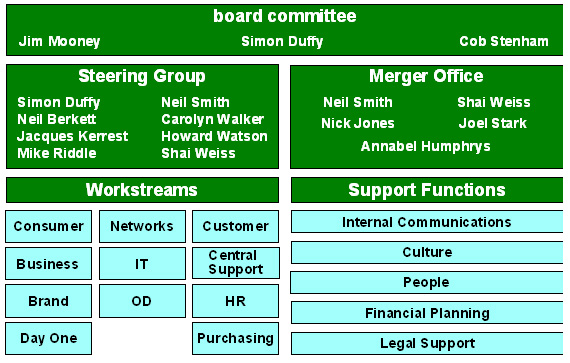

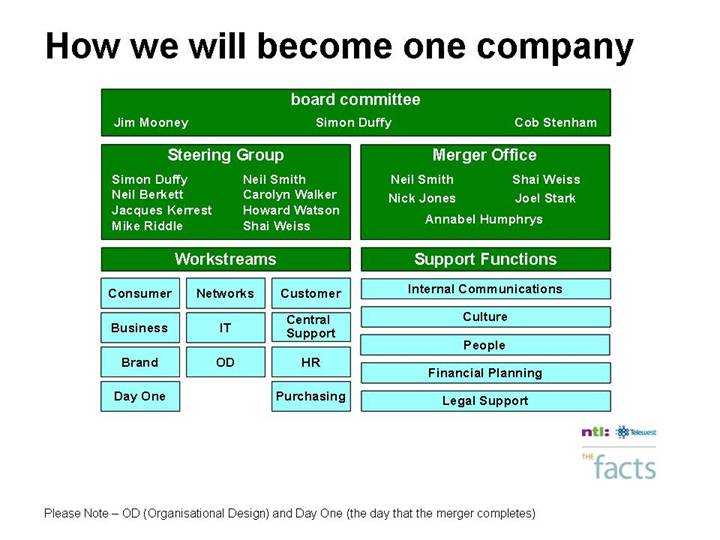

Telewest and ntl are large, complex businesses and bringing them together successfully is a complex task. We have set up teams with representatives from both organisations to lead this process at every level.

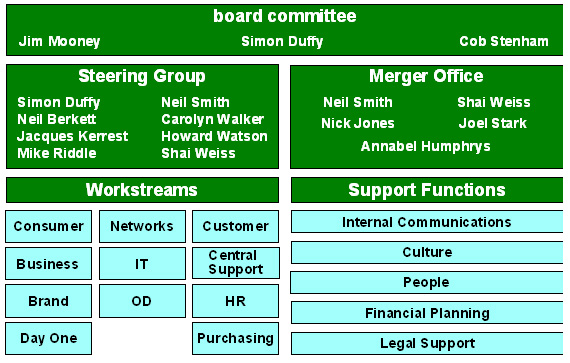

The project will be overseen by the Steering Group and board committee. As well as high level guidance the Steering Group will have a particular focus on the major strategic decisions required through the integration process.

On a day-to-day basis the programme will be overseen by the Merger Office. This is led by Neil Smith from Telewest and Shai Weiss from ntl. It has responsibility for the overall planning and delivery of the project and will provide coordination to ensure that the best interests of our customers and businesses are fully represented at all times.

Workstreams have been set up to manage the more detailed integration planning process for key areas of our businesses. Each workstream has been allocated Sponsors and Leaders. Workstream Sponsors are responsible for guiding the workstream activity and ensuring that overall progress is in line with the project schedule. Workstream Leaders coordinate work on a day-to- day basis.

We held a Workstream Leaders’ meeting on 1 November. More details on the workstreams, the Sponsors and Leaders can be found on Oneline.

The diagram below shows the project management structure.

Guiding principles

During the merger planning process we will work to the following guiding principles:

• Stay focused on the customer at all times

• Give cultural issues a high priority

• Decide senior team early to provide clarity

• Base all decisions on the facts

• Continue to meet high operational standards

• Prioritise projects needed to create the new company

• Co-ordinate, manage and monitor the planning process tightly

• Communicate comprehensively throughout

Senior appointments

We will continue to work towards identifying the new senior team as quickly as possible, so that there is clarity about the structure and leadership at the top of the new organisation.

The process by which we will identify the senior team for the new company will be rigorous and fair, ensuring that we identify the best person.

Next steps

Within the next few weeks, we will issue a Proxy Statement to all current ntl and Telewest stockholders. The Proxy Statement is a

comprehensive document which invites stockholders to two stockholders meetings held separately by ntl and Telewest, where they will be asked to approve the proposed merger.

The document will contain detailed financial and background information about both companies and will set out the reasons the two companies would like to merge and why we recommend stockholders vote to approve the agreement.

Questions and Answers

Finally, we wanted to mention some of the main issues people have raised through the questions email accounts within both businesses. The full list of Q&A can be found here.

1. Organisational structures, office closures, potential redundancies

All we can say at this stage is that it will probably be quite some time before we can give this kind of detail. The workstreams will need to work through the detail in the next few months. We understand the level of uncertainty people are feeling and as soon as we have taken decisions that we can share, we will communicate them clearly. You will get the facts from us.

2. Merger or acquisition?

What is important is how we work together to create the combined company.

This is an opportunity to build on the best of both companies, and the workstreams are made up of both ntl and Telewest people to work collaboratively in developing our goals, structures, systems and processes.

3. The kind of information that can be shared between the two companies

ntl and Telewest are still two separate companies and we must keep working as two separate companies. More specific legal guidelines have been issued to everyone working on the 11 workstreams. If you have a specific question, please ask separately so that we can follow it up with the legal teams.

And finally…

It’s very important to remember that for now, absolutely nothing has changed — ntl and Telewest are two separate companies. We will stay separate companies until the deal closes — and that could be several months away.

Until that point, there is no change for any of us. There is no change for our customers either. It’s important that we stay focused on customer service and that we stay focused on meeting our targets so that both businesses have a solid platform from which to build the new company.

There are tight restrictions on what we can communicate until the deal is closed but we will give you the facts as and when decisions are made and we have information that we can share.

Thank you for your continued support.

The Merger Office

Forward Looking Statements

Certain statements in this communication regarding the proposed transaction between NTL Incorporated (“ntl”) and Telewest, Inc. (“Telewest”), the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Telewest’s or ntl’s future expectations, beliefs, goals or prospects constitute forward-looking statements as that term is defined in the U.S. Private Securities Litigation Reform Act of 1995. When used in this document, the words “believe”, “anticipate”, “should”, “intend”, “plan”, “will”, “expects”, “estimates”, “projects”, “positioned”, “strategy”, and similar expressions or statements that are not historical facts, in each case as they relate to ntl and Telewest, the management of either such company or the proposed transaction, are intended to identify those expressions or statements as forward-looking statements. In addition to the risks and uncertainties noted in this document, there are certain factors, risks and uncertainties that could cause actual results to differ materially from those anticipated by some of the statements made, many of which are beyond the control of ntl and Telewest. These include: (1) the failure to obtain and retain expected synergies from the proposed transaction, (2) rates of success in executing, managing and integrating key acquisitions, including the proposed acquisition, (3) the ability to achieve business plans for the combined company, (4) the ability to manage and maintain key customer relationships, (5) delays in obtaining, or adverse conditions contained in, any regulatory or third-party approvals in connection with the proposed acquisition, (6) availability and cost of capital, (7) the ability to manage regulatory, tax and legal matters, and to resolve pending matters within current estimates, (8) other similar factors, and (9) the risk factors summarized and explained in our Form 10-K. For additional information concerning factors that could cause actual results to materially differ from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

Additional Information and Where to Find it

This filing may be deemed to be solicitation material in respect of the proposed merger of ntl and Telewest. In connection with the proposed merger, ntl and Telewest will file a joint proxy statement / prospectus with the U.S. Securities and Exchange Commission (the “SEC”). INVESTORS AND SECURITY HOLDERS OF NTL AND TELEWEST ARE ADVISED TO READ THE JOINT PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final joint proxy statement / prospectus will be mailed to stockholders of ntl and Telewest. Investors and security holders may obtain a free copy of the joint proxy statement / prospectus, when it becomes available, and other documents filed by ntl and Telewest with the SEC, at the SEC’s web site at http://www.sec.gov.

Free copies of the joint proxy statement / prospectus, when it becomes available, and each company’s other filings with the SEC may also be obtained from the respective companies. Free copies of Telewest’s filings may be obtained by directing a request to Telewest Global, Inc., 160 Great Portland Street, London W1W 5QA, United Kingdom, Attention: Investor Relations.

Participants in the Solicitation

ntl, Telewest and their respective directors, executive officers and other members of their management and employees may be deemed to be soliciting proxies from their respective stockholders in favour of the merger. Information regarding ntl’s directors and executive officers is available in ntl’s proxy statement for its 2005 annual meeting of stockholders, which was filed with the SEC on April 5, 2005. Information regarding Telewest’s directors and executive officers is available in Telewest’s proxy statement for its 2005 annual meeting of stockholders, while was filed with the SEC on April 11, 2005. Additional information regarding the interests of such potential participants will be included in the joint proxy statement

Who is leading the work to plan how the ntl & Telewest businesses will be combined after the deal closes?

The project will be overseen by the Steering Group and board committee. These groups will give high level guidance and will have a particular focus on the major strategic decisions required through the integration process.

On a day-to-day basis the programme will be overseen by the Merger Office. This is led by Neil Smith from Telewest and Shai Weiss from ntl. It has responsibility for the overall planning and delivery of the project and will provide coordination to ensure that the best interests of our customers and businesses are fully represented at all times.

Workstreams have been set up to manage the more detailed integration planning process for key areas of our businesses. Each workstream has been allocated Sponsors and Leaders. Workstream Sponsors are responsible for guiding the workstream activity and ensuring that overall progress is in line with the project schedule. Workstream Leaders coordinate work on a day-to-day basis.

Click HERE to see the members of the Steering Group, board committee, and Workstreams

How long will it take to merge?

Some things can happen relatively quickly, for example merging intranet sites. However, there are some things that may take up to two years. These include large projects in IT and Networks, which require serious investment but also provide the foundation for the future growth of the company. The Merger Office is carefully assessing timing implications for various workstreams and generally to ensure that all merger-related efforts are well coordinated.

How should current work programmes take account of the likely merger?

Current work programmes should continue irrespective of the merger, unless you are advised otherwise. ntl and Telewest are two separate companies. As long as the transaction goes ahead as planned, when the deal closes we would look to remove duplicated projects and focus our resources to speed up development times.

Do we have an optimum size for the new company?

No, although clearly we will have growth targets and will need to continue to give our shareholders the returns they expect from the combined company, and to continue giving our customers a high quality of service.

Have Telewest been undergoing internal restructuring like ntl to make the merger simpler?

ntl has changed various parts of its structure over a number of years to work more effectively and efficiently. However, there has not been any restructuring with the specific intention of ‘making the merger simpler.’ With regard to the similarity or difference of structures between the two companies, ntl and Telewest are structured fairly similarly already and we share a common history. Both firms have been through numerous integrations before and both have been through financial restructurings. The single biggest difference is that ntl has COBI, whereas in Telewest the customer-facing divisions are more dispersed.

Can we have guidance on what conversations we can have with Telewest and what information we can share?

Our relationship with Telewest has not changed. We remain separate companies and we should not share any information that we would not usually share in the course of normal business. If you have any doubts or questions, you should speak to the Legal team.

Is it possible that the deal may not go ahead? If so, why announce it?

The deal is subject to shareholder approval, and there are various regulatory, legal and other conditions that have to be satisfied. ntl and Telewest are both publicly traded on the Nasdaq National Market in the U.S. We are subject to U.S. securities laws and we made the announcement in compliance with these laws.

How will the involvement and consultation forums work across ntl and Telewest to represent associate views?

We already have well-established and successful consultation processes within both companies: the National Information and Consultation forum (NICF) within ntl and TIME within Telewest. The new combined company will want to create a process that draws on the best aspects of both. In developing this, we will work closely with NICF and TIME representatives.

When can we have more details about whether there will be any redundancies or office closures?

All we can say at this stage is that it will probably be quite some time before we can give this kind of detail. The workstreams will need to work through the detail in the next few months. We understand the level of uncertainty people are feeling and as soon as we have taken decisions that we can share, we will communicate them clearly.

What processes will be followed if there are redundancies?

It’s too early to talk about details at this stage, but both companies have historically done their best to treat people fairly, sensitively and objectively. Our priority in any potential redundancy scenario would be to follow the proper consultation process, to help those people affected think through their plans and options and to offer them every support in finding a new role.

Forward Looking Statements

Certain statements in this communication regarding the proposed transaction between NTL Incorporated (“ntl”) and Telewest, Inc. (“Telewest”), the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Telewest’s or ntl’s future expectations, beliefs, goals or prospects constitute forward-looking statements as that term is defined in the U.S. Private Securities Litigation Reform Act of 1995. When used in this document, the words “believe”, “anticipate”, “should”, “intend”, “plan”, “will”, “expects”, “estimates”, “projects”, “positioned”, “strategy”, and similar expressions or statements that are not historical facts, in each case as they relate to ntl and Telewest, the management of either such company or the proposed transaction, are intended to identify those expressions or statements as forward-looking statements. In addition to the risks and uncertainties noted in this document, there are certain factors, risks and uncertainties that could cause actual results to differ materially from those anticipated by some of the statements made, many of which are beyond the control of ntl and Telewest. These include: (1) the failure to obtain and retain expected synergies from the proposed transaction, (2) rates of success in executing, managing and integrating key acquisitions, including the proposed acquisition, (3) the ability to achieve business plans for the combined company, (4) the ability to manage and maintain key customer relationships, (5) delays in obtaining, or adverse conditions contained in, any regulatory or third-party approvals in connection with the proposed acquisition, (6) availability and cost of capital, (7) the ability to manage regulatory, tax and legal matters, and to resolve pending matters within current estimates, (8) other similar factors, and (9) the risk factors summarized and explained in our Form 10-K. For additional information concerning factors that could cause actual results to materially differ from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

Additional Information and Where to Find it

This filing may be deemed to be solicitation material in respect of the proposed merger of ntl and Telewest. In connection with the proposed merger, ntl and Telewest will file a joint proxy statement / prospectus with the U.S. Securities and Exchange Commission (the “SEC”). INVESTORS AND SECURITY HOLDERS OF NTL AND TELEWEST ARE ADVISED TO READ THE JOINT PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final joint proxy statement / prospectus will be mailed to stockholders of ntl and Telewest. Investors and security holders may obtain a free copy of the joint proxy statement / prospectus, when it becomes available, and other documents filed by ntl and Telewest with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the joint proxy statement / prospectus, when it becomes available, and each company’s other filings with the SEC may also be obtained from the respective companies. Free copies of Telewest’s filings may be obtained by directing a request to Telewest Global, Inc., 160 Great Portland Street, London W1W 5QA, United Kingdom, Attention: Investor Relations.

Participants in the Solicitation

ntl, Telewest and their respective directors, executive officers and other members of their management and employees may be deemed to be soliciting proxies from their respective stockholders in favour of the merger. Information regarding ntl’s directors and executive officers is available in ntl’s proxy statement for its 2005 annual meeting of stockholders, which was filed with the SEC on April 5, 2005. Information regarding Telewest’s directors and executive officers is available in Telewest’s proxy statement for its 2005 annual meeting of stockholders, while was filed with the SEC on April 11, 2005. Additional information regarding the interests of such potential participants will be included in the joint proxy statement

Searchable text section of graphics shown above

Monthly Merger Update

November 05

Briefing Presentation

[LOGO]

Progress so far

• Proposed merger announced on 3 October

• Senior leadership conference held on 10 October with 180 attendees, from both businesses

• Teams in place to plan how we will combine the two companies

• ‘THE facts’ magazine distributed to all colleagues

How we will become one company

| board committee | |

Jim Mooney | Simon Duffy | Cob Stenham |

Steering Group | | Merger Office |

Simon Duffy | Neil Smith | | Neil Smith | Shai Weiss |

Neil Berkett | Carolyn Walker | | Nick Jones | Joel Stark |

Jacques Kerrest | Howard Watson | | Annabel Humphrys |

Mike Riddle | Shai Weiss | | |

Workstreams | | Support Functions |

| | |

Consumer | Networks | Customer | | Internal Communications

Culture

People

Financial Planning

Legal Support |

| | | |

Business | IT | Central

Support | |

| | | |

Brand | OD | HR | |

| | | |

Day One | | Purchasing | |

Please Note – OD (Organisational Design) and Day One (the day that the merger completes)

Merger Project Objectives

• Develop the goals, structures, processes, systems and culture for the new company

• Plan how and when they will be implemented

• Make sure the plans enable the new company to grow at least at the same rate as ntl and Telewest today – and preferably faster

• Make sure the plans enable us to meet the savings we set out to our stockholders

Merger Project Guiding Principles

• Stay focused on the customer at all times

• Give cultural issues a high priority

• Decide senior team early to provide clarity

• Base all decisions on facts

• Continue to meet high operational standards

• Prioritise projects needed to create the new company

• Co-ordinate, manage and monitor the planning process tightly

• Communicate comprehensively throughout

Senior Appointments

• We will continue to work towards identifying the new senior team as quickly as possible, so that there is clarity about the structure and leadership at the top of the new organisation

• The process by which we will identify the senior team for the new company is under way. The process will be rigorous and fair ensuring that we identify the best person

• Until the merger is completed existing job titles and reporting lines remain unchanged

Plans for the month ahead

• Workstream Leaders build their teams and begin developing their plans as we enter the collaborative working phase

• Proxy statement issued to stockholders of both companies

• Invites stockholders to stockholders’ meeting to approve the deal

• Gives detailed background information about both companies

• Outlines reasons why we recommend that stockholders approve the deal

The main issues you have raised (1)

• When will we know more about structures, locations and impact on jobs?

• Although we are working hard on these issues, it’s too early to say

• when there are decisions made that we can share, we will communicate them. You will get the facts from us

• What process will be followed if there are redundancies?

• It’s too early to talk about details at this stage, but both companies have historically done their best to treat people fairly, sensitively and objectively

The main issues you have raised (2)

• Merger or acquisition?

• What is important is that we work together and get the best from both companies and as such we are approaching this as a merger

• What information can be shared between the two companies?

• We must continue to work as two separate companies

• The Workstreams are leading this process

• More detailed guidelines are available from the legal teams on request

Remember …

• ntl & Telewest will stay separate companies until the deal closes. There’s no change for you or our customers. It’s business as usual for all of us.

• It could well be several months before the deal completes and we become one company.

• There are restrictions on what we can communicate until the deal is closed, but we will give you the facts as and when decisions are made and we have information that we can share.

Where to get more information

• More detail is contained on Oneline together with all other communication issued about the ntl/Telewest agreement

• You can send questions to questions@telewest.co.uk

• New Q&As will be published on Oneline each month

• A merger update will be issued by email, for cascade to all colleagues, each month

Forward Looking Statements

Certain statements in this communication regarding the proposed transaction between NTL Incorporated (“ntl”) and Telewest, Inc. (“Telewest”), the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Telewest’s or ntl’s future expectations, beliefs, goals or prospects constitute forward-looking statements as that term is defined in the U.S. Private Securities Litigation Reform Act of 1995. When used in this document, the words “believe”, “anticipate”, “should”, “intend”, “plan”, “will”, “expects”, “estimates”, “projects”, “positioned”, “strategy”, and similar expressions or statements that are not historical facts, in each case as they relate to ntl and Telewest, the management of either such company or the proposed transaction, are intended to identify those expressions or statements as forward-looking statements. In addition to the risks and uncertainties noted in this document, there are certain factors, risks and uncertainties that could cause actual results to differ materially from those anticipated by some of the statements made, many of which are beyond the control of ntl and Telewest. These include: (1) the failure to obtain and retain expected synergies from the proposed transaction, (2) rates of success in executing, managing and integrating key acquisitions, including the proposed acquisition, (3) the ability to achieve business plans for the combined company, (4) the ability to manage and maintain key customer relationships, (5) delays in obtaining, or adverse conditions contained in, any regulatory or third-party approvals in connection with the proposed acquisition, (6) availability and cost of capital, (7) the ability to manage regulatory, tax and legal matters, and to resolve pending matters within current estimates, (8) other similar factors, and (9) the risk factors summarized and explained in our Form 10-K. For additional information concerning factors that could cause actual results to materially differ from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

Additional Information and Where to Find it

This filing may be deemed to be solicitation material in respect of the proposed merger of ntl and Telewest. In connection with the proposed merger, ntl and Telewest will file a joint proxy statement / prospectus with the U.S. Securities and Exchange Commission (the “SEC”). INVESTORS AND SECURITY HOLDERS OF NTL AND TELEWEST ARE ADVISED TO READ THE JOINT PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final joint proxy statement / prospectus will be mailed to stockholders of ntl and Telewest. Investors and security holders may obtain a free copy of the joint proxy statement / prospectus, when it becomes available, and other documents filed by ntl and Telewest with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the joint proxy statement / prospectus, when it becomes available, and each company’s other filings with the SEC may also be obtained from the respective companies. Free copies of Telewest’s filings may be obtained by directing a request to Telewest Global, Inc., 160 Great Portland Street, London W1W 5QA, United Kingdom, Attention: Investor Relations.

Participants in the Solicitation

ntl, Telewest and their respective directors, executive officers and other members of their management and employees may be deemed to be soliciting proxies from their respective stockholders in favour of the merger. Information regarding ntl’s directors and executive officers is available in ntl’s proxy statement for its 2005 annual meeting of stockholders, which was filed with the SEC on April 5, 2005. Information regarding Telewest’s directors and executive officers is available in Telewest’s proxy statement for its 2005 annual meeting of stockholders, while was filed with the SEC on April 11, 2005. Additional information regarding the interests of such potential participants will be included in the joint proxy statement