UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

ý | Soliciting Material Pursuant to §240.14a-12 |

|

TELEWEST GLOBAL, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

Filed by Telewest Global, Inc.

Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

This filing consists of certain communications made in connection with the announcement of an Agreement and Plan of Merger among Telwest Global, Inc., NTL Incorporated and Merger Sub Inc., dated as of October 2, 2005.

2

Merger Update

and Q3 Results

Nov / Dec 2005

[LOGO]

Agenda

• Mergers – What does it mean?

• Q3 Results : Telewest & ntl

• Telewest Offers : Why we have them

• New Technology

• TiME : Successes

• Successes & Interesting Facts

• Development Update

• Engagement Update

• Q&A

Merger - what does it mean ?

[LOGO]

Mergers

They are all around us.

Mergers you may have heard of………….

UK Cable

Where did it all begin?

Do you know your Telewest and NTL history ?

Rationale for Mergers

Why do you think companies merge? [Exercise]

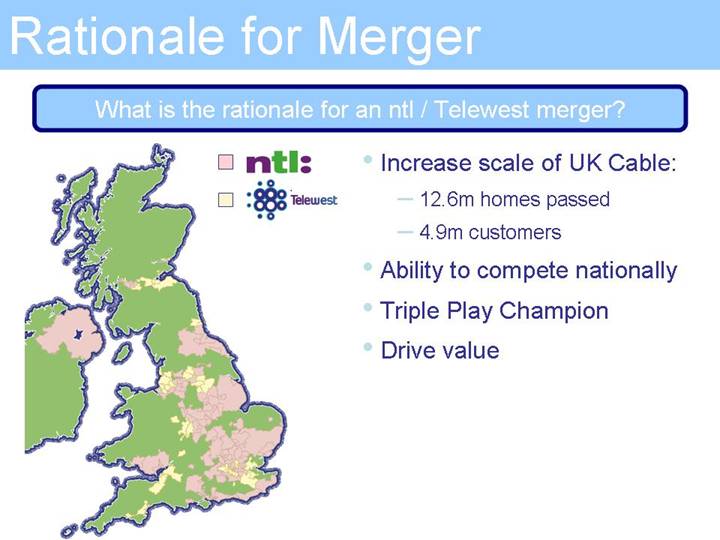

Rationale for Merger

What is the rationale for an ntl / Telewest merger?

[GRAPHIC]

• Increase scale of UK Cable:

• 12.6m homes passed

• 4.9m customers

• Ability to compete nationally

• Triple Play Champion

• Drive value

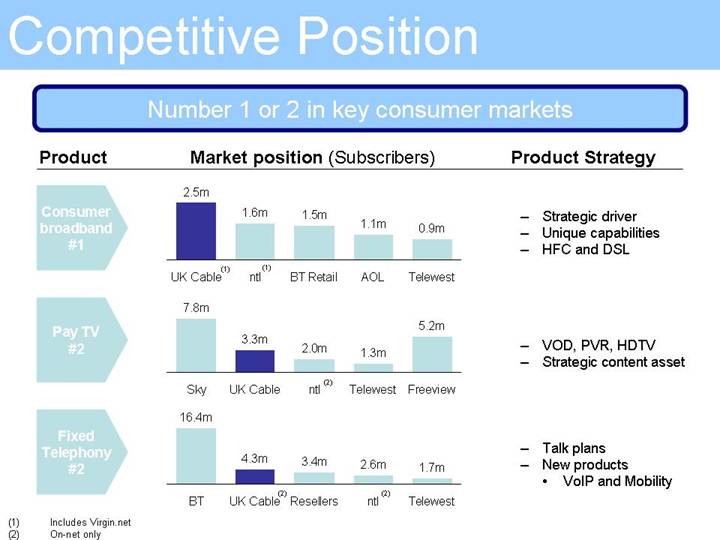

Competitive Position

Number 1 or 2 in key consumer markets

Product | | Market position (Subscribers) | | Product Strategy |

| | | | |

Consumer broadband #1 | | [CHART] | | • Strategic driver • Unique capabilities • HFC and DSL |

| | | | |

Pay TV #2 | | [CHART] | | • VOD, PVR, HDTV • Strategic content asset |

| | | | |

Fixed

Telephony #2 | | [CHART] | | • Talk plans • New products • VoIP and Mobility |

(1) Includes Virgin.net

(2) On-net only

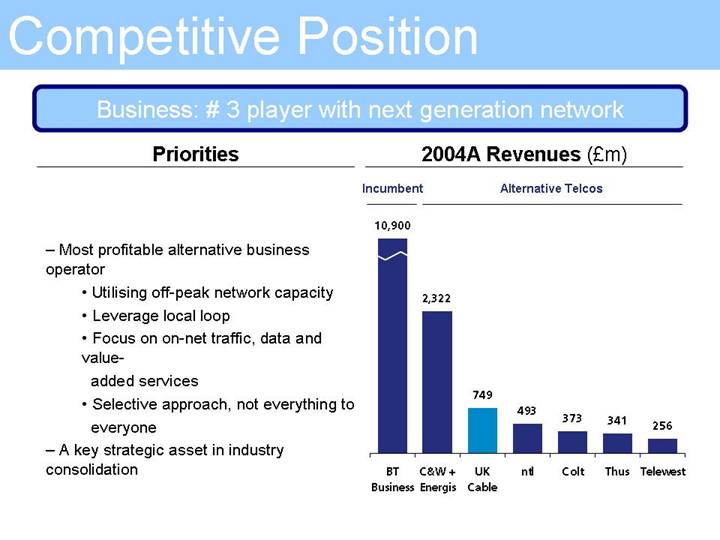

Competitive Position

Business: # 3 player with next generation network

Priorities

• Most profitable alternative business operator

• Utilising off-peak network capacity

• Leverage local loop

• Focus on on-net traffic, data and value-added services

• Selective approach, not everything to everyone

• A key strategic asset in industry consolidation

2004A Revenues (£m)

[CHART]

The Announcement

Merger was announced on 3rd October…

• The intention for ntl and Telewest to merge

• Subject to regulatory and shareholder approval

• Board and Senior Leadership Team (SLT) drawn from ntl and Telewest senior management

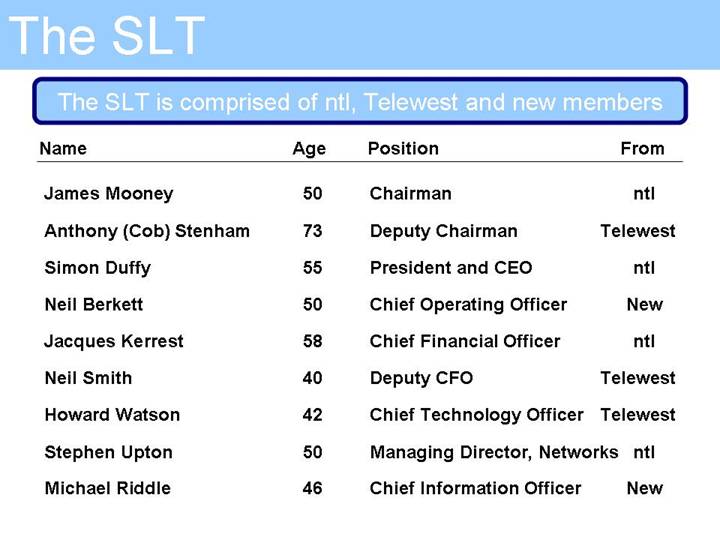

The SLT

The SLT is comprised of ntl, Telewest and new members

Name | | Age | | Position | | From |

| | | | | | |

James Mooney | | 50 | | Chairman | | ntl |

| | | | | | |

Anthony (Cob) Stenham | | 73 | | Deputy Chairman | | Telewest |

| | | | | | |

Simon Duffy | | 55 | | President and CEO | | ntl |

| | | | | | |

Neil Berkett | | 50 | | Chief Operating Officer | | New |

| | | | | | |

Jacques Kerrest | | 58 | | Chief Financial Officer | | ntl |

| | | | | | |

Neil Smith | | 40 | | Deputy CFO | | Telewest |

| | | | | | |

Howard Watson | | 42 | | Chief Technology Officer | | Telewest |

| | | | | | |

Stephen Upton | | 50 | | Managing Director, Networks | | ntl |

| | | | | | |

Michael Riddle | | 46 | | Chief Information Officer | | New |

Next Steps

Business as usual for a few more months

• Regulatory Approval

• File with the Office of Fair Trading (OFT)

• Could be referred to the Competition Commission (CC)

• Shareholder Approval

• File Securities and Exchange Commission (SEC) in the US

• Shareholder vote

• Internal planning to bring companies together

• 87 work-streams kicked off across business

• Lead by senior management

Merger Communications

Keeping you up to date with the latest developments

[LOGO]

• You should have by now received your first copy of THE facts.

• More detail is contained on Oneline together with all other communication issued about the ntl / Telewest agreement

• You can send questions to questions@telewest.co.uk

• New Q&As will be published on Oneline each month

• A merger update will be issued by email to all colleagues each month

Telewest and NTL Q3 Results

[LOGO]

Summary of Telewest results

• Continuing profitable consumer growth

• Focus on product innovation and higher value services

• Roll-out of VOD ahead of schedule

• Good progress on broadband speed upgrades

• Launch DVR and HDTV in Q1-06

• Award-winning customer service

• Business division stable in a competitive market

• Flextech performing well

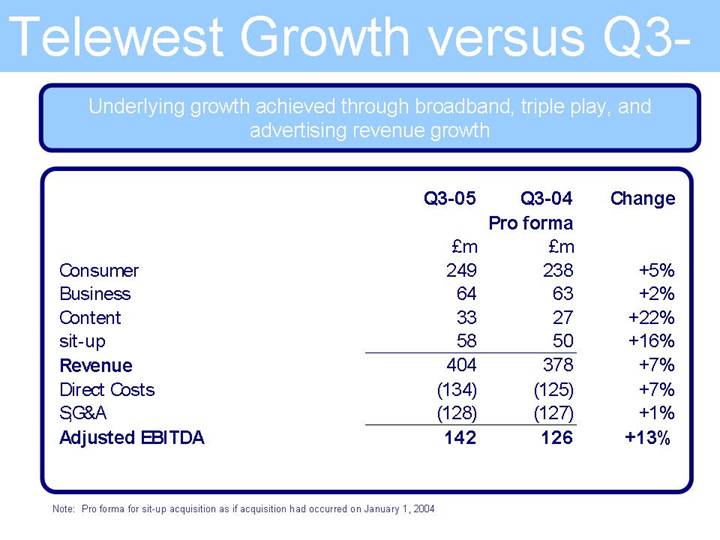

Telewest Growth versus Q3-04

Underlying growth achieved through broadband, triple play, and advertising revenue growth

| | Q3-05 | | Q3-04 | | Change | |

| | Pro forma | | | |

| | £m | | £m | | | |

Consumer | | 249 | | 238 | | +5 | % |

Business | | 64 | | 63 | | +2 | % |

Content | | 33 | | 27 | | +22 | % |

sit-up | | 58 | | 50 | | +16 | % |

Revenue | | 404 | | 378 | | +7 | % |

Direct Costs | | (134 | ) | (125 | ) | +7 | % |

S,G&A | | (128 | ) | (127 | ) | +1 | % |

Adjusted EBITDA | | 142 | | 126 | | +13 | % |

Note: Pro forma for sit-up acquisition as if acquisition had occurred on January 1, 2004

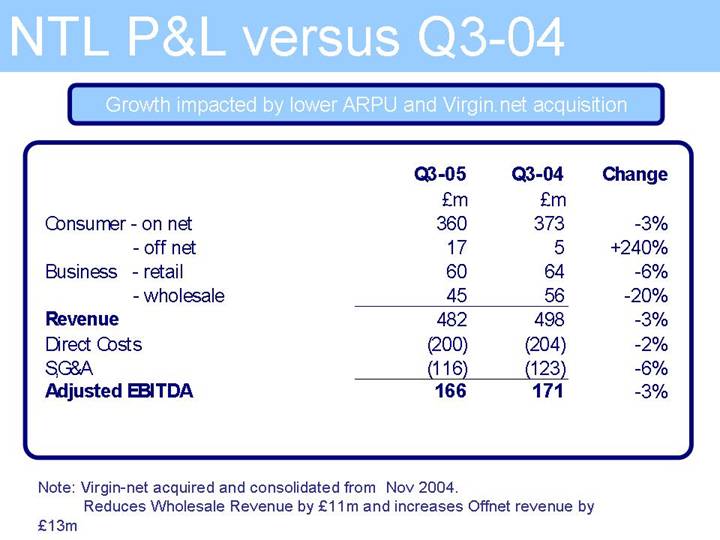

NTL P&L versus Q3-04

Growth impacted by lower ARPU and Virgin.net acquisition

| | Q3-05 | | Q3-04 | | Change | |

| | £m | | £m | | | |

Consumer | - on net | | 360 | | 373 | | -3 | % |

| - off net | | 17 | | 5 | | +240 | % |

Business | - retail | | 60 | | 64 | | -6 | % |

| - wholesale | | 45 | | 56 | | -20 | % |

Revenue | | 482 | | 498 | | -3 | % |

Direct Costs | | (200 | ) | (204 | ) | -2 | % |

S,G&A | | (116 | ) | (123 | ) | -6 | % |

Adjusted EBITDA | | 166 | | 171 | | -3 | % |

Note: Virgin-net acquired and consolidated from Nov 2004.

Reduces Wholesale Revenue by £11m and increases Offnet revenue by £13m

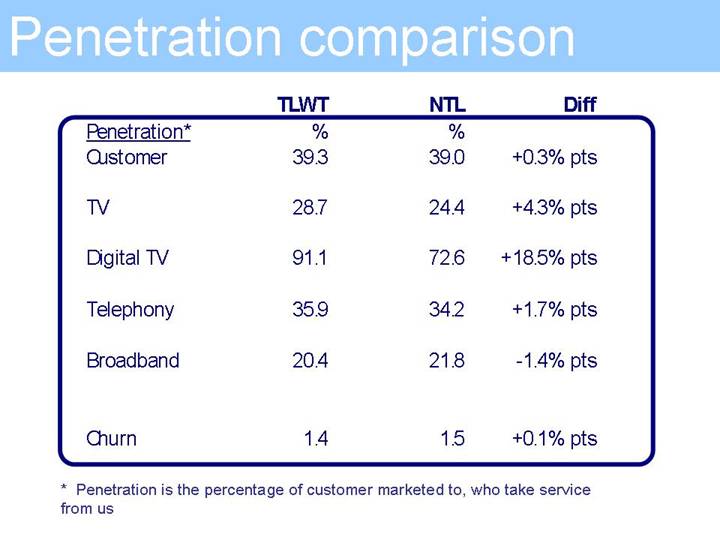

Penetration comparison

Penetration* | | TLWT | | NTL | | Diff | |

| | % | | % | | | |

Customer | | 39.3 | | 39.0 | | +0.3 | % pts |

| | | | | | | |

TV | | 28.7 | | 24.4 | | +4.3 | % pts |

| | | | | | | |

Digital TV | | 91.1 | | 72.6 | | +18.5 | % pts |

| | | | | | | |

Telephony | | 35.9 | | 34.2 | | +1.7 | % pts |

| | | | | | | |

Broadband | | 20.4 | | 21.8 | | -1.4 | % pts |

| | | | | | | |

Churn | | 1.4 | | 1.5 | | +0.1 | % pts |

* Penetration is the percentage of customer marketed to, who take service from us

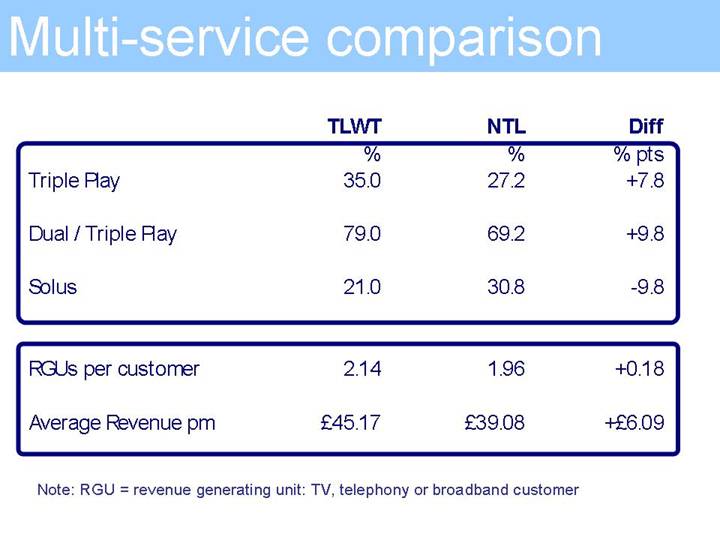

Multi-service comparison

| | TLWT | | NTL | | Diff | |

| | % | | % | | % pts | |

| | | | | | | |

Triple Play | | 35.0 | | 27.2 | | +7.8 | |

| | | | | | | |

Dual / Triple Play | | 79.0 | | 69.2 | | +9.8 | |

| | | | | | | |

Solus | | 21.0 | | 30.8 | | -9.8 | |

| | | | | | | |

RGUs per customer | | 2.14 | | 1.96 | | +0.18 | |

| | | | | | | |

Average Revenue pm | | £ | 45.17 | | £ | 39.08 | | £ | +6.09 | |

| | | | | | | | | | |

Note: RGU = revenue generating unit: TV, telephony or broadband customer

Questions and Answers

[LOGO]

Forward Looking Statements

Certain statements in this communication regarding the proposed transaction between NTL Incorporated (“ntl”) and Telewest, Inc. (“Telewest”), the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Telewest’s or ntl’s future expectations, beliefs, goals or prospects constitute forward-looking statements as that term is defined in the U.S. Private Securities Litigation Reform Act of 1995. When used in this document, the words “believe”, “anticipate”, “should”, “intend”, “plan”, “will”, “expects”, “estimates”, “projects”, “positioned”, “strategy”, and similar expressions or statements that are not historical facts, in each case as they relate to ntl and Telewest, the management of either such company or the proposed transaction, are intended to identify those expressions or statements as forward-looking statements. In addition to the risks and uncertainties noted in this document, there are certain factors, risks and uncertainties that could cause actual results to differ materially from those anticipated by some of the statements made, many of which are beyond the control of ntl and Telewest. These include: (1) the failure to obtain and retain expected synergies from the proposed transaction, (2) rates of success in executing, managing and integrating key acquisitions, including the proposed acquisition, (3) the ability to achieve business plans for the combined company, (4) the ability to manage and maintain key customer relationships, (5) delays in obtaining, or adverse conditions contained in, any regulatory or third-party approvals in connection with the proposed acquisition, (6) availability and cost of capital, (7) the ability to manage regulatory, tax and legal matters, and to resolve pending matters within current estimates, (8) other similar factors, and (9) the risk factors summarized and explained in our Form 10-K. For additional information concerning factors that could cause actual results to materially differ from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

[LOGO]

Additional Information and Where to Find it

This filing may be deemed to be solicitation material in respect of the proposed merger of ntl and Telewest. In connection with the proposed merger, ntl and Telewest will file a joint proxy statement / prospectus with the U.S. Securities and Exchange Commission (the “SEC”). INVESTORS AND SECURITY HOLDERS OF NTL AND TELEWEST ARE ADVISED TO READ THE JOINT PROXY STATEMENT / PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THOSE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final joint proxy statement / prospectus will be mailed to stockholders of ntl and Telewest. Investors and security holders may obtain a free copy of the joint proxy statement / prospectus, when it becomes available, and other documents filed by ntl and Telewest with the SEC, at the SEC’s web site at http://www.sec.gov. Free copies of the joint proxy statement / prospectus, when it becomes available, and each company’s other filings with the SEC may also be obtained from the respective companies. Free copies of Telewest’s filings may be obtained by directing a request to Telewest Global, Inc., 160 Great Portland Street, London W1W 5QA, United Kingdom, Attention: Investor Relations.

Participants in the Solicitation

ntl, Telewest and their respective directors, executive officers and other members of their management and employees may be deemed to be soliciting proxies from their respective stockholders in favour of the merger. Information regarding ntl’s directors and executive officers is available in ntl’s proxy statement for its 2005 annual meeting of stockholders, which was filed with the SEC on April 5, 2005. Information regarding Telewest’s directors and executive officers is available in Telewest’s proxy statement for its 2005 annual meeting of stockholders, while was filed with the SEC on April 11, 2005. Additional information regarding the interests of such potential participants will be included in the joint proxy statement