Exhibit 99.3

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

This discussion and analysis of financial position, results of operations (“MD&A”) and cash flows of Entrée Gold Inc. (the “Company”) should be read in conjunction with the audited consolidated financial statements of the Company for the year ended December 31, 2008. Additional information relating to the Company, including the Company’s Annual Information Form is available on SEDAR at www.sedar.com. The effective date of this MD&A is March 26, 2009. The annual financial statements accompanying this MD&A have been prepared by the Company in conformity with generally accepted accounting principles in the United States of America (“US GAAP”).

In this MD&A, all dollar amounts are expressed in United States dollars, unless otherwise specified such as “Cdn $” or “C$” for Canadian dollars. All references to "common shares" refer to the common shares in our capital stock.

As used in this quarterly report, the terms "we", "us", "our", the “Company” and "Entrée" mean Entree Gold Inc. and our wholly-owned subsidiaries, unless otherwise indicated. We have six wholly-owned subsidiary companies:

Entrée LLC, a Mongolian limited liability company,

Entrée Resources International Ltd, a British Columbia Corporation,

Entrée U.S Holdings Inc., a British Columbia corporation,

Entrée Resources LLC., a Mongolian limited liability company,

Entrée Gold (US) Inc., an Arizona corporation, and,

Beijing Entrée Minerals Technology Company Limited, a wholly-foreign owned enterprise (WFOE) in China.

This MD&A contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors” that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Robert Cann, P.Geo., Entrée’s Vice-President, Exploration and a Qualified Person as defined by National Instrument 43-101, is responsible for the preparation of technical information in this MD&A.

We are an exploration stage resource company engaged in exploring mineral resource properties. We have exploration properties in Mongolia, China, and the USA. In Mongolia, we hold four mineral exploration licenses granted by the Mineral Resources and Petroleum Authority of Mongolia. All of these mineral exploration licenses have been registered in the name of our Mongolian subsidiary Entrée LLC. Three of these exploration licenses cover contiguous parcels of land which comprise the Company’s “Lookout Hill” property. As of June 30, 2008, Ivanhoe Mines had expended a total of $35 million on exploration on a portion of Lookout Hill subject to the Earn-In Agreement (see details below). In accordance with the Earn-In Agreement, Entrée and Ivanhoe Mines formed a joint venture on terms annexed to the Earn-In Agreement.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

In July 2007, the Company entered into an agreement with Empirical Discovery LLC (“Empirical”) to explore for and develop porphyry copper targets in southeastern Arizona and adjoining southwestern New Mexico.

In November 2007, we entered into an earn-in agreement with the Zhejiang No. 11 Geological Brigade to acquire 78% interest in the Huaixi property in Zhejiang Province in Southeast China.

In January 2008, the Company entered into an additional agreement with Empirical to explore for and develop porphyry copper targets within a specified area around Bisbee, Arizona. This agreement is separate from the August 2007 agreement with Empirical.

The Company trades on three stock exchanges: the Toronto Stock Exchange (TSX:ETG), the NYSE Amex (NYSE Amex:EGI) and the Frankfurt Stock Exchange (FWB:EKA, WKN 121411).

Treasury Offering

On November 26, 2007, Entrée closed a short form prospectus offering of 10 million common shares at a price of C$3.00 per share on a bought deal basis for gross proceeds of C$30 million (the ”Treasury Offering”) pursuant to an underwriting agreement between the Company and BMO Nesbitt Burns (the “Underwriter”). The Underwriter received a fee of C$1.8 million, being 6% of the gross proceeds of the Treasury Offering.

In order to maintain their ownership of Entrée’s issued and outstanding shares, approximately 14.7% and 15.9% respectively, Ivanhoe Mines and Rio Tinto, through its wholly-owned subsidiary Kennecott Canada Exploration Inc. (collectively, “Rio Tinto”), exercised their pre-emptive rights and acquired, concurrently with the closing of the Treasury Offering, an aggregate of 4,428,640 shares of the Company at a price of C$3.00 per share for additional gross proceeds of C$13,285,920.

Equity Participation and Earn-In Agreement and Joint Venture with Ivanhoe Mines

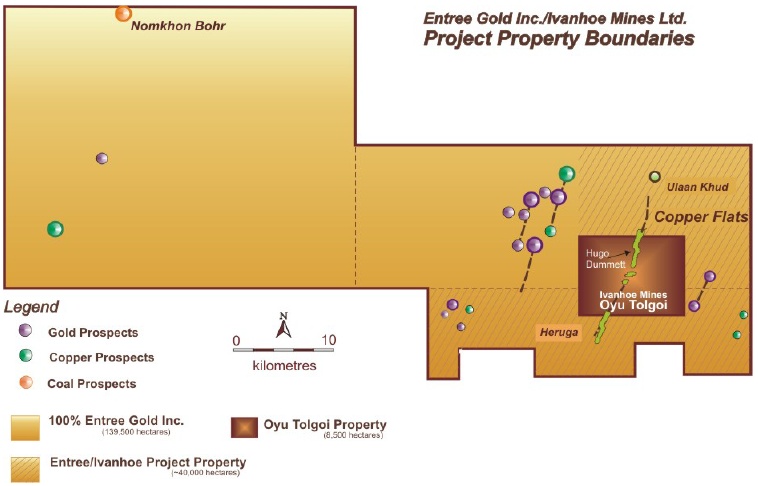

Entrée entered into an arm’s-length Equity Participation and Earn-In Agreement (the “Earn-In Agreement”) in October 2004 with Ivanhoe Mines Ltd., title holder of the Oyu Tolgoi copper-gold deposit, which is located adjacent to and is surrounded by Entrée’s Lookout Hill property (see map on page 3). This agreement was subsequently assigned to a subsidiary of Ivanhoe Mines Ltd., Ivanhoe Mines Mongolia Inc. XXK, (collectively, “Ivanhoe Mines”).

The Earn-in Agreement provided that Ivanhoe Mines would have the right, subject to certain conditions outlined in the Earn-in Agreement, to earn a participating interest in a mineral exploration and, if warranted, development and mining project on a portion of the Lookout Hill property (the “Project Property”). Under the Earn-in Agreement, Ivanhoe Mines would conduct exploration activities in an effort to determine if the Oyu Tolgoi mineralized system extended onto the Project Property. Following execution of the Earn-in Agreement Ivanhoe Mines undertook an aggressive exploration program, which eventually confirmed the presence of two resources on Lookout Hill within the Project Property: the Hugo North Extension indicated and inferred resource to the north of Oyu Tolgoi and the inferred resource of the Heruga Deposit to the south of Oyu Tolgoi.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

As of June 30, 2008, Ivanhoe Mines had expended a total of $35 million on exploration on the Project Property and in accordance with the Earn-In Agreement, Entrée and Ivanhoe Mines formed a joint venture on terms annexed to the Earn-In Agreement. During the six months to December 31, 2008, the joint venture expended approximately $1.9 million. Ivanhoe has advanced to Entrée its 20% portion of the expenditures.

Certain of Ivanhoe Mines' rights and obligations under the Earn-In Agreement, including a right to nominate one member of our Board of Directors, a pre-emptive right to enable them to preserve their ownership percentage in our company, and an obligation to vote their shares as our Board of Directors directs on certain matters, expired with the formation of the joint venture. Ivanhoe’s right of first refusal to the remainder of Lookout Hill is maintained with the formation of the joint venture.

We believe that both the initial Earn-in Agreement and the joint venture are of significant benefit to our company. The Earn-in Agreement enabled us to raise money that we used to pursue our exploration activities on the balance of our Lookout Hill property and elsewhere. It also enabled the exploration of the Project Property at little or no cost to our company, leading to the delineation of indicated and inferred mineral resource estimates for the Hugo North Extension and the discovery and subsequent definition of a significant inferred resource on the Heruga deposit.

The Project Property subject to the joint venture is shown below:

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

Investment by Rio Tinto in Entrée Gold Inc.

In June 2005, Rio Tinto completed a private placement into Entrée, whereby it purchased 5,665,730 units at a price of C$2.20 per unit, which consisted of one Entrée common share and two warrants (one “A” warrant and one “B” warrant). Two “A” warrants entitled Rio Tinto to purchase one Entrée common share for C$2.75 within two years; two “B” warrants entitled Rio Tinto to purchase one Entrée common share for C$3.00 within two years. Proceeds from Rio Tinto’s investment were $10,170,207. Ivanhoe Mines exercised its pre-emptive right and participated in the private placement to maintain proportional ownership of Entrée’s shares. After exercising its warrant for 4,600,000 shares at C$1.10, resulting in proceeds to Entrée of $4,069,214, Ivanhoe Mines purchased 1,235,489 units, resulting in further proceeds to Entrée of $2,217,209. Rio Tinto purchased an additional 641,191 units of the private placement to maintain proportional ownership, resulting in further proceeds of $1,150,681.

Rio Tinto is required to vote its shares as our board of directors directs on matters pertaining to fixing the number of directors to be elected, the election of directors, the appointment and remuneration of auditors and the approval of any corporate incentive compensation plan or any amendment thereof, provided the compensation plan could not result in any time in the number of common shares reserved for issuance under the plan exceeding 20% of the issued and outstanding common shares.

On June 27, 2007, Rio Tinto exercised its “A” and “B” warrants and the Company issued 6,306,920 common shares for cash proceeds of $17,051,716.

On November 26, 2007, in order to maintain its percentage ownership of Entrée’s issued and outstanding shares, approximately 15.9%, Rio Tinto exercised its pre-emptive rights and acquired, concurrently with the closing of the Treasury Offering, an aggregate of 2,300,284 shares of the Company at a price of C$3.00 per share for additional gross proceeds of C$6,900,852.

At December 31, 2008, Ivanhoe Mines owned approximately 14.6% of Entrée’s issued and outstanding shares.

At December 31, 2008, Rio Tinto owned approximately 15.8% of Entrée’s issued and outstanding shares.

Investment by Rio Tinto in Ivanhoe Mines Ltd.

In October 2006, Rio Tinto announced that it had agreed to invest up to $1.5 billion to acquire up to a 33.35% interest in Ivanhoe Mines. The proceeds from this investment were targeted to fund the joint development of the Oyu Tolgoi copper-gold project. An initial tranche of $303 million was granted to acquire 9.95% of Ivanhoe Mines’ shares. It was further announced on September 12, 2007 that Rio Tinto will provide Ivanhoe Mines with a convertible credit facility of $350 million for interim financing for the Oyu Tolgoi copper-gold project in Mongolia. The credit facility is directed at maintaining the momentum of mine development activities at Oyu Tolgoi while Ivanhoe Mines and Rio Tinto continue to engage in finalising an Investment Agreement between Ivanhoe Mines and the government of Mongolia. If converted, this investment could result in Rio Tinto’s owning 46.65% of Ivanhoe Mines.” Entrée believes these investments represent, together with the investments in Entrée made by both companies, a major vote of confidence by one of the world’s pre-eminent mining companies in both the Oyu Tolgoi project and in the country of Mongolia.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

Mongolian Government

A general election was held in Mongolia on June 29, 2008. The Mongolian People’s Revolutionary Party (“MPRP”) was returned with a majority government and chose to form a coalition government with the Democratic Party. The MPRP held the majority of seats in Parliament between 2000 and 2004, the period which witnessed the largest foreign investment into the country and the country’s mining sector. The Mongolian government is discussing changes to the mineral and tax laws and negotiating with Ivanhoe Mines and Rio Tinto with regards to a possible investment agreement for Oyu Tolgoi. A draft investment agreement has been presented to the Mongolian Parliament as announced by Ivanhoe Mines on March 9, 2009. Final approval has not been received as of this filing. Mongolian Parliament recessed on March 13, 2009 and is expected to reconvene in early April 2009. Discussion of the Investment Agreement with Ivanhoe Mines is expected to be one of the first orders of business.

Entrée continues to monitor developments in Mongolia, and maintains regular contact with Rio Tinto and Ivanhoe Mines regarding this matter.

Corporate Information

Our corporate headquarters are located in Vancouver, British Columbia, but we conduct all of our operations in Mongolia through our wholly-owned subsidiary, Entrée LLC and Entrée Resources LLC. We maintain an office for this purpose in Ulaanbaatar, the capital of Mongolia. Our Mongolian office is staffed by our Vice-President, Exploration, an operations manager, a business manager, two office assistants, and a full-time accountant. Operations in the U.S. are conducted through field offices set-up for specific projects. Entrée leases an office in Beijing for the purposes of managing operations in China. Our China office is staffed by an office manager, a part-time accountant, and an administrator/cashier. The Company has received a license for its Chinese business entity and has completed all business registrations.

We believe that Entrée is in sound financial condition and well positioned to build upon the value of our company, both in terms of our arrangement with Ivanhoe Mines and Rio Tinto and our promising prospects elsewhere. As part of our ongoing strategy, we are also actively seeking quality acquisitions to complement our existing portfolio.

Mineral Resource Estimate

Hugo North Extension

In February 2006, Entrée announced that a mineral resource estimate prepared by Ivanhoe Mines under the supervision of AMEC Americas Limited (“AMEC”) had delineated an initial Inferred Resource for the northern extension of the Hugo North deposit (the “Hugo North Extension”) on the Copper Flats area of Entrée’s Shivee Tolgoi license. The drilling and exploration work that resulted in the preparation of this Inferred Resource estimate was conducted in order for Ivanhoe Mines to earn an interest in Lookout Hill.

In March 2007, the Company announced that an updated mineral resource estimate had been calculated, based on in-fill drilling conducted by Ivanhoe Mines up to November 1, 2006. The updated mineral resource estimate was prepared by AMEC and the corresponding technical report was filed on SEDAR (www.sedar.com). At a 0.6% copper equivalent cut-off, the Hugo North Extension is now estimated to contain an Indicated Resource of 117 million tonnes grading 1.80% copper and 0.61 grams per tonne (“g/t”) gold (a copper equivalent grade of 2.19%). This Indicated Resource is estimated to contain 4.6 billion pounds of copper and 2.3 million ounces of gold. In addition, the Hugo North Extension is estimated to contain an Inferred Resource of 95.5 million tonnes grading 1.15% copper and 0.31 g/t gold (a copper equivalent grade of 1.35%). The contained metal estimated within the Inferred Resource portion of the Hugo North Extension is 2.4 billion pounds of copper and 950,000 ounces of gold (see Table 1 on Page 9). For further information, see the Company’s news release dated March 29, 2007 available on SEDAR.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

Heruga

On March 12, 2008, Entrée announced an initial mineral resource estimate prepared for the Heruga copper, gold, and molybdenum deposit, under the supervision of Quantitative Geoscience Pty Ltd., of Perth, Australia (QG). Heruga is estimated to contain an Inferred Resource of 760 million tonnes grading 0.48% copper, 0.55 g/t gold and 142 parts per million (“ppm”) molybdenum for a copper equivalent grade of 0.91%, using a 0.60% copper equivalent cut-off grade(see Table 2 on page 9). Based on these figures, the Heruga deposit is estimated to contain at least 8.0 billion pounds of copper and 13.4 million ounces of gold. Drilling was conducted by joint venture partner, Ivanhoe Mines.

Listing of Common Stock on Other Stock Exchanges

Trading of our shares of common stock commenced on the NYSE Amex effective July 18, 2005, under the trading symbol “EGI’. On April 24, 2006, Entrée began trading on the Toronto Stock Exchange and discontinued trading on the TSX Venture Exchange. The trading symbol remained “ETG”. The Company is also traded on the Frankfurt Stock Exchange, under the trading symbol “EKA”, and “WKN 121411”.

Results of operations are summarized as follows:

| | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | |

| Depreciation | | $ | 146,703 | | | $ | 212,819 | | | $ | 200,530 | |

| General and administrative | | | 3,113,663 | | | | 2,896,364 | | | | 2,060,233 | |

| Interest income | | | (1,981,316 | ) | | | (1,090,718 | ) | | | (721,873 | ) |

| Stockholder communications and | | | | | | | | | | | - | |

| investor relations | | | 691,926 | | | | 739,964 | | | | 1,273,422 | |

| Mineral Property Interests | | | 9,386,189 | | | | 6,343,777 | | | | 5,811,346 | |

| Impairment of asset backed | | | | | | | | | | | - | |

| commercial paper | | | 1,334,160 | | | | 998,371 | | | | - | |

| Loss from equity investment | | | 366,595 | | | | - | | | | - | |

| Stock-based compensation | | | 3,672,358 | | | | 1,732,839 | | | | 1,031,683 | |

| Net loss | | $ | 16,730,278 | | | $ | 11,833,416 | | | $ | 9,655,341 | |

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

Mineral properties expenditures are summarized as follows:

| | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | |

| Lookout Hill | | $ | 6,547,495 | | | $ | 4,222,145 | | | $ | 4,021,121 | |

| Manlai | | | 40,766 | | | | 829,215 | | | | 1,667,356 | |

| Sol Dos | | | 2,432 | | | | 1,023,817 | | | | 166,551 | |

| Empirical | | | 1,358,966 | | | | 103,961 | | | | - | |

| Bisbee | | | 193,875 | | | | - | | | | - | |

| Lordsburg | | | 1,167,998 | | | | - | | | | - | |

| Huaixi | | | 626,325 | | | | - | | | | - | |

| Other | | | 302,913 | | | | 340,317 | | | | 231,863 | |

| Total costs | | | 10,240,770 | | | | 6,519,455 | | | | 6,086,891 | |

| Less stock-based compensation | | | (854,581 | ) | | | (175,678 | ) | | | (275,545 | ) |

| Total expenditures, cash | | $ | 9,386,189 | | | $ | 6,343,777 | | | $ | 5,811,346 | |

Cautionary Note to U.S. Investors concerning estimates of Inferred and Indicated Mineral Resources.

This section uses the term “Inferred and Indicated Mineral Resources.” We advise U.S investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred and Indicated Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of the Inferred and Indicated Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred and Indicated Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. U.S. investors are cautioned not to assume that part or all of an Inferred and Indicated Mineral Resource exists, or is economically or legally mineable.

| | i. | Ivanhoe Mines Joint Venture |

As discussed earlier, Ivanhoe Mines commenced an aggressive exploration program on the Project Property in 2004 under the terms of the Earn-In Agreement. This program was designed to determine if the Oyu Tolgoi mineralized system continued onto Entrée’s Lookout Hill ground, within the Project Property area. Ivanhoe Mines has spent over $35 million thus far earning the right to form a joint venture as described previously. To date, Ivanhoe Mines has outlined two deposits: the Hugo North Extension, which contains indicated and inferred resource estimates and the Heruga Deposit, which contains an inferred resource estimate.

Hugo North Extension

On February 1, 2006, Entrée announced that an initial mineral resource estimate prepared by Ivanhoe Mines under the supervision of AMEC had delineated an initial Inferred Resource for the Hugo North Extension on the Copper Flats area of the Project Property. The resource estimate was the result of a work program that defined a 625 metre extension to the Hugo North Deposit onto Entrée’s property and outlined some extremely rich copper-gold mineralization.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

This initial Hugo North Extension Inferred Resource, at a 0.6% copper equivalent cut-off, was estimated to be 190 million tonnes at an average grade of 1.57% copper and 0.53 g/t gold for a copper equivalent grade of 1.91%, at a 0.6% copper equivalent cut-off. The Inferred Resource was estimated to contain 6.6 billion pounds of copper and 3.2 million ounces of gold.

In March 2007, the Company announced that an updated mineral resource estimate had been calculated, based on in-fill drilling conducted by Ivanhoe Mines up to November 1, 2006. The updated mineral resource estimate was prepared by AMEC and the corresponding technical report was filed on SEDAR (www.sedar.com). At a 0.6% copper equivalent cut-off, the Hugo North Extension is now estimated to contain an Indicated Resource of 117 million tonnes grading 1.80% copper and 0.61 g/t gold (a copper equivalent grade of 2.19%). This Indicated Resource is estimated to contain 4.6 billion pounds of copper and 2.3 million ounces of gold (Table 1). In addition the Hugo North Extension is estimated to contain an Inferred Resource of 95.5 million tonnes grading 1.15% copper and 0.31 g/t gold (a copper equivalent grade of 1.35%). The contained metal estimated within the Inferred Resource portion of the Hugo North Extension is 2.4 billion pounds of copper and 950,000 ounces of gold. See Table 1 below for details. For further information, see the Company’s news release dated March 29, 2007 available on SEDAR.

| | Table 1: | Hugo North Extension Indicated and Inferred Mineral Resource on the Entrée/Ivanhoe Shivee Tolgoi Joint Venture Property as of February 20, 2007 at various Copper-Equivalent (CuEq) cut-off grades |

| Class | CuEq Cut-off | Tonnage (tonnes) | Copper (%) | Gold (g/t) | CuEq* (%) | Contained Metal |

| Cu (‘000 lb) | Au (oz) | CuEq('000 lb) |

| Indicated | 1.0 | 84,800,000 | 2.22 | 0.80 | 2.73 | 4,150,000 | 2,180,000 | 5,104,000 |

| | 0.6 | 117,000,000 | 1.80 | 0.61 | 2.19 | 4,643,000 | 2,290,000 | 5,649,000 |

| | | | | | | | | |

| Inferred | 1.0 | 62,200,000 | 1.39 | 0.39 | 1.64 | 1,906,000 | 780,000 | 2,249,000 |

| | 0.6 | 95,500,000 | 1.15 | 0.31 | 1.35 | 2,421,000 | 950,000 | 2,842,000 |

*Copper equivalent (CuEq) grades have been calculated using assumed metal prices (US$1.35/lb. for copper and US$650/oz. for gold); %CuEq = %Cu + [Au(g/t)x(18.98/29.76)]. The equivalence formula was calculated assuming that gold recovery was 91% of copper recovery. The contained gold and copper represent estimated contained metal in the ground and have not been adjusted for the metallurgical recoveries of gold and copper

In 2006, Ivanhoe Mines completed a program of condemnation drilling on the Entrée-Ivanhoe Lookout Hill Agreement Area in preparation for infrastructure construction associated with the development of Oyu Tolgoi. On October 25, 2006, the Company announced that a body of low-grade shallow copper and gold mineralization (“Ulaan Khud”) was intersected approximately 7 kilometres north of the Hugo North Extension. The area between Ulaan Khud and the Hugo North Extension has received only limited drill testing and remains a high priority exploration target.

Javhlant License (Heruga Deposit)

The southward extension to the Oyu Tolgoi copper-gold mineralized system onto the Entrée-Ivanhoe Project Property has now been documented through drill testing by Ivanhoe Mines (see Entrée news releases of October 3 and 9, 2007 and January 16 and February 26, 2008 and the subsequent Inferred Resource estimate on March 12, 2008). The discovery of the Heruga Deposit marks a new style of molybdenum-rich mineralization not previously encountered on the Oyu Tolgoi trend.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

Results from drilling at Heruga have identified significant molybdenum-rich copper-gold mineralization. These results demonstrate that the Heruga discovery extends for a strike length of at least 1,800 metres, and remains open to the north, south and east. The Heruga Deposit was discovered by drill-testing an induced polarization (“IP”) geophysical anomaly that defined a 3 kilometre-long, north-south zone of high chargeability with a width up to 1,000 metres. The anomaly trends north-northeast towards the Southwest Oyu Deposit on Oyu Tolgoi.

On March 12, 2008, Entrée announced an initial mineral resource estimate prepared for the Heruga copper, gold, and molybdenum deposit. Heruga is estimated to contain an Inferred Resource of 760 million tonnes grading 0.48% copper, 0.55 g/t gold and 142 ppm molybdenum for a copper equivalent grade of 0.91%, using a 0.60% copper equivalent cut-off grade, see Table 2 on page 9. Based on these figures, the Heruga deposit is estimated to contain at least 8 billion pounds of copper and 13.4 million ounces of gold. The drilling was conducted by partner and project operator, Ivanhoe Mines.

Over 54,000 metres have been drilled to date on Heruga, outlining a coherent block of copper-gold-molybdenum mineralization extending for approximately 1,800 metres north-south, with a vertical thickness typically varying between 400 to 800 metres, and a width of 200 to 300 metres. The southern, shallowest portion of this mineralized system starts at a vertical depth of 550 metres.

Table 2: Heruga Inferred Mineral Resource on the Shivee Tolgoi Joint Venture Property as of March 2008

| Cut-off | Tonnage | Cu | Au | Mo | Cu Eq* | Contained Metal |

CuEq % | 1000's (t) | % | g/t | ppm | % | Cu ('000 lb) | Au ('000 oz.) | CuEq ('000 lb) |

| >1.00 | 210,000 | 0.57 | 0.97 | 145 | 1.26 | 2,570,000 | 6,400 | 5,840,000 |

| >0.60 | 760,000 | 0.48 | 0.55 | 142 | 0.91 | 8,030,000 | 13,400 | 15,190,000 |

*Copper Equivalent estimated using $1.35/pound (“lb”) copper (“Cu”), $650/ounce (“oz”) gold (“Au”) and $10/lb molybdenum (“Mo”). The equivalence formula was calculated assuming that gold and molybdenum recovery was 91% and 72% of copper recovery respectively. CuEq was calculated using the formula CuEq = %Cu + ((g/t Au*18.98) + (Mo*0.01586))/29.76. The contained gold, copper and molybdenum in the tables have not been adjusted for recovery. The 0.6% CuEq cut-off is highlighted as the base case resource for underground bulk mining.

Identified deposits now occur over 20 kilometres along the structural trend hosting Oyu Tolgoi, Hugo North Extension and Heruga. Entrée management’s long held belief that significant mineralization could extend onto Entrée’s ground beyond the borders of Oyu Tolgoi has now been confirmed both to the north and south.

Results obtained during the 2008 exploration season were sufficiently encouraging that the technical team proposed a phased follow-up program for 2009. A Phase I program including 2,000 metres of drilling has been designed to further test areas of interest with a second phase with 3,000 metres of drilling proposed if Phase I is successful.

Entrée commenced the 2008 exploration season on its 100% owned Lookout Hill property in May. In August 2008, Entrée announced the discovery of coal in the northwest corner of the large western Togoot licence (Nomkhon Bohr target) and in September announced a $2 million increase in exploration spending on Nomkhon Bohr and other targets such as Coking Flats.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

The main target, Nomkhon Bohr, is a near-surface discovery in a complex geological environment. Although the zone does not crop out on surface, it has been traced by drilling and trenching over a strike length of 1,300 m. Analyses to date indicate the Nomkhon Bohr coal is predominantly low- to medium-volatile bituminous in rank with some analyses indicating anthracite rank as determined by applying PARR formula. The coal is high in ash with variable sulphur. Coal-bearing horizons in drill holes can be up to 57 m in apparent thickness; within these, multiple high-ash coal seams are usually present, ranging in apparent thickness from 0.2 m to 4.35 m. True thicknesses are uncertain due to the amount of deformation of the host stratigraphy.

The other two coal targets, Coking Flats and Khar Suul, are blind discoveries underlying Cretaceous comglomerates and sandstones which are up to 130 m thick. Coal intercepts are narrower when compared to Nomkhon Bohr. To date, no analytical results have been received for these targets.

On the 100% owned portion of the Shivee Tolgoi Licence, Entrée drilled three holes in 2008. Two holes on the Altan Khulan gold target did not return significant gold assays. One hole on the Tom Bogd copper-molybdenum target was abandoned due to drilling conditions prior to reaching target depth.

For the year ended December 31, 2008, Lookout Hill expenses were $6,547,495 compared to $4,222,145 during the year ended December 31, 2007 as set out above. The higher expenses in 2008 were due to the costs associated with evaluating the new coal discovery, Nomkhon Bohr.

Entrée’s Manlai property is located approximately 125 kilometres to the north of Lookout Hill and to the east of Ivanhoe Mines’ Kharmagtai porphyry copper-gold project.

Limited work on the Manlai project was done in 2008. The Company has extended the licence to 2010.

For the year ended December 31, 2008, Manlai expenses were $40,766 compared to $829,215 during the year ended December 31, 2007 as set out above. This decrease in expenditures was due to the termination of exploration at this location in August 2007.

In February, 2008, the Company chose to discontinue earning-in on the Sol Dos prospect due to the lack of favourable results and has terminated this agreement.

For the year ended December 31, 2008, Sol Dos expenses were $2,432 compared to $1,023,817 during the year ended December 31, 2007 as set out above. This decrease was due to the termination of exploration in 2007 and subsequent termination of the agreement in 2008. 2008 costs were incurred completing drill site reclamation which could not be completed in 2007.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

| | v. | Empirical Discovery Agreement 2007 |

In July 2007, the Company entered into an agreement with Empirical Discovery LLC to explore for and develop porphyry copper targets in southeastern Arizona and adjoining southwestern New Mexico. Under the terms of the agreement, Entrée has the option to acquire an 80% interest in any of the properties by incurring exploration expenditures totaling a minimum of $1.9 million and issuing 300,000 shares within 5 years of the anniversary of Toronto Stock Exchange (“TSX”) acceptance of the agreement (August 9, 2007). If Entrée exercises its option, Empirical may elect within 90 days to retain a 20% participating interest or convert to a 2% Net Smelter Returns (“NSR”) royalty, half of which may be purchased for $2 million.

Entrée has exploration rights to approximately 24,600 acres (9,995 ha) southeast of Safford, Arizona and extending into southwest New Mexico. Geophysical (IP and AMT), geochemical and geological surveys have been completed on the Gold Hill, Duncan and Ash Peak porphyry copper targets in Arizona and New Mexico. Based on encouraging results from these surveys Gold Hill and Duncan will be drill tested in the second quarter of 2009. No work is planned at Ash Peak due to lack of encouraging results.

For the year ended December 31, 2008, Empirical expenses were $1,358,966 compared to $103,961 during the year ended December 31, 2007 as set out above. The Company did not begin active exploration until the end of 2007; therefore there were limited exploration costs in 2007.

| | vi. | Empirical Discovery Agreement 2008 (Bisbee) |

In January 2008, the Company entered into a second agreement with Empirical Discovery LLC to explore for and test porphyry copper targets in a specified area near Bisbee, Arizona. Bisbee is located within a copper district that produced over 8 billion pounds of copper and 3 million ounces of gold in the last century. The Company intends to use the proprietary geophysical interpretation techniques developed by the principals of Empirical to locate buried porphyry copper targets. The recently acquired property covers over 10,800 acres (4,370 ha). Under the terms of the agreement, Entrée has the option to acquire an 80% interest in any of the properties by incurring exploration expenditures totaling a minimum of $1.9 million and issuing 150,000 shares within 5 years of the anniversary of TSX acceptance of the agreement (Feb 13, 2008). If Entrée exercises its option, Empirical may elect within 90 days to retain a 20% participating interest or convert to a 2% NSR royalty, half of which may be purchased for $2 million.

Land acquisition and reconnaissance exploration were conducted during the first half of 2008. In February 2009, an approximately 9 line-km test AMT survey budgeted at US$43,000 was completed. Once received, results of the survey will help in better definition of the target areas.

For the year ended December 31, 2008, Bisbee expenses were $193,875 compared to $Nil during the year ended December 31, 2007 as set out above. The Company did not enter into an agreement to explore this location until 2008; therefore there were no costs in 2007.

The Lordsburg claims cover 3,885 ha (9,600 acres) adjacent to the historic Lordsburg copper-gold-silver district, New Mexico, USA. The claims were originally acquired under the 2007 Empirical Discovery agreement.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

In September 2008, Entrée announced a $1.2 million drilling budget to test three geophysical, geochemical and geological targets outlined under the Empirical exploration program. Diamond drilling to test the principal targets commenced October 18, 2008 and four widely-spaced diamond drill holes totaling 2,563 m (8,405 ft) were completed by mid-December, 2009. The best hole, EG-L-08-002, intersected 310 m of 0.14% copper and 0.08 g/t gold with intervals of higher grade mineralization up to 0.33% copper and 0.26 g/t gold. The remaining three holes did not intersect significant mineralization. This is the first time porphyry-style mineralization has been found in this region of New Mexico, previously known only for high grade narrow vein deposits.

A three hole, 1,214 metre follow-up drill program was completed in March 2009. Results from this work are pending.

For the year ended December 31, 2008, Lordsburg expenses were $1,167,998 compared to $Nil during the year ended December 31, 2007 as set out above. The Company began exploration of this location in 2008; therefore there were no costs in 2007.

In November, 2007, Entrée entered into an agreement with the Zhejiang No. 11 Geological Brigade to explore for copper within three contiguous exploration licenses, totaling approximately 61 square kilometres in Pingyang County, Zhejiang Province, People’s Republic of China.

Entrée has agreed to spend $3 million to fund exploration activities on the licences (collectively known as “Huaixi” - see maps at www.entreegold.com) over a four year period. After Entrée has expended $3 million, the Company will hold a 78% interest and Zhejiang No. 11 Geological Brigade will hold a 22% interest in the project. The first year commitment under the agreement has been completed.

The licenses cover a large area of advanced argillic alteration with peripheral, small scale, past-producing copper and pyrite mines. As the area has not been extensively drill-tested to depth or explored using deep-penetrating geophysical techniques, it is believed to offer excellent potential for buried copper-gold deposits. The geology of the Huaixi area is similar to that of high-level alteration systems associated with a number of porphyry copper deposits elsewhere in the world.

In late 2008, Entrée completed a systematic, property-wide stream sediment survey and a grid-controlled soil survey over selected areas of the Huaixi property. The surveys highlighted a 7 km long, northwest-trending structural corridor with a strong, multielement porphyry signature.

For the year ended December 31, 2008, Huaixi expenses were $626,325 compared to $Nil during the year ended December 31, 2007 as set out above. The Company did not enter into an agreement to explore this location until the end of 2007; therefore there were no costs in 2007.

| B) | GENERAL AND ADMINISTRATIVE |

For the year ended December 31, 2008, general and administrative expense before stock-based compensation was $3,113,664 compared to $2,896,364 during the year ended December 31, 2007 as set out above. The increase was primarily due to Sarbanes Oxley Act Section 404 Compliance, increased expenses associated with the administration of new projects and increased salary and legal costs.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

| C) | STOCK-BASED COMPENSATION |

For the year ended December 31, 2008, stock-based compensation expense was $3,672,358 compared to $1,732,839 during the year ended December 31, 2007 as set out above. During the year ended December 31, 2008, 2,957,000 options were granted with a fair value of $3,536,355 compared to 1,500,500 options granted during the year ended December 31, 2007, with fair value of $2,082,780.

| D) | STOCKHOLDER COMMUNICATIONS AND INVESTOR RELATIONS |

For the year ended December 31, 2008, stockholder communications and investor relations expense before stock-based compensation was $691,926 compared to $739,964 during the year ended December 31, 2007 as set out above. This decrease was due to a reduction in advertising and conference expenses.

For the year ended December 31, 2008, interest income was $1,981,316 compared to $1,090,718 during the year ended December 31, 2007 as set out above. The Company earns income on its cash and cash equivalents. The increase was due to greater principal amounts invested due to the proceeds from the exercise of warrants, the exercise of options and the Treasury Offering.

Asset Backed Commercial Paper

At December 31, 2008, the Company had approximately C$4.0 million invested in asset backed commercial paper (“ABCP”) which was originally rated R1-high by Dominion Bond Rating Service. In mid-August 2007, a number of non-bank sponsors of ABCP, including those with which the Company had invested, announced that they could not place ABCP due to unfavourable conditions in the Canadian capital markets. As a result, there is presently no active market for the ABCP held by the Company.

As at December 31, 2008, the non-bank ABCP market remained the subject of a restructuring process with the expressed intention of replacing the ABCP with a number of long-term floating rate notes (“New Notes”). The restructuring plan, which was completed on January 21, 2009, pooled all of the underlying assets from all the ABCP trusts with the exception of those assets designated as ineligible for pooling (“Ineligible Assets”) and those series of assets backed exclusively by traditional financial assets (“Traditional Series”). None of the Company’s ABCP consisted of Ineligible Assets or Traditional Series.

ABCP relating to the pooled assets was replaced with four classes of asset backed notes named A1, A2, B and C in declining order of seniority. ABCP relating to Ineligible Assets and Traditional Series was replaced with new tracking notes whose characteristics are designed to track the performance of the particular assets of the series to which they correspond.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

The Company has estimated the fair value of ABCP at December 31, 2008 using the methodology and assumptions outlined below. The fair value estimate of the New Notes to be received under the restructuring has been calculated based on information provided by the Pan Canadian Investor Committee as well as Ernst & Young, the Monitor of the restructuring. The table below summarizes the Company’s valuation.

Restructuring categories | C$ thousands | | |

MAV 2 Notes | Face value | Fair value estimate* | | Expected maturity date |

| A1 (rated A) | 1,966,529 | 984,490 | | 12/31/2016 |

| A2 (rated A) | 1,630,461 | 614,952 | | 12/31/2016 |

| B | 295,974 | 24,034 | | 12/31/2016 |

| C | 120,401 | 4,713 | | 12/31/2016 |

| Total original investment | 4,013,365 | 1,628,189 | | |

* - the range of fair values estimated by the Company varied between $1.2 million and $1.9 million

- the total United States dollars fair value of the investment at December 31, 2008 is $1,329,568.

The A1, A2 and traditional asset tracking notes comprise the major categories of the notes contemplated to be received totalling 90% of the face value of the original investments made and 98% of the fair value estimate of the Company’s holdings. In the case of the A1 and A2 notes, it is estimated that they will pay interest at a rate 0.5% less than the bankers’ acceptance (“BA”) rate and it is estimated that prospective buyers of these notes will require premium yields between 8% and 12% over the BA rate.

The Company has the applied its best estimate of prospective buyers’ required yield and calculated the present value of the new notes using required yield as the discount factor. Using a range of potential discount factors allows the Company to estimate a range of recoverable values.

The Class B notes are not expected to pay any current interest until the Class A1 and A2 notes are paid in full, which is not anticipated until December 20, 2016. These notes, which will be subordinate to the Class A1 and A2 notes, will not receive a credit rating and it is expected that Class B notes will initially trade at less than 10% of par value.

The Class C notes also will not pay any current interest and are subordinate to the Class B notes. In light of this subordination, the Class C notes are viewed as highly speculative with regard to ultimate payment of principal at maturity in 2016. Accordingly, it is expected that Class C notes will initially trade at less than 5% of par value.

Restructuring costs are excluded from this valuation as it has been stated that the costs will be deducted from the accrued interest that the Company will receive shortly after the completion of the restructuring.

Based upon a sensitivity analysis of the assumptions used, the expected yield required by a potential investor remains the most significant assumption included in the fair value estimate. Based on this exercise the Company estimated that as at December 31, 2008 the range of potential values was between $1.87 million and $1.25 million. There can be no assurance that this estimate will be realized. Subsequent adjustments, which could be material, may be required in future reporting periods.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

Equity Method Investment

The Company has a 20% equity investment in a joint venture with Ivanhoe Mines Ltd. At December 31, 2008, the Company’s investment in the joint venture is $Nil. The Company’s share of the loss of the joint venture is $366,595 for the year ended December 31, 2008 (December 31, 2007, $Nil).

In Mongolia, the Company proposed a two phase work program for its 100% owned ground outside of the joint venture area of Lookout Hill and had budgeted approximately $3.8 million. A focused geophysical program commenced in May 2008 and in August 2008 the Company announced the discovery of coal on the western, 100% owned Togoot licence. In September 2008, the Company announced a budget increase of an additional $2 million to further evaluate the coal discovery and surrounding areas. Results have been significant enough to warrant a two-phase program for 2009, focused primarily on the Nomkhon Bohr and Coking Flats targets. The first phase budget will be approximately $2.6 million.

Mineral licenses for the Shivee Tolgoi, Javhlant and Togoot properties were extended for final expiry in March and April 2010, unless previously converted to mining licenses. A portion of the Shivee Tolgoi license and the Javhlant license are subject to the joint venture with Ivanhoe Mines. The Manlai licence also expires in March 2010. Mongolian exploration licenses are maintained in good standing by payment to the Mineral Resources and Petroleum Authority of Mongolia of set annual fees escalating from $0.10 to $1.50 per hectare over the course of the mineral tenure. The total estimated annual fee in order to maintain the licenses in good standing is approximately $280,000.

Drilling by the Ivanhoe-Entrée joint venture is expected to be limited in 2009.

Ground acquisition of priority targets has largely been completed in Arizona and New Mexico as per the Empirical Agreement 2007. Initial evaluation of the four acquired targets (including Lordsburg) has been completed and drilling of high priority targets on Gold Hill and on Duncan is planned for the second quarter 2009. No further work is planned for Ash Peak due to lack of encouraging results.

In September 2008, the Empirical Lordsburg target was upgraded to a separate project and $1.2 million budgeted for drill testing of three significant geophysical, geochemical and geological anomalies. Drilling at Lordsburg commenced in mid-October 2008 and four widely-spaced drill holes totaling 2,563 m were completed in mid-December, 2008. The Company announced the discovery of significant porphyry copper-gold mineralization at Lordsburg in January 2009. A follow-up, 2009 drill program commenced in mid-February.

The Company entered into an agreement with the Zhejiang No. 11 Geological Brigade to explore for copper within three prospective contiguous exploration licences, totaling approximately 61 square kilometres in Pingyang County, Zhejiang Province, People’s Republic of China. After Entrée has expended $3 million over 4 years, the Company will have earned a 78% interest and Zhejiang No. 11 Geological Brigade will hold a 22% interest in the project. The Company has completed registration of a Chinese business entity. Geochemical surveys (stream sediment and soil) were completed in the last quarter 2008. These surveys highlighted a 7 km long, northwest-trending structural corridor with a strong, multi-element porphyry signature. Additional fill-in geochemistry and a geophysical survey (IP and magnetics) are planned for the first half 2009.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

The Company is actively engaged in looking for properties to acquire and manage, which are complementary to its existing projects, particularly large tonnage base and precious metal targets in eastern Asia and in the Americas.

The commodities the Company is most likely to pursue include copper, gold and molybdenum, which are often associated with large tonnage, porphyry related environments. The Company has entered into agreements to acquire these types of targets over the past several months in the southwestern U.S and more recently in China. Other jurisdictions may be considered, depending on the merits of the potential asset.

Smaller, higher grade systems will be considered by the Company if they demonstrate potential for near-term production and cash-flow. If the Company is able to identify smaller, higher grade bodies that may be indicative of concealed larger tonnage mineralized systems, it may negotiate and enter into agreements to acquire them.

The Company feels confident that it has sufficient funds available for ongoing operations and possible future acquisitions.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

| | | Three Months | | | Three Months | | | Three Months | | | Three Months | |

| | | Ended | | | Ended | | | Ended | | | Ended | |

| | | December 31, | | | September 30, | | | June 30, | | | March 31, | |

| | | 2008 | | | 2008 | | | 2008 | | | 2008 | |

| | | | | | | | | | | | | |

| Exploration | | $ | 4,236,000 | | | $ | 2,889,592 | | | $ | 2,112,848 | | | $ | 1,002,330 | |

| General and administrative | | | 742,828 | | | | 2,350,113 | | | | 2,514,253 | | | | 1,162,875 | |

| Loss from operations | | | (4,978,828 | ) | | | (5,239,705 | ) | | | (4,627,101 | ) | | | (2,165,205 | ) |

| Interest income | | | 324,686 | | | | 443,438 | | | | 537,010 | | | | 676,182 | |

| Loss from equity investee | | | (40,606 | ) | | | (325,989 | ) | | | - | | | | - | |

Fair value adjustment to asset backed commercial paper | | | - | | | | (844,537 | ) | | | - | | | | (489,623 | ) |

| Net loss | | $ | (4,694,748 | ) | | $ | (5,966,793 | ) | | $ | (4,090,091 | ) | | $ | (1,978,646 | ) |

| | | | | | | | | | | | | | | | | |

| Loss per share, basic and diluted | | $ | (0.05 | ) | | $ | (0.06 | ) | | $ | (0.04 | ) | | $ | (0.03 | ) |

| | | Three Months | | | Three Months | | | Three Months | | | Three Months | |

| | | Ended | | | Ended | | | Ended | | | Ended | |

| | | December 31, | | | September 30, | | | June 30, | | | March 31, | |

| | | 2007 | | | 2007 | | | 2007 | | | 2007 | |

| | | | | | | | | | | | | |

| Exploration | | $ | 1,097,168 | | | $ | 2,120,233 | | | $ | 2,783,829 | | | $ | 509,916 | |

| General and administrative | | | 1,222,037 | | | | 773,664 | | | | 2,612,514 | | | | 806,402 | |

| Loss from operations | | | (2,319,205 | ) | | | (2,893,897 | ) | | | (5,396,343 | ) | | | (1,316,318 | ) |

| Interest income | | | 494,635 | | | | 318,226 | | | | 138,175 | | | | 139,682 | |

| Loss from equity investee | | | - | | | | | | | | | | | | | |

Fair value adjustment to asset backed commercial paper | | | (425,108 | ) | | | (573,263 | ) | | | - | | | | - | |

| Net loss | | $ | (2,249,678 | ) | | $ | (3,148,934 | ) | | $ | (5,258,168 | ) | | $ | (1,176,636 | ) |

| | | | | | | | | | | | | | | | | |

| Loss per share, basic and diluted | | $ | (0.03 | ) | | $ | (0.04 | ) | | $ | (0.07 | ) | | $ | (0.03 | ) |

The Company’s Mongolian exploration season typically begins in April and ends in November or December. Exploration costs in the third and fourth quarters of 2008 increased compared to the same quarters in 2007 due to the addition of projects in China and the USA and costs associated with evaluating the new coal discovery, Nomkhon Bohr. Exploration costs in the second quarter of 2008 decreased compared to the same quarter in 2007 due to a later start of the field season. Increased costs were incurred in the first quarter of 2008 compared to the same period in 2007 due to increased general and administrative costs related to corporate matters, particularly Sarbanes Oxley Act Section 404 compliance and the addition of exploration projects in China and Arizona. Interest income in the fourth quarter of 2008 has decreased due to a decrease in interest rates and a reduction in capital invested. General and administrative costs fluctuate throughout the year, primarily due to stock-based compensation expenses.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

5. LIQUIDITY

To date the Company has not generated significant revenues from its operations and is considered to be in the exploration stage. Working capital on hand at December 31, 2008 was $45,131,538 and is more than sufficient to finance budgeted exploration, general and administrative expense, investor relations for 2009. Cash and cash equivalents and short-term investments were $45,212,815 at December 31, 2008 or $0.48 per weighted average share outstanding. The Company has approximately $37 million surplus funds available for acquisitions and/or operating requirements for 2009 and subsequent years. At present, the Company is dependent on equity financing for additional funding if required. Should one of the Company’s projects proceed to the mine development stage, it is expected that a combination of debt and equity financing would be available.

Operating activities

Cash used in operations was $10,513,065 for the year ended December 31, 2008 (December 31, 2007 - $9,248,969) and represents expenditures on mineral property exploration and general and administrative expense as described above for both periods.

Financing activities

During the year ended December 31, 2008 and 2007, the Company issued common shares as follows:

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2008 | | | 2008 | | | 2007 | | | 2007 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | | | | | | | | | | |

| Private placements | | | - | | | $ | - | | | | 14,428,640 | | | $ | 43,826,994 | |

| Share issue costs | | | - | | | | (7,186 | ) | | | - | | | | (1,981,360 | ) |

| Exercise of warrants | | | - | | | | - | | | | 7,542,408 | | | | 20,392,043 | |

| Exercise of stock options | | | 958,057 | | | | 856,470 | | | | 728,700 | | | | 603,484 | |

| Mineral property interests | | | 30,000 | | | | 60,941 | | | | | | | | | |

| | | | 988,057 | | | $ | 910,225 | | | | 22,699,748 | | | $ | 62,841,161 | |

Warrants exercised in June 2007 represent in part the exercise by Rio Tinto of 12,613,842 warrants to purchase one half of one share and the resultant issuance of 6,306,920 shares for proceeds of $17,051,716. Warrants exercised in June 2007 represent in part the exercise by Ivanhoe Mines of 2,470,978 warrants to purchase one half of one share and the resultant issuance of 1,235,488 shares for proceeds of $3,340,327.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

On November 26, 2007, the Company closed a Treasury Offering on a bought deal basis, consisting of 10 million Common Shares of the Company at an offering price of C$3.00 per Common Share representing gross proceeds to the Company treasury of C$30 million from which fees and closing costs were deducted. In order to maintain their percentage ownership of Entrée’s issued and outstanding shares of approximately 14.7% and 15.9% respectively, Ivanhoe Mines and Rio Tinto exercised their pre-emptive rights and acquired, concurrently with the closing of the Treasury Offering, an aggregate of 4,428,640 shares of the Company at a price of C$3.00 per share for additional gross proceeds of C$13,285,920.

Investing activities

During the year ended December 31, 2008, the Company advanced $366,595 to the joint venture with Ivanhoe Mines representing the Company’s 20% participation in joint venture expenditures. During the year ended December 31, 2008, the Company expended $255,959 on equipment, primarily for exploration activities (December 31, 2007 - $80,457).

Table of Contractual Commitments

The following table lists as of December 31, 2008 information with respect to the Company’s known contractual obligations.

| | | | | | | | | | | | More | | | | |

| | | Less than | | | | | | | | | than | | | | |

| | | 1 Year | | | 1-3 Years | | | 3-5 Years | | | 5 Year | | | Total | |

| | | | | | | | | | | | | | | | |

| Office leases | | $ | 124,968 | | | $ | 106,751 | | | | - | | | | - | | | $ | 231,719 | |

| Total | | $ | 124,968 | | | $ | 106,751 | | | | - | | | | - | | | $ | 231,719 | |

Outstanding share data

As at December 31, 2008, there were 94,560,898 common shares outstanding. In addition there were 10,651,800 stock options outstanding with exercise prices ranging from C$1.15 to C$3.10 per share. There were no warrants outstanding at December 31, 2008. As at March 27, 2008, there were 94,580,898 common shares outstanding.

| | The Company had no commitments for capital assets at December 31, 2008. |

At December 31, 2008, the Company had working capital of $45,161,538 compared to $67,593,390 at December 31, 2007. In addition, the Company had an investment in asset backed commercial paper of $1,329,568 net of an impairment adjustment in the amount of $2,332,531. Budgeted expenditures for the 12 months ending December 31, 2009 are approximately $9 million for exploration and $3 million for administration and stockholder communications, net of interest and other income. The exploration budget is in two Phases, Phase 1 which is $5 million and Phase 2, which will be implemented upon favourable results in Phase 1 is $4 million. Working capital on hand is expected to exceed cash requirements for the ensuing twelve months by approximately $33 million.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

The Company is committed to make lease payments for the rental of office space totaling $177,605 over the remaining three years of its five year office lease in Vancouver, an annual office lease in Beijing and an annual lease for accommodations in Vancouver.

7. OFF-BALANCE SHEET TRANSACTIONS

The Company has no off-balance sheet arrangements except for the contractual obligation noted above.

| TRANSACTIONS WITH RELATED PARTIES | |

The Company entered into the following transactions with related parties during the nine month period ended December 31, 2008:

a) Paid or accrued management fees of $33,005 (December 31, 2007 - $70,911) to directors and officers of the Company.

These transactions were in the normal course of operations and were measured at the exchange amount which represented the amount of consideration established and agreed to by the related parties.

Not applicable.

| 10. | CRITICAL ACCOUNTING ESTIMATES |

The preparation of consolidated financial statements in conformity with generally accepted accounting principles in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the period. Actual results could differ from these estimates.

The Company follows accounting guidelines in determining the value of stock option compensation, as disclosed in Note 6 to the Financial Statements. Unlike other numbers in the accounts, this is a calculated amount not based on historical cost, but on subjective assumptions introduced to an option pricing model, in particular: (1) an estimate for the average future hold period of issued stock options before exercise, expiry or cancellation and (2) future volatility of the Company’s share price in the expected hold period (using historical volatility as a reference). Given that there is no market for the options and they are not transferable, the resulting value calculated is not necessarily the value the holder of the option could receive in an arm’s-length transaction.

The Company’s accounting policy is to expense exploration costs on a project by project basis consistent with United States GAAP. The policy is consistent with that of the other exploration companies that have not established mineral reserves. When a mineral reserve has been objectively established further exploration costs would be deferred. Management is of the view that its current policy is appropriate for the Company.

Under generally accepted accounting principles, the events and circumstances affecting ABCP since August 2007 constitute an indication of impairment and it is therefore necessary to carry ABCP at the lower of cost and estimated fair value. Fair value is estimated based on the results of a valuation technique that makes maximum use of inputs observed from markets, and relies as little as possible on inputs generated by the entity.

The Company has estimated the fair value of ABCP at December 31, 2008 using the methodology and assumptions outlined below. The fair value estimate of the New Notes to be received under the restructuring has been calculated based on information provided by the Pan Canadian Investor Committee as well as Ernst & Young, the Monitor of the restructuring.

The Company has the applied its best estimate of prospective buyers’ required yield and calculated the present value of the new notes using required yield as the discount factor. Using a range of potential discount factors allows the Company to estimate a range of recoverable values.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

Restructuring costs are excluded from this valuation as it has been stated that the costs will be deducted from the accrued interest that the Company will receive shortly after the completion of the restructuring.

Based on the fair value estimation, the Company has recorded an impairment charge of $1,334,160 (2007- $998,371). There can be no assurance that the fair value estimate will be realized or that it will be adequate. Subsequent adjustments, which could be material, may be required in future reporting periods.

| 11. | CHANGES IN ACCOUNTING POLICIES |

The Company adopted SFAS No. 157, Fair Value Measurements, on January 1, 2008. SFAS No. 157 applies to all financial instruments being measured and reported on a fair value basis. In February 2008, the FASB issued a staff position that delays the effective date of SFAS No. 157 for all nonfinancial assets and liabilities except for those recognized or disclosed at least annually. Therefore, the Company has adopted the provision SFAS No. 157 with respect to its financial assets and liabilities only.

Effective January 1, 2008, the Company adopted SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” which permits entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at fair value. The Company did not elect to adopt the fair value option under this statement.

In December 2007, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 160, “Non-controlling Interest in Consolidated Financial Statement” (“SFAS 160”), which clarifies that a non-controlling interest in a subsidiary is an ownership interest in the consolidated entity that should be reported as equity in the consolidated financial statements. It requires consolidated net income to be reported at amounts that include the amounts attributable to both the parent and the non-controlling interest. It also requires disclosures, on the face of the consolidated statement of income, of the amounts of consolidated net income attributable to the parent and to the non-controlling interest. This consolidated financial statement will continue to be based on amounts attributable to the parent. SFAS 160 is effective for fiscal years beginning after December 31, 2008. The Company is currently evaluating the impact of SFAS 160 on its consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141 “Business Combinations” (“SFAS 141”) (revised 2007) to improve the relevance, representational faithfulness, and comparability of the information that a reporting entity provides in its financial reports about a business combination and its effects. SFAS 141 establishes principles and requirements for the acquirer to (1) recognize and measure in its financial statements the identifiable assets acquired, the liabilities assumed, and any non-controlling interest; (2) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; (3) determines what information to disclose to enable users of financial statements to evaluate the nature and financial effects of the business combination. The effective date of SFAS 141 is December 15, 2008. The Company is currently evaluating the impact of SFAS 141 on its consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles” which sets out the framework for selecting accounting principles to be used in preparing financial statements that are presented in conformity with US GAAP. Up to now, the US GAAP hierarchy has been defined in the US auditing literature. Because of the interrelationship with the auditing literature, SFAS 162 will be effective 60 days following the SEC’s approval of the PCAOB’s amendment to their auditing standards. The adoption of SFAS 162 is not expected to have an effect on the Company’s consolidated financial statements.

A detailed summary of all of the Company’s significant accounting policies and the estimates derived therefrom is included in Note 2 to the annual consolidated financial statements for the year ended December 31, 2008.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

| FINANCIAL INSTRUMENTS AND OTHER INSTRUMENTS |

The Company’s financial assets and liabilities consist of cash and cash equivalents, investments, receivables, accounts payable and accrued liabilities and loan payable some of which are denominated in U.S. dollars, Mongolian Tugriks and Chinese Renminbi. The Company is at risk to financial gain or loss as a result of foreign exchange movements against the Canadian dollar. The Company minimizes its foreign exchange risk by maintaining low account balances in currencies other than the Canadian dollar. The Company does not currently have major commitments to acquire assets in foreign currencies; but historically it has incurred the majority of its exploration costs in foreign currencies.

| 13. | OTHER MD&A REQUIREMENTS |

Forward-Looking Statements

Except for historical information contained in this discussion and analysis, disclosure statements contained herein are forward-looking, as defined in the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

Risk

The Company is a mineral exploration and development company and is exposed to a number of risks and uncertainties that are common to other companies in the same business; some of these risks have been discussed elsewhere in this report. The reader should also refer to the more extensive discussion of risks contained in the Annual Information Form available on SEDAR at www.sedar.com.

There is no assurance that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically and legally feasible to develop or exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know whether that mineral deposit will constitute a reserve (a reserve is a commercially viable mineral deposit).

The Company must comply with license and permitting requirements. Exploration licenses, as extended, for the four Mongolian properties expire in March or April 2010, unless converted before these dates to mining licenses. The total estimated annual fees in order to maintain the licenses in good standing is approximately $280,000.

The Company must comply with environmental regulations that govern air and water quality and land disturbance and provide mine reclamation and closure costs.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

The Company’s financial success is subject to, among other things, fluctuations in copper and gold prices which may affect current or future operating results and may affect the economic value of its mineral resources. The Company’s ability to obtain financing to explore for mineral deposits and to complete the development of those properties it has classified as assets is not assured; nor is there assurance that the expenditure of funds will result in the discovery of an economic mineral deposit. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements.

The Company has not completed a feasibility study on any of its deposits to determine if its hosts a mineral resource that can be economically developed and profitably mined.

Management’s Report on Internal Control over Financial Reporting

Management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f) and National Instrument 52-109 - Certificate of Disclosure in Issuers' Annual and Interim Filings of the Canadian Securities Administrations. Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting as of December 31, 2008 based on Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Our internal control over financial reporting includes policies and procedures that provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external reporting purposes in accordance with U.S. generally accepted accounting principles.

Changes in Internal Control over Financial Reporting

Management of the Company conducted an evaluation of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2007, which identified material weaknesses in the Company’s control processes around information technology systems. These weaknesses included inadequate security, inadequate restricted access to systems and insufficient disaster recovery plans. Management also identified material weaknesses in the Company’s internal control processes over the accounting for income taxes, including deferred tax assets and the availability of resource expenditures in foreign jurisdictions. During the fiscal year ended December 31, 2008, management took steps to remedy all of the identified material weaknesses. In particular, management increased the security of the Company’s network, initiated a disaster recovery plan and utilized the services of an external tax consultant to remedy the weaknesses in the Company’s income tax process. Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2008, after all of the changes to internal control over financial reporting had been implemented. Management concluded that, as of December 31, 2008, the Company’s internal control over financial reporting was effective and no material weaknesses in the Company’s internal control over financial reporting were discovered.

Disclosure Controls and Procedures

Management is responsible for establishing and maintaining disclosure controls and procedures, which provide reasonable assurance that material information relating to the Company and its subsidiaries is accumulated and communicated to management to allow timely decisions regarding required disclosure. Management has evaluated the effectiveness of its disclosure and procedures as of December 31, 2008 and believes its disclosure controls and procedures to be effective.

It is important to recognize that the Company has limited administrative staffing. As a result, internal controls and disclosure controls and procedures which rely on segregation of duties in many cases are not appropriate or possible. The Company relies heavily on senior management review and approval of disclosure documents to ensure that the controls are effective as possible.

Canadian Disclosure Standards in Mineral Resources and Mineral Reserves

The terms “Mineral Reserve,” “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) CIM Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time by the CIM.

The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in the United States Securities and Exchange Commission ("SEC") Industry Guide 7. Under SEC Guide 7 standards, a "Final" or "Bankable" feasibility study is required to report reserves, the three year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

ENTRÉE GOLD INC.

MANAGEMENT DISCUSSION AND ANALYSIS

For the Year Ended December 31, 2008

(In United States dollars unless stated otherwise)

In addition, the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Accordingly, information contained in this report and the documents incorporated by reference herein containing descriptions of our mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

24