Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on June 21, 2005

Registration No. 333-125610

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

To

FORMS F-4* and S-4*

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

North American Energy Partners Inc.

(Exact name of registrant as specified in its charter)

| Canada | 1629 | Not Applicable | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Zone 3, Acheson Industrial Area 2-53016 Highway 60 Acheson, Alberta T7X 5A7 (780) 960-7171 | Vincent J. Gallant Zone 3, Acheson Industrial Area 2-53016 Highway 60 Acheson, Alberta T7X 5A7 (780) 960-7171 | |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Gary W. Orloff

Bracewell & Giuliani LLP

711 Louisiana Street, Suite 2300

Houston, Texas 77002-2770

Phone: (713) 221-1306

Fax: (713) 221-2166

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

TABLE OF ADDITIONAL REGISTRANTS

Exact Name of Registrant as Specified in its Charter(1) | State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | ||

Griffiths Pile Driving Inc. | Alberta, Canada | Not applicable | ||

NACG Finance LLC | Delaware | 74-3107147 | ||

North American Caisson Ltd. | Alberta, Canada | Not applicable | ||

North American Construction Group Inc. | Canada | Not applicable | ||

North American Construction Ltd. | Canada | Not applicable | ||

North American Engineering Inc. | Alberta, Canada | Not applicable | ||

North American Enterprises Ltd. | Alberta, Canada | Not applicable | ||

North American Industries Inc. | Alberta, Canada | Not applicable | ||

North American Maintenance Ltd. | Alberta, Canada | Not applicable | ||

North American Mining Inc. | Alberta, Canada | Not applicable | ||

North American Pipeline Inc. | Alberta, Canada | Not applicable | ||

North American Road Inc. | Alberta, Canada | Not applicable | ||

North American Services Inc. | Alberta, Canada | Not applicable | ||

North American Site Development Ltd. | Alberta, Canada | Not applicable | ||

North American Site Services Inc. | Alberta, Canada | Not applicable |

| (1) | The address, including zip code, and telephone number, including area code, of each of the additional registrant’s principal executive offices is c/o North American Energy Partners Inc., Zone 3, Acheson Industrial Area, 2-53016 Highway 60, Acheson, Alberta T7X 5A7, (780) 960-7171. |

| * | Explanatory Note—This registration statement comprises a filing on Form F-4 with respect to the securities of the non-U.S. registrants and a filing on Form S-4 with respect to the security of the U.S. registrant. |

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statements filed with the Securities and Exchange Commission are effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated June 21, 2005

US$60,481,000

NORTH AMERICAN ENERGY PARTNERS INC.

Offer to Exchange

9% Exchange Senior Secured Notes due 2010

for any and all outstanding 9% Senior Secured Notes due 2010

This prospectus, and accompanying letter of transmittal, relate to our proposed exchange offer. We are offering to exchange up to US$60,481,000 aggregate principal amount of new 9% exchange senior secured notes due 2010, which we call the exchange notes, for any and all outstanding 9% senior secured notes due 2010, which we call the original notes, previously issued in a private offering and which have various transfer restrictions because they were not issued pursuant to a registration statement.

In this prospectus we sometimes refer to the exchange notes and the original notes collectively as the notes.

| • | The exchange offer expires at 5:00 p.m., New York City time, on , 2005, unless extended. |

| • | The terms of the exchange notes are substantially identical to the terms of the original notes, except that the exchange notes will be issued free of the transfer restrictions and covenants regarding exchange and registration rights applicable to the original notes. |

| • | All original notes that are validly tendered and not validly withdrawn will be exchanged. |

| • | Tenders of original notes may be withdrawn at any time prior to expiration of the exchange offer. |

| • | We will not receive any proceeds from the exchange offer. |

| • | The exchange of original notes for exchange notes will not be a taxable event for United States federal income tax purposes. |

| • | Holders of original notes do not have any appraisal or dissenters’ rights in connection with the exchange offer. |

| • | Original notes not exchanged in the exchange offer will remain outstanding and be entitled to the benefits of the indenture, but except under limited circumstances, will have no further exchange or registration rights under the registration rights agreement discussed in this prospectus. |

Please see “Risk Factors” beginning on page 9 for a discussion of factors you should consider in connection with the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the exchange notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus, the accompanying letter of transmittal and related documents and any amendments or supplements to this prospectus carefully before making your investment decision.

The date of this prospectus is , 2005.

Table of Contents

Index to Financial Statements

| Page | ||

| 1 | ||

| 9 | ||

| 21 | ||

| 33 | ||

| 34 | ||

| 35 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 38 | |

| 55 | ||

| 70 | ||

| 78 | ||

| 82 | ||

| 85 | ||

| 88 | ||

| 133 | ||

| 135 | ||

| 137 | ||

| 138 | ||

| 138 | ||

| 138 | ||

| 138 | ||

| 139 | ||

| F-1 | ||

| A-1 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell the notes. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of the prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

The exchange notes have not been and will not be qualified for public distribution under the securities laws of any province or territory of Canada. The exchange notes are not being offered for sale and may not be offered or sold, directly or indirectly, in Canada or to any resident thereof except in accordance with the securities laws of the provinces and territories of Canada. The notes have been issued pursuant to the exemption from the prospectus requirements of the applicable Canadian provincial and territorial securities laws and may be sold in Canada only pursuant to an exemption therefrom.

A number of terms commonly used in our industry and this prospectus are defined in the glossary section of this prospectus.

i

Table of Contents

Index to Financial Statements

EXCHANGE RATE DATA

The following table sets forth the exchange rates for one Canadian dollar, expressed in U.S. dollars, based on the Bank of Canada nominal noon exchange rate. As of May 31, 2005, the Bank of Canada nominal noon exchange rate was C$1.00 = US$0.7994.

| 2004 | 2005 | |||||||||||

| December | January | February | March | April | May | |||||||

High for period | 0.8433 | 0.8342 | 0.8131 | 0.8320 | 0.8232 | 0.8083 | ||||||

Low for period | 0.8056 | 0.8051 | 0.7958 | 0.8024 | 0.7956 | 0.7872 | ||||||

| Year Ended March 31, | ||||||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | ||||||

Average for period | 0.6811 | 0.6634 | 0.6386 | 0.6478 | 0.7420 | |||||

ii

Table of Contents

Index to Financial Statements

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that may be important to you. Therefore, you are encouraged to carefully read this entire prospectus, including the section entitled “Risk Factors.” This prospectus includes the historical financial statements of Norama Ltd., the holding company for the business that we acquired on November 26, 2003. We state our financial statements in Canadian dollars. In this prospectus, references to “Canadian dollars,” “dollars,” “C$” or “$” are to the currency of Canada, and references to “U.S. dollars” or “US$” are to the currency of the United States. In this prospectus, unless the context otherwise requires, references to “we,” “us” or “our” are to North American Energy Partners Inc. and its subsidiaries.

Our Company

We are one of the largest providers of mining and site preparation, piling and pipeline installation services in western Canada. We provide our services primarily to the major integrated and independent oil and gas, petrochemical and other natural resources companies operating in this geographic region. In serving our customers, we operate 450 pieces of heavy equipment and over 600 support vehicles, and we have developed expertise operating in the difficult working conditions created by the climate and terrain of the Alberta oil sands and other areas of western Canada. Our work on private sector oil sands and pipeline installation projects results from focusing our asset deployment on the more technically difficult and profitable revenue opportunities rather than traditional public sector construction activity. Our services consist of:

| • | surface mining for oil sands and other natural resources; site preparation, which includes clearing, stripping, excavating and grading for mining operations and other general construction projects, as well as underground utility installation for plant, refinery and commercial building construction; |

| • | piling installation, including the installation of all types of driven and drilled piles, caissons and earth retention and stabilization systems for commercial buildings, private industrial projects, such as plants and refineries, and infrastructure projects, such as bridges; and |

| • | pipeline installation, including the installation of transmission and distribution pipe made of steel, plastic and fiberglass materials in sizes up to and including 36 inches in diameter for oil and gas transmission. |

For the nine months ended December 31, 2004, we had revenue of $234.5 million and EBITDA of $11.0 million.

We have long-term, stable relationships with our customers, some of whom we have been serving for over 30 years. We believe we are the principal provider of mining and site preparation and piling services in the Alberta oil sands to many major operators in the area, including Syncrude Canada Ltd., our largest customer and the largest producer of bitumen in the oil sands. We also provide pipeline installation services in British Columbia to EnCana Corporation.

Our principal office is located at Zone 3, Acheson Industrial Area, 2-53016 Highway 60, Acheson, Alberta, T7X 5A7. Our telephone number is (780) 960-7171.

1

Table of Contents

Index to Financial Statements

Corporate Structure

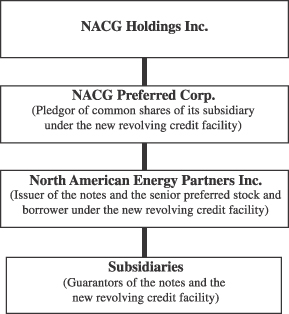

We are a wholly-owned subsidiary of NACG Preferred Corp., a company without any business operations. NACG Preferred Corp. is a wholly-owned subsidiary of NACG Holdings Inc., our ultimate parent. NACG Holdings Inc. has no business operations. All of our restricted subsidiaries (other than any immaterial subsidiaries) guarantee the notes. The following chart depicts our organizational structure.

2

Table of Contents

Index to Financial Statements

The Exchange Offer

Registration Rights Agreement | We sold US$60,481,000 in aggregate principal amount of original notes to qualified institutional buyers as defined in Rule 144A under the Securities Act and outside the United States in accordance with Regulation S under the Securities Act through Jefferies & Company, Inc., as initial purchaser. We entered into a registration rights agreement with the initial purchaser which grants the holders of the original notes limited exchange and registration rights. The exchange offer made pursuant to this prospectus is intended to satisfy those exchange rights. |

The Exchange Offer | US$1,000 principal amount of exchange notes in exchange for each US$1,000 principal amount of original notes. As of the date of this prospectus, US$60,481,000 aggregate principal amount of the original notes are outstanding. We will issue exchange notes to holders on the earliest practicable date following the Expiration Date. |

Resales of the Exchange Notes | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that, except as described below, the exchange notes issued pursuant to the exchange offer may be offered for resale, resold and otherwise transferred by a holder of the exchange notes, other than any holder that is an “affiliate” of ours within the meaning of Rule 405 under the Securities Act, without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that such exchange notes are acquired in the ordinary course of such holder’s business and that such holder has no arrangement or understanding with any person to participate in the distribution of such exchange notes. |

Each broker-dealer that receives exchange notes pursuant to the exchange offer in exchange for original notes that such broker-dealer acquired for its own account as a result of market-making activities or other trading activities, other than original notes acquired directly from us or our affiliates, must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. |

If we receive certain notices in the letter of transmittal, this prospectus, as it may be amended or supplemented from time to time, may be used for the appropriate time period by a broker-dealer in connection with resales of exchange notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities and not acquired directly from us. We have agreed that, if we receive the notices in the letter of transmittal, we will make this prospectus available to any such broker-dealer for use in connection with any such resale. |

3

Table of Contents

Index to Financial Statements

The letter of transmittal requires broker-dealers tendering original notes in the exchange offer to indicate whether the broker-dealer acquired the original notes for its own account as a result of market-making activities or other trading activities, other than original notes acquired directly from us or any of our affiliates. If no broker-dealer indicates that the original notes were so acquired, we have no obligation under the registration rights agreement to maintain the effectiveness of the registration statement past the consummation of the exchange offer or to allow the use of this prospectus for such resales. See “The Exchange Offer—Registration Rights” and “—Resale of the Exchange Notes; Plan of Distribution.” |

Expiration Date | The exchange offer expires at 5:00 p.m., New York City time, on , 2005, unless we extend the exchange offer in our sole discretion, in which case the term “Expiration Date” means the latest date and time to which the exchange offer is extended. |

Conditions to the Exchange Offer | The exchange offer is subject to certain conditions which we may waive. See “The Exchange Offer—Conditions to the Exchange Offer.” |

Procedures for Tendering the Original Notes | Each holder of original notes wishing to accept the exchange offer must complete, sign and date the accompanying letter of transmittal in accordance with the instructions contained in this prospectus and in the letter of transmittal, and mail or otherwise deliver the letter of transmittal together with the original notes and any other required documentation to the exchange agent identified below under “Exchange Agent” at the address set forth in this prospectus. By executing the letter of transmittal, a holder will make a number of representations to us. See “The Exchange Offer—Registration Rights” and “—Procedures for Tendering Original Notes.” |

Special Procedures for Beneficial Owners | Any beneficial owner whose original notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and who wishes to tender should contact the registered holder promptly and instruct the registered holder to tender on such beneficial owner’s behalf. See “The Exchange Offer—Procedures for Tendering Original Notes.” |

Guaranteed Delivery Procedures | Holders of original notes who wish to tender their original notes when those securities are not immediately available or who cannot deliver their original notes, the letter of transmittal or any other documents required by the letter of transmittal to the exchange agent prior to the Expiration Date must tender their original notes according to the guaranteed delivery procedures set forth in “The Exchange Offer—Procedures for Tendering Original Notes—Guaranteed Delivery.” |

Withdrawal Rights | Tenders of original notes pursuant to the exchange offer may be withdrawn at any time prior to the Expiration Date. |

4

Table of Contents

Index to Financial Statements

Acceptance of Original Notes and Delivery of Exchange Notes | We will accept for exchange any and all original notes that are properly tendered in the exchange offer, and not withdrawn, prior to the exchange offer’s Expiration Date. The exchange notes issued pursuant to the exchange offer will be issued on the earliest practicable date following our acceptance for exchange of original notes. See “The Exchange Offer—Terms of the Exchange Offer.” |

Exchange Agent | Wells Fargo Bank, N.A. is serving as exchange agent in connection with the exchange offer. |

U.S. Federal Income Tax Considerations | The exchange of original notes for exchange notes pursuant to the exchange offer will not be treated as a taxable exchange for federal income tax purposes. See “Income Tax Considerations.” |

5

Table of Contents

Index to Financial Statements

Summary Historical Financial Information

North American Energy Partners Inc. was formed in October 2003 and had no operations before November 26, 2003. As a result, the summary historical consolidated financial information presented below as of and for each of the fiscal years ended March 31, 2002 and 2003 is derived from the audited consolidated financial statements of our predecessor company, Norama Ltd. The summary consolidated historical financial information presented below for the year ended March 31, 2004 is constructed from the historical audited consolidated financial statements of Norama Ltd. for the period from April 1, 2003 to November 25, 2003 and the historical audited consolidated financial statements of North American Energy Partners Inc. for the period from November 26, 2003 to March 31, 2004. The summary consolidated historical financial information presented below for the nine months ended December 31, 2003 is constructed from the historical audited consolidated financial statements of Norama Ltd. for the period from April 1, 2003 to November 25, 2003 and the historical unaudited consolidated financial statements of North American Energy Partners Inc. for the period from November 26, 2003 to December 31, 2003. The consolidated financial information for the periods before November 26, 2003 are not comparable in all respects to the consolidated financial information for periods after November 26, 2003. The pro forma balance sheet data as of February 28, 2005 is derived from our preliminary unaudited financial statements as of February 28, 2005. In the opinion of our management, the historical consolidated financial statements include all adjustments necessary for a fair presentation of our financial position and results of operations for such periods.

The summary historical consolidated financial information for the nine months ended December 31, 2004 is not necessarily indicative of the results that may be expected for the full fiscal year ending March 31, 2005.

The information presented below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes to those financial statements included elsewhere in this prospectus. All of the financial information presented below has been prepared in accordance with Canadian GAAP, which differs in certain material respects from U.S. GAAP. For a discussion of the principal differences between Canadian GAAP and U.S. GAAP as they pertain to us, see note 19 to our audited consolidated financial statements and note 11 to our unaudited interim consolidated financial statements included elsewhere in this prospectus.

6

Table of Contents

Index to Financial Statements

| Year Ended March 31, | Nine Months Ended December 31, | |||||||||||||||||||

| 2002 | 2003 | 2004 (a) | 2003 (a) | 2004 (a) | ||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Revenue | $ | 249,351 | $ | 344,186 | $ | 378,533 | $ | 275,855 | $ | 234,532 | ||||||||||

Project costs | 127,996 | 219,979 | 240,043 | 174,412 | 167,644 | |||||||||||||||

Equipment costs | 77,289 | 72,228 | 69,102 | 57,550 | 39,741 | |||||||||||||||

Depreciation | 11,299 | 10,974 | 13,240 | 7,930 | 14,946 | |||||||||||||||

Gross profit | 32,767 | 41,005 | 56,148 | 35,963 | 12,201 | |||||||||||||||

General and administrative | 12,794 | 12,233 | 14,037 | 8,848 | 15,349 | |||||||||||||||

Gain on sale of capital assets | (218 | ) | (2,265 | ) | 82 | (49 | ) | 509 | ||||||||||||

Amortization of intangible assets | — | — | 12,928 | 1,968 | 2,971 | |||||||||||||||

Operating income | 20,191 | 31,037 | 29,101 | 25,196 | (6,628 | ) | ||||||||||||||

Management fee (b) | 14,400 | 8,000 | 41,070 | 41,070 | — | |||||||||||||||

Interest expense | 3,786 | 4,173 | 13,474 | 5,556 | 24,811 | |||||||||||||||

Foreign exchange (gain) loss | (17 | ) | (234 | ) | 72 | 5 | 516 | |||||||||||||

Other income | (276 | ) | (11 | ) | (326 | ) | (418 | ) | (261 | ) | ||||||||||

Income (loss) before income taxes | 2,298 | 19,109 | (25,189 | ) | (21,017 | ) | (31,694 | ) | ||||||||||||

Income taxes (benefit) | 689 | 6,620 | (9,492 | ) | (8,057 | ) | (5,244 | ) | ||||||||||||

Net earnings (loss) | $ | 1,609 | $ | 12,489 | $ | (15,697 | ) | $ | (12,960 | ) | $ | (26,450 | ) | |||||||

Balance Sheet Data (end of period): | ||||||||||||||||||||

Cash | $ | — | $ | — | $ | 36,595 | $ | 21,025 | $ | 3,344 | ||||||||||

Total assets | 120,431 | 158,584 | 489,389 | 482,731 | 478,981 | |||||||||||||||

Total debt (c) | 50,137 | 63,401 | 313,798 | 311,497 | 322,879 | |||||||||||||||

Total shareholder’s equity (c) | 17,379 | 29,818 | 123,081 | 124,800 | 96,938 | |||||||||||||||

Other Financial Data: | ||||||||||||||||||||

EBITDA (d) | $ | 17,383 | $ | 34,256 | $ | 14,453 | $ | (5,563 | ) | $ | 11,034 | |||||||||

Capital expenditures | 8,668 | 22,932 | 7,735 | 5,836 | 20,494 | |||||||||||||||

Ratio of earnings to fixed charges (e) | 1.3x | 4.1x | — | — | — | |||||||||||||||

| (a) | Amounts for the nine months ended December 31, 2003 and 2004 are unaudited. While amounts for the year ended March 31, 2004 are unaudited, they are constructed from the historical audited consolidated financial statements of Norama Ltd. for the period from April 1, 2003 to November 25, 2003 and the historical audited consolidated financial statements of North American Energy Partners Inc. for the period from November 26, 2003 to March 31, 2004. |

| (b) | Management fees paid to the corporate shareholder of our predecessor company, Norama Ltd., represented fees for services rendered and were determined with reference to taxable income. Subsequent to our acquisition on November 26, 2003, these fees are no longer paid. |

| (c) | The following amounts as calculated under U.S. GAAP differ from the amounts under Canadian GAAP due to the difference in the method of accounting for derivative and hedging activities: |

| Year ended March 31, | Nine Months Ended December 31, | ||||||||||||||

| 2002 | 2003 | 2004 | 2003 | 2004 | |||||||||||

| (in thousands) | |||||||||||||||

Total debt in accordance with U.S. GAAP | $ | 50,137 | $ | 63,401 | $ | 320,147 | $ | 319,850 | $ | 337,571 | |||||

Total shareholder's equity in accordance with U.S. GAAP | 17,379 | 29,818 | 116,732 | 116,447 | 82,246 | ||||||||||

7

Table of Contents

Index to Financial Statements

| (d) | EBITDA is defined as earnings before interest expense, income taxes and depreciation and amortization. EBITDA is not a measure of performance under Canadian GAAP or U.S. GAAP. We believe that EBITDA is a meaningful measure of the performance of our business because it excludes items, such as depreciation, interest and taxes, that are not directly related to the operating performance of our employees and equipment. Management reviews EBITDA to determine whether capital assets are being allocated efficiently. However, EBITDA does not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with Canadian GAAP or U.S. GAAP, and EBITDA is not necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. In addition, our definition of EBITDA may differ from that of other companies. A reconciliation of net earnings (loss) to EBITDA as set forth in our consolidated statements of operations is as follows: |

| Year ended March 31, | Nine Months Ended December 31, | |||||||||||||||||

| 2002 | 2003 | 2004 | 2003 | 2004 | ||||||||||||||

| (unaudited) | ||||||||||||||||||

| (in thousands) | ||||||||||||||||||

Net earnings (loss) | $ | 1,609 | $ | 12,489 | $ | (15,697 | ) | $ | (12,960 | ) | $ | (26,450 | ) | |||||

Adjustments: | ||||||||||||||||||

Depreciation | 11,299 | 10,974 | 13,240 | 7,930 | 14,946 | |||||||||||||

Amortization | — | — | 12,928 | 1,968 | 2,971 | |||||||||||||

Interest expense | 3,786 | 4,173 | 13,474 | 5,556 | 24,811 | |||||||||||||

Income taxes | 689 | 6,620 | (9,492 | ) | (8,057 | ) | (5,244 | ) | ||||||||||

EBITDA | $ | 17,383 | $ | 34,256 | $ | 14,453 | $ | (5,563 | ) | $ | 11,034 | |||||||

| (e) | For the purposes of calculating the ratio of earnings to fixed charges, (1) earnings consist of earnings (loss) before fixed charges and income taxes and (2) fixed charges consist of interest expense on all indebtedness, including capital lease obligations. During the periods presented, no interest costs have been capitalized. The amount by which fixed charges exceeded earnings was $25,189 for the fiscal year ended March 31, 2004, $21,017 for the nine months ended December 31, 2003 and $31,694 for the nine months ended December 31, 2004. |

8

Table of Contents

Index to Financial Statements

An investment in the notes entails a high degree of risk. You should carefully consider the following risk factors and other information presented in this prospectus before making an investment decision with respect to the notes. The risks described below are not the only ones facing us.

Risks Related to the Notes and Our Other Indebtedness

Our substantial debt could adversely affect our financial health, make us more vulnerable to adverse economic conditions and prevent us from fulfilling our obligations under the notes or our new revolving credit facility.

We have a significant amount of debt outstanding and significant debt service requirements. As of February 28, 2005, on a pro forma basis after giving effect to the offering of the original notes on May 19, 2005, we would have had outstanding $355.2 million of consolidated debt, $100.0 million of which, including capital leases and the Canadian GAAP-calculated liability related to our derivative financial instruments, would have been secured debt. As of June 1, 2005, we had the ability to borrow up to approximately $16.6 million under our new revolving credit facility, after taking into account $20.0 million of outstanding and undrawn letters of credit.

Our high level of debt could have important consequences to holders of notes, such as:

| • | limiting our ability to obtain additional financing to fund our working capital, capital expenditures, debt service requirements, potential growth or other purposes; |

| • | limiting our ability to use operating cash flow in other areas of our business because we must dedicate a substantial portion of these funds to make payments on our debt; |

| • | limiting our ability to obtain bonding which is required by some of our customers; |

| • | limiting our ability to lease equipment; |

| • | placing us at a competitive disadvantage compared to competitors with less debt; |

| • | increasing our vulnerability to adverse economic and industry conditions; and |

| • | increasing our vulnerability to increases in interest rates because borrowings under our new revolving credit facility are subject to variable interest rates. |

Our ability to pay interest on the notes and to satisfy our other debt obligations will depend upon, among other things, our future operating performance and our ability to refinance debt when necessary. Each of these factors is to a large extent dependent on economic, financial, competitive and other factors beyond our control. If, in the future, we cannot generate sufficient cash from operations to make scheduled payments on the notes or to meet our other obligations, we will need to refinance some or all of our debt, obtain additional financing or sell assets or we would be unable to generate cash flow, or obtain funding, sufficient to satisfy our debt service requirements.

Despite existing debt levels, we may still be able to incur substantially more debt, which would increase the risks associated with our leverage.

We may be able to incur substantial amounts of additional debt in the future, including debt resulting from the issuance of additional notes and borrowings under our new revolving credit facility. Although the terms of the notes and our new revolving credit facility limit our ability to incur additional debt, such terms do not and will not prohibit us from incurring substantial amounts of additional debt for specific purposes or under certain circumstances. As of June 1, 2005, we had the ability to borrow up to approximately $16.6 million under our new revolving credit facility, after taking into account $20.0 million of outstanding and undrawn letters of credit, subject to availability and the restrictions contained therein.

9

Table of Contents

Index to Financial Statements

Restrictive covenants in our debt agreements may restrict the manner in which we can operate our business.

Our new revolving credit facility and the indenture governing the notes limit, among other things, our ability and the ability of our restricted subsidiaries to:

| • | incur or guarantee additional debt, issue disqualified capital stock or enter into sale and leaseback transactions; |

| • | pay dividends or distributions on our capital stock or repurchase our capital stock, redeem subordinated debt or make other restricted payments; |

| • | incur dividend or other payment restrictions affecting certain of our subsidiaries; |

| • | issue stock of subsidiaries; |

| • | make certain investments or acquisitions; |

| • | create liens on our assets to secure debt; |

| • | enter into transactions with affiliates; |

| • | consolidate, merge or transfer all or substantially all of our assets; and |

| • | transfer or sell assets, including capital stock of our subsidiaries. |

If we fail to comply with these covenants, we would be in default under our new revolving credit facility and the indenture, and perhaps the indenture governing our 8 3/4% senior notes due 2011. The principal and accrued interest on the notes and our other outstanding indebtedness may become immediately due and payable. See “Description of Certain Indebtedness—New Revolving Credit Facility” and “Description of the Notes—Certain Covenants.” In addition, our new revolving credit facility contains, and the agreements governing the terms of our future indebtedness may contain, additional affirmative and negative covenants that are generally more restrictive than those contained in the indenture.

As a result of these covenants, our ability to respond to changes in business and economic conditions and to obtain additional financing, if needed, may be significantly restricted, and we may be prevented from engaging in transactions that might otherwise be considered beneficial to us. Our new revolving credit facility also requires us, and our future credit facilities may require us, to maintain specified financial ratios and satisfy specified financial tests. Our ability to meet these financial ratios and tests can be affected by events beyond our control, and we may be unable to meet those tests. The breach of any of these covenants could result in a default under our new revolving credit facility or any future credit facilities. Upon the occurrence of an event of default under our new revolving credit facility or future credit facilities, the lenders could elect to declare all amounts outstanding under such credit facilities, including accrued interest or other obligations, to be immediately due and payable. If amounts outstanding under such credit facilities were to be accelerated, our assets may not be sufficient to repay in full that indebtedness and our other indebtedness, including the notes.

We may not be able to generate sufficient cash flow to meet our debt service and other obligations due to events beyond our control.

Our ability to generate net cash flow provided by operating activities and to make scheduled payments on our indebtedness will depend on our future financial performance. Our future performance will be affected by a range of economic, competitive and business factors that we cannot control, such as general economic and financial conditions in our industry or the economy generally. A significant reduction in operating cash flows resulting from changes in economic conditions, increased competition, or other events beyond our control could increase the need for additional or alternative sources of liquidity and could have a material adverse effect on our business, financial condition, results of operations, prospects and our ability to service our debt and other obligations. If we are unable to service our indebtedness, we will be forced to adopt an alternative strategy that may include actions such as selling assets, restructuring or refinancing our indebtedness, seeking additional

10

Table of Contents

Index to Financial Statements

equity capital or reducing capital expenditures. We may be unable to effect any of these alternative strategies on satisfactory terms, if at all, or they may yield insufficient funds to make required payments on the notes and our other indebtedness

We may be prevented from financing, or may not have the ability to raise funds necessary to finance, the change of control offer required by the indenture.

Upon the occurrence of a change of control, we will be required to make an offer to each holder of notes outstanding under the indenture to purchase all or a portion of the notes at a purchase price equal to 101% of the principal amount of the notes, plus accrued and unpaid interest. Upon a change of control event, we may be required to repay immediately the outstanding principal, any accrued interest on and any other amounts owed by us under our new revolving credit facility, but we may not be able to repay immediately amounts outstanding under our new revolving credit facility. Upon a change of control, we also may not have sufficient funds available to purchase all of the notes tendered to us. Any requirement to offer to purchase any outstanding notes may result in us having to refinance our outstanding debt or obtain necessary consents under our other debt agreements to repurchase the notes, which we may not be able to do. In such case, our failure to offer to purchase notes following a change of control would constitute an event of default under the indenture, which would, in turn, constitute a default under our new revolving credit facility.

If the indebtedness under our new revolving credit facility is not paid, the lenders thereunder may seek to enforce their security interests in the collateral securing such indebtedness, thereby limiting our ability to raise cash to purchase the notes, and reducing the practical benefit of the offer to purchase provisions to the holders of the notes.

One of the circumstances under which a change of control may occur is upon the sale or disposition of all or substantially all of our capital stock or assets. However, the phrase “all or substantially all” will likely be interpreted under applicable state or provincial law and will be dependent upon particular facts and circumstances. As a result, there may be a degree of uncertainty in ascertaining whether a sale or disposition of “all or substantially all” of our capital stock or assets has occurred, in which case, the ability of a holder of the notes to obtain the benefit of an offer to repurchase all of a portion of the notes held by such holder may be impaired. By definition, the term “Change of Control” contains significant exceptions. See “Description of the Notes—Certain Definitions.”

We are a holding company and rely on our subsidiaries for our operating funds, and our subsidiaries have no obligation to supply us with any funds.

We are a holding company with no operations of our own. We conduct our operations through subsidiaries and are dependent upon our subsidiaries for the funds we need to operate. We will be dependent on the transfer of funds from our subsidiaries to make the payments due under the notes. Although our restricted subsidiaries (other than any immaterial subsidiaries) guarantee the notes, each of our subsidiaries is a distinct legal entity and has no obligation to transfer funds to us. Our ability to pay the notes, and the ability of our subsidiaries to transfer funds to us, could be restricted by the terms of subsequent financings. The payment of dividends to us by our subsidiaries is subject to legal restrictions as well as various business considerations and contractual provisions which may restrict the payment of dividends and distributions and the transfer of assets to us.

Your ability to transfer the notes may be limited by the absence of an active trading market, and an active trading market may not develop for the notes.

The notes are a new issue of securities for which there is no established trading market. We do not intend to have the notes listed on a national securities exchange or quoted on the National Association of Securities Dealers Automated Quotation System, although the original notes are eligible for trading in The PORTAL MarketSM. At the time of the private placement of the original notes, the initial purchaser advised us that it intended to make a market in the original notes, and, if issued, the exchange notes, as permitted by applicable

11

Table of Contents

Index to Financial Statements

law; however, the initial purchaser is not obligated to make a market in the original notes or the exchange notes and may discontinue its market-making activities at any time in its sole discretion without notice. Therefore, an active market for the original notes or the exchange notes may not develop or, if a market develops, it may not continue. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. The market, if any, for the original notes or the exchange notes may experience similar disruptions or such disruptions may adversely affect the prices at which you may sell your notes. In addition, subsequent to their initial issuance, the original notes or the exchange notes may trade at a discount from their initial offering price depending on prevailing interest rates, the market for similar notes, our performance and other factors.

Currency exchange rate fluctuations could adversely affect our ability to repay the notes and to borrow under the new revolving credit facility.

Substantially all of our revenues and costs are incurred in Canadian dollars. However, the obligations represented by the notes are denominated in U.S. dollars. If the Canadian dollar loses value against the U.S. dollar while other factors remain constant, our ability to pay interest and principal on the notes may be diminished.

Our ability to borrow under the new revolving credit facility will be limited, in part, by the mark-to-market liabilities under the Swap Agreements, as defined in “Description of the Notes—Certain Definitions.” If the Canadian dollar increases in value against the U.S. dollar, the mark-to-market liabilities under the Swap Agreements will increase, which may adversely affect our liquidity or even cause a default under the new revolving credit facility if the mark-to-market liabilities were to increase to the extent that the amount of outstanding borrowings and letters of credit would exceed the reduced availability under the new revolving credit facility.

The collateral securing the notes is subject to prior liens and may be insufficient or unavailable in the event of a default.

The value of the collateral in the event of liquidation will depend on market and economic conditions, the availability of buyers and other factors. Consequently, liquidating the collateral securing the notes may not produce proceeds in an amount sufficient to pay any amounts due under the notes after also satisfying the obligations to pay any other senior secured creditors that have prior liens on the collateral. Additionally, the fair market value of the collateral securing the notes may not be sufficient to pay any amounts due under the notes.

The notes are effectively subordinated to indebtedness that may be incurred under our new revolving credit facility, the Swap Agreements, certain equipment financing and certain purchase money indebtedness, in each case to the extent of the value of the assets securing such indebtedness. Our new revolving credit facility and the Swap Agreements are secured by substantially all of the collateral securing the notes. In the event of a default under the notes, the proceeds from the sale of the collateral may not be sufficient to satisfy in full our obligations under the notes following the repayment of our new revolving credit facility and obligations under the Swap Agreements. The amount to be received upon such a sale would depend upon numerous factors, including the timing and manner of the sale. By its nature, the collateral, other than accounts receivable, will be illiquid and may have no readily ascertainable market value. Accordingly, the collateral agent may be unable to sell the collateral in a short period of time or the proceeds obtained therefrom may be insufficient to pay all amounts owing to the lenders under our new revolving credit facility, the counterparties to the Swap Agreements and the holders of the notes.

In addition, to the extent that third parties (including the lenders under our new revolving credit facility and the counterparties to the Swap Agreements) have prior liens, such third parties may have rights and remedies with respect to the property subject to such liens that, if exercised, could adversely affect the value of the collateral. Additionally, certain other usual and customary permitted liens, including statutory and governmental liens, will be prior to the liens securing the notes. The indenture governing the notes does not require that we

12

Table of Contents

Index to Financial Statements

maintain the current level of collateral or maintain a specific ratio of indebtedness to collateral value. Additionally, the terms of the indenture governing the notes allow us to issue additional notes provided that we meet a specified consolidated fixed charge coverage ratio or have availability under a general debt carve out. Any additional notes issued pursuant to the indenture governing the notes will rank pari passu to the notes and be entitled to the same rights and priority as such notes with respect to the collateral. Thus, the issuance of additional notes pursuant to the indenture governing the notes may have the effect of significantly diluting your ability to recover payment in full from the then existing pool of collateral. See “Description of the Notes—Collateral.”

The lien-ranking provisions set forth in the intercreditor agreement relating to the indenture governing the notes limit the rights of the indenture trustee and the holders of the notes with respect to the collateral securing the notes.

The rights of the indenture trustee and the holders of the notes with respect to the collateral securing the notes are limited pursuant to the terms of the intercreditor agreement relating to the indenture governing the notes. The intercreditor agreement limits the actions that may be taken in respect of the collateral, including the ability to cause the commencement of enforcement proceedings against such collateral and to control the conduct of such proceedings, if obligations under our new revolving credit facility are outstanding or the Swap Agreements have not been terminated or expired. In certain cases, these actions may only be taken at the direction of the administrative agent or the lenders under the revolving credit facility and/or the counterparties to the Swap Agreements. The indenture trustee, on behalf of itself and the holders of the notes, will not under certain circumstances have the ability to control or direct such actions, even if the rights of the holders of the notes are or may be adversely affected. Additional releases of collateral from the liens securing the notes will be permitted under some circumstances. See “Description of the Notes—Collateral.”

Holders of the notes may suffer losses because they have limited control over actions of the indenture trustee upon an event of default under the indenture.

If an event of default occurs under the indenture, the holders of at least 25% in aggregate principal amount of the then outstanding notes may declare all the notes to be due and payable. The holders of a majority in aggregate principal amount of all notes then outstanding may direct the indenture trustee in its exercise of any trust or power or agency granted to the indenture trustee by the Collateral Agreements, as defined under “Description of the Notes—Certain Definitions,” which actions may be restricted by the intercreditor agreement referred to above. In addition, the holders of a majority in aggregate principal amount of the notes have the right to waive events of default (except an event of default in the payment of interest or premium or additional interest, if any, or the principal of the notes) without consideration of the effect that the waiver would have on the other holders of notes.

In addition, under the indenture, the indenture trustee will be entitled to indemnification or reimbursement by the holders of the notes in connection with the indenture trustee’s actions, including foreclosure on the collateral or the pursuit of other remedies following an event of default. Prior to taking action to foreclose or pursue other remedies, the indenture trustee may require additional undertakings by or on behalf of the holders of the notes relating to its rights to indemnification or reimbursement.

U.S. federal and state and Canadian federal and provincial laws allow courts, under specific circumstances, to void the guarantees, subordinate claims in respect of the guarantees and require note holders to return payments received from the guarantors.

Our subsidiary guarantors guarantee our obligations under the notes. The issuance of the guarantees by the guarantors may be subject to review under U.S. federal or state or Canadian federal or provincial laws if a bankruptcy, liquidation or reorganization case or a lawsuit, including in circumstances in which bankruptcy is not involved, were commenced at some future date by, or on behalf of, our unpaid creditors or those of the guarantors. Under the federal U.S. and Canadian bankruptcy laws and comparable provisions of state and

13

Table of Contents

Index to Financial Statements

provincial fraudulent transfer laws, a court may void or otherwise decline to enforce a guarantor’s guarantee, or subordinate such guarantee to the applicable guarantor’s existing and future indebtedness. While the relevant laws may vary from jurisdiction to jurisdiction, a court might do so if it found that when the applicable guarantor entered into its guarantee or, in some jurisdictions, when payments became due under such guarantee, the applicable guarantor received less than reasonably equivalent value or fair consideration and either:

| • | was insolvent or rendered insolvent by reason of such incurrence, or if in Canada, becomes subject to an insolvency proceeding within one year; |

| • | was engaged in a business or transaction for which such guarantor’s remaining assets constituted unreasonably small capital; or |

| • | intended to incur, or believed that such guarantor would incur, debts beyond such guarantor’s ability to pay such debts as they mature. |

The court might also void a guarantee, without regard to the above factors, if the court found that the applicable guarantor entered into its guarantee with actual intent to hinder, delay or defraud its creditors. In addition, any payment by a guarantor pursuant to its guarantees could be voided and required to be returned to such guarantor or to a fund for the benefit of such guarantor’s creditors.

A court would likely find that a guarantor did not receive reasonably equivalent value or fair consideration for such guarantee if such guarantor did not substantially benefit directly or indirectly from the issuance of the notes. If a court were to void a guarantee, you would no longer have a claim against the applicable guarantor. Sufficient funds to repay the notes may not be available from other sources, including the remaining guarantors, if any. In addition, the court might direct you to repay any amounts that you already received from any guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a guarantor would be considered insolvent if:

| • | the sum of such guarantor’s debts, including contingent liabilities, was greater than the fair saleable value of such guarantor’s assets; or |

| • | if the present fair saleable value of such guarantor’s assets were less than the amount that would be required to pay such guarantor’s probable liability on such guarantor’s existing debts, including contingent liabilities, as they become absolute and mature; or |

| • | such guarantor could not pay such guarantor’s debts as they become due. |

To the extent a court voids any of the guarantees as fraudulent transfers or holds any of the guarantees unenforceable for any other reason, holders of notes would cease to have any direct claim against the applicable guarantor. If a court were to take this action, the applicable guarantor’s assets would be applied first to satisfy the applicable guarantor’s liabilities, if any, before any portion of its assets could be applied to the payment of the notes.

Each guarantee contains a provision intended to limit the guarantor’s liability to the maximum amount that it could incur without causing the incurrence of obligations under its guarantee to be a fraudulent transfer. This provision may not be effective to protect the guarantees from being voided under fraudulent transfer law, or may reduce the guarantor’s obligation to an amount that effectively makes the guarantee worthless.

You may be unable to enforce your rights under U.S. bankruptcy law, and Canadian bankruptcy and insolvency laws may impair the indenture trustee’s ability to enforce remedies on your behalf.

We are incorporated under the laws of Canada and our principal operating assets are located in Canada. Accordingly, we would likely be subject to Canadian bankruptcy, insolvency and other restructuring legislation, principally either theBankruptcy and Insolvency Act (Canada), referred to as the “BIA,” or theCompanies’ Creditors Arrangement Act (Canada), referred to as the “CCAA.”

14

Table of Contents

Index to Financial Statements

The rights of the indenture trustee and holders of the notes to enforce remedies under the indenture (including foreclosing upon the collateral securing the notes and the related guarantees) could be delayed by the restructuring provisions of applicable Canadian federal bankruptcy, insolvency and other restructuring legislation if the benefit of such legislation is sought with respect to us. The BIA provides an “insolvent person” with automatic protection, and the CCAA allows an “insolvent person” to apply to court for an order granting it protection that could prevent its creditors and others from initiating or continuing proceedings against it while it prepares a proposal or plan of arrangement for approval by those creditors who will be affected by the proposal or plan of arrangement. An insolvent person is defined as a non-bankrupt person resident or carrying on business in Canada who is for any reason unable to meet his obligations as they generally become due, who has ceased paying his current obligations in the ordinary course of business as they generally become due or whose property is not of sufficient value to enable payment of all his obligations due and accruing due. Such a restructuring plan or proposal, if accepted by the requisite majorities of each affected class of the insolvent person’s creditors and approved by the supervising court, would be binding on the minorities in any such class who vote against the plan or proposal but would not be binding on any class that voted against the proposal or plan by the prescribed majority. The BIA proposal provisions and stay orders under the CCAA generally permit the insolvent debtor to retain possession and administration of its property (including the collateral that secures the notes and the related guarantees, to the extent that such guarantors are also subject to such restructuring legislation), even though it may be in default under the applicable debt instrument during the period that the protection against proceedings remains in force, provided that in the case of a BIA proposal proceeding, secured creditors have not completed the necessary steps under the BIA to cause them to become unaffected creditors. Both the BIA and the CCAA grant rights to affected creditors to challenge the debtor’s entitlement to claim the protection of those statutes.

During the stay period, the indenture trustee and holders of the notes are likely to be restrained from enforcing remedies under the indenture (including foreclosing upon the collateral that secures the notes and the related guarantees) and payments under the notes or the guarantees, as applicable, are unlikely to be made. It is equally unlikely that holders of the notes would be compensated for any delay in payment, if any, of principal or premium, if any, or interest on the notes other than a right to claim accrued and unpaid interest on the amounts owing under the notes and the indenture, unless the right is itself compromised under any restructuring plan or proposal approved by creditors and the court.

We are controlled by NACG Holdings Inc., whose interests in our business may be different than yours.

We are a wholly-owned indirect subsidiary of NACG Holdings Inc. Consequently, NACG Holdings Inc. has the ability to approve all significant transactions involving our company, including the incurrence of additional indebtedness and mergers, acquisitions or sales of all or substantially all of our assets.

The interests of NACG Holdings Inc. and its affiliates could conflict with your interests. For example, if we encounter financial difficulties or are unable to pay our debts as they mature, the interests of NACG Holdings Inc., as an indirect holder of all of our common equity, might conflict with your interests as a holder of our debt. Affiliates of NACG Holdings Inc. may also have an interest in pursuing acquisitions, divestitures, financings or other transactions that, in their judgment, could enhance their equity investment, even though such transactions might involve risks to you as a holder of the notes. In addition, NACG Holdings Inc. or its affiliates may in the future control businesses that directly compete with ours.

Risks Related to Our Business

We rely on a small number of customers from whom we receive a significant amount of our revenues.

We provide our services primarily to a small number of major integrated and independent oil and gas and other natural resources companies operating in western Canada. Revenue from our five largest customers represented approximately 91% of our total revenue for the fiscal year ended March 31, 2004 and those customers are expected to continue to provide a significant percentage of our revenues in the future. Each year

15

Table of Contents

Index to Financial Statements

any one of our customers may constitute a significant portion of our revenue. For example, for the fiscal year ended March 31, 2004, revenue generated from work for Syncrude constituted approximately 52% of our total revenue primarily due to several large projects with Syncrude and our status as one of their preferred contractors. We may not be able to replace the work generated by these projects with work from other customers. Our services to our customers are typically provided under contracts with terms ranging from six months to ten years, some of which have terms allowing for automatic or optional renewals of the contract. However, a significant number of our contracts terminate upon completion of the project without having a definite termination date, and the contracts typically allow the customer to reduce or eliminate the work which we are to perform. In addition, the customers may choose not to extend the existing contracts or enter into new contracts. The loss of or significant reduction in business with one or more of these customers could have a material adverse effect on our business.

Fixed price and unit price contracts with our customers expose us to losses when our estimates of project costs are too low or when we fail to perform within our cost estimates.

Our recent operating results have been adversely affected by losses incurred on fixed price and unit price contracts. The terms of these contracts require us to guarantee the price of the services we provide and assume the risk that our costs to perform the services and provide the materials will be greater than anticipated. Our profitability under such contracts is therefore dependent upon our ability to accurately predict the costs associated with our services. These costs may be affected by a variety of factors, some of which may be beyond our control. Factors that contribute to changes in our costs incurred as compared to our estimates and which therefore affect profitability include, without limitation, actual site conditions which differ from those assumed in the original bid, the availability and skill level of workers in the geographic location of the project, inclement weather, equipment productivity and timing differences that result from actual project starting time as compared to projected starting time and the general coordination of work inherent in all substantial projects we undertake. When we are unable to accurately estimate the costs of fixed price and unit price contracts, or when we incur unrecoverable cost overruns, some projects will have lower margins than anticipated or even incur losses, which will materially adversely impact our results of operations, financial condition and cash flow.

Approximately 29% and 56% of our revenue for the fiscal year ended March 31, 2004 and the nine months ended December 31, 2004, respectively, was derived from fixed price and unit price contracts. However, going forward, the percentage of our revenue derived from fixed price and unit price contracts is expected to increase as several of the contracts recently entered into between our joint venture Noramac and CNRL, including the 10-year overburden removal contract and a large site grading contract, are unit price and/or fixed price contracts. Given the magnitude of the projected revenues from these contracts with CNRL as compared to the revenues expected to be earned from other contracts, if we underestimated the costs to perform these contracts, or if we were to incur unrecoverable cost overruns on these projects, it is likely that we would be unable to service our debt obligations.

Until we establish and maintain effective internal controls and procedures for financial reporting, we may not have appropriate procedures in place to eliminate future financial reporting inaccuracies or delays.

We have had to restate our financial statements for the first and second quarters of fiscal 2005, primarily due to certain inaccurate expense accruals. During the preparation of our financial statements for the third quarter of fiscal 2005, we discovered a number of invoices recorded in the third quarter of fiscal 2005 which were related to costs actually incurred in the first and second quarters of fiscal 2005. A review of our accounting and control procedures identified a number of deficiencies in our financial reporting processes and internal controls that contributed to several misstated amounts as detailed in note 3 to our unaudited interim consolidated financial statements for the nine months ended December 31, 2004 included elsewhere in this prospectus.

While we have begun to evaluate our accounting and control procedures relating to the causes for the misstatements, we may be unable to implement the changes required to provide accurate and timely operating and financial reports. Failure to do so would have a material adverse effect on our business, financial condition

16

Table of Contents

Index to Financial Statements

and results of operations. Until we establish and maintain effective internal controls and procedures for financial reporting, we may not have appropriate procedures in place to eliminate financial statement inaccuracies or delays in the future.

If our access to the surety market were to be restricted in the future, or if our demand for surety bonds were to increase significantly, our business could be impaired.

Like all businesses providing similar services, we are at times required to post bid or performance bonds issued by a financial institution known as a surety. The surety industry experiences periods of unsettled and volatile markets, usually in the aftermath of substantial loss exposures or corporate bankruptcies with significant surety exposure. Historically, these types of events have caused reinsurers and sureties to reevaluate their committed levels of underwriting and required returns. As needed in the ordinary course of business, we have been able to secure necessary bonds and we will seek opportunities to expand our surety relationships. However, under our existing bonding arrangements, we may only obtain surety bonds to the extent they are fully secured by letters of credit. If for any reason, whether because of our financial condition, our level of secured debt or general conditions in the bond market, our bonding capacity becomes insufficient to satisfy our future bonding requirements, our business could be impaired.

We are dependent upon continued outsourcing by our customers of mining and site preparation services.

Outsourced mining and site preparation services constitute a large portion of the work we perform for our customers. For example, our mining project revenues constituted approximately 29%, 29% and 52% of our revenues in the fiscal years ended March 31, 2004, 2003 and 2002, respectively. The election by one or more of our customers to perform some or all of these services themselves, rather than outsourcing the work to us, could have a material adverse impact on our business.

Changes in oil and gas prices could cause our customers to slow down or curtail their current production and future expansions which would in turn reduce our revenue from those customers.

The profitability and growth of our customers may be impacted by the prices of oil and gas. Prices for oil are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil, market uncertainty and a variety of additional factors beyond our control. Such factors include weather conditions, the condition of the Canadian and U.S. economies, the actions of the Organization of Petroleum Exporting Countries, governmental regulation, political stability in the Middle East, increasing foreign demand for oil and gas, war or the threat of war in oil producing regions, the foreign supply of oil and the availability of fuel from alternate sources. In addition, our customers make their major expansion investment decisions based on their long-term outlook for the prices of oil and gas and their profitability based on those prices. If they believe the prices of those commodities will remain at depressed levels or that their profitability will be adversely affected by fluctuations in currency exchange rates, they may delay or curtail their current expansion plans. Such a delay or curtailment could have a material adverse impact on our financial condition and results of operations.

Our operations are subject to weather-related factors that may cause delays in our completion of projects.

Because our operations are located in western Canada and northern Ontario, we are often subject to extreme weather conditions. While our operations are not significantly affected by normal seasonal weather patterns, extreme weather, including heavy rain and snow, can cause us to delay the completion of a project, which could result in lower margins than estimated.

Insufficient pipeline and refining capacity for heavy crude products could cause our customers to slow down or curtail their current production and future expansions which would, in turn, reduce our revenue from those customers.

While current pipeline capacity is sufficient to transport existing oil sands production to market, future production growth will require increased pipeline capacity. If such increases do not materialize, our customers

17

Table of Contents

Index to Financial Statements

may be unable to efficiently deliver increased production to market. Additionally, we expect that increases in oil sands production will require added heavy crude oil refinery capacity. Similarly, if such increased capacity or alternative markets do not materialize, future growth in demand for our customers’ products could be reduced.

Because most of our customers are located or operate in western Canada, a downturn in the energy industry in western Canada could result in a decrease in the demand for our services by our customers.

Most of our customers are located or operate in western Canada. In the nine months ended December 31, 2004, we believe we generated over half of our operating revenues from the Alberta oil sands. A downturn in the energy industry in western Canada could cause our customers to slow down or curtail their current production and future expansions which would, in turn, reduce our revenue from those customers. Such a delay or curtailment could have a material adverse impact on our financial condition and results of operations.

Shortages of skilled labor, work stoppages or other labor disruptions at our operations or those of our principal customers or service providers could have an adverse effect on our profitability and financial condition.

Our ability to provide high-quality services on a timely basis requires an adequate number of skilled workers such as engineers, trades people and equipment operators. We may not be able to maintain an adequate skilled labor force, or our labor expenses may increase. A shortage of skilled labor would require us to curtail our planned internal growth or may require us to use less skilled labor which could adversely affect our ability to perform work.

Substantially all of our hourly employees are subject to collective bargaining agreements to which we are a party or are otherwise subject because of a bargaining relationship with the particular trade union that is a party to the collective bargaining agreement. Any work stoppage resulting from a strike or lockout could have a material adverse effect on our financial condition and results of operations.

In the province of Alberta, collective bargaining in the construction industry is conducted by sector, by registered groups consisting of an employers’ organization, on behalf of the employers, and a defined group of trade unions, on behalf of the unions in that sector. An employers’ organization which has been registered by the Labour Relations Board bargains with the trade unions named in the certificate on behalf of all employers who work in that part of the construction industry described in the certificate with whom the unions have a bargaining relationship. Any collective agreement entered into by the employers’ organization is binding on all such employers. We do not have control over the terms of such agreements but will be bound by these because of the provisions of the Labour Relations Code and the registrations.

In addition, our customers employ workers under other collective bargaining agreements. Any work stoppage or labor disruption at our key customers could significantly reduce the amount of services that we provide.

Because approximately 80% of the major projects that we pursue are awarded to us based on bid proposals, competitors with lower cost structures may underbid us, subsequently impeding our growth.

Approximately 80% of the major projects that we pursue are awarded to us based on bid proposals. We may compete in the future for these projects against companies that may have substantially greater financial and other resources than we do. Some competitors may have lower cost structures, including lower labor costs based on the use of non-union labor, and may be able to provide their services at lower rates than we can. Further, public sector work is often performed by governmental agencies. Our growth may be impacted to the extent that we are unable to successfully bid against these companies.

Cost overruns by our customers on their projects may cause our customers to terminate future projects or expansions which could adversely affect the amount of work we receive from those customers.

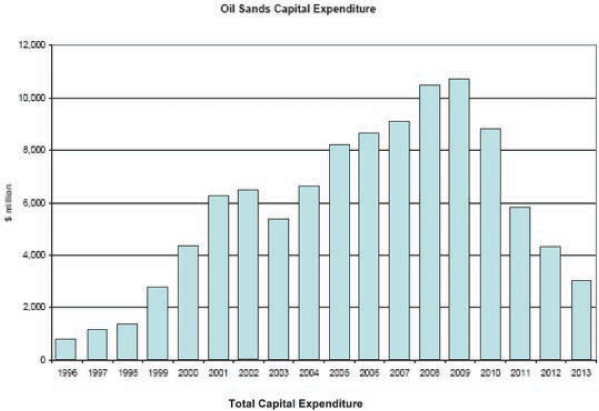

Oil sands development projects require substantial capital expenditures. In the past, several of our customers’ projects have experienced significant cost overruns, impacting their returns. As new projects are

18

Table of Contents

Index to Financial Statements

contemplated or built, if cost overruns continue to challenge our customers, they could reassess future projects and expansions which could adversely affect the amount of work we receive from our customers, causing an adverse effect on our financial condition.

A significant amount of our revenues are generated by providing non-recurring services.

We believe a majority of our revenue for the fiscal year ended March 31, 2004 was derived from projects which we consider to be non-recurring. This revenue primarily relates to site preparation and piling services provided for the construction of extraction, upgrading and other oil sands mining infrastructure projects. Future revenues from these types of services will depend upon customers expanding existing mines and developing new projects.

Penalty clauses in our customer contracts could expose us to losses if total project costs exceed original estimates or if projects are not completed by specified completion date milestones.

A portion of our revenue is derived from contracts which have performance incentives and penalties depending on the total cost of a project as compared to the original estimate. We could incur significant penalties based on cost overruns. In addition, the total project cost as defined in the contract may include not only our work, but also work performed by other contractors. As a result, we could incur penalties due to work performed by others over which we have no control. We may also incur penalties if projects are not completed by specified completion date milestones. Such penalties, if incurred, could have a significant impact on our profitability under these contracts.

Demand for our services may be adversely impacted by regulations affecting the energy industry.

Our principal customers are energy companies involved in the development of the Alberta oil sands and natural gas production. The operations of these companies, including the mining operations in the oil sands, are subject to or impacted by a wide array of regulations in the jurisdictions where they operate, including those directly impacting mining activities and those indirectly affecting their businesses, such as applicable environmental laws. As a result of changes in regulations and laws relating to the energy production industry including the operation of mines, our customers’ operations could be disrupted or curtailed by governmental authorities. The high cost of compliance with applicable regulations may induce customers to discontinue or limit their operations, and may discourage companies from continuing development activities. As a result, demand for our services could be substantially affected by regulations adversely impacting the energy industry.

Environmental laws and regulations may expose us to liability arising out of our operations or the operations of our customers in and around sensitive environmental areas.

Our operations are subject to numerous environmental protection laws and regulations that are complex and stringent. Contracts with our customers require us to operate in compliance with these laws and regulations. We regularly perform work in and around sensitive environmental areas such as rivers, lakes and forests. Significant fines and penalties may be imposed on us or our customers for non-compliance with environmental laws and regulations, and our contracts generally require us to indemnify our customers for environmental claims suffered by them as a result of our actions. In addition, some environmental laws provide for joint and several strict liability for remediation of releases of hazardous substances, rendering a person liable for environmental damage, without regard to negligence or fault on the part of such person. In addition to potential liabilities that may be incurred in satisfying these requirements, we may be subject to claims alleging personal injury or property damage as a result of alleged exposure to hazardous substances. These laws and regulations may expose us to liability arising out of the conduct of operations or conditions caused by others, or for our acts which were in compliance with all applicable laws at the time these acts were performed.