UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

Lee Thoresen, Esq.

RBC Plaza

60 South Sixth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612)-313-1341

Date of fiscal year end: March 31

Date of reporting period: September 30, 2015

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | | | |

| PORTFOLIO MANAGERS | | | | | | |

| | | | | | | |

RBC Global Asset Management (U.S.) Inc. (“RBC GAM (US)”) serves as the investment advisor and RBC Global Asset Management (UK) Limited (“RBC GAM (UK)”) serves as the investment sub-advisor to the Funds and is responsible for the overall management of the Funds’ portfolios. The individual primarily responsible for the day-to-day management of the Funds’ portfolios is set forth below. | | | | | | |

Philippe Langham | | | | | | |

Head of Emerging Market Equities | | | | | | |

| Philippe Langham is Head of Emerging Market Equities at RBC GAM (UK) and is responsible for portfolio management of RBC Emerging Markets Equity Fund and RBC Emerging Markets Small Cap Equity Fund. Philippe joined RBC GAM (UK) in November 2009 from the asset management division of a large European bank, where he was Head of Global Emerging Markets. He was previously based at another global financial services firm in Zurich for four years where he was a director and Head of Emerging Markets and Asia in their Multi Asset Class Division. Prior to that, he managed Global Emerging Markets, Asian, Latin American and U.S. portfolios for nine years at the Kuwait Investment Office. Philippe holds a degree in Economics from the University of Manchester and has qualified as a Chartered Accountant. | | | | | | |

Habib Subjally Senior Portfolio Manager and Head of Global Equities | | | | | | |

| Habib Subjally is Head of Global Equities at RBC GAM (UK) and is responsible for portfolio management of RBC Global Opportunities Fund and RBC International Opportunities Fund. Prior to joining RBC GAM (UK) in 2006, Habib held various leadership and portfolio management positions at Credit Suisse, Invesco and Merrill Lynch Investment Managers, and also worked at Ernst & Young. He holds a BSc (Hons) from the London School of Economics and holds Chartered Accountant and ASIP designations. | | | | | | |

| | | | | | |

1

| | | | | | | | | | | | | | |

| | | | | Since | | Net

Expense | | Gross

Expense |

| | | 1 Year | | Inception(a) | | Ratio(1)(2) | | Ratio (1)(2) |

| | | | |

Average Annual Total Returns as of September 30, 2015 (Unaudited) | | | | | | | | | | | |

| | | | |

RBC Emerging Markets Equity Fund | | | | | | | | | | | |

Class A | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | | | (14.29 | )% | | (3.96)% | | | | |

- At Net Asset Value | | | | (9.08 | )% | | (0.71)% | | 1.45% | | 4.96% |

| | | | |

Class I | | | | (8.86 | )% | | (0.42)% | | 1.20% | | 4.65% |

| | | | |

MSCI Emerging Markets Net Index (b) | | | | (19.28 | )% | | (9.38)% | | | | |

| | | | |

RBC Emerging Markets Small Cap Equity Fund | | | | | | | | | | | |

Class A | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | | | (20.43 | )% | | (7.49)% | | | | |

- At Net Asset Value | | | | (15.56 | )% | | (4.36)% | | 1.85% | | 5.58% |

| | | | |

Class I | | | | (15.39 | )% | | (4.15)% | | 1.60% | | 5.32% |

| | | | |

MSCI Emerging Markets Small Cap Net Index (b) | | | | (15.23 | )% | | (3.93)% | | | | |

| | | | |

RBC Global Opportunities Fund | | | | | | | | | | | |

| | | | |

Class I | | | | N/A | | | (2.77)% | | 1.05%(3)(4) | | 3.46%(3)(4) |

| | | | |

MSCI ACWI Index (b) | | | | N/A | | | (8.68)% | | | | |

| | | | |

RBC International Opportunities Fund | | | | | | | | | | | |

| | | | |

Class I | | | | N/A | | | (7.08)% | | 1.00%(3)(4) | | 3.50%(3)(4) |

| | | | |

MSCI ACWI ex US Index (b) | | | | N/A | | | (11.32)% | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us.

2

| (1) | The Funds’ expenses reflect actual expenses for the most recent fiscal year end or period ended March 31, 2015. |

| (2) | The advisor has contractually agreed to waive fees and/or make payments in order to keep total operating expenses of the Fund to the levels listed under net expense ratio until July 31, 2017 (October 31, 2017 for Emerging Markets Equity Fund). For Emerging Markets Equity Fund, effective August 3, 2015, the annual rate under the expense limitation agreement is 0.98% for Class A and 0.73% for Class I. |

| (4) | For the period from December 3, 2014 (commencement of operations) to March 31, 2015. |

| (a) | The since inception date (commencement of operations) is December 20, 2013 for Emerging Markets Equity Fund and Emerging Markets Small Cap Equity Fund and December 3, 2014 for Global Opportunities Fund and International Opportunities Fund. |

| (b) | Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but do not include sales fees or operating expenses. You cannot invest directly in indices. |

The MSCI Emerging Markets Net Index is a free float-adjusted market capitalization index that is designed to measure equity performance of emerging markets.

The MSCI Emerging Markets Small Cap Net Index includes small cap representation across 21 emerging markets countries. The index covers approximately 14% of the free float-adjusted market capitalization in each country.

The MSCI All Country World (“ACWI”) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The MSCI All Country World (“ACWI”) ex US Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the US.

3

This Page Intentionally Left Blank

4

| | | | | | | | | | | | | | |

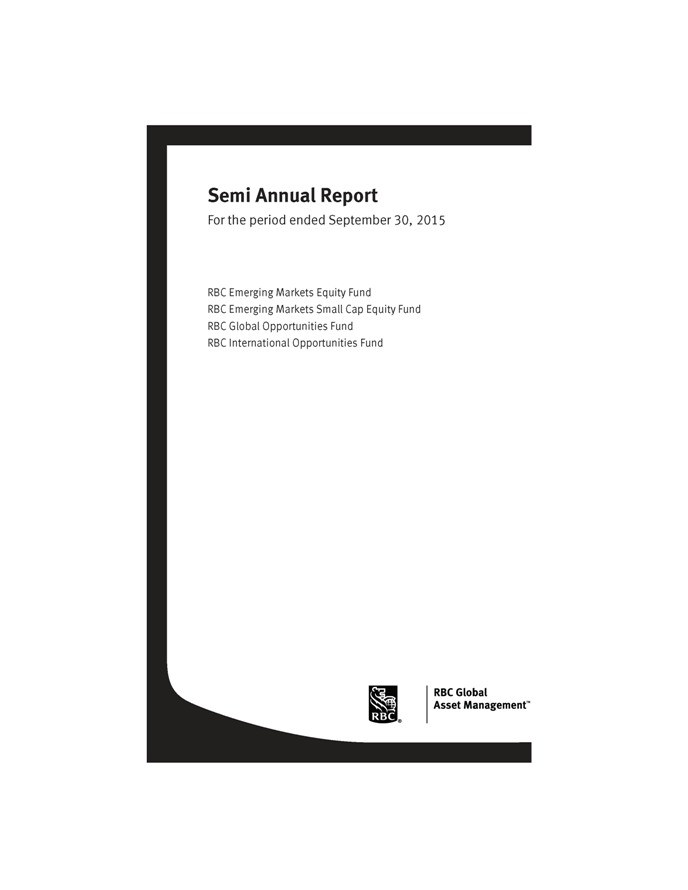

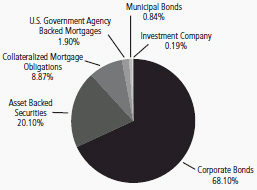

| FUND STATISTICS (UNAUDITED) | | | | | | |

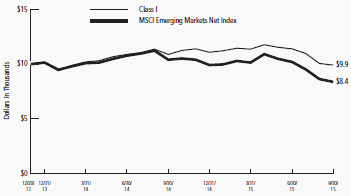

RBC Emerging Markets Equity Fund | | | | | | |

Long-term growth of capital. | | | | | | Investment Objective |

MSCI Emerging Markets Net Index | | | | | | Benchmark |

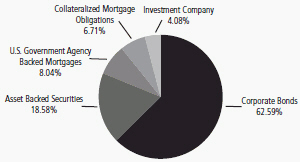

| | | | | | Asset Allocation as of 9/30/15 (% of Fund’s investments) & Top Five Industries as of 9/30/15 (% of Fund’s net assets) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| *Includes U.S. dollar denominated cash equivalent investments representing 4.99% of investments. | | | | | | |

| | | | | | | |

HDFC Bank Ltd. ADR Taiwan Semiconductor

Manufacturing Co. Ltd. ADR Infosys Ltd. ADR Dr. Reddy’s Laboratories Ltd. ADR SM Investments Corp. | | 4.81% 4.35% 4.35% 4.15% 3.80% | | | | Naspers Ltd. China Mobile Ltd. SABMiller Plc CK Hutchison Holdings Ltd. Samsung Electronics Co. Ltd., Preferred | | 3.32% 3.18% 2.74% 2.66% 2.46% | | | | | | Top Ten Holdings (excluding investment companies) as of 9/30/15 (% of Fund’s net assets) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| *A listing of all portfolio holdings can be found beginning on page 9. | | | | | | |

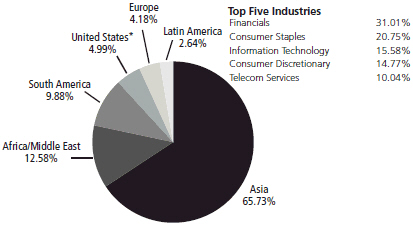

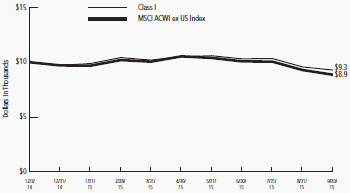

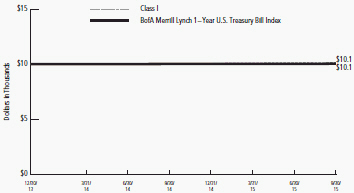

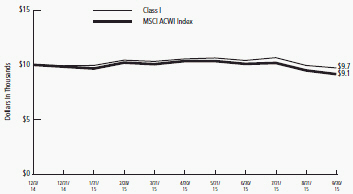

| | | | | | Growth of $10,000 Initial Investment Since Inception (12/20/13) |

| | | | | |

| | | | | |

| | | | | |

| The graph reflects an initial investment of $10,000 over the period from December 20, 2013 (commencement of operations) to September 30, 2015 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | | |

| | | | | |

| | | | | |

5

| | | | | | | | | | | | | | | | | | | | |

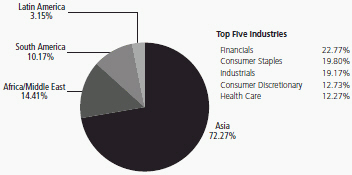

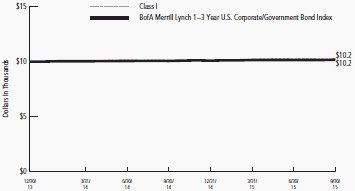

| | | | | | | | | FUND STATISTICS (UNAUDITED) | |

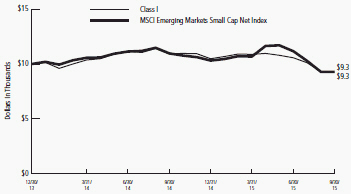

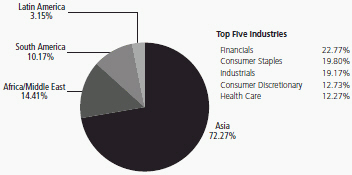

| | | | | | | | RBC Emerging Markets Small Cap Equity Fund | |

Investment Objective | | | | | | | | Long-term growth of capital. | | | | | | | | | | | | |

Benchmark | | | | | | | | MSCI Emerging Markets Small Cap Net Index | | | | | | | | | | | | |

Asset Allocation

as of 9/30/15

(% of Fund’s

investments)

as of 9/30/15

(% of Fund’s

net assets) | | | | | | | |

| |

| | | | | | | | |

Top Ten Holdings

(excluding investment companies) as of 9/30/15 (% of Fund’s net assets) | | | | | | | | WuXi PharmaTech Cayman, Inc. ADR Market Vectors India Small-Cap Index ETF Delta Electronics Thailand Public Co. Ltd. - FOR Sino Biopharmaceutical Ltd. Security Bank Corp. | |

| 4.83

4.82 4.63 3.95 3.45 | %

% % % % | | | | Aeon Thana Sinsap Thailand Public Co. Ltd. NVDR DGB Financial Group, Inc. Marico Ltd. Hyprop Investments Ltd. Amarex PJSC | | | 3.21 2.86 2.81 2.75 2.73 | % % % % % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | *A listing of all portfolio holdings can be found beginning on page 13. | |

Growth of

$10,000 Initial

Investment Since

Inception (12/20/13) | | | | | | | |

| |

| | | | | | | | The graph reflects an initial investment of $10,000 over the period from December 20, 2013 (commencement of operations) to September 30, 2015 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

6

| | | | | | | | | | | | | | |

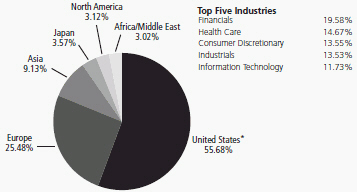

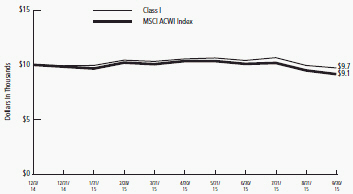

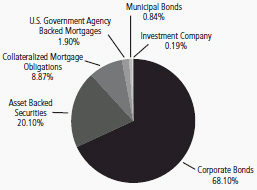

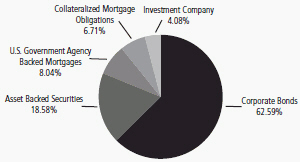

| FUND STATISTICS (UNAUDITED) | | | | | | |

| | | |

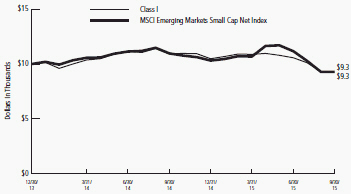

| RBC Global Opportunities Fund | | | | | | |

Long-term growth of capital. | | | | | | Investment Objective |

MSCI ACWI Index | | | | | | Benchmark |

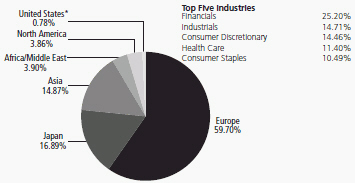

*Includes U.S. dollar denominated cash equivalent investments representing 1.32% of investments. | | | | | | Asset Allocation as of 9/30/15 (% of Fund’s investments) & Top Five Industries as of 9/30/15 (% of Fund’s net assets) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | |

Amazon.com, Inc. | | 4.17% | | | | UnitedHealth Group, Inc. | | 3.55% | | | | | | Top Ten Holdings (excluding investment companies) as of 9/30/15 (% of Fund’s net assets) |

TJX Cos., Inc. (The) | | 4.08% | | | | Roche Holding AG | | 3.50% | | | | | |

HDFC Bank Ltd. ADR | | 3.98% | | | | Safran SA | | 3.46% | | | | | |

Google, Inc., Class A | | 3.90% | | | | Estee Lauder Cos., Inc. (The), Class A | | 3.45% | | | | | |

First Republic Bank | | 3.71% | | | | ITC Holdings Corp. | | 3.40% | | | | | |

*A listing of all portfolio holdings can be found beginning on page 18. | | | | | |

| | | | | | Growth of $10,000 Initial Investment Since Inception (12/3/14) |

| | | | | |

| | | | | |

| | | | | |

| The graph reflects an initial investment of $10,000 over the period from December 3, 2014 (commencement of operations) to September 30, 2015 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | | |

| | | | | |

| | | | | |

7

| | | | | | | | | | | | | | | | | | | | |

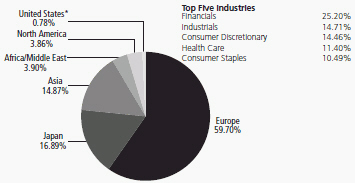

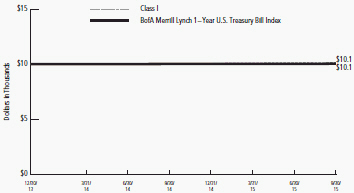

| | | | | | | | | FUND STATISTICS (UNAUDITED) | |

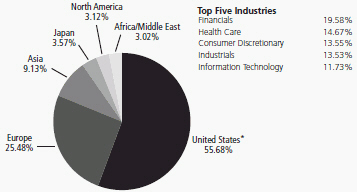

| | | | | | | | RBC International Opportunities Fund | |

Investment Objective | | | | | | | | Long-term growth of capital. | | | | | | | | | | | | |

Benchmark | | | | | | | | MSCI ACWI ex US Index | | | | | | | | | | | | |

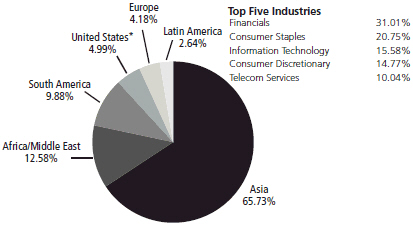

Asset Allocation

as of 9/30/15

(% of Fund’s

investments)

& Top Five

Industries

as of 9/30/15

(% of Fund’s

net assets) | | | | | | | |

*Includes U.S. dollar denominated cash equivalent investments representing 0.78% of investments. | |

| | | | | | | | |

Top Ten Holdings

(excluding investment companies) as of 9/30/15 (% of Fund’s net assets) | | | | | | | | Taiwan Semiconductor Manufacturing

Co. Ltd. ADR HDFC Bank Ltd. ADR Safran SA Anheuser-Busch InBev NV Roche Holding AG | | | 4.32 4.32 4.25 4.20 4.14 | % % % % % | | | | Pernod Ricard SA Naspers Ltd., N Shares Enbridge, Inc. Deutsche Post AG Shire Plc | |

| 4.04

3.93 3.88 3.86 3.52 | %

% % % % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | | | | | | *A listing of all portfolio holdings can be found beginning on page 21. | |

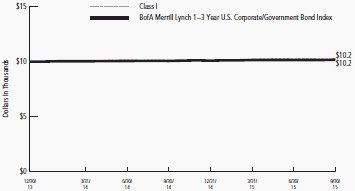

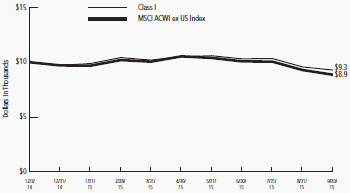

Growth of

$10,000 Initial

Investment Since

Inception (12/3/14) | | | | | | | |

| |

| | | | | | | | The graph reflects an initial investment of $10,000 over the period from December 3, 2014 (commencement of operations) to September 30, 2015 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

8

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Equity Fund

September 30, 2015 (Unaudited)

| | | | | | |

| | Shares | | | | | Value |

| Common Stocks — 93.89% |

| Brazil — 5.64% | | |

| | 41,520 | | | Banco Bradesco SA ADR | | $ 222,547 |

| | 24,300 | | | Natura Cosmeticos SA | | 119,217 |

| | 13,400 | | | Totvs SA | | 99,135 |

| | 23,000 | | | WEG SA | | 89,749 |

| | |

| | | | | | |

| | | | | | 530,648 |

| | | | | | |

| Chile — 2.45% | | |

| | 12,240 | | | Cia Cervecerias Unidas SA | | 134,973 |

| | 47,449 | | | Quinenco SA | | 95,439 |

| | |

| | | | | | |

| | | | | | 230,412 |

| | | | | | |

| China — 22.95% | | |

| | 40,400 | | | AIA Group Ltd. | | 210,110 |

| | 2,100 | | | Alibaba Group Holding Ltd. ADR* | | 123,837 |

| | 968 | | | Baidu, Inc. ADR* | | 133,013 |

| | 18,250 | | | Cheung Kong Property Holdings Ltd. | | 133,705 |

| | 48,600 | | | China Merchants Holdings International Co. Ltd. | | 143,495 |

| | 25,000 | | | China Mobile Ltd. | | 299,244 |

| | 43,000 | | | China Resources Land Ltd. | | 101,537 |

| | 19,249 | | | CK Hutchison Holdings Ltd. | | 250,384 |

| | 75,800 | | | Fuyao Glass Industry Group Co. Ltd. - Series A | | 141,511 |

| | 112,000 | | | Guangdong Investment Ltd. | | 167,185 |

| | 181,000 | | | Lenovo Group Ltd. | | 153,015 |

| | 63,400 | | | Samsonite International SA | | 207,184 |

| | 37,200 | | | Weifu High-Technology Group Co. Ltd. - Series B | | 93,619 |

| | |

| | | | | | |

| | | | | | 2,157,839 |

| | | | | | |

| India — 13.30% | | |

| | 6,100 | | | Dr. Reddy’s Laboratories Ltd. ADR | | 389,851 |

| | 7,400 | | | HDFC Bank Ltd. ADR | | 452,066 |

| | 21,400 | | | Infosys Ltd. ADR | | 408,526 |

| | |

| | | | | | |

| | | | | | 1,250,443 |

| | | | | | |

| Indonesia — 2.84% | | |

| | 167,700 | | | Bank Central Asia Tbk PT | | 140,797 |

| | 1,344,600 | | | Kalbe Farma Tbk PT | | 126,518 |

| | |

| | | | | | |

| | | | | | 267,315 |

| | | | | | |

| Jordan — 1.44% | | |

| | 3,921 | | | Hikma Pharmaceuticals Plc | | 135,446 |

| |

| Korea — 5.22% | | |

| | 2,346 | | | Hanon Systems | | 77,997 |

| | 171 | | | Samsung Electronics Co. Ltd. | | 164,067 |

| | 349 | | | Samsung Fire & Marine Insurance Co. Ltd. | | 82,414 |

9

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Equity Fund (cont.)

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

4,741 | | Shinhan Financial Group Co. Ltd. | | $165,803 |

| | |

| | | | |

| | | | 490,281 |

| | | | |

Malaysia — 3.68% | | |

151,100 | | Axiata Group Berhad | | 199,588 |

36,600 | | Public Bank Berhad | | 145,940 |

| | |

| | | | |

| | | | 345,528 |

| | | | |

Mexico — 2.76% | | |

3,600 | | Grupo Televisa SAB ADR | | 93,672 |

73,200 | | Kimberly-Clark de Mexico SAB de CV - Series A | | 165,540 |

| | |

| | | | |

| | | | 259,212 |

| | | | |

Nigeria — 0.83% | | |

647,667 | | Guaranty Trust Bank Plc | | 78,086 |

| |

Peru — 2.24% | | |

1,979 | | Credicorp Ltd. | | 210,486 |

| |

Philippines — 3.80% | | |

18,730 | | SM Investments Corp. | | 357,030 |

| |

Poland — 1.20% | | |

2,782 | | Bank Pekao SA | | 113,074 |

| |

Russia — 1.44% | | |

570 | | Magnit OJSC | | 101,209 |

708 | | Magnit OJSC GDR | | 33,821 |

| | |

| | | | |

| | | | 135,030 |

| | | | |

South Africa — 9.65% | | |

20,209 | | Clicks Group Ltd. | | 131,152 |

6,307 | | Mr. Price Group Ltd. | | 88,043 |

2,491 | | Naspers Ltd. | | 312,190 |

4,561 | | SABMiller Plc | | 257,405 |

27,458 | | Sanlam Ltd. | | 118,741 |

| | |

| | | | |

| | | | 907,531 |

| | | | |

Taiwan — 10.16% | | |

13,400 | | Airtac International Group | | 70,867 |

20,000 | | Delta Electronics, Inc. | | 94,335 |

14,000 | | Giant Manufacturing Co. Ltd. | | 102,083 |

68,471 | | Standard Foods Corp. | | 148,424 |

19,700 | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | 408,775 |

10

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Equity Fund (cont.)

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

75,469 | | Uni-President Enterprises Corp. | | $ 131,055 |

| | |

| | | | |

| | | | 955,539 |

| | | | |

Thailand — 1.31% | | |

99,800 | | Central Pattana Public Co. Ltd. - FOR | | 123,207 |

| |

Turkey — 1.74% | | |

98,799 | | Enka Insaat Ve Sanayi AS | | 163,267 |

| |

United Arab Emirates — 1.24% | | |

138,103 | | Emaar Malls Group PJSC* | | 116,640 |

| | |

| | | | |

| |

Total Common Stocks | | 8,827,014 |

| | | | |

(Cost $9,484,268) | | |

| |

Equity Linked Securities — 0.62% | | |

India — 0.62% | | |

1,605 | | Hero Motocorp Ltd. | | 58,549 |

| | |

| | | | |

| |

Total Equity Linked Securities | | 58,549 |

| | | | |

(Cost $56,155) | | |

| |

Preferred Stocks — 4.88% | | |

Korea — 4.88% | | |

1,290 | | Hyundai Motor Co. | | 120,632 |

298 | | Samsung Electronics Co. Ltd. | | 231,327 |

757 | | Samsung Fire & Marine Insurance Co. Ltd. | | 106,649 |

| | |

| | | | |

| |

Total Preferred Stocks | | 458,608 |

| | | | |

(Cost $507,360) | | |

11

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Equity Fund (cont.)

September 30, 2015 (Unaudited)

| | | | | | |

| Shares | | | | | Value | |

Investment Company — 5.23% | | | | |

491,061 | | Dreyfus Cash Management, Institutional Shares | | $ | 491,061 | |

| | | | | | |

| |

Total Investment Company | | | 491,061 | |

| | | | | | |

(Cost $491,061) | | | | |

| |

Total Investments | | $ | 9,835,232 | |

(Cost $10,538,844)(a) — 104.62% | | | | |

| |

Liabilities in excess of other assets — (4.62)% | | | (433,881 | ) |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 9,401,351 | |

| | | | | | |

|

| |

| * | Non-income producing security. |

| (a) | See Notes to Financial Statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

ADR - American Depositary Receipt

FOR - Foreign Ownership Restrictions

GDR - Global Depositary Receipt

Portfolio Diversification (Unaudited)

| | | | |

| | | Percentage | |

Industries | | of Net Assets | |

Financials | | | 31.01 | % |

Consumer Staples | | | 20.75 | % |

Information Technology | | | 15.58 | % |

Consumer Discretionary | | | 14.77 | % |

Telecom Services | | | 10.04 | % |

Industrials | | | 5.46 | % |

Utilities | | | 1.78 | % |

Other* | | | 0.61 | % |

| | | | |

| | | 100.00 | % |

| | | | |

| * | Includes cash, Investment Company, interest and dividend receivable, |

| | pending trades and Fund share transactions and accrued expenses payable. |

See Notes to Financial Statements.

12

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

Common Stocks — 82.17% |

Botswana — 0.74% |

77,050 | | Choppies Enterprises Ltd. | | $ 32,247 |

| |

Brazil — 4.36% | | |

13,700 | | Cia Hering | | 48,518 |

11,500 | | Natura Cosmeticos SA | | 56,419 |

6,750 | | Totvs SA | | 49,938 |

4,850 | | Wilson Sons Ltd. BDR | | 36,395 |

| | |

| | | | |

| | | | 191,270 |

| | | | |

Chile — 5.36% | | |

86,000 | | Inversiones Aguas Metropolitanas SA | | 118,847 |

38,062 | | Parque Arauco SA | | 65,331 |

34,184 | | Sonda SA | | 51,165 |

| | |

| | | | |

| | | | 235,343 |

| | | | |

China — 18.05% | | |

29,000 | | Asia Satellite Telecommunications Holdings Ltd. | | 45,174 |

5,500 | | Hollysys Automation Technologies Ltd. | | 96,140 |

74,700 | | Luthai Textile Co. Ltd. | | 92,444 |

36,000 | | Samsonite International SA | | 117,644 |

140,000 | | Sino Biopharmaceutical Ltd. | | 173,370 |

168,000 | | Tao Heung Holdings Ltd. | | 55,328 |

4,900 | | WuXi PharmaTech Cayman, Inc. ADR* | | 211,729 |

| | |

| | | | |

| | | | 791,829 |

| | | | |

Egypt — 1.91% | | |

2,105 | | Edita Food Industries SAE GDR* | | 38,102 |

7,308 | | Integrated Diagnostics Holdings Plc*(a) | | 45,675 |

| | |

| | | | |

| | | | 83,777 |

| | | | |

Indonesia — 3.65% | | |

2,977,000 | | Ace Hardware Indonesia Tbk PT | | 102,778 |

102,100 | | Bank Tabungan Pensiunan Nasional Tbk PT* | | 20,292 |

1,643,600 | | Pakuwon Jati Tbk PT | | 37,272 |

| | |

| | | | |

| | | | 160,342 |

| | | | |

Korea — 4.00% | | |

14,095 | | DGB Financial Group, Inc. | | 125,343 |

1,746 | | Hy-Lok Corp. | | 50,325 |

| | |

| | | | |

| | | | 175,668 |

| | | | |

13

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund (cont.)

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

Malaysia — 3.41% |

176,000 | | CapitaMalls Malaysia Trust REIT | | $ 56,426 |

18,400 | | LPI Capital Berhad | | 57,649 |

123,200 | | Oldtown Berhad | | 35,648 |

| | |

| | | | |

| | | | 149,723 |

| | | | |

Mexico — 3.16% | | |

38,100 | | Corp. Inmobiliaria Vesta SAB de CV | | 59,635 |

29,800 | | Grupo Herdez SAB de CV | | 78,885 |

| | |

| | | | |

| | | | 138,520 |

| | | | |

Nigeria — 0.56% | | |

204,500 | | Guaranty Trust Bank Plc | | 24,655 |

| |

Peru — 0.47% | | |

25,664 | | Grana y Montero SA | | 20,644 |

| |

Philippines — 4.68% | | |

153,100 | | Century Pacific Food, Inc. | | 54,044 |

51,500 | | Security Bank Corp. | | 151,376 |

| | |

| | | | |

| | | | 205,420 |

| | | | |

South Africa — 8.48% | | |

10,262 | | Clicks Group Ltd. | | 66,598 |

35,900 | | Consolidated Infrastructure Group Ltd.* | | 85,658 |

9,354 | | Howden Africa Holdings Ltd.* | | 17,270 |

13,858 | | Hyprop Investments Ltd. | | 120,705 |

11,718 | | Oceana Group Ltd. | | 81,738 |

| | |

| | | | |

| | | | 371,969 |

| | | | |

South Korea — 1.02% | | |

616 | | Youngone Holdings Co. Ltd. | | 44,613 |

| |

Taiwan — 12.77% | | |

19,900 | | Airtac International Group | | 105,242 |

60,000 | | Chroma ATE, Inc. | | 102,695 |

10,000 | | Giant Manufacturing Co. Ltd. | | 72,916 |

4,000 | | Ginko International Co. Ltd. | | 40,280 |

22,000 | | Lumax International Corp. Ltd. | | 28,985 |

35,000 | | Pacific Hospital Supply Co. Ltd. | | 67,323 |

51,150 | | Standard Foods Corp. | | 110,877 |

20,000 | | Yungtay Engineering Co. Ltd. | | 31,763 |

| | |

| | | | |

| | | | 560,081 |

| | | | |

Thailand — 9.55% | | |

53,300 | | Aeon Thana Sinsap Thailand Public Co. Ltd. NVDR | | 140,710 |

83,700 | | Delta Electronics Thailand Public Co. Ltd. - FOR | | 203,205 |

14

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund (cont.)

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

205,000 | | MC Group Public Co. Ltd. - FOR | | $ 75,221 |

| | |

| | | | |

| | | | 419,136 |

| | | | |

| |

Total Common Stocks | | 3,605,237 |

| | | | |

(Cost $4,380,750) | | |

| |

Equity Linked Securities — 10.86% | | |

India — 8.13% | | |

22,017 | | Godrej Industries Ltd. | | 116,760 |

20,000 | | Marico Ltd. | | 123,157 |

5,000 | | Sundaram Finance Ltd. | | 116,971 |

| | |

| | | | |

| | | | 356,888 |

| | | | |

| |

United Arab Emirates — 2.73% | | |

140,000 | | Aramex PJSC | | 119,687 |

| | | | |

| |

Total Equity Linked Securities | | 476,575 |

| | | | |

(Cost $336,684) | | |

| |

Exchange Traded Funds — 4.82% | | |

India — 4.82% | | |

5,000 | | Market Vectors India Small-Cap Index ETF | | 211,500 |

| | | | |

| |

Total Exchange Traded Funds | | 211,500 |

| | | | |

(Cost $149,435) | | |

| |

Preferred Stocks — 2.37% | | |

Korea — 2.37% | | |

659 | | Amorepacific Corp. | | 103,864 |

| |

Philippines — 0.00% | | |

58,000 | | Security Bank Corp.(b) | | 124 |

| | |

| | | | |

| |

Total Preferred Stocks | | 103,988 |

| | | | |

(Cost $28,181) | | |

15

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund (cont.)

September 30, 2015 (Unaudited)

| | | | | | |

Principal Amount | | | | | Value | |

Convertible Bonds — 0.04% | | | | |

Oman — 0.04% | | | | |

$698 | | Bank Muscat SAOG, 3.20%, 12/31/49(b) | | $ | 1,813 | |

| | | | | | |

| |

Total Convertible Bonds | | | 1,813 | |

| | | | | | |

(Cost $1,831) | | | | | | |

| |

Total Investments (Cost $4,896,881)(c) — 100.26% | | $ | 4,399,113 | |

| |

Liabilities in excess of other assets — (0.26)% | | | (11,389 | ) |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 4,387,724 | |

| | | | | | |

|

| |

| * | Non-income producing security. |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. Security has been deemed to be liquid based on procedures approved by the Board of Trustees. |

| (b) | The Pricing Committee has fair valued this security under procedures established by the Fund’s Board of Trustees. |

| (c) | See Notes to Financial Statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

ADR - American Depositary Receipt

BDR - Brazilian Depositary Receipt

FOR - Foreign Ownership Restrictions

GDR - Global Depositary Receipt

NVDR - Non-Voting Depository Receipt

REIT - Real Estate Investment Trust

16

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Emerging Markets Small Cap Equity Fund (cont.)

September 30, 2015 (Unaudited)

Portfolio Diversification (Unaudited)

| | | | |

| | | Percentage | |

Industries | | of Net Assets | |

Financials | | | 22.77 | % |

Consumer Staples | | | 19.80 | % |

Industrials | | | 19.17 | % |

Consumer Discretionary | | | 12.73 | % |

Health Care | | | 12.27 | % |

Utilities | | | 2.71 | % |

Materials | | | 2.66 | % |

Information Technology | | | 2.30 | % |

Telecom Services | | | 1.03 | % |

Other* | | | 4.56 | % |

| | | | |

| | | 100.00 | % |

| | | | |

| * | Includes cash, Exchange Traded Funds, Investment Company, interest and dividend receivable, |

| | pending trades and Fund share transactions, and accrued expenses payable. |

See Notes to Financial Statements.

17

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Global Opportunities Fund

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

Common Stocks — 99.59% |

Belgium — 3.12% |

1,439 | | Anheuser-Busch InBev NV | | $153,046 |

| |

Canada — 3.14% | | |

4,156 | | Enbridge, Inc. | | 154,312 |

| |

France — 6.59% | | |

1,518 | | Pernod Ricard SA | | 153,271 |

2,259 | | Safran SA | | 169,859 |

| | |

| | | | |

| | | | 323,130 |

| | | | |

Germany — 5.22% | | |

6,017 | | Deutsche Post AG | | 166,690 |

1,677 | | Drillisch AG | | 89,381 |

| | |

| | | | |

| | | | 256,071 |

| | | | |

Hong Kong — 1.97% | | |

18,600 | | AIA Group Ltd. | | 96,734 |

| |

India — 3.98% | | |

3,200 | | HDFC Bank Ltd. ADR | | 195,488 |

| |

Japan — 3.61% | | |

300 | | SMC Corp. | | 65,687 |

1,900 | | Toyota Motor Corp. | | 111,241 |

| | |

| | | | |

| | | | 176,928 |

| | | | |

Netherlands — 1.31% | | |

731 | | ASML Holding NV | | 64,257 |

| |

South Africa — 3.05% | | |

1,193 | | Naspers Ltd., N Shares | | 149,515 |

| |

Switzerland — 3.49% | | |

646 | | Roche Holding AG | | 171,495 |

| |

Taiwan — 3.26% | | |

7,700 | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | 159,775 |

| |

United Kingdom — 5.99% | | |

50,295 | | Lloyds Banking Group Plc | | 57,259 |

1,997 | | Shire Plc | | 136,518 |

7,782 | | St. James’s Place Plc | | 100,155 |

| | |

| | | | |

| | | | 293,932 |

| | | | |

18

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Global Opportunities Fund (cont.)

September 30, 2015 (Unaudited)

| | | | | | |

| Shares | | | | | Value | |

United States — 54.86% | |

400 | | Amazon.com, Inc.* | | $ | 204,756 | |

1,000 | | Amgen, Inc. | | | 138,320 | |

5,000 | | Blackstone Group LP (The) - MLP | | | 158,350 | |

1,800 | | Citigroup, Inc. | | | 89,298 | |

1,900 | | Danaher Corp. | | | 161,899 | |

1,400 | | EOG Resources, Inc. | | | 101,920 | |

2,100 | | Estee Lauder Cos., Inc. (The), Class A | | | 169,428 | |

2,900 | | First Republic Bank | | | 182,033 | |

300 | | Google, Inc., Class A* | | | 191,511 | |

900 | | Incyte Corp.* | | | 99,297 | |

1,600 | | International Flavors & Fragrances, Inc. | | | 165,216 | |

1,800 | | Intuit, Inc. | | | 159,750 | |

2,600 | | Invesco Ltd. | | | 81,198 | |

5,000 | | ITC Holdings Corp. | | | 166,700 | |

1,100 | | Kansas City Southern | | | 99,968 | |

900 | | LyondellBasell Industries NV, Class A | | | 75,024 | |

1,100 | | Occidental Petroleum Corp. | | | 72,765 | |

2,800 | | TJX Cos., Inc. (The) | | | 199,976 | |

1,500 | | UnitedHealth Group, Inc. | | | 174,015 | |

| | |

| | | | | | |

| | | | | 2,691,424 | |

| | | | | | |

| |

Total Common Stocks | | | 4,886,107 | |

| | | | | | |

(Cost $5,048,946) | | | | |

Investment Company — 1.34% | | | | |

65,466 | | Dreyfus Cash Management, Institutional Shares | | | 65,466 | |

| | | | | | |

| |

Total Investment Company | | | 65,466 | |

| | | | | | |

(Cost $65,466) | | | | |

| |

Total Investments (Cost $5,114,412)(a) — 100.93% | | $ | 4,951,573 | |

| |

Liabilities in excess of other assets — (0.93)% | | | (45,504 | ) |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 4,906,069 | |

| | | | | | |

|

| |

| * | Non-income producing security. |

| (a) | See Notes to Financial Statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

ADR - American Depositary Receipt

MLP - Master Limited Partnership

19

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Global Opportunities Fund (cont.)

September 30, 2015 (Unaudited)

Portfolio Diversification (Unaudited)

| | | | |

| | | Percentage | |

Industries | | of Net Assets | |

Financials | | | 19.58 | % |

Health Care | | | 14.67 | % |

Consumer Discretionary | | | 13.55 | % |

Industrials | | | 13.53 | % |

Information Technology | | | 11.73 | % |

Consumer Staples | | | 9.70 | % |

Energy | | | 6.71 | % |

Materials | | | 4.90 | % |

Utilities | | | 3.40 | % |

Telecom Services | | | 1.82 | % |

Other* | | | 0.41 | % |

| | | | |

| | | 100.00 | % |

| | | | |

| * | Includes cash, Investment Company, interest and dividend receivable, |

| | pending trades and Fund share transactions and accrued expenses payable. |

See Notes to Financial Statements.

20

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC International Opportunities Fund

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

|

Common Stocks — 99.79% |

Australia — 3.00% |

30,941 | | Oil Search Ltd. | | $157,101 |

| |

Belgium — 4.20% | | |

2,068 | | Anheuser-Busch InBev NV | | 219,944 |

| |

Canada — 3.88% | | |

5,470 | | Enbridge, Inc. | | 203,101 |

| |

France — 10.15% | | |

823 | | Air Liquide SA | | 97,569 |

2,095 | | Pernod Ricard SA | | 211,530 |

2,957 | | Safran SA | | 222,343 |

| | |

| | | | |

| | | | 531,442 |

| | | | |

Germany — 9.07% | | |

609 | | Continental AG | | 130,074 |

7,285 | | Deutsche Post AG | | 201,817 |

2,675 | | Drillisch AG | | 142,572 |

| | |

| | | | |

| | | | 474,463 |

| | | | |

Hong Kong — 3.32% | | |

33,400 | | AIA Group Ltd. | | 173,705 |

| |

India — 4.32% | | |

3,700 | | HDFC Bank Ltd. ADR | | 226,033 |

| |

Japan — 16.98% | | |

9,500 | | Astellas Pharma, Inc. | | 122,969 |

5,000 | | Kubota Corp | | 68,812 |

1,800 | | Nidec Corp. | | 123,779 |

2,000 | | Oriental Land Co. Ltd | | 111,686 |

5,400 | | Santen Pharmaceutical Co. Ltd. | | 72,498 |

700 | | SMC Corp. | | 153,271 |

2,200 | | Sumitomo Mitsui Financial Group, Inc. | | 83,425 |

2,600 | | Toyota Motor Corp. | | 152,225 |

| | |

| | | | |

| | | | 888,665 |

| | | | |

Netherlands — 3.21% | | |

1,000 | | AKZO Nobel NV | | 65,040 |

1,173 | | ASML Holding NV | | 103,111 |

| | |

| | | | |

| | | | 168,151 |

| | | | |

21

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC International Opportunities Fund (cont.)

September 30, 2015 (Unaudited)

| | | | |

| Shares | | Value |

|

South Africa — 3.93% |

1,640 | | Naspers Ltd., N Shares | | $ 205,537 |

| |

Spain — 1.73% | | |

23,504 | | CaixaBank SA | | 90,708 |

| |

Sweden — 2.25% | | |

4,201 | | Svenska Cellulosa AB SCA, Series B | | 117,553 |

| |

Switzerland — 12.07% | | |

365 | | Partners Group Holding AG | | 123,713 |

817 | | Roche Holding AG | | 216,890 |

184 | | Syngenta AG | | 58,956 |

2,088 | | Temenos Group AG* | | 85,734 |

7,935 | | UBS Group AG* | | 146,703 |

| | |

| | | | |

| | | | 631,996 |

| | | | |

Taiwan — 4.32% | | |

10,900 | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | 226,175 |

| |

United Kingdom — 17.36% | | |

7,562 | | Admiral Group Plc | | 171,988 |

2,107 | | Liberty Global Plc, Series A* | | 90,475 |

131,277 | | Lloyds Banking Group Plc | | 149,453 |

0 | | Royal Dutch Shell Plc | | 7 |

3,883 | | Royal Dutch Shell Plc, B Shares | | 91,807 |

2,696 | | Shire Plc | | 184,303 |

11,935 | | St. James’s Place Plc | | 153,605 |

3,221 | | WPP Plc | | 67,058 |

| | |

| | | | |

| | | | 908,696 |

| | | | |

Total Common Stocks | | 5,223,270 |

| | | | |

(Cost $5,585,019) | | |

| |

Investment Company — 0.78% | | |

41,142 | | Dreyfus Cash Management, Institutional Shares | | 41,142 |

| | | | |

Total Investment Company | | 41,142 |

| | | | |

(Cost $41,142) | | |

22

|

| SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC International Opportunities Fund (cont.)

September 30, 2015 (Unaudited)

| | | | | | |

| | | | | | Value | |

| |

Total Investments (Cost $5,626,161)(a) — 100.57% | | $ | 5,264,412 | |

| |

Liabilities in excess of other assets — (0.57)% | | | (29,975 | ) |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 5,234,437 | |

| | | | | | |

|

| |

| * | Non-income producing security. |

| (a) | See Notes to Financial Statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

ADR - American Depositary Receipt

Portfolio Diversification (Unaudited)

| | | | |

| | | Percentage | |

Industries | | of Net Assets | |

Financials | | | 25.20 | % |

Industrials | | | 14.71 | % |

Consumer Discretionary | | | 14.46 | % |

Health Care | | | 11.40 | % |

Consumer Staples | | | 10.49 | % |

Energy | | | 8.64 | % |

Information Technology | | | 7.93 | % |

Materials | | | 4.23 | % |

Telecom Services | | | 2.73 | % |

Other* | | | 0.21 | % |

| | | | |

| | | 100.00 | % |

| | | | |

| * | Includes cash, Investment Company, interest and dividend receivable, |

| | pending trades and Fund share transactions, and accrued expenses payable. |

See Notes to Financial Statements.

23

Statements of Assets and Liabilities

September 30, 2015 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Emerging

Markets

Equity Fund | | | Emerging

Markets

Small Cap

Equity Fund | | | Global

Opportunities

Fund | | | International

Opportunities

Fund | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Investments, at value (cost $10,538,844, $4,896,881, $5,114,412 and $5,626,161, respectively) | | | | $ | 9,835,232 | | | | | $ | 4,399,113 | | | | | $ | 4,951,573 | | | | | $ | 5,264,412 | |

Foreign currency, at value (cost $0, $2,625,

$573 and $3,347, respectively) | | | | | — | | | | | | 2,653 | | | | | | 571 | | | | | | 3,364 | |

Interest and dividends receivable | | | | | 14,817 | | | | | | 2,849 | | | | | | 6,760 | | | | | | 18,659 | |

Receivable from advisor | | | | | 9,441 | | | | | | 7,629 | | | | | | 10,271 | | | | | | 11,126 | |

Receivable for Fund shares sold | | | | | 4,100 | | | | | | — | | | | | | — | | | | | | — | |

Receivable for investments sold | | | | | 76,662 | | | | | | 1,692 | | | | | | — | | | | | | — | |

Prepaid expenses | | | | | 15,201 | | | | | | 14,911 | | | | | | 10,238 | | | | | | 10,478 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Assets | | | | | 9,955,453 | | | | | | 4,428,847 | | | | | | 4,979,413 | | | | | | 5,308,039 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash overdraft | | | | | — | | | | | | 3,874 | | | | | | — | | | | | | — | |

Foreign withholding tax payable | | | | | 26 | | | | | | 58 | | | | | | — | | | | | | — | |

Payable for investments purchased | | | | | 526,140 | | | | | | 1,831 | | | | | | — | | | | | | — | |

Accrued expenses and other payables: | | | | | | | | | | | | | | | | | | | | | | | | |

Accounting fees | | | | | 6,999 | | | | | | 6,970 | | | | | | 6,973 | | | | | | 6,976 | |

Distribution fees | | | | | 2,347 | | | | | | 1,670 | | | | | | — | | | | | | — | |

Custodian fees | | | | | — | | | | | | — | | | | | | 2,719 | | | | | | 2,745 | |

Shareholder reports | | | | | 2,248 | | | | | | 4,300 | | | | | | 958 | | | | | | 672 | |

Audit fees | | | | | 12,714 | | | | | | 12,714 | | | | | | 17,584 | | | | | | 17,584 | |

Transfer agent fees | | | | | 1,166 | | | | | | 1,233 | | | | | | 1,125 | | | | | | 1,093 | |

Offering costs | | | | | — | | | | | | — | | | | | | 37,535 | | | | | | 37,535 | |

Other | | | | | 2,462 | | | | | | 8,473 | | | | | | 6,450 | | | | | | 6,997 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Liabilities | | | | | 554,102 | | | | | | 41,123 | | | | | | 73,344 | | | | | | 73,602 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets | | | | $ | 9,401,351 | | | | | $ | 4,387,724 | | | | | $ | 4,906,069 | | | | | $ | 5,234,437 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets Consist Of: | | | | | | | | | | | | | | | | | | | | | | | | |

Capital | | | | $ | 9,911,375 | | | | | $ | 4,863,257 | | | | | $ | 5,031,774 | | | | | $ | 5,642,445 | |

Undistributed net investment income | | | | | 52,757 | | | | | | 69,774 | | | | | | 33,368 | | | | | | 75,198 | |

Accumulated net realized gains (losses) from investment and foreign currency transactions | | | | | 141,631 | | | | | | (47,564 | ) | | | | | 3,736 | | | | | | (121,352 | ) |

Net unrealized depreciation on investments and foreign currency transactions | | | | | (704,412 | ) | | | | | (497,743 | ) | | | | | (162,809 | ) | | | | | (361,854 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets | | | | $ | 9,401,351 | | | | | $ | 4,387,724 | | | | | $ | 4,906,069 | | | | | $ | 5,234,437 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

24

Statements of Assets and Liabilities (cont.)

September 30, 2015 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Emerging

Markets

Equity Fund | | | Emerging

Markets

Small Cap

Equity Fund | | | Global

Opportunities

Fund | | | International

Opportunities

Fund | |

Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | $ | 3,414,126 | | | | | $ | 2,185,734 | | | | | | N/A | | | | | | N/A | |

Class I | | | | | 5,987,225 | | | | | | 2,201,990 | | | | | $ | 4,906,069 | | | | | $ | 5,234,437 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | $ | 9,401,351 | | | | | $ | 4,387,724 | | | | | $ | 4,906,069 | | | | | $ | 5,234,437 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Shares Outstanding (Unlimited number of shares authorized, no par value): | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | 356,527 | | | | | | 244,875 | | | | | | N/A | | | | | | N/A | |

Class I | | | | | 623,172 | | | | | | 246,276 | | | | | | 504,822 | | | | | | 563,644 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | 979,699 | | | | | | 491,151 | | | | | | 504,822 | | | | | | 563,644 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Values and Redemption Prices Per Share: | | | | | | | | | | | | | | | | | | | | | | | | |

Class A (a) | | | | $ | 9.58 | | | | | $ | 8.93 | | | | | | N/A | | | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | $ | 9.61 | | | | | $ | 8.94 | | | | | $ | 9.72 | | | | | $ | 9.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Maximum Offering Prices Per Share: | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | $ | 10.16 | | | | | $ | 9.47 | | | | | | N/A | | | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Maximum Sales Charge - Class A | | | | | 5.75 | % | | | | | 5.75 | % | | | | | N/A | | | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(a) For Class A shares, redemption price per share will be reduced by 1.00% for sales of shares within 12 months of purchase (only applicable on purchases of $1 million or more on which no initial sales charge was paid). Such reduction is not reflected in the net asset value and the redemption price per share.

See Notes to Financial Statements.

25

Statements of Operations

For the Period Ended September 30, 2015 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Emerging

Markets

Equity Fund | | | Emerging

Markets

Small Cap

Equity Fund | | | Global

Opportunities

Fund | | | International

Opportunities

Fund | |

Investment Income: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividend income | | | | $ | 111,439 | | | | | $ | 118,753 | | | | | $ | 47,409 | | | | | $ | 92,632 | |

Foreign tax withholding | | | | | (13,254 | ) | | | | | (9,645 | ) | | | | | (3,118 | ) | | | | | (8,223 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Investment Income | | | | | 98,185 | | | | | | 109,108 | | | | | | 44,291 | | | | | | 84,409 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Investment advisory fees | | | | | 36,848 | | | | | | 32,097 | | | | | | 22,150 | | | | | | 22,344 | |

Distribution fees - Class A | | | | | 3,839 | | | | | | 3,202 | | | | | | — | | | | | | — | |

Accounting fees | | | | | 21,694 | | | | | | 21,628 | | | | | | 21,630 | | | | | | 21,640 | |

Audit fees | | | | | 16,259 | | | | | | 16,259 | | | | | | 16,457 | | | | | | 16,456 | |

Legal fees | | | | | 5,642 | | | | | | 6,948 | | | | | | 3,921 | | | | | | 3,920 | |

Custodian fees | | | | | 7,995 | | | | | | 4,116 | | | | | | 1,207 | | | | | | 2,627 | |

Insurance fees | | | | | 2,782 | | | | | | 2,782 | | | | | | 1,073 | | | | | | 1,073 | |

Trustees’ fees | | | | | 74 | | | | | | 65 | | | | | | 33 | | | | | | 33 | |

Transfer agent fees - Class A | | | | | 1,809 | | | | | | 1,848 | | | | | | — | | | | | | — | |

Transfer agent fees - Class I | | | | | 2,067 | | | | | | 1,797 | | | | | | 2,316 | | | | | | 2,308 | |

Shareholder reports | | | | | 4,470 | | | | | | 4,759 | | | | | | 3,751 | | | | | | 3,753 | |

Registration and filing fees | | | | | 10,943 | | | | | | 10,919 | | | | | | 8,167 | | | | | | 8,168 | |

Offering costs | | | | | — | | | | | | — | | | | | | 25,093 | | | | | | 25,056 | |

Other fees | | | | | 10,514 | | | | | | 10,615 | | | | | | 4,166 | | | | | | 7,341 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses before fee waiver/reimbursement | | | | | 124,936 | | | | | | 117,035 | | | | | | 109,964 | | | | | | 114,719 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Expenses waived/reimbursed by: | | | | | | | | | | | | | | | | | | | | | | | | |

Advisor | | | | | (80,890 | ) | | | | | (72,749 | ) | | | | | (82,602 | ) | | | | | (86,789 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Expenses | | | | | 44,046 | | | | | | 44,286 | | | | | | 27,362 | | | | | | 27,930 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | | | 54,139 | | | | | | 64,822 | | | | | | 16,929 | | | | | | 56,479 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Realized/Unrealized Gains (Losses): | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains (losses) on: | | | | | | | | | | | | | | | | | | | | | | | | |

Investment transactions | | | | | 43,634 | | | | | | (81,843 | ) | | | | | 15,730 | | | | | | (107,985 | ) |

Foreign currency transactions | | | | | (3,980 | ) | | | | | (4,585 | ) | | | | | (3,819 | ) | | | | | (7,939 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains (losses) | | | | | 39,654 | | | | | | (86,428 | ) | | | | | 11,911 | | | | | | (115,924 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | | | | | | | | | |

Investments | | | | | (1,223,835 | ) | | | | | (788,155 | ) | | | | | (323,099 | ) | | | | | (471,352 | ) |

Foreign currency transactions | | | | | 56 | | | | | | 1,544 | | | | | | 45 | | | | | | 39 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net unrealized losses | | | | | (1,223,779 | ) | | | | | (786,611 | ) | | | | | (323,054 | ) | | | | | (471,313 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Change in net assets resulting from operations | | | | $ | (1,129,986 | ) | | | | $ | (808,217 | ) | | | | $ | (294,214 | ) | | | | $ | (530,758 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

26

Statements of Changes in Net Assets

| | | | | | | | | | | | |

| |

| | | Emerging

Markets

Equity Fund | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Year Ended

March 31,

2015 | |

| | | | | (Unaudited) | | | | | | |

| | | | |

From Investment Activities: | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net investment income | | | | $ | 54,139 | | | | | $ | 44,178 | |

Net realized gains from investments and foreign currency transactions | | | | | 39,654 | | | | | | 200,633 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency transactions | | | | | (1,223,779 | ) | | | | | 369,171 | |

| | | | | | | | | | | | |

Change in net assets resulting from operations | | | | | (1,129,986 | ) | | | | | 613,982 | |

| | | | | | | | | | | | |

Distributions to Class A Shareholders: | | | | | | | | | | | | |

From net investment income | | | | | — | | | | | | (54,630 | ) |

From net realized gains from investment transactions | | | | | — | | | | | | (27,392 | ) |

Distributions to Class I Shareholders: | | | | | | | | | | | | |

From net investment income | | | | | — | | | | | | (63,092 | ) |

From net realized gains from investment transactions | | | | | — | | | | | | (30,012 | ) |

| | | | | | | | | | | | |

Change in net assets resulting from shareholder distributions | | | | | — | | | | | | (175,126 | ) |

| | | | | | | | | | | | |

Capital Transactions: | | | | | | | | | | | | |

Proceeds from shares issued | | | | | 4,290,142 | | | | | | 1,151,428 | |

Distributions reinvested | | | | | — | | | | | | 175,126 | |

Cost of shares redeemed | | | | | (625,177 | ) | | | | | (10 | ) |

| | | | | | | | | | | | |

Change in net assets resulting from capital transactions | | | | | 3,664,965 | | | | | | 1,326,544 | |

| | | | | | | | | | | | |

Net increase in net assets | | | | | 2,534,979 | | | | | | 1,765,400 | |

Net Assets: | | | | | | | | | | | | |

Beginning of period | | | | | 6,866,372 | | | | | | 5,100,972 | |

| | | | | | | | | | | | |

End of period | | | | $ | 9,401,351 | | | | | $ | 6,866,372 | |

| | | | | | | | | | | | |

Undistributed (Distributions in excess of) net investment income | | | | $ | 52,757 | | | | | $ | (1,382 | ) |

| | | | | | | | | | | | |

Share Transactions: | | | | | | | | | | | | |

Issued | | | | | 414,823 | | | | | | 107,153 | |

Reinvested | | | | | — | | | | | | 16,936 | |

Redeemed | | | | | (59,212 | ) | | | | | (1 | ) |

| | | | | | | | | | | | |

Change in shares resulting from capital transactions | | | | | 355,611 | | | | | | 124,088 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

27

Statements of Changes in Net Assets (cont.)

| | | | | | | | | | | | | | |

| |

| | | Emerging

Markets

Small Cap

Equity Fund | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Year Ended

March 31,

2015 | |

| | | (Unaudited) | | | | | | |

From Investment Activities: | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 64,822 | | | | | $ | 23,744 | |

Net realized gains (losses) from investments and foreign currency transactions | | | | | | | (86,428 | ) | | | | | 127,605 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency transactions | | | | | | | (786,611 | ) | | | | | 97,156 | |

| | | | | | | | | | | | | | |

Change in net assets resulting from operations | | | | | | | (808,217 | ) | | | | | 248,505 | |

| | | | | | | | | | | | | | |

Distributions to Class A Shareholders: | | | | | | | | | | | | | | |

From net investment income | | | | | | | — | | | | | | (49,928 | ) |

From net realized gains from investment transactions | | | | | | | — | | | | | | (37,490 | ) |

Distributions to Class I Shareholders: | | | | | | | | | | | | | | |

From net investment income | | | | | | | — | | | | | | (56,725 | ) |

From net realized gains from investment transactions | | | | | | | — | | | | | | (37,270 | ) |

| | | | | | | | | | | | | | |

Change in net assets resulting from shareholder distributions | | | | | | | — | | | | | | (181,413 | ) |

| | | | | | | | | | | | | | |

Capital Transactions: | | | | | | | | | | | | | | |

Proceeds from shares issued | | | | | | | 6,950 | | | | | | 30,762 | |

Distributions reinvested | | | | | | | — | | | | | | 181,413 | |

Cost of shares redeemed | | | | | | | (253,884 | ) | | | | | (21,873 | ) |

| | | | | | | | | | | | | | |

Change in net assets resulting from capital transactions | | | | | | | (246,934 | ) | | | | | 190,302 | |

| | | | | | | | | | | | | | |

Net increase (decrease) in net assets | | | | | | | (1,055,151 | ) | | | | | 257,394 | |

Net Assets: | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 5,442,875 | | | | | | 5,185,481 | |

| | | | | | | | | | | | | | |

End of period | | | | | | $ | 4,387,724 | | | | | $ | 5,442,875 | |

| | | | | | | | | | | | | | |

Undistributed net investment income | | | | | | $ | 69,774 | | | | | $ | 4,952 | |

| | | | | | | | | | | | | | |

Share Transactions: | | | | | | | | | | | | | | |

Issued | | | | | | | 680 | | | | | | 2,846 | |

Reinvested | | | | | | | — | | | | | | 17,980 | |

Redeemed | | | | | | | (28,329 | ) | | | | | (2,026 | ) |

| | | | | | | | | | | | | | |

Change in shares resulting from capital transactions | | | | | | | (27,649 | ) | | | | | 18,800 | |

| | | | | | | | | | | | | | |

See Notes to Financial Statements.

28

Statements of Changes in Net Assets (cont.)

| | | | | | | | | | | | |

| |

| | | Global Opportunities Fund | |

| | | For the Period Ended

September 30,

2015 | | | For the

Period Ended

March 31, 2015(a) | |

| | | (Unaudited) | | | | | | |

From Investment Activities: | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net investment income | | | | $ | 16,929 | | | | | $ | 3,160 | |

Net realized gains (losses) from investments and foreign currency transactions | | | | | 11,911 | | | | | | (8,872 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currency transactions | | | | | (323,054 | ) | | | | | 160,245 | |

| | | | | | | | | | | | |

Change in net assets resulting from operations | | | | | (294,214 | ) | | | | | 154,533 | |

| | | | | | | | | | | | |

Distributions to Class I Shareholders: | | | | | | | | | | | | |

From net investment income | | | | | — | | | | | | (1,445 | ) |

From net realized gains from investment transactions | | | | | — | | | | | | — | |

| | | | | | | | | | | | |

Change in net assets resulting from shareholder distributions | | | | | — | | | | | | (1,445 | ) |

| | | | | | | | | | | | |

Capital Transactions: | | | | | | | | | | | | |

Proceeds from shares issued | | | | | 45,250 | | | | | | 5,000,500 | |

Distributions reinvested | | | | | — | | | | | | 1,445 | |

Cost of shares redeemed | | | | | — | | | | | | — | |

| | | | | | | | | | | | |

Change in net assets resulting from capital transactions | | | | | 45,250 | | | | | | 5,001,945 | |

| | | | | | | | | | | | |

Net increase (decrease) in net assets | | | | | (248,964 | ) | | | | | 5,155,033 | |

Net Assets: | | | | | | | | | | | | |

Beginning of period | | | | | 5,155,033 | | | | | | — | |

| | | | | | | | | | | | |

End of period | | | | $ | 4,906,069 | | | | | $ | 5,155,033 | |

| | | | | | | | | | | | |

Undistributed net investment income | | | | $ | 33,368 | | | | | $ | 16,439 | |

| | | | | | | | | | | | |

Share Transactions: | | | | | | | | | | | | |

Issued | | | | | 4,621 | | | | | | 500,051 | |

Reinvested | | | | | — | | | | | | 150 | |

Redeemed | | | | | — | | | | | | — | |

| | | | | | | | | | | | |

Change in shares resulting from capital transactions | | | | | 4,621 | | | | | | 500,201 | |

| | | | | | | | | | | | |

(a) For the period from December 3, 2014 (commencement of operations) to March 31, 2015.

See Notes to Financial Statements.

29

Statements of Changes in Net Assets (cont.)

| | | | | | | | | | | | |

| | | International Opportunities Fund | |

| | | For the Period Ended

September 30,

2015 | | | For the

Period Ended

March 31,

2015(a) | |

| | | (Unaudited) | | | | | | |

From Investment Activities: | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net investment income | | | | $ | 56,479 | | | | | $ | 9,637 | |

Net realized losses from investments and foreign currency transactions | | | | | (115,924 | ) | | | | | (10,738 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currency transactions | | | | | (471,313 | ) | | | | | 109,459 | |

| | | | | | | | | | | | |

Change in net assets resulting from operations | | | | | (530,758 | ) | | | | | 108,358 | |

| | | | | | | | | | | | |

Distributions to Class I Shareholders: | | | | | | | | | | | | |

From net investment income | | | | | — | | | | | | (1,025 | ) |

From net realized gains from investment transactions | | | | | — | | | | | | — | |

| | | | | | | | | | | | |

Change in net assets resulting from shareholder distributions | | | | | — | | | | | | (1,025 | ) |

| | | | | | | | | | | | |

Capital Transactions: | | | | | | | | | | | | |

Proceeds from shares issued | | | | | 457,602 | | | | | | 5,200,000 | |

Distributions reinvested | | | | | — | | | | | | 1,025 | |

Cost of shares redeemed | | | | | (765 | ) | | | | | — | |

| | | | | | | | | | | | |

Change in net assets resulting from capital transactions | | | | | 456,837 | | | | | | 5,201,025 | |

| | | | | | | | | | | | |

Net increase (decrease) in net assets | | | | | (73,921 | ) | | | | | 5,308,358 | |

Net Assets: | | | | | | | | | | | | |

Beginning of period | | | | | 5,308,358 | | | | | | — | |

| | | | | | | | | | | | |

End of period | | | | $ | 5,234,437 | | | | | $ | 5,308,358 | |

| | | | | | | | | | | | |

Undistributed net investment income | | | | $ | 75,198 | | | | | $ | 18,719 | |

| | | | | | | | | | | | |

Share Transactions: | | | | | | | | | | | | |

Issued | | | | | 43,848 | | | | | | 519,763 | |

Reinvested | | | | | — | | | | | | 107 | |

Redeemed | | | | | (74 | ) | | | | | — | |

| | | | | | | | | | | | |

Change in shares resulting from capital transactions | | | | | 43,774 | | | | | | 519,870 | |

| | | | | | | | | | | | |

(a) For the period from December 3, 2014 (commencement of operations) to March 31, 2015.

See Notes to Financial Statements.

30

RBC Emerging Markets Equity Fund

(Selected data for a share outstanding throughout the periods indicated)

| | | | | | | | | | | | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Year Ended

March 31,

2015 | | | For the

Period Ended

March 31,

2014(a) | |

| Class A | | (Unaudited) | | | | | | | |

Per Share Operating Performance: | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.99 | | | | $10.20 | | | | $10.00 | |

Net investment income(b) | | | 0.07 | | | | 0.07 | | | | — | |

Realized and unrealized gains/(losses) | | | (1.48 | ) | | | 1.05 | | | | 0.20 | |

Total from investment activities | | | (1.41 | ) | | | 1.12 | | | | 0.20 | |

Distributions: | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.22 | ) | | | — | |

Realized gains | | | — | | | | (0.11 | ) | | | — | |

Total distributions | | | — | | | | (0.33 | ) | | | — | |

Net asset value, end of period | | | | | | | $10.99 | | | | $10.20 | |

| | | |

Total Return:*(c) | | | (12.92)%(d) | | | | 11.17 | % | | | 2.00%(d) | |

| | | |

Ratios to Average Net Assets: | | | | | | | | | | | | |

Ratio of Net Expenses to Average Net Assets | | | 1.30%(e)(f) | | | | 1.45 | % | | | 1.45%(f) | |

Ratio of Net Investment Income to Average Net Assets | | | 1.26%(f) | | | | 0.64 | % | | | 0.04%(f) | |

Ratio of Expenses to Average Net Assets** | | | 3.39%(f) | | | | 4.96 | % | | | 8.77%(f) | |

| | | |

Net assets, end of period (in thousands) | | | $3,414 | | | | $2,849 | | | | $2,550 | |

Portfolio turnover*** | | | 14 | % | | | 37 | % | | | 11 | % |

| ** | During the period, certain fees were contractually or voluntarily reduced and/or reimbursed. If such contractual/voluntary fee reductions and reimbursements had not occurred, the ratio would have been as indicated. |

| *** | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| (a) | For the period from December 20, 2013 (commencement of operations) to March 31, 2014. |

| (b) | Per share net investment income has been calculated using the average daily shares method. |

| (c) | Assumes investment at net asset value at the beginning of the period, reinvestment of all dividends and distributions, and a complete redemption of the investment at net asset value at the end of the period. |

| (e) | Beginning August 3, 2015, the net operating expenses were contractually limited to 0.98% of average daily net assets of Class A. The ratio of net expenses to average net assets represents a blended percentage for the period ended September 30, 2015. |

See Notes to Financial Statements.

31

RBC Emerging Markets Equity Fund

(Selected data for a share outstanding throughout the periods indicated)

| | | | | | | | | | | | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Year Ended

March 31,

2015 | | | For the

Period Ended

March 31,

2014(a) | |

| Class I | | (Unaudited) | | | | | | | |

Per Share Operating Performance: | | | | | | | | | | | | |

Net asset value, beginning of period | | | $11.01 | | | | $10.21 | | | | $10.00 | |

Net investment income(b) | | | 0.08 | | | | 0.09 | | | | 0.01 | |

Realized and unrealized gains/(losses) | | | (1.48 | ) | | | 1.05 | | | | 0.20 | |

Total from investment activities | | | (1.40 | ) | | | 1.14 | | | | 0.21 | |

Distributions: | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.23 | ) | | | — | |

Realized gains | | | — | | | | (0.11 | ) | | | — | |

Total distributions | | | — | | | | (0.34 | ) | | | — | |

Net asset value, end of period | | | $ 9.61 | | | | $11.01 | | | | $10.21 | |

| | | |

Total Return:(c) | | | (12.72)%(d) | | | | 11.38 | % | | | 2.10%(d) | |

| | | |

Ratios to Average Net Assets: | | | | | | | | | | | | |

Ratio of Net Expenses to Average Net Assets | | | 1.02%(e)(f) | | | | 1.20 | % | | | 1.20%(f) | |

Ratio of Net Investment Income to Average Net Assets | | | 1.48%(f) | | | | 0.87 | % | | | 0.29%(f) | |

Ratio of Expenses to Average Net Assets* | | | 3.10%(f) | | | | 4.65 | % | | | 8.52%(f) | |

| | | |

Net assets, end of period (in thousands) | | | $5,987 | | | | $4,017 | | | | $2,551 | |

Portfolio turnover** | | | 14 | % | | | 37 | % | | | 11 | % |

| * | During the period, certain fees were contractually or voluntarily reduced and/or reimbursed. If such contractual/voluntary fee reductions and reimbursements had not occurred, the ratio would have been as indicated. |

| ** | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| (a) | For the period from December 20, 2013 (commencement of operations) to March 31, 2014. |

| (b) | Per share net investment income has been calculated using the average daily shares method. |

| (c) | Assumes investment at net asset value at the beginning of the period, reinvestment of all dividends and distributions, and a complete redemption of the investment at net asset value at the end of the period. |

| (e) | Beginning August 3, 2015, the net operating expenses were contractually limited to 0.73% of average daily net assets of Class I. The ratio of net expenses to average net assets represents a blended percentage for the period ended September 30, 2015. |

See Notes to Financial Statements.

32

RBC Emerging Markets Small Cap Equity Fund

(Selected data for a share outstanding throughout the periods indicated)

| | | | | | | | | | | | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Year Ended

March 31,

2015 | | | For the

Period Ended

March 31,

2014(a) | |

| Class A | | (Unaudited) | | | | | | | |

Per Share Operating Performance: | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.49 | | | | $10.37 | | | | $10.00 | |

Net investment income(b) | | | 0.12 | | | | 0.03 | | | | 0.04 | |

Realized and unrealized gains/(losses) | | | (1.68 | ) | | | 0.44 | | | | 0.33 | |

Total from investment activities | | | (1.56 | ) | | | 0.47 | | | | 0.37 | |

Distributions: | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.20 | ) | | | — | |

Realized gains | | | — | | | | (0.15 | ) | | | — | |

Total distributions | | | — | | | | (0.35 | ) | | | — | |

Net asset value, end of period | | | $ 8.93 | | | | $10.49 | | | | $10.37 | |

| | | |

Total Return:*(c) | | | (14.87)%(d) | | | | 4.64 | % | | | 3.70%(d) | |

| | | |

Ratios to Average Net Assets: | | | | | | | | | | | | |

Ratio of Net Expenses to Average Net Assets | | | 1.85%(e) | | | | 1.85 | % | | | 1.85%(e) | |

Ratio of Net Investment Income to Average Net Assets | | | 2.39%(e) | | | | 0.31 | % | | | 1.49%(e) | |

Ratio of Expenses to Average Net Assets** | | | 4.67%(e) | | | | 5.58 | % | | | 8.96%(e) | |

| | | |

Net assets, end of period (in thousands) | | | $2,186 | | | | $2,719 | | | | $2,592 | |

Portfolio turnover*** | | | 19 | % | | | 32 | % | | | 19 | % |

| ** | During the period, certain fees were contractually or voluntarily reduced and/or reimbursed. If such contractual/voluntary fee reductions and reimbursements had not occurred, the ratio would have been as indicated. |

| *** | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| (a) | For the period from December 20, 2013 (commencement of operations) to March 31, 2014. |

| (b) | Per share net investment income has been calculated using the average daily shares method. |

| (c) | Assumes investment at net asset value at the beginning of the period, reinvestment of all dividends and distributions, and a complete redemption of the investment at net asset value at the end of the period. |

See Notes to Financial Statements.

33

RBC Emerging Markets Small Cap Equity Fund

(Selected data for a share outstanding throughout the periods indicated)

| | | | | | | | | | | | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Year Ended

March 31,

2015 | | | For the

Period Ended

March 31,

2014(a) | |

| Class I | | (Unaudited) | | | | | | | |

Per Share Operating Performance: | | | | | | | | | | | | |

Net asset value, beginning of period | | | $10.49 | | | | $10.37 | | | | $10.00 | |

Net investment income(b) | | | 0.13 | | | | 0.06 | | | | 0.05 | |

Realized and unrealized gains/(losses) | | | (1.68 | ) | | | 0.44 | | | | 0.32 | |

Total from investment activities | | | (1.55 | ) | | | 0.50 | | | | 0.37 | |

Distributions: | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.23 | ) | | | — | |

Realized gains | | | — | | | | (0.15 | ) | | | — | |

Total distributions | | | — | | | | (0.38 | ) | | | — | |

Net asset value, end of period | | | $ 8.94 | | | | $10.49 | | | | $10.37 | |

| | | |

Total Return:(c) | | | (14.78)%(d) | | | | 4.93 | % | | | 3.70%(d) | |

| | | |

Ratios to Average Net Assets: | | | | | | | | | | | | |

Ratio of Net Expenses to Average Net Assets | | | 1.60%(e) | | | | 1.60 | % | | | 1.60%(e) | |

Ratio of Net Investment Income to Average Net Assets | | | 2.64%(e) | | | | 0.56 | % | | | 1.74%(e) | |

Ratio of Expenses to Average Net Assets* | | | 4.42%(e) | | | | 5.32 | % | | | 8.71%(e) | |

| | | |

Net assets, end of period (in thousands) | | | $2,202 | | | | $2,724 | | | | $2,594 | |

Portfolio turnover** | | | 19 | % | | | 32 | % | | | 19 | % |

| * | During the period, certain fees were contractually or voluntarily reduced and/or reimbursed. If such contractual/voluntary fee reductions and reimbursements had not occurred, the ratio would have been as indicated. |

| ** | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| (a) | For the period from December 20, 2013 (commencement of operations) to March 31, 2014. |

| (b) | Per share net investment income has been calculated using the average daily shares method. |

| (c) | Assumes investment at net asset value at the beginning of the period, reinvestment of all dividends and distributions, and a complete redemption of the investment at net asset value at the end of the period. |

See Notes to Financial Statements.

34

RBC Global Opportunities Fund

(Selected data for a share outstanding throughout the period indicated)

| | | | | | | | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Period Ended

March 31,

2015(a) | |

| Class I | | (Unaudited) | | | | |

Per Share Operating Performance: | | | | | | | | |

Net asset value, beginning of period | | | $10.31 | | | | $10.00 | |

Net investment income(b) | | | 0.03 | | | | 0.01 | |

Realized and unrealized gains/(losses) | | | (0.62 | ) | | | 0.30 | |

Total from investment activities | | | (0.59 | ) | | | 0.31 | |

Distributions: | | | | | | | | |

Net investment income | | | — | | | | 0.00(c) | |

Realized gains | | | — | | | | — | |

Total distributions | | | — | | | | 0.00(c) | |

Net asset value, end of period | | | $ 9.72 | | | | $10.31 | |

| | |

Total Return:(d)(e) | | | (5.72) | % | | | 3.13 | % |

| | |

Ratios to Average Net Assets:(f) | | | | | | | | |

Ratio of Net Expenses to Average Net Assets | | | 1.05 | % | | | 1.05 | % |

Ratio of Net Investment Income to Average Net Assets | | | 0.65 | % | | | 0.19 | % |

Ratio of Expenses to Average Net Assets* | | | 3.32 | % | | | 3.46 | % |

| | |

Net assets, end of period (in thousands) | | | $4,906 | | | | $5,155 | |

Portfolio turnover** | | | 15 | % | | | 11 | % |

| * | During the year, certain fees were contractually or voluntarily reduced and/or reimbursed. If such contractual/voluntary fee reductions and reimbursements had not occurred, the ratio would have been as indicated. |

| ** | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued. |

| (a) | For the period from December 3, 2014 (commencement of operations) to March 31, 2015. |

| (b) | Per share net investment income has been calculated using the average daily shares method. |

| (c) | Less than $0.01 or $(0.01) per share. |

| (e) | Assumes investment at net asset value at the beginning of the period, reinvestment of all dividends and distributions, and a complete redemption of the investment at net asset value at the end of the period. |

See Notes to Financial Statements.

35

RBC International Opportunities Fund

(Selected data for a share outstanding throughout the period indicated)

| | | | | | | | |

| | | For the

Period Ended

September 30,

2015 | | | For the

Period Ended

March 31,

2015(a) | |

| Class I | | (Unaudited) | | | | |

Per Share Operating Performance: | | | | | | | | |

Net asset value, beginning of period | | | $10.21 | | | | $10.00 | |

Net investment income(b) | | | 0.10 | | | | 0.02 | |

Realized and unrealized gains/(losses) | | | (1.02 | ) | | | 0.19 | |

Total from investment activities | | | (0.92 | ) | | | 0.21 | |

Distributions: | | | | | | | | |

Net investment income | | | — | | | | 0.00(c) | |

Realized gains | | | — | | | | — | |

Total distributions | | | — | | | | 0.00(c) | |

Net asset value, end of period | | | $ 9.29 | | | | $10.21 | |

| | |

Total Return:(d)(e) | | | (9.01 | )% | | | 2.12 | % |

| | |

Ratios to Average Net Assets:(f) | | | | | | | | |

Ratio of Net Expenses to Average Net Assets | | | 1.00 | % | | | 1.00 | % |

Ratio of Net Investment Income to Average Net Assets | | | 2.02 | % | | | 0.59 | % |

Ratio of Expenses to Average Net Assets* | | | 3.27 | % | | | 3.50 | % |

| | |