UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

Lee Thoresen, Esq.

RBC Plaza

60 South Sixth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612)-313-1341

Date of fiscal year end: September 30

Date of reporting period: March 31, 2014

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | RBC Funds | | | | |

| | | | | | | | | |

About Your Semi Annual Report | | | | | | | | This semi annual report includes detailed information about the Access Capital Community Investment Fund (the “Fund”) including financial statements, performance, and a complete list of holdings. | |

| | | | | | | | The Fund compares its performance against the Barclays U.S. Securitized Index and the Barclays U.S. Aggregate Bond Index which are widely used market indices. | |

| | | | | | | | We hope the financial information presented will help you evaluate your investment in the Fund. We also encourage you to read your Fund’s prospectus for further detail as to the Fund’s investment policies and risk profile. Fund prospectuses and performance information subsequent to the date of this report are available on our website at www.rbcgam.us. | |

| | | | | | | | A description of the policies and procedures that your Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-422-2766; (ii) on the Fund’s website at www.rbcgam.us; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov. | |

| | | | | | | | Information regarding how your Fund voted proxies relating to portfolio securities during the most recent 12 month period ended June 30 is available (i) on the Fund’s website at www.rbcgam.us; and (ii) on the Commission’s website at http://www.sec.gov. | |

| | | | | | | | A schedule of the Fund’s portfolio holdings will be filed with the Commission for the first and third quarters of each fiscal year on Form N-Q. This information is available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room is available by calling 1-202-551-8090. | |

| | | | | | | | | | | | |

Table of Contents | | | | | | | | | | | | |

| | | | | | | | Portfolio Managers | | | 1 | |

| | | | | | | | Performance Summary | | | 2 | |

| | | | | | | | Fund Statistics | | | 3 | |

| | | | | | | | Schedule of Portfolio Investments | | | 5 | |

| | | | | | | | Financial Statements | | | | |

| | | | | | | | - Statement of Assets and Liabilities | | | 26 | |

| | | | | | | | - Statement of Operations | | | 28 | |

| | | | | | | | - Statements of Changes in Net Assets | | | 29 | |

| | | | | | | | - Statement of Cash Flows | | | 30 | |

| | | | | | | | Financial Highlights | | | 32 | |

| | | | | | | | Notes to Financial Statements | | | 35 | |

| | | | | | | | Share Class Information | | | 45 | |

| | | | | | | | Supplemental Information | | | 46 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | |

PORTFOLIO MANAGERS | | | | | | |

| | | | | | | |

RBC Global Asset Management (U.S.) Inc.(“RBC GAM (US)”) serves as the investment advisor to the Access Capital Community Investment Fund. RBC GAM (US) employs a team approach to the management of the Access Capital Community Investment Fund, with no individual team member being solely responsible for the investment decisions. The Fund’s management team has access to RBC GAM (US)’s investment research and other money management resources. | | | | | | |

Brian Svendahl, CFA Managing Director, Co-Head, U.S. Fixed Income Brian Svendahl oversees the fixed income research, portfolio management and trading at RBC GAM (US). In addition to shaping the firm’s overall fixed income philosophy and process, he is a portfolio manager for its community investment strategy, including the Access Capital Community Investment Fund, and many of RBC GAM (US)’s government mandates. Brian joined RBC GAM (US) in 2005 and most recently led the mortgage and government team before being promoted to Co-Head. Prior to joining RBC GAM (US), he held several risk management, research and trading positions at Wells Fargo. Brian’s experience also includes liability management and implementing balance sheet hedging strategies. He earned a BS in economics from the University of Minnesota and a BBA in finance and an MBA from the University of Minnesota Carlson School of Management. Brian is a CFA charterholder. | | | | | |

Brian Svendahl, CFA |

Scott Kirby Vice President, Senior Portfolio Manager Scott Kirby is a member of the rates research team in RBC GAM (US)’s fixed income group and serves as co-portfolio manager for the firm’s community investment strategy, including the Access Capital Community Investment Fund. Scott joined RBC GAM (US) in 2012 and most recently served as manager of investments of a broad-based asset portfolio for a large foundation, supporting its mission to reduce poverty. Previously he led the structured assets team of Ameriprise Financial/Riversource Investments, where he served as senior portfolio manager for more than $20 billion in agency and non-agency mortgage-backed, commercial mortgage-backed and asset-backed securities. He earned a BS in finance and an MBA in finance from the University of Minnesota Carlson School of Management. | | | | | |

Scott Kirby |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

1

| | | | | | | | | | | | | | | | |

| | | | | PERFORMANCE SUMMARY |

| | | |

| | | | | Average Annual Total Returns as of March 31, 2014 (Unaudited) |

| | | | | Access Capital Community Investment Fund |

| | | | | | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception | | Expense

Ratio* |

| | | | | Class A (a) | | | | | | | | | | | | |

| | | | | - Including Maximum Sales Charge of 3.75% | | (4.57)% | | 1.12% | | 2.60% | | 3.36% | | 4.16% | | |

| | | | | - At Net Asset Value

| | (0.90)% | | 2.40% | | 3.37% | | 3.76% | | 4.41% | | 0.99% |

| | | | | Class I (b) | | | | | | | | | | | | |

| | | | | - At Net Asset Value | | (0.59)% | | 2.64% | | 3.64% | | 3.95% | | 4.69% | | 0.74% |

| | | | | | | | | |

| | | | | Barclays U. S. Securitized Index (c) | | 0.26% | | 2.89% | | 4.31% | | 4.50% | | 5.33% | | |

| | | | | Barclays U. S. Aggregate Bond Index (c) | | (0.10)% | | 3.75% | | 4.80% | | 4.46% | | 5.40% | | |

| | | | | Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. For performance data current to most recent month-end go to www.rbcgam.us. |

| | | | | The Barclays U.S. Securitized Index is an unmanaged index that tracks the performance of mortgage-backed pass-through securities issued by Ginnie Mae, Fannie Mae, and Freddie Mac, investment-grade bonds and asset-backed securities. |

| | | | | The Barclays U.S. Aggregate Bond Index is an unmanaged index that tracks the performance of a representative list of government, corporate, asset-backed and mortgage-backed securities. |

| | | | | (a) The inception date for Class A shares of the Fund is January 29, 2009. All performance shown for such class of shares prior to its inception date is based on the performance of the Class I shares of the Fund, adjusted to reflect the fees and expenses of Class A shares, as applicable. |

| | | | | (b) Class I commenced operations on July 28, 2008. The performance in the table reflects the performance of Access Capital Strategies Community Investment Fund, Inc., the predecessor to the Fund. From its inception, June 23, 1998, until May 30, 2006, the predecessor fund elected status as a business development company. From May 31, 2006 until July 27, 2008, the predecessor fund operated as a continuously offered closed-end interval management company. If the predecessor fund had operated as an open-end management company, performance may have been adversely affected. Fund performance reflects applicable fee waivers/expense reimbursements which, if excluded, would cause performance to be lower. |

| | | | | (c) You cannot invest directly into the index. |

| | | | | * The Fund’s expenses reflect the most recent year end (September 30, 2013). |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

2

| | | | | | | | | | | | |

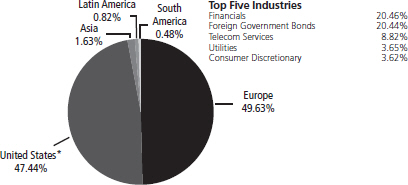

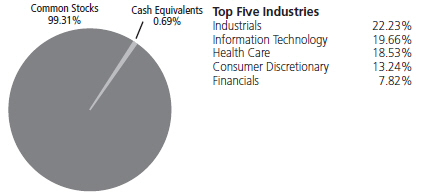

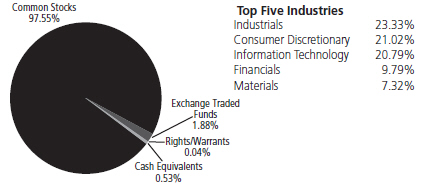

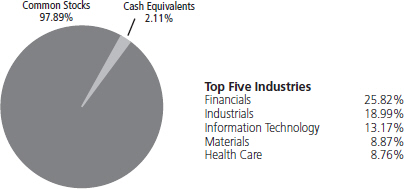

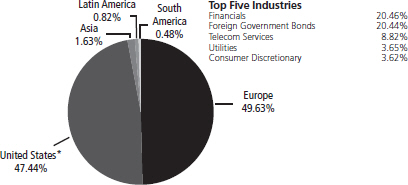

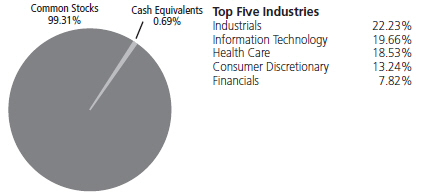

| FUND STATISTICS (UNAUDITED) | | | | | | |

Access Capital Community Investment Fund | | | | | | |

Current income and capital appreciation | | | | | | Investment

Objective

Benchmark |

Barclays U.S. Securitized Index | | | | | | | |

Barclays U.S. Aggregate Bond Index | | | | | | |

| | | | | | Asset Allocation

(as of 3/31/14)

(% of fund’s

investments) |

Fannie Mae Pool #AK2386,

3.50%, 2/1/42 | | 2.53% | | Massachusetts Housing Finance

Agency Revenue, Series B, | | 1.35% | | | | | | Top Ten Holdings

(as of 3/31/14)

(% of fund’s net

assets) |

Small Business Administration,

1.45%, 3/25/36 | | 2.28% | | 6.53%, 12/1/27

Ginnie Mae, Series 2012-114, | | 1.27% | | | | | |

Massachusetts Housing

Investment Corp. Term Loan,

6.67%, 1/31/35 | | 1.84% | | Class A, 2.10%, 1/16/53

Fannie Mae Pool #466934,

4.10%, 1/1/21 | | 1.22% | | | | | | |

Fannie Mae Pool #465537,

4.20%, 7/1/20 | | 1.55% | | Fannie Mae Pool #AK6715,

3.50%, 3/1/42 | | 1.17% | | | | | | |

Ginnie Mae Series 2012-58,

Class B, 2.20%, 3/16/44 | | 1.43% | | Ginnie Mae Pool #AC9541,

2.12%, 2/15/48 | | 1.12% | | | | | | |

*A listing of all portfolio holdings can be found beginning on page 5. | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

3

| | | | | | |

| | | | | | FUND STATISTICS (UNAUDITED) |

| | | |

| | | | | | Access Capital Community Investment Fund |

| | | |

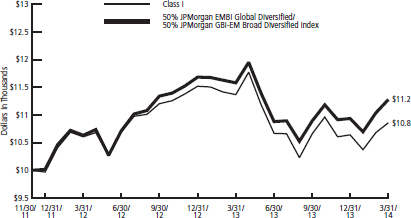

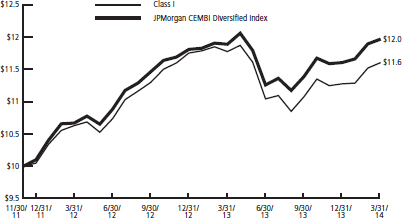

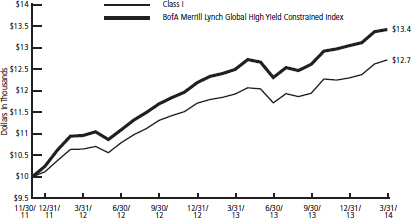

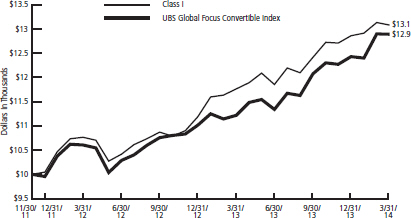

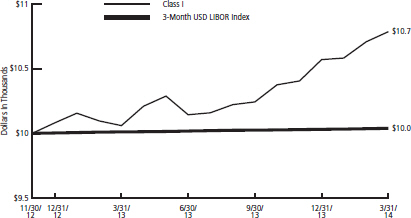

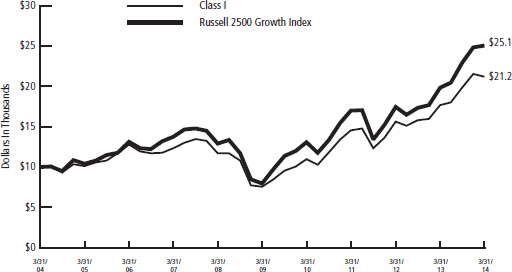

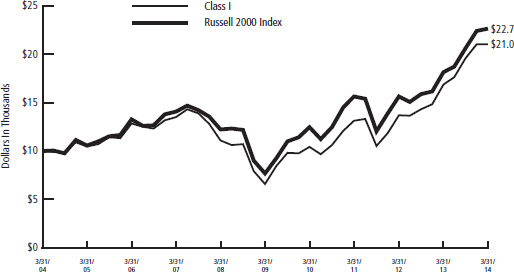

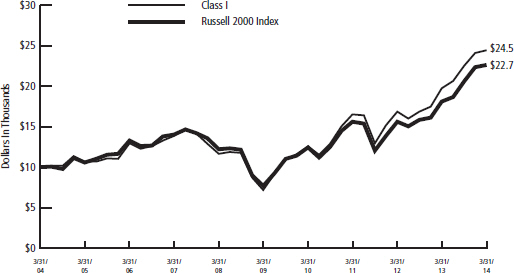

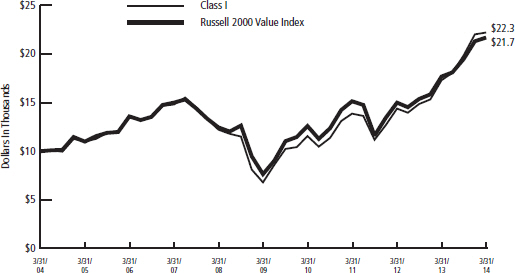

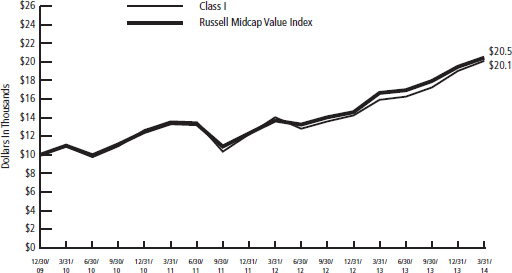

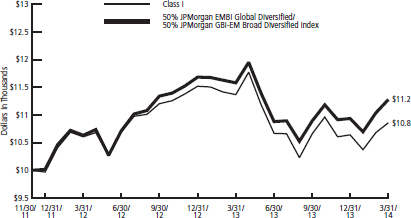

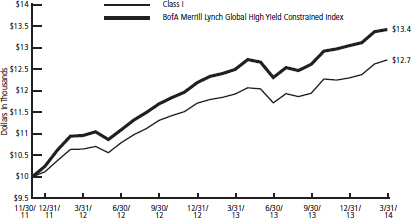

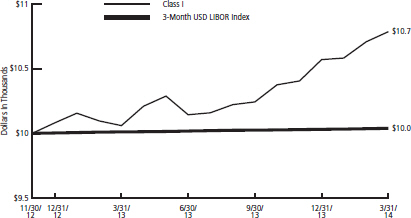

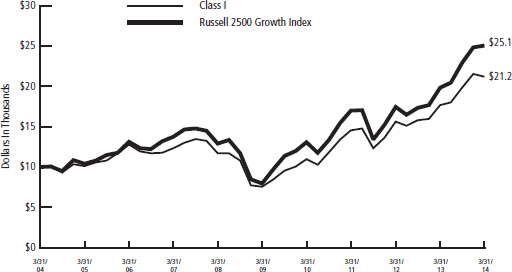

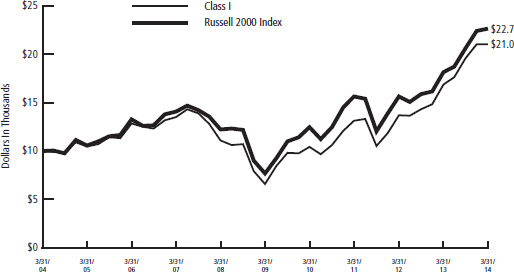

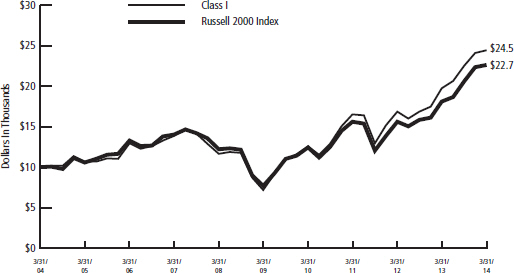

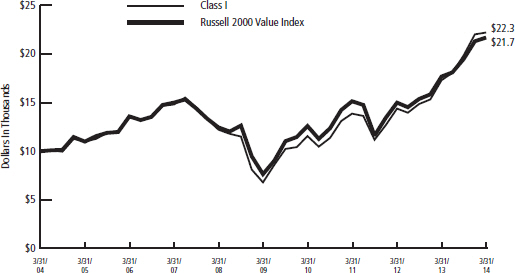

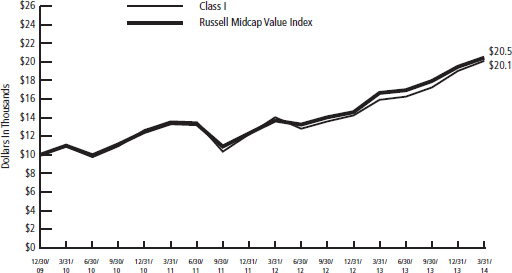

Growth of

$10,000 Initial

Investment Over

10 Years | | | | | |  |

| | | |

| | | | | | The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. |

| | | |

| | | | | | |

| | | |

| | | | | | |

| | | |

| | | | | | |

| | | |

| | | | | | |

| | | |

| | | | | | |

| | | |

| | | | | | |

4

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

Municipal Bonds — 4.82% | |

California — 0.21% | |

$110,000 | | California Rural Home Mortgage Finance Authority Revenue, Series C, 5.40%, 8/1/35, (Credit Support: Ginnie Mae, Fannie Mae, Freddie Mac), Callable 2/1/17 @ 104 | | $ | 113,080 | |

| | |

975,000 | | California Statewide Communities Development Authority Revenue, Series B, 5.25%, 10/20/42, (Credit Support: Ginnie Mae), Callable 10/20/17 @ 102 | | | 978,695 | |

| | | | | | |

| | | | | 1,091,775 | |

| | | | | | |

Delaware — 0.72% | | | | |

| | |

320,000 | | Delaware State Housing Authority Revenue, 4.65%, 7/1/26, (Credit Support: AMBAC), Callable 7/1/15 @ 100 | | | 321,901 | |

| | |

155,000 | | Delaware State Housing Authority Revenue, 4.55%, 7/1/16, (Credit Support: AGM), Callable 1/1/15 @ 100 | | | 155,622 | |

| | |

150,000 | | Delaware State Housing Authority Revenue, 4.55%, 1/1/16, (Credit Support: AGM), Callable 1/1/15 @ 100 | | | 150,602 | |

| | |

60,000 | | Delaware State Housing Authority Revenue, 4.50%, 7/1/15, (Credit Support: AGM), Callable 1/1/15 @ 100 | | | 60,171 | |

| | |

665,000 | | Delaware State Housing Authority Revenue, Series 2, 1.50%, 1/1/15, (Credit Support: Ginnie Mae, Fannie Mae, Freddie Mac) | | | 667,899 | |

| | |

915,000 | | Delaware State Housing Authority Revenue, Series A, 5.25%, 7/1/28, (Credit Support: Ginnie Mae, Fannie Mae, Freddie Mac), Callable 1/1/18 @ 100 | | | 917,644 | |

| | |

790,000 | | Delaware State Housing Authority Revenue, Series A, 5.05%, 7/1/23, (Credit Support: Ginnie Mae, Fannie Mae, Freddie Mac), Callable 1/1/18 @ 100 | | | 792,283 | |

| | |

660,000 | | Delaware State Housing Authority Revenue, Series A, 5.35%, 7/1/31, (Credit Support: Ginnie Mae, Fannie Mae, Freddie Mac), Callable 1/1/18 @ 100 | | | 673,616 | |

| | | | | | |

| | | | | 3,739,738 | |

| | | | | | |

Massachusetts — 1.75% | | | | |

575,000 | | Massachusetts Housing Finance Agency Revenue, Series 170, 2.61%, 12/1/19 | | | 567,261 | |

| | |

545,000 | | Massachusetts Housing Finance Agency Revenue, Series 170, 1.51%, 12/1/17 | | | 537,741 | |

5

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 330,000 | | Massachusetts Housing Finance Agency Revenue, Series 170, 2.31%, 12/1/18 | | $ | 327,505 | |

| | |

250,000 | | Massachusetts Housing Finance Agency Revenue, Series 170, 2.21%, 6/1/18 | | | 249,258 | |

| | |

205,000 | | Massachusetts Housing Finance Agency Revenue, Series 170, 3.09%, 6/1/20 | | | 205,070 | |

| | |

160,000 | | Massachusetts Housing Finance Agency Revenue, Series 170, 2.51%, 6/1/19 | | | 158,843 | |

| | |

6,790,000 | | Massachusetts Housing Finance Agency Revenue, Series B, 6.53%, 12/1/27, (Credit Support: NATL-RE,IBC), Callable 6/1/17 @ 100 | | | 7,000,083 | |

| | | | | | |

| | | | | 9,045,761 | |

| | | | | | |

Mississippi — 0.02% | | | | |

100,000 | | Mississippi Home Corp. Multi Family Revenue OID, 5.35%, 8/20/48, (Credit Support: Ginnie Mae, FHA), Callable 9/1/18 @ 105 | | | 98,907 | |

| | | | | | |

New York — 1.83% | | | | |

750,000 | | New York City Housing Development Corp. Revenue, 1.54%, 2/1/17 | | | 748,868 | |

| | |

750,000 | | New York City Housing Development Corp. Revenue, 1.94%, 2/1/18 | | | 744,053 | |

| | |

500,000 | | New York City Housing Development Corp. Revenue, 1.73%, 8/1/17 | | | 498,050 | |

| | |

665,000 | | New York City Housing Development Corp. Revenue, Series A, 4.15%, 7/15/15, (Credit Support: Fannie Mae) | | | 682,071 | |

| | |

700,000 | | New York State Housing Finance Agency Revenue, 4.50%, 11/15/27, (Credit Support: Fannie Mae), Callable 11/15/16 @ 100 | | | 709,107 | |

| | |

1,000,000 | | New York State Housing Finance Agency Revenue, Series A, 4.65%, 11/15/38, (Credit Support: Fannie Mae), Callable 11/15/16 @ 100 | | | 1,004,110 | |

| | |

1,335,000 | | New York State Mortgage Agency Revenue, Series 184, 2.10%, 4/1/19 | | | 1,319,421 | |

| | |

1,335,000 | | New York State Mortgage Agency Revenue, Series 184, 1.85%, 10/1/18 | | | 1,318,713 | |

6

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$1,335,000 | | New York State Mortgage Agency Revenue, Series 184, 1.59%, 4/1/18 | | $ | 1,314,721 | |

| | |

1,140,000 | | New York State Mortgage Agency Revenue, Series 187, 1.59%, 4/1/18 | | | 1,129,615 | |

| | | | | | |

| | | | | 9,468,729 | |

| | | | | | |

| |

Texas — 0.23% | | | | |

1,085,000 | | Texas Department of Housing & Community Affairs Revenue, 5.13%, 12/1/38, (Credit Support: Fannie Mae), Callable 6/1/21 @ 102(a) | | | 1,205,771 | |

| | | | | | |

| |

Vermont — 0.06% | | | | |

165,000 | | Vermont Housing Finance Agency Revenue, Series C, 1.95%, 8/15/17 | | | 164,518 | |

| | |

160,000 | | Vermont Housing Finance Agency Revenue, Series C, 1.20%, 8/15/16 | | | 159,554 | |

| | | | | | |

| | | | | 324,072 | |

| | | | | | |

| |

Total Municipal Bonds | | | 24,974,753 | |

| | | | | | |

(Cost $24,577,941) | | | | |

U.S. Government Agency Backed Mortgages — 105.58% | | | | |

Fannie Mae — 66.37% | | | | |

7,264 | | Pool #253214, 7.00%, 1/1/15 | | | 7,376 | |

49,235 | | Pool #257612, 5.00%, 5/1/38 | | | 54,146 | |

369,110 | | Pool #257613, 5.50%, 6/1/38 | | | 407,146 | |

172,780 | | Pool #257631, 6.00%, 7/1/38 | | | 192,499 | |

55,172 | | Pool #257632, 5.50%, 7/1/38 | | | 61,228 | |

183,635 | | Pool #257649, 5.50%, 7/1/38 | | | 203,017 | |

77,393 | | Pool #257656, 6.00%, 8/1/38 | | | 86,036 | |

133,895 | | Pool #257663, 5.50%, 8/1/38 | | | 148,111 | |

224,092 | | Pool #257857, 6.00%, 12/1/37 | | | 249,119 | |

67,034 | | Pool #257869, 5.50%, 12/1/37 | | | 74,298 | |

236,473 | | Pool #257890, 5.50%, 2/1/38 | | | 261,432 | |

125,976 | | Pool #257892, 5.50%, 2/1/38 | | | 138,958 | |

49,818 | | Pool #257897, 5.50%, 2/1/38 | | | 55,247 | |

106,620 | | Pool #257898, 6.00%, 2/1/38 | | | 118,937 | |

52,585 | | Pool #257902, 6.00%, 2/1/38 | | | 58,665 | |

140,191 | | Pool #257903, 5.50%, 2/1/38 | | | 154,703 | |

111,664 | | Pool #257904, 6.00%, 2/1/38 | | | 124,134 | |

83,823 | | Pool #257913, 5.50%, 1/1/38 | | | 92,736 | |

74,997 | | Pool #257926, 5.50%, 3/1/38 | | | 83,170 | |

58,599 | | Pool #257942, 5.50%, 4/1/38 | | | 64,986 | |

100,171 | | Pool #257943, 6.00%, 4/1/38 | | | 111,627 | |

7

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 80,674 | | Pool #257995, 6.00%, 7/1/38 | | | $ 89,896 | |

68,047 | | Pool #258022, 5.50%, 5/1/34 | | | 75,527 | |

91,401 | | Pool #258027, 5.00%, 5/1/34 | | | 100,020 | |

107,331 | | Pool #258030, 5.00%, 5/1/34 | | | 117,452 | |

151,638 | | Pool #258070, 5.00%, 6/1/34 | | | 166,505 | |

85,814 | | Pool #258090, 5.00%, 6/1/34 | | | 93,906 | |

45,646 | | Pool #258121, 5.50%, 6/1/34 | | | 50,664 | |

150,533 | | Pool #258152, 5.50%, 8/1/34 | | | 166,797 | |

211,766 | | Pool #258157, 5.00%, 8/1/34 | | | 231,735 | |

178,670 | | Pool #258163, 5.50%, 8/1/34 | | | 198,142 | |

127,519 | | Pool #258166, 5.50%, 9/1/34 | | | 141,297 | |

79,918 | | Pool #258171, 5.50%, 10/1/34 | | | 88,552 | |

162,127 | | Pool #258173, 5.50%, 10/1/34 | | | 179,645 | |

149,005 | | Pool #258180, 5.00%, 10/1/34 | | | 163,009 | |

401,160 | | Pool #258188, 5.50%, 11/1/34 | | | 444,880 | |

44,332 | | Pool #258222, 5.00%, 11/1/34 | | | 48,498 | |

118,106 | | Pool #258224, 5.50%, 12/1/34 | | | 130,867 | |

132,418 | | Pool #258225, 5.50%, 11/1/34 | | | 146,725 | |

217,397 | | Pool #258238, 5.00%, 1/1/35 | | | 237,829 | |

102,141 | | Pool #258251, 5.50%, 1/1/35 | | | 113,081 | |

119,954 | | Pool #258258, 5.00%, 1/1/35 | | | 131,191 | |

241,147 | | Pool #258305, 5.00%, 3/1/35 | | | 263,736 | |

104,553 | | Pool #258336, 5.00%, 4/1/35 | | | 114,347 | |

69,293 | | Pool #258340, 5.00%, 3/1/35 | | | 75,784 | |

115,849 | | Pool #258388, 5.50%, 6/1/35 | | | 127,968 | |

140,802 | | Pool #258393, 5.00%, 5/1/35 | | | 153,991 | |

71,056 | | Pool #258394, 5.00%, 5/1/35 | | | 77,712 | |

268,193 | | Pool #258395, 5.50%, 6/1/35 | | | 296,248 | |

70,429 | | Pool #258402, 5.00%, 6/1/35 | | | 77,037 | |

68,499 | | Pool #258403, 5.00%, 6/1/35 | | | 74,926 | |

92,195 | | Pool #258404, 5.00%, 6/1/35 | | | 100,802 | |

53,328 | | Pool #258410, 5.00%, 4/1/35 | | | 58,323 | |

56,303 | | Pool #258411, 5.50%, 5/1/35 | | | 62,307 | |

129,824 | | Pool #258448, 5.00%, 8/1/35 | | | 141,944 | |

219,464 | | Pool #258450, 5.50%, 8/1/35 | | | 242,422 | |

102,235 | | Pool #258456, 5.00%, 8/1/35 | | | 111,780 | |

76,082 | | Pool #258479, 5.50%, 7/1/35 | | | 84,041 | |

92,146 | | Pool #258552, 5.00%, 11/1/35 | | | 101,094 | |

105,502 | | Pool #258569, 5.00%, 10/1/35 | | | 115,352 | |

417,706 | | Pool #258571, 5.50%, 11/1/35 | | | 461,793 | |

98,680 | | Pool #258600, 6.00%, 1/1/36 | | | 109,700 | |

602,077 | | Pool #258627, 5.50%, 2/1/36 | | | 664,119 | |

113,895 | | Pool #258634, 5.50%, 2/1/36 | | | 125,702 | |

237,086 | | Pool #258658, 5.50%, 3/1/36 | | | 261,517 | |

59,179 | | Pool #258721, 5.50%, 4/1/36 | | | 65,472 | |

60,189 | | Pool #258737, 5.50%, 12/1/35 | | | 66,589 | |

83,817 | | Pool #258763, 6.00%, 5/1/36 | | | 93,288 | |

49,080 | | Pool #259004, 8.00%, 2/1/30 | | | 58,948 | |

8

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 55,957 | | Pool #259030, 8.00%, 4/1/30 | | $ | 66,741 | |

52,263 | | Pool #259181, 6.50%, 3/1/31 | | | 58,724 | |

19,114 | | Pool #259187, 6.50%, 4/1/31 | | | 21,208 | |

82,405 | | Pool #259190, 6.50%, 4/1/31 | | | 92,692 | |

79,976 | | Pool #259201, 6.50%, 4/1/31 | | | 89,976 | |

40,487 | | Pool #259306, 6.50%, 9/1/31 | | | 45,504 | |

93,785 | | Pool #259316, 6.50%, 11/1/31 | | | 105,529 | |

61,237 | | Pool #259369, 6.00%, 1/1/32 | | | 67,957 | |

36,026 | | Pool #259378, 6.00%, 12/1/31 | | | 40,167 | |

39,824 | | Pool #259393, 6.00%, 1/1/32 | | | 44,430 | |

48,626 | | Pool #259398, 6.50%, 2/1/32 | | | 54,738 | |

49,628 | | Pool #259590, 5.50%, 11/1/32 | | | 55,228 | |

205,245 | | Pool #259611, 5.50%, 11/1/32 | | | 228,178 | |

110,913 | | Pool #259614, 6.00%, 11/1/32 | | | 123,688 | |

83,214 | | Pool #259634, 5.50%, 12/1/32 | | | 92,361 | |

68,485 | | Pool #259655, 5.50%, 2/1/33 | | | 76,013 | |

159,270 | | Pool #259659, 5.50%, 2/1/33 | | | 176,777 | |

38,028 | | Pool #259671, 5.50%, 2/1/33 | | | 42,209 | |

93,237 | | Pool #259686, 5.50%, 3/1/33 | | | 103,486 | |

45,201 | | Pool #259722, 5.00%, 5/1/33 | | | 49,464 | |

56,815 | | Pool #259724, 5.00%, 5/1/33 | | | 62,172 | |

146,884 | | Pool #259725, 5.00%, 5/1/33 | | | 160,735 | |

71,476 | | Pool #259726, 5.00%, 5/1/33 | | | 78,216 | |

122,584 | | Pool #259729, 5.00%, 6/1/33 | | | 134,143 | |

66,590 | | Pool #259734, 5.50%, 5/1/33 | | | 73,910 | |

47,297 | | Pool #259753, 5.00%, 7/1/33 | | | 51,757 | |

171,921 | | Pool #259761, 5.00%, 6/1/33 | | | 188,777 | |

140,371 | | Pool #259764, 5.00%, 7/1/33 | | | 153,608 | |

137,589 | | Pool #259777, 5.00%, 7/1/33 | | | 150,563 | |

94,863 | | Pool #259781, 5.00%, 7/1/33 | | | 103,808 | |

57,771 | | Pool #259789, 5.00%, 7/1/33 | | | 63,219 | |

106,001 | | Pool #259807, 5.00%, 8/1/33 | | | 115,996 | |

148,232 | | Pool #259816, 5.00%, 8/1/33 | | | 162,210 | |

32,045 | | Pool #259819, 5.00%, 8/1/33 | | | 35,067 | |

138,552 | | Pool #259830, 5.00%, 8/1/33 | | | 151,617 | |

39,187 | | Pool #259848, 5.00%, 9/1/33 | | | 42,883 | |

82,516 | | Pool #259867, 5.50%, 10/1/33 | | | 91,664 | |

127,598 | | Pool #259869, 5.50%, 10/1/33 | | | 141,623 | |

129,648 | | Pool #259875, 5.50%, 10/1/33 | | | 143,899 | |

79,489 | | Pool #259876, 5.50%, 10/1/33 | | | 88,227 | |

45,957 | | Pool #259879, 5.50%, 10/1/33 | | | 51,008 | |

93,761 | | Pool #259906, 5.50%, 11/1/33 | | | 104,067 | |

58,236 | | Pool #259928, 5.50%, 12/1/33 | | | 64,692 | |

208,544 | | Pool #259930, 5.00%, 11/1/33 | | | 228,209 | |

5,403 | | Pool #259939, 5.50%, 11/1/33 | | | 5,997 | |

43,705 | | Pool #259961, 5.50%, 3/1/34 | | | 48,509 | |

120,914 | | Pool #259976, 5.00%, 3/1/34 | | | 132,770 | |

43,952 | | Pool #259998, 5.00%, 3/1/34 | | | 48,097 | |

9

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 531,555 | | Pool #381985, 7.97%, 9/1/17 | | $ | 543,406 | |

2,498,222 | | Pool #386641, 5.80%, 12/1/33 | | | 2,708,530 | |

661,045 | | Pool #386674, 5.51%, 11/1/21 | | | 740,992 | |

858,768 | | Pool #387472, 4.89%, 6/1/15 | | | 879,600 | |

614,059 | | Pool #462834, 4.70%, 2/1/17 | | | 659,384 | |

7,347,660 | | Pool #465537, 4.20%, 7/1/20 | | | 8,009,524 | |

721,569 | | Pool #465946, 3.61%, 9/1/20 | | | 766,329 | |

5,824,597 | | Pool #466934, 4.10%, 1/1/21 | | | 6,316,548 | |

3,347,336 | | Pool #467882, 4.24%, 6/1/21 | | | 3,643,766 | |

2,410,169 | | Pool #468104, 3.93%, 5/1/18 | | | 2,606,294 | |

599,253 | | Pool #469239, 2.69%, 10/1/18 | | | 619,412 | |

465,448 | | Pool #470439, 2.91%, 5/1/22 | | | 467,065 | |

3,384,505 | | Pool #470561, 2.94%, 2/1/22 | | | 3,410,608 | |

3,994,022 | | Pool #471320, 2.96%, 5/1/22 | | | 4,021,608 | |

3,570,110 | | Pool #471948, 2.86%, 7/1/22 | | | 3,561,130 | |

226,609 | | Pool #557295, 7.00%, 12/1/29 | | | 261,655 | |

32,456 | | Pool #575886, 7.50%, 1/1/31 | | | 38,028 | |

84,404 | | Pool #576445, 6.00%, 1/1/31 | | | 93,787 | |

183,518 | | Pool #579402, 6.50%, 4/1/31 | | | 206,169 | |

159,485 | | Pool #583728, 6.50%, 6/1/31 | | | 179,323 | |

79,977 | | Pool #585148, 6.50%, 7/1/31 | | | 89,984 | |

40,275 | | Pool #590931, 6.50%, 7/1/31 | | | 45,298 | |

72,534 | | Pool #590932, 6.50%, 7/1/31 | | | 81,515 | |

181,820 | | Pool #601865, 6.50%, 4/1/31 | | | 203,002 | |

142,444 | | Pool #601868, 6.00%, 7/1/29 | | | 158,440 | |

126,527 | | Pool #607611, 6.50%, 11/1/31 | | | 142,167 | |

222,694 | | Pool #634271, 6.50%, 5/1/32 | | | 250,681 | |

56,038 | | Pool #640146, 5.00%, 12/1/17 | | | 58,752 | |

143,883 | | Pool #644232, 6.50%, 6/1/32 | | | 162,005 | |

30,060 | | Pool #644432, 6.50%, 7/1/32 | | | 33,798 | |

48,962 | | Pool #644437, 6.50%, 6/1/32 | | | 55,128 | |

3,223,016 | | Pool #663159, 5.00%, 7/1/32 | | | 3,530,572 | |

180,537 | | Pool #670278, 5.50%, 11/1/32 | | | 200,824 | |

51,343 | | Pool #676702, 5.50%, 11/1/32 | | | 57,034 | |

59,641 | | Pool #677591, 5.50%, 12/1/32 | | | 66,197 | |

599,643 | | Pool #681883, 6.00%, 3/1/33 | | | 669,223 | |

84,463 | | Pool #683087, 5.00%, 1/1/18 | | | 89,031 | |

67,774 | | Pool #684644, 4.50%, 6/1/18 | | | 71,859 | |

292,268 | | Pool #686542, 5.50%, 3/1/33 | | | 324,395 | |

436,573 | | Pool #695961, 5.50%, 1/1/33 | | | 485,423 | |

146,762 | | Pool #695962, 6.00%, 11/1/32 | | | 163,757 | |

341,284 | | Pool #696407, 5.50%, 4/1/33 | | | 378,799 | |

750,060 | | Pool #702478, 5.50%, 6/1/33 | | | 832,508 | |

234,047 | | Pool #702479, 5.00%, 6/1/33 | | | 256,117 | |

81,116 | | Pool #703210, 5.50%, 9/1/32 | | | 89,921 | |

357,770 | | Pool #720025, 5.00%, 8/1/33 | | | 391,507 | |

511,418 | | Pool #723066, 5.00%, 4/1/33 | | | 559,643 | |

378,353 | | Pool #723067, 5.50%, 5/1/33 | | | 419,942 | |

10

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 261,915 | | Pool #723068, 4.50%, 5/1/33 | | $ | 281,507 | |

317,331 | | Pool #723070, 4.50%, 5/1/33 | | | 341,069 | |

434,993 | | Pool #727311, 4.50%, 9/1/33 | | | 467,532 | |

1,128,087 | | Pool #727312, 5.00%, 9/1/33 | | | 1,234,462 | |

254,180 | | Pool #727315, 6.00%, 10/1/33 | | | 283,243 | |

311,770 | | Pool #738589, 5.00%, 9/1/33 | | | 341,169 | |

187,814 | | Pool #738683, 5.00%, 9/1/33 | | | 205,525 | |

349,926 | | Pool #739269, 5.00%, 9/1/33 | | | 382,923 | |

186,238 | | Pool #743595, 5.50%, 10/1/33 | | | 206,710 | |

194,554 | | Pool #748041, 4.50%, 10/1/33 | | | 209,107 | |

251,189 | | Pool #749891, 5.00%, 9/1/33 | | | 275,818 | |

298,773 | | Pool #749897, 4.50%, 9/1/33 | | | 321,123 | |

57,476 | | Pool #750984, 5.00%, 12/1/18 | | | 61,141 | |

193,071 | | Pool #751008, 5.00%, 12/1/18 | | | 204,974 | |

287,896 | | Pool #753533, 5.00%, 11/1/33 | | | 315,043 | |

102,383 | | Pool #755679, 6.00%, 1/1/34 | | | 114,117 | |

117,400 | | Pool #755745, 5.00%, 1/1/34 | | | 129,058 | |

171,470 | | Pool #755746, 5.50%, 12/1/33 | | | 190,318 | |

46,915 | | Pool #763551, 5.50%, 3/1/34 | | | 52,072 | |

333,289 | | Pool #763820, 5.50%, 1/1/34 | | | 369,924 | |

112,746 | | Pool #763824, 5.00%, 3/1/34 | | | 123,378 | |

145,987 | | Pool #765216, 5.00%, 1/1/19 | | | 155,296 | |

34,181 | | Pool #765217, 4.50%, 1/1/19 | | | 36,241 | |

79,483 | | Pool #765306, 5.00%, 2/1/19 | | | 84,380 | |

53,144 | | Pool #773084, 4.50%, 3/1/19 | | | 56,347 | |

17,038 | | Pool #773096, 4.50%, 3/1/19 | | | 18,065 | |

188,000 | | Pool #773175, 5.00%, 5/1/34 | | | 205,728 | |

262,043 | | Pool #773476, 5.50%, 7/1/19 | | | 280,856 | |

90,047 | | Pool #773547, 5.00%, 5/1/34 | | | 98,539 | |

43,082 | | Pool #773553, 5.00%, 4/1/34 | | | 47,306 | |

388,335 | | Pool #773568, 5.50%, 5/1/34 | | | 431,022 | |

176,945 | | Pool #776850, 5.50%, 11/1/34 | | | 196,063 | |

52,241 | | Pool #776851, 6.00%, 10/1/34 | | | 58,156 | |

66,675 | | Pool #777444, 5.50%, 5/1/34 | | | 74,004 | |

2,079,954 | | Pool #777621, 5.00%, 2/1/34 | | | 2,276,087 | |

325,566 | | Pool #781437, 6.00%, 8/1/34 | | | 361,925 | |

94,228 | | Pool #781741, 6.00%, 9/1/34 | | | 104,751 | |

197,155 | | Pool #781907, 5.00%, 2/1/21 | | | 211,956 | |

229,225 | | Pool #781954, 5.00%, 6/1/34 | | | 250,840 | |

220,433 | | Pool #781959, 5.50%, 6/1/34 | | | 244,664 | |

421,447 | | Pool #781960, 5.50%, 6/1/34 | | | 467,773 | |

420,683 | | Pool #783893, 5.50%, 12/1/34 | | | 466,136 | |

195,522 | | Pool #783929, 5.50%, 10/1/34 | | | 216,647 | |

75,156 | | Pool #788329, 6.50%, 8/1/34 | | | 83,783 | |

67,522 | | Pool #790282, 6.00%, 7/1/34 | | | 75,359 | |

181,837 | | Pool #797623, 5.00%, 7/1/35 | | | 198,813 | |

159,733 | | Pool #797626, 5.50%, 7/1/35 | | | 176,442 | |

137,827 | | Pool #797627, 5.00%, 7/1/35 | | | 150,695 | |

11

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 129,919 | | Pool #797674, 5.50%, 9/1/35 | | $ | 143,509 | |

513,149 | | Pool #798725, 5.50%, 11/1/34 | | | 568,594 | |

169,668 | | Pool #799547, 5.50%, 9/1/34 | | | 188,000 | |

118,842 | | Pool #799548, 6.00%, 9/1/34 | | | 132,114 | |

1,531,659 | | Pool #806754, 4.50%, 9/1/34 | | | 1,646,234 | |

371,543 | | Pool #806757, 6.00%, 9/1/34 | | | 413,037 | |

1,604,037 | | Pool #806761, 5.50%, 9/1/34 | | | 1,777,348 | |

82,252 | | Pool #808185, 5.50%, 3/1/35 | | | 90,985 | |

358,278 | | Pool #808205, 5.00%, 1/1/35 | | | 391,839 | |

72,985 | | Pool #813942, 5.00%, 11/1/20 | | | 78,323 | |

491,400 | | Pool #815009, 5.00%, 4/1/35 | | | 537,430 | |

387,845 | | Pool #817641, 5.00%, 11/1/35 | | | 424,054 | |

137,056 | | Pool #820334, 5.00%, 9/1/35 | | | 149,852 | |

586,325 | | Pool #820335, 5.00%, 9/1/35 | | | 641,064 | |

202,193 | | Pool #820336, 5.00%, 9/1/35 | | | 221,070 | |

558,059 | | Pool #822008, 5.00%, 5/1/35 | | | 610,334 | |

916,997 | | Pool #829005, 5.00%, 8/1/35 | | | 1,002,607 | |

205,081 | | Pool #829006, 5.50%, 9/1/35 | | | 226,535 | |

385,255 | | Pool #829274, 5.00%, 8/1/35 | | | 421,222 | |

473,601 | | Pool #829275, 5.00%, 8/1/35 | | | 517,816 | |

178,983 | | Pool #829276, 5.00%, 8/1/35 | | | 195,693 | |

134,355 | | Pool #829277, 5.00%, 8/1/35 | | | 146,898 | |

621,880 | | Pool #829649, 5.50%, 3/1/35 | | | 689,072 | |

436,452 | | Pool #844361, 5.50%, 11/1/35 | | | 481,427 | |

283,580 | | Pool #845245, 5.50%, 11/1/35 | | | 313,246 | |

144,015 | | Pool #866969, 6.00%, 2/1/36 | | | 160,124 | |

175,913 | | Pool #867569, 6.00%, 2/1/36 | | | 195,559 | |

183,765 | | Pool #867574, 5.50%, 2/1/36 | | | 202,902 | |

157,605 | | Pool #868788, 6.00%, 3/1/36 | | | 175,274 | |

216,421 | | Pool #870599, 6.00%, 6/1/36 | | | 240,591 | |

167,904 | | Pool #870684, 6.00%, 7/1/36 | | | 186,655 | |

524,511 | | Pool #871072, 5.50%, 2/1/37 | | | 578,396 | |

3,071,348 | | Pool #874900, 5.45%, 10/1/17 | | | 3,451,471 | |

260,896 | | Pool #882044, 6.00%, 5/1/36 | | | 290,032 | |

276,769 | | Pool #884693, 5.50%, 4/1/36 | | | 305,548 | |

1,067,949 | | Pool #885724, 5.50%, 6/1/36 | | | 1,177,830 | |

227,836 | | Pool #899800, 6.00%, 8/1/37 | | | 253,281 | |

156,581 | | Pool #901412, 6.00%, 8/1/36 | | | 174,068 | |

85,834 | | Pool #908671, 6.00%, 1/1/37 | | | 95,559 | |

278,119 | | Pool #908672, 5.50%, 1/1/37 | | | 306,691 | |

630,014 | | Pool #911730, 5.50%, 12/1/21 | | | 684,145 | |

191,091 | | Pool #919368, 5.50%, 4/1/37 | | | 211,320 | |

554,549 | | Pool #922582, 6.00%, 12/1/36 | | | 616,480 | |

1,190,398 | | Pool #934941, 5.00%, 8/1/39 | | | 1,298,557 | |

828,282 | | Pool #934942, 5.00%, 9/1/39 | | | 904,057 | |

298,311 | | Pool #941204, 5.50%, 6/1/37 | | | 329,330 | |

167,833 | | Pool #943394, 5.50%, 6/1/37 | | | 185,600 | |

480,816 | | Pool #944502, 6.00%, 6/1/37 | | | 534,514 | |

12

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 135,704 | | Pool #945853, 6.00%, 7/1/37 | | $ | 150,859 | |

375,333 | | Pool #948600, 6.00%, 8/1/37 | | | 417,250 | |

167,733 | | Pool #948672, 5.50%, 8/1/37 | | | 184,965 | |

467,768 | | Pool #952598, 6.00%, 7/1/37 | | | 520,009 | |

241,856 | | Pool #952623, 6.00%, 8/1/37 | | | 268,866 | |

483,656 | | Pool #952632, 6.00%, 7/1/37 | | | 537,671 | |

105,910 | | Pool #952659, 6.00%, 8/1/37 | | | 117,738 | |

140,026 | | Pool #952665, 6.00%, 8/1/37 | | | 155,664 | |

395,650 | | Pool #952678, 6.50%, 8/1/37 | | | 442,552 | |

112,128 | | Pool #952693, 6.50%, 8/1/37 | | | 125,354 | |

2,490,746 | | Pool #957324, 5.43%, 5/1/18 | | | 2,817,792 | |

374,107 | | Pool #958502, 5.07%, 5/1/19 | | | 421,482 | |

184,171 | | Pool #959093, 5.50%, 11/1/37 | | | 203,149 | |

214,333 | | Pool #960919, 5.00%, 2/1/38 | | | 233,807 | |

78,569 | | Pool #965239, 5.84%, 9/1/38 | | | 87,700 | |

426,537 | | Pool #975769, 5.50%, 3/1/38 | | | 470,290 | |

141,696 | | Pool #982656, 5.50%, 6/1/38 | | | 156,297 | |

87,544 | | Pool #982898, 5.00%, 5/1/38 | | | 95,594 | |

157,427 | | Pool #983033, 5.00%, 5/1/38 | | | 171,632 | |

156,683 | | Pool #984842, 5.50%, 6/1/38 | | | 173,000 | |

82,467 | | Pool #986230, 5.00%, 7/1/38 | | | 90,076 | |

391,682 | | Pool #986239, 6.00%, 7/1/38 | | | 435,425 | |

425,585 | | Pool #986957, 5.50%, 7/1/38 | | | 469,906 | |

109,160 | | Pool #986958, 5.50%, 7/1/38 | | | 120,750 | |

67,105 | | Pool #986985, 5.00%, 7/1/23 | | | 72,649 | |

83,351 | | Pool #990510, 5.50%, 8/1/38 | | | 92,317 | |

383,240 | | Pool #990511, 6.00%, 8/1/38 | | | 426,040 | |

183,684 | | Pool #990617, 5.50%, 9/1/38 | | | 202,612 | |

404,470 | | Pool #AA0526, 5.00%, 12/1/38 | | | 441,283 | |

547,450 | | Pool #AA0527, 5.50%, 12/1/38 | | | 603,863 | |

403,323 | | Pool #AA0643, 4.00%, 3/1/39 | | | 419,692 | |

445,000 | | Pool #AA0644, 4.50%, 3/1/39 | | | 475,437 | |

710,433 | | Pool #AA0645, 4.50%, 3/1/39 | | | 759,581 | |

166,266 | | Pool #AA2243, 4.50%, 5/1/39 | | | 178,392 | |

700,018 | | Pool #AA3142, 4.50%, 3/1/39 | | | 747,242 | |

118,532 | | Pool #AA3143, 4.00%, 3/1/39 | | | 123,621 | |

742,100 | | Pool #AA3206, 4.00%, 4/1/39 | | | 771,755 | |

565,865 | | Pool #AA3207, 4.50%, 3/1/39 | | | 604,304 | |

295,546 | | Pool #AA4468, 4.00%, 4/1/39 | | | 307,588 | |

980,755 | | Pool #AA7042, 4.50%, 6/1/39 | | | 1,046,917 | |

442,976 | | Pool #AA7658, 4.00%, 6/1/39 | | | 461,023 | |

501,570 | | Pool #AA7659, 4.50%, 6/1/39 | | | 536,739 | |

447,397 | | Pool #AA7741, 4.50%, 6/1/24 | | | 478,068 | |

469,190 | | Pool #AA8455, 4.50%, 6/1/39 | | | 502,088 | |

4,138,167 | | Pool #AB7798, 3.00%, 1/1/43 | | | 4,000,929 | |

4,792,691 | | Pool #AB9203, 3.00%, 4/1/43 | | | 4,633,746 | |

2,177,389 | | Pool #AB9204, 3.00%, 4/1/43 | | | 2,105,177 | |

1,509,981 | | Pool #AB9497, 3.00%, 5/1/43 | | | 1,459,432 | |

13

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$1,593,218 | | Pool #AB9831, 3.00%, 6/1/43 | | $ | 1,539,883 | |

1,225,196 | | Pool #AC1463, 5.00%, 8/1/39 | | | 1,340,537 | |

118,063 | | Pool #AC1464, 5.00%, 8/1/39 | | | 128,790 | |

1,698,640 | | Pool #AC2109, 4.50%, 7/1/39 | | | 1,814,029 | |

302,094 | | Pool #AC4394, 5.00%, 9/1/39 | | | 330,533 | |

741,174 | | Pool #AC4395, 5.00%, 9/1/39 | | | 811,527 | |

706,743 | | Pool #AC5328, 5.00%, 10/1/39 | | | 773,276 | |

499,924 | | Pool #AC5329, 5.00%, 10/1/39 | | | 545,347 | |

790,453 | | Pool #AC6304, 5.00%, 11/1/39 | | | 862,273 | |

369,443 | | Pool #AC6305, 5.00%, 11/1/39 | | | 404,222 | |

882,858 | | Pool #AC6307, 5.00%, 12/1/39 | | | 963,074 | |

751,482 | | Pool #AC6790, 5.00%, 12/1/39 | | | 822,227 | |

3,136,211 | | Pool #AC7199, 5.00%, 12/1/39 | | | 3,421,165 | |

1,605,074 | | Pool #AD1470, 5.00%, 2/1/40 | | | 1,750,910 | |

2,275,507 | | Pool #AD1471, 4.50%, 2/1/40 | | | 2,429,015 | |

1,176,069 | | Pool #AD1560, 5.00%, 3/1/40 | | | 1,282,926 | |

2,571,673 | | Pool #AD1585, 4.50%, 2/1/40 | | | 2,745,160 | |

834,851 | | Pool #AD1586, 5.00%, 1/1/40 | | | 910,705 | |

694,948 | | Pool #AD1638, 4.50%, 2/1/40 | | | 742,156 | |

550,627 | | Pool #AD1640, 4.50%, 3/1/40 | | | 587,773 | |

2,334,482 | | Pool #AD1942, 4.50%, 1/1/40 | | | 2,491,968 | |

798,948 | | Pool #AD1943, 5.00%, 1/1/40 | | | 871,540 | |

2,904,807 | | Pool #AD1988, 4.50%, 2/1/40 | | | 3,100,767 | |

426,267 | | Pool #AD2896, 5.00%, 3/1/40 | | | 466,596 | |

1,462,995 | | Pool #AD4456, 4.50%, 4/1/40 | | | 1,561,690 | |

334,971 | | Pool #AD4457, 4.50%, 4/1/40 | | | 357,569 | |

1,271,453 | | Pool #AD4458, 4.50%, 4/1/40 | | | 1,357,822 | |

631,513 | | Pool #AD4940, 4.50%, 6/1/40 | | | 676,483 | |

583,795 | | Pool #AD4946, 4.50%, 6/1/40 | | | 625,368 | |

644,695 | | Pool #AD5728, 5.00%, 4/1/40 | | | 705,689 | |

919,671 | | Pool #AD7239, 4.50%, 7/1/40 | | | 985,449 | |

629,688 | | Pool #AD7242, 4.50%, 7/1/40 | | | 672,168 | |

568,072 | | Pool #AD7256, 4.50%, 7/1/40 | | | 608,969 | |

1,454,786 | | Pool #AD7271, 4.50%, 7/1/40 | | | 1,552,927 | |

714,983 | | Pool #AD7272, 4.50%, 7/1/40 | | | 766,121 | |

1,078,806 | | Pool #AD8960, 5.00%, 6/1/40 | | | 1,178,343 | |

1,157,541 | | Pool #AD9613, 4.50%, 8/1/40 | | | 1,235,811 | |

1,744,828 | | Pool #AD9614, 4.50%, 8/1/40 | | | 1,862,808 | |

504,844 | | Pool #AE2011, 4.00%, 9/1/40 | | | 525,018 | |

2,091,349 | | Pool #AE2012, 4.00%, 9/1/40 | | | 2,175,411 | |

1,299,981 | | Pool #AE2023, 4.00%, 9/1/40 | | | 1,352,234 | |

1,387,753 | | Pool #AE5432, 4.00%, 10/1/40 | | | 1,443,534 | |

572,145 | | Pool #AE5435, 4.50%, 9/1/40 | | | 610,832 | |

460,878 | | Pool #AE5806, 4.50%, 9/1/40 | | | 493,842 | |

1,437,669 | | Pool #AE5861, 4.00%, 10/1/40 | | | 1,495,456 | |

586,526 | | Pool #AE5862, 4.00%, 10/1/40 | | | 609,964 | |

1,011,856 | | Pool #AE5863, 4.00%, 10/1/40 | | | 1,052,290 | |

1,056,019 | | Pool #AE6850, 4.00%, 10/1/40 | | | 1,098,466 | |

14

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 688,201 | | Pool #AE6851, 4.00%, 10/1/40 | | $ | 715,863 | |

658,074 | | Pool #AE7699, 4.00%, 11/1/40 | | | 684,526 | |

950,218 | | Pool #AE7703, 4.00%, 10/1/40 | | | 988,412 | |

1,819,702 | | Pool #AE7707, 4.00%, 11/1/40 | | | 1,892,846 | |

781,387 | | Pool #AH0300, 4.00%, 11/1/40 | | | 812,856 | |

1,261,438 | | Pool #AH0301, 3.50%, 11/1/40 | | | 1,270,356 | |

599,832 | | Pool #AH0302, 4.00%, 11/1/40 | | | 623,990 | |

784,915 | | Pool #AH0306, 4.00%, 12/1/40 | | | 817,385 | |

1,315,556 | | Pool #AH0508, 4.00%, 11/1/40 | | | 1,368,538 | |

1,662,641 | | Pool #AH0537, 4.00%, 12/1/40 | | | 1,730,381 | |

1,224,981 | | Pool #AH0914, 4.50%, 11/1/40 | | | 1,307,428 | |

1,292,365 | | Pool #AH0917, 4.00%, 12/1/40 | | | 1,344,412 | |

1,145,621 | | Pool #AH1077, 4.00%, 1/1/41 | | | 1,194,623 | |

1,570,294 | | Pool #AH2973, 4.00%, 12/1/40 | | | 1,633,535 | |

1,588,794 | | Pool #AH2980, 4.00%, 1/1/41 | | | 1,652,780 | |

1,365,720 | | Pool #AH5656, 4.00%, 1/1/41 | | | 1,421,362 | |

875,251 | | Pool #AH5657, 4.00%, 2/1/41 | | | 910,500 | |

1,431,209 | | Pool #AH5658, 4.00%, 2/1/41 | | | 1,488,849 | |

915,233 | | Pool #AH5662, 4.00%, 2/1/41 | | | 952,092 | |

1,298,424 | | Pool #AH5882, 4.00%, 2/1/26 | | | 1,382,010 | |

1,217,836 | | Pool #AH6764, 4.00%, 3/1/41 | | | 1,266,883 | |

2,839,161 | | Pool #AH6768, 4.00%, 3/1/41 | | | 2,953,504 | |

744,892 | | Pool #AH7277, 4.00%, 3/1/41 | | | 774,659 | |

1,610,178 | | Pool #AH7281, 4.00%, 3/1/41 | | | 1,674,522 | |

666,859 | | Pool #AH7526, 4.50%, 3/1/41 | | | 713,722 | |

1,918,504 | | Pool #AH7537, 4.00%, 3/1/41 | | | 1,995,169 | |

697,262 | | Pool #AH7576, 4.00%, 3/1/41 | | | 725,343 | |

1,194,594 | | Pool #AH8878, 4.50%, 4/1/41 | | | 1,274,809 | |

932,240 | | Pool #AH8885, 4.50%, 4/1/41 | | | 994,985 | |

1,103,965 | | Pool #AH9050, 3.50%, 2/1/26 | | | 1,158,474 | |

619,309 | | Pool #AI0114, 4.00%, 3/1/41 | | | 644,057 | |

1,564,639 | | Pool #AI1846, 4.50%, 5/1/41 | | | 1,669,702 | |

1,211,084 | | Pool #AI1847, 4.50%, 5/1/41 | | | 1,292,406 | |

2,038,986 | | Pool #AI1848, 4.50%, 5/1/41 | | | 2,175,901 | |

1,255,504 | | Pool #AI1849, 4.50%, 5/1/41 | | | 1,343,732 | |

969,807 | | Pool #AJ0651, 4.00%, 8/1/41 | | | 1,008,864 | |

1,277,798 | | Pool #AJ7668, 4.00%, 11/1/41 | | | 1,329,259 | |

1,178,985 | | Pool #AJ9133, 4.00%, 1/1/42 | | | 1,226,467 | |

13,028,116 | | Pool #AK2386, 3.50%, 2/1/42 | | | 13,120,229 | |

6,018,758 | | Pool #AK6715, 3.50%, 3/1/42 | | | 6,060,373 | |

2,165,634 | | Pool #AK6716, 3.50%, 3/1/42 | | | 2,180,607 | |

1,144,603 | | Pool #AK6717, 3.50%, 3/1/42 | | | 1,152,517 | |

755,437 | | Pool #AK6718, 3.50%, 2/1/42 | | | 760,661 | |

488,725 | | Pool #AM0635, 2.55%, 10/1/22 | | | 469,360 | |

3,656,505 | | Pool #AM2935, 3.69%, 9/1/23 | | | 3,801,071 | |

5,098,468 | | Pool #AM4392, 3.79%, 10/1/23 | | | 5,327,820 | |

517,081 | | Pool #AM4590, 3.18%, 10/1/20 | | | 535,945 | |

2,426,627 | | Pool #AM5335, 3.69%, 2/1/24 | | | 2,512,097 | |

15

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$1,997,123 | | Pool #AM5486, 3.70%, 2/1/24 | | $ | 2,069,601 | |

953,589 | | Pool #AO0844, 3.50%, 4/1/42 | | | 960,182 | |

1,221,868 | | Pool #AO2923, 3.50%, 5/1/42 | | | 1,230,316 | |

3,561,167 | | Pool #AO8029, 3.50%, 7/1/42 | | | 3,585,790 | |

1,000,184 | | Pool #AP7483, 3.50%, 9/1/42 | | | 1,007,100 | |

1,506,687 | | Pool #AP9716, 3.00%, 10/1/42 | | | 1,456,719 | |

4,437,156 | | Pool #AQ0517, 3.00%, 11/1/42 | | | 4,290,002 | |

1,237,328 | | Pool #AQ6710, 2.50%, 10/1/27 | | | 1,239,987 | |

2,887,342 | | Pool #AQ7193, 3.50%, 7/1/43 | | | 2,907,306 | |

2,914,079 | | Pool #AR3088, 3.00%, 1/1/43 | | | 2,817,436 | |

1,071,435 | | Pool #AR6712, 3.00%, 1/1/43 | | | 1,036,404 | |

1,381,894 | | Pool #AR6928, 3.00%, 3/1/43 | | | 1,336,065 | |

993,175 | | Pool #AR6933, 3.00%, 3/1/43 | | | 960,237 | |

2,569,000 | | Pool #AS0713, 4.00%, 10/1/43 | | | 2,671,660 | |

1,128,678 | | Pool #AS1429, 4.00%, 12/1/43 | | | 1,173,781 | |

1,142,474 | | Pool #AS1916, 4.00%, 3/1/44 | | | 1,188,129 | |

1,278,169 | | Pool #AS1917, 4.00%, 3/1/44 | | | 1,329,246 | |

1,987,249 | | Pool #AT0536, 4.00%, 10/1/43 | | | 2,066,661 | |

2,805,474 | | Pool #AT0542, 4.50%, 12/1/43 | | | 2,995,172 | |

1,565,601 | | Pool #AT2688, 3.00%, 5/1/43 | | | 1,513,679 | |

2,253,310 | | Pool #AT2689, 3.00%, 5/1/43 | | | 2,178,581 | |

1,202,249 | | Pool #AT2690, 3.00%, 4/1/43 | | | 1,162,377 | |

1,026,944 | | Pool #AT2691, 3.00%, 5/1/43 | | | 992,886 | |

1,323,745 | | Pool #AT3963, 2.50%, 3/1/28 | | | 1,325,762 | |

1,065,051 | | Pool #AT7873, 2.50%, 6/1/28 | | | 1,065,675 | |

879,150 | | Pool #AT8051, 3.00%, 6/1/43 | | | 849,719 | |

1,543,908 | | Pool #AU0971, 3.50%, 8/1/43 | | | 1,554,462 | |

1,374,437 | | Pool #AU2165, 3.50%, 7/1/43 | | | 1,383,832 | |

1,244,941 | | Pool #AU2188, 3.50%, 8/1/43 | | | 1,253,452 | |

1,069,993 | | Pool #AU3700, 3.50%, 8/1/43 | | | 1,077,642 | |

1,010,093 | | Pool #AU4653, 3.50%, 9/1/43 | | | 1,016,997 | |

1,882,404 | | Pool #AU6054, 4.00%, 9/1/43 | | | 1,957,627 | |

1,213,717 | | Pool #AU6718, 4.00%, 10/1/43 | | | 1,262,218 | |

1,643,938 | | Pool #AU7003, 4.00%, 11/1/43 | | | 1,712,714 | |

1,203,943 | | Pool #AU7005, 4.00%, 11/1/43 | | | 1,252,053 | |

1,620,636 | | Pool #AV0679, 4.00%, 12/1/43 | | | 1,688,437 | |

1,124,282 | | Pool #AV9282, 4.00%, 2/1/44 | | | 1,169,210 | |

1,123,775 | | Pool #AW1565, 4.00%, 4/1/44 | | | 1,168,682 | |

252,379 | | Pool #MC0007, 5.50%, 12/1/38 | | | 278,386 | |

59,732 | | Pool #MC0013, 5.50%, 12/1/38 | | | 66,382 | |

98,101 | | Pool #MC0014, 5.50%, 12/1/38 | | | 108,854 | |

80,013 | | Pool #MC0016, 5.50%, 11/1/38 | | | 88,733 | |

257,739 | | Pool #MC0038, 4.50%, 3/1/39 | | | 276,737 | |

128,001 | | Pool #MC0046, 4.00%, 4/1/39 | | | 133,196 | |

27,544 | | Pool #MC0047, 4.50%, 4/1/39 | | | 29,552 | |

55,020 | | Pool #MC0059, 4.00%, 4/1/39 | | | 57,390 | |

208,292 | | Pool #MC0081, 4.00%, 5/1/39 | | | 216,876 | |

223,209 | | Pool #MC0082, 4.50%, 5/1/39 | | | 238,859 | |

16

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 484,978 | | Pool #MC0111, 4.00%, 6/1/39 | | $ | 504,434 | |

118,957 | | Pool #MC0112, 4.50%, 6/1/39 | | | 128,004 | |

216,855 | | Pool #MC0127, 4.50%, 7/1/39 | | �� | 232,162 | |

72,369 | | Pool #MC0135, 4.50%, 6/1/39 | | | 77,772 | |

391,143 | | Pool #MC0137, 4.50%, 7/1/39 | | | 417,530 | |

1,105,085 | | Pool #MC0154, 4.50%, 8/1/39 | | | 1,179,635 | |

100,926 | | Pool #MC0155, 5.00%, 8/1/39 | | | 110,617 | |

505,900 | | Pool #MC0160, 4.50%, 8/1/39 | | | 540,265 | |

600,186 | | Pool #MC0171, 4.50%, 9/1/39 | | | 640,675 | |

473,704 | | Pool #MC0177, 4.50%, 9/1/39 | | | 507,289 | |

136,603 | | Pool #MC0270, 4.50%, 3/1/40 | | | 145,818 | |

792,378 | | Pool #MC0325, 4.50%, 7/1/40 | | | 848,432 | |

74,388 | | Pool #MC0422, 4.00%, 2/1/41 | | | 77,639 | |

102,186 | | Pool #MC0426, 4.50%, 1/1/41 | | | 109,063 | |

956,407 | | Pool #MC0584, 4.00%, 1/1/42 | | | 994,925 | |

503,873 | | Pool #MC0585, 4.00%, 1/1/42 | | | 524,165 | |

816,382 | | Pool #MC0637, 3.00%, 10/1/42 | | | 789,307 | |

71,530 | | Pool #MC3344, 5.00%, 12/1/38 | | | 78,476 | |

| | | | | | |

| | | | | 343,972,138 | |

| | | | | | |

Freddie Mac — 9.98% | | | | |

95,700 | | Pool #A10124, 5.00%, 6/1/33 | | | 104,612 | |

241,948 | | Pool #A10548, 5.00%, 6/1/33 | | | 264,479 | |

527,115 | | Pool #A12237, 5.00%, 8/1/33 | | | 576,202 | |

392,024 | | Pool #A12969, 4.50%, 8/1/33 | | | 420,752 | |

81,410 | | Pool #A12985, 5.00%, 8/1/33 | | | 88,991 | |

108,883 | | Pool #A12986, 5.00%, 8/1/33 | | | 119,023 | |

45,917 | | Pool #A14028, 4.50%, 9/1/33 | | | 49,282 | |

378,896 | | Pool #A14325, 5.00%, 9/1/33 | | | 414,181 | |

91,956 | | Pool #A15268, 6.00%, 10/1/33 | | | 102,600 | |

553,692 | | Pool #A15579, 5.50%, 11/1/33 | | | 612,586 | |

439,144 | | Pool #A17393, 5.50%, 12/1/33 | | | 485,855 | |

248,430 | | Pool #A17397, 5.50%, 1/1/34 | | | 274,855 | |

273,188 | | Pool #A18617, 5.50%, 1/1/34 | | | 302,502 | |

294,204 | | Pool #A19019, 5.50%, 2/1/34 | | | 325,498 | |

239,798 | | Pool #A20069, 5.00%, 3/1/34 | | | 262,130 | |

782,017 | | Pool #A20070, 5.50%, 3/1/34 | | | 865,198 | |

671,546 | | Pool #A20540, 5.50%, 4/1/34 | | | 742,977 | |

135,483 | | Pool #A20541, 5.50%, 4/1/34 | | | 149,894 | |

135,058 | | Pool #A21679, 5.50%, 4/1/34 | | | 149,424 | |

206,434 | | Pool #A21681, 5.00%, 4/1/34 | | | 225,658 | |

324,617 | | Pool #A23192, 5.00%, 5/1/34 | | | 354,847 | |

797,415 | | Pool #A25310, 5.00%, 6/1/34 | | | 871,674 | |

306,178 | | Pool #A25311, 5.00%, 6/1/34 | | | 334,691 | |

81,869 | | Pool #A26270, 6.00%, 8/1/34 | | | 90,806 | |

47,977 | | Pool #A26386, 6.00%, 9/1/34 | | | 53,218 | |

315,083 | | Pool #A26395, 6.00%, 9/1/34 | | | 349,288 | |

93,934 | | Pool #A26396, 5.50%, 9/1/34 | | | 103,926 | |

17

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$344,737 | | Pool #A28241, 5.50%, 10/1/34 | | $ | 381,083 | |

41,621 | | Pool #A30055, 5.00%, 11/1/34 | | | 45,627 | |

363,870 | | Pool #A30591, 6.00%, 12/1/34 | | | 403,199 | |

362,363 | | Pool #A31135, 5.50%, 12/1/34 | | | 400,567 | |

270,981 | | Pool #A32976, 5.50%, 8/1/35 | | | 298,704 | |

406,977 | | Pool #A33167, 5.00%, 1/1/35 | | | 444,622 | |

680,605 | | Pool #A34999, 5.50%, 4/1/35 | | | 751,723 | |

265,573 | | Pool #A35628, 5.50%, 6/1/35 | | | 293,323 | |

468,105 | | Pool #A37185, 5.00%, 9/1/35 | | | 510,820 | |

489,193 | | Pool #A38830, 5.00%, 5/1/35 | | | 534,138 | |

118,082 | | Pool #A39561, 5.50%, 11/1/35 | | | 130,273 | |

555,275 | | Pool #A40538, 5.00%, 12/1/35 | | | 605,596 | |

320,941 | | Pool #A42095, 5.50%, 1/1/36 | | | 353,073 | |

518,917 | | Pool #A42097, 5.00%, 1/1/36 | | | 565,944 | |

272,520 | | Pool #A42098, 5.50%, 1/1/36 | | | 299,804 | |

111,028 | | Pool #A42099, 6.00%, 1/1/36 | | | 123,029 | |

60,652 | | Pool #A42802, 5.00%, 2/1/36 | | | 66,149 | |

366,812 | | Pool #A42803, 5.50%, 2/1/36 | | | 403,536 | |

265,744 | | Pool #A42804, 6.00%, 2/1/36 | | | 294,467 | |

115,570 | | Pool #A42805, 6.00%, 2/1/36 | | | 128,061 | |

157,087 | | Pool #A44638, 6.00%, 4/1/36 | | | 174,066 | |

261,793 | | Pool #A44639, 5.50%, 3/1/36 | | | 288,003 | |

497,436 | | Pool #A45396, 5.00%, 6/1/35 | | | 543,138 | |

225,758 | | Pool #A46321, 5.50%, 7/1/35 | | | 248,854 | |

93,132 | | Pool #A46735, 5.00%, 8/1/35 | | | 101,630 | |

437,024 | | Pool #A46746, 5.50%, 8/1/35 | | | 481,733 | |

200,619 | | Pool #A46748, 5.50%, 8/1/35 | | | 221,143 | |

100,740 | | Pool #A46996, 5.50%, 9/1/35 | | | 111,046 | |

510,011 | | Pool #A46997, 5.50%, 9/1/35 | | | 562,188 | |

678,912 | | Pool #A47552, 5.00%, 11/1/35 | | | 740,438 | |

461,434 | | Pool #A47553, 5.00%, 11/1/35 | | | 503,540 | |

198,609 | | Pool #A47554, 5.50%, 11/1/35 | | | 218,493 | |

113,719 | | Pool #A48788, 5.50%, 5/1/36 | | | 124,962 | |

275,906 | | Pool #A48789, 6.00%, 5/1/36 | | | 305,727 | |

91,018 | | Pool #A49013, 6.00%, 5/1/36 | | | 100,855 | |

175,412 | | Pool #A49526, 6.00%, 5/1/36 | | | 194,372 | |

176,914 | | Pool #A49843, 6.00%, 6/1/36 | | | 196,036 | |

488,969 | | Pool #A49844, 6.00%, 6/1/36 | | | 541,819 | |

30,989 | | Pool #A49845, 6.50%, 6/1/36 | | | 33,972 | |

158,895 | | Pool #A50128, 6.00%, 6/1/36 | | | 176,069 | |

307,210 | | Pool #A59530, 5.50%, 4/1/37 | | | 337,199 | |

215,668 | | Pool #A59964, 5.50%, 4/1/37 | | | 237,226 | |

195,898 | | Pool #A61754, 5.50%, 5/1/37 | | | 215,480 | |

95,721 | | Pool #A61779, 5.50%, 5/1/37 | | | 105,423 | |

105,230 | | Pool #A61915, 5.50%, 6/1/37 | | | 115,749 | |

160,295 | | Pool #A61916, 6.00%, 6/1/37 | | | 177,620 | |

354,786 | | Pool #A63456, 5.50%, 6/1/37 | | | 389,807 | |

570,583 | | Pool #A64012, 5.50%, 7/1/37 | | | 626,282 | |

18

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$375,167 | | Pool #A64015, 6.00%, 7/1/37 | | $ | 415,717 | |

36,059 | | Pool #A64450, 6.00%, 8/1/37 | | | 39,956 | |

92,201 | | Pool #A65713, 6.00%, 9/1/37 | | | 102,166 | |

522,831 | | Pool #A66061, 5.50%, 8/1/37 | | | 574,440 | |

381,688 | | Pool #A66122, 6.00%, 8/1/37 | | | 422,943 | |

324,472 | | Pool #A66133, 6.00%, 6/1/37 | | | 359,543 | |

168,789 | | Pool #A66156, 6.50%, 9/1/37 | | | 187,811 | |

233,485 | | Pool #A67630, 6.00%, 11/1/37 | | | 258,722 | |

224,882 | | Pool #A68766, 6.00%, 10/1/37 | | | 249,189 | |

193,490 | | Pool #A70292, 5.50%, 7/1/37 | | | 212,499 | |

112,588 | | Pool #A73816, 6.00%, 3/1/38 | | | 124,757 | |

122,777 | | Pool #A75113, 5.00%, 3/1/38 | | | 133,616 | |

181,916 | | Pool #A76187, 5.00%, 4/1/38 | | | 198,203 | |

459,550 | | Pool #A78354, 5.50%, 11/1/37 | | | 504,984 | |

114,061 | | Pool #A79561, 5.50%, 7/1/38 | | | 125,606 | |

845,958 | | Pool #A91887, 5.00%, 4/1/40 | | | 925,267 | |

321,446 | | Pool #A92388, 4.50%, 5/1/40 | | | 343,847 | |

702,078 | | Pool #A93962, 4.50%, 9/1/40 | | | 751,443 | |

902,485 | | Pool #A95573, 4.00%, 12/1/40 | | | 937,492 | |

815,054 | | Pool #A96339, 4.00%, 12/1/40 | | | 846,669 | |

832,416 | | Pool #A97099, 4.00%, 1/1/41 | | | 865,615 | |

894,161 | | Pool #A97715, 4.00%, 3/1/41 | | | 929,823 | |

569,926 | | Pool #A97716, 4.50%, 3/1/41 | | | 609,464 | |

43,465 | | Pool #B31140, 6.50%, 10/1/31 | | | 48,301 | |

71,121 | | Pool #B31150, 6.50%, 11/1/31 | | | 79,476 | |

74,470 | | Pool #B31188, 6.00%, 1/1/32 | | | 81,320 | |

26,176 | | Pool #B31206, 6.00%, 3/1/32 | | | 28,654 | |

24,326 | | Pool #B31292, 6.00%, 9/1/32 | | | 26,633 | |

75,763 | | Pool #B31493, 5.00%, 2/1/34 | | | 81,618 | |

45,235 | | Pool #B31516, 5.00%, 4/1/34 | | | 48,728 | |

62,561 | | Pool #B31532, 5.00%, 5/1/34 | | | 67,391 | |

93,681 | | Pool #B31546, 5.50%, 5/1/34 | | | 101,876 | |

173,907 | | Pool #B31547, 5.50%, 5/1/34 | | | 189,116 | |

95,118 | | Pool #B31551, 5.50%, 6/1/34 | | | 103,427 | |

66,501 | | Pool #B31587, 5.00%, 11/1/34 | | | 71,660 | |

126,826 | | Pool #B31588, 5.50%, 11/1/34 | | | 137,934 | |

103,284 | | Pool #B31642, 5.50%, 5/1/35 | | | 111,862 | |

33,366 | | Pool #B50443, 5.00%, 11/1/18 | | | 35,342 | |

72,203 | | Pool #B50450, 4.50%, 1/1/19 | | | 76,621 | |

58,667 | | Pool #B50451, 5.00%, 1/1/19 | | | 62,146 | |

10,069 | | Pool #B50470, 4.50%, 4/1/19 | | | 10,684 | |

118,845 | | Pool #B50496, 5.50%, 9/1/19 | | | 128,123 | |

143,677 | | Pool #B50499, 5.00%, 11/1/19 | | | 153,351 | |

39,003 | | Pool #B50500, 5.50%, 10/1/19 | | | 42,073 | |

32,479 | | Pool #B50501, 4.50%, 11/1/19 | | | 34,327 | |

50,675 | | Pool #B50504, 5.50%, 11/1/19 | | | 54,698 | |

246,136 | | Pool #B50506, 5.00%, 11/1/19 | | | 264,171 | |

44,825 | | Pool #C37233, 7.50%, 2/1/30 | | | 52,793 | |

19

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 81,450 | | Pool #C48137, 7.00%, 1/1/31 | | $ | 94,599 | |

264,667 | | Pool #C51686, 6.50%, 5/1/31 | | | 297,742 | |

176,169 | | Pool #C53210, 6.50%, 6/1/31 | | | 198,291 | |

59,754 | | Pool #C53914, 6.50%, 6/1/31 | | | 67,283 | |

49,643 | | Pool #C60020, 6.50%, 11/1/31 | | | 55,917 | |

60,882 | | Pool #C60804, 6.00%, 11/1/31 | | | 67,834 | |

60,534 | | Pool #C65616, 6.50%, 3/1/32 | | | 68,112 | |

57,026 | | Pool #C68324, 6.50%, 6/1/32 | | | 64,263 | |

212,615 | | Pool #C73273, 6.00%, 11/1/32 | | | 236,204 | |

186,469 | | Pool #C73525, 6.00%, 11/1/32 | | | 207,860 | |

62,215 | | Pool #C74672, 5.50%, 11/1/32 | | | 68,979 | |

391,495 | | Pool #C77844, 5.50%, 3/1/33 | | | 433,138 | |

152,885 | | Pool #C77845, 5.50%, 3/1/33 | | | 169,147 | |

378,315 | | Pool #C78252, 5.50%, 3/1/33 | | | 418,556 | |

100,578 | | Pool #C78380, 5.50%, 3/1/33 | | | 111,276 | |

183,135 | | Pool #J00980, 5.00%, 1/1/21 | | | 197,783 | |

106,612 | | Pool #J05466, 5.50%, 6/1/22 | | | 114,632 | |

1,123,994 | | Pool #J21142, 2.50%, 11/1/27 | | | 1,127,067 | |

1,045,429 | | Pool #J23532, 2.50%, 5/1/28 | | | 1,046,654 | |

342,421 | | Pool #N31468, 6.00%, 11/1/37 | | | 370,554 | |

337,054 | | Pool #Q00462, 4.00%, 3/1/41 | | | 350,076 | |

948,697 | | Pool #Q00465, 4.50%, 4/1/41 | | | 1,012,290 | |

923,500 | | Pool #Q05867, 3.50%, 12/1/41 | | | 928,875 | |

1,016,047 | | Pool #Q06239, 3.50%, 1/1/42 | | | 1,021,961 | |

1,003,043 | | Pool #Q06406, 4.00%, 2/1/42 | | | 1,041,480 | |

1,625,285 | | Pool #Q13349, 3.00%, 11/1/42 | | | 1,568,464 | |

1,412,975 | | Pool #Q17662, 3.00%, 4/1/43 | | | 1,363,577 | |

1,840,768 | | Pool #Q18754, 3.00%, 6/1/43 | | | 1,776,413 | |

1,305,331 | | Pool #Q18772, 3.00%, 6/1/43 | | | 1,259,696 | |

| | | | | | |

| | | | | 51,752,577 | |

| | | | | | |

Ginnie Mae — 29.23% | | | | |

359,366 | | Pool #409117, 5.50%, 6/20/38 | | | 397,029 | |

244,725 | | Pool #487643, 5.00%, 2/15/39 | | | 268,337 | |

442,673 | | Pool #588448, 6.25%, 9/15/32 | | | 443,246 | |

755,270 | | Pool #616936, 5.50%, 1/15/36 | | | 845,224 | |

482,542 | | Pool #617904, 5.75%, 9/15/23 | | | 480,782 | |

2,925,584 | | Pool #618363, 4.00%, 9/20/41 | | | 3,077,349 | |

527,642 | | Pool #624106, 5.13%, 3/15/34 | | | 527,285 | |

1,143,898 | | Pool #654705, 4.00%, 9/20/41 | | | 1,203,238 | |

435,898 | | Pool #664269, 5.85%, 6/15/38 | | | 452,596 | |

411,991 | | Pool #675509, 5.50%, 6/15/38 | | | 457,455 | |

442,765 | | Pool #697672, 5.50%, 12/15/38 | | | 491,901 | |

301,550 | | Pool #697814, 5.00%, 2/15/39 | | | 329,891 | |

616,368 | | Pool #697885, 4.50%, 3/15/39 | | | 664,907 | |

123,071 | | Pool #698112, 4.50%, 5/15/39 | | | 132,878 | |

1,172,200 | | Pool #698113, 4.50%, 5/15/39 | | | 1,265,609 | |

20

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 557,780 | | Pool #699294, 5.63%, 9/20/38 | | $ | 617,682 | |

3,258,080 | | Pool #713519, 6.00%, 7/15/39 | | | 3,647,965 | |

702,772 | | Pool #714561, 4.50%, 6/15/39 | | | 758,774 | |

563,309 | | Pool #716822, 4.50%, 4/15/39 | | | 607,845 | |

717,422 | | Pool #716823, 4.50%, 4/15/39 | | | 774,368 | |

812,411 | | Pool #717132, 4.50%, 5/15/39 | | | 879,435 | |

988,131 | | Pool #717133, 4.50%, 5/15/39 | | | 1,065,947 | |

1,180,719 | | Pool #720080, 4.50%, 6/15/39 | | | 1,279,374 | |

927,484 | | Pool #720521, 5.00%, 8/15/39 | | | 1,021,029 | |

1,145,714 | | Pool #724629, 5.00%, 7/20/40 | | | 1,249,857 | |

2,091,295 | | Pool #726550, 5.00%, 9/15/39 | | | 2,302,222 | |

1,130,279 | | Pool #729018, 4.50%, 2/15/40 | | | 1,221,893 | |

461,811 | | Pool #729019, 5.00%, 2/15/40 | | | 508,389 | |

733,941 | | Pool #729346, 4.50%, 7/15/41 | | | 793,573 | |

1,399,653 | | Pool #737574, 4.00%, 11/15/40 | | | 1,472,315 | |

777,845 | | Pool #738844, 3.50%, 10/15/41 | | | 795,346 | |

867,121 | | Pool #738845, 3.50%, 10/15/41 | | | 886,631 | |

1,830,579 | | Pool #738862, 4.00%, 10/15/41 | | | 1,925,612 | |

617,325 | | Pool #747241, 5.00%, 9/20/40 | | | 673,439 | |

1,298,710 | | Pool #748654, 3.50%, 9/15/40 | | | 1,327,931 | |

848,830 | | Pool #748846, 4.50%, 9/20/40 | | | 918,626 | |

1,034,627 | | Pool #757016, 3.50%, 11/15/40 | | | 1,057,906 | |

909,903 | | Pool #757017, 4.00%, 12/15/40 | | | 957,140 | |

1,066,970 | | Pool #759297, 4.00%, 1/20/41 | | | 1,122,819 | |

1,046,413 | | Pool #759298, 4.00%, 2/20/41 | | | 1,101,186 | |

703,021 | | Pool #762877, 4.00%, 4/15/41 | | | 739,517 | |

492,441 | | Pool #763564, 4.50%, 5/15/41 | | | 532,452 | |

1,152,664 | | Pool #770391, 4.50%, 6/15/41 | | | 1,246,317 | |

1,388,018 | | Pool #770481, 4.00%, 8/15/41 | | | 1,460,076 | |

712,461 | | Pool #770482, 4.50%, 8/15/41 | | | 768,568 | |

1,716,343 | | Pool #770517, 4.00%, 8/15/41 | | | 1,805,446 | |

801,875 | | Pool #770529, 4.00%, 8/15/41 | | | 843,504 | |

1,615,817 | | Pool #770537, 4.00%, 8/15/41 | | | 1,699,700 | |

761,484 | | Pool #770738, 4.50%, 6/20/41 | | | 821,719 | |

1,671,823 | | Pool #779592, 4.00%, 11/20/41 | | | 1,758,549 | |

1,120,980 | | Pool #779593, 4.00%, 11/20/41 | | | 1,179,131 | |

3,460,017 | | Pool #791406, 3.50%, 6/15/37 | | | 3,513,519 | |

1,135,593 | | Pool #AA5831, 3.00%, 11/15/42 | | | 1,118,914 | |

1,079,928 | | Pool #AA6312, 3.00%, 4/15/43 | | | 1,064,067 | |

1,446,772 | | Pool #AA6424, 3.00%, 5/15/43 | | | 1,425,522 | |

2,400,021 | | Pool #AB2733, 3.50%, 8/15/42 | | | 2,454,021 | |

1,245,997 | | Pool #AB2744, 3.00%, 8/15/42 | | | 1,227,696 | |

2,718,571 | | Pool #AB2745, 3.00%, 8/15/42 | | | 2,678,642 | |

2,822,556 | | Pool #AB2841, 3.00%, 9/15/42 | | | 2,781,100 | |

976,329 | | Pool #AB2842, 3.00%, 9/15/42 | | | 961,989 | |

1,573,791 | | Pool #AB2843, 3.00%, 9/15/42 | | | 1,550,676 | |

908,218 | | Pool #AB2852, 3.50%, 9/15/42 | | | 928,653 | |

1,479,578 | | Pool #AB9083, 3.00%, 9/15/42 | | | 1,457,847 | |

21

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$5,850,474 | | Pool #AC9541, 2.12%, 2/15/48 | | $ | 5,817,184 | |

1,114,816 | | Pool #AE6946, 3.00%, 6/15/43 | | | 1,098,791 | |

1,633,502 | | Pool #AE8253, 4.00%, 2/20/44 | | | 1,718,240 | |

1,482,508 | | Pool #AG8915, 4.00%, 2/20/44 | | | 1,559,413 | |

700,000 | | Series 2012-100, Class B, 2.31%, 11/16/51(a) | | | 617,796 | |

2,908,149 | | Series 2012-107, Class A, 1.15%, 1/16/45 | | | 2,774,350 | |

1,600,000 | | Series 2012-112, Class B, 2.70%, 1/16/53 | | | 1,430,386 | |

6,806,451 | | Series 2012-114, Class A, 2.10%, 1/16/53(a) | | | 6,584,151 | |

2,184,550 | | Series 2012-115, Class A, 2.13%, 4/16/45 | | | 2,136,200 | |

3,897,328 | | Series 2012-120, Class A, 1.90%, 2/16/53 | | | 3,746,279 | |

1,852,530 | | Series 2012-131, Class A, 1.90%, 2/16/53 | | | 1,779,717 | |

971,315 | | Series 2012-144 Class AD, 1.77%, 1/16/53 | | | 918,116 | |

6,000,000 | | Series 2012-33, Class B, 2.89%, 3/16/46 | | | 5,674,125 | |

3,000,000 | | Series 2012-35, Class C, 3.25%, 11/16/52(a) | | | 2,781,526 | |

1,600,000 | | Series 2012-45, Class C, 3.45%, 4/16/53(a) | | | 1,503,372 | |

2,457,872 | | Series 2012-53, Class AC, 2.38%, 12/16/43 | | | 2,434,771 | |

8,000,000 | | Series 2012-58, Class B, 2.20%, 3/16/44 | | | 7,434,312 | |

1,441,366 | | Series 2012-70, Class A, 1.73%, 5/16/42 | | | 1,431,651 | |

3,750,382 | | Series 2012-72, Class A, 1.71%, 5/16/42 | | | 3,708,964 | |

4,335,604 | | Series 2012-78, Class A, 1.68%, 3/16/44 | | | 4,268,212 | |

1,679,865 | | Series 2013-101, Class AG, 1.76%, 4/16/38 | | | 1,678,140 | |

1,322,501 | | Series 2013-105, Class A, 1.71%, 2/16/37 | | | 1,316,481 | |

1,866,028 | | Series 2013-107, Class A, 2.00%, 5/16/40 | | | 1,848,096 | |

1,532,721 | | Series 2013-126, Class BK, 2.45%, 10/16/47 | | | 1,481,698 | |

992,238 | | Series 2013-127, Class A, 2.00%, 3/16/52(b) | | | 986,858 | |

968,513 | | Series 2013-139, Class AB, 2.38%, 10/16/43 | | | 974,522 | |

977,624 | | Series 2013-17, Class A, 1.13%, 1/16/49 | | | 944,265 | |

974,093 | | Series 2013-29, Class AB, 1.77%, 10/16/45 | | | 955,022 | |

969,737 | | Series 2013-33, Class A, 1.06%, 7/16/38 | | | 954,224 | |

2,944,308 | | Series 2013-63, Class AB, 1.38%, 3/16/45 | | | 2,840,904 | |

1,578,066 | | Series 2013-97, Class AC, 2.00%, 6/16/45 | | | 1,530,514 | |

1,000,000 | | Series 2014-47, Class AB, 2.25%, 2/16/54(b) | | | 1,013,027 | |

1,500,000 | | Series 2014-54, Class AB, 2.62%, 11/1/55(b) | | | 1,517,847 | |

| | | | | | |

| | | | | 151,481,810 | |

| | | | | | |

Total U.S. Government Agency Backed Mortgages | | | 547,206,525 | |

| | | | | | |

(Cost $537,901,900) | | | | |

U.S. Government Agency Obligations — 7.86% | | | | |

Small Business Administration — 7.34% | | | | |

2,463,660 | | 0.38%, 12/25/37(a) | | | 2,392,781 | |

1,775,910 | | 0.38%, 11/7/36(b) | | | 1,782,504 | |

287,779 | | 0.38%, 3/5/37(b) | | | 288,894 | |

3,246,103 | | 0.53%, 3/25/21(a) | | | 3,217,124 | |

261,831 | | 0.53%, 4/30/35(b) | | | 262,573 | |

1,031,370 | | 0.55%, 9/25/30(a) | | | 1,016,472 | |

214,332 | | 0.55%, 4/25/28(a) | | | 211,514 | |

22

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 176,116 | | 0.55%, 3/25/29(a) | | $ | 173,710 | |

360,808 | | 0.60%, 11/25/29(a) | | | 356,671 | |

225,658 | | 0.60%, 3/25/28(a) | | | 223,235 | |

997,329 | | 0.63%, 4/15/32(b) | | | 1,000,000 | |

134,890 | | 0.63%, 6/25/18(a) | | | 134,299 | |

174,023 | | 0.66%, 3/8/26(b) | | | 174,839 | |

198,703 | | 0.70%, 7/15/20(b) | | | 199,377 | |

153,414 | | 0.70%, 2/17/20(b) | | | 153,859 | |

559,890 | | 0.75%, 11/29/32(b) | | | 564,025 | |

1,196,692 | | 0.80%, 4/15/33(b) | | | 1,207,104 | |

228,450 | | 0.80%, 3/15/33(b) | | | 230,461 | |

4,160,343 | | 0.88%, 5/25/37(a) | | | 4,175,495 | |

1,225,876 | | 0.88%, 8/1/32(b) | | | 1,240,659 | |

630,623 | | 0.88%, 1/26/32(b) | | | 637,757 | |

136,891 | | 0.88%, 12/1/19(b) | | | 137,627 | |

4,566 | | 0.88%, 6/4/14(b) | | | 4,566 | |

122,664 | | 0.91%, 4/16/20(b) | | | 123,338 | |

1,775,284 | | 1.00%, 5/25/22(a) | | | 1,778,508 | |

58,007 | | 1.13%, 7/30/17(a)(b) | | | 58,287 | |

934,637 | | 1.14%, 11/4/34(b) | | | 953,534 | |

11,050,591 | | 1.26%, 7/18/30*(b)(c) | | | 234,273 | |

11,441,216 | | 1.45%, 3/25/36(a) | | | 11,825,977 | |

95,052 | | 2.00%, 6/20/14(b) | | | 95,095 | |

185,963 | | 3.13%, 10/25/15(a) | | | 187,893 | |

297,194 | | 3.38%, 10/25/15(a) | | | 300,536 | |

104,746 | | 3.38%, 5/25/16(a) | | | 106,470 | |

167,817 | | 3.58%, 12/25/15(a) | | | 170,064 | |

163,132 | | 3.83%, 7/23/16(b) | | | 166,627 | |

127,865 | | 3.83%, 4/2/17(b) | | | 131,892 | |

37,818 | | 4.13%, 7/18/17(b) | | | 39,110 | |

31,389 | | 4.33%, 10/1/16(b) | | | 31,991 | |

37,735 | | 5.70%, 8/1/17(b) | | | 38,660 | |

502,558 | | 6.03%, 10/31/32(b) | | | 514,598 | |

488,453 | | 6.35%, 8/13/26(b) | | | 507,566 | |

915,981 | | 6.45%, 2/19/32(b) | | | 949,096 | |

45,355 | | 6.69%, 5/28/24(b) | | | 47,887 | |

13,902 | | 7.38%, 1/1/15(b) | | | 14,197 | |

| | | | | | |

| | | | | 38,061,145 | |

| | | | | | |

United States Department of Agriculture — 0.52% | | | | |

38,708 | | 1.13%, 5/31/14(b) | | | 38,932 | |

268,539 | | 5.38%, 10/26/22(b) | | | 272,984 | |

211,350 | | 5.73%, 4/20/37(b) | | | 214,582 | |

716,435 | | 5.75%, 1/20/33(b) | | | 730,308 | |

120,301 | | 6.01%, 11/8/32(b) | | | 123,073 | |

156,331 | | 6.05%, 1/5/26(b) | | | 160,835 | |

494,535 | | 6.07%, 4/20/37(b) | | | 505,350 | |

23

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | |

Principal

Amount | | | | Value | |

$ 133,944 | | 6.08%, 7/1/32(b) | | $ | 137,474 | |

254,266 | | 6.22%, 1/20/37(b) | | | 260,642 | |

213,477 | | 6.38%, 2/16/37(b) | | | 219,405 | |

| | | | | | |

| | | | | 2,663,585 | |

| | | | | | |

| |

Total U.S. Government Agency Obligations | | | 40,724,730 | |

| | | | | | |

(Cost $41,545,626) | | | | |

| |

Promissory Notes — 1.84% | | | | |

9,039,204 | | Massachusetts Housing Investment Corp. Term Loan, 6.67%, 1/31/35(b)(c) | | | 9,526,681 | |

| | | | | | |

| |

Total Promissory Notes | | | 9,526,681 | |

| | | | | | |

(Cost $9,039,204) | | | | |

| | |

Shares | | | | | |

Investment Company — 0.53% | | | | |

2,776,747 | | JPMorgan Prime Money Market Fund, Institutional Class | | | 2,776,747 | |

| | | | | | |

| |

Total Investment Company | | | 2,776,747 | |

| | | | | | |

(Cost $2,776,747) | | | | |

| |

Total Investments | | $ | 625,209,436 | |

(Cost $615,841,418)(d) — 120.63% | | | | |

| |

Liabilities in excess of other assets — (20.63)% | | | (106,907,333 | ) |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 518,302,103 | |

| | | | | | |

| * | Interest Only security represents the right to receive the monthly interest payment on an underlying pool of mortgage loans. The principal amount shown represents the par value on the underlying pool. |

| (a) | Floating rate note. Rate shown is as of report date. |

| (b) | The Pricing Committee fair valued security under procedures established by the Fund’s Board of Trustees. |

| (c) | This security is restricted and illiquid as the security may not be offered or sold within the United States or to U.S. persons except to qualified purchasers who are also either qualified institutional buyers or “accredited investors” (as defined in Rule 501 (a) of Regulation D under the Securities Act of 1933). The total investment in restricted and illiquid securities representing $9,760,954 or 1.88% of net assets are as follows: |

24

|

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

|

Access Capital Community Investment Fund (cont.) |

|

| March 31, 2014 (Unaudited) |

| | | | | | | | | | | | | | |

Acquisition

Principal

Amount | | Issuer | | Acquisition

Date | | | Acquisition

Cost | | | 3/31/2014

Carrying

Value

Per Unit | |

$11,050,591 | | Small Business Administration Massachusetts Housing | | | 01/10/2008 | | | $ | 860,184 | | | | $2.12 | |

$9,039,204 | | Investment Corp. | | | 03/29/2005 | | | $ | 9,039,204 | | | | $1.05 | |

| (d) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

AGM – Insured by Assured Guaranty Municipal Corp.

AMBAC – Insured by American Municipal Bond Insurance Assurance Corp.

FHA - Insured by Federal Housing Administration

IBC - Insured by International Bancshares Corp.

NATL-RE - Insured by National Public Guarantee Corp.

OID - Original Issue Discount

Financial futures contracts as of March 31, 2014:

| | | | | | | | | | | | | | | | |

| | | Number of

Contracts | | Expiration

Date | | Unrealized

(Depreciation) | | | Notional

Value | | | Clearinghouse | |

Short Position: | | | | | | | | | | | | | | | | |

90 Day Euro | | | | | | | | | | | | | | | | |

Dollar | | 25 | | June, 2014 | | $ | (168,125 | ) | | $ | 6,066,562 | | | | Barclays Capital | |

| | 25 | | September, 2014 | | | (181,563 | ) | | | 6,051,563 | | | | Barclays Capital | |

Five Year | | | | | | | | | | | | | | | | |

USD Interest Rate | | | | | | | | | | | | | | | | |

Swap | | 450 | | June, 2014 | | | 126,563 | | | | 45,217,969 | | | | Barclays Capital | |

Thirty Year | | | | | | | | | | | | | | | | |

U.S. Treasury Bonds | | 85 | | June, 2014 | | | (92,969 | ) | | | 11,230,625 | | | | Barclays Capital | |

| | | | | | | | | | | | | | | | |

Total | | | | | | $ | (316,094 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | |

Abbreviations used are defined below:

USD – U.S. Dollar

See notes to financial statements.

25

Statement of Assets and Liabilities

March 31, 2014 (Unaudited)

| | | | |

Assets: | | | | |

Investments in securities, at value (cost $615,841,418) | | $ | 625,209,436 | |

Interest and dividends receivable | | | 2,258,637 | |

Receivable for Fund shares sold | | | 1,174,891 | |

Cash pledged for financial futures contracts | | | 4,925,333 | |

Unrealized gain on futures contracts | | | 126,563 | |

Prepaid expenses and other assets | | | 24,381 | |

| | | | |

Total Assets | | | 633,719,241 | |

| | | | |

Liabilities: | | | | |

Unrealized loss on futures contracts | | | 442,657 | |

Distributions payable | | | 752,641 | |

Payable for capital shares redeemed | | | 35,657 | |

Payable for investments purchased | | | 1,524,632 | |

Reverse repurchase agreements (including interest of $30,523) | | | 112,354,536 | |

Accrued expenses and other payables: | | | | |

Investment advisory fees | | | 207,317 | |

Accounting fees | | | 7,983 | |

Distribution fees | | | 34,990 | |

Trustee fees | | | 253 | |

Audit fees | | | 24,506 | |

Transfer Agent fees | | | 6,738 | |

Other | | | 25,228 | |

| | | | |

Total Liabilities | | | 115,417,138 | |

| | | | |

Net Assets | | $ | 518,302,103 | |

| | | | |

Net Assets Consist Of: | | | | |

Capital | | $ | 548,556,589 | |

Distributions in excess of net investment income | | | (1,322,639 | ) |

Accumulated net realized losses from investment transactions, futures contracts and sale commitments | | | (37,983,771 | ) |

Net unrealized appreciation on investments, futures contracts, and sale commitments | | | 9,051,924 | |

| | | | |

Net Assets | | $ | 518,302,103 | |

| | | | |

26

Statement of Assets and Liabilities (cont.)

| | | | |

Net Assets: | | | | |

Class A | | $ | 16,134,042 | |

Class I | | | 502,168,061 | |

| | | | |

Total | | $ | 518,302,103 | |