UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

100 South Fifth Street, Suite 2300

Minneapolis, MN 55402-1240

(Address of principal executive offices) (Zip code)

Lee Thoresen, Esq.

RBC Plaza

60 South Sixth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 313-1341

Date of fiscal year end: September 30

Date of reporting period: March 31, 2012

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | RBC Funds | |

About Your Semi Annual Report | | | | | | | | This semi annual report includes detailed information about your Fund including financial statements, performance, and a complete list of its holdings. The RBC Funds compare their performance against various Russell equity indices. Each of these indices is a widely recognized measure of return for the underlying category of securities. However, the indices are unmanaged, do not include fees, and cannot be invested in directly. We hope the financial information presented will help you evaluate your investment in the RBC Funds. We also encourage you to read your Funds’ prospectus for further detail as to your Funds’ investment policies and risk profile. RBC Funds prospectuses and performance information subsequent to the date of this report are available on our website at www.rbcgam.us. A description of the policies and procedures that your Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-422-2766; (ii) on the Fund’s website at www.rbcgam.us; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov. Information regarding how your Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (i) on the Fund’s website at www.rbcgam.us; and (ii) on the Commission’s website at http://www.sec.gov. A schedule of each Fund’s portfolio holdings will be filed with the Commission for the first and third quarters of each fiscal year on Form N-Q. This information is available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room is available by calling 1-202-551-8090. | |

| Table of | | | | | | | | | | | | | | | | |

| Contents | | | | | | | | Equity Portfolio Managers | | | 1 | |

| | | | | | | | Performance Summary | | | 3 | |

| | | | | | | | RBC SMID Cap Growth Fund | | | 8 | |

| | | | | | | | RBC Enterprise Fund | | | 9 | |

| | | | | | | | RBC Small Cap Core Fund | | | 10 | |

| | | | | | | | RBC Microcap Value Fund | | | 11 | |

| | | | | | | | RBC Mid Cap Value Fund | | | 12 | |

| | | | | | | | Schedules of Portfolio Investments | | | 13 | |

| | | | | | | | Financial Statements | | | | |

| | | | | | | | - Statements of Assets and Liabilities | | | 36 | |

| | | | | | | | - Statements of Operations | | | 38 | |

| | | | | | | | - Statements of Changes in Net Assets | | | 39 | |

| | | | | | | | Financial Highlights | | | 44 | |

| | | | | | | | Notes to Financial Statements | | | 54 | |

| | | | | | | | Share Class Information | | | 64 | |

| | | | | | | | Supplemental Information | | | 65 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | |

EQUITY PORTFOLIO MANAGERS | | | | | | |

| | | | | | | |

RBC Global Asset Management (U.S.) Inc. (“RBC GAM (US)”) serves as the investment advisor to the RBC Funds. RBC GAM (US) employs a team approach to the management of the RBC Equity Funds, with no individual team member being solely responsible for the investment decisions. | | | | | | |

Lance F. James Managing Director, Senior Portfolio Manager Lance James is responsible for portfolio management of the RBC Small Cap Core Fund, RBC Enterprise Fund, and RBC Microcap Value Fund. He is also co-manager of RBC Mid Cap Value Fund. Prior to joining RBC GAM (US) in 2006, Lance was an equity analyst and portfolio manager for OFI Institutional and Babson Capital Management, affiliated companies of Mass Mutual Life Insurance Company. During his tenure he served as head of the firm’s small/mid cap value investment team. Prior to joining Babson Capital in 1986, Lance worked at Rockwell International Corporation, EBF Associates of Boston and Hewitt Associates. Lance began his career in the investment industry in 1980. He received an AB in Economics from Princeton University and an MBA in Finance from the Wharton School of Business at the University of Pennsylvania. | | | | | |

Lance F. James |

George Prince Vice President, Portfolio Manager, Senior Equity Analyst George Prince serves as the co-portfolio manager for the RBC Enterprise Fund. George also provides research support for the RBC Small Cap Core Fund. He joined RBC GAM (US) in 2006 from Eagle Asset Management, where he was a senior equity analyst. Prior to his experience at Eagle Asset Management, George was an analyst at Babson Capital Management. George also has a great deal of entrepreneurial experience and founded SignStorey, a leader in place-based digital communications in retail stores and co-founded Cutting Edge Inc., a global CAD-CAM technology company. George has over 12 years of investment industry experience. He received a BA from Yale University. | | | | | |

George Prince |

Kenneth A. Tyszko, CPA, CFA Managing Director, Senior Portfolio Manager Ken Tyszko is responsible for portfolio management of the RBC SMID Cap Growth Fund, and is responsible for Small Cap Growth and SMID Cap Growth research and portfolio management at RBC GAM (US). Ken has been in the investment industry since 1984 and has been managing small cap growth and SMID cap growth portfolios since 1988. He joined RBC GAM (US) in 2001. Ken previously served as a portfolio manager for Oberweis Asset Management, ABN AMRO Asset Management (USA) Inc., ABN AMRO Incorporated, and Sears Investment Management Company. His background also includes experience at Main Hurdman, an international accounting and consulting firm. Ken earned a BS in Accountancy from the University of Illinois. He is a CFA charterholder. Ken is a member of the Illinois CPA Society, the CFA Society of Chicago, and the CFA Institute. He has been a guest on Bloomberg Television, Bloomberg Radio, CNBC, and WebFN. | | | | | |

Kenneth A. Tyszko, CPA, CFA |

1

| | | | | | |

| | | | | | EQUITY PORTFOLIO MANAGERS |

| | | | | | |

Stephen E. Kylander | | | | | | Stephen E. Kylander Vice President, Senior Portfolio Manager Steve Kylander is responsible for portfolio management of the RBC Mid Cap Value Fund. Prior to joining RBC GAM (US) in 2006, he was a portfolio manager and research analyst for Babson Capital Management. Steve’s previous experience also includes strategy consulting, mergers and acquisitions work and investment banking for L.E.K. Consulting, The Yarmouth Group, and First Boston Corporation. He began working in the investment industry in 1986. Steve earned a BA from Dartmouth College and an MBA from Harvard Business School. |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

2

Average Annual Total Returns as of March 31, 2012 (Unaudited)

RBC SMID Cap Growth Fund (a)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(b) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

| | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | | 1.12% | | | | 24.82% | | | | 3.39% | | | | 4.42% | | | | 10.66% | | | | | | | | | |

- At Net Asset Value | | | 7.27% | | | | 27.33% | | | | 4.62% | | | | 5.04% | | | | 10.97% | | | | 1.35% | | | | 1.61% | |

| | | | | | | |

Class C (c) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | | 5.52% | | | | 26.33% | | | | 3.83% | | | | 4.25% | | | | 10.15% | | | | | | | | | |

- At Net Asset Value | | | 6.52% | | | | 26.33% | | | | 3.83% | | | | 4.25% | | | | 10.15% | | | | 2.09% | | | | 2.36% | |

| | | | | | | |

Class I | | | 7.51% | | | | 27.64% | | | | 4.89% | | | | 5.30% | | | | 11.30% | | | | 1.10% | | | | 1.35% | |

| | | | | | | |

Class S (d) | | | 7.51% | | | | 27.64% | | | | 4.88% | | | | 5.30% | | | | 11.30% | | | | 1.10% | | | | 1.35% | |

| | | | | | | |

Russell 2500 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Growth Index* | | | 2.70% | | | | 29.86% | | | | 4.90% | | | | 6.99% | | | | 9.82% | | | | | | | | | |

| | | | | | | |

Russell Midcap | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Growth Index* | | | 4.43% | | | | 29.16% | | | | 4.44% | | | | 6.92% | | | | 10.33% | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| RBC Enterprise Fund (e) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(f) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

| | | | | | | |

Class A (g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | | (2.11)% | | | | 24.93% | | | | (1.16)% | | | | 5.16% | | | | 10.16% | | | | | | | | | |

- At Net Asset Value | | | 3.86% | | | | 27.43% | | | | 0.02% | | | | 5.78% | | | | 10.39% | | | | 1.33% | | | | 1.57% | |

| | | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | | 2.05% | | | | 26.43% | | | | (0.73)% | | | | 4.98% | | | | 9.56% | | | | | | | | | |

- At Net Asset Value | | | 3.05% | | | | 26.43% | | | | (0.73)% | | | | 4.98% | | | | 9.56% | | | | 2.08% | | | | 2.32% | |

| | | | | | | |

Class I (h) | | | 4.06% | | | | 27.70% | | | | 0.25% | | | | 6.04% | | | | 10.66% | | | | 1.08% | | | | 1.29% | |

| | | | | | | |

Class S | | | 4.12% | | | | 27.75% | | | | 0.26% | | | | 6.04% | | | | 10.66% | | | | 1.08% | | | | 1.32% | |

| | | | | | | |

Russell 2000 Index* | | | (0.18)% | | | | 26.90% | | | | 2.13% | | | | 6.45% | | | | 8.95% | | | | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us. Please see footnotes beginning on page 5.

3

RBC Small Cap Core Fund (i)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(j) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

| | | | | | | |

Class A (g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | | (3.88 | )% | | | 30.27 | % | | | 2.53 | % | | | 6.82 | % | | | 9.88 | % | | | | | | | | |

- At Net Asset Value | | | 1.98 | % | | | 32.87 | % | | | 3.75 | % | | | 7.46 | % | | | 10.19 | % | | | 1.30 | % | | | 1.80 | % |

| | | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | | 0.32 | % | | | 31.90 | % | | | 3.05 | % | | | 6.69 | % | | | 9.39 | % | | | | | | | | |

- At Net Asset Value | | | 1.27 | % | | | 31.90 | % | | | 3.05 | % | | | 6.69 | % | | | 9.39 | % | | | 2.05 | % | | | 2.56 | % |

| | | | | | | |

Class S | | | 2.25 | % | | | 33.20 | % | | | 4.08 | % | | | 7.75 | % | | | 10.48 | % | | | 1.05 | % | | | 1.54 | % |

| | | | | | | |

Russell 2000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Index* | | | (0.18 | )% | | | 26.90 | % | | | 2.13 | % | | | 6.45 | % | | | 9.38 | % | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| RBC Microcap Value Fund (k) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(l) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

| | | | | | | |

Class A (g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | | (2.21 | )% | | | 25.83 | % | | | (2.02 | )% | | | 5.96 | % | | | 8.41 | % | | | | | | | | |

- At Net Asset Value | | | 3.74 | % | | | 28.32 | % | | | (0.85 | )% | | | 6.59 | % | | | 8.67 | % | | | 1.32 | % | | | 1.60 | % |

| | | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | | 1.96 | % | | | 27.35 | % | | | (1.60 | )% | | | 5.80 | % | | | 7.86 | % | | | | | | | | |

- At Net Asset Value | | | 2.96 | % | | | 27.35 | % | | | (1.60 | )% | | | 5.80 | % | | | 7.86 | % | | | 2.07 | % | | | 2.35 | % |

| | | | | | | |

Class S | | | 4.00 | % | | | 28.64 | % | | | (0.60 | )% | | | 6.86 | % | | | 8.94 | % | | | 1.07 | % | | | 1.35 | % |

| | | | | | | |

Russell 2000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Value Index* | | | (1.07 | )% | | | 25.36 | % | | | 0.01 | % | | | 6.59 | % | | | 9.72 | % | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us. Please see footnotes beginning on page 5.

4

RBC Mid Cap Value Fund

| | | | | | | | |

| | | 1 Year | | Since Inception(m) | | Net Expense Ratio(1)(2) | | Gross Expense Ratio(1)(2) |

Class I | | | | | | | | |

- At Net Asset Value | | 3.28% | | 16.34% | | 0.90% | | 5.59% |

| | | | |

Russell MidCap Value Index* | | 2.28% | | 15.09% | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us. Please see footnotes below.

(1) The Funds’ expenses reflect the most recent fiscal year-end (September 30, 2011).

(2) The Adviser has contractually agreed to waive fees and/or make payments in order to keep total operating expenses of the Fund to the levels listed under net expense ratio until January 31, 2013.

*Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but do not include sales fees or operating expenses. You cannot invest directly in indices.

| (a) | The performance in the table for the period from June 1, 1994 to April 19, 2004 reflects the performance of RBC Mid Cap Equity Fund, the predecessor to RBC SMID Cap Growth Fund. The performance of the Fund also includes the performance of a common trust fund (“CTF”) account advised by RBC GAM (US) (including its predecessor) and managed the same as the Fund in all material respects for the period from December 31, 1990 to June 1, 1994, as adjusted to reflect the full contractual rate of expenses associated with the Fund at its inception. The CTF account was not registered with the SEC under the 1940 Act and therefore was not subject to the investment restrictions imposed by law on registered mutual funds. If the CTF account had been registered, the CTF account’s performance may have been adversely affected. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (b) | The since inception date (commencement of operations) of the Fund is December 31, 1990. |

| (c) | The inception date for Class C Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class A Shares of the Fund, adjusted to reflect the fees and expenses of Class C Shares, as applicable (and where applicable, the maximum sales charges of the Class C Shares). |

| (d) | The inception date for Class S Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class I Shares of the Fund, adjusted to reflect the fees and expenses of Class S Shares. |

| (e) | The performance in the table for the period from December 2, 1983 to April 19, 2004 reflects the performance of Babson Enterprise Fund, the predecessor to RBC Enterprise Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (f) | The since inception date (commencement of operations) of the Fund is December 2, 1983. The performance of the index since inception of the Fund is calculated from November 30, 1983. |

| (g) | The inception date for Class A and Class C Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class A and Class C Shares, as applicable (and where applicable, the maximum sales charges of the Class A and Class C Shares). |

5

| (h) | The inception date for Class I Shares of the Fund is September 30, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class I Shares, as applicable. |

| (i) | The performance in the table for the period from August 5, 1991 to April 19, 2004 reflects the performance of Babson Enterprise Fund II, the predecessor to RBC Small Cap Core Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (j) | The since inception date (commencement of operations) of the Fund is August 5, 1991. The performance of the index since inception of the Fund is calculated from July 31, 1991. |

| (k) | The performance in the table for the period from September 10, 1987 to April 19, 2004 reflects the performance of Shadow Stock Fund, the predecessor to RBC Microcap Value Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (l) | The since inception date (commencement of operations) of the Fund is September 10, 1987. The performance of the index since inception of the Fund is calculated from August 31, 1987. |

| (m) | The since inception date (commencement of operations) of the Fund is December 31, 2009. The performance of the index since inception of the Fund is calculated from December 31, 2009. |

The Russell 2500 Growth Index is an unmanaged index that measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 2000 Value Index is an unmanaged index that measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Index is an unmanaged index that measures the performance of approximately 2,000 of the smallest securities in the Russell 3000 Index based on a combination of their market cap and current index membership.

The Russell Midcap Value Index is an unmanaged, market-weighted total return index that tracks the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth rates.

The Russell Midcap Growth Index is an unmanaged index that measures the performance of those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

The Russell Microcap Index is an unmanaged index that measures the performance of 1000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership.

6

This Page Intentionally Left Blank

7

| | | | | | | | | | | | | | |

| | | | | | FUND STATISTICS (UNAUDITED) |

| | | |

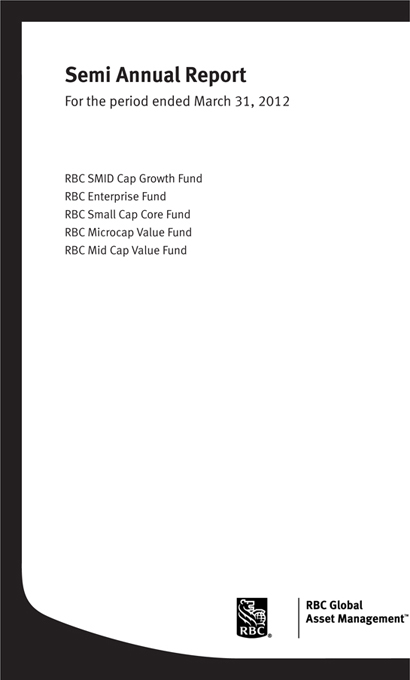

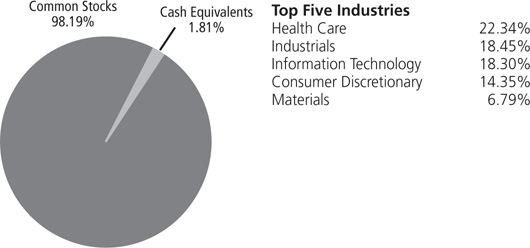

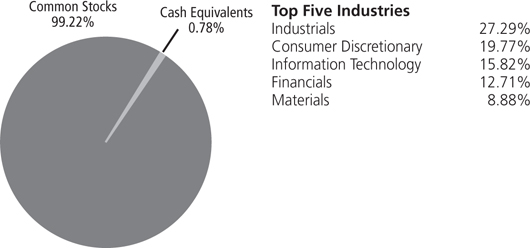

| | | | | | RBC SMID Cap Growth Fund |

Investment Objective | | | | | | Long-term capital appreciation. |

| Benchmark | | | | | | Russell Midcap Growth Index and Russell 2500 Growth Index |

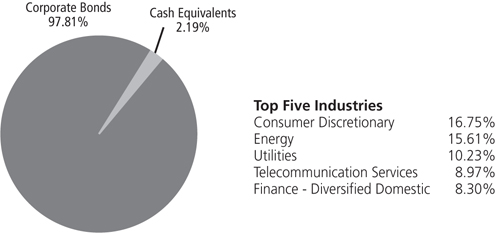

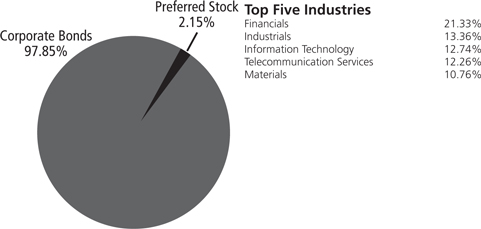

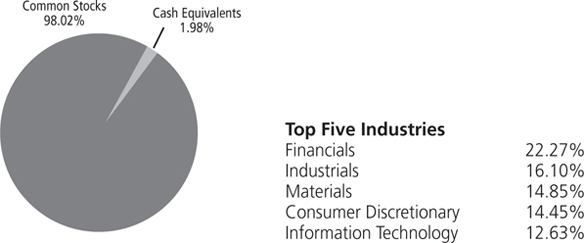

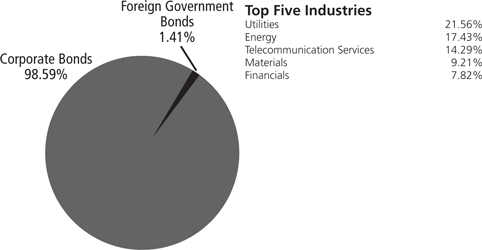

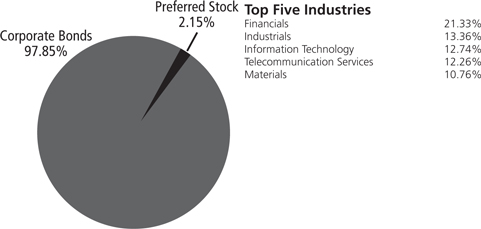

Asset Allocation (as of 3/31/12) (% of fund’s investments) & Top Five Industries (as of 3/31/12) (% of fund’s net assets) | | | | | |

|

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Top Ten Holdings (as of 3/31/12) (% of fund’s net assets) | | | | | | Tractor Supply Co. | | 3.50% | | | | Fossil, Inc. | | 2.24% |

| | | | | | Ross Stores, Inc. | | 2.59% | | | | LKQ Corp. | | 2.02% |

| | | | | | Pricesmart, Inc. | | 2.48% | | | | AMETEK, Inc. | | 1.90% |

| | | | | | Catalyst Health Solutions, Inc. | | 2.32% | | | | Cerner Corp. | | 1.83% |

| | | | | | Airgas, Inc. | | 2.32% | | | | Roper Industries, Inc. | | 1.76% |

| | | | | | *A listing of all portfolio holdings can be found beginning on page 13. |

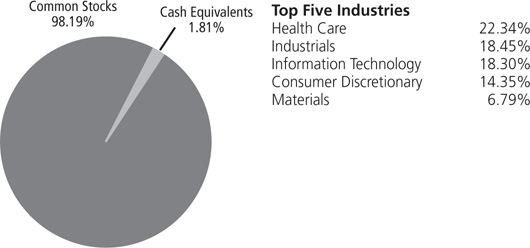

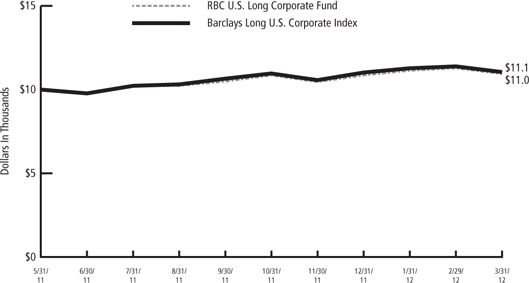

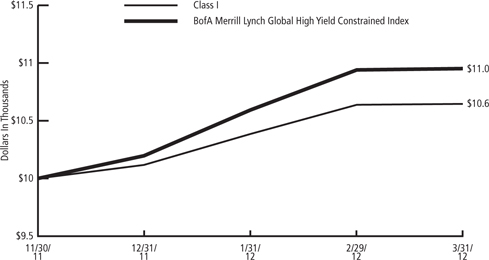

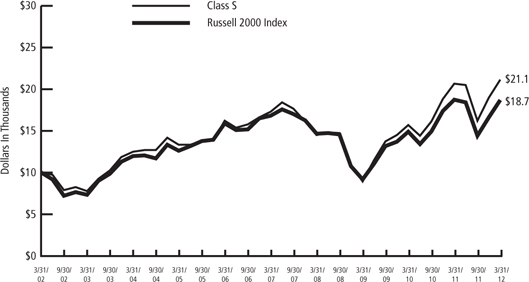

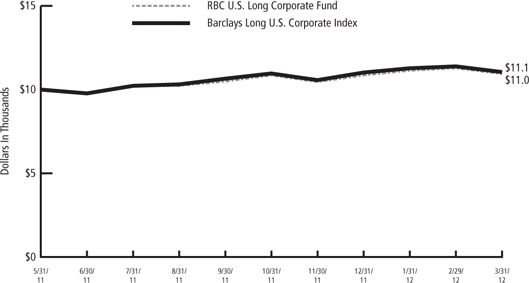

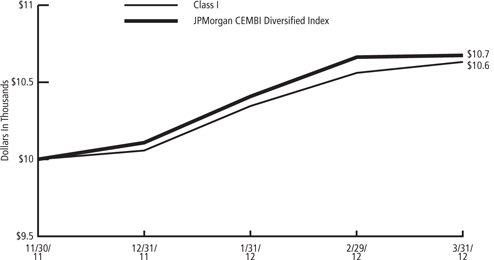

Growth of $10,000 Initial Investment Over 10 Years | | | | | |

|

| | | | | |

| | | | | |

| | | | | |

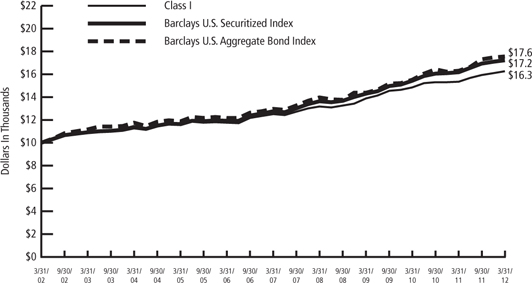

| | | | | | The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from September 30, 2001 to April 19, 2004 reflects the performance of RBC Mid Cap Equity Fund, the predecessor to RBC SMID Cap Growth Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. |

| | | | | | |

| | | | | | |

8

| | | | | | | | | | | | | | |

FUND STATISTICS (UNAUDITED) | | | | | | |

| | | |

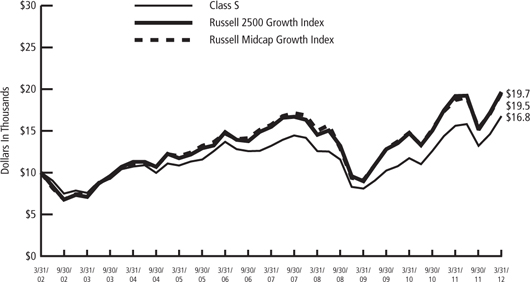

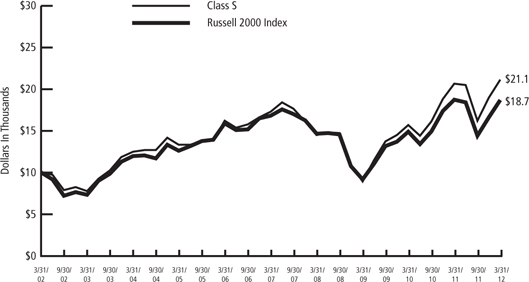

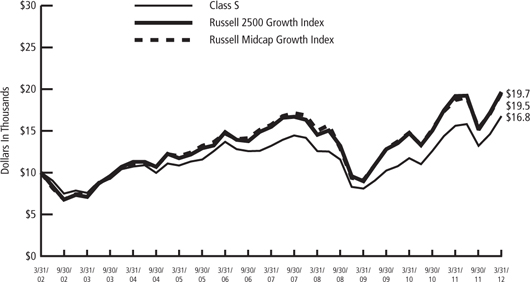

RBC Enterprise Fund | | | | | | |

Long-term growth of capital. | | | | | | Investment Objective |

Russell 2000 Index | | | | | | Benchmark |

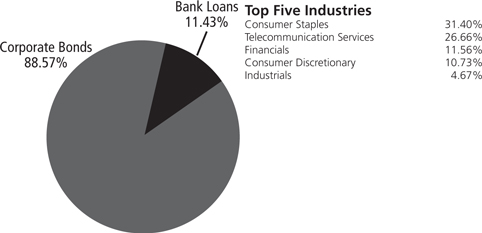

| | | | | | Asset Allocation (as of 3/31/12) (% of fund’s investments) & Top Five Industries (as of 3/31/12) (% of fund’s net assets) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Universal Electronics, Inc. | | 3.99% | | | | Acacia Research Corp. | | 3.60% | | | | | | Top Ten Holdings (as of 3/31/12) (% of fund’s net assets) |

| Benihana, Inc. | | 3.97% | | | | Tyler Technologies, Inc. | | 3.31% | | | | | |

| Universal Stainless & Alloy | | 3.92% | | | | Columbus McKinnon Corp. | | 2.97% | | | | | |

| AZZ, Inc. | | 3.72% | | | | Tessco Technologies, Inc. | | 2.93% | | | | | |

| Steinway Musical Instruments, Inc. | | 3.71% | | | | Compass Diversified Holdings | | 2.90% | | | | | |

| *A listing of all portfolio holdings can be found beginning on page 16. | | | | | |

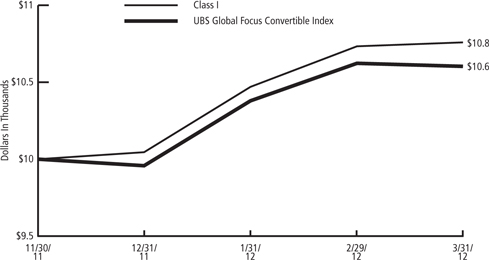

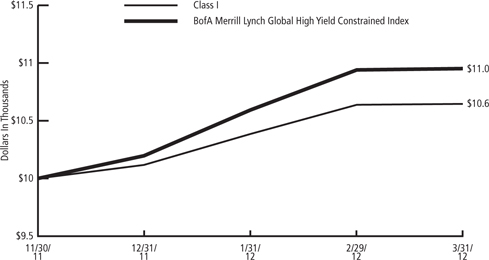

| | | | | | Growth of $10,000 Initial Investment Over 10 Years |

| | | | | |

| | | | | |

| | | | | |

| The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from September 30, 2001 to April 19, 2004 reflects the performance of Babson Enterprise Fund, the predecessor to RBC Enterprise Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | |

| | | | | |

| | | | | |

9

| | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | FUND STATISTICS (UNAUDITED) |

| | | |

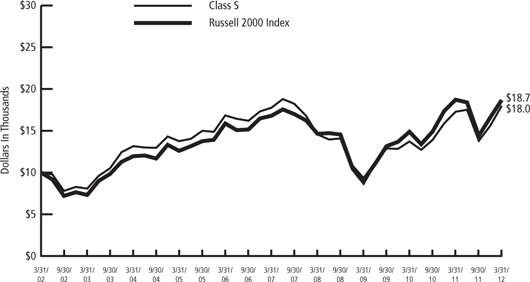

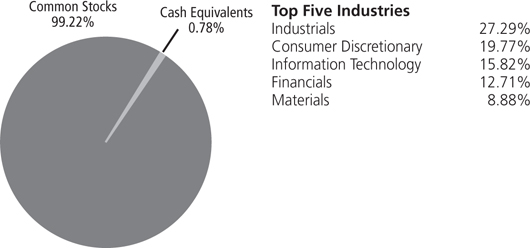

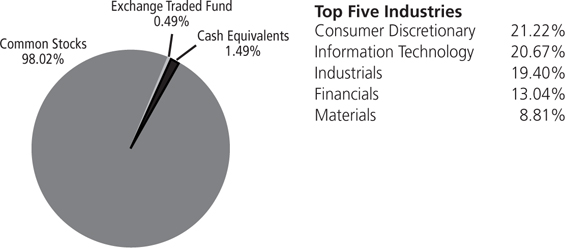

| | | | | | RBC Small Cap Core Fund |

Investment Objective | | | | | | Long-term growth of capital and income. |

| Benchmark | | | | | | Russell 2000 Index |

Asset Allocation (as of 3/31/12) (% of fund’s investments) & Top Five Industries (as of 3/31/12) (% of fund’s net assets) | | | | | |

|

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Top Ten Holdings (as of 3/31/12) (% of fund’s net assets) | | | | | | Universal Stainless & Alloy | | | 3.70 | % | | | | Compass Diversified Holdings | | 2.48% | | |

| | | | | | Gardner Denver, Inc. | | | 2.77 | % | | | | Universal Electronics, Inc. | | 2.34% | | |

| | | | | | Acacia Research Corp. | | | 2.73 | % | | | | ACCO Brands Corp. | | 2.26% | | |

| | | | | | Steinway Musical Instruments, Inc. | | | 2.61 | % | | | | Xyratex Ltd. | | 2.24% | | |

| | | | | | AZZ, Inc. | | | 2.49 | % | | | | Ares Capital Corp. | | 2.16% | | |

| | | | | | *A listing of all portfolio holdings can be found beginning on page 19. |

| Growth of $10,000 Initial Investment Over 10 Years | | | | | |

|

| | | | | | The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from September 30, 2001 to April 19, 2004 reflects the performance of Babson Enterprise Fund II, the predecessor to RBC Small Cap Core Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. |

| | | | | | |

| | | | | | |

10

| | | | | | | | | | | | | | |

FUND STATISTICS (UNAUDITED) | | | | | | |

| | | |

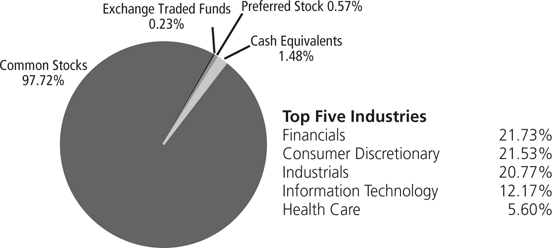

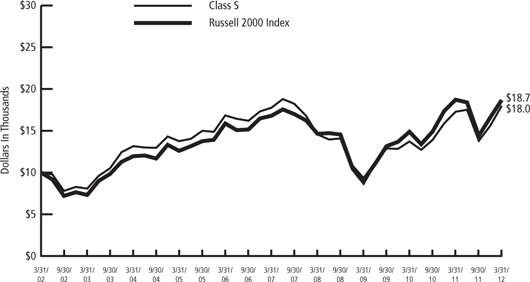

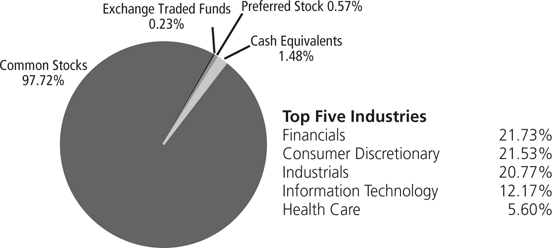

RBC Microcap Value Fund | | | | | | |

Long-term growth of capital. | | | | | | Investment Objective |

Russell 2000 Value Index | | | | | | Benchmark |

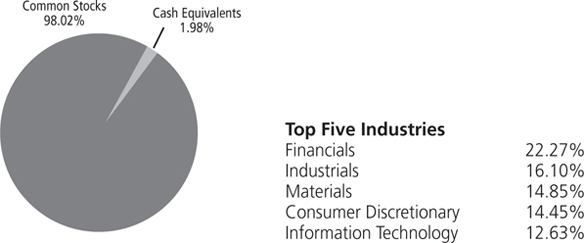

| | | | | | Asset Allocation (as of 3/31/12) (% of fund’s investments) & Top Five Industries (as of 3/31/12) (% of fund’s net assets) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Cantel Medical Corp. | | 0.81% | | | | Adams Golf, Inc. | | 0.66% | | | | | | Top Ten Holdings (as of 3/31/12) (% of fund’s net assets) |

| On Assignment, Inc. | | 0.75% | | | | Benihana, Inc. | | 0.64% | | | | | |

| SureWest Communications | | 0.71% | | | | Tessco Technologies, Inc. | | 0.61% | | | | | |

| Arctic Cat, Inc. | | 0.69% | | | | Alere, Inc. | | 0.57% | | | | | |

| Insight Enterprises, Inc. | | 0.69% | | | | Allied Motion Technologies, Inc. | | 0.56% | | | | | |

| *A listing of all portfolio holdings can be found beginning on page 22. | | | | | | |

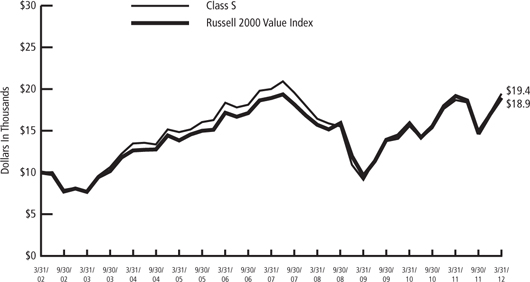

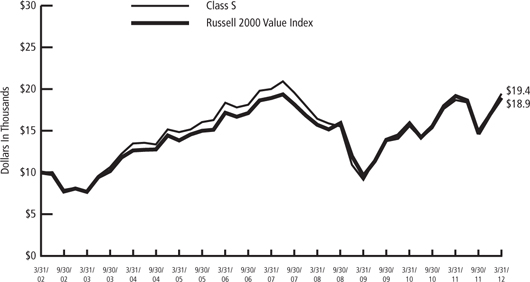

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from September 30, 2001 to April 19, 2004 reflects the performance of Shadow Stock Fund, the predecessor to RBC Microcap Value Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | | Growth of $10,000 Initial Investment Over 10 Years |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

11

| | | | | | | | | | | | | | | | | | |

| | | | | | | | FUND STATISTICS (UNAUDITED) |

| | | | | | | | RBC Mid Cap Value Fund |

Investment Objective | | | | | | | | Long-term capital appreciation. |

| Benchmark | | | | | | | | Russell Midcap Value Index |

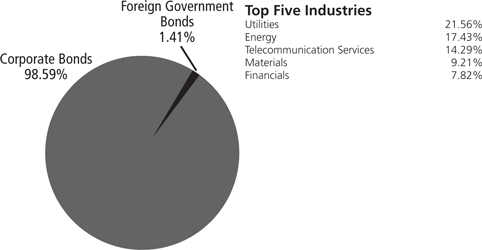

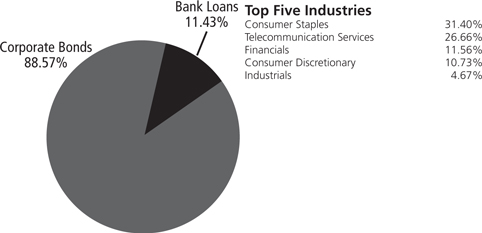

Asset Allocation (as of 3/31/12) (% of fund’s investments) & Top Five Industries (as of 3/31/12) (% of fund’s net assets) | | | | | | | |

|

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Top Ten Holdings (as of 3/31/12) (% of fund’s net assets) | | | | | | | | Dana Holding Corp. | | 3.93% | | | | Crown Holdings, Inc. | | 2.53% | | |

| | | | | KKR Financial Holdings LLC | | 3.77% | | | | Gardner Denver, Inc. | | 2.46% | | |

| | | | | Jarden Corp. | | 3.08% | | | | Mylan, Inc. | | 2.42% | | |

| | | | | Schweitzer-Mauduit | | 3.00% | | | | Edison International | | 2.41% | | |

| | | | | | | | International, Inc. | | | | | | Fifth Third Bancorp | | 2.37% | | |

| | | | | | | | Ashland, Inc. | | 2.87% | | | | | | | | |

| | | | | | | | *A listing of all portfolio holdings can be found beginning on page 33. |

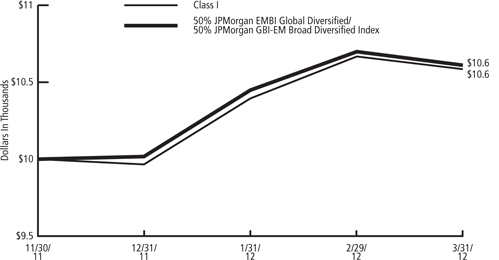

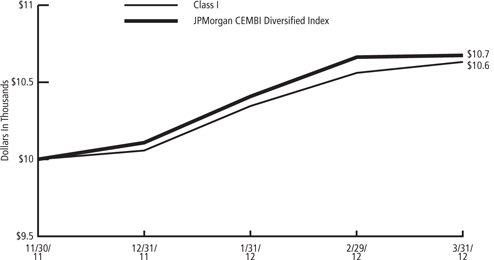

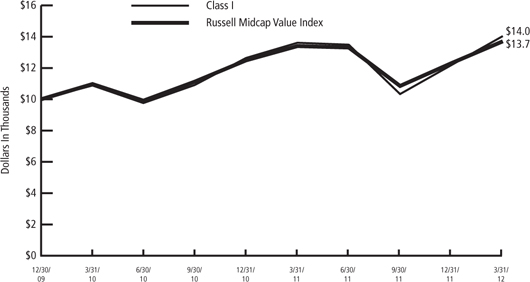

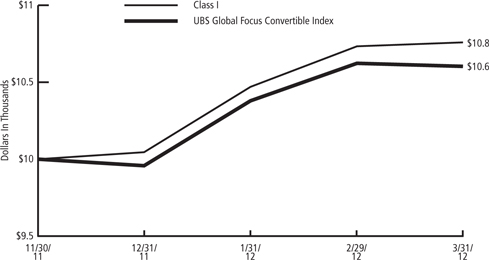

Growth of $10,000 Initial Investment Since Inception (12/30/09) | | | | | | | |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

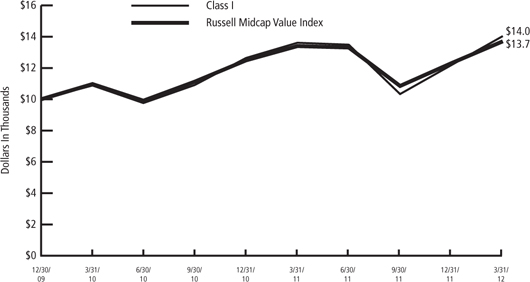

| | | | | | | | The graph reflects an initial investment of $10,000 over the period from December 30, 2009 to March 31, 2012 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

12

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC SMID Cap Growth Fund

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | Value | |

Common Stocks — 98.49% | | | | |

Consumer Discretionary — 14.35% | | | | |

| 11,700 | | Fossil, Inc.* | | | $ 1,544,166 | |

| 16,000 | | Guess?, Inc. | | | 500,000 | |

| 44,660 | | LKQ Corp.* | | | 1,392,052 | |

| 18,000 | | Monro Muffler Brake, Inc. | | | 746,820 | |

| 7,100 | | Panera Bread Co., Class A* | | | 1,142,532 | |

| 30,800 | | Ross Stores, Inc. | | | 1,789,480 | |

| 26,700 | | Tractor Supply Co. | | | 2,417,952 | |

| 16,000 | | WMS Industries, Inc.* | | | 379,680 | |

| | |

| | | | | | |

| | | | | 9,912,682 | |

| | | | | | |

Consumer Staples — 6.06% | | | | |

| 16,000 | | Church & Dwight Co., Inc. | | | 787,040 | |

| 23,500 | | Pricesmart, Inc. | | | 1,711,035 | |

| 8,000 | | Ralcorp Holdings, Inc.* | | | 592,720 | |

| 23,500 | | United Natural Foods, Inc.* | | | 1,096,510 | |

| | |

| | | | | | |

| | | | | 4,187,305 | |

| | | | | | |

Energy — 6.22% | | | | |

| 12,100 | | Dril-Quip, Inc.* | | | 786,742 | |

| 17,600 | | Gulfport Energy Corp.* | | | 512,512 | |

| 22,580 | | Oceaneering International, Inc. | | | 1,216,836 | |

| 13,700 | | Oil States International, Inc.* | | | 1,069,422 | |

| 16,600 | | Unit Corp.* | | | 709,816 | |

| | |

| | | | | | |

| | | | | 4,295,328 | |

| | | | | | |

Financials — 5.98% | | | | |

| 17,300 | | Eaton Vance Corp. | | | 494,434 | |

| 14,400 | | Federated Investors, Inc., Class B | | | 322,704 | |

| 18,700 | | First Cash Financial Services, Inc.* | | | 802,043 | |

| 26,400 | | HCC Insurance Holdings, Inc. | | | 822,888 | |

| 27,000 | | Raymond James Financial, Inc. | | | 986,310 | |

| 31,500 | | Tower Group, Inc. | | | 706,545 | |

| | |

| | | | | | |

| | | | | 4,134,924 | |

| | | | | | |

Health Care — 22.34% | | | | |

| 44,300 | | Bruker Corp.* | | | 678,233 | |

| 25,200 | | Catalyst Health Solutions, Inc.* | | | 1,605,996 | |

| 20,600 | | Cepheid, Inc.* | | | 861,698 | |

| 16,600 | | Cerner Corp.* | | | 1,264,256 | |

| 9,700 | | Charles River Laboratories International, Inc.* | | | 350,073 | |

| 8,000 | | Edwards Lifesciences Corp.* | | | 581,840 | |

| 10,300 | | Gen-Probe, Inc.* | | | 684,023 | |

| 14,600 | | Henry Schein, Inc.* | | | 1,104,928 | |

| 11,800 | | IDEXX Laboratories, Inc.* | | | 1,031,910 | |

13

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC SMID Cap Growth Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | Value | |

| 12,400 | | Integra LifeSciences Holdings Corp.* | | | $ 430,156 | |

| 6,200 | | Laboratory Corp of America Holdings* | | | 567,548 | |

| 5,500 | | Mettler-Toledo International, Inc.* | | | 1,016,125 | |

| 10,600 | | MWI Veterinary Supply, Inc.* | | | 932,800 | |

| 17,000 | | NuVasive, Inc.* | | | 286,280 | |

| 22,600 | | PAREXEL International Corp.* | | | 609,522 | |

| 8,900 | | Perrigo Co. | | | 919,459 | |

| 8,000 | | Varian Medical Systems, Inc.* | | | 551,680 | |

| 21,800 | | Volcano Corp.* | | | 618,030 | |

| 9,700 | | Waters Corp.* | | | 898,802 | |

| 10,300 | | West Pharmaceutical Services, Inc. | | | 438,059 | |

| | | | | | |

| | | | | 15,431,418 | |

| | | | | | |

Industrials — 18.45% | | | | |

| 8,000 | | Alliant Techsystems, Inc. | | | 400,960 | |

| 27,000 | | AMETEK, Inc. | | | 1,309,770 | |

| 26,040 | | Donaldson Co., Inc. | | | 930,409 | |

| 12,080 | | Expeditors International of Washington, Inc. | | | 561,841 | |

| 6,400 | | Flowserve Corp. | | | 739,264 | |

| 9,340 | | Huron Consulting Group, Inc.* | | | 350,811 | |

| 13,400 | | Jacobs Engineering Group, Inc.* | | | 594,558 | |

| 12,500 | | Landstar System, Inc. | | | 721,500 | |

| 14,300 | | MSC Industrial Direct Co., Class A | | | 1,190,904 | |

| 14,600 | | Polypore International, Inc.* | | | 513,336 | |

| 12,290 | | Roper Industries, Inc. | | | 1,218,676 | |

| 11,100 | | Stericycle, Inc.* | | | 928,404 | |

| 12,200 | | Teledyne Technologies, Inc.* | | | 769,210 | |

| 14,200 | | Towers Watson & Co., Class A | | | 938,194 | |

| 18,500 | | Waste Connections, Inc. | | | 601,805 | |

| 22,900 | | Woodward, Inc. | | | 980,807 | |

| | | | | | |

| | | | | 12,750,449 | |

| | | | | | |

Information Technology — 18.30% | | | | |

| 12,520 | | ANSYS, Inc.* | | | 814,051 | |

| 22,010 | | Autodesk, Inc.* | | | 931,463 | |

| 11,800 | | Comtech Telecommunications Corp. | | | 384,444 | |

| 20,000 | | Digital River, Inc.* | | | 374,200 | |

| 11,840 | | Dolby Laboratories, Inc., Class A* | | | 450,631 | |

| 8,700 | | F5 Networks, Inc.* | | | 1,174,152 | |

| 18,700 | | Global Payments, Inc.(a) | | | 888,250 | |

| 17,400 | | Informatica Corp.* | | | 920,460 | |

| 8,100 | | Mantech International Corp., Class A | | | 279,126 | |

| 20,050 | | Microchip Technology, Inc. | | | 745,860 | |

| 20,700 | | MICROS Systems, Inc.* | | | 1,144,503 | |

| 21,750 | | National Instruments Corp. | | | 620,310 | |

| 14,300 | | Open Text Corp.* | | | 874,445 | |

| 20,000 | | Plexus Corp.* | | | 699,800 | |

| 26,600 | | Riverbed Technology, Inc.* | | | 746,928 | |

14

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC SMID Cap Growth Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| | |

| Shares | | | | Value | |

| 20,000 | | Synopsys, Inc.* | | | $ 613,200 | |

| 13,400 | | Ultimate Software Group, Inc.* | | | 981,952 | |

| | | | | | |

| | | | | 12,643,775 | |

| | | | | | |

Materials — 6.79% | | | | |

| 18,000 | | Airgas, Inc. | | | 1,601,460 | |

| 17,500 | | AptarGroup, Inc. | | | 958,475 | |

| 19,700 | | Balchem Corp. | | | 595,925 | |

| 12,200 | | Reliance Steel & Aluminum Co. | | | 689,056 | |

| 11,600 | | Sigma-Aldrich Corp. | | | 847,496 | |

| | | | | | |

| | | | | 4,692,412 | |

| | | | | | |

| |

Total Common Stocks | | | 68,048,293 | |

| | | | | | |

(Cost $44,441,065) | | | | |

Investment Company — 1.81% | | | | |

| 1,251,315 | | JPMorgan Prime Money Market Fund | | | 1,251,315 | |

| | | | | | |

| |

Total Investment Company | | | 1,251,315 | |

| | | | | | |

(Cost $1,251,315) | | | | |

| |

Total Investments | | | $ 69,299,608 | |

(Cost $45,692,380)(b) — 100.30% | | | | |

| |

Liabilities in excess of other assets — (0.30)% | | | (210,307 | ) |

| | | | | | |

| |

NET ASSETS — 100.00% | | | $ 69,089,301 | |

| | | | | | |

| | | | | | |

| | | | | | | |

| * | Non-income producing security. |

| (a) | Fair valued security under procedures established by the Fund’s Board of Trustees. |

| (b) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

See notes to financial statements.

15

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Enterprise Fund

March 31, 2012 (Unaudited)

| | | | | | |

| | | | | | |

| Shares | | | | Value | |

Common Stocks — 98.53% | | | | |

Consumer Discretionary — 21.22% | | | | |

| 330,878 | | Benihana, Inc. | | | $ 4,317,958 | |

| 41,400 | | Books-A-Million, Inc. | | | 132,480 | |

| 917,773 | | Casual Male Retail Group, Inc.* | | | 3,083,717 | |

| 122,438 | | Delta Apparel, Inc.* | | | 2,011,656 | |

| 72,700 | | Grand Canyon Education, Inc.* | | | 1,291,152 | |

| 52,530 | | Mac-Gray Corp. | | | 794,779 | |

| 250,900 | | RG Barry Corp. | | | 3,060,980 | |

| 161,233 | | Steinway Musical Instruments, Inc.* | | | 4,030,825 | |

| 216,700 | | Universal Electronics, Inc.* | | | 4,329,666 | |

| | | | | | |

| | | | | 23,053,213 | |

| | | | | | |

Energy — 6.04% | |

| 44,000 | | GeoResources, Inc.* | | | 1,440,560 | |

| 102,400 | | Gulfport Energy Corp.* | | | 2,981,888 | |

| 20,254 | | OYO Geospace Corp.* | | | 2,133,354 | |

| | | | | | |

| | | | | 6,555,802 | |

| | | | | | |

Financials — 13.04% | |

| 205,300 | | Asta Funding, Inc. | | | 1,677,301 | |

| 96,100 | | Boston Private Financial Holdings, Inc. | | | 952,351 | |

| 91,059 | | CoBiz Financial, Inc. | | | 643,787 | |

| 212,900 | | Compass Diversified Holdings | | | 3,148,791 | |

| 50,800 | | Firstcity Financial Corp.* | | | 443,992 | |

| 56,400 | | LaSalle Hotel Properties REIT | | | 1,587,096 | |

| 27,626 | | Mercantile Bank Corp.* | | | 393,118 | |

| 84,489 | | MetroCorp Bancshares, Inc.* | | | 844,890 | |

| 80,000 | | National Interstate Corp. | | | 2,046,400 | |

| 71,174 | | Northrim BanCorp, Inc. | | | 1,531,665 | |

| 65,000 | | Washington Banking Co. | | | 897,650 | |

| | | | | | |

| | | | | 14,167,041 | |

| | | | | | |

Health Care — 7.41% | |

| 235,600 | | BioScrip, Inc.* | | | 1,599,724 | |

| 85,900 | | Exactech, Inc.* | | | 1,361,515 | |

| 60,600 | | Kensey Nash Corp. | | | 1,773,156 | |

| 58,700 | | Meridian Bioscience, Inc. | | | 1,137,606 | |

| 94,700 | | US Physical Therapy, Inc. | | | 2,182,835 | |

| | | | | | |

| | | | | 8,054,836 | |

| | | | | | |

Industrials — 19.40% | |

| 93,800 | | Acacia Research Corp.* | | | 3,915,212 | |

| 263,700 | | Air Transport Services Group, Inc.* | | | 1,526,823 | |

| 111,456 | | Allied Defense Group, Inc. (The)*(a)(b) | | | 601,862 | |

| 78,200 | | AZZ, Inc. | | | 4,038,248 | |

| 198,325 | | Columbus McKinnon Corp.* | | | 3,230,714 | |

| 59,900 | | Ducommun, Inc.* | | | 712,810 | |

| 81,600 | | Ennis, Inc. | | | 1,290,912 | |

16

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Enterprise Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | Value | |

| 67,800 | | Greenbrier Cos., Inc.* | | | $ 1,341,762 | |

| 13,500 | | Hurco Cos, Inc.* | | | 381,375 | |

| 13,500 | | Marten Transport Ltd. | | | 297,945 | |

| 52,400 | | NN, Inc.* | | | 427,584 | |

| 17,250 | | Old Dominion Freight Line, Inc.* | | | 822,308 | |

| 50,900 | | Orion Marine Group, Inc.* | | | 368,007 | |

| 376,000 | | PGT, Inc.* | | | 680,560 | |

| 54,950 | | Sun Hydraulics Corp. | | | 1,437,492 | |

| | | | | | |

| | | | | 21,073,614 | |

| | | | | | |

Information Technology — 20.67% | | | | |

| 80,982 | | Aspen Technology, Inc.* | | | 1,662,561 | |

| 78,000 | | Authentec, Inc.* | | | 245,700 | |

| 147,674 | | Computer Task Group, Inc.* | | | 2,262,366 | |

| 30,000 | | comScore, Inc.* | | | 641,700 | |

| 102,200 | | Interactive Intelligence Group, Inc.* | | | 3,118,122 | |

| 99,400 | | KEYW Holding Corp. (The)* | | | 770,350 | |

| 62,238 | | Lionbridge Technologies, Inc.* | | | 179,245 | |

| 178,800 | | NIC, Inc. | | | 2,168,844 | |

| 47,500 | | Rubicon Technology, Inc.* | | | 495,425 | |

| 47,400 | | STEC, Inc.* | | | 447,456 | |

| 124,951 | | Tessco Technologies, Inc. | | | 3,182,502 | |

| 53,000 | | TNS, Inc.* | | | 1,151,690 | |

| 93,700 | | Tyler Technologies, Inc.* | | | 3,599,017 | |

| 159,100 | | Xyratex Ltd. | | | 2,531,281 | |

| | | | | | |

| | | | | 22,456,259 | |

| | | | | | |

Materials — 8.81% | | | | |

| 172,116 | | Intertape Polymer Group, Inc.* | | | 800,339 | |

| 63,700 | | Koppers Holdings, Inc. | | | 2,456,272 | |

| 57,300 | | Landec Corp.* | | | 374,169 | |

| 249,900 | | Omnova Solutions, Inc.* | | | 1,686,825 | |

| 99,588 | | Universal Stainless & Alloy* | | | 4,254,399 | |

| | | | | | |

| | | | | 9,572,004 | |

| | | | | | |

Telecommunication Services — 0.56% | | | | |

| 128,300 | | Towerstream Corp.* | | | 609,425 | |

| | | | | | |

Utilities — 1.38% | | | | |

| 55,800 | | Unitil Corp. | | | 1,497,114 | |

| | | | | | |

| |

Total Common Stocks (Cost $74,835,951) | | | 107,039,308 | |

| | | | | | |

Rights/Warrants — 0.00% | |

| 6,203 | | US Concrete, Inc. Warrants, Expire 8/31/17*(a)(b)(c) | | | 0 | |

17

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Enterprise Fund (cont.)

| | | | | | |

| March 31, 2012 (Unaudited) | |

| | |

| Shares | | | | Value | |

| 6,203 | | US Concrete, Inc. Warrants, Expire 8/31/17*(a)(b)(c) | | $ | 0 | |

| | | | | | |

| |

Total Rights/Warrants | | | 0 | |

| | | | | | |

(Cost $0) | | | | |

|

Exchange Traded Funds — 0.49% | |

| 18,800 | | SPDR KBW Regional Banking | | | 535,236 | |

| | | | | | |

| |

Total Exchange Traded Funds | | | 535,236 | |

| | | | | | |

(Cost $373,522) | | | | |

Investment Company — 1.50% | | | | |

| 1,629,150 | | JPMorgan Prime Money Market Fund | | | 1,629,150 | |

| | | | | | |

| |

Total Investment Company | | | 1,629,150 | |

| | | | | | |

(Cost $1,629,150) | | | | |

| |

Total Investments | | $ | 109,203,694 | |

(Cost $76,838,623)(d) — 100.52% | | | | |

| |

Liabilities in excess of other assets — (0.52)% | | | (563,755 | ) |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 108,639,939 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | Fair valued security under procedures established by the Fund’s Board of Trustees. |

| (b) | This security is restricted and illiquid as the security may not be offered or sold within the United States or to U.S. persons except to qualified purchasers who are also either qualified institutional buyers or “accredited investors” (as defined in Rule 501 (a) of Regulation D under the Securities Act of 1933). |

The total investment in restricted and illiquid securities representing $601,862 or 0.55% of net assets was as follows:

| | | | | | | | | | | | | | | | | | |

Acquisition

Shares | | | | Issuer | | | | Acquisition

Date | | | Acquisition

Cost | | | 3/31/12

Carrying

Value

Per Unit | |

| 111,456 | | | | Allied Defense Group, Inc. (The) | | | | | 12/21/2007 | | | $ | 667,484 | | | $ | 5.40 | |

| 6,203 | | | | U.S. Concrete, Inc., Warrants | | | | | 09/09/2010 | | | $ | — | | | $ | — | |

| 6,203 | | | | U.S. Concrete, Inc., Warrants | | | | | 09/09/2010 | | | $ | — | | | $ | — | |

| (c) | Security delisted or issuer in bankruptcy. |

| (d) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

REIT - Real Estate Investment Trust

See notes to financial statements.

18

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Small Cap Core Fund

| | | | | | |

| March 31, 2012 (Unaudited) | |

| | |

| Shares | | | | Value | |

Common Stocks — 99.00% | |

Consumer Discretionary — 19.77% | |

| 20,500 | | Ascena Retail Group, Inc.* | | $ | 908,560 | |

| 81,219 | | Benihana, Inc. | | | 1,059,908 | |

| 354,500 | | Casual Male Retail Group, Inc.* | | | 1,191,120 | |

| 22,200 | | Drew Industries, Inc.* | | | 606,282 | |

| 38,500 | | Grand Canyon Education, Inc.* | | | 683,760 | |

| 19,500 | | Maidenform Brands, Inc.* | | | 438,945 | |

| 66,623 | | RG Barry Corp. | | | 812,801 | |

| 46,900 | | Sally Beauty Holdings, Inc.* | | | 1,163,120 | |

| 58,907 | | Steinway Musical Instruments, Inc.* | | | 1,472,675 | |

| 18,675 | | Steven Madden Ltd.* | | | 798,356 | |

| 26,000 | | True Religion Apparel, Inc.* | | | 712,400 | |

| 66,323 | | Universal Electronics, Inc.* | | | 1,325,133 | |

| | | | | | |

| | | | | 11,173,060 | |

| | | | | | |

Consumer Staples — 1.04% | |

| 20,700 | | Nash Finch Co. | | | 588,294 | |

| | | | | | |

Energy — 6.84% | |

| 6,700 | | CARBO Ceramics, Inc. | | | 706,515 | |

| 21,100 | | GeoResources, Inc.* | | | 690,814 | |

| 29,400 | | Gulfport Energy Corp.* | | | 856,128 | |

| 6,700 | | OYO Geospace Corp.* | | | 705,711 | |

| 22,100 | | World Fuel Services Corp. | | | 906,100 | |

| | | | | | |

| | | | | 3,865,268 | |

| | | | | | |

Financials — 12.71% | |

| 29,400 | | AMERISAFE, Inc.* | | | 727,356 | |

| 74,600 | | Ares Capital Corp. | | | 1,219,710 | |

| 43,327 | | Asta Funding, Inc. | | | 353,982 | |

| 9,200 | | Community Bank System, Inc. | | | 264,776 | |

| 94,700 | | Compass Diversified Holdings | | | 1,400,613 | |

| 81,500 | | KKR Financial Holdings LLC | | | 750,615 | |

| 27,500 | | LaSalle Hotel Properties REIT | | | 773,850 | |

| 25,400 | | Netspend Holdings, Inc.* | | | 197,104 | |

| 11,400 | | ProAssurance Corp. | | | 1,004,454 | |

| 13,100 | | Safeguard Scientifics, Inc.* | | | 225,320 | |

| 21,500 | | SeaBright Holdings, Inc. | | | 195,435 | |

| 4,072 | | TriCo Bancshares | | | 70,934 | |

| | | | | | |

| | | | | 7,184,149 | |

| | | | | | |

Health Care — 5.91% | |

| 91,900 | | BioScrip, Inc.* | | | 624,001 | |

| 23,700 | | Masimo Corp.* | | | 554,106 | |

| 17,600 | | Meridian Bioscience, Inc. | | | 341,088 | |

| 19,875 | | PSS World Medical, Inc.* | | | 503,633 | |

| 6,900 | | Thoratec Corp.* | | | 232,599 | |

19

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Small Cap Core Fund (cont.)

| | | | | | |

| March 31, 2012 (Unaudited) | |

| | |

| Shares | | | | Value | |

| 25,500 | | West Pharmaceutical Services, Inc. | | $ | 1,084,515 | |

| | | | | | |

| | | | | 3,339,942 | |

| | | | | | |

Industrials — 27.29% | |

| 36,914 | | Acacia Research Corp.* | | | 1,540,790 | |

| 102,900 | | ACCO Brands Corp.* | | | 1,276,989 | |

| 16,900 | | Astronics Corp.* | | | 590,824 | |

| 860 | | Astronics Corp., Class B* | | | 29,464 | |

| 14,400 | | Atlas Air Worldwide Holdings, Inc.* | | | 708,624 | |

| 27,208 | | AZZ, Inc. | | | 1,405,021 | |

| 10,700 | | Chart Industries, Inc.* | | | 784,631 | |

| 62,400 | | Columbus McKinnon Corp.* | | | 1,016,496 | |

| 26,900 | | Ducommun, Inc.* | | | 320,110 | |

| 24,700 | | EnerSys* | | | 855,855 | |

| 24,800 | | Gardner Denver, Inc. | | | 1,562,896 | |

| 34,700 | | Greenbrier Cos., Inc.* | | | 686,713 | |

| 44,000 | | II-VI, Inc.* | | | 1,040,600 | |

| 32,000 | | Insteel Industries, Inc. | | | 388,800 | |

| 55,300 | | Interface, Inc., Class A | | | 771,435 | |

| 6,400 | | Knoll, Inc. | | | 106,496 | |

| 59,100 | | Meritor, Inc.* | | | 476,937 | |

| 4,100 | | Old Dominion Freight Line, Inc.* | | | 195,447 | |

| 28,600 | | Sun Hydraulics Corp. | | | 748,176 | |

| 12,100 | | Wabtec Corp. | | | 911,977 | |

| | | | | | |

| | | | | 15,418,281 | |

| | | | | | |

Information Technology — 15.82% | |

| 43,400 | | Aspen Technology, Inc.* | | | 891,002 | |

| 23,800 | | Checkpoint Systems, Inc.* | | | 268,464 | |

| 37,139 | | Computer Task Group, Inc.* | | | 568,969 | |

| 24,158 | | Interactive Intelligence Group, Inc.* | | | 737,061 | |

| 23,900 | | InterDigital, Inc. | | | 833,154 | |

| 19,000 | | Measurement Specialties, Inc.* | | | 640,300 | |

| 60,300 | | NIC, Inc. | | | 731,439 | |

| 29,200 | | Skyworks Solutions, Inc.* | | | 807,380 | |

| 27,400 | | STEC, Inc.* | | | 258,656 | |

| 51,400 | | Take-Two Interactive Software, Inc.* | | | 790,789 | |

| 29,900 | | Tyler Technologies, Inc.* | | | 1,148,459 | |

| 79,600 | | Xyratex Ltd. | | | 1,266,436 | |

| | | | | | |

| | | | | 8,942,109 | |

| | | | | | |

Materials — 8.88% | |

| 6,100 | | Kaiser Aluminum, Corp. | | | 288,286 | |

| 28,600 | | Koppers Holdings, Inc. | | | 1,102,816 | |

| 105,100 | | Omnova Solutions, Inc.* | | | 709,425 | |

| 8,700 | | Rockwood Holdings, Inc.* | | | 453,705 | |

| 5,400 | | Schweitzer-Mauduit International, Inc. | | | 372,924 | |

20

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Small Cap Core Fund (cont.)

| | | | | | |

| March 31, 2012 (Unaudited) | |

| | |

| Shares | | | | Value | |

| 48,991 | | Universal Stainless & Alloy* | | $ | 2,092,895 | |

| | | | | | |

| | | | | 5,020,051 | |

| | | | | | |

Utilities — 0.74% | |

| 11,400 | | Unisource Energy Corp. | | | 416,898 | |

| | | | | | |

| |

Total Common Stocks | | | 55,948,052 | |

| | | | | | |

(Cost $39,070,771) | | | | |

Investment Company — 0.78% | | | | |

| 440,126 | | JPMorgan Prime Money Market Fund | | | 440,126 | |

| | | | | | |

| |

Total Investment Company | | | 440,126 | |

| | | | | | |

(Cost $440,126) | | | | |

| |

Total Investments | | $ | 56,388,178 | |

(Cost $39,510,897)(a) — 99.78% | | | | |

| |

Other assets in excess of liabilities — 0.22% | | | 122,759 | |

| | | | | | |

| |

NET ASSETS — 100.00% | | $ | 56,510,937 | |

| | | | | | |

| * | Non-income producing security. |

| (a) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

REIT - Real Estate Investment Trust

See notes to financial statements.

21

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund

| | | | | | |

| March 31, 2012 (Unaudited) | |

| | |

| Shares | | | | Value | |

Common Stocks — 97.69% | |

Consumer Discretionary — 21.53% | |

| 81,000 | | Adams Golf, Inc.* | | | $869,130 | |

| 3,725 | | Ambassadors International, Inc.* | | | 56 | |

| 18,000 | | Ambow Education Holding Ltd. ADR* | | | 132,480 | |

| 13,500 | | America’s Car-Mart, Inc.* | | | 593,730 | |

| 21,000 | | Arctic Cat, Inc.* | | | 899,430 | |

| 25,000 | | Asbury Automotive Group, Inc.* | | | 675,000 | |

| 64,000 | | Benihana, Inc. | | | 835,200 | |

| 800 | | Biglari Holdings, Inc.* | | | 322,280 | |

| 54,000 | | Bluegreen Corp.* | | | 232,740 | |

| 5,000 | | Blyth, Inc. | | | 374,150 | |

| 46,000 | | Books-A-Million, Inc. | | | 147,200 | |

| 15,127 | | Bowl America, Inc., Class A | | | 204,215 | |

| 14,000 | | Brown Shoe Co., Inc. | | | 129,220 | |

| 47,500 | | Build-A-Bear Workshop, Inc.* | | | 249,375 | |

| 44,000 | | Carriage Services, Inc. | | | 332,200 | |

| 35,000 | | Christopher & Banks Corp. | | | 65,100 | |

| 12,000 | | Core-Mark Holding Co., Inc. | | | 491,280 | |

| 24,000 | | CSS Industries, Inc. | | | 467,040 | |

| 34,000 | | Delta Apparel, Inc.* | | | 558,620 | |

| 82 | | Digital Generation, Inc.* | | | 837 | |

| 11,700 | | Dorman Products, Inc.* | | | 592,020 | |

| 17,500 | | Duckwall-ALCO Stores, Inc.* | | | 156,450 | |

| 15,000 | | E.W. Scripps Co. (The), Class A* | | | 148,050 | |

| 23,000 | | Entercom Communications Corp., Class A* | | | 149,270 | |

| 28,000 | | Flexsteel Industries | | | 506,800 | |

| 36,000 | | Fred’s, Inc., Class A | | | 525,960 | |

| 70,000 | | Golfsmith International Holdings, Inc.* | | | 303,800 | |

| 58,000 | | Hastings Entertainment, Inc.* | | | 161,240 | |

| 10,000 | | Haverty Furniture Cos., Inc. | | | 111,000 | |

| 15,000 | | Helen of Troy Ltd.* | | | 510,150 | |

| 31,000 | | Hooker Furniture Corp. | | | 423,150 | |

| 52,800 | | Isle of Capri Casinos, Inc.* | | | 372,768 | |

| 26,800 | | Jakks Pacific, Inc. | | | 467,660 | |

| 24,000 | | Johnson Outdoors, Inc., Class A* | | | 458,400 | |

| 82,000 | | Journal Communications, Inc., Class A* | | | 461,660 | |

| 36,000 | | Kid Brands, Inc.* | | | 97,200 | |

| 50,310 | | Lakeland Industries, Inc.* | | | 506,118 | |

| 95,270 | | Lazare Kaplan International, Inc.* | | | 242,939 | |

| 42,000 | | La-Z-Boy, Inc.* | | | 628,320 | |

| 31,000 | | Lifetime Brands, Inc. | | | 348,440 | |

| 24,000 | | Lithia Motors, Inc., Class A | | | 628,800 | |

| 46,000 | | Luby’s, Inc.* | | | 279,220 | |

| 33,000 | | Mac-Gray Corp. | | | 499,290 | |

| 33,000 | | Marcus Corp. | | | 414,150 | |

| 19,000 | | MarineMax, Inc.* | | | 156,370 | |

| 7,500 | | McRae Industries, Inc., Class A | | | 115,125 | |

22

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund (cont.)

| | | | | | |

March 31, 2012 (Unaudited) | |

| | |

| Shares | | | | Value | |

| 26,000 | | Media General, Inc., Class A* | | | $ 133,640 | |

| 13,800 | | Meritage Homes Corp.* | | | 373,428 | |

| 21,300 | | Mestek, Inc.* | | | 244,950 | |

| 20,000 | | Modine Manufacturing Co.* | | | 176,600 | |

| 23,400 | | Movado Group, Inc. | | | 574,470 | |

| 10,300 | | Nobility Homes, Inc.* | | | 79,825 | |

| 32,000 | | O’Charleys, Inc.* | | | 314,880 | |

| 24,000 | | Officemax, Inc.* | | | 137,280 | |

| 41,000 | | Orleans Homebuilders, Inc.*(a)(b)(c) | | | 0 | |

| 18,350 | | Perry Ellis International, Inc.* | | | 342,595 | |

| 135,000 | | Point.360* | | | 101,250 | |

| 90,600 | | Radio One, Inc., Class D* | | | 87,891 | |

| 56,000 | | Red Lion Hotels Corp.* | | | 459,760 | |

| 23,550 | | REX American Resources Corp.* | | | 722,985 | |

| 40,000 | | Rocky Brands, Inc.* | | | 544,400 | |

| 34,000 | | Ruby Tuesday, Inc.* | | | 310,420 | |

| 16,000 | | Saga Communications, Inc., Class A* | | | 572,800 | |

| 45,150 | | Salem Communications Corp., Class A | | | 212,657 | |

| 45,000 | | Shiloh Industries, Inc. | | | 428,850 | |

| 30,000 | | Stage Stores, Inc. | | | 487,200 | |

| 31,000 | | Standard Motor Products, Inc. | | | 549,940 | |

| 33,000 | | Stein Mart, Inc.* | | | 217,800 | |

| 25,000 | | Steinway Musical Instruments, Inc.* | | | 625,000 | |

| 80,000 | | Stewart Enterprises, Inc., Class A | | | 485,600 | |

| 17,000 | | Strattec Security Corp. | | | 397,800 | |

| 3,000 | | Sturm Ruger & Co, Inc. | | | 147,300 | |

| 24,000 | | Superior Industries International, Inc. | | | 468,960 | |

| 33,000 | | Systemax, Inc.* | | | 556,380 | |

| 75,000 | | Trans World Entertainment Corp.* | | | 159,000 | |

| 38,000 | | Tuesday Morning Corp.* | | | 145,920 | |

| 16,000 | | Unifi, Inc.* | | | 154,560 | |

| 30,000 | | Universal Travel Group*(a)(c) | | | 0 | |

| 54,000 | | VOXX International Corp.* | | | 732,240 | |

| 20,000 | | Walking Co. Holdings, Inc. (The) | | | 122,000 | |

| 12,400 | | Weyco Group, Inc. | | | 293,880 | |

| | | | | | |

| | | | | 28,205,894 | |

| | | | | | |

Consumer Staples — 3.36% | |

| 13,600 | | Andersons, Inc. (The) | | | 662,184 | |

| 61,000 | | Central Garden and Pet Co.* | | | 574,010 | |

| 36,000 | | Chiquita Brands International, Inc.* | | | 316,440 | |

| 30,000 | | Ingles Markets, Inc., Class A | | | 529,200 | |

| 73,000 | | ML Macadamia Orchards LP* | | | 204,400 | |

| 10,000 | | Nash Finch Co. | | | 284,200 | |

| 12,000 | | Oil-Dri Corp. of America | | | 255,480 | |

| 63,000 | | Omega Protein Corp.* | | | 479,430 | |

| 40,000 | | Prestige Brands Holdings, Inc.* | | | 699,200 | |

23

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund (cont.)

| | | | | | |

March 31, 2012 (Unaudited) | |

| Shares | | | | | Value | |

| 22,000 | | Spartan Stores, Inc. | | | $ 398,640 | |

| | | | | | |

| | | | | 4,403,184 | |

| | | | | | |

Energy — 3.21% | | | | | | |

| 23,000 | | Calumet Specialty Products Partners LP | | | 607,660 | |

| 31,000 | | Constellation Energy Partners LLC* | | | 79,360 | |

| 17,000 | | Endeavour International Corp.* | | | 201,450 | |

| 9,000 | | Global Partners LP | | | 209,070 | |

| 27,000 | | Harvest Natural Resources, Inc.* | | | 191,160 | |

| 17,000 | | Hornbeck Offshore Services, Inc.* | | | 714,510 | |

| 34,000 | | Knightsbridge Tankers Ltd. | | | 488,920 | |

| 19,000 | | Natural Gas Services Group, Inc.* | | | 250,800 | |

| 30,000 | | Newpark Resources, Inc.* | | | 245,700 | |

| 11,000 | | Niska Gas Storage Partners LLC | | | 104,940 | |

| 30,000 | | North American Energy Partners, Inc.* | | | 147,000 | |

| 14,600 | | PHI, Inc.* | | | 326,456 | |

| 13,000 | | PHI, Inc., Non voting* | | | 300,950 | |

| 25,000 | | Teekay Tankers, Ltd., Class A | | | 151,750 | |

| 110,300 | | Trico Marine Services, Inc.*(a)(c) | | | 0 | |

| 21,000 | | Tsakos Energy Navigation Ltd. | | | 182,280 | |

| | | | | | |

| | | | | 4,202,006 | |

| | | | | | |

Financials — 21.73% | |

| 70,000 | | 21st Century Holding Co.* | | | 310,800 | |

| 40,000 | | Affirmative Insurance Holdings, Inc.* | | | 21,200 | |

| 9,000 | | Agree Realty Corp. REIT | | | 203,220 | |

| 28,000 | | American Equity Investment Life Holding Co. | | | 357,560 | |

| 75,000 | | American Independence Corp.* | | | 322,500 | |

| 23,000 | | American Safety Insurance Holdings Ltd.* | | | 433,550 | |

| 34,190 | | Ameris Bancorp* | | | 449,256 | |

| 9,000 | | Apollo Commercial Real Estate Finance, Inc. REIT | | | 140,850 | |

| 6,000 | | Arlington Asset Investment Corp., Class A | | | 133,200 | |

| 68,000 | | Asta Funding, Inc. | | | 555,560 | |

| 20,000 | | Baldwin & Lyons, Inc., Class B | | | 447,600 | |

| 14,000 | | Banco Latinoamericano de Comercio Exterior SA | | | 295,540 | |

| 63,600 | | Bancorp, Inc.* | | | 638,544 | |

| 8,228 | | Banner Corp. | | | 181,263 | |

| 100,000 | | Beverly Hills Bancorp, Inc.* | | | 1,400 | |

| 34,000 | | California First National Bancorp | | | 521,560 | |

| 21,000 | | Camco Financial Corp.* | | | 58,800 | |

| 5,200 | | Capital Southwest Corp. | | | 491,660 | |

| 38,000 | | Capitol Bancorp Ltd.* | | | 12,920 | |

| 15,750 | | Citizens South Banking Corp. | | | 71,663 | |

| 48,150 | | Citizens, Inc.* | | | 475,722 | |

| 133,000 | | Consumer Portfolio Services* | | | 166,250 | |

| 18,856 | | Cowen Group, Inc., Class A* | | | 51,100 | |

| 35,777 | | Donegal Group, Inc., Class A | | | 489,071 | |

| 8,444 | | Donegal Group, Inc., Class B | | | 139,073 | |

24

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | | Value | |

| 3,000 | | Duff & Phelps Corp., Class A | | | $ 46,620 | |

| 58,040 | | Dynex Capital, Inc. REIT | | | 554,282 | |

| 37,000 | | Edelman Financial Group, Inc. | | | 244,570 | |

| 27,000 | | EMC Insurance Group, Inc. | | | 542,430 | |

| 20,000 | | Federal Agricultural Mortgage Corp., Class C | | | 454,000 | |

| 34,300 | | First Defiance Financial Corp. | | | 578,298 | |

| 11,000 | | First Financial Corp. | | | 349,250 | |

| 45,400 | | First Financial Holdings, Inc. | | | 499,400 | |

| 27,000 | | First Industrial Realty Trust, Inc. REIT* | | | 333,450 | |

| 54,000 | | First Merchants Corp. | | | 666,360 | |

| 47,200 | | First Pactrust Bancorp, Inc. | | | 562,624 | |

| 38,000 | | First Place Financial Corp.* | | | 28,120 | |

| 42,000 | | First State Bancorporation* | | | 67 | |

| 25,000 | | Firstcity Financial Corp.* | | | 218,500 | |

| 6,600 | | Flagstar Bancorp, Inc.* | | | 6,072 | |

| 2,250 | | FRMO Corp.* | | | 6,075 | |

| 45,000 | | Gladstone Investment Corp. | | | 340,650 | |

| 50,400 | | Green Bankshares, Inc.* | | | 85,176 | |

| 43,000 | | Guaranty Bancorp* | | | 85,570 | |

| 52,528 | | Hercules Technology Growth Capital, Inc. | | | 582,010 | |

| 38,000 | | HF Financial Corp. | | | 455,620 | |

| 6,059 | | Hudson Valley Holding Corp. | | | 97,731 | |

| 39,600 | | Independence Holding Co. | | | 394,416 | |

| 13,000 | | Indiana Community Bancorp | | | 305,500 | |

| 9,000 | | Infinity Property & Casualty Corp. | | | 470,970 | |

| 31,000 | | Intervest Bancshares Corp., Class A* | | | 118,420 | |

| 8,300 | | Investors Title Co. | | | 387,776 | |

| 24,000 | | Jefferson Bancshares, Inc.* | | | 54,960 | |

| 24,000 | | JMP Group, Inc. | | | 177,120 | |

| 17,000 | | Kansas City Life Insurance Co. | | | 547,400 | |

| 7,000 | | Main Street Capital Corp. | | | 172,410 | |

| 44,000 | | Marlin Business Services Corp. | | | 662,640 | |

| 48,000 | | MCG Capital Corp. | | | 204,000 | |

| 54,750 | | Meadowbrook Insurance Group, Inc. | | | 510,817 | |

| 53,000 | | Medallion Financial Corp. | | | 591,480 | |

| 103,000 | | MicroFinancial, Inc. | | | 705,550 | |

| 15,000 | | Monmouth Real Estate Investment Corp. REIT, Class A | | | 146,100 | |

| 52,100 | | MutualFirst Financial, Inc. | | | 508,496 | |

| 5,300 | | National Security Group, Inc. | | | 46,057 | |

| 4,000 | | National Western Life Insurance Co., Class A | | | 547,480 | |

| 11,400 | | Navigators Group, Inc.* | | | 538,536 | |

| 43,000 | | NGP Capital Resources Co. | | | 281,650 | |

| 44,000 | | Nicholas Financial, Inc. | | | 580,360 | |

| 13,000 | | One Liberty Properties, Inc. REIT | | | 237,900 | |

| 13,000 | | Onebeacon Insurance Group, Ltd., Class A | | | 200,330 | |

| 6,000 | | Oppenheimer Holdings, Inc., Class A | | | 104,100 | |

| 18,000 | | Pacific Mercantile Bancorp* | | | 98,640 | |

| 8,000 | | Parkway Properties, Inc. REIT | | | 83,840 | |

25

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | | Value | |

| 29,000 | | Peoples Bancorp, Inc. | | | $ 508,660 | |

| 6,000 | | Piper Jaffray Cos.* | | | 159,720 | |

| 37,900 | | PMC Commercial Trust REIT | | | 324,424 | |

| 40,000 | | Presidential Life Corp. | | | 457,200 | |

| 19,000 | | Provident Financial Holdings, Inc. | | | 207,670 | |

| 20,000 | | Ramco-Gershenson Properties Trust REIT | | | 244,400 | |

| 59,000 | | Reis, Inc.* | | | 525,690 | |

| 23,000 | | Resource Capital Corp. REIT | | | 123,970 | |

| 11,000 | | Safety Insurance Group, Inc. | | | 458,040 | |

| 42,000 | | SeaBright Holdings, Inc. | | | 381,780 | |

| 109,000 | | Signature Group Holdings, Inc.* | | | 27,795 | |

| 14,000 | | Simmons First National Corp., Class A | | | 361,620 | |

| 32,000 | | Southern Community Financial Corp.* | | | 83,840 | |

| 38,300 | | Southwest Bancorp, Inc.* | | | 353,126 | |

| 25,000 | | Sterling Bancorp NY | | | 239,750 | |

| 35,600 | | Sun Bancorp, Inc.* | | | 125,668 | |

| 46,500 | | SWS Group, Inc. | | | 265,980 | |

| 54,000 | | TierOne Corp.* | | | 189 | |

| 52,000 | | Unico American Corp.* | | | 582,400 | |

| 99,716 | | United Community Financial Corp.* | | | 229,347 | |

| 19,000 | | United Western Bancorp, Inc.* | | | 2,850 | |

| 29,000 | | Winthrop Realty Trust REIT | | | 336,110 | |

| 4,600 | | Ziegler Cos., Inc. (The)* | | | 87,400 | |

| | | | | | |

| | | | | 28,471,314 | |

| | | | | | |

Health Care — 5.60% | |

| 4,000 | | Air Methods Corp.* | | | 349,000 | |

| 34,000 | | Albany Molecular Research, Inc.* | | | 91,800 | |

| 11,000 | | American Shared Hospital Services* | | | 37,400 | |

| 40,000 | | Angiodynamics, Inc.* | | | 490,000 | |

| 16,000 | | Assisted Living Concepts, Inc., Class A | | | 265,760 | |

| 77,000 | | BioScrip, Inc.* | | | 522,830 | |

| 22,000 | | Cambrex Corp.* | | | 153,780 | |

| 42,500 | | Cantel Medical Corp. | | | 1,066,325 | |

| 45,000 | | Capital Senior Living Corp.* | | | 415,800 | |

| 22,000 | | CONMED Corp. | | | 657,140 | |

| 46,000 | | Cross Country Healthcare, Inc.* | | | 230,460 | |

| 40,000 | | CryoLife, Inc.* | | | 210,800 | |

| 27,970 | | Hanger Orthopedic Group, Inc.* | | | 611,424 | |

| 20,313 | | IntegraMed America, Inc.* | | | 245,889 | |

| 20,000 | | Invacare Corp. | | | 331,400 | |

| 7,100 | | Kewaunee Scientific Corp. | | | 61,770 | |

| 10,362 | | Kindred Healthcare, Inc.* | | | 89,528 | |

| 30,000 | | Lannett Co., Inc.* | | | 125,100 | |

| 15,000 | | Medcath Corp.* | | | 117,900 | |

| 19,000 | | Mediware Information Systems* | | | 279,110 | |

| 41,000 | | PharMerica Corp.* | | | 509,630 | |

| 25,000 | | Symmetry Medical, Inc.* | | | 176,750 | |

26

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | | Value | |

13,000 | | Triple-S Management Corp., Class B* | | | $ 300,300 | |

| | | | | | |

| | | | | 7,339,896 | |

| | | | | | |

Industrials — 20.77% | |

| 45,839 | | Aceto Corp. | | | 435,012 | |

| 24,000 | | Aegean Marine Petroleum Network, Inc. | | | 165,840 | |

| 3,000 | | Aegion Corp.* | | | 53,490 | |

| 21,000 | | Alamo Group, Inc. | | | 631,260 | |

| 102,000 | | Allied Motion Technologies, Inc. | | | 739,500 | |

| 8,000 | | Altra Holdings, Inc.* | | | 153,600 | |

| 8,000 | | Ampco-Pittsburgh Corp. | | | 161,040 | |

| 10,000 | | AMREP Corp.* | | | 87,400 | |

| 22,000 | | Baltic Trading Ltd. | | | 91,300 | |

| 24,000 | | Beacon Roofing Supply, Inc.* | | | 618,240 | |

| 17,000 | | CAI International, Inc.* | | | 309,060 | |

| 10,800 | | Cascade Corp. | | | 541,296 | |

| 30,000 | | CBIZ, Inc.* | | | 189,600 | |

| 42,000 | | Celadon Group, Inc. | | | 653,100 | |

| 93,525 | | Cenveo, Inc.* | | | 316,115 | |

| 2,800 | | Chicago Rivet & Machine Co. | | | 55,468 | |

| 14,400 | | CIRCOR International, Inc. | | | 479,088 | |

| 12,000 | | Comfort Systems USA, Inc. | | | 130,920 | |

| 36,178 | | Compx International, Inc. | | | 503,236 | |

| 12,000 | | Consolidated Graphics, Inc.* | | | 543,000 | |

| 58,000 | | Contra Mair Holdings, Inc.*(a)(b)(c) | | | 0 | |

| 20,000 | | Dolan Co. (The)* | | | 182,200 | |

| 24,000 | | Ducommun, Inc.* | | | 285,600 | |

| 43,000 | | Eagle Bulk Shipping, Inc.* | | | 83,420 | |

| 14,700 | | Eastern Co. (The) | | | 294,000 | |

| 9,880 | | Ecology and Environment, Inc., Class A | | | 149,682 | |

| 21,000 | | Encore Wire Corp. | | | 624,330 | |

| 35,000 | | Ennis, Inc. | | | 553,700 | |

| 10,000 | | EnPro Industries, Inc.* | | | 411,000 | |

| 24,000 | | Espey Manufacturing & Electronics Corp. | | | 592,560 | |

| 56,000 | | Excel Maritime Carriers Ltd.* | | | 112,000 | |

| 30,000 | | Federal Signal Corp.* | | | 166,800 | |

| 10,000 | | FLY Leasing Ltd. ADR | | | 122,100 | |

| 69,000 | | Frozen Food Express Industries* | | | 84,180 | |

| 20,000 | | G&K Services, Inc., Class A | | | 684,000 | |

| 15,000 | | Genco Shipping & Trading Ltd.* | | | 95,400 | |

| 25,000 | | GenCorp, Inc.* | | | 177,500 | |

| 40,000 | | Gibraltar Industries, Inc.* | | | 606,000 | |

| 10,300 | | GP Strategies Corp.* | | | 180,250 | |

| 35,000 | | Griffon Corp. | | | 374,500 | |

| 25,750 | | Hardinge, Inc. | | | 243,595 | |

| 22,000 | | Hill International, Inc.* | | | 86,460 | |

| 23,350 | | International Shipholding Corp. | | | 539,151 | |

| 26,000 | | Jinpan International Ltd. | | | 226,980 | |

27

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | | Value | |

| 6,000 | | Kadant, Inc.* | | | $ 142,920 | |

| 12,000 | | Key Technology, Inc.* | | | 158,640 | |

| 33,000 | | Kforce, Inc.* | | | 491,700 | |

| 40,000 | | Kimball International, Inc., Class B | | | 276,400 | |

| 9,408 | | Kratos Defense & Security Solutions, Inc.* | | | 50,239 | |

| 64,000 | | LECG Corp.* | | | 640 | |

| 38,000 | | LS Starrett Co. (The), Class A | | | 492,100 | |

| 51,750 | | LSI Industries, Inc. | | | 379,327 | |

| 52,000 | | Lydall, Inc.* | | | 529,880 | |

| 22,875 | | Marten Transport Ltd. | | | 504,851 | |

| 72,000 | | Mesa Air Group, Inc.*(a)(b)(c) | | | 0 | |

| 38,117 | | Met-Pro Corp. | | | 402,515 | |

| 89,294 | | MFC Industrial Ltd. | | | 686,671 | |

| 34,000 | | Miller Industries, Inc. | | | 575,280 | |

| 34,000 | | NN, Inc.* | | | 277,440 | |

| 18,800 | | Northwest Pipe Co.* | | | 399,312 | |

| 56,000 | | On Assignment, Inc.* | | | 978,320 | |

| 20,000 | | Orion Marine Group, Inc.* | | | 144,600 | |

| 53,600 | | PAM Transportation Services, Inc. | | | 599,784 | |

| 52,000 | | Paragon Shipping, Inc., Class A | | | 42,640 | |

| 43,160 | | Patrick Industries, Inc.* | | | 524,394 | |

| 16,000 | | Pike Electric Corp.* | | | 131,680 | |

| 29,000 | | RCM Technologies, Inc.* | | | 161,530 | |

| 33,500 | | Rush Enterprises, Inc., Class A* | | | 710,870 | |

| 13,000 | | Schawk, Inc. | | | 162,630 | |

| 10,000 | | SeaCube Container Leasing Ltd. | | | 172,000 | |

| 13,800 | | SL Industries, Inc.* | | | 270,066 | |

| 16,000 | | Standex International Corp. | | | 659,040 | |

| 41,000 | | Superior Uniform Group, Inc. | | | 481,340 | |

| 58,115 | | Supreme Industries, Inc., Class A* | | | 180,737 | |

| 5,269 | | SYKES Enterprises, Inc.* | | | 83,250 | |

| 26,000 | | Tredegar Corp. | | | 509,340 | |

| 3,000 | | Trex Co., Inc.* | | | 96,240 | |

| 17,000 | | Universal Forest Products, Inc. | | | 586,160 | |

| 16,000 | | USA Truck, Inc.* | | | 124,000 | |

| 6,000 | | Viad Corp. | | | 116,580 | |

| 38,000 | | Vitran Corp., Inc.* | | | 303,240 | |

| 43,200 | | Volt Information Sciences, Inc.* | | | 269,568 | |

| 75,000 | | Willdan Group, Inc.* | | | 273,750 | |

| 41,000 | | Willis Lease Finance Corp.* | | | 533,410 | |

| | | | | | |

| | | | | 27,216,057 | |

| | | | | | |

Information Technology — 12.17% | |

| 67,300 | | Acorn Energy, Inc. | | | 731,551 | |

| 31,000 | | Agilysys, Inc.* | | | 278,690 | |

| 31,000 | | Anaren, Inc.* | | | 568,850 | |

| 12,000 | | Black Box Corp. | | | 306,120 | |

| 70,000 | | CIBER, Inc.* | | | 296,800 | |

28

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

RBC Microcap Value Fund (cont.)

March 31, 2012 (Unaudited)

| | | | | | |

| Shares | | | | | Value | |

| 50,000 | | Comarco, Inc.* | | | $ 10,000 | |

| 21,000 | | Communications Systems, Inc. | | | 275,730 | |

| 13,000 | | CTS Corp. | | | 136,760 | |

| 30,000 | | Digi International, Inc.* | | | 329,700 | |

| 49,598 | | Dynamics Research Corp.* | | | 478,125 | |

| 30,000 | | Edgewater Technology, Inc.* | | | 117,600 | |

| 35,000 | | Electro Rent Corp. | | | 644,350 | |

| 33,000 | | Electro Scientific Industries, Inc. | | | 495,330 | |

| 22,400 | | ePlus, Inc.* | | | 716,128 | |

| 9,000 | | Fabrinet* | | | 159,390 | |

| 21,332 | | GSI Group, Inc.* | | | 257,264 | |

| 19,000 | | GTSI Corp.* | | | 94,620 | |

| 32,000 | | Infospace, Inc.* | | | 409,920 | |

| 41,000 | | Insight Enterprises, Inc.* | | | 899,130 | |

| 63,375 | | Integrated Silicon Solution, Inc.* | | | 707,265 | |

| 15,000 | | JinkoSolar Holding Co. Ltd. ADR* | | | 91,500 | |

| 13,000 | | Kemet Corp.* | | | 121,680 | |

| 25,000 | | Keynote Systems, Inc. | | | 494,000 | |

| 21,000 | | Magal Security Systems Ltd.* | | | 97,440 | |

| 20,000 | | Measurement Specialties, Inc.* | | | 674,000 | |

| 56,000 | | Methode Electronics, Inc. | | | 519,680 | |

| 39,000 | | Newport Corp.* | | | 691,080 | |

| 29,000 | | Oplink Communications, Inc.* | | | 495,900 | |

| 83,000 | | Optical Cable Corp. | | | 291,330 | |

| 66,000 | | PC Connection, Inc. | | | 542,520 | |

| 67,000 | | Perceptron, Inc.* | | | 391,280 | |

| 120,000 | | Performance Technologies, Inc.* | | | 309,600 | |

| 37,930 | | Photronics, Inc.* | | | 252,235 | |

| 28,000 | | Retalix Ltd.* | | | 510,720 | |

| 47,000 | | Richardson Electronics Ltd. | | | 563,060 | |

| 9,000 | | Rosetta Stone, Inc.* | | | 92,880 | |

| 29,000 | | Rudolph Technologies, Inc.* | | | 322,190 | |

| 70,000 | | Sigmatron International, Inc.* | | | 291,200 | |

| 13,000 | | STR Holdings, Inc.* | | | 62,920 | |

| 31,500 | | Tessco Technologies, Inc. | | | 802,305 | |

| 8,000 | | Vishay Precision Group, Inc.* | | | 118,640 | |

| 30,000 | | WebMediaBrands, Inc.* | | | 31,200 | |

| 100,000 | | WPCS International, Inc.* | | | 127,000 | |

| 15,000 | | XO Group, Inc.* | | | 140,850 | |

| | | | | | |

| | | | | 15,948,533 | |

| | | | | | |

Materials — 4.60% | |

| 68,200 | | American Pacific Corp.* | | | 512,864 | |

| 37,000 | | Blue Earth Refineries, Inc.* | | | 5,920 | |

| 20,000 | | China Green Agriculture, Inc.* | | | 86,000 | |