UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-21475 |

Tamarack Funds Trust

|

| (Exact name of registrant as specified in charter) |

|

100 South Fifth Street, Suite 2300 Minneapolis, MN 55402-1240 |

| (Address of principal executive offices) (Zip code) |

Lee Greenhalgh, Esq.

RBC Plaza

60 South Sixth Street

Minneapolis, MN 55402

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (612) 376-7000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2009

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | | | | | | | |

| | | | | | |

| | | | | Tamarack Funds |

About Your Semi-Annual Report | | | | | | This semi-annual report includes detailed information about your Fund including financial statements, performance, and a complete list of its holdings. The Tamarack Funds compare their performance against various Russell equity indices. Each of these indices is a widely recognized measure of return for the underlying category of securities. However, the indices are unmanaged, do not include fees, and cannot be invested in directly. We hope the financial information presented will help you evaluate your investment in the Tamarack Funds. We also encourage you to read your Fund’s prospectus for further detail as to your Fund’s investment policies and risk profile. Tamarack Funds prospectuses and performance information subsequent to the date of this report are available on our website at www.voyageur.net. A description of the policies and procedures that your Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-422-2766; (ii) on the Fund’s website at www.voyageur.net; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov. Information regarding how your Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (i) on the Fund’s website at www.voyageur.net; and (ii) on the Commission’s website at http://www.sec.gov. A schedule of each Fund’s portfolio holdings will be filed with the Commission for the first and third quarters of each fiscal year on Form N-Q. This information is available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room is available by calling 1-800-SEC-0330. |

| Table of Contents | | | | | | | | |

| | | | | | Letter from the CIO of Equities | | 1 |

| | | | | | Equity Portfolio Managers | | 4 |

| | | | | | Performance Summary | | 6 |

| | | | | | Mid Cap Growth Fund | | 10 |

| | | | | | Enterprise Fund | | 11 |

| | | | | | Small Cap Core Fund | | 12 |

| | | | | | Microcap Value Fund | | 13 |

| | | | | | Schedules of Portfolio Investments | | 14 |

| | | | | | Financial Statements | | |

| | | | | | - Statements of Assets and Liabilities | | 25 |

| | | | | | - Statements of Operations | | 27 |

| | | | | | - Statements of Changes in Net Assets | | 28 |

| | | | | | Financial Highlights | | 30 |

| | | | | | Notes to Financial Statements | | 34 |

| | | | | | Share Class Information | | 43 |

| | | | | | Supplemental Information | | 44 |

| | | | | | Renewal of Investment Advisory Fees | | 46 |

| | | | | | |

LETTER FROM THE CIO OF EQUITIES | | | | | | |

| | | |

| | | | | | | |

Market Review The last six months proved extremely challenging for equity investors. Cumulatively, equity indices across all capitalization ranges lost on average approximately 35% of their value in one of the three worst bear markets on record. The heavier losses occurred during the fourth quarter of 2008. However, the New Year offered no respite. January 2009 proved the worst opening month on record for the S&P 500, which fell 8.4%. While a number of factors contributed to the market’s fall, the one central area concerning investors was the health of the U.S. and, furthermore, global financial systems. Major market averages put in new lows in November and again in early March as worries regarding the health of U.S. banks peaked. The March S&P 500 bottom equated to a level last experienced in 1996. As financials, especially banks, pulled the market down over these past two quarters, they also sparked a powerful rally in the period’s closing weeks. S&P financials rallied 46% off the March low, helping the broad averages to gains of about 9% for the month. While March ended strongly, the first quarter overall still delivered losses of 10-15% across the market cap spectrum. The late-period rally persisted into the early weeks of April, leading many to wonder whether we’ve seen the worst of this market already. In considering the entire six-month period we observe that large-cap stocks experienced the best relative returns. The lower one went in market cap the worse the relative return experience during this timeframe. Value and growth stocks did equally poorly during the fourth quarter of 2008, but growth stocks emerged as clear leaders in 2009’s first quarter. Not Your Average Recession To be clear, while Voyageur acknowledges the economy is mired in a deep recession with unusual challenges, we do not think comparisons to the Great Depression of the 1930s are valid. Nevertheless, this contraction is somewhat unique in many respects, including the underlying causes, the breadth and depth of economic weakness, and the fact that the entire world has suffered. As mentioned, the global banking system’s poor health was the spark that set our markets aflame. The causes are well-known by now: essentially a combination of extremely poor lending, borrowing, and investing decisions based on the erroneous assumption that home prices would rise without interruption. While the U.S. rightly accepts most of the blame for the consequences of the bursting real estate bubble, it’s clear that similar errors were also made in the U.K. and Europe. What generally differentiates this recession from the Great Depression is the global coordination and rapidity of policy responses to the crisis. Here in the U.S. we’ve seen the Federal Reserve take its policy rate down to essentially zero. They’ve introduced myriad programs aimed at providing or improving liquidity in a number of important corners of the financial system. They’ve embarked on pumping $1.2 trillion of cash into the economy | | | | | | |

| | | |

| | | | | | |

1

| | | | |

| | | | | LETTER FROM THE CIO OF EQUITIES |

| | | | | through asset purchases which also provide the benefit of lower Treasury and mortgage lending rates. The federal government enacted an $800 billion stimulus package – cutting payroll taxes for most workers, providing financial aid to strapped state governments, dedicating funds to various infrastructure projects, and offering an $8,000 tax credit to first time home buyers. The Treasury and Fed are executing a plan to both assure the market’s confidence in the health of our major banks and to (finally) relieve these banks of some of their most troubled assets. The unemployment rate has exploded but is nowhere close to the 25% experienced during the Depression. A broad array of government support programs for the unemployed which did not exist in the ‘30s are in place today. Lastly, while there have been isolated exceptions there appears a strong global consensus to maintain an open trading system as major global leaders recognize the harmful impact protectionist policies would have on the economy. The Promises The administration has referred to early signs of stabilization or improvement in the economy as “green shoots.” The desire is that enough of these hopeful signs sprout and are fed by stimulus and monetary policy to halt and then reverse the economy’s slide. What do we see? The administration’s policy responses in both fiscal and monetary terms have been rapid and unprecedented. True, some of the proposals have seemed scattershot or indecisive, but the amount of intervention has been massive in scale. Coming quarters will begin to reveal the boost these programs should provide to the economy. The hope behind these stimulus efforts is that they spark a recovery that is self-sustaining. Fed policy changes work with variable lags, but if past form is followed a lower cost of capital, increased money supply, and improved access to credit should begin having a positive impact during the second half of this year. Rising unemployment presents a problem, but as we have already discussed, a number of counter-balances are in place: expanded unemployment insurance, a cut in payroll taxes, cash to help states balance their budgets with fewer program cuts and/or tax increases, and a material tax credit to incentivize first-time home buyers. Consumers have also been aided by the sharp drop in gasoline prices and inflation in general. Heavy refinancing of mortgage loans not only help put more cash in consumer pockets but provide a valuable stream of fee income and higher quality loans to banks that desperately need it. Another boon to consumers has been tax refunds, which so far this year are running on average over 10% higher than refunds last year. It’s fair to look at housing as the culprit behind this recession, and it will be necessary for housing markets to stabilize before the economy returns to a growth track. Inventories remain high, and prices appear at risk of some further decline. Still, we see some green shoots in the form of extremely high housing affordability. Sales paces are at depressingly low levels; however, we see promise in the fact that sales seem to have stabilized an even improved slightly from their lows. The months of supply at current sales paces have fallen for both new and existing homes. This is a key barometer for gauging the supply/demand |

| | | |

2

| | | | | | |

LETTER FROM THE CIO OF EQUITIES | | | | | | |

balance in these markets. We are still in a state of excess supply, but we are moving in the right direction. Lastly, the stock market itself may be telling us something important at this very moment. Markets are forward-looking. Despite all the discouraging economic statistics, we’ve witnessed a strong rebound in stock prices that began in early March and continued well into April. Only in hindsight will we be able to say whether March 2009 marked the end of this bear market, but the rally must be taken as a support to the economy for now. Not only has the market risen lately, but volatility is down by over half from its 2008 peak. Volatility remains above long-term averages, and we would prefer to see it lower as another encouraging sign that this rally has legs. For now volatility is moving in the right direction. The Opportunity Emerging from recession and bearish periods stocks typically deliver strong and fast-moving recoveries that can more than offset losses incurred during the market decline. Pinpointing the date when a recession will end or when a sustained market recovery will begin is an impossible task. However, it’s at these moments after the markets have delivered their harshest blows that patient investors can potentially reap their greatest rewards. If you’ve resisted the urge to sell when things seemed darkest then we believe you are on the verge of seeing your portfolios begin to increase in value again. With earnings estimates having come down in response to the current economic environment market valuations appear quite attractive, and we’ve yet to enjoy any boost from the government’s policy prescriptions. Those who have been sidelined through this period or who currently have an allocation to equities below their normal range may wish to consider beginning to put some of their cash back to work. After witnessing the third-worst bear market on record the recovery we experience, when it comes, may be equally breathtaking.

Nancy M. Scinto Tamarack Funds Chief Investment Officer Equity Products | | | | | |

|

| | | | | |

3

| | | | | | |

| | | | | | | EQUITY PORTFOLIO MANAGERS |

| | | | | | | |

| | | | | | Voyageur Asset Management Inc. (“Voyageur”), the investment advisor to the Tamarack Funds, employs a team approach to the management of the Tamarack Equity Funds, with no individual team member being solely responsible for the investment decisions. |

| | | | | | Nancy M. Scinto Chief Investment Officer Equity Products, Director of Global Equity Investments, Managing Director, Senior Portfolio Manager Nancy Scinto is responsible for portfolio management of the Mid Cap Growth and Microcap Value Funds and directing the Voyageur growth equity research efforts. She joined Voyageur in 1999 from Chicago Trust Company where she managed institutional accounts and was co-manager of the five-star Alleghany / Chicago Growth and Income Fund. Nancy has held various positions including personal trust, equity trader, senior equity analyst and senior portfolio manager. She began her career in the investment industry in 1984. Nancy received a BA from Governors State University and an MBA from DePaul University. She is a member of the CFA Society of Chicago. |

| | | | | | Gordon Telfer Managing Director, Head of Growth Equities Gordon Telfer is head of Voyageur’s growth equity team and co-manager of the Mid Cap Growth Fund. Fund. He joined Voyageur in 2003 from Alliance Capital Management where he was a senior portfolio manager and a member of Alliance’s Investment Policy Group. Prior to Alliance, he worked for Scudder Kemper Investments as senior vice president and global strategist and spokesperson for Scudder Kemper’s U.S. and International Portfolio Management Group. Gordon began his career in the investment industry in 1986 at Murray Johnstone International in portfolio management. He has spoken at numerous regional and national conferences on portfolio management and been a guest on CNBC. A native of Glasgow, Scotland, Gordon received his Stock Exchange Diploma from the Herriott Watt University, Edinburgh, Scotland. |

| | | | | | Lance F. James Managing Director, Senior Portfolio Manager Lance James is responsible for portfolio management of the Small Cap Core Fund and Enterprise Fund and is a co-manager of the Microcap Value Fund. Prior to joining Voyageur in 2006, Lance was an equity analyst and portfolio manager for OFI Institutional and Babson Capital Management, affiliated companies of Mass Mutual Life Insurance Company. During his tenure he served as head of the firm’s small/mid cap value investment team. Prior to joining Babson Capital in 1986, Lance worked at Rockwell International Corporation, EBF Associates of Boston and Hewitt Associates. Lance began his career in the investment industry in 1980. He received an AB in Economics from Princeton University and an MBA in Finance from the Wharton School of Business at the University of Pennsylvania. |

| | | | | | |

4

| | | | | | | | | | | | | | | | | | | | |

EQUITY PORTFOLIO MANAGERS | | | | | | |

| | | | | | | |

| | | | | | | |

George Prince Portfolio Manager, Senior Equity Analyst George Prince serves as the co-portfolio manager for the Enterprise Fund. George also provides research support for the Small Cap Core Fund. He joined Voyageur in 2006 from Eagle Asset Management, where he was a senior equity analyst. Prior to his experience at Eagle Asset Management, George was an analyst at Babson Capital Management. George also has a great deal of entrepreneurial experience and founded SignStorey, a leader in place-based digital communications in retail stores and co-founded Cutting Edge Inc., a global CAD-CAM technology company. George has over 12 years of investment industry experience. He received a BA from Yale University. | | | | | |  |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | PERFORMANCE SUMMARY |

| | | | | | Average Annual Total Returns as of March 31, 2009 (Unaudited) |

| | | | | | Tamarack Mid Cap Growth Fund (a) |

| | | | | | | | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(b) | | Net

Expense

Ratio*(1)(2) | | Gross

Expense

Ratio*(1)(2) |

| | | | | | Class A | | | | | | | | | | | | | | |

| | | | | | - Including | | | | | | | | | | | | | | |

| | | | | | Maximum Sales | | | | | | | | | | | | | | |

| | | | | | Charge of 5.75% | | (39.67)% | | (17.98)% | | (6.88)% | | 0.72% | | 8.14% | | | | |

| | | | | | - At Net Asset Value | | (35.96)% | | (16.35)% | | (5.77)% | | 1.32% | | 8.49% | | 1.35% | | 1.44% |

| | | | | | | | | | |

| | | | | | Class C (c) | | | | | | | | | | | | | | |

| | | | | | - Including | | | | | | | | | | | | | | |

| | | | | | Contingent | | | | | | | | | | | | | | |

| | | | | | Deferred Sales | | | | | | | | | | | | | | |

| | | | | | Charge of 1.00% | | (37.05)% | | (16.96)% | | (6.46)% | | 0.57% | | 7.69% | | | | |

| | | | | | - At Net Asset Value | | (36.42)% | | (16.96)% | | (6.46)% | | 0.57% | | 7.69% | | 2.10% | | 2.19% |

| | | | | | | | | | |

| | | | | | Class I | | (35.78)% | | (16.12)% | | (5.53)% | | 1.60% | | 8.82% | | 1.10% | | 1.19% |

| | | | | | | | | | |

| | | | | | Class R (c) | | (36.08)% | | (16.53)% | | (5.99)% | | 1.08% | | 8.23% | | 1.60% | | 1.69% |

| | | | | | | | | | |

| | | | | | Class S (d) | | (35.84)% | | (16.14)% | | (5.53)% | | 1.60% | | 8.82% | | 1.10% | | 1.19% |

| | | | | | | | | | |

| | | | | | Russell Midcap | | | | | | | | | | | | | | |

| | | | | | Growth Index** | | (39.58)% | | (14.89)% | | (3.91)% | | (0.86)% | | 7.51% | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Tamarack Enterprise Fund (e) |

| | | | | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(f) | | Net

Expense

Ratio*(1)(2) | | Gross

Expense

Ratio*(1)(2) |

| | | | | | Class A (g) | | | | | | | | | | | | | | |

| | | | | | - Including | | | | | | | | | | | | | | |

| | | | | | Maximum Sales | | | | | | | | | | | | | | |

| | | | | | Charge of 5.75% | | (44.26)% | | (21.74)% | | (9.39)% | | 3.73% | | 8.27% | | | | |

| | | | | | - At Net Asset Value | | (40.86)% | | (20.18)% | | (8.31)% | | 4.35% | | 8.53% | | 1.33% | | 1.56% |

| | | | | | | | | | |

| | | | | | Class C (g) | | | | | | | | | | | | | | |

| | | | | | - Including | | | | | | | | | | | | | | |

| | | | | | Contingent | | | | | | | | | | | | | | |

| | | | | | Deferred Sales | | | | | | | | | | | | | | |

| | | | | | Charge of 1.00% | | (41.79)% | | (20.77)% | | (8.99)% | | 3.58% | | 7.72% | | | | |

| | | | | | - At Net Asset Value | | (41.29)% | | (20.77)% | | (8.99)% | | 3.58% | | 7.72% | | 2.08% | | 2.31% |

| | | | | | | | | | |

| | | | | | Class I (h) | | (40.68)% | | (19.98)% | | (8.07)% | | 4.62% | | 8.80% | | 1.08% | | 1.31% |

| | | | | | | | | | |

| | | | | | Class R (g) | | (40.98)% | | (20.37)% | | (8.54)% | | 4.09% | | 8.26% | | 1.58% | | 1.81% |

| | | | | | | | | | |

| | | | | | Class S | | (40.74)% | | (20.00)% | | (8.09)% | | 4.61% | | 8.80% | | 1.08% | | 1.31% |

| | | | | | | | | | |

| | | | | | Russell 2000 | | | | | | | | | | | | | | |

| | | | | | Index** | | (37.50)% | | (16.80)% | | (5.24)% | | 1.93% | | 7.00% | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.voyageur.net. Please see footnotes on page 8. |

| | | | | | |

6

| | | | | | | | | | | | | | | | | | | | |

PERFORMANCE SUMMARY | | | | | | |

Tamarack Small Cap Core Fund (i) | | | | | |

| | | | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(j) | | Net

Expense

Ratio*(1)(2) | | Gross

Expense

Ratio*(1)(2) | | | | | | |

Class A (g) | | | | | | | | | | | | | | | | | | | |

- Including | | | | | | | | | | | | | | | | | | | |

Maximum Sales | | | | | | | | | | | | | | | | | | | |

Charge of 5.75% | | (42.10)% | | (19.87)% | | (7.87)% | | 2.18% | | 6.39% | | | | | | | | | |

- At Net Asset Value | | (38.58)% | | (18.28)% | | (6.77)% | | 2.78% | | 6.74% | | 1.55% | | 2.02% | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | |

- Including | | | | | | | | | | | | | | | | | | | |

Contingent | | | | | | | | | | | | | | | | | | | |

Deferred Sales | | | | | | | | | | | | | | | | | | | |

Charge of 1.00% | | (39.58)% | | (18.81)% | | (7.42)% | | 2.05% | | 5.96% | | | | | | | | | |

- At Net Asset Value | | (39.06)% | | (18.81)% | | (7.42)% | | 2.05% | | 5.96% | | 2.30% | | 2.77% | | | | | |

Class I (k) | | (38.39)% | | (17.98)% | | (6.49)% | | 3.07% | | 7.02% | | 1.30% | | 1.77% | | | | | |

Class R (g) | | (38.72)% | | (18.39)% | | (6.96)% | | 2.56% | | 6.49% | | 1.80% | | 2.27% | | | | | |

Class S | | (38.39)% | | (17.98)% | | (6.49)% | | 3.07% | | 7.02% | | 1.30% | | 1.77% | | | | | |

Russell 2000

Index** | | (37.50)% | | (16.80)% | | (5.24)% | | 1.93% | | 7.00% | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Tamarack Microcap Value Fund (l) | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception(m) | | Net

Expense

Ratio*(1)(2) | | Gross

Expense

Ratio*(1)(2) | | | | | |

Class A (g) | | | | | | | | | | | | | | | | | | | |

- Including | | | | | | | | | | | | | | | | | | | |

Maximum Sales | | | | | | | | | | | | | | | | | | | |

Charge of 5.75% | | (47.86)% | | (22.52)% | | (8.84)% | | 3.72% | | 5.89% | | | | | | | | | |

- At Net Asset Value | | (44.68)% | | (20.97)% | | (7.75)% | | 4.33% | | 6.19% | | 1.32% | | 1.51% | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | |

- Including | | | | | | | | | | | | | | | | | | | |

Contingent | | | | | | | | | | | | | | | | | | | |

Deferred Sales | | | | | | | | | | | | | | | | | | | |

Charge of 1.00% | | (45.55)% | | (21.56)% | | (8.43)% | | 3.56% | | 5.40% | | | | | | | | | |

- At Net Asset Value | | (45.05)% | | (21.56)% | | (8.43)% | | 3.56% | | 5.40% | | 2.07% | | 2.26% | | | | | |

Class R (g) | | (44.77)% | | (21.17)% | | (7.98)% | | 4.07% | | 5.92% | | 1.57% | | 1.76% | | | | | |

Class S | | (44.50)% | | (20.77)% | | (7.51)% | | 4.59% | | 6.45% | | 1.07% | | 1.26% | | | | | |

Russell 2000 Value

Index** | | (38.89)% | | (17.54)% | | (5.30)% | | 4.87% | | 9.17% | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.voyageur.net. Please see footnotes on page 8. | | | | | |

| | | | | |

| | | | | | |

| | | | | PERFORMANCE SUMMARY |

| | | |

| | | | | (1) The Funds expenses reflect the most recent fiscal year-end (September 30, 2008). |

| | | |

| | | | | (2) The Adviser has contractually agreed to waive fees and/or make payments in order to keep total operating expenses of the Fund to the levels listed under net expense ratio until January 31, 2010. |

| | | |

| | | | | *The expense ratios are from the Funds’ prospectus dated January 28, 2009. Additional information pertaining to the Funds’ expense ratios as of March 31, 2009 can be found in the financial highlights. |

| | | |

| | | | | **Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but do not include sales fees or operating expenses. You cannot invest directly in indices. |

| | | | | (a) | | The performance in the table for the period from June 1, 1994 to April 19, 2004 reflects the performance of RBC Mid Cap Equity Fund, the predecessor to Tamarack Mid Cap Growth Fund. The performance of the Fund also includes the performance of a common trust fund (“CTF”) account advised by the Advisor (including its predecessor) and managed the same as the Fund in all material respects for the period from December 31, 1990 to June 1, 1994, as adjusted to reflect the full contractual rate of expenses associated with the Fund at its inception. The CTF account was not registered with the SEC under the 1940 Act and therefore was not subject to the investment restrictions imposed by law on registered mutual funds. If the CTF account had been registered, the CTF account’s performance may have been adversely affected. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| | | | | (b) | | The since inception date (commencement of operations) of the Fund is December 31, 1990. |

| | | | | (c) | | The inception date for Class C and Class R Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class A Shares of the Fund, adjusted to reflect the fees and expenses of Class C and Class R Shares, as applicable (and where applicable, the maximum sales charges of the Class C Shares). |

| | | | | (d) | | The inception date for Class S Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class I Shares of the Fund, adjusted to reflect the fees and expenses of Class S Shares. |

| | | | | (e) | | The performance in the table for the period from December 2, 1983 to April 19, 2004 reflects the performance of Babson Enterprise Fund, the predecessor to Tamarack Enterprise Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| | | | | (f) | | The since inception date (commencement of operations) of the Fund is December 2, 1983. The performance of the index since inception of the Fund is calculated from November 30, 1983. |

| | | | | (g) | | The inception date for Class A, Class C and Class R Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class A, Class C and Class R Shares, as applicable (and where applicable, the maximum sales charges of the Class A and Class C Shares). |

| | | | | (h) | | The inception date for Class I Shares of the Fund is September 30, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class I Shares, as applicable. |

| | | | | (i) | | The performance in the table for the period from August 5, 1991 to April 19, 2004 reflects the performance of Babson Enterprise Fund II, the predecessor to Tamarack Small Cap Core Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| | | | | (j) | | The since inception date (commencement of operations) of the Fund is August 5, 1991. The performance of the index since inception of the Fund is calculated from July 31, 1991. |

| | | | | (k) | | The inception date for Class I Shares of the Fund is August 2, 2007. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class I Shares, as applicable. |

| | | | | (l) | | The performance in the table for the period from September 10, 1987 to April 19, 2004 reflects the performance of Shadow Stock Fund, the predecessor to Tamarack Microcap Value Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| | | | | (m) | | The since inception date (commencement of operations) of the Fund is September 10, 1987. The performance of the index since inception of the Fund is calculated from August 31, 1987. |

| | | | | The Russell Midcap Growth Index is an unmanaged index that measures the performance of U.S. mid cap companies in the Russell 3000 Index, which have higher price-to-book ratios and higher forecasted growth rates. |

| | | | | |

8

| | | | | | |

PERFORMANCE SUMMARY | | | | | | |

The Russell 2000 Value Index is an unmanaged index that measures the performance of small cap companies in the Russell 3000 Index with lower price-to-book ratios and lower forecasted growth rates. The Russell 2000 Index is an unmanaged index that measures the performance of U.S. small cap companies in the Russell 3000 Index. | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | FUND STATISTICS (UNAUDITED) |

| | | | | | | | Tamarack Mid Cap Growth Fund |

| Investment Objective | | | | | | | | Long-term capital appreciation. |

| Benchmark | | | | | | | | Russell Midcap Growth Index |

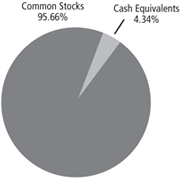

Asset Allocation (as of 3/31/09) (% of fund’s investments) & Top Five Industries (as of 3/31/09) (% of fund’s net assets) | | | | | | | |

| | | | Top Five Industries Consumer Discretionary Health Care Industrials Information Technology Energy | | 19.56%

18.34% 17.97% 15.84% 10.43% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Top Ten Holdings (as of 3/31/09) (% of fund’s net assets) | | | | | | | | Stericycle, Inc. | | 4.22% | | Dril-Quip, Inc. | | 2.96% |

| | | | | | | | LKQ Corp. | | 3.56% | | Quest Diagnostics, Inc. | | 2.80% |

| | | | | | | | Core Laboratories NV | | 3.51% | | Microchip Technology, Inc. | | 2.65% |

| | | | | | | | O’Reilly Automotive, Inc. | | 3.12% | | Fastenal Co. | | 2.57% |

| | | | | | | | Roper Industries, Inc. | | 3.07% | | GameStop Corp., Class A | | 2.47% |

| | | | | | | | *A listing of all portfolio holdings can be found on page 14. |

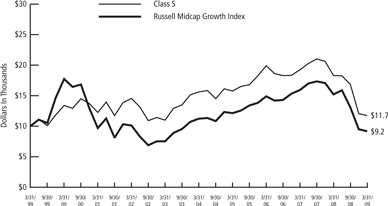

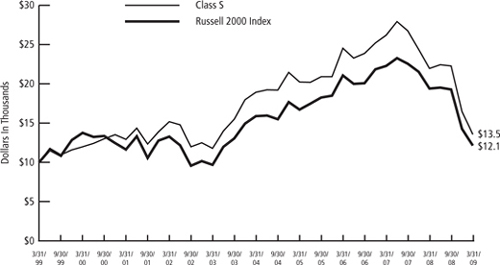

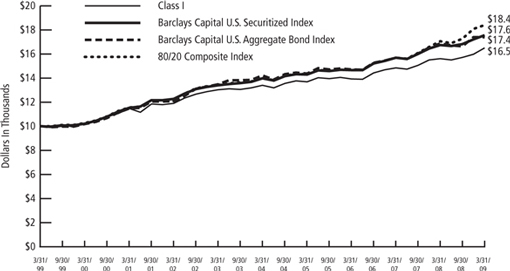

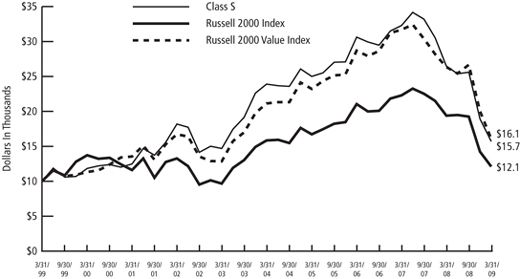

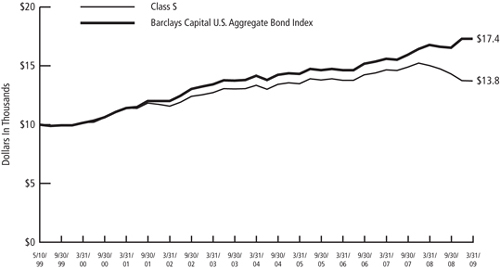

Growth of $10,000 Initial Investment Over 10 Years | | | | | | | |

|

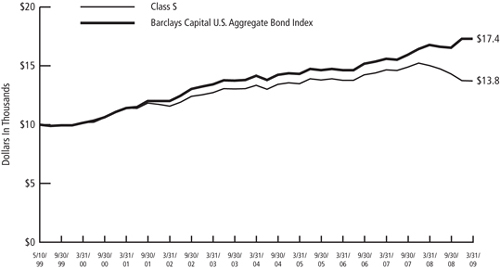

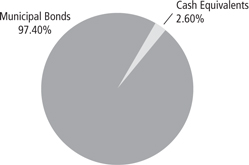

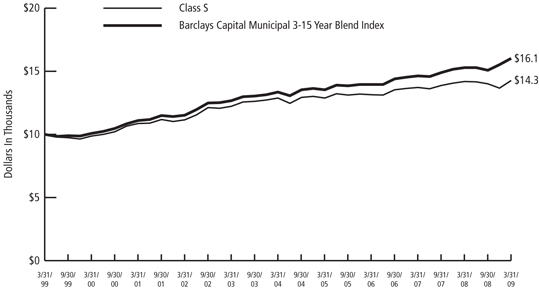

| | | | | | | | The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 1999 to April 19, 2004 reflects the performance of RBC Mid Cap Equity Fund, the predecessor to Tamarack Mid Cap Growth Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. |

| | | | | | | | |

10

| | | | | | | | | | | | | | |

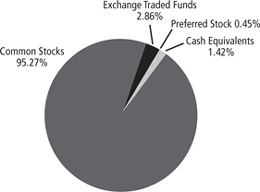

FUND STATISTICS (UNAUDITED) | | | | | | | | |

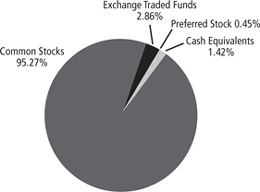

Tamarack Enterprise Fund | | | | | | | | |

Long-term growth of capital. | | | | | | | | Investment Objective |

Russell 2000 Index | | | | | | | | Benchmark |

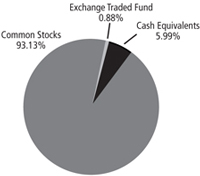

| | | | Top Five Industries

Information Technology

Industrials Consumer Discretionary Health Care Financials | | 29.67% 22.45% 15.41% 9.38% 8.36% | | | | | | | | Asset Allocation (as of 3/31/09) (% of fund’s investments) & Top Five Industries (as of 3/31/09) (% of fund’s net assets) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Universal Electronics, Inc. | | 4.87% | | Comtech Telecommunications Corp. | | 3.71% | | | | | | | | Top Ten Holdings (as of 3/31/09) (% of fund’s net assets) |

| Spectrum Control, Inc. | | 4.74% | | | | | | | | | |

| NIC, Inc. | | 4.64% | | Steinway Musical Instruments | | 3.64% | | | | | | | |

| EMS Technologies, Inc. | | 4.53% | | Landauer, Inc. | | 3.37% | | | | | | | |

| LaBarge, Inc. | | 4.42% | | AZZ, Inc. | | 3.17% | | | | | | | |

| Tyler Technologies, Inc. | | 3.83% | | | | | | | | | | | |

*A listing of all portfolio holdings can be found beginning on page 15. | | | | | | | | |

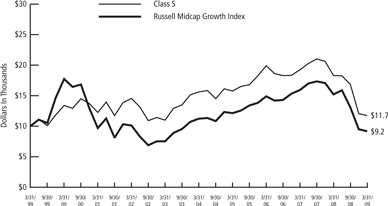

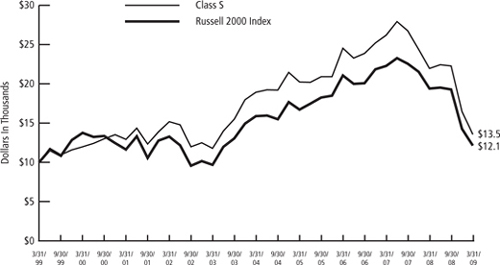

| �� | | | | | | | Growth of $10,000 Initial Investment Over 10 Years |

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 1999 to April 19, 2004 reflects the performance of Babson Enterprise Fund, the predecessor to Tamarack Enterprise Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | | | |

| | | | |

| | | | | | | | | | | | | | |

| | | | | | | | FUND STATISTICS (UNAUDITED) |

| | | | | | | | Tamarack Small Cap Core Fund |

| Investment Objective | | | | | | | | Long-term growth of capital and income. |

| Benchmark | | | | | | | | Russell 2000 Index |

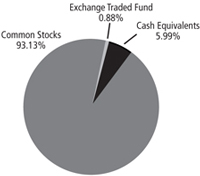

Asset Allocation (as of 3/31/09) (% of fund’s investments) & Top Five Industries (as of 3/31/09) (% of fund’s net assets) | | | | | | | |

| | | | Top Five Industries Industrials Information Technology Health Care Consumer Discretionary Financials | | 22.68%

19.97% 14.38% 11.85% 10.37% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Top Ten Holdings (as of 3/31/09) (% of fund’s net assets) | | | | | | | | West Pharmaceutical Services, Inc. | | 4.02% | | Comtech Telecommunications Corp. | | 3.03% |

| | | | | | | | EMS Technologies, Inc. | | 3.33% | | Gardner Denver, Inc. | | 2.97% |

| | | | | | | | AZZ, Inc. | | 3.29% | | Spectrum Control, Inc. | | 2.87% |

| | | | | | | | PSS World Medical, Inc. | | 3.11% | | Powell Industries, Inc. | | 2.69% |

| | | | | | | | Nash Finch Co. | | 3.09% | | Steinway Musical Instruments | | 2.57% |

| | | | | | | | *A listing of all portfolio holdings can be found beginning on page 17. |

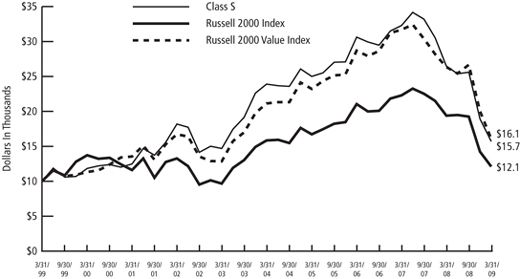

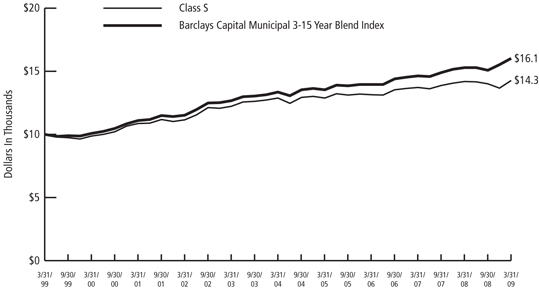

Growth of $10,000 Initial Investment Over 10 Years | | | | | | | |

|

| | | | | | | | The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 1999 to April 19, 2004 reflects the performance of Babson Enterprise Fund II, the predecessor to Tamarack Small Cap Core Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. |

| | | | | | | | |

| | | | | | | | | | | | |

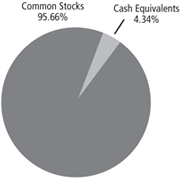

FUND STATISTICS (UNAUDITED) | | | | | | |

Tamarack Microcap Value Fund | | | | | | |

Long-term growth of capital. | | | | | | Investment Objective |

Russell 2000 Value Index | | | | | | Benchmark |

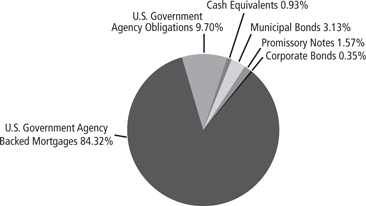

| | | | Top Five Industries Financials Industrials Consumer Discretionary Information Technology Health Care | | 20.18%

19.65% 17.90% 13.03% 6.73% | | | | | | Asset Allocation (as of 3/31/09) (% of fund’s investments) & Top Five Industries (as of 3/31/09) (% of fund’s net assets) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

iShares Russell Microcap Index | | 2.05% | | Empire District Electric Co. (The) | | 0.74% | | | | | | Top Ten Holdings (as of 3/31/09) (% of fund’s net assets) |

Fund | | | | Encore Wire Corp. | | 0.74% | | | | | |

| Enbridge Energy Management | | 0.90% | | CIRCOR International, Inc. | | 0.73% | | | | | |

| LLC | | | | Donegal Group, Inc., Class A | | 0.73% | | | | | |

| PowerShares Zacks Micro Cap | | 0.81% | | Robbins & Myers, Inc. | | 0.73% | | | | | |

| Portfolio | | | | Ingles Markets, Inc., Class A | | 0.72% | | | | | |

| Navigators Group, Inc. | | 0.76% | | | | | | | | | |

*A listing of all portfolio holdings can be found beginning on page 19. | | | | | |

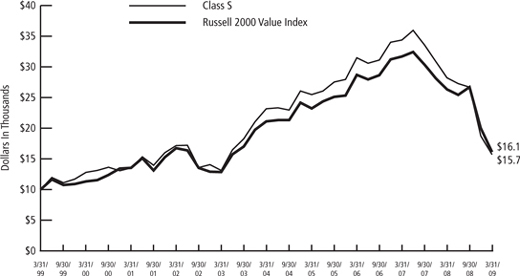

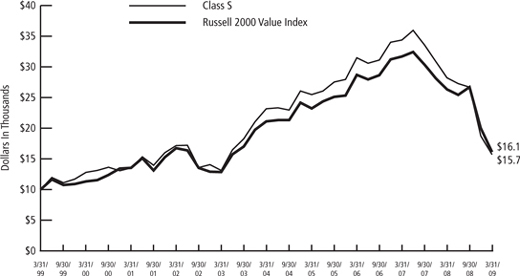

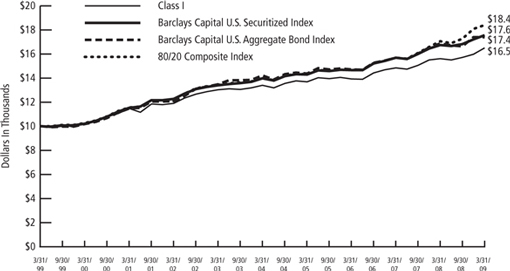

| | | | | | Growth of $10,000 Initial Investment Over 10 Years |

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 1999 to April 19, 2004 reflects the performance of Shadow Stock Fund, the predecessor to Tamarack Microcap Value Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | | | |

13

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Mid Cap Growth Fund

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| Common Stocks — 98.63% | | | |

| Consumer Discretionary — 19.56% | | | |

| 40,990 | | Aeropostale, Inc.* | | $ | 1,088,694 |

| 52,320 | | GameStop Corp., Class A* | | | 1,466,006 |

| 25,800 | | John Wiley & Sons, Inc., Class A | | | 768,324 |

| 148,160 | | LKQ Corp.* | | | 2,114,243 |

| 17,000 | | New Oriental Education & Technology Group ADR* | | | 854,250 |

| 52,920 | | O’Reilly Automotive, Inc.* | | | 1,852,729 |

| 46,090 | | PetSmart, Inc. | | | 966,047 |

| 6,680 | | Strayer Education, Inc. | | | 1,201,532 |

| 36,150 | | Tractor Supply Co.* | | | 1,303,569 |

| | | | | |

| | | | | 11,615,394 |

| | | | | |

| Consumer Staples — 6.67% | | | |

| 48,000 | | Alberto-Culver Co. | | | 1,085,280 |

| 19,000 | | Chattem, Inc.* | | | 1,064,950 |

| 16,700 | | Church & Dwight Co., Inc. | | | 872,241 |

| 26,030 | | Hansen Natural Corp.* | | | 937,080 |

| | | | | |

| | | | | 3,959,551 |

| | | | | |

| Energy — 10.43% | | | |

| 28,450 | | Core Laboratories NV | | | 2,081,402 |

| 57,300 | | Dril-Quip, Inc.* | | | 1,759,110 |

| 33,290 | | Oceaneering International, Inc* | | | 1,227,402 |

| 52,420 | | Smith International, Inc. | | | 1,125,982 |

| | | | | |

| | | | | 6,193,896 |

| | | | | |

| Financials — 3.68% | | | |

| 58,000 | | Eaton Vance Corp. | | | 1,325,300 |

| 73,320 | | Hudson City Bancorp, Inc. | | | 857,111 |

| | | | | |

| | | | | 2,182,411 |

| | | | | |

| Health Care — 18.34% | | | |

| 17,050 | | Cephalon, Inc.* | | | 1,161,105 |

| 33,000 | | Charles River Laboratories International, Inc.* | | | 897,930 |

| 15,840 | | Express Scripts, Inc.* | | | 731,333 |

| 23,900 | | Henry Schein, Inc.* | | | 956,239 |

| 53,950 | | Immucor, Inc.* | | | 1,356,842 |

| 33,220 | | Pharmaceutical Product Development, Inc. | | | 787,978 |

| 35,000 | | Quest Diagnostics, Inc. | | | 1,661,800 |

| 36,000 | | ResMed, Inc.* | | | 1,272,240 |

| 23,990 | | Varian Medical Systems, Inc.* | | | 730,256 |

| | | | | | |

| Shares | | | | Value | |

| 59,120 | | VCA Antech, Inc.* | | $ | 1,333,156 | |

| | | | | | |

| | | | | 10,888,879 | |

| | | | | | |

| Industrials — 17.97% | | | | |

| 56,150 | | Barnes Group, Inc. | | | 600,244 | |

| 19,820 | | Donaldson Co., Inc. | | | 531,969 | |

| 37,480 | | Expeditors International of Washington, Inc. | | | 1,060,309 | |

| 47,520 | | Fastenal Co. | | | 1,528,006 | |

| 13,940 | | Huron Consulting Group, Inc.* | | | 591,474 | |

| 34,000 | | IHS, Inc., Class A* | | | 1,400,120 | |

| 20,470 | | Regal-Beloit Corp. | | | 627,201 | |

| 42,990 | | Roper Industries, Inc. | | | 1,824,925 | |

| 52,480 | | Stericycle, Inc.* | | | 2,504,870 | |

| | | | | | |

| | | | | 10,669,118 | |

| | | | | | |

| Information Technology — 15.84% | | | | |

| 65,600 | | Altera Corp. | | | 1,151,280 | |

| 32,000 | | Amdocs Ltd.* | | | 592,640 | |

| 49,220 | | Ansys, Inc.* | | | 1,235,422 | |

| 68,910 | | Autodesk, Inc.* | | | 1,158,377 | |

| 47,000 | | Cognizant Technology Solutions Corp., Class A* | | | 977,130 | |

| 37,140 | | Dolby Laboratories, Inc., Class A* | | | 1,266,845 | |

| 29,000 | | FactSet Research Systems, Inc. | | | 1,449,710 | |

| 74,350 | | Microchip Technology, Inc. | | | 1,575,477 | |

| | | | | | |

| | | | | 9,406,881 | |

| | | | | | |

| Materials — 6.14% | | | | |

| 38,000 | | Airgas, Inc. | | | 1,284,780 | |

| 51,920 | | Albemarle Corp. | | | 1,130,298 | |

| 36,860 | | Greif, Inc., Class A | | | 1,227,070 | |

| | | | | | |

| | | | | 3,642,148 | |

| | | | | | |

| |

| Total Common Stocks | | | | |

| (Cost $69,235,136) | | | 58,558,278 | |

| | | | | | |

| |

| Investment Companies — 6.07% | | | | |

| 3,605,618 | | Wells Fargo Prime Investment Money Market Fund | | | 3,605,618 | |

| | | | | | |

| |

| Total Investment Companies | | | | |

| (Cost $3,605,618) | | | 3,605,618 | |

| | | | | | |

| |

Total Investments

(Cost $72,840,754)(a) — 104.70% | | | 62,163,896 | |

| |

| Liabilities in excess of other assets — (4.70)% | | | (2,789,205 | ) |

| | | | | | |

| |

| NET ASSETS — 100.00% | | $ | 59,374,691 | |

| | | | | | |

|

* Non-income producing security. |

(a) See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

|

Abbreviations used are defined below: |

ADR - American Depository Receipt |

|

|

| See notes to financial statements. |

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Enterprise Fund

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| Common Stocks — 97.36% | | | |

| Consumer Discretionary — 15.41% | | | |

| 537,000 | | Benihana, Inc., Class A* | | $ | 1,390,830 |

| 300,250 | | Cache, Inc.* | | | 864,720 |

| 740,800 | | Casual Male Retail Group, Inc.* | | | 362,992 |

| 133,630 | | Mac-Gray Corp.* | | | 698,885 |

| 134,900 | | McCormick & Schmick’s Seafood Restaurants, Inc.* | | | 528,808 |

| 421,291 | | Movado Group, Inc. | | | 3,176,534 |

| 202,900 | | Regent Communications, Inc.* | | | 26,377 |

| 315,512 | | Steinway Musical Instruments* | | | 3,776,679 |

| 27,150 | | Tefron Ltd. | | | 96,382 |

| 279,100 | | Universal Electronics, Inc.* | | | 5,051,710 |

| | | | | |

| | | | | 15,973,917 |

| | | | | |

| Consumer Staples — 0.12% | | | |

| 500,000 | | NutraCea* | | | 120,000 |

| | | | | |

| Energy — 2.42% | | | |

| 73,300 | | Goodrich Petroleum Corp.* | | | 1,419,088 |

| 28,000 | | Gulf Island Fabrication, Inc. | | | 224,280 |

| 40,000 | | OYO Geospace Corp.* | | | 522,400 |

| 44,300 | | Tesco Corp.* | | | 346,426 |

| | | | | |

| | | | | 2,512,194 |

| | | | | |

| Financials — 8.36% | | | |

| 301,300 | | Asta Funding, Inc. | | | 738,185 |

| 71,900 | | Boston Private Financial Holdings, Inc. | | | 252,369 |

| 81,059 | | CoBiz Financial, Inc. | | | 425,560 |

| 165,000 | | Compass Diversified Holdings | | | 1,471,800 |

| 52,157 | | Dearborn Bancorp, Inc.* | | | 94,926 |

| 78,800 | | Firstcity Financial Corp.* | | | 145,780 |

| 131,280 | | Harrington West Financial Group, Inc. | | | 160,161 |

| 70,000 | | LaSalle Hotel Properties | | | 408,800 |

| 84,626 | | Mercantile Bank Corp. | | | 454,442 |

| 115,389 | | MetroCorp Bancshares, Inc. | | | 320,781 |

| 115,160 | | National Interstate Corp. | | | 1,947,356 |

| 65,374 | | Northrim BanCorp, Inc. | | | 651,779 |

| 10,666 | | Sanders Morris Harris Group, Inc. | | | 41,597 |

| 99,900 | | SWS Group, Inc. | | | 1,551,447 |

| | | | | |

| | | | | 8,664,983 |

| | | | | |

| Health Care — 9.38% | | | |

| 31,832 | | HMS Holdings Corp.* | | | 1,047,273 |

| 94,800 | | Kensey Nash Corp.* | | | 2,016,396 |

| 68,900 | | Landauer, Inc. | | | 3,491,852 |

| 175,100 | | Meridian Bioscience, Inc. | | | 3,172,812 |

| | | | | |

| | | | | 9,728,333 |

| | | | | |

| Industrials — 22.45% | | | |

| 410,870 | | Allied Defense Group, Inc. (The)* | | | 1,618,828 |

| 124,700 | | AZZ, Inc.* | | | 3,290,833 |

| 600,000 | | C&D Technologies, Inc.* | | | 1,110,000 |

| 301,725 | | Columbus McKinnon Corp.* | | | 2,631,042 |

| 82,200 | | Ennis, Inc. | | | 728,292 |

| | | | | |

| Shares | | | | Value |

| 58,700 | | Hardinge, Inc. | | $ | 163,773 |

| 18,900 | | Hurco Cos, Inc.* | | | 200,907 |

| 547,894 | | LaBarge, Inc.* | | | 4,585,873 |

| 278,100 | | NN, Inc. | | | 350,406 |

| 44,200 | | Old Dominion Freight Line, Inc.* | | | 1,038,258 |

| 180,000 | | Orion Marine Group, Inc.* | | | 2,358,000 |

| 250,000 | | PGT, Inc.* | | | 347,500 |

| 5,589 | | Rush Enterprises, Inc., Class A* | | | 49,854 |

| 159,578 | | Standard Parking Corp.* | | | 2,617,079 |

| 150,000 | | Sun Hydraulics Corp. | | | 2,191,500 |

| | | | | |

| | | | | 23,282,145 |

| | | | | |

| Information Technology — 29.67% | | | |

| 247,682 | | Aspen Technology, Inc.* | | | 1,731,297 |

| 100,000 | | Computer Task Group, Inc.* | | | 345,000 |

| 155,277 | | Comtech Telecommunications Corp.* | | | 3,846,212 |

| 502,402 | | DivX, Inc.* | | | 2,527,082 |

| 257,691 | | Edgewater Technology, Inc.* | | | 721,535 |

| 269,200 | | EMS Technologies, Inc.* | | | 4,700,232 |

| 221,200 | | Hypercom Corp.* | | | 212,352 |

| 113,000 | | Interactive Intelligence, Inc.* | | | 1,023,780 |

| 574,238 | | Lionbridge Technologies, Inc.* | | | 562,753 |

| 924,500 | | NIC, Inc. | | | 4,807,400 |

| 249,190 | | NU Horizons Electronics Corp.* | | | 498,380 |

| 751,511 | | Sonic Solutions, Inc.* | | | 901,813 |

| 699,300 | | Spectrum Control, Inc.* | | | 4,916,079 |

| 271,300 | | Tyler Technologies, Inc.* | | | 3,969,119 |

| | | | | |

| | | | | 30,763,034 |

| | | | | |

| Materials — 6.21% | | | |

| 624,900 | | Intertape Polymer Group, Inc.* | | | 262,458 |

| 110,000 | | Koppers Holdings, Inc. | | | 1,597,200 |

| 209,800 | | Landec Corp.* | | | 1,168,586 |

| 178,800 | | Omnova Solutions, Inc.* | | | 311,112 |

| 79,442 | | Penford Corp. | | | 288,374 |

| 187,088 | | Universal Stainless & Alloy* | | | 1,809,141 |

| 503,300 | | US Concrete, Inc.* | | | 1,006,600 |

| | | | | |

| | | | | 6,443,471 |

| | | | | |

| Utilities — 3.34% | | | |

| 107,400 | | Central Vermont Public Service Corp. | | | 1,858,020 |

| 79,800 | | Unitil Corp. | | | 1,602,384 |

| | | | | |

| | | | | 3,460,404 |

| | | | | |

| |

| Total Common Stocks | | | |

| (Cost $166,252,871) | | | 100,948,481 |

| | | | | |

| |

| Exchange Traded Fund — 0.93% | | | |

| 50,000 | | SPDR KBW Regional Banking | | | 961,000 |

| | | | | |

| |

| Total Exchange Traded Fund | | | |

| (Cost $1,368,357) | | | 961,000 |

| | | | | |

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Enterprise Fund (cont.)

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| Investment Companies — 6.26% | | | |

| 47,700 | | First Opportunity Fund, Inc. | | $ | 206,064 |

| 6,282,705 | | Wells Fargo Prime Investment Money Market Fund | | | 6,282,705 |

| | | | | |

| |

Total Investment Companies

(Cost $6,676,620) | | | 6,488,769 |

| | | | | |

| | | | |

| | | Value | |

Total Investments (Cost $174,297,848)(a) — 104.55% | | $ | 108,398,250 | |

| |

Liabilities in excess of other assets — (4.55)% | | | (4,712,729 | ) |

| | | | |

| |

NET ASSETS — 100.00% | | $ | 103,685,521 | |

| | | | |

| * | Non-income producing security. |

| (a) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

See notes to financial statements.

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Small Cap Core Fund

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| Common Stocks — 96.32% | | | |

| Consumer Discretionary — 11.85% | | | |

| 237,000 | | Casual Male Retail Group, Inc.* | | $ | 116,130 |

| 23,000 | | Dress Barn, Inc.* | | | 282,670 |

| 16,600 | | Drew Industries, Inc.* | | | 144,088 |

| 12,800 | | Jo-Ann Stores, Inc.* | | | 209,152 |

| 62,900 | | Movado Group, Inc. | | | 474,266 |

| 58,900 | | Steinway Musical Instruments* | | | 705,033 |

| 15,300 | | Steven Madden Ltd.* | | | 287,334 |

| 36,600 | | True Religion Apparel, Inc.* | | | 432,246 |

| 32,962 | | Universal Electronics, Inc.* | | | 596,612 |

| | | | | |

| | | | | 3,247,531 |

| | | | | |

| Consumer Staples — 5.33% | | | |

| 22,400 | | Alberto-Culver Co. | | | 506,464 |

| 30,100 | | Nash Finch Co. | | | 845,509 |

| 19,300 | | Sally Beauty Holdings, Inc.* | | | 109,624 |

| | | | | |

| | | | | 1,461,597 |

| | | | | |

| Energy — 3.53% | | | |

| 3,000 | | CARBO Ceramics, Inc. | | | 85,320 |

| 1,800 | | Core Laboratories NV | | | 131,688 |

| 15,200 | | Swift Energy Co.* | | | 110,960 |

| 28,100 | | Tesco Corp.* | | | 219,742 |

| 17,800 | | Willbros Group, Inc.* | | | 172,660 |

| 7,800 | | World Fuel Services Corp. | | | 246,714 |

| | | | | |

| | | | | 967,084 |

| | | | | |

| Financials — 10.37% | | | |

| 21,000 | | Amerisafe, Inc.* | | | 321,720 |

| 67,300 | | Ares Capital Corp. | | | 325,732 |

| 38,600 | | Asta Funding, Inc. | | | 94,570 |

| 72,900 | | Compass Diversified Holdings | | | 650,268 |

| 24,325 | | Delphi Financial Group, Inc., Class A | | | 327,415 |

| 55,400 | | LaSalle Hotel Properties | | | 323,536 |

| 7,200 | | ProAssurance Corp.* | | | 335,664 |

| 9,600 | | SeaBright Insurance Holdings, Inc.* | | | 100,416 |

| 8,800 | | SWS Group, Inc. | | | 136,664 |

| 4,072 | | Trico Bancshares | | | 68,165 |

| 105,300 | | UCBH Holdings, Inc. | | | 159,003 |

| | | | | |

| | | | | 2,843,153 |

| | | | | |

| Health Care — 14.38% | | | |

| 15,400 | | Amedisys, Inc.* | | | 423,346 |

| 13,900 | | Emergency Medical Services Corp., Class A* | | | 436,321 |

| 30,200 | | Invacare Corp. | | | 484,106 |

| 11,700 | | Kinetic Concepts, Inc.* | | | 247,104 |

| 21,900 | | Meridian Bioscience, Inc. | | | 396,828 |

| 59,375 | | PSS World Medical, Inc.* | | | 852,031 |

| 33,600 | | West Pharmaceutical Services, Inc. | | | 1,102,416 |

| | | | | |

| | | | | 3,942,152 |

| | | | | |

| | | | | |

| Shares | | | | Value |

| Industrials — 22.68% | | | |

| 34,200 | | AZZ, Inc.* | | $ | 902,538 |

| 185,800 | | C&D Technologies, Inc.* | | | 343,730 |

| 25,800 | | Chart Industries, Inc.* | | | 203,304 |

| 64,200 | | Columbus McKinnon Corp.* | | | 559,824 |

| 23,900 | | Forward Air Corp. | | | 387,897 |

| 37,500 | | Gardner Denver, Inc.* | | | 815,250 |

| 22,100 | | II-VI, Inc.* | | | 379,678 |

| 31,000 | | Insteel Industries, Inc. | | | 215,760 |

| 142,000 | | Interface, Inc., Class A | | | 424,580 |

| 5,500 | | LB Foster Co., Class A* | | | 136,565 |

| 20,900 | | Powell Industries, Inc.* | | | 737,979 |

| 29,100 | | Sun Hydraulics Corp. | | | 425,151 |

| 6,800 | | Tennant Co. | | | 63,716 |

| 23,500 | | Wabtec Corp. | | | 619,930 |

| | | | | |

| | | | | 6,215,902 |

| | | | | |

| Information Technology — 19.97% | | | |

| 45,000 | | ADC Telecommunications, Inc.* | | | 197,550 |

| 83,300 | | Aspen Technology, Inc.* | | | 582,267 |

| 33,500 | | Comtech Telecommunications Corp.* | | | 829,795 |

| 116,724 | | DivX, Inc.* | | | 587,122 |

| 52,200 | | EMS Technologies, Inc.* | | | 911,412 |

| 119,400 | | NIC, Inc. | | | 620,880 |

| 66,700 | | Skyworks Solutions, Inc.* | | | 537,602 |

| 151,700 | | Sonic Solutions, Inc.* | | | 182,040 |

| 111,900 | | Spectrum Control, Inc.* | | | 786,657 |

| 107,900 | | Xyratex Ltd.* | | | 237,380 |

| | | | | |

| | | | | 5,472,705 |

| | | | | |

| Materials — 2.93% | | | |

| 7,200 | | Arch Chemicals, Inc. | | | 136,512 |

| 59,900 | | Intertape Polymer Group, Inc.* | | | 25,158 |

| 24,200 | | Koppers Holdings, Inc. | | | 351,384 |

| 30,000 | | Universal Stainless & Alloy* | | | 290,100 |

| | | | | |

| | | | | 803,154 |

| | | | | |

| Telecommunication Services — 2.38% | | | |

| 74,100 | | Premiere Global Services, Inc.* | | | 653,562 |

| | | | | |

| Utilities — 2.90% | | | |

| 14,000 | | Energen Corp. | | | 407,820 |

| 13,700 | | Unisource Energy Corp. | | | 386,203 |

| | | | | |

| | | | | 794,023 |

| | | | | |

| |

| Total Common Stocks | | | |

| (Cost $36,729,668) | | | 26,400,863 |

| | | | | |

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Small Cap Core Fund (cont.)

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| Investment Companies — 4.37% | | | |

| 47,800 | | First Opportunity Fund, Inc. | | $ | 206,496 |

| 991,039 | | Wells Fargo Prime Investment Money Market Fund | | | 991,039 |

| | | | | |

| |

Total Investment Companies

(Cost $1,437,187) | | | 1,197,535 |

| | | | | |

| | | | |

| | | Value | |

Total Investments (Cost $38,166,855)(a) — 100.69% | | $ | 27,598,398 | |

| |

Liabilities in excess of other assets — (0.69)% | | | (190,063 | ) |

| | | | |

| |

NET ASSETS — 100.00% | | $ | 27,408,335 | |

| | | | |

| * | Non-income producing security. |

| (a) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

See notes to financial statements.

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Microcap Value Fund

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| Common Stocks — 95.38% | | | |

| Consumer Discretionary — 17.90% | | | |

| 96,000 | | Adams Golf, Inc.* | | $ | 230,400 |

| 2,800 | | Allen Organ Co.(a)(b) | | | 0 |

| 29,800 | | Ambassadors International, Inc.* | | | 11,622 |

| 34,500 | | America’s Car-Mart, Inc.* | | | 468,855 |

| 53,000 | | Arctic Cat, Inc. | | | 202,990 |

| 60,000 | | Asbury Automotive Group, Inc. | | | 258,600 |

| 65,000 | | Audiovox Corp., Class A* | | | 222,950 |

| 90,000 | | Bakers Footwear Group, Inc.* | | | 36,000 |

| 29,000 | | Bassett Furniture Industries, Inc. | | | 56,260 |

| 48,000 | | Beazer Homes USA, Inc.* | | | 48,480 |

| 69,000 | | Benihana, Inc., Class A* | | | 178,710 |

| 69,000 | | Bluegreen Corp.* | | | 120,060 |

| 45,000 | | Bon-Ton Stores, Inc. (The) | | | 78,750 |

| 46,000 | | Books-A-Million, Inc. | | | 211,600 |

| 15,127 | | Bowl America, Inc., Class A | | | 148,245 |

| 43,000 | | Brookfield Homes Corp. | | | 148,350 |

| 72,000 | | Build-A-Bear Workshop, Inc.* | | | 437,040 |

| 44,000 | | Carriage Services, Inc.* | | | 67,320 |

| 61,000 | | Charlotte Russe Holding, Inc.* | | | 497,150 |

| 45,000 | | Cobra Electronics Corp. | | | 40,500 |

| 23,000 | | Core-Mark Holding Co., Inc.* | | | 419,060 |

| 84,000 | | Cost Plus, Inc.* | | | 79,800 |

| 99,000 | | Craftmade International, Inc.* | | | 130,680 |

| 32,000 | | CSS Industries, Inc. | | | 544,000 |

| 42,000 | | Delta Apparel, Inc.* | | | 181,860 |

| 43,000 | | Destination Maternity Corp.* | | | 271,330 |

| 56,000 | | Dixie Group, Inc.* | | | 61,600 |

| 40,000 | | Dorman Products, Inc.* | | | 373,200 |

| 17,500 | | Duckwall-ALCO Stores, Inc.* | | | 157,325 |

| 84,000 | | Emmis Communications Corp., Class A* | | | 32,760 |

| 41,000 | | Entercom Communications Corp., Class A | | | 45,100 |

| 117,000 | | Finish Line, Inc. (The), Class A | | | 774,540 |

| 56,000 | | Flexsteel Industries | | | 288,960 |

| 67,000 | | Fred’s, Inc., Class A | | | 755,760 |

| 53,000 | | Furniture Brands International, Inc. | | | 77,910 |

| 36,000 | | Gaiam, Inc., Class A* | | | 118,080 |

| 85,000 | | Golfsmith International Holdings, Inc.* | | | 84,150 |

| 24,000 | | Group 1 Automotive, Inc. | | | 335,280 |

| 26,000 | | Hampshire Group Ltd.* | | | 136,500 |

| 106,000 | | Handleman Co.* | | | 3,604 |

| 78,300 | | Hartmarx Corp.* | | | 3,445 |

| 89,000 | | Hastings Entertainment, Inc.* | | | 224,280 |

| 61,750 | | Haverty Furniture Cos., Inc. | | | 650,228 |

| 27,000 | | Helen of Troy Ltd.* | | | 371,250 |

| 31,000 | | Hooker Furniture Corp. | | | 261,640 |

| 50,000 | | HOT Topic, Inc.* | | | 559,500 |

| 135,000 | | Interstate Hotels & Resorts, Inc.* | | | 59,400 |

| 75,000 | | Isle of Capri Casinos, Inc.* | | | 396,750 |

| 15,000 | | J Alexander’s Corp.* | | | 42,225 |

| | | | | |

| Shares | | | | Value |

| 73,000 | | Jakks Pacific, Inc.* | | $ | 901,550 |

| 29,000 | | Johnson Outdoors, Inc., Class A | | | 146,450 |

| 24,000 | | Jos. A. Bank Clothiers, Inc.* | | | 667,440 |

| 82,000 | | Journal Communications, Inc., Class A | | | 61,500 |

| 102,000 | | Journal Register Co.* | | | 510 |

| 58,310 | | Lakeland Industries, Inc.* | | | 315,457 |

| 22,000 | | Landry’s Restaurants, Inc. | | | 114,840 |

| 95,270 | | Lazare Kaplan International, Inc.* | | | 100,986 |

| 100,000 | | La-Z-Boy, Inc. | | | 125,000 |

| 48,000 | | Lee Enterprises, Inc. | | | 13,440 |

| 31,000 | | Lifetime Brands, Inc. | | | 41,230 |

| 77,000 | | LIN TV Corp., Class A* | | | 86,240 |

| 25,000 | | Lithia Motors, Inc., Class A | | | 56,250 |

| 91,000 | | Luby’s, Inc.* | | | 446,810 |

| 37,800 | | M/I Homes, Inc. | | | 264,222 |

| 36,000 | | Mac-Gray Corp.* | | | 188,280 |

| 28,000 | | Marcus Corp. | | | 238,000 |

| 43,000 | | MarineMax, Inc.* | | | 84,280 |

| 64,000 | | McCormick & Schmick’s Seafood Restaurants, Inc.* | | | 250,880 |

| 7,500 | | McRae Industries, Inc., Class A | | | 95,700 |

| 26,000 | | Media General, Inc., Class A | | | 49,920 |

| 38,000 | | Meritage Homes Corp.* | | | 433,960 |

| 21,300 | | Mestek, Inc.* | | | 133,125 |

| 39,000 | | Modine Manufacturing Co. | | | 97,500 |

| 18,250 | | Monro Muffler Brake, Inc. | | | 498,772 |

| 82,000 | | Morton’s Restaurant Group, Inc.* | | | 218,940 |

| 69,400 | | Movado Group, Inc. | | | 523,276 |

| 18,300 | | Nobel Learning Communities, Inc.* | | | 214,842 |

| 10,300 | | Nobility Homes, Inc. | | | 74,675 |

| 32,000 | | O’Charleys, Inc. | | | 96,320 |

| 41,000 | | Orleans Homebuilders, Inc. | | | 97,990 |

| 29,000 | | Oxford Industries, Inc. | | | 178,930 |

| 60,000 | | Palm Harbor Homes, Inc.* | | | 133,800 |

| 36,750 | | Perry Ellis International, Inc.* | | | 127,155 |

| 135,000 | | Point.360* | | | 166,050 |

| 71,000 | | Pomeroy IT Solutions, Inc.* | | | 265,540 |

| 90,600 | | Radio One, Inc., Class D* | | | 40,770 |

| 34,000 | | RC2 Corp.* | | | 179,180 |

| 56,000 | | Red Lion Hotels Corp.* | | | 164,080 |

| 37,550 | | Rex Stores Corp.* | | | 402,536 |

| 40,000 | | Rocky Brands, Inc.* | | | 140,000 |

| 85,000 | | Ruby Tuesday, Inc.* | | | 248,200 |

| 20,000 | | Saga Communications, Inc., Class A* | | | 75,200 |

| 45,150 | | Salem Communications Corp., Class A* | | | 25,284 |

| 90,000 | | Shiloh Industries, Inc.* | | | 184,500 |

| 36,000 | | Shoe Carnival, Inc.* | | | 372,600 |

| 131,000 | | Source Interlink Cos., Inc.* | | | 24,235 |

| 49,000 | | Stage Stores, Inc. | | | 493,920 |

| 89,000 | | Standard Motor Products, Inc. | | | 244,750 |

| 55,000 | | Steak N Shake Co. (The)* | | | 416,350 |

| 111,000 | | Stein Mart, Inc.* | | | 320,790 |

| 26,000 | | Steinway Musical Instruments* | | | 311,220 |

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Microcap Value Fund (cont.)

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| 103,000 | | Stewart Enterprises, Inc., Class A | | $ | 333,720 |

| 66,000 | | Stoneridge, Inc.* | | | 139,260 |

| 17,000 | | Strattec Security Corp. | | | 141,780 |

| 30,000 | | Superior Industries International, Inc. | | | 355,500 |

| 43,000 | | Syms Corp.* | | | 263,160 |

| 72,000 | | Systemax, Inc.* | | | 930,240 |

| 150,000 | | Trans World Entertainment Corp.* | | | 91,500 |

| 50,000 | | Tuesday Morning Corp.* | | | 63,500 |

| 22,000 | | Walking Co. Holdings, Inc. (The)* | | | 46,860 |

| 75,080 | | Westwood One, Inc.* | | | 4,505 |

| 13,400 | | Weyco Group, Inc. | | | 347,328 |

| | | | | |

| | | | | 24,774,927 |

| | | | | |

| Consumer Staples — 4.96% | | | |

| 18,307 | | American Italian Pasta Co., Class A* | | | 637,267 |

| 42,800 | | Andersons, Inc. (The) | | | 605,192 |

| 9,300 | | Cagle’s, Inc., Class A* | | | 16,275 |

| 94,000 | | Central Garden and Pet Co.* | | | 715,340 |

| 36,000 | | Chiquita Brands International, Inc.* | | | 238,680 |

| 110,000 | | Craft Brewers Alliance, Inc.* | | | 127,600 |

| 83,000 | | Elizabeth Arden, Inc.* | | | 483,890 |

| 31,000 | | Farmer Bros. Co. | | | 551,800 |

| 67,000 | | Ingles Markets, Inc., Class A | | | 1,000,310 |

| 44,000 | | MGP Ingredients, Inc.* | | | 32,560 |

| 143,000 | | ML Macadamia Orchards LP* | | | 264,550 |

| 10,000 | | Nash Finch Co. | | | 280,900 |

| 35,500 | | National Beverage Corp.* | | | 325,535 |

| 69,000 | | Omega Protein Corp.* | | | 182,160 |

| 54,000 | | Prestige Brands Holdings, Inc.* | | | 279,720 |

| 10,575 | | Sanderson Farms, Inc. | | | 397,091 |

| 22,000 | | Spartan Stores, Inc. | | | 339,020 |

| 76,450 | | Spectrum Brands, Inc.* | | | 9,938 |

| 91,000 | | Tasty Baking Co. | | | 384,020 |

| | | | | |

| | | | | 6,871,848 |

| | | | | |

| Energy — 3.85% | | | |

| 119,000 | | Aventine Renewable Energy Holdings, Inc.* | | | 10,115 |

| 119,000 | | Brigham Exploration Co.* | | | 226,100 |

| 44,000 | | Bronco Drilling Co., Inc.* | | | 231,440 |

| 40,000 | | Callon Petroleum Co.* | | | 43,600 |

| 39,000 | | Calumet Specialty Products Partners LP | | | 425,100 |

| 31,000 | | Constellation Energy Partners LLC | | | 48,670 |

| 43,124 | | Enbridge Energy Management LLC* | | | 1,249,302 |

| 19,000 | | EV Energy Partner LP | | | 275,500 |

| 98,000 | | Harvest Natural Resources, Inc.* | | | 332,220 |

| 61,000 | | HKN, Inc.* | | | 90,280 |

| 47,000 | | Knightsbridge Tankers Ltd. | | | 683,850 |

| 25,000 | | Lufkin Industries, Inc. | | | 947,000 |

| 106,000 | | Newpark Resources, Inc.* | | | 268,180 |

| 14,600 | | PHI, Inc.* | | | 191,844 |

| 20,000 | | PHI, Inc., Non voting* | | | 199,600 |

| | | | | |

| Shares | | | | Value |

| 48,000 | | Trico Marine Services, Inc.* | | $ | 100,800 |

| 78,570 | | VeraSun Energy Corp.* | | | 1,572 |

| | | | | |

| | | | | 5,325,173 |

| | | | | |

| Financials — 20.18% | | | |

| 70,000 | | 21st Century Holding Co. | | | 233,800 |

| 68,000 | | Advanta Corp., Class A | | | 34,680 |

| 40,000 | | Affirmative Insurance Holdings, Inc. | | | 127,200 |

| 105,000 | | American Equity Investment Life Holding Co. | | | 436,800 |

| 75,000 | | American Independence Corp.* | | | 266,250 |

| 19,000 | | American Safety Insurance Holdings Ltd.* | | | 218,690 |

| 30,000 | | Ameris Bancorp | | | 141,300 |

| 92,000 | | Asta Funding, Inc. | | | 225,400 |

| 16,000 | | Avatar Holdings, Inc.* | | | 239,680 |

| 21,000 | | Baldwin & Lyons, Inc., Class B | | | 397,320 |

| 14,500 | | Bancinsurance Corp.* | | | 50,895 |

| 45,000 | | BankUnited Financial Corp., Class A | | | 10,350 |

| 31,000 | | Banner Corp. | | | 90,210 |

| 100,000 | | Beverly Hills Bancorp, Inc.* | | | 12,000 |

| 52,000 | | California First National Bancorp | | | 390,000 |

| 21,000 | | Camco Financial Corp. | | | 35,280 |

| 5,200 | | Capital Southwest Corp. | | | 397,228 |

| 38,000 | | Capitol Bancorp Ltd. | | | 157,700 |

| 44,000 | | Central Pacific Financial Corp. | | | 246,400 |

| 25,000 | | Citizens South Banking Corp. | | | 131,000 |

| 48,150 | | Citizens, Inc.* | | | 350,050 |

| 133,000 | | Consumer Portfolio Services* | | | 67,830 |

| 43,000 | | Cowen Group, Inc.* | | | 209,410 |

| 58,821 | | Crawford & Co., Class B* | | | 395,277 |

| 4,150 | | Deerfield Capital Corp. | | | 4,150 |

| 65,777 | | Donegal Group, Inc., Class A | | | 1,010,992 |

| 12,444 | | Donegal Group, Inc., Class B | | | 188,527 |

| 75,040 | | Dynex Capital, Inc. REIT | | | 526,781 |

| 31,000 | | EMC Insurance Group, Inc. | | | 653,170 |

| 21,000 | | First Cash Financial Services, Inc.* | | | 313,320 |

| 11,000 | | First Financial Corp. | | | 405,900 |

| 58,000 | | First Industrial Realty Trust, Inc. | | | 142,100 |

| 54,000 | | First Merchants Corp. | | | 582,660 |

| 14,000 | | First Pactrust Bancorp, Inc. | | | 94,500 |

| 38,000 | | First Place Financial Corp. | | | 127,680 |

| 42,000 | | First State Bancorp | | | 59,220 |

| 25,000 | | Firstcity Financial Corp.* | | | 46,250 |

| 66,000 | | Flagstar Bancorp, Inc.* | | | 49,500 |

| 60,660 | | FNB Corp. | | | 465,262 |

| 45,000 | | FNB United Corp. | | | 108,900 |

| 22,000 | | FPIC Insurance Group, Inc.* | | | 814,660 |

| 62,000 | | Franklin Bank Corp.*(b) | | | 0 |

| 109,000 | | Fremont General Corp.* | | | 6,649 |

| 2,250 | | FRMO Corp.* | | | 1,688 |

| 45,000 | | Gladstone Investment Corp. | | | 171,900 |

| 108,000 | | Guaranty Bancorp* | | | 189,000 |

| 36,850 | | Hampton Roads Bankshares, Inc. | | | 287,061 |

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Microcap Value Fund (cont.)

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| 36,180 | | Harleysville National Corp. | | $ | 219,251 |

| 66,529 | | Hercules Technology Growth Capital, Inc. | | | 332,643 |

| 38,000 | | HF Financial Corp. | | | 484,500 |

| 36,000 | | Independence Holding Co. | | | 180,360 |

| 13,000 | | Indiana Community Bancorp | | | 169,000 |

| 13,000 | | Infinity Property & Casualty Corp. | | | 441,090 |

| 31,000 | | Intervest Bancshares Corp., Class A | | | 66,650 |

| 8,300 | | Investors Title Co. | | | 240,617 |

| 24,000 | | Jefferson Bancshares, Inc. | | | 184,560 |

| 17,000 | | Kansas City Life Insurance Co. | | | 609,450 |

| 56,930 | | LaBranche & Co., Inc.* | | | 212,918 |

| 11,000 | | LSB Corp. | | | 98,340 |

| 53,000 | | Marlin Business Services Corp.* | | | 207,760 |

| 41,353 | | Mass Financial Corp., Class A* | | | 184,021 |

| 108,000 | | MCG Capital Corp. | | | 138,240 |

| 138,751 | | Meadowbrook Insurance Group, Inc. | | | 846,379 |

| 62,000 | | Medallion Financial Corp. | | | 459,420 |

| 43,000 | | Mercer Insurance Group, Inc. | | | 614,470 |

| 136,000 | | MicroFinancial, Inc. | | | 272,000 |

| 12,000 | | MutualFirst Financial, Inc. | | | 57,600 |

| 5,300 | | National Security Group, Inc. | | | 37,842 |

| 6,000 | | National Western Life Insurance Co., Class A | | | 678,000 |

| 22,400 | | Navigators Group, Inc.* | | | 1,056,832 |

| 43,000 | | NGP Capital Resources Co. | | | 213,710 |

| 90,000 | | Nicholas Financial, Inc.* | | | 235,800 |

| 16,000 | | NYMAGIC, Inc. | | | 195,200 |

| 18,000 | | Pacific Mercantile Bancorp* | | | 63,540 |

| 19,000 | | Parkway Properties, Inc. | | | 195,700 |

| 50,000 | | Patriot Capital Funding, Inc. | | | 91,500 |

| 104,830 | | Paulson Capital Corp.* | | | 105,878 |

| 29,000 | | Peoples Bancorp, Inc. | | | 376,420 |

| 65,000 | | PMA Capital Corp., Class A* | | | 271,050 |

| 37,900 | | PMC Commercial Trust REIT | | | 210,345 |

| 40,000 | | Presidential Life Corp. | | | 311,600 |

| 39,000 | | Prospect Capital Corp. | | | 332,280 |

| 19,000 | | Provident Financial Holdings, Inc. | | | 99,940 |

| 89,000 | | Reis, Inc.* | | | 289,250 |

| 49,000 | | Resource America, Inc., Class A | | | 195,510 |

| 17,000 | | Safety Insurance Group, Inc. | | | 528,360 |

| 50,000 | | Sanders Morris Harris Group, Inc. | | | 195,000 |

| 42,000 | | SeaBright Insurance Holdings, Inc.* | | | 439,320 |

| 21,000 | | Simmons First National Corp., Class A | | | 528,990 |

| 32,000 | | Southern Community Financial Corp. | | | 113,920 |

| 98,000 | | Specialty Underwriters Alliance, Inc.* | | | 355,740 |

| 47,000 | | Stewart Information Services Corp. | | | 916,500 |

| 8,999 | | Stifel Financial Corp.* | | | 389,747 |

| 72,000 | | Sun Bancorp, Inc.* | | | 373,680 |

| 46,500 | | SWS Group, Inc. | | | 722,145 |

| 54,000 | | TierOne Corp. | | | 115,560 |

| 68,000 | | Unico American Corp.* | | | 510,000 |

| 99,716 | | United Community Financial Corp. | | | 120,656 |

| 128,000 | | United PanAm Financial Corp.* | | | 185,600 |

| | | | | |

| Shares | | | | Value |

| 19,000 | | United Western Bancorp, Inc. | | $ | 92,720 |

| 29,000 | | Winthrop Realty Trust | | | 200,390 |

| 4,600 | | Ziegler Cos., Inc. (The)* | | | 52,900 |

| | | | | |

| | | | | 27,935,514 |

| | | | | |

| Health Care — 6.73% | | | |

| 31,000 | | Air Methods Corp.* | | | 524,210 |

| 54,000 | | Albany Molecular Research, Inc.* | | | 509,220 |

| 128,000 | | Allied Healthcare International, Inc.* | | | 162,560 |

| 131,000 | | Allion Healthcare, Inc.* | | | 602,600 |

| 11,000 | | American Shared Hospital Services* | | | 22,000 |

| 46,000 | | Angiodynamics, Inc.* | | | 517,040 |

| 92,000 | | BioScrip, Inc.* | | | 215,280 |

| 57,000 | | Cantel Medical Corp.* | | | 733,590 |

| 67,000 | | Cardiac Science Corp.* | | | 201,670 |

| 26,000 | | Conmed Corp.* | | | 374,660 |

| 46,000 | | Cross Country Healthcare, Inc.* | | | 301,300 |

| 27,970 | | Hanger Orthopedic Group, Inc.* | | | 370,602 |

| 82,000 | | HealthTronics, Inc.* | | | 111,520 |

| 20,313 | | IntegraMed America, Inc.* | | | 123,706 |

| 28,000 | | Invacare Corp. | | | 448,840 |

| 7,100 | | Kewaunee Scientific Corp. | | | 65,675 |

| 30,000 | | Lannett Co., Inc.* | | | 162,000 |

| 31,000 | | Medcath Corp.* | | | 225,370 |

| 84,000 | | Medical Staffing Network Holdings, Inc.* | | | 12,600 |

| 19,000 | | Mediware Information Systems* | | | 79,800 |

| 51,000 | | MedQuist, Inc. | | | 130,050 |

| 42,000 | | National Dentex Corp.* | | | 163,380 |

| 42,000 | | PDI, Inc.* | | | 127,680 |

| 41,000 | | PharMerica Corp.* | | | 682,240 |

| 49,000 | | RehabCare Group, Inc.* | | | 854,560 |

| 62,000 | | Res-Care, Inc.* | | | 902,720 |

| 13,888 | | SXC Health Solutions Corp.* | | | 299,148 |

| 28,000 | | Synovis Life Technologies, Inc.* | | | 387,520 |

| | | | | |

| | | | | 9,311,541 |

| | | | | |

| Industrials — 19.65% | | | |

| 50,839 | | Aceto Corp. | | | 303,000 |

| 24,000 | | Alamo Group, Inc. | | | 255,840 |

| 125,000 | | Allied Motion Technologies, Inc.* | | | 203,750 |

| 44,000 | | Altra Holdings, Inc.* | | | 170,720 |

| 13,000 | | Amrep Corp.* | | | 204,100 |

| 59,000 | | ATC Technology Corp.* | | | 660,800 |

| 25,000 | | AZZ, Inc.* | | | 659,750 |

| 34,000 | | Beacon Roofing Supply, Inc.* | | | 455,260 |

| 103,000 | | Builders FirstSource, Inc.* | | | 208,060 |

| 28,800 | | Cascade Corp. | | | 507,744 |

| 94,000 | | Celadon Group, Inc.* | | | 521,700 |

| 2,800 | | Chicago Rivet & Machine Co. | | | 33,824 |

| 45,000 | | CIRCOR International, Inc. | | | 1,013,400 |

| 41,000 | | Commercial Vehicle Group, Inc.* | | | 22,550 |

| 40,000 | | Compx International, Inc. | | | 227,200 |

| 39,000 | | Consolidated Graphics, Inc.* | | | 496,080 |

| 37,000 | | Cornell Cos., Inc.* | | | 605,690 |

|

SCHEDULE OF PORTFOLIO INVESTMENTS |

Tamarack Microcap Value Fund (cont.)

March 31, 2009 (Unaudited)

| | | | | |

| Shares | | | | Value |

| 29,000 | | Ducommun, Inc. | | $ | 421,660 |

| 63,000 | | Eagle Bulk Shipping, Inc. | | | 267,750 |

| 14,700 | | Eastern Co. (The) | | | 158,760 |

| 11,880 | | Ecology and Environment, Inc., Class A | | | 149,450 |

| 48,000 | | Encore Wire Corp. | | | 1,028,640 |

| 62,000 | | Ennis, Inc. | | | 549,320 |

| 20,000 | | EnPro Industries, Inc.* | | | 342,000 |

| 39,000 | | Espey Manufacturing & Electronics Corp. | | | 588,900 |

| 62,000 | | Excel Maritime Carriers Ltd. | | | 280,240 |

| 14,600 | | Exponent, Inc.* | | | 369,818 |

| 12,000 | | ExpressJet Holdings, Inc.* | | | 12,960 |

| 79,000 | | Frozen Food Express Industries | | | 237,000 |

| 21,000 | | G&K Services, Inc., Class A | | | 397,110 |

| 80,000 | | Gibraltar Industries, Inc. | | | 377,600 |

| 47,000 | | Griffon Corp.* | | | 352,500 |

| 25,750 | | Hardinge, Inc. | | | 71,843 |

| 43,000 | | Herley Industries, Inc.* | | | 514,280 |

| 31,000 | | Houston Wire & Cable Co. | | | 240,250 |

| 65,000 | | ICT Group, Inc.* | | | 362,050 |

| 31,000 | | Insituform Technologies, Inc., Class A* | | | 484,840 |

| 43,350 | | International Shipholding Corp. | | | 852,695 |

| 19,000 | | Jinpan International Ltd. | | | 320,150 |

| 12,000 | | Key Technology, Inc.* | | | 105,600 |

| 76,000 | | Kforce, Inc.* | | | 534,280 |

| 74,000 | | KHD Humboldt Wedag International | | | |

| | Ltd.* | | | 511,340 |

| 55,000 | | Kimball International, Inc., Class B | | | 360,800 |

| 37,000 | | Ladish Co., Inc.* | | | 268,620 |

| 64,000 | | LECG Corp.* | | | 162,560 |

| 38,000 | | LS Starrett Co., Class A | | | 237,500 |

| 51,750 | | LSI Industries, Inc. | | | 267,548 |

| 66,000 | | Lydall, Inc.* | | | 196,020 |

| 58,000 | | Mair Holdings Escrow Shares(a) | | | 13,920 |

| 26,875 | | Marten Transport Ltd.* | | | 502,025 |

| 72,000 | | Mesa Air Group, Inc.* | | | 9,180 |

| 36,117 | | Met-Pro Corp. | | | 294,356 |

| 13,800 | | Michael Baker Corp.* | | | 358,800 |

| 59,000 | | Miller Industries, Inc.* | | | 383,500 |

| 85,000 | | Nashua Corp.* | | | 85,000 |

| 21,000 | | NCI Building Systems, Inc.* | | | 46,620 |

| 63,000 | | NN, Inc. | | | 79,380 |

| 18,800 | | Northwest Pipe Co.* | | | 535,236 |

| 106,000 | | On Assignment, Inc.* | | | 287,260 |

| 33,100 | | PAM Transportation Services, Inc.* | | | 181,719 |

| 62,000 | | Paragon Shipping, Inc., Class A | | | 216,380 |

| 41,000 | | Park-Ohio Holdings Corp.* | | | 133,660 |

| 43,160 | | Patrick Industries, Inc.* | | | 21,148 |

| 99,000 | | RCM Technologies, Inc.* | | | 101,970 |