UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21475

Tamarack Funds Trust

(Exact name of registrant as specified in charter)

100 S. Fifth Street, Suite 2300,

Minneapolis, MN | 55402-1240 |

(Address of principal executive offices) | (Zip code) |

BISYS Fund Services Ohio, Inc., 3435 Stelzer Road, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: | (800) 422-2766 |

Date of fiscal year end: | September 30 |

Date of reporting period: | March 31, 2007 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. | Reports to Stockholders. |

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

| |

| SEMI-ANNUAL REPORT March 31, 2007 |

Large Cap Growth Fund Mid Cap Growth Fund SMID Cap Growth Fund Enterprise Fund Small Cap Core Fund Value Fund Microcap Value Fund | |

Tamarack Funds

About Your Semi-Annual Report

This semi-annual report includes detailed information regarding your Fund’s performance. This report is provided to help answer your questions as a shareholder. Among these questions may be: How has my Fund performed against its benchmark both in the last year and over the last ten years (or since inception if less than ten years)? What are the annual expenses of my Fund? What are the significant accounting policies and procedures followed by my Fund?

The Tamarack Funds compare their performance against various Russell Equity indices. Each of these indices is a widely recognized measure of return for the underlying category of securities. However, the indices are unmanaged, do not include fees, and cannot be invested in directly.

We hope the financial information presented, as well as the discussion and analysis from your portfolio manager(s), will help you evaluate your investment in the Tamarack Funds. We also encourage you to read your Fund’s prospectus for further detail as to your Fund’s investment policies and risk profile. Tamarack Funds prospectuses and performance information subsequent to the date of this report are available on our website at www.voyageur.net.

A description of the policies and procedures that your Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1 800-422-2766; (ii) on the Fund’s website at www.voyageur.net; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov.

Information regarding how your Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2006 is available (i) on the Fund’s website at www.voyageur.net; and (ii) on the Commission’s website at http://www.sec.gov.

A schedule of each Fund’s portfolio holdings will be filed with the Commission for the first and third quarters of each fiscal year on Form N-Q. This information is available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room is available by calling 1-800-SEC-0330.

Table of Contents

Table of Contents

LETTER FROM THE CIO OF EQUITIES

A Change in Sentiment?

The U.S. equity markets were generally strong during 2006, with most indices posting double-digit returns. In what has become a common pattern over the past several years, equities rallied strongly in the fourth quarter. Steady interest rates, cheaper energy prices, good inflation readings, decent retail sales and potential signs of a bottoming in the housing market fueled investor optimism. The rally was broad-based, allowing the S&P 500 Index to hit a new multi-year high, rising 6.7% for the fourth quarter and finish up 15.8% for the year.

During the fourth quarter of 2006, small cap stocks (as measured by the Russell 2000 Index) outperformed their large and mid cap counterparts. This has been the case for several years, although there was some evidence in the last half of 2006 that large cap stocks were regaining market leadership. Also during the fourth quarter, value stocks performed significantly better than growth stocks across all capitalization ranges, especially in large cap. In large cap, the Russell 1000 Value Index out-performed the Russell 1000 Growth Index by 210 basis points (8.0% vs. 5.9%) for the quarter and finished ahead of large cap growth by 1310 basis points (22.2% vs. 9.1%) for the year. In mid cap, value finished ahead of growth by 150 basis points (8.5% vs. 7.0%) for the quarter and by 950 basis points (20.2% vs. 10.7%) for the year. In small cap, value beat growth by a narrow 20 basis points (9.0% vs. 8.8%) for the fourth quarter but by a wide 1010 basis points (23.5% vs. 13.4%) for the year.

At the sector level, all ten sectors of the broad market S&P 500 Index posted positive returns in the fourth quarter and the year. Materials 11.4%, Energy 11.2% and Consumer Discretionary 10.3% led all sectors in the fourth quarter while Health Care 1.4% and Consumer Staples 3.5% trailed. For the year, Telecommunications Services 36.8%, Energy 24.2%, and Utilities 21.0% were up most while Health Care 7.5% lagged.

In 2007, investors began where they left off in 2006, namely with a significant appetite for risk. The combination of robust “fundamentals”, including corporate earnings, economic growth, subdued inflation and interest rates together with still-ample liquidity, encouraged continued speculative behavior among investors. However, after months of building a bulletproof conviction in a “Goldilocks” investment environment where slow, steady economic growth would be just right to keep earnings growing and inflation shrinking, risk aversion suddenly returned. After foiling many market strategists who had been calling for a market correction since last summer, the eight-month S&P 500 winning streak was finally broken in February. Tuesday, February 27 was the 16th largest 1-day drop in the S&P 500 since 1990. The pullback began with the Shanghai stock market falling 9%. Investor bullishness shifted toward bearish concerns about global liquidity, sub-prime mortgages, a potential credit crunch, the housing market and a Greenspan warning among others. But underlying it all was concern about future economic growth. This change in investor behavior also caused the VIX, (the Chicago Board Options Exchange Volatility Index - a popular measure of investor sentiment and risk), to almost double. U.S. equity markets remained jittery through end of the first quarter as investors continued to digest the news flow and change in sentiment. At the close on March 30, the broad market S&P 500 eked out a first quarter return of 0.7%, the Dow Jones Industrial Average declined 0.3% and the NASDAQ Composite added 0.5%.

1

Table of Contents

LETTER FROM THE CIO OF EQUITIES

The Opportunities Ahead

We periodically find ourselves in the midst of uncertain economic signals. The current environment presents opportunities for discerning and patient investors to take advantage of clear investment opportunities amid the uncertainty.

Overall, equities remain an attractive asset class. Last year was an above-average year for all equities, with the exception perhaps of growth stocks. Stock prices rose significantly in 2006, but corporate earnings rose in tandem, keeping valuations reasonable. Key equity ratios are close to their long-term averages and nowhere near levels that could be viewed as excessive. Corporations that strengthened their balance sheets, in recent years, are taking advantage to make acquisitions and buy back their stock. In fact, stock buybacks and cash acquisitions have increased 289% since 2004.

More directly tied to stock prices, investors will have to adjust to the fact that they probably just enjoyed the last quarter of double-digit corporate earnings growth for a while. According to First Call estimates, S&P 500 operating profits will only be growing at 6.9% for the calendar year 2007. In the previous four cycles where corporate profit growth decelerated, higher quality stocks have delivered superior investment returns.

Volatile market environments have also favored higher quality stocks. Over the past 20 years, there is a high correlation between an increase in the VIX Index and the outperformance of higher quality stocks. Regardless of why volatility is occurring, we think that it is quite healthy because a pickup in volatility tends to draw assets back toward their “intrinsic value”. Periods of stability, such as we have experienced for the past three years, often spur speculation during which asset valuations sometimes stray far from reasonable levels. Volatility tends to increase investors’ risk aversion and dampen speculation. When that happens, asset prices tend to decline to more reasonable levels, ones that are based more on actual fundamentals than on speculation. This is something that long-term investors (rather that traders or speculators) who take a rational approach to buying securities should welcome.

The recent shift in market leadership, with signs of investors’ attention being drawn to higher quality stocks, is typical of the late stages of an economic cycle. We think this trend is positive for Voyageur’s investment approach. At this advanced stage of an economic expansion, we believe that corporate earnings can continue to grow, but at a reduced rate. So, while some companies may experience difficulty in a low-growth environment we expect that the innovative companies with strong financials will continue to prosper and we remain committed to our diversified, high quality approach to investing.

Nancy M. Scinto

Chief Investment Officer,

Equity Products | |

Nancy M. Scinto

Tamarack Funds Chief Investment Officer

Equity Products |

2

Table of Contents

EQUITY PORTFOLIO MANAGERS

Voyageur Asset Management Inc. (“Voyageur”), the investment advisor to the Tamarack Funds, employs a team approach to the management of the Tamarack Equity Funds, with no individual team member being solely responsible for the investment decisions.

Nancy M. Scinto

Chief Investment Officer Equity Products, Managing Director, Director of Equity Research, Senior Portfolio Manager

Nancy Scinto is responsible for equity portfolio management and directing the Voyageur growth equity research efforts. She joined Voyageur in 1999 from Chicago Trust Company where she managed institutional accounts and was co-manager of the five-star Alleghany / Chicago Growth and Income Fund. Nancy has held various positions including personal trust, equity trader, senior equity analyst and senior portfolio manager. She began her career in the investment industry in 1984. Nancy received a BA from Governors State University and an MBA from DePaul University. She is a member of the CFA Society of Chicago. |

Nancy M. Scinto |

David J. Cox, CFA

Senior Managing Director, Director of Equity Investments, Senior Portfolio Manager

David Cox is responsible for equity portfolio management and directing the Voyageur growth equity efforts. He joined Voyageur in 1999 from Chicago Trust Company where he held positions as director of equity research, portfolio manager and senior equity analyst. While at Chicago Trust, David co-managed the Alleghany/Chicago Trust Balanced Fund, which held a Morningstar five-star rating in the Domestic Hybrid category. Prior to his experience at Voyageur and Chicago Trust, David held analyst positions at Driehaus Securities and at Kirr, Marbach & Company. David began his career in the investment industry in 1984. He received a BS from the University of Illinois and an MBA from the Kelley School of Business at Indiana University. He is a CFA charterholder and member of the CFA Society of Chicago and the CFA Institute. David is also a member of the Reese Fund Advisory Board. |

David J. Cox, CFA |

Steven A. Rusnak, CFA

Vice President, Senior Portfolio Manager, Senior Equity Analyst

Steven Rusnak is a member of the growth equity team and conducts fundamental equity research for a diverse group of industries, including financials and health care. He joined Voyageur in 1999 from Chicago Trust Company where he was a senior equity analyst and portfolio manager. Previously Steve held positions with Mesirow Financial as senior equity analyst, the State Teachers Retirement System of Ohio as an analyst and at Feldman Securities Corporation as a portfolio analyst. Steve has been in the investment industry since 1985. He earned a BA in Economics and an MBA from The Stephen M. Ross School of Business at the University of Michigan. Steve is CFA charterholder and a member of the CFA Society of Chicago and CFA Institute. |

Steven A. Rusnak, CFA |

| |

3

Table of Contents

EQUITY PORTFOLIO MANAGERS

Forbes L. Watson | Forbes L. Watson

Vice President, Senior Portfolio Manager

Forbes Watson is responsible for small cap growth and SMID cap growth equity portfolio management. He joined Voyageur in 2002 from RBC Centura Bank where he managed separate accounts and the five-star RBC Mid Cap Equity Fund. Forbes held portfolio management positions with Trustmark National Bank and ParkSouth Corporation, a registered investment advisor, before joining RBC Centura Bank in 1998. He began his career with May, Cullum, Ragland & Brittain, Inc., a Dallas-based investment boutique, and also worked in the Dallas NASDAQ trading office of Shearson/Lehman Brothers. Forbes began his career in the investment industry in 1981. He received a BA in Finance from the University of North Texas and an MBA from Millsaps College. Forbes is a member of the CFA Society of North Carolina and CFA Institute. |

Michael T. Lee, CFA | Michael T. Lee, CFA

President, Chief Investment Officer, Senior Portfolio Manager

Mike Lee is the President of Voyageur and responsible for overseeing the firm’s investment activities. He is also a portfolio manager with Voyageur’s Growth Equity team. Mike began his career with Voyageur in 1993 as an equity analyst. His prior professional experience included seven years with Northwest Airlines in corporate sales and strategic systems development. Mike serves on the board of the Minnesota Children’s Museum and is a mentor and advisor for the Carlson School Funds Enterprise at the University of Minnesota. Mike received a BS in Economics from DePauw University and an MBA in Finance from the University of Minnesota, Carlson School of Management. He is a CFA charterholder and member of the CFA Society of Minnesota. |

Lance F. James | Lance F. James

Managing Director, Senior Portfolio Manager

Lance James is responsible for portfolio management of Voyageur’s Small Cap Core Fund and Enterprise Fund. Prior to joining Voyageur in 2006, Lance was an equity analyst and portfolio manager for OFI Institutional and Babson Capital Management, affiliated companies of Mass Mutual Life Insurance Company. During his tenure he served as head of the firm’s small/mid cap value investment team. Prior to joining Babson Capital in 1986, Lance worked at Rockwell International Corporation, EBF Associates of Boston and Hewitt Associates. Lance began his career in the investment industry in 1980. He received an AB in Economics from Princeton University and an MBA in Finance from the Wharton School of Business at the University of Pennsylvania. |

George Prince | George Prince

Portfolio Manager, Senior Equity Analyst

George Prince serves as the co-portfolio manager for the Enterprise Fund. George also provides research support for Voyageur’s Small Cap Core Fund and mid cap value portfolios. He joined Voyageur in 2006 from Eagle Asset Management, where he was a senior equity analyst. Prior to his experience at Eagle Asset Management, George was an analyst at Babson Capital Management. George also has a great deal of entrepreneurial experience and founded SignStorey, a leader in place-based digital communications in retail stores and co-founded Cutting Edge Inc., a global CAD-CAM technology company. George has over 10 years of investment industry experience. He received a BA from Yale University. |

4

Table of Contents

EQUITY PORTFOLIO MANAGERS

Bruce W. Kaser, CFA

Senior Portfolio Manager

Bruce Kaser is responsible for large cap value portfolio management and is a member of Voyageur’s large cap value and concentrated large cap value team. Bruce joined Voyageur in 2007 from Freedom Capital where he served as a senior large cap value portfolio manager for six years. Prior to his experience at Voyageur and Freedom Capital, Bruce was a portfolio manager for value equity clients at Loomis Sayles. Bruce began his career in the investment industry in 1985. He received a BS from Miami University (Ohio) and an MBA from the University of Chicago’s Graduate School of Business. Bruce is a CFA charterholder and member of the CFA Institute. Bruce is also a member of the Petroleum Analysts of Boston and is the Treasurer for the Boston charity, Strike Out Cancer. |

Bruce W. Kaser, CFA |

Stuart A. (“Sam”) Lippe

Senior Portfolio Manager

Sam Lippe is responsible for large cap value portfolio management and is a member of Voyageur’s large cap value and concentrated large cap value team. Sam joined Voyageur in 2007 from Freedom Capital where he served as a senior large cap value portfolio manager for over five years. Prior to his experience at Voyageur and Freedom Capital, Sam was a portfolio manager and analyst for the Endowment Fund at Howard Hughes Medical Institute. He also worked as an analyst for value-oriented portfolios at Legg Mason Capital Management. Sam began his career in the investment industry in 1978. He received a BS from Cornell University and an MBA from New York University. Sam is a member of the Association of Insurance and Financial Analysts. |

Stuart A. Lippe |

5

Table of Contents

PERFORMANCE SUMMARY

Average Annual Total Returns as of March 31, 2007 (Unaudited)

Tamarack Large Cap Growth Fund

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception (a) | |

|---|

| | |

| | |

| | |

| | |

| | |

| |

| Class A (g) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Maximum Sales Charge of 5.75% | | | | | -6.78 | % | | | 1.26 | % | | | -0.11 | % | | | 2.81 | % | | | 6.92 | % |

| - At Net Asset Value | | | | | -1.07 | % | | | 3.29 | % | | | 1.07 | % | | | 3.42 | % | | | 7.31 | % |

| Class C (h) | | | | | | | |

| - Including Contingent Deferred Sales Charge of 1.00% | | | | | -2.78 | % | | | 2.53 | % | | | 0.32 | % | | | 2.65 | % | | | 6.51 | % |

| - At Net Asset Value | | | | | -1.80 | % | | | 2.53 | % | | | 0.32 | % | | | 2.65 | % | | | 6.51 | % |

| Class I (g) | | | | | -0.79 | % | | | 3.53 | % | | | 1.32 | % | | | 3.67 | % | | | 7.67 | % |

| Class R (h) | | | | | -1.34 | % | | | 3.02 | % | | | 0.82 | % | | | 3.16 | % | | | 7.04 | % |

| Class S (i) | | | | | -0.79 | % | | | 3.53 | % | | | 1.32 | % | | | 3.67 | % | | | 7.67 | % |

| Russell 1000 Growth Index* | | | | | 7.06 | % | | | 7.01 | % | | | 3.48 | % | | | 5.51 | % | | | 9.77 | % |

Tamarack Mid Cap Growth Fund

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception (a) | |

|---|

| | |

| | |

| | |

| | |

| | |

| |

| Class A (g) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Maximum Sales Charge of 5.75% | | | | | -9.16 | % | | | 4.85 | % | | | 4.21 | % | | | 9.76 | % | | | 12.59 | % |

| - At Net Asset Value | | | | | -3.61 | % | | | 6.94 | % | | | 5.45 | % | | | 10.41 | % | | | 13.01 | % |

| Class C (h) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Contingent Deferred Sales Charge of 1.00% | | | | | -5.27 | % | | | 6.16 | % | | | 4.67 | % | | | 9.60 | % | | | 12.17 | % |

| - At Net Asset Value | | | | | -4.34 | % | | | 6.16 | % | | | 4.67 | % | | | 9.60 | % | | | 12.17 | % |

| Class I (g) | | | | | -3.36 | % | | | 7.21 | % | | | 5.70 | % | | | 10.72 | % | | | 13.35 | % |

| Class R (h) | | | | | -3.85 | % | | | 6.68 | % | | | 5.19 | % | | | 10.14 | % | | | 12.72 | % |

| Class S (i) | | | | | -3.36 | % | | | 7.23 | % | | | 5.72 | % | | | 10.73 | % | | | 13.36 | % |

| Russell Midcap Growth Index | | | | | 6.90 | % | | | 12.41 | % | | | 9.45 | % | | | 9.44 | % | | | 12.21 | % |

Tamarack SMID Cap Growth Fund

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception (b) | |

|---|

| | |

| | |

| | |

| | |

| | |

| |

| Class A (g) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Maximum Sales Charge of 5.75% | | | | | -11.11 | % | | | 6.18 | % | | | 5.88 | % | | | 9.43 | % | | | 10.78 | % |

| - At Net Asset Value | | | | | -5.68 | % | | | 8.30 | % | | | 7.14 | % | | | 10.08 | % | | | 11.31 | % |

| Class C (h) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Contingent Deferred Sales Charge of 1.00% | | | | | -7.22 | % | | | 7.48 | % | | | 6.33 | % | | | 9.25 | % | | | 10.48 | % |

| - At Net Asset Value | | | | | -6.34 | % | | | 7.48 | % | | | 6.33 | % | | | 9.25 | % | | | 10.48 | % |

| Class I (g) | | | | | -5.41 | % | | | 8.57 | % | | | 7.41 | % | | | 10.34 | % | | | 11.62 | % |

| Class R (h) | | | | | -5.99 | % | | | 7.98 | % | | | 6.85 | % | | | 9.79 | % | | | 11.02 | % |

| Class S (i) | | | | | -5.42 | % | | | 8.55 | % | | | 7.39 | % | | | 10.33 | % | | | 11.62 | % |

| Russell 2500 Growth Index* | | | | | 4.44 | % | | | 11.12 | % | | | 9.13 | % | | | 8.43 | % | | | 9.89 | % |

| Russell 2000 Growth Index* | | | | | 1.56 | % | | | 9.41 | % | | | 7.88 | % | | | 6.31 | % | | | 7.43 | % |

6

Table of Contents

PERFORMANCE SUMMARY

Tamarack Enterprise Fund

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception (c) | |

|---|

| | |

| | |

| | |

| | |

| | |

| |

| Class A (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Maximum Sales Charge of 5.75% | | | | | -0.93 | % | | | 8.08 | % | | | 10.56 | % | | | 11.36 | % | | | 12.46 | % |

| - At Net Asset Value | | | | | 5.13 | % | | | 10.23 | % | | | 11.87 | % | | | 12.03 | % | | | 12.75 | % |

| Class C (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Contingent Deferred Sales Charge of 1.00% | | | | | 3.31 | % | | | 9.39 | % | | | 11.03 | % | | | 11.19 | % | | | 11.91 | % |

| - At Net Asset Value | | | | | 4.26 | % | | | 9.39 | % | | | 11.03 | % | | | 11.19 | % | | | 11.91 | % |

| Class I (k) | | | | | 5.39 | % | | | 10.52 | % | | | 12.16 | % | | | 12.31 | % | | | 13.03 | % |

| Class R (j) | | | | | 4.85 | % | | | 9.94 | % | | | 11.58 | % | | | 11.74 | % | | | 12.46 | % |

| Class S | | | | | 5.35 | % | | | 10.51 | % | | | 12.15 | % | | | 12.31 | % | | | 13.03 | % |

| Russell 2000 Index * | | | | | 5.91 | % | | | 12.00 | % | | | 10.95 | % | | | 10.23 | % | | | 10.47 | % |

| Russell 2000 Value Index * | | | | | 10.38 | % | | | 14.47 | % | | | 13.61 | % | | | 13.46 | % | | | 13.23 | % |

Tamarack Small Cap Core Fund

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception (d) | |

|---|

| | |

| | |

| | |

| | |

| | |

| |

| Class A (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Maximum Sales Charge of 5.75% | | | | | 0.38 | % | | | 9.00 | % | | | 9.98 | % | | | 10.82 | % | | | 11.91 | % |

| - At Net Asset Value | | | | | 6.49 | % | | | 11.17 | % | | | 11.29 | % | | | 11.48 | % | | | 12.33 | % |

| Class C (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Contingent Deferred Sales Charge of 1.00% | | | | | 4.76 | % | | | 10.34 | % | | | 10.46 | % | | | 10.65 | % | | | 11.49 | % |

| - At Net Asset Value | | | | | 5.71 | % | | | 10.34 | % | | | 10.46 | % | | | 10.65 | % | | | 11.49 | % |

| Class R (j) | | | | | 6.23 | % | | | 10.87 | % | | | 11.00 | % | | | 11.19 | % | | | 12.05 | % |

| Class S | | | | | 6.75 | % | | | 11.43 | % | | | 11.56 | % | | | 11.75 | % | | | 12.61 | % |

| Russell 2000 Index * | | | | | 5.91 | % | | | 12.00 | % | | | 10.95 | % | | | 10.23 | % | | | 15.08 | % |

Tamarack Value Fund

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception (e) | |

|---|

| | |

| | |

| | |

| | |

| | |

| |

| Class A (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Maximum Sales Charge of 5.75% | | | | | 3.82 | % | | | 7.46 | % | | | 4.21 | % | | | 6.43 | % | | | 11.43 | % |

| - At Net Asset Value | | | | | 10.15 | % | | | 9.60 | % | | | 5.45 | % | | | 7.06 | % | | | 11.72 | % |

| Class C (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Contingent Deferred Sales Charge of 1.00% | | | | | 8.32 | % | | | 8.77 | % | | | 4.66 | % | | | 6.26 | % | | | 10.89 | % |

| - At Net Asset Value | | | | | 9.32 | % | | | 8.77 | % | | | 4.66 | % | | | 6.26 | % | | | 10.89 | % |

| Class R (j) | | | | | 9.86 | % | | | 9.31 | % | | | 5.18 | % | | | 6.79 | % | | | 11.44 | % |

| Class S | | | | | 10.40 | % | | | 9.86 | % | | | 5.71 | % | | | 7.33 | % | | | 12.00 | % |

| Russell 1000 Value Index * | | | | | 16.83 | % | | | 14.42 | % | | | 10.25 | % | | | 10.85 | % | | | 13.78 | % |

7

Table of Contents

PERFORMANCE SUMMARY

Tamarack Microcap Value Fund

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception (f) | |

|---|

| | |

| | |

| | |

| | |

| | |

| |

| Class A (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Maximum Sales Charge of 5.75% | | | | | 2.61 | % | | | 11.56 | % | | | 13.24 | % | | | 13.88 | % | | | 10.91 | % |

| - At Net Asset Value | | | | | 8.86 | % | | | 13.79 | % | | | 14.59 | % | | | 14.56 | % | | | 11.25 | % |

| Class C (j) | | | | | | | | | | | | | | | | | | | | | | |

| - Including Contingent Deferred Sales Charge of 1.00% | | | | | 7.05 | % | | | 12.95 | % | | | 13.75 | % | | | 13.71 | % | | | 10.42 | % |

| - At Net Asset Value | | | | | 8.05 | % | | | 12.95 | % | | | 13.75 | % | | | 13.71 | % | | | 10.42 | % |

| Class R (j) | | | | | 8.56 | % | | | 13.49 | % | | | 14.30 | % | | | 14.27 | % | | | 10.97 | % |

| Class S | | | | | 9.12 | % | | | 14.08 | % | | | 14.88 | % | | | 14.84 | % | | | 11.53 | % |

| Russell 2000 Value Index * | | | | | 10.38 | % | | | 14.47 | % | | | 13.61 | % | | | 13.46 | % | | | 12.35 | % |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. For performance data current to the most recent month-end go to www.voyageur.net.

*Each of the comparative indices is a widely recognized market value weighted measure of the return of securities. Index returns do not include sales fees or operating expenses. You cannot invest directly in indices.

| (a) | The since inception date (commencement of operations) of the Fund is December 31, 1990. |

| (b) | The since inception date (commencement of operations) of the Fund is January 1, 1995. |

| (c) | The since inception date (commencement of operations) of the Fund is December 2, 1983. |

| (d) | The since inception date (commencement of operations) of the Fund is August 5, 1991. |

| (e) | The since inception date (commencement of operations) of the Fund is September 30, 1984. |

| (f) | The since inception date (commencement of operations) of the Fund is September 10, 1987. |

| (g) | The performance in the table reflects the performance of the former RBC Funds, the predecessors to the Tamarack Funds. The quoted performance of the Funds include the performance of a common trust fund (“CTF”) account advised by the Adviser (including its predecessor) and managed the same as the Fund in all material respects, for periods dating prior to the Fund’s commencement of operations (October 1, 1996 for the Large Cap Growth Fund, June 1, 1994 for the Mid Cap Growth Fund, and May 2, 1997 for the SMID Cap Growth Fund), as adjusted to reflect the full contractual rate of expenses associated with the Fund at its inception. Each CTF account was not registered with the SEC under the 1940 Act and therefore was not subject to the investment restrictions imposed by law on registered mutual funds. If each CTF account had been registered, the CTF account’s performance may have been adversely affected. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (h) | The inception date for Class C and Class R shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class A Shares of the Fund, adjusted to reflect the fees and expenses of Class C and Class R shares, as applicable (and where applicable, the maximum sales charges of the Class C shares). |

| (i) | The inception date for Class S of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class I Shares of the Fund, adjusted to reflect the fees and expenses of Class S. |

| (j) | The inception date for Class A, Class C and Class R shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class A, Class C and Class R shares, as applicable (and where applicable, the maximum sales charges of the Class A and Class C shares). |

| (k) | The inception date for Class I shares of the Fund is September 30, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class I shares, as applicable. |

The Russell Midcap Growth Index is an unmanaged index that measures the performance of U.S. mid cap companies in the Russell 3000 Index, which have higher price-to-book ratios and higher forecasted growth rates.

The Russell 1000 Growth Index is an unmanaged index that measures the performance of U.S. large cap companies in the Russell 3000 Index with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Value Index is an unmanaged index that measures the performance of U.S. large cap companies in the Russell 3000 Index, which have lower price-to-book ratios and lower forecasted growth rates.

8

Table of Contents

PERFORMANCE SUMMARY

The Russell 2000 Growth Index is an unmanaged index that measures the performance of U.S. small cap companies in the Russell 2000 Index, which have higher price-to-book ratios and higher forecasted growth rates.

The Russell 2000 Value Index is an unmanaged index that measures the performance of small cap companies in the Russell 3000 Index with lower price-to-book ratios and lower forecasted growth rates.

The Russell 2000 Index is an unmanaged index that measures the performance of U.S. small cap companies in the Russell 3000 Index.

The Russell 2500 Growth Index is an unmanaged index that measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

9

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Large Cap Growth Fund

Investment Objective

Seeks long-term growth by purchasing high-quality, larger capitalization companies that display consistent earnings growth and superior financial characteristics. Utilizing fundamental research, the Fund employs a bottom-up approach and strict risk controls to build a diversified portfolio of stocks that offer above average expected growth with lower than average market risk.

Performance

For the six-month period ending March 31, 2007, the Fund had a total return of 2.67% (Class A, at net asset value). That compares to a total return of 7.19% for the Russell 1000 Growth Index, the Fund’s primary benchmark.

Factors That Made Positive Contributions

| | • | Stryker Corp. (medical technology) was the best performing stock in the portfolio, for the period, returning +33.7% and contributing 78bps to total returns. |

| | • | An overweight allocation to Energy stocks, the second best performing sector in the Russell 1000 Index, added to returns. Smith International (oil well equipment), +23.8%, strongly outperformed both its sector and the Index. |

| | • | An underweight allocation to the Information Technology sector, an underperforming group made a positive contribution. |

Factors That Detracted From Relative Returns

| | • | The six month period continued to be a challenging environment for our investment approach. Consistent growth companies that we own generally lagged as fundamentals diverged from stock prices. |

| | • | In addition, our portfolio returns were hurt by a small number of stocks primarily in the Financials, Health Care and Consumer Staples sectors. |

| | • | Stock selection in Financials was the largest detractor to returns. SLM Corporation, (lending/ financing), stock price declined, - -21.3%, largely due to concerns that the new make-up of Congress, following the mid-term elections, may threaten its margins. |

| | • | Within Health Care, Quest Diagnostics, (clinical laboratories), stock price was negatively impacted by news the company had lost a contract with United Healthcare. We feel the market’s reaction to this news was overdone and continue to hold this stock in the Fund. |

| | • | Among our Consumer Staples picks, Whole Foods Market, (food retailer), declined as investors became increasingly concerned about intensified competition, slowing business growth and reduced profit margins. This stock was sold from the portfolio. |

10

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Large Cap Growth Fund

Investment Objective

Long-term capital appreciation.

Benchmark

Russell 1000 Growth Index

Asset Allocation

(% of fund’s investments excluding securities lending collateral) & Top Five Industries (% of fund’s net assets)

| Top Five Industries | |

|---|

| Information Technology | 22.9% |

| Healthcare | 15.9% |

| Consumer Discretionary | 15.3% |

| Industrials | 14.4% |

| Financials | 12.9% |

Top Ten Holdings

(as of 3/31/07)

(% of fund’s net assets)

| Danaher Corp. | 4.38% | | Procter & Gamble Co. (The) | 3.60% |

| Cisco Systems, Inc. | 4.21% | | Chicago Mercantile Exchange Holdings, Inc. | 3.34% |

| General Electric Co. | 3.80% | | Stryker Corp. | 3.21% |

| Adobe Systems, Inc. | 3.71% | | PepsiCo, Inc. | 3.18% |

| United Technologies Corp. | 3.61% | | Johnson Controls, Inc. | 3.00% |

*A listing of all portfolio holdings can be found on page 60.

Growth of $10,000 Initial Investment Over 10 Years

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class A shares including the maximum sales charge of 5.75%. The quoted performance of the Fund includes performance of certain collective trust funds (“Commingled Accounts”) advised by Centura Bank prior to the establishment of the Fund on October 1, 1996. On that date, the assets of the Commingled Accounts were equivalent in all material aspects to those of the Fund. During that time, the Commingled Accounts were not registered under the Investment Company Act of 1940 (the “1940 Act”), and therefore were not subject to certain investment restrictions that are imposed under the 1940 Act. If the Commingled Accounts had been registered under the 1940 Act, the Commingled Accounts’ performance may have been adversely affected. Because the Commingled Accounts did not charge any expenses, their performance has been adjusted to reflect the Fund’s estimated expenses at the time of its inception, which was 1.00% of average daily net assets for Class A. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures.

11

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Mid Cap Growth Fund

Investment Objective

Seeks long-term growth by primarily investing in high quality, mid-capitalization companies that display consistent earnings growth and superior financial characteristics. Utilizing fundamental research, the Fund employs a bottom-up approach and strict risk controls to build a diversified portfolio of stocks that offer above average expected growth with lower than average market risk.

Performance

For the six-month period ending March 31, 2007, the Fund had a total return of 4.97% (Class A, at net asset value). That compares to a total return of 11.18% for the Russell Midcap Growth Index, the Fund’s primary benchmark.

Factors That Made Positive Contributions

| | • | Overall, including both stock selection and sector weightings, Materials and Information Technology stocks added the most to the Fund’s returns. |

| | • | Among our Materials picks, Florida Rock Industries, (cement and aggregate), was the greatest contributor, adding 124 bps to Fund returns, following an announcement the company is to be acquired by Vulcan Materials. |

| | • | In Information Technology, FactSet Research Systems, (computer software), +29.4%, outperformed both the Russell Midcap Growth Index and the Information Technology sector. |

| | • | An overweight allocation to Industrials, an outperforming sector and an underweight allocation to Consumer Staples, a lagging sector, made a slight positive contribution in the period. |

Factors That Detracted From Relative Returns

| | • | The six month period continued to be a challenging environment for our investment approach. Consistent growth companies that we own generally lagged as fundamentals diverged from stock prices. |

| | • | Overall, including both stock selection and sector weightings, Consumer Discretionary and Health Care detracted the most from Fund returns. |

| | • | Among our Consumer Discretionary holdings, several of our previously strongest performing stocks experienced a pullback. This included Coldwater Creek, (specialty retailer), -29.5% and Pool Corp. (swimming pool supplies), -7.0%. |

| | • | Within the Health Care sector, Quest Diagnostics, (clinical laboratories), -18.5%, was a significant negative. However, we are maintaining this position as we believe investors’ concerns about the United Healthcare contract loss are overdone. |

| | • | Finally, an underweight allocation to Materials, the best performing sector +30.7%, negatively impacted Fund returns. |

12

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Mid Cap Growth Fund

Investment Objective

Long-term capital appreciation.

Benchmark

Russell Midcap Growth Index

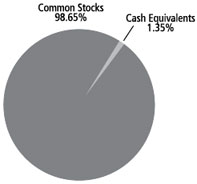

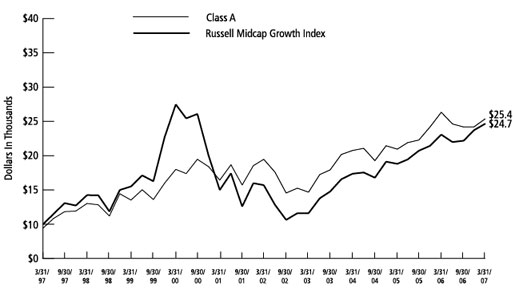

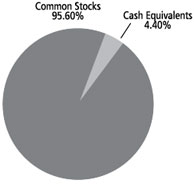

Asset Allocation

(% of fund’s investments excluding securities lending collateral) & Top Five Industries (% of fund’s net assets)

| Top Five Industries | |

|---|

| Industrials | 24.6% |

| Consumer Discretionary | 23.4% |

| Information Technology | 19.6% |

| Healthcare | 13.9% |

| Financials | 7.7% |

Top Ten Holdings

(as of 3/31/07)

(% of fund’s net assets)

| Roper Industries, Inc. | 4.44% | | Expeditors International of Washington, Inc. | 2.77% |

| FactSet Research Systems, Inc. | 4.04% | | Cognos, Inc. ADR | 2.70% |

| Varian Medical Systems, Inc. | 3.11% | | VCA Antech, Inc. | 2.68% |

| CDW Corp. | 3.10% | | Dick’s Sporting Goods, Inc. | 2.63% |

| Stericycle, Inc. | 2.90% | | | |

| Pool Corp. | 2.89% | | | |

*A listing of all portfolio holdings can be found on page 62.

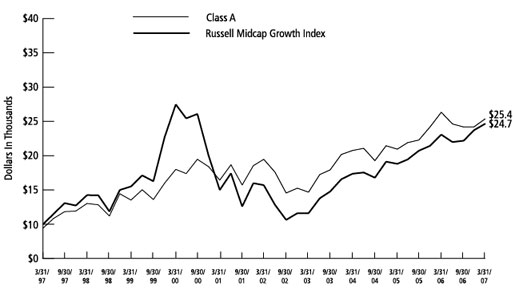

Growth of $10,000 Initial Investment Over 10 Years

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class A shares including the maximum sales charge of 5.75%. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures.

13

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack SMID Cap Growth Fund

Investment Objective

Invests in a diversified portfolio of high-quality, small and mid capitalization companies. Utilizing fundamental research, the Fund seeks to identify profitable companies, selling at reasonable valuations with the most potential for long-term capital appreciation and less than average market risk.

Performance

For the six-month period ending March 31, 2007, the Fund had a total return of 3.95% (Class A, at net asset value). That compares to a total return of 12.61% for the Russell 2500 Growth Index, the Fund’s primary benchmark.

Factors That Made Positive Contributions

| | • | Performance benefited by strong security selection in the Energy sector during the first fiscal quarter. |

| | • | Performance benefited by strong security selection in the Health Care, Financials, and Industrials during the second fiscal quarter. |

| | • | An increasing number of the portfolio companies are subject to takeover activity, as the cash hoards being built up by private equity firms and public corporations start being put to use. |

Factors That Detracted From Relative Returns

| | • | The Fund remained committed to its higher quality growth style while the market placed higher rewards on lower quality, smaller cap stocks. |

| | • | Overweight allocations to the Financial sector and underweight to the Materials sector during the first three months of the period. |

| | • | Security selection in Consumer Discretionary, Information Technology, and Consumer Staples during the second three months of the period. |

14

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack SMID Cap Growth Fund

Investment Objective

Long-term capital appreciation.

Benchmark

Russell 2500 Growth Index

Asset Allocation

(% of fund’s investments excluding securities lending collateral) & Top Five Industries (% of fund’s net assets)

| Top Five Industries | |

|---|

| Healthcare | 22.5% |

| Information Technology | 20.1% |

| Consumer Discretionary | 18.0% |

| Industrials | 15.2% |

| Financials | 11.4% |

Top Ten Holdings

(as of 3/31/07)

(% of fund’s net assets)

| Wells Fargo Prime Investment Money Market Fund | 4.01% | | Cymer, Inc. | 2.47% |

| DST Systems, Inc. | 3.07% | | FactSet Research Systems, Inc. | 2.44% |

| Legg Mason, Inc. | 3.01% | | Coldwater Creek, Inc. | 2.41% |

| Valspar Corp. | 2.54% | | Dick’s Sporting Goods, Inc. | 2.38% |

| Roper Industries, Inc. | 2.52% | | PetSmart, Inc. | 2.37% |

*A listing of all portfolio holdings can be found beginning on page 64.

Growth of $10,000 Initial Investment Over 10 Years

The graph reflects an initial investment of $10,000 over a ten year period and is based on Class A shares including the maximum sales charge of 5.75%. The quoted performance of the Fund includes performance of certain collective trust funds (“Commingled Accounts”) advised by Centura Bank prior to the establishment of the Fund on May 2, 1997. On that date, the assets of the Commingled Accounts were equivalent in all material aspects to those of the Fund. During that time, the Commingled Accounts were not registered under the Investment Company Act of 1940 (the “1940 Act”), and therefore were not subject to certain investment restrictions that are imposed under the 1940 Act. If the Commingled Accounts had been registered under the 1940 Act, the Commingled Accounts’ performance may have been adversely affected. Because the Commingled Accounts did not charge any expenses, their performance has been adjusted to reflect the Fund’s estimated expenses at the time of its inception, which was 1.50% of average daily net assets for Class A. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures.

15

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Enterprise Fund

Investment Objective

Invests in profitable, established small companies that are dominant in their industries. By selecting undervalued companies with small market capitalizations, this Fund strives to achieve growth with greater price stability than many other small stock funds.

Performance

For the six-month period ending March 31, 2007, the Fund had a total return of 9.44% (Class A, at net asset value). That compares to a total return of 11.02% for the Russell 2000 Index, the Fund’s primary benchmark.

Factors That Made Positive Contributions

| | • | Favorable stock selection in the Technology sector as compared to Russell 2000 index. An example would be Covansys which returned 44%. |

| | • | Favorable stock selection in the Health Care sector. An example would be Adeza Biomedical which returned 46%. |

| | • | Favorable Consumer Discretionary stock selection such as Steinway Musical which returned 25%. |

Factors That Detracted From Relative Returns

| | • | Adverse stock selection compared to the index in the Transportation industry. One of the bigger detractors in the portfolio was the trucking firm SAIA, which declined by -27%. |

| | • | Adverse Producer Durables sector stock selection such as Allied defense Group which declined by -48%. |

| | • | Underweight versus the Russell 2000 index in the top performing Consumer Staples sector. |

16

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Enterprise Fund

Investment Objective

Long-term growth of capital.

Benchmark

Russell 2000 Index

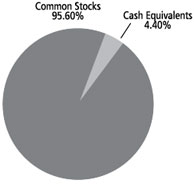

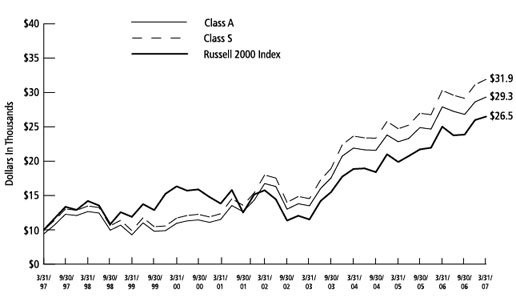

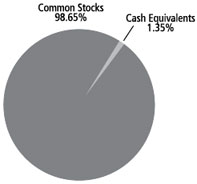

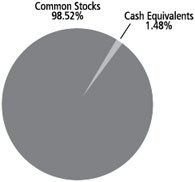

Asset Allocation

(% of fund’s investments excluding securities lending collateral) & Top Five Industries (% of fund’s net assets)

| Top Five Industries | |

|---|

| Industrials | 24.9% |

| Consumer Discretionary | 17.2% |

| Financials | 15.8% |

| Information Technology | 12.4% |

| Materials | 11.1% |

Top Ten Holdings

(as of 3/31/07)

(% of fund’s net assets)

| Movado Group, Inc. | 4.37% | | Universal Stainless & Alloy Products, Inc. | 2.42% |

| Steinway Musical Instruments, Inc. | 3.40% | | Comtech Telecommunications Corp. | 2.41% |

| HMS Holdings Corp. | 3.37% | | Penford Corp. | 2.35% |

| ASTA Funding, Inc. | 2.72% | | Columbus McKinnon Corp. | 2.16% |

| Tetra Technologies, Inc. | 2.52% | | Covansys Corp. | 2.11% |

*A listing of all portfolio holdings can be found beginning on page 65.

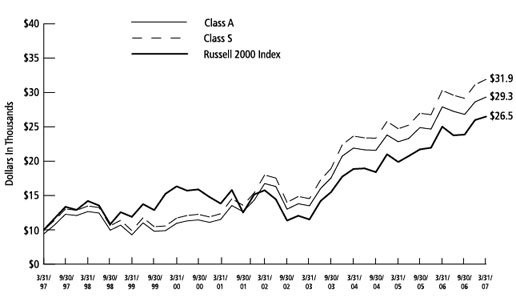

Growth of $10,000 Initial Investment Over 10 Years

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class A shares including the maximum sales charge of 5.75%. The inception date for Class A shares of the Fund is April 19, 2004. All performance shown for Class A shares prior to the inception date is based on the performance of the Class S shares of the Fund, adjusted to reflect the fees, expenses and maximum sales charges of Class A shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures.

17

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Small Cap Core Fund

Investment Objective

Invests in profitable, established small companies that are dominant in their industries. By selecting undervalued growth companies with small to mid-size market capitalizations, this Fund strives to achieve growth with greater price stability than many other small stock funds.

Performance

For the six-month period ending March 31, 2007, the Fund had a total return of 9.67% (Class A, at net asset value). That compares to a total return of 11.02% for the Russell 2000 Index, the Fund’s primary benchmark.

Factors That Made Positive Contributions

| | • | Strong 1st Quarter 2007 performance as compared to the Russell 2000 index (Fund Class A +3.91%, compared to Russell 2000 +1.95%). |

| | • | The Fund was underweight versus the index in the poorly performing Financial Services sector. |

| | • | Favorable stock selection in the Financial Services sector such as S.L. Green Realty (up +25%) and Asta Funding (up +15%). |

| | • | Favorable stock selection in Utilities sector such as Energen (up +22%). |

Factors That Detracted From Relative Returns

| | • | Weak 4th Quarter 2006 performance as compared to the Russell 2000 index. |

| | • | Adverse Basic Materials sector stock selection such as Intertape Polymer Group (down -46%). |

| | • | Adverse Consumer Discretionary stock selection such as Casual male Retail Group (down -14%). |

| | • | Adverse Health Care sector stock selection such as Angiotech Pharmaceutical (down -38%). |

18

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Small Cap Core Fund

Investment Objective

Long-term growth of capital.

Benchmark

Russell 2000 Index

Asset Allocation

(% of fund’s investments excluding securities lending collateral) & Top Five Industries (% of fund’s net assets)

| Top Five Industries | |

|---|

| Industrials | 23.0% |

| Consumer Discretionary | 22.5% |

| Financials | 13.3% |

| Information Technology | 11.3% |

| Healthcare | 8.9% |

Top Ten Holdings

(as of 3/31/07)

(% of fund’s net assets)

| Carlisle Co. | 4.42% | | Steinway Musical Instruments, Inc. | 3.03% |

| Movado Group, Inc. | 3.49% | | Polymedica Corp. | 2.88% |

| Gardner Denver, Inc. | 3.40% | | Men’s Wearhouse, Inc. | 2.50% |

| Interface, Inc. | 3.39% | | Ashford Hospitality Trust, Inc. | 2.47% |

| Inverness Medical Innovations, Inc. | 3.09% | | Manitowoc Co., Inc. (The) | 2.34% |

*A listing of all portfolio holdings can be found beginning on page 67.

Growth of $10,000 Initial Investment Over 10 Years

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class A shares including the maximum sales charge of 5.75%. The inception date for Class A shares of the Fund is April 19, 2004. All performance shown for Class A shares prior to the inception date is based on the performance of the Class S shares of the Fund, adjusted to reflect the fees, expenses and maximum sales charges of Class A shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures.

19

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Value Fund

Investment Objective

Seeks long-term growth by purchasing larger capitalization companies that are unpopular and undervalued based on their earnings, assets and/or dividends. The Fund’s goal is to invest in stocks that offer above-average potential for growth in principal and income while assuming less than market risk.

Performance

For the six-month period ending March 31, 2007, the Fund had a total return of 5.65% (Class A, at net asset value). That compares to a total return of 9.34% for the Russell 1000 Value Index, the Fund’s primary benchmark. The style of investment management changed in February of 2007 as the Large Cap Value Team formerly with Freedom Capital Management assumed responsibility for the Fund.

Factors That Made Positive Contributions

| | • | During the six-month period the performance was aided by strong stock selection in the consumer discretionary sector with Johnson Controls, up 32.9%, being the top performer. Subsequent to the investment team change in February, the large cap value portfolio showed strong relative performance in Utilities, Energy and Financials. |

| | • | Utilities was the second strongest sector in the market, up 9.40%. Our stock selection and slight overweight in the electric utilities part of the sector combined to produce 15 basis points of relative outperformance. FPL up 13.18%, and MDU, up 12.67%, were some notable holdings in the sector. |

| | • | Energy produced 14 basis points of excess return. Noble Energy, up 21.7% during the quarter, led the way in this sector. |

| | • | We also gained relative to the market in the Financial sector. Financials, responding to worries in the subprime market, was the weakest sector in the benchmark, down 2.65%. We made a very good trade selling Lehman Brothers during the quarter as the stock gained 8.26% during the time we held it, but ended the quarter down 10.15%. While neutral the sector as a whole, we were underweight commercial banks within the sector which also helped performance. |

Factors That Detracted From Relative Returns

| | • | In Financials, the fund’s holding in SLM Corp hurt performance while in Energy the fund’s Integrated Oil Holdings were unable to match the 14.5% return of that industry within the index. |

| | • | Telecommunication equipment was a weak spot as our holdings in Motorola and Tellabs hurt us in the first quarter. |

| | • | Within the Industrials sector, Machinery was up strongly while our holding in the space, Dover Corporation, was flat in the quarter. |

20

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Value Fund

Investment Objective

Long-term growth of capital and income.

Benchmark

Russell 1000 Value Index

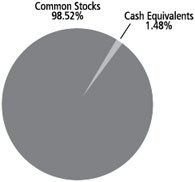

Asset Allocation

(% of fund’s investments excluding securities lending collateral) & Top Five Industries (% of fund’s net assets)

| Top Five Industries | |

|---|

| Financials | 31.0% |

| Energy | 9.0% |

| Healthcare | 8.8% |

| Telecommunication Services | 8.8% |

| Consumer Staples | 8.1% |

Top Ten Holdings

(as of 3/31/07)

(% of fund’s net assets)

| Exxon Mobil Corp. | 5.34% | | Merck & Co., Inc. | 2.93% |

| Citigroup, Inc. | 4.03% | | AT&T, Inc. | 2.62% |

| Verizon Communications, Inc. | 3.64% | | General Electric Co. | 2.54% |

| American International Group, Inc. | 3.46% | | Coca-Cola Co. | 2.48% |

| JPMorgan Chase & Co. | 3.33% | | Bank of America Corp. | 2.42% |

*A listing of all portfolio holdings can be found beginning on page 69.

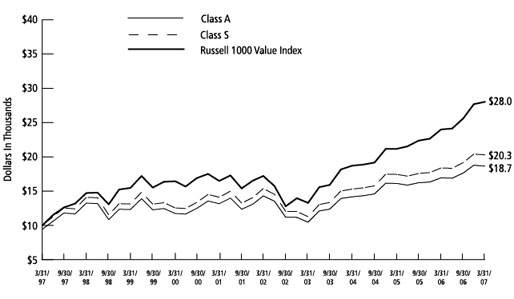

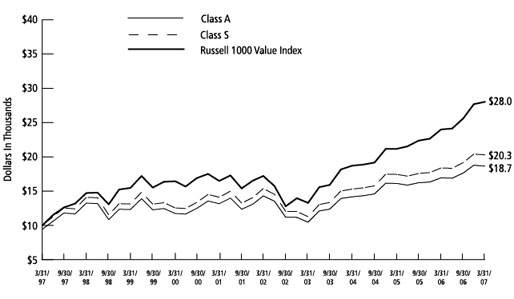

Growth of $10,000 Initial Investment Over 10 Years

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class A shares including the maximum sales charge of 5.75%. The inception date for Class A shares of the Fund is April 19, 2004. All performance shown for Class A shares prior to the inception date is based on the performance of the Class S shares of the Fund, adjusted to reflect the fees, expenses and maximum sales charges of Class A shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures.

21

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Microcap Value Fund

Investment Objective

Invests in a diversified portfolio of the smallest companies that have been neglected by institutional shareholders. Utilizing a quantitative process to identify value-oriented investments, the Fund strives to achieve long-term growth while offering shareholders some protection from market declines and fluctuations.

Performance

For the six-month period ending March 31, 2007, the Fund had a total return of 10.43% (Class A, at net asset value). That compares to a total return of 10.62% for the Russell 2000 Value Index, the Fund’s primary benchmark.

Factors That Made Positive Contributions

| | • | Sector weightings (allocation) contributed strongly to relative performance versus the benchmark with all ten sectors making a positive contribution. The total contribution to relative performance from allocation was roughly 230 basis points. |

| | • | Overall the top three sectors were Financials, Consumer Staples and Utilities. Both allocation and stock selection in each of the sectors made a positive contribution versus the benchmark. |

| | • | Financials, the top sector overall, had the strongest relative contribution from allocation at over 110 basis points. Consumer Staples, the second best sector, had the strongest relative contribution from stock selection at 45 basis points. |

Factors That Detracted From Relative Returns

| | • | Overall stock selection detracted from relative performance versus the benchmark. |

| | • | Consumer Discretionary and Materials had the weakest relative stock selection and were the weakest overall sectors. |

22

Table of Contents

MANAGEMENT DISCUSSION AND ANALYSIS

Tamarack Microcap Value Fund

Investment Objective

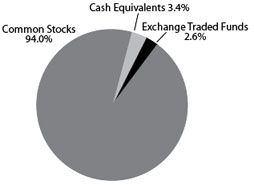

Long-term growth of capital.

Benchmark

Russell 2000 Value Index

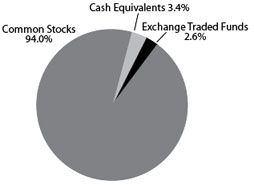

Asset Allocation

(% of fund’s investments excluding securities lending collateral) & Top Five Industries (% of fund’s net assets)

| Top Five Industries | |

|---|

| Consumer Discretionary | 20.4% |

| Financials | 17.3% |

| Industrials | 16.5% |

| Consumer Staples | 8.6% |

| Information Technology | 8.5% |

Top Ten Holdings

(as of 3/31/07)

(% of fund’s net assets)

| iShares Russell Microcap Index Fund | 2.06% | | South Jersey Industries, Inc. | 0.73% |

| Credit Acceptance Corp. | 0.91% | | HEICO Corp. | 0.69% |

| Hub International Ltd. ADR | 0.89% | | HEICO Corp., Class A | 0.69% |

| Consolidated Graphics, Inc. | 0.78% | | Bon-Ton Stores, Inc. | 0.69% |

| Ingles Markets, Inc., Class A | 0.74% | | M & F Worldwide Corp. | 0.68% |

*A listing of all portfolio holdings can be found beginning on page 71.

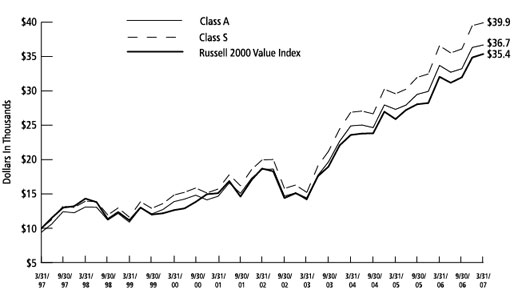

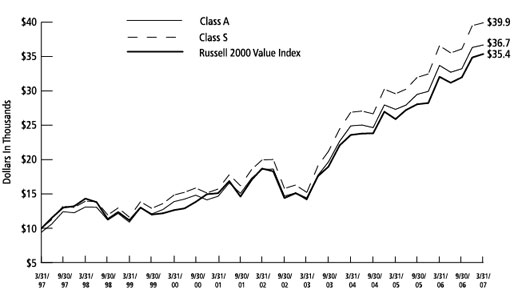

Growth of $10,000 Initial Investment Over 10 Years

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class A shares including the maximum sales charge of 5.75%. The inception date for Class A shares of the Fund is April 19, 2004. All performance shown for Class A shares prior to the inception date is based on the performance of the Class S shares of the Fund, adjusted to reflect the fees, expenses and maximum sales charges of Class A shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures.

23

Table of Contents

FINANCIAL STATEMENTS

Statements of Assets and Liabilities

March 31, 2007

(Unaudited)

| | | Tamarack

Large Cap

Growth Fund | | | Tamarack

Mid Cap

Growth Fund | | | Tamarack

SMID Cap

Growth Fund | | | Tamarack

Enterprise

Fund | |

|---|

| | |

| | |

| | |

| | |

| |

| Assets: | | | | | | | | | | | | | | | | | | |

| Investments, at value (cost $104,750,359; $93,418,412; $8,794,438 and $256,716,251, respectively) | | | | $ | 118,617,232 | | | $ | 115,166,872 | | | $ | 10,050,275 | | | $ | 359,051,248 | |

| Investment of cash collateral for securities on loan, at value (cost $11,210,762; $16,887,814; $-; and $54,531,034, respectively) | | | | | 11,210,762 | | | | 16,887,814 | | | | — | | | | 54,531,034 | |

| | |

| | |

| | |

| | |

| |

| Total Investments | | | | | 129,827,994 | | | | 132,054,686 | | | | 10,050,275 | | | | 413,582,282 | |

| Interest and dividends receivable | | | | | 102,540 | | | | 28,277 | | | | 3,087 | | | | 202,689 | |

| Cash | | | | | — | | | | — | | | | — | | | | 420,647 | |

| Receivable for capital shares issued | | | | | 1,183 | | | | 40,809 | | | | 1,382 | | | | 279,101 | |

| Receivable from advisor | | | | | — | | | | — | | | | 7,102 | | | | — | |

| Prepaid expenses | | | | | 13,050 | | | | 20,333 | | | | 15,787 | | | | 30,969 | |

| | |

| | |

| | |

| | |

| |

| Total Assets | | | | | 129,944,767 | | | | 132,144,105 | | | | 10,077,633 | | | | 414,515,688 | |

| | |

| | |

| | |

| | |

| |

| Liabilities: | | | | | | | | | | | | | | | | | | |

| Cash overdraft | | | | | 53,174 | | | | 2 | | | | — | | | | — | |

| Payable for capital shares redeemed | | | | | 145,778 | | | | 12,369 | | | | 10,461 | | | | 170,305 | |

| Payable for investments purchased | | | | | — | | | | — | | | | — | | | | 393,904 | |

| Payable upon return of securities on loan | | | | | 11,210,762 | | | | 16,887,814 | | | | — | | | | 54,531,034 | |

| Accrued expenses and other payables: | | | | | | | | | | | | | | | | | | |

| Investment advisory fees | | | | | 38,601 | | | | 42,304 | | | | — | | | | 179,039 | |

| Administration fees | | | | | 10,092 | | | | 9,780 | | | | 859 | | | | 30,325 | |

| Distribution fees | | | | | 929 | | | | 10,350 | | | | 1,222 | | | | 6,488 | |

| Other | | | | | 167,315 | | | | 129,063 | | | | 36,795 | | | | 147,503 | |

| | |

| | |

| | |

| | |

| |

| Total Liabilities | | | | | 11,626,651 | | | | 17,091,682 | | | | 49,337 | | | | 55,458,598 | |

| | |

| | |

| | |

| | |

| |

| Net Assets | | | | $ | 118,318,116 | | | $ | 115,052,423 | | | $ | 10,028,296 | | | $ | 359,057,090 | |

| | |

| | |

| | |

| | |

| |

| Net Assets Consist Of: | | | | | | | | | | | | | | | | | | |

| Capital | | | | $ | 135,038,377 | | | $ | 89,829,389 | | | $ | 7,666,892 | | | $ | 238,608,664 | |

| Undistributed net investment income (loss) | | | | | (5,665 | ) | | | (369,328 | ) | | | (63,676 | ) | | | 900,074 | |

| Accumulated net realized gains (losses) from investment transactions | | | | | (30,581,469 | ) | | | 3,843,902 | | | | 1,169,243 | | | | 17,213,355 | |

| Net unrealized appreciation (depreciation) on investments | | | | | 13,866,873 | | | | 21,748,460 | | | | 1,255,837 | | | | 102,334,997 | |

| | |

| | |

| | |

| | |

| |

| Net Assets | | | | $ | 118,318,116 | | | $ | 115,052,423 | | | $ | 10,028,296 | | | $ | 359,057,090 | |

| | |

| | |

| | |

| | |

| |

| Net Assets: | | | | | | | | | | | | | | | | | | |

| Class A | | | | $ | 4,179,388 | | | $ | 40,159,596 | | | $ | 5,275,690 | | | $ | 20,103,882 | |

| Class I | | | | | 1,129,383 | | | | 71,183,226 | | | | 4,399,390 | | | | 43,352,932 | |

| Class C | | | | | 34,775 | | | | 2,020,731 | | | | 30,103 | | | | 2,643,011 | |

| Class R | | | | | 10,195 | | | | 10,768 | | | | 35,788 | | | | 50,306 | |

| Class S | | | | | 112,964,375 | | | | 1,678,102 | | | | 287,325 | | | | 292,906,959 | |

| | |

| | |

| | |

| | |

| |

| Total | | | | $ | 118,318,116 | | | $ | 115,052,423 | | | $ | 10,028,296 | | | $ | 359,057,090 | |

| | |

| | |

| | |

| | |

| |

24

Table of Contents

FINANCIAL STATEMENTS

Statements of Assets and Liabilities (cont.)

| | | Tamarack

Large Cap

Growth Fund | | | Tamarack

Mid Cap

Growth Fund | | | Tamarack

SMID Cap

Growth Fund | | | Tamarack

Enterprise

Fund | |

|---|

| | |

| | |

| | |

| | |

| |

| Shares Outstanding (Unlimited number of shares authorized, no par value): | | | | | | | | | | | | | | | | | | |

| Class A | | | | | 375,040 | | | | 3,153,566 | | | | 522,516 | | | | 798,484 | |

| Class I | | | | | 100,018 | | | | 5,414,802 | | | | 420,321 | | | | 1,707,792 | |

| Class C | | | | | 3,190 | | | | 162,355 | | | | 3,073 | | | | 107,777 | |

| Class R | | | | | 922 | | | | 852 | | | | 3,586 | | | | 2,016 | |

| Class S | | | | | 10,003,341 | | | | 127,535 | | | | 27,482 | | | | 11,542,495 | |

| | |

| | |

| | |

| | |

| |

| Total | | | | | 10,482,511 | | | | 8,859,110 | | | | 976,978 | | | | 14,158,564 | |

| | |

| | |

| | |

| | |

| |

| Net Asset Values and Redemption Price per Share: | | | | | | | | | | | | | | | | | | |

| Class A (a) | | | | $ | 11.14 | | | $ | 12.73 | | | $ | 10.10 | | | $ | 25.18 | |

| | |

| | |

| | |

| | |

| |

| Class I | | | | $ | 11.29 | | | $ | 13.15 | | | $ | 10.47 | | | $ | 25.39 | |

| | |

| | |

| | |

| | |

| |

| Class C (b) | | | | $ | 10.90 | | | $ | 12.45 | | | $ | 9.80 | | | $ | 24.52 | |

| | |

| | |

| | |

| | |

| |

| Class R | | | | $ | 11.05 | (c) | | $ | 12.64 | | | $ | 9.98 | | | $ | 24.95 | |

| | |

| | |

| | |

| | |

| |

| Class S | | | | $ | 11.29 | | | $ | 13.16 | | | $ | 10.46 | | | $ | 25.38 | |

| | |

| | |

| | |

| | |

| |

| Maximum Offering Price Per Share: | | | | | | | | | | | | | | | | | | |

| Class A | | | | $ | 11.82 | | | $ | 13.51 | | | $ | 10.72 | | | $ | 26.72 | |

| | |

| | |

| | |

| | |

| |

| Maximum Sales Charge - Class A | | | | | 5.75 | % | | | 5.75 | % | | | 5.75 | % | | | 5.75 | % |

| | |

| | |

| | |

| | |

| |

| (a) | For Class A shares, redemption price per share is reduced by 1.00% for sales of shares within 12 months of purchase (applicable on purchases of $1 million or more on which no initial sales charge was paid). |

| (b) | For Class C shares, redemption price per share is reduced by 1.00% for sales of shares within 12 months of purchase. |

| (c) | Net asset value is calculated using unrounded net assets of $10,195.21 divided by the unrounded shares of 922.37. |

See notes to financial statements.

25

Table of Contents

FINANCIAL STATEMENTS

Statements of Assets and Liabilities (cont.)

March 31, 2007

(Unaudited)

| | | Tamarack

Small Cap

Core Fund | | | Tamarack

Value Fund | | | Tamarack

Microcap

Value Fund | |

|---|

| | |

| | |

| | |

| |

| Assets: | | | | | | | | | | | | | | |

| Investments, at value (cost $47,007,093; $244,924,653 and $269,284,570, respectively) | | | | $ | 71,045,547 | | | $ | 279,756,016 | | | $ | 367,928,946 | |

| Investment of cash collateral for securities on loan, at value (cost $10,168,057; $13,215,583 and $-, respectively) | | | | | 10,168,057 | | | | 13,215,583 | | | | — | |

| | |

| | |

| | |

| |

| Total Investments | | | | | 81,213,604 | | | | 292,971,599 | | | | 367,928,946 | |

| Interest and dividends receivable | | | | | 55,900 | | | | 510,276 | | | | 274,144 | |

| Receivable for capital shares issued | | | | | 75,527 | | | | 8,323 | | | | 1,648,567 | |

| Receivable for investments sold | | | | | 220,588 | | | | 5,411,899 | | | | — | |

| Prepaid expenses | | | | | 30,861 | | | | 26,694 | | | | 64,488 | |

| | |

| | |

| | |

| |

| Total Assets | | | | | 81,596,480 | | | | 298,928,791 | | | | 369,916,145 | |

| | |

| | |

| | |

| |

| Liabilities: | | | | | | | | | | | | | | |

| Cash overdraft | | | | | 43 | | | | — | | | | 7 | |

| Payable for capital shares redeemed | | | | | 12,035 | | | | 231,358 | | | | 87,421 | |

| Payable for investments purchased | | | | | 542,268 | | | | 8,355,078 | | | | 677,084 | |

| Payable upon return of securities on loan | | | | | 10,168,057 | | | | 13,215,583 | | | | — | |

| Accrued expenses and other payables: | | | | | | | | | | | | | | |

| Investment advisory fees | | | | | 42,170 | | | | 113,775 | | | | 212,926 | |

| Administration fees | | | | | 5,914 | | | | 23,367 | | | | 30,514 | |

| Distribution fees | | | | | 1,052 | | | | 138 | | | | 11,793 | |

| Other | | | | | 65,078 | | | | 197,972 | | | | 78,108 | |

| | |

| | |

| | |

| |

| Total Liabilities | | | | | 10,836,617 | | | | 22,137,271 | | | | 1,097,853 | |

| | |

| | |

| | |

| |

| Net Assets | | | | $ | 70,759,863 | | | $ | 276,791,520 | | | $ | 368,818,292 | |

| | |

| | |

| | |

| |

| Net Assets Consist Of: | | | | | | | | | | | | | | |

| Capital | | | | $ | 42,595,478 | | | $ | 165,190,891 | | | $ | 269,692,013 | |

| Undistributed net investment income (loss) | | | | | 218,411 | | | | 2,110,480 | | | | (285,393 | ) |

| Accumulated net realized gains (losses) from investment transactions | | | | | 3,907,520 | | | | 74,658,786 | | | | 767,296 | |

| Net unrealized appreciation (depreciation) on investments | | | | | 24,038,454 | | | | 34,831,363 | | | | 98,644,376 | |

| | |

| | |

| | |

| |

| Net Assets | | | | $ | 70,759,863 | | | $ | 276,791,520 | | | $ | 368,818,292 | |

| | |

| | |

| | |

| |

| Net Assets: | | | | | | | | | | | | | | |

| Class A | | | | $ | 2,821,029 | | | $ | 554,643 | | | $ | 41,127,770 | |

| Class C | | | | | 572,002 | | | | 25,467 | | | | 3,767,010 | |

| Class R | | | | | 15,510 | | | | 4,223 | | | | 540,086 | |

| Class S | | | | | 67,351,322 | | | | 276,207,187 | | | | 323,383,426 | |

| | |

| | |

| | |

| |

| Total | | | | $ | 70,759,863 | | | $ | 276,791,520 | | | $ | 368,818,292 | |

| | |

| | |

| | |

| |

26

Table of Contents

FINANCIAL STATEMENTS

Statements of Assets and Liabilities (cont.)

| | | Tamarack

Small Cap

Core Fund | | | Tamarack

Value Fund | | | Tamarack

Microcap

Value Fund | |

|---|

| | |

| | |

| | |

| |

| Shares Outstanding (Unlimited number of shares authorized, no par value): | | | | | | | | | | | | | | |

| Class A | | | | | 90,682 | | | | 13,898 | | | | 1,795,230 | |

| Class C | | | | | 18,827 | | | | 645 | | | | 167,754 | |

| Class R | | | | | 502 | | | | 106 | | | | 23,677 | |

| Class S | | | | | 2,152,555 | | | | 6,914,332 | | | | 14,051,898 | |

| | |

| | |

| | |

| |

| Total | | | | | 2,262,566 | | | | 6,928,981 | | | | 16,038,559 | |

| | |

| | |

| | |

| |

| Net Asset Values and Redemption Price per Share: | | | | | | | | | | | | | | |

| Class A (a) | | | | $ | 31.11 | | | $ | 39.91 | | | $ | 22.91 | |

| | |

| | |

| | |

| |

| Class C (b) | | | | $ | 30.38 | | | $ | 39.48 | | | $ | 22.46 | |

| | |

| | |

| | |

| |

| Class R | | | | $ | 30.87 | (c) | | $ | 39.84 | | | $ | 22.81 | |

| | |

| | |

| | |

| |

| Class S | | | | $ | 31.29 | | | $ | 39.95 | | | $ | 23.01 | |

| | |

| | |

| | |

| |

| Maximum Offering Price Per Share: | | | | | | | | | | | | | | |

| Class A | | | | $ | 33.01 | | | $ | 42.34 | | | $ | 24.31 | |

| | |

| | |

| | |

| |

| Maximum Sales Charge - Class A | | | | | 5.75 | % | | | 5.75 | % | | | 5.75 | % |

| | |

| | |

| | |

| |

| (a) | For Class A shares, redemption price per share is reduced by 1.00% for sales of shares within 12 months of purchase (applicable on purchases of $1 million or more on which no initial sales charge was paid). |

| (b) | For Class C shares, redemption price per share is reduced by 1.00% for sales of shares within 12 months of purchase. |

| (c) | Net asset value is calculated using unrounded net assets of $15,509.86 divided by the unrounded shares outstanding of 502.40. |

See notes to financial statements.

27

Table of Contents

FINANCIAL STATEMENTS

Statements of Operations

For the Six Months Ended

March 31, 2007

(Unaudited)

| | | Tamarack

Large Cap

Growth Fund | | | Tamarack

Mid Cap

Growth Fund | | | Tamarack

SMID Cap

Growth Fund | | | Tamarack

Enterprise

Fund | |

|---|

| | |

| | |

| | |

| | |

| |

| Investment Income: | | | | | | | | | | | | | | | | | | |

| Interest income | | | | $ | 27,984 | | | $ | 27,703 | | | $ | 504 | | | $ | 304,589 | |

| Dividend income | | | | | 599,153 | | | | 304,777 | | | | 19,066 | | | | 2,564,879 | |

| Securities lending income (a) | | | | | 8,004 | | | | 11,124 | | | | — | | | | 114,800 | |

| | |

| | |

| | |

| | |

| |

| Total Investment Income | | | | | 635,141 | | | | 343,604 | | | | 19,570 | | | | 2,984,268 | |

| | |

| | |

| | |

| | |

| |

| Expenses: | | | | | | | | | | | | | | | | | | |

| Investment advisory fees | | | | | 444,596 | | | | 413,419 | | | | 37,117 | | | | 1,697,494 | |

| Administration fees | | | | | 63,513 | | | | 59,059 | | | | 5,302 | | | | 180,298 | |

| Distribution fees - Class A | | | | | 12,124 | | | | 105,615 | | | | 14,135 | | | | 48,499 | |

| Distribution fees - Class C | | | | | 155 | | | | 10,434 | | | | 178 | | | | 12,492 | |

| Distribution fees - Class R | | | | | 25 | | | | 26 | | | | 79 | | | | 130 | |

| Accounting fees | | | | | 47,930 | | | | 44,899 | | | | 7,888 | | | | 130,018 | |

| Custodian fees | | | | | 1,863 | | | | 1,519 | | | | 1,562 | | | | 4,863 | |

| Insurance fees | | | | | 4,469 | | | | 4,205 | | | | 385 | | | | 12,610 | |

| Legal and Audit fees | | | | | 20,913 | | | | 16,514 | | | | 9,607 | | | | 28,534 | |

| Registration and filing fees | | | | | 28,295 | | | | 29,280 | | | | 28,778 | | | | 28,027 | |

| Shareholder reports | | | | | 31,894 | | | | 13,182 | | | | 5,022 | | | | 43,756 | |

| Transfer agent fees | | | | | 177,451 | | | | 170,453 | | | | 37,401 | | | | 223,264 | |

| Trustees’ fees | | | | | 9,523 | | | | 9,508 | | | | 9,351 | | | | 9,850 | |

| Other fees | | | | | 1,555 | | | | 1,441 | | | | 257 | | | | 4,079 | |

| | |

| | |

| | |

| | |

| |

| Total expenses before fee reductions | | | | | 844,306 | | | | 879,554 | | | | 157,062 | | | | 2,423,914 | |

| Expenses reduced by: | | | | | | | | | | | | | | | | | | |

| Advisor | | | | | (197,438 | ) | | | (113,814 | ) | | | (66,749 | ) | | | (415,797 | ) |

| Distributor | | | | | (6,062 | ) | | | (52,808 | ) | | | (7,067 | ) | | | (24,249 | ) |

| | |

| | |

| | |

| | |

| |

| Net Expenses | | | | | 640,806 | | | | 712,932 | | | | 83,246 | | | | 1,983,868 | |

| | |

| | |

| | |

| | |

| |

| Net Investment Income (Loss) | | | | | (5,665 | ) | | | (369,328 | ) | | | (63,676 | ) | | | 1,000,400 | |

| | |

| | |