UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

100 South Fifth Street, Suite 2300

Minneapolis, MN 55402-1240

(Address of principal executive offices) (Zip code)

Lee Greenhalgh, Esq.

RBC Plaza

60 South Sixth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 313-1341

Date of fiscal year end: September 30

Date of reporting period: March 31, 2010

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Semi-Annual Report

For the period ended March 31, 2010

RBC Mid Cap Growth Fund

RBC Enterprise Fund

RBC Small Cap Core Fund

RBC Microcap Value Fund

RBC Mid Cap Value Fund

| | | | |

| | RBC Funds | | |

| | |

About Your Semi-Annual Report | | | | |

| | This semi-annual report includes detailed information about your Fund including financial statements, performance, and a complete list of its holdings. |

| |

| | The RBC Funds compare their performance against various Russell equity indices. Each of these indices is a widely recognized measure of return for the underlying category of securities. However, the indices are unmanaged, do not include fees, and cannot be invested in directly. |

| |

| | We hope the financial information presented will help you evaluate your investment in the RBC Funds. We also encourage you to read your Funds’ prospectus for further detail as to your Funds’ investment policies and risk profile. RBC Funds prospectuses and performance information subsequent to the date of this report are available on our website at www.rbcgam.us. |

| |

| | A description of the policies and procedures that your Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-422-2766; (ii) on the Fund’s website at www.rbcgam.us; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov. |

| |

| | Information regarding how your Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available (i) on the Fund’s website at www.rbcgam.us; and (ii) on the Commission’s website at http://www.sec.gov. |

| |

| | A schedule of each Fund’s portfolio holdings will be filed with the Commission for the first and third quarters of each fiscal year on Form N-Q. This information is available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room is available by calling 1-800-SEC-0330. |

| | |

Table of Contents | | | | |

| | | | |

| | |

| | Letter from the CIO of Equities | | 1 |

| | Equity Portfolio Managers | | 3 |

| | Performance Summary | | 5 |

| | RBC Mid Cap Growth Fund | | 9 |

| | RBC Enterprise Fund | | 10 |

| | RBC Small Cap Core Fund | | 11 |

| | RBC Microcap Value Fund | | 12 |

| | RBC Mid Cap Value Fund | | 13 |

| | Schedules of Portfolio Investments | | 14 |

| | Financial Statements | | |

| | - Statements of Assets and Liabilities | | 36 |

| | - Statements of Operations | | 38 |

| | - Statements of Changes in Net Assets | | 39 |

| | Financial Highlights | | 44 |

| | Notes to Financial Statements | | 54 |

| | Share Class Information | | 65 |

| | Supplemental Information | | 66 |

| | Approval of Investment Advisory Fees | | 68 |

| | |

| | LETTER FROM THE CIO OF EQUITIES A Strong Year Continues In retrospect, 2009 will be recorded in the history books as a remarkable year. In the span of 12 months, the stock market experienced both the depths of the credit-crisis-driven decline and the relief of a surprisingly strong-though still incomplete recovery. The broad market S&P 500 Index returned 26.5% for the 2009 calendar year, its best showing since 2003. Investors who had the fortitude to maintain their long-term strategies were able to regain a sizable portion of what they had lost during the downturn, although they had to endure a nerve testing ride along the way. The upward trend for U.S. equity markets continued in a volatile fashion for the first three months of 2010. For the quarter, the S&P 500 rose 5.4%. Early January saw the benchmark rise 3.2% to January 19th. From there to February 8th, the market declined 8%, as worries about China slowing down, and about Greece defaulting on its debt, weighed upon investors. Subsequently strong economic data across the world, and a belief that the Greek situation would be worked out, helped fuel a rally of 11% from February 8th to the end of the first quarter. Going Forward As has been the case for more than a year, investors remain inclined toward skepticism over the health and longevity of the current economic recovery. To a certain extent, such doubts are normal at this relatively youthful point in the business cycle. However, current levels of concern are somewhat higher than have been observed at previous similar cyclical junctures, suggesting that the severity of the 2008-09 recessions continues to exact a toll on sentiment. Such distrust is perfectly natural and reflects the severe beatings taken by stock market investors back in 2000-02 and more recently in 2007-09 when such allegedly once in a lifetime hits became a twice in a decade phenomenon. The actual economic outlook is biased toward a continued strengthening of economic growth. It is therefore likely that accumulating evidence of economic strength may erode investor skepticism regarding the robustness of the recovery, potentially producing a continuation of the rally in cyclical assets. Investors should also be prepared for some positive surprises illuminating the near-universal gloom surrounding fiscal prospects. Currently, many investors are worried about a potential economic slowdown and stock market correction once the inventory re-stocking phase has finished. These concerns appear to be centered on the simple observation that sensitive cyclical indicators, such as the Purchasing Managers Index new order series, have often been highly correlated with stock market returns. But the data looking out over the next few quarters should provide proof to investors that the approximately 70% rebound in equities is appropriate given the likely earnings trend. As we have highlighted in the past, equity markets do trade with quarterly earnings and earnings have a strong relationship with industrial activity. Given that credit conditions generally lead industrial activity by nine months, one can feel reasonably good about the balance of the year in terms of economic data. As far as equities are concerned, stronger-than-expected growth should bolster confidence in the durability of the current expansion. Although equities appear to be fairly valued on this year’s earnings, it is harder to make that statement about longer forward valuations, in particular with developed markets. These longer forward valuations are definitively cheap. The discount |

1

| | |

| | LETTER FROM THE CIO OF EQUITIES |

| | |

| | for longer forward equity valuations is larger than usual, suggesting a higher-than-normal level of skepticism regarding the persistence and durability of this business cycle. This discount can be thought of as a barometer of confidence in the longer-term outlook for corporate profits and economic growth. Understandably, strong growth boosts confidence in the longer run economic outlook and reduces the discount placed on longer forward valuations. |

| |

| | Stay the Course |

| |

| | Once the details of the financial crisis have faded, history will show that it created an opportunity for equity investors to profit from a strong year of returns. 2008, one of the worst years ever for stocks was followed by 2009- one of the best. A potent reminder of how important it is to stay invested, even through very challenging times. Many equity investors suffered steep losses in the extended downturn that started in October 2007, and they have yet to regain all the ground lost. The S&P 500 Index’s 69.4% return from its bottom on March 6, 2009 through March 31, 2010 has allowed many investors to recoup losses in stocks. Investors who had faith in the market’s ability to recover kept their money at work instead of abandoning their long-term strategy. Those investors should be better off today than 12 months ago. |

| |

| | Many pieces for the potential continuation of the equity rally are in place. An unscientific reading of the press reveals a great deal of disbelief that the rally can continue. In addition, individuals, at least based on mutual fund data, have not yet returned to the stock market. Manufacturing and capital spending surveys around the world are showing a high degree of strength. The leg of the economy that needs to follow a rebound in manufacturing, consumer spending, may be turning as the employment report for March showed significant job growth. |

| |

| | However, based on what moved the market in the first quarter, much will depend upon economic growth and risks to sovereign debt outside of the U.S. While the picture on growth is constructive, the picture on debt is less so. That risk bears watching. So the way forward will not be without ups and downs. While the long-term path of equity markets has been upward, the journey has frequently been interrupted by bear market declines-sometimes substantial ones. As long as stock markets exist, there will be exhilarating rallies and harrowing sell-offs. That is why it is so important to consider your portfolio asset allocation carefully. And once a strategy is in place, check in regularly to ensure that the portfolio is still appropriate. |

| |

Gordon Telfer Chief Investment Officer, Equity Products | |  |

| | Gordon Telfer |

| | RBC Funds Chief Investment Officer |

| | Equity Products |

| | Past performance is not a guarantee of future results. |

| | Opinions expressed are subject to change, are not guaranteed, and should not be considered a recommendation to buy or sell any security. |

| | Mutual fund investing involves risk. Principal loss is possible. |

| | The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. You cannot invest directly in an index. |

2

EQUITY PORTFOLIO MANAGERS

| | |

| RBC Global Asset Management (U.S.) Inc. (“RBC GAM (US)”) (formerly known as Voyageur Asset Management, Inc.), serves as the investment advisor to the RBC Funds. RBC GAM (US) employs a team approach to the management of the RBC Equity Funds, with no individual team member being solely responsible for the investment decisions. | | |

| |

| Gordon Telfer | | |

| Chief Investment Officer, Equity Products, Managing Director, Head of | | |

| Growth Equities US. | |

Gordon Telfer |

Gordon Telfer is Chief Investment Officer, Equity Products and is responsible for directing RBC GAM (US)’s U.S. equities research efforts. He joined RBC GAM (US) in 2003 from Alliance Capital Management where he was a senior portfolio manager and a member of Alliance’s Investment Policy Group. Prior to Alliance, he worked for Scudder Kemper Investments as senior vice president and global strategist and spokesperson for Scudder Kemper’s U.S. and International Portfolio Management Group. Gordon began his career in the investment industry in 1986 at Murray Johnstone International in portfolio management. He has spoken at numerous regional and national conferences on portfolio management and been a guest on CNBC. A native of Glasglow, Scotland, Gordon received his Stock Exchange Diploma from the Herriott Watt University, Edinburgh, Scotland | |

| |

| Lance F. James | | |

| Managing Director, Senior Portfolio Manager | |

Lance F. James |

Lance James is responsible for portfolio management of the RBC Small Cap Core Fund, RBC Enterprise Fund, and RBC Microcap Value Fund. He is also co-manager of RBC Mid Cap Value Fund. Prior to joining RBC GAM (US) in 2006, Lance was an equity analyst and portfolio manager for OFI Institutional and Babson Capital Management, affiliated companies of Mass Mutual Life Insurance Company. During his tenure he served as head of the firm’s small/mid cap value investment team. Prior to joining Babson Capital in 1986, Lance worked at Rockwell International Corporation, EBF Associates of Boston and Hewitt Associates. Lance began his career in the investment industry in 1980. He received an AB in Economics from Princeton University and an MBA in Finance from the Wharton School of Business at the University of Pennsylvania. | |

| |

| George Prince | | |

| Portfolio Manager, Senior Equity Analyst | |

George Prince |

George Prince serves as the co-portfolio manager for the RBC Enterprise Fund. George also provides research support for the RBC Small Cap Core Fund. He joined RBC GAM (US) in 2006 from Eagle Asset Management, where he was a senior equity analyst. Prior to his experience at Eagle Asset Management, George was an analyst at Babson Capital Management. George also has a great deal of entrepreneurial experience and founded SignStorey, a leader in place-based digital communications in retail stores and co-founded Cutting Edge Inc., a global CAD-CAM technology company. George has over 12 years of investment industry experience. He received a BA from Yale University. | |

3

| | |

| | EQUITY PORTFOLIO MANAGERS |

| |

| | Kenneth A. Tyszko, CPA, CFA |

Kenneth A. Tyszko | | Vice President, Senior Portfolio Manager |

| | Ken Tyszko is responsible for portfolio management of the RBC Mid Cap Growth Fund. He joined RBC GAM (US) in 2001 from Oberweis Asset Management Inc., where he served as a portfolio manager. From 1996 to 1999, he managed small cap growth assets for ABN AMRO Asset Management (USA) Inc. and ABN AMRO Incorporated. Before working at ABN AMRO, Ken was a portfolio manager with Sears Investment Management Co. (SIMCO). His background also includes experience at Main Hurdman, an international accounting and consulting firm. Ken began his career in the investment industry in 1984. He received a BS in Accountancy from the University of Illinois. Ken is both a CFA charterholder and a Certified Public Accountant. He is a member of the Illinois CPA Society, the CFA Society of Chicago and the CFA Institute. Ken has been a guest on Bloomberg Television and WebFN. |

| | |

| | |

| | |

| |

| | Stephen E. Kylander |

Stephen E. Kylander | | Vice President, Senior Portfolio Manager |

| | Steve Kylander is responsible for portfolio management of the RBC Mid Cap Value Fund. Prior to joining RBC GAM (US) in 2006, he was a portfolio manager and research analyst for Babson Capital Management. Steve’s previous experience also includes strategy consulting, mergers and acquisitions work and investment banking for L.E.K. Consulting, The Yarmouth Group, and First Boston Corporation. He began working in the investment industry in 1986. Steve earned a BA from Dartmouth College and an MBA from Harvard Business School. |

| | |

| | |

| | |

| | |

| | |

| | |

4

PERFORMANCE SUMMARY

Average Annual Total Returns as of March 31, 2010 (Unaudited)

RBC Mid Cap Growth Fund (a)

| | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(b) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

Class A | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | 36.56 | % | | (6.04 | )% | | 0.10 | % | | 1.58 | % | | 9.80 | % | | | | | | |

- At Net Asset Value | | 44.94 | % | | (4.16 | )% | | 1.29 | % | | 2.18 | % | | 10.14 | % | | 1.35 | % | | 1.88 | % |

| | | | | | | |

Class C (c) | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | 42.69 | % | | (4.90 | )% | | 0.52 | % | | 1.42 | % | | 9.32 | % | | | | | | |

- At Net Asset Value | | 43.69 | % | | (4.90 | )% | | 0.52 | % | | 1.42 | % | | 9.32 | % | | 2.10 | % | | 2.38 | % |

| | | | | | | |

Class I | | 45.34 | % | | (3.90 | )% | | 1.57 | % | | 2.45 | % | | 10.47 | % | | 1.10 | % | | 1.38 | % |

| | | | | | | |

Class R (c) | | 44.51 | % | | (4.38 | )% | | 1.06 | % | | 1.94 | % | | 9.87 | % | | 1.59 | % | | 1.86 | % |

| | | | | | | |

Class S (d) | | 45.34 | % | | (3.93 | )% | | 1.57 | % | | 2.45 | % | | 10.47 | % | | 1.10 | % | | 1.38 | % |

| | | | | | | |

Russell Midcap Growth Index* | | 63.00 | % | | (2.04 | )% | | 4.27 | % | | (1.69 | )% | | 9.86 | % | | | | | | |

RBC Enterprise Fund (e)

| | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(f) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

Class A (g) | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | 49.21 | % | | (10.29 | )% | | (1.48 | )% | | 6.81 | % | | 9.85 | % | | | | | | |

- At Net Asset Value | | 58.35 | % | | (8.50 | )% | | (0.31 | )% | | 7.45 | % | | 10.10 | % | | 1.33 | % | | 2.01 | % |

| | | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | 56.16 | % | | (9.16 | )% | | (1.05 | )% | | 6.65 | % | | 9.28 | % | | | | | | |

- At Net Asset Value | | 57.16 | % | | (9.16 | )% | | (1.05 | )% | | 6.65 | % | | 9.28 | % | | 2.08 | % | | 2.50 | % |

| | | | | | | |

Class I (h) | | 58.68 | % | | (8.28 | )% | | (0.06 | )% | | 7.72 | % | | 10.37 | % | | 1.08 | % | | 1.50 | % |

| | | | | | | |

Class R (g) | | 57.98 | % | | (8.70 | )% | | (0.55 | )% | | 7.18 | % | | 9.82 | % | | 1.57 | % | | 1.98 | % |

| | | | | | | |

Class S | | 58.86 | % | | (8.26 | )% | | (0.06 | )% | | 7.72 | % | | 10.37 | % | | 1.08 | % | | 1.51 | % |

| | | | | | | |

Russell 2000 Index* | | 62.76 | % | | (3.99 | )% | | 3.36 | % | | 3.68 | % | | 8.71 | % | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us. Please see footnotes on page 7.

5

PERFORMANCE SUMMARY

RBC Small Cap Core Fund (i)

| | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(j) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

Class A (g) | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | 64.92 | % | | (5.45 | )% | | 1.74 | % | | 6.18 | % | | 9.26 | % | | | | | | |

- At Net Asset Value | | 75.00 | % | | (3.56 | )% | | 2.95 | % | | 6.81 | % | | 9.61 | % | | 1.55 | % | | 2.65 | % |

| | | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | 72.84 | % | | (4.17 | )% | | 2.27 | % | | 6.05 | % | | 8.81 | % | | | | | | |

- At Net Asset Value | | 73.84 | % | | (4.17 | )% | | 2.27 | % | | 6.05 | % | | 8.81 | % | | 2.30 | % | | 3.16 | % |

| | | | | | | |

Class R (g) | | 74.68 | % | | (3.67 | )% | | 2.78 | % | | 6.58 | % | | 9.35 | % | | 1.79 | % | | 2.65 | % |

| | | | | | | |

Class S | | 75.42 | % | | (3.21 | )% | | 3.28 | % | | 7.11 | % | | 9.90 | % | | 1.30 | % | | 2.16 | % |

| | | | | | | |

Russell 2000 Index* | | 62.76 | % | | (3.99 | )% | | 3.36 | % | | 3.68 | % | | 9.10 | % | | | | | | |

RBC Microcap Value Fund (k)

| | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception(l) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

Class A (g) | | | | | | | | | | | | | | | | | | | | | |

- Including Maximum Sales Charge of 5.75% | | 60.22 | % | | (10.12 | )% | | (0.50 | )% | | 6.74 | % | | 8.14 | % | | | | | | |

- At Net Asset Value | | 69.93 | % | | (8.32 | )% | | 0.69 | % | | 7.37 | % | | 8.42 | % | | 1.32 | % | | 1.87 | % |

| | | | | | | |

Class C (g) | | | | | | | | | | | | | | | | | | | | | |

- Including Contingent Deferred Sales Charge of 1.00% | | 67.68 | % | | (9.00 | )% | | (0.05 | )% | | 6.57 | % | | 7.62 | % | | | | | | |

- At Net Asset Value | | 68.68 | % | | (9.00 | )% | | (0.05 | )% | | 6.57 | % | | 7.62 | % | | 2.07 | % | | 2.37 | % |

| | | | | | | |

Class R (g) | | 69.55 | % | | (8.54 | )% | | 0.44 | % | | 7.10 | % | | 8.15 | % | | 1.56 | % | | 1.88 | % |

| | | | | | | |

Class S | | 70.35 | % | | (8.09 | )% | | 0.94 | % | | 7.64 | % | | 8.69 | % | | 1.07 | % | | 1.37 | % |

| | | | | | | |

Russell 2000 Value Index* | | 65.07 | % | | (5.71 | )% | | 2.75 | % | | 8.90 | % | | 9.76 | % | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us. Please see footnotes on page 7.

6

PERFORMANCE SUMMARY

RBC Mid Cap Value Fund

| | | | | | | | | |

| | | Since

Inception(m) | | | Net

Expense

Ratio(1)(2) | | | Gross

Expense

Ratio(1)(2) | |

Class I | | | | | | | | | |

- At Net Asset Value | | 7.60 | % | | 0.90 | % | | 3.54 | % |

| | | |

Russell MidCap Value Index* | | 9.61 | % | | | | | | |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. Performance information does not reflect the 2% fee on shares redeemed or exchanged within 30 days of purchase. If such redemption fee was included, performance would be reduced. For performance data current to the most recent month-end go to www.rbcgam.us. Please see footnotes below.

| (1) | The Funds’ expenses reflect the most recent fiscal year-end (September 30, 2009). For the RBC Mid Cap Value Fund, the expenses reflected are from the Fund’s current prospectus. |

| (2) | The Adviser has contractually agreed to waive fees and/or make payments in order to keep total operating expenses of the Fund to the levels listed under net expense ratio until January 31, 2011. |

| * | Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but do not include sales fees or operating expenses. You cannot invest directly in indices. (a) The performance in the table for the period from June 1, 1994 to April 19, 2004 reflects the performance of RBC Mid Cap Equity Fund, the predecessor to RBC Mid Cap Growth Fund. The performance of the Fund also includes the performance of a common trust fund (“CTF”) account advised by RBC GAM (US) (including its predecessor) and managed the same as the Fund in all material respects for the period from December 31, 1990 to June 1, 1994, as adjusted to reflect the full contractual rate of expenses associated with the Fund at its inception. The CTF account was not registered with the SEC under the 1940 Act and therefore was not subject to the investment restrictions imposed by law on registered mutual funds. If the CTF account had been registered, the CTF account’s performance may have been adversely affected. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (b) | The since inception date (commencement of operations) of the Fund is December 31, 1990. |

| (c) | The inception date for Class C and Class R Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class A Shares of the Fund, adjusted to reflect the fees and expenses of Class C and Class R Shares, as applicable (and where applicable, the maximum sales charges of the Class C Shares). |

| (d) | The inception date for Class S Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class I Shares of the Fund, adjusted to reflect the fees and expenses of Class S Shares. |

| (e) | The performance in the table for the period from December 2, 1983 to April 19, 2004 reflects the performance of Babson Enterprise Fund, the predecessor to RBC Enterprise Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (f) | The since inception date (commencement of operations) of the Fund is December 2, 1983. The performance of the index since inception of the Fund is calculated from November 30, 1983. |

| (g) | The inception date for Class A, Class C and Class R Shares of the Fund is April 19, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class A, Class C and Class R Shares, as applicable (and where applicable, the maximum sales charges of the Class A and Class C Shares). |

7

PERFORMANCE SUMMARY

| (h) | The inception date for Class I Shares of the Fund is September 30, 2004. All performance shown for each such class of shares prior to its inception date is based on the performance of the Class S Shares of the Fund, adjusted to reflect the fees and expenses of Class I Shares, as applicable. |

| (i) | The performance in the table for the period from August 5, 1991 to April 19, 2004 reflects the performance of Babson Enterprise Fund II, the predecessor to RBC Small Cap Core Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (j) | The since inception date (commencement of operations) of the Fund is August 5, 1991. The performance of the index since inception of the Fund is calculated from July 31, 1991. |

| (k) | The performance in the table for the period from September 10, 1987 to April 19, 2004 reflects the performance of Shadow Stock Fund, the predecessor to RBC Microcap Value Fund. Fund performance reflects applicable fee waivers/expense reimbursements (which, if excluded, would cause performance to be lower). |

| (l) | The since inception date (commencement of operations) of the Fund is September 10, 1987. The performance of the index since inception of the Fund is calculated from August 31, 1987. |

| (m) | The since inception date (commencement of operations) of the Fund is December 31, 2009. The performance of the index since inception of the Fund is calculated from December 31, 2009. |

The Russell Midcap Growth Index is an unmanaged index that measures the performance of those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 2000 Value Index is an unmanaged index that measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Index is an unmanaged index that measures the performance of approximately 2,000 of the smallest securities in the Russell 3000 Index based on a combination of their market cap and current index membership.

The Russell Midcap Value Index is an unmanaged, market-weighted total return index that tracks the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth rates.

8

| | | | | | | | | | |

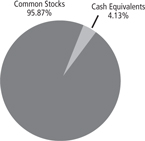

| | FUND STATISTICS (UNAUDITED) RBC Mid Cap Growth Fund | |

| | | | |

| Investment Objective | | Long-term capital appreciation. | | | | | | | | |

Benchmark | | Russell Midcap Growth Index | | | | | | | | |

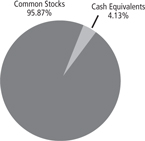

Asset Allocation (as of 3/31/10) (% of fund’s investments) & Top Five Industries (as of 3/31/10) (% of fund’s net assets) | |

| | | | | Top Five Industries | | | |

| | | | | | Health Care | | 24.08 | % |

| | | | | | Information Technology | | 22.77 | % |

| | | | | | Industrials | | 16.67 | % |

| | | | | | Consumer Discretionary | | 13.64 | % |

| | | | | | Financials | | 7.34 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | |

Top Ten Holdings (as of 3/31/10) (% of fund’s net assets) | | F5 Networks, Inc. | | 2.47 | % | | LKQ Corp. | | 1.88 | % |

| | Catalyst Health Solutions, Inc. | | 2.30 | % | | Tractor Supply Co. | | 1.85 | % |

| | Riverbed Technology, Inc. | | 2.21 | % | | Edwards Lifesciences Corp. | | 1.84 | % |

| | Ross Stores, Inc. | | 2.00 | % | | Fossil, Inc. | | 1.83 | % |

| | Akamai Technologies, Inc. | | 1.94 | % | | Henry Schein, Inc. | | 1.81 | % |

| |

| | * A listing of all portfolio holdings can be found beginning on page 15. | |

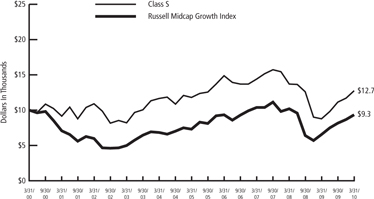

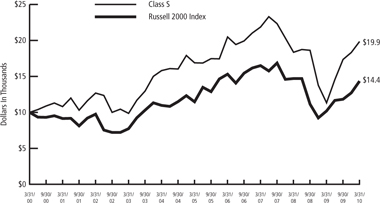

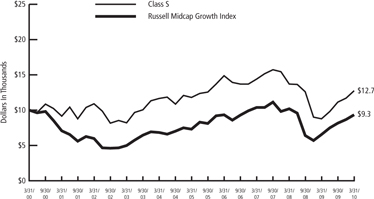

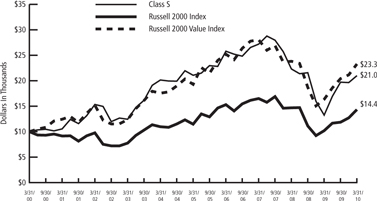

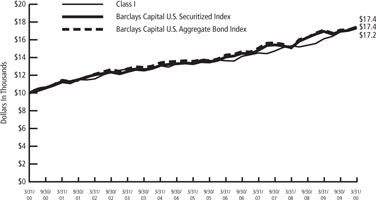

Growth of $10,000 Initial Investment Over 10 Years | |

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 2000 to April 19, 2004 reflects the performance of RBC Mid Cap Equity Fund, the predecessor to RBC Mid Cap Growth Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | |

9

FUND STATISTICS (UNAUDITED)

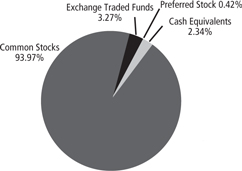

RBC Enterprise Fund

| | | | | | | | | | |

Long-term growth of capital. | | | | | | | | | | Investment Objective |

| | | | |

Russell 2000 Index | | | | | | | | | | Benchmark |

| | | | | Top Five Industries | | | | | Asset Allocation (as of 3/31/10) (% of fund’s investments) & Top Five Industries (as of 3/31/10) (% of fund’s net assets) |

| | | | | Information Technology | | 27.30 | % | |

| | | | | Industrials | | 20.59 | % | |

| | | | | Consumer Discretionary | | 17.16 | % | |

| | | | | Health Care | | 9.44 | % | |

| | | | | Financials | | 9.15 | % | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | |

Spectrum Control, Inc. | | 4.54 | % | | Columbus McKinnon Corp. | | 3.18 | % | | Top Ten Holdings (as of 3/31/10) (% of fund’s net assets) |

Universal Electronics, Inc. | | 4.13 | % | | Universal Stainless & Alloy | | 3.10 | % | |

Steinway Musical Instruments | | 3.81 | % | | Sonic Solutions, Inc. | | 3.00 | % | |

LaBarge, Inc. | | 3.53 | % | | NIC, Inc. | | 2.82 | % | |

AZZ, Inc. | | 3.24 | % | | EMS Technologies, Inc. | | 2.47 | % | |

| |

* A listing of all portfolio holdings can be found beginning on page 18. | | | |

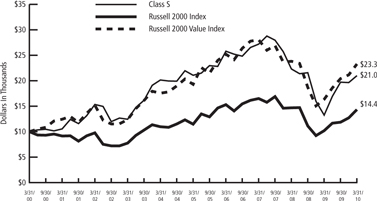

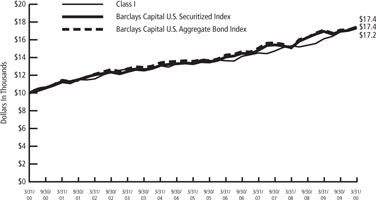

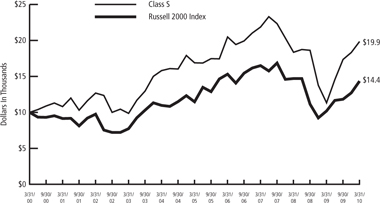

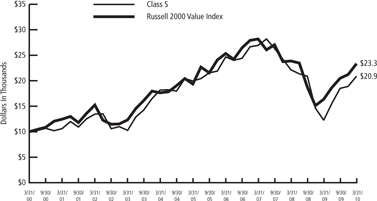

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 2000 to April 19, 2004 reflects the performance of Babson Enterprise Fund, the predecessor to RBC Enterprise Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | Growth of $10,000 Initial Investment Over 10 Years |

10

| | | | | | | | | | |

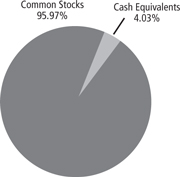

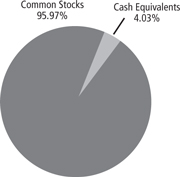

| | FUND STATISTICS (UNAUDITED) RBC Small Cap Core Fund | |

| | | | |

| Investment Objective | | Long-term growth of capital and income. | | | | | | | | |

| | | | |

| Benchmark | | Russell 1000 Value Index | | | | | | | | |

Asset Allocation (as of 3/31/10) (% of fund’s investments) & Top Five Industries (as of 3/31/10) (% of fund’s net assets) | |

| | | | | Top Five Industries | | | |

| | | | | | Industrials | | 23.27 | % |

| | | | | | Information Technology | | 19.10 | % |

| | | | | | Consumer Discretionary | | 14.60 | % |

| | | | | | Health Care | | 11.77 | % |

| | | | | | Financials | | 11.15 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Top Ten Holdings (as of 3/31/10) (% of fund’s net assets) | | PSS World Medical, Inc. | | 2.98 | % | | Steinway Musical Instruments | | 2.41 | % |

| | Gardner Denver, Inc. | | 2.96 | % | | Casual Male Retail Group, Inc. | | 2.34 | % |

| | AZZ, Inc. | | 2.57 | % | | Ares Capital Corp. | | 2.30 | % |

| | True Religion Apparel, Inc. | | 2.54 | % | | Universal Electronics, Inc. | | 2.29 | % |

| | Spectrum Control, Inc. | | 2.46 | % | | Xyratex Ltd. | | 2.28 | % |

| |

| | * A listing of all portfolio holdings can be found beginning on page 21. | |

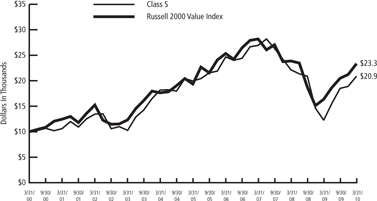

Growth of $10,000 Initial Investment Over 10 Years | |

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 2000 to April 19, 2004 reflects the performance of Babson Enterprise Fund II, the predecessor to RBC Small Cap Core Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | |

11

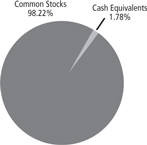

FUND STATISTICS (UNAUDITED)

RBC Microcap Value Fund

| | | | | | | | | | |

| |

| Long-term growth of capital. | | | Investment Objective |

| |

| Russell 2000 Value Index | | | Benchmark |

| | | | | Top Five Industries | | | | | Asset Allocation (as of 3/31/10) (% of fund’s investments) & Top Five Industries (as of 3/31/10) (% of fund’s net assets) |

| | | | | Consumer Discretionary | | 20.77 | % | |

| | | | | Industrials | | 20.54 | % | |

| | | | | Financials | | 19.20 | % | |

| | | | | Information Technology | | 12.49 | % | |

| | | | | Health Care | | 5.74 | % | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Consolidated Graphics, Inc. | | 0.75 | % | | PAM Transportation Services, Inc. | | 0.59 | % | | Top Ten Holdings (as of 3/31/10) (% of fund’s net assets) |

Integrated Silicon Solution, Inc. | | 0.64 | % | | Celadon Group, Inc. | | 0.57 | % | |

Systemax, Inc. | | 0.61 | % | | Elizabeth Arden, Inc. | | 0.55 | % | |

Buckeye Technologies, Inc. | | 0.60 | % | | Perry Ellis International, Inc. | | 0.53 | % | |

American Equity Investment Life Holding Co. | | 0.59 | % | | Kforce, Inc. | | 0.53 | % | |

| |

* A listing of all portfolio holdings can be found beginning on page 24. | | | |

The graph reflects an initial investment of $10,000 over a 10 year period and is based on Class S shares. The performance of the Fund for the period from March 31, 2000 to April 19, 2004 reflects the performance of Shadow Stock Fund, the predecessor to RBC Microcap Value Fund. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. | | | Growth of $10,000 Initial Investment Over 10 Years |

12

| | | | | | | | | | |

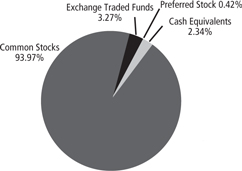

| | FUND STATISTICS (UNAUDITED) RBC Mid Cap Value Fund | |

| | | | |

| Investment Objective | | Long-term capital appreciation. | | | | | | | | |

| | | | |

| Benchmark | | Russell Midcap Value Index | | | | | | | | |

Asset Allocation (as of 03/31/10) (% of fund’s investments) & Top Five Industries (as of 03/31/10) (% of fund’s net assets) | |

| | | | | Top Five Industries | | | |

| | | | | | | Financials | | 18.88 | % |

| | | | | | | Materials | | 17.44 | % |

| | | | | | | Information Technology | | 15.28 | % |

| | | | | | | Industrials | | 14.02 | % |

| | | | | | | Consumer Discretionary | | 9.75 | % |

| | | | |

| Top Ten Holdings (as of 03/31/10) (% of fund’s net assets) | | Harris Corp. | | 4.29 | % | | Owens-Illinois, Inc. | | 2.25 | % |

| | Crown Holdings, Inc. | | 3.82 | % | | Reinsurance Group of America, Inc. | | 2.22 | % |

| | Pactiv Corp. | | 3.66 | % | | First Horizon National Corp. | | 2.20 | % |

| | Kohl’s Corp. | | 2.45 | % | | FMC Corp. | | 2.19 | % |

| | CACI International, Inc., Class A | | 2.43 | % | | | | | |

| | Comtech Telecommunications Corp. | | 2.32 | % | | | | | |

| | |

| | * A listing of all portfolio holdings can be found beginning on page 34. | | | |

| |

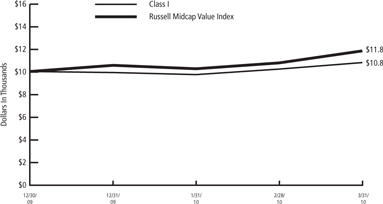

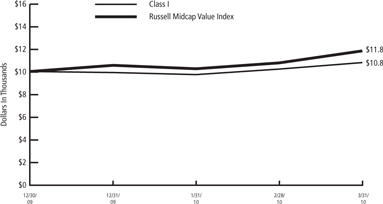

| Growth of $10,000 Initial Investment Since Inception (12/30/09) | |

The graph reflects an initial investment of $10,000 over the period from December 30,2009 to March 31, 2010 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return, while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | |

13

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Mid Cap Growth Fund

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

Common Stocks — 96.27% | | | |

Consumer Discretionary — 13.64% | | | |

| | 10,400 | | Capella Education Co.* | | $ | 965,536 |

| | 29,400 | | Fossil, Inc.* | | | 1,109,556 |

| | 20,100 | | Guess?, Inc. | | | 944,298 |

| | 56,160 | | LKQ Corp.* | | | 1,140,048 |

| | 12,200 | | Panera Bread Co., Class A* | | | 933,178 |

| | 22,700 | | Ross Stores, Inc. | | | 1,213,769 |

| | 19,350 | | Tractor Supply Co. | | | 1,123,267 |

| | 20,100 | | WMS Industries, Inc.* | | | 842,994 |

| | | | | | | |

| | | | | | | 8,272,646 |

| | | | | | | |

Consumer Staples — 3.65% | | | |

| | 10,100 | | Church & Dwight Co., Inc. | | | 676,195 |

| | 10,400 | | Ralcorp Holdings, Inc.* | | | 704,912 |

| | 29,700 | | United Natural Foods, Inc.* | | | 835,461 |

| | | | | | | |

| | | | | | | 2,216,568 |

| | | | | | | |

Energy — 5.08% | | | |

| | 15,100 | | Dril-Quip, Inc.* | | | 918,684 |

| | 12,390 | | Oceaneering International, Inc.* | | | 786,641 |

| | 17,400 | | Oil States International, Inc.* | | | 788,916 |

| | 13,900 | | Unit Corp.* | | | 587,692 |

| | | | | | | |

| | | | | | | 3,081,933 |

| | | | | | | |

Financials — 7.34% | | | |

| | 16,500 | | Eaton Vance Corp. | | | 553,410 |

| | 18,300 | | Federated Investors, Inc., Class B | | | 482,754 |

| | 33,200 | | HCC Insurance Holdings, Inc. | | | 916,320 |

| | 16,500 | | Investment Technology Group, Inc.* | | | 275,385 |

| | 28,800 | | Knight Capital Group, Inc., Class A* | | | 439,200 |

| | 34,100 | | Raymond James Financial, Inc. | | | 911,834 |

| | 39,300 | | Tower Group, Inc. | | | 871,281 |

| | | | | | | |

| | | | | | | 4,450,184 |

| | | | | | | |

Health Care — 24.08% | | | |

| | 55,100 | | Bruker Corp.* | | | 807,215 |

| | 33,700 | | Catalyst Health Solutions, Inc.* | | | 1,394,506 |

| | 10,400 | | Cerner Corp.* | | | 884,624 |

| | 12,200 | | Charles River Laboratories International, Inc.* | | | 479,582 |

| | 11,300 | | Edwards Lifesciences Corp.* | | | 1,117,344 |

| | 13,000 | | Gen-Probe, Inc.* | | | 650,000 |

| | 18,600 | | Henry Schein, Inc.* | | | 1,095,540 |

| | 14,800 | | IDEXX Laboratories, Inc.* | | | 851,740 |

| | 15,600 | | Integra LifeSciences Holdings Corp.* | | | 683,748 |

| | 7,800 | | Laboratory Corp of America Holdings* | | | 590,538 |

| | 18,300 | | Meridian Bioscience, Inc. | | | 372,771 |

14

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Mid Cap Growth Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 6,900 | | Mettler-Toledo International, Inc.* | | $ | 753,480 |

| | 16,900 | | MWI Veterinary Supply, Inc.* | | | 682,760 |

| | 14,800 | | NuVasive, Inc.* | | | 668,960 |

| | 19,200 | | Parexel International Corp.* | | | 447,552 |

| | 11,300 | | Perrigo Co. | | | 663,536 |

| | 21,800 | | Pharmaceutical Product Development, Inc. | | | 517,750 |

| | 10,400 | | Varian Medical Systems, Inc.* | | | 575,432 |

| | 12,200 | | Waters Corp.* | | | 823,988 |

| | 13,000 | | West Pharmaceutical Services, Inc. | | | 545,350 |

| | | | | | | |

| | | | | | | 14,606,416 |

| | | | | | | |

Industrials — 16.67% | | | |

| | 10,400 | | Alliant Techsystems, Inc.* | | | 845,520 |

| | 22,700 | | AMETEK, Inc. | | | 941,142 |

| | 16,520 | | Donaldson Co., Inc. | | | 745,382 |

| | 10,380 | | Expeditors International of Washington, Inc. | | | 383,230 |

| | 6,900 | | Flowserve Corp. | | | 760,863 |

| | 11,740 | | Huron Consulting Group, Inc.* | | | 238,322 |

| | 12,200 | | Jacobs Engineering Group, Inc.* | | | 551,318 |

| | 13,000 | | Landstar System, Inc. | | | 545,740 |

| | 18,300 | | MSC Industrial Direct Co., Class A | | | 928,176 |

| | 15,490 | | Roper Industries, Inc. | | | 895,942 |

| | 14,000 | | Stericycle, Inc.* | | | 763,000 |

| | 13,000 | | Teledyne Technologies, Inc.* | | | 536,510 |

| | 15,700 | | Towers Watson & Co., Class A | | | 745,750 |

| | 15,600 | | Waste Connections, Inc.* | | | 529,776 |

| | 21,800 | | Woodward Governor Co. | | | 697,164 |

| | | | | | | |

| | | | | | | 10,107,835 |

| | | | | | | |

Information Technology — 22.77% | | | |

| | 37,500 | | Akamai Technologies, Inc.* | | | 1,177,875 |

| | 32,800 | | Altera Corp. | | | 797,368 |

| | 15,820 | | ANSYS, Inc.* | | | 682,475 |

| | 27,810 | | Autodesk, Inc.* | | | 818,170 |

| | 14,800 | | Comtech Telecommunications Corp.* | | | 473,452 |

| | 47,700 | | Cybersource Corp.* | | | 841,428 |

| | 14,840 | | Dolby Laboratories, Inc., Class A* | | | 870,663 |

| | 24,400 | | F5 Networks, Inc.* | | | 1,500,844 |

| | 18,300 | | Global Payments, Inc. | | | 833,565 |

| | 30,700 | | Logitech International SA* | | | 501,638 |

| | 10,400 | | Mantech International Corp., Class A* | | | 507,832 |

| | 19,850 | | Microchip Technology, Inc. | | | 558,976 |

| | 26,100 | | MICROS Systems, Inc.* | | | 858,168 |

| | 18,300 | | National Instruments Corp. | | | 610,305 |

| | 18,300 | | Open Text Corp.* | | | 868,701 |

| | 47,200 | | Riverbed Technology, Inc.* | | | 1,340,480 |

15

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Mid Cap Growth Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | | |

Shares | | | | Value | |

| | 25,300 | | Synopsys, Inc.* | | $ | 565,961 | |

| | | | | | | | |

| | | | | | | 13,807,901 | |

| | | | | | | | |

Materials — 3.04% | | | | |

| | 13,900 | | AptarGroup, Inc. | | | 546,965 | |

| | 12,200 | | Reliance Steel & Aluminum Co. | | | 600,606 | |

| | 13,000 | | Sigma-Aldrich Corp. | | | 697,580 | |

| | | | | | | | |

| | | | | | | 1,845,151 | |

| | | | | | | | |

| |

Total Common Stocks (Cost $50,095,593) | | | 58,388,634 | |

| | | | | | | | |

Investment Company — 4.15% | | | | |

| | 2,518,330 | | JPMorgan Prime Money Market Fund | | | 2,518,330 | |

| | | | | | | | |

| |

Total Investment Company (Cost $2,518,330) | | | 2,518,330 | |

| | | | | | | | |

| |

Total Investments (Cost $52,613,923)(a) — 100.42% | | $ | 60,906,964 | |

| |

Liabilities in excess of other assets — (0.42)% | | | (252,578 | ) |

| | | | | | | | |

| |

NET ASSETS — 100.00% | | $ | 60,654,386 | |

| | | | | | | | |

| * | Non-income producing security. |

| (a) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

See notes to financial statements.

16

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Enterprise Fund

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

Common Stocks — 97.00% | | | |

Consumer Discretionary — 17.16% | | | |

| | 441,378 | | Benihana, Inc., Class A* | | $ | 2,868,957 |

| | 160,250 | | Cache, Inc.* | | | 882,977 |

| | 854,973 | | Casual Male Retail Group, Inc.* | | | 3,295,921 |

| | 90,000 | | CKE Restaurants, Inc. | | | 996,300 |

| | 13,100 | | Delta Apparel, Inc.* | | | 204,360 |

| | 93,630 | | Mac-Gray Corp.* | | | 1,057,083 |

| | 221,191 | | Movado Group, Inc.* | | | 2,495,034 |

| | 143,300 | | RG Barry Corp. | | | 1,461,660 |

| | 292,956 | | Steinway Musical Instruments* | | | 5,516,361 |

| | 27,150 | | Tefron Ltd.* | | | 103,442 |

| | 267,700 | | Universal Electronics, Inc.* | | | 5,980,418 |

| | | | | | | |

| | | | | | | 24,862,513 |

| | | | | | | �� |

Energy — 2.25% | | | |

| | 27,200 | | Goodrich Petroleum Corp.* | | | 425,408 |

| | 28,000 | | Gulf Island Fabrication, Inc. | | | 609,000 |

| | 56,400 | | Gulfport Energy Corp.* | | | 633,936 |

| | 19,954 | | OYO Geospace Corp.* | | | 954,001 |

| | 54,300 | | Tesco Corp.* | | | 633,681 |

| | | | | | | |

| | | | | | | 3,256,026 |

| | | | | | | |

Financials — 9.15% | | | |

| | 301,300 | | Asta Funding, Inc. | | | 2,121,152 |

| | 51,900 | | Boston Private Financial Holdings, Inc. | | | 382,503 |

| | 91,059 | | CoBiz Financial, Inc. | | | 567,298 |

| | 175,000 | | Compass Diversified Holdings | | | 2,670,500 |

| | 65,000 | | Cypress Sharpridge Investments, Inc. REIT | | | 869,700 |

| | 68,800 | | Firstcity Financial Corp.* | | | 481,600 |

| | 32,000 | | LaSalle Hotel Properties REIT | | | 745,600 |

| | 34,626 | | Mercantile Bank Corp. | | | 136,080 |

| | 95,389 | | MetroCorp Bancshares, Inc.* | | | 281,397 |

| | 100,700 | | National Interstate Corp. | | | 2,085,497 |

| | 60,374 | | Northrim BanCorp, Inc. | | | 1,031,188 |

| | 108,900 | | SWS Group, Inc. | | | 1,255,617 |

| | 50,000 | | Washington Banking Co. | | | 629,500 |

| | | | | | | |

| | | | | | | 13,257,632 |

| | | | | | | |

Health Care — 9.44% | | | |

| | 92,000 | | Exactech, Inc. | | | 1,929,240 |

| | 15,832 | | HMS Holdings Corp.* | | | 807,274 |

| | 134,800 | | Kensey Nash Corp.* | | | 3,179,932 |

| | 36,900 | | Landauer, Inc. | | | 2,406,618 |

| | 51,200 | | LHC Group, Inc.* | | | 1,716,736 |

| | 102,700 | | Meridian Bioscience, Inc. | | | 2,091,999 |

| | 66,500 | | Symmetry Medical, Inc.* | | | 667,660 |

17

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Enterprise Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 50,800 | | US Physical Therapy, Inc.* | | $ | 883,920 |

| | | | | | | |

| | | | | | | 13,683,379 |

| | | | | | | |

Industrials — 20.59% | | | |

| | 41,656 | | Allied Defense Group, Inc. (The)* | | | 300,340 |

| | 138,700 | | AZZ, Inc. | | | 4,694,995 |

| | 613,000 | | C&D Technologies, Inc.* | | | 980,800 |

| | 290,225 | | Columbus McKinnon Corp.* | | | 4,605,871 |

| | 175,000 | | Eagle Bulk Shipping, Inc.* | | | 929,250 |

| | 69,200 | | Ennis, Inc. | | | 1,125,884 |

| | 26,900 | | Hurco Cos, Inc.* | | | 452,727 |

| | 462,894 | | LaBarge, Inc.* | | | 5,114,979 |

| | 157,300 | | NN, Inc.* | | | 865,150 |

| | 214,952 | | North American Galvanizing & Coating, Inc.* | | | 1,195,133 |

| | 400,000 | | OceanFreight, Inc.* | | | 300,800 |

| | 31,200 | | Old Dominion Freight Line, Inc.* | | | 1,041,768 |

| | 135,600 | | Orion Marine Group, Inc.* | | | 2,447,580 |

| | 337,639 | | PGT, Inc.* | | | 611,126 |

| | 48,073 | | Powell Industries, Inc.* | | | 1,563,814 |

| | 129,578 | | Standard Parking Corp.* | | | 2,127,671 |

| | 22,100 | | Sun Hydraulics Corp. | | | 574,158 |

| | 125,000 | | TBS International PLC* | | | 912,500 |

| | | | | | | |

| | | | | | | 29,844,546 |

| | | | | | | |

Information Technology — 27.30% | | | |

| | 197,182 | | Aspen Technology, Inc.* | | | 2,021,116 |

| | 100,000 | | Computer Task Group, Inc.* | | | 725,000 |

| | 98,577 | | Comtech Telecommunications Corp.* | | | 3,153,478 |

| | 418,502 | | DivX, Inc.* | | | 2,996,474 |

| | 215,200 | | EMS Technologies, Inc.* | | | 3,572,320 |

| | 124,000 | | Interactive Intelligence, Inc.* | | | 2,317,560 |

| | 524,238 | | Lionbridge Technologies, Inc.* | | | 1,902,984 |

| | 519,500 | | NIC, Inc.* | | | 4,088,465 |

| | 27,900 | | NU Horizons Electronics Corp.* | | | 89,559 |

| | 144,087 | | SkillSoft PLC - ADR* | | | 1,486,978 |

| | 463,411 | | Sonic Solutions, Inc.* | | | 4,342,161 |

| | 562,810 | | Spectrum Control, Inc.* | | | 6,579,249 |

| | 70,000 | | StarTek, Inc.* | | | 486,500 |

| | 129,300 | | Tyler Technologies, Inc.* | | | 2,423,082 |

| | 200,000 | | Xyratex Ltd.* | | | 3,386,000 |

| | | | | | | |

| | | | | | | 39,570,926 |

| | | | | | | |

Materials — 8.46% | | | |

| | 467,116 | | Intertape Polymer Group, Inc.* | | | 1,546,154 |

| | 97,000 | | Koppers Holdings, Inc. | | | 2,747,040 |

| | 194,600 | | Landec Corp.* | | | 1,290,198 |

| | 257,500 | | Omnova Solutions, Inc.* | | | 2,021,375 |

| | 187,088 | | Universal Stainless & Alloy* | | | 4,488,241 |

18

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Enterprise Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | | |

Shares | | | | Value | |

| | 453,300 | | US Concrete, Inc.* | | $ | 172,254 | |

| | | | | | | | |

| | | | | | | 12,265,262 | |

| | | | | | | | |

Utilities — 2.65% | | | | |

| | 107,400 | | Central Vermont Public Service Corp. | | | 2,166,258 | |

| | 71,800 | | Unitil Corp. | | | 1,669,350 | |

| | | | | | | | |

| | | | | | | 3,835,608 | |

| | | | | | | | |

| |

Total Common Stocks (Cost $128,877,821) | | | 140,575,892 | |

| | | | | | | | |

Exchange Traded Fund — 1.54% | | | | |

| | 85,000 | | SPDR KBW Regional Banking | | | 2,228,700 | |

| | | | | | | | |

| |

Total Exchange Traded Fund (Cost $2,108,292) | | | 2,228,700 | |

| | | | | | | | |

Investment Company — 1.61% | | | | |

| | 2,335,005 | | JPMorgan Prime Money Market Fund | | | 2,335,005 | |

| | | | | | | | |

| |

Total Investment Company (Cost $2,335,005) | | | 2,335,005 | |

| | | | | | | | |

| |

Total Investments (Cost $133,321,118)(a) — 100.15% | | $ | 145,139,597 | |

| |

Liabilities in excess of other assets — (0.15)% | | | (215,535 | ) |

| | | | | | | | |

| |

NET ASSETS — 100.00% | | $ | 144,924,062 | |

| | | | | | | | |

| * | Non-income producing security. |

| (a) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

REIT - Real Estate Investment Trust

See notes to financial statements.

19

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Small Cap Core Fund

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

Common Stocks — 96.57% | | | |

Consumer Discretionary — 14.60% | | | |

| | 67,719 | | Benihana, Inc., Class A* | | $ | 440,174 |

| | 296,800 | | Casual Male Retail Group, Inc.* | | | 1,144,164 |

| | 25,300 | | Dress Barn, Inc.* | | | 661,848 |

| | 9,800 | | Drew Industries, Inc.* | | | 215,796 |

| | 5,600 | | Jo-Ann Stores, Inc.* | | | 235,088 |

| | 43,000 | | Movado Group, Inc.* | | | 485,040 |

| | 62,707 | | Steinway Musical Instruments* | | | 1,180,773 |

| | 8,500 | | Steven Madden Ltd.* | | | 414,800 |

| | 40,900 | | True Religion Apparel, Inc.* | | | 1,241,724 |

| | 50,198 | | Universal Electronics, Inc.* | | | 1,121,423 |

| | | | | | | |

| | | | | | | 7,140,830 |

| | | | | | | |

Consumer Staples — 3.89% | | | |

| | 20,400 | | Alberto-Culver Co. | | | 533,460 |

| | 31,600 | | Nash Finch Co. | | | 1,063,340 |

| | 34,300 | | Sally Beauty Holdings, Inc.* | | | 305,956 |

| | | | | | | |

| | | | | | | 1,902,756 |

| | | | | | | |

Energy — 4.59% | | | |

| | 2,500 | | CARBO Ceramics, Inc. | | | 155,850 |

| | 1,100 | | Core Laboratories NV | | | 143,880 |

| | 30,200 | | Georesources, Inc.* | | | 461,154 |

| | 16,300 | | Tesco Corp.* | | | 190,221 |

| | 20,700 | | Willbros Group, Inc.* | | | 248,607 |

| | 39,200 | | World Fuel Services Corp. | | | 1,044,288 |

| | | | | | | |

| | | | | | | 2,244,000 |

| | | | | | | |

Financials — 11.15% | | | |

| | 34,100 | | Amerisafe, Inc.* | | | 558,217 |

| | 75,700 | | Ares Capital Corp. | | | 1,123,388 |

| | 55,027 | | Asta Funding, Inc. | | | 387,390 |

| | 70,900 | | Compass Diversified Holdings | | | 1,081,934 |

| | 19,900 | | Cypress Sharpridge Investments, Inc. REIT | | | 266,262 |

| | 27,325 | | Delphi Financial Group, Inc., Class A | | | 687,497 |

| | 10,200 | | LaSalle Hotel Properties REIT | | | 237,660 |

| | 8,500 | | ProAssurance Corp.* | | | 497,590 |

| | 23,500 | | SeaBright Insurance Holdings, Inc. | | | 258,735 |

| | 23,700 | | SWS Group, Inc. | | | 273,261 |

| | 4,072 | | Trico Bancshares | | | 81,033 |

| | | | | | | |

| | | | | | | 5,452,967 |

| | | | | | | |

Health Care — 11.77% | | | |

| | 14,800 | | Amedisys, Inc.* | | | 817,256 |

| | 12,000 | | Emergency Medical Services Corp., Class A* | | | 678,600 |

| | 22,500 | | Invacare Corp. | | | 597,150 |

| | 11,700 | | Kinetic Concepts, Inc.* | | | 559,377 |

20

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Small Cap Core Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 17,800 | | Meridian Bioscience, Inc. | | $ | 362,586 |

| | 61,975 | | PSS World Medical, Inc.* | | | 1,457,032 |

| | 34,500 | | Symmetry Medical, Inc.* | | | 346,380 |

| | 22,300 | | West Pharmaceutical Services, Inc. | | | 935,485 |

| | | | | | | |

| | | | | | | 5,753,866 |

| | | | | | | |

Industrials — 23.27% | | | |

| | 89,600 | | ACCO Brands Corp.* | | | 686,336 |

| | 2,800 | | American Science & Engineering, Inc. | | | 209,776 |

| | 17,900 | | Atlas Air Worldwide Holdings, Inc.* | | | 949,595 |

| | 37,100 | | AZZ, Inc. | | | 1,255,835 |

| | 202,500 | | C&D Technologies, Inc.* | | | 324,000 |

| | 15,700 | | Chart Industries, Inc.* | | | 314,000 |

| | 61,200 | | Columbus McKinnon Corp.* | | | 971,244 |

| | 18,700 | | Forward Air Corp. | | | 491,810 |

| | 32,900 | | Gardner Denver, Inc. | | | 1,448,916 |

| | 26,700 | | II-VI, Inc.* | | | 903,528 |

| | 43,600 | | Insteel Industries, Inc. | | | 466,084 |

| | 80,200 | | Interface, Inc., Class A | | | 928,716 |

| | 34,000 | | Knoll, Inc. | | | 382,500 |

| | 13,900 | | LB Foster Co., Class A* | | | 401,571 |

| | 15,400 | | Old Dominion Freight Line, Inc.* | | | 514,206 |

| | 11,578 | | Powell Industries, Inc.* | | | 376,632 |

| | 5,500 | | Sun Hydraulics Corp. | | | 142,890 |

| | 14,500 | | Wabtec Corp. | | | 610,740 |

| | | | | | | |

| | | | | | | 11,378,379 |

| | | | | | | |

Information Technology — 19.10% | | | |

| | 43,900 | | ADC Telecommunications, Inc.* | | | 320,909 |

| | 58,500 | | Aspen Technology, Inc.* | | | 599,625 |

| | 21,100 | | Comtech Telecommunications Corp.* | | | 674,989 |

| | 123,324 | | DivX, Inc.* | | | 883,000 |

| | 36,300 | | EMS Technologies, Inc.* | | | 602,580 |

| | 20,200 | | InterDigital, Inc.* | | | 562,772 |

| | 78,200 | | NIC, Inc. | | | 615,434 |

| | 54,200 | | Skyworks Solutions, Inc.* | | | 845,520 |

| | 111,542 | | Sonic Solutions, Inc.* | | | 1,045,148 |

| | 102,945 | | Spectrum Control, Inc.* | | | 1,203,427 |

| | 30,900 | | STEC, Inc.* | | | 370,182 |

| | 26,700 | | Tyler Technologies, Inc.* | | | 500,358 |

| | 65,900 | | Xyratex Ltd.* | | | 1,115,687 |

| | | | | | | |

| | | | | | | 9,339,631 |

| | | | | | | |

Materials — 5.25% | | | |

| | 59,900 | | Intertape Polymer Group, Inc.* | | | 198,269 |

| | 26,900 | | Koppers Holdings, Inc. | | | 761,808 |

| | 20,500 | | Rockwood Holdings, Inc.* | | | 545,710 |

21

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Small Cap Core Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | | |

Shares | | | | Value | |

| | 44,351 | | Universal Stainless & Alloy* | | $ | 1,063,981 | |

| | | | | | | | |

| | | | | | | 2,569,768 | |

| | | | | | | | |

Telecommunication Services — 0.92% | | | | |

| | 54,700 | | Premiere Global Services, Inc.* | | | 451,822 | |

| | | | | | | | |

Utilities — 2.03% | | | | |

| | 11,900 | | Energen Corp. | | | 553,707 | |

| | 13,900 | | Unisource Energy Corp. | | | 437,016 | |

| | | | | | | | |

| | | | | | | 990,723 | |

| | | | | | | | |

| |

Total Common Stocks (Cost $35,643,550) | | | 47,224,742 | |

| | | | | | | | |

Investment Company — 4.06% | | | | |

| | 1,982,933 | | JPMorgan Prime Money Market Fund | | | 1,982,933 | |

| | | | | | | | |

| |

Total Investment Company (Cost $1,982,933) | | | 1,982,933 | |

| | | | | | | | |

| |

Total Investments (Cost $37,626,483)(a) — 100.63% | | $ | 49,207,675 | |

| |

Liabilities in excess of other assets — (0.63)% | | | (305,751 | ) |

| | | | | | | | |

| |

NET ASSETS — 100.00% | | $ | 48,901,924 | |

| | | | | | | | |

| * | Non-income producing security. |

| (a) | See notes to financial statements for the tax cost of securities and the breakdown of unrealized appreciation (depreciation). |

Abbreviations used are defined below:

REIT - Real Estate Investment Trust

See notes to financial statements.

22

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Microcap Value Fund

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

Common Stocks — 94.09% | | | |

Consumer Discretionary — 20.77% | | | |

| | 96,000 | | Adams Golf, Inc.* | | $ | 313,920 |

| | 2,800 | | Allen Organ Co.(a)(b) | | | 0 |

| | 29,800 | | Ambassadors International, Inc.* | | | 15,496 |

| | 27,500 | | America’s Car-Mart, Inc.* | | | 663,300 |

| | 53,000 | | Arctic Cat, Inc.* | | | 575,050 |

| | 50,000 | | Asbury Automotive Group, Inc.* | | | 665,000 |

| | 86,000 | | Audiovox Corp., Class A* | | | 669,080 |

| | 90,000 | | Bakers Footwear Group, Inc.* | | | 207,900 |

| | 69,000 | | Benihana, Inc., Class A* | | | 448,500 |

| | 69,000 | | Bluegreen Corp.* | | | 225,630 |

| | 46,000 | | Books-A-Million, Inc. | | | 333,040 |

| | 15,127 | | Bowl America, Inc., Class A | | | 196,651 |

| | 43,000 | | Brookfield Homes Corp.* | | | 375,820 |

| | 72,000 | | Build-A-Bear Workshop, Inc.* | | | 512,640 |

| | 44,000 | | Carriage Services, Inc.* | | | 201,960 |

| | 45,000 | | Cobra Electronics Corp.* | | | 112,950 |

| | 21,000 | | Core-Mark Holding Co., Inc.* | | | 642,810 |

| | 99,000 | | Craftmade International, Inc.* | | | 495,000 |

| | 32,000 | | CSS Industries, Inc. | | | 643,200 |

| | 42,000 | | Delta Apparel, Inc.* | | | 655,200 |

| | 56,000 | | Dixie Group, Inc.* | | | 277,200 |

| | 36,000 | | Dorman Products, Inc.* | | | 683,640 |

| | 17,500 | | Duckwall-ALCO Stores, Inc.* | | | 253,575 |

| | 84,000 | | Emmis Communications Corp., Class A* | | | 95,760 |

| | 21,000 | | Entercom Communications Corp., Class A* | | | 249,690 |

| | 56,000 | | Finish Line, Inc. (The), Class A | | | 913,920 |

| | 56,000 | | Flexsteel Industries | | | 761,040 |

| | 57,000 | | Fred’s, Inc., Class A | | | 682,860 |

| | 31,000 | | Gaiam, Inc., Class A | | | 257,300 |

| | 85,000 | | Golfsmith International Holdings, Inc.* | | | 342,550 |

| | 22,000 | | Group 1 Automotive, Inc.* | | | 700,920 |

| | 26,000 | | Hampshire Group Ltd.* | | | 109,200 |

| | 89,000 | | Hastings Entertainment, Inc.* | | | 392,490 |

| | 27,000 | | Helen of Troy Ltd.* | | | 703,620 |

| | 31,000 | | Hooker Furniture Corp. | | | 498,480 |

| | 50,000 | | HOT Topic, Inc.* | | | 325,000 |

| | 65,000 | | Isle of Capri Casinos, Inc.* | | | 505,700 |

| | 15,000 | | J Alexander’s Corp.* | | | 62,700 |

| | 52,000 | | Jakks Pacific, Inc.* | | | 678,600 |

| | 29,000 | | Johnson Outdoors, Inc., Class A* | | | 329,150 |

| | 11,000 | | Jos. A. Bank Clothiers, Inc.* | | | 601,150 |

| | 82,000 | | Journal Communications, Inc., Class A* | | | 344,400 |

| | 58,310 | | Lakeland Industries, Inc.* | | | 495,635 |

| | 22,000 | | Landry’s Restaurants, Inc.* | | | 394,240 |

| | 95,270 | | Lazare Kaplan International, Inc.*(b) | | | 238,175 |

23

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Microcap Value Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 70,000 | | La-Z-Boy, Inc.* | | $ | 877,800 |

| | 31,000 | | Lifetime Brands, Inc.* | | | 365,800 |

| | 25,000 | | Lithia Motors, Inc., Class A* | | | 160,000 |

| | 91,000 | | Luby’s, Inc.* | | | 358,540 |

| | 36,000 | | Mac-Gray Corp. | | | 406,440 |

| | 28,000 | | Marcus Corp. | | | 363,720 |

| | 43,000 | | MarineMax, Inc.* | | | 462,680 |

| | 64,000 | | McCormick & Schmick’s Seafood Restaurants, Inc.* | | | 644,480 |

| | 7,500 | | McRae Industries, Inc., Class A | | | 79,725 |

| | 26,000 | | Media General, Inc., Class A* | | | 215,540 |

| | 31,000 | | Meritage Homes Corp.* | | | 651,000 |

| | 21,300 | | Mestek, Inc.* | | | 166,140 |

| | 39,000 | | Modine Manufacturing Co.* | | | 438,360 |

| | 82,000 | | Morton’s Restaurant Group, Inc.* | | | 501,020 |

| | 59,400 | | Movado Group, Inc.* | | | 670,032 |

| | 18,300 | | Nobel Learning Communities, Inc.* | | | 143,472 |

| | 10,300 | | Nobility Homes, Inc. | | | 100,837 |

| | 32,000 | | O’Charleys, Inc.* | | | 286,080 |

| | 41,000 | | Orleans Homebuilders, Inc.* | | | 5,740 |

| | 42,350 | | Perry Ellis International, Inc.* | | | 959,227 |

| | 135,000 | | Point.360* | | | 195,750 |

| | 90,600 | | Radio One, Inc., Class D* | | | 276,330 |

| | 34,000 | | RC2 Corp.* | | | 508,980 |

| | 56,000 | | Red Lion Hotels Corp.* | | | 404,320 |

| | 37,550 | | Rex Stores Corp.* | | | 608,310 |

| | 40,000 | | Rocky Brands, Inc.* | | | 381,600 |

| | 85,000 | | Ruby Tuesday, Inc.* | | | 898,450 |

| | 20,000 | | Saga Communications, Inc., Class A* | | | 449,600 |

| | 45,150 | | Salem Communications Corp., Class A* | | | 161,637 |

| | 90,000 | | Shiloh Industries, Inc.* | | | 508,500 |

| | 49,000 | | Stage Stores, Inc. | | | 754,110 |

| | 75,000 | | Standard Motor Products, Inc.* | | | 744,000 |

| | 44,000 | | Stein Mart, Inc.* | | | 397,320 |

| | 26,000 | | Steinway Musical Instruments* | | | 489,580 |

| | 103,000 | | Stewart Enterprises, Inc., Class A | | | 643,750 |

| | 16,000 | | Stoneridge, Inc.* | | | 158,240 |

| | 17,000 | | Strattec Security Corp.* | | | 345,440 |

| | 30,000 | | Superior Industries International, Inc. | | | 482,400 |

| | 43,000 | | Syms Corp.* | | | 428,280 |

| | 51,000 | | Systemax, Inc. | | | 1,108,740 |

| | 150,000 | | Trans World Entertainment Corp.* | | | 270,000 |

| | 50,000 | | Tuesday Morning Corp.* | | | 329,500 |

| | 22,000 | | Walking Co. Holdings, Inc. (The)* | | | 50,600 |

| | 13,400 | | Weyco Group, Inc. | | | 315,168 |

| | | | | | | |

| | | | | | | 37,617,380 |

| | | | | | | |

Consumer Staples — 3.49% | | | |

| | 19,600 | | Andersons, Inc. (The) | | | 656,208 |

24

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Microcap Value Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 80,000 | | Central Garden and Pet Co.* | | $ | 789,600 |

| | 36,000 | | Chiquita Brands International, Inc.* | | | 566,280 |

| | 55,000 | | Elizabeth Arden, Inc.* | | | 990,000 |

| | 52,000 | | Ingles Markets, Inc., Class A | | | 781,560 |

| | 143,000 | | ML Macadamia Orchards LP* | | | 343,200 |

| | 10,000 | | Nash Finch Co. | | | 336,500 |

| | 69,000 | | Omega Protein Corp.* | | | 396,750 |

| | 54,000 | | Prestige Brands Holdings, Inc.* | | | 486,000 |

| | 22,000 | | Spartan Stores, Inc. | | | 317,240 |

| | 91,000 | | Tasty Baking Co. | | | 657,020 |

| | | | | | | |

| | | | | | | 6,320,358 |

| | | | | | | |

Energy — 3.50% | | | |

| | 119,000 | | Aventine Renewable Energy Holdings, Inc.*(a)(b) | | | 0 |

| | 44,000 | | Bronco Drilling Co., Inc.* | | | 206,800 |

| | 36,000 | | Calumet Specialty Products Partners LP | | | 750,600 |

| | 31,000 | | Constellation Energy Partners LLC | | | 108,500 |

| | 16,966 | | Enbridge Energy Management LLC* | | | 866,114 |

| | 19,000 | | EV Energy Partner LP | | | 606,480 |

| | 98,000 | | Harvest Natural Resources, Inc.* | | | 737,940 |

| | 47,000 | | Knightsbridge Tankers Ltd. | | | 796,180 |

| | 9,000 | | Lufkin Industries, Inc. | | | 712,350 |

| | 106,000 | | Newpark Resources, Inc.* | | | 556,500 |

| | 14,600 | | PHI, Inc.* | | | 323,828 |

| | 20,000 | | PHI, Inc., Non voting* | | | 423,600 |

| | 110,300 | | Trico Marine Services, Inc.* | | | 255,896 |

| | 78,570 | | VeraSun Energy Corp.* | | | 951 |

| | | | | | | |

| | | | | | | 6,345,739 |

| | | | | | | |

Financials — 19.20% | | | |

| | 70,000 | | 21st Century Holding Co. | | | 285,600 |

| | 40,000 | | Affirmative Insurance Holdings, Inc.* | | | 188,000 |

| | 100,000 | | American Equity Investment Life Holding Co. | | | 1,065,000 |

| | 75,000 | | American Independence Corp.* | | | 468,750 |

| | 19,000 | | American Safety Insurance Holdings Ltd.* | | | 315,210 |

| | 68,864 | | Ameris Bancorp | | | 621,838 |

| | 92,000 | | Asta Funding, Inc. | | | 647,680 |

| | 21,000 | | Baldwin & Lyons, Inc., Class B | | | 505,890 |

| | 14,500 | | Bancinsurance Corp.* | | | 76,850 |

| | 70,600 | | Bancorp, Inc.* | | | 628,340 |

| | 65,600 | | Banner Corp. | | | 251,904 |

| | 100,000 | | Beverly Hills Bancorp, Inc.* | | | 3,000 |

| | 50,000 | | California First National Bancorp | | | 667,500 |

| | 21,000 | | Camco Financial Corp. | | | 61,740 |

| | 5,200 | | Capital Southwest Corp. | | | 472,576 |

| | 38,000 | | Capitol Bancorp Ltd.* | | | 91,960 |

| | 44,000 | | Central Pacific Financial Corp.* | | | 73,920 |

25

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Microcap Value Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 25,000 | | Citizens South Banking Corp. | | $ | 154,000 |

| | 48,150 | | Citizens, Inc.* | | | 332,716 |

| | 133,000 | | Consumer Portfolio Services* | | | 297,920 |

| | 41,037 | | Crawford & Co., Class B* | | | 167,021 |

| | 43,777 | | Donegal Group, Inc., Class A | | | 635,204 |

| | 12,444 | | Donegal Group, Inc., Class B | | | 204,828 |

| | 75,040 | | Dynex Capital, Inc. REIT | | | 675,360 |

| | 31,000 | | EMC Insurance Group, Inc. | | | 698,120 |

| | 34,300 | | First Defiance Financial Corp. | | | 347,116 |

| | 11,000 | | First Financial Corp. | | | 318,560 |

| | 45,400 | | First Financial Holdings, Inc. | | | 683,724 |

| | 58,000 | | First Industrial Realty Trust, Inc. REIT* | | | 450,080 |

| | 54,000 | | First Merchants Corp. | | | 375,840 |

| | 47,200 | | First Pactrust Bancorp, Inc. | | | 366,744 |

| | 38,000 | | First Place Financial Corp.* | | | 151,620 |

| | 42,000 | | First State Bancorp* | | | 23,100 |

| | 25,000 | | Firstcity Financial Corp.* | | | 175,000 |

| | 66,000 | | Flagstar Bancorp, Inc.* | | | 39,600 |

| | 45,660 | | FNB Corp. | | | 370,303 |

| | 45,000 | | FNB United Corp. | | | 54,450 |

| | 25,500 | | FPIC Insurance Group, Inc.* | | | 691,305 |

| | 62,000 | | Franklin Bank Corp.* | | | 310 |

| | 109,000 | | Fremont General Corp.* | | | 105,730 |

| | 2,250 | | FRMO Corp.* | | | 5,625 |

| | 45,000 | | Gladstone Investment Corp. | | | 269,100 |

| | 50,400 | | Green Bankshares, Inc. | | | 411,264 |

| | 108,000 | | Guaranty Bancorp* | | | 171,720 |

| | 36,850 | | Hampton Roads Bankshares, Inc. | | | 57,486 |

| | 21,180 | | Harleysville National Corp. | | | 141,906 |

| | 63,528 | | Hercules Technology Growth Capital, Inc. | | | 672,761 |

| | 38,000 | | HF Financial Corp. | | | 383,800 |

| | 36,000 | | Independence Holding Co. | | | 341,640 |

| | 13,000 | | Indiana Community Bancorp | | | 118,950 |

| | 13,000 | | Infinity Property & Casualty Corp. | | | 590,720 |

| | 31,000 | | Intervest Bancshares Corp., Class A | | | 122,450 |

| | 8,300 | | Investors Title Co. | | | 282,864 |

| | 24,000 | | Jefferson Bancshares, Inc. | | | 109,680 |

| | 17,000 | | Kansas City Life Insurance Co. | | | 536,860 |

| | 56,930 | | LaBranche & Co., Inc.* | | | 299,452 |

| | 11,000 | | LSB Corp. | | | 136,400 |

| | 53,000 | | Marlin Business Services Corp.* | | | 537,950 |

| | 23,294 | | Mass Financial Corp., Class A* | | | 216,168 |

| | 108,000 | | MCG Capital Corp.* | | | 562,680 |

| | 113,750 | | Meadowbrook Insurance Group, Inc. | | | 898,625 |

| | 62,000 | | Medallion Financial Corp. | | | 493,520 |

| | 43,000 | | Mercer Insurance Group, Inc. | | | 774,000 |

| | 136,000 | | MicroFinancial, Inc. | | | 524,960 |

| | 52,100 | | MutualFirst Financial, Inc. | | | 346,465 |

26

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Microcap Value Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 5,300 | | National Security Group, Inc. | | $ | 64,501 |

| | 5,100 | | National Western Life Insurance Co., Class A | | | 940,185 |

| | 17,400 | | Navigators Group, Inc.* | | | 684,342 |

| | 43,000 | | NGP Capital Resources Co. | | | 366,360 |

| | 44,000 | | Nicholas Financial, Inc.* | | | 333,080 |

| | 16,000 | | NYMAGIC, Inc. | | | 339,680 |

| | 67,400 | | Old Second Bancorp, Inc. | | | 444,166 |

| | 18,000 | | Pacific Mercantile Bancorp* | | | 49,500 |

| | 19,000 | | Parkway Properties, Inc. REIT | | | 356,820 |

| | 29,000 | | Peoples Bancorp, Inc. | | | 477,920 |

| | 65,000 | | PMA Capital Corp., Class A* | | | 399,100 |

| | 37,900 | | PMC Commercial Trust REIT | | | 277,428 |

| | 40,000 | | Presidential Life Corp. | | | 398,800 |

| | 58,705 | | Prospect Capital Corp. | | | 713,266 |

| | 19,000 | | Provident Financial Holdings, Inc. | | | 66,120 |

| | 89,000 | | Reis, Inc.* | | | 508,190 |

| | 49,000 | | Resource America, Inc., Class A | | | 235,200 |

| | 17,000 | | Safety Insurance Group, Inc. | | | 640,390 |

| | 50,000 | | Sanders Morris Harris Group, Inc. | | | 309,500 |

| | 42,000 | | SeaBright Insurance Holdings, Inc. | | | 462,420 |

| | 21,000 | | Simmons First National Corp., Class A | | | 578,970 |

| | 32,000 | | Southern Community Financial Corp. | | | 71,040 |

| | 52,300 | | Southwest Bancorp, Inc. | | | 432,521 |

| | 2,999 | | Stifel Financial Corp.* | | | 161,196 |

| | 75,600 | | Sun Bancorp, Inc.* | | | 297,864 |

| | 46,500 | | SWS Group, Inc. | | | 536,145 |

| | 54,000 | | TierOne Corp.* | | | 17,280 |

| | 27,440 | | Tower Group, Inc. | | | 608,345 |

| | 68,000 | | Unico American Corp. | | | 652,800 |

| | 99,716 | | United Community Financial Corp.* | | | 150,571 |

| | 19,000 | | United Western Bancorp, Inc. | | | 29,070 |

| | 29,000 | | Winthrop Realty Trust REIT | | | 349,160 |

| | 4,600 | | Ziegler Cos., Inc. (The)* | | | 73,600 |

| | | | | | | |

| | | | | | | 34,776,985 |

| | | | | | | |

Health Care — 5.74% | | | |

| | 19,000 | | Air Methods Corp.* | | | 646,000 |

| | 54,000 | | Albany Molecular Research, Inc.* | | | 450,900 |

| | 128,000 | | Allied Healthcare International, Inc.* | | | 348,160 |

| | 11,000 | | American Shared Hospital Services* | | | 31,240 |

| | 46,000 | | Angiodynamics, Inc.* | | | 718,520 |

| | 77,000 | | BioScrip, Inc.* | | | 614,460 |

| | 45,000 | | Cantel Medical Corp. | | | 893,250 |

| | 67,000 | | Cardiac Science Corp.* | | | 125,290 |

| | 26,000 | | Conmed Corp.* | | | 619,060 |

| | 46,000 | | Cross Country Healthcare, Inc.* | | | 465,060 |

| | 27,970 | | Hanger Orthopedic Group, Inc.* | | | 508,495 |

27

SCHEDULE OF PORTFOLIO INVESTMENTS

RBC Microcap Value Fund (cont.)

March 31, 2010 (Unaudited)

| | | | | | | |

Shares | | | | Value |

| | 82,000 | | HealthTronics, Inc.* | | $ | 293,560 |

| | 20,313 | | IntegraMed America, Inc.* | | | 178,958 |

| | 28,000 | | Invacare Corp. | | | 743,120 |

| | 7,100 | | Kewaunee Scientific Corp. | | | 99,435 |

| | 30,000 | | Lannett Co., Inc.* | | | 127,500 |

| | 31,000 | | Medcath Corp.* | | | 324,570 |

| | 19,000 | | Mediware Information Systems* | | | 170,240 |

| | 51,000 | | MedQuist, Inc.* | | | 398,310 |

| | 56,800 | | National Dentex Corp.* | | | 553,800 |

| | 41,000 | | PharMerica Corp.* | | | 747,020 |

| | 22,000 | | RehabCare Group, Inc.* | | | 599,940 |

| | 62,000 | | Res-Care, Inc.* | | | 743,380 |

| | | | | | | |

| | | | | | | 10,400,268 |

| | | | | | | |

Industrials — 20.54% | | | |

| | 50,839 | | Aceto Corp. | | | 307,067 |

| | 24,000 | | Alamo Group, Inc. | | | 479,760 |

| | 125,000 | | Allied Motion Technologies, Inc.* | | | 450,000 |

| | 34,000 | | Altra Holdings, Inc.* | | | 466,820 |

| | 13,000 | | Amrep Corp.* | | | 188,890 |

| | 32,000 | | ATC Technology Corp.* | | | 549,120 |

| | 34,000 | | Beacon Roofing Supply, Inc.* | | | 650,420 |

| | 27,800 | | Cascade Corp. | | | 895,438 |